Understanding the RAM Price Explosion of 2025

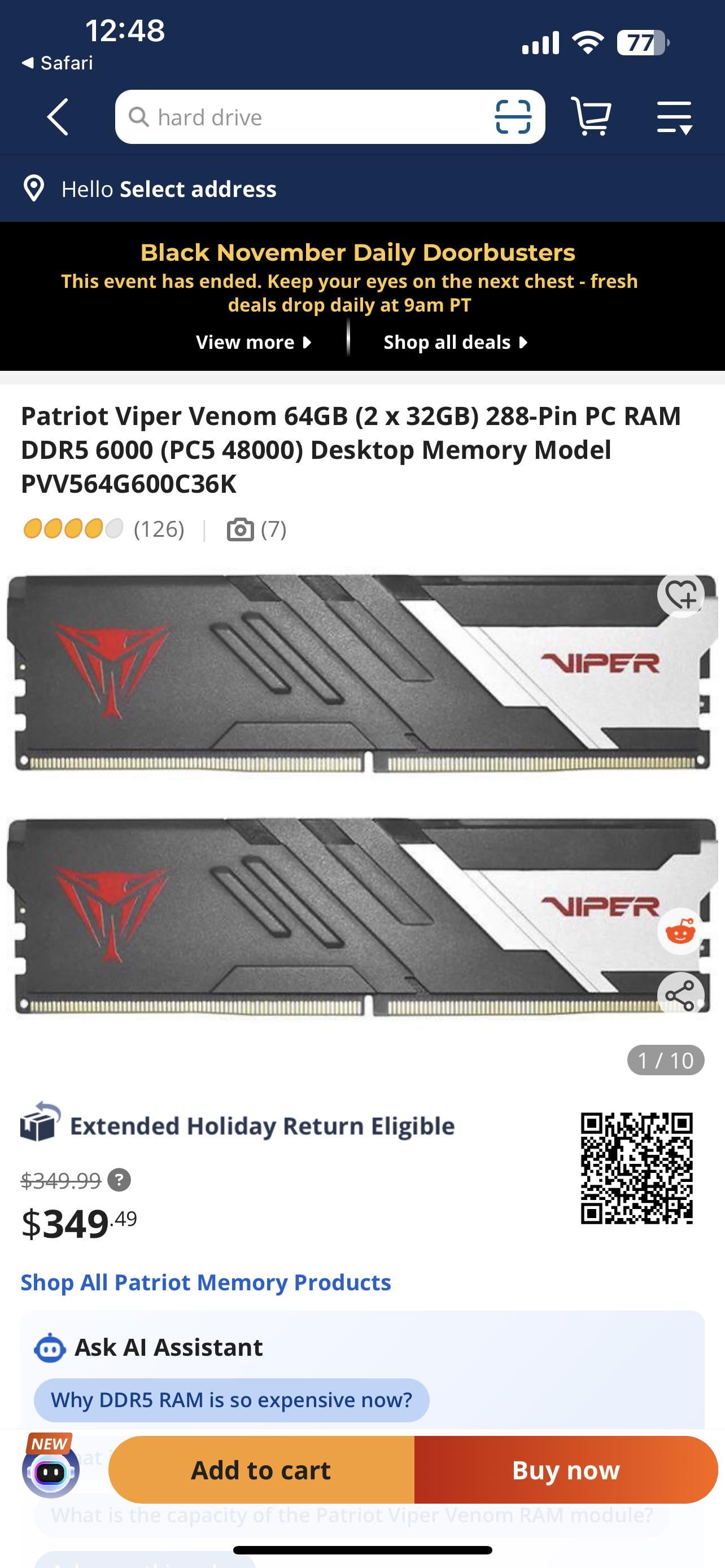

Your next PC upgrade just got a lot more expensive. If you've checked RAM prices lately, you've probably noticed something disturbing: DDR5 memory modules that cost

I started digging into this after a friend's budget PC build got derailed. The memory alone consumed nearly half of his total spending cap. What I found was a perfect storm of supply constraints, manufacturing challenges, demand spikes, and market dynamics that nobody really saw coming.

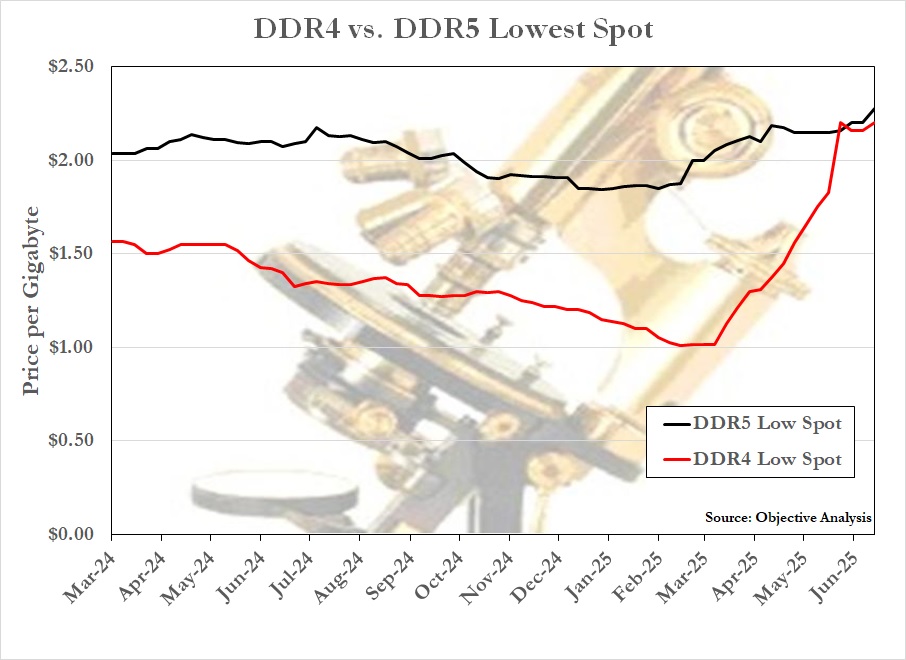

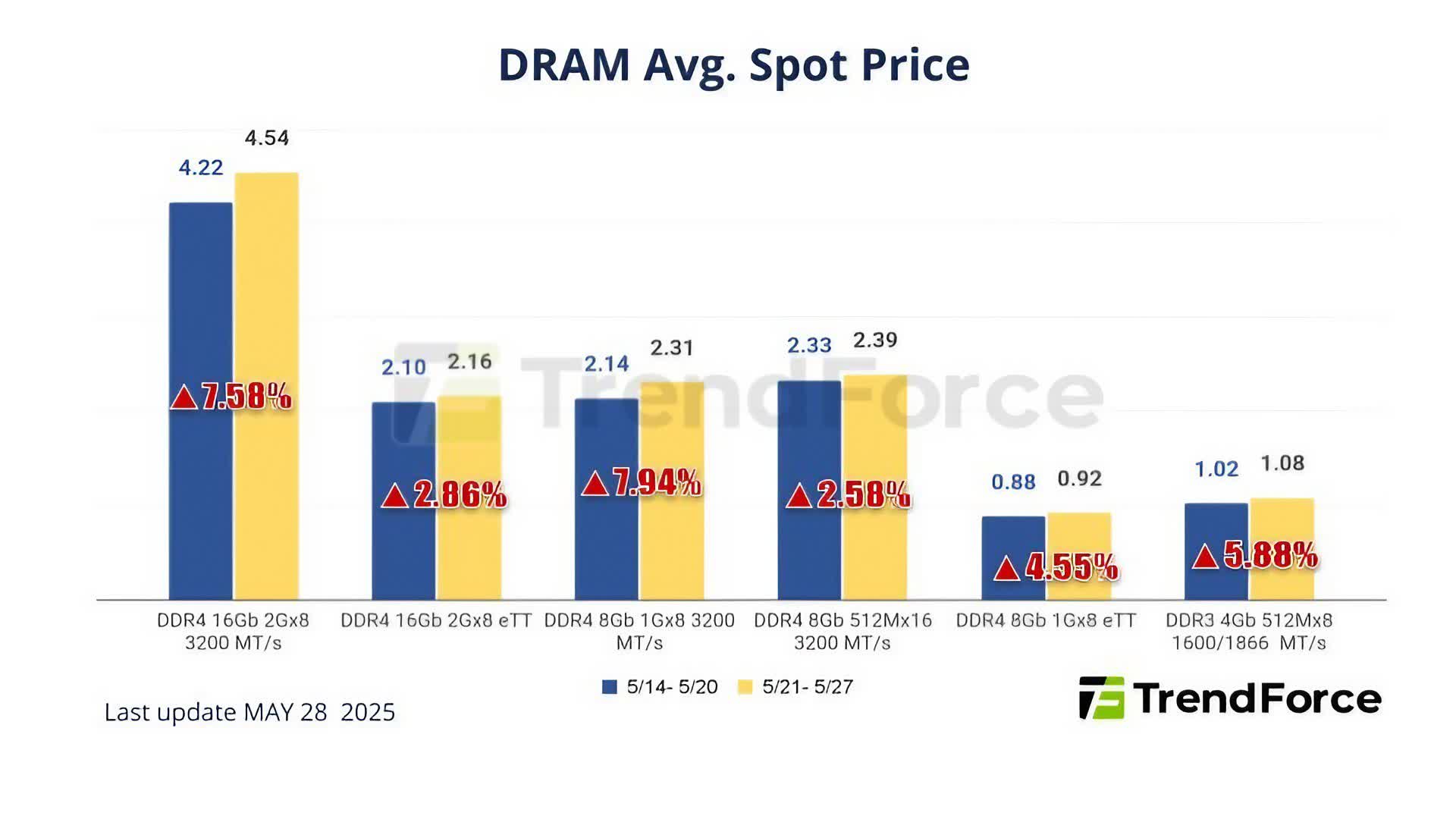

The thing that shocked me most wasn't just that prices went up. It's that they're still going up while everyone expected them to fall. DDR4, the older standard that should be getting cheaper as it's phased out, is actually getting more expensive too. That's the real warning sign here.

This isn't just affecting gamers or PC enthusiasts building custom machines. It's hitting data centers, enterprise customers, and anyone who needs to upgrade or build a system right now. Cloud providers are paying more for server memory. Universities refreshing labs are paying more. Small businesses adding workstations are paying more.

So what's actually happening? Why can't manufacturers just make more memory? And when—if ever—will prices come back down to something reasonable? Let's break down the crisis piece by piece.

TL; DR

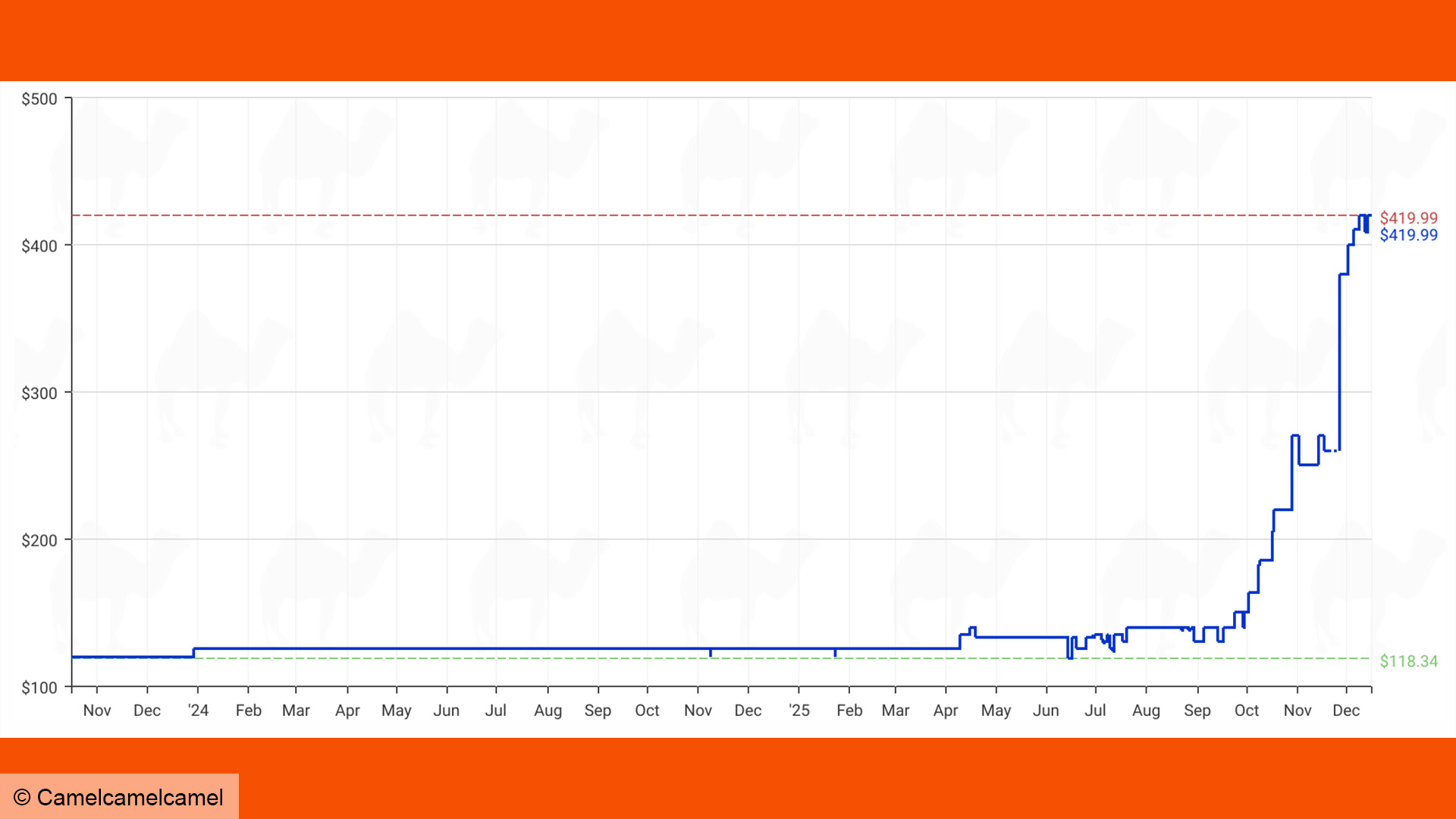

- DDR5 prices surged 440% in six months, from roughly 180 per module

- DDR4 costs are rising too, breaking the typical price decay pattern for older standards

- Supply-demand mismatch stems from high-bandwidth memory (HBM) competition and AI server demand

- Manufacturing capacity constraints limit how quickly supply can catch up

- Prices unlikely to stabilize until late 2025 at earliest, with no guarantee of dramatic relief

- Older systems become more valuable as upgrades grow financially painful

- Enterprise budgets face serious strain from unexpected memory cost escalation

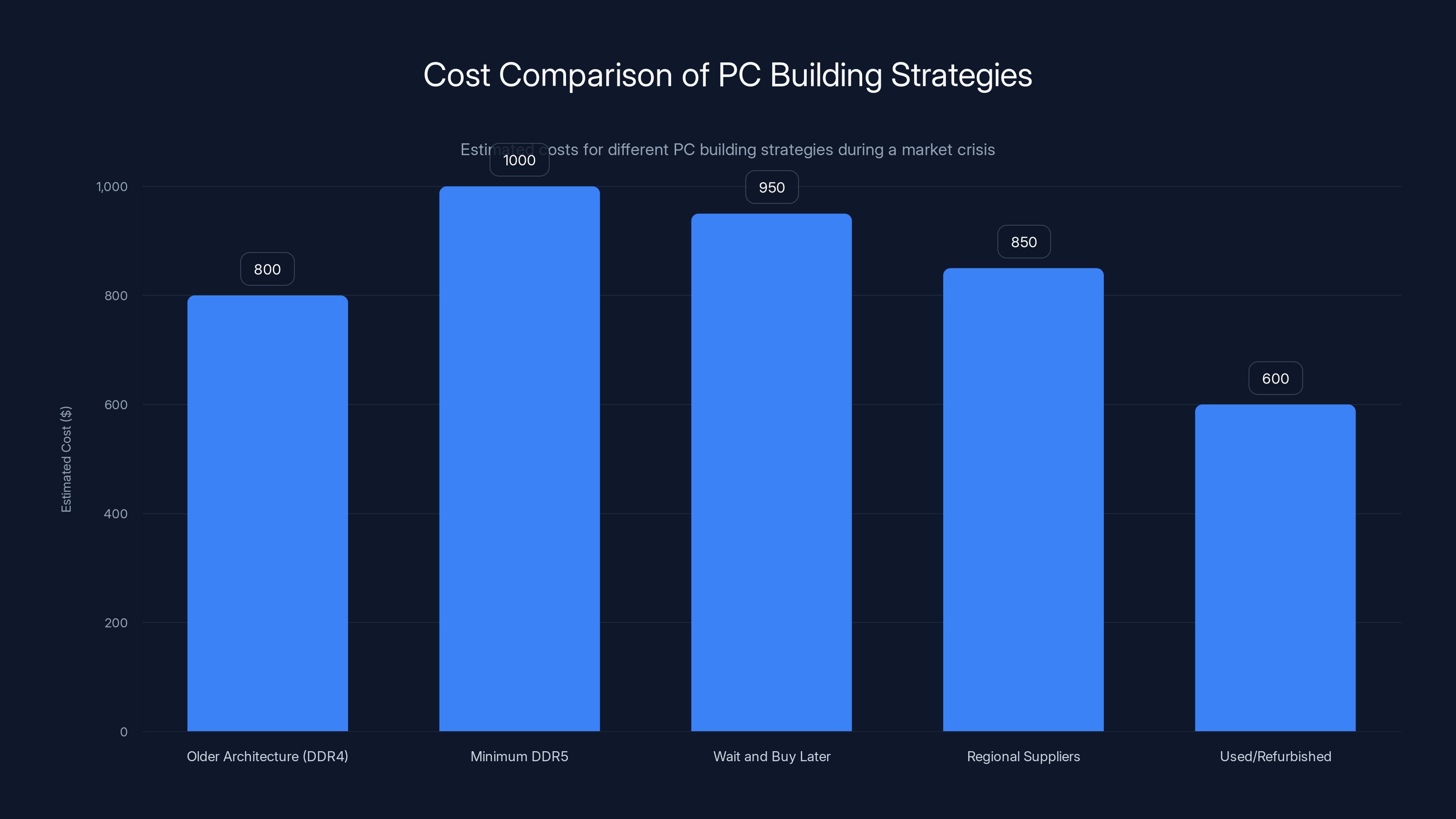

Estimated data shows that buying used or refurbished systems is the most cost-effective strategy, while opting for minimum DDR5 is the most expensive. Estimated data.

The Scale of the DDR5 Price Crisis

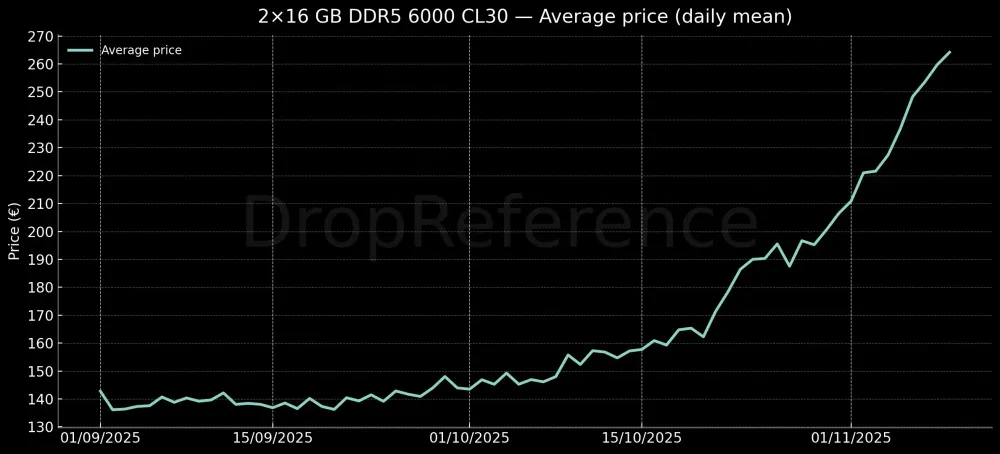

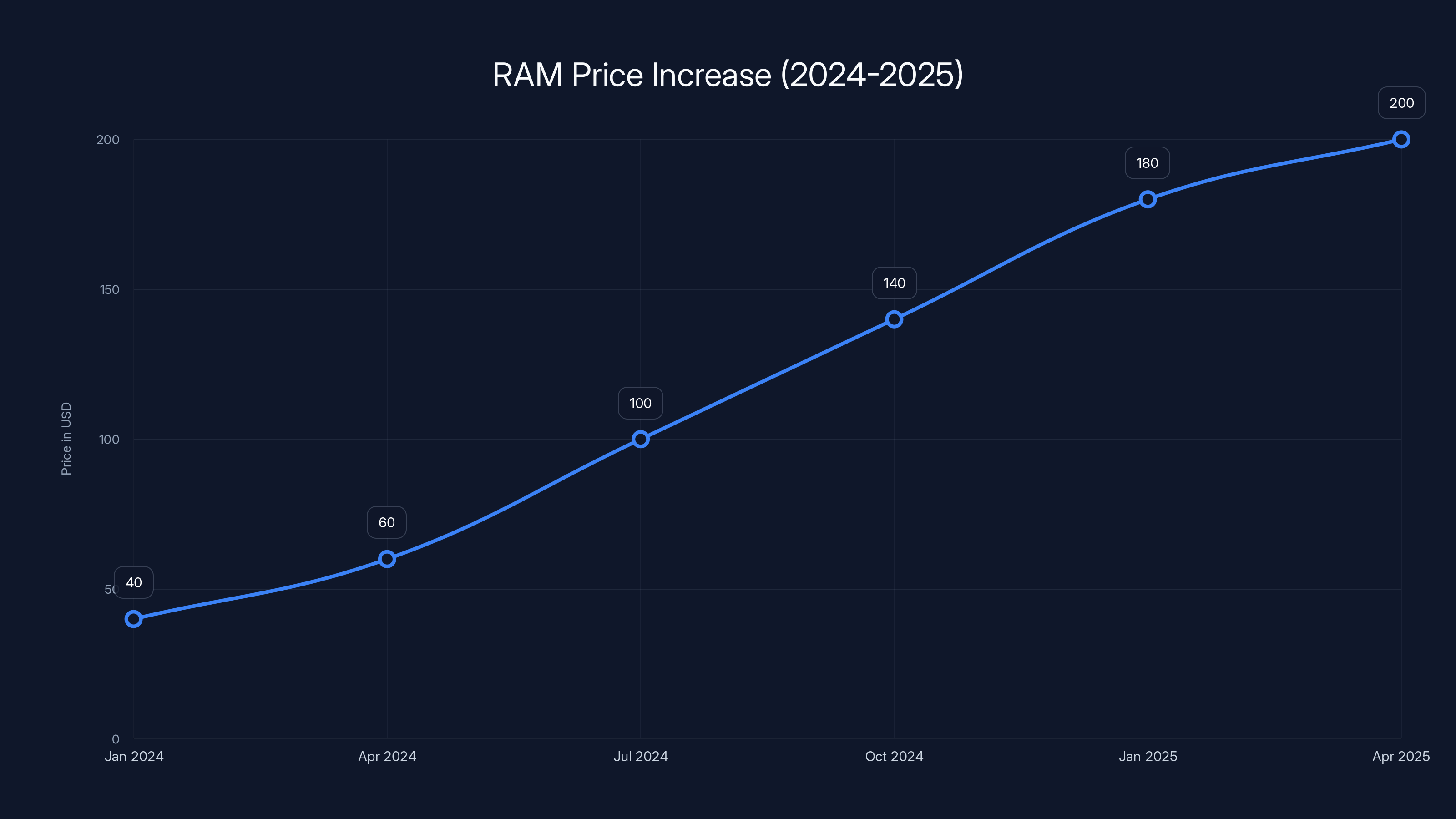

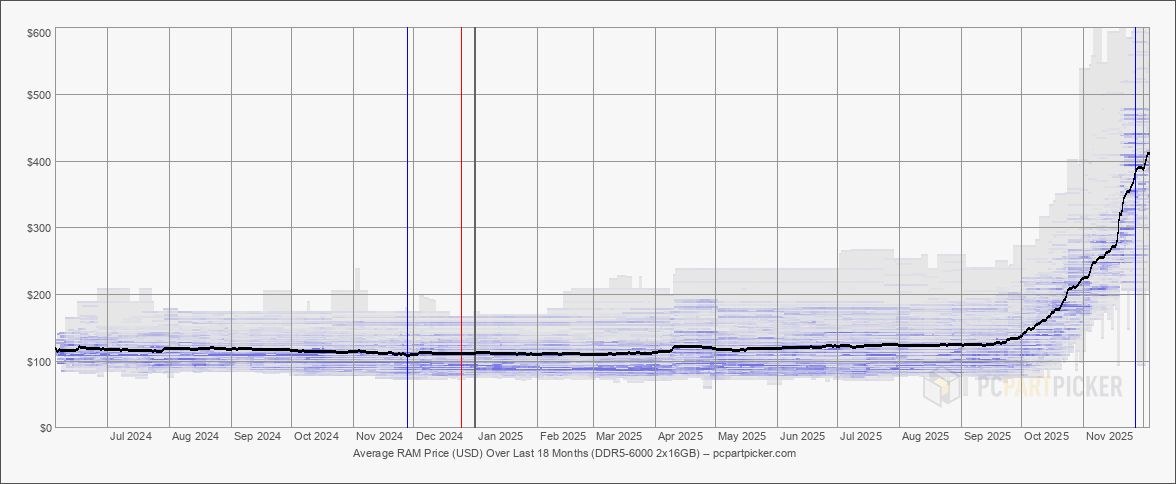

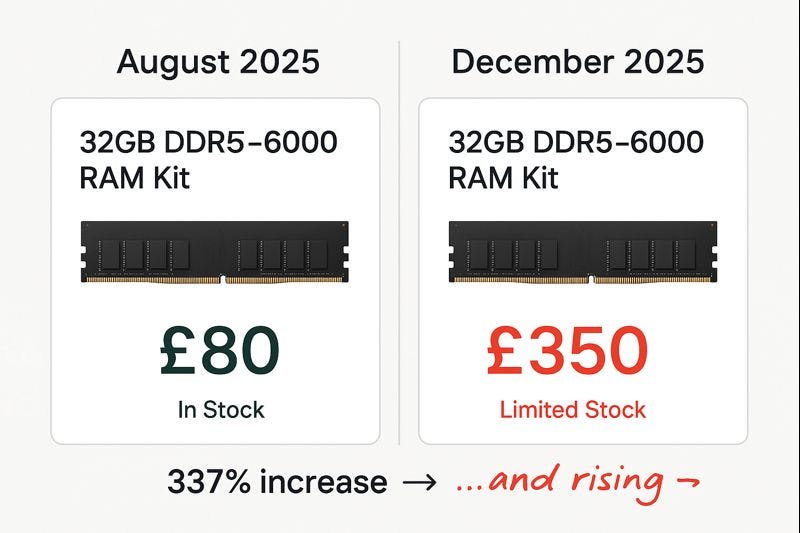

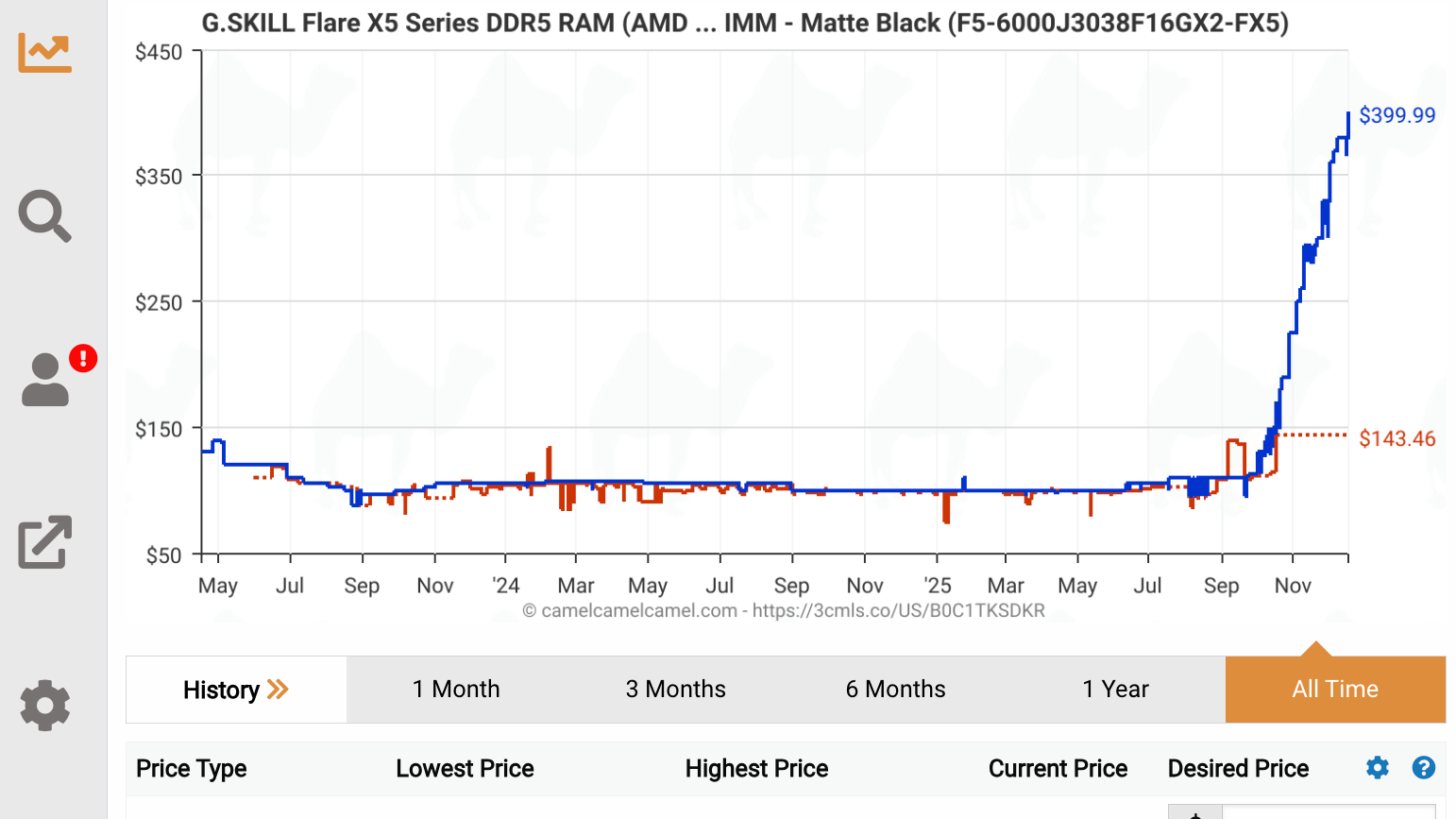

Let's put some real numbers on this. Six months ago, a quality 32GB DDR5 module from reputable manufacturers sat around

Historically, RAM prices follow predictable patterns. When a new standard launches, it's expensive because production capacity is limited and demand is uncertain. But as manufacturing ramps up and adoption spreads, prices fall. Usually, they fall fast. Within a couple years, prices drop 40% to 60% from launch levels.

DDR5 broke that script entirely.

Launched in 2021, DDR5 should have followed the normal trajectory. Instead, prices initially stayed high for longer than expected (normal), then they were supposed to drop sharply as supply caught up. That didn't happen. Instead, they've been climbing since late 2024.

What makes this especially painful: DDR4 prices aren't falling to compensate. They're climbing too. A 32GB DDR4 module that cost

This creates a nightmare scenario for anyone actually trying to build or upgrade a system. You can't go with the older, cheaper option because DDR4 is also expensive. You can't jump to the new standard because it's prohibitively costly. You're squeezed from both directions.

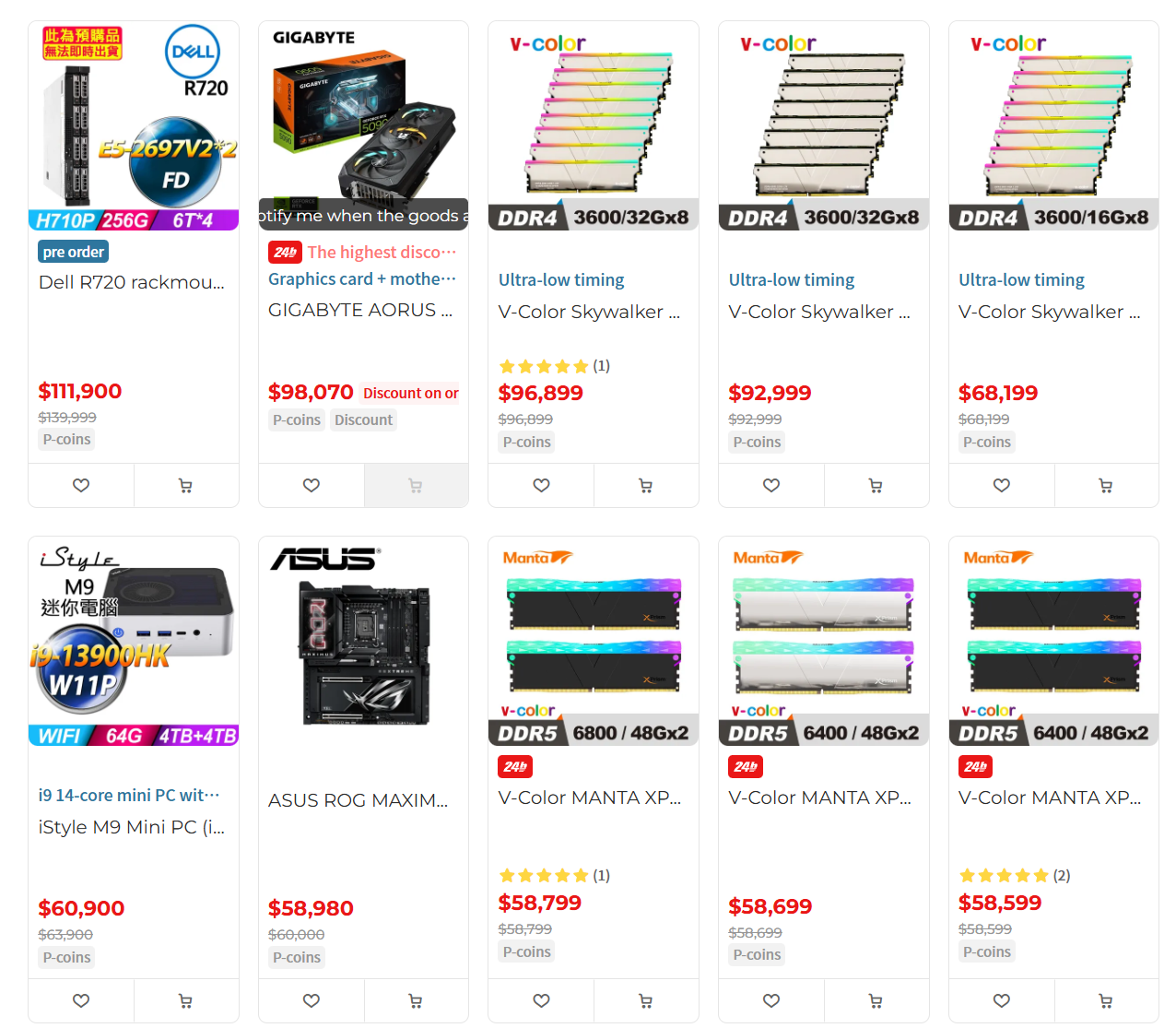

Enterprise customers are particularly unhappy. A data center refresh that was budgeted at

Small businesses buying office PC upgrades are feeling it too. A manager I spoke with said her company's planned refresh of 20 workstations with 32GB RAM each went from roughly

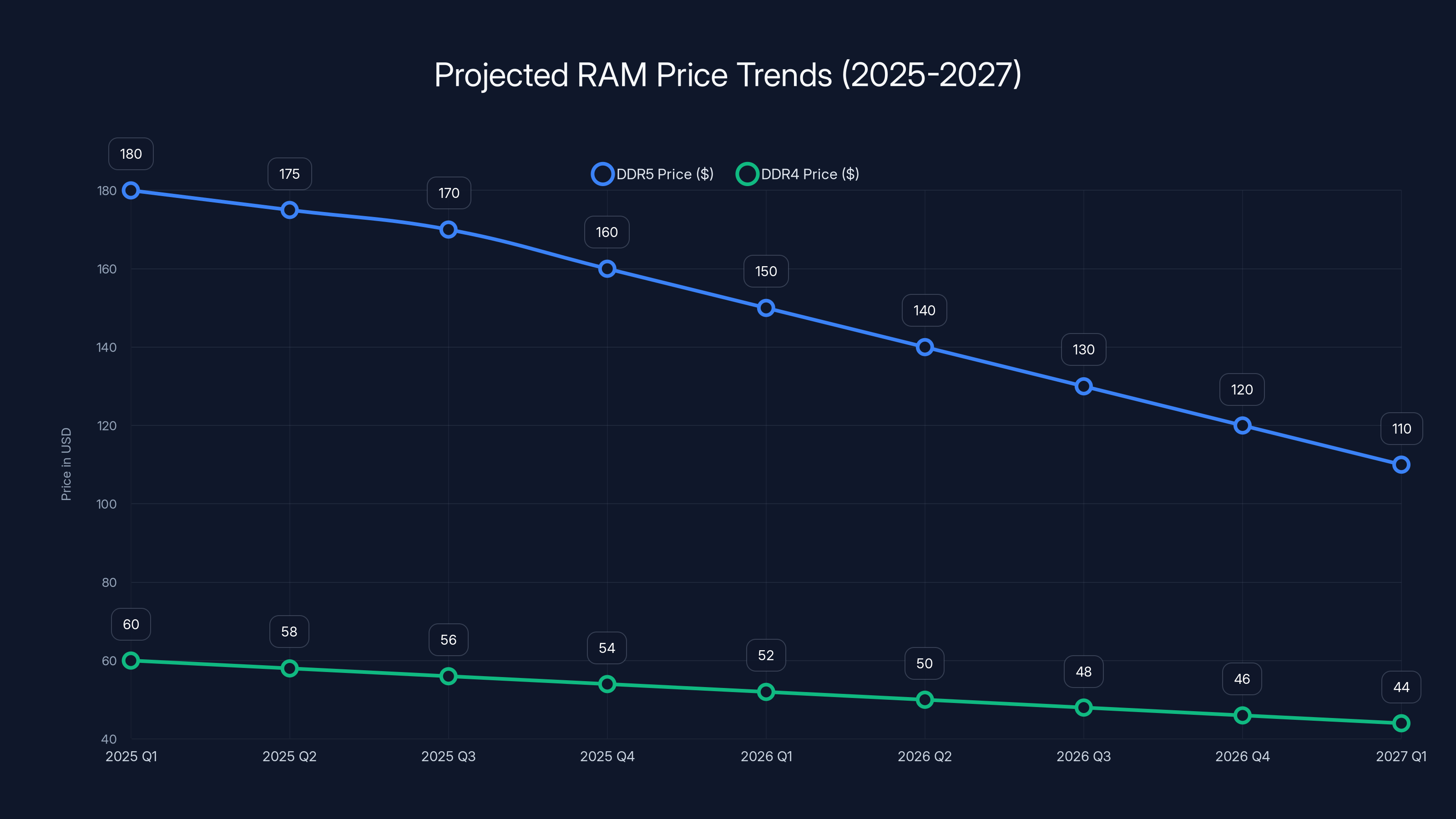

DDR5 prices are expected to gradually decrease from

Why High-Bandwidth Memory Became the Real Competition

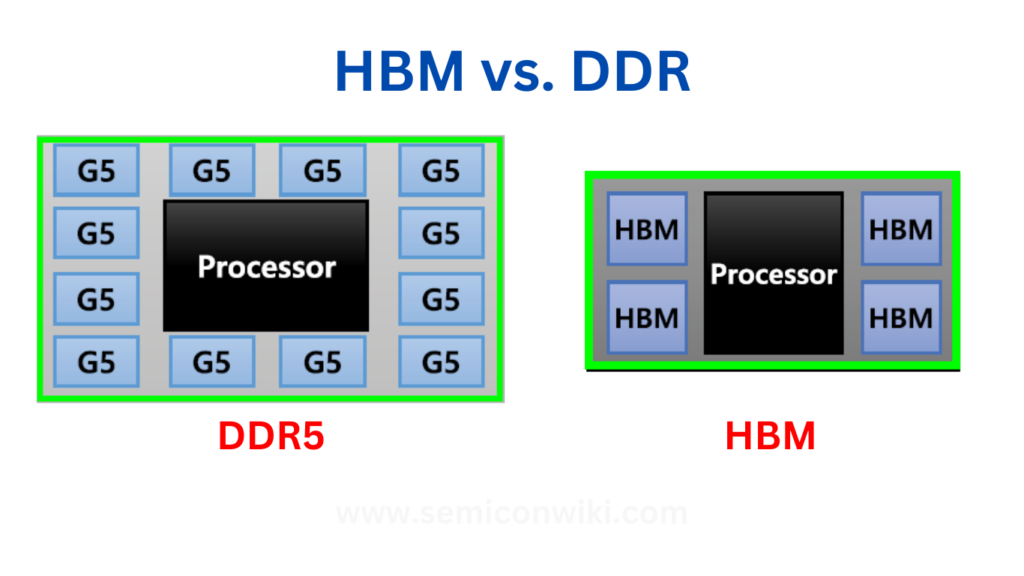

Here's the part that caught me off guard. DDR5 price increases aren't primarily driven by lack of DDR5 manufacturing capacity. They're driven by manufacturers' decision to prioritize high-bandwidth memory (HBM) production instead.

HBM is completely different from DDR5. It's specialized memory used in AI accelerators, graphics cards, and high-performance computing systems. NVIDIA's H100 and H200 GPUs need HBM. So do AMD's MI300 accelerators. As AI adoption exploded in 2024, demand for HBM went vertical.

Manufacturers like SK Hynix, Samsung, and Micron face a choice: produce traditional DDR5 for consumer and enterprise PC markets, or shift capacity toward HBM for the AI server gold rush. Which one generates more revenue? HBM, by a significant margin.

A single H100 GPU requires about 80GB of HBM. The margins on that are substantial. Meanwhile, a DDR5 module generates steady but lower revenue. From a manufacturing economics standpoint, the choice is obvious. Allocate the best production lines, the most experienced technicians, and the most rigorous quality control to HBM. Treat DDR5 as secondary.

This creates a ripple effect. The manufacturing capacity that would normally handle peak DDR5 demand simply isn't available. Supply tightens. Prices rise. Customers have to wait longer for stock. Panic buying sets in. Prices rise further.

We're seeing this play out in real time. Several manufacturers have publicly stated they're not significantly expanding DDR5 capacity. Why would they? HBM demand could sustain their growth for the next two years. By the time HBM demand normalizes, maybe DDR6 will be launching and pushing DDR5 toward obsolescence anyway.

The irony is painful. The AI boom that everyone expected to drive technology forward has actually created a bottleneck for mainstream computing. Consumers upgrading their PCs are paying the price while data center operators buying AI hardware get preferential treatment.

How AI Server Demand Changed the Memory Equation

The AI accelerator market exploded faster than anyone predicted. In 2023, people talked about AI becoming important. In 2024, it actually happened at scale. Every major cloud provider—AWS, Google Cloud, Azure—started deploying AI inference and training infrastructure at unprecedented volumes.

This created insane demand pressure on memory, especially HBM. But it also created secondary effects that rippled through DDR5 markets.

When manufacturers prioritize HBM production, they're not just choosing between products. They're choosing between supply chains, manufacturing equipment allocations, and capacity planning. A fabrication plant that runs HBM production at maximum capacity can't simultaneously run DDR5 at maximum capacity. The equipment overlaps. The expertise overlaps. The power budgets overlap.

Plus, there's a multiplier effect. A single AI server might need 4 to 8 H100 GPUs, each with 80GB of HBM. That's 320GB to 640GB of HBM per server. But that same server also needs 512GB of DDR5 system memory, plus 100GB to 200GB of NVMe SSD storage, plus networking, plus cooling, plus power infrastructure.

HBM is the bottleneck. Everything else waits. But the waiting creates scarcity signals that persist across the entire memory market. When HBM is scarce, investors worry about all memory being scarce. That psychology pushes DDR5 prices higher.

Meanwhile, customers holding older systems face a terrible choice. Upgrade now and pay inflated prices? Or wait, knowing that AI trends might accelerate the timeline for newer standards like DDR6, potentially making DDR5 upgrades obsolete faster than usual?

The cost impact of DDR5 pricing varies significantly across customer segments, with data centers facing the most substantial increases. Estimated data.

The Supply Chain Bottleneck: Manufacturing Reality

Manufacturing memory isn't something you ramp up overnight. DRAM production requires specialized fabs—fabrication plants that cost

SK Hynix, Samsung, and Micron decided years ago how many DRAM production lines to build. They made those decisions in 2020 and 2021, when DDR5 was theoretical and AI acceleration was still a niche research area. By the time 2024 arrived and reality looked different, they couldn't just flip a switch and build more capacity.

They could retool existing lines, shift production allocation, and prioritize certain products over others. That's what they've been doing. But there's a hard limit to how much flexibility exists in manufacturing equipment designed to produce memory efficiently.

This is why prices remain sticky at elevated levels. Supply isn't growing because it can't grow quickly. Demand might moderate slightly if customers price-shop or delay upgrades, but that just spreads the shortage over more time rather than solving it.

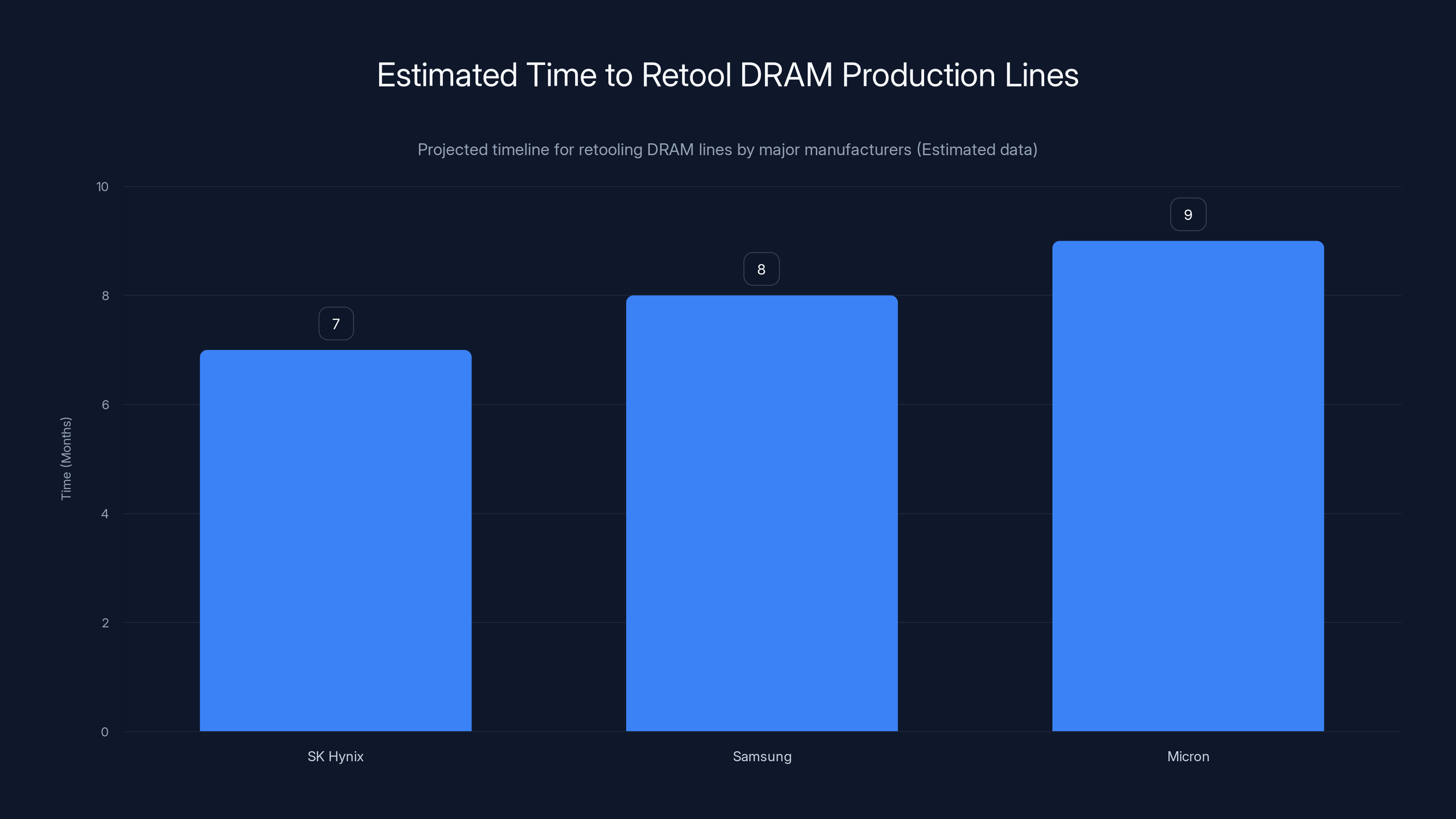

Here's the math that illustrates the problem. If all three major manufacturers decided right now to shift 30% of their DRAM capacity from mainstream products to DDR5, it would take 6 to 9 months to retool and restart lines. That's assuming zero complications. In reality, retooling introduces yield losses, quality-control challenges, and temporary production dips.

Meanwhile, your PC that needs an upgrade can't wait 9 months. You need it now. So you pay the market price. And that market price, with limited supply and consistent demand, stays elevated.

The manufacturers aren't happy about this situation either. Higher prices look good in quarterly earnings, but they create long-term problems. Customers who got burned by $300 RAM modules might switch to alternative architectures. They might buy less memory than they actually need. They might invest in older architectures that don't require DDR5 at all.

DDR4 Prices Rising: A Worrying Trend Nobody Expected

The scariest part of this crisis isn't the DDR5 prices themselves. It's what's happening with DDR4.

DDR4 has been the industry standard for nearly a decade. Adoption is mature. Manufacturing is optimized. Prices are supposed to be stable or declining. Instead, they're climbing.

Why? Because manufacturers see an opportunity. Customers who can't afford DDR5 are turning to DDR4. Demand for "the cheaper option" increased when "the new option" became unaffordable. Supply, however, didn't increase proportionally because manufacturers are still pulling capacity toward DDR5 and HBM production.

You end up with a weird situation where the older technology is actually becoming scarcer, not by accident but by manufacturer choice. If they're going to limit production anyway, they'd rather produce the product with higher margins: DDR5.

This breaks one of the fundamental assumptions about technology evolution. Usually, as new standards launch, old standards become commoditized. Prices fall. Availability increases. The margin shrinks but volume compensates.

Not this time. Both DDR4 and DDR5 are being squeezed for supply. Customers caught in the middle are essentially trapped. Neither option is affordable or readily available.

I've talked to systems integrators who are struggling to fulfill customer orders. They quote a job at cost-plus-margin, the customer approves, and then memory prices increase between order approval and purchase. The integrator eats the difference or goes back to the customer asking for more money. Neither option is good.

Some integrators are now offering "memory price hold" guarantees, which sounds great until you realize they're building in a 20-30% buffer just to cover potential price increases. That buffer gets passed to customers as higher quotes.

It's a cascading problem. Every layer in the supply chain is trying to protect itself from price volatility, which adds cost that ultimately reaches consumers.

DDR5 RAM prices have surged from

Market Speculation and Panic Buying Amplifying Prices

When prices start rising consistently, it changes human behavior. People start buying ahead of anticipated increases. This is rational from an individual perspective but destructive from a market perspective.

A business that needs 100 DDR5 modules might buy 150, figuring that having extra inventory is cheaper than waiting six months and buying at higher prices. Multiply that by thousands of businesses, and you've artificially accelerated demand even beyond what the market fundamentals require.

Price speculation also attracts investment capital into memory stocks and memory-heavy companies. Investors see supply constraints, increasing prices, and assume this is a long-term trend. Money flows in. Companies expand operations or acquire competitors. The frenzy builds.

What people forget is that price spikes eventually become self-correcting. High prices encourage substitution. They encourage waiting. They encourage innovation. Eventually, they encourage new supply to enter the market.

But in the short term—and we're talking about a timeframe measured in months, not years—prices can remain elevated even as underlying supply-demand fundamentals start to improve.

I've watched this play out in previous technology shortages. The GPU shortage of 2020-2022 followed this exact pattern. Prices spiked, remained elevated longer than fundamentals suggested they should, and then fell sharply once the psychology shifted from "supply is tight" to "I can get these if I wait."

Memory could follow the same pattern, or it could be different because HBM keeps pulling capacity away. That's the uncertainty keeping prices high.

Cost Impact for Different Customer Segments

The price crisis doesn't affect everyone equally. Some customers face minor inconvenience. Others face serious business disruptions.

Individual PC Builders and Gamers

For someone building a gaming PC or general-purpose workstation, DDR5 is becoming a luxury component. A

Some builders are responding by choosing older CPUs and motherboards that use DDR4. A Ryzen 5000 series CPU with DDR4 motherboard costs less, uses more mature ecosystem, and avoids the DDR5 premium. It's a rational economic decision, even if it means leaving performance on the table.

Gaming content creators face even worse math. If you need 64GB or 128GB of RAM, you're looking at

Small and Medium Businesses

SMBs refresh workstation fleets on annual or biennial cycles. Those refresh plans assumed DDR5 would be reasonably priced by 2025. Instead, they're facing sticker shock that forces choices between delaying upgrades or breaking budget.

A company with 50 workstations that planned to upgrade to current-generation systems can now either upgrade fewer workstations or downgrade to previous-generation hardware. Neither option is ideal.

The disruption cascades into IT planning. If you delay workstation refresh, you delay software deployment. You delay operating system upgrades. Systems stay vulnerable longer. Productivity stays suboptimal longer.

Data Centers and Cloud Providers

Large-scale infrastructure operators face the most severe cost impact because they buy at scale. A 1% increase in DDR5 pricing translates to millions of dollars for a company deploying thousands of servers.

They have leverage that smaller customers lack. They can negotiate volume discounts, lock in pricing contracts, and diversify suppliers. But even with those advantages, they're feeling the pain.

AWS, Google Cloud, and Microsoft Azure all need to factor memory costs into their service pricing. If memory becomes 30% more expensive, that pressure eventually shows up as higher cloud compute costs for their customers.

Large hyperscalers are also the customers pushing HBM demand hardest. Google spending billions on custom TPUs and H100s directly competes with your PC's memory supply. The company getting the AI advantage pays the cost by pulling memory capacity toward themselves.

Retooling DRAM production lines for DDR5 takes 6-9 months, with SK Hynix, Samsung, and Micron facing different timelines due to varying complexities. Estimated data.

Historical Context: How This Compares to Previous Shortages

This isn't the first time memory markets have faced severe supply constraints. Understanding history helps clarify whether we're looking at a temporary issue or a structural problem.

The 2017-2018 DRAM Shortage

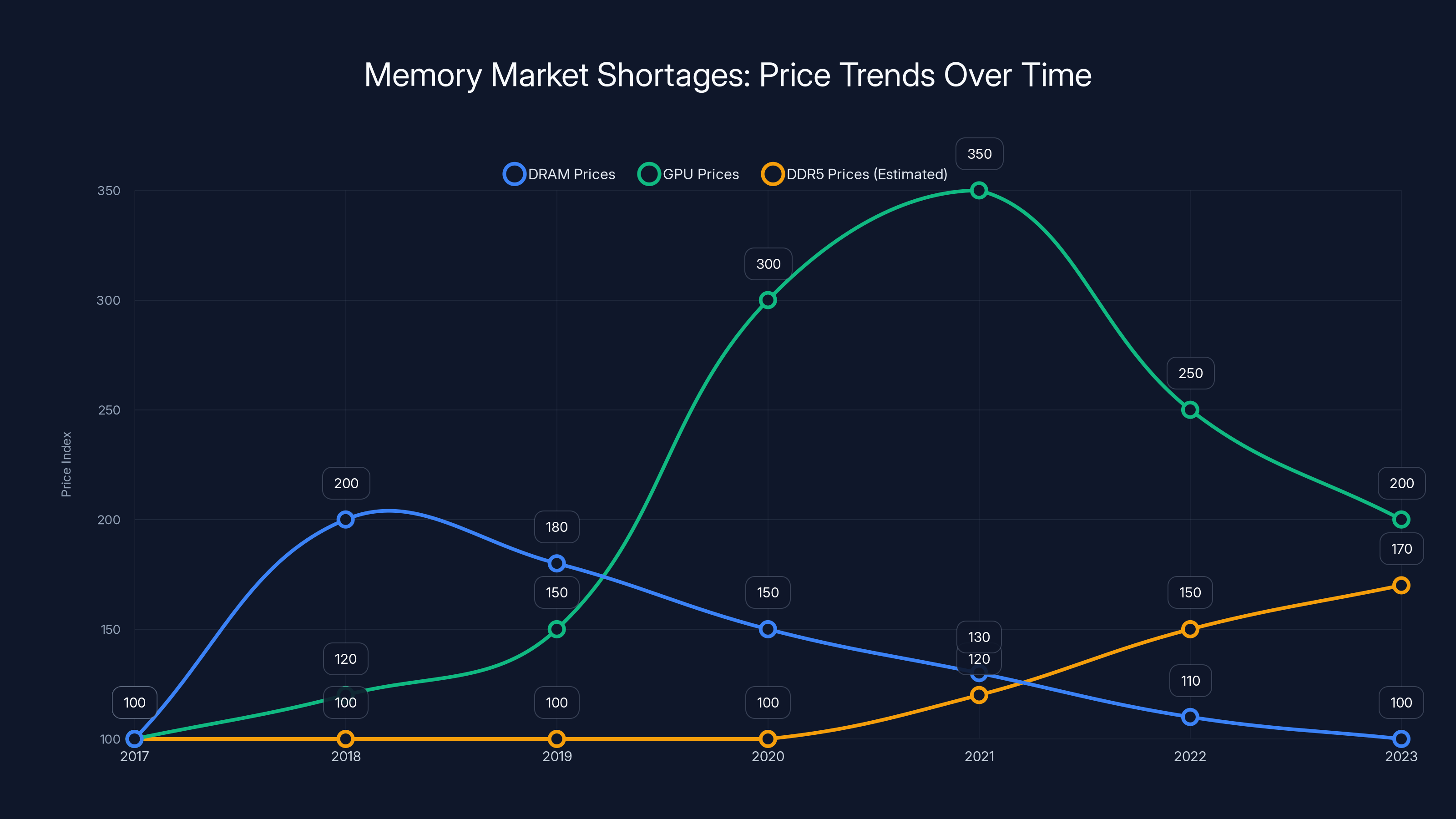

Memory prices doubled in 2017 and held elevated throughout 2018. The cause was bit growth outpacing supply—basically, demand for total memory capacity exceeded production growth. Phones needed more RAM. Servers needed more memory. Consumer demand was strong. Supply couldn't keep up.

Prices peaked and then fell sharply starting in 2019 as manufacturers increased capacity and bit growth moderated. The shortage lasted roughly 18 to 24 months total from when prices started rising to when they normalized.

The 2020-2022 GPU Shortage

This is a different category since it's GPU-specific, but it's relevant context. The shortage lasted nearly three years. Prices for NVIDIA and AMD GPUs reached multiples of MSRP. Miners, gamers, and businesses all competed for limited stock.

What made this shortage persist so long? Structural demand shifts. Cryptocurrency mining created continuous artificial demand. Pandemic-driven computing upgrades persisted longer than expected. Supply chain disruptions compounded the problem. Even when GPU manufacturers brought new capacity online, it filled with miner orders.

The GPU shortage teaches an important lesson: shortages persist when multiple factors align and when buyers at different market layers have fundamentally different priorities than consumers.

Comparison to Current DDR5 Situation

The current DDR5 situation has elements of both previous shortages, plus unique factors:

- Like 2017-2018: There's a real capacity constraint, not just temporary supply disruption

- Like 2020-2022: A higher-margin use case (HBM for AI) is pulling capacity, creating artificial scarcity

- Unique factor: Older standard (DDR4) is also getting scarce, suggesting supply constraints rather than just demand shift

- Unique factor: The bottleneck isn't temporary; it's built into manufacturing economics that won't change until HBM demand moderates

Based on this analysis, the DDR5 shortage probably lasts 12 to 18 months before prices start meaningful decline. That's an educated guess, not a certainty, but it's informed by historical patterns.

When Will Prices Actually Come Down? Realistic Timeline

Every article about price spikes inevitably gets asked: when does it end? Here's my honest answer: nobody knows for certain, but we can make educated guesses based on observable trends.

Best Case Scenario: Late 2025

If HBM demand moderates faster than expected, if AI accelerator demand hits a temporary plateau, and if manufacturers actually start increasing DDR5 capacity allocation, prices could start declining by Q4 2025. We're talking about a gradual process though—maybe 10-15% price reduction initially, spreading over several months.

Full normalization (back to 2024 levels) probably takes until mid-2026 in this scenario.

Realistic Scenario: Mid-2026

HBM demand continues strong through 2025, manufacturers don't aggressively shift capacity toward DDR5, and prices stay elevated through 2025. Starting in early 2026, as manufacturers commit to new capacity and some customers start switching to DDR6-ready systems, prices decline more meaningfully.

In this scenario, you might see 20-30% price reductions by mid-2026, with further normalization continuing through 2027.

Worst Case Scenario: 2027 or Beyond

If HBM demand stays intense through 2026, if new capacity takes longer to come online than planned, and if DDR6 launches and fractures the market between DDR5 and DDR6 customers, prices could stay elevated well into 2027.

Historically, worst-case scenarios in memory markets don't actually happen because market forces eventually correct. But in this environment with HBM creating a structural demand floor, the typical self-correction mechanisms are weaker.

What would change this timeline? Several factors could accelerate price declines:

- HBM oversupply: If AI accelerator demand hits a plateau or oversupply emerges, manufacturers pull capacity back toward DDR5

- New fab capacity: If Micron, Samsung, or SK Hynix bring new capacity online earlier than expected

- Customer substitution: If significant numbers of customers switch to alternatives or simply stop upgrading

- DDR6 launch: Surprisingly, a new standard could relieve DDR5 pressure by attracting premium customers

- Market shock: Recession or major economic disruption could crash demand across the board

None of these are highly likely in the next 6 months. Most would take 12 to 24 months to fully manifest.

The DRAM shortage from 2017-2018 saw prices double before normalizing in 2019. The GPU shortage from 2020-2022 was prolonged due to structural demand shifts, with prices peaking in 2021. The current DDR5 situation shows rising prices, influenced by both capacity constraints and high-margin demand. (Estimated data for DDR5)

Why Manufacturers Aren't Fixing This (And Why They Won't)

You might wonder why manufacturers don't just build more capacity and solve this problem. The answer is boring economics.

Building a new DRAM fab takes 3 to 5 years and costs

Meanwhile, you've got HBM demand that's urgent and immediate. A company can invest in expanding HBM capacity at existing fabs much faster and cheaper than building new DRAM fabs. So that's where capital goes.

Manufacturers are also rationally pessimistic about long-term DDR5 demand. DDR6 is already being designed. By the time a new fab reaches full production capacity in 4-5 years, DDR6 might be 2-3 years old already. Building capacity for a standard that's being phased out is terrible economics.

Instead, manufacturers are using retooling and allocation to manage the current shortage. It's not as effective as building new capacity, but it requires no capital expenditure and lets them hedge bets about which standards matter long-term.

From their perspective, this makes perfect sense. From your perspective (trying to buy RAM), it's deeply frustrating.

The Role of AI in Reshaping Memory Markets

The AI boom isn't just a temporary demand spike. It's reshaping how memory markets work fundamentally.

For decades, memory improvements followed processors. CPUs got faster, demanded more bandwidth, and memory kept pace. The tail didn't wag the dog.

Now, AI accelerators are demanding memory architectures and capacities that exceed what traditional systems need. HBM is fundamentally superior to DDR5 for AI workloads. It's got higher bandwidth, better power efficiency, and closer integration with compute logic.

As AI becomes central to computing (and everything suggests it will), HBM will get more important, not less. This means the supply pressure on DDR5 isn't temporary—it's the new normal.

Older generations might upgrade from DDR4 to DDR5. Current generation systems will upgrade to DDR5 or HBM-adjacent systems. But the golden age of memory abundance and steadily declining prices? That era is probably over.

What we're transitioning into is a world where different applications have fundamentally different memory requirements, competing for limited manufacturing capacity. That competition translates to higher prices for applications that aren't AI workloads—which is most of the computing world.

Practical Survival Strategies: How to Navigate This Crisis

If you need a system now, here are realistic approaches:

Option 1: Choose Older Architecture (DDR4)

DDR4 systems are still fast, still capable, and still available. Buying a Ryzen 5000 or Intel 12th gen system with 32GB DDR4 costs less total than a new-gen system with DDR5. You sacrifice some futureproofing, but you save money immediately.

This makes sense if your workload doesn't need cutting-edge performance. Office work, web development, content creation—DDR4 is fine.

Option 2: Buy Minimum DDR5 and Plan for Later Upgrade

Buy a current-gen CPU/motherboard with DDR5, but compromise on memory capacity. Get 16GB or 32GB instead of 64GB. Prices for smaller modules are slightly more reasonable. Later, when prices normalize, buy additional modules to upgrade.

This works if your motherboard supports future upgrades and if you can tolerate temporary performance constraints.

Option 3: Wait, but Set a Timeline

If you don't need a system immediately, wait. But don't wait indefinitely. Set a decision point 6 to 9 months out. Reevaluate then. If prices have dropped 20-30%, great—buy. If not, buy anyway because the pain of waiting another year is worse than buying at slightly-elevated prices.

Option 4: Look at Regional or Secondary Suppliers

Large retailers like Best Buy and Amazon have the most visibility, which means they get slammed with demand and face the most aggressive price increases. Regional PC builders, secondary retailers, and specialized suppliers sometimes have better pricing and stock. Not always, but worth checking.

Option 5: Buy Used or Refurbished Systems

If you're upgrading from an older system, look at used systems from 2023 or early 2024. Someone's upgrading to DDR5, and they're selling their older system cheap. You get better value than buying new systems in this market.

Enterprise Solutions and Workarounds

Large organizations have options that consumers don't. They can:

- Lock in volume pricing: Negotiate contracts with manufacturers for guaranteed prices across 2025

- Diversify suppliers: Instead of relying on one manufacturer, spread purchases across multiple suppliers

- Consider heterogeneous deployments: Mix different generation hardware if it's architecturally compatible

- Cloud transition: Some infrastructure that was supposed to be on-premise might migrate to cloud more aggressively

- Extend hardware lifecycle: Run existing systems longer than planned, deferring refresh

These solutions have downsides. Lock-in pricing commits you to volumes that might be excessive. Heterogeneous deployments complicate management. Cloud transition increases operating costs even as it reduces capital expenditure. Hardware lifecycle extension increases support and security costs.

But all of these are better than paying peak prices for everything at once. Enterprise customers are already pursuing these strategies, which is slowing their hardware refresh cycles and indirectly affecting total memory demand.

What This Means for Different Types of Users

Casual PC Users

If you use your PC for web browsing, email, streaming, and general office work, this crisis is an annoying delay, not a crisis. You can stick with your current system longer without much pain. When you do upgrade, buy 16GB or 32GB (not 64GB) and move on. The extra expense is 5-10% of your total system cost.

Content Creators and Professionals

If you need 64GB or more, you're facing real decisions. Either delay your upgrade by 6-12 months, eat the cost increase, or pivot to cloud-based systems for some workloads. There's no great option, just less-bad options.

Small Business IT

You're probably in the middle of a workstation refresh cycle right now. This crisis forced you to either delay refresh, reduce upgrade scope, or pay more than budgeted. Whatever you chose, it's suboptimal. Make sure you document the actual cost so when the conversation happens about upgrading next year, you can justify adjusting the budget based on 2025 experience.

Large Enterprise IT

You have the capital and leverage to mostly insulate your operations from the worst impacts. But even with that, you're allocating more budget to memory than you expected. That money comes from somewhere—either from other tech investments, from margin, or from customers in the form of higher service prices.

The Broader Implications: What This Crisis Reveals

Memory shortages aren't just about RAM prices. They're signals about deeper structural issues in computing infrastructure.

First, manufacturing concentration matters. Three companies (SK Hynix, Samsung, Micron) control essentially all DRAM production globally. When one of them prioritizes HBM, it affects everyone. More manufacturing competition or more distributed production would reduce this risk.

Second, AI is reshaping technology economics in ways we're still figuring out. We built manufacturing infrastructure based on assumptions about demand. AI came along and shifted those assumptions fundamentally. Similar disruptions might happen in other tech categories where AI creates sudden structural demand shifts.

Third, pricing power is concentrated. When manufacturers have limited supply, they have pricing power. That power gets passed through the entire supply chain and ultimately to consumers. More competition—from new fabs, from alternative memory architectures, from new manufacturers—would help. But capital barriers to entry in DRAM manufacturing are enormous.

Fourth, the old assumption that technology gets cheaper is under stress. We've had 30 years of Moore's Law and related trends driving technology prices down. That's been the baseline expectation. But with manufacturing concentration, environmental constraints on chip production, and structural demand shifts from AI, the next 30 years might look different.

These broader implications matter more than the immediate RAM price question.

Future Outlook: When Does Normal Resume?

Memory prices will normalize eventually. Markets always correct. But the timing is genuinely uncertain, and the new equilibrium might be different from the old normal.

2025 will be difficult. Prices will stay elevated. Availability will be strained. Options will feel limited. But scarcity rarely persists beyond about 18 months without forcing fundamental market adjustments (new supply, demand destruction, or substitution).

Late 2025 to 2026 is when we'll probably start seeing meaningful relief. HBM demand might moderate. New capacity might come online. Customers might adapt their purchasing patterns. These things take time to manifest, but they're predictable based on historical patterns.

2026 and beyond is when things stabilize. DDR5 becomes a mature, standard component. Prices normalize. DDR6 starts emerging as the premium option. The cycle repeats with a new standard.

Meanwhile, the structural lessons persist. Manufacturing in concentrated markets is fragile. Demand shifts from new technologies create ripple effects through entire industries. And the age of always-falling technology prices might actually be ending.

FAQ

What is causing the DDR5 RAM price spike in 2025?

The price spike results from multiple factors combining simultaneously: manufacturers prioritizing high-bandwidth memory (HBM) production for AI accelerators, limited DRAM manufacturing capacity, sustained demand from cloud providers and AI deployment, and speculation-driven panic buying. HBM is more profitable and urgent, so capital and capacity allocation favors it over consumer DDR5 production.

Why are DDR4 prices also increasing when they should be getting cheaper?

DDR4 prices are rising because manufacturers are deliberately limiting DDR4 production as they shift capacity toward DDR5 and HBM. As customers find DDR5 prohibitively expensive, demand for DDR4 increases unexpectedly. With constrained supply and rising demand, DDR4 prices climb instead of falling as they normally would during a technology transition.

How much higher are RAM prices compared to historical norms?

DDR5 prices have increased approximately 440% in six months (from roughly

When will RAM prices come back down to normal levels?

Based on historical patterns, meaningful price relief will likely begin in late 2025 or early 2026, with fuller normalization continuing through 2026 and into 2027. The timeline depends on when HBM demand moderates, when manufacturers bring new capacity online, and when customer demand patterns shift. Complete normalization to 2024 pricing levels probably requires 18-24 months from when prices peaked.

Should I buy RAM now or wait for prices to drop?

If you need a system now, buy DDR4 architecture (older CPUs and motherboards) to avoid premium DDR5 pricing, or buy the minimum DDR5 capacity you need while planning a future memory upgrade. If you can delay purchase, waiting until late 2025 or early 2026 will likely save 20-30% compared to buying in early 2025. Set a firm decision timeline rather than waiting indefinitely—indefinite waiting creates opportunity costs that exceed savings.

What's the connection between AI demand and RAM prices?

AI accelerators like NVIDIA's H100 GPUs require high-bandwidth memory (HBM), which commands higher profit margins than DDR5. Manufacturers are allocating their best production capacity toward HBM to serve the AI boom, pulling capacity away from consumer DDR5 production. This creates artificial scarcity in DDR5 even though manufacturing capacity exists—it's allocated toward higher-margin products instead.

Are there any workarounds or alternatives to buying expensive DDR5 RAM?

Yes. Consider sticking with DDR4-based systems (older-generation CPUs and motherboards) until prices normalize. Buy minimum DDR5 capacity now and plan to upgrade later when prices fall. Look at regional suppliers and secondary retailers for better pricing than major retailers. For cloud workloads, consider temporary migration to cloud infrastructure rather than buying hardware at peak prices. Enterprise customers can negotiate volume pricing contracts or diversify suppliers.

How does this RAM shortage compare to previous shortages like 2017-2018?

The current shortage is more severe in percentage terms (440% increase vs. 100% in 2017-2018) and is hitting both new and older standards simultaneously. Unlike previous shortages driven purely by demand outpacing supply growth, this shortage has structural components (HBM competition) that persist even as manufacturers try to increase capacity. That structural component means this shortage might last longer than historical precedents.

Will DDR6 memory help solve the current price crisis?

DDR6 launches will probably relieve pressure on DDR5 by attracting premium customers and new demand. However, DDR6 will likely launch at even higher prices than DDR5 launched at, offering no immediate relief for budget-conscious customers. DDR6 availability will be limited for the first 12-18 months, and during that transition period, DDR5 prices might remain elevated longer as manufacturers split production between standards.

What can enterprises do to manage memory cost increases?

Enterprise options include locking in volume pricing contracts with manufacturers, diversifying suppliers to reduce single-vendor dependence, extending hardware refresh timelines to spread costs, considering heterogeneous deployments if architecturally compatible, or temporarily shifting workloads to cloud infrastructure. Large organizations can also negotiate priority supply status in exchange for long-term commitments, something individual consumers cannot access.

Conclusion: Navigating the New Memory Economics

The RAM price crisis of 2025 isn't an anomaly. It's a glimpse into how technology markets will work when manufacturing is concentrated, when new applications (AI) create structural demand shifts, and when supply constraints are more permanent than temporary.

For the next 12 to 18 months, memory will be expensive and constrained. That's the reality. Fighting it accomplishes nothing. Instead, the practical approach is acknowledging the constraint and making decisions within that reality.

If you absolutely need a system now, buy DDR4 or buy minimum DDR5. If you can delay 6-9 months, do so. If you're an enterprise, lock in pricing and diversify suppliers. These aren't ideal responses, but they're rational responses to market conditions that exist, not the market conditions you wish existed.

The broader lesson is about resilience. Technology infrastructure that depends on just-in-time manufacturing from concentrated suppliers is fragile. The next crisis—whether memory, chips, or something else—will surprise us because we built systems optimized for normal conditions, not for disruption.

When you do upgrade, whether now or later, you'll have working hardware that does what you need. The extra money you spent on memory? That's the cost of upgrading in a constrained market. It's not ideal, but it's the price of computing in 2025.

Key Takeaways

- DDR5 prices increased 440% in six months (from ~180), far exceeding historical shortage patterns like the 2017-2018 crisis which roughly doubled prices

- Manufacturers prioritize high-bandwidth memory (HBM) for AI accelerators over consumer DDR5, creating artificial scarcity despite adequate fab capacity existing

- Both DDR5 and DDR4 prices are climbing simultaneously, breaking normal technology transition patterns where older standards become cheaper as new ones launch

- DRAM fab expansion takes 3-5 years and costs $15-20 billion, making quick capacity responses impossible—manufacturers chose to allocate existing capacity toward HBM instead

- Realistic timeline for meaningful price relief: late 2025 to early 2026, with full normalization potentially extending to 2027 as HBM demand sustains throughout 2025

- Customer strategies: DDR4 systems offer better value now, wait if possible until Q4 2025, or buy minimum DDR5 capacity and plan future upgrades

- Enterprise customers face multi-million dollar cost impacts at scale; cloud providers increasingly factor higher memory costs into service pricing passed to customers

- The crisis reflects deeper structural issues: manufacturing concentration in three companies, AI creating unexpected demand shifts, and the end of the era of always-declining technology prices

Related Articles

- Samsung RAM Price Hikes: What's Behind the AI Memory Crisis [2025]

- DDR5 Memory Theft Crisis: Why Thieves Are Smashing Gaming PCs [2025]

- ASUS RTX 5070 Ti Not Discontinued: Supply Shortage vs. EOL Clarification [2025]

- RTX 5070 Ti Memory Shortage: What's Really Happening in the GPU Market [2025]

- Why AI PCs Failed (And the RAM Shortage Might Be a Blessing) [2025]

- Why RAM Prices Are Skyrocketing: AI Demand Reshapes Memory Markets [2025]

![DDR5 RAM Price Crisis: Why Memory Costs Keep Climbing [2025]](https://tryrunable.com/blog/ddr5-ram-price-crisis-why-memory-costs-keep-climbing-2025/image-1-1768837060970.jpg)