Crypto.com's $70M AI.com Gambit: Why Domain Names Matter [2025]

When you hear that someone paid seventy million dollars for a web address, your first instinct is probably skepticism. That's a lot of zeros for something that costs twelve dollars a year to maintain. But what if I told you this single investment might fundamentally change how companies think about digital branding, AI adoption, and the relationship between memorable real estate and user acquisition?

That's exactly what happened when Crypto.com founder Kris Marszalek acquired AI.com in early 2026, setting a new world record for domain purchases and sparking conversations that extend far beyond the crypto industry. The deal wasn't just a headline grab or a vanity play. It represents a strategic calculation about the future of artificial intelligence, where brand perception happens, and how a single perfect domain name can become an asset worth protecting and investing in at nearly any price.

This article breaks down why this purchase matters, what it tells us about how major companies now view AI positioning, the hidden economics of premium domain names, and what other organizations should understand about digital real estate in an age where AI is reshaping everything.

TL; DR

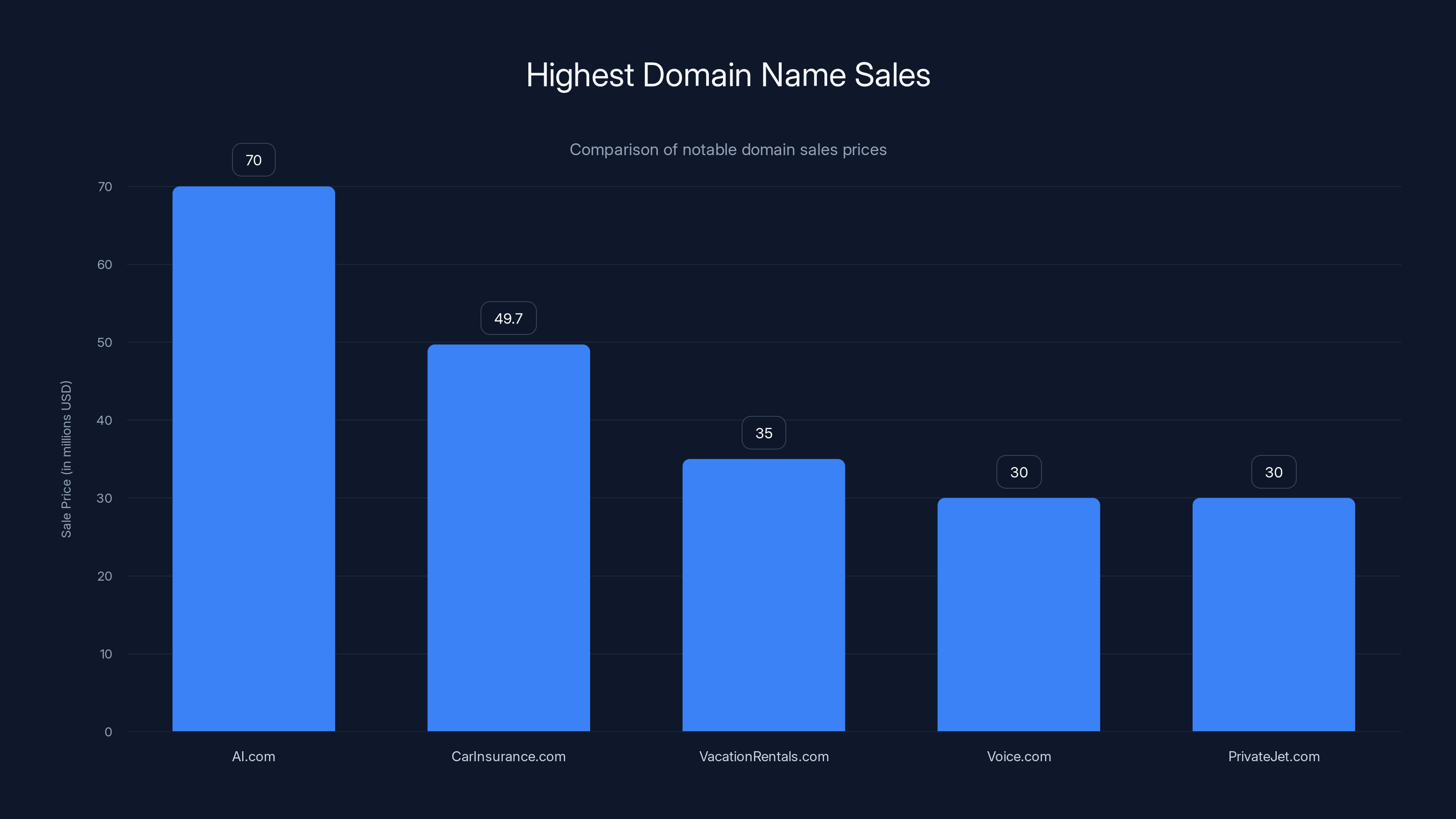

- Record-breaking investment: Crypto.com paid 49.7 million

- Super Bowl timing: The domain was positioned for a major advertising campaign during one of the year's biggest sporting events

- Strategic positioning: AI.com serves as the flagship property for Crypto.com's personal AI agent offering

- Market trend indicator: The purchase reflects broader corporate confidence in AI as a central technology for the next decade

- Digital real estate strategy: Premium domains increasingly function as foundational brand assets rather than optional marketing expenses

AI.com domain purchase (

The Context: Why This Domain Mattered Right Now

To understand why Marszalek made this move, you need to grasp the timing. This wasn't a random acquisition pulled together in a weekend. The purchase happened specifically to align with Super Bowl advertising, one of the most watched annual events globally and a venue where brands make their boldest announcements.

Super Bowl advertising has evolved beyond traditional 30-second spots. Today's biggest tech companies use the game as a platform to introduce new categories, rebrand themselves, or make statements about where technology is heading. The event reaches over 100 million viewers in North America alone, and the price tag for a 30-second spot climbs above $5 million every year now. When you're already paying that much for attention, owning the domain that directs people to your actual service becomes strategically essential.

But here's what most articles miss: the domain purchase wasn't primarily about the Super Bowl ad. It was about what comes after. Once millions of people see the commercial and want to learn more, where do they go? They go to AI.com. They don't type "Crypto.com's AI agent tool" into Google. They go directly to the domain they just heard about. That direct navigation is worth an enormous amount in terms of acquisition cost, brand authority, and user intent.

Crypto.com already owned Crypto.com, naturally. The company had spent years building that brand and authority. But Crypto.com as a brand suggests one thing: cryptocurrency. It's specific. AI.com, by contrast, is the generic placeholder for the entire category. Owning that domain means claiming a position at the center of an industry that most experts believe will define the next decade of technology.

Understanding Domain Economics: Why $70M Isn't Completely Insane

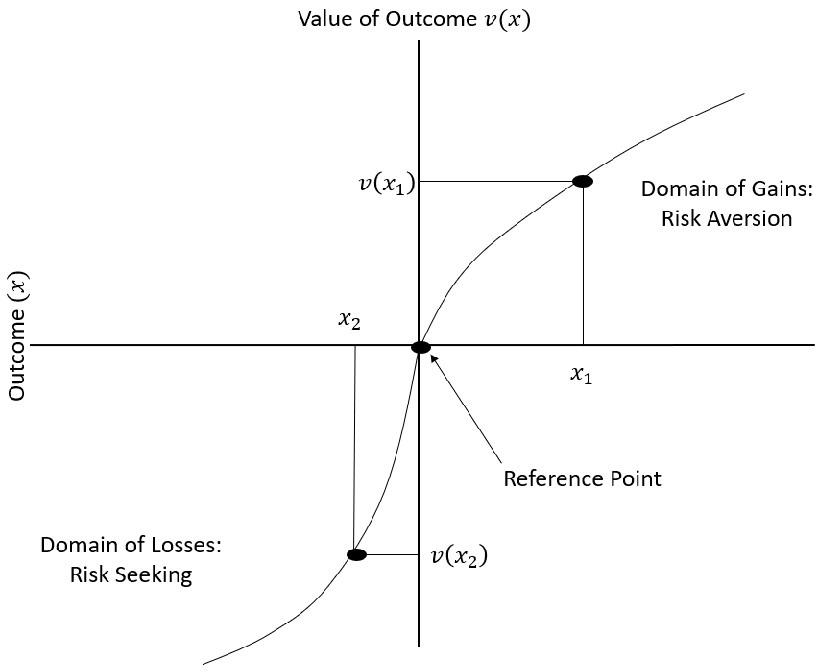

Before dismissing this as wasteful spending, let's actually do the math on domain valuations. The economics of premium domains don't work the way most people assume.

Consider what a domain like AI.com actually represents. It's not just a URL. It's a traffic magnet, a brand shorthand, and a psychological anchor point. When someone mentions "the company with the AI.com domain," that's immediately memorable and distinctive. When someone types "AI.com" directly into their browser, they're demonstrating high intent. They're not browsing randomly. They're looking for something specific.

Larry Fischer, the broker who facilitated the sale, understood this perfectly. When he told the Financial Times that "when one becomes available, the opportunity may never present itself again," he was stating an economic truth. AI.com won't come on the market again in anyone's lifetime. Once Crypto.com owns it, it's essentially off the market. The next company that wants to own a generic two-letter domain referring to artificial intelligence will need to either negotiate with Crypto.com or settle for something far less premium.

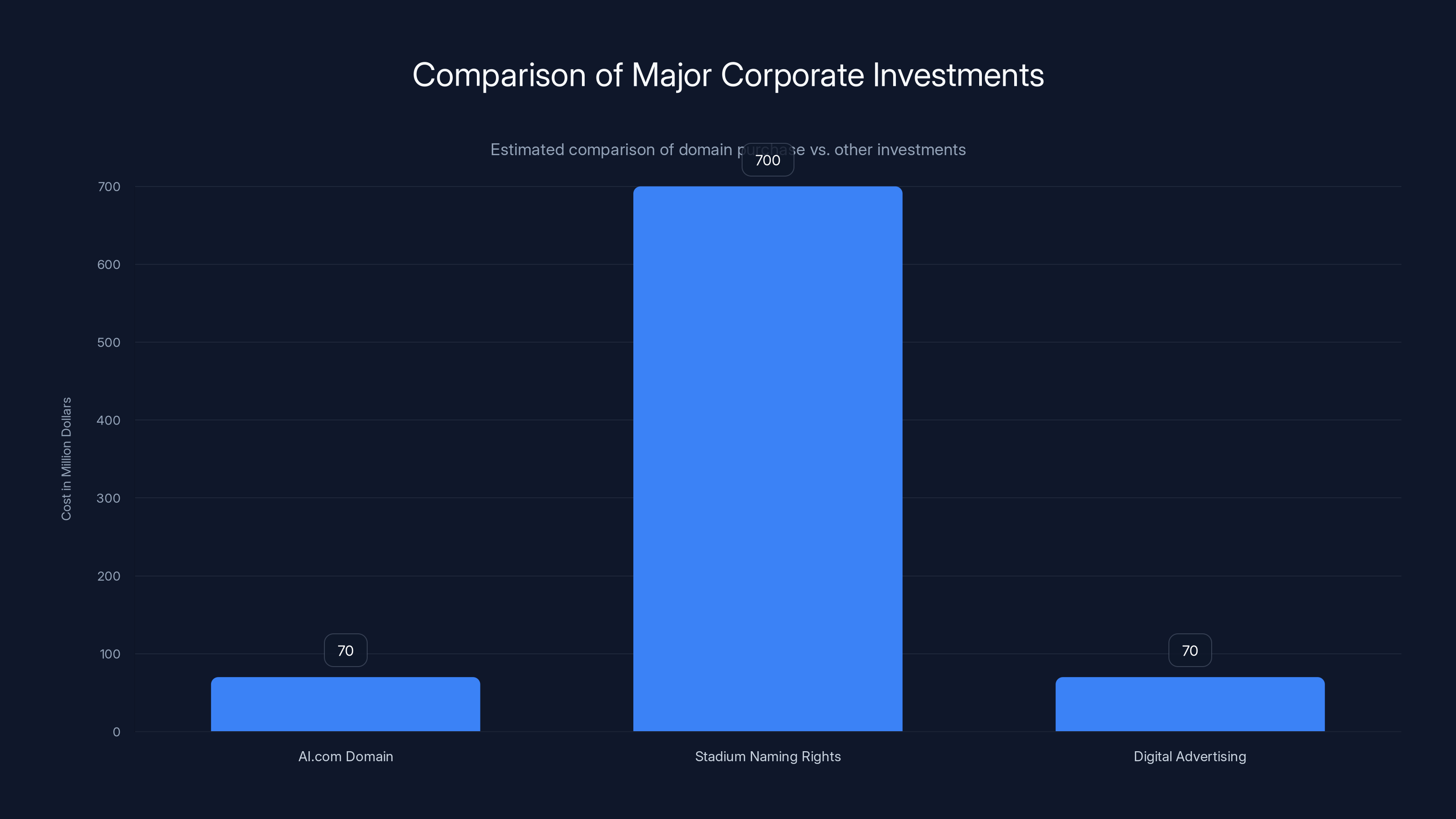

Let's put this in perspective with other major corporate investments. Crypto.com spent $700 million on naming rights to a sports stadium. That's for the privilege of having "Crypto.com Arena" on a building in Los Angeles for 20 years. The stadium naming rights are temporary, limited to geography, and require renewal. The AI.com domain is permanent, global, and costs nothing to maintain beyond the annual registration fee.

From a pure cost-per-impression standpoint, compare it to advertising spend. If Crypto.com spent $70 million on traditional digital advertising, Google and Facebook would be happy to take that money. But digital ads are temporary. You buy ad impressions that vanish as soon as the user closes the tab. The AI.com domain is a permanent asset. Every single person who navigates to that domain or sees it in marketing materials, press coverage, or word of mouth is being exposed to the Crypto.com brand.

Estimate the acquisition value at even a modest

The chart illustrates the increasing value of premium domain names over time, with AI.com projected to surpass previous records in 2026. Estimated data for AI.com.

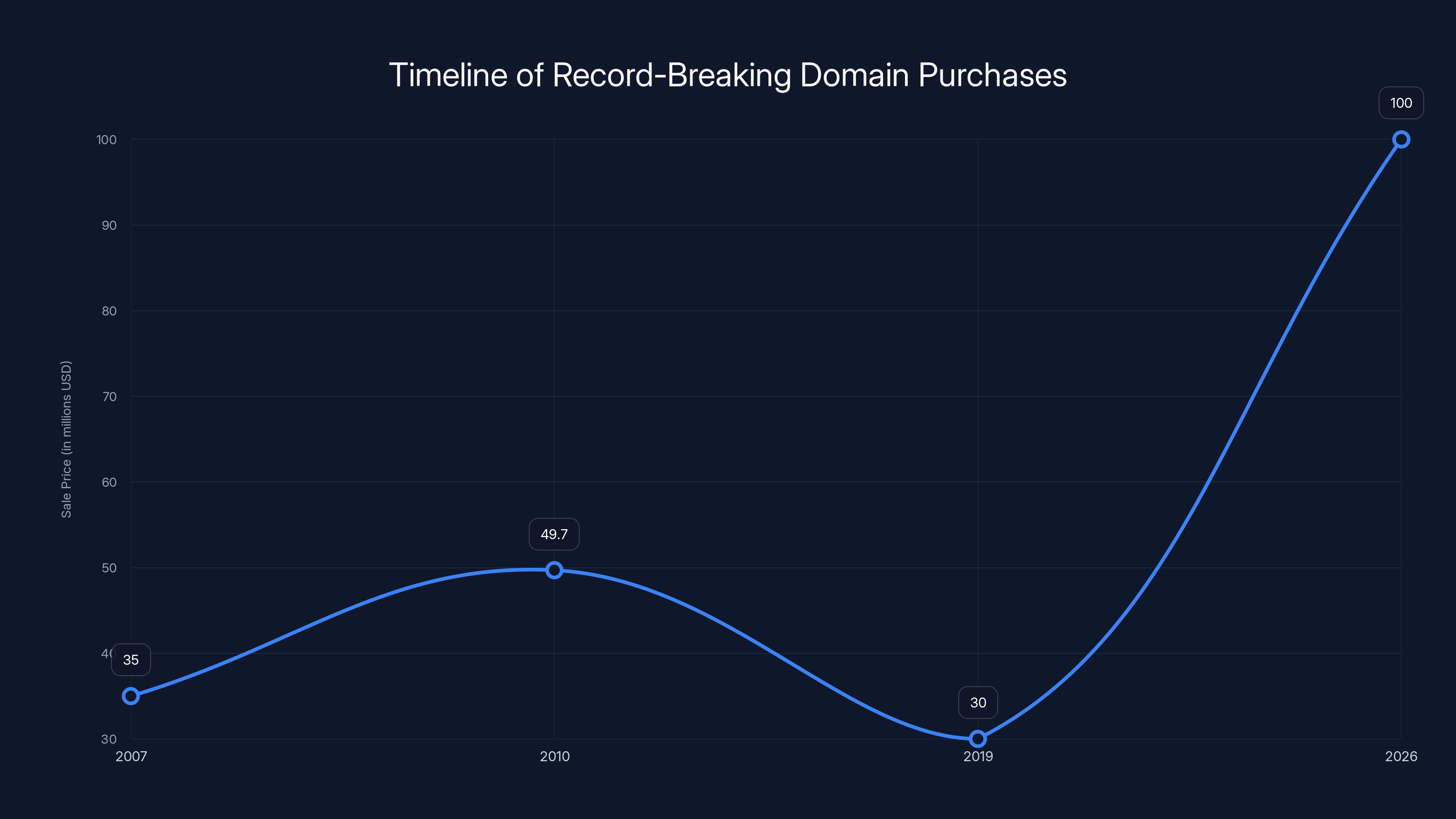

The History of Record-Breaking Domain Purchases: A Timeline of Digital Real Estate

AI.com didn't emerge from nowhere as the most valuable domain in history. It's the latest milestone in a long progression of companies recognizing that certain domain names have extraordinary value.

Before 2026, Car Insurance.com held the record at $49.7 million, purchased in 2010. At the time, that seemed almost unimaginably high. Why would anyone spend that much for a domain? The answer: because people search for car insurance constantly, and owning the exact domain that matches that search intent is worth an enormous premium. Every person looking for car insurance online would see that domain prominently in search results. The brand recognition, the direct navigation traffic, and the implied authority all combine to make that domain more valuable than the vast majority of websites ever built.

Before that milestone, Vacation Rentals.com sold for

Then there are the unusual cases that reveal how domain value works in less obvious ways. Sex.com sold for over $13 million in multiple separate transactions, a remarkable achievement for a domain whose commercial utility is constrained by its subject matter and the difficulty of mainstream advertising. The fact that it commanded such high prices anyway proves something important: even if the domain's primary use case is limited, the sheer certainty of traffic and the generic nature of the keyword make it valuable enough to command extraordinary prices.

The trajectory is clear. As digital commerce has grown, as search engines have become the primary way people find information and services, and as brands have realized that owning the exact domain matching their category is almost always worth the investment, prices have climbed steadily. Each new record typically represents a company betting on a category's growth trajectory and banking on being the first to claim the definitional domain.

AI.com is the natural culmination of this trend. Artificial intelligence is the technology category everyone believes will define the next twenty years. The domain that owns the generic, unqualified name for that category is inherently more valuable than any other domain in existence right now. From an economics standpoint, $70 million might actually be a bargain.

The AI Landscape in 2025: Why AI.com Specifically?

To understand why Crypto.com specifically targeted AI.com, you need to understand where the AI industry currently stands and where companies believe it's heading.

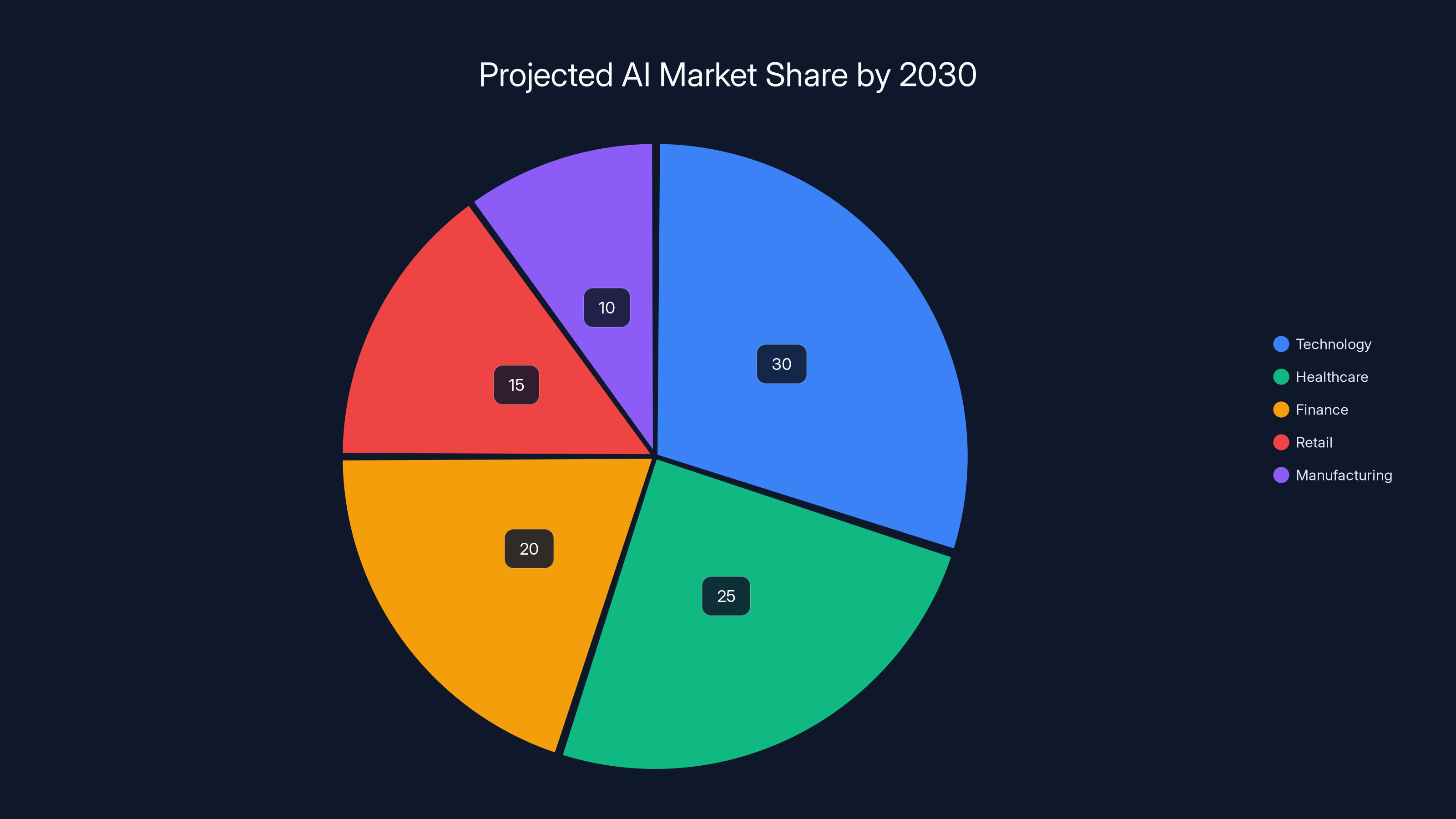

In 2025, artificial intelligence isn't a niche technology anymore. It's infrastructure. Every major tech company has integrated AI capabilities into their core products. Every industry from healthcare to manufacturing to finance is finding ways to use AI to improve efficiency, reduce costs, or create new products. The question isn't whether AI matters. The question is how companies position themselves within the AI economy.

Most existing AI companies have clear categorical homes. OpenAI owns the large language model space through Chat GPT. Anthropic competes in the same lane with Claude. Midjourney owns image generation. Perplexity is establishing itself in search augmentation. Each company has a specific positioning within the broader AI ecosystem.

But what if you're a crypto company trying to enter the AI space? Crypto has its own challenges with brand perception. The industry deals with skepticism around security, volatility, regulation, and whether decentralization actually solves real problems. When Crypto.com wanted to launch a new product category in AI, they faced a strategic choice: would they position it as "Crypto.com's AI thing," or would they claim a position at the center of AI itself?

By purchasing AI.com, Marszalek essentially said: "We're not positioning this as a crypto product that happens to use AI. We're positioning ourselves as an AI company." The domain signals a shift in how the company wants to be perceived. It's a rebranding move as much as it is an acquisition.

That strategy makes sense given where enterprise technology is heading. Companies increasingly want to work with AI providers that specialize in AI, not companies that treat AI as an add-on feature. By owning AI.com and launching a personal AI agent, Crypto.com can claim the high ground in its own category immediately. Users visiting AI.com aren't thinking "Crypto.com's product." They're thinking "the AI company." That psychological shift, maintained across millions of user interactions, is genuinely valuable.

Super Bowl Advertising: When 5M in Ad Spend

The timing of the domain purchase wasn't accidental. It coincided with Crypto.com's decision to debut AI.com during Super Bowl advertising, one of the most expensive and visible advertising events on the global calendar.

A 30-second Super Bowl advertisement costs more than

But here's what makes the timing of the AI.com purchase strategically brilliant: the domain becomes the callback mechanism for the entire advertisement. When millions of people see the Crypto.com commercial, they remember one thing above all else: the domain. They might forget the company name. They might forget most details of the offer. But they'll remember "AI.com." That domain becomes the anchor point for the entire marketing message.

From an advertising efficiency standpoint, this creates a powerful conversion funnel. The Super Bowl ad gets attention. The domain provides the friction-free destination. No one has to search for the offer or navigate through unclear website structures. They type AI.com, they arrive at the service, and they're presented with the new personal AI agent offering.

Historically, this is how major tech companies have approached category-defining moments. When Google wanted to own search, they didn't just make a great search engine. They made Google.com the natural destination for search queries. When Apple wanted to own "the computer for everyone," they made Apple.com iconic. When Slack wanted to own workplace communication, Slack.com became synonymous with that category. Marszalek is following a well-established playbook, just at a much higher price point.

The domain purchase also gives Crypto.com insurance against competition. If another crypto company had purchased AI.com first, they would have been able to claim the category's high ground. By securing it before the major advertising push, Crypto.com prevents competitors from using the same strategy. For a company investing heavily in category creation, that competitive protection is worth a significant premium.

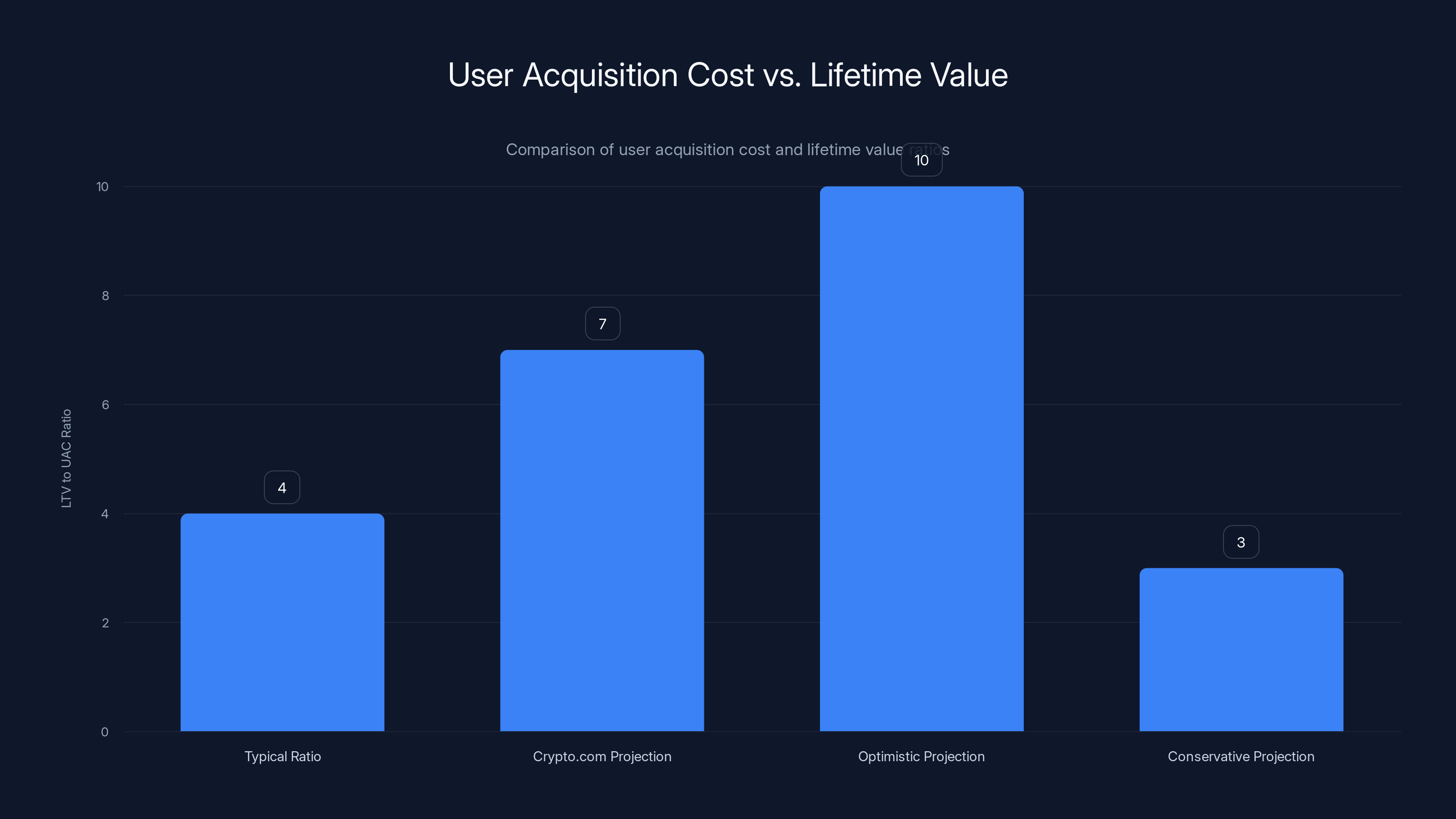

Crypto.com's projected 7:1 LTV to UAC ratio through AI.com is significantly better than the typical 4:1 ratio, highlighting the domain's potential value. Estimated data based on content.

What Personal AI Agents Actually Do (And Why They Matter)

To understand the strategic value of AI.com, you also need to understand what product Crypto.com is actually trying to promote. The domain isn't just a billboard. It's the destination for a specific technological offering: a personal AI agent designed for messaging, app usage, and financial trading.

Personal AI agents are one of the most active battlegrounds in AI development right now. Unlike general-purpose AI chatbots that answer questions about anything, personal AI agents are designed to learn your preferences, integrate with your other tools and applications, and help you accomplish specific tasks more efficiently.

Crypto.com's vision appears to be an AI system that understands your portfolio, your trading preferences, your communication patterns, and your financial goals. The agent could monitor markets for you, alert you when certain conditions occur, execute trades according to your stated preferences, and handle communication on your behalf. This represents a significant step beyond current chatbot capabilities.

The challenge for any personal AI agent is trust and integration. Users need to trust that the system understands their objectives and won't make catastrophic mistakes. They need to integrate it with their existing tools and workflows. They need constant reassurance that it's operating according to their wishes and not making decisions that could damage their finances or privacy.

By owning AI.com, Crypto.com is essentially saying: "This is our flagship product in this space. This is where we're betting our future." The domain gives the product legitimacy and presence that it wouldn't have with a more generic URL like "Crypto.com/ai-agent" or a brand-new invented name.

Domain Economics and User Acquisition: The Real ROI Calculation

When evaluating whether $70 million is reasonable for a domain, sophisticated investors think in terms of user acquisition cost (UAC) and lifetime value (LTV).

Typically, tech companies aim for a ratio where the lifetime value of a user is at least three to five times the acquisition cost. If you spend

Crypto.com's user acquisition cost through traditional channels is probably measured in the double digits per user. Through referral programs, it might be much lower. Through paid advertising, it could be significantly higher. AI.com as a direct navigation asset functions more efficiently than any advertising channel because it captures high-intent traffic at zero marginal cost per user.

Consider the calculation: if Crypto.com acquires one million new users through AI.com over the next five years, the cost per user is

Even if those numbers are too optimistic, the math doesn't have to be that extreme to justify the investment. If Crypto.com acquires 500,000 users at an average value of

The key insight here is that the value of the domain doesn't come from a single transaction or a single year of acquisition. It comes from continuous usage over decades. Every year that AI.com exists as a Crypto.com property, users worldwide can find it directly without needing advertising or search optimization. That permanent asset continues generating value indefinitely.

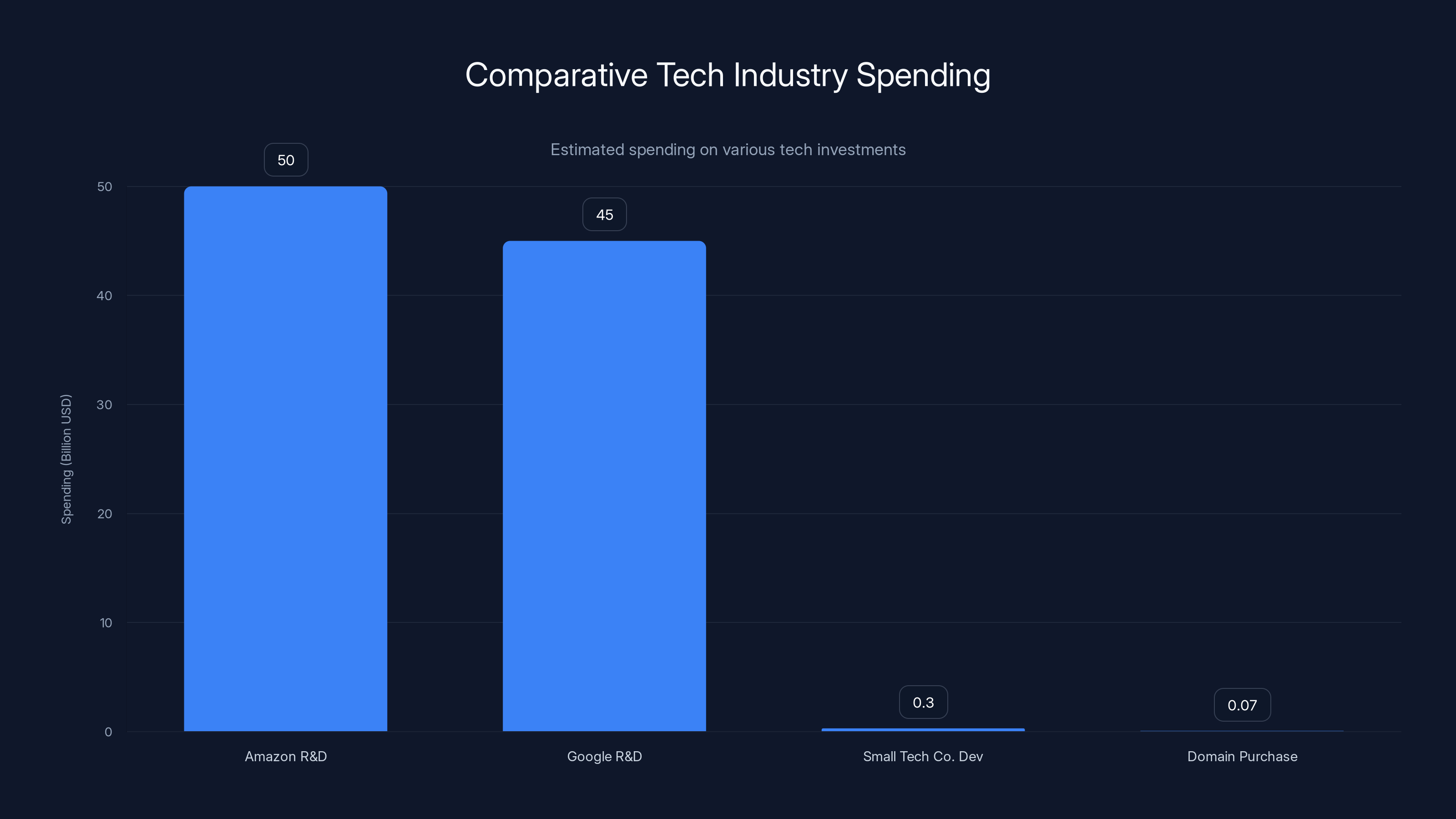

Comparative Tech Industry Spending: Putting $70M in Perspective

To truly understand whether $70 million is a reasonable investment for a domain, compare it to other ways major tech companies spend money at similar price points.

Amazon's annual research and development budget is over

Consider what else $70 million could fund: a small acquisition of a startup, 500 top engineers for a year, a regional marketing campaign, or the full development of a new product feature. Each of these options would generate value, but much of that value would be internal to the company and difficult to translate into concrete outcomes.

The domain, by contrast, is a public-facing asset that generates value through brand recognition and traffic. Unlike an engineering expense or a product development cost, the domain's value is immediately visible and understood by the market. When people type AI.com into their browser or see it in advertising, they're immediately aware that this domain is valuable and that Crypto.com was willing to pay an extraordinary sum to own it.

That perception itself is valuable. It signals confidence in AI as a strategic direction. It suggests that Crypto.com is serious about becoming an AI company, not just dabbling in AI as a feature. It creates a powerful brand story that traditional advertising could never achieve at any price point.

AI.com set a new record with a

Brand Psychology: The Power of Owning the Generic Domain

Psychologically, owning a generic domain like AI.com changes how the entire market perceives a company.

When Microsoft owns microsoft.com, people know they're visiting the official Microsoft site. When Google owns google.com, there's no ambiguity. But when Crypto.com owns AI.com, something different happens. The domain doesn't scream "Crypto.com." It screams "the AI company." It claims authority and priority in the category itself.

This psychological shift matters enormously for brand positioning. Every competitor in the AI space is always explaining who they are and what they do. They're clarifying how their AI offering differs from others. But Crypto.com, with AI.com, gets to occupy a different position. They're not competing for position within AI. They are the baseline for AI.

This kind of categorical ownership has historical precedent. When Kleenex became synonymous with facial tissues, the brand achieved something that no amount of advertising could buy: the ability to be the default answer when someone asks "what do you use for tissues?" When Band-Aid became synonymous with adhesive bandages, they captured an entire category in the consumer's mind.

Crypto.com is making a bet that they can do something similar in the AI space. By owning AI.com and launching a flagship personal AI agent, they're positioning themselves as the default AI company. Competitors will be defined as "the crypto company's AI agent," "the search company's AI," or "the chat company's AI." Crypto.com wants to be just "AI.com."

That positioning advantage is worth far more than $70 million if it works, and worth significantly less if it doesn't. But given the state of AI adoption and the importance of the category, the bet seems rational from a brand strategy perspective.

Regulatory and Patent Considerations: Protecting Digital Real Estate

One dimension that often gets overlooked in these discussions is how owning premium domains can provide competitive and regulatory advantages beyond simple marketing and user acquisition.

Domains are inherently global assets protected by international domain name regulations and intellectual property law. Unlike trademarks, which must be separately registered in each jurisdiction and can be challenged if not actively used, domains are acquired and held under clear, enforceable property rights. Once Crypto.com owns AI.com, no one else can own it. There's no registration ceremony needed in each country. There's no maintenance burden beyond annual renewal.

This becomes strategically important when you consider how regulations around AI are developing globally. Different countries are implementing different AI governance frameworks. The EU has the AI Act. The US is developing various sectoral regulations. China has its own AI governance approach. If Crypto.com is truly committing to becoming an AI company, owning the generic domain for the category provides protection and prestige across all these jurisdictions.

A domain like AI.com also becomes valuable from an intellectual property perspective. If Crypto.com builds valuable trademarks or patents related to personal AI agents, owning AI.com reinforces their position as the canonical company in that space. When their patents are cited in legal proceedings, when they're referenced in academic papers about AI development, the prestige of owning AI.com amplifies their authority and market position.

There's also a competitive moat consideration. If Crypto.com is truly successful in building a world-class personal AI agent, the entire category becomes more valuable. If other companies want to compete in this space, they'll necessarily be competing on Crypto.com's domain. Owning AI.com means owning the high ground in category competition, which becomes increasingly valuable as the category grows.

The Broader Trend: When Domains Become Strategic Acquisitions

Crypto.com's purchase of AI.com isn't an isolated incident. It's part of a broader trend where major companies increasingly recognize that owning specific domains is a strategic priority.

Consider what's happening in the AI space right now. Every major company is making aggressive investments in AI positioning. OpenAI commands enormous mindshare through Chat GPT and GPT-4. Anthropic is investing heavily in Claude. Google is pushing Gemini. Microsoft is integrating AI throughout its product suite. Meta is developing LLaMA. Each of these companies is racing to establish category ownership.

But where is the ownership competition happening? It's happening on the platforms where people actually search and navigate. A crucial part of that competition is owning the domain that matches user intent. For OpenAI, that's openai.com. For Anthropic, that's anthropic.com. For Google, that's google.com. Each company owns the domain that matches its brand name.

But what if you wanted to own the generic domain for a category? What would that cost, and would it be worth it? Before AI.com, the answer was somewhere in the

This trend reflects a fundamental shift in how companies think about digital real estate. Domains aren't just technical infrastructure anymore. They're brand assets, user acquisition channels, and categorical anchors. They're worth thinking about at the strategic level, not just the operational level.

Estimated data shows technology leading AI market share by 2030, followed by healthcare and finance. This reflects AI's broad impact across industries.

Crypto.com's Broader Strategy: Stadium Naming Rights, Domain Ownership, and Brand Positioning

To understand the AI.com purchase in full context, you also need to understand Crypto.com's broader brand strategy, which includes the $700 million investment in stadium naming rights.

When Crypto.com paid $700 million for naming rights to the Los Angeles sports arena, it was making a statement about brand ambition and market position. The company was saying: "We're big enough, confident enough, and strategically positioned enough to be a household name globally." Every time someone in LA watched a sports game or attended an event, they saw "Crypto.com Arena." The brand became ubiquitous.

But stadium naming rights are temporary and geographically limited. The contract for Crypto.com Arena runs for 20 years. After that, someone else might own the naming rights. The value is constrained to Los Angeles and its surrounding region. It's a time-limited, location-limited asset.

The AI.com domain purchase represents a different strategic layer. Where the stadium naming purchase claims physical presence and regional authority, the domain purchase claims categorical authority globally and permanently. The domain doesn't expire or get handed off to another company. It's owned indefinitely as long as Crypto.com continues to renew the registration.

Together, these investments tell a coherent story about Crypto.com's brand ambitions. The company is positioning itself not just as a crypto company anymore, but as a technology company competing at the highest levels with platforms like Google, Meta, and Microsoft. The stadium naming rights establish presence. The domain ownership establishes categorical authority. The AI agent product establishes functional capability.

This is sophisticated brand strategy. Many companies make acquisitions and launch products without a cohesive narrative tying them together. Crypto.com is building a narrative where every investment reinforces the same message: we're a major technology company with a presence in the most important category of our time.

Market Implications: What This Purchase Signals About AI's Future

When Marszalek told the Financial Times that he takes "a long-term view—10 to 20 years—[AI] is going to be one of the greatest technological waves of our lifetime," he was articulating a belief that's increasingly mainstream in tech investment circles.

The purchase of AI.com for

Market observers have taken notice of this bet. The fact that someone was willing to spend $70 million on a domain signals extraordinary confidence in the AI sector's growth trajectory. It's the kind of signal that other executives notice. It's the kind of investment that can shift perceptions about how seriously to take an emerging technology or category.

We're at an inflection point with AI. The technology has clearly moved past the "hype" phase into the "real implementation" phase. Major enterprises are building AI capabilities. Governments are writing regulations around AI. Consumers are using AI tools daily. The question now isn't whether AI is important, but how important it will become and how the market will reorganize around it.

Crypto.com's $70 million bet is a wager that AI becomes so central to technology and commerce that owning the semantic home of the category is worth that level of investment. Time will tell whether that bet was brilliant or excessive, but either way, it's a bet that's impossible to ignore.

Lessons for Other Companies: When Should You Invest in Premium Domains?

For other companies watching this play out, the natural question is: should we be making similar investments in our own domains?

The answer depends on several factors. First, is your company operating in an emerging or rapidly growing category? If you're in a mature market where the dominant players are already established, premium domain investments are probably less valuable. But if you're in a growth category where brand positioning and category ownership are still being determined, owning the generic domain for your category could be strategically crucial.

Second, do you have the financial resources to make the investment without jeopardizing your core business? Crypto.com can afford $70 million for a domain because they have a stable revenue base from crypto trading and other services. A startup trying to establish itself would be better served spending that capital on product development, marketing, or team building.

Third, is the domain actually important to your business model and user acquisition strategy? If your customers primarily find you through search advertising, social media, or referrals, a premium domain is less crucial. If your business depends on direct navigation and brand recognition, owning the perfect domain becomes more valuable.

Fourth, what is the alternative cost of not owning the domain? If competitors might purchase the domain and use it to claim category authority, the cost of losing out might exceed the cost of purchasing it yourself. This was likely part of Crypto.com's calculation.

For most companies, the lesson isn't necessarily "go spend $70 million on a domain." The lesson is "think strategically about whether your domain portfolio supports your long-term brand positioning, and be prepared to invest appropriately." For a company building in a new category, that might mean paying a million dollars for a perfect domain rather than settling for a domain that requires explanation. For a company with a strong existing brand, it might mean holding firm at reasonable prices rather than getting into bidding wars.

The key is to view domains strategically rather than tactically. They're not just technical infrastructure. They're brand assets that shape how customers perceive and remember your company.

Amazon and Google spend tens of billions on R&D, dwarfing the $70M domain investment, highlighting its strategic value. Estimated data.

The Broker's Perspective: Larry Fischer and Domain Valuation Expertise

Larry Fischer, the broker who facilitated the AI.com sale, plays a crucial role in this story that often gets overlooked in media coverage.

Domain brokers are specialists in valuing and selling high-value digital real estate. They understand the market for premium domains, they have networks of potential buyers and sellers, and they can articulate why a seemingly ordinary web address is actually a priceless asset. Fischer's comments to the Financial Times reveal the mindset of someone who understands domain economics at the highest level.

When Fischer said "When one becomes available, the opportunity may never present itself again," he was articulating a core truth about generic, single-category domains. Unlike company-specific domains like "Google.com," which can be built from scratch or replaced with alternative marketing, a generic domain like "AI.com" cannot be recreated or improved upon. There's only one AI.com. Once it's owned, it's off the market.

Brokers like Fischer make their living understanding which domains have genuine utility value versus which are speculation. They understand that a domain's value isn't primarily determined by the registrar's list price (usually $8-15 per year). It's determined by how much a potential buyer is willing to pay for the scarcity and definitional nature of the domain.

For a broker facilitating the sale of AI.com, there would be significant preparation involved. They would need to identify serious potential buyers (and there are probably only a handful of companies that could justify spending $70 million on a domain). They would need to negotiate with both sides. They would likely take a commission on the sale, which at a percentage would be substantial. Fischer's reward for facilitating this transaction was probably in the high six figures or low seven figures, making this a significant deal for the broker themselves.

The involvement of a skilled broker in this transaction is important because it adds credibility to the deal. This wasn't a spontaneous transaction between two parties. This was a brokered deal that likely involved extensive negotiation and valuation work.

Super Bowl 2026: The Ad Campaign That Launched with AI.com

The Super Bowl advertisement that accompanied the AI.com launch represents one of the most expensive advertising debuts in tech history when you combine the cost of the domain with the cost of the Super Bowl ad buy.

A 30-second Super Bowl spot typically costs between

Superior Super Bowl advertisements work through repetition and simplicity. The best ones are memorable, emotionally resonant, and easy to recall. They often feature celebrities, surprise moments, or emotional hooks that create cultural conversation.

For Crypto.com's AI advertisement, the core message needed to be simple enough to convey in 30 seconds: there's a new personal AI agent available, and you can find it at AI.com. Everything else in the advertisement is supporting that core message.

The beauty of this strategy is the way it concentrates brand messaging. Rather than trying to communicate complex product features through the advertisement, the ad simply needs to point people to the domain. The actual product experience, the detailed features, the use cases, and the benefits can all be communicated through the website and through the product experience.

This separation of concerns (advertisement drives awareness, website provides depth) is much more efficient than trying to compress product information into 30 seconds. The viewer sees the ad, remembers AI.com, visits the domain, and discovers the full product offering.

Personal AI Agents: The Product Behind the Purchase

The actual product being promoted through this entire campaign is a personal AI agent designed to assist with messaging, app usage, and stock trading. This isn't a generic chatbot. It's a specialized AI system designed for specific user needs.

Personal AI agents represent one of the most active product categories in AI development right now. Unlike general-purpose AI assistants that can answer questions about anything, personal agents are designed to be contextual to specific user needs and preferences.

For a crypto trading platform, a personal AI agent offers several advantages. First, it can monitor markets continuously and alert users to significant price movements or trading opportunities. Second, it can learn user preferences and risk tolerances, suggesting trades that align with user objectives. Third, it can handle administrative tasks like portfolio rebalancing, tax reporting, or account management. Fourth, it can provide personalized financial education or market analysis.

The challenge with personal AI agents is earning user trust. Users need to be confident that the system understands their objectives and won't make catastrophic financial mistakes. They need transparency into how the system is making decisions. They need safeguards against the agent executing trades that contradict explicit user preferences.

Crypto.com's personal AI agent presumably includes sophisticated safeguards and user controls to address these concerns. Users would likely set explicit parameters around what actions the AI can and cannot take, what trades it can execute, what spending limits apply, etc.

The personal AI agent market is competitive. Numerous companies are working on similar products. But Crypto.com's advantage is their existing user base of traders and investors who already trust the platform. Adding an AI layer to an existing platform is often more successful than trying to build a new platform from scratch.

The Larger Context: Crypto's Rehabilitation Through AI

From a strategic perspective, Crypto.com's investment in AI and the AI.com domain represents something larger than a single product launch. It represents an attempt to rehabilitate the crypto industry's brand image through association with a more mainstream and trusted technology sector.

Cryptocurrency has always struggled with mainstream perception. Bitcoin and Ethereum are genuinely innovative technologies, but the broader crypto industry has been plagued by scams, volatility, hacks, and regulatory uncertainty. Crypto companies face skepticism from mainstream institutions, skepticism from regulators, and skepticism from regular consumers.

AI, by contrast, is a technology that's gaining mainstream acceptance. Consumers are actively using AI tools. Enterprises are investing heavily in AI. Governments are developing AI policies. AI is presented as the future of technology by virtually every major tech company.

By positioning Crypto.com as an AI company first and a crypto company second, Marszalek is making a strategic choice about brand rehabilitation. The argument is: "Don't think of us as a crypto company that happens to do AI. Think of us as an AI company that happens to work with crypto." This repositioning could be enormously valuable if it shifts how consumers and enterprises perceive the company.

This strategy has historical precedent. Companies often shed negative brand associations by introducing new product categories and brands. When Microsoft wanted to move beyond its "evil monopoly" brand perception in the 2000s, they invested heavily in consumer products, design, and corporate responsibility. When Facebook wanted to escape its reputation for privacy violations, they invested heavily in VR/metaverse technology and rebranded to Meta. When Amazon wanted to broaden its perception beyond "book seller," they invested in cloud services, streaming, and logistics.

Crypto.com's investment in AI and the AI.com domain is following this same pattern. The company is trying to build a new brand narrative that centers on AI innovation rather than crypto volatility.

Predicting the Future: Will This Investment Pay Off?

The ultimate test of whether Crypto.com's AI.com investment was wise will come over the next 5-10 years. Did the domain drive meaningful user acquisition to the personal AI agent platform? Did it improve brand perception? Did it position Crypto.com as a legitimate AI company in consumer and enterprise minds?

Optimistic scenarios: The AI.com domain becomes the second-most-trafficked AI destination after Chat GPT. Crypto.com's personal AI agent gains traction with crypto traders and becomes popular with enterprises for financial automation. The domain creates a valuable halo effect for the Crypto.com brand more broadly. Competitors fail to launch equivalent offerings because they don't own comparable domains. The investment breaks even within three years and becomes spectacularly profitable by year five.

Middle-ground scenarios: The domain drives decent traffic, but the personal AI agent product doesn't gain mass adoption because it faces competition from more general AI assistants integrated into existing platforms. The domain investment becomes a moderate success, paying for itself but not generating extraordinary returns. Brand perception improves modestly but not dramatically.

Pessimistic scenarios: The personal AI agent product fails to find product-market fit and adoption remains niche. Traffic to AI.com disappoints. The domain becomes a symbol of Crypto.com's overspending rather than a symbol of innovation. The investment is written off as a wasteful brand vanity project.

Historically, mega-expensive marketing investments have a mixed track record. Some pay off brilliantly. Some fail spectacularly. The outcome usually depends on whether the underlying product is actually good and whether the market is ready for the solution being offered.

Crypto.com's bet is that AI will become so central to personal finance and trading that owning the categorical domain is worth the investment, that the personal AI agent is a genuinely useful product, and that the brand association with AI helps rehabilitate Crypto.com's image among mainstream consumers and enterprises.

Only time will tell if that bet was justified, but the willingness to make it says something profound about how seriously major companies are now taking artificial intelligence as the organizing technology of the next decade.

Lessons from Corporate Domain Strategy: Building Brand Through Digital Real Estate

Looking across successful tech companies, several patterns emerge about how domain strategy supports overall brand positioning and user acquisition.

Google's strategy was always elegant in its simplicity. By owning Google.com and making Google synonymous with search, the company created a situation where their brand name is literally a verb in multiple languages. People don't say "search for information." They say "Google it." That's the ultimate outcome of owning a perfect domain in a dominant category.

Amazon's strategy was different. They didn't own the generic domain for online retail (that would be something like "Shop.com" or "Online.com"). Instead, Amazon.com became synonymous with online commerce through the quality of their service and their aggressive marketing. They didn't need the generic domain because they became the default option through sheer scale and quality.

Facebook followed a similar strategy with Facebook.com. They didn't own "Social.com" or "Network.com" (even if those existed). They owned Facebook.com and made Facebook the default social network through product excellence and network effects.

But some companies did invest heavily in owning generic domains. Uber.com is arguably the canonical domain for ride-sharing. Airbnb.com is arguably the canonical domain for short-term rentals. These companies' willingness to be the default option in their categories played a role in their dominance.

Crypto.com's investment in AI.com is a more aggressive version of this strategy. Rather than building a category over time and claiming default status through product excellence, they're claiming the categorical domain upfront and building a product to justify that claim.

There's risk in this approach. If the product disappoints, the expensive domain becomes a symbol of wasteful spending. But if the product succeeds, owning the categorical domain amplifies that success dramatically. It's a high-risk, high-reward strategy appropriate for a company confident in its execution and its market position.

FAQ

Why would anyone spend $70 million on a domain name?

Domain names representing entire categories or technologies are immensely valuable because they capture user intent directly and globally. When someone types "AI.com" into their browser, they're demonstrating high purchase intent. They arrive at the destination without advertising costs, search engine optimization, or brand confusion. For a company betting on AI as the defining technology of the next decade, owning the categorical domain provides permanent competitive advantage and serves as a powerful brand anchor.

How does owning AI.com give Crypto.com an advantage over competitors?

Owning AI.com allows Crypto.com to position itself as "the AI company" rather than "the crypto company that also does AI." This repositioning has profound implications for brand perception, user acquisition, and competitive positioning. When potential users think of personal AI agents for trading, they'll see AI.com dominate search results, advertising, and word-of-mouth referrals. Competitors without the categorical domain must constantly clarify their positioning and differentiate themselves.

What did Crypto.com get for the $70 million?

Crypto.com obtained permanent, global ownership of the domain AI.com (subject to annual renewal fees) and associated traffic, brand authority, search engine prominence, and user acquisition benefits. The domain serves as the primary destination for their new personal AI agent product and provides long-term competitive positioning in the AI market. The investment also generated enormous brand visibility and positioned Crypto.com as a company serious about becoming an AI platform.

Did previous domain sales ever reach this price?

Prior to AI.com, Car Insurance.com held the record at

How will Crypto.com make back the $70 million investment?

The investment returns through user acquisition, brand authority, and competitive positioning rather than direct revenue. If the personal AI agent acquires even a fraction of Crypto.com's crypto trading user base, and if those users generate trading volume and fees, the domain pays for itself within years. The permanent nature of the asset and its continuous traffic generation provide returns indefinitely. Additionally, the brand positioning and competitive advantage may generate returns across all Crypto.com products and services.

Could Crypto.com have achieved similar results without buying AI.com?

Crypto.com could launch personal AI agent products using domains like Crypto.com/ai or through an alternative domain, but they would face significant disadvantages. Users would need to remember and navigate to a longer, less memorable address. Competitors might own competing AI.com alternatives. The psychological impact of owning the categorical domain versus owning a subdomain is enormous in terms of brand perception and market positioning.

What does this purchase tell us about the future of AI?

Crypto.com's willingness to spend $70 million on the AI.com domain signals extraordinary confidence that artificial intelligence will be as transformative in the next 20 years as the internet has been in the past 25 years. It suggests that major technology companies now view AI not as an interesting feature but as the central organizing technology of the digital future. This level of investment in categorical positioning indicates deep, sustained commitment to AI as a strategic priority.

Are there other valuable single-word domains that companies should be eyeing?

Potentially valuable single-word domains would include category-defining terms in emerging technology spaces like "AGI.com" (artificial general intelligence), "Metaverse.com," "Blockchain.com," or "Quantum.com." However, these domains would command extraordinary prices if they came available, and in many cases ownership is already determined or protected. The pool of truly available, valuable generic domains shrinks every year as major companies recognize their strategic value.

How does this compare to Crypto.com's $700 million stadium naming investment?

Both investments represent major brand positioning plays but serve different strategic purposes. The

Is this investment likely to be remembered as brilliant or wasteful in 20 years?

The answer depends primarily on whether Crypto.com's personal AI agent product gains meaningful adoption and whether AI becomes as central to commerce and communication as the internet currently is. If AI dominates the next 20 years and Crypto.com successfully positions itself as a major AI platform, the $70 million investment will be viewed as bargain-priced. If AI adoption disappoints or if Crypto.com's product fails to gain traction, the investment will be remembered as excessive spending by a company with more money than discipline.

Conclusion: The Domain as Strategic Asset

Crypto.com's purchase of AI.com for $70 million represents far more than a single transaction or a marketing stunt. It's a declaration about where technology is heading, what categories will matter most in the future, and how companies can stake claims in emerging markets before they fully mature.

Domains have always been important in the digital economy, but they've traditionally been viewed as technical infrastructure rather than strategic assets. They were the necessary URL where your website lived, priced at roughly the cost of a coffee per year. Crypto.com's investment signals a shift in how sophisticated companies think about digital real estate.

When you have the perfect domain for your category, it becomes a permanent competitive advantage. It's the destination that users naturally gravitate toward. It's the domain that appears in headlines and press coverage. It's the address that symbolizes categorical authority and market leadership.

For most companies, the lesson isn't "go spend $70 million on a domain." It's "think strategically about whether your domain portfolio supports your long-term positioning, and be prepared to invest appropriately in securing the domains that define your category." For a startup in a new market, that might mean allocating more budget to domain acquisition than seems typical. For an established company, it might mean protecting existing domains or acquiring related domains to prevent competitors from using them for category confusion.

The broader lesson is that branding happens everywhere, including in places we don't always think about. Your domain is one of the first things users notice about your company. It shapes their perception of your authority and professionalism. In an increasingly crowded marketplace where AI is becoming the defining technology of our time, owning the categorical domain matters more than ever before.

Crypto.com's $70 million bet on AI.com is a bet that artificial intelligence will be as important to the next 20 years as the internet has been to the last 25 years. It's a bet that personal AI agents will become as common as web browsers. It's a bet that owning the semantic center of an emerging category is worth defending at nearly any price. Only time will tell if that bet is vindicated, but either way, it's a decision that's impossible to ignore.

Key Takeaways

- Crypto.com's 20+ million, reflecting extraordinary confidence in AI's future

- Premium domain ownership functions as permanent, global brand asset with continuous user acquisition benefits unavailable through traditional advertising

- Strategic domain investment breaks even at acquisition of 1 million users (300+

- Categorical domain ownership provides psychological and competitive advantage by positioning company at center of category rather than periphery

- Domain strategy complements broader brand positioning efforts like stadium naming rights, creating comprehensive narrative about company's technological vision

Related Articles

- Cloud Print Migration: Why 2026 is the Year to Ditch On-Prem Servers [2025]

- Modern Log Management: Unlocking Real Business Value [2025]

- AI.com's Super Bowl Bet: Inside Kris Marszalek's AI Agent Platform [2025]

- Google Gemini Hits 750M Users: How It Competes with ChatGPT [2025]

- Why Dyson's Brand Extensions Are Failing: A Case Study [2025]

- Microsoft's Maia 200 AI Chip Strategy: Why Nvidia Isn't Going Away [2025]

![Crypto.com's $70M AI.com Gambit: Why Domain Names Matter [2025]](https://tryrunable.com/blog/crypto-com-s-70m-ai-com-gambit-why-domain-names-matter-2025/image-1-1770583245860.png)