Introduction: The Social Media Subscription Revolution Takes Shape

When Snapchat announced it had crossed $1 billion in annualized direct revenue, driven by 25 million Snapchat+ subscribers, the announcement went largely unnoticed by mainstream tech media. But this milestone represents something genuinely important about how social platforms are evolving. We're watching a seismic shift in how companies monetize social networks, and Snapchat is leading the charge in ways that traditional tech analysis often misses.

For years, the conventional wisdom about social media was simple: advertising is everything. Facebook built a $100 billion empire on ads. Instagram followed the same playbook. TikTok operates under the same principle. But Snapchat, the app that everyone thought peaked in 2015, has quietly built something different. It's created a direct revenue business that's genuinely meaningful—not a rounding error, not a vanity metric, but a core part of how the company makes money.

The path to this milestone tells us something crucial about consumer behavior, platform economics, and the future of social media business models. Snapchat didn't just launch a subscription and hope for the best. The company built a layered monetization strategy that appeals to different user segments with different needs and different willingness to pay. That's sophisticated business strategy, and it's working at massive scale.

This article examines how Snapchat reached this milestone, why it matters for the broader tech industry, and what it means for the future of social media monetization. We'll break down the subscription tiers, analyze the revenue implications, look at how creators are being integrated into the platform's economic model, and explore what Meta and other platforms are learning from Snapchat's success.

The numbers are striking, but the strategy behind them is even more interesting. Snapchat+ started as an experiment in 2022. Four years later, it's generating over $1 billion in annual revenue. That's not luck. That's the result of product decisions, pricing psychology, and a deep understanding of what different user segments value.

TL; DR

- **Snapchat reached 3.99 to $15.99 monthly

- Tiered subscription strategy including Snapchat+ (8.99), and Platinum ($15.99) allows revenue optimization across user segments

- Paid storage for Memories feature ($1.99/month) and creator subscriptions represent new revenue diversification beyond core subscriptions

- Meta is adopting similar strategies on Instagram, Facebook, and WhatsApp, validating the subscription model across social platforms

- Average revenue per user from subscriptions demonstrates that direct-to-consumer revenue can coexist profitably alongside advertising

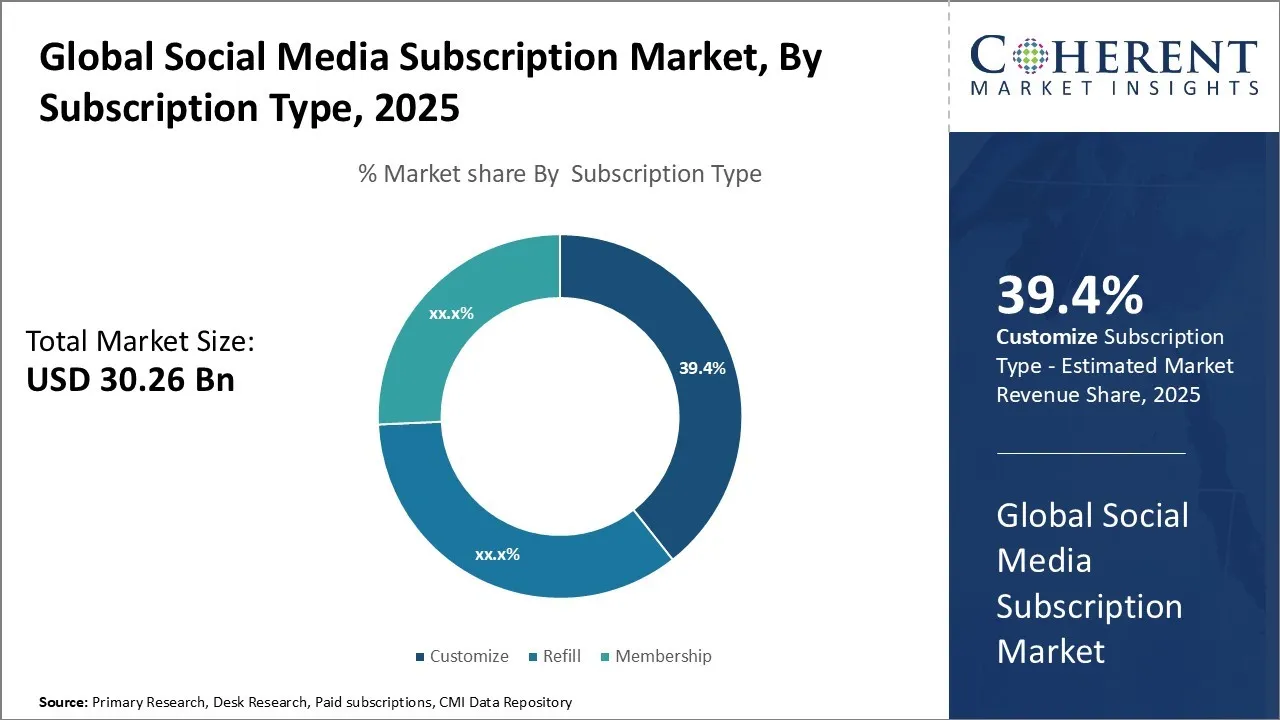

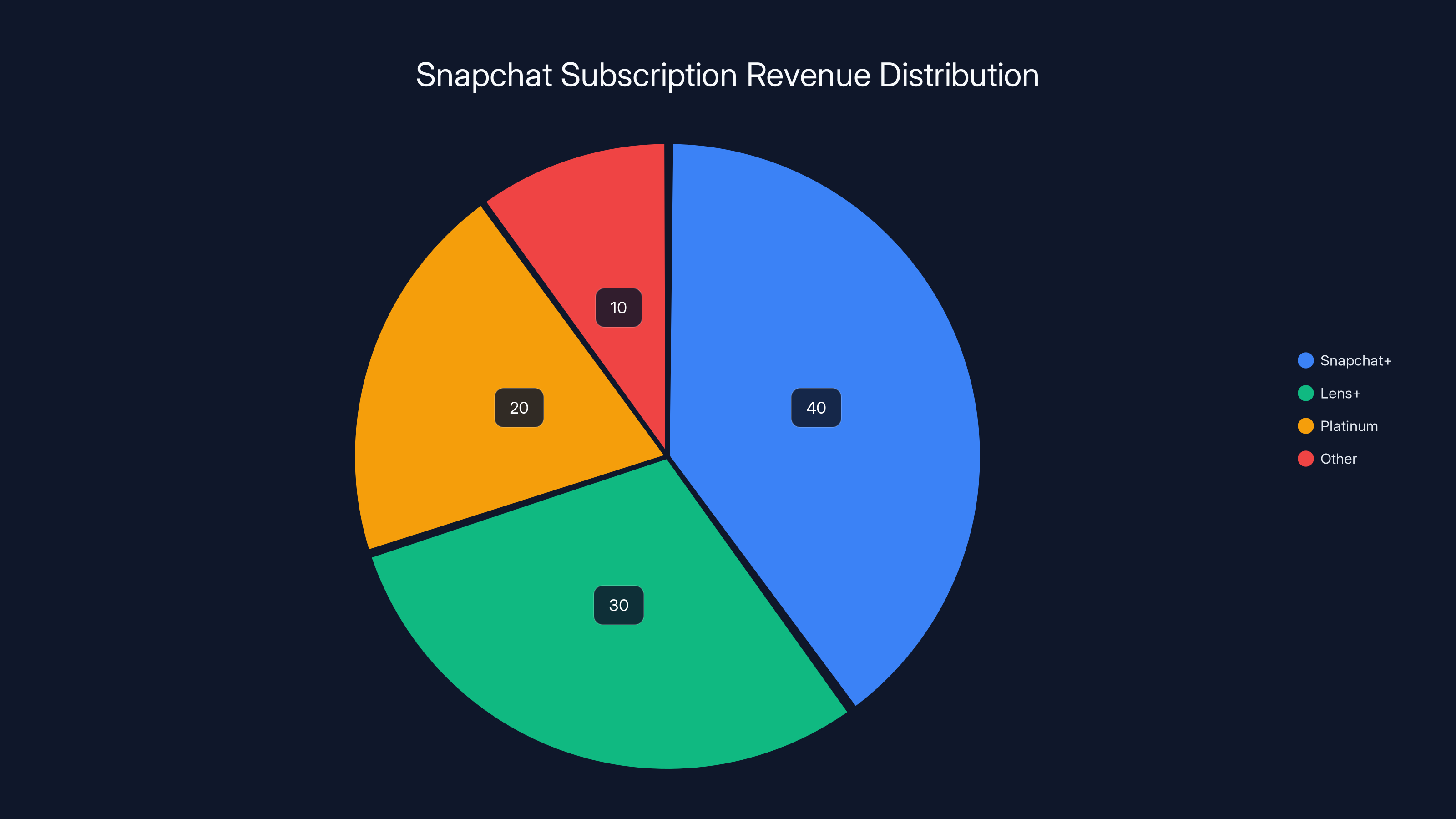

Snapchat+ accounts for an estimated 40% of subscription revenue, with Lens+ and Platinum contributing 30% and 20% respectively. Estimated data.

The Snapchat+ Foundation: How One Subscription Became a Billion-Dollar Business

The Original Vision: Premium Access to Features

When Snapchat launched Snapchat+ in September 2022, the company made a deliberate choice that many competitors dismissed. Instead of building a subscription that fundamentally changes what the app can do, Snapchat created a premium tier that gives engaged users access to exclusive features and early access to new capabilities. The pricing was aggressive—$3.99 per month—but the target was specific: power users who were already spending significant time on the platform.

The initial Snapchat+ offering included features like custom app icons, the ability to pin a friend as a "Best Friend," exclusive sticker packs, and the ability to see who replayed their Stories. These weren't core features that everyone needed. They were exactly the kind of thing that deeply engaged power users wanted but that wouldn't feel essential to casual users. This distinction matters enormously. Snapchat could charge for these features without risking the free user experience or the loyalty of people who check the app once a week.

What made this strategy brilliant is that Snapchat understood something fundamental about subscription economics: different users have different valuations. A casual Snapchat user might think "I'm not paying anything for app features." But a power user who opens Snapchat 20 times a day, has 500+ friends, and creates Stories daily? That user sees Snapchat+ as genuinely valuable. For that person, $3.99 per month is trivial compared to the value they get from the app.

Snapchat's initial growth was steady but not explosive. The company hit 1 million subscribers relatively quickly, then 2 million, then 5 million. But what happened next was important: the growth didn't plateau. Instead, Snapchat's team realized something critical—there was significant untapped demand for additional premium features at higher price points.

From Single Tier to Tiered Monetization

By mid-2024, Snapchat made a pivotal decision. Rather than trying to cram more features into a single Snapchat+ tier, the company introduced a second tier called Lens+. This was subscription strategy evolution in real time. Lens+ launched at $8.99 per month and focused on something Snapchatters obsess over: augmented reality effects. Lens+ gave subscribers access to exclusive Lenses, plus all the perks from standard Snapchat+.

The pricing here is instructive. Lens+ wasn't

Then, in early 2025, Snapchat did something even more aggressive. The company launched Platinum, an ad-free tier priced at $15.99 per month. This was the third tier, and it represented a fundamental shift in Snapchat's monetization philosophy. The company was saying: we have different user segments with different needs, and we're going to price for each of them.

Here's the tier structure that emerged:

| Tier | Monthly Price | Key Features | Ideal User |

|---|---|---|---|

| Snapchat+ | $3.99 | Custom icons, Best Friend pinning, exclusive stickers, Story replays | Casual power users |

| Lens+ | $8.99 | Exclusive AR filters + all Snapchat+ features | Content creators, AR enthusiasts |

| Platinum | $15.99 | Ad-free experience, all Snapchat+ and Lens+ features, 5TB storage | Heavy daily users, ad-averse users |

This tiered approach is textbook price discrimination—not in a negative way, but in the economic sense. Snapchat is using price to separate users into different segments based on how much value they extract from the platform. Each tier is designed to capture value from a different user type.

What's fascinating about Snapchat's approach is that the tiers aren't cannibalistic. Someone paying for Platinum isn't "lost" from the Snapchat+ revenue pool. Instead, Snapchat has created a path where a new user might start with Snapchat+ at

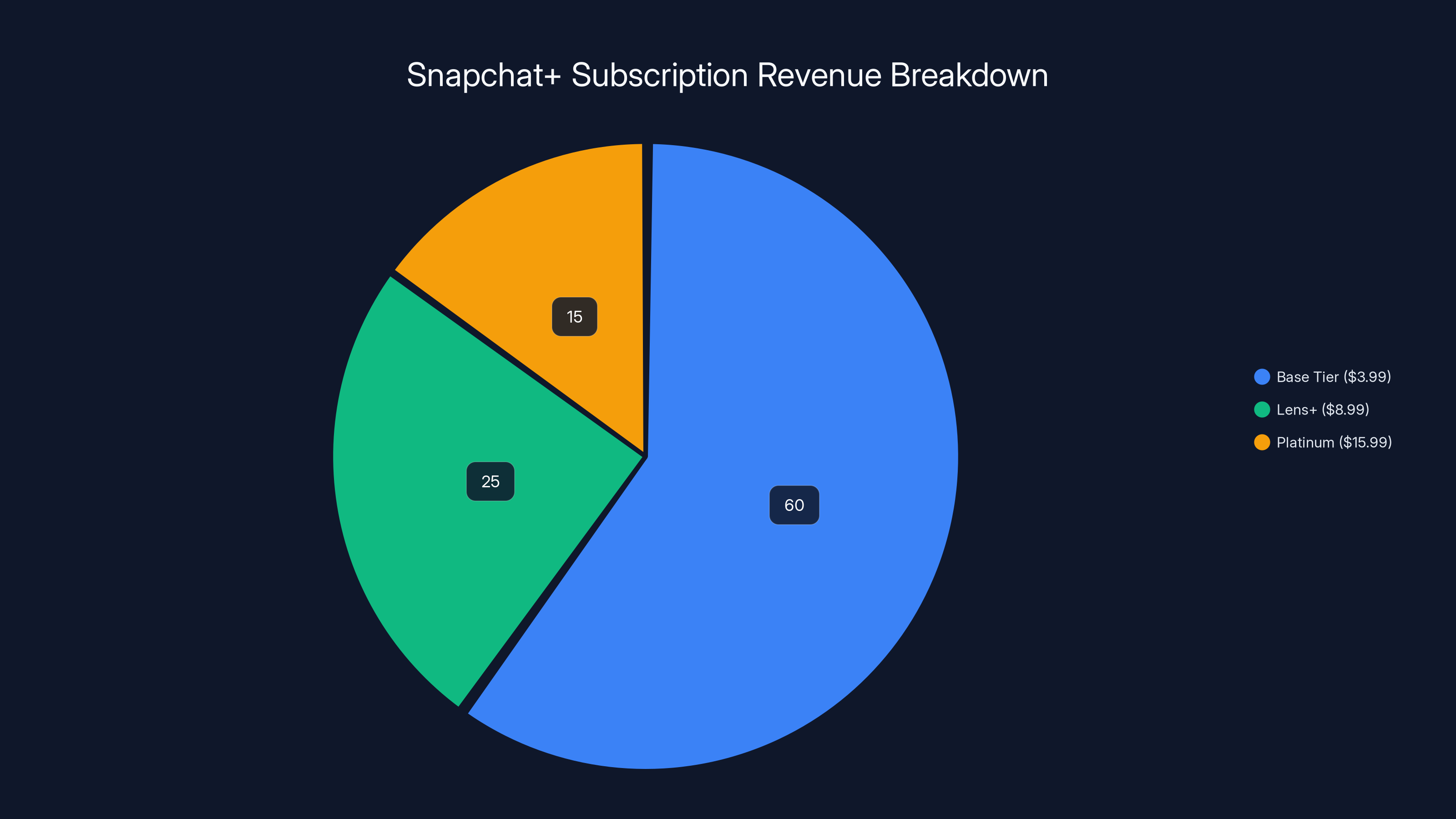

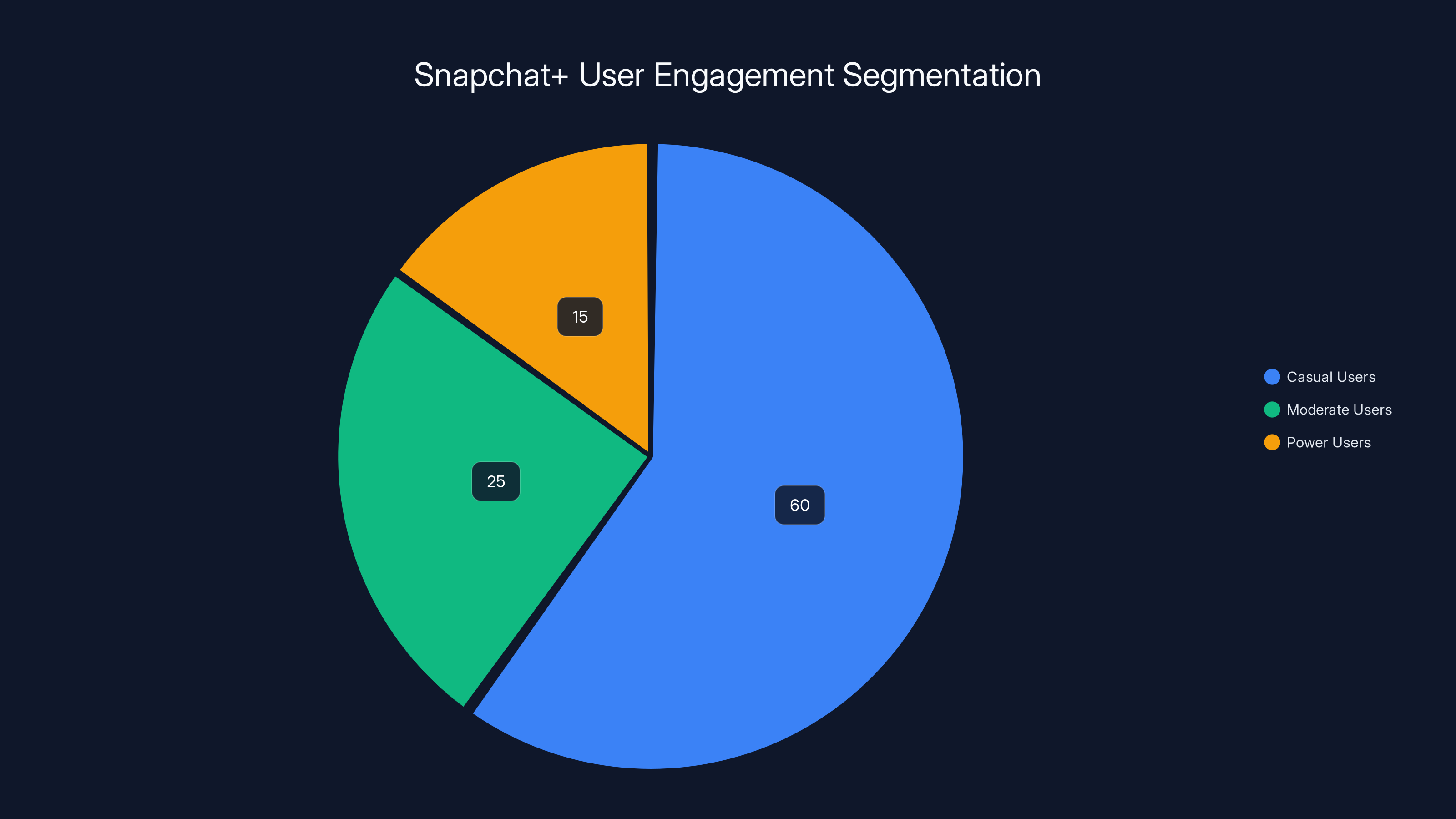

Estimated data suggests that the majority of Snapchat+ revenue comes from the base tier, with smaller contributions from higher tiers. This reflects typical user behavior in freemium models.

Revenue Dynamics: How 25 Million Subscribers Generate $1 Billion Annually

The Math Behind the Milestone

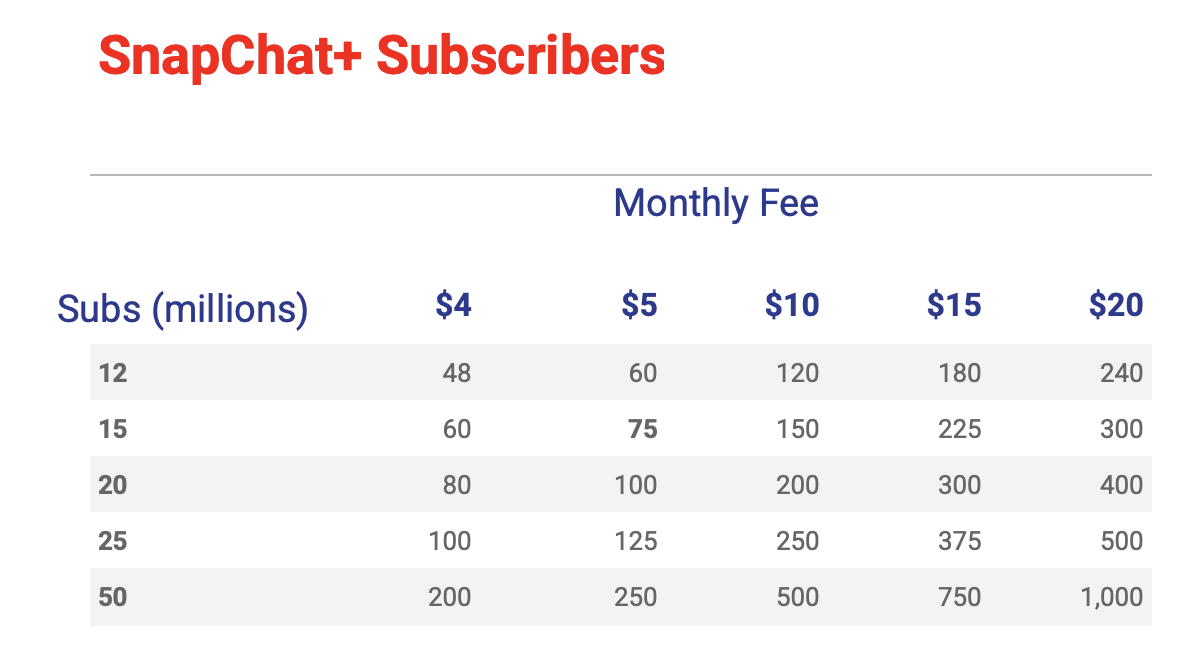

Let's do some basic math here, because the numbers are illuminating. Snapchat announced $1 billion in annualized direct revenue driven by 25 million Snapchat+ subscribers. This includes all three tiers plus additional revenue streams we'll discuss.

If we assume an average revenue per subscription of roughly

Let's recalibrate. If direct revenue is

- Most Snapchat+ revenue comes from the base tier at $3.99/month

- A smaller percentage upgrade to Lens+ ($8.99/month)

- An even smaller percentage upgrade to Platinum ($15.99/month)

- Churn rates probably sit around 5-8% monthly (typical for freemium subscriptions)

But here's what matters more than the exact math: Snapchat has proven that

What Direct Revenue Actually Means

Direct revenue is the money Snapchat makes from users paying directly. It's distinct from advertising revenue. This matters because advertising revenue depends on how many impressions Snapchat can serve and what advertisers are willing to pay. Direct revenue, by contrast, depends on converting users to paying customers and retaining them.

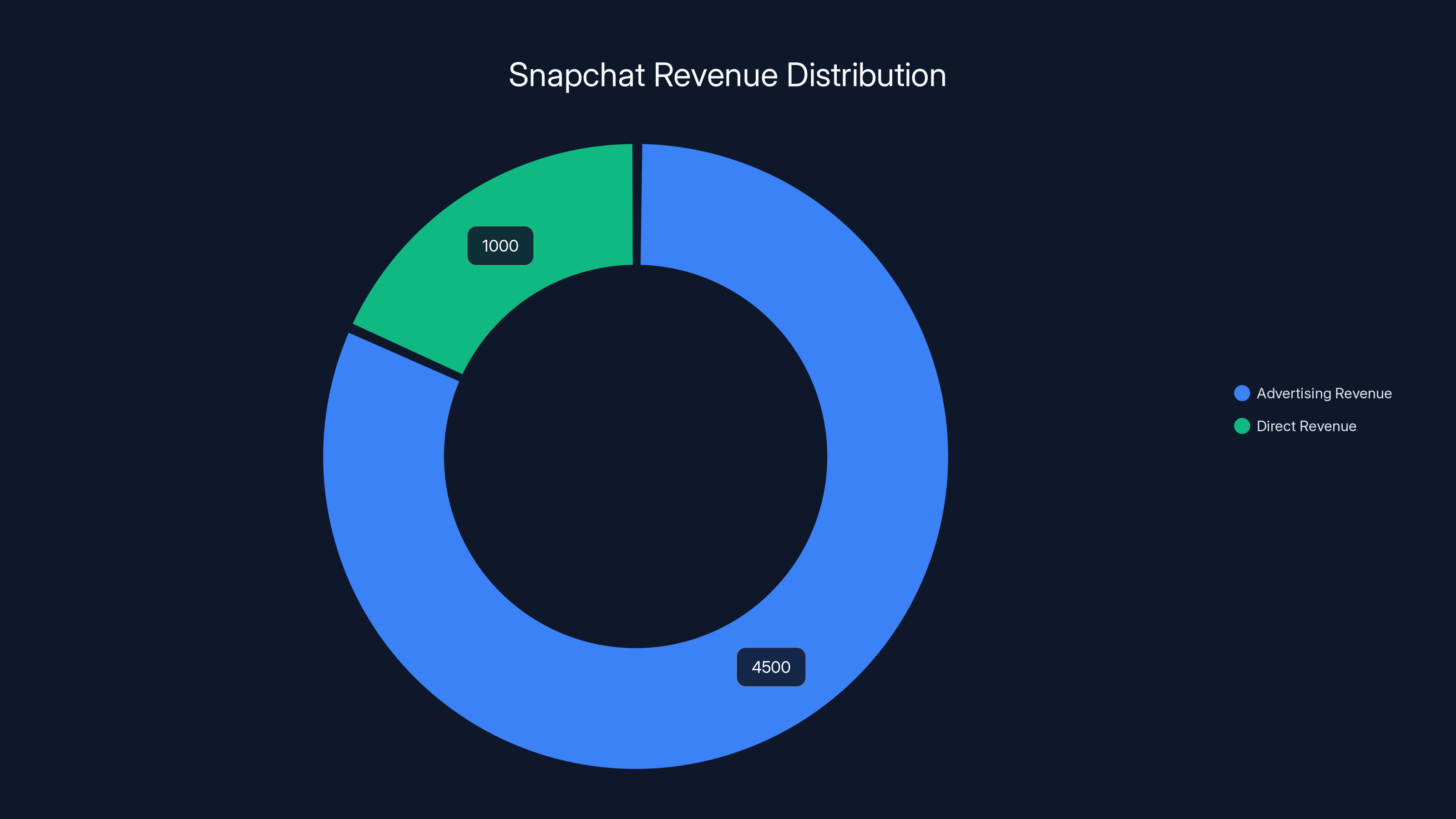

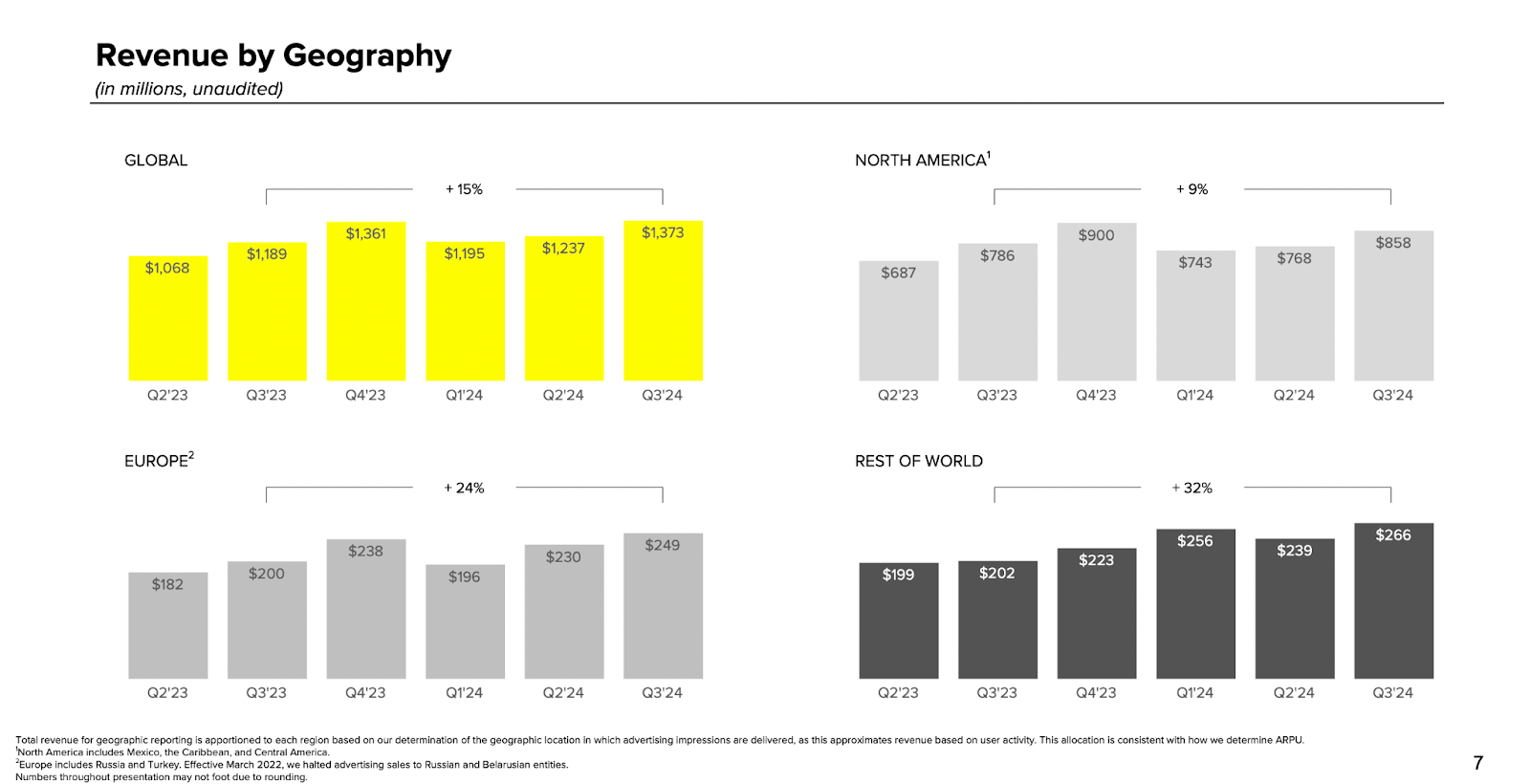

For most of Snapchat's history, the company's revenue came entirely from advertising. Snap's annual ad revenue hit roughly

The $1 billion milestone is significant because it means Snapchat now has a meaningful revenue diversification. The company isn't wholly dependent on ad dollars. It has a substantial direct consumer revenue business sitting alongside advertising. That's valuable from a business stability perspective and from an investor confidence perspective.

Regional and Currency Considerations

One factor that often gets overlooked in these announcements is regional pricing. Snapchat almost certainly doesn't charge $3.99 everywhere. In India, Brazil, and other emerging markets, Snapchat+ probably costs significantly less. In wealthy markets like the US, UK, Switzerland, and Australia, the company probably prices higher.

This regional pricing strategy is crucial for reaching global scale. Charge a single global price and you leave money on the table in wealthy countries and exclude price-sensitive users in emerging markets. Localize pricing and you can expand the addressable market while optimizing revenue. The $1 billion number represents Snapchat's global revenue, so the company has clearly executed well on regional pricing.

The Expansion: New Revenue Streams Beyond Core Subscriptions

Memories Storage: The Controversial Pivot

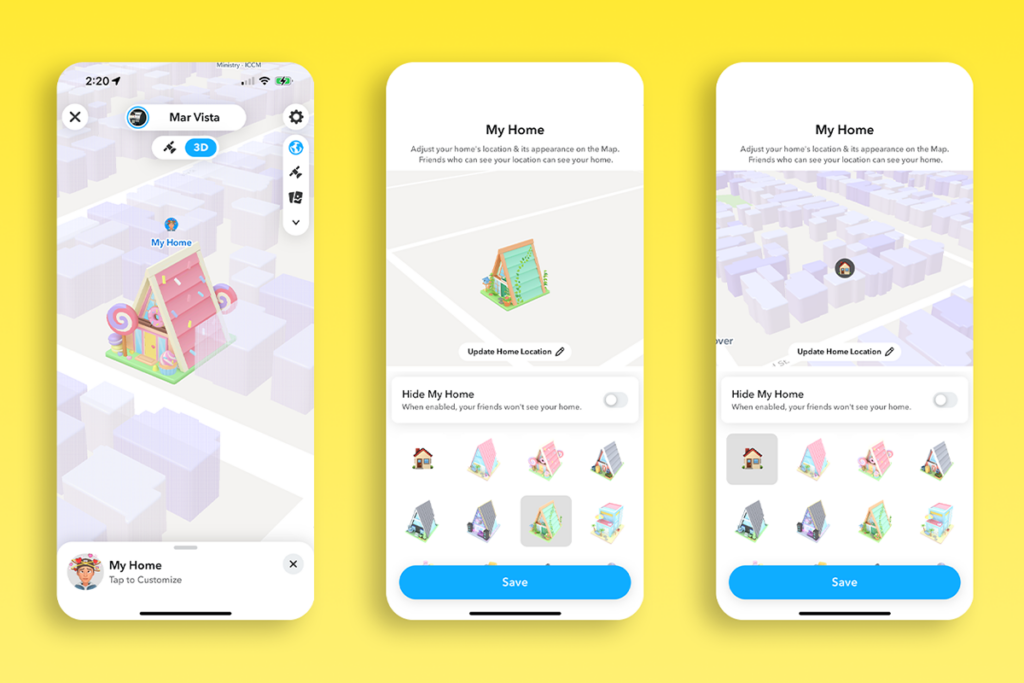

In September 2024, Snapchat made a controversial move. The company announced it would cap free storage for its Memories feature—the in-app library where Snapchat stores user photos and videos. Free users would get limited storage, while paying subscribers would get generous allocations: Snapchat+ users get 250GB, while Platinum users get a whopping 5TB.

This was a paid-storage play, and it generated real pushback. The company offered a $1.99 per month storage plan for non-subscribers. The reaction on social media was predictable: users felt nickeled-and-dimed, angry that a core feature was now behind a paywall.

But here's the thing: the move was strategically brilliant even if it wasn't popular. Snapchat was essentially saying: "Memories storage has real value. We pay for the servers, the redundancy, the support. If you use it, you should pay for it." This is economically sound. Cloud storage isn't free. AWS, Google Cloud, and Microsoft Azure all charge for it. Snapchat was passing along some of that cost to power users who actually use the feature.

The push-back also revealed something important: Snapchatters who complained about the storage paywall were also exactly the kind of users likely to eventually convert to Snapchat+ or Platinum anyway. They were heavy users. Heavy users were Snapchat's target market for subscriptions. So the storage feature became another lever to push users toward the subscription tiers.

Creator Subscriptions: Monetizing the Creator Economy

In parallel with expanding its own subscription offerings, Snapchat launched creator subscriptions. This is a fundamentally different revenue model. Instead of charging users to access premium Snapchat features, Snapchat is enabling creators to charge their fans for exclusive content.

Creator subscriptions launched in alpha with select creators including Jeremiah Brown, Harry Jowsey, and Skai Jackson. The model is straightforward: creators set their own monthly subscription price, and subscribers get access to exclusive content, priority replies, and an ad-free experience for that creator's Stories.

Snap takes a cut of creator subscription revenue—the exact percentage wasn't announced, but industry standard is 30%. This creates a new revenue stream that doesn't depend on Snap's platform creating value. Instead, individual creators create value, fans pay for it, and Snap extracts a percentage.

This is an important strategic move because it aligns Snapchat's incentives with creators' incentives. Snapchat benefits when creators earn more. Creators benefit when they can monetize their audience. This isn't zero-sum; both sides win. Compare this to advertising-driven models where creator earnings are often secondary to advertiser ROI.

The creator subscription model also opens the door to significant scale. Snapchat has millions of content creators. Even if 100,000 creators launch subscription offerings, and even if average creator subscription revenue is modest, the aggregate revenue becomes material. And Snap's cut is pure leverage—the company doesn't create the content, doesn't manage creator relationships, but extracts revenue from the economic value created.

Estimated data shows that power users, who are more likely to subscribe to Snapchat+, make up about 15% of the user base, but they are crucial for subscription revenue.

Competitive Implications: How Meta Responded

Facebook and Instagram's Subscription Tier Strategy

Approximately one month after Snapchat's latest revenue announcement, Meta told TechCrunch it was testing new subscription tiers on Instagram, Facebook, and WhatsApp. This wasn't coincidental. Meta watched Snapchat's success and recognized the opportunity. The company is pursuing a similar strategy: multiple tiers at different price points, targeting different user segments.

Facebook and Instagram users can now pay for subscription tiers that offer exclusive features, ad reduction or elimination, and priority support. Meta hasn't announced specific numbers, but the company has the advantage of operating at much larger scale. Facebook has nearly 3 billion monthly active users. Even a 1% conversion to paid subscriptions would be 30 million subscribers—more than Snapchat's current base.

The strategic lesson here is important: Snapchat proved that social platform subscription models work. This validated the hypothesis that other companies were reluctant to test. Meta, having seen the evidence, is now deploying similar strategies across its platforms.

TikTok's Approach and Global Differences

TikTok's monetization strategy differs from Snapchat's. TikTok has focused on creator monetization—gift-giving systems where viewers send paid gifts to creators—rather than user-facing subscriptions. But TikTok isn't ignoring the subscription opportunity. The platform has experimented with paid tiers in various markets, particularly in Southeast Asia and India.

The difference in approach likely reflects different user bases and market conditions. Snapchat's audience is older and wealthier on average than TikTok's. Snapchat users are more likely to be in North America and Western Europe where subscription penetration is higher. TikTok's audience is younger and more global, including large cohorts in price-sensitive markets. This suggests that different social platforms will optimize for different monetization models based on their user demographics.

The Economics of Free Users vs. Paying Users

The Freemium Sustainability Question

Here's a question that matters: can Snapchat sustain its free offering while 25 million users pay for premium? The answer is yes, but with nuance. Let's think through the economics.

Snapchat's infrastructure costs are dominated by the need to serve its entire user base—free and paid users both need servers, bandwidth, storage, and support. But the marginal cost of an additional user is actually quite low. Once the infrastructure is built to handle, say, 400 million concurrent users, adding a few million more marginal users doesn't require proportional infrastructure scaling.

What really matters is the revenue side. Snapchat's advertising revenue depends on having a large user base to show ads to. Free users generate advertising revenue. Paid users also generate some advertising revenue (except for Platinum users who have ad reduction or elimination). So Snapchat's business model is: generate most revenue from advertising (to the massive free user base), and supplement with direct revenue from the 25 million paying users.

The

Churn Dynamics and Retention Challenges

One thing Snapchat hasn't publicly disclosed: churn rates for each subscription tier. This is critical information because subscription businesses live and die by retention. If Snapchat+ has a 10% monthly churn rate, the company needs to add roughly 2.5 million new subscribers annually just to maintain the current subscriber base.

Based on industry benchmarks, subscription app churn typically ranges from 2-8% monthly depending on the category. Freemium social apps probably cluster at the higher end—maybe 5-8% monthly. This would mean Snapchat+ churns roughly 1.25-2 million subscribers per month if the base is stable at 25 million. That's significant, and it requires constant new subscriber acquisition to maintain growth.

Snapchat's announcement that Snapchat+ has grown every quarter suggests that the company is acquiring more new subscribers than it loses to churn. But this also implies that Snap needs continuous marketing and product investment to sustain the subscription business. It's not a one-time success; it's an ongoing operation.

Snapchat's advertising revenue constitutes the majority of its income, with direct revenue from paying users making up approximately 17-22% of the total. Estimated data based on provided figures.

The User Experience: Premium Features That Justify Payment

Beyond Cosmetics: What Snapchat+ Actually Offers

Criticism of Snapchat+ sometimes frames the subscription as purely cosmetic—paying for custom app icons and emojis. But the actual feature set is more substantive. Let's break down what Snapchat+ actually provides:

Exclusive Access Features:

- Custom app icons that change the visual appearance of the Snapchat icon on the home screen

- Exclusive sticker packs that rotate and are unavailable to free users

- The ability to pin a friend as "#1 Best Friend" in the UI

Pre-Release Access:

- Early access to new Snapchat features before they roll out to everyone

- This is significant because Snapchat launches new features constantly, and getting them first appeals to power users

Customization Features:

- Priority customer support (Snapchat+ users get faster support)

- Extended story availability (Stories persist longer than free users)

- Best Friend list customization

Lens+ Additions (when upgrading):

- Exclusive AR filters unavailable to free users

- Pre-release access to new Lenses

- AR effects that creators use for content

Platinum Additions (when upgrading):

- Ad-free experience across Stories and ads spaces

- Massive storage allocation (5TB)

- Priority support

Looking at this list, it's not just cosmetics. Early access to features is genuinely valuable for power users. Exclusive Lenses matter for creators. Ad elimination matters for daily users. This is a subscription that has real value beyond the badge of paying.

Positioning Premium as Enhanced, Not Necessary

Snapchat made a critical choice: Snapchat+ is positioned as an enhancement to the free experience, not as something required to use the app. You can send Snaps, view Stories, create content, and hang out with friends completely free. The subscription adds value, but doesn't gate core functionality.

This positioning is crucial. It avoids the resentment that comes from pay-to-play games where free users hit walls. Instead, free users have the full social experience, and paying users get that experience plus extras. This keeps churn manageable and preserves goodwill.

Market Conditions: Why Subscriptions Work for Snapchat

Who Pays for Social Apps and Why

Subscription adoption on social apps is still relatively novel, which makes Snapchat's 25 million subscribers impressive. But it's worth asking: who actually pays, and why do they choose to do so?

Research on freemium adoption suggests that subscription-paying users typically have several characteristics:

- High usage frequency: They use Snapchat multiple times daily, sometimes dozens of times

- Creator identity: They generate content—Stories, Snaps, Lenses—rather than just consuming

- Social capital: They have large friend networks and care about their status within those networks

- Weak price sensitivity: They have disposable income and don't find $3.99-15.99/month materially expensive

- Feature urgency: They want features now, not when free users eventually get them

Snapchat's user base skews younger and wealthier than some social apps, which makes subscription adoption more likely. A 25-year-old in the US making

Why Now? The Subscription Maturation Curve

Snapchat+ launched in 2022, but subscription apps didn't become mainstream until the late 2010s. Consumers needed time to accept that they'd pay for apps. They went through a phase of "app fatigue" where they'd paid for dozens of mediocre apps at $0.99 and became skeptical of all app purchases. Then, over several years, subscription apps proved their value: Netflix, Spotify, Slack, Notion, Discord Nitro, and many others established that subscriptions could deliver real value.

By 2022, when Snapchat+ launched, the subscription app market was mature. Users weren't shocked by the idea of paying for an app. They'd already internalized the concept. This timing advantage was significant. Ten years earlier, Snapchat+ would have struggled. Ten years later, other social apps are copying the model.

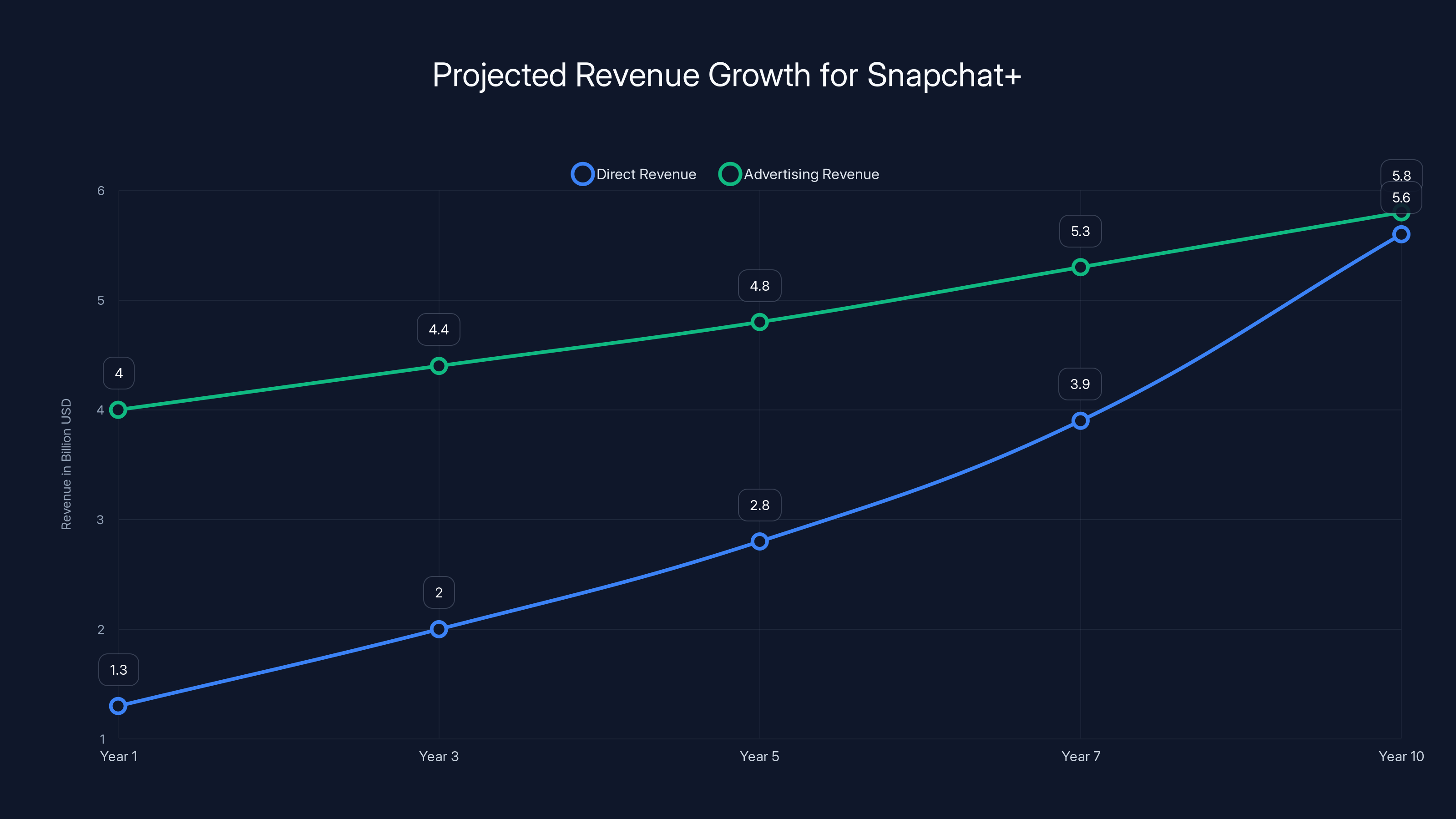

Estimated data shows Snapchat+ direct revenue growing at 15% annually, potentially reaching 40-50% of total revenue in 10 years, compared to a 5% annual growth in advertising revenue.

The Creator Economy Integration: Extending the Monetization

How Creator Subscriptions Change the Power Dynamic

Snapchat's move into creator subscriptions represents a significant shift in platform economics. For the first time, Snapchat is enabling creators to build direct relationships with audiences and charge those audiences for premium content. This is different from the usual influence system where creators get paid by advertisers.

With creator subscriptions, the power dynamic shifts. A creator with 100,000 engaged followers can now generate meaningful income directly. If even 5% of followers subscribe at an average price of

But more important than the absolute numbers is the incentive alignment. Snapchat is saying: "We want you to be successful. We've built tools so you can monetize your audience. When you make money, we make money." This creates a virtuous cycle where creator success drives platform engagement, which drives user growth, which increases advertiser value.

The Tension Between Creator Monetization and User Experience

There's a tension that Snapchat needs to navigate carefully. If too many creators put content behind paywalls, the free user experience degrades. Users see "Subscribe to see this creator's content" too often and churn. The platform needs to maintain enough free creator content to keep the free user base engaged.

Snapchat's approach seems to be to position creator subscriptions as additive. The best content stays free. Exclusive bonus content goes behind the paywall. This is the same model YouTube uses with channel memberships—creators can monetize without walling off their entire presence.

It's early days for Snapchat creator subscriptions (launched in alpha), but this is an important initiative to watch. If it scales successfully, it could represent a third revenue pillar alongside user subscriptions and advertising.

Business Model Diversification: Reducing Dependence on Ads

Why Diversification Matters

The tech industry has watched multiple platform collapses driven by over-reliance on advertising. When the advertising market contracts, platforms with only advertising revenue get crushed. Facebook's stock was heavily punished in 2022 when Apple's privacy changes reduced ad targeting effectiveness. Snap itself has been vulnerable to advertising fluctuations.

Diversifying into direct revenue makes Snapchat more resilient. If the advertising market softens, the company still has $1 billion in relatively stable direct revenue. That's not enough to sustain the company alone (Snapchat needs both revenue streams), but it reduces vulnerability to macro advertising downturns.

Publicly, Snap emphasizes that direct revenue and advertising revenue are complementary, not competitive. Direct revenue customers are also exposed to ads (except Platinum users who opt out of ads). The company isn't cannibalizing ad revenue by converting users to subscriptions. It's expanding revenue by capturing additional monetization from users who have high willingness to pay.

Margin Improvement Through Direct Revenue

Direct revenue typically has higher gross margins than advertising revenue. Why? Because advertising requires Snap to employ salespeople, maintain customer relationships, and deal with churn as advertiser budgets fluctuate. Direct revenue, by contrast, is mostly software costs—servers, payments processing, support—once the product is built.

A subscription business scaling to $1 billion revenue probably sees gross margins north of 70%, possibly 80%+. Advertising businesses see lower margins because of sales and support costs. By growing direct revenue, Snapchat is improving overall company margins, which increases profitability even if total revenue grows slowly.

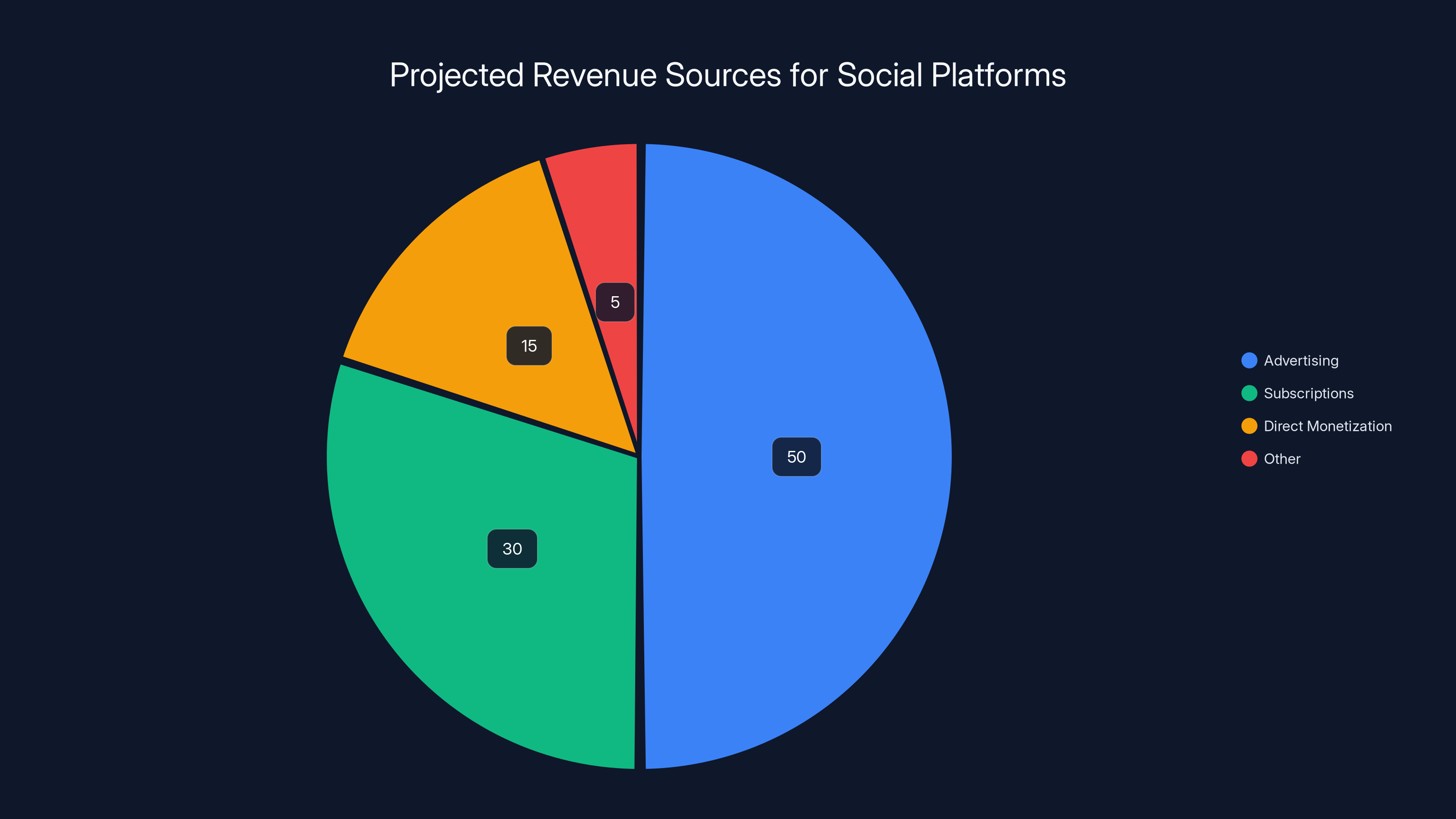

Estimated data shows a shift towards subscriptions and direct monetization, reducing reliance on advertising.

The Competitive Threat: Protecting Market Share

Why Competitors Are Following Snapchat's Playbook

When Meta announced it was testing subscriptions on Facebook and Instagram, it wasn't reacting to a new idea. It was responding to Snapchat's demonstrated success. Meta saw that Snapchat+ worked, reached scale at 25 million subscribers, and generated $1 billion, and realized it needed to pursue the same strategy.

Meta has advantages: vastly larger user base, more resources, stronger brand in many demographics. Meta can launch subscription tiers and probably convert higher percentages of users to paid. But Meta also faces the same challenges: how to position premium features without fragmenting the user experience, how to avoid backlash from users who feel nickeled-and-dimed, and how to retain subscribers when competing for discretionary spending.

TikTok's approach is different, but TikTok is also watching. The platform is experimenting with subscriptions in certain markets. YouTube has long had premium ($13.99/month for ad-free viewing plus YouTube Music). The subscription social media space is becoming crowded.

Snapchat's Defensive Advantages

Snapchat has first-mover advantage in the social media subscription space. It has 25 million subscribers who are paying, feature-tested subscription tiers that work, and institutional knowledge about what pricing strategies convert users. New competitors starting from scratch need to build all of this.

Snapchat also has a differentiated product. The company's focus on Stories (which it invented), Lenses and AR effects, and ephemerality creates a unique value proposition. While Meta has copied Stories, it hasn't fully replicated the Snapchat experience. Users who prefer Snapchat's UI, friend-focused approach, and creativity tools will stay on Snapchat even if Instagram offers a subscription tier.

The real threat isn't necessarily Meta stealing Snapchat's customers. It's that Meta will fragment social media time by offering its own compelling premium subscription experience. Attention is zero-sum. If users spend an hour per day choosing between Snapchat, Instagram, and TikTok, and each platform is optimized differently, Snapchat's growth could slow.

Product Roadmap: What Comes Next

Customization and Community-Driven Features

Snapchat announced that its focus for future Snapchat+ improvements would be customization and community-driven features. This is interesting strategic language. Instead of piling on new features, Snapchat is doubling down on user control and community engagement.

Customization might include:

- More app icon options, themes, UI customization

- Personalized feeds and Story filtering

- Custom notification sounds and alerts

- Theme packs that change the color scheme

Community-driven features might include:

- Group subscriptions (paying together to unlock group features)

- Friend group collections and private Stories

- Community Lenses that groups of friends can create together

- Subscription-only group features like persistent group Chats

This strategic direction suggests Snapchat is thinking about how to deepen social bonds through premium features, rather than just adding convenience features. That's a sophisticated understanding of what makes social apps sticky.

International Expansion and Localization

One area with significant upside: international expansion of Snapchat+ and other paid offerings. Snapchat currently has strong penetration in North America and Western Europe, but the platform is smaller in many other regions. As Snapchat expands internationally, localized subscription pricing could unlock additional growth.

A Snapchat+ subscription in India might cost

Snapchat has taken steps in this direction with regional pricing on storage, but a more aggressive international expansion of premium features could be significant growth lever.

The Broader Implications: Redefining Social Platform Economics

The End of "Free Forever"

Snapchat's success, followed by Meta's response, signals something important: the era of purely ad-supported social media is ending. Not immediately, and not completely, but directionally, social platforms are recognizing that a diversified revenue model is healthier than relying solely on advertising.

This has implications for users, creators, platforms, and the entire advertising industry. Users will increasingly see paywalls on social platforms. Creators will have more direct monetization opportunities but also more complexity managing multiple revenue streams. Platforms will earn more but also take on the customer service and retention challenges of running subscription businesses.

The advertising industry needs to adjust to the reality that some users will opt out of ads (like Platinum users). This could reduce overall ad inventory and put upward pressure on CPM (cost per thousand impressions). Or it could push advertisers to be smarter about targeting and creative since they have a smaller audience pool.

The Power Shift from Advertisers to Users

For years, the relationship between social platforms and users was asymmetrical. Platforms provided a service for free, users provided data and attention, and advertisers paid for access to users. It was a three-way relationship where users had the least power—they weren't paying, so they weren't customers, so they couldn't vote with their wallet.

Subscription models flip this dynamic slightly. When a user pays $15.99 per month for Platinum, that user becomes a customer. Snapchat has to maintain satisfaction or risk churn. The platform can't ignore user complaints because the user is generating direct revenue.

This doesn't mean users suddenly have equal power—platforms still have network effects and switching costs that create lock-in. But it does mean that paying users have more leverage than free users. This could lead to better user experiences, fewer dark patterns, and more respectful platform design.

The Subscription Saturation Question

Eventually, there's a limit to how many subscriptions users will maintain. Someone might subscribe to Spotify, Netflix, Discord, Notion, and Snapchat+ when each is

This suggests the total addressable market for social media subscriptions is bounded. If every major social platform successfully converted 5-10% of users to paid, you'd have perhaps 100-200 million subscription customers globally. That's a huge market, but it's not unlimited.

Snapchat has reached 25 million (6% of monthly active users). Meta could theoretically reach 200+ million if it achieves similar conversion rates on its platforms. But as subscription penetration increases, growth will slow. The platforms that are successful early (like Snapchat) have an advantage.

Challenges and Risks Going Forward

The Churn Risk: Maintaining Retention at Scale

Subscription businesses are perpetually fighting churn. A 5% monthly churn rate means you need to add 5% new customers per month just to stay flat. At larger scale, this becomes harder. The low-hanging fruit—the power users most likely to convert—pays sooner. Reaching the next tier requires either better product or more aggressive marketing.

Snapchat's next 25 million subscribers are harder to acquire than the first 25 million. This is a fundamental law of growth. The company will need to continue innovating on Snapchat+ features, expand internationally, and potentially lower prices to reach wider audiences.

The User Backlash Risk: Free-to-Premium Positioning

There's a real risk that users perceive Snapchat's shift toward paid offerings as hostile. When Snapchat capped storage and added a paid tier, users complained. When Meta added subscriptions, there was backlash. If platforms are perceived as deliberately making the free experience worse to push users toward paid, there's a reputational risk.

Snapchat's success so far suggests the company has navigated this risk reasonably well. The free experience remains good. Paid features feel additive. But this is an ongoing balance that requires careful management.

The Regulatory Risk: Antitrust and App Store Rules

Bigger social platforms increasingly face regulatory scrutiny. If Apple or Google decided that they dislike how Snapchat's subscription model works (perhaps taking issue with Snap's cut of creator subscriptions or some other detail), they could change app store policies. This would directly impact Snapchat's subscription revenue.

Furthermore, if regulators pursue antitrust action against Meta or other platforms, subscription strategies could face new restrictions. This is speculative, but it's a tail risk worth monitoring.

Looking Ahead: Where This All Leads

The Trajectory for Snapchat+ Beyond $1B

If Snapchat maintains current growth rates, the platform could reach 30 million subscribers (and $1.3-1.4 billion in direct revenue) within 12-18 months. Beyond that, growth probably slows as the company approaches saturation in high-income countries. But international expansion could unlock additional growth in emerging markets.

The real question is whether Snapchat's direct revenue grows faster than advertising revenue. If advertising grows 5% annually and direct revenue grows 15%, then the mix changes significantly over time. In 10 years, direct revenue could represent 40-50% of total revenue instead of the current 17-22%. That would make Snapchat a different kind of company—less advertising-dependent, more subscription-dependent.

What This Means for Other Platforms

The Snapchat success story is a playbook for other platforms. TikTok, LinkedIn, Discord, Telegram, and others will all look at Snapchat+ and think: "We can do that." Some will succeed. Others will fail because they don't understand their users or can't position premium features in ways that feel valuable.

The companies that will win at social media subscriptions are those that:

- Have strong user retention and engagement (subscription customers must come back)

- Understand what different user segments value (pricing and positioning matter enormously)

- Can execute at quality without fragmenting the free experience

- Have international reach and localization capabilities

- Can handle the operational complexity of running a subscription business

Not every platform will be good at all five. This is an advantage for companies like Meta and Snapchat that are already sophisticated operators.

The Lesson for Startups and Smaller Platforms

Can Smaller Platforms Replicate Snapchat's Success?

Snapchat had advantages that other platforms might not have: a massive user base, high engagement, valuable exclusive features (AR Lenses), and strong brand awareness. A smaller platform would struggle to replicate these advantages.

But there are lessons even smaller platforms can learn: (1) subscription success requires genuine value, not desperation; (2) tiering is more effective than a single tier; (3) international pricing expands the addressable market; (4) existing engaged users are your best conversion opportunities.

A smaller platform with even 5 million monthly active users and 5% subscription conversion would have 250,000 subscribers. At average revenue of

Conclusion: The Era of Subscription Social Media Is Here

Snapchat's milestone of 25 million Snapchat+ subscribers and $1 billion in direct revenue marks a turning point in social media economics. For the first time, a major social platform has successfully proven that users will pay meaningful subscription fees for enhanced experiences alongside advertising-supported base products. This is not a niche outcome. This is a viable business model at significant scale.

The implications are broad. Users are entering an era where social media costs money—not necessarily for everyone, but for the people who get the most value from these platforms. Creators now have new monetization opportunities beyond advertising and brand partnerships. Platforms can reduce their dependence on advertising volatility through subscription revenue diversification. Competitors are watching and copying, which will likely accelerate the shift toward subscriptions across social media.

What makes Snapchat's success particularly impressive is that the company didn't get here by accident. The strategy was deliberate: identify power users, create genuine value through exclusive features, price for different segments, expand internationally, build creator monetization tools, and communicate the value proposition clearly. Each element contributed to reaching this milestone.

Meta is already responding by launching subscriptions on its own platforms. TikTok and other competitors will follow. The subscription social media era isn't coming—it's already here. Snapchat just got there first, and that first-mover advantage might prove decisive in what becomes one of the most important platform economics shifts of the 2020s.

The story from here is whether this remains sustainable. Can Snapchat maintain retention at 25+ million subscribers? Can it grow internationally? Can it build successful creator subscriptions? Can it fend off Meta's subscription offerings? These are the questions that will determine whether the $1 billion milestone is a peak or a launching point for significantly larger direct revenue numbers in coming years.

What's certain is that the business model works. Users will pay for premium social experiences. The conversation has shifted from "if" to "how much" and "what should we charge for." Snapchat answered those questions. Now every other platform needs to do the same.

FAQ

What is Snapchat+ and why did Snap create it?

Snapchat+ is a premium subscription tier that gives users access to exclusive and pre-release features for $3.99 per month. Snap created it in 2022 to diversify revenue beyond advertising and to monetize power users who get exceptional value from the platform. The core idea was to create a subscription that enhances the experience without making the free version feel incomplete.

How does Snapchat's tiered pricing strategy work?

Snapchat currently offers three main subscription tiers: Snapchat+ at

How many Snapchat+ subscribers does the platform have?

Snapchat reported reaching 25 million Snapchat+ subscribers, which collectively drive $1 billion in annualized direct revenue. This includes revenue from the base Snapchat+ tier, higher-priced tiers like Lens+ and Platinum, storage subscriptions, and creator subscription fees. The company has achieved this level of adoption in less than four years since launching Snapchat+ in 2022.

What are creator subscriptions and how do they work?

Creator subscriptions allow individual content creators on Snapchat to charge their followers a monthly fee (set by the creator) for exclusive content, priority replies, and ad-free access to that creator's Stories. Snapchat takes a percentage cut (likely around 30% based on industry standards), while creators retain the rest of the revenue. This creates a new monetization pathway that doesn't depend on the platform itself creating value.

Why did Snapchat charge for storage and was it controversial?

In September 2024, Snapchat began capping free cloud storage for the Memories feature and launched a $1.99/month paid storage tier. The move was economically logical because cloud storage has real infrastructure costs, but it generated user backlash because it felt like putting a previously free feature behind a paywall. However, the company offered generous storage allocations to Snapchat+ subscribers, making subscriptions more valuable and potentially offsetting friction from the storage paywall.

How does Snapchat's direct revenue compare to its advertising revenue?

Snapchat's advertising revenue is still the primary revenue source (roughly

Is Meta copying Snapchat's subscription strategy?

Yes, Meta announced it was testing new subscription tiers on Facebook, Instagram, and WhatsApp shortly after Snapchat's latest milestone announcement. Meta is pursuing a similar strategy of offering premium tiers at various price points with exclusive features and ad reduction. However, Meta has the advantage of vastly larger user bases, so even modest conversion rates could yield significantly more subscribers than Snapchat's current 25 million.

What is the churn rate for Snapchat+ subscriptions?

Snapchat hasn't publicly disclosed specific churn rates, but based on industry benchmarks for freemium social apps, churn probably ranges from 5-8% monthly. This means Snapchat needs to continuously acquire new subscribers to maintain its subscriber base and achieve growth. The fact that the company reports quarter-over-quarter growth suggests that new subscriber acquisition is exceeding churn.

Why would someone pay for a social media subscription?

Users pay for social media subscriptions because they get genuine value from features like early access to new capabilities, exclusive AR effects (valuable for creators), ad-free experiences, large storage allocations, and customization options. Snapchat's subscription targets power users who spend significant time on the platform and for whom $3.99-15.99/month is a trivial expense compared to the value they extract from the service.

What are the risks to Snapchat's subscription business going forward?

Key risks include churn as the platform approaches saturation in wealthy markets, potential user backlash if the free experience feels degraded by paid features, regulatory changes that could impact the subscription model, and competition from Meta's larger user base and resources. International expansion and creator subscription growth are likely critical to maintaining momentum beyond the current $1 billion revenue level.

Key Takeaways

- Snapchat reached $1B in direct revenue with 25M Snapchat+ subscribers, proving social media subscriptions work at massive scale

- Multi-tier pricing strategy (15.99/month) allows revenue optimization across different user segments with different value perceptions

- Direct revenue diversification reduces platform dependence on volatile advertising market while improving profit margins

- Creator subscriptions and storage monetization create additional revenue streams beyond core Snapchat+ offering

- Meta's rapid adoption of Instagram and Facebook subscriptions validates Snapchat's model, signaling shift from ad-only social platforms

- 6% conversion rate from monthly active users to paying subscribers demonstrates strong product-market fit without cannibalizing free experience

Related Articles

- Snapchat Creator Subscriptions: Complete Guide [2025]

- How Top YouTubers Are Ditching Ad Revenue for Real Businesses [2025]

- MyMiniFactory Acquires Thingiverse: Protecting 8M Creators From AI [2025]

- Seedance 2.0 and Hollywood's AI Reckoning [2025]

- Seedance 2.0 Sparks Hollywood Copyright War: What's Really at Stake [2025]

- 25 Best Newsletters to Subscribe to in 2026 [Updated]

![Snapchat+ 25M Subscribers Drive $1B Revenue: Inside the Strategy [2025]](https://tryrunable.com/blog/snapchat-25m-subscribers-drive-1b-revenue-inside-the-strateg/image-1-1771433025939.jpg)