Introduction: The Metaverse Pivots Away from VR Headsets

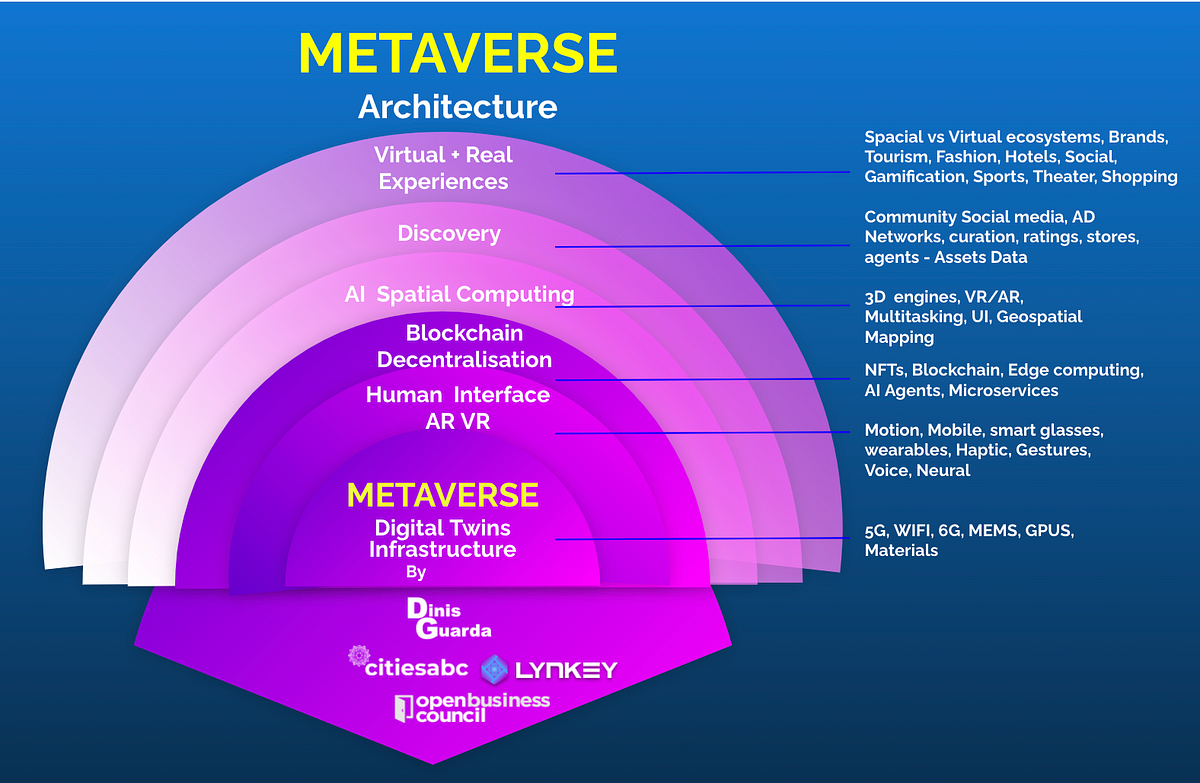

Meta's journey toward building the metaverse has taken a dramatic turn. After years of betting billions on virtual reality hardware and immersive VR experiences, the company is fundamentally reshaping its strategy around Horizon Worlds—moving away from its exclusive focus on Quest VR headsets and embracing a mobile-first approach instead. This shift represents far more than a tactical adjustment; it signals a profound recalibration of how one of the world's largest tech companies envisions the future of digital interaction.

When Mark Zuckerberg first announced the metaverse vision in 2021, the narrative centered on VR headsets as the primary gateway to immersive digital worlds. Meta invested heavily in this thesis, acquiring VR studios, developing the Oculus ecosystem, and rebranding the company itself around the metaverse concept. Yet reality has diverged sharply from this vision. VR adoption rates have plateaued, hardware costs remain prohibitive for mainstream users, and consumer enthusiasm for spending hours in virtual worlds has failed to materialize at scale.

Now, Meta is acknowledging this reality by formally decoupling Horizon Worlds from its Quest VR platform. This decision represents a pragmatic evolution—one that many industry observers saw coming but that demonstrates Meta's willingness to pivot when faced with market realities. By repositioning Horizon Worlds as a mobile-first platform, Meta is essentially admitting that the metaverse's near-term future will be experienced through smartphones and tablets, not premium VR headsets.

But what does this transition mean for developers building on Meta's platforms? How will it affect the broader competitive landscape of immersive experiences? And what alternatives exist for companies and creators looking to build interactive, social, virtual experiences? This comprehensive analysis explores Meta's strategic shift in granular detail, examining the technical implications, competitive positioning, market dynamics, and the ecosystem of alternative solutions that developers and organizations should consider.

The mobile-first pivot isn't just about accessibility—it's about acknowledging where users actually are. With billions of smartphones in circulation globally and VR penetration stubbornly stuck below 5% in most markets, the mathematical reality is unavoidable: mobile devices represent the only realistic path to scale. By embracing this shift, Meta is finally aligning its metaverse strategy with user behavior and technological adoption patterns.

The Strategic Decision: Separating Horizon Worlds from Quest

Understanding the Formal Separation

Meta's announcement, delivered by Samantha Ryan (VP of Content, Reality Labs) in an official blog post, represents a formal architectural and strategic separation of two previously intertwined product lines. This isn't a minor organizational change—it's a fundamental acknowledgment that Horizon Worlds and the Quest VR platform are pursuing different markets, different user bases, and different business models that cannot be efficiently served by a unified platform strategy.

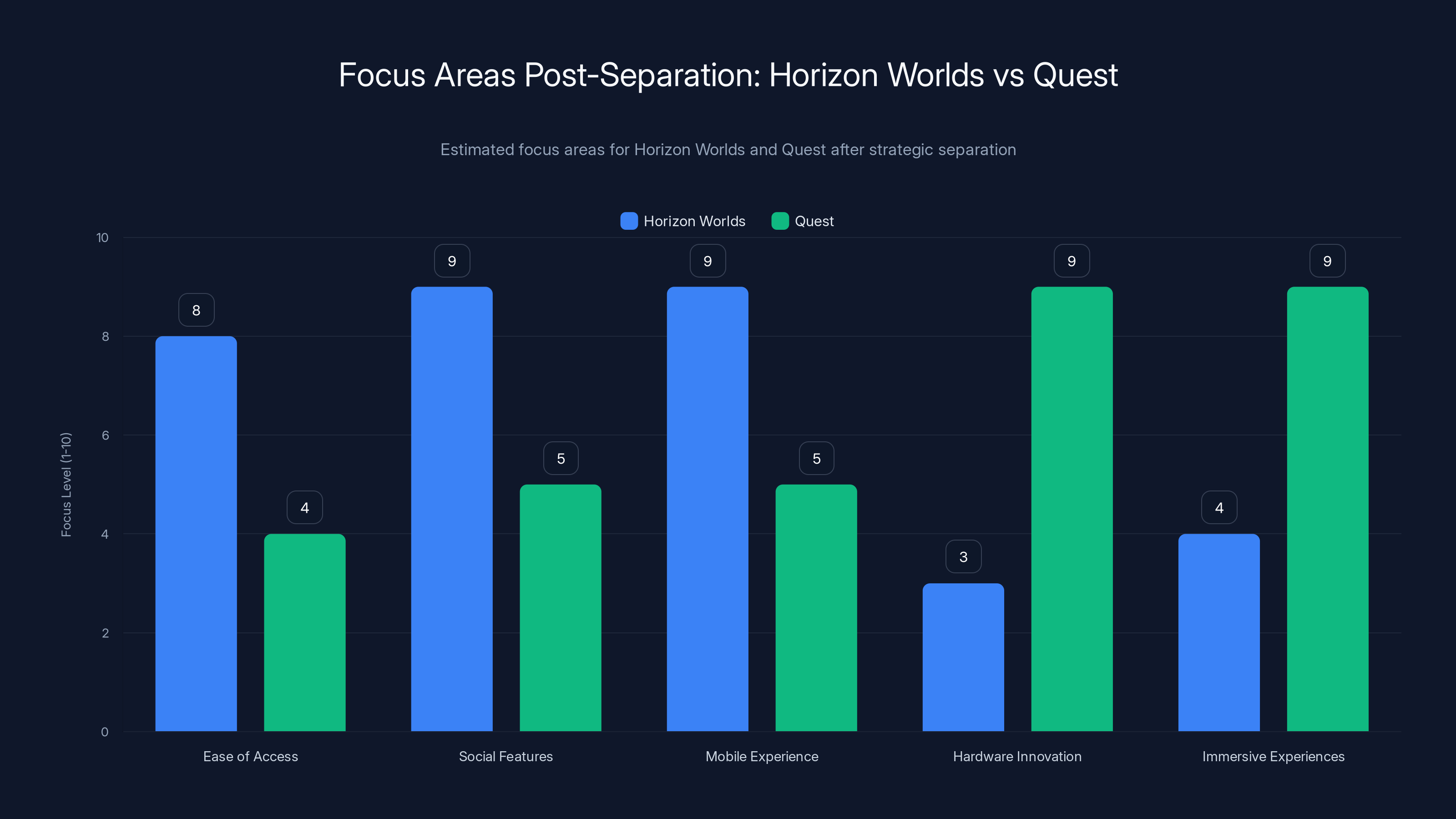

The separation works at multiple levels. Technically, Horizon Worlds will now operate as an independent software platform with its own development roadmap, resource allocation, and feature priorities. The Quest VR platform continues to serve VR enthusiasts and developers building premium VR experiences, but it no longer functions as the default or primary distribution channel for Horizon Worlds. This bifurcation allows each product to optimize for its distinct user base without the compromises that come from trying to serve both simultaneously.

From a business perspective, this separation enables Meta to allocate resources more efficiently. VR development requires different expertise, marketing approaches, and monetization strategies than mobile-first virtual worlds. By separating these concerns, each team can focus entirely on what matters most for their respective platforms. The VR team can concentrate on pushing the boundaries of hardware and immersive experiences for the dedicated VR community. The Worlds team can focus on what actually drives mainstream adoption: ease of access, social features, and experiences that feel native to mobile interfaces.

The timing of this announcement carries significance as well. Meta made substantial cuts to its Reality Labs division in 2024, a costly operation that had burned through billions annually without delivering breakthrough consumer products. By publicly repositioning Horizon Worlds as a mobile platform, Meta is signaling to investors, employees, and stakeholders that the company has learned from this period and is pursuing a more disciplined, market-validated approach to immersive experiences.

The Original Vision vs. New Reality

Understanding this pivot requires examining Meta's original metaverse vision. When Zuckerberg articulated the metaverse concept in late 2021, he painted an ambitious picture of a unified digital realm where people would work, socialize, play, and transact within immersive virtual environments. The vision assumed that VR headsets would become the primary computing interface—a device category that would eventually supersede smartphones in importance. This belief led Meta to rebrand from Facebook to Meta and to invest approximately $36 billion annually in Reality Labs through 2024, despite the division never generating meaningful revenue.

This vision had internal logic. If VR headsets were truly the future of computing, then owning the platform and the primary content experience (Horizon Worlds) would give Meta a dominant position in that future market. It was essentially a bet-the-company strategy based on technological determinism: VR adoption would follow the S-curve adoption pattern of previous computing platforms, and Meta would position itself to capture value across hardware, software, and commerce.

But markets don't always validate technological visions, regardless of how much capital you deploy. Several factors converged to undermine this thesis:

Consumer adoption flatlined: VR headset sales never achieved the growth curves that would justify $36 billion in annual spending. The installed base of VR headsets worldwide remains below 200 million units—a meaningful number, but far below the billions of potential users Meta needed to reach to achieve platform dominance.

Comfort and accessibility barriers persisted: VR headsets cause motion sickness, fatigue, and social awkwardness for many users. The high barrier to entry—both financial and experiential—meant that VR remained a niche enthusiast category rather than a mainstream technology.

Content flywheel never developed: Despite investments in exclusive titles and experiences, killer apps for VR failed to emerge at scale. Users weren't spending hours daily in VR worlds the way they do in mobile apps or web platforms. The content library, while growing, didn't create the network effects that drive adoption.

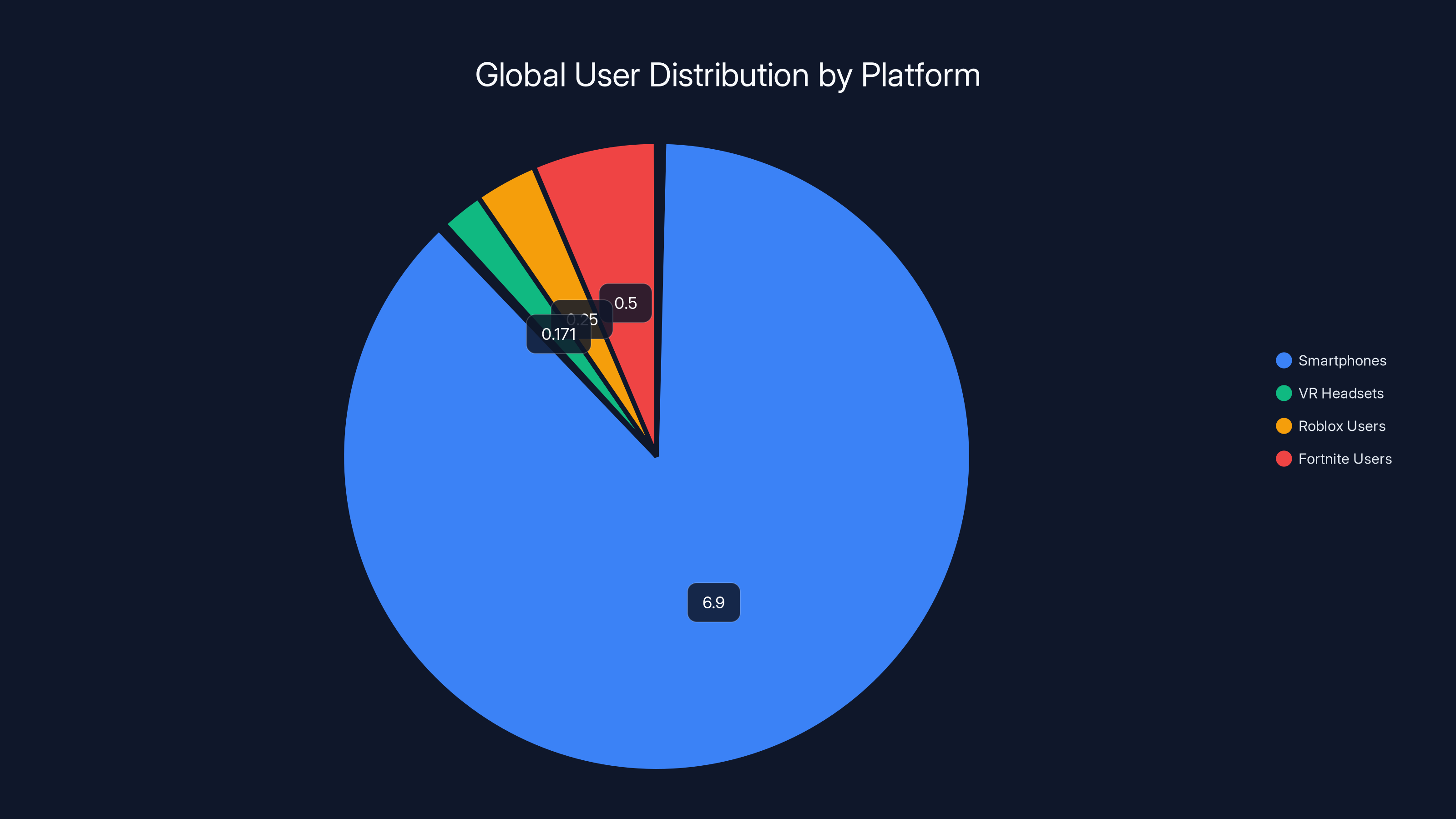

Mobile won the distribution battle: Meanwhile, smartphones continued their relentless march toward ubiquity. Every demographic, age group, and income level uses smartphones. The installed base of smartphones is over 6 billion globally, dwarfing any plausible VR market. For Meta to reach scale, it needed to follow users to where they already are—mobile devices.

The mobile-first pivot represents Meta accepting market reality: virtual worlds can be valuable and engaging, but they'll reach mainstream audiences through mobile-first interfaces, not premium VR hardware. This is a humbling realization for a company that spent years betting everything on the opposite proposition.

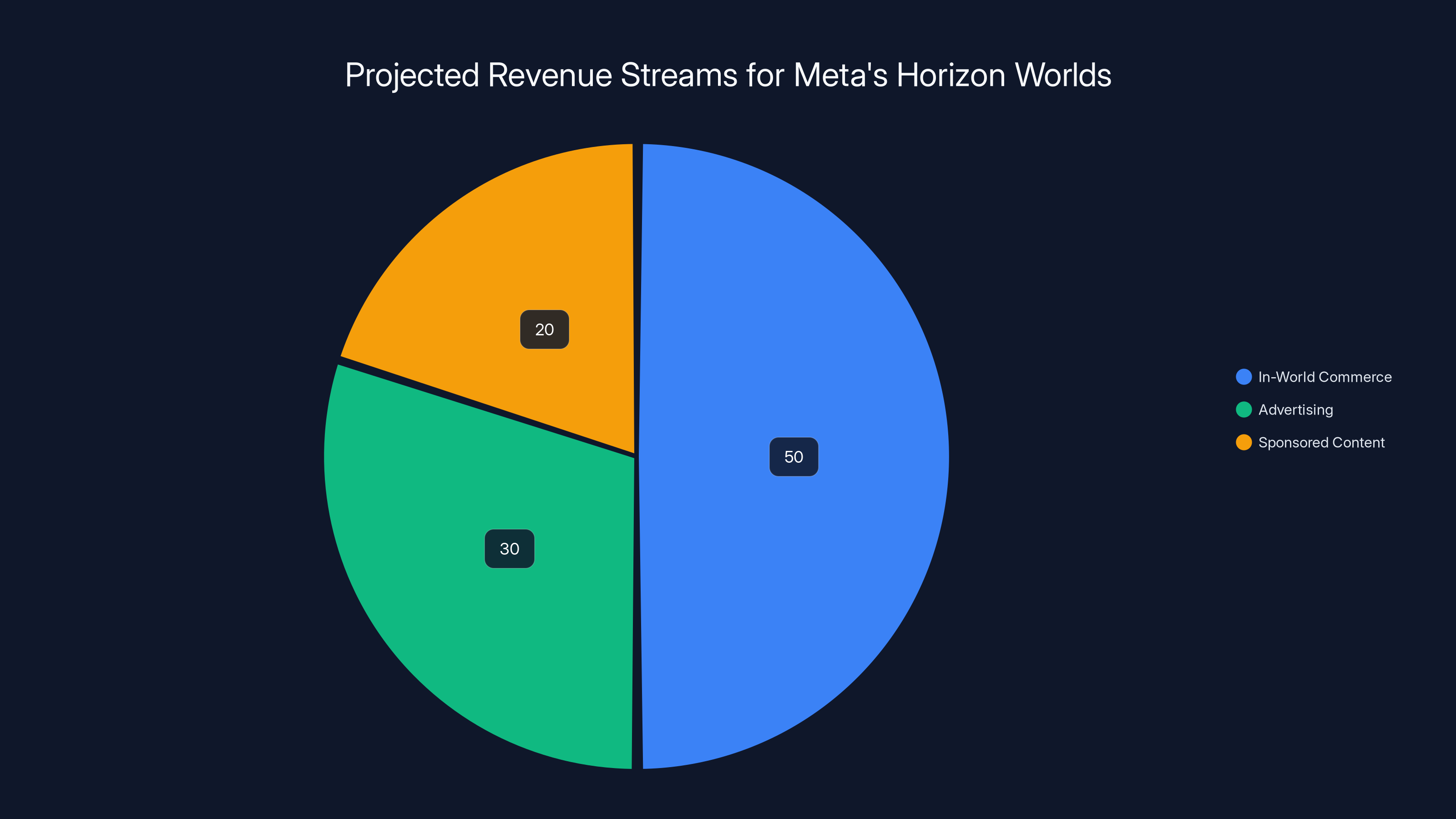

In-world commerce is projected to be the largest revenue source for Meta's Horizon Worlds, followed by advertising and sponsored content. Estimated data based on industry trends.

Market Context: Why Mobile-First Makes Business Sense

The Mathematics of Scale

The decision to pivot Horizon Worlds toward mobile isn't driven by ideology or technological preference—it's rooted in basic mathematics. Mobile phones represent the only distribution channel capable of reaching billions of potential users. The numbers are stark:

- Smartphones: 6.9 billion users globally, with over 3.8 billion monthly active users on Meta's platforms (Facebook, Instagram, Whats App)

- VR headsets: Approximately 171 million units installed globally, with annual shipments in decline

- Mobile app downloads: 299 billion apps downloaded in 2024 alone

- Mobile commerce: $3.9 trillion in global mobile commerce transactions annually

These aren't marginal differences—they're orders of magnitude. For Meta to build a true platform business around Horizon Worlds, it needs to be where users are. And users are on mobile devices.

Consider the competitive landscape. Roblox, which Meta cited as a direct competitor, operates primarily as a mobile and web platform. Its success demonstrates that you don't need VR hardware to build a profitable virtual world platform—you need accessibility, user-created content, and robust monetization. Roblox serves over 250 million monthly active users, the vast majority of whom are accessing the platform on mobile devices or web browsers.

Fortnite, another platform Meta likely monitors closely, reaches over 500 million registered accounts through its availability on mobile devices (despite its tempestuous relationship with Apple's App Store). The success of these competitors on mobile-first distribution channels proves that engagement and monetization are possible without VR hardware requirements.

Meta's own data likely showed this as well. If Horizon Worlds users were predominantly accessing the platform through mobile and web clients rather than VR, that would be powerful evidence that the real growth opportunity lies in mobile-first development rather than VR-first development. This data-driven reasoning explains why Samantha Ryan specifically mentioned Meta's ability to "connect games to billions of people on the world's biggest social networks"—Meta's competitive advantage isn't VR hardware, it's the existing audience on Facebook, Instagram, and Whats App.

The Economics of Platform Development

Beyond raw user numbers, the economics of platform development heavily favor mobile-first strategies. Developing for mobile devices is substantially cheaper than developing for VR ecosystems. Here's why:

Fragmentation management: Mobile app development requires supporting different screen sizes and capabilities, but the fundamental platform architecture is similar across i OS and Android. VR development requires optimizing for multiple headset architectures (Meta Quest, Play Station VR, HTC Vive, Valve Index, and others), each with different capabilities, input methods, and performance characteristics.

Development tooling: The mobile development ecosystem is vastly more mature. Hundreds of thousands of developers have mobile skills, tools like React Native enable cross-platform development, and the infrastructure for deployment, analytics, and monetization is standardized. VR development remains more specialized, requiring deeper expertise and custom solutions.

User onboarding: New users can instantly access a mobile app by downloading it through an app store. VR onboarding requires purchasing hardware, installing software, dealing with setup complexity, and adapting to the technical/physical requirements of VR. The friction is orders of magnitude higher.

Monetization infrastructure: Mobile platforms have established monetization models—in-app purchases, ads, subscriptions—that are proven at scale. VR monetization remains experimental, with lower average revenue per user and less mature payment infrastructure.

From a pure business perspective, mobile-first development allows Meta to allocate development resources more efficiently, reach a larger potential audience, and deploy monetization strategies that are already validated through Facebook, Instagram, and Whats App's existing operations. It's simply a more rational use of capital than continuing to bet heavily on VR-first development.

Investor and Stakeholder Pressures

Meta's pivot also reflects broader investor and stakeholder pressures that intensified throughout 2024. The company's stock performance had recovered significantly from 2023 lows, but Reality Labs remained a persistent drag on profitability and investor confidence. Some major investors began questioning whether the metaverse bet made strategic sense, and several prominent Wall Street analysts suggested that the company's resources would be better deployed toward artificial intelligence and other growth initiatives.

Mark Zuckerberg's public pivot toward artificial intelligence in early 2025 reinforced this pressure. By refocusing Reality Labs's strategic narrative from building the future of computing around VR to supporting Meta's broader AI strategy, the company signaled that the VR/metaverse bet was being subordinated to more immediate business priorities. The mobile-first pivot for Horizon Worlds fits neatly into this repositioning—it suggests Reality Labs is becoming more disciplined about capital allocation and more willing to pursue strategies that align with market realities rather than long-term technological visions.

Post-separation, Horizon Worlds focuses on ease of access and social features, while Quest emphasizes hardware innovation and immersive experiences. (Estimated data)

Technical Architecture: How Mobile-First Changes Development

Platform Architecture Differences

The shift from VR-first to mobile-first development involves fundamental architectural changes that ripple through every aspect of the platform. Understanding these technical differences illuminates why the separation makes sense and what challenges lie ahead.

VR-optimized architecture requires:

- 6-degree-of-freedom (6DOF) tracking using controller inputs

- High frame rates (90+ FPS) to prevent motion sickness

- Stereo rendering for each eye

- Complex spatial audio systems

- Optimized physics for tracked hand and body movement

- Heavy reliance on specialized VR SDKs and engines

Mobile-optimized architecture focuses on:

- Touch and gesture-based interfaces

- Lower power consumption to extend battery life

- Responsive performance across variable device capabilities

- Network efficiency for cellular connectivity

- Streamlined 3D rendering for mobile GPUs

- Integration with mobile operating system features (notifications, social sharing, etc.)

These aren't minor differences—they're architectural divergences that affect how content is designed, how users interact with experiences, and how the platform handles input, rendering, and networking. Trying to support both architectures simultaneously creates complexity that slows development and prevents optimization for either use case.

By formally separating these platforms, Meta enables its Quest VR team to optimize aggressively for VR-specific requirements without compromise, while the Horizon Worlds mobile team can build experiences that feel native to mobile interfaces and leverage the unique strengths of mobile devices.

Content Creation and Developer Tools

The mobile-first pivot will require updating content creation tools and developer resources. VR content creation often relies on tools like Unreal Engine or Unity configured for VR-specific constraints. Mobile Horizon Worlds development will benefit from tools optimized for mobile game development, including:

- Lower poly-count 3D assets: Mobile devices have significantly less GPU memory and processing power than VR-capable computers. Content optimized for mobile requires more aggressive asset reduction and LOD (level of detail) strategies.

- Touch-first interface design: Experiences optimized for VR often use spatial menus and gesture controls. Mobile experiences need to be designed around touch input, which is fundamentally different from tracked hand controllers.

- Cross-platform testing infrastructure: Mobile developers need tools to test experiences across the fragmented landscape of Android and i OS devices with varying capabilities.

- Performance profiling for mobile: Tools that measure performance on mobile devices—battery consumption, thermal management, memory usage—become critical.

Meta will need to evolve its development tools to support these requirements. This likely involves partnerships with engine providers (Unreal, Unity, Godot) to ensure mobile-optimized tools are available to developers building on Horizon Worlds.

Rendering and Performance Optimization

Mobile rendering presents different challenges than VR rendering. On a VR headset, you're rendering two views (one for each eye) at high frame rates (90+ FPS) with low-latency tracking. On mobile, you're rendering a single view, but you're doing so within significant power and thermal constraints.

Mobile Horizon Worlds will need to employ aggressive optimization techniques:

- Dynamic resolution: Automatically reducing rendering resolution when performance dips to maintain smooth gameplay

- Deferred rendering: More efficient rendering technique for scenes with many light sources

- Mesh optimization: Reducing polygon counts and texture sizes compared to VR versions

- Spatial caching: Optimizing how the game loads and manages nearby world content

- Battery-aware performance: Dynamically adjusting visual quality based on device battery level

These optimizations are well-established in mobile game development, but they require a different engineering mindset than VR development. The mobile team will benefit from recruiting experienced mobile game engineers and potentially leveraging expertise from studios that have successfully scaled games to billions of mobile users (like Tencent, Supercell, or King).

The Quest Platform: What Changes for VR?

Quest's Continued Role in Meta's Strategy

While Horizon Worlds moves to mobile-first, the Quest VR platform itself isn't being abandoned. Meta still plans to invest in VR hardware and software, and the company has acknowledged having "multiple Quest devices on its roadmap." The separation of Horizon Worlds from Quest actually clarifies the Quest platform's focus: it can now concentrate entirely on being an excellent VR gaming and experiences platform without the burden of also serving as the default home for Horizon Worlds.

This is potentially beneficial for the Quest ecosystem. VR enthusiasts have long complained that Meta's focus on Horizon Worlds as a "virtual desktop" experience diluted focus on what VR hardware is genuinely great at: immersive gaming and specialized applications. With Horizon Worlds no longer crowding the narrative, Meta can market Quest primarily as a gaming and entertainment device, which is where VR has proven most compelling.

Business Insider reported in December 2024 that Meta was developing a gaming-focused Quest headset, and this makes more strategic sense given the separation. Rather than trying to be all things to all users (office meetings, social hangouts, and gaming), Meta can develop hardware specifically optimized for gaming, which is where the VR consumer market has the strongest product-market fit.

Developer Support and Monetization

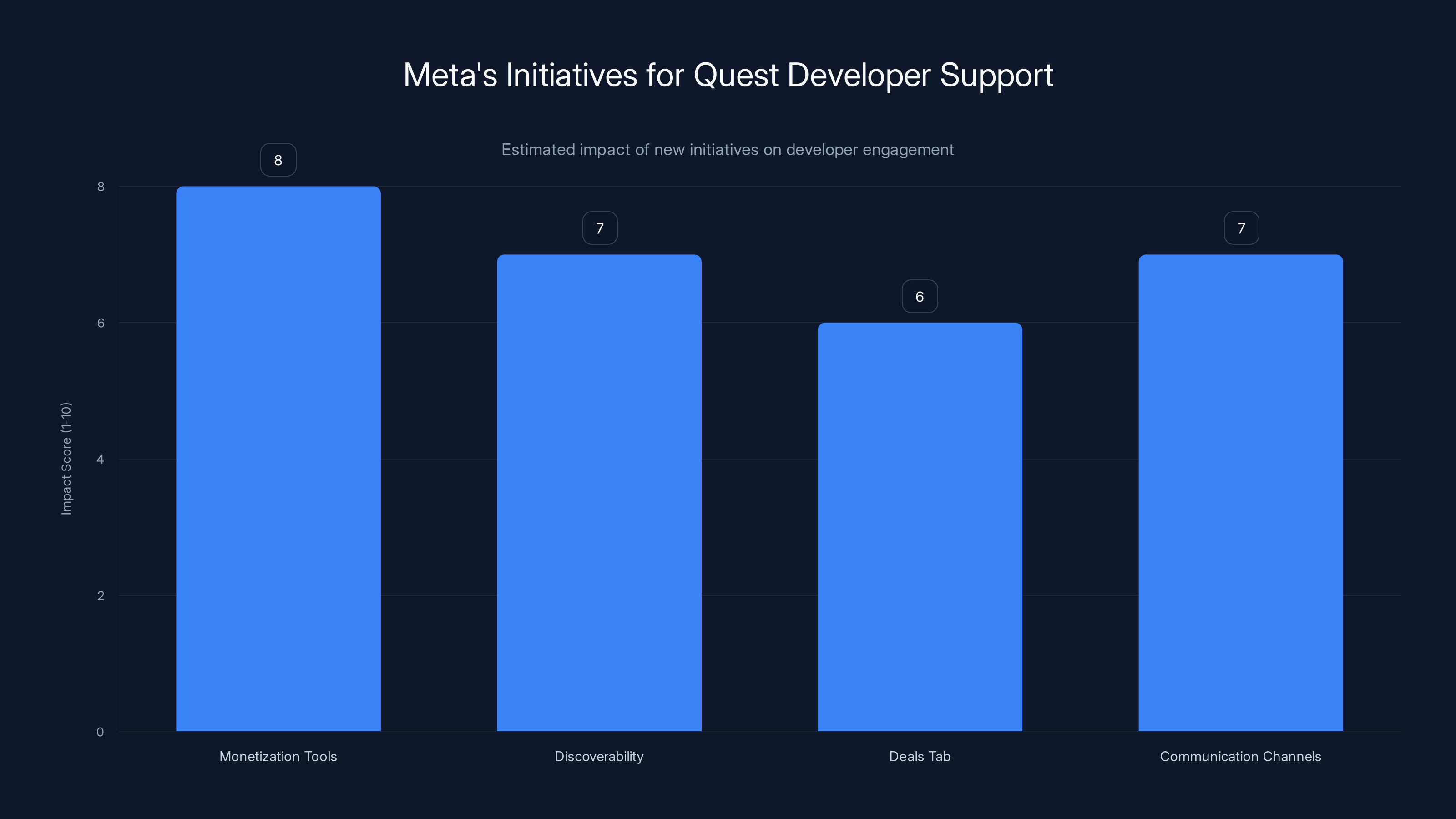

The announcement emphasizes Meta's continued commitment to third-party developers on Quest. The company is implementing several initiatives:

- New monetization tools: Giving developers more flexibility in how they monetize VR experiences

- Better discoverability: Improving how players find new VR games and experiences

- Deals tab: Creating promotional opportunities for developers

- Developer communication channels: Better infrastructure for developers to reach players

These initiatives suggest Meta is taking seriously the risk that separating Horizon Worlds from Quest could reduce engagement on the platform. If Quest loses Horizon Worlds as an engaging, free-to-play social experience that keeps users engaged, the platform could become even more niche. By investing in better monetization and discoverability tools, Meta is trying to ensure that premium VR games remain compelling enough to drive engagement and justify headset purchases.

The timing is significant: Meta shuttered several of its own VR game studios in 2024, which sent a concerning signal to the VR developer community. By emphasizing new tools and opportunities for third-party developers, Meta is attempting to rebuild confidence in the platform and assure developers that there's still a viable business model for VR game development.

The Hardware Roadmap Question

One major unanswered question is whether Meta's commitment to VR hardware will remain as ambitious as previously stated. Reality Labs lost over $50 billion cumulatively between 2020 and 2024. At some point, even a company as profitable as Meta has to seriously evaluate whether this investment thesis still makes sense.

The mobile-first pivot for Horizon Worlds suggests Meta may be gradually reducing its VR ambitions to focus on AI and other growth areas. The company might settle for a smaller but profitable VR business serving gaming enthusiasts, rather than pursuing the expensive bet of making VR a mainstream platform. This would represent a significant strategic retreat from the original metaverse vision, but it might be the most rational outcome given the market realities we've observed over the past three years.

Smartphones dominate with 6.9 billion users globally, highlighting the vast reach compared to VR headsets and popular platforms like Roblox and Fortnite. Estimated data.

Horizon Worlds on Mobile: What the Platform Offers

Core Experience Model

Horizon Worlds is fundamentally a user-generated content platform where players can build, share, and monetize virtual spaces and experiences. On mobile, this becomes more accessible and social, but the core concept remains similar to competitors like Roblox and Fortnite Creative.

Users can:

- Create spaces: Build virtual worlds using Horizon's creation tools

- Socialize: Hang out with friends and other players in shared spaces

- Create games and experiences: Build interactive content for others to enjoy

- Monetize: Earn revenue through in-world purchases, Robux-like currency, and creator programs

- Discover content: Browse and engage with experiences created by other users

The mobile-first positioning emphasizes accessibility. Rather than requiring a $300-500 VR headset, users can access Horizon Worlds through smartphones that most already own. This dramatically reduces the barrier to entry and should theoretically unlock much larger audiences.

Meta's positioning against Roblox and Fortnite is explicitly about scale: Meta can leverage its existing social graph (Facebook, Instagram) to drive distribution and network effects. Someone can encounter an interesting Horizon Worlds experience shared by a friend on Instagram, click a link, and immediately start playing without downloading an app (through web access) or searching an app store. This advantage—turning social platforms into distribution channels for immersive experiences—is genuinely unique.

Creation Tools and Developer Experience

Horizon Worlds' mobile version will need to maintain reasonably powerful creation tools to keep developers motivated. Meta hasn't provided detailed specifications about what creation capabilities will be available on mobile, but the platform has been developing these tools since at least 2023.

Expectations likely include:

- Simplified world building: Tools for placing objects, designing spaces, and creating environments

- Visual scripting: Block-based coding (like Scratch) rather than text-based programming

- Asset library: Pre-built objects, avatars, and components developers can customize

- Performance management: Tools to help developers optimize their experiences for mobile devices

- Monetization controls: Interfaces for setting up payments and tracking revenue

The creation tools will be significantly simpler than VR-focused tools, but they should remain powerful enough to support engaging game and experience development. Mobile game development platforms like Unity and Unreal already demonstrate that you can create rich, engaging content for mobile devices with the right tooling.

Social and Network Features

Mobile Horizon Worlds' most significant advantage over competitors like Roblox will likely be its deep integration with Facebook, Instagram, and other Meta platforms. Rather than requiring users to navigate through Horizon's native discovery mechanisms, Meta can surface interesting experiences directly within the platforms where users already spend most of their time.

Expect features like:

- Instagram integration: Sharing Horizon experiences directly to Instagram Stories or Feed

- Facebook Groups: Communities building Horizon experiences together

- Messenger integration: Inviting friends to Horizon experiences through Messenger

- Cross-platform presence: Your friends on Instagram knowing what you're doing in Horizon

- Social commerce: Seamless purchasing of digital goods across Meta's ecosystem

This integration advantage is legitimate and could be a significant differentiator versus Roblox, which lacks access to a similarly massive social network. However, it's also a fragile advantage—if Meta's social platforms continue to decline in cultural relevance (particularly among younger users who are more engaged with Tik Tok and other platforms), the distribution advantage diminishes.

Competitive Positioning: How Horizon Worlds Compares

Direct Competitors: Roblox

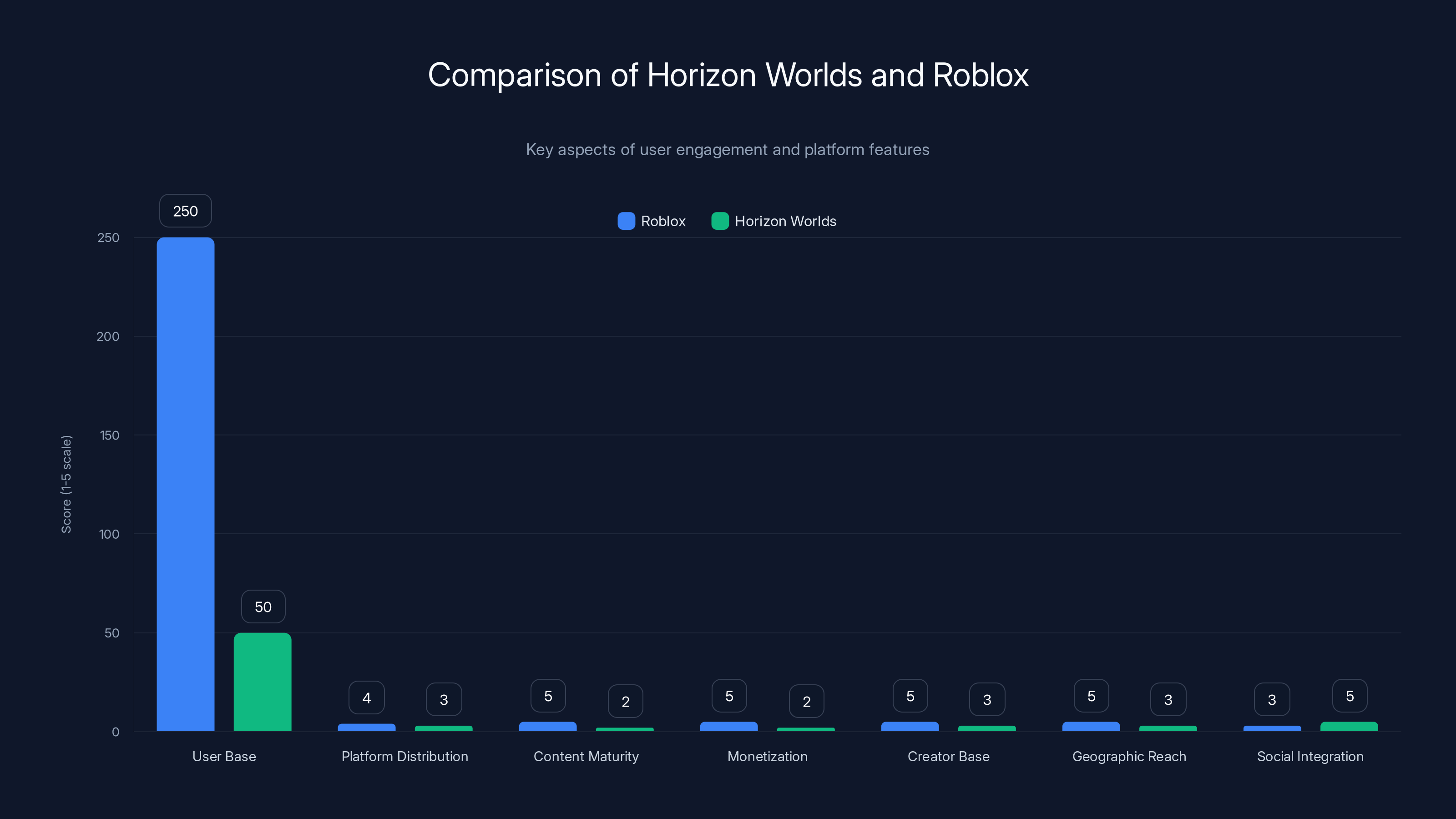

Roblox is the most natural competitor to mobile Horizon Worlds. Both platforms emphasize user-generated content, creator monetization, and social play. The comparison reveals strengths and weaknesses on both sides:

| Aspect | Roblox | Horizon Worlds |

|---|---|---|

| User Base | 250M+ monthly active users | <50M estimated monthly active users |

| Platform Distribution | Mobile, web, desktop, console | Mobile, web (VR on Quest) |

| Content Maturity | 15+ years of content ecosystem | Newer, smaller content library |

| Monetization | Robux currency system (proven) | Developing monetization (newer) |

| Creator Base | Millions of active creators | Growing creator community |

| Average Revenue Per User | ~$0.40-0.60 | Unknown (likely lower) |

| Geographic Reach | Global, strong in Western markets | Global but weaker user traction |

| Social Integration | Limited (platform-native) | Deep Meta platform integration |

Roblox's massive user base advantage is substantial. The 250 million monthly active users represent years of network effects, content accumulation, and creator ecosystem development that Horizon Worlds will struggle to match in the near term. A new user joining Roblox encounters millions of high-quality experiences to try. A new user joining Horizon Worlds encounters a smaller catalog, though one that includes content from Meta employees and professional developers.

However, Horizon Worlds has potential advantages:

- Distribution leverage: Facebook's 3 billion monthly active users represent a vastly larger audience than Roblox can access

- Payment infrastructure: Meta's existing payment systems across Instagram, Facebook, and Whats App are mature and proven

- Monetization models: Meta's experience with ad-supported platforms could enable more sophisticated monetization than Roblox's currency-focused model

- Creator economics: Meta could offer developers better revenue sharing (Roblox notoriously takes a large cut of creator revenue)

The race will likely hinge on whether Meta can successfully leverage its distribution advantages faster than Roblox can grow through its organic network effects.

Indirect Competitors: Fortnite and Decentraland

Fortnite's Creative mode is an indirect competitor—it allows players to build and share experiences, though the primary user base is still attracted by the main battle royale game. Fortnite reaches over 500 million registered users, though it's been struggling with i OS distribution issues and declining engagement among younger players.

Fortnite's advantages include brand strength, a massive creative toolset, and direct line of sight to billions in metaverse-related revenue. Its disadvantages include Epic's contentious relationship with Apple, inconsistent platform policies, and the reality that most users are there for battle royale, not creative world-building.

Decentraland is a different category entirely—a blockchain-based virtual world where property ownership is tied to cryptocurrency assets. While Decentraland has generated interesting headlines about virtual real estate sales, the project has struggled with user adoption (estimates suggest fewer than 10,000 daily active users) and remains highly speculative. The blockchain-based approach appeals to crypto enthusiasts but has proven to have limited mainstream appeal. Horizon Worlds, by contrast, uses traditional game development tools and monetization rather than blockchain complexity.

Emerging Competitors: Other Platforms

Several other platforms are pursuing similar niches:

- Rec Room: A social VR platform that also offers mobile access, focusing on user-created games and social experiences

- VRChat: A dedicated VR platform that allows custom avatars and user-created worlds

- Spatial: An AR-focused platform for enterprise and social experiences

- Gather. Town: A more productivity-focused virtual space for teams

These platforms serve different markets or specific use cases. Rec Room is probably the closest analog to Horizon Worlds, but it has maintained focus on being a VR-first platform despite adding mobile support, whereas Horizon Worlds is explicitly pivoting to mobile-first. This positioning choice could allow Horizon Worlds to reach a much larger addressable market.

Meta's new initiatives for Quest are estimated to significantly enhance developer engagement, with monetization tools and improved discoverability leading the impact. Estimated data.

Monetization Strategy: How Meta Plans to Make Money

In-World Commerce and Digital Goods

The primary monetization lever for mobile Horizon Worlds will be in-world commerce—users purchasing digital goods like customized avatars, virtual real estate, or cosmetic items. This is the model that makes Roblox over $1 billion annually and drives engagement on Fortnite.

Horizon Worlds is implementing several commerce mechanisms:

- User-to-user commerce: Creators selling items they've designed to other players

- Creator storefronts: Dedicated spaces where creators can showcase and sell content

- Cosmetic marketplace: Avatar customizations, clothing, accessories

- Experience bundles: Packages of content or items sold together

Meta's advantage here is that it already processes payments across Facebook, Instagram, and Whats App at massive scale. The company understands payment fraud, regional variations in payment methods, local currency conversions, and regulatory complexities that might slow competitors. It can likely offer payment infrastructure that's more robust and lower-cost than what competitors have built.

The challenge is that Horizon Worlds currently has a much smaller user base than Roblox or Fortnite, which means lower total commerce volume. Building a thriving creator economy requires demonstrating that creators can earn meaningful income, which in turn requires sufficient players willing to spend money on items. This is a chicken-and-egg problem that Meta must solve through investments in user acquisition and creator incentives.

Advertising and Sponsored Content

While Roblox has historically avoided aggressive advertising (focusing on direct purchase monetization), Meta will likely explore advertising opportunities given its core competency in ad-supported platforms. Potential advertising approaches include:

- Branded experiences: Companies creating sponsored worlds or areas within Horizon Worlds (similar to Roblox's branded experiences)

- In-world advertising: Billboards, storefronts, and branded items within experiences

- Promoted discovery: Paying to have experiences featured in discovery feeds

- Analytics and targeting: Leveraging Meta's unmatched advertising capabilities to help brands reach specific demographics

Advertising monetization is sensitive—too much advertising ruins user experience and drives players to competitors. However, done thoughtfully, advertising can diversify monetization without directly charging users, which is important for freemium gaming economics.

Meta's advertising capabilities are sophisticated enough to enable performance-based advertising, where brands pay based on engagement metrics rather than impressions. This could create opportunities for creators and brands to collaborate on monetized experiences that users find valuable rather than intrusive.

Subscription and Premium Features

Meta might implement a subscription tier offering premium features:

- Creator tools: Advanced building and monetization tools for serious creators

- Account features: Premium avatar slots, private world hosting, enhanced storage

- Discovery advantages: Highlighted placement in discovery systems

- Revenue sharing: Better revenue splits for premium subscribers

Subscription revenue is predictable and valuable—if even 5% of Horizon Worlds users subscribed at $5/month, that would be meaningful recurring revenue. However, subscription models in free-to-play games require careful balancing to avoid alienating free users or making paying users feel like they're getting insufficient value.

Creator Revenue Sharing Models

One of Meta's potential competitive advantages is offering better creator revenue sharing than Roblox, which typically takes 30-70% of revenue depending on currency and context. If Meta could offer 50-50 or even 60-40 splits to creators, it could attract high-quality creators from Roblox and other platforms.

This would be a deliberate investment in ecosystem quality—sacrificing near-term revenue to build a creator moat that drives long-term platform dominance. Meta has the financial resources to pursue this strategy if it decides the long-term opportunity justifies the investment.

User Experience: From Headset to Smartphone

Interface and Control Adaptation

Moving from VR to mobile fundamentally changes how users interact with experiences. VR relies on spatial 6DOF hand tracking, head movement, and gesture controls. Mobile relies on touch input, swiping, tapping, and gyroscope controls (tilting the phone).

Designing Horizon Worlds for mobile requires rethinking interfaces:

- Spatial menus become flat interfaces: The intuitive gesture of reaching out to grab a virtual menu in VR becomes tapping a button on mobile

- Avatar control changes: In VR, you control avatars with your full body through tracked movement and controllers. On mobile, you likely control movement with a virtual joystick and actions through buttons

- Interaction paradigm shift: VR emphasizes spatial proximity and gesture recognition; mobile emphasizes tap targets and gesture recognition (swiping, pinching)

- Social presence: VR conveys rich nonverbal communication through tracked body position and gesture. Mobile loses much of this fidelity, though animations and avatar states can partially compensate

Developers building for mobile Horizon Worlds will need to rethink experiences from the ground up rather than simply porting VR content. An experience optimized for VR's spatial fidelity may feel clunky on mobile, while a mobile-optimized experience would likely feel constraining in VR.

Meta's separation decision makes sense here—allowing each platform's development teams to optimize for their respective interfaces rather than trying to build interfaces that work adequately on both but excel on neither.

Device Capability Variations

Mobile development introduces complexity that VR-first development avoids: massive variations in hardware capability. Someone accessing Horizon Worlds on a flagship i Phone 16 Pro Max has dramatically more GPU power and screen resolution than someone on a mid-range Android phone from two years ago. VR development typically assumes relatively consistent hardware (people buying a $400+ headset are usually buying relatively recent hardware).

Mobile Horizon Worlds must support:

- Devices from i Phone 12 to i Phone 16 Pro (and equivalents on Android)

- Screen sizes from 4-inch to 7-inch phones (and tablets up to 12-inch)

- Performance variations spanning 10x differences in GPU performance

- Varying network conditions (4G LTE, 5G, Wi Fi with variable bandwidth)

- Different input capabilities (some devices have advanced AR capabilities, others don't)

Managing this fragmentation requires sophisticated optimization strategies:

- Hardware detection: Automatically adjusting visual quality based on detected device capability

- Network detection: Adjusting experience detail based on connection speed

- Graceful degradation: Ensuring experiences remain fun even on lower-end devices, just with reduced visual fidelity

- Cross-device compatibility: Testing across representative devices from multiple manufacturers

This is manageable complexity—any successful mobile game does this already—but it's a shift from the more controlled VR environment.

Network and Bandwidth Considerations

VR experiences typically run on local Wi Fi networks or tethered to a PC. Mobile experiences need to contend with variable cellular connectivity, variable bandwidth, and potential latency challenges that VR connections might not face.

Horizon Worlds needs to handle:

- Asynchronous loading: Loading world content progressively rather than waiting for everything to load

- Mesh LOD systems: Showing lower-detail versions of geometry when bandwidth is limited

- Prediction and interpolation: Using client-side prediction to compensate for network latency

- Graceful degradation: Maintaining playability even with poor connectivity

Mobile games routinely implement these techniques, but they require engineering discipline to get right. Poor implementation creates frustrating user experiences where games feel laggy or unresponsive. Given that user experience will be critical to driving adoption beyond Meta's existing user base, this engineering work is important.

Roblox has a significant advantage in user base and content maturity, while Horizon Worlds benefits from deep Meta platform integration. Estimated data based on qualitative analysis.

Developer Ecosystem Implications

Attracting New Developers

Mobile-first positioning should make it easier to attract developers to Horizon Worlds. The barrier to entry for mobile game development is lower than VR development:

- Lower-cost hardware: You don't need a VR headset to develop for Horizon Worlds—a laptop and smartphone suffice

- More available talent: Mobile game development skills are far more prevalent than VR development skills

- Proven monetization: Mobile has decades of proven games with successful monetization models

- Faster iteration: Mobile development tools typically enable faster iteration than VR tools

- Larger addressable market: Developers know they're building for mobile's 3+ billion users rather than VR's 171 million

Meta could potentially attract developers from mobile game companies or web game companies who have been skeptical of Horizon Worlds because of its VR orientation. By positioning the platform as mobile-first, Meta removes a fundamental objection from developers who don't have VR expertise.

Supporting VR-to-Mobile Porting

For existing Horizon Worlds developers who built VR experiences, the pivot creates challenges. Their VR-optimized experiences won't simply work on mobile—they'll need significant reworking to adapt interfaces, optimize performance, and redesign interactions for touch input.

Meta should ideally provide:

- Porting guides and best practices: Documentation on how to adapt VR experiences for mobile

- Porting tools: Automated systems that can help convert VR-specific systems to mobile equivalents

- Technical support: Engineers who can help successful VR developers tackle mobile optimization

- Incentives: Grants or revenue guarantees for developers bringing successful VR experiences to mobile

Failing to support this transition risks alienating existing developers who invested in learning Horizon's VR tools. However, the reality is that few Horizon Worlds experiences have reached significant player bases, so the disruption is probably manageable.

Creator Economy Viability

The most critical question for the developer ecosystem is whether creators can earn meaningful income. Roblox supports full-time creator careers because it has enough players spending enough money that top creators earn six-figure annual incomes. This incentivizes talented developers to focus on Roblox rather than traditional game development.

Horizon Worlds currently lacks this proof point. Without existing evidence that creators can build six-figure incomes, it's hard to convince talented developers to focus their efforts on the platform rather than alternatives.

Meta's monetization improvements and new developer tools are meant to address this, but they won't work unless simultaneously driving meaningful user acquisition. Meta needs to reach a critical mass of engaged players willing to spend money—likely at least 100 million monthly active users—before creators can count on meaningful income from the platform.

Market Challenges and Adoption Barriers

The User Acquisition Challenge

Horizon Worlds' biggest challenge is user adoption. Despite Meta's enormous distribution advantages through Facebook and Instagram, Horizon Worlds has failed to achieve significant traction. Current estimates suggest monthly active users are below 50 million—far below Roblox and Fortnite.

Several barriers exist:

Onboarding friction: Even accessing Horizon Worlds requires downloading an app (on mobile) or visiting a web URL, creating drop-off. Users need to understand what the platform is, why they should try it, and how it differs from Roblox or other options they might already use.

Content library: When new users join, they encounter a smaller library of experiences than on Roblox. The 250 million users on Roblox collectively create network effects that make the platform stickier. Horizon Worlds needs critical mass to create similar network effects.

Social proof: Influential creators and streamers drive adoption. If Horizon Worlds lacks visible creators, streamers won't promote it, and users won't adopt it. Building this flywheel requires investment.

Alternative options: Users can already access immersive experiences on Roblox, Fortnite, Rec Room, and other platforms. Switching costs are real—existing friend networks are on other platforms, users have invested in other accounts and cosmetics.

Meta's strategy should involve aggressive user acquisition through its social platforms, partnerships with popular creators, and attractive monetization for developers. However, changing user behavior at scale is always slow and uncertain.

Monetization Challenges

Even with millions of users, converting them to paying users is challenging. The free-to-play economics require:

- High engagement: Users must spend enough time in the platform to encounter monetization opportunities

- Clear value exchange: Users must perceive that purchases offer genuine value

- Peer effects: When friends are visibly using cosmetics or premium features, it increases desire to purchase

Horizon Worlds is currently weak on all three dimensions. Without critical mass, it's hard to create the peer effects that drive monetization. Without existing engagement, it's hard to demonstrate value. These are solvable problems, but they require sustained investment and operator focus.

Retention Challenges

Beyond acquisition, Horizon Worlds must improve retention. Many platforms track that first-time users drop off quickly if they don't find engaging content immediately. The 30-day retention rate is particularly important—if new users don't return within their first month, they're unlikely to ever become engaged.

Improving retention requires:

- High-quality, diverse content: A library of experiences that cater to different interests

- Social features: Making it easy to find friends and play together

- Progression systems: Giving players goals and objectives to work toward

- Regular updates: Keeping experiences fresh so engaged players have new things to discover

Roblox and Fortnite excel at these retention mechanics. Horizon Worlds needs to match or exceed their sophistication to prevent the engagement churn that has plagued it historically.

Meta's pivot to mobile-first Horizon Worlds presents significant opportunities, such as reaching a vast user base and leveraging distribution advantages. However, it also faces substantial risks, including competition and user retention challenges. (Estimated data)

Strategic Implications and Future Outlook

Meta's Broader Metaverse Strategy

The Horizon Worlds pivot should be understood as part of Meta's broader metaverse strategy recalibration. Rather than betting everything on immersive VR, Meta is pursuing a more pragmatic approach:

- Immersive experiences wherever users are: VR for enthusiasts, mobile for mainstream users

- AI as the core differentiator: Rather than hardware, AI tools for content generation and personalization

- Social integration: Leveraging Meta's massive social graph as the distribution advantage

- Flexible monetization: Supporting multiple revenue models (ads, subscriptions, commerce) rather than one approach

This strategy is more likely to succeed than the previous all-in bet on VR, but it's also more fragmented. Rather than unified "the metaverse," Meta is building multiple immersive experiences optimized for different platforms and audiences.

The VR Market's Uncertain Future

The Horizon Worlds pivot reflects broader uncertainty about VR's future. The industry entered 2023 with hope that Apple's Vision Pro would spark mainstream VR adoption. However, Vision Pro has sold below expectations (estimated 500,000-700,000 units in its first year despite a $3,500+ price), suggesting that even premium VR hardware with Apple's resources and ecosystem isn't achieving mainstream adoption.

This raises questions about whether VR will ever become mainstream in its current form, or whether VR experiences will instead be served through:

- AR glasses: Lighter, more socially acceptable devices

- Smartphone-based AR: Using phone cameras and sensors

- Holographic displays: Far-future technology still in research stages

- Mobile and web platforms: Immersive experiences without special hardware

Meta's pragmatic bet on mobile-first immersive experiences hedges this uncertainty. Rather than waiting for VR hardware to achieve ubiquity, Meta is meeting users where they already are—on mobile devices.

Timeline for Horizon Worlds Mobile Maturity

If Meta executes well on mobile Horizon Worlds, the likely timeline is:

2025 (Now): Announcement, mobile platform expansion, developer outreach, initial web experiences

2026: Significant user acquisition campaign, creator spotlight programs, initial monetization data showing viability

2027-2028: Platform reaching 100+ million monthly active users if acquisition succeeds, creator ecosystem maturing, competitive positioning becoming clear

2028+: Potential IPO or spin-off of Horizon Worlds as separate entity if it achieves meaningful profitability

This timeline is optimistic and assumes successful execution. Historical precedent suggests major platform pivots often take longer than expected, and user acquisition is harder to achieve than projections suggest. A more conservative timeline would see Horizon Worlds reaching meaningful scale by 2028-2029 at earliest.

Alternatives and Competitive Landscape Analysis

Traditional VR Platforms

For users and developers specifically interested in VR, several alternatives exist beyond Meta's Quest platform:

Play Station VR2: Sony's advanced VR headset with excellent exclusive content library, particularly strong for gaming experiences. Best for console gamers who want premium VR gaming.

HTC Vive: Offers multiple price points from consumer headsets to professional VR systems, with strong software ecosystem. Good for developers wanting non-Meta VR platforms.

Valve Index: PC-based VR with the strongest technical specifications and most sophisticated controllers. Popular among VR enthusiasts and developers.

Pico (owned by Byte Dance): Affordable VR headsets gaining market share, particularly in Asia. Offers alternative to Meta's ecosystem.

These alternatives serve users committed to VR hardware. However, if Meta's mobile-first pivot proves successful, these platforms may see slower growth as the mainstream audience shifts toward mobile immersive experiences.

Immersive Experience Platforms

For users interested in social virtual worlds without VR requirements, platforms worth considering:

Roblox: As discussed extensively, the market leader with 250M+ users. Offers the most mature creator ecosystem and user base. Best choice for users wanting established, proven platform with guaranteed content library.

Fortnite Creative: Strong tools for building and sharing experiences within the Fortnite ecosystem. Benefits from Fortnite's massive user base. Best for users already engaged with Fortnite's main game.

Rec Room: Balances VR and mobile access with focus on social experiences. Growing but smaller user base than Roblox. Good alternative for users wanting lighter experience.

Core (by Amazon): Lightweight game creation platform for casual developers. Simpler than Horizon or Roblox but less powerful. Good for users wanting to create without technical complexity.

VRChat: VR-focused social platform with emphasis on custom avatars and user-created content. Thriving niche community. Best for VR users wanting social-first experience.

For teams and organizations building automation or productivity solutions, alternatives like Runable offer AI-powered workflow automation and content generation tools that complement rather than directly compete with Horizon Worlds. Runable's $9/month AI agents can help creators generate content, automate workflows, and manage documentation—useful complementary tools for Horizon Worlds developers building experiences at scale. Teams managing multiple creator accounts or needing to automate content generation workflows might find Runable's automation capabilities valuable alongside their work on immersive platforms.

Blockchain-Based Alternatives

For users interested in blockchain-based virtual worlds where property ownership is cryptographically secured:

Decentraland: Pioneering blockchain virtual world, though with limited user adoption (estimated <10,000 daily active users). Appeals to crypto enthusiasts but hasn't achieved mainstream traction.

The Sandbox: Similar blockchain-based approach with slightly larger community. Offers tokenized land and assets. Good for users believing in blockchain-based ownership models.

Axie Infinity: Play-to-earn game with blockchain assets. Popular among players in developing countries where play-to-earn economics are more attractive. Best for users seeking income from gaming.

Blockchain-based alternatives offer property ownership and verifiable scarcity that traditional platforms can't, but they come with increased complexity, volatility, and speculative risk. Most mainstream users still prefer traditional platforms without blockchain friction.

Enterprise and Professional Alternatives

For professional and enterprise use cases beyond consumer entertainment:

Spatial: AR-focused platform for professional collaboration and presentations. Strong for enterprise and education use cases.

Gather.town: Lightweight platform for virtual coworking and team gathering. Popular among remote teams.

Horizon Workrooms (Meta's enterprise offering): While Horizon Worlds targets consumers, Meta also offers Workrooms for enterprise VR meetings and collaboration.

Microsoft Mesh: Microsoft's mixed reality collaboration platform integrated with Microsoft Teams. Positioning as enterprise-focused alternative.

These alternatives serve different markets than consumer Horizon Worlds and may ultimately prove more successful given clearer ROI and established buyer relationships in enterprise markets.

How to Choose: Framework for Developers and Users

For Developers Choosing Platforms

Deciding whether to develop for Horizon Worlds versus alternatives depends on several factors:

Choose Horizon Worlds if:

- You want access to Meta's distribution advantage through Facebook, Instagram, and Whats App

- You're building social experiences where network effects matter

- You want to reach mainstream mobile users rather than VR enthusiasts

- You're interested in integrating with Meta's advertising and commerce infrastructure

- You believe in Meta's long-term vision and willingness to invest resources

Choose Roblox if:

- You need an established user base and proven monetization model

- You want to build in a mature ecosystem with established best practices

- You're targeting younger audiences where Roblox dominates

- Creator economics are paramount—you need proof that developers can earn income

- You want to avoid platform risk (Roblox is already public and proven)

Choose Fortnite if:

- You want brand leverage from Fortnite's massive player base

- You're building gaming experiences where existing Fortnite mechanics apply

- You believe Epic's long-term vision of an open metaverse ecosystem

- You're willing to accept Epic's platform policies and potential limitations

Choose Rec Room if:

- You want a balanced approach between VR and mobile

- You're targeting social experiences over games

- You want to avoid competition from massive companies

- Community and quirkiness matter more than market size

Choose Traditional Game Development (Unity, Unreal) if:

- You want maximum control over the experience

- Platform independence and avoiding lock-in is critical

- You're building something too specialized for platform tools

- Long-term viability of platforms concerns you

For Users Choosing Platforms

Deciding which platform to engage with depends on your interests and use case:

Choose Horizon Worlds if:

- You're already embedded in Meta's ecosystem (Facebook, Instagram)

- You want social experiences with friends who use Meta platforms

- You prefer accessing experiences through familiar interfaces

- You want to support newer, experimental immersive experiences

Choose Roblox if:

- You want the largest library of user-created experiences

- You're interested in gaming with the most mature virtual economies

- You want to engage with a thriving global creator community

- You prefer a proven platform with established social communities

Choose Fortnite if:

- You enjoy the main Fortnite game and want related experiences

- You prefer experiences from a well-resourced developer (Epic)

- You're interested in seeing how large publishers approach metaverse ideas

Choose VR if:

- You want the most immersive, spatially-aware experiences possible

- You value presence and embodiment over convenience

- You're willing to invest in dedicated hardware

- You specifically seek experiences designed for VR's unique capabilities

FAQ

What is Horizon Worlds?

Horizon Worlds is Meta's user-generated content platform for creating and experiencing virtual worlds. Users can build spaces, socialize with friends, create interactive experiences like games, and earn money through creator monetization programs. Traditionally VR-exclusive on Meta's Quest headsets, Horizon Worlds is now pivoting to mobile-first development to reach broader audiences on smartphones and tablets.

Why is Meta separating Horizon Worlds from Quest VR?

Meta is separating these platforms to allow each to optimize independently. Quest VR can focus entirely on premium gaming and immersive experiences for VR enthusiasts, while Horizon Worlds can concentrate on mobile-first development to reach the billions of smartphone users. This separation reflects market reality: mobile devices have vastly larger addressable markets than VR headsets, and trying to serve both architectures compromised optimization for each.

How does mobile Horizon Worlds compare to Roblox?

Both platforms emphasize user-generated content and creator monetization. Roblox has significantly more users (250M+ monthly active users versus Horizon Worlds' estimated <50M), a more mature content ecosystem, and proven creator economics. Horizon Worlds' advantages include deep integration with Meta's social platforms (Facebook, Instagram), more sophisticated payment infrastructure, and potentially better creator revenue sharing. Roblox currently leads in user base and ecosystem maturity, while Horizon Worlds offers distribution advantages through Meta's platforms.

What monetization opportunities exist in Horizon Worlds?

Developers and creators can monetize through multiple channels: in-world digital goods sales, subscription features, sponsored experiences, advertising partnerships, and participation in creator revenue-sharing programs. Users can earn money by building and selling virtual items, creating popular experiences that drive engagement, or partnering with brands for sponsored content. The exact revenue structures Meta offers continue to evolve as the platform matures.

What are the technical challenges of mobile-first development for Horizon Worlds?

Mobile development introduces complexity compared to VR: device capability fragmentation (hardware performance varies 10x across models), variable network connectivity (4G, 5G, Wi Fi), battery constraints, screen size variations, and different input models (touch versus tracked controllers). Developers must build experiences that degrade gracefully across hardware capabilities, optimize for lower-power rendering, and design interfaces native to mobile touch input rather than VR spatial interaction.

Is VR being abandoned by Meta?

No, Meta is continuing to invest in VR hardware and software through its Quest platform, which now focuses specifically on gaming and immersive VR experiences. However, Meta is no longer betting that VR will become the primary platform for its metaverse ambitions. Instead, Meta is pursuing a more realistic approach where VR serves enthusiasts, while mainstream users access immersive experiences through mobile and web platforms.

How long until Horizon Worlds becomes competitive with Roblox?

If execution is successful, Horizon Worlds could reach competitive scale within 2-4 years. However, this assumes aggressive user acquisition and successful creator ecosystem development. Historical precedent suggests platform pivots often take longer than projected. The platform needs to reach 100+ million monthly active users and demonstrate that creators can earn meaningful income before it achieves true competitive parity with Roblox.

What skills do I need to develop for mobile Horizon Worlds?

Developers should understand mobile game development fundamentals: mobile-optimized 3D rendering, touch input design, performance optimization for variable hardware, network efficiency for cellular connectivity, and free-to-play monetization mechanics. Programming skills in languages like C# (with Unity) or C++ (with Unreal) are useful. Platform-specific skills include learning Horizon's creation tools, visual scripting systems, and integration with Meta's monetization infrastructure.

Will VR experiences work on mobile Horizon Worlds?

Existing VR experiences won't directly port to mobile without significant reworking. VR experiences use 6DOF hand tracking and spatial gestures that don't map directly to touch input. Developers will need to redesign interfaces, optimize performance for mobile hardware constraints, and adapt interaction paradigms for mobile devices. Meta should provide porting guides and tools to help, but expect meaningful development effort from creators wanting to bring successful VR experiences to mobile.

What's the business model for Meta's Reality Labs after this pivot?

Reality Labs will focus on multiple vectors: hardware sales for Quest VR gaming, software sales and subscriptions for Horizon Worlds, monetization from Horizon Worlds' creator ecosystem, and advertising/partnership revenue. Rather than betting everything on VR dominance, Meta is pursuing a portfolio approach across multiple platforms. This is more realistic given market realities but also requires excellence across multiple operating models simultaneously.

Should I learn to develop for Horizon Worlds instead of Roblox or other platforms?

This depends on your goals. If you want to engage with an established, proven platform immediately, Roblox remains the better choice given its mature ecosystem and 250M+ user base. If you believe in Meta's distribution advantages and are willing to take platform risk, Horizon Worlds could offer first-mover advantages in the mobile-first immersive space. Many successful creators develop for multiple platforms, so learning tools that transfer across platforms (Unity, Unreal) provides optionality while developing platform-specific expertise where you see opportunity.

Conclusion: The Pragmatism of Meta's Pivot

Meta's decision to separate Horizon Worlds from its Quest VR platform and pursue mobile-first development represents a significant strategic recalibration born from pragmatism rather than ideology. After years of betting billions on VR as the future of computing, the company is finally acknowledging market realities: VR hardware adoption has plateaued, consumers overwhelmingly prefer smartphones as their primary computing device, and building a truly massive platform requires following users to where they already are rather than asking them to adopt new hardware.

This pivot carries both risks and opportunities. The opportunity is substantial—Horizon Worlds reaching even 10% of Meta's 3.8 billion monthly active users would create a platform dwarfing Roblox. The company has genuine distribution advantages through Facebook, Instagram, and Whats App that competitors cannot replicate. Meta's mature payment infrastructure, advertising capabilities, and content moderation systems give it operational advantages over younger competitors. If executed well, mobile Horizon Worlds could become a meaningful global platform for immersive experiences.

However, risks remain significant. Roblox has a five-year head start with a mature ecosystem, established network effects, and proven creator economics. Users have existing friend networks on other platforms and psychological switching costs. Horizon Worlds has historically struggled with user retention and engagement despite Meta's resources. The company must simultaneously acquire hundreds of millions of new users, build a thriving creator economy, and maintain monetization—a remarkably difficult feat even for a company as resourced as Meta.

For developers evaluating where to build immersive experiences, the reality is more nuanced than simple platform choice. The most sophisticated approach likely involves presence on multiple platforms—Roblox for proven scale and user base, Fortnite for brand leverage and gaming audiences, and Horizon Worlds for Meta's distribution advantages. Developers with platform-agnostic skills (Unity, Unreal, etc.) retain optionality and can pivot as market conditions evolve.

For users interested in immersive experiences, this pivot expands rather than contracts options. Rather than requiring VR headset adoption, users can now access Horizon Worlds through smartphones and tablets. This accessibility is unambiguously positive for user choice and market growth. The competitive dynamic between Horizon Worlds and Roblox will likely benefit both platforms through increased overall category awareness and investment.

The broader metaverse narrative evolves here too. Rather than a unified future where everyone inhabits a single virtual space called "the metaverse," we're seeing a more pragmatic future where immersive experiences exist across multiple platforms optimized for different devices and audiences. This fragmentation is messier than the unified vision Zuckerberg articulated in 2021, but it's almost certainly more aligned with how technology adoption actually happens.

Meta's ability to execute on this new vision will determine whether Horizon Worlds becomes a legitimate competitor to Roblox or remains a notable also-ran. The company has never excelled at creator ecosystem development or long-term platform building across different communities. Success will require attracting and supporting millions of creators, each with different needs and ambitions. It will require balancing monetization pressures against user experience concerns. It will require sustained focus and investment even as company priorities shift.

The next 18-24 months will be critical. Meta needs to demonstrate traction in mobile user acquisition, show that creators can earn meaningful income, and build visible momentum that attracts top creators and developers. If the company succeeds at these challenges, Horizon Worlds could become a major platform. If it stumbles—as Meta has on creator-focused initiatives previously—the pivot may ultimately be remembered as one of many failed metaverse experiments rather than a successful strategic repositioning.

What's clear is that VR's near-term future no longer depends on Horizon Worlds or Meta's metaverse ambitions. Instead, the future of immersive experiences will be determined by whether platforms like Horizon Worlds, Roblox, and others can build compelling, sustainable ecosystems on the devices people actually use—smartphones, tablets, and the occasional VR headset for enthusiasts. Meta's pivot acknowledges this reality. Whether the company can capitalize on it remains to be seen.

For developers, creators, and users, the key takeaway is simple: the race for immersive experience platforms is competitive and contested. Rather than one clear winner, we'll likely see multiple platforms coexisting, each serving different audiences and use cases. Choose platforms based on your specific goals—whether that's audience reach, creator economics, technical capabilities, or long-term vision—and remain flexible as market dynamics continue evolving.

Key Takeaways

- Meta formally separated Horizon Worlds from Quest VR platform to enable independent optimization for mobile-first development strategy

- Mobile-first pivot reflects market reality: 6.9B smartphone users vs 171M VR headset users—mathematics of scale demands mobile accessibility

- Horizon Worlds now competes directly with Roblox (250M+ users) and Fortnite (500M+ registered), facing significant user adoption challenges

- Technical challenges of mobile development include hardware fragmentation (10x performance variations), network variability, and touch-input interface design

- Creator economy viability remains uncertain—platform must reach 100M+ monthly active users with meaningful monetization before creators can earn consistent income

- Meta's distribution advantages through Facebook, Instagram, and WhatsApp provide competitive edge over competitors but require successful user acquisition execution

- VR platform continues serving gaming enthusiasts with new monetization tools and developer support, but no longer constrained by Horizon Worlds' architectural requirements

- Timeline for competitive maturity likely 2-4 years if execution successful; platform must overcome Roblox's ecosystem maturity advantage and user network effects

- Alternative platforms (Roblox, Fortnite, Rec Room) remain viable options with different trade-offs around user base size, creator economics, and maturity

- Pragmatic pivot acknowledges that immersive experiences will reach mainstream audiences through mobile devices rather than premium VR hardware

Related Articles

- Snapchat+ 25M Subscribers Drive $1B Revenue: Inside the Strategy [2025]

- Snapchat Creator Subscriptions: Complete Guide [2025]

- Call of Duty: Warzone Mobile Shutting Down April 17, 2026 [Complete Guide]

- MyMiniFactory Acquires Thingiverse: Protecting 8M Creators From AI [2025]

- Seedance 2.0 and Hollywood's AI Reckoning [2025]

- Seedance 2.0 Sparks Hollywood Copyright War: What's Really at Stake [2025]