Why Framework's Price Hike Matters More Than You Think

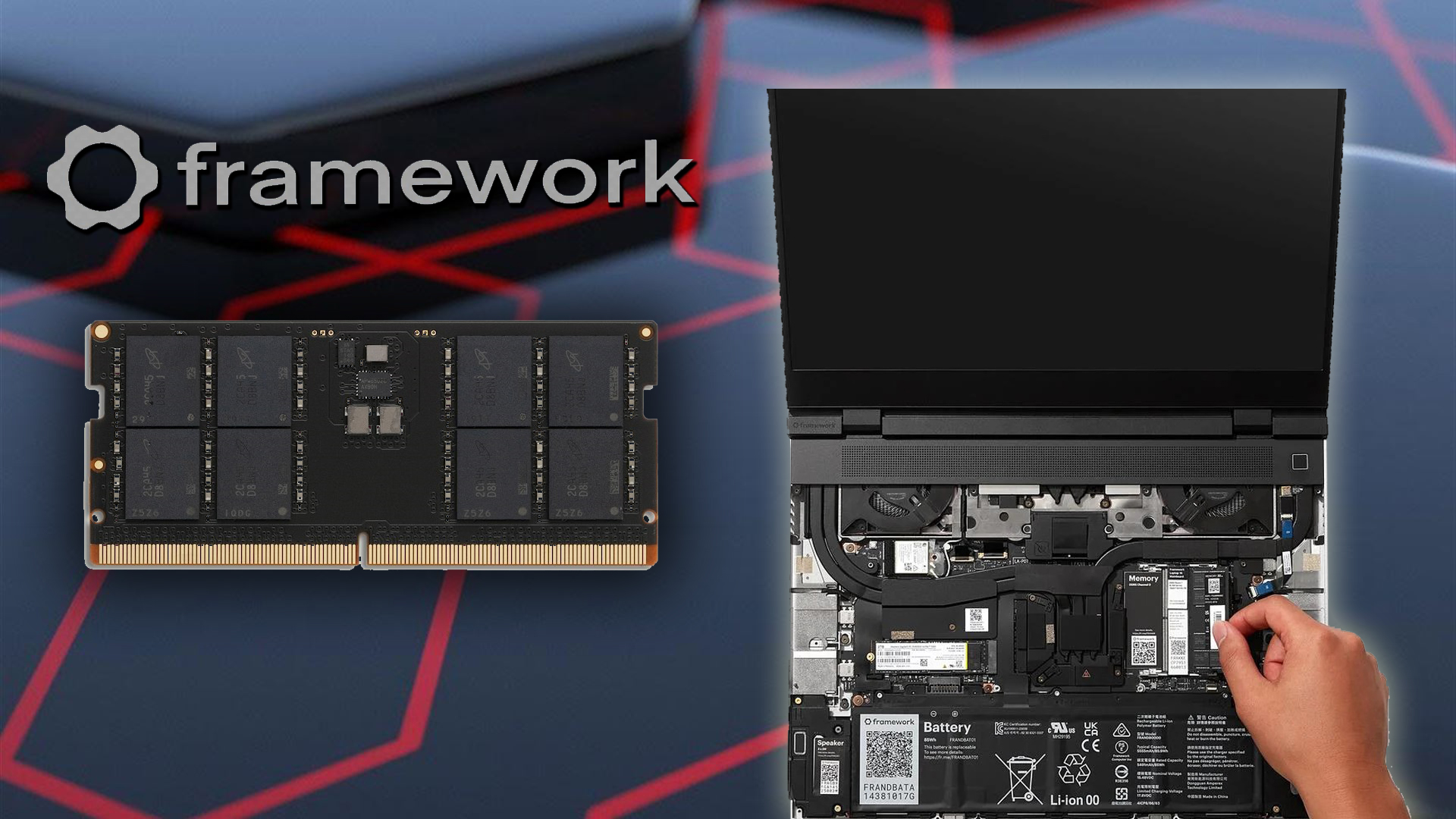

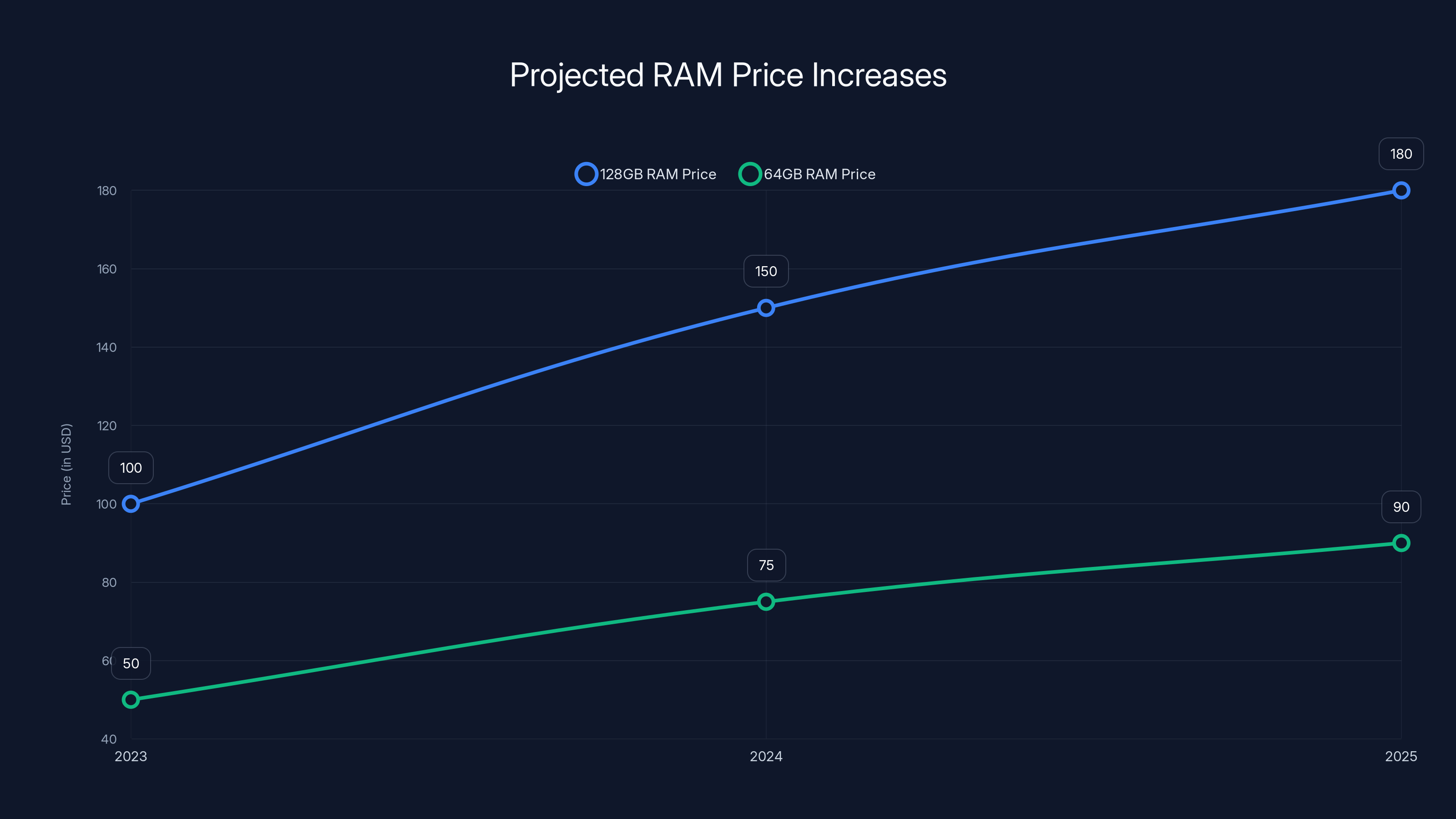

Framework just dropped some genuinely sobering news about their new desktop PC, and it's not the kind of announcement that gets buried in press releases. The company openly admitted they held off raising prices for as long as humanly possible. But reality finally caught up, and now the 128GB configuration costs 50% more than the 64GB model sitting directly below it, as reported by Engadget.

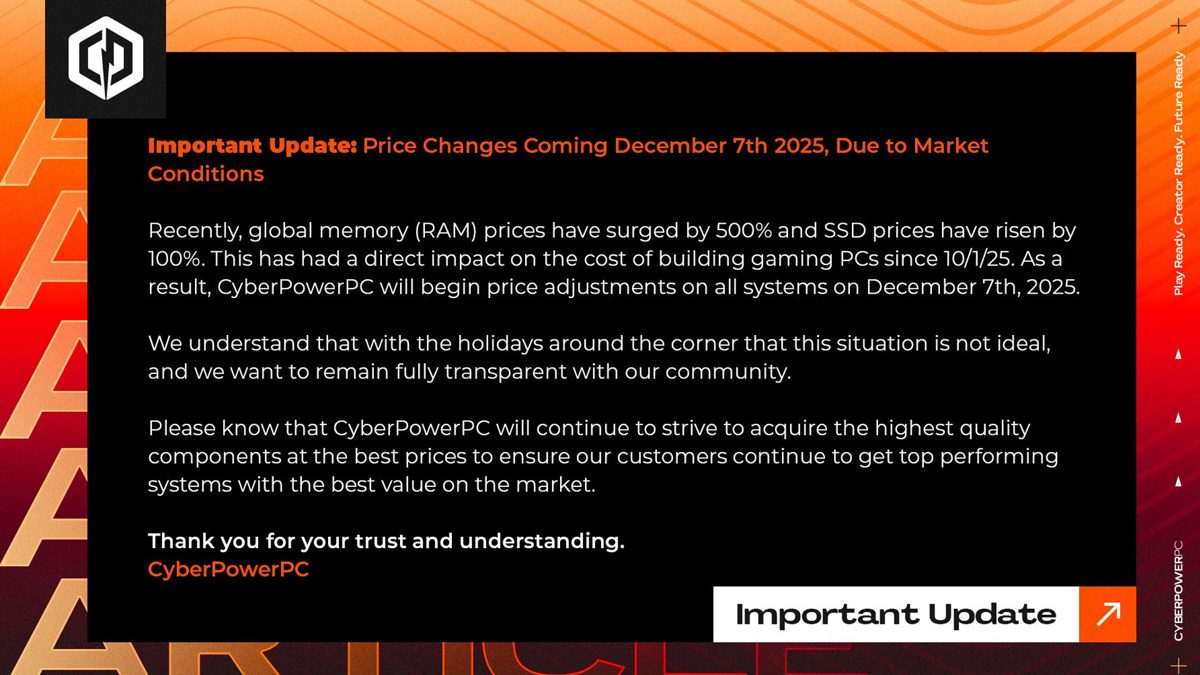

This isn't just Framework's problem. It's a massive canary in the coal mine for the entire PC industry. When a company known for transparency and reasonable pricing throws up their hands and says "we can't absorb these costs anymore," something structural is broken in the hardware supply chain.

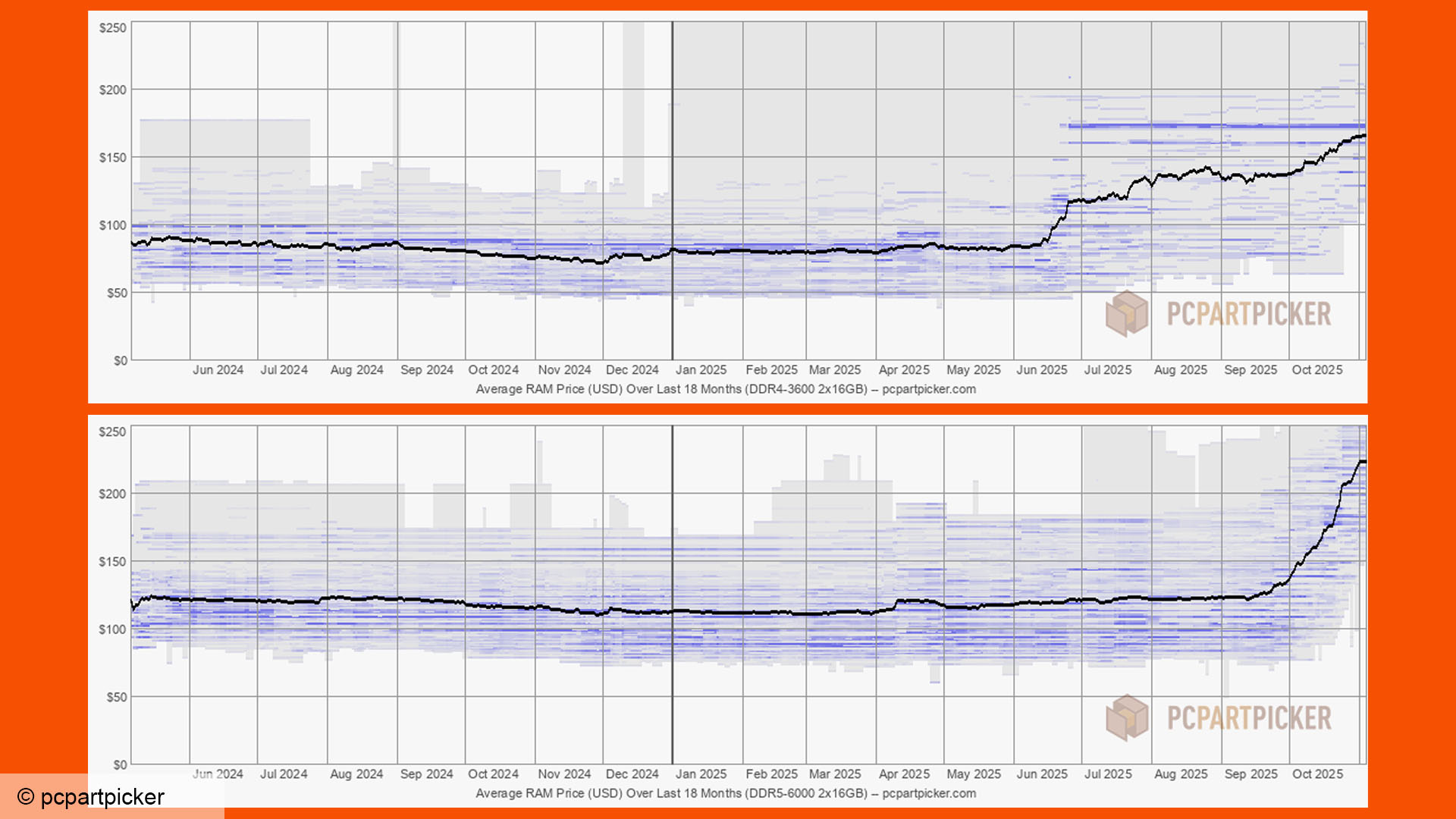

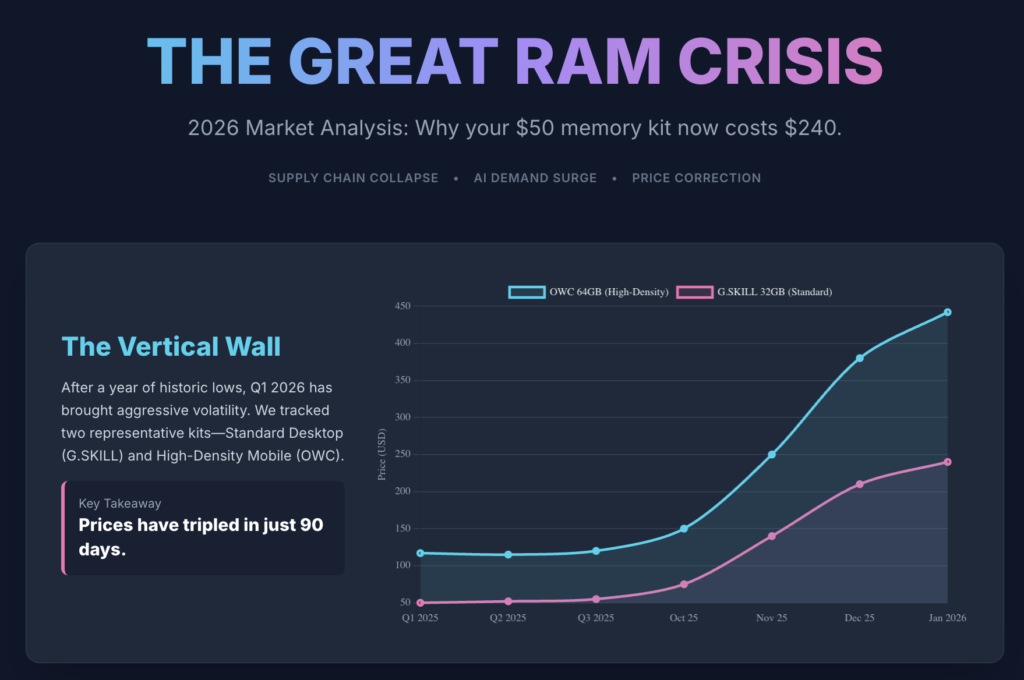

I've been tracking PC component costs for years, and I've never seen RAM pricing behave quite like this. The gap between 64GB and 128GB shouldn't be this brutal. It signals something deeper: the memory chip industry is in genuine crisis mode, and the pain is about to get a lot worse before it gets better, as noted by IDC.

Here's what's actually happening, why Framework had to make this move, and what it means for anyone thinking about building or buying a PC in 2025.

TL; DR

- 128GB RAM costs have skyrocketed: Framework's 128GB desktop is now 50% pricier than the 64GB model, signaling widespread supply constraints.

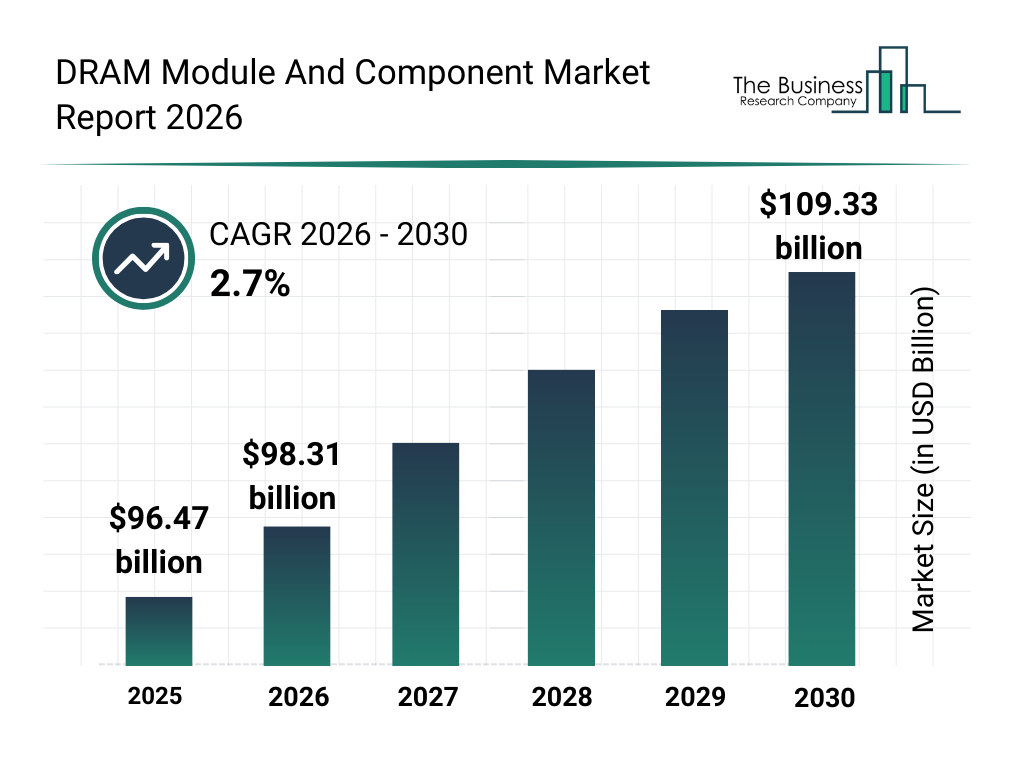

- The supply chain is fractured: DRAM manufacturers are struggling to meet demand for high-capacity modules while managing inventory and production costs, as highlighted by South China Morning Post.

- Companies can't absorb losses anymore: Framework explicitly stated they held prices as long as possible, meaning other manufacturers will follow suit.

- This affects everyone: From gaming PC builders to workstation users, RAM pricing is becoming the primary cost driver in custom PC builds.

- Expect more increases ahead: Memory shortages and demand spikes suggest prices won't stabilize until late 2025 at the earliest, according to Network World.

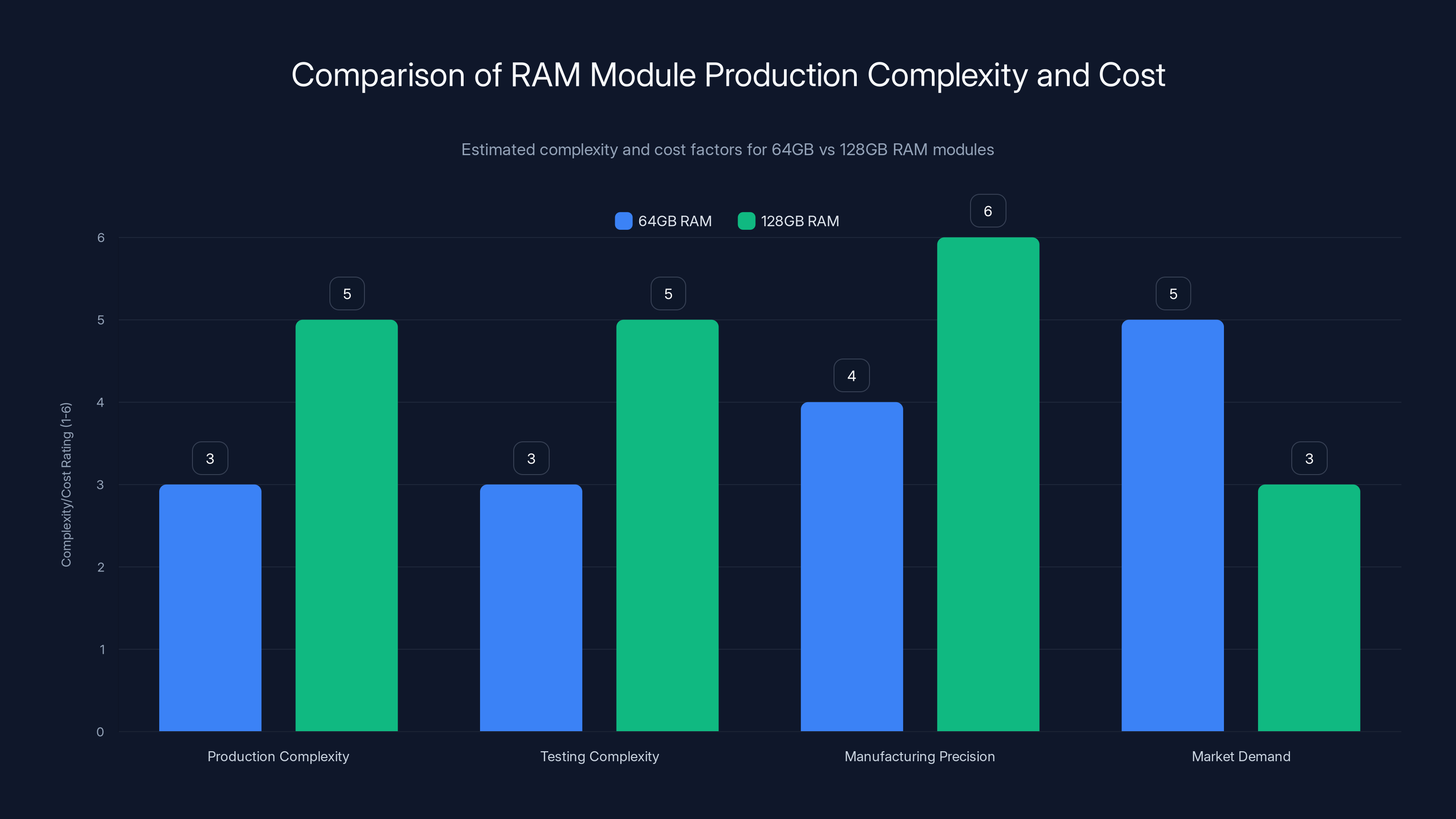

128GB RAM modules are more complex and costly to produce and test due to higher precision requirements, despite lower market demand compared to 64GB modules. (Estimated data)

The Supply Chain Squeeze: How We Got Here

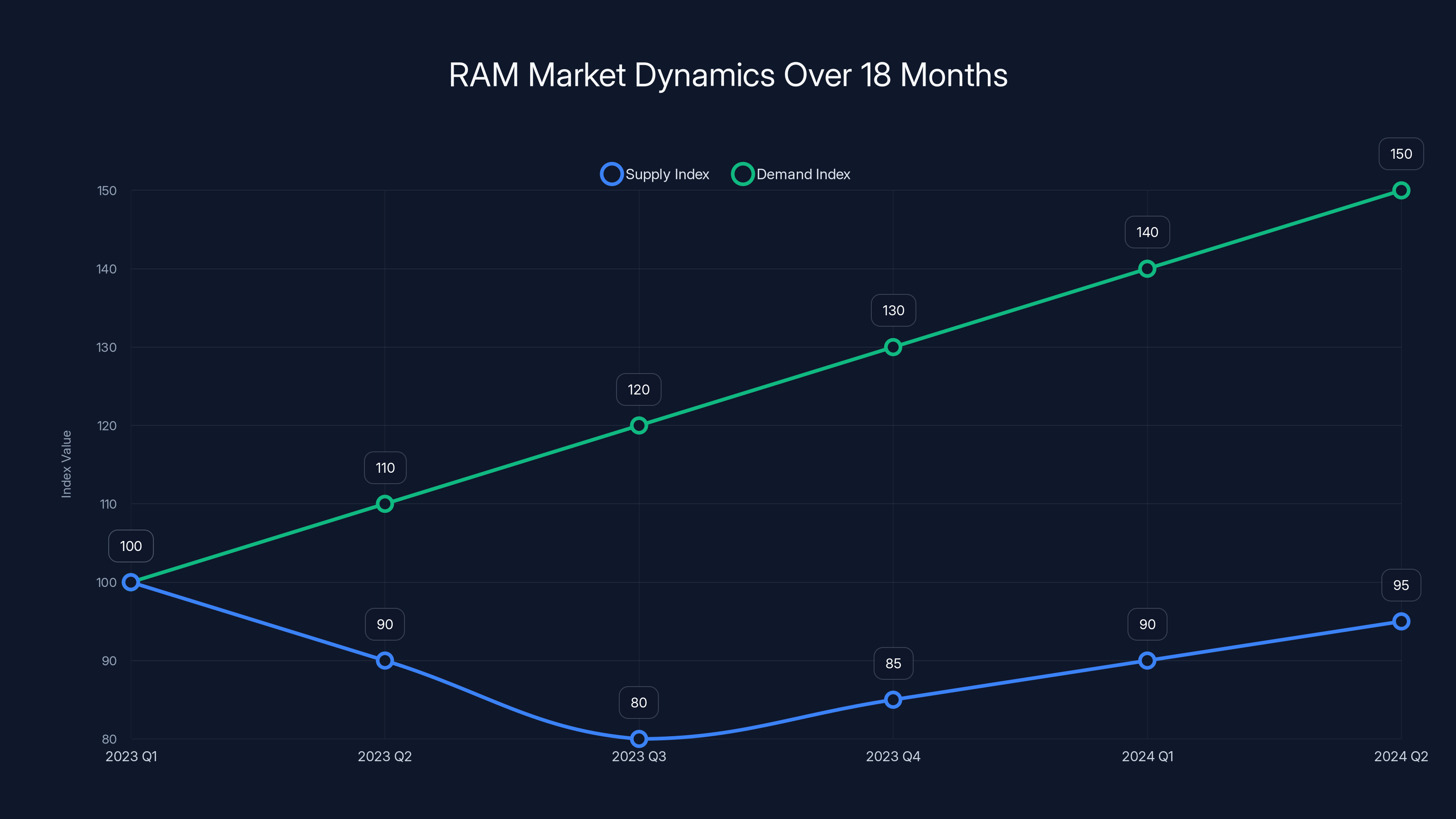

To understand Framework's predicament, you need to understand what happened in the RAM market over the past 18 months. It's not a simple story of "people need more RAM." It's actually much weirder than that.

Back in 2023, the memory chip industry went through a brutal oversupply phase. Manufacturers had built too much capacity, prices tanked, and companies like Samsung, SK Hynix, and Micron were burning cash. They responded by cutting production. This was meant to rebalance the market and let prices recover, as detailed by CNBC.

But then something unexpected happened. AI training exploded. Not consumer AI—enterprise AI. Data centers started demanding absurd amounts of memory. Simultaneously, laptop manufacturers doubled down on RAM, workstations needed more capacity, and consumer demand for gaming and content creation actually stayed healthy.

The manufacturers found themselves in an impossible position: they'd slashed production to fix oversupply, but demand surged for different use cases than they'd expected. Now they can't scale production fast enough. Building a new chip fabrication plant takes 3-5 years. Restarting production lines takes months, as noted by India Briefing.

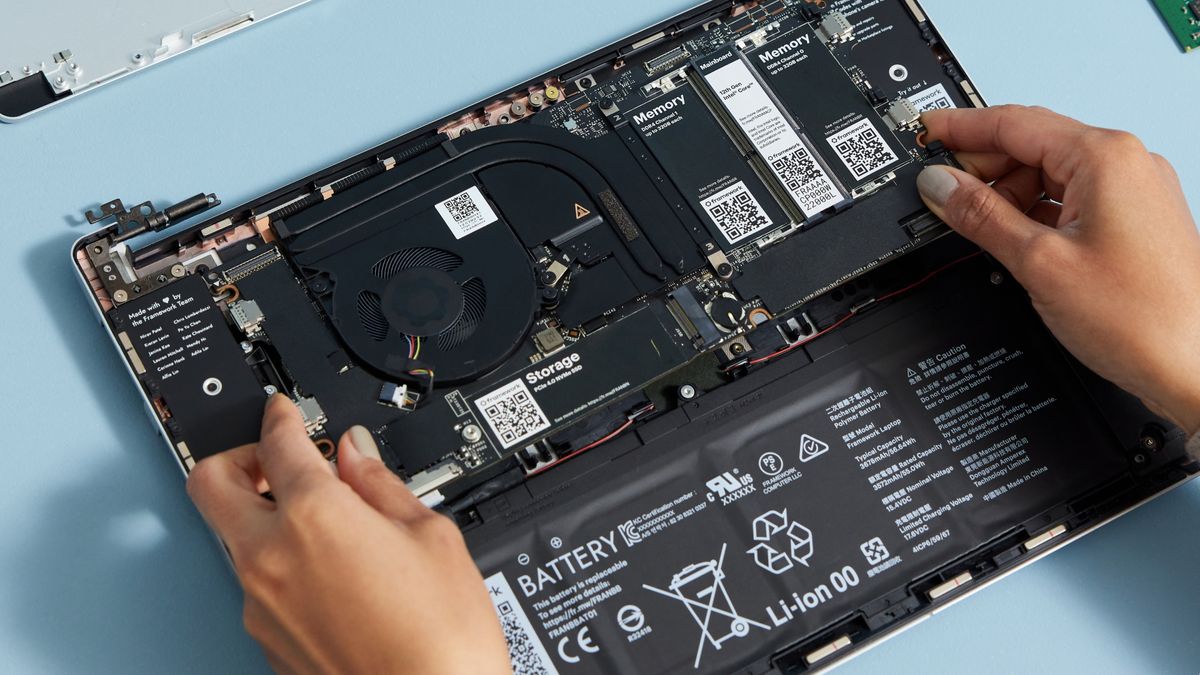

Framework sits in a uniquely painful position. They're not a massive OEM like Dell or HP that can pressure manufacturers for favorable contracts. They're not a chip maker that can just decide to produce more. They're caught in the middle, passing through wholesale costs directly to customers while trying to maintain competitive pricing.

The company basically ran a pricing bluff for 18 months. They absorbed the increases from their suppliers, kept consumer prices flat, and hoped the market would normalize. When production finally ramped and prices fell, they'd recoup the losses.

That never happened. In fact, things got worse, as reported by NPR.

Why 128GB RAM Became a Luxury Item

This is where the 50% pricing gap actually makes sense, even though it feels unreasonable on the surface.

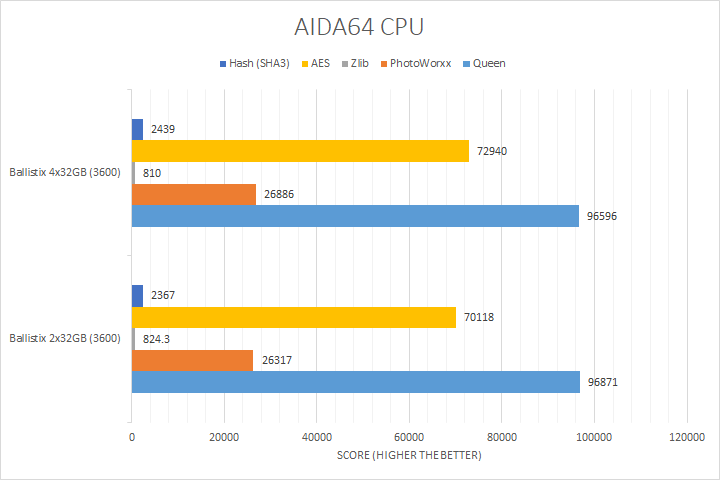

High-capacity DRAM modules are functionally different from lower-capacity ones. A 64GB stick requires specific engineering, testing, and binning. A 128GB stick requires even more precision. These aren't just "two stacks of 64GB"—the electrical characteristics, timing requirements, and thermal behavior change when you go ultra-high-capacity.

When supply is tight, manufacturers have to make brutal choices about what to produce. Do you make 100 million units of 8GB modules for laptops? Or do you burn the same fab capacity on fewer units of 128GB sticks? One serves a gigantic market (every laptop ever). The other serves a much smaller market (high-end workstations, content creators, extremely gamers).

From a purely economic standpoint, manufacturers should optimize for volume. But workstation and creator markets are more profitable per unit. So they do both, but when push comes to shove and they have to cut production, high-capacity modules get squeezed harder, as explained by Ars Technica.

Framework likely found that their supplier's allocation of 128GB modules dropped by 40-50% while 64GB modules stayed relatively stable. To hit the same number of configurations in inventory, they'd either have to raise prices dramatically on 128GB (to reduce demand and match supply), or build far fewer 128GB systems.

They chose the honest approach: raise prices and warn customers. No surprise bundles, no price manipulation, just "here's what it costs now because here's what it costs us."

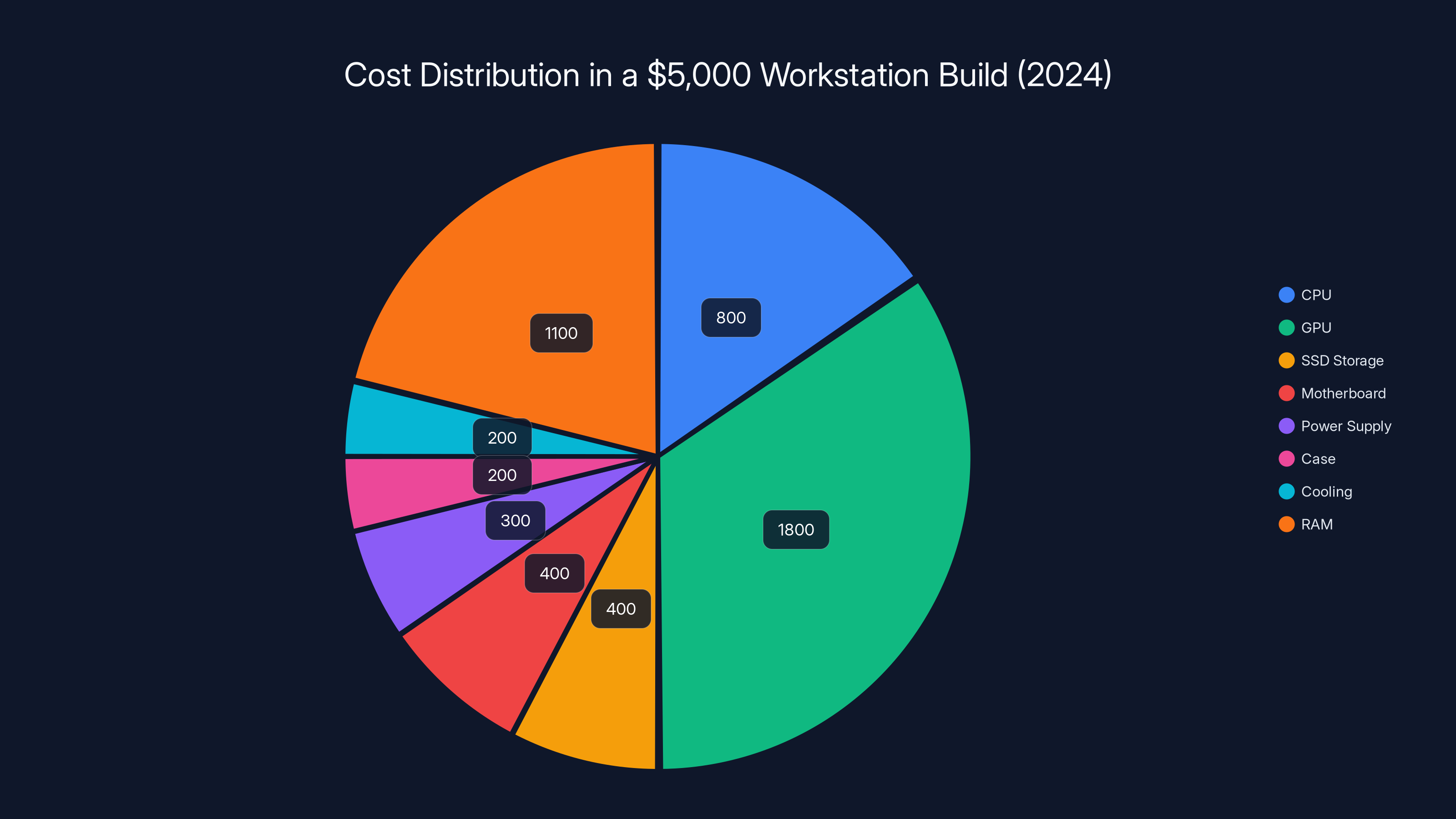

In a $5,000 workstation build for 2024, RAM accounts for 22% of the total cost, highlighting its significant cost increase compared to previous years.

What This Tells Us About PC Market Fundamentals

Framework's transparency is actually revealing something most manufacturers hide behind marketing speak. The PC market is fractured right now, and different segments are experiencing wildly different conditions.

Budget gaming PCs? Prices are actually stabilizing or dropping slightly. A solid 1440p gaming machine at $800-1000 is achievable, and that hasn't moved much. The reason: these systems use 16-32GB RAM, and lower-capacity modules are produced at volume, as noted by Ultrabook Review.

Content creation and workstation machines? Prices are climbing fast. A 64GB workstation that cost

The gap between these markets tells you exactly where the supply problem lives: it's not affecting the mainstream. It's strangling the enthusiast and professional tiers.

This matters because it changes the economics of PC building. For years, the "good value" play was to build your own machine and get more specs per dollar than off-the-shelf options. That's still true for gaming. But for workstations? You might actually be better off buying a pre-built from a manufacturer that has better supplier relationships.

The DRAM Cartel Effect: Market Consolidation Makes It Worse

Here's something that rarely gets discussed openly: the RAM market is dominated by three companies. Samsung, SK Hynix, and Micron control roughly 95% of global DRAM production, as highlighted by TradingView.

When you have three players controlling 95% of a market, they don't need to explicitly collude to see prices rise together. They just need to make rational economic decisions independently, and those decisions often align.

In this case, all three have announced that they're cutting production to raise prices. SK Hynix said they'd reduce output by 30%. Samsung paused their HBM production (high-bandwidth memory used in AI chips) to focus on standard DRAM. Micron has been conservative with new capacity investments.

Each manufacturer wants the same outcome: fewer chips on the market means higher prices, which means better margins. They don't need a meeting in a dark room to achieve this. The incentive structure does it for them.

Framework (and every other PC builder) sits at the mercy of these three companies. They can't negotiate for better pricing because there's nowhere else to go. They can't stockpile inventory because they don't have capital to sit on millions of dollars worth of chips that might depreciate.

This is why companies like Framework end up in this position. They're not choosing to raise prices because they want higher margins. They're raising prices because they have zero alternative.

The AI Boom's Hidden Cost: Enterprise Demand Crushing Consumer Markets

Let's talk about the elephant in the room: artificial intelligence consumed massive amounts of memory capacity that was supposed to go to consumer PCs.

Data centers training large language models, running inference workloads, and serving AI applications at scale need absolutely absurd amounts of RAM. We're talking about systems with terabytes of memory. A single training run for a large model might use more DRAM than an entire year's worth of consumer PC demand, as noted by IDC.

When those data center orders started flowing to Samsung, SK Hynix, and Micron, consumer DRAM basically got bumped to the back of the line. Why? Because data center customers buy in bulk, negotiate contracts, and represent more long-term revenue than consumer markets.

A hyperscaler like Google or Meta orders 100 million GB of memory capacity in a single contract. That's not spread across a year. That's needed in the next quarter. When you're trying to keep production lines running at full capacity and you get an order like that, you fulfill it. Consumer PC builders and small OEMs wait.

Framework explicitly hasn't mentioned AI demand as a factor in their price hike, which is smart (avoid the AI panic narrative). But it's definitely in the background. When SK Hynix cuts production by 30%, that cut isn't coming from their data center contracts. It's coming from consumer DRAM.

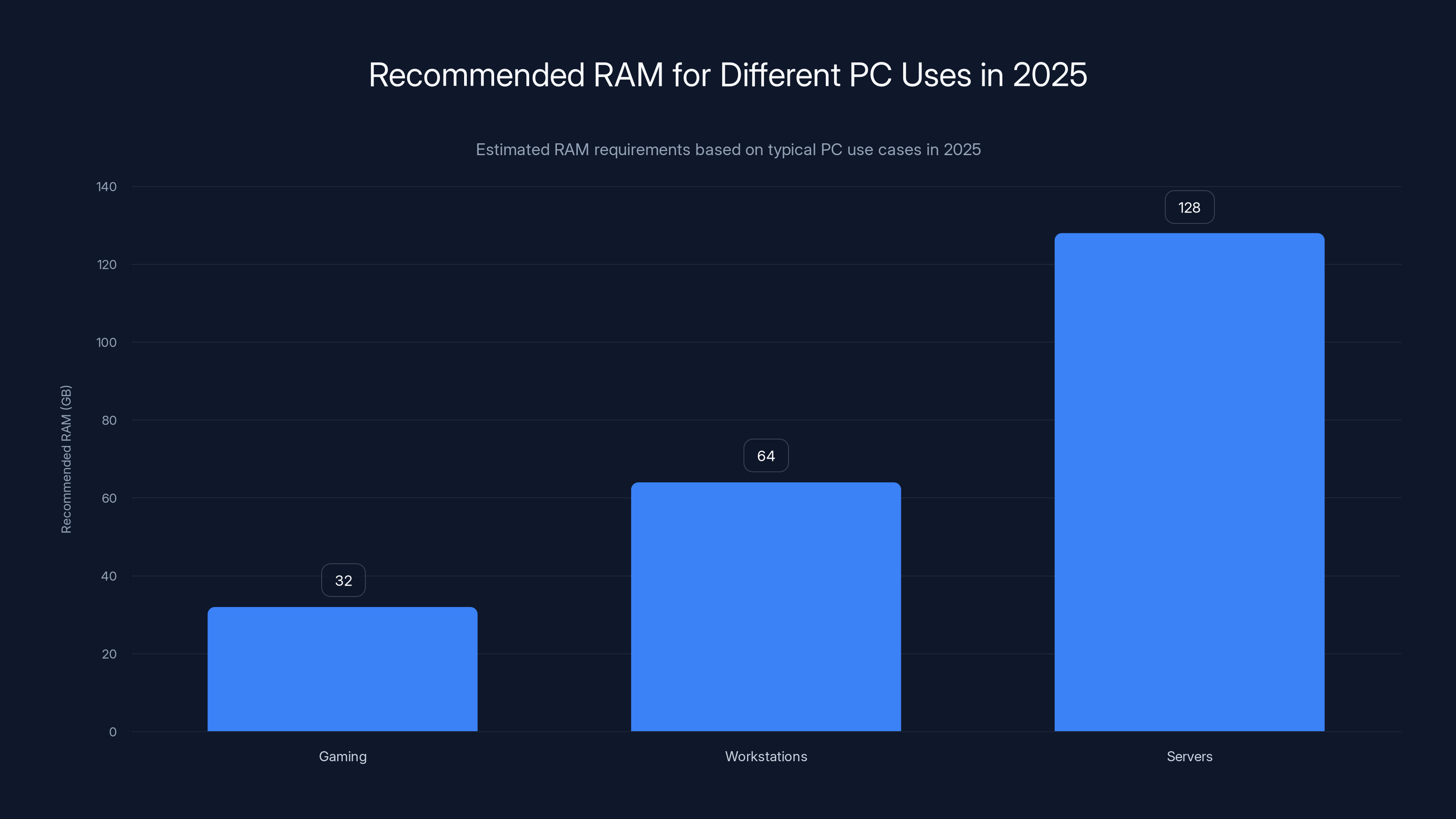

In 2025, 32GB RAM is optimal for gaming, 64GB for workstations, and 128GB for servers. Estimated data.

How Component Costs Are Shifting the PC Building Equation

For 15 years, RAM was basically a commodity. You could build a PC, and RAM represented maybe 10-15% of the total cost. CPU, GPU, storage, and power supply were the real money.

That's flipping. In high-end builds, RAM is now competing with the GPU for the second-largest expense category. And the gap between RAM options is becoming absurdly large.

Consider a $5,000 workstation build in late 2024:

- CPU: $800

- GPU: $1,800

- SSD storage: $400

- Motherboard: $400

- Power supply: $300

- Case: $200

- Cooling: $200

- RAM (128GB): $1,100

RAM is now 22% of total cost. In 2020, that same build would have had RAM at around 8-10%.

This changes how people approach builds. You start making compromises: Do you go with 64GB of fast RAM or 128GB of slower RAM? Do you buy now or wait? Do you step down from your dream GPU to afford the RAM you actually need?

For companies like Framework, this creates a pricing nightmare. They can't just say "RAM is expensive." They have to price each configuration independently, which creates these brutal gaps between models. A 64GB system is viable at a reasonable price. A 128GB system requires a price jump that looks absurd.

Supply Chain Fragility: Why This Keeps Happening

The RAM supply chain is fragile in ways that most people don't appreciate. It's not just tight right now. It's structurally vulnerable to shocks.

First, the manufacturing side is concentrated in three countries: South Korea, Japan, and Taiwan. Geopolitical disruption in any of these regions ripples globally. Taiwan especially is a geopolitical flashpoint, and it produces the most advanced DRAM technology.

Second, DRAM fabs are absurdly expensive to build and operate. A single fabrication plant costs

Third, DRAM is used in literally everything. When demand surges in one sector (like AI), it affects pricing across all sectors. There's no way to isolate "gaming RAM" from "server RAM." The factories produce what's profitable.

Framework's price hike is actually them being honest about a supply chain problem that most manufacturers just eat and hide in their profit margins. It's a moment of vulnerability that shows how fragile the current system is.

The Timeline Problem: Production Can't Keep Up

Here's a misconception worth clearing up: the RAM shortage isn't a shortage. It's not like 2020 when every computer part was impossible to find. It's a production problem.

Manufacturers are producing DRAM continuously. Yields are fine. The issue is that they're not producing enough of the right type of DRAM at the right time to meet demand exactly.

If you need 128GB modules in Q1 2025, Samsung can't instantly say "let's make more 128GB this week." Their production is planned months in advance. Resin, wafers, testing equipment, and personnel are allocated based on forecasts made 90 days prior.

When demand comes in hot for 128GB modules, Samsung has to choose: do we reprogram existing production lines mid-run (which is expensive and wasteful)? Or do we take the demand for Q2 instead of Q1?

Most of the time, they take the lost demand. They can't afford to retool. So buyers either wait or pay a premium for faster delivery.

Framework is basically absorbing that premium and passing it to customers. Which is honest, but it means their timeline for 128GB systems just got longer. Either they work with allocation they have (sell fewer systems) or they price high enough that demand drops (naturally rationing supply).

They chose option B, which is what a rational pricing strategy looks like in constrained supply.

Estimated data shows a 50% increase in 128GB RAM prices compared to 64GB modules, with prices expected to rise further due to supply constraints.

Shipping and Logistics: The Hidden Cost

Something that doesn't get enough attention in pricing discussions is logistics. When supply is tight, shipping costs go up dramatically.

Manufacturers have to air-freight components instead of using slower, cheaper ocean shipping. A container of DRAM modules that normally ships via ocean freight for

Framework builds in the US, so they're shipping domestically. But the RAM they use comes from Asia. When supply is tight, they can't consolidate shipments. They have to order smaller batches more frequently, and each shipment is more expensive.

It's not visible to customers, but it's a real cost driver. When Framework talks about holding prices as long as they could, this is part of what they're holding.

What Competitors Are Quietly Doing

Framework is transparent about their price hike. Most other manufacturers aren't.

Dell, HP, Lenovo, and others are handling this differently. Some are limiting the configurations they offer (you can't get 128GB on many consumer systems). Some are raising prices on specific configurations without announcing it (just listing the new price). Some are using older, slower RAM to hit price points (which technically works but feels deceptive).

Framework's approach of being transparent about it is actually rare. It signals to customers: "we tried to absorb this, we can't, here's why, here's the new price." It's not great for their sales, but it's good for trust.

You can expect other manufacturers to follow suit over the next 3-4 months. When the market leader (Lenovo in consumer/commercial, or companies like HP for workstations) raises prices, everyone else follows. Right now, they're probably still hoping to absorb costs or find supplier negotiations that work. By mid-2025, they'll probably join Framework's approach.

The Workstation Market Gets Hit Hardest

Workstation buyers are suffering more than any other market segment right now. And it makes sense: workstations are the only market where 128GB RAM is standard, not exotic.

A professional who needs a workstation for 3D rendering, video editing, or scientific computing has basically two options: buy a pre-built from Dell (Precision), HP (Z-series), or Lenovo (Think Pad P or Think Station), or build custom.

Pre-builds are seeing price increases of 10-20% across the board. Custom builds are hitting the same wall Framework is: you can get 64GB at a reasonable price, but 128GB costs as much as a GPU upgrade.

For creative professionals on a tight budget, this is forcing compromises. Instead of upgrading from 64GB to 128GB, they're buying smaller SSDs or stepping down GPU tiers. It changes what kind of work they can do.

This matters at scale. If even 10% of creative professionals delay workstation upgrades because RAM pricing is unreasonable, that's millions of dollars in deferred spending, which ripples through the entire market.

Estimated data shows a significant increase in RAM demand driven by enterprise AI and consumer needs, while supply struggled to keep pace due to previous production cuts.

Gaming and Consumer Segment: The Bright Spot

While workstations are getting crushed, gaming and consumer PCs are holding up better than expected.

Most gamers buy 32GB systems and call it a day. Some enthusiasts go 64GB. Almost nobody goes 128GB. So the supply crunch that's decimating 128GB availability barely affects gaming at all.

RAM for gaming systems is abundant enough that prices have stabilized. You can find 32GB DDR5 kits for

This creates a weird market split: gaming PC builders (or companies building gaming systems) aren't seeing the pain Framework is describing. But creators, engineers, and workstation users absolutely are.

If you're shopping for a gaming PC right now, you're actually in a good position. Prices are reasonable, competition is fierce, and availability is solid. Enjoy it, because this window might not last long.

Server RAM vs. Consumer RAM: The Supply War

There's another dynamic worth understanding: server DRAM and consumer DRAM are increasingly diverging in terms of supply.

Server RAM (the kind used in data centers and enterprise systems) uses different specifications: registered DIMMs, ECC memory, specific timing profiles. The production lines are separate from consumer systems.

But they use the same underlying silicon dies. When SK Hynix produces a die that could go into either a server module or a consumer module, they're going to send it to whoever pays more. Data centers pay more.

Moreover, data center demand is consistent and contractual. A cloud provider signs a multi-year deal for millions of GB. A consumer PC buyer just needs it now. Manufacturers preferentially fill long-term contracts.

So consumer DRAM gets whatever leftover capacity is available after data center orders are fulfilled. When data center demand is booming (which it is, because AI), consumer availability drops.

Framework can't offer a 128GB consumer system if the silicon isn't available at an acceptable price. It's not a pricing decision. It's a supply constraint that forces a pricing decision.

When Will Prices Normalize?

This is the question everyone asks, and the answer is honest: nobody knows with certainty, but we can make educated guesses.

SK Hynix has signaled they'll maintain production cuts through 2025. Samsung has committed to limited capacity increases. Micron is being cautious. So we're probably stuck with constrained supply through Q3 or Q4 2025 at minimum, as noted by KEYT.

What could fix it faster:

- A recession that kills data center demand

- Breakthrough manufacturing technology that increases yields

- A surprise competitor (Intel making DRAM again, or someone new entering)

- Geopolitical disruption that forces countries to support domestic production

None of these seem likely in the next 12 months. So expect elevated RAM prices through at least the end of 2025.

Framework's price hike is basically telling us to expect this to be the "new normal" for a while. They wouldn't move pricing if they thought it was a temporary blip.

The Broader Industry Implications

Framework's transparency about this pricing situation has broader implications for how hardware companies communicate with customers.

Instead of hiding cost increases in marketing obfuscation or just silently raising prices, Framework explicitly said: "we held off, we can't hold off anymore, here's why." It's a trust signal, even though it's bad news.

This sets a precedent that customers appreciate. When Dell or HP inevitably raises their workstation prices in the next quarter, they could learn from Framework's approach. Be honest about why. Don't hide it behind product repositioning or spec changes.

The opposite approach (what most companies do) is to subtly change configurations, retire certain SKUs, and launch new ones at higher prices. It's technically honest, but it feels dishonest. Customers hate it.

Framework's approach, while bad news for customers' wallets, is good news for the relationship between hardware makers and customers. It demonstrates respect for customer intelligence and budget planning.

What This Means for PC Building in 2025

If you're planning to build or buy a PC in 2025, here's the practical takeaway: be realistic about RAM.

For gaming, 32GB is the sweet spot. It's affordable, abundant, and covers everything from 1440p gaming to streaming to light content creation. There's no reason to pay premium prices for 64GB unless you specifically do video editing or 3D rendering.

For workstations and creative work, 64GB is the new minimum. It's pricey, but it's the threshold where you start having real headroom for complex projects. 128GB is a luxury you should only consider if you're professionally depending on that performance, because the pricing premium is brutal.

For servers and data center applications, expect to pay more and wait longer. Enterprise DRAM supply is tight, and cloud providers are locking up allocation.

Don't feel like you need to upgrade beyond what you have right now. If your PC is running well with 64GB and you're not hitting memory limits, there's no financial case for upgrading to 128GB in 2025. Wait until 2026 when prices stabilize.

Build with current-generation components. DDR5 is mature enough now that the price premium over DDR4 is reasonable. But don't pay a 50% markup for the next tier up in capacity. That money is better spent on CPU, GPU, or SSD improvements.

The Longer View: What Comes After This

Every supply shortage eventually ends. Memory chip manufacturing has been through multiple cycles of boom and bust. Eventually, new capacity comes online, demand stabilizes, and prices normalize.

But "eventually" might be 18-24 months away. Framework is basically saying: don't expect this problem to go away quickly. Plan your builds and budgets accordingly.

When prices do normalize (probably late 2025 or 2026), there will be a reversal. Companies that paid premium prices now will look foolish. Customers who waited will feel vindicated. But that's how cyclical industries work.

The lesson here isn't just about RAM. It's about understanding supply chain dynamics and not assuming that current prices represent fair value. Sometimes they do. Sometimes they reflect structural problems that will reverse. The key is knowing which is which.

Framework's honesty helps us understand that this is the latter. They're not making this move because they want to. They're making it because supply realities leave them no choice.

FAQ

Why is 128GB RAM so much more expensive than 64GB?

128GB memory modules are more complex to produce and test than 64GB modules, requiring higher precision in manufacturing. When supply is tight, manufacturers prioritize producing lower-capacity modules because they serve larger markets (laptops, mainstream systems). This leaves 128GB availability at a premium, forcing companies like Framework to raise prices significantly to match constrained supply.

Is the RAM shortage real or manufactured?

The supply constraint is real, but not what most people think of as a "shortage." DRAM is being produced continuously; the issue is that production isn't growing fast enough to meet demand from data centers (AI demand), workstations, and consumer PCs simultaneously. Manufacturers have also deliberately cut production to raise prices and improve margins, which is economically rational for them but painful for buyers.

Should I buy a PC with 128GB RAM right now?

Unless you professionally need 128GB for video rendering, 3D modeling, scientific computing, or running local AI models, the pricing premium isn't justified in 2025. Stick with 64GB for most workstation work, or 32GB for gaming and consumer use. Prices on 128GB modules likely won't normalize until late 2025 or early 2026.

Why can't manufacturers just make more RAM?

Building new DRAM manufacturing capacity takes 3-5 years and costs $10-20 billion per facility. Existing fabs operate on production schedules planned months in advance. Restarting production lines mid-run is expensive and wasteful. So when demand suddenly spikes, manufacturers can't instantly increase output; they have to make difficult choices about what to produce with existing capacity.

Will other PC makers follow Framework's price increase?

Yes. Framework being transparent about their price hike suggests they've concluded that the supply situation won't improve soon. Other manufacturers (Dell, HP, Lenovo) are likely absorbing costs right now, but when pressure becomes unsustainable, they'll announce price increases as well. By mid-2025, expect similar pricing across most quality PC manufacturers.

What should I do if I need a high-RAM system right now?

If you can delay 2-3 months, wait for stock levels to stabilize and potential price adjustments from competitors. If you can't wait, buy a 64GB system and plan to upgrade storage or GPU instead of RAM. If you absolutely need 128GB immediately, accept Framework's pricing and factor it into your budget as a non-negotiable premium.

Is DDR5 RAM expensive because of the same supply constraints as high-capacity modules?

Partially. DDR5 production is newer and less mature than DDR4, which means lower yields and higher costs per unit. But the broader supply constraint affecting 128GB modules also affects DDR5 availability. The pricing premium for DDR5 is a combination of newness (normal for new technology), lower volume production (improving as adoption grows), and supply tightness (being affected by the broader DRAM situation).

How does data center demand affect consumer PC pricing?

Data centers buy DRAM in massive volumes through long-term contracts that lock in priority access and favorable pricing. When hyperscalers like Google, Meta, and Microsoft place large orders for AI and cloud infrastructure, manufacturers fulfill those contracts first. Consumer demand gets whatever production capacity remains. This priority structure means consumer PC pricing indirectly reflects data center competition, with tighter supply whenever data center demand surges.

The Bottom Line

Framework's 50% price hike on 128GB systems isn't an arbitrary business decision. It's a data point showing that the memory chip market is under structural stress that won't resolve quickly.

The company's explicit statement that they "held off for as long as they could" is probably the most honest communication we've heard from any PC manufacturer about component cost inflation. It tells us this isn't temporary. It tells us other manufacturers will follow. It tells us that anyone buying a high-RAM system in 2025 should expect to pay significantly more than they paid in 2023.

If you're building or buying a PC, adjust your expectations. 64GB is reasonable. 128GB is a luxury purchase. 32GB is still fine for gaming. Don't assume that higher specs automatically mean better value right now. Sometimes they do. Sometimes they mean you're paying a supply premium that will reverse in 12-18 months.

Wait where you can. Buy intelligently where you must. And appreciate companies like Framework that are honest about why prices are moving instead of hiding increases behind marketing speak.

Key Takeaways

- Framework's 128GB system costs 50% more than 64GB model, signaling that RAM supply constraints won't resolve quickly and other manufacturers will follow with price increases.

- Three companies (Samsung, SK Hynix, Micron) control 95% of DRAM production, creating structural pricing power that affects all PC makers simultaneously when supply tightens.

- Data center AI demand consumes production priority over consumer PC orders, leaving memory allocation tight for workstation and gaming systems through at least late 2025.

- RAM has become 20-25% of high-end PC build costs (vs. 10-15% in 2020), making memory pricing volatility the primary budget driver for workstations and creative systems.

- New DRAM fabrication capacity takes 3-5 years and $10-20 billion to build, making supply constraints structural problems that can't be quickly fixed with increased manufacturing investment.

Related Articles

- Hyte X50 PC Case Review: Aesthetic Design Meets Performance [2025]

- Samsung AI Chip Boom Drives Record $13.8B Profits [2025]

- Samsung TV Price Hikes: AI Chip Shortage Impact [2025]

- Why PCs Don't Need AI: Dell's Marketing Reality Check [2025]

- Samsung RAM Price Hikes: What's Behind the AI Memory Crisis [2025]

- Dell XPS Makes Epic Comeback at CES 2026 [2025]

![Framework Desktop PC Price Hike: Why RAM Costs Are Crushing PC Builders [2025]](https://tryrunable.com/blog/framework-desktop-pc-price-hike-why-ram-costs-are-crushing-p/image-1-1768314963461.jpg)