Rivian's Software Partnership Saves the EV Maker: How a VW Deal Became the Game-Changer [2025]

Rivian didn't need a hero. It needed a strategy.

And in 2025, it found one through an unlikely partnership that had nothing to do with building electric trucks. When Rivian announced its fourth-quarter and full-year earnings in early 2026, something remarkable emerged from the numbers. The company wasn't drowning. It wasn't even treading water. It was starting to climb.

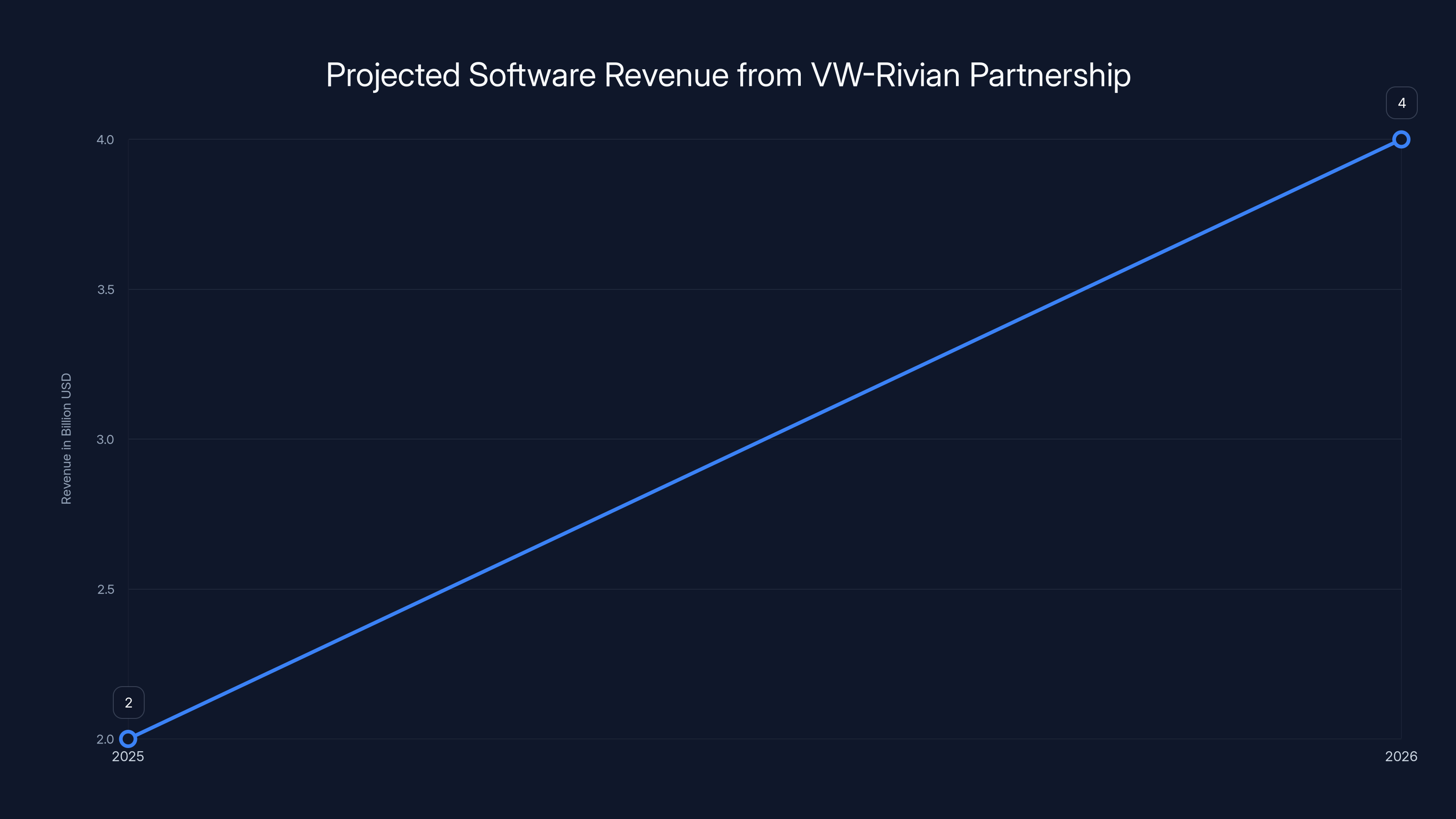

The culprit? Software revenue from its joint venture with the Volkswagen Group. That partnership generated over

Most analysis of electric vehicle companies focuses on vehicle production, range improvements, and charging infrastructure. Those things matter. But the story of Rivian in 2025 reveals something deeper about how automakers survive in the EV transition: diversification beyond hardware. Software, platform licensing, and technology partnerships aren't afterthoughts anymore. They're lifelines.

TL; DR

- **Volkswagen partnership generated 2 billion expected in 2026

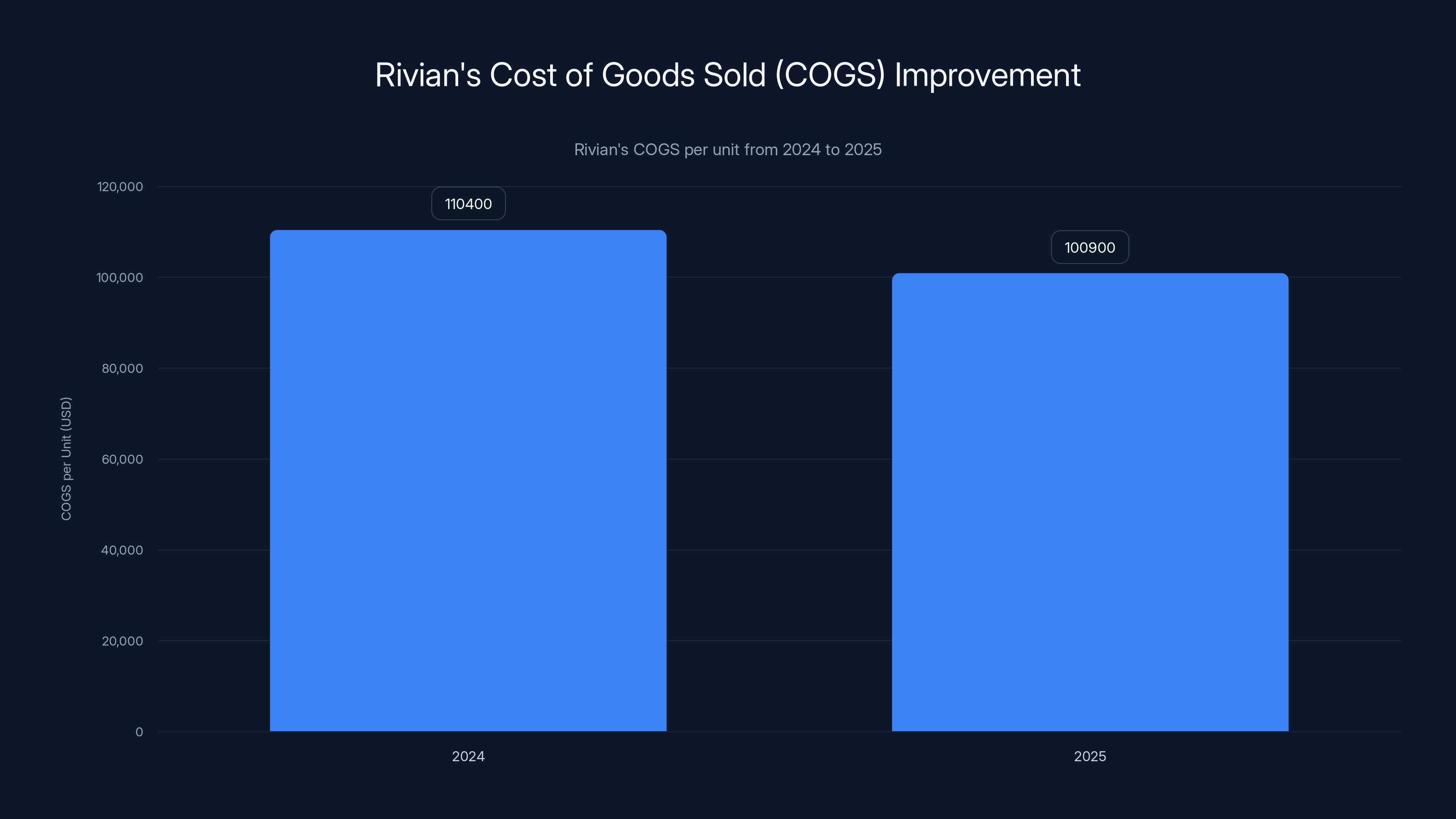

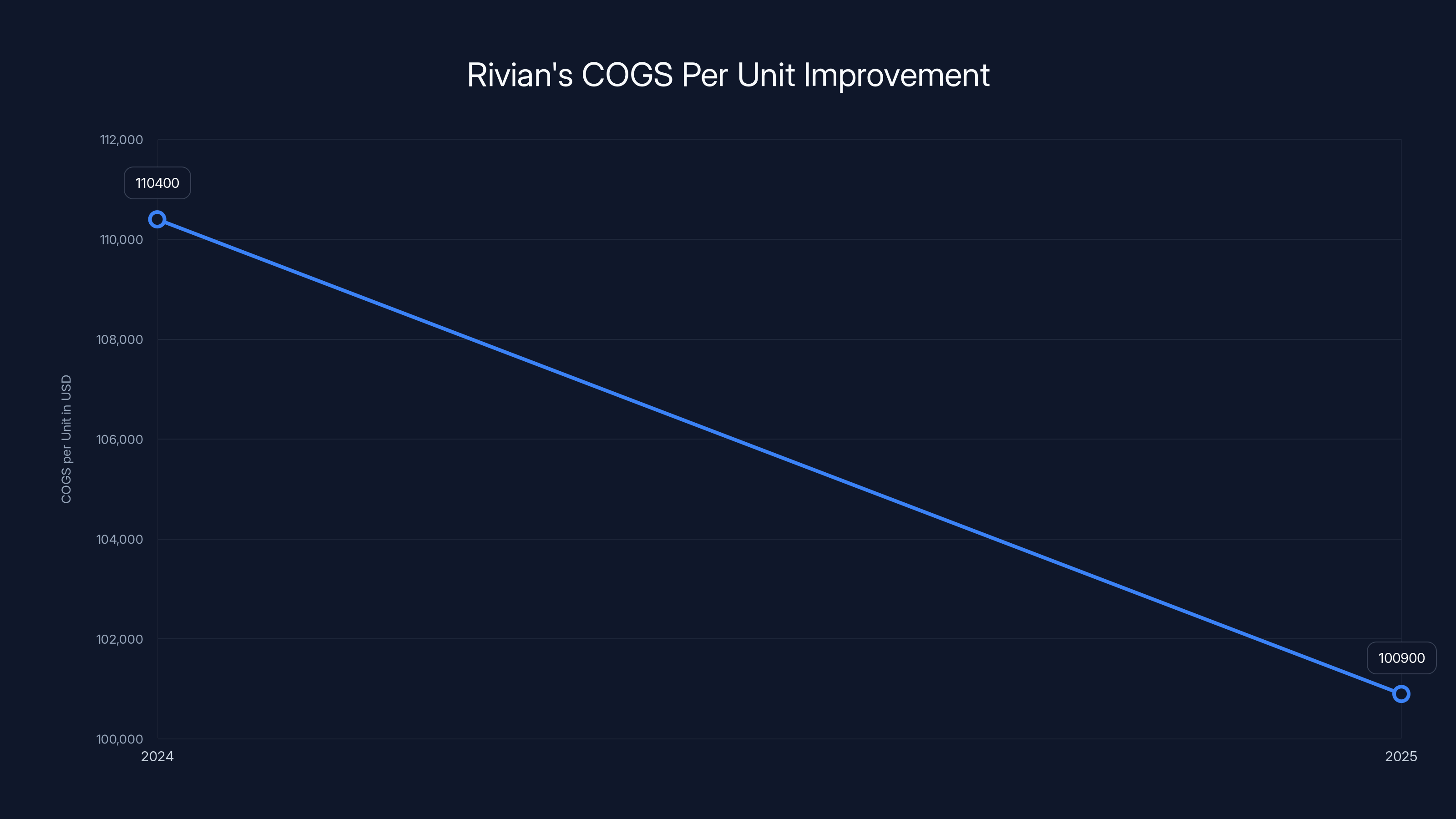

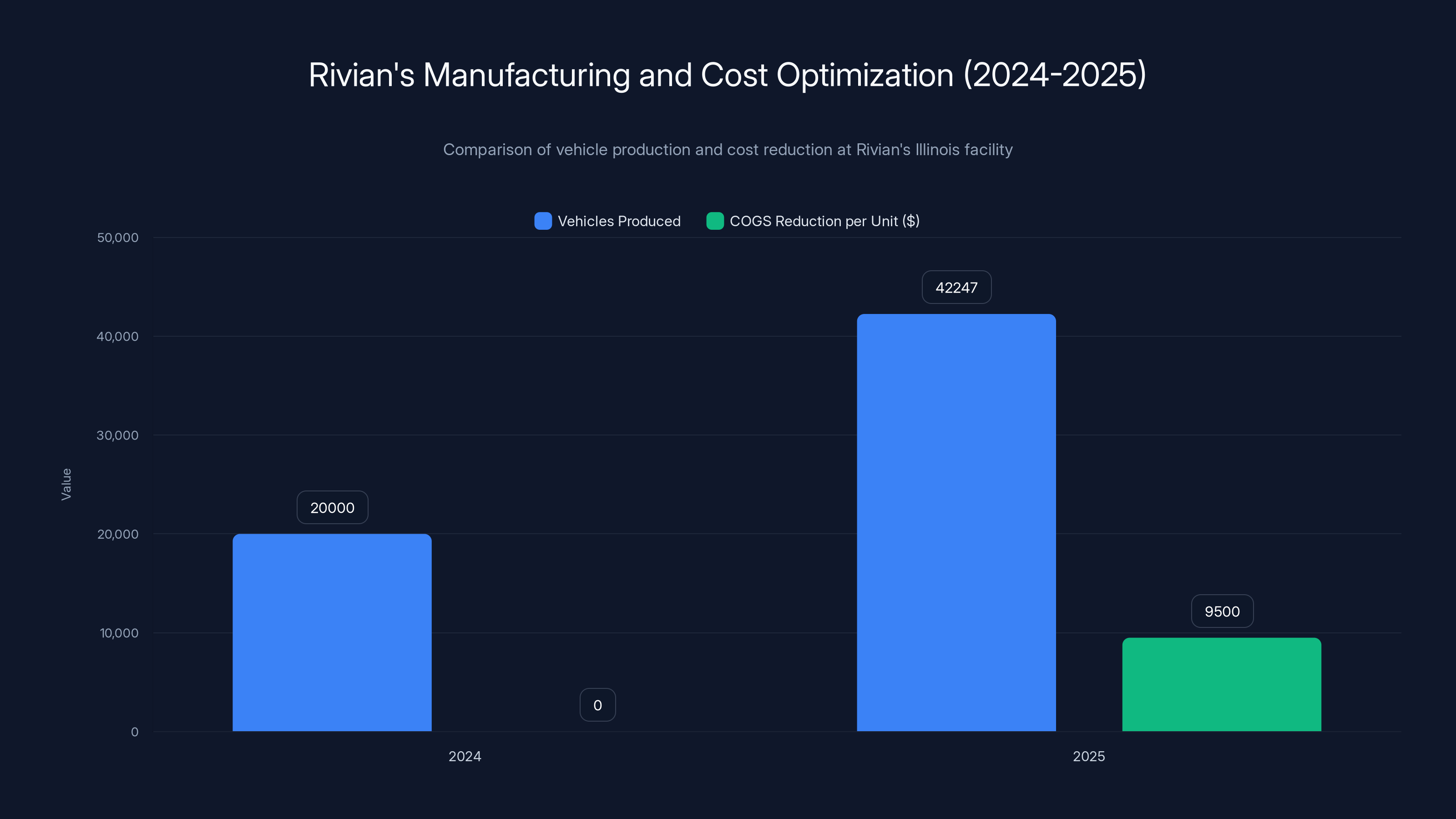

- Cost per unit dropped significantly: automotive COGS per unit fell from 100,900 (2025), showing Rivian is losing less per vehicle

- R2 launch in first half of 2026 (likely June) will be the critical test for lower-cost production and profitability at scale

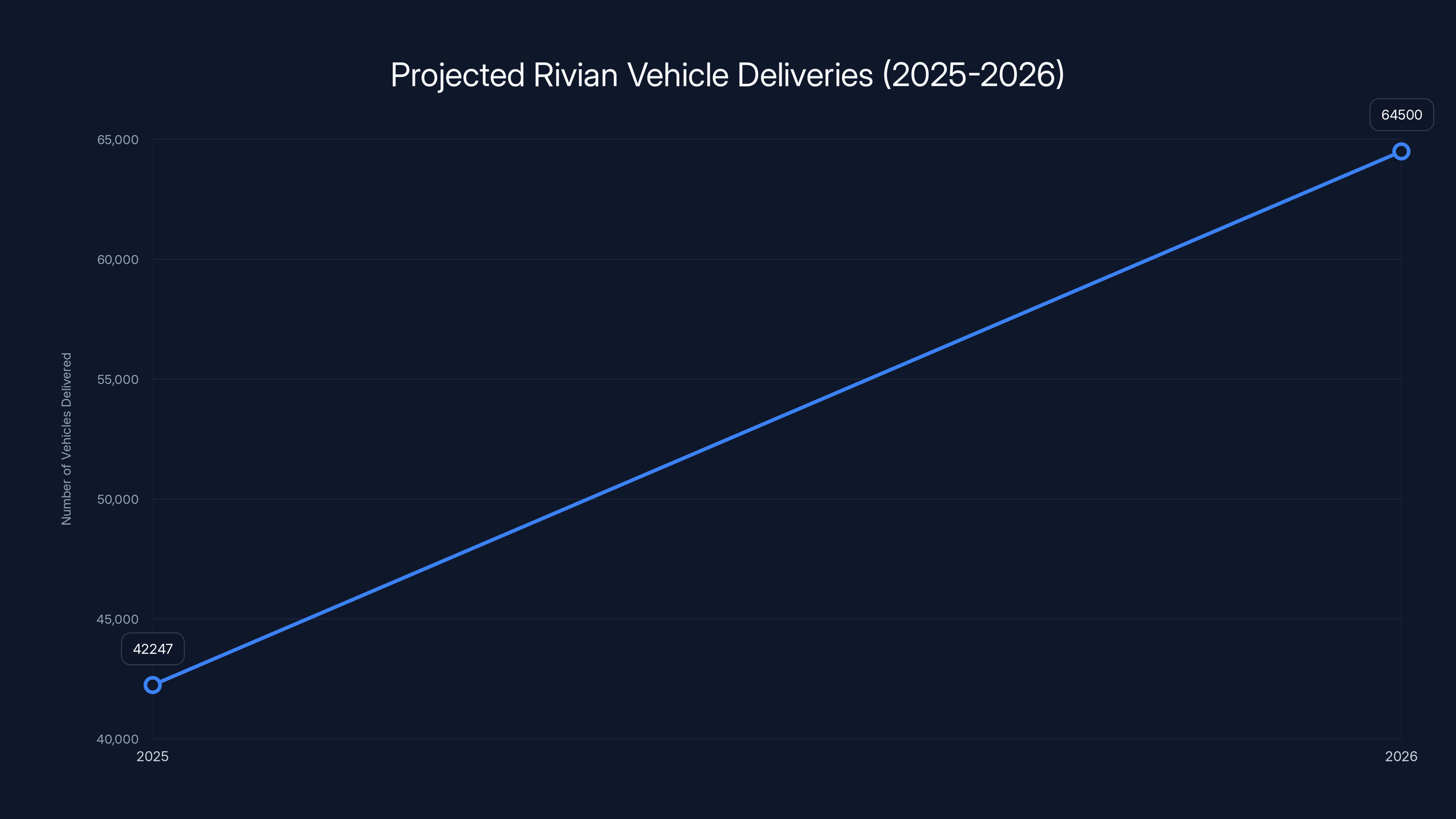

- Delivery guidance increased 59%: Rivian projects 62,000-67,000 vehicle deliveries in 2026 versus 42,247 in 2025

- Stock market validated the strategy: Rivian shares jumped 27% the day after earnings announcement, reflecting investor confidence in the partnership and R2 roadmap

Rivian's COGS per unit decreased by $9,500 from 2024 to 2025, indicating significant cost optimization efforts.

The Software Partnership That Changed Everything

When Volkswagen Group announced its software partnership with Rivian, industry observers nodded politely. Another tech deal in the automotive sector. Another attempt by a legacy automaker to modernize its digital infrastructure. It seemed incremental.

It wasn't.

The scale of the financial injection revealed itself slowly. Rivian received approximately

Why would Volkswagen Group invest this amount? Because the legacy automaker faces an existential problem: it needs software expertise faster than it can build it internally. Volkswagen Group generates over 4.5 million vehicle sales annually across multiple brands including Volkswagen, Audi, Porsche, Lamborghini, Bentley, and SEAT. Moving that entire operation toward electric vehicles while simultaneously developing competitive software platforms is impossible at legacy engineering speeds.

Rivian's software platform essentially became a white-label solution for one of the world's largest automotive companies. The company that was bleeding money on hardware development suddenly had a revenue stream that didn't require building physical vehicles. It's almost elegant in its simplicity: let VW build and sell their vehicles while you collect licensing fees on the software that runs them.

This changes the financial model entirely. Instead of Rivian needing to reach profitability exclusively through R1T, R1S, and future vehicle sales, it now has a parallel revenue stream. The company can afford to take more time perfecting the R2 launch. It can invest more in supply chain optimization. It can hire and retain the engineering talent needed to compete long-term.

The market understood the significance immediately. Rivian stock jumped 27% the day after earnings were announced, reflecting investor validation that the company has found a sustainable revenue model beyond vehicle production.

Rivian aims for a significant increase in vehicle deliveries in 2026, projecting a 59% growth from 2025 with the launch of the R2 model. Estimated data based on company guidance.

Automotive Economics: The Cost Per Unit Breakthrough

Hardware economics in electric vehicles are brutal. Tesla proved it's possible to achieve profitability at scale. Rivian, like most EV startups, has been proving exactly how difficult it is to get there.

The cost of goods sold (COGS) per vehicle for Rivian tells the story of this struggle, and more importantly, the glimmers of progress. In 2024, Rivian's automotive COGS per unit was

In 2025, that COGS per unit dropped to $100,900.

That's a

Where did this improvement come from? Manufacturing efficiency, supply chain optimization, and scale. Rivian's production ramp across its Illinois facility is achieving higher volumes, which spreads fixed costs across more units. Component suppliers that struggled with low-volume orders last year are now producing at higher volumes, reducing per-unit costs through economies of scale. Factory workers are faster and more efficient because they've done the job thousands of times instead of hundreds.

But here's the critical insight:

The R2 is supposed to be cheaper to produce than the R1T and R1S. Rivian has never officially disclosed the target COGS for the R2, but industry analysts estimate it could be in the

The $9,500 per-unit improvement in 2025 wasn't magical. It was tedious manufacturing optimization, process improvement, and increasing scale working in unison. It proves the company can continue this trajectory.

The R2: The Most Important Product Launch in Rivian's History

Everything in Rivian's 2025 strategy—the software partnership, the cost reduction, the production increases—leads to one event: the R2 production launch in the first half of 2026.

Industry sources indicate June 2026 as the likely production start date, though Rivian has been cautious with public statements. The R2 is different from everything Rivian has built. The R1T was a statement about premium electric trucks. The R1S was proof that platform extension works. The R2 is about competing for market share at prices where actual volume happens.

The traditional automotive industry doesn't make serious profits on

Launch timing matters here. By the time the R2 enters production, Rivian will have substantial experience managing production of two different vehicles (R1T and R1S) across the same facility. The company will have 18+ months of post-2025 cost optimization under its belt. Supply chain relationships that struggled with low volumes in 2023-2024 will be mature and optimized.

More critically, the market for electric vehicles has shifted. Tesla has aggressively reduced prices on Model Y and Model 3, bringing capable EVs into the

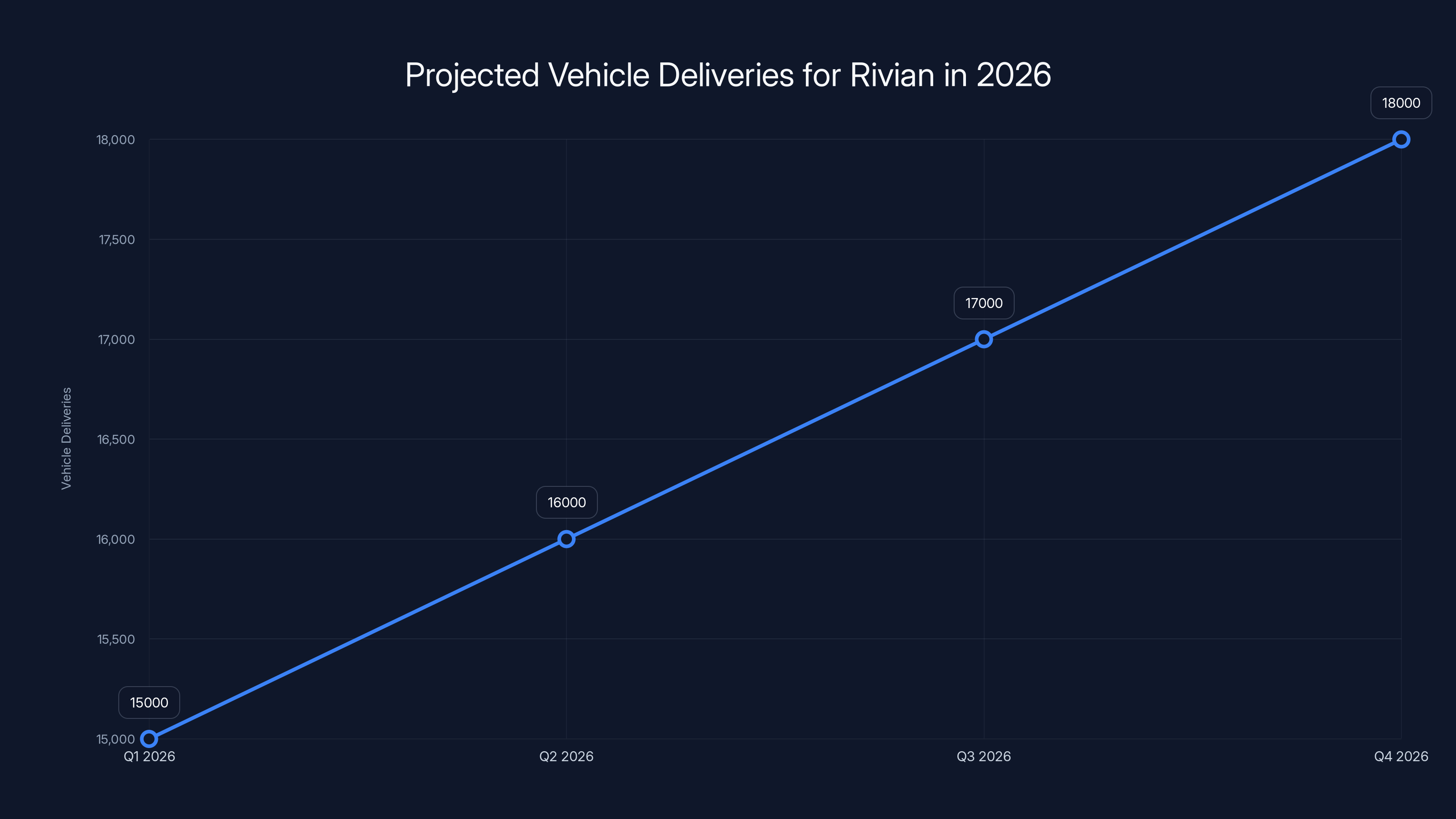

Rivian's guidance for 2026 delivery is aggressive but achievable: 62,000-67,000 vehicles. That represents a 59% increase from 2025's 42,247 vehicles. If the company hits the midpoint of that guidance (64,500 vehicles), and if 30-40% of those are R2s as production ramps from June onward, we're talking about 15,000-25,000 R2s delivered in 2026 alone.

That production volume is meaningful because it's the threshold where manufacturing economies of scale start to create real efficiencies. At 15,000+ units annually of a single model, suppliers start investing in tooling and processes specifically designed for that volume. Rivian's manufacturing teams can specialize and optimize for specific production lines. The software that runs the factory can be refined based on millions of hours of operational data.

Projected vehicle deliveries for Rivian in 2026 show a gradual increase each quarter, aiming to meet the annual guidance of 62,000-67,000 vehicles. Estimated data based on guidance.

How Rivian Plans to Compete Against Tesla and Traditional Makers

Rivian's competitive position in 2026-2027 will depend on three factors: price, features, and availability.

Price is obvious. The R2 needs to hit its target price point—likely starting under

Features matter, but they're increasingly commoditized. Range, acceleration, and towing capacity are table stakes now. What differentiates vehicles in this price range is software quality, interior comfort, reliability, and service network. Rivian has invested heavily in its software platform. Its service network is still small but growing. Reliability data is limited since the company hasn't been in production for a full market cycle, but early models haven't had catastrophic failure rates.

Availability is the unspoken third factor. If Rivian ramps R2 production successfully and maintains supply chain stability through 2026-2027, customers can actually buy one. Tesla manages this through regional production facilities and aggressive logistics. Traditional makers manage it through decades-old dealer networks and supply chain relationships. Rivian is building this from scratch, which is harder but also gives the company flexibility that legacy players lack.

The company's partnership with Volkswagen Group adds another strategic advantage: the VW relationship validates Rivian's technology for skeptical consumers who might wonder if a startup's software is reliable. When Volkswagen is building software stacks on Rivian's platform, it's endorsing the company's technical competence.

The Broader EV Industry Context: Why Rivian's Survival Matters

Rivian's 2025 earnings and 2026 projections matter beyond the company itself. They reveal what success looks like for EV startups in a consolidating market.

Five years ago, dozens of EV startups existed. Lordstown Motors was going to revolutionize electric pickup trucks. Faraday Future was going to build ultra-premium electric vehicles. Lucid Motors was supposed to be the "Tesla killer." Most of these companies burned through capital attempting to do too much at once: build a brand, establish manufacturing, develop vehicles, and achieve profitability simultaneously.

Rivian avoided this trap partially by luck (early capital from Amazon and other institutional investors), but also by strategic discipline. The company focused on premium vehicles where margins could support development costs. It built proprietary manufacturing infrastructure rather than relying on contract manufacturers. And crucially, it diversified revenue through partnerships rather than betting everything on one model.

The VW partnership is the proof point that this strategy works. By 2026, Rivian will have generated roughly $4 billion in software licensing revenue—money that barely touches the company's vehicle sales. That changes the burn rate calculus entirely.

For other EV startups watching Rivian's playbook, the lesson is clear: pure hardware manufacturers don't survive the EV transition. Companies that can provide something else—software, platforms, licenses, or partnerships—have a better chance.

Rivian reduced its COGS per vehicle by $9,500 from 2024 to 2025, an 8.6% improvement, highlighting operational efficiencies and scale benefits.

Manufacturing Scale and Supply Chain Optimization

Rivian's Illinois facility produced 42,247 vehicles in 2025. That's more than double the roughly 20,000 vehicles produced in 2024. Doubling production in a year while reducing COGS per unit by $9,500 is a manufacturing achievement worth understanding.

Supply chain optimization happens in layers. The first layer is component sourcing. Rivian's battery supplier, likely Samsung SDI or LG Chem, was ramping production specifically for Rivian's needs. As volumes increased, the supplier's per-unit costs decreased through manufacturing efficiency. These savings were passed back to Rivian. The same dynamic happened with electric motor suppliers, power electronics manufacturers, and other component providers.

The second layer is logistics. When Rivian was producing 15,000 vehicles annually, shipping components from suppliers to the manufacturing facility was handled through spot market logistics. By 2025, at 42,000+ vehicles annually, Rivian can negotiate direct logistics arrangements with carriers, consolidating shipments and reducing per-unit transportation costs. This might save

The third layer is labor efficiency. Rivian's workforce in Illinois became more experienced and productive in 2025. Workers who were new to EV manufacturing in 2023-2024 had 12-18 months of experience by 2025. The factory's processes became standardized. Rework rates decreased as employees understood the build procedures more deeply. Training new shifts became faster because the company had proven processes to follow.

The fourth layer is asset utilization. Rivian's manufacturing facility has fixed overhead: real estate, equipment depreciation, management salaries, utilities. In 2024, that fixed overhead was spread across roughly 20,000 vehicles. In 2025, it was spread across 42,000 vehicles. Suddenly, that

When you add these layers together—supplier efficiencies, logistics optimization, labor productivity, and asset utilization—the $9,500 per-unit COGS improvement becomes credible. It's not one breakthrough. It's dozens of small improvements across the entire supply chain compounding together.

The critical question for 2026 and beyond is whether Rivian can continue this trajectory. If the company produces 62,000-67,000 vehicles in 2026, is COGS per unit reduced to

That's still high, but it's getting closer to the level where the R2 can be produced and sold at prices that move the company toward profitability.

Rivian's Vehicle Lineup in 2026: Portfolio Dynamics

Rivian's 2025 delivery of 42,247 vehicles broke down as follows: the R1T pickup truck, the R1S three-row SUV, and the electric delivery van (EDV) for Amazon's logistics operations.

The R1T and R1S are premium vehicles carrying price tags of

The EDV is interesting because it's a wholesale business, not a consumer retail business. Amazon committed to purchasing 100,000 Rivian EDVs, representing a long-term revenue contract. This provides predictable revenue that helps stabilize cash flow. In 2025, Rivian delivered roughly 6,000-8,000 EDVs based on available data, which means the company has years of contracted production ahead at these vehicles.

The R2 changes the portfolio entirely. By 2027, Rivian's production could look like: R1T and R1S (declining market share as the company reduces premium vehicle volumes), EDV (steady Amazon demand), and R2 (the volume player). If the R2 reaches 40,000-50,000 annual units by 2027, the company transforms from a premium vehicle niche player to something approaching a mainstream automaker.

This portfolio transition is where Rivian faces its biggest risk. The company has never manufactured mass-market vehicles. The R1T and R1S are precision-engineered premium products. The R2 needs to be cost-competitive without cutting corners on quality. This is harder than it sounds. Many automotive companies have failed at this transition (see: Porsche's attempt to compete below $50,000, or Acura's struggles in the mainstream market). Getting the R2 right is an existential test for Rivian.

Rivian's Illinois facility more than doubled its vehicle production from 2024 to 2025, while achieving a significant cost reduction of $9,500 per unit. Estimated data for cost reduction.

Industry Consolidation: Autonomous Vehicles and AV Partnerships

While Rivian secured its software partnership, another major trend was reshaping the mobility sector: autonomous vehicle partnerships and consolidation.

Uber has been locking up autonomous vehicle partnerships with every credible AV player available. Waymo, Aurora, and other AV developers are increasingly partnering with ride-hailing and delivery companies rather than operating their own fleets. Uber's strategy is clear: secure the autonomous taxi market before competitors do.

Lyft, by contrast, has been passive on AV partnerships, drawing criticism from industry insiders. The company has

For Rivian, the AV question is more indirect. The company isn't building autonomous driving technology itself (that's the domain of Tesla, Waymo, Aurora, and others). But Rivian's vehicles could be platforms for autonomous technology. If Waymo, Aurora, or other AV developers want to deploy autonomous taxis using EVs, Rivian's vehicles are potential hardware partners.

The broader consolidation trend in mobility reflects a reality that Rivian already understands: nobody does everything alone anymore. Tesla builds its own chips, but partners with Panasonic on batteries. General Motors is partnering with Cruise on autonomous technology. Every automaker is partnering with battery suppliers, software platforms, and autonomous driving companies.

Rivian's Volkswagen partnership fits this pattern perfectly. The company isn't trying to build everything independently. It's leveraging its software platform and manufacturing expertise to create revenue while partners—like VW—handle global distribution and market reach.

Sensor Technology and the Perception Stack Race

One of the more interesting developments in 2025 was consolidation in perception sensor suppliers. Ouster, which started as a tiny startup with a booth in the Eureka Park section of CES, has become a major perception sensor player.

The company acquired Stereolabs, which specializes in vision-based perception systems for robotics and industrial applications, for a combination of

Why does this matter to Rivian? Because the company's vehicles need reliable perception systems. Rivian doesn't manufacture sensors; it integrates them from suppliers. As the sensor supplier market consolidates, Rivian benefits from having fewer, more-stable suppliers with larger production capabilities.

The lidar and camera market in 2026 is dominated by a handful of players: SICK, IBEO, Valeo, and now the consolidating startups like Ouster and Micro Vision. Rivian can negotiate volume discounts with stable suppliers much more effectively than when the market had 20+ competing lidar companies fighting for customers.

Conversely, the broader "physical AI" trend—the focus on robots, autonomous systems, and embodied AI requiring sophisticated perception—has reignited investment in sensor technology after years of decline. The sensors that Rivian needs for its manufacturing facilities and vehicle platforms are becoming more capable and cheaper as the market expands beyond just automotive applications.

Rivian is projected to earn $4 billion from VW Group by 2026 through software licensing, marking a significant shift in its revenue model. Estimated data.

Funding Landscape: The EV Funding Crunch and Alternative Capital Models

Rivian raised $42 billion in disclosed capital through its IPO and various funding rounds before going public. By 2025, most EV startups have exhausted traditional venture funding, IPO windows have closed for marginal startups, and the emphasis has shifted to strategic partnerships that generate revenue without requiring capital raises.

The companies still raising funding in 2025-2026 are either extremely specialized or backed by institutional investors with deep pockets. Ever, an EV-only marketplace for used electric vehicles, raised

The traditional EV startup funding playbook—raise capital, build factories, launch vehicles, achieve scale—is effectively dead for companies that haven't already reached critical milestones. Rivian succeeded because it reached production before 2023, when venture funding for EVs dried up. Companies founded after 2021 face a much harder path.

This consolidation and capital constraint actually benefits Rivian. The company no longer faces competition from dozens of EV startups. The likely competitors in 2026-2027 are Tesla, legacy automakers like Ford, General Motors, and Stellantis, and international players like BYD and NIO. Rivian can compete in that arena because it has proven manufacturing, a real product roadmap, and now a profitable partnership generating material revenue.

The Path to Profitability: Math and Timeline

Let's do the arithmetic on Rivian's path to profitability. If the company continues its trajectory, what does the financial model look like?

Current State (2025):

- 42,247 vehicles delivered

- $100,900 COGS per unit

- Average selling price approximately $85,000 (weighted average across R1T, R1S, EDV)

- Gross margin per vehicle: roughly 100,900 = negative $15,900 per vehicle

- Total vehicle gross loss: 42,247 × 672 million

- Software revenue: approximately $2 billion

- Net result: Profitable due to software revenue offsetting vehicle losses

Projected 2026:

- 62,000-67,000 vehicles delivered (assume 65,000 midpoint)

- COGS per unit: estimate $90,000 (8% reduction from additional scale)

- Average selling price: $82,000 (more R2s at lower price points)

- Gross margin per vehicle: 90,000 = negative $8,000 per vehicle

- Total vehicle gross loss: 65,000 × 520 million

- Software revenue: approximately $2 billion

- Net result: Profitable, with vehicle losses declining

Path to Vehicle-Level Profitability (2027):

- To achieve positive gross margin per vehicle, Rivian needs to either reduce COGS below ASP or increase ASP above COGS

- If COGS reaches 80,000 (assuming a mix of R2 at100,000+), gross margin turns positive

- This requires COGS reduction from 75,000—a 26% reduction

- Is this achievable? Historically, automotive companies achieve 15-20% COGS reductions over 3-4 years through manufacturing optimization. Getting 26% in two years is aggressive but possible if the R2 is significantly cheaper to produce than R1T/R1S

The timeline is more aggressive than traditional automotive, but Rivian has advantages that legacy companies lack. The company is building from a clean manufacturing sheet. Every dollar spent goes to optimization, not legacy infrastructure. The partnership with VW provides a financial cushion that lets the company invest in long-term efficiency rather than short-term profit.

Competitive Positioning: Tesla, Legacy OEMs, and Chinese Players

Rivian's competitive environment in 2026 will be crowded but fundamentally different than it was in 2020. Tesla is no longer the only serious EV competitor. Ford's Mustang Mach-E, General Motors' Ultium platform vehicles, BMW's i 5, and Mercedes-Benz's EQE are mature, competitive products. BYD is producing more EVs annually than any other manufacturer, though mostly in China. NIO and XPeng are competing in premium and mid-market segments.

Where does Rivian fit? The company's advantage isn't technology—legacy automakers now have equally capable EV platforms. The advantage isn't cost—legacy automakers have lower manufacturing costs due to scale. The advantage isn't brand—legacy brands are more established.

Rivian's advantages are specificity and focus. The company makes premium electric trucks and SUVs for customers who want something different from Tesla. The R2 will compete in the mainstream segment where legacy automakers are still finding their footing. The EDV contract with Amazon provides a moat that competitors can't easily replicate.

The software platform—the actual strategic advantage—doesn't show up on consumer balance sheets. But it changes the financial equation entirely. Rivian doesn't need to achieve profitability faster than Ford or GM on vehicles alone because software revenue covers the burn.

This is the actual secret to Rivian's survival: diversification of revenue streams reduces the pressure on any single product line to achieve profitability immediately.

The Rest of 2026: What to Watch

Rivian's 2026 will be defined by three events:

R2 Production Ramp (Q2/Q3 2026): The June production start and subsequent ramp are critical. If Rivian hits production timelines, the market believes the company can scale. If production is delayed, it signals manufacturing challenges that will concern investors.

Quarterly Delivery Reports: Rivian reports deliveries quarterly. The market will scrutinize whether the company is tracking toward its 62,000-67,000 vehicle guidance. Missing guidance in Q2 or Q3 would suggest production or demand problems.

Cost Metrics: Every earnings report will feature COGS per unit. Investors will want to see continued reduction toward the

Software Revenue: The VW partnership will continue generating $2 billion in 2026. Any change to this arrangement (renegotiation, disputes, delays) would be material to Rivian's financial trajectory.

The company enters 2026 from a position of strength that would have seemed impossible in 2023-2024. The question isn't whether Rivian survives anymore. The question is whether it becomes a scaled, profitable automaker or remains a niche player dependent on strategic partnerships.

Beyond Vehicles: Rivian as a Mobility Platform Company

The most underrated aspect of Rivian's strategy is that the company is no longer just a vehicle manufacturer. It's becoming a mobility platform company. The VW software partnership. The Amazon EDV contract. These aren't side businesses. They're the central structure of the company.

In 2026, Rivian will generate revenue from three distinct streams: consumer vehicle sales (R1T, R1S), software licensing (Volkswagen), and wholesale deliveries (Amazon EDVs). These streams have different unit economics, different margins, and different growth trajectories.

Consumer vehicles are the most visible but arguably the least important to financial stability. Software licensing is passive revenue with exceptional margins once developed. Amazon contract vehicles are steady, predictable, and immune to consumer market fluctuations.

A company that can balance these three streams doesn't look like a traditional automaker anymore. It looks like a platform company with automotive exposure. And platform companies—think Microsoft, Amazon, Google—command higher valuations and enjoy more financial stability than single-product businesses.

This is Rivian's actual competitive advantage. Not vehicles. Not technology. Not brand. The ability to monetize the company's core assets through multiple revenue models while competitors are still figuring out how to make a single product profitably.

That's what the market rewarded with a 27% stock price jump. And that's what makes Rivian's 2026 genuinely interesting to watch.

FAQ

What is the Volkswagen Group software partnership with Rivian?

The partnership is a joint venture where Rivian licenses its software platform architecture and technology to Volkswagen Group for integration across their vehicle fleet. Rivian receives licensing revenue per vehicle produced and direct payments, totaling

How does Rivian's cost per unit improvement translate to profitability?

Rivian reduced its automotive cost of goods sold (COGS) per unit from

What is the R2 and why is it critical for Rivian?

The R2 is Rivian's lower-cost, mainstream SUV expected to enter production in June 2026, competing in the

Why did Rivian's stock price jump 27% after earnings?

The market responded to Rivian's combination of continued COGS reduction, software partnership revenue validation, and aggressive but credible delivery guidance for 2026 (62,000-67,000 vehicles, a 59% increase). The 27% stock price jump reflected investor confidence that the company has found a sustainable financial model (software partnerships) that doesn't depend exclusively on vehicle profitability, plus the R2 ramp provides a clear path to higher-volume manufacturing where additional cost reductions can be realized.

How does Rivian compare to Tesla in 2026?

Tesla remains the market leader in EV manufacturing, brand recognition, and autonomous driving technology. Rivian competes in different segments: Tesla dominates mass-market EVs and premium sedans, while Rivian focuses on premium electric trucks and SUVs plus the incoming R2 mainstream SUV. Rivian's actual competitive advantage isn't technological—legacy automakers have equally capable platforms—but rather the software partnership revenue model that provides financial stability independent of vehicle profitability. Tesla has never needed external partnerships because it achieved vehicle profitability early, but Rivian's partnership model is equally valid for a startup without Tesla's initial margins.

What risks could derail Rivian's 2026 trajectory?

Key risks include: R2 production delays that miss the June 2026 timeline, COGS reduction stalling due to manufacturing or supply chain challenges, consumer demand weaker than guidance projects, complications with the Volkswagen partnership, or major competitors introducing superior products at aggressive pricing. Additionally, broader EV market contraction could reduce demand for all electric vehicles, requiring Rivian to cut prices and margins. The software partnership, while stable, depends on Volkswagen Group's continued commitment and successful integration of Rivian's platform, which could face technical or organizational complications.

How long until Rivian is profitable per vehicle sold?

Based on current COGS reduction trajectory (8.6% improvement 2024-2025), Rivian could reach vehicle-level profitability between late 2026 and mid-2027, assuming ASPs of

What happens to Rivian if the Volkswagen partnership ends?

Loosing the VW partnership would remove approximately $4 billion in expected revenue over 2025-2026, which would be devastating to Rivian's financial stability. The company would need to accelerate vehicle profitability or raise additional capital. However, the partnership is structured as a long-term joint venture, not a short-term contract, reducing the likelihood of sudden termination. More realistic scenarios involve renegotiation of terms or speed of payments, not complete dissolution. From VW's perspective, discontinuing the partnership would mean rebuilding software capabilities independently, which is more expensive than continuing the existing arrangement.

What does Rivian's success mean for the broader EV industry?

Rivian's 2025 performance suggests that pure hardware manufacturing is increasingly insufficient for startup viability in the EV space. The company that combines manufacturing with platform licensing, partnerships, and diversified revenue streams has a better survival profile than companies betting everything on vehicles. This validates the strategy that Tesla had to discover alone but that newer entrants can replicate. For the industry, this means more partnerships, more licensing arrangements, and more diversified revenue models. The days of startups raising capital to simply "build cars" are over. Successful EV startups will combine manufacturing with something else—software, platforms, licenses, or services.

Rivian entered 2026 from a position that would have seemed impossible just three years earlier. A company that was burning billions with no clear path to profitability secured a $4 billion software partnership, reduced costs per unit systematically, and charted a credible path to scaled manufacturing. The 27% stock jump wasn't irrational exuberance. It was the market recognizing that Rivian had solved the fundamental problem facing EV startups: how to survive the transition from startup cash-burning to profitable manufacturing.

The R2 will be the test. If Rivian executes the 2026 production ramp, the company becomes a serious player in the EV market. If the company stumbles on timing or COGS targets, the software partnership becomes life support rather than a platform for growth.

But for the first time in years, Rivian's survival isn't in question. The question is how big it gets.

Key Takeaways

- Volkswagen partnership generated 2 billion committed for 2026, fundamentally stabilizing Rivian's cash flow

- Automotive COGS per unit improved 8.6% ($9,500 reduction) through manufacturing scale, supply chain optimization, and facility utilization improvements

- R2 production launch (June 2026) is the critical test for mainstream market competitiveness and scaled manufacturing at lower price points

- Delivery guidance of 62,000-67,000 vehicles in 2026 represents 59% growth and aligns with proven automotive ramp benchmarks, suggesting credible targets

- Rivian's three-stream revenue model (consumer vehicles, software licensing, commercial deliveries) reduces dependence on any single product achieving profitability immediately

Related Articles

- How Rivian's Software Strategy Saved the Company in 2025

- Waymo's $16 Billion Funding Round: The Future of Robotaxis [2025]

- Waymo's Sixth-Generation Robotaxi: The Future of Autonomous Vehicles [2025]

- 2027 Toyota Highlander Electric: 320-Mile Range & Features [2025]

- Epstein's Silicon Valley Network: The EV Startup Connection [2025]

- Why America's $12B Mineral Stockpile Proves the Future Is Electric [2025]

![Rivian's Software Partnership Saves the EV Maker: 2025 Analysis [2025]](https://tryrunable.com/blog/rivian-s-software-partnership-saves-the-ev-maker-2025-analys/image-1-1771176993471.jpg)