Introduction: A Landmark Partnership in AI Development

When Apple announced its partnership with Google to power Siri and future AI features using Gemini models, the technology industry took notice. This wasn't just another vendor agreement—it represented a significant shift in how Apple approaches artificial intelligence development and deployment. For years, Apple built its reputation on vertical integration, controlling every aspect of hardware and software from device design to operating system functionality. Yet here was the company, publicly acknowledging that it would leverage Google's foundational AI models to enhance experiences across its ecosystem.

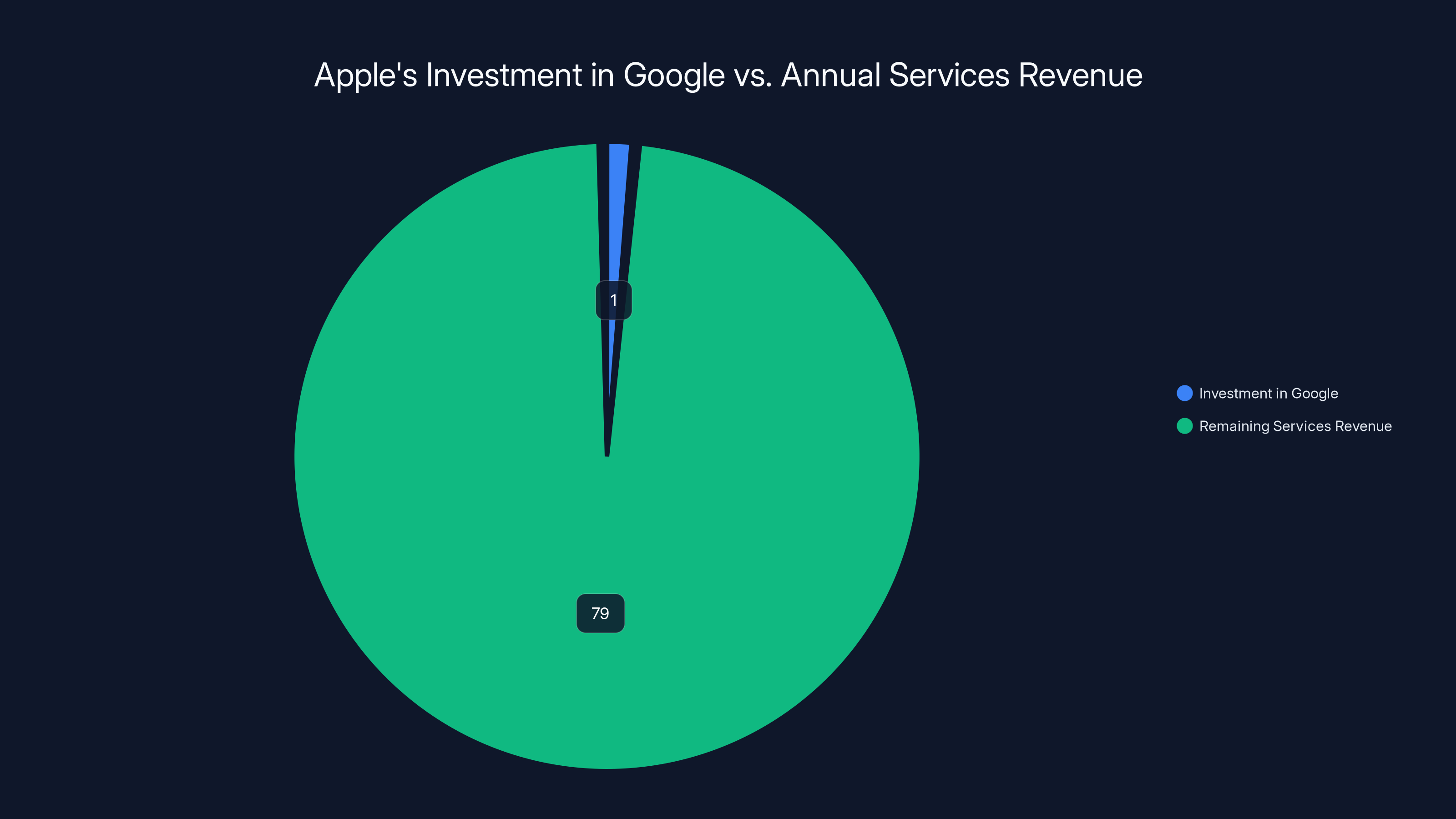

The partnership, confirmed in early 2026, marks a crucial inflection point in the AI arms race. Apple reportedly invested around $1 billion for access to Google's technology, signaling the company's serious commitment to competitive AI capabilities. This wasn't a decision made lightly. Apple evaluated competitors including OpenAI and Anthropic before selecting Google's Gemini as the foundation for its next-generation AI experiences.

What makes this partnership particularly noteworthy is its scope and duration. The multi-year, non-exclusive agreement encompasses not just Siri improvements but the entire foundation of Apple's future AI models. This means Gemini technology will underpin features across iOS, macOS, watchOS, and other platforms. For developers building on Apple platforms, this partnership signals significant implications for how AI capabilities will evolve and what tools will be available for integration.

The stakes extend far beyond product updates. Google faces multiple antitrust lawsuits, and this partnership could influence regulatory decisions around data sharing and market competition. For Apple, the partnership represents pragmatism—acknowledging that catching up on AI required external expertise rather than continuing to invest in proprietary solutions that lagged competitors. For consumers and developers, it promises smarter Siri interactions, more capable AI-powered features, and a foundation for future applications.

This article provides a comprehensive analysis of the Apple-Google partnership, examining what it means for the technology landscape, how it affects developers, what it signals about enterprise AI strategy, and what alternative solutions exist for organizations evaluating similar partnerships.

The Strategic Context: Why Apple Needed External AI Partners

Apple's Historical AI Challenges

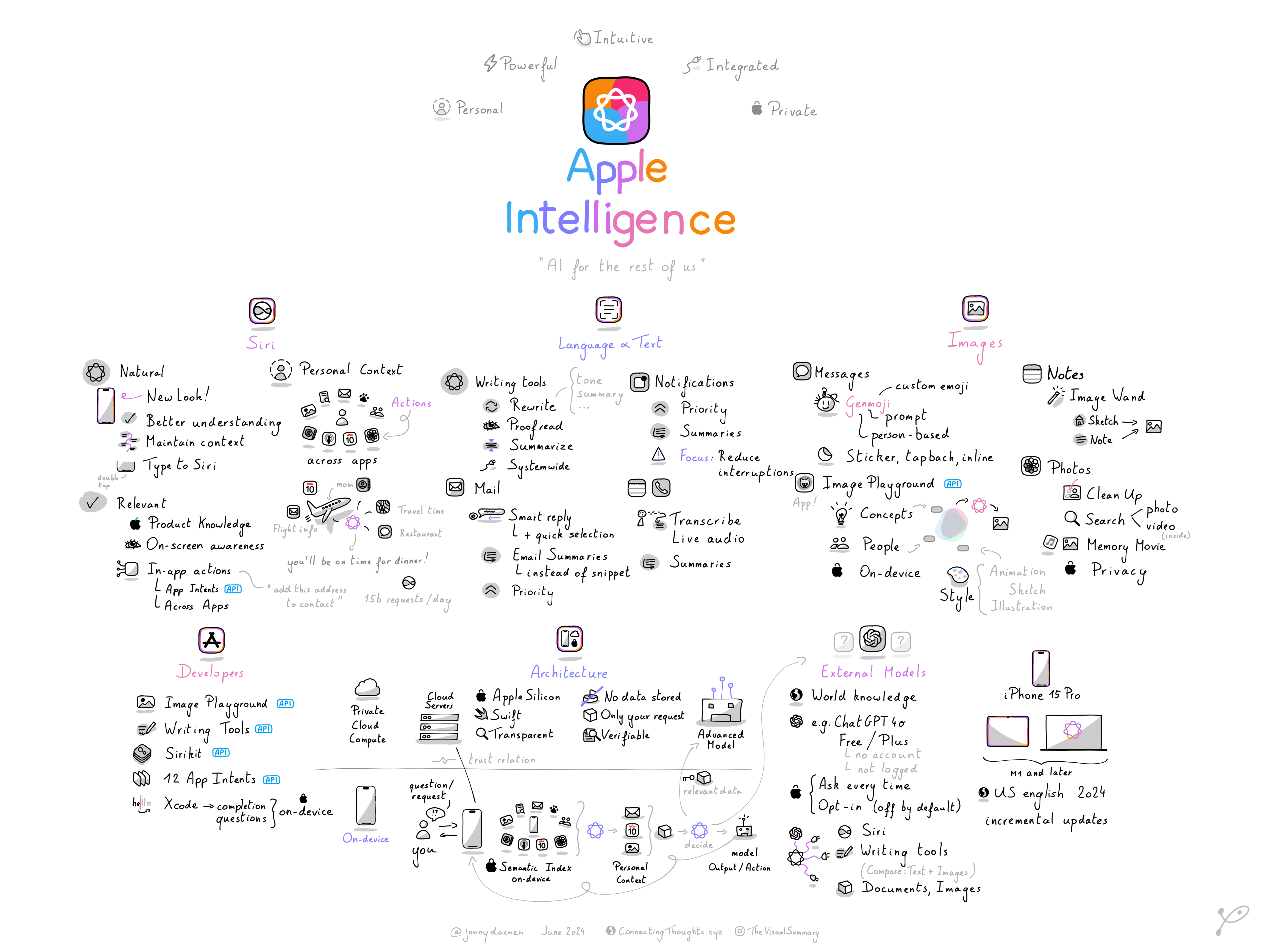

Apple's journey into artificial intelligence has been unconventional compared to other tech giants. While companies like Google invested heavily in machine learning infrastructure from the search engine era and Microsoft developed deep ties to AI research through partnerships with OpenAI, Apple took a more cautious, privacy-first approach. The company developed Apple Intelligence in 2024, a framework emphasizing on-device processing and user privacy. This differentiation strategy proved compelling in marketing but limited the sophistication of features Apple could offer.

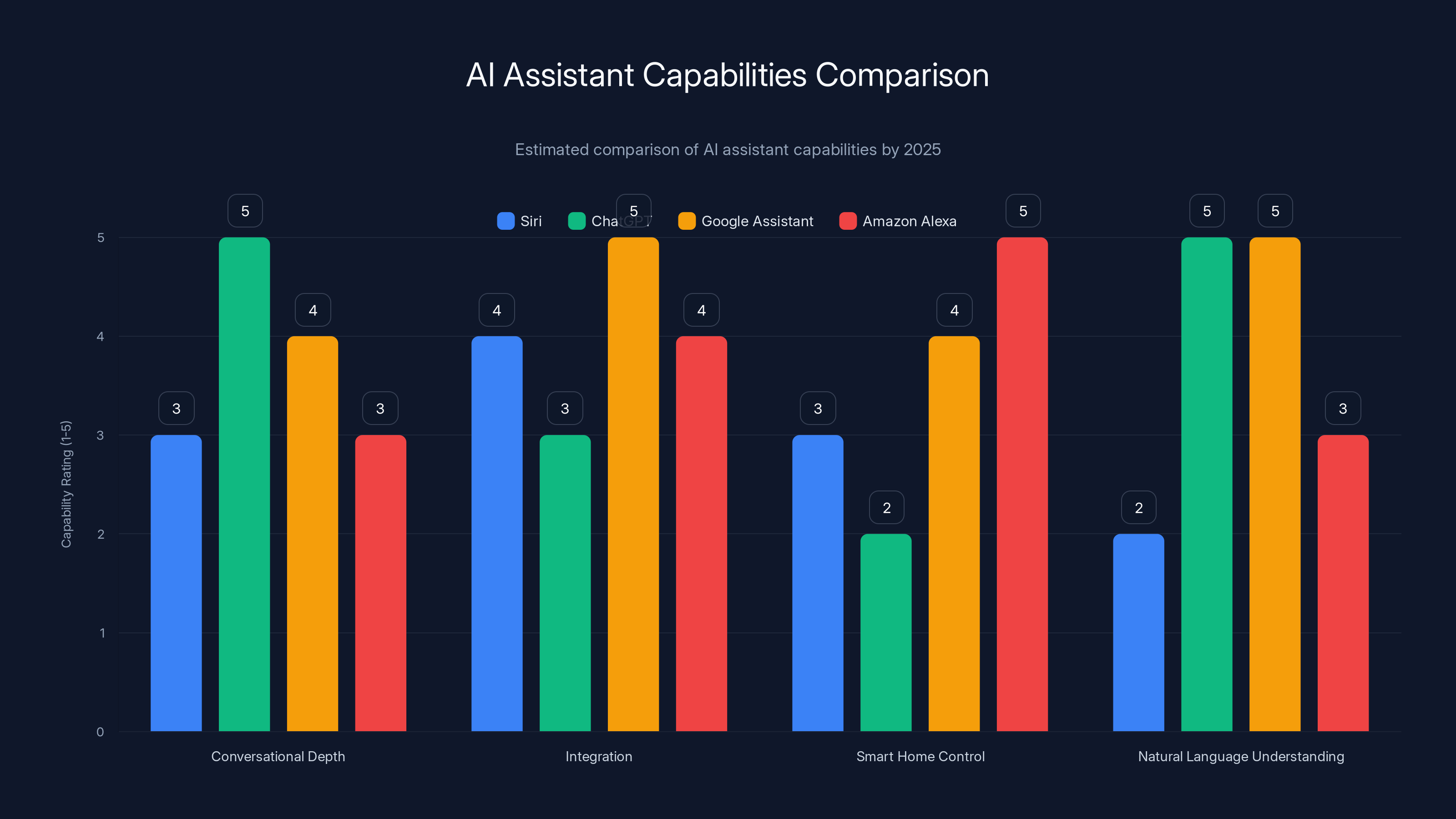

Siri, Apple's virtual assistant, became a case study in technological stagnation. Launched in 2011, Siri was revolutionary for its time, but by 2024-2025, it had fallen significantly behind competitors. ChatGPT offered conversational depth and reasoning capabilities that Siri couldn't match. Google Assistant integrated seamlessly with Google's search capabilities and knowledge graph. Amazon's Alexa controlled smart home ecosystems with sophistication. Meanwhile, Siri struggled with basic natural language understanding, often misinterpreting queries or requiring awkwardly specific command structures.

The public criticism was relentless. Technology journalists and users pointed out that despite Apple's vaunted engineering prowess, Siri remained frustratingly limited. The assistant couldn't engage in genuine conversation, struggled with complex requests requiring reasoning, and frequently had to fall back to web searches or screen reading. This gap between Apple's brand promise of innovation and its actual assistant capabilities created a credibility problem that became harder to ignore as competitors accelerated their AI capabilities.

The Privacy vs. Capability Tradeoff

Apple's emphasis on privacy—with features processed on-device or through encrypted channels—created a technical constraint that company leadership hadn't fully appreciated. Building genuinely capable foundational models requires massive datasets and computational resources. While Apple had access to billions of devices, it restricted the data it could use for training purposes due to privacy commitments. This self-imposed limitation meant Apple's models lagged behind those trained on more expansive datasets.

The company faced a genuine dilemma: maintain strict privacy standards and offer limited AI features, or relax constraints and risk alienating users concerned about privacy. Google's approach—leveraging massive search data and user behavior signals—allowed it to build more capable models. Apple couldn't replicate this without fundamentally changing its privacy positioning. This technical and philosophical incompatibility between Apple's values and the requirements for leading-edge AI became increasingly apparent as generative AI matured.

External Evaluation and Decision Process

Apple didn't rush into the Google partnership. Company leadership conducted extensive evaluations of potential partners, testing technology from OpenAI (creator of ChatGPT), Anthropic (focused on AI safety), and others. This evaluation process provided valuable competitive intelligence. By comparing how different companies' models performed on Apple's specific use cases, Apple's engineering teams understood exactly what capabilities they needed and which partners could deliver.

OpenAI likely received serious consideration, given ChatGPT's consumer popularity and capabilities. However, OpenAI's reliance on cloud infrastructure and Microsoft's involvement may have created complications. Anthropic offered sophisticated AI aligned with safety principles, but the company was still proving its scalability. Google presented a clear advantage: proven track record at massive scale, existing cloud infrastructure through Google Cloud, established privacy compliance frameworks, and a foundation in search technology that naturally complemented Apple's needs.

The decision signals that Apple's leadership pragmatically chose capability over internal development purity. Rather than continuing to invest in internal foundational models that would take years to reach competitive parity, Apple opted to partner with a proven leader and focus internal resources on integration, on-device optimization, and user experience design.

Apple's

Unpacking the Partnership: Technical and Commercial Architecture

What Gemini Brings to Apple's Ecosystem

Google's Gemini family of models represents the company's most advanced AI offering. Available in multiple variants (Gemini Ultra, Gemini Pro, Gemini Nano), these models excel at reasoning, code generation, multimodal understanding (text, images, audio), and real-time interaction. For Apple's purposes, the partnership likely focuses on Gemini Pro and custom variants optimized for Apple's specific requirements.

The technical benefits are substantial. Gemini's reasoning capabilities enable Siri to handle multi-step requests that previously required multiple turns of conversation. When a user asks Siri to "remind me to call my doctor to discuss the test results from the health app," a more capable Gemini-powered assistant can understand the full context, extract relevant information from multiple apps, and create a properly contextualized reminder. This moves Siri from a command-response interface to something approaching a genuine intelligent agent.

Multimodal capabilities are equally important. Gemini understands images, text, and audio equally well. This means Siri can help users search photos by describing scenes ("show me pictures from the beach trip"), understand documents, and process audio context. For on-device optimization, Google can provide smaller Gemini Nano variants optimized for specific tasks, reducing the computational burden on iPhones and Macs.

The Cloud Infrastructure Component

The partnership explicitly includes Google Cloud technology, not just the Gemini models themselves. This is significant because it means Apple will use Google Cloud infrastructure for features requiring cloud processing. Apple maintained its privacy position, with sensitive data processed on-device when possible, but certain features—like training personalized models or accessing broader knowledge—will route through Google Cloud.

This arrangement creates interesting architectural considerations. Apple will establish direct connections between its devices and Google Cloud, potentially using dedicated infrastructure or Virtual Private Cloud setups to minimize exposure. Data governance agreements likely include strict limitations on how Google can use Apple's data—critical given the companies' competitive relationship in search.

The cloud infrastructure piece also enables continuous improvement. Rather than waiting for OS updates to deploy new capabilities, Apple can push improvements through cloud endpoints. This allows for rapid iteration and fixes without requiring users to update their entire operating system, a significant operational advantage.

On-Device vs. Cloud Processing Strategies

The technical implementation will balance on-device processing with cloud capabilities. Simple requests—setting reminders, controlling smart home devices, basic information retrieval—will process entirely on-device using optimized Gemini Nano variants. This preserves privacy and reduces latency. More complex requests requiring broader knowledge or personalization will route to the cloud with proper encryption and anonymization.

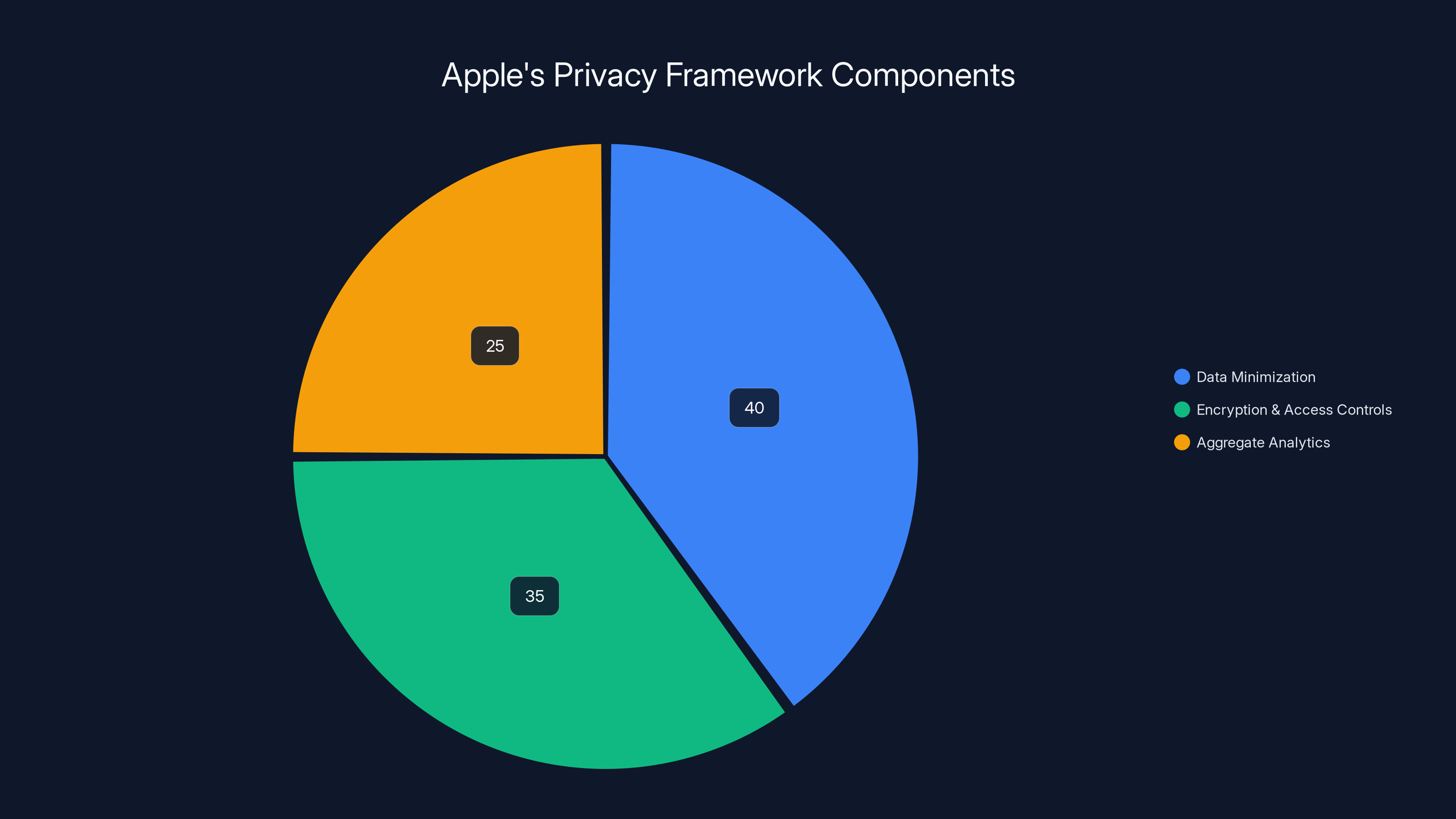

Apple's historical privacy commitments mean the company will implement techniques to minimize what cloud services can learn from user interactions. Techniques may include differential privacy (adding noise to prevent individual user identification), federated learning (training models on-device and only sharing model updates), and aggregated analytics rather than individual event logging.

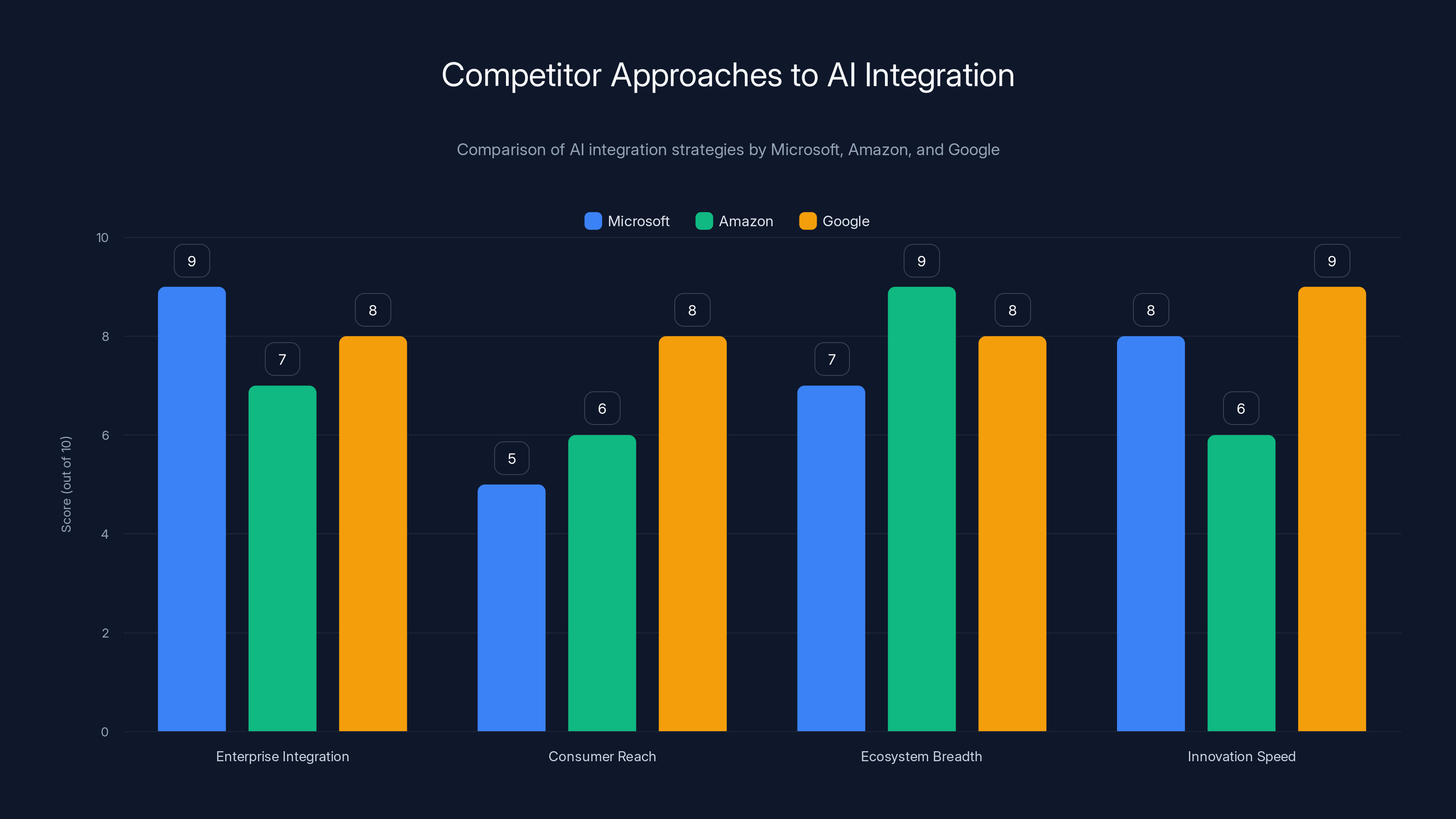

Microsoft excels in enterprise integration with OpenAI, while Amazon leads in ecosystem breadth with Alexa. Google shows balanced strength across all aspects. Estimated data based on strategic insights.

Implications for Siri and User-Facing Features

The Siri Overhaul

The Siri enhancement promised for spring 2026 represents the first major consumer-facing manifestation of the partnership. Rather than incremental improvements, Apple plans a comprehensive overhaul leveraging Gemini's capabilities. The new Siri will understand context across conversations, maintain memory of user preferences and previous interactions, and handle genuinely complex multi-step requests.

Examples of enhanced Siri capabilities would include: understanding references to previously discussed topics ("what did I say about that restaurant?"), executing sequences of actions across apps ("add those song recommendations to my playlist, then increase my Apple Music subscription"), and providing nuanced advice by understanding personal context ("should I take this job offer given my current schedule?").

The conversational quality will improve dramatically. Rather than Siri's current stilted, command-like interaction pattern, users will experience natural dialogue. Siri will ask clarifying questions, offer multiple options, and explain reasoning rather than simply executing commands or returning search results. This transformation addresses years of user frustration and positions Siri as genuinely useful rather than a novelty feature.

Beyond Siri: System-Wide AI Features

The partnership extends far beyond voice assistance. Apple Intelligence features across iOS, macOS, and other platforms will gain sophistication. Photo search, notification summarization, writing assistance, and intelligent suggestions will become more contextually aware and capable. The integration means these features won't feel bolted-on but rather deeply woven into the operating system experience.

Document understanding will improve significantly. Apple users will be able to upload photos of receipts, documents, or handwritten notes, and have Gemini help extract information, answer questions, or summarize content. This has practical applications for productivity, finance tracking, and information management.

Creative tools will benefit from multimodal capabilities. Image generation, audio processing, and video understanding become possible through Gemini integration. Apple can offer these capabilities while maintaining control over sensitive implementation details through the partnership structure.

Privacy Considerations and Transparency

Apple must navigate careful messaging around the partnership. Users who appreciate Apple's privacy positioning might worry about Google's involvement. The company will need to transparently communicate which data routes through Google Cloud, how it's protected, and what controls users have. This transparency is essential for maintaining the trust that has been central to Apple's positioning.

Apple's historical approach—allowing users to opt out of Siri and disabling it entirely—will likely continue. Users uncomfortable with cloud processing can disable new Siri features and use simpler local functionality. This opt-in approach to cloud-powered features respects user preferences while enabling innovation for those willing to trade some privacy for capability.

The Business Model: How Apple Compensates Google

The Reported $1 Billion Investment

News reports indicated Apple would pay Google approximately $1 billion for access to Gemini technology and cloud infrastructure. While neither company confirmed this specific figure, the magnitude makes sense in context. This represents a one-time or multi-year licensing fee rather than per-query charges, aligning incentives around long-term partnership success rather than usage metrics.

For perspective, this investment is substantial but manageable for Apple's economics. Apple's annual services revenue exceeds **

Google's perspective differs. The company gains a billion-dollar contract while positioning Gemini as the chosen foundation for the world's largest premium device ecosystem. This validates Google's AI strategy and creates future expansion opportunities. As Gemini matures and Apple integrates it more deeply, the relationship could evolve into larger arrangements.

Non-Exclusive Arrangement Implications

The partnership being non-exclusive matters significantly. Apple isn't locked into exclusive reliance on Google, and Google isn't locked into exclusive partnership with Apple. This flexibility allows both companies to maintain competitive positioning and explore other partnerships as technology evolves.

For Apple, non-exclusivity means the company can still develop internal foundational models, potentially complementing Gemini for specific use cases. Apple might eventually move some features to internal models as those mature. This preserves strategic optionality and prevents over-dependence on a single external partner.

For Google, non-exclusivity prevents Apple from leveraging the partnership to demand preferential treatment in other areas—particularly relevant given ongoing antitrust scrutiny. The company can honestly claim the partnership doesn't create exclusive lock-in, supporting its legal position against antitrust claims.

Long-Term Revenue Dynamics

The multi-year structure suggests Apple and Google mapped out a 3-5 year arrangement (likely longer). This provides stability for both parties but also creates the question of evolution as technology advances. If Gemini capabilities reach a plateau while competitors introduce next-generation models, will Apple consider alternatives? Similarly, if Apple develops competitive internal models, will the partnership need renegotiation?

The arrangement likely includes provisions for capability benchmarking and performance guarantees. Google probably committed to maintaining minimum standards of model performance and availability, while Apple committed to specified usage levels and data sharing.

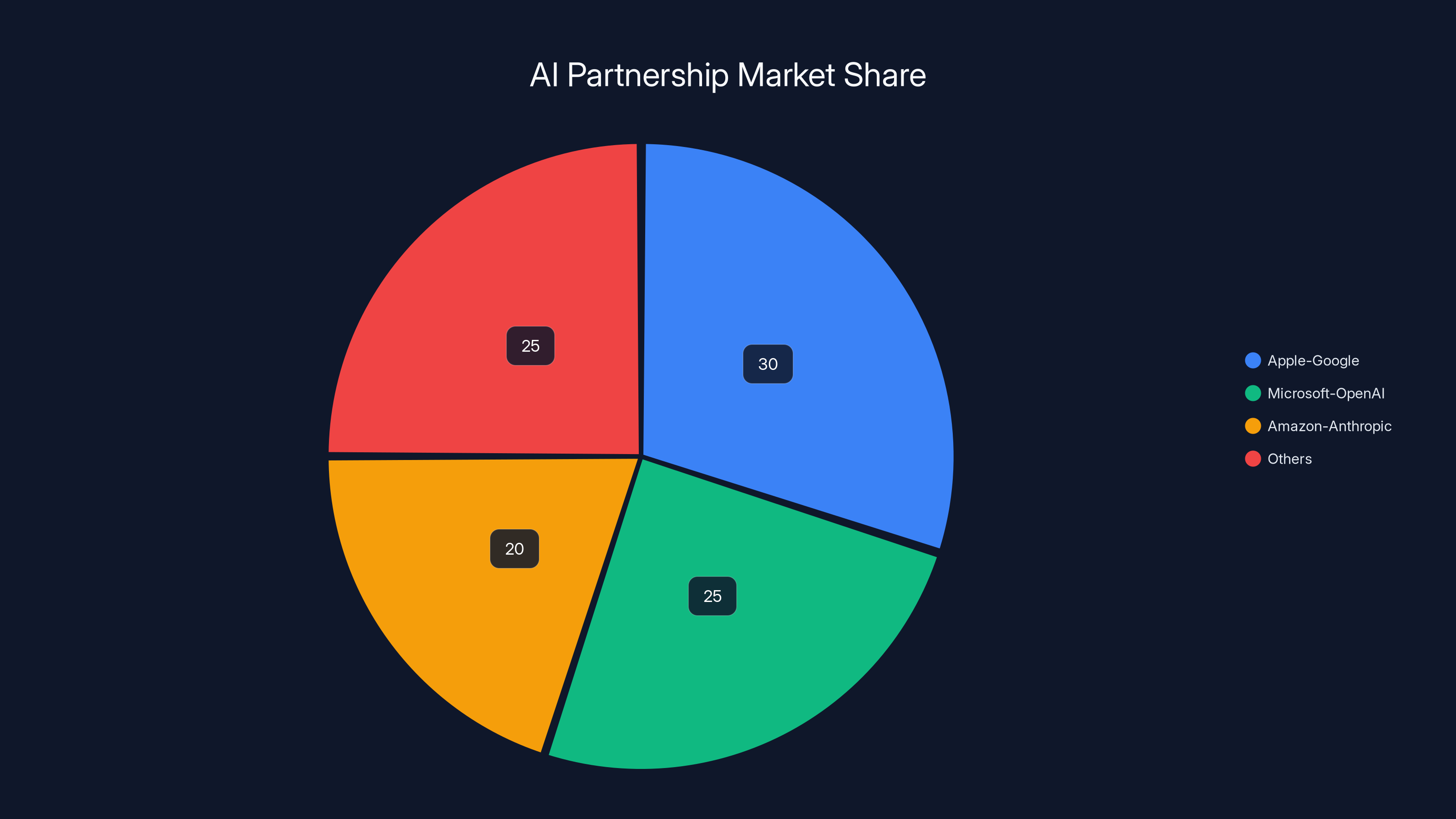

Apple's partnership with Google is estimated to capture 30% of the AI partnership market share in 2026, reflecting its strategic move to enhance AI capabilities. Estimated data.

Antitrust and Regulatory Implications

The Broader Context of Google's Legal Challenges

The partnership announcement comes amid significant antitrust scrutiny. In August 2024, a federal judge ruled that Google acted illegally to maintain search dominance by paying Apple (and others) billions to set Google as the default search engine. Between 2021 and 2022 alone, Google paid Apple approximately $38 billion for default search placement. These payments created dependency and reduced competitive pressure from other search engines.

In December 2025, Judge Amit Mehta issued final remedies, banning Google from exclusive default agreements (they must terminate within one year). This restricts Google's historical strategy of locking in default placements through massive payments. The timing of the Gemini partnership—occurring as these restrictions were being finalized—creates interesting questions about whether the AI partnership represents a shift toward more genuine collaboration versus simply replacing one form of dependence with another.

Regulatory Scrutiny of the AI Partnership

Regulators and antitrust experts will examine whether the partnership circumvents or sidesteps antitrust concerns. Specifically, questions will include: Does the partnership create new lock-in mechanisms? Does it give Google unfair advantages in AI competition? Does it harm other AI companies seeking to partner with Apple? Does it involve problematic data sharing arrangements that advantage Google's competitive position?

The non-exclusive nature of the deal helps mitigate some concerns. By explicitly stating Apple can work with other AI partners, the companies signal they're not creating exclusive arrangements that would restrict competition. However, regulators might examine whether being "Gemini-first" in Apple's integration strategy gives Google an advantage even without formal exclusivity.

Data governance will receive particular attention. If the partnership involves Apple sharing user data with Google beyond what's necessary for providing services, regulators will likely challenge it. The companies will need to demonstrate robust data minimization, encryption, and separation—ensuring Google's competitive teams don't benefit from Apple user data obtained through the partnership.

International Regulatory Considerations

Beyond U.S. antitrust law, the partnership faces scrutiny under the Digital Markets Act (DMA) in Europe and similar frameworks globally. The DMA requires companies designated as "gatekeepers" to provide fair terms to competitors and not abuse their market position. Apple, as a gatekeeper platform, must ensure the partnership terms don't unfairly disadvantage competing AI providers seeking to integrate with iOS or macOS.

This likely means Apple will need to document that other AI providers received fair consideration, that terms offered to Google aren't preferentially better than terms offered to other providers, and that the partnership doesn't create technical barriers to competitors. Maintaining detailed documentation of the partnership terms and selection process provides crucial legal protection.

Enterprise and Developer Implications

Impact on App Developers and Third-Party AI Integration

For developers building on Apple platforms, the partnership creates both opportunities and questions. On the opportunity side, Siri improvements and enhanced on-device capabilities provide hooks for app integration. Apps can leverage improved Siri understanding to offer better voice control. Apps can use on-device AI features for faster, more private processing of user content.

However, developers also worry about potential disadvantages. Will Apple grant itself better access to Gemini capabilities than it grants third-party developers? Will Apple's own AI-powered features (like improved email summarization or photo search) out-compete third-party services? Historical patterns suggest Apple integrates best-of-breed third-party functionality into the OS over time, potentially commodifying market segments where third-party developers compete.

Apple's positioning through App Store terms will matter significantly. The company must provide clear policies on whether third-party developers can integrate Gemini through the same channels as Apple, whether there are preferential terms Apple receives, and how conflicts are resolved when Apple's native features compete with third-party AI services.

Enterprise AI Strategy Signals

The partnership signals important lessons for enterprise organizations evaluating AI partnerships. Apple, despite world-class engineering and resources, recognized that partnering with a specialized AI leader made more sense than continuing internal development. This validates a hybrid approach: companies should develop AI capabilities aligned with core competencies while partnering with specialized providers for foundational technology.

For enterprises, this suggests evaluating AI partnerships based on complementary capabilities rather than requiring complete internal ownership. An organization strong in data engineering but lacking deep learning expertise might partner with AI providers for models while building internal expertise in deployment, privacy, and integration. This distributed approach often accelerates capability development compared to building everything internally.

Developer Expectations for API and SDK Support

Developers will anticipate clear APIs and SDKs for leveraging partnership capabilities. Apple will likely introduce new frameworks allowing apps to call Gemini-powered features in standardized ways. Expect developer documentation for voice interaction, on-device model access, and cloud capability invocation. These frameworks will enable apps to offer users consistent, integrated experiences.

Developers working on multimodal applications (combining text, image, and audio) will particularly benefit. They'll be able to use Gemini capabilities for understanding complex content without rebuilding these models themselves. This accelerates time-to-market for sophisticated AI applications while ensuring users experience consistent quality.

Apple's privacy strategy emphasizes data minimization (40%), followed by encryption & access controls (35%), and aggregate analytics (25%). Estimated data.

Competitive Landscape: How This Partnership Shifts AI Market Dynamics

Impact on OpenAI and ChatGPT's Position

OpenAI built its market position partly on Apple's default access to premium devices. ChatGPT became widely known among iPhone and Mac users, with integrations available through Siri and across iOS. The Gemini partnership creates direct competition for OpenAI's consumer positioning. Rather than being one AI option among several, ChatGPT becomes one of many competitors available through the Apple ecosystem.

This doesn't eliminate OpenAI's opportunity with Apple users—the company can still develop iOS apps and integrate through APIs. However, the default integration advantage disappears. ChatGPT will no longer have a privileged position but rather compete as an alternative users explicitly install. For OpenAI, this necessitates stronger product differentiation and deeper integration possibilities.

OpenAI's enterprise positioning remains strong, particularly with business customers and Microsoft integration. But in the consumer AI assistant space, the partnership shifts competitive dynamics meaningfully in Google's favor.

Anthropic's Challenges and Opportunities

Anthropic, focused on AI safety and alignment, likely hoped for Apple partnership consideration. The company's positioning around responsible AI development aligns well with Apple's privacy emphasis. However, Anthropic didn't win the partnership, suggesting Apple prioritized raw capability over philosophical alignment. For Anthropic, this signals that even sophisticated, well-funded AI startups struggle to compete with incumbents for large platform partnerships once the field matures.

Anthropic's opportunity lies in enterprise applications and specialized use cases where its safety-first approach offers advantages. Regulatory compliance, high-stakes applications (healthcare, legal), and organizations with strong governance requirements might prefer Anthropic over alternatives. The Apple partnership exclusion might even benefit Anthropic by clarifying that it competes on different dimensions than Gemini—safety, explainability, and alignment rather than raw capability.

Microsoft and Azure's Positioning

Microsoft's substantial investment in OpenAI (over $13 billion) and integration with Azure services positioned the company as the enterprise AI leader. The Apple-Google partnership doesn't directly threaten Microsoft's enterprise dominance, where Windows, Office, and Azure provide substantial advantages. However, in consumer AI and mixed-workload scenarios, the partnership strengthens Google's position relative to Microsoft.

For Microsoft, the partnership reinforces the importance of deepening Azure integration with OpenAI and potentially developing alternative partnerships. Microsoft must ensure that enterprise customers see clear advantages in Microsoft + OpenAI combinations compared to alternatives.

Smaller AI Providers and Specialized Solutions

The partnership consolidates the AI market around two dominant players—Google and Microsoft. Smaller AI providers focused on specific domains (e.g., healthcare AI, financial modeling, creative tools) face pressure to differentiate rather than compete on foundational models. Successful smaller providers will likely focus on specialized capabilities, better domain understanding, or superior user experiences for specific use cases.

The partnership also highlights the increasing importance of scale. Building competitive foundational models requires massive computational resources, extensive datasets, and significant expertise. Barriers to entry are rising, making it harder for new competitors to emerge unless they secure substantial capital or develop genuinely novel approaches.

Technical Architecture Deep Dive: On-Device vs. Cloud Processing

Gemini Nano: Edge AI on Apple Devices

For on-device processing, Apple will use Gemini Nano, Google's smallest model variant optimized for edge computing. Nano variants are purpose-built for devices with limited computation and memory, running efficiently on smartphone processors. These models sacrifice some of the reasoning and knowledge breadth of larger variants but still provide substantial capabilities for local processing.

Gemini Nano enables features like real-time photo understanding, local text processing, and voice interaction without cloud connectivity. Users can use Siri features while offline, ask questions about photos in their library, and receive real-time suggestions based on device-local data. Apple's advantage here is optimization—the company can customize Nano models specifically for iPhone architecture, potentially achieving better performance than generic mobile AI implementations.

Quantized versions reduce model size further, using reduced-precision numerics that maintain reasonable accuracy while dramatically lowering memory requirements. A quantized Gemini Nano model might consume only a few gigabytes on disk—manageable even for users with limited storage. This makes sophisticated AI capabilities accessible on lower-end iPhone models, not just premium devices.

Gemini Pro: Cloud-Powered Advanced Features

For complex requests requiring broader knowledge or personalization, Apple will route to Gemini Pro running on Google Cloud. These larger, more capable models excel at reasoning, writing, and understanding nuance. Cloud processing enables features that would be impractical on-device due to computational requirements.

The cloud processing path will be carefully architected for privacy. Apple likely implements end-to-end encryption—encrypting requests on the device before transmission, decrypting responses only after receiving them back. This ensures Google's cloud infrastructure processes encrypted queries without access to unencrypted user data. Implementing this correctly requires sophisticated cryptographic engineering but provides genuine privacy protection.

Apple might also implement differential privacy techniques, adding noise to queries before encryption to prevent individual user identification even if cloud logs were compromised. For example, if a user asks "what should I cook for dinner?", Apple might aggregate the request with thousands of similar queries before sharing patterns with Google's infrastructure. This prevents Google from identifying specific user requests.

Network Architecture and Data Flow

The physical data flow architecture matters for both performance and privacy. Rather than routing all requests through standard Google APIs, Apple likely negotiated dedicated infrastructure—possibly VPC (Virtual Private Cloud) endpoints or dedicated networks within Google Cloud. This isolation prevents the requests from mixing with general-purpose Google infrastructure where they might influence Google's search algorithms or commercial services.

Data residency requirements likely specify that Apple user data doesn't leave certain geographic regions without explicit consent. European users might have data processed exclusively in EU data centers to comply with GDPR. This adds complexity to Apple's architecture—requiring multi-region deployment and sophisticated request routing.

Latency and Performance Optimization

For user experience to remain responsive, latency must be minimized. Cloud requests require network transmission, introducing minimum latencies of 100-500ms depending on network conditions. Apple will optimize by preprocessing requests locally, caching frequent queries locally, and using speculative execution—predicting likely requests and starting processing before users complete their queries.

For latency-sensitive features, Apple will maintain on-device processing exclusively. Conversely, for features where slight delays are acceptable (background processing, asynchronous responses), cloud processing is more viable. This careful architectural decision-making determines user experience quality.

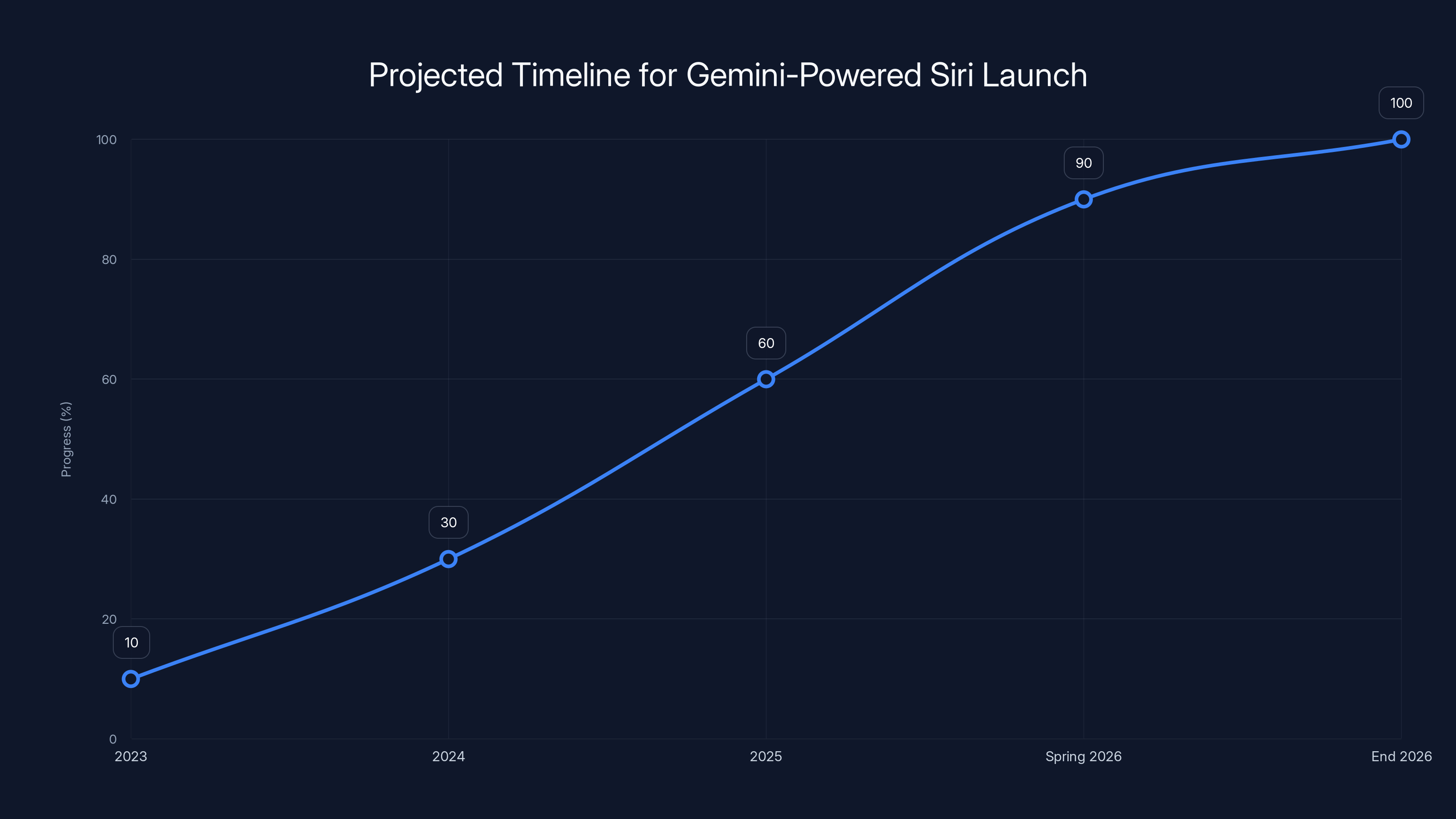

The integration of Gemini AI into Siri is projected to be fully realized by the end of 2026, with significant progress expected by spring 2026. Estimated data based on typical development timelines.

Privacy Framework: How Apple Maintains Its Privacy Promise

Data Minimization Strategies

Apple's commitment to user privacy requires strict data minimization—processing only essential information and limiting retention. In practice, this means on-device processing for sensitive personal data, aggregated analytics instead of individual event logging, and explicit deletion of processing artifacts once requests complete.

When a user asks Siri about health data from the Health app, that data processes locally and never transmits to Google. Only the processed result (e.g., "your average heart rate this week was 70 bpm") might be sent if the user requests cloud-powered follow-up analysis. This separation ensures medical data never touches external infrastructure.

Encryption and Access Controls

End-to-end encryption protects requests and responses during transmission. Apple encrypts the request on the device, sends the encrypted payload to Google Cloud, receives an encrypted response, and decrypts only on-device. Google's infrastructure never sees unencrypted user queries. This is technically sophisticated—requiring careful key management and cryptographic implementation—but provides genuine privacy protection.

Access controls limit which Google employees and systems can access processing infrastructure. Apple likely negotiates data access agreements specifying that Google's competitive teams (search, ads, business intelligence) have no access to Apple partnership data. These agreements are legally binding and subject to audit.

Aggregate and Anonymous Analytics

Apple collects anonymous usage analytics to improve systems—understanding which features are used most, where errors occur, which Siri requests fail. However, these analytics won't include personally identifiable information. Aggregated statistics ("90% of summarization requests complete within 2 seconds") provide valuable improvement signals without exposing individual user behavior.

Apple likely uses differential privacy—adding noise to aggregate data before sharing with Google—to prevent de-anonymization attacks. Even if Google received aggregated data, the added noise prevents reconstructing individual user information. This statistical technique enables system improvement while maintaining privacy.

User Transparency and Control

Apple will transparently communicate which features use cloud processing and allow granular control. Users can review and delete Siri history, see which data was shared in cloud requests, and disable cloud features if they prefer local-only processing. This transparency builds trust—users aren't surprised by data handling and maintain agency over their information.

Historically, Apple has allowed users to disable Siri entirely and prevents most Siri data from being included in iTunes backups. Expect similar controls for Gemini-powered features. Users uncomfortable with cloud processing can opt out, accepting reduced functionality in exchange for enhanced privacy.

Alternative Solutions: Exploring Competitor Approaches

Microsoft's OpenAI-Integrated Ecosystem

For organizations evaluating alternatives to Apple's approach, Microsoft's integration of OpenAI across Office 365, Azure, and Windows provides a distinct alternative. Rather than relying on a single partnership, Microsoft invested directly in OpenAI, creating deeper integration. Enterprise users gain access to GPT-powered features in Word, Excel, Outlook, and Teams, with Azure providing the underlying infrastructure.

Microsoft's approach emphasizes enterprise capabilities—security clearances, compliance certifications, detailed audit trails. For business users, this provides advantages over consumer-focused solutions. However, Microsoft's consumer positioning remains weaker than Apple's, limiting reach in the broader user market.

Amazon's Alexa and AWS Strategy

Amazon pursued a different path, developing Alexa as a voice-first assistant integrated with AWS services. Rather than partnering with a single foundational model provider, Amazon built its own machine learning capabilities supplemented by partnerships (including partnerships for advanced language understanding). This creates a comprehensive ecosystem where smart home devices, commerce, entertainment, and cloud services integrate around Alexa.

Amazon's advantage lies in ecosystem breadth—Alexa controls thousands of smart home devices, integrates with retail and music services, and provides unified access to AWS capabilities. However, Alexa's conversation quality hasn't reached parity with newer models, and Amazon's efforts to upgrade capabilities have been slower than competitors. Amazon may announce its own foundational model partnerships to compete more effectively.

Google's Internal Leverage: Bard to Gemini Evolution

Google took a different approach than Apple, developing Gemini internally and deploying it across its own products (Search, Gmail, Workspace, etc.) and increasingly through partnerships. Google didn't need external partnerships to build capability—instead, leveraging its vast search data, research expertise, and computational infrastructure. The company is now in the position to partner with other platforms from strength, offering proven technology to others.

For enterprises, this means Google provides both direct access (through Google Workspace, Cloud AI services) and partnership-based access (like Apple). Organizations can choose depth of integration based on their needs.

Meta's Open-Source and Partnership Model

Meta took yet another approach, developing Llama models and releasing them open-source. This creates a different competitive dynamic—Meta doesn't offer proprietary partnerships but rather allows anyone to use and customize its models. Organizations unwilling to depend on closed partnerships can deploy Llama. However, Llama hasn't reached parity with Gemini or GPT-4 in capability benchmarks, and Meta's smaller AI infrastructure limits continuous improvement capabilities.

Meta's approach works well for organizations that want to maintain control and avoid vendor lock-in, at the cost of requiring more internal expertise to optimize and deploy the models effectively.

Specialized Solutions: Domain-Specific AI

Beyond general-purpose foundational models, specialized AI solutions address specific use cases. Companies like Scale AI (data engineering), Cohere (customizable language models), or Hugging Face (open-source ecosystem) focus on specific problems rather than competing across the entire AI landscape. For organizations with specialized needs, these focused solutions often outperform general-purpose alternatives.

For developers and teams evaluating automation solutions, platforms like Runable offer practical alternatives for specific use cases. Runable provides AI-powered automation at $9/month, focusing on content generation (slides, docs, reports), workflow automation, and developer productivity tools. Teams seeking to automate routine content and documentation tasks might find Runable's specialized approach more cost-effective than building on general-purpose foundational models. Where Apple and Google focus on consumer-facing AI, Runable targets developer efficiency through AI agents—addressing different market segments with different economics.

By 2025, Siri lagged behind competitors in conversational depth and natural language understanding, highlighting Apple's need for external AI partnerships. Estimated data.

Implementation Timeline: What's Coming and When

Spring 2026: Siri Overhaul Launch

The first major consumer-facing manifestation of the partnership will arrive in spring 2026 with the Siri overhaul. This update represents the culmination of multi-year development efforts, combining Gemini capabilities with Apple's integration expertise. The new Siri will likely debut with iOS 18 or a significant update, requiring new iPhone models and potentially limiting availability on older devices depending on computational requirements.

Key features expected: context awareness across conversation turns, multi-step request handling, device control across smart home systems, and improved accuracy on complex natural language inputs. Apple will market the update as a dramatic improvement, positioning new Siri as fundamentally different from previous versions.

Summer-Fall 2026: Broader AI Feature Rollout

Following the Siri launch, Apple will introduce Gemini-powered capabilities across the broader OS. Photo search and organization improvements should arrive, leveraging multimodal understanding to identify content by description rather than metadata. Writing assistance features will enhance Mail, Notes, and Messages, helping users compose messages and documents more effectively.

Expect smart notifications—summaries of email threads, notification grouping based on context, and predictive feature suggestions. These represent powerful but subtle improvements that enhance daily productivity without the fanfare of major feature announcements.

2026-2027: Iterative Improvements and Expansion

Throughout 2026 and into 2027, Apple will refine capabilities based on user feedback and Gemini improvements. This period focuses on quality, reliability, and expanding feature scope. Apple might introduce new capabilities like real-time translation, document understanding, or creative tools as Gemini develops and as Apple finds new integration opportunities.

Expect developer APIs to stabilize, allowing third-party applications to leverage Gemini-powered features through documented frameworks. This opens opportunities for app developers to offer users consistent, integrated experiences.

Industry Precedent: Lessons from Past AI Partnerships

Google Glass and Strategic Technology Failures

Google's own history offers lessons. The company invested billions in Glass, a wearable computing project that failed to achieve consumer adoption. Despite sophisticated technology, Glass couldn't overcome user concerns about privacy, social acceptance, and practical limitations. The lesson: technology capability alone doesn't ensure market success. Apple and Google must ensure that users actually want the features being developed and feel comfortable with how they work.

For the Apple partnership, this suggests success requires not just technical capability but also user education, privacy transparency, and demonstrable value. Siri must become genuinely useful, not just technically impressive.

Microsoft's Bing AI Integration

Microsoft's integration of OpenAI technology into Bing represents a closer precedent. The company invested substantially, developed integrated search with AI capabilities, and promoted aggressively. Initial reception highlighted potential issues—the AI hallucinating information, providing problematic responses, and requiring significant refinement. This illustrates that integrating powerful AI into user-facing products requires careful quality control and iterative improvement.

Apple, learning from Bing's experience, will likely take a more measured approach—rolling out features gradually, monitoring quality closely, and being prepared to disable features that aren't meeting standards. The company's reputation for quality demands high bars.

IBM Watson and Enterprise AI Partnerships

IBM's Watson partnerships in healthcare and other domains showed that AI partnerships work best when both parties deeply understand domain requirements and can work collaboratively on optimization. Generic AI capabilities, without domain-specific customization, often underperform. This suggests Apple and Google will need deep collaboration on features, not just licensing Gemini as-is but customizing it for Apple's specific use cases and user populations.

Future Outlook: Evolution Beyond 2026

Potential Expansion of Partnership Scope

As the initial partnership matures, Apple and Google might expand scope. Today's focus on Siri and consumer features might eventually extend to enterprise tools, cloud services, or creative applications. Apple's growing Services business might benefit from Gemini integration in new ways—Apple TV+, Apple Music, Apple News could all leverage AI for personalization and recommendation.

Expansion might also involve infrastructure changes. Rather than simply licensing models, Apple might adopt more of Google's AI infrastructure technology, deepening dependency. Or conversely, as Apple's internal models improve, the partnership might shift toward selective feature licensing rather than foundational model reliance.

Potential Partnership Evolution or Replacement

The partnership's non-exclusive nature means Apple maintains optionality. As foundational models continue evolving, Apple might periodically evaluate alternatives. If OpenAI launches a more capable model, if Anthropic achieves breakthroughs, or if Apple's internal efforts reach competitive parity, the partnership terms might change.

This isn't a permanent lock-in but a pragmatic arrangement subject to evolution. Given competitive AI dynamics, both parties should expect periodic re-evaluation. However, switching costs and integration depth will create significant inertia—it's easier to update a partnership than to rip out deeply integrated technology.

Potential Regulatory Changes and Implications

Future antitrust enforcement, international regulation, or data privacy laws might reshape the partnership. Stricter data protection requirements would necessitate revised data-sharing arrangements. Antitrust remedies might impose new limitations on exclusive arrangements or preferential terms. International regulations might require localization of infrastructure or capabilities.

Apple and Google should anticipate these changes and design flexible systems that accommodate regulatory evolution. The partnership's success depends partly on maintaining regulatory approval across all jurisdictions where both companies operate.

Recommendations for Organizations and Developers

For Enterprise Decision-Makers

If your organization relies on Apple platforms and AI-powered features, understand the technical architecture and privacy framework. Request detailed information from your Apple account team about data handling, security controls, and compliance certifications. For regulated industries (healthcare, finance, government), ensure the partnership meets specific compliance requirements.

Consider multi-platform strategies rather than betting exclusively on Apple. While the partnership is substantial, it represents one approach among several. Evaluate Microsoft + OpenAI, Google Cloud + Gemini, and specialized providers to understand trade-offs and identify which combination best serves your organization's needs.

Planned technology roadmaps should anticipate AI capabilities arriving in Apple platforms through this partnership. If your apps currently offer functionality that Apple will subsume into the OS, begin planning how to differentiate before features become commoditized.

For App Developers

Prepare for Siri and AI integration APIs that Apple will likely announce following the 2026 launch. Document which features your apps currently offer that might conflict with or complement improved Siri. Design apps assuming users have access to more capable voice control—this might change how users interact with your app.

Consider where your app's data or capabilities could enhance Siri. Working with Apple's Siri framework (Intents, SiriKit) positions your app to integrate naturally with improved Siri. Developers who enable rich Siri functionality will create better user experiences and reduce user friction.

For AI-powered features you build, evaluate whether to use direct Gemini APIs (through potential future developer access), Apple's Siri capabilities, or alternative providers. Each approach involves trade-offs around control, cost, and user experience. Plan transitions as capabilities evolve.

For Privacy-Conscious Users

Apple will provide controls to disable cloud-powered features and process exclusively locally. If privacy is your primary concern, enable these restrictions and accept the trade-off of reduced capability. Understand what data Apple shares with Google by reviewing privacy settings and support documentation.

Regularly review your Siri and AI feature history through iOS settings. Apple provides tools to view and delete individual interactions. Use these tools to maintain agency over your data. Consider disabling personalization if you're uncomfortable with Apple building detailed profiles of your preferences and interactions.

Conclusion: The Significance and Broader Implications

The Apple-Google partnership represents a watershed moment in how large technology companies approach artificial intelligence. Rather than seeing AI as a competitive moat requiring total internal development, Apple pragmatically partnered with a leader, acknowledging that capability requires scale, data, and expertise beyond its immediate resources.

This partnership signals several important trends. First, foundational AI models are becoming commoditized—differentiation increasingly occurs through integration, user experience, and domain-specific customization rather than model architecture. Second, scale matters enormously in AI development, creating natural consolidation around companies with sufficient resources and data. Third, partnerships will define competitive strategy—companies combine their strengths while maintaining optionality through non-exclusive arrangements.

For consumers, the partnership promises meaningful improvements to AI-powered features within Apple's ecosystem. Siri will become genuinely useful rather than frustrating, and OS-level AI features will feel natural and helpful rather than gimmicky. Privacy protections, while requiring trust in both companies' intentions, should remain strong given Apple's historical commitment and explicit partnership agreements.

For developers, the partnership creates both opportunities and challenges. Siri improvements enable richer app integration, while OS-level AI features might commoditize some app functionality. Developers must differentiate through specialized capabilities, superior user experience, or domain expertise rather than relying on AI as a standalone feature.

For the broader technology industry, this partnership validates a hybrid approach to AI development. Companies don't require absolute self-sufficiency in AI to compete effectively. Instead, strategic partnerships, careful integration, and user-experience excellence create competitive advantage. This is good news for specialized AI companies, domain-specific startups, and organizations lacking Google or OpenAI's scale.

The partnership succeeds or fails based on execution over the next 2-3 years. If Siri becomes genuinely intelligent and helpful, if privacy frameworks prove robust, and if the feature integration feels natural, the partnership validates this approach for other companies. If privacy concerns emerge, if capabilities disappoint, or if regulatory challenges arise, the model becomes less attractive.

Ultimately, this partnership represents pragmatic reality: building everything internally is no longer competitive when specialized leaders exist. By combining Apple's user-experience expertise and platform reach with Google's AI capability and infrastructure, both companies strengthen their competitive positions. For users, this means better AI features delivered with appropriate privacy considerations. For the industry, this means expect more partnerships as companies recognize that competitive strategy increasingly requires orchestration across complementary providers rather than total internal control.

FAQ

What exactly is the Apple-Google partnership?

The partnership is a multi-year, non-exclusive agreement in which Apple uses Google's Gemini foundational AI models and Google Cloud infrastructure to power Siri and other AI features across Apple devices. Apple reportedly invested approximately $1 billion for access to this technology, enabling more capable voice assistance, on-device AI processing, and cloud-powered features while maintaining its privacy commitments.

How does Gemini power Apple's features differently from Siri's previous approach?

Previous Siri relied on Apple's proprietary machine learning models, which were comparatively limited in reasoning capability, conversational quality, and knowledge breadth. Gemini brings advanced natural language understanding, multi-step reasoning, context awareness, and the ability to handle complex requests that previously required multiple Siri turns. The new Siri can maintain conversation context, understand implicit references, and provide nuanced responses rather than simply executing discrete commands.

How does Apple maintain privacy with Google infrastructure involved?

Apple employs several privacy-preserving techniques: sensitive data processes on-device and never transmits to Google, requests to cloud services are end-to-end encrypted (Apple encrypts before transmission, Google processes encrypted data, Apple decrypts responses), differential privacy techniques add noise to aggregate analytics to prevent individual identification, and data access controls restrict Google teams' access to Apple partnership data. Users can also disable cloud features and restrict data sharing through device settings.

When will the Gemini-powered Siri improvements arrive?

The enhanced Siri with Gemini integration is expected to launch in spring 2026, likely arriving with a major iOS update. This represents the first major consumer-facing manifestation of the partnership. Subsequent updates throughout 2026-2027 will roll out additional AI-powered features across Photos, Mail, Notes, and other applications.

Could the partnership affect third-party app developers?

Yes, third-party developers will face both opportunities and challenges. Improved Siri opens better app integration possibilities through SiriKit frameworks. However, OS-level AI features might commoditize functionality some apps currently provide. Developers should focus on differentiation through specialized capabilities, superior user experience, and domain expertise rather than general AI features that Apple might subsume into the OS.

What does this partnership mean for the antitrust issues Google faces?

The partnership arrives as Google faces antitrust restrictions on exclusive arrangements. The non-exclusive nature of this partnership helps address regulatory concerns, though regulators will examine whether the arrangement creates new lock-in or gives Google unfair competitive advantages. Data governance and preventing Google's competitive teams from benefiting from Apple user data will be critical legal considerations in ongoing antitrust proceedings.

Why didn't Apple partner with OpenAI instead?

Apple evaluated multiple partners including OpenAI and Anthropic before selecting Google. Google likely won based on several factors: proven track record at massive scale, existing cloud infrastructure already integrated with Google services, established privacy and security frameworks, and comprehensive AI capabilities across text, image, and audio. OpenAI's reliance on cloud infrastructure and Microsoft's involvement may have complicated the arrangement.

Is this partnership exclusive or can Apple work with other AI companies?

The partnership is explicitly non-exclusive. Apple can work with other AI providers, and Google isn't locked into exclusive partnership with Apple. This flexibility allows both companies to maintain strategic optionality—Apple can develop internal models or partner with other providers as technology evolves, and Google can pursue partnerships with other platforms. However, Gemini will likely be the primary AI engine for Apple's ecosystem in the near term.

How much is Apple paying Google for this partnership?

Neither company officially confirmed the price, but reports indicated Apple would pay approximately

What are the main technical components of the partnership?

The partnership includes both Gemini foundational models and Google Cloud infrastructure. For on-device processing, Apple uses Gemini Nano—a smaller model variant optimized for efficient local operation. For complex requests requiring broader knowledge, Apple routes to Gemini Pro running on Google Cloud. The architecture balances privacy (local processing for sensitive data) with capability (cloud processing for sophisticated features).

How does this impact consumers who prioritize privacy?

Apple maintains privacy-first options. Users can disable cloud-powered Siri features and process queries entirely locally, accepting reduced capability in exchange for enhanced privacy. Apple provides transparency through settings showing which data was shared in cloud requests and allows history deletion. Users uncomfortable with any Google involvement can completely disable Siri and rely on local processing only, though this reduces functionality.

What alternatives exist for organizations uncomfortable with this partnership?

Organizations have several alternatives. Microsoft offers OpenAI integration across Office, Azure, and Windows with strong enterprise security. Amazon's Alexa provides voice intelligence integrated with AWS. Google Cloud offers direct Gemini access without platform lock-in. For specialized needs, domain-specific AI providers focus on particular use cases. Teams seeking developer-focused automation tools at lower cost might consider alternatives like Runable, which offers AI-powered content generation and workflow automation at $9/month—providing different economics for specific use cases rather than competing across the entire AI landscape.

Key Takeaways

- Apple partnered with Google for $1B to integrate Gemini AI models, acknowledging that competitive AI requires external partnerships and scale

- The multi-year, non-exclusive arrangement enables Siri overhaul launching spring 2026 with improved conversational ability, context awareness, and reasoning

- Technical architecture balances privacy (on-device processing with Gemini Nano) and capability (cloud processing with Gemini Pro) through encryption and data minimization

- Partnership faces antitrust scrutiny; non-exclusive terms and strict data governance help address regulatory concerns around lock-in and competitive fairness

- For developers, Siri improvements create integration opportunities while OS-level AI features may commoditize current app functionality, requiring differentiation strategy

- Alternative approaches exist: Microsoft's OpenAI integration, Amazon's Alexa strategy, Google's internal development, and specialized domain-specific AI providers serve different needs

- Organizations uncomfortable with Apple-Google partnership have multiple alternatives ranging from Microsoft Azure to open-source solutions to cost-effective automation platforms

Related Articles

- [2025] Empromptu Raises $2M to Revolutionize AI Apps

- Go-to-Market Strategies for the AI Era: Complete Guide [2025]

- NousCoder-14B: Open-Source AI Coding Model Guide & Alternatives 2025

- Lenovo ThinkPad Rollable XD: Features, Design & Laptop Alternatives

- AMD Ryzen AI 400 Series: Complete Guide & Developer Alternatives 2025

- Nvidia's AI Startup Investments 2025: Strategy, Impact & Alternatives