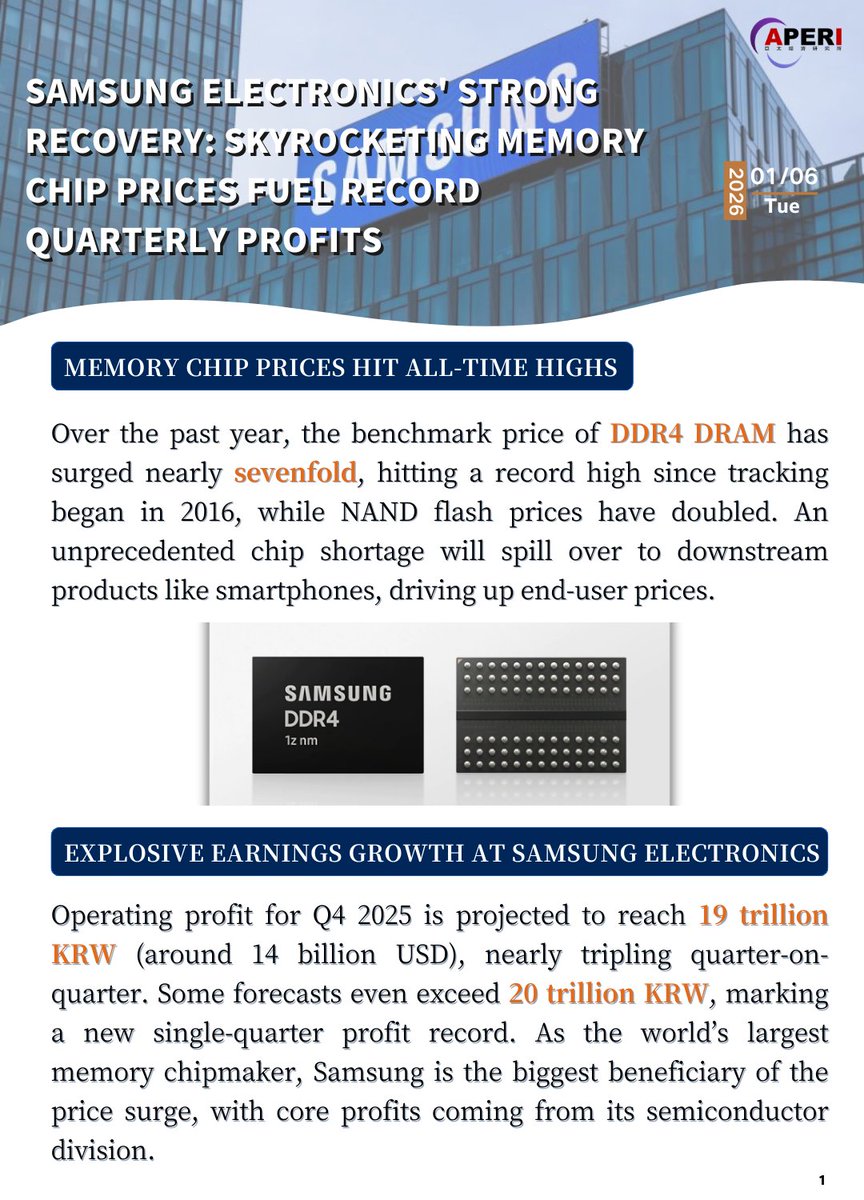

Samsung AI Chip Boom Drives Record $13.8B Profits: What This Means for Tech [2025]

There's a story unfolding right now in the semiconductor industry that most people aren't paying attention to, but they should be. Samsung just announced something that sounds boring on the surface—record quarterly profits in the next quarter—but the reason behind it reshapes how we should think about the entire tech ecosystem.

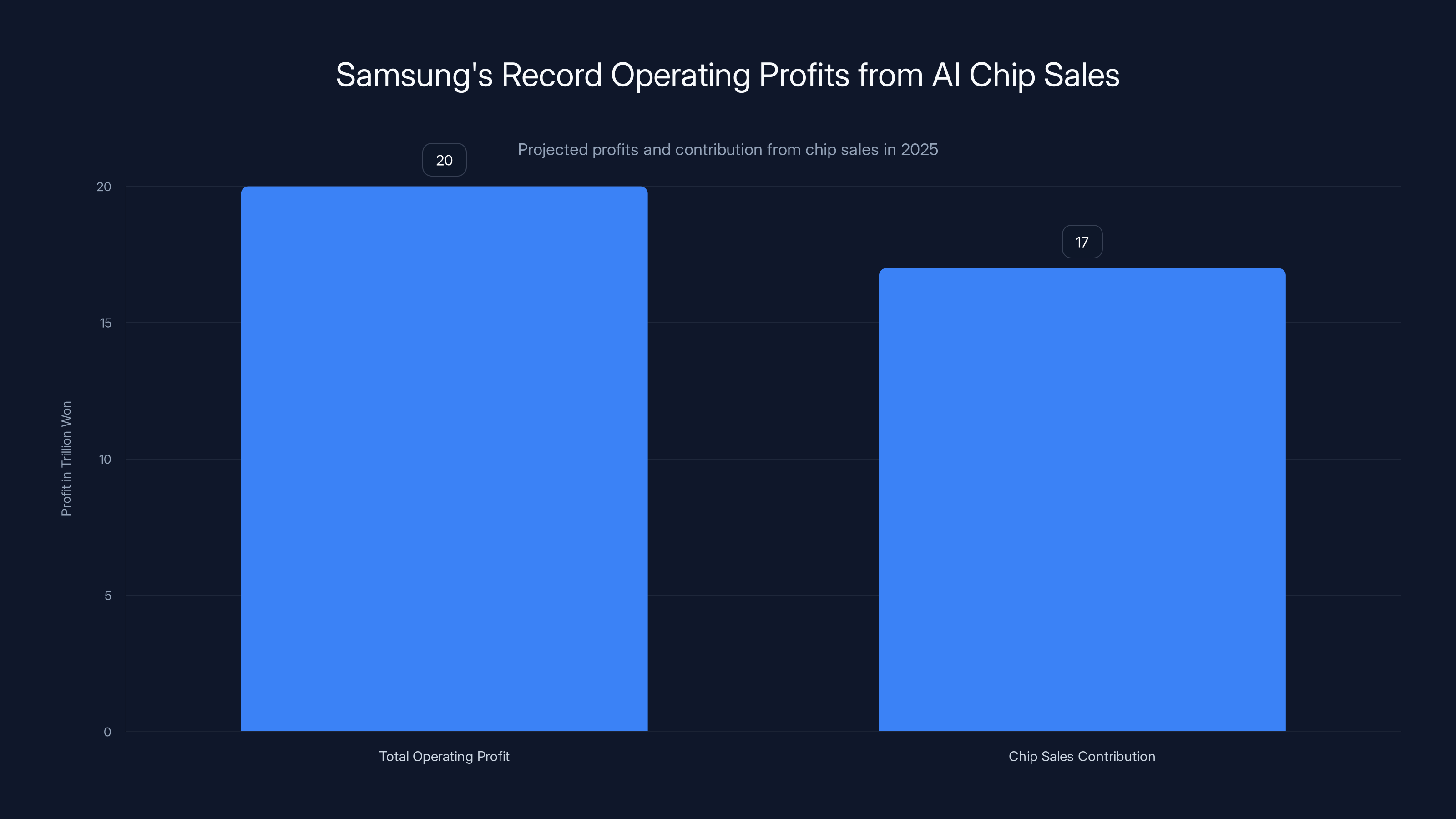

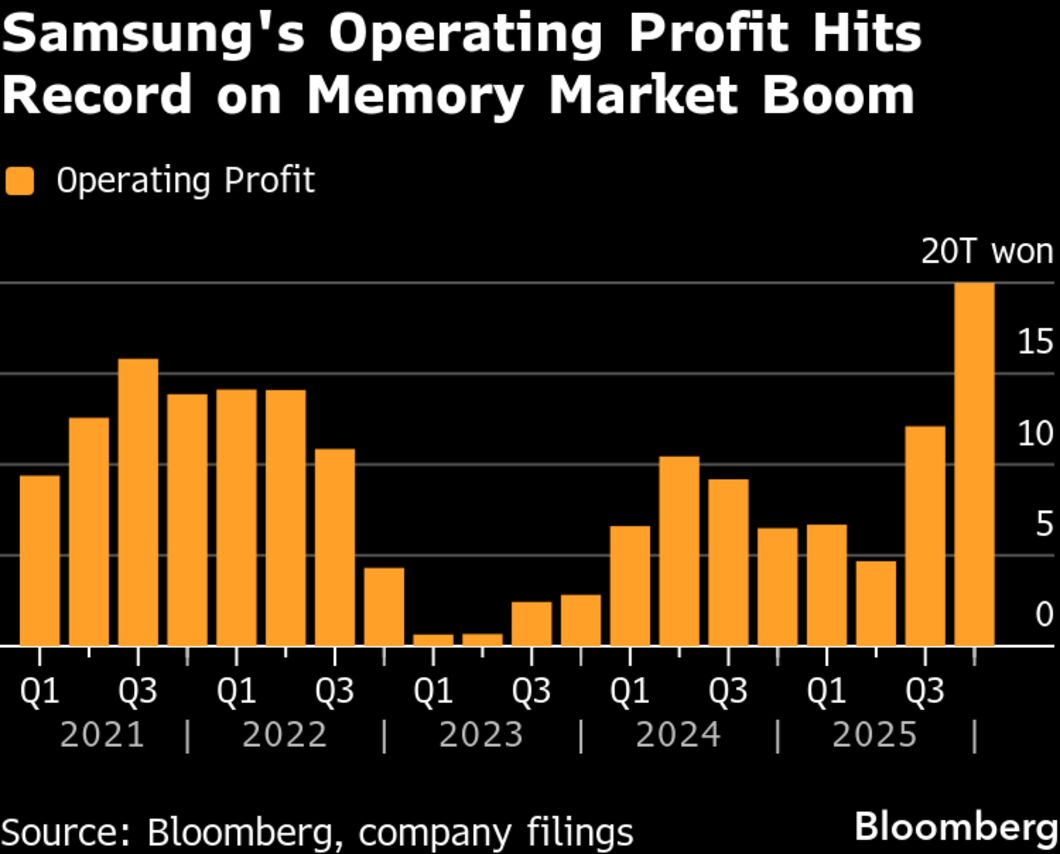

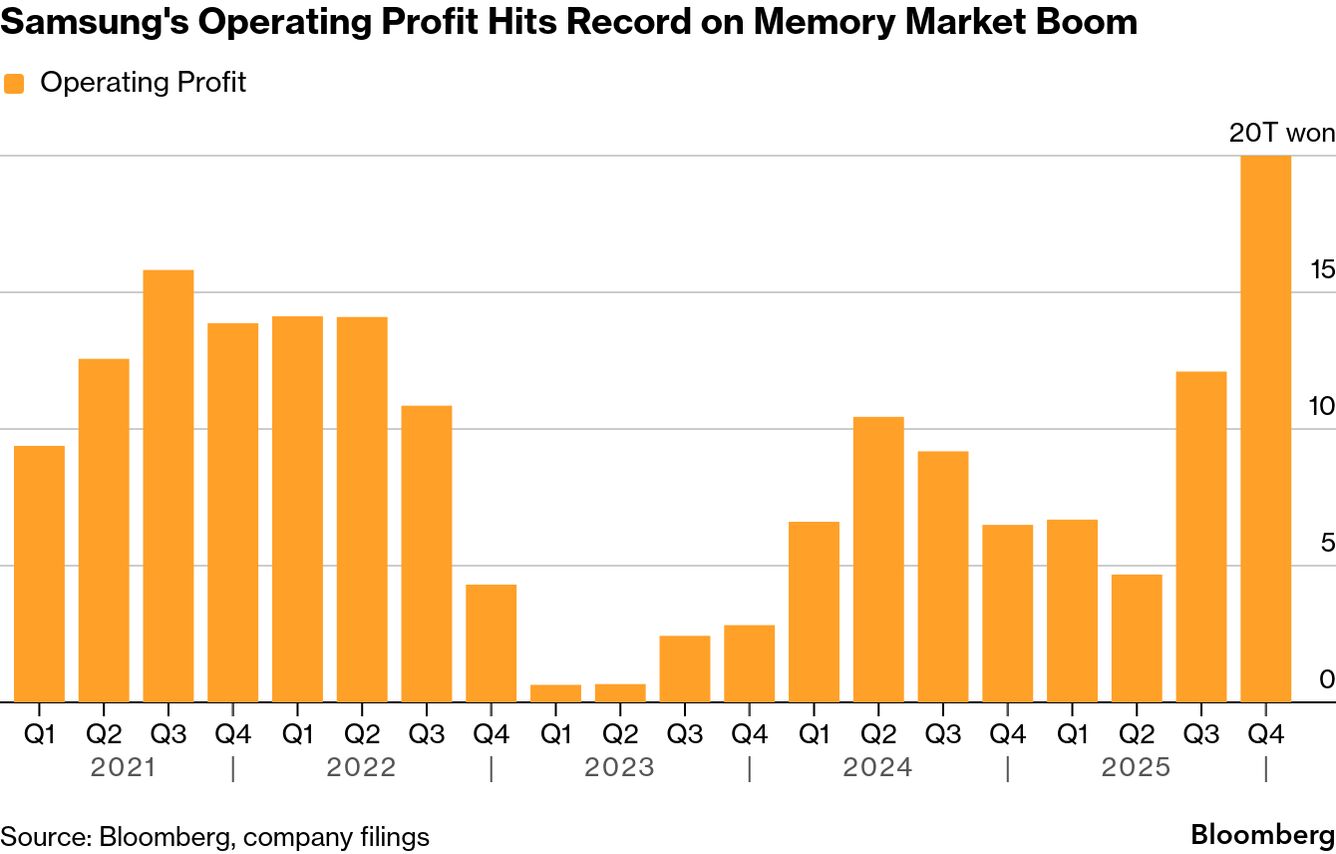

We're talking about 19.9 to 20.1 trillion Korean won (roughly $13.8 billion) in projected operating profit. That's more than triple what Samsung made in the same quarter last year. If that number holds, it breaks Samsung's previous record from 2018 by a significant margin. But here's the kicker: almost all of that money—around 17 trillion won—is coming from chip sales alone.

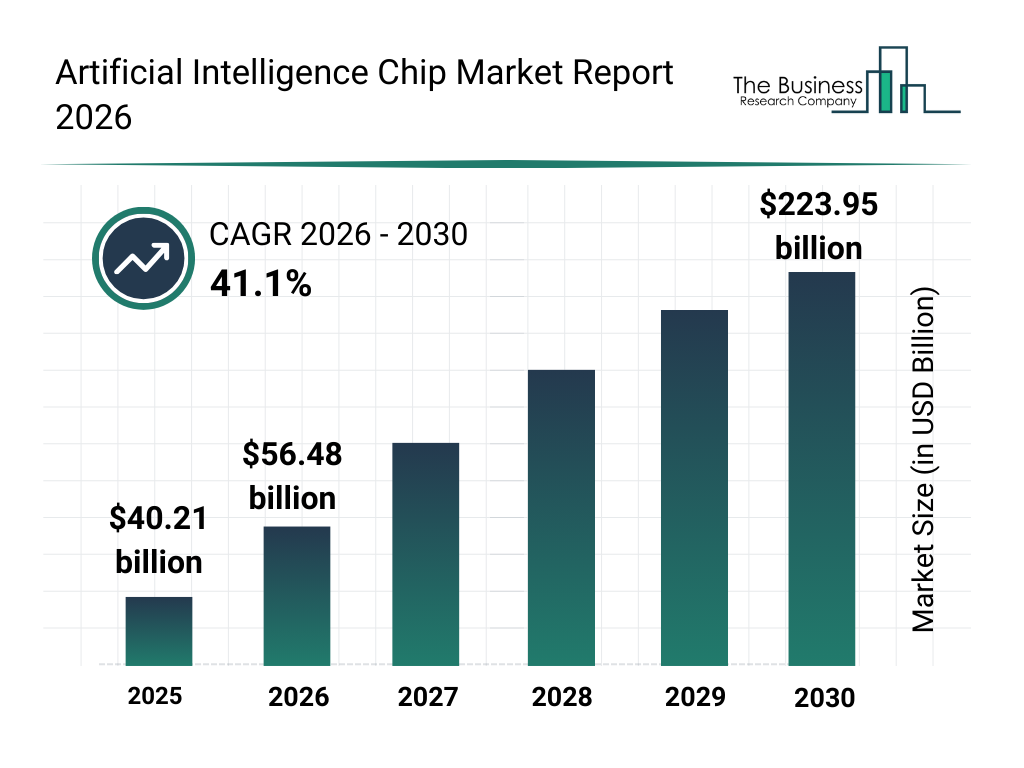

This isn't some random blip in quarterly earnings. This is a fundamental shift in how the semiconductor industry operates, and it's connected directly to one thing: artificial intelligence. The AI boom we've been reading about in headlines is no longer theoretical. It's translating into real demand, real supply constraints, and real money flowing into companies like Samsung.

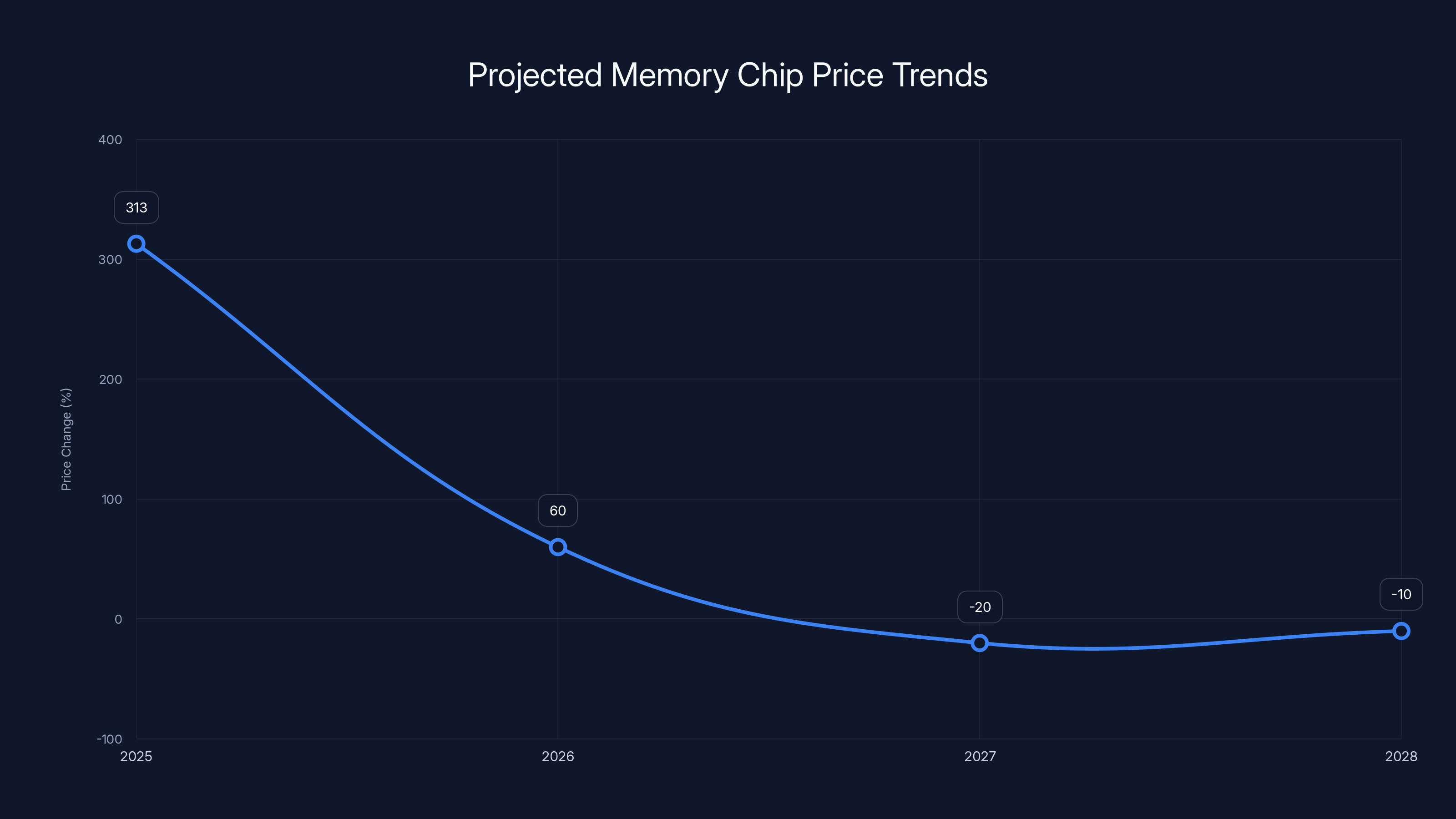

But this comes with a cost that's already rippling through the market. Memory chip prices have skyrocketed. DRAM prices alone jumped 313% year-over-year in the final three months of 2025. Analysts are predicting another 55 to 60% price increase this quarter. Those numbers might not mean much in the abstract, but they mean your next PC could be more expensive. Your next smartphone might be pricier. The devices you rely on every single day are going to cost more because of what's happening right now in the chip market.

Let's break down what's actually happening, why it matters, and what it means for you.

TL; DR

- Samsung projects $13.8 billion quarterly profit, more than triple year-over-year growth driven entirely by AI chip demand

- DRAM prices surged 313% year-over-year in Q4 2025, with another 55-60% increase expected this quarter

- Memory chip shortage is shifting production away from consumer devices toward high-margin AI server components

- PC and smartphone prices are expected to rise substantially in 2026 as manufacturers struggle with chip costs

- Samsung, SK Hynix, and Micron are all planning new fabrication plants to meet demand, but supply constraints will persist

- Stock prices reflect the boom, with Samsung up 147% over twelve months despite post-announcement decline

Samsung's projected operating profit for 2025 is 20 trillion won, with 17 trillion won from chip sales, highlighting the impact of AI demand on the semiconductor industry.

The AI Chip Demand Explosion: How We Got Here

To understand Samsung's record profit forecast, you need to understand what happened in the AI space over the last 18 months. This wasn't a gradual trend. It was more like someone flipped a switch.

When large language models started becoming commercially viable—when OpenAI released Chat GPT, when Anthropic launched Claude, when every major tech company rushed to integrate AI features into their products—demand for data center infrastructure exploded. And data centers need chips. Lots of them.

But not just any chips. They need high-performance memory chips that can handle the massive datasets and complex calculations required by modern AI models. This is where DRAM (dynamic random-access memory) and NAND flash come in. These are Samsung's bread and butter.

What makes this moment different from previous chip booms is the margin profile. When you're selling chips to a smartphone manufacturer, you're competing on price. Margins are thin. Volumes are massive, but the profit per unit is small. When you're selling memory chips for AI servers, you can charge significantly more because there's limited supply and massive demand. The economics completely flip.

Samsung and its competitors realized this quickly. They started shifting production toward the AI market. SK Hynix did the same. Micron pivoted its manufacturing strategy as well. This wasn't a coordinated decision—it was just rational business. High-margin business attracts capital and production capacity.

The problem, of course, is that this creates a supply gap for consumer-facing products. Your phone still needs memory chips. Your laptop still needs them. But if Samsung's fabrication plants are running at full capacity for AI server components, where do the chips for your devices come from?

They come from the reduced pool of available inventory, which drives up prices for everyone else. This is classic supply and demand, but playing out at a scale that affects billions of people.

The Math Behind Samsung's Record Profits

Let's actually look at the numbers here, because they're wild.

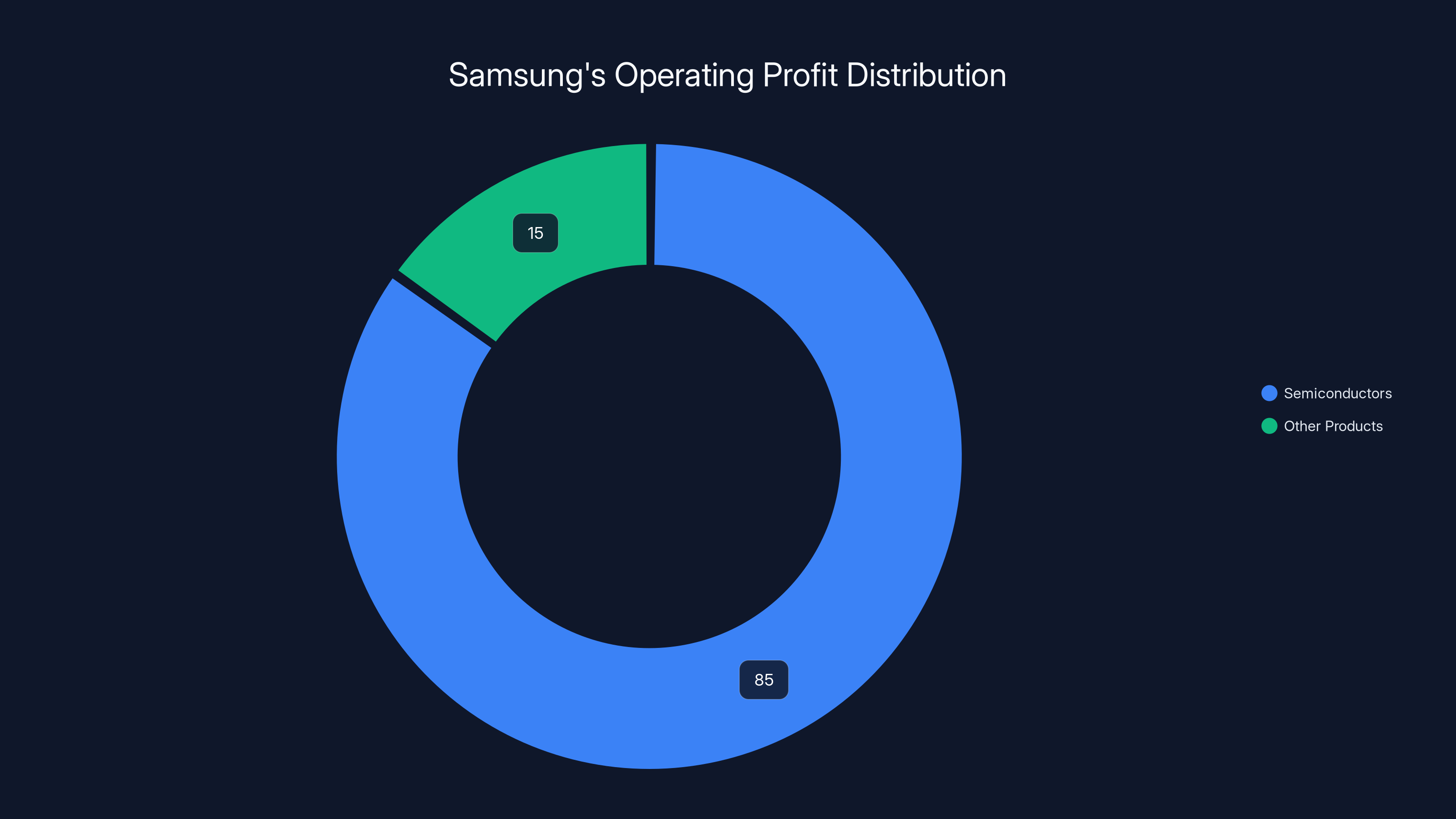

Samsung is projecting operating profit of 19.9 to 20.1 trillion won. Of that, approximately 17 trillion won is coming from chip sales. That means the company is making roughly 85% of its profit from semiconductors, with the remaining 15% coming from everything else—phones, displays, appliances, consumer electronics. Everything.

To put this in perspective, Samsung's previous record quarterly operating profit was 17.6 trillion won in 2018. The company is on pace to exceed that by approximately 2-3 trillion won. That's not a modest improvement. That's a fundamental reordering of the company's profit structure.

The 313% year-over-year increase in DRAM prices is the driver here. Let's think about what that means mathematically.

If Samsung was selling a certain volume of DRAM chips at price point X in Q4 2024, they're now selling similar volumes at price point X + 313%. That's roughly a 4x price increase in just twelve months. Even accounting for slightly lower volumes (because some customers can't afford the higher prices), the revenue impact is massive.

Where New Price = Old Price × 4.13 (accounting for the 313% increase)

Even if volume dropped by 20% due to pricing resistance, you'd still see revenue increase by approximately 230%. The margin expansion is even more dramatic because the cost of manufacturing doesn't increase proportionally with price.

Analysts are projecting another 55 to 60% price increase this quarter. If that materializes, we're looking at sustained, elevated memory chip pricing for the foreseeable future.

Here's the really important part: this isn't being driven by supply manipulation or price fixing. It's being driven by genuine supply constraint. There isn't enough memory chip manufacturing capacity in the world right now to meet demand for both AI infrastructure and consumer products.

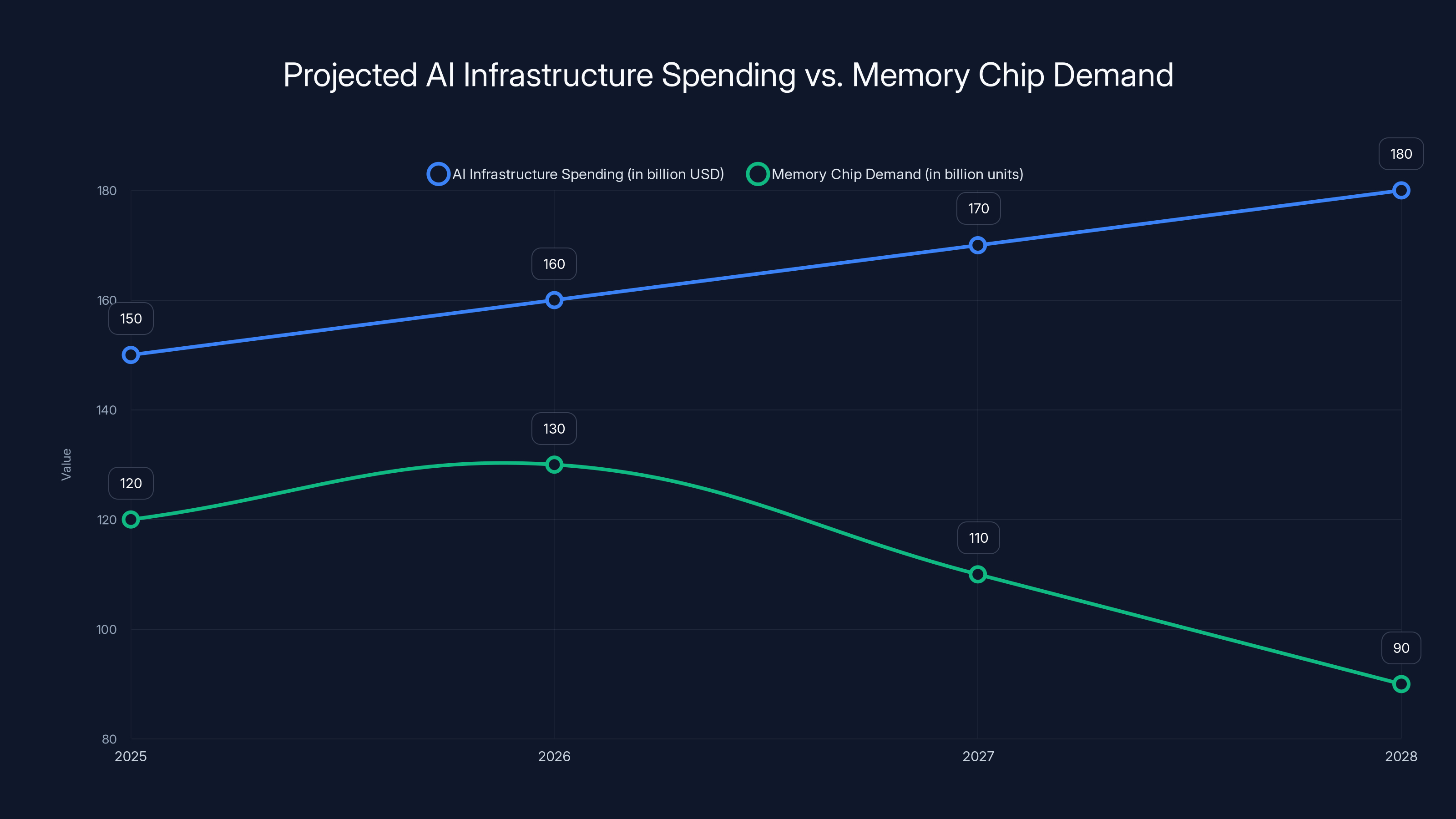

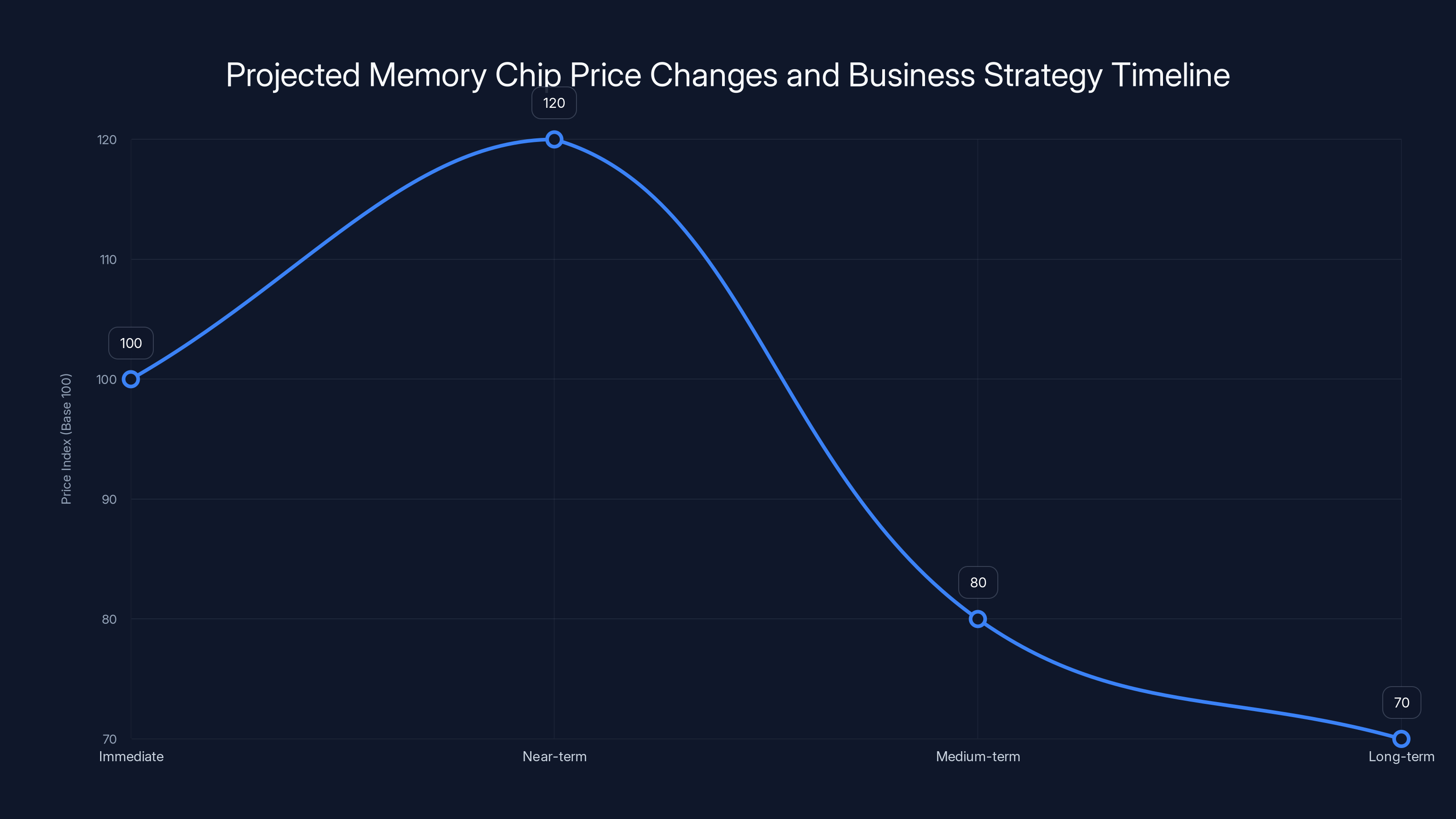

Memory chip prices are projected to increase significantly in 2025 and 2026, followed by a gradual decline as new manufacturing capacity comes online. Estimated data.

Why Memory Chips Are the New Bottleneck

Let's zoom out for a second. The semiconductor industry has multiple layers. You've got logic chips (processors), memory chips (DRAM and NAND flash), and manufacturing infrastructure (fabrication plants, or "fabs").

Logic chips are getting more attention in AI discussions because companies like NVIDIA (with their H100 and newer GPUs) and Apple (with their custom processors) are making headlines. But here's what most people don't realize: you can't have a functional AI server with just a powerful processor. You need massive amounts of memory to feed that processor.

Think of it like this: the GPU is a sprinter. It's incredibly fast. But if you're only feeding it one piece of data at a time, you're wasting its potential. DRAM is the pipeline that keeps data flowing to the processor. Without sufficient DRAM bandwidth and capacity, even the fastest processor gets bottlenecked.

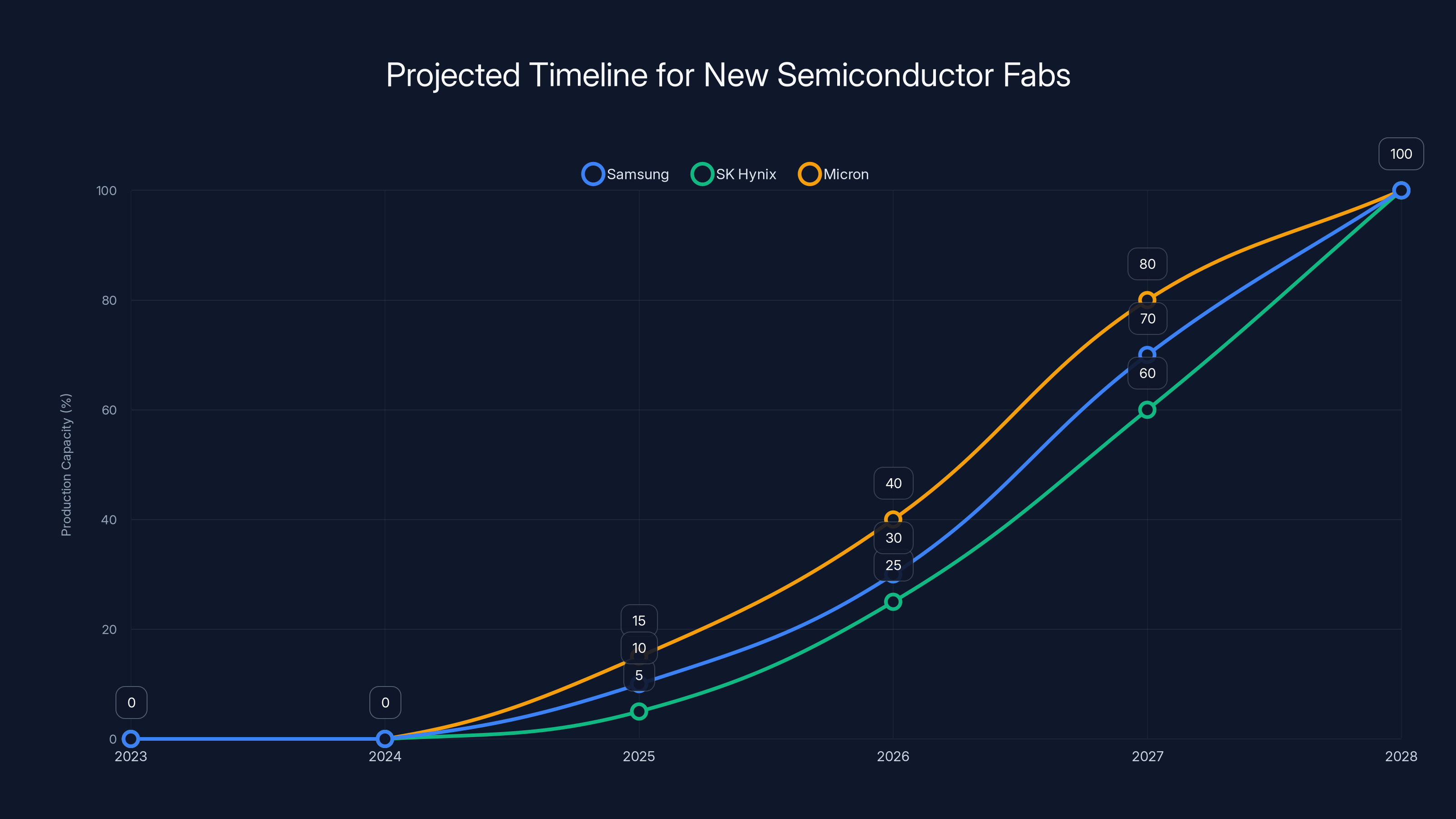

This is why memory chips are becoming the constraint. Samsung, SK Hynix, and Micron can't manufacture DRAM fast enough to meet demand. And it takes years to build a new fabrication plant. We're talking about $10-20 billion capital investments that require years of planning, construction, and calibration before they're producing commercially viable chips.

Samsung announced plans for a new fabrication plant. So did SK Hynix. So did Micron. But these plants won't be producing meaningful volumes for years. In the meantime, the shortage continues.

This creates a window—probably lasting through 2026 and possibly into 2027—where memory chip pricing will remain elevated. Companies will be forced to choose: pay premium prices for chips, or reduce production volumes. Most will choose to pay the premium because the alternative (losing market share) is worse.

The Smartphone Market Impact: Fewer Foldables, Higher Prices

Here's where Samsung's own product strategy gets interesting. The company just released the Galaxy Z Fold 7 and Galaxy Z Flip 7 foldable phones, and they've been outselling previous models. But here's the catch: foldable phones use more memory than regular smartphones. The complex software required to manage folding displays, multiple processors, and responsive transitions needs more RAM and faster storage.

As memory chip prices explode, it becomes more expensive to manufacture foldable phones. Samsung could absorb the cost (killing margins) or pass it to consumers (killing demand). Neither option is great.

According to industry analysts, smartphones account for roughly 25-30% of global DRAM consumption. But as memory prices surge, that percentage might drop. Manufacturers will make fewer phones, or they'll make phones with less memory (worse performance), or they'll charge significantly more.

Apple is particularly vulnerable here because the iPhone's global market share is under pressure. If iPhone prices have to increase due to memory chip costs, it makes the phone even less competitive in price-sensitive markets like India and Southeast Asia, where Apple is trying to gain traction.

The smartphone market was already consolidating around a few major players. Memory chip shortages and price spikes could accelerate that consolidation. Smaller manufacturers might not have the leverage to negotiate favorable chip prices, and they might not have the financial resources to absorb cost increases.

As of Q3 2025, Samsung held an 18.8% global smartphone market share, putting it ahead of Apple. But that lead could evaporate if Samsung has to raise prices more than competitors do. The dynamics here are tense and unpredictable.

PC Market Disruption: RAM Prices as a Demand Killer

The personal computer market is facing a parallel crisis. PC shipments have been declining for years as people rely increasingly on smartphones and tablets. But the PC market still matters—it's where real work happens. Developers, designers, engineers, and knowledge workers all rely on PCs.

And PCs need memory. A lot of it. Modern laptops commonly ship with 16GB or 32GB of RAM. Gaming PCs often have 32GB or more. Workstations designed for professional applications might have 64GB, 128GB, or higher.

Now imagine DRAM prices are up 313% and heading higher. A PC that used to cost

This creates a demand cliff. People delay upgrades. Businesses push out refresh cycles. Consumers who might have bought a new laptop decide their current one is "good enough" for another year.

Market research from IDC and others is already warning that PC market contraction could accelerate in 2026 if memory chip prices remain elevated. This is the opposite of what the PC market needs. It's already struggling with declining unit sales. Price increases driven by component shortages could make the situation worse.

For manufacturers, the incentive structure is perverse. If you can build fewer PCs and sell them at higher prices with similar or higher margins, you might actually prefer that outcome (at least in the short term). But this doesn't help consumers, and it doesn't help the overall market recovery.

Samsung's projected operating profit is heavily reliant on semiconductors, contributing 85% of the total, highlighting the strategic importance of their chip business.

Investment Implications: Stock Markets React

Samsung's stock has had an interesting reaction to this earnings forecast. Shares are up 147% over the past twelve months, reflecting the AI boom and Samsung's advantage in the memory chip space. But the stock actually fell in the day following the earnings announcement.

Why? Because markets are forward-looking. Samsung's record profits are already priced into the stock. The announcement confirmed what investors already expected. What they're worried about is what comes next.

If memory chip prices remain artificially high due to supply constraints, it could trigger demand destruction. If PC and smartphone makers decide to produce fewer devices because they can't make margins work at current memory chip prices, then the demand for memory chips will eventually decline. That's the concern.

There's also the geopolitical dimension. Samsung is a South Korean company. SK Hynix is also South Korean. Micron is American. But the vast majority of advanced chip manufacturing is concentrated in a handful of countries. Taiwan, South Korea, and the United States dominate global chip production. Any geopolitical tension in these regions could exacerbate supply constraints.

For investors, Samsung represents a pure-play bet on AI infrastructure spending. But it's a bet with an expiration date. Once supply normalizes (probably in 2027-2028), memory chip prices will decline toward normalized levels. Samsung's record profitability will compress. Investors who bought at recent highs might be disappointed by 2027-2028 returns.

The Manufacturing Reality: Years to Expand Supply

Here's the uncomfortable truth about the semiconductor industry: you can't just scale production quickly. It doesn't work that way.

Samsung announced a new memory chip fabrication plant. SK Hynix announced one. Micron announced plans as well. These are real, serious investments—we're talking tens of billions of dollars. But they won't start producing meaningful volumes until 2027 or 2028 at the earliest.

The process looks something like this:

- Planning and site selection: 6-12 months of determining where to build, securing permits, negotiating with governments

- Construction: 2-3 years of actual building

- Equipment installation: 12-18 months of installing multi-billion-dollar manufacturing equipment

- Calibration and testing: 6-12 months of running test wafers and optimizing production

- Ramp to volume production: 6-12 months of gradually increasing output

That's 4-6 years from announcement to meaningful production volume. Samsung's new fab won't be meaningfully contributing to supply until 2028 or 2029.

Meanwhile, demand for AI chips continues to grow. It's not growing at the same rate as last year (nothing grows forever), but it's still strong. Companies like Microsoft, Google, Amazon, and Meta are all investing heavily in data center infrastructure. They're building their own chips and negotiating long-term supply agreements with manufacturers. Competition for available capacity is intense.

The only way supply normalizes faster is if demand suddenly collapses (unlikely) or if new manufacturing technology dramatically increases yields (possible but not certain). The semiconductor industry is working on advanced processes—3-nanometer and smaller—that could help, but these are incremental improvements, not game-changers.

Global Supply Chain Implications

Samsung's supply chain dominates key regions. South Korea, where Samsung is headquartered, is now explicitly critical to global AI infrastructure. Japan, which supplies materials and equipment to Korean chip manufacturers, has also become strategically critical. Taiwan remains critical for other chip manufacturers.

This concentration of critical infrastructure in a handful of regions has geopolitical implications. Governments are taking notice. The United States is investing heavily in domestic chip manufacturing through the CHIPS Act and related initiatives. Europe is doing something similar. India is exploring chip manufacturing investments.

But these initiatives take years to come to fruition. The United States is building new fabrication capacity, but it won't be producing advanced memory chips in volume until 2025-2026 at the earliest. Europe's plans are even further out.

In the meantime, Samsung and South Korean manufacturers remain the swing supplier for global AI infrastructure. This gives South Korea enormous leverage in international negotiations and trade discussions. It also makes South Korea a potential target for sanctions or supply chain disruption.

Companies are starting to build strategic reserves of memory chips, just like they do with oil. Companies like Microsoft and Google are negotiating multi-year contracts at favorable prices, essentially hedging against future supply disruptions. Smaller companies that can't negotiate favorable contract terms are stuck buying on the spot market at inflated prices.

This creates a two-tier system: large companies with leverage get reasonable prices through long-term contracts, while smaller companies and consumers pay premium prices. Over time, this concentration of chip supply benefits big tech companies at the expense of smaller competitors.

Estimated data shows that new semiconductor fabrication plants by Samsung, SK Hynix, and Micron will not reach full production capacity until 2027-2028.

Technology Roadmap: When Does Supply Normalize?

Let's make a realistic projection of when memory chip supplies normalize and prices return to historical levels.

2025-2026: Memory chip prices remain elevated. New fabrication plants announced but not yet producing. Demand for AI infrastructure remains strong. Consumer PC and smartphone markets experience price pressure and demand softness.

2026-2027: First new fabrication plants start ramping production. Prices begin to decline but remain above historical averages. Demand for AI infrastructure starts to moderate as the easy wins (obvious inefficiencies in existing systems) are addressed. Consumer electronics markets start to stabilize as supply increases.

2027-2028: Multiple new fabrication plants achieve volume production. Memory chip prices decline significantly toward normalized levels. Demand for AI infrastructure stabilizes at a sustainable level. Consumer electronics markets see price reductions and renewed demand.

2028 and beyond: Memory chip prices return to historical normalized levels (or lower, if there's overcapacity). The AI boom completes its cycle and integrates into normal operations. Tech companies face a reality check on profitability as pricing normalizes.

The wild card in this timeline is demand destruction. If PC and smartphone prices stay too high for too long, demand could collapse faster than expected. This could cause memory chip prices to decline even faster than the supply timeline suggests. Alternatively, if AI adoption accelerates faster than expected, demand could remain elevated longer, keeping prices high through 2028.

Competitive Dynamics: SK Hynix and Micron's Response

Samsung isn't alone in benefiting from memory chip shortages. SK Hynix and Micron are also seeing record profitability. But their strategic positions are different.

SK Hynix is South Korean like Samsung, and it's executing a similar strategy: shifting production toward high-margin AI server memory. SK Hynix has a slightly smaller market share than Samsung but similar advantages in proximity to demand and manufacturing expertise.

Micron is American, based in Idaho. Micron has less manufacturing capacity than Samsung or SK Hynix, but it has strategic advantages: government support through the CHIPS Act, proximity to American customers (particularly major cloud providers), and flexibility in manufacturing locations.

All three companies are announcing new manufacturing capacity, but the details matter:

- Samsung's new plants will be in South Korea, maintaining its regional advantage

- SK Hynix's new plants will also be in South Korea

- Micron's new plants will be in the United States, giving it geographic diversification

From a geopolitical perspective, Micron's strategy is clever. By manufacturing in the United States, Micron can position itself as a "trusted" supplier for American companies concerned about supply chain resilience. This is worth a premium to many buyers.

But Micron has a capacity disadvantage. Even with its new plants, Micron will have less total manufacturing capacity than Samsung and SK Hynix combined. This means Samsung and SK Hynix will likely remain the price setters in memory chip markets for the next few years.

Real-World Impact: What You'll Actually Experience

All of this might sound abstract, but it has concrete consequences for your actual purchases and experiences.

Your next laptop will likely cost 15-25% more than comparable models from 2024. If you buy one in Q2 2026, the price might normalize somewhat as new manufacturing capacity starts contributing. If you buy one in Q4 2025 or Q1 2026, prepare for sticker shock.

Your next smartphone will probably cost 10-20% more, particularly if you want a model with higher memory configurations. The impact varies by manufacturer—premium brands with manufacturing scale (like Apple and Samsung) will absorb some costs. Budget brands might not be able to do so.

Your video game console might be delayed or pricier. Play Station 6 or Xbox Series Z announcements might not happen until memory chip supplies are more abundant. When they do launch, expect premium pricing that reflects elevated component costs.

Your cloud computing bills might creep up. Companies using cloud services will see providers trying to maintain margins despite elevated memory chip costs. This cost will get passed to customers one way or another—either through price increases or reduced resource allocation per dollar spent.

Your data storage could become more expensive. NAND flash (used in SSDs and flash storage) is also experiencing supply constraints and price increases. Your next SSD upgrade will cost more than you'd expect.

The cumulative effect is that consumer electronics across the board will be more expensive in 2026 than they were in 2024. For consumers in wealthy countries, this is annoying. For consumers in developing economies where device costs are already a significant percentage of disposable income, it could mean going without upgrades entirely. This could widen the digital divide globally.

Estimated data suggests AI infrastructure spending will continue to grow, while memory chip demand may peak and then decline by 2028, indicating potential overcapacity risks.

The AI Infrastructure Spending Spree: Is It Sustainable?

Here's the question nobody's asking loudly enough: Is the pace of AI infrastructure spending sustainable?

Major cloud providers are spending hundreds of billions on data centers, GPU clusters, and supporting infrastructure. They're doing this because they believe AI will drive enormous value. But what if the ROI timeline is longer than expected? What if AI adoption plateaus before infrastructure spending pays off?

Right now, companies are making expansion decisions based on the assumption that AI demand will only increase. But market adoption curves aren't always monotonic. Early adopters grab the easy wins. The harder the wins become, the slower adoption accelerates.

We might be entering a phase where companies have built enough infrastructure to meet current demand, and they're shifting from expansion mode to optimization mode. If that happens, memory chip demand could soften faster than analysts expect.

This is the tail risk that worried investors after Samsung's earnings announcement. The company is forecasting record profits, but those profits are based on elevated memory chip pricing and continued strong AI infrastructure demand. If either of those factors changes, Samsung's profit forecast could evaporate quickly.

Samsung is betting on this trend continuing. SK Hynix and Micron are betting the same way. They're all building new fabrication plants based on projections of sustained high demand. If those projections are wrong, the industry will have massive overcapacity by 2027-2028, and memory chip prices will collapse.

History suggests this is a real possibility. The semiconductor industry has experienced multiple booms and busts. Each boom convinces manufacturers that the growth will continue indefinitely. Each bust proves them wrong. We might be approaching a similar inflection point.

Strategic Implications for Major Tech Companies

Let's think about how major tech companies are responding to memory chip shortages and elevated prices.

Microsoft is investing in its own AI infrastructure, in part because they can't rely on external suppliers to provide capacity fast enough. Microsoft is also working with partners on custom chip designs (like their Cobalt AI chips) that are optimized for their specific workloads, potentially reducing memory requirements and costs.

Google is similarly investing in custom chips and internal infrastructure. Google has the advantage of owning Android, which lets them influence hardware manufacturers' chip choices. They're using that leverage to shift the ecosystem toward their preferred architectures.

Amazon (through AWS) is the incumbent cloud provider with the most customer base. Amazon can negotiate the best terms with Samsung and other chip suppliers because of their purchasing power. This gives Amazon a cost advantage over competitors.

Meta is in a more vulnerable position. Meta spent roughly $35 billion on capital expenditures in 2024, much of it on AI infrastructure. If memory chip costs remain elevated, Meta's infrastructure spending might not deliver the ROI they projected. Meta is trying to negotiate directly with chip manufacturers to secure supply, but they have less leverage than Microsoft or Google.

The companies with the most leverage—Microsoft, Google, Amazon—can negotiate better prices through long-term contracts. The companies with less leverage—Meta, smaller AI companies, startups—are stuck paying spot market prices, which are inflated.

Over time, this could concentrate AI infrastructure investment among the largest companies, further entrenching their competitive advantages.

Future Outlook: 2026 and Beyond

Let's make some projections about what happens next.

Q1-Q2 2026: Samsung and SK Hynix report strong earnings driven by continued elevated memory chip prices. Micron's new plants start ramping production but don't yet contribute meaningfully to global supply. PC and smartphone prices remain high, demand softens. Some market contraction in consumer electronics.

Q3-Q4 2026: New manufacturing capacity starts contributing to supply. Memory chip prices begin declining. Analysts start issuing warnings about the sustainability of current profitability levels. Tech stocks that benefited from the AI boom start to falter.

2027: Memory chip supplies normalize. Prices decline significantly. Profitability for Samsung, SK Hynix, and Micron compresses. Capital spending on AI infrastructure moderates as companies realize they've built enough capacity. Memory chip manufacturers start dealing with overcapacity.

2028 and beyond: The industry enters a new equilibrium. AI remains important, but it's no longer driving extraordinary demand growth. Memory chip prices return to historical normalized levels or lower. Tech companies focus on optimizing existing infrastructure rather than expanding it.

This timeline is speculative—the actual path could diverge significantly. But it's a plausible base case based on historical patterns and current indicators.

For consumers, the implication is clear: expect expensive tech in 2026, potentially more affordable tech in 2027-2028 as supplies normalize and prices decline.

Projected data shows an initial increase in memory chip prices, followed by a decline over the medium to long term. Businesses should adapt strategies accordingly. Estimated data.

Investment Strategy: How to Position Yourself

If you're an investor or a company making strategic decisions, how should you respond to Samsung's record profit forecast and the underlying supply dynamics?

For retail investors: Samsung and SK Hynix are likely to deliver strong results through 2026, but they might underperform thereafter as profitability compresses. Playing this cycle requires timing—buying when memory chip prices are elevated, selling before they normalize. This is market timing, which is notoriously difficult.

For enterprise customers: Lock in long-term contracts for memory chips and other critical components now, before supplies become tighter. If you're planning major infrastructure upgrades, do them in the next 6 months while you might still have negotiating leverage. After supplies tighten further, your leverage disappears.

For hardware manufacturers: Optimize your designs for lower memory requirements where possible. Negotiate aggressively with suppliers for long-term contracts. Consider vertical integration—building your own memory chip manufacturing capacity—if you're large enough. This sounds radical, but major cloud providers are doing it.

For startups and smaller companies: Accept that hardware costs are higher right now and build that into your financial models. Look for ways to reduce memory requirements through algorithmic optimization. Consider focusing on cloud-based services where you can pass infrastructure costs to end users.

The Bigger Picture: AI Infrastructure as Critical Infrastructure

Here's what's happening at a macro level: AI infrastructure is becoming critical infrastructure, like electricity or telecommunications. Governments are taking notice. Countries are investing in domestic chip manufacturing capacity for security reasons. Companies are treating AI infrastructure like a strategic resource.

Samsung's record profits are a symptom of this transition. Memory chips have moved from commodity components to strategic resources. Nations with manufacturing capacity (South Korea, Taiwan, United States) have leverage. Nations without manufacturing capacity (most others) are vulnerable to supply disruptions.

This is reshaping global economics and geopolitics. Companies and governments are making long-term strategic decisions based on semiconductor supply chain resilience. This will probably dominate tech industry dynamics for the next decade.

Samsung is well-positioned in this new environment. South Korea's dominance in memory chip manufacturing gives it enormous leverage. But leverage is only valuable if you can use it. Samsung's challenge is to balance maximizing short-term profits with maintaining customer relationships for the long term.

Raising prices 313% year-over-year feels great in the moment. But it also motivates customers to find alternatives, invest in their own manufacturing, or shift to competing products. Samsung is probably acutely aware of this dynamic.

Practical Takeaways: What You Should Do Now

If you're not an investor or strategist, what should you actually do with this information?

If you're shopping for electronics: Buy now if you were planning to buy anyway. Prices are going up through mid-2026. Waiting is likely to cost you more money, not less.

If you're responsible for IT infrastructure: Audit your memory chip purchases. Are you buying on long-term contracts (good) or on spot markets (bad)? If you're on spot markets, negotiate with your provider for contracts now while you still have leverage. Plan infrastructure upgrades for the next 6 months if possible.

If you're a business owner: Think about how supply chain constraints affect your operations. Can you redesign your products to require less memory? Can you negotiate better supplier contracts? Can you invest in redundancy to reduce supply chain risk?

If you're interested in investing: Do your homework before investing in chip manufacturers or companies dependent on chip supplies. The easy money in this cycle is probably behind us. The risk-reward is shifting.

If you're a technologist or engineer: Focus on efficiency. Can you write more efficient code that uses less memory? Can you architect systems that are less dependent on expensive components? In a resource-constrained environment, efficiency is valuable.

FAQ

What caused Samsung's record profit forecast?

Samsung's record $13.8 billion quarterly profit forecast is driven almost entirely by surging demand for memory chips from AI data centers. DRAM prices increased 313% year-over-year in Q4 2025, allowing Samsung to generate enormous profits from its semiconductor business. Approximately 17 trillion won of the 20 trillion won profit forecast comes from chip sales, making semiconductors the dominant profit driver for the company.

How high will memory chip prices go?

Analysts are predicting another 55-60% price increase this quarter on top of the existing 313% year-over-year increase. The exact ceiling depends on demand elasticity—at some price point, customers will start finding alternatives or reducing purchases. However, for AI infrastructure, the demand is relatively inelastic because there's no good alternative to memory chips. Prices will likely remain elevated through 2026 before normalizing in 2027-2028 as new manufacturing capacity comes online.

When will memory chip prices return to normal?

Realistic timeline: Memory chip prices will likely start declining in late 2026 or 2027 when new fabrication plants from Samsung, SK Hynix, and Micron start contributing meaningful volumes to the market. Prices probably won't return to 2023-2024 levels until 2028 or later. However, this timeline assumes demand doesn't collapse and manufacturing plants ramp on schedule, both of which are somewhat uncertain.

How will this affect PC and smartphone prices?

Consumer electronics prices will increase 10-25% in 2026 due to elevated memory chip costs. Smartphone prices might increase 10-20%, particularly for devices with higher memory configurations. PC prices could increase more substantially, 15-25%, because PCs use more memory than phones. Budget manufacturers might be hit harder than premium brands because they have less negotiating leverage with suppliers, as noted by IDC analysts.

Why can't Samsung just increase manufacturing capacity faster?

Building a new semiconductor fabrication plant takes 4-6 years from announcement to volume production and requires $10-20 billion in capital investment. You can't simply flip a switch and increase capacity overnight. Equipment must be custom-designed and manufactured. Staff must be trained. Quality control protocols must be established. Even with aggressive timelines, new plants won't contribute meaningfully to global supply before 2027-2028.

Is the AI infrastructure spending boom sustainable?

That's the critical question, and the answer is uncertain. Major cloud providers are spending over $300 billion on AI infrastructure, but the ROI timeline is long and unpredictable. If AI adoption plateaus or if companies realize they've built enough capacity, spending could moderate significantly. Memory chip demand could soften faster than analysts expect, potentially causing prices to decline and manufacturers to face overcapacity by 2027-2028, similar to previous semiconductor cycles.

Who benefits most from elevated memory chip prices?

Large companies with manufacturing scale and purchasing leverage (Microsoft, Google, Amazon) can negotiate favorable long-term contracts despite elevated prices. Medium-sized companies and startups that lack leverage pay spot market prices, which are significantly inflated. Consumers and smaller businesses are worst off, facing higher prices for products that depend on memory chips. This concentration of advantages could accelerate consolidation in tech industries, benefiting the largest players.

Should I buy electronics now or wait?

If you're planning to purchase electronics anyway, buy within the next 6 months. Prices will likely increase through mid-2026 before potentially declining in late 2026 or 2027. Waiting 6 months will almost certainly result in higher prices, not lower. The only exception is if you can wait until late 2026 or 2027 when new manufacturing capacity starts normalizing supply and prices begin declining. If you're willing to wait 18 months, you might see better prices than buying now.

Conclusion: Understanding the Memory Chip Boom and Its Implications

Samsung's record profit forecast isn't just corporate earnings news. It's a window into a fundamental shift happening in the global economy. AI infrastructure has become critical infrastructure, and the companies that control the supply chains that support AI have enormous leverage.

Memory chips went from commodity components to strategic bottlenecks in the span of about 18 months. This happened because demand for AI infrastructure increased faster than the industry could expand manufacturing capacity. This gap between supply and demand creates the conditions for elevated pricing and record profits.

But this situation is inherently temporary. Either demand will moderate (as companies realize they've built enough capacity and shift to optimization), or supply will increase (as new manufacturing plants ramp production). Most likely, both will happen simultaneously. Over the next 2-3 years, memory chip prices will decline significantly, profitability for chip manufacturers will compress, and the industry will settle into a new equilibrium.

For consumers and businesses, the implication is clear: expect higher electronics prices through mid-2026, potentially moderating in late 2026 and declining in 2027-2028. If you're making significant hardware purchases, do it sooner rather than later. If you're making strategic infrastructure investments, do them now while you still have negotiating leverage.

For investors, this cycle presents both opportunity and risk. The easy money in the AI boom is probably behind us. The real money will go to investors who can time the transition from the supply-constrained phase (elevated prices, strong profitability) to the normalized supply phase (declining prices, compressed profitability).

This is how semiconductor cycles work. They've followed this pattern for decades. We're probably somewhere around the peak of this particular cycle. The smart move is to position yourself accordingly.

Preparing Your Business for Memory Chip Price Changes

If you're a business decision-maker, here's a practical framework for responding to memory chip supply dynamics:

Immediate (Next 3 months):

- Audit current memory chip supply contracts

- Identify which products and services are memory-constrained

- Calculate the impact of a 50% increase in memory chip costs on your margins

- Contact suppliers to understand contract terms and lock-in options

Near-term (3-12 months):

- Negotiate long-term contracts at current or fixed prices if possible

- Identify cost reduction opportunities (more efficient code, better architectures)

- Plan product refreshes for times when supply might normalize

- Build strategic relationships with multiple suppliers

Medium-term (1-2 years):

- Monitor spot market prices and new manufacturing announcements

- Plan major infrastructure investments for late 2026 or 2027 when prices start declining

- Consider vertical integration or internal manufacturing if you're large enough

- Develop supply chain diversification strategies

Long-term (2+ years):

- Prepare for a return to normalized memory chip pricing

- Position products for a price-competitive environment

- Invest in efficiency and innovation as differentiation factors

- Think about how this cycle shapes competitive dynamics in your industry

The companies that manage this transition well will gain advantage. The companies that get caught by surprise will struggle.

Related Technologies and Ecosystem Changes

Memory chip constraints are affecting the broader semiconductor ecosystem in interesting ways. Manufacturers are innovating in adjacent areas to work around memory limitations.

Edge AI and on-device processing are becoming more important because processing data locally reduces memory requirements compared to sending everything to a cloud data center. This is driving demand for specialized chips that optimize local AI inference.

Chiplet architecture (breaking processors into smaller, specialized components) is gaining adoption because it allows manufacturers to optimize for specific use cases rather than creating monolithic chips. This could help reduce memory requirements and manufacturing complexity.

New memory technologies like HBM (High Bandwidth Memory) are being developed to provide more bandwidth with less capacity, allowing systems to achieve similar performance with fewer memory chips. This is expensive now but could become more mainstream as manufacturers scale production.

Software optimization is becoming more valuable as hardware becomes more constrained. Companies are investing heavily in making their software more efficient, which reduces memory requirements and costs.

These trends will shape the tech industry for years. The memory chip supply constraint is accelerating innovation in all of these areas.

This comprehensive analysis shows that Samsung's record profit forecast is a symptom of deeper structural changes in the tech industry. Memory chips are now critical infrastructure. Supply constraints and elevated pricing will persist through 2026 before normalizing. Smart investors and business leaders are positioning themselves for this transition now.

The window for action is closing. Supplies are tightening. Prices are rising. In another 6 months, your leverage to negotiate favorable contracts will have declined significantly. Make decisions now based on this understanding of the cycle.

That's the real story behind Samsung's record profits. It's not just good corporate news. It's a fundamental shift in how global technology infrastructure works.

Key Takeaways

- Samsung projects record $13.8 billion quarterly profit, with 85% driven by semiconductor sales amid AI infrastructure demand

- DRAM prices increased 313% year-over-year in Q4 2025, expected to rise another 55-60% this quarter as supply cannot meet demand

- Memory chip shortages are forcing manufacturers to choose between higher prices or reduced production, both damaging to consumer electronics

- New fabrication plants from Samsung, SK Hynix, and Micron won't reach volume production until 2027-2028, meaning elevated prices persist through 2026

- Consumer electronics including PCs and smartphones will cost 10-25% more in 2026, with normalization expected in late 2026 or 2027

- Companies with purchasing leverage (Microsoft, Google, Amazon) can negotiate favorable contracts; smaller companies pay inflated spot market prices

- This semiconductor cycle will likely peak in 2026 before declining as supply increases and AI infrastructure spending moderates

Related Articles

- AMD at CES 2026: Lisa Su's AI Revolution & Ryzen Announcements [2026]

- Samsung TV Price Hikes: AI Chip Shortage Impact [2025]

- DDR5 Memory Prices Could Hit $500 by 2026: What You Need to Know [2025]

- Nvidia's Upfront Payment Policy for H200 Chips in China [2025]

- AI Factories: The Enterprise Foundation for Scale [2025]

- AMD Instinct MI500: CDNA 6 Architecture, HBM4E Memory & 2027 Timeline [2025]

![Samsung AI Chip Boom Drives Record $13.8B Profits [2025]](https://tryrunable.com/blog/samsung-ai-chip-boom-drives-record-13-8b-profits-2025/image-1-1767980374817.jpg)