DDR5 Memory Theft Crisis: Why Thieves Are Smashing Gaming PCs [2025]

It sounds like a plot from a heist movie. A South Korean design office gets broken into. Thieves methodically smash the tempered-glass side panels off two desktop computers. They grab exactly four Micron DDR5-5600 32GB memory modules and vanish. They don't touch the monitors. They ignore the keyboards. They leave the CPUs, GPUs, and storage drives sitting there like they're worthless.

Because, right now, they basically are compared to DDR5.

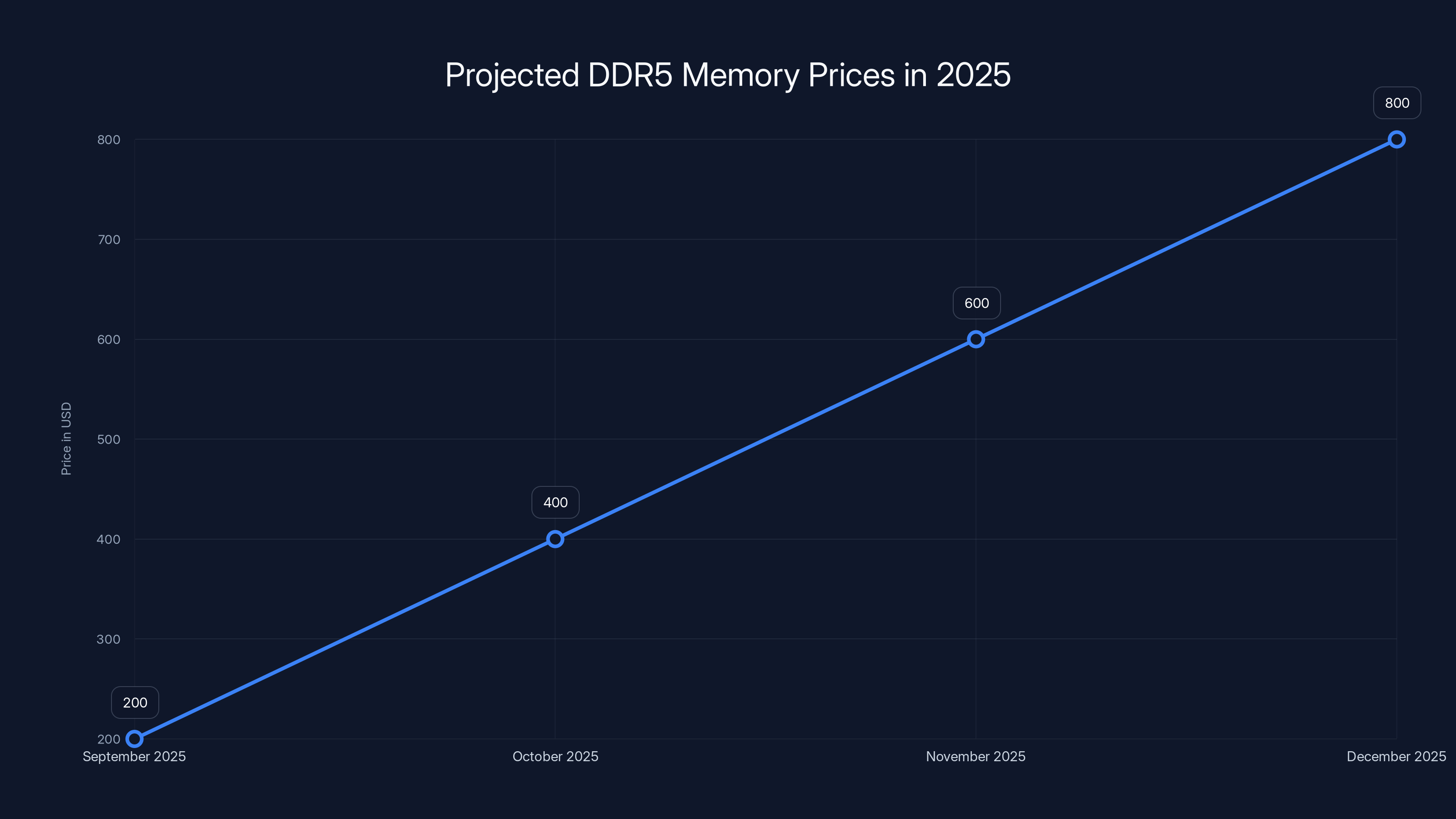

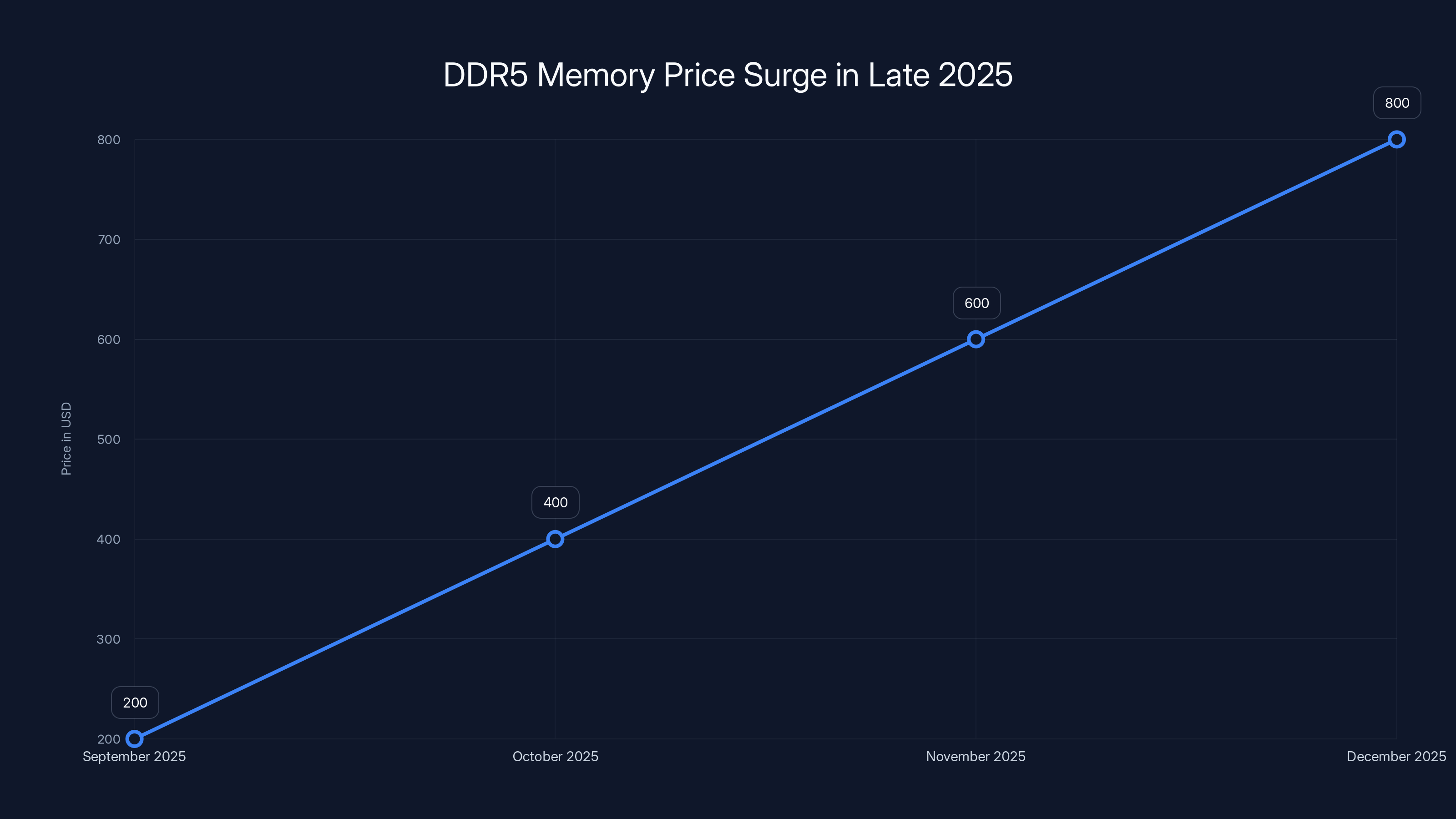

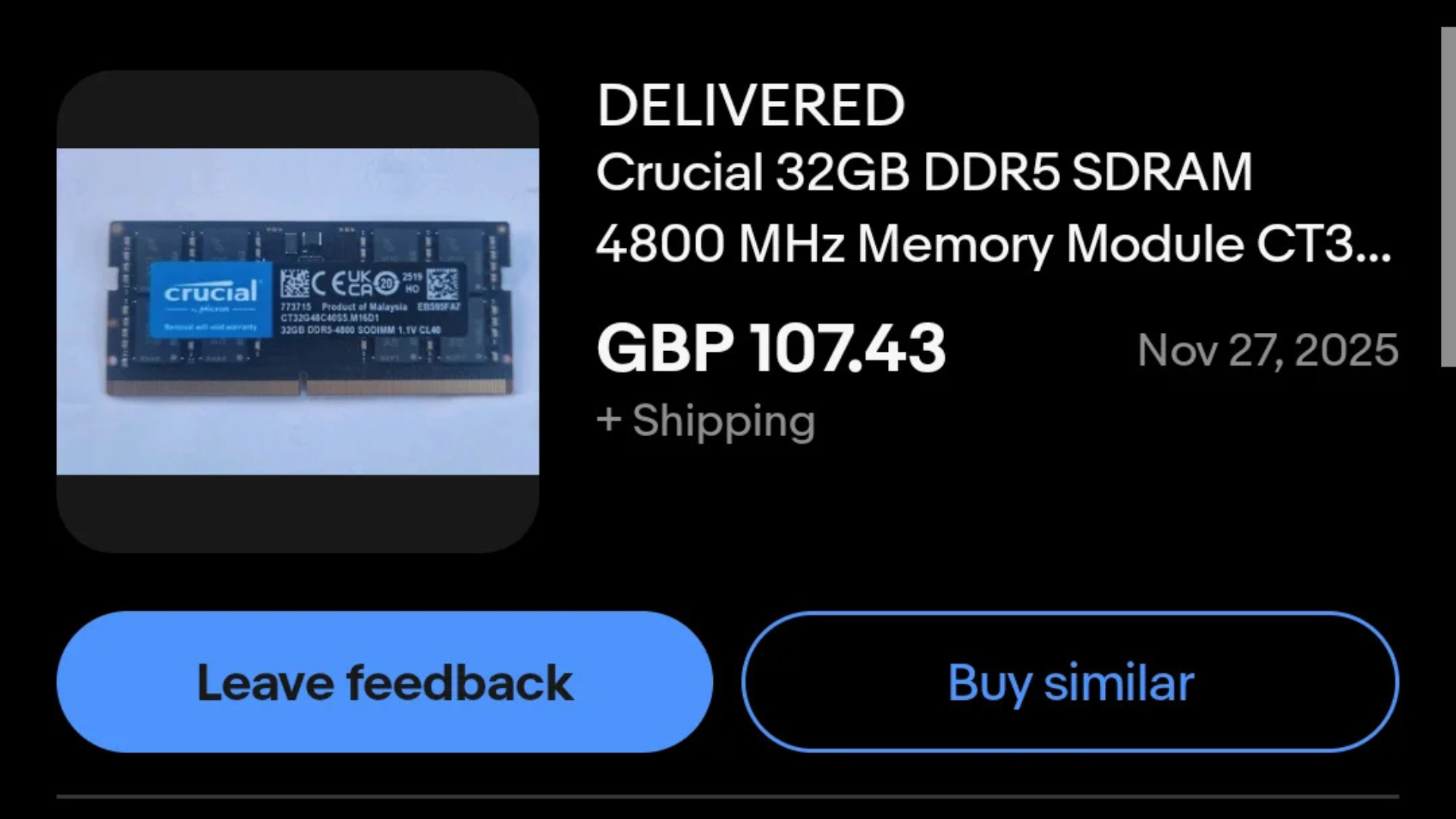

This wasn't random. This was targeted. And it's the clearest signal yet that memory pricing has entered a completely different universe. We're no longer talking about incremental cost increases. We're talking about 32GB DDR5 kits reaching

For context, in September 2025, you could grab a solid 32GB DDR5-5600 kit for around

This isn't just about one office break-in. It's a symptom of a much bigger problem brewing in the PC hardware market. And if current trends and expert predictions hold, 2026 could be absolutely brutal.

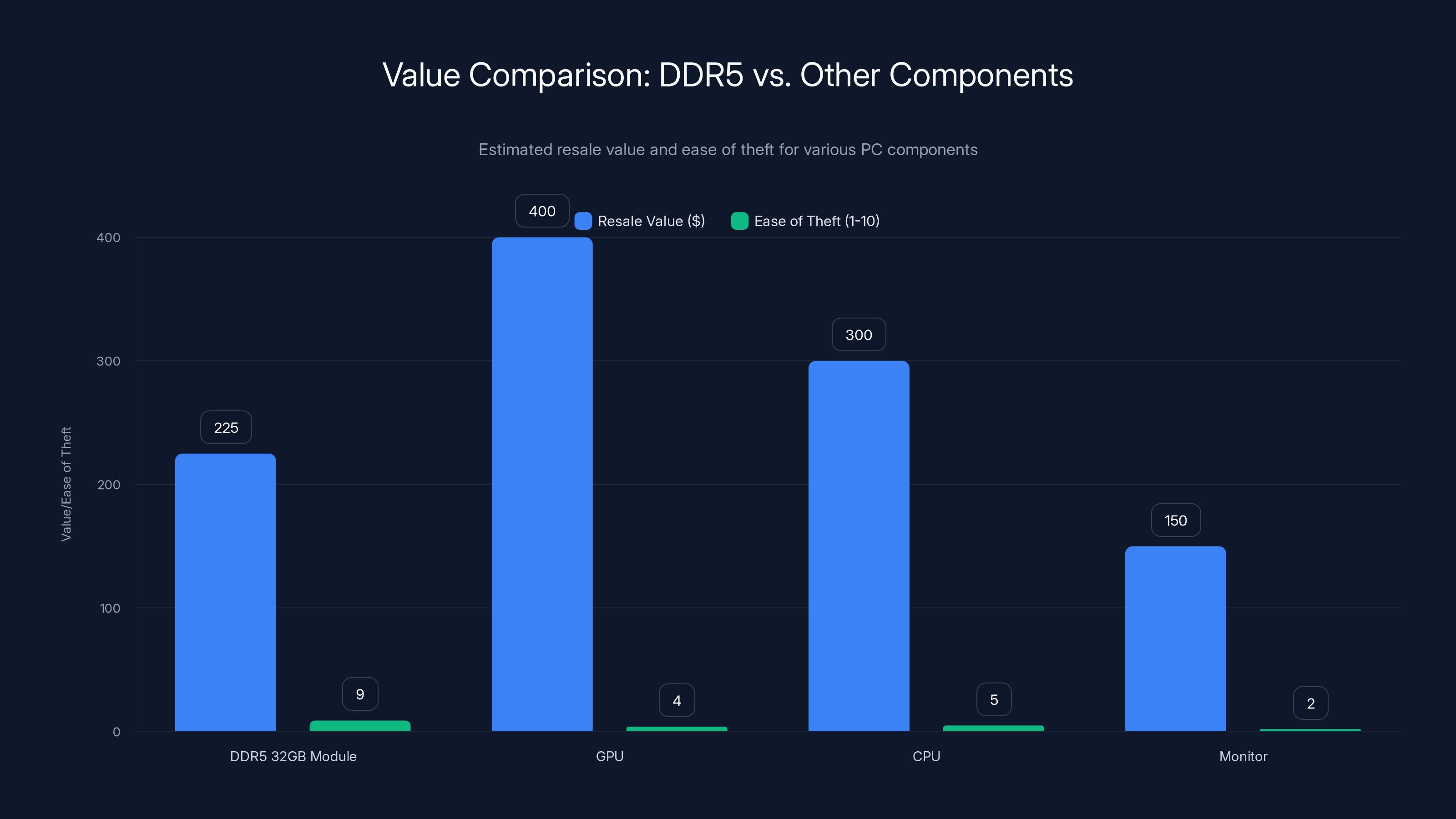

The Anatomy of the Perfect Theft Target

Why DDR5 Became Thieves' Favorite Score

Let's break down why memory suddenly matters more than GPUs or CPUs to criminal planners. Size and value create opportunity. A DDR5 32GB module is roughly the size of a stick of gum. It weighs almost nothing. You can fit

The South Korean theft is instructive here. The perpetrators knew exactly what they wanted. They didn't grab the monitor, the keyboard, the mouse, or even the hard drives. They went straight for the memory. This suggests either significant market knowledge or advance intelligence about what specific hardware was in the office. The fact that they targeted four modules specifically, enough to fully equip a high-end system or sell as kits, indicates this was professional.

Criminal targeting has become sophisticated. Thieves can identify systems with DDR5 just by looking at them. Transparent and tempered-glass cases, which have exploded in popularity, make component identification trivial. You can see which modules are installed without ever opening the case. A knowledgeable thief knows that a system with visibly expensive DDR5 is worth breaking into. A system with older DDR4 might not be worth the risk.

Resale markets have become equally sophisticated. Online forums, Discord servers, and secondary markets exist where stolen components move quickly. Memory modules don't have serial numbers that are tracked the way graphics cards do. They're fungible commodities. Selling stolen memory is almost risk-free compared to moving stolen GPUs, which often have warranty registrations or identification mechanisms.

The Perfect Storm of Supply, Demand, and Price

None of this happens without the pricing explosion. Let's look at what actually created these conditions. DDR5 is still relatively new in the mainstream market. It launched in late 2021 and early 2022, but adoption has been slower than expected. Most people still use DDR4. Only higher-end systems, gaming builds, and professional workstations have migrated to DDR5.

That limited adoption meets constrained supply. Samsung, Micron, and SK Hynix are the primary producers of high-capacity DDR5, and they've been dealing with ongoing production bottlenecks. When demand suddenly spikes and supply can't keep up, prices explode. That's exactly what happened in late 2025.

But here's where it gets interesting. This isn't just about normal market forces. Geopolitical tensions, especially around semiconductor manufacturing in Asia, have put additional pressure on supply chains. When people worry about future availability, they buy now. Panic buying + limited supply = exponential price growth.

Some retailers reported being completely out of high-capacity DDR5 stock for weeks. Backorders stretched months. Prices moved daily based on what little inventory remained. In this environment, thieves see clear opportunity. Steal today, sell tomorrow, take the cash. The stolen memory will move quickly because demand is so high.

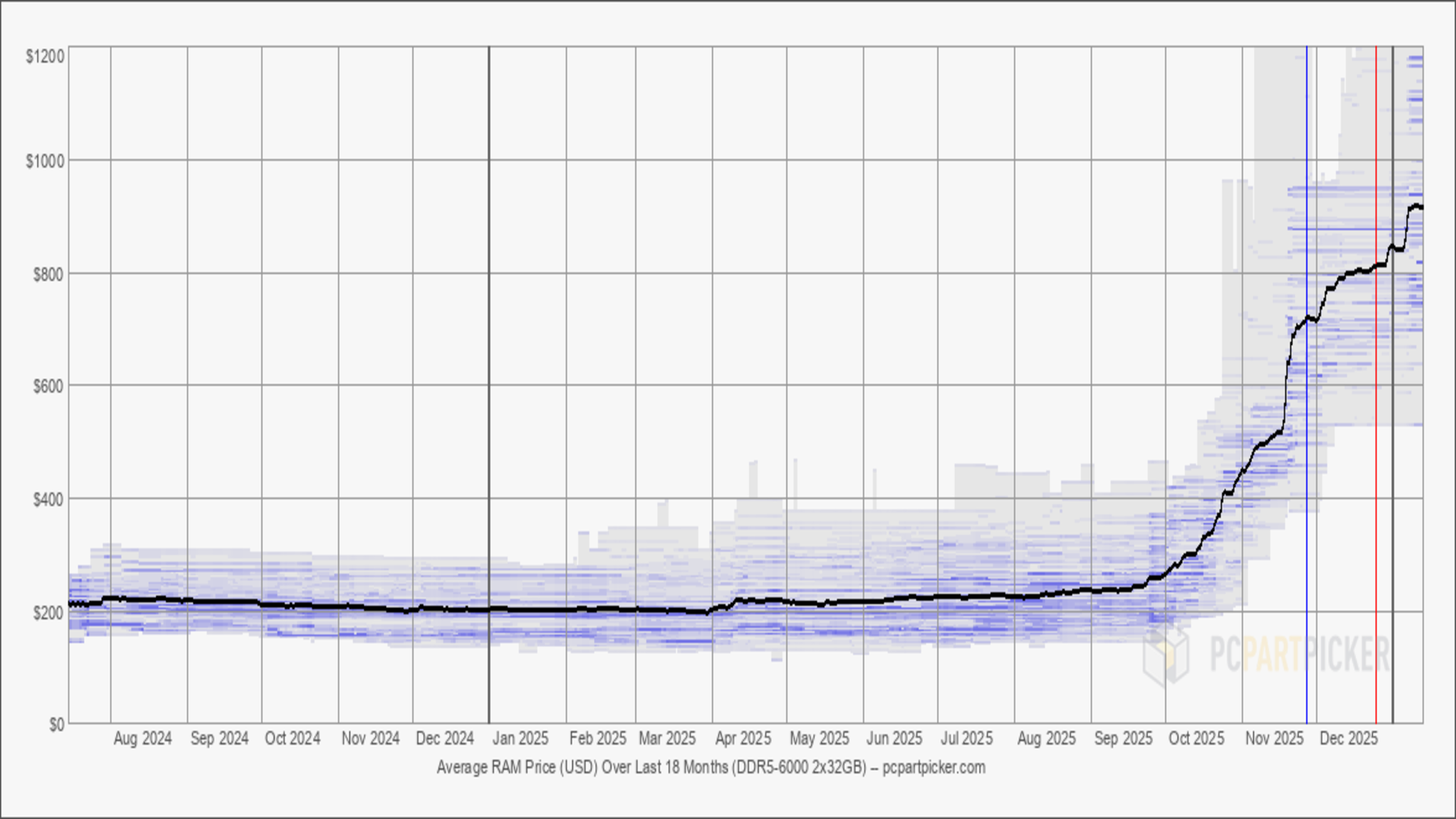

DDR5 memory prices increased fourfold from September to December 2025, driven by limited production and high demand.

The Numbers: How Much Did Prices Actually Jump?

DDR5-5600 32GB Kits: From Affordable to Gold-Plated

Let's put real numbers on this. According to PCPart Picker data from late 2025, the 32GB DDR5-5600 kits that were

Here's the math:

To put that in perspective, if your grocery store's milk price went up 300%, a gallon that cost

Premium DDR5-6000 modules went even higher, averaging around

The Ripple Effect: Lower-Capacity Modules Catch the Wave

It's not just 32GB kits that got expensive. The entire DDR5 market shifted upward. Single 16GB sticks that should cost

This matters for theft because it means even smaller, less prominent memory modules became valuable targets. You don't need to steal a full 32GB kit. Grabbing one or two 16GB modules is enough for decent return. The risk-reward calculation shifts further toward theft being worthwhile.

Expert Predictions: How Bad Could It Get?

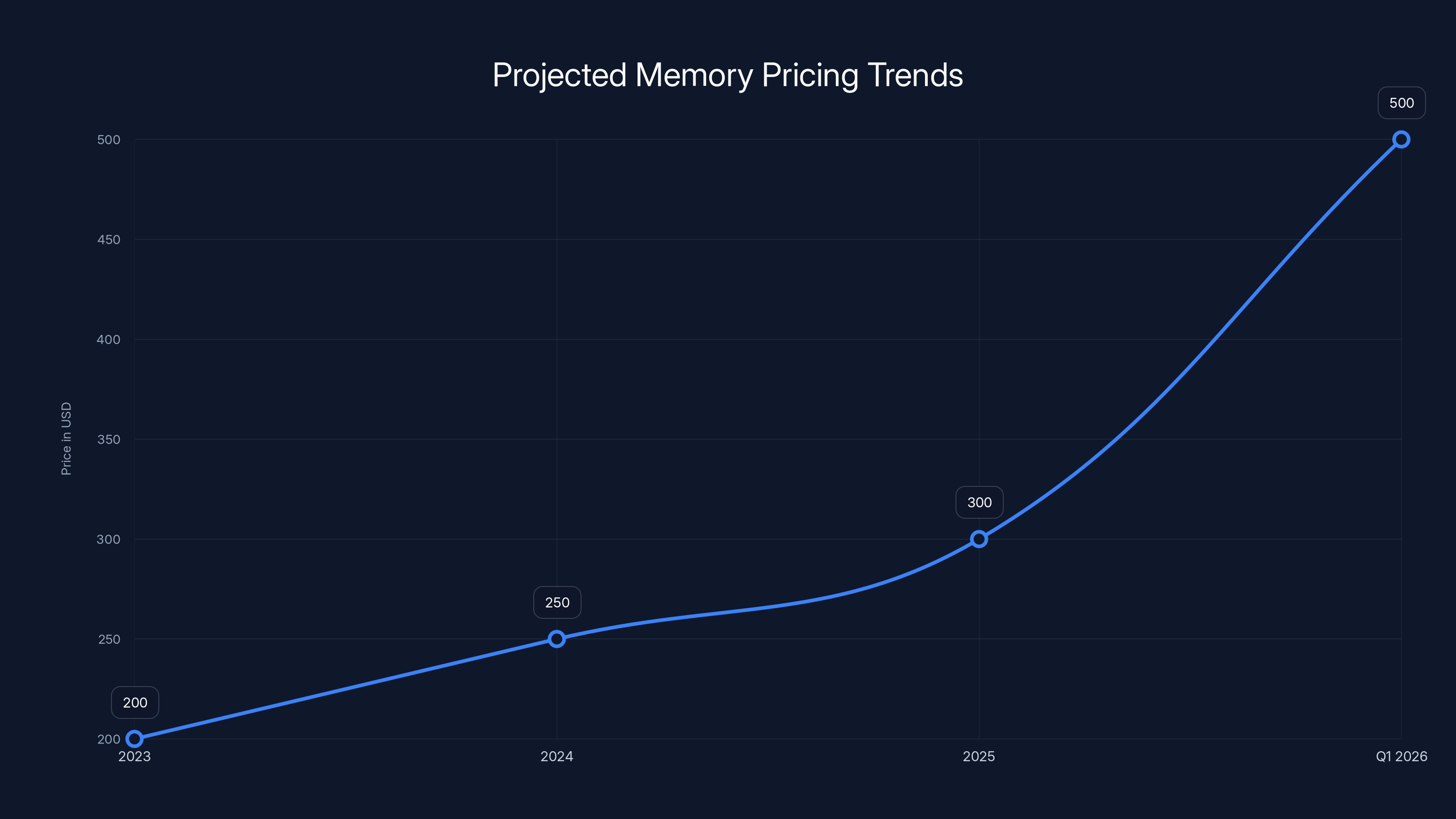

Industry analysts are sounding alarms. Some predictions for Q1 2026 suggest DDR5 prices could increase another 60%. If 32GB kits hit

Does this mean DDR5 is becoming "the new Bitcoin" as some online forums are joking? That might be hyperbolic, but the comparison isn't entirely crazy. Bitcoin became a theft target when prices got high enough. Memory could follow the same pattern if this continues.

How Supply Chain Issues Created This Perfect Storm

Production Bottlenecks in Semiconductor Manufacturing

DDR5 production requires precision manufacturing at scales that don't tolerate mistakes. Memory fabs operate with razor-thin margins. A single contamination event or equipment failure can shut down production for weeks. When you're operating at near-capacity to begin with, that's catastrophic.

The semiconductor industry has been dealing with ongoing challenges since 2021. COVID-era supply chain issues never fully resolved. Now add geopolitical tensions involving Taiwan and restrictions on advanced chip exports to certain countries. Memory manufacturers are producing at maximum capacity just to keep up with normal demand. Any disruption sends prices skyrocketing.

Micron specifically has faced yield challenges with certain DDR5 production lines. When yields are lower than expected, fewer finished modules come off the line. Fewer modules means higher prices. Higher prices create panic buying. Panic buying drains inventory faster. It's a vicious cycle.

Geopolitical Uncertainties Driving Panic Buying

People aren't just buying because they need memory. They're buying because they're scared future prices will be worse. This is classic supply-shock behavior. When uncertainty enters the market, rational actors move forward their purchasing timeline.

In late 2025, there was significant concern about potential new trade restrictions on semiconductors. Whether those concerns were justified doesn't matter. Market psychology is what drives prices. When enough buyers believe prices will be worse next month, they buy today. That frontloaded demand crushes prices upward immediately.

Some retailers reported selling out of entire DDR5 inventory in 48 hours. Backorders hit 8 to 12 weeks for many modules. The message to buyers was clear: if you want memory, you'll need to pay what's being asked, and you'll need to wait months for delivery anyway.

Slower-Than-Expected DDR5 Adoption Compounds the Problem

DDR5 has been surprisingly slow to gain mainstream adoption. DDR5 launched in 2021-2022, but four years later, most people still use DDR4. This means demand for DDR5 is concentrated in a narrow segment: high-end gamers, content creators, and professional workstations.

When demand is concentrated rather than distributed, small supply changes create big price swings. If demand was spread across 100 million potential buyers, supply disruptions would be absorbed. But when demand is concentrated among maybe 10 to 20 million buyers, supply shocks feel catastrophic.

Manufacturers underestimated demand growth in late 2025. They'd built production lines based on earlier adoption rates. When late-year buying accelerated, production capacity couldn't keep pace. By then, it was too late to ramp production quickly. New fabs take years to build.

DDR5-5600 32GB kits saw a 300% price increase from

The South Korean Theft: A Case Study in Vulnerability

What Happened and Why It Matters

A design office in South Korea reported a break-in. The thieves entered, targeted two specific desktop computers, and methodically smashed the tempered-glass side panels. This isn't a casual break-in. There was purpose here.

They extracted exactly four Micron DDR5-5600 32GB modules rated at CL46. This particular line has been discontinued from consumer market availability, making these modules actually harder to find and thus more valuable. The potential combined value: approximately

What's most telling is what they didn't steal. The monitors? Untouched. The keyboards and mice? Left behind. The storage drives? Ignored. Even the power supplies, which are valuable and relatively easy to extract, stayed in place.

This indicates professional targeting. Either someone scoped the office beforehand and knew exactly what was inside, or the thieves had the knowledge to identify valuable systems just by looking at them. The fact that they knew to target these specific modules suggests advance intelligence.

Why Office Hardware Is Vulnerable

Most offices don't have physical security commensurate with their hardware value. Sure, they might have door locks and alarm systems, but those systems often aren't aggressive about small theft. A break-in that takes 30 minutes to extract a few memory modules and leave might not even trigger an effective alarm response.

Additionally, office workers often don't know what's installed in their systems. Memory modules aren't something IT staff regularly inventories. When modules go missing, it might take days or weeks to discover. By then, the stolen goods are long gone.

Transparent cases, which are increasingly popular in professional offices for aesthetic reasons, make component identification trivial. A thief doesn't need to open the case. They can see at a glance whether memory is worth stealing. This fundamentally changes the risk-reward calculation for break-in attempts.

The Resale Market Pipeline

Once stolen, memory modules move fast. There's a robust secondary market for used memory. Unlike graphics cards, which often have warranty registrations tied to serial numbers, memory modules are anonymous. Sold one, sold them all. A thief can list stolen modules on various platforms, sell them within hours, and pocket the cash.

Online forums dedicated to hardware sales operate with minimal verification. International shipping makes it nearly impossible to trace stolen goods. A module stolen in South Korea could be sold and reshipped to five different countries within 48 hours.

The global nature of the computer market means stolen memory can find buyers anywhere in the world. If oversupply ever happens in one region, undersupply in another creates arbitrage opportunities. Stolen modules slot perfectly into this ecosystem.

Industry Warnings: The Theft Trend Is Just Beginning

Hardware Manufacturers Wake Up to the Problem

Memory manufacturers aren't oblivious to this dynamic. They're aware that their products have become theft targets. But their options are limited. They can't really design theft-resistant memory modules. They can't tag them with tracking systems. And they can't slow production to reduce supply-shock volatility because demand is genuinely high.

What some manufacturers are doing is working with retailers to improve inventory security. Some are implementing stricter wholesale restrictions to prevent "grey market" distribution, which can help curb stolen goods moving through normal channels. But these are band-aid measures for a structural problem.

Companies like Corsair and G. Skill, which specialize in high-end memory, are quietly improving their customer verification processes. They want to make sure products sold under warranty are legitimate. Counterfeit and stolen goods erode brand trust.

System Builders and Integrators Face Increased Risk

Companies that build PCs for clients face new vulnerabilities. A thief can target a PC builder's workshop, extract high-end memory from finished systems, and cause massive financial loss. A single break-in could net thousands of dollars in stolen memory.

Some integrators are responding by implementing better physical security. Separate secured areas for memory components. Inventory tracking systems that flag missing modules immediately. Some are even insuring against theft specifically for high-value components.

This adds cost to the business. That cost eventually gets passed to customers. So in an indirect way, the theft trend is making custom PC builds more expensive for everyone.

What This Means for Average Users: The Security Questions You Should Ask

Protecting Your System from Targeted Theft

If you built a high-end system recently with expensive DDR5 memory, you might be wondering about your vulnerability. The risk depends on several factors: whether your system is visible to strangers, whether you live in an area with organized theft activity, and whether your physical security is robust.

For home users, the practical risk is relatively low. A thief would need to know what's in your system and target you specifically. That requires advance intelligence. Random home burglaries targeting memory modules aren't really happening—yet. The risk is concentrated in businesses, offices, and retail environments where systems are knowable and accessible.

But here's the thing: if prices stay elevated and supply stays constrained through 2026, risk profiles could change. We might start seeing more organized efforts to identify high-value systems in residential areas. It sounds dramatic, but not unprecedented. Home burglaries targeting specific valuables have always existed.

Best Practices for Hardware Security

If you're concerned about theft, here are practical steps:

-

Obscure your hardware: Use non-transparent case panels. Remove tempered-glass panels and replace them with solid aluminum or steel. Thieves target visible high-value components.

-

Inventory tracking: Keep detailed records of your hardware, including serial numbers. This makes insurance claims faster if theft happens, and makes it harder for thieves to resell recognizable modules.

-

Lock your case: Cheap cable locks on case panels prevent opportunistic component theft. Not foolproof, but effective against casual thieves.

-

Store backups securely: If you have spare memory or components, store them in a locked cabinet or safe. Thieves usually grab what they can see and reach quickly.

-

Physical security: If you're building a system for an office or business, implement proper physical security measures. Locked server rooms, surveillance cameras, restricted access, alarm systems.

-

Insurance verification: Make sure your homeowners or business insurance covers computer hardware theft. Many policies don't cover specific high-value components properly. Update your coverage before problems occur.

The Broader Question: When Do You Upgrade vs. Wait?

High memory prices create a dilemma. Do you buy now at inflated prices, or wait and hope prices drop? There's no perfect answer, but here's a framework:

If you need a system now for work or business, buy DDR5 at current prices. The productivity gain justifies the premium. Delaying a work system to save money on memory is a bad trade.

If you're upgrading a gaming system that's still adequate, waiting might make sense. Gaming performance doesn't require the newest memory. A 3-4 month wait could save you

If you're building a long-term workstation or content creation system, buy now but buy conservatively. Get what you need plus maybe one extra 32GB module for future expansion. Don't overpay for the highest-end specs. Mid-range DDR5-5600 performs nearly identically to premium DDR5-6000 in most workflows, but costs notably less.

Estimated data shows a significant increase in memory module prices, potentially reaching $500 by Q1 2026 due to supply constraints and high demand.

The 2026 Outlook: Experts Predict Further Increases

Q1 2026 Predictions: 60% Price Increase Feared

Industry analysts surveyed by various tech publications are predicting grim scenarios for Q1 2026. The consensus estimate is a 60% increase in DDR5 prices in the first quarter alone. Some outliers predict even worse.

Here's the math on what that means:

If 32GB kits are

Why such dire predictions? Several factors:

- Continued supply constraints: Memory fabs can't ramp production quickly enough to meet demand

- Geopolitical uncertainty: Trade restrictions remain a threat

- End-of-quarter dynamics: Businesses often front-load purchasing before quarter-end for budget reasons

- Panic buying cycle: As prices climb, buyers panic, driving demand even higher

The Worst-Case Scenario: $500 per 32GB Module

Some industry veterans are worried about something even darker: single modules hitting

At that point, entire market segments stop building new systems. You'd only upgrade if absolutely necessary. Content creators and data scientists would delay projects. Gaming community would get priced out. This would eventually trigger oversupply and price normalization, but not before massive market disruption.

Is this likely? Probably not. But it's possible if multiple supply disruptions happen simultaneously. A major fab outage combined with new trade restrictions could create exactly these conditions.

Historical Parallels: When Hardware Became Scarce

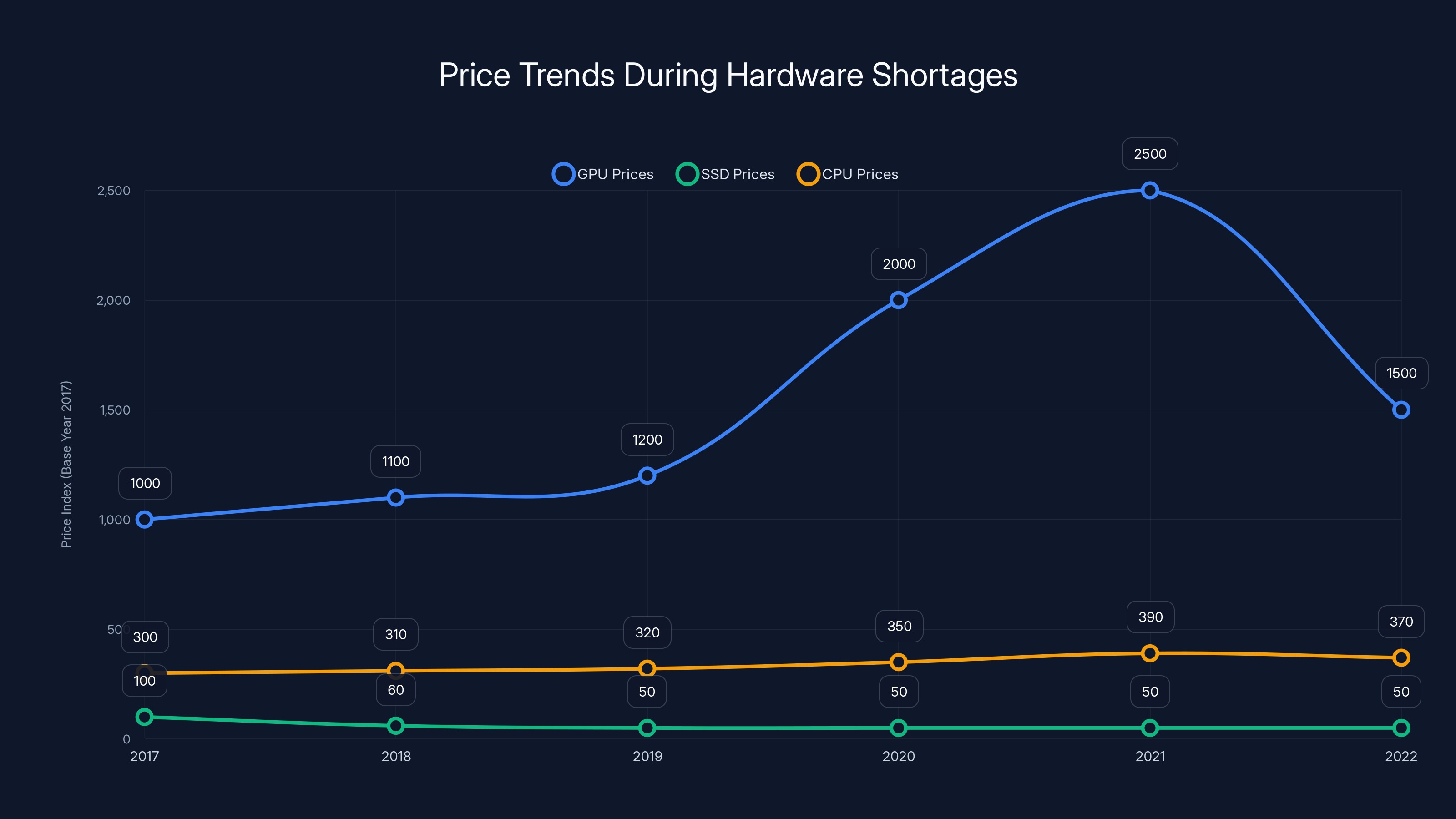

We've seen this movie before. During the crypto boom of 2017-2018, GPUs became nearly impossible to buy at reasonable prices. Gaming-grade graphics cards that cost

That situation resolved when crypto prices crashed and mining became less profitable. Suddenly supply recovered and prices collapsed. The memory market could follow a similar pattern, but the trigger is different. Memory demand is driven by computing needs, not speculative asset prices. That means the cycle might persist longer.

Another parallel: the GPU shortage during the pandemic and into 2021. Chip production was disrupted. Demand exceeded supply for 18+ months. Prices remained elevated throughout. Only as manufacturing normalized did prices gradually recover to normal levels.

What's Actually Causing Demand to Remain High

Genuine Need for Capacity: AI, Data, And High-Performance Computing

It's not just miners or speculators driving demand. Real computing needs are pushing memory requirements upward. AI workloads require enormous amounts of RAM. Machine learning models with billions of parameters need high-capacity systems to operate efficiently. Large language models, image generation tools, and data processing pipelines all demand memory.

Companies building AI infrastructure are buying memory in bulk. They don't care about consumer prices. They'll pay whatever it costs because the return on computing performance justifies it. This institutional demand creates persistent pressure on supply that wouldn't exist in a normal market.

Data centers and cloud computing providers are similarly aggressive buyers. They're building infrastructure for a world where AI is fundamental. That demand is inelastic—they need the memory regardless of price.

Content Creation and Professional Workloads Push Capacity Needs

Video editing, 3D rendering, scientific computing, and data analysis all require high memory capacity. A video editor working with 8K footage needs 64GB to 128GB of RAM. A 3D artist rendering complex scenes might use 256GB. A data scientist training machine learning models needs similar capacity.

These professionals will buy high-end DDR5 regardless of price because it's essential for their work. A content creator billing clients

This professional demand floor ensures memory pricing remains elevated. Supply would need to massively exceed demand to push prices down, and that's not happening.

System Builders Locked Into Expensive Memory

Once you commit to the DDR5 platform, you're committed to high memory costs. You can't use cheap DDR4 in a DDR5 system. You can't mix generations. So every new system builder entering the market in this pricing environment faces the same reality: memory is expensive, and there's no alternative.

Some potential builders are likely deferring purchases. They're stretching DDR4 systems a bit longer. They're delaying upgrades. But many professionals and enthusiasts can't wait. That persistent demand keeps prices elevated.

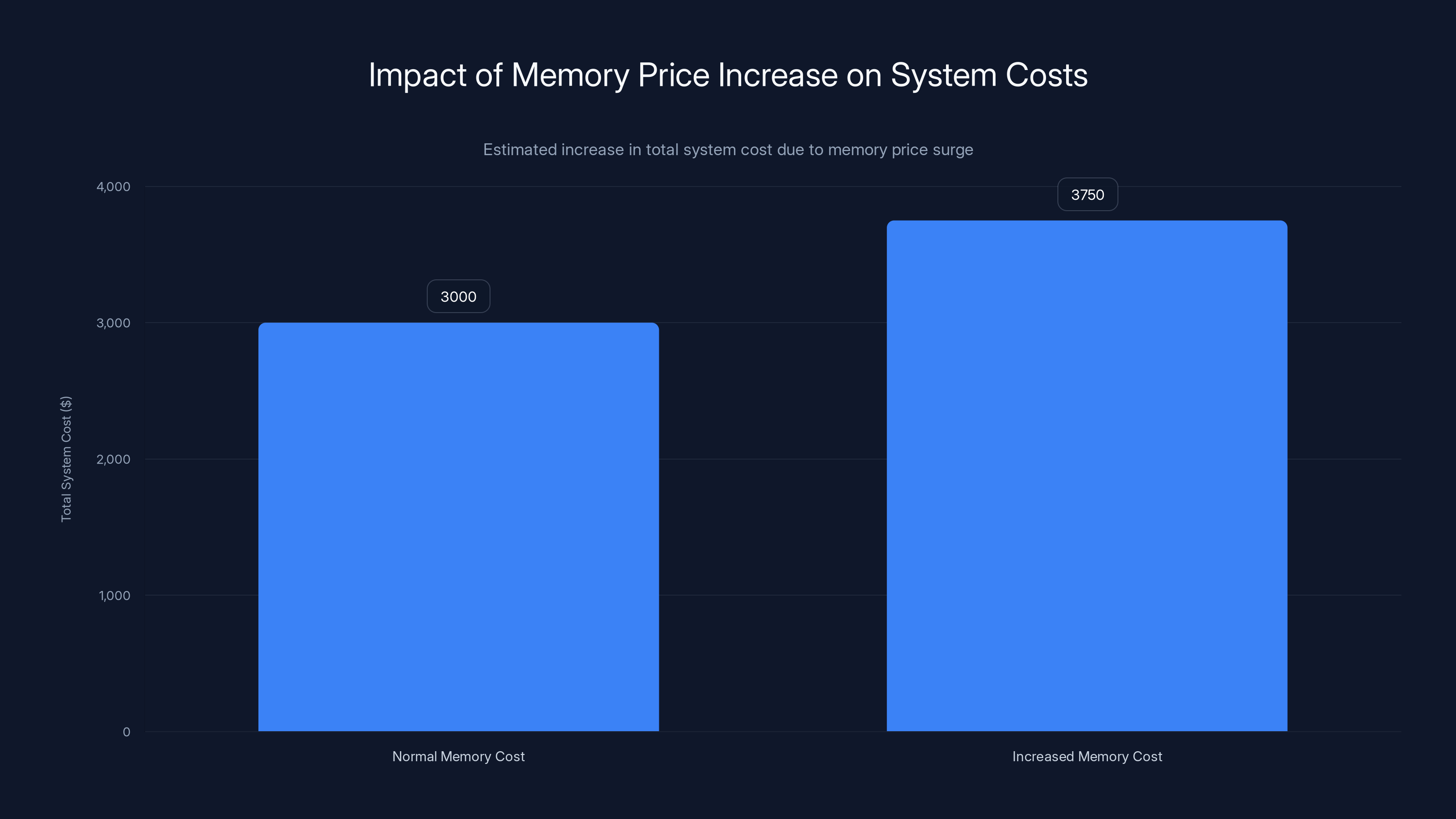

The Ripple Effects: How Memory Pricing Impacts Everything Else

System Cost Inflation Across the Board

When memory becomes dramatically more expensive, entire system costs rise. A

Consumers with fixed budgets have to make hard choices. Spend the same total amount and get less powerful CPU or GPU. Or spend more and get a comparable system to what would have cost 25% less a year ago. Neither option is attractive.

This creates demand destruction. Some potential buyers simply opt out. They keep their existing systems longer. The total number of new systems entering the market shrinks. This actually reduces long-term demand for memory, GPUs, CPUs, and every other component. The price spike is self-limiting in that sense.

Secondary Market Disruption

Used systems are affected too. A three-year-old system with 32GB of DDR4 RAM might have gone for $1200 on the used market. Now, with expensive new DDR5 systems available, the dynamics change. Some buyers opt for older systems because new systems are absurdly expensive. Others pay more for used equipment expecting to upgrade the memory themselves—but memory prices make that upgrade unaffordable.

Refurbished equipment becomes more appealing. Enterprise systems that come with generous memory configurations suddenly become valuable for consumers at prices lower than new systems. The used market starts bidding up prices for these older enterprise systems.

Prebuilt System Manufacturer Challenges

Companies like Dell, HP, and Lenovo that build computers at scale face inventory challenges. They buy memory in bulk, locking in prices months in advance. If they committed to memory at lower prices, they're protected from the spike. But if they're buying at current prices, their margins are crushed.

Many prebuilts responded by configuring systems with less memory. A gaming PC that would normally come with 32GB now comes with 16GB. Professionals building content creation systems are forced to pay premiums for the memory tier they need.

This creates buying friction. Customers see higher prices for less memory and get upset. Manufacturers' profit margins compress. Some consider dropping high-memory configurations from their standard offerings, limiting options for buyers.

DDR5 modules offer a high resale value with minimal risk, making them attractive targets for theft. Estimated data based on typical market values.

Theft Prevention Technology and Industry Response

Can Manufacturers Do Anything to Prevent Theft?

Memory modules are inherently vulnerable to theft because they're physically small and valuable. Manufacturers can't really engineer theft resistance into the products themselves. What they can do is work upstream and downstream.

Upstream: Improve fab security and shipping security. Some manufacturers are using more secure shipping methods for memory destined for high-risk regions. Some are improving facility security to prevent internal theft or vendor theft.

Downstream: Work with retailers and integrators to prevent grey market distribution of stolen goods. Implement verification systems where legitimate retailers can confirm they're buying from authorized channels. This makes it harder for thieves to sell stolen memory through official channels, but doesn't prevent secondary market sales.

Serialization and Tracking: Impractical But Tempting

Some have suggested putting unique serial numbers on memory modules for tracking purposes. This would theoretically allow stolen modules to be identified. But there are massive practical problems.

First, memory modules are consumables. Consumers don't typically track serial numbers like they do for graphics cards or monitors. Implementing a tracking system would require consumer cooperation, which is unlikely.

Second, serial numbers would need to be tied to ownership somehow. That requires a registry. Registries can be hacked or manipulated. Bad actors could register stolen modules under fake identities, defeating the entire system.

Third, memory modules are identical from a functional perspective. Unlike GPUs, which have unique firmware, memory modules are fungible. Tracking doesn't add functional value to the consumer.

For these reasons, serialization hasn't been implemented despite the theft problem.

Market Normalization: When Will Prices Actually Come Down?

Supply-Side Solutions: New Capacity Coming Online

Memory manufacturers are investing heavily in new production capacity, but these investments take time. Building a new semiconductor fab costs billions and takes 3-5 years from planning to production. Some capacity is coming online, but it won't meaningfully impact supply until mid-to-late 2026 at the earliest.

Samsung and Micron have both announced capacity expansions. Micron is building a new fab in Idaho. Samsung is expanding production in South Korea. But announcement to actual production is a long journey with many failure points.

Once new capacity does come online, supply will increase gradually. Manufacturers won't suddenly flood the market with cheap memory. They'll ramp production methodically, managing inventory to avoid oversupply. But eventually, supply will exceed demand and prices will normalize.

Demand-Side Cooling: When Will Market Saturation Hit?

Demand is currently driven by three forces: genuine computing need, system upgrading, and panic buying. Over time, panic buying will stop. People who upgraded will have new systems and won't upgrade again for years. Genuine computing needs are growing but not at exponential rates.

As demand moderates, prices will gradually fall. The process is slow because manufacturers don't want sudden price crashes—that destroys profit margins and makes memory unprofitable to produce. They'll manage prices downward methodically.

Historically, memory prices normalize within 18-24 months after a major supply shock. If the current spike is indeed a supply shock, prices could stabilize by mid-to-late 2026. But that assumes no new disruptions occur.

Macroeconomic Factors: Recession Could Accelerate Normalization

If the broader economy enters recession, corporate and consumer spending on electronics drops dramatically. Demand for new systems collapses. Suddenly memory manufacturers have excess inventory. Prices crash as they compete to move stock.

This sounds great for memory buyers, but comes with the downside of economic recession. It's a mixed blessing at best.

Conversely, if AI spending accelerates and more companies invest in high-performance computing infrastructure, demand could remain elevated. That would keep prices higher longer.

How Thieves Are Actually Selling Stolen Memory

The Online Secondary Market Ecosystem

Once memory is stolen, it enters the global secondary market. Online platforms facilitate sales with minimal verification. Reddit communities like r/hardwareswap exist for computer hardware sales. eBay listings don't require proof of ownership. Facebook Marketplace has minimal verification. These platforms move the stolen goods globally.

A thief steals memory in South Korea. Lists it on a global platform. A buyer in the US purchases it. Money moves through cryptocurrency or international payment services. Memory ships to the buyer. The transaction leaves minimal traces.

The buyer might be legitimate, not knowing the memory is stolen. Or they might be knowingly purchasing stolen goods at a discount. Either way, the thief's goods move fast and convert to cash immediately.

Cryptocurrency and Money Movement

Criminals use cryptocurrency to move money across borders without traditional banking scrutiny. A thief sells stolen memory for $600, receives payment in Bitcoin or Ethereum, and immediately converts it to local currency through cryptocurrency exchanges.

Tracing money through crypto is possible but requires significant law enforcement resources and international cooperation. Most police departments don't have the expertise or funding to pursue stolen memory thefts through crypto money trails.

This asymmetry—easy to steal, easy to sell, hard to trace—makes memory an attractive theft target.

The Role of Gray Market Resellers

Not all secondary market sales are from individual thieves. Gray market resellers buy memory from various sources and redistribute it. Some of their inventory comes from legitimate overstock. Some comes from returned merchandise. And some comes from stolen goods.

A gray market reseller might not know their inventory is stolen. They buy in bulk from a supplier and resell. The supply chain is long enough that theft is hidden. Law enforcement struggles to determine where in the chain theft occurred.

This creates a barrier to enforcement. Even if authorities identify stolen memory on a platform, proving it's actually the stolen merchandise is hard. Memory modules aren't engraved with theft-report information. They're functionally identical to legitimately purchased modules.

Estimated data shows a 25% increase in total system cost when memory prices rise from

What International Law Enforcement Is Doing About It

The Challenge: Low-Value Individual Thefts, High-Value Collective Damage

Police departments face a resourcing problem. A single memory theft for

But when thousands of memory thefts occur across multiple countries, the collective damage is substantial. Tens of millions of dollars in stolen goods. Yet no single jurisdiction sees a big enough number to justify dedicated investigation.

This fragmentation makes organized memory theft attractive for criminals. A coordinated crew hitting offices across multiple countries can steal millions in total value, but each individual theft is small enough that no single country pursues it aggressively.

Interpol and International Cooperation

Interpol exists to coordinate international crime investigations, but again faces resourcing challenges. Memory theft isn't a top priority compared to human trafficking, terrorism, or major fraud.

For organized theft to be successfully prosecuted, multiple countries would need to share intelligence, coordinate investigations, and extradite suspects. The bureaucratic and political challenges are substantial. Most memory theft cases fly under the radar of international investigation.

However, if memory theft becomes more organized and visible, law enforcement might eventually respond. The South Korean case could be the beginning of more organized attention to the problem.

Retail Security and Loss Prevention

Retailers selling memory are implementing better loss prevention. Security measures include display cases, requiring sales associates to retrieve items, and RFID tagging. Some retailers check receipts at exit points like jewelry stores do.

These measures deter casual theft but don't prevent organized criminals. A professional crew hitting a retail location can work around security measures, especially if they have inside information.

The Bigger Picture: Supply Chain Vulnerability in Computing

How Computer Hardware Became a Vulnerability

Computers have become so essential to modern life that supply chain disruptions are basically economic attacks. When GPUs become expensive, AI research is delayed. When memory becomes expensive, system performance is constrained. When CPUs are scarce, entire businesses can't scale.

The consolidation of semiconductor manufacturing has made the ecosystem fragile. A small number of fabs in a small number of countries produce most of the world's memory. Political tensions, natural disasters, or equipment failures in these regions ripple globally.

Additionally, just-in-time manufacturing principles mean there's minimal buffer inventory. Manufacturers keep just enough stock for current production. Any disruption immediately affects market supply.

Thieves taking advantage of this fragility are a symptom of a bigger system vulnerability.

Strategic Implications: Governments Are Watching

Governments are increasingly aware that semiconductor supply is critical infrastructure. The US is trying to bring semiconductor manufacturing home through initiatives like the CHIPS and Science Act. Europe is doing similar things. China is investing heavily in semiconductor self-sufficiency.

Major memory theft, if it becomes more organized, could actually accelerate these initiatives. Governments might mandate higher security standards, closer monitoring, and even domestic production reserves.

Paradoxically, addressing the security side of the memory shortage might require government intervention that increases supply, which brings prices down for everyone.

Lessons for System Builders and Buyers Going Forward

Planning for Volatility: Building in Stages

Instead of building a complete system at once, consider staging purchases. Buy the CPU and GPU when they're reasonably priced. Wait on memory until prices stabilize. This approach requires research and timing but can save significant money.

Staging is easier for some configurations than others. A gaming system can operate reasonably with 16GB DDR5 while you wait for prices to drop before upgrading to 32GB or 64GB. A content creation workstation has less flexibility—it really needs the memory to function well from day one.

Buying Used or Refurbished: New Strategy

Used and refurbished systems sometimes represent better value when memory prices are high. A refurbished workstation that originally came with 64GB of DDR5 might be available at a price lower than building a new system with similar specs today.

This strategy works if you can find systems with the memory configuration you need. It doesn't work if you're looking for specific components. But for general-purpose computing, looking at used systems could save significant money in this pricing environment.

Minimum Viable Memory: Building Lean

Don't overspend on memory you don't immediately need. A gaming system can work fine with 16GB DDR5 today and upgrade later when prices normalize. A work system can start with 32GB and expand as needs grow.

This is different from usual advice, which emphasizes buying all the memory you think you'll ever need upfront. But when memory prices are at historical highs, lean builds make financial sense.

Memory Buying Coalitions: Bulk Purchasing Power

Small businesses and content creator collectives could potentially band together to buy memory in bulk. Bulk purchases get better pricing from retailers and wholesalers. This doesn't combat the underlying supply constraints, but it does reduce the premium paid for small quantities.

Some PC building communities are already organizing bulk purchases. The practice isn't widespread yet, but it could become more common if prices stay elevated.

Estimated data shows GPU prices spiked dramatically during 2020-2021, while SSD prices dropped significantly in 2017-2018. CPU prices saw moderate increases during 2021-2022.

Looking at Analogues: What Happened With Other Scarce Computing Hardware

The GPU Shortage: 2020-2022 Lessons

Graphics cards became nearly impossible to buy during the pandemic and into 2021-2022. Prices reached absurd levels. GeForce RTX 3080s that should have cost

The GPU shortage eventually normalized through a combination of increased production, reduced mining profitability, and market saturation. People eventually stopped panic-buying and GPUs returned to reasonable prices.

Key lesson: Supply shocks eventually normalize, but it takes time. And during the shortage, people who needed GPUs either paid inflated prices or made do without. There was no good option.

The SSD Price Crash: 2017-2018

Solid-state drives had massive price declines in 2017-2018. Prices fell 40-50% year-over-year. This happened because production capacity ramped up faster than demand growth. Suddenly there was excess inventory. Manufacturers competed on price.

This is the scenario memory buyers are hoping for. But SSDs benefited from rapid production scaling. Memory doesn't scale as fast due to the complexity of fab operations.

CPU Shortages: 2021-2022

Server CPUs and some consumer CPUs faced shortages during the pandemic recovery. High-end Intel and AMD CPUs were often backordered. Prices rose 20-30% above MSRP. The shortage eventually eased as manufacturing normalized.

CPU shortages were less severe than GPU shortages, probably because CPU demand is more predictable and manufacturing is more established. Memory could follow a similar pattern—moderately elevated prices, eventual normalization, but not a complete crisis.

The Theft Prevention Technology That Actually Works

Physical Security Fundamentals

Theft prevention comes down to basics: making theft harder and slower. The South Korean office theft succeeded because the thieves had time and access. Better security would have involved:

Locked server room: High-value systems in a secured facility accessible only to authorized personnel

Surveillance: Video cameras in equipment areas, with footage retention and monitoring

Access controls: Badge readers, access logs, restricted doors

Inventory systems: Real-time tracking of where hardware is located, when moved, and by whom

None of this is sophisticated technology. It's standard practice in any serious organization. But many offices skip these measures because they seem paranoid when hardware was cheap.

When hardware becomes expensive, paranoia becomes prudent.

Environmental Monitoring and Alerts

Systems that alert when case panels are opened, when components are removed, or when systems are moved. These systems exist and aren't expensive, but aren't common in office environments.

Adding environmental sensors to expensive systems means alerting security immediately if someone opens a case. This could be the difference between a successful theft and a caught thief.

Network-Based Inventory

Systems that automatically report their hardware configuration on network boot. This allows IT to immediately detect if memory is missing when a system comes online. Some workstations support this through management tools like Intel AMT or Dell iDRAC.

If a system should have 64GB of DDR5 and reports 32GB on boot, IT knows immediately that memory was removed. The speed of detection makes prosecution more likely because theft is discovered quickly.

The Human Element: Why Thieves Target Memory Specifically

Knowledge Requirements

Not every thief knows what DDR5 memory is or why it's valuable. The South Korean office theft suggests the perpetrators had specific knowledge. They knew what to look for. They knew what it was worth. They knew they could resell it.

This suggests the theft might have been orchestrated by someone with computing knowledge or at least someone taking direction from someone with that knowledge. A street criminal stealing for quick cash would grab whatever electronics they can carry. The selective targeting suggests sophistication.

Criminal networks are adapting to hardware market realities. Information about what's valuable and why spreads in criminal forums online. Would-be thieves learn what targets are worth hitting.

Risk-Reward Calculation

From a thief's perspective, memory is ideal. Value-to-weight ratio is extraordinary. Four memory modules worth

Memory is also hard to trace. Unlike a GPU, which might have a warranty sticker or identification, memory modules are completely anonymous. Sold through gray market, resold through international platforms, and the criminal has converted stolen goods to cash.

The risk of getting caught is relatively low because memory theft isn't treated with high priority by law enforcement. A professional operation hitting multiple offices in multiple countries could steal millions without facing serious investigation.

Demographics of Organized Hardware Theft

Organized memory theft is likely conducted by criminal networks with technical knowledge. These might be:

- Street criminals who've evolved from mugging and robbery to organized tech theft

- Criminal organizations traditionally focused on other goods who've diversified into electronics

- Insider theft networks where office employees tip off thieves about valuable systems

- International criminal organizations coordinating thefts across multiple countries

The exact structure is hard to determine from public information, but the sophistication of the South Korean theft suggests coordination and knowledge.

The Wild Card: What If Prices Actually Do Hit $1000 Per Module?

Market Collapse Scenario

If 32GB DDR5 modules actually do reach $500-1000 each, something has to give. At those price points:

- New system builds become economically irrational for most buyers

- Businesses delay computing infrastructure upgrades

- Demand for memory collapses

- Memory manufacturers are forced to cut prices to move inventory

This is actually self-correcting, in a painful way. Prices that are too high kill demand. Dead demand forces prices down. Eventually equilibrium is restored.

But the lag between price spike and demand destruction is painful. In that gap, people who need computing systems pay enormous premiums or go without.

Potential Government Intervention

If prices get absurd enough, governments might intervene. This could look like:

- Price controls: Government-mandated maximum prices on memory (unlikely in capitalist economies, but possible in crisis)

- Memory reserves: Government purchasing and stockpiling of memory at reasonable prices

- Tariff removal: Temporarily removing tariffs on memory imports to increase supply

- Production incentives: Subsidizing manufacturers to ramp production

None of this is currently happening. But if memory prices reach truly crisis levels, political pressure might force government action.

Supply Shock Accelerated Solutions

Ultimate crisis sometimes forces innovation. If memory becomes so expensive that computing becomes economically infeasible, companies have to innovate. This might lead to:

- New memory technologies with different economics

- Alternative architectures requiring less memory

- Software optimization pushing memory efficiency

- Quantum computing or other computing paradigm shifts

Historically, extreme resource scarcity has driven technological change. It's possible (though not guaranteed) that a severe memory shortage would spur innovations that eventually solved the problem better than waiting for supply to normalize.

FAQ

What is DDR5 memory and why is it so expensive?

DDR5 is the newest generation of computer RAM, offering faster speeds and higher capacities than DDR4. Prices have skyrocketed due to limited production capacity from a small number of manufacturers, combined with high demand driven by AI workloads and gaming systems. A 32GB DDR5 kit that cost

How did thieves know what to steal from the South Korean office?

The targeted theft of exactly four Micron DDR5-5600 modules suggests the perpetrators had advance knowledge of what was in the office or had the expertise to identify valuable systems by sight. Transparent and tempered-glass PC cases make component identification easy for knowledgeable thieves. The selective nature of the theft, ignoring other valuable hardware, indicates this was organized targeting rather than opportunistic crime.

Why are memory modules more vulnerable to theft than graphics cards or CPUs?

Memory modules are smaller and lighter than other high-value components, making them easier to steal and transport. They're also completely anonymous—unlike GPUs which have warranty registrations or identifying features, memory modules are identical and fungible. This makes stolen memory extremely difficult to trace, and easy to resell through gray market channels without detection.

What should I do to protect my gaming PC from component theft?

You can reduce theft risk by using non-transparent case panels instead of tempered glass, keeping your system in a locked room, using cable locks on case panels, maintaining inventory records with serial numbers, and installing surveillance in areas where valuable systems are located. For business environments, implement physical security measures including restricted access, alarm systems, and regular hardware audits.

Will DDR5 prices drop in 2026?

Industry experts predict further price increases in Q1 2026, with some forecasting 60% increases. However, prices should eventually normalize once new production capacity comes online in mid-to-late 2026. Historical precedent suggests supply shocks typically resolve within 18-24 months, but new disruptions could extend the timeline. Buying decisions should factor in both near-term price predictions and your actual computing needs.

Is stolen memory actually being resold, and how do I know if I'm buying legitimate hardware?

Yes, stolen memory moves through secondary markets including Reddit, eBay, and Facebook Marketplace. To verify legitimacy, buy from authorized retailers or reputable sellers with strong track records. Request proof of purchase for high-value modules. Check for manufacturer packaging and documentation. If a deal seems too good to be true, it might involve stolen goods. Consider that legitimate retailers offer warranties, while secondary market sales typically don't.

Could memory shortages actually trigger government intervention or emergency measures?

If prices reach truly crisis levels, potential government responses could include tariff suspension, subsidies for manufacturers, or strategic material reserves. However, government intervention in consumer memory markets is unlikely unless shortages affect critical infrastructure or national security. More probable is that the market will self-correct through demand destruction—when prices become too high, fewer people buy, supply exceeds demand, and prices fall.

How much memory do I actually need, given current prices?

For gaming, 16GB DDR5 is adequate for modern titles, with 32GB offering headroom for heavy multitasking. For content creation, 32GB is the minimum, with 64GB or more for professional video editing and 3D rendering. For general computing, 16GB handles most workloads comfortably. Given current pricing, buy the minimum you need today and upgrade when prices normalize rather than overpaying for future-proofing.

What's the difference between DDR5-5600 and DDR5-6000 memory?

These refer to memory speed ratings in MHz. DDR5-6000 is faster than DDR5-5600 and typically costs 10-15% more. In real-world performance, the difference is minimal for gaming and general computing—you'll see maybe 1-3% performance difference. For professional workloads, the difference is equally small. Most users shouldn't pay premium pricing for higher-speed DDR5; the sweet spot is mid-range DDR5-5600 or DDR5-6000 depending on your budget.

How can I determine if memory theft is becoming a problem in my area?

Monitor local police reports and community forums for reports of PC component theft. Talk to local computer shops and IT service providers about theft trends they're observing. If you work in an office, check with your IT department about any theft incidents. Contact neighboring businesses that use similar equipment. If multiple offices in your area have experienced targeted computer theft, consult with physical security professionals about upgrading protections.

Why does memory theft suddenly matter when it didn't before?

Memory theft matters now because prices have made it economically rational. When DDR5 modules cost

Conclusion: The Collision of Supply, Demand, and Crime

The South Korean office break-in is a canary in the coal mine. It signals a market inflection point where computing hardware has become valuable enough that thieves are specifically targeting it. Not as a side opportunity encountered during general burglary, but as the primary objective.

We're witnessing the collision of several forces:

Supply constraints that have persisted longer than anyone expected, driven by manufacturing complexity and geopolitical tensions.

Demand that won't quit, fueled by genuine computing needs around AI, data processing, and professional work.

Pricing that has reached absurd levels, with 32GB memory kits approaching the cost of entire gaming systems from a decade ago.

Criminality that adapts, as organized networks recognize the opportunity created by valuable, anonymous, easily-transported hardware.

The situation is likely to get worse before it gets better. Q1 2026 predictions of 60% price increases suggest the peak hasn't arrived yet. Some experts fear $500 single-module pricing. If that happens, computing becomes inaccessible to average consumers. Businesses delay upgrades. Markets suffer.

But scarcity is self-limiting. Prices that are too high kill demand. Demand destruction forces price cuts. Entrepreneurs see opportunity and invest in solutions. New manufacturing capacity eventually comes online. Supply gradually exceeds demand. Prices normalize.

The question is how much pain occurs in the interim. Will prices increase 60% in Q1 2026 as predicted, or will demand destruction arrive earlier than expected? Will supply capacity ramp faster than anyone projects? Will new geopolitical disruptions extend the shortage further?

No one really knows. But one thing is certain: memory theft will continue and probably accelerate as long as the economic incentives exist. Organizations handling high-value systems need to increase physical security. Buyers need to make strategic decisions about timing and quantity. And everyone needs to hope that supply chain improvements arrive sooner rather than later.

The good news? This is temporary. History shows that hardware supply shocks resolve within 18-24 months typically. Memory prices won't stay at these levels forever. But getting through the next 12 months is going to be painful for anyone needing new systems or upgrades.

Plan accordingly, secure your hardware, and maybe hold off on that full system upgrade unless you absolutely need it right now.

Key Takeaways

- DDR5 memory prices increased 300% in three months, from 800 for 32GB kits, creating conditions where theft becomes economically rational

- Thieves specifically targeted memory modules in a South Korean office break-in, ignoring all other hardware, indicating sophisticated organized targeting

- Memory is the perfect theft target: small, lightweight, valuable, untraceable, and fungible with no warranty registrations or identifying features

- Expert predictions suggest further 60% price increases in Q1 2026, with some forecasting $500-1000 per 32GB module, potentially driving market collapse

- New manufacturing capacity won't meaningfully impact supply until mid-to-late 2026, meaning elevated prices will persist for at least another year

Related Articles

- RAM Price Hikes & Global Memory Shortage [2025]

- Why AI PCs Failed (And the RAM Shortage Might Be a Blessing) [2025]

- DDR5 Memory Prices Could Hit $500 by 2026: What You Need to Know [2025]

- DDR5 RAM Prices Stabilize at $900: What It Means [2025]

- ASUS RTX 5070 Ti Not Discontinued: Supply Shortage vs. EOL Clarification [2025]

- RTX 5070 Ti Memory Shortage: What's Really Happening in the GPU Market [2025]

![DDR5 Memory Theft Crisis: Why Thieves Are Smashing Gaming PCs [2025]](https://tryrunable.com/blog/ddr5-memory-theft-crisis-why-thieves-are-smashing-gaming-pcs/image-1-1768774020878.jpg)