The Creator Economy's Existential Pivot Away From Advertising

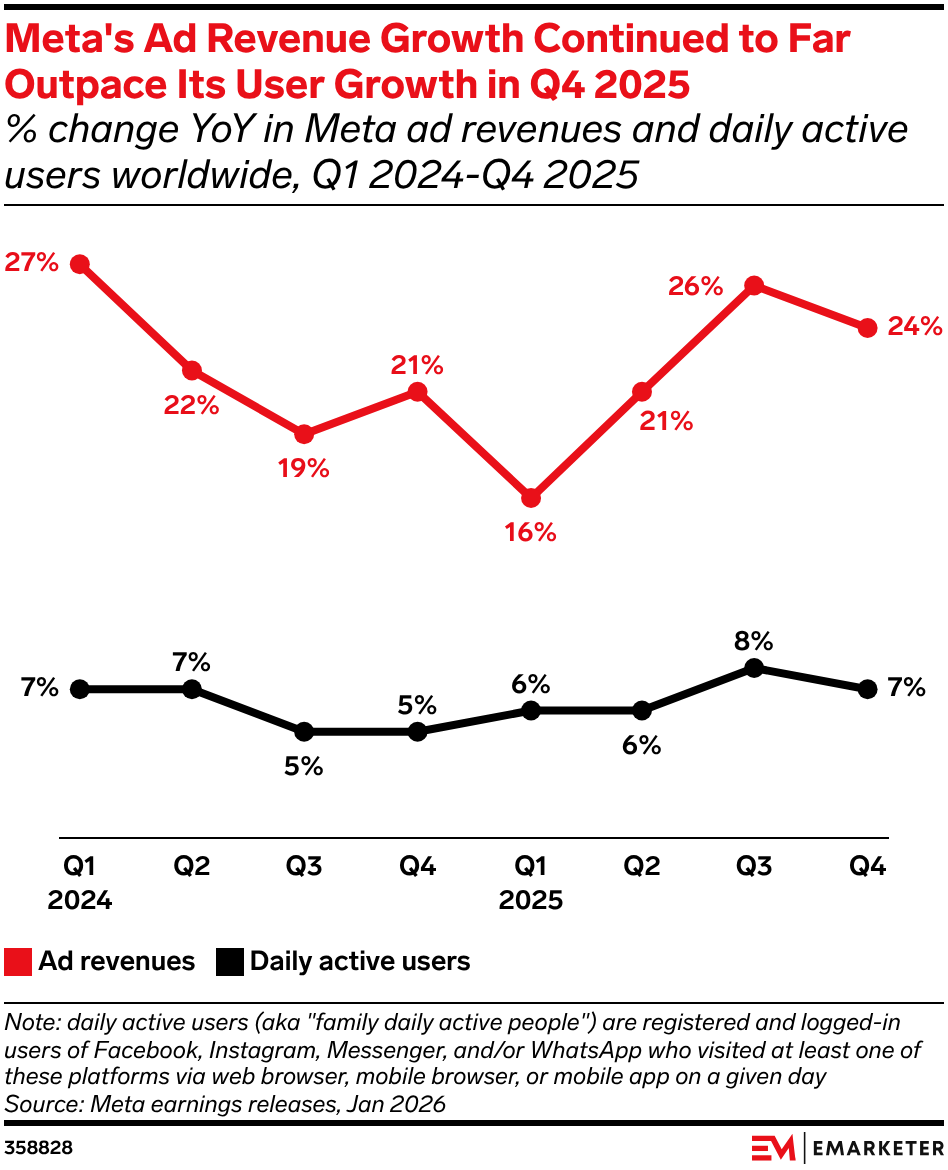

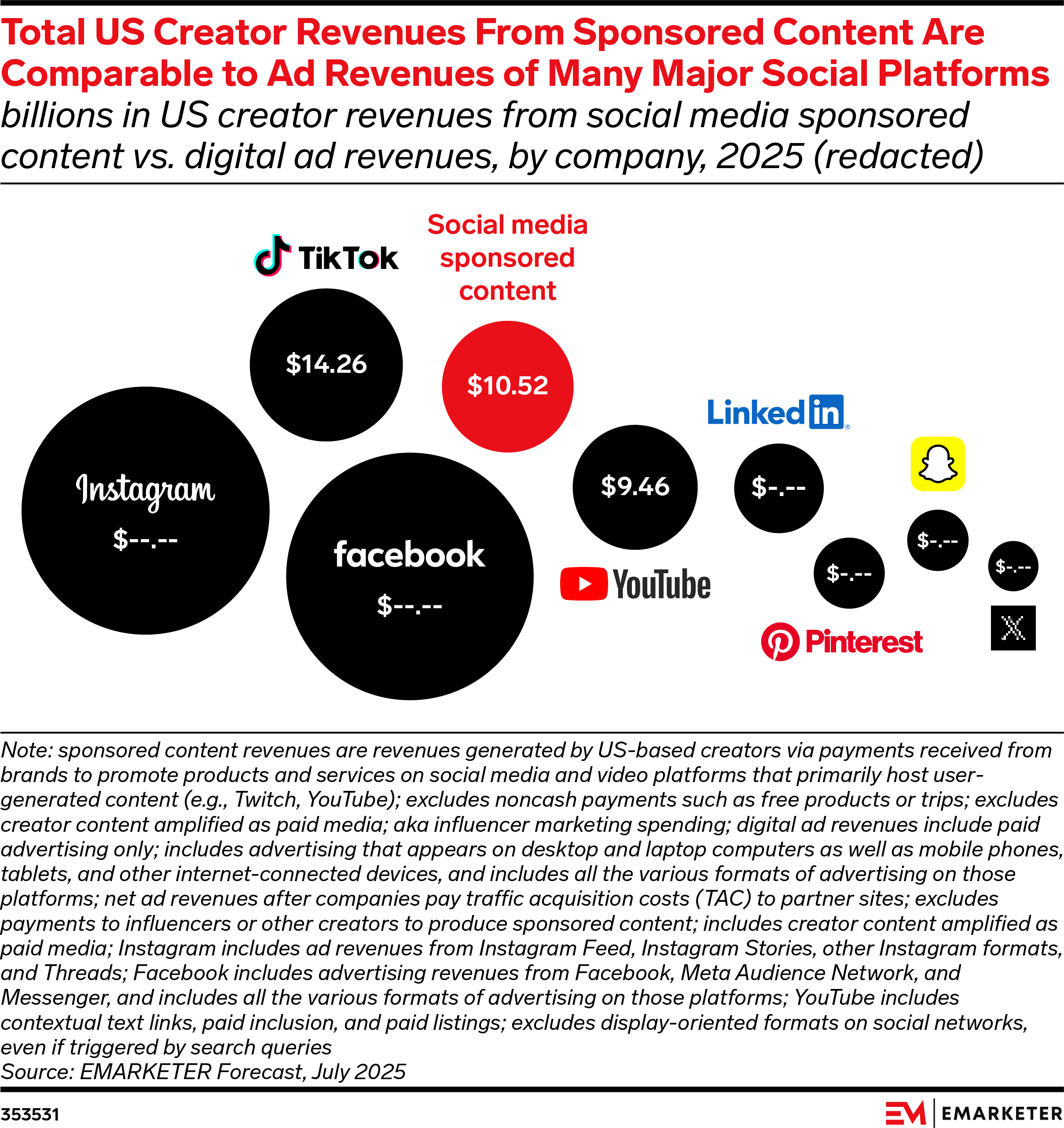

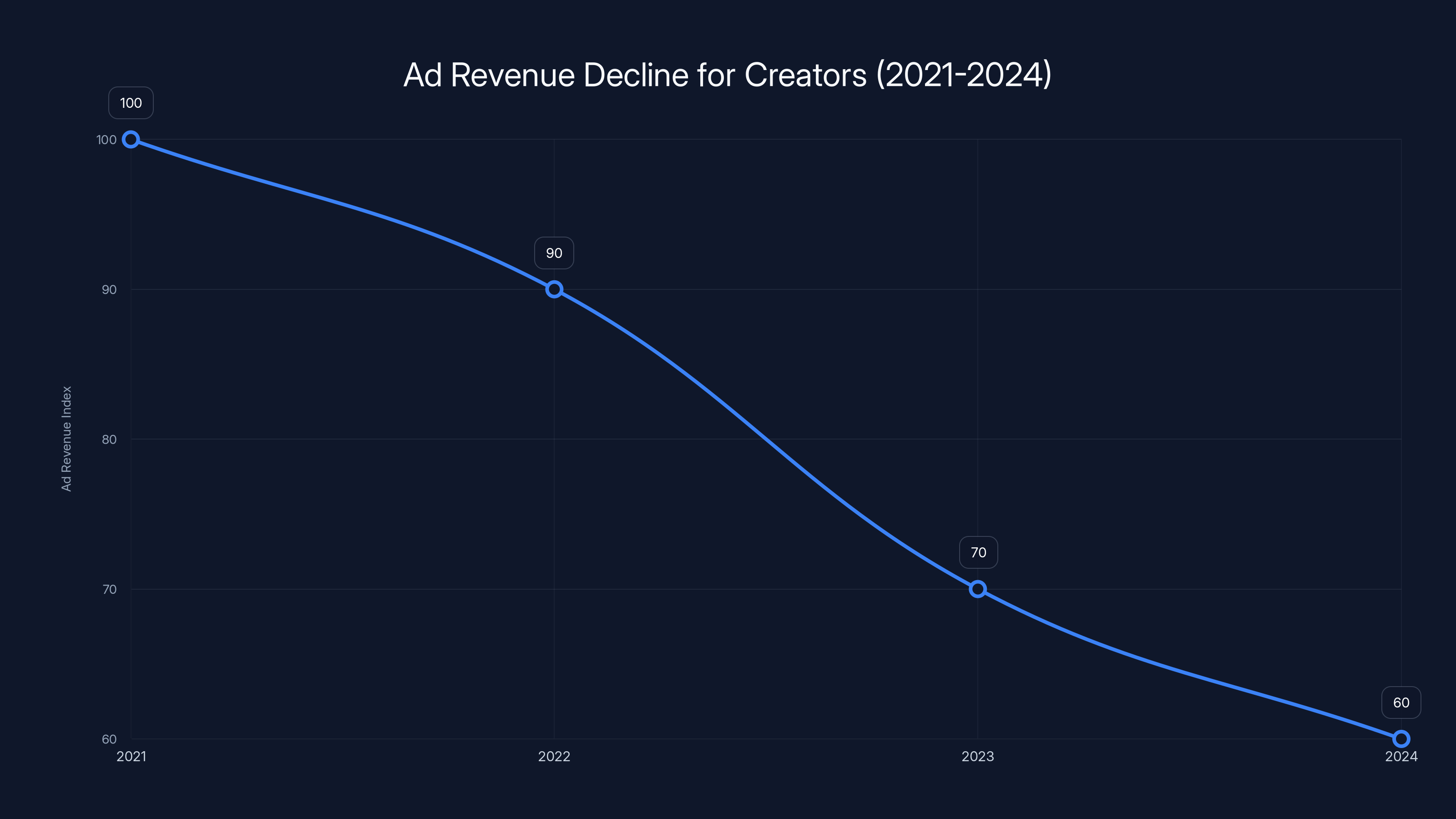

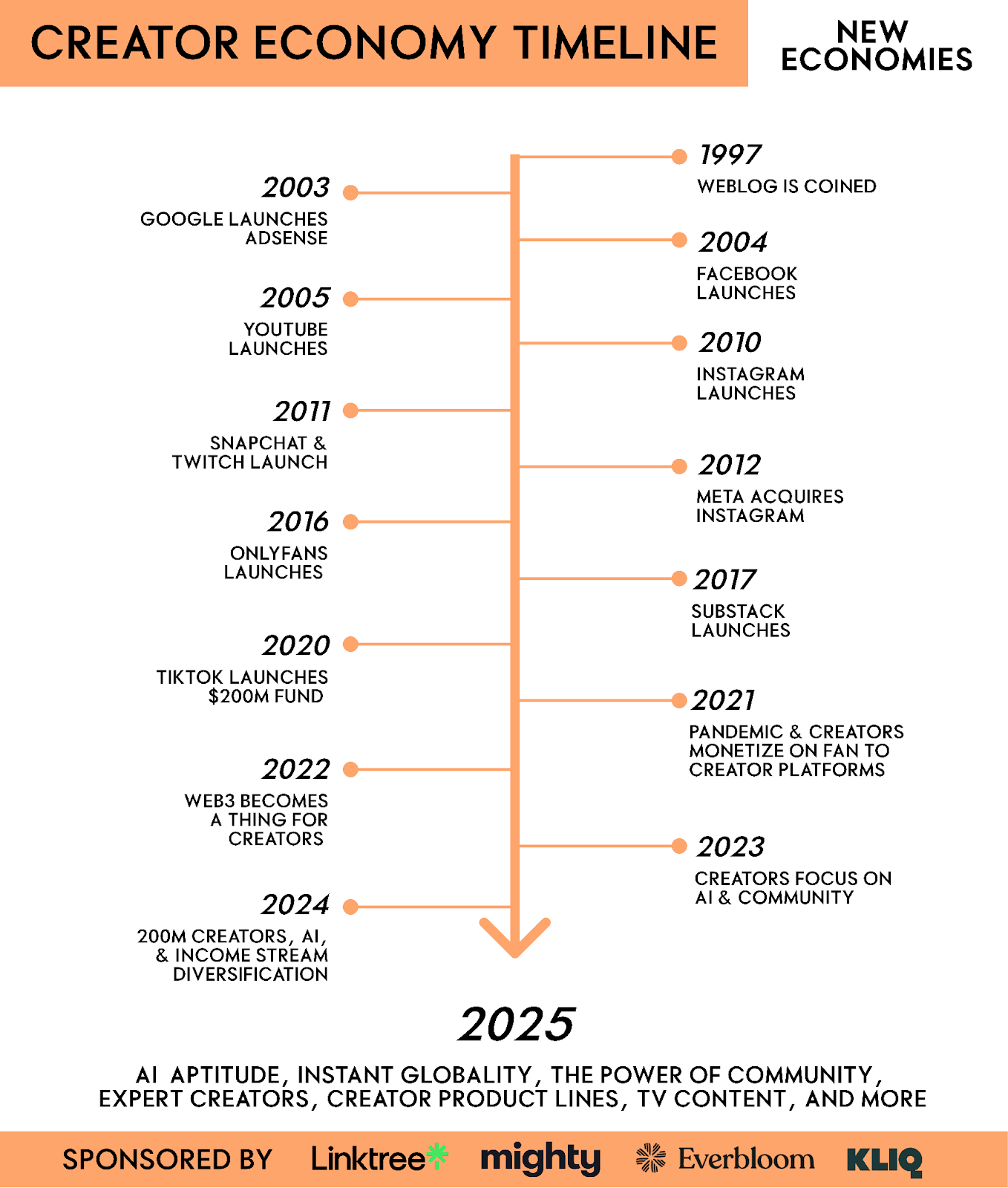

Something fundamental shifted in the creator economy around 2023, and most people didn't notice. Ad revenue, once the golden ticket for anyone with a camera and persistence, stopped being enough. YouTubers started talking about it casually in interviews. Podcast hosts mentioned it in passing. TikTok creators called it out directly. Then came the proof that this wasn't just whining about algorithm changes—it was a structural problem.

MrBeast, arguably the world's most successful creator by traditional metrics, did something that stopped industry watchers cold. His company acquired Step, a fintech startup targeting teenagers. Not as some vanity project. As a genuine business acquisition where the fintech arm now generates more revenue than his media empire. Let that sink in. The creator famous for spending $100,000 to give away money on YouTube decided his actual money came from something else entirely. According to CNBC, this acquisition was a strategic move to diversify revenue streams.

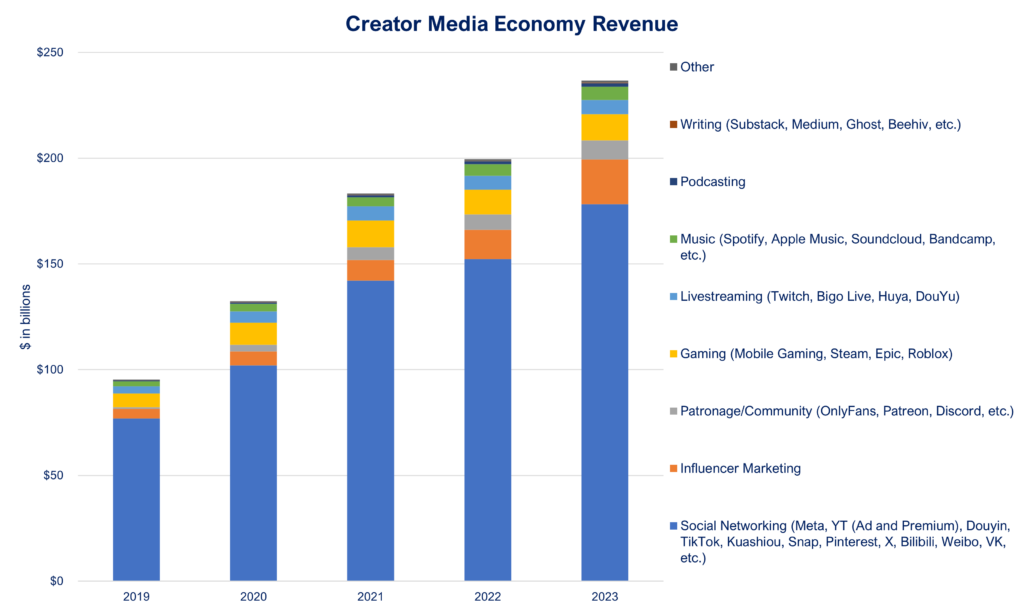

This isn't an outlier story. It's the new template. Creators with serious audiences are launching product lines, starting subscription services, acquiring startups, investing in property, building apps, launching educational platforms, and creating their own merchandise ecosystems. The common thread isn't necessarily genius business acumen. It's desperation masquerading as diversification.

The math doesn't work anymore. A creator with 10 million subscribers might pull in

But here's where it gets interesting. The diversification strategy works for the top 0.1% of creators. The genuinely difficult question that nobody wants to answer is whether it scales down. Can a creator with 500,000 subscribers build a fintech company? Can a mid-tier podcaster launch a successful product line? The honest answer is probably not at the same margin or speed. This creates a two-tiered creator economy where mega-creators get richer through leverage and diversification while mid-tier creators face a slow squeeze on multiple fronts.

The platforms know this. They're terrified of it. Because the creator economy is their legitimacy. If creators can't make money, the whole ecosystem collapses. YouTube, TikTok, Instagram, and emerging platforms need creators more than creators need them. But they've spent so long extracting value that they've trained creators to look elsewhere for real income.

Why Ad Revenue Became Unstable

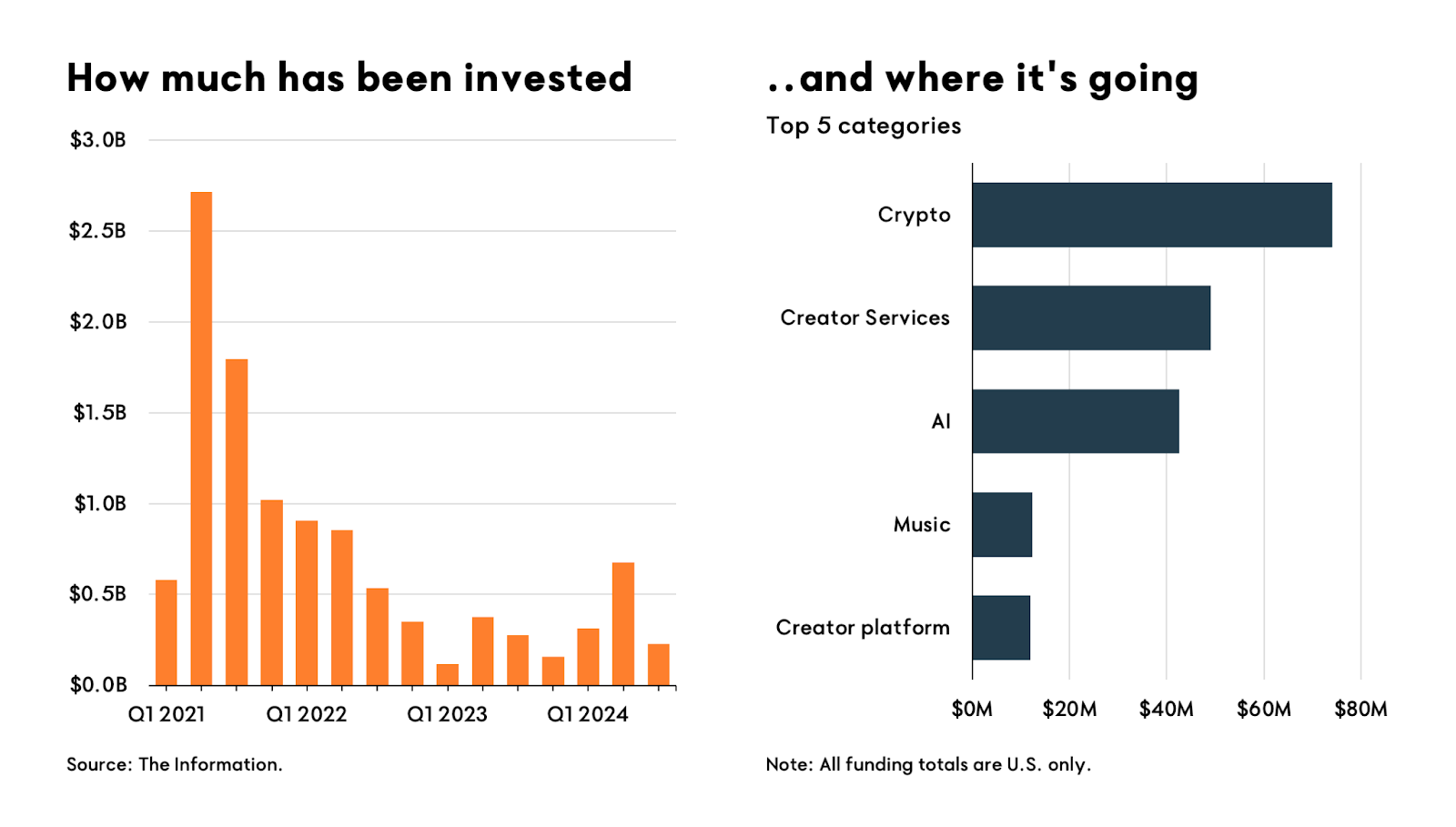

Advertising has always been fragile. But around 2022-2023, the fragility turned into structural collapse for most creators. Understanding why requires looking at three separate, reinforcing trends that hit simultaneously.

First, the economic downturn. When GDP growth slows, corporations cut marketing budgets. Not proportionally. They usually cut more aggressively than revenue drops because executives get nervous and overcorrect. Advertising budgets are first on the chopping block because they're not as obviously tied to survival as product development or customer service. Between 2022 and 2024, major advertisers reduced digital ad spending or flat-lined it despite inflation. This directly crushes CPM rates—the amount advertisers pay per thousand impressions. According to CRFB, fiscal crises often lead to drastic cuts in marketing budgets.

Second, AI changed the game. Not in some distant future way, but immediately. Generative AI could produce short-form video content that looked almost real by late 2023. It could write scripts, generate thumbnails, even create voiceovers. Suddenly, creating content became cheaper. If a brand can generate decent short-form video content for

Third, and most underestimated, the platform algorithmic shift toward engagement over audience size. YouTube and TikTok stopped purely prioritizing subscriber count and started pushing for watch time and engagement. This meant a creator with 1 million highly engaged subscribers actually started outearning a creator with 5 million partially-engaged subscribers. This sounds logical, but it broke the old playbook where you could build massive audiences and coast on ad revenue. Now you needed constant optimization. The bar for entry kept rising while the payout kept falling.

Add these together and you get creators earning 30-60% less from ads than three years prior, even with identical or larger audiences. Some niches got hit harder than others. Finance, technology, and self-improvement creators got crushed because those sectors are where advertisers tightened budgets most. Gaming and entertainment creators held up slightly better because entertainment ad spending proved more resilient.

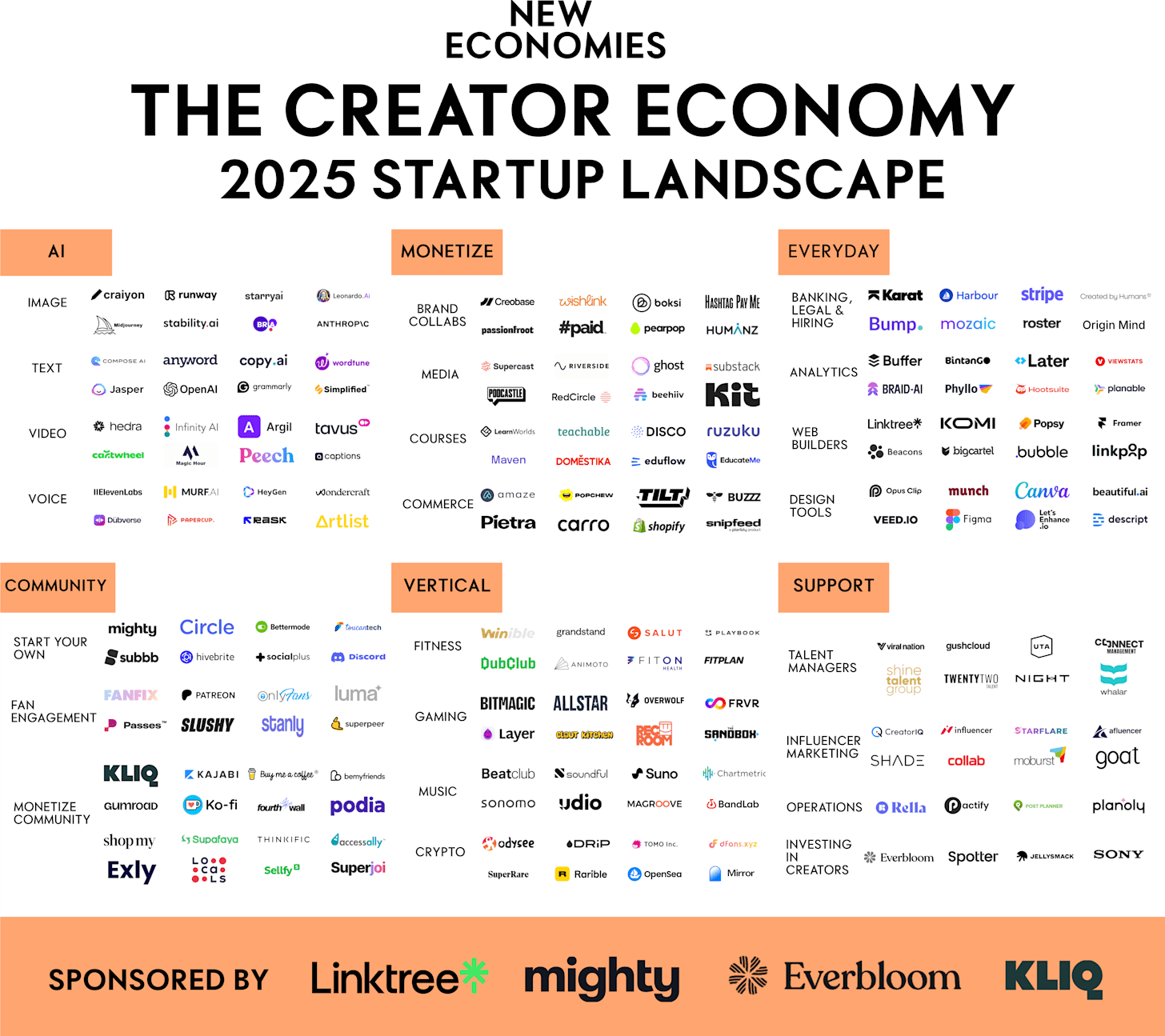

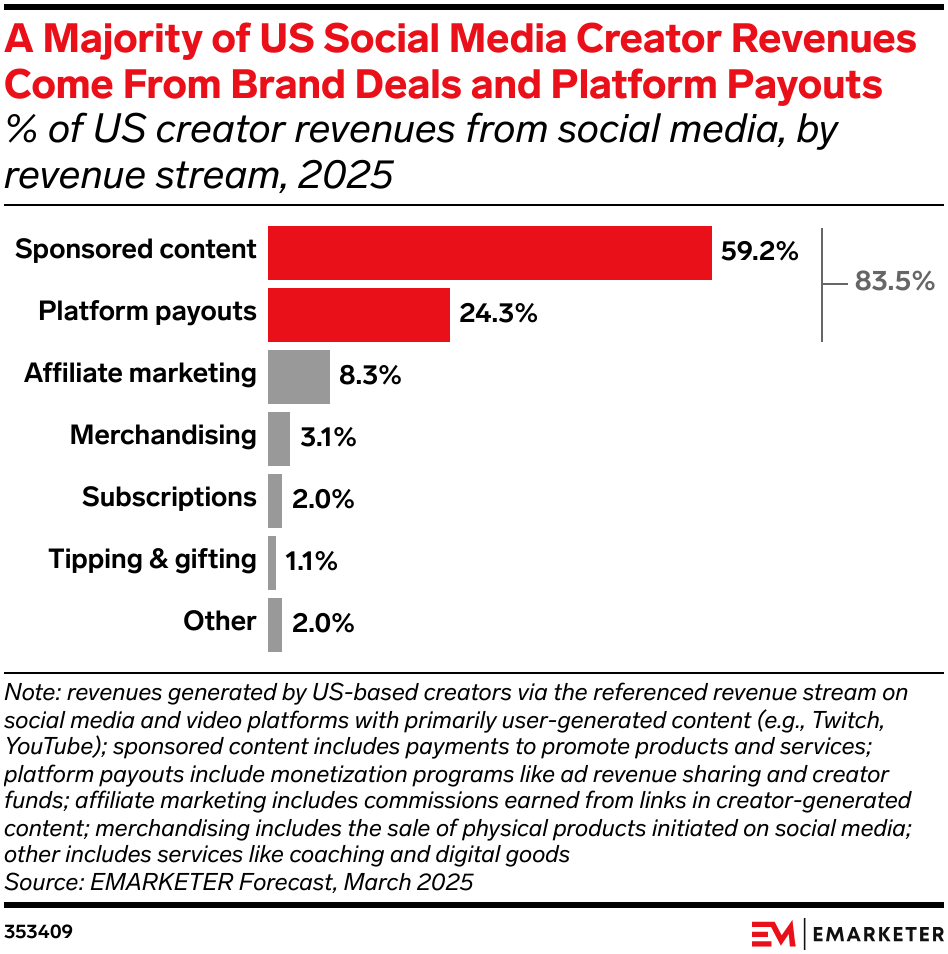

The response has been swift and rational. Creators looked at the math, realized it wasn't working, and started building direct-to-consumer businesses. Merchandise, digital products, community platforms, cohort-based courses, subscription tiers, consulting, and yes, fintech acquisitions. Anything that doesn't depend on the platform's ability or willingness to pay them.

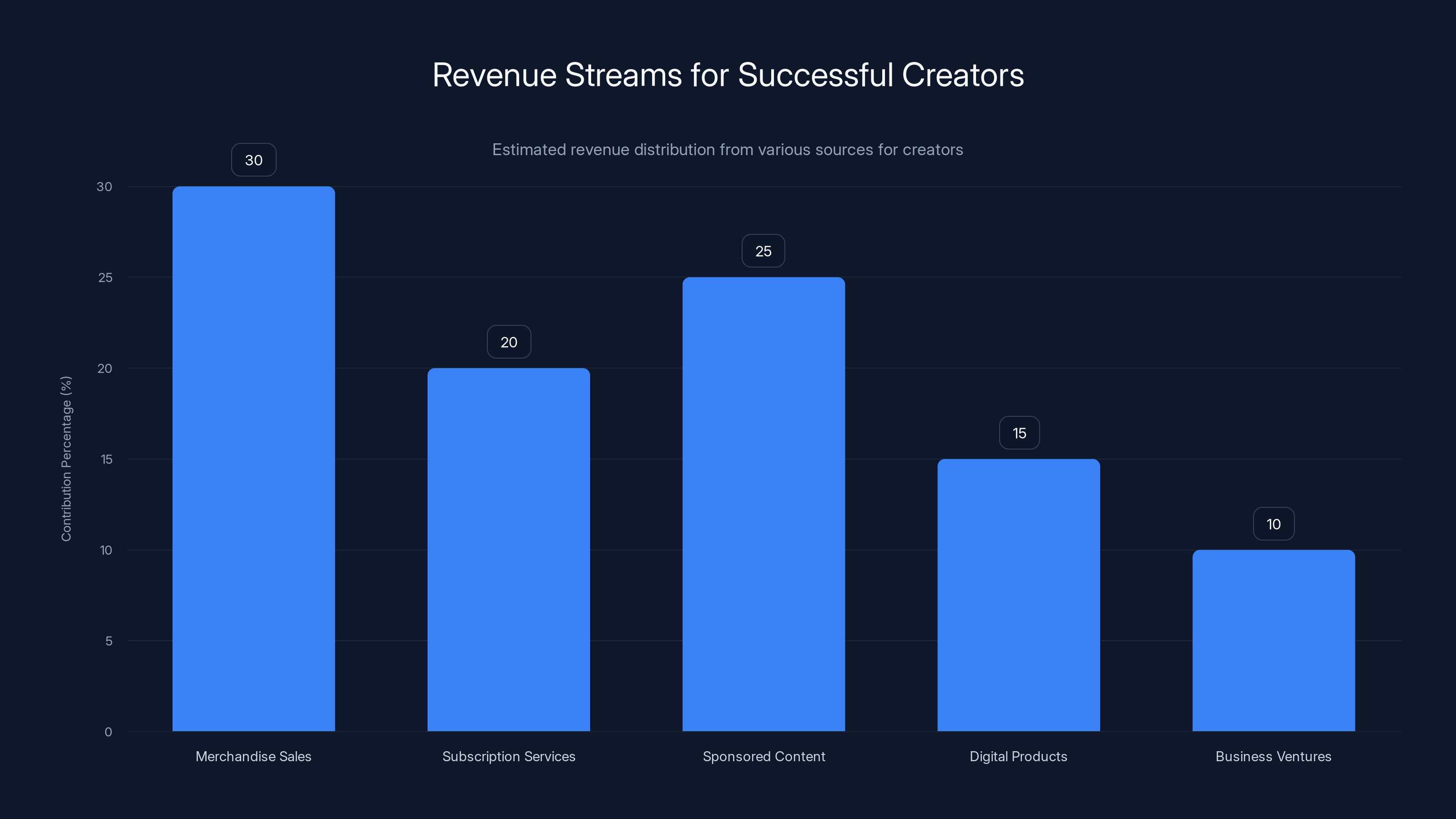

Successful creators diversify income through multiple streams, with merchandise and sponsorships being significant contributors. Estimated data.

The Mr Beast Model: Acquisition as Revenue Strategy

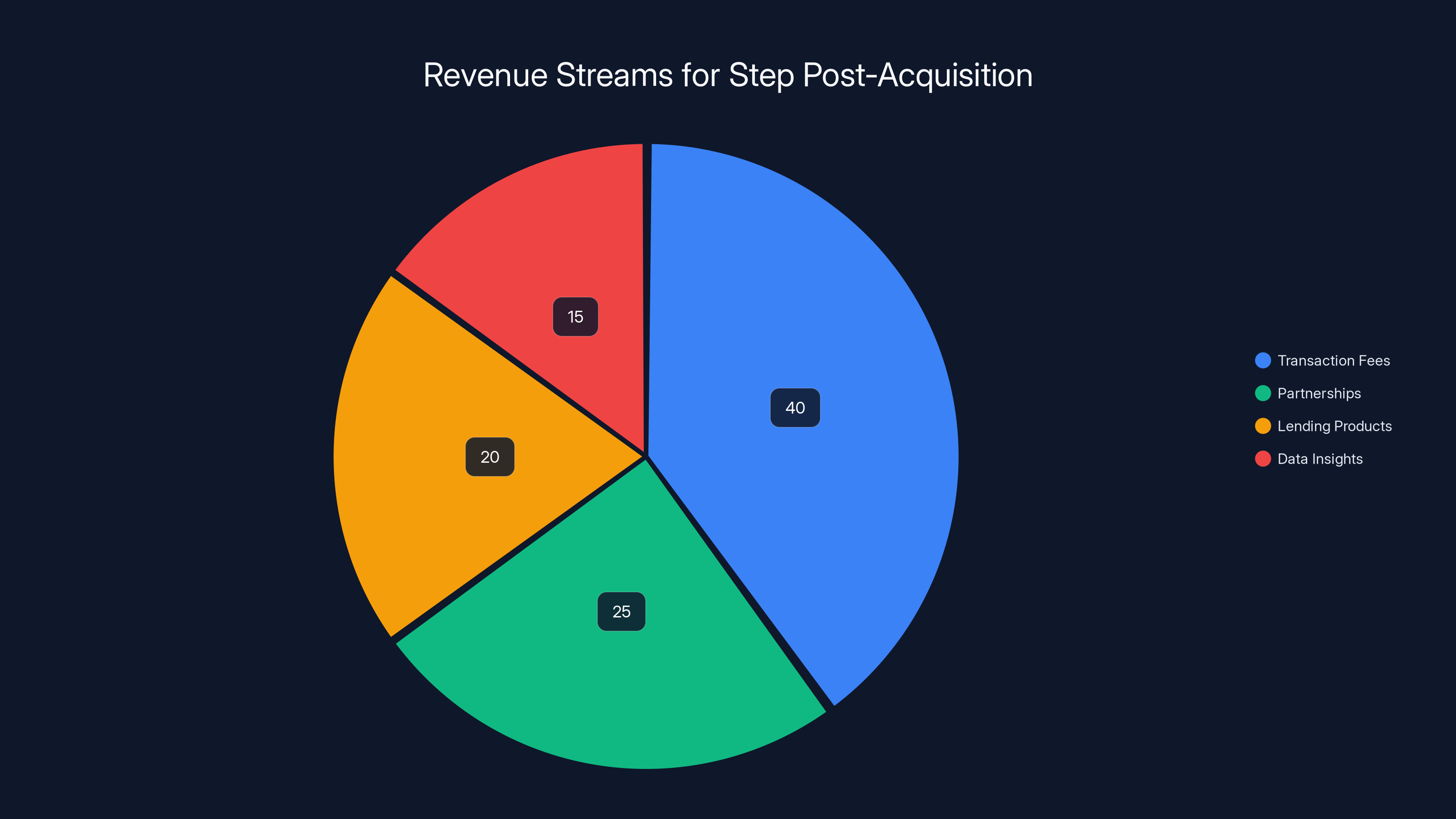

MrBeast's acquisition of Step wasn't just strategic. It was prophetic. It showed that the most valuable resource a creator has isn't their audience—it's the trust and distribution network their audience represents. A creator with 200 million YouTube subscribers can introduce a financial product to people who actually know them and trust them more than they trust most financial institutions. That's extraordinary leverage.

Step itself was struggling pre-acquisition. A fintech app targeting Gen Z teenagers was fighting for adoption in a crowded market. The product was fine. The marketing problem was brutal. Banks, established fintech apps, and alternatives were everywhere. Then MrBeast's audience knew about it. And not because of banner ads. Because they watched MrBeast use it, talk about it, and normalize it as something trustworthy.

The revenue model for Step isn't complicated, but it's diverse. Transaction fees from users, partnerships with financial institutions, potential lending products, and data insights are all on the table. MrBeast's company now owns a piece of a business that generates recurring revenue from a user base that naturally expands as his audience grows.

But here's the critical part everyone misses: this only works if you have enormous audience trust. A creator with 1 million subscribers but mediocre engagement wouldn't pull this off. The audience has to trust you implicitly. MrBeast spent years building the perception that he was generous, honest, and genuinely excited by the things he promoted. That capital allowed him to move into fintech without his audience immediately assuming he was just grifting.

His chocolate business, Feastables, operates on a different playbook. It's pure consumer packaged goods. Create a product, use distribution network to get initial traction, then move into traditional retail. The margins on candy are reasonable but not exceptional—usually 40-50% gross margin for a decent brand. But distribution is the hard part. Most CPG brands spend 40-60% of revenue on marketing just to get shelf space and awareness. MrBeast gets distribution for free because his audience is already aware and predisposed to buy.

The financial results are telling. His reports suggest Feastables is tracking toward

However—and this is crucial—this model doesn't scale down. A creator with 10 million subscribers probably can't pull off either acquisition or CPG success at similar speed. The leverage works best at the top. As you go down the creator hierarchy, the advantages diminish exponentially.

Estimated data shows that transaction fees are the largest revenue source for Step, followed by partnerships and lending products. MrBeast's influence likely boosts these streams.

The Merch Game: Scaling Direct-to-Consumer

If the MrBeast approach is 1% strategy, merchandise is the 10-40% solution. It doesn't require raising capital, acquiring companies, or building complex financial products. You slap your name on a t-shirt and sell it to your audience. The margins are real because you're not paying platform fees.

The typical merch business works like this: a creator partners with a fulfillment company like Printful or Teespring. They design a shirt, mug, or hoodie. The creator controls pricing, keeps the margin (usually 20-40% depending on the product), and the fulfillment company handles everything else. No inventory risk, no shipping headaches, pure upside.

For a mid-tier creator with 500,000 engaged followers, selling 10,000 hoodies at

But the merch market got saturated around 2021-2022. Every creator with a following started selling merch. Quality suffered. Audiences got tired of seeing the same low-effort designs. Fulfillment quality became inconsistent. Returns and complaints increased. The market matured into something more competitive.

Successful creators started treating merch like actual brand building rather than a cash grab. They designed higher-quality products. They limited drops to create scarcity. They told stories around products. They tied designs to content moments. They created collectible lines. The winners in merch right now are creators who treat it as brand extension, not just revenue extraction.

The economics still work. But the work got harder. A creator launching merch today needs to understand margins, logistics, brand positioning, inventory management, and customer service. It's not passive income. It's a real business.

Subscription and Membership Models: Recurring Revenue

Patreon, membership features on YouTube, and platform-specific subscriptions changed the revenue conversation. Suddenly, creators could ask audiences directly for money in exchange for exclusive content, early access, or community access. No algorithm. No advertiser whims. Direct exchange of value.

The numbers are compelling for creators who build true community. A creator with 1 million subscribers might get 10,000 paying members at

But again, this scales with community strength, not just audience size. A creator with 5 million subscribers and weak community might make less from subscriptions than a creator with 500,000 highly engaged followers. The model requires building genuine community, not just broadcast audience.

Cohort-based courses take this further. A creator launches an 8-week course at

Where this model excels is in niches with professional development value: writing, design, business, marketing, tech skills. Where it struggles is entertainment niches, where the relationship is one-way and monetization feels awkward.

Estimated data shows that hoodies typically offer the highest profit margin for creators, making them a lucrative merchandise option.

The Scaling Problem: Why Mid-Tier Creators Are Squeezed

Here's the uncomfortable truth nobody wants to discuss publicly. The diversification strategies that work at scale don't translate to mid-tier creators. A creator with 500,000 followers can't realistically acquire a startup or launch a viable fintech company. The operational complexity, capital requirements, and business risk are too high.

But a creator with 500,000 followers also can't rely on ad revenue anymore. They're stuck in a squeeze where the old model is broken and the new models don't quite fit.

Let's model the economics. A creator with 500,000 subscribers getting 50 million annual views might earn

If this creator adds merchandise, optimistically they move

That's workable. That's a real business. But notice what it required: building merchandise infrastructure, building community, creating subscription-exclusive content, and maintaining ad revenue simultaneously. It's not easier. It's harder. It requires business skills that content creation doesn't teach.

Meanwhile, a top creator with 50 million subscribers is pulling

India's AI Ambitions: The New Frontier

While the creator economy was imploding in developed markets, India was laying groundwork for something different. India's government and tech sector started aggressively positioning the country as an AI powerhouse. This isn't about individual creators. This is about building AI infrastructure at national scale.

India's AI Impact Summit in 2024-2025 wasn't ceremonial. It represented serious capital and policy focus. The government recognized that AI would define economic power in the next decade, and India was determined not to be left behind. With a population of 1.4 billion and a massive software engineering workforce, India had advantages others lacked.

The key claim being made by Indian tech leaders is staggering: AI could contribute

NASSCOM, India's tech industry association, wasn't being reckless with this estimate. They modeled it based on AI applications in manufacturing, healthcare, finance, education, agriculture, and creative services. India's agricultural sector alone, which employs 40% of the workforce, could see massive productivity gains from AI-driven precision farming, pest prediction, and crop optimization.

Healthcare is another massive opportunity. India has a severe doctor shortage relative to population. AI diagnostic tools, telemedicine platforms, and predictive health monitoring could provide healthcare access to hundreds of millions who currently have little to none. The economic value of that alone is enormous.

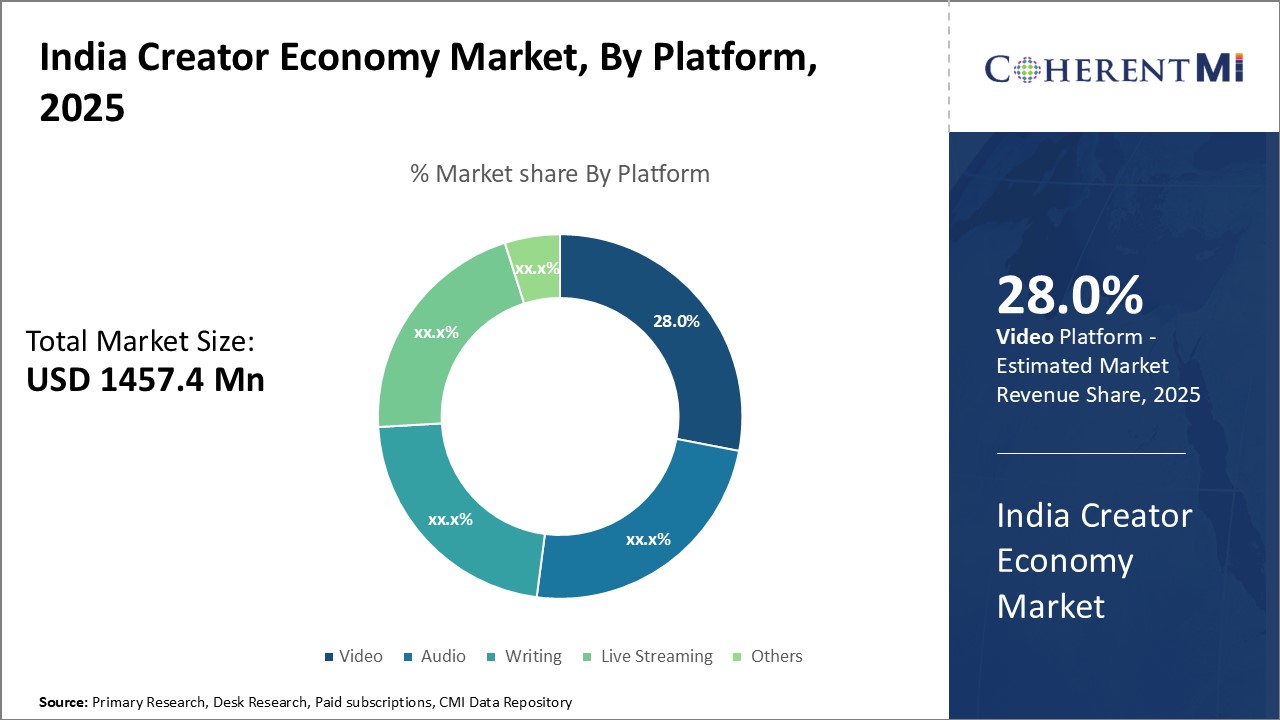

Where India's ambitions get really interesting is in creative services and content creation. India has already become the world's largest consumer of online video content. YouTube's biggest market by watch hours is India. But India hasn't captured the creator economy upside because creators elsewhere built audiences first. AI changes this dynamic.

With AI tools, Indian creators can produce content faster and more cheaply. With AI translation and voiceover, content created in Hindi, Tamil, Bengali, and other Indian languages can reach global audiences. AI-powered personalization means Indian platforms can compete with YouTube on relevance. This could democratize creator success in ways that benefit millions of Indian creators who currently lack the resources for professional production.

Estimated data shows a decline in ad revenue for creators from 2021 to 2024, driven by economic downturns, AI advancements, and algorithm changes.

The National AI Strategy: Government and Private Sector Alignment

India's approach to AI differs fundamentally from the US and EU approaches. America is letting markets decide. Europe is regulating heavily. India is trying to get its entire government and private sector aligned toward a common goal.

The Modi government positioned AI as a key pillar of the National Development Plan. Massive investments in computing infrastructure, AI research institutions, and startup funding were announced. The government is trying to build the institutional capacity to compete with Silicon Valley and Beijing as an AI innovation center.

This isn't just about building better AI models, though that's part of it. India is trying to become a platform for AI deployment. Western companies have massive AI capabilities but limited deployment infrastructure in India. Indian companies understand the market but have historically lagged in AI development. The strategy is to bridge that gap and position India as the place where AI gets deployed at scale across manufacturing, agriculture, healthcare, education, and services.

Private sector tech giants—TCS, Infosys, Wipro, and newer companies—are rapidly building AI practices. They're hiring AI engineers aggressively, setting up research labs, and acquiring AI startups. The government is encouraging this with favorable tax treatment and regulatory clarity.

Where this gets politically interesting is China. India sees AI capability as a strategic necessity partly because of geopolitical competition with China. China has invested heavily in AI and is moving faster in some areas like surveillance and facial recognition. India's AI ambitions partly reflect concern about being left behind strategically.

AI-Powered Content Creation: Implications for Creators

India's AI ambitions have direct implications for the global creator economy. Better, cheaper AI tools for content creation will democratize production. A creator in rural India could use AI to generate scripts, edit video, create voiceovers, design graphics, and optimize for different platforms without hiring a team.

But here's the tension: if content creation tools get free or cheap enough, does creator differentiation collapse? If everyone can produce Netflix-quality content using AI, why does audience loyalty matter?

The answer is probably that audience loyalty becomes even more important. Content gets easier to produce but harder to stand out in. Human connection, authentic personality, and genuine perspective become rarer and more valuable. The creators who build real community around authentic voice will thrive. The creators trying to hustle quick views with optimization tricks will struggle even more.

India's AI push could actually help democratize creator success if tools proliferate. But it could also cannibalize lower-quality creator income even faster as AI-generated content floods platforms. The net effect probably depends on how aggressively AI is deployed and whether platforms actively differentiate human-created content or treat it identically to AI-generated content.

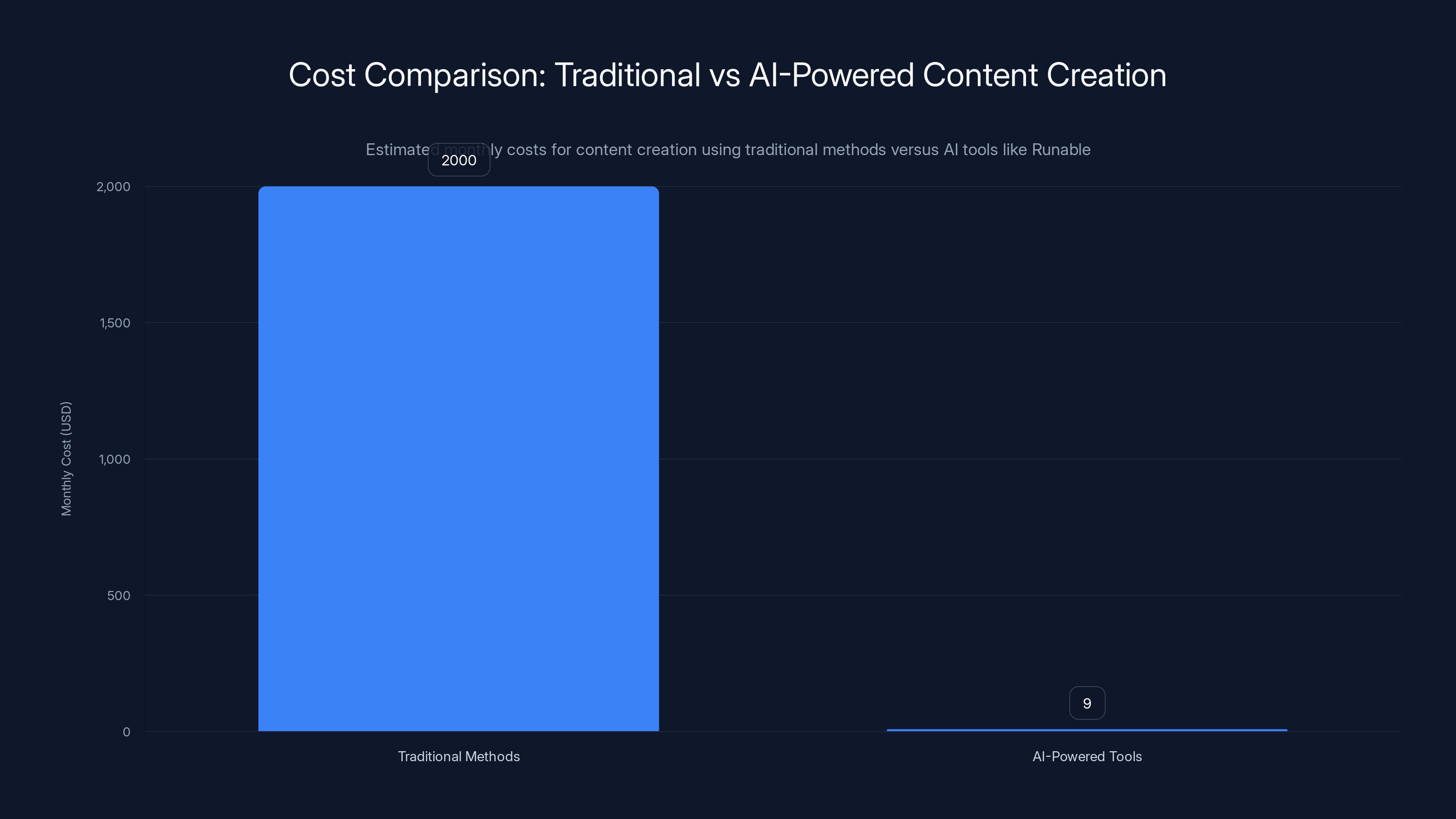

Using AI-powered tools like Runable significantly reduces content creation costs from an estimated

The Convergence: India's AI Boom Meeting Creator Economy Evolution

There's an interesting intersection here. As India builds AI infrastructure and capability, it creates tools that could reshape the creator economy globally. Indian startups could build the next generation of content creation tools. Indian platforms could deploy AI in new ways that western platforms haven't explored. Indian creators could benefit from infrastructure that gives them parity with western creators.

Alternatively, cheap AI tools could further devalue creator income as content proliferates and CPM rates compress further globally. The irony would be dark: India invests in AI to create economic value, but part of that value comes from making creator livelihoods less sustainable.

Most likely, we'll see both. Top-tier creators will leverage AI tools to become more productive and build larger businesses. Mid-tier creators will see increased pressure as supply of content increases. New creators will find it easier to get started but harder to breakthrough. The stratification in the creator economy will likely accelerate.

Content Authenticity in the Age of AI

As AI becomes ubiquitous in content creation, authenticity becomes paradoxically more valuable. Audiences can sense when content feels manufactured. They've developed sophisticated BS detectors for overly polished, algorithm-optimized content. The creator who posts raw, unedited clips from their life often outperforms the creator with perfectly produced content.

This creates a new category of creative advantage. It's not about production quality anymore. It's about genuine perspective, humor, vulnerability, or unique knowledge. The things AI can't easily replicate are precisely the things audiences increasingly value.

But this shift has implications for the mid-tier creator squeeze. If authenticity is the new premium, then building authentic community requires time and consistency. You can't short-circuit it with better editing or production. This favors older creators who have built real relationships and penalizes newer creators trying to maximize growth quickly.

Building Sustainable Creator Businesses

The creators who are thriving right now share some common characteristics, regardless of niche or audience size. First, they're diversified. They don't depend on any single revenue stream. Second, they're building community rather than just audience. Third, they're thinking like business operators, not just content creators. Fourth, they're willing to experiment and fail on new platforms and formats.

The most sustainable creator businesses right now combine several revenue streams: ads (still valuable for scale), direct sales (merch, products, digital goods), subscriptions (Patreon, YouTube membership), sponsorships (not algorithmic, relationship-based), affiliate marketing (recommending products they actually use), and potentially their own app or platform (for top-tier creators).

This is work. It requires skills in marketing, product development, community management, financial analysis, and business operations. It's not just content creation anymore. It's entrepreneurship that happens to be built on a content foundation.

Creators who stay creators—meaning they focus purely on content and try to live off ads—are likely to face continuous pressure. Creators who become operator-entrepreneurs, using their audience as leverage for business ventures, are building real, sustainable enterprises.

The Global Opportunity for Indian Creators

India's AI ambitions aren't just national. They're global. Indian tech companies are building AI tools that will be used worldwide. Indian creators, equipped with these tools, could theoretically compete globally on par with creators from developed markets for the first time.

The barrier was never talent. India has extraordinary creative talent. The barrier was access to production tools, capital, and global distribution infrastructure. AI tools reduce the production barrier. YouTube and TikTok provide distribution. What's missing is capital and knowledge about building sustainable creator businesses.

This is actually where Runable and similar platforms create real opportunity. Automation platforms that let creators focus on creative work rather than production logistics, documentation, and administrative overhead could democratize creator success. A creator anywhere with internet access could use AI-powered tools to generate presentations, documents, reports, and multimedia assets that previously required hiring expensive teams.

For Indian creators specifically, this could be transformative. The cost structure for building creator businesses drops substantially when you're not paying Silicon Valley rates for outsourced production. An Indian creator could use Runable to automatically generate weekly reports, documentation, or presentation materials, freeing time for actual creative work. At just $9/month, the cost is negligible compared to hiring even junior production staff.

Scenario: A creator with 500,000 followers wants to launch an educational platform. They need to generate course materials, transcripts, summaries, and documentation. Using traditional methods, this requires hiring writers and editors. Using AI-powered automation, they generate initial drafts in minutes, edit for quality, and ship. The time savings alone could be 20-30 hours per course, which translates directly to faster launches and more courses per year.

Use Case: Create AI-powered course materials, documentation, and reports automatically while focusing on content creation and audience building.

Try Runable For Free

The Future of Creator Economics

The creator economy in 2025-2030 will look substantially different from the YouTube-era boom of 2015-2020. Ad-dependent creators will be less common. Diversified creator-entrepreneurs will be more common. The stratification between mega-creators and everyone else will be more extreme. But simultaneously, better tools and platforms will make it easier for new creators to get started.

The opportunity exists for creators who treat their audience as the foundation for multiple businesses rather than just a source of ad revenue. For creators in markets like India with lower cost structures and growing digital adoption, the opportunity is particularly large. The constraint isn't talent or audience availability. It's execution and business acumen.

India's AI ambitions matter in this context because better tools could level the playing field. A creator in Chennai could have equivalent production capability to a creator in Los Angeles if they have access to the same AI tools and platforms. That's genuinely new.

The creators who will thrive are those who combine creative talent with entrepreneurial thinking. They'll use AI to augment their productivity. They'll build community authentically. They'll diversify revenue streams ruthlessly. They'll think about unit economics and sustainable growth rather than chasing viral moments.

The ad revenue problem forced this evolution. The creator economy is becoming more sophisticated, more challenging, and more rewarding for people who can execute as operators. It's also becoming less accessible for people who just want to make videos and get paid. That's the trade-off of maturation.

FAQ

Why is ad revenue declining for creators?

Ad revenue per thousand impressions (CPM rates) has fallen 30-60% since 2020 due to economic slowdowns reducing advertiser budgets, increased content supply from AI and new creators flooding platforms, algorithm changes prioritizing engagement over audience size, and advertiser risk aversion pulling budgets from certain categories like finance and tech. Simultaneously, platform cuts have increased, leaving creators with substantially less per view than historical rates.

How do successful creators diversify beyond ads?

Successful creators typically build multiple revenue streams including direct merchandise sales (typically 20-40% margins through fulfillment partners), subscription services like Patreon or platform memberships (recurring revenue with 10-30% platform cuts), sponsored content and brand deals (relationship-based, not algorithmic), digital products and courses (high margin, one-time work), and for top creators, acquiring or building complementary businesses like MrBeast's fintech and chocolate ventures. The key is that diversification requires building genuine community and trust first.

Can mid-tier creators scale the MrBeast model of business acquisitions?

Unfortunately, the mega-creator acquisition model doesn't scale down effectively. MrBeast's strategy works because he has enormous audience trust, 200+ million subscribers for distribution, and access to capital for acquisitions. A creator with 500,000 subscribers lacks the distribution advantage and would struggle to raise capital or execute an acquisition. Mid-tier creators typically focus on merchandise, courses, and subscription models instead, which require less capital but more operational overhead.

What is India's strategy for AI and how does it affect creators?

India is positioning itself as a global AI hub, with government backing, infrastructure investment, and private sector alignment to make AI a key economic driver. NASSCOM projects AI could contribute $967 billion to the Indian economy by 2035. For creators, this means cheaper and better AI tools for content production could emerge from India, potentially democratizing production capabilities globally. However, cheaper tools also increase content supply, which could compress creator income further unless creators focus on authentic differentiation.

How does AI-powered automation help creators?

AI automation tools like Runable help creators by automatically generating supporting materials like documentation, reports, presentations, and transcripts, reducing the time spent on non-creative work. For a creator launching courses or educational content, AI can generate initial course materials and summaries in minutes rather than hours, freeing time for actual creative work. The cost of these tools—often under $10/month—is negligible compared to hiring production staff, making them particularly valuable for mid-tier creators operating on limited budgets.

What is the realistic income potential for mid-tier creators in 2025?

A creator with 500,000 engaged subscribers pursuing diversified revenue (ads, merchandise, subscriptions, sponsorships) could realistically generate

Should new creators still pursue YouTube and content platforms in 2025?

Yes, but with different expectations. Platforms remain valuable for building audience and authority, but they should be viewed as distribution channels for multiple businesses rather than direct income sources. New creators should treat initial success as building audience capital that enables future monetization through products, services, community, or other businesses. The YouTube channel becomes a foundation rather than a primary business.

What skills do creators need to succeed in the diversified economy?

Beyond content creation, successful creators in 2025 need basic business skills: financial analysis (understanding margins and unit economics), product management (building offerings customers want), community building (creating genuine loyalty), marketing (beyond just the algorithm), and operation execution (shipping consistently). These aren't natural extensions of creative talent, which is why many creators struggle with diversification despite having the audience foundation to succeed.

Conclusion

The creator economy's ad revenue crisis isn't a temporary correction. It's a structural shift that's forcing the entire ecosystem to mature. Creators can no longer treat content production as their primary business and expect sustainability. They must become entrepreneurs who produce content as a foundation for multiple revenue streams.

MrBeast's acquisition of Step isn't an anomaly. It's a signal. The most valuable creators aren't those with the biggest audiences but those with the most trust and demonstrated ability to execute business ventures. This shift has opened opportunities for newer, more business-oriented creators while squeezing traditional content-first creators.

Simultaneously, India's aggressive AI ambitions create a wild card. If India successfully builds and exports AI content creation tools, it could democratize production capabilities globally. Creators everywhere could access tools that previously required hiring expensive teams. This could expand the addressable creator economy while simultaneously compressing margins through increased supply.

The path forward for creators is clear even if it's uncomfortable: build community authentically, diversify revenue ruthlessly, develop business acumen, and leverage technology to augment your productivity. Tools like Runable, with its AI-powered automation starting at just $9/month, can reduce operational overhead so creators focus on the work that actually builds sustainable businesses. The creators who combine creative talent with entrepreneurial execution will thrive. The rest will face continuous pressure to evolve or exit.

India's AI boom isn't separate from the creator economy's challenges. It's the same macro force—automation and AI—reshaping economic value. The question for every creator isn't whether to adapt. It's how quickly they can.

Use Case: Automate weekly reports, documentation generation, and content summaries so you can spend more time building your actual business.

Try Runable For Free

Key Takeaways

- Creator ad revenue has declined 30-60% since 2020, making diversification essential rather than optional for sustainable income.

- Top creators are acquiring startups, launching CPG brands, and building subscription businesses—strategies that don't scale effectively for mid-tier creators.

- India's AI ambitions could contribute $967 billion to the economy by 2035, democratizing creator tools globally while potentially increasing content supply compression.

- Successful creators in 2025 are operator-entrepreneurs building multiple revenue streams from merchandise, subscriptions, sponsorships, and owned businesses.

- Mid-tier creators face a squeeze where old ad revenue models are broken and mega-creator strategies require capital and scale they lack.

- Better AI tools and automation platforms are lowering operational costs, enabling creators to compete on authentic differentiation rather than production polish.

Related Articles

- Meta's Mobile-First Metaverse: Horizon Worlds Strategy Shift 2025

- Snapchat+ 25M Subscribers Drive $1B Revenue: Inside the Strategy [2025]

- Snapchat Creator Subscriptions: Complete Guide [2025]

- MyMiniFactory Acquires Thingiverse: Protecting 8M Creators From AI [2025]

- Seedance 2.0 and Hollywood's AI Reckoning [2025]

- Seedance 2.0 Sparks Hollywood Copyright War: What's Really at Stake [2025]

![Creator Economy Ad Revenue Crisis & India's AI Boom [2025]](https://tryrunable.com/blog/creator-economy-ad-revenue-crisis-india-s-ai-boom-2025/image-1-1771630652427.jpg)