Go-to-Market Strategies for the AI Era: Complete Guide [2025]

Introduction: The Fundamental Shift in How Startups Win

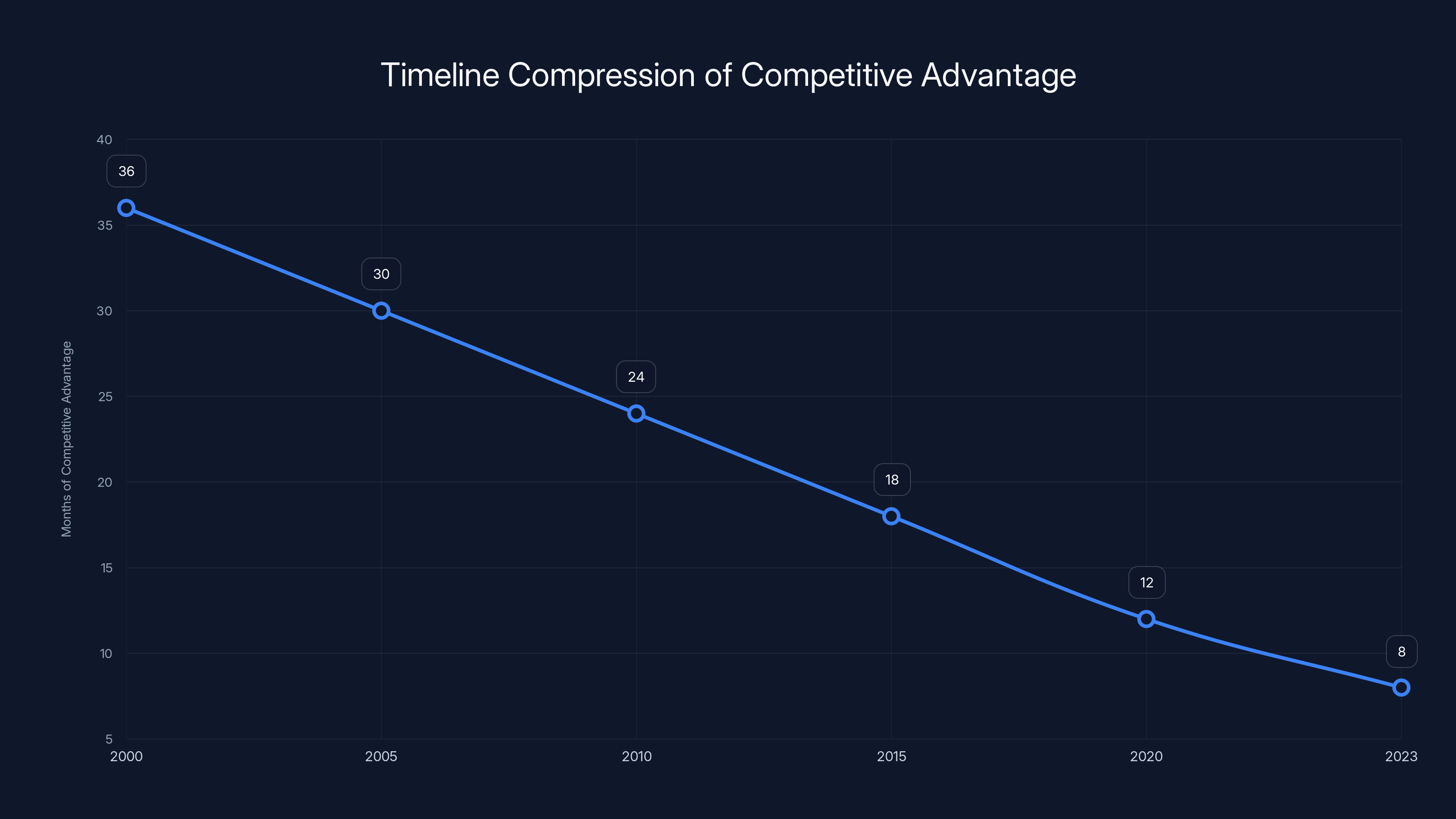

The landscape of go-to-market strategy has undergone a seismic transformation. Five years ago, a well-funded startup with a superior product and a six-month engineering advantage could dominate its market. Today, that same advantage evaporates in weeks. The technical moat—once the most defensible competitive advantage—has collapsed under the weight of rapidly advancing artificial intelligence and distributed engineering talent.

This collapse presents both a crisis and an unprecedented opportunity. The crisis stems from the brutal reality that product differentiation alone no longer guarantees market success. A competitor with adequate funding can match your technical features within weeks, not months. The opportunity emerges from a counterintuitive truth: as technical advantages compress, the companies that win are those who master distribution and customer relationships at unprecedented scale and personalization.

We're entering an era where the final remaining moat isn't engineering excellence—it's strategic distribution combined with authentic relationship-building amplified by AI-driven precision. The ability to reach the right customer at the right time with the right message, at scale, has become the ultimate competitive differentiator.

This comprehensive guide explores actionable go-to-market strategies designed specifically for the AI era. We'll examine why channel focus matters more than channel diversity, how AI enables personalization at scale, the mechanics of warm-introduction mapping, and the psychological principles that drive startup success when capital is abundant but attention is scarce. Whether you're building a developer tool, enterprise software, or AI infrastructure platform, these strategies apply across verticals.

The fundamental question facing every founder today is no longer "Can we build a better product?" but rather "How do we systematically reach our ideal customers, understand their problems deeply, and position our solution as indispensable to their growth?" This guide answers that question through frameworks, methodologies, and real-world patterns that separate unicorns from acquihires.

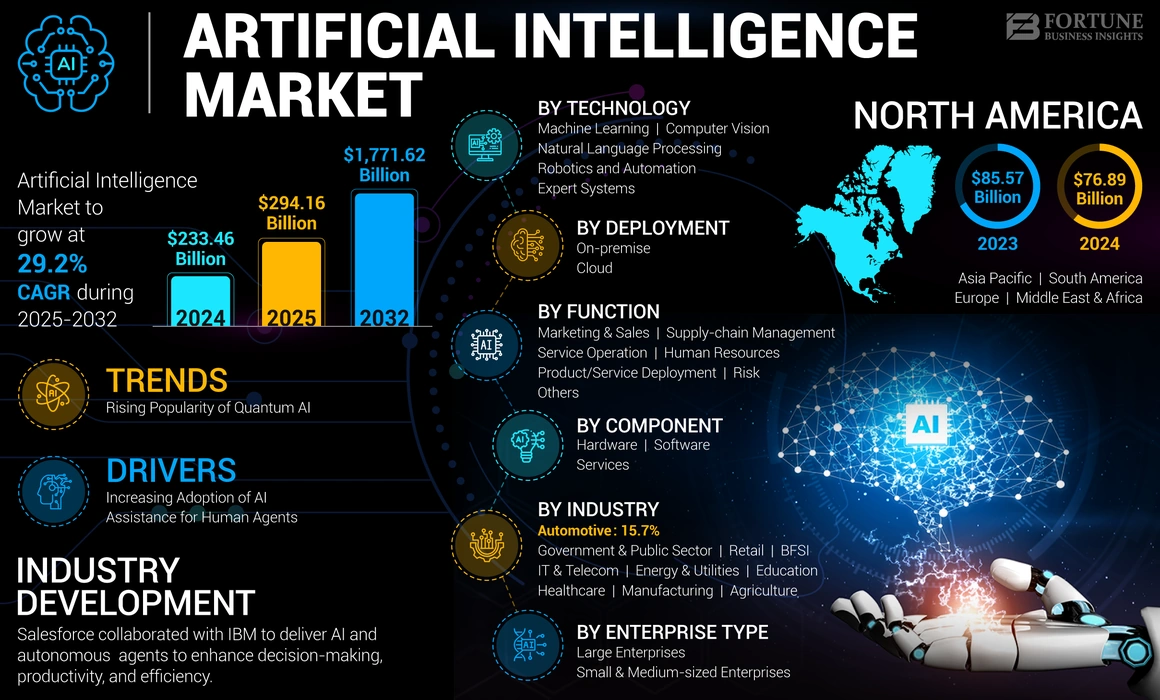

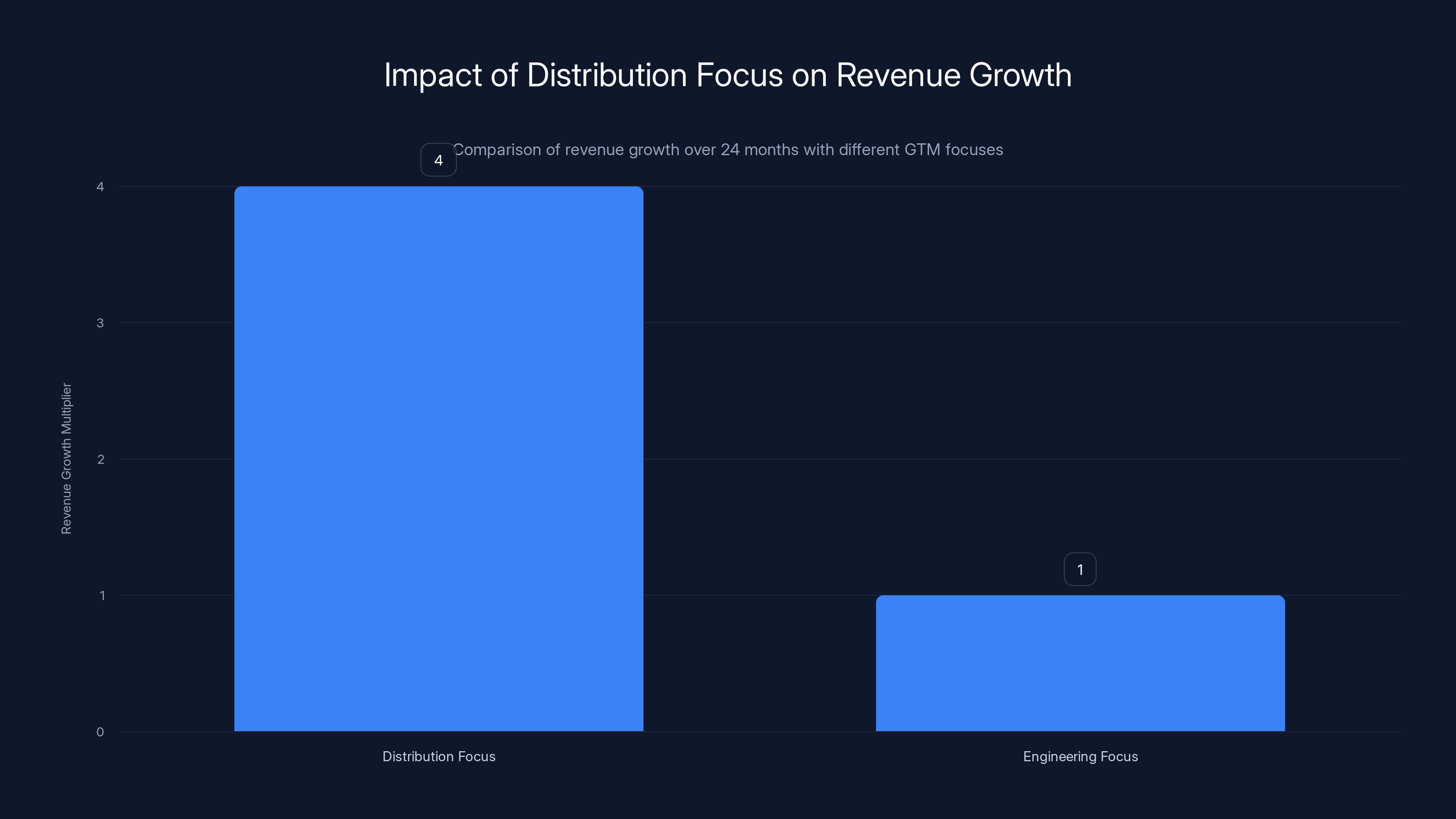

Companies focusing on distribution alongside product development can achieve 3-5x more revenue growth over 24 months compared to those focusing purely on engineering. (Estimated data)

The Collapse of Technical Moats: Why Distribution Now Dominates

Understanding the Timeline Compression

Historically, a company with superior engineering could sustain competitive advantage for 18-36 months before competitors replicated core features. This created a window—sometimes long enough for an entire market category to emerge and consolidate. Today, that window has compressed to 8-16 weeks.

Several factors drive this acceleration. First, the availability of large language models and pre-built AI components means engineers can implement sophisticated features without pioneering novel architectures. Second, the open-source ecosystem has matured to the point where most infrastructure problems have validated solutions. Third, talent dispersion—enabled by remote work and global recruitment—means technical talent no longer concentrates in singular geographic hubs. A well-funded competitor anywhere can hire senior engineers anywhere.

The compression creates a psychological shift among founders. Many respond by obsessing over feature velocity and engineering excellence—the competitive factors they can control and understand. But this response is precisely backward. Excellence in execution becomes table stakes rather than a differentiator. The founders who win are those who accept that technical parity is inevitable and shift their energy to the one area competitors cannot easily replicate: authentic customer relationships and distribution channels refined through deep market understanding.

Why Distribution Became the Final Moat

Distribution as a moat operates through several mechanisms. First, established channels create network effects. A sales team with relationships in your target industry becomes more valuable with time, not less. Their reputation, trust, and understanding of customer problems compound. Second, distribution reveals information asymmetry. Your distribution team learns what competitors are doing, what customers actually want versus what they claim to want, and which segments are expanding or contracting. Third, distribution enables rapid feedback loops that inform product decisions—creating a flywheel where market understanding feeds better product decisions, which feed customer satisfaction, which feeds distribution growth.

Consider the contrast between two hypothetical companies: Company A invests 80% of its resources in engineering and 20% in sales and marketing. Company B invests 50% in each. Company A will ship features faster. Company B will understand its market faster, reach customers faster, and iterate based on real feedback rather than internal hypotheses. Over 24 months, Company B's continuous advantage in customer understanding typically generates 3-5x the revenue of Company A, despite A's technical superiority.

Distribution moats also create switching costs. Once customers have integrated your solution into their workflows and your sales team understands their specific operational constraints, the cost to switch increases exponentially. Not just the software switching cost, but the relationship-rebuilding cost with a new vendor.

The Channel Focus Principle: Mastering One or Two GTM Channels

Why Multi-Channel Approaches Fail

Conventional startup wisdom suggests diversification: build presence on LinkedIn, Twitter, product forums, industry conferences, outbound sales, partner channels, and content marketing. Spread the net wide and something will catch. This approach has become conventional precisely because it's intuitive—and intuitive approaches are often the most dangerous in competitive environments.

The fatal flaw of the multi-channel approach is resource dilution coupled with message degradation. When a founding team divides attention across ten channels, they can't achieve mastery in any single channel. More importantly, each channel has distinct norms, communication styles, and expectations. A LinkedIn outreach message that resonates with CTOs looks completely different from a Twitter thread that attracts indie developers. A conference sponsorship strategy differs fundamentally from a community-building strategy. The cognitive load of context-switching between ten parallel initiatives—each with its own metrics, feedback loops, and optimization vectors—exceeds what most early-stage teams can manage.

The result is mediocrity across all channels. The LinkedIn outreach is generic enough to apply to hundreds of personas, reducing response rates. The Twitter presence feels inauthentic because posting consistency and personality are interrupted by other channel demands. The content marketing stalls because consistent publishing requires deep focus. The conference strategy underperforms because attendees sense hesitant engagement rather than confident expertise.

Moreover, multi-channel strategies obscure learning. If you're running ten parallel acquisition experiments simultaneously, you can't isolate what's working and why. Did your conversions increase because of your new email sequence or because enterprise buyers happen to be evaluating solutions this quarter? Without channel isolation, you're flying blind.

The One-Two Channel Strategic Approach

The companies that dominate—especially in the AI era—ruthlessly focus on one or two channels where they can achieve mastery and where their target customer actually spends attention and builds trust.

The first step is channel-customer matching: mapping where your ideal customer profile actually discovers solutions. This isn't where you hope they look. It's where they demonstrably spend time making buying decisions. A B2B infrastructure company's CTO doesn't buy new tools because of Twitter—she discovers them through GitHub, technical communities, or recommendations from other CTOs. An enterprise compliance officer doesn't discover solutions through indie hacker forums—she discovers them through regulatory updates, peer networks, and industry events.

Channel-customer matching requires research. Interview your ideal customers directly: "When you last evaluated a solution in this category, where did you look? Who influenced your decision? What communities do you trust?" Document patterns. If you hear "I check GitHub" from 70% of respondents and "I read industry blogs" from 40%, those are your primary channels. If only 15% mention Twitter, it should not be a focus area.

Once you've identified your primary channels, dedicate 70% of your GTM resources to achieving mastery in one, and 20-30% to testing a secondary channel. This concentration enables several advantages. First, you develop genuine expertise. You understand not just the mechanics of the channel but the culture, unwritten rules, and authentic way to participate. Second, you build authority. Consistent, valuable contribution in a focused channel builds reputation faster than scattered contribution across ten channels. Third, you collect feedback from a concentrated audience, enabling rapid iteration. The 50 high-quality conversations you have in your primary channel teach you more than 200 generic interactions across ten channels.

Real-World Channel-Customer Matching Examples

Developer tools companies typically dominate through GitHub and technical communities (Discord, Slack communities, Hacker News). The customer research for these companies consistently reveals that developers discover tools, evaluate quality, and make decisions within these ecosystems. A developer tools company that invests heavily in traditional B2B sales channels is fighting against their customer's natural discovery process.

Enterprise security companies find that their ideal customers—CISO and security teams—congregate in professional associations, industry conferences, and peer networks. A security startup that focuses on content marketing or social media is optimizing for the wrong channel. Their customer is attending conferences, participating in professional groups, and taking recommendations from peers. The GTM strategy should reflect this reality.

API infrastructure companies discover that their users are engineering teams adopting new technologies. These teams evaluate tools through technical documentation, GitHub activity, and recommendations within engineering communities. The most effective GTM for these companies combines excellent technical documentation (optimized for developer search) with consistent engagement in developer communities and technical events.

The pattern that emerges: the companies that grow fastest in competitive environments are those whose GTM channels align with their customer's natural buying process, not the channels that marketing theory suggests.

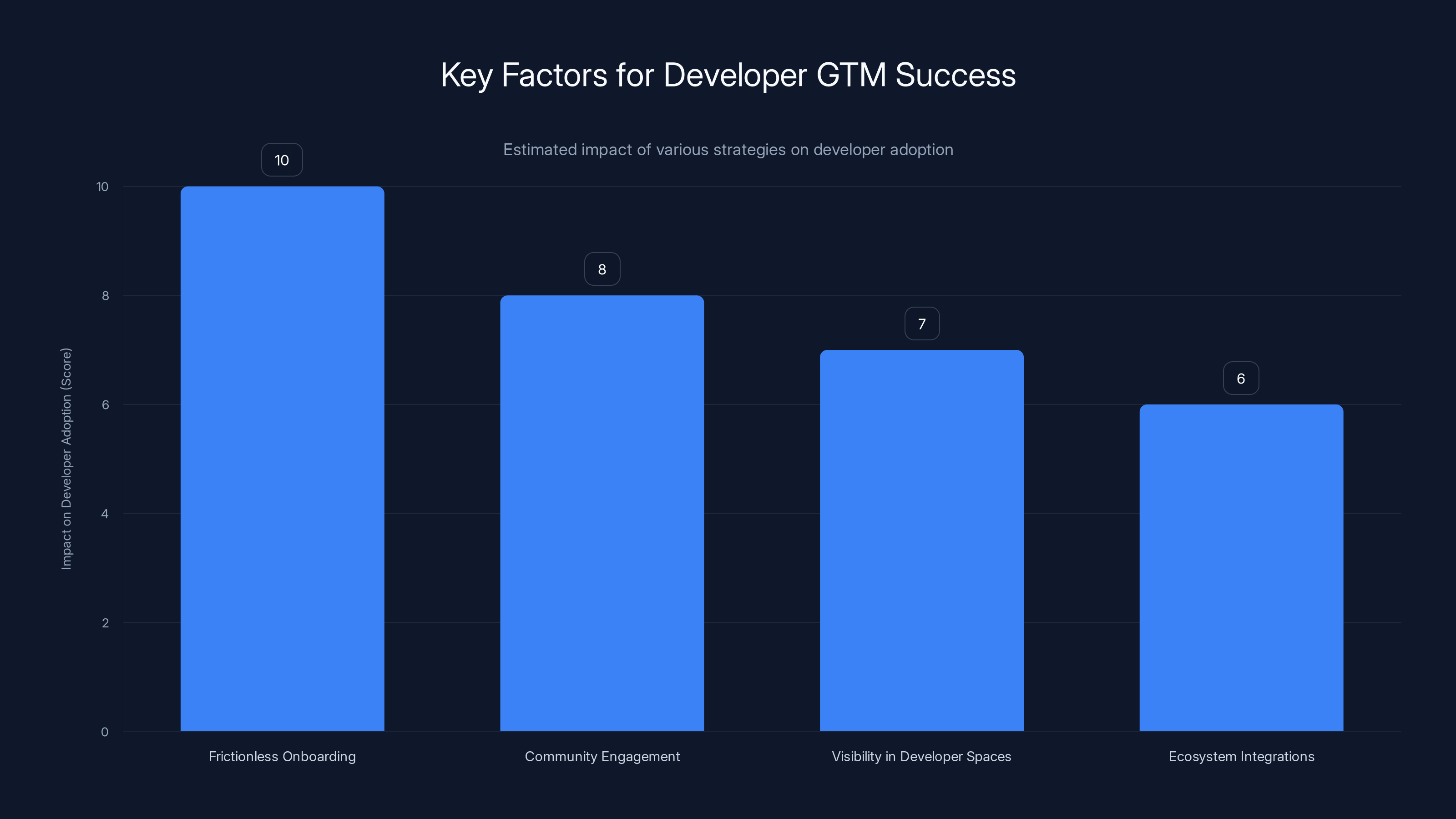

Frictionless onboarding has the highest impact on developer adoption, potentially increasing it by 10x compared to competitors. (Estimated data)

AI-Powered Precision in Customer Outreach and Segmentation

Moving Beyond Demographic Segmentation

Traditional customer segmentation relies on demographic criteria: company size, revenue, industry, geography. These categories are easy to measure but increasingly meaningless. A 500-person fintech company has entirely different technical needs than a 500-person manufacturing company. These demographic peers have almost nothing in common regarding their pain points, buying processes, or GTM receptiveness.

AI enables what we might call "behavioral-intent segmentation"—understanding customers not by who they are but by what they're actually trying to accomplish and what signals indicate they're ready to solve a specific problem. This requires analyzing behavioral data at scale: what public GitHub repos does a company's engineering team maintain? What technologies do they publicly adopt? What conference talks have their engineers given? What problems are they discussing in public forums? What job postings are they running? What recent funding did they raise?

AI systems can process these signals from hundreds of potential customers in the time it takes a human to manually research five. More importantly, AI can weight these signals according to probability of receptiveness. A company that just raised a Series A and is hiring data engineers and published three papers on machine learning is statistically more likely to be interested in an ML infrastructure solution than a company of similar size operating in the same industry that shows no such signals.

Personalization at Scale Through AI-Driven Messaging

Historically, personalization operated at two extremes. Generic outreach achieved scale but suffered from low response rates. Highly personalized outreach achieved reasonable response rates but required so much human effort that it only worked for high-value enterprise accounts. AI enables a third mode: personalization at scale.

The mechanism works through several steps. First, AI analyzes your ideal customer profile and reverse-engineers the signals that indicate strong fit. Second, for each prospect in your target list, AI gathers publicly available information about their company, technology stack, recent hires, funding, public statements, and competitive positioning. Third, AI generates a personalized outreach message that references specific, relevant details from this prospect research—creating the feeling of personal attention at machine scale.

The psychological mechanism is powerful. A founder receives an email that mentions their recent Series B fundraise, references a specific technical challenge they discussed at a conference, and proposes a solution that directly addresses their likely implementation roadmap. This message feels different from a template email. It signals that someone did research, understood their specific situation, and believed the solution mattered enough to warrant careful attention. Response rates increase by 3-5x compared to generic outreach.

What makes this AI-powered approach different from manual research is the scalability. A human could craft this level of personalization for 20 prospects per week, perhaps 1,000 per year. An AI system can do it for 10,000+ per year while learning and improving the personalization framework as it accumulates results.

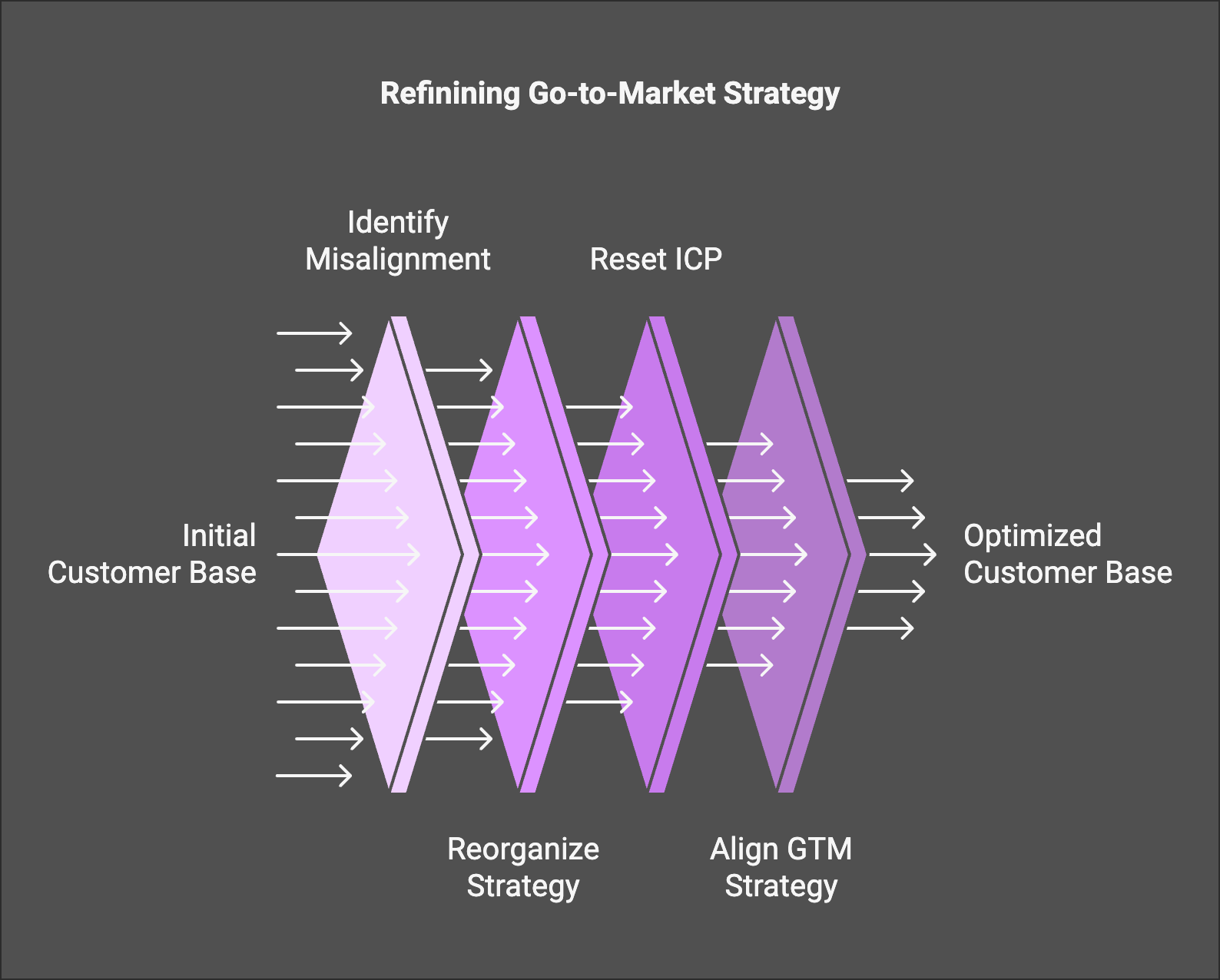

Building Ideal Customer Profile Intelligence

The quality of AI-powered segmentation and personalization depends entirely on the clarity of your Ideal Customer Profile (ICP). A vague ICP—"mid-market SaaS companies in the financial services space"—produces vague personalization. A sharp ICP—"Series B-funded fintech companies with 50-300 employees that have built custom data infrastructure and are expanding their data science teams"—produces sharp, relevant outreach.

Building a defensible ICP in the AI era requires continuous data analysis. Analyze the companies where you have the strongest customer relationships. What do they have in common? It's not just industry or size. Look deeper: what stage are they at? What recent strategic decisions have they made? What resources are they investing in? What problems are they publicly discussing? What technologies are they adopting? Create a detailed profile of these best-fit customers.

Next, reverse-engineer what signals indicate this profile. For Series B fintech companies, relevant signals might include: raised Series B funding in the last 24 months; hired at least 2 data engineers in the last 6 months; published technical content about data infrastructure; operate in payments, lending, or trading; have at least one conference talk or major blog post about their data architecture. These signals don't have to be perfect. They're probability indicators that improve your accuracy over time.

The final step is testing. Use these signals to identify 50-100 prospects and reach out with AI-personalized messages. Track response rates, conversation quality, and conversion rates. Use these results to refine your signal weights. Which indicators most strongly correlate with strong customer fit? Which indicators don't matter? Over 2-3 months of systematic testing, your ICP signal framework becomes increasingly accurate.

Warm-Introduction Mapping and Relationship Engineering

The Hidden Power of Existing Networks

Most founders underestimate the density of potential connections within their existing network. If you've built a business before, attended relevant conferences, or worked in the industry, your network likely contains 20-50 potential warm introductions to decision-makers at your target companies. These introductions are massively underutilized.

Warm introductions work because they short-circuit the trust deficit that cold outreach faces. When someone you know introduces you to a prospect and personally vouches for your credibility, you're not starting from zero. You're starting with a recommendation from someone the prospect already respects. This dramatically changes the conversation dynamic.

The challenge is systematic mapping. Most founders have an intuitive sense of their network—they can name people they know—but they haven't mapped the network structure. They don't realize that a former colleague is now VP of Engineering at a target company. They don't recognize that a friend from a startup accelerator is connected to decision-makers across their target vertical. They certainly don't have a system for identifying all possible introduction paths.

Warm-introduction mapping requires creating a simple spreadsheet: column one lists all people you know (former colleagues, conference attendees, introductions from friends, investors, advisors). Column two lists their current company and role. Column three identifies your target companies. Then you systematically work through it: Is this person at one of my target companies? Could this person introduce me to someone at a target company? Do I know someone who knows them?

Most founders are shocked by the results. What feels like a small network often contains surprising density. A founder with 300 first-degree connections might identify 50+ potential warm-introduction paths to target companies. This doesn't mean all 50 paths are equally strong. But suddenly you have systematic access to decision-makers rather than relying on cold outreach.

Authenticity and Curiosity as Distribution Channels

One of the overlooked truths in modern startup culture is the genuine willingness of founders and operators to help other founders—but only if approached with authentic curiosity rather than transactional intent.

Consider two approaches to a warm introduction. Approach one: "My friend knows you. I have an exciting AI analytics platform that helps companies understand customer behavior. Can we grab 30 minutes next week?" This approach signals transaction. The person receiving it understands they're being added to a sales pipeline. They may be helpful, but they're not invested in your success.

Approach two: "My friend mentioned you built a really interesting data infrastructure at your previous company. I'm exploring how companies in your industry think about storing and analyzing behavioral data. I'd love to spend 20 minutes understanding your perspective—no pitch, just curiosity. I'm genuinely trying to understand if our approach makes sense for this space." This approach signals respect and genuine learning intent. Even if they're skeptical about your product, most operators will spend 20 minutes sharing expertise because it engages a part of human nature that enjoys being valued for knowledge.

The insight is counterintuitive: abandoning the sales pitch often produces better sales outcomes. This works because trust is built through genuine exchange of ideas before it's leveraged for business transactions. If you approach someone with curiosity, listen carefully, ask thoughtful follow-up questions, and genuinely incorporate their feedback, you're building relationship capital. Later, when you do pitch, it's not a first impression—it's a natural evolution of a conversation where they've already invested time and intellectual energy in understanding your domain.

This approach scales through systematic process. Every warm introduction, every cold email, every conference conversation starts with genuine curiosity about the person and their problems. You collect these insights, consolidate patterns, and let them inform your product and messaging. The operator who spoke with you for 20 minutes becomes an advisor who opens doors. Advisors become customers. Customers become advocates who make more introductions.

Channel-Specific GTM Playbooks: From Initial Contact to Revenue

Developer-Focused Channel Strategy

Developer acquisition follows different rules than traditional B2B sales. Developers are suspicious of sales processes. They evaluate tools by doing things with them, not by reading marketing copy. They trust peer recommendations and community consensus far more than vendor claims.

The effective developer GTM strategy has several components. First, make the first experience frictionless. Developers should be able to understand and start using your product within 5 minutes of discovering it. This means exceptional documentation, quick-start guides, and a generous free tier. The company whose onboarding is 20% faster than competitors wins 10x more developer adoption.

Second, focus on community rather than sales. Build Discord servers, GitHub discussions, or Slack communities where developers can ask questions, share how they're using your product, and contribute ideas. These communities become self-reinforcing. Developers help other developers, reducing support burden while building network effects. They also generate continuous feedback that informs product decisions.

Third, achieve visibility in places developers naturally congregate. If you've identified GitHub as your primary channel, this means maintaining active repositories, contributing to relevant open-source projects, and ensuring your documentation is discoverable through developer search. If it's technical communities like Hacker News or specialized forums, it means consistent, valuable participation without overt selling.

Fourth, build network effects through integrations and ecosystem. Developers are more likely to adopt your tool if it plugs cleanly into their existing workflows. If you build AI infrastructure, making it easy to integrate with popular data frameworks, logging systems, and deployment tools increases adoption by 2-3x.

Measuring success in developer channels looks different than traditional B2B. Key metrics include free-to-paid conversion rate, time-to-first-value, community activity, and GitHub stars. These leading indicators typically predict revenue growth 60-90 days in advance.

Enterprise Sales Channel Strategy

Enterprise GTM operates at the opposite end of the spectrum. Enterprise buyers are risk-averse, change-resistant, and highly political. Decisions involve multiple stakeholders with conflicting incentives. Sales cycles are long (6-18 months), and deals are large enough that losing one creates painful revenue volatility.

The effective enterprise GTM strategy builds on several principles. First, understand the buying committee. Enterprise purchases aren't made by a single person but by a coalition of stakeholders: the technical evaluator, the budget owner, the executive sponsor, and often the end user. Each stakeholder has different criteria for success. The CTO cares about technical integration. The CFO cares about cost and ROI. The VP of the business unit cares about time-to-implementation and impact on operations. Your messaging must speak to each stakeholder's priorities, or the deal stalls when stakeholders disagree.

Second, reduce perceived risk through social proof and reference-ability. Enterprise buyers call references. They attend industry conferences to find other customers. They ask if similar companies in their vertical use your solution. This means your first enterprise customers should be in categories or geographies that don't compete with your target accounts. A successful implementation at a non-competing company in the same vertical is worth millions in future sales.

Third, build relationships with gatekeepers and influencers inside target companies. These are often not the official decision-maker but people who influence decisions through expertise and trust. In financial services, this might be the Chief Risk Officer's technical advisor. In manufacturing, this might be the operations lead who reports to the COO. These influencers often have 18+ months of tenure, deep understanding of organizational pain, and credibility across stakeholder groups.

Fourth, optimize the sales process for the buyer's journey, not your sales process. Buyers move through stages of awareness, consideration, and decision. Providing the right information at each stage—not too early, not too late—dramatically improves close rates and sales cycle length.

Product-Led Growth Channel Strategy

Product-led growth (PLG) is a distinct distribution channel where the product itself drives acquisition and activation. Rather than sales pitches, customers experience the product's value before making purchase decisions.

The PLG strategy works when your product has clear value within 15-30 minutes of usage, when users can experience value without credit card entry, and when expansion (moving from small team to department to company-wide) is a natural progression.

Implementing PLG requires investing heavily in onboarding, within-product guidance, and free-tier engagement. Every friction point in the initial experience represents a lost user. Tools like interactive walkthroughs, in-product messaging, and contextual help become critical GTM components.

PLG also requires disciplined free-tier management. The free tier should be genuinely valuable enough that users get meaningful value but constrained enough that expansion to paid tiers is a logical next step as usage grows. Too generous a free tier and you never convert. Too restricted a free tier and users never get invested enough to convert.

Successful PLG companies instrument every interaction: how long does activation take? At what point do users engage with key features? Which features correlate with strong retention and expansion? This data drives product roadmap decisions that directly impact GTM success.

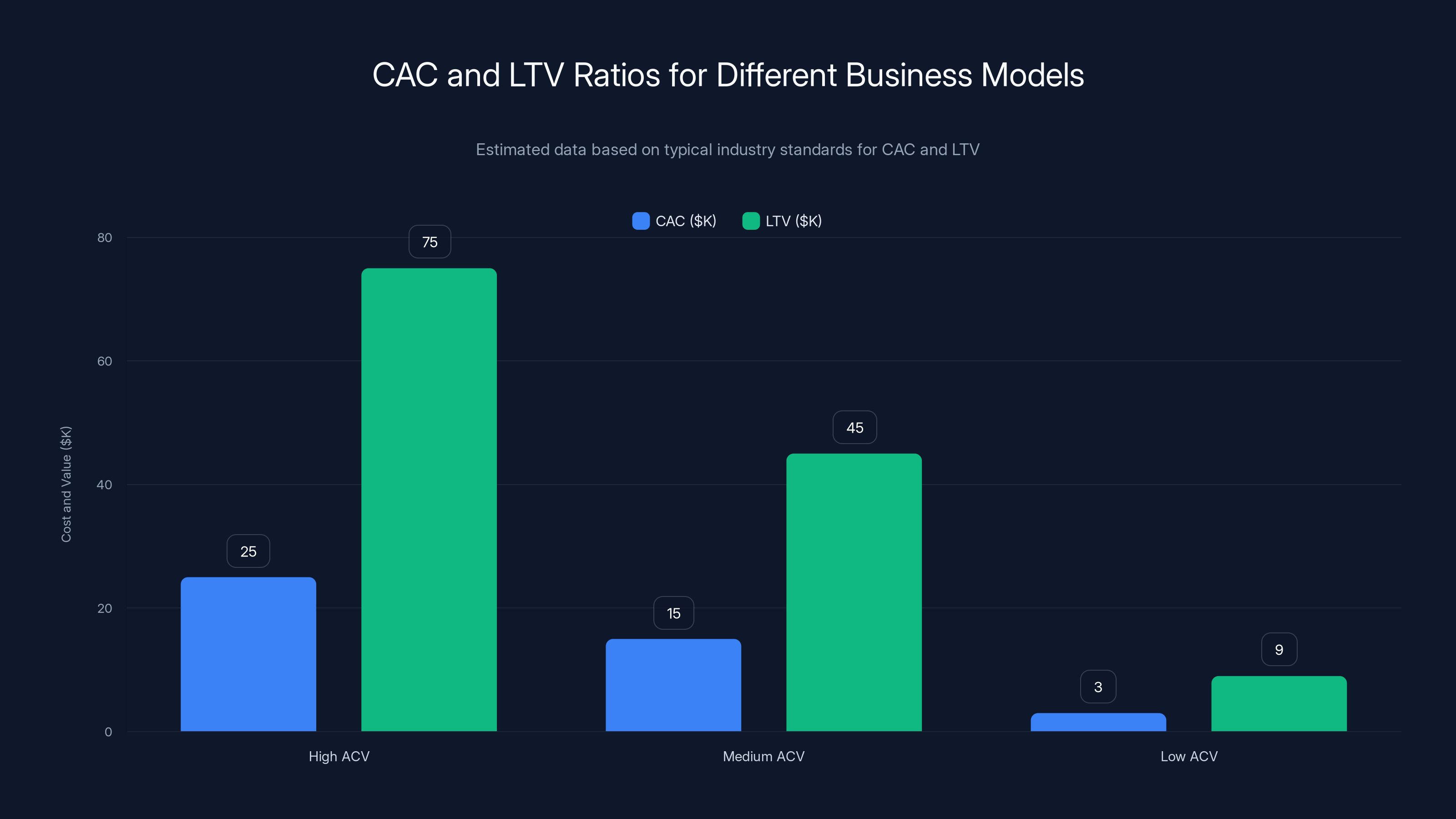

For high ACV businesses, CAC is typically

The Role of Content Strategy in AI-Era GTM

Content as Distribution Infrastructure, Not Marketing Tactics

Content in the AI era serves a fundamentally different purpose than traditional content marketing. Historically, content was a tactic within the marketing function: blog posts to attract traffic, whitepapers to capture leads, case studies to support sales conversations. This tactical approach has become increasingly marginal as AI makes content production cheaper and search competition intensifies.

Modern content strategy inverts this relationship. Rather than content supporting distribution, content becomes the distribution infrastructure itself. Content drives discovery because it's the only way you control your visibility in a crowded information environment. Content establishes expertise because it's the primary way prospects evaluate your knowledge. Content builds network effects because good content gets shared, quoted, and referenced.

The difference manifests in strategic questions. The old approach asks: "What content should we create to attract leads?" The new approach asks: "What are the essential problems our ideal customers are trying to solve? What's the current state of thinking about these problems? What unique perspective or insight do we have that would shift how practitioners think about this problem?"

The first approach produces commodity content that competes with thousands of similar pieces. The second approach produces distinctive content that serves a community by expanding what's possible within that domain.

Building a Content-Driven ICP Discovery Process

Content becomes a direct GTM channel when it's built around systematic customer research. The process works like this: interview 20-30 practitioners in your target market (even if they're not prospects). Ask them their biggest challenges, where they currently find solutions, what information gaps exist, what they wish they understood better. Synthesize these conversations to identify 5-8 major themes.

For each theme, create a comprehensive piece of content that meaningfully advances thinking. This isn't a blog post. It's a 5,000+ word research piece, a video series, an interactive tool, or an original study. The content should be genuinely useful to someone facing this problem, even if they never buy your product.

Publish this content with zero expectation of immediate ROI. Instead, distribute it to the professional communities where your target customers congregate. Make it easy for people to share. Build a community around each major content pillar. Track who engages with your content, what questions they ask in discussions, what insights seem to resonate. This engagement data becomes your most valuable market research.

Over time, a pattern emerges. People in your target market come to view your content as valuable resource. They recommend it to colleagues. They share it in their professional networks. When they face a problem your product solves, your company comes to mind because you've already spent months educating them about the domain.

Content-driven GTM only works if content quality is exceptional. Mediocre content produces noise. Exceptional content produces authority.

SEO and Technical Content Strategy

SEO in the AI era requires different thinking than traditional SEO. Search engines are increasingly conversational and intent-based. People search for things they need to understand, not just products to buy. Your content strategy should optimize for these information-seeking queries before optimizing for purchase queries.

A company selling infrastructure for machine learning might optimize for terms like "how to structure ML data pipelines," "common mistakes in feature engineering," "scaling machine learning infrastructure," before optimizing for "ML infrastructure software pricing." The first category builds authority and captures audience during the research phase. The second category captures audience in the purchase phase. Both matter, but the first matters more because it shapes which company the prospect considers during evaluation.

Technical content also requires depth. Generic pieces about machine learning at scale rank poorly and convert poorly. Specific, technical pieces about specific architectural patterns, implementation details, and failure modes rank better and convert better because they capture practitioners who are beyond the awareness phase.

Building Authentic Advisor Networks as GTM Infrastructure

The Compounding Value of Advisor Relationships

Most startups think of advisors as people who provide strategic guidance in exchange for equity. But advisors serve a more fundamental function in modern GTM: they're distribution channels, customer research instruments, and credibility proxies simultaneously.

An effective advisor relationship operates like this: over 6-12 months, you have systematic conversations (ideally monthly) with an advisor who has deep expertise in your domain and credibility with companies you want to reach. During these conversations, you share what you're learning from customers, your hypothesis about market problems, your strategic direction. The advisor, in turn, asks hard questions, shares their perspective based on their experience, and gradually becomes invested in your success.

At a certain point—usually 6-12 months in—an advisor will organically offer introductions. These aren't introductions they're obligated to make because it's their job. They're introductions they want to make because they believe in your solution and value the relationships enough to put their credibility on the line. Introductions made for this reason have dramatically higher conversion rates than transactional introductions.

The advisor network also becomes your most valuable customer research infrastructure. Instead of running formal customer interviews (which many customers avoid), you're having ongoing conversations with advisors who understand your market context and can give you feedback on product decisions, positioning, and strategy. They challenge your assumptions and help you avoid building things that sound good in theory but won't work in practice.

Identifying and Recruiting Effective Advisors

The most effective advisors aren't always the most famous people in the category. Famous people are often approached by hundreds of founders and have limited capacity. More effective advisors are people with genuine expertise and relationships in your target market who are often approached but still willing to help early-stage companies.

Look for people who:

- Have 10-20 years of experience in your domain (enough to have credibility, not so much they're disconnected from current practice)

- Work inside one of your target customer industries or have spent significant time there

- Have built successful businesses or internal teams that solved problems similar to what you're solving

- Have proven willingness to help other founders

- Are thoughtful communicators who explain their thinking clearly

When recruiting advisors, be explicit about what you're asking. Don't position it as a vague "strategic advice" request that could mean anything. Say something like: "I'm building in this space and I think you have unique perspective on how companies in financial services evaluate this type of solution. Would you be willing to spend an hour a month sharing your perspective and helping us think through strategic decisions? In return, you'd get early visibility into what we're building and equity in the company." This clarity respects their time and sets clear expectations.

Competitive Positioning When Technical Advantages Evaporate

Positioning as a Strategic Differentiator

When technology commoditizes within months, positioning becomes the final sustainable differentiator. Positioning is how you frame your solution in your customer's mind relative to all alternatives including doing nothing.

Effective positioning in the AI era rests on several principles. First, acknowledge what's table stakes in your category. Everyone has AI. Everyone has cloud infrastructure. Everyone has integrations. Talking about these factors wastes credibility and positioning space. Instead, position on factors that matter to your customer but are difficult to replicate: your expertise in a specific vertical, your understanding of specific implementation challenges, your community, your differentiated business model.

Second, position against what your customer actually evaluates against, not what competitors claim to differentiate against. If your actual competitive set is legacy solutions and manual processes rather than other AI startups, your positioning should speak to the problems of modernization rather than AI capabilities. A company evaluating AI document processing is often choosing between your solution and custom-built approaches from existing vendors. Position yourself around reducing the risk and cost of custom implementations.

Third, use specificity rather than breadth. A claim that applies to everyone ("We use advanced AI") differentiates no one. A claim that applies to specific customers in specific situations ("Our approach reduces manual review time by 40% in financial compliance use cases") creates distinction. Specificity reduces addressable market in the short term but increases market captureability.

Owning a Specific Segment or Use Case

With technical differentiation eroding, defensibility comes from owning a specific segment or use case where you've built deeper expertise and customization than competitors.

This requires discipline. It's tempting to build solutions that work for multiple industries or use cases. But that breadth typically produces solutions optimized for nobody. Superior outcomes come from choosing a specific segment (e.g., financial services, healthcare, manufacturing) and obsessively understanding its specific challenges, regulatory requirements, competitive dynamics, and implementation constraints.

As you build deeper segment expertise, you make product decisions that make sense for that segment but might not make sense for others. You build domain-specific templates. You develop relationships with industry associations. You understand the regulatory landscape. You know the buying process. You can articulate specific ROI in financial terms that matter to that segment. This segment ownership becomes difficult for generalist competitors to overcome because matching your depth requires rebuilding their entire organization around the segment.

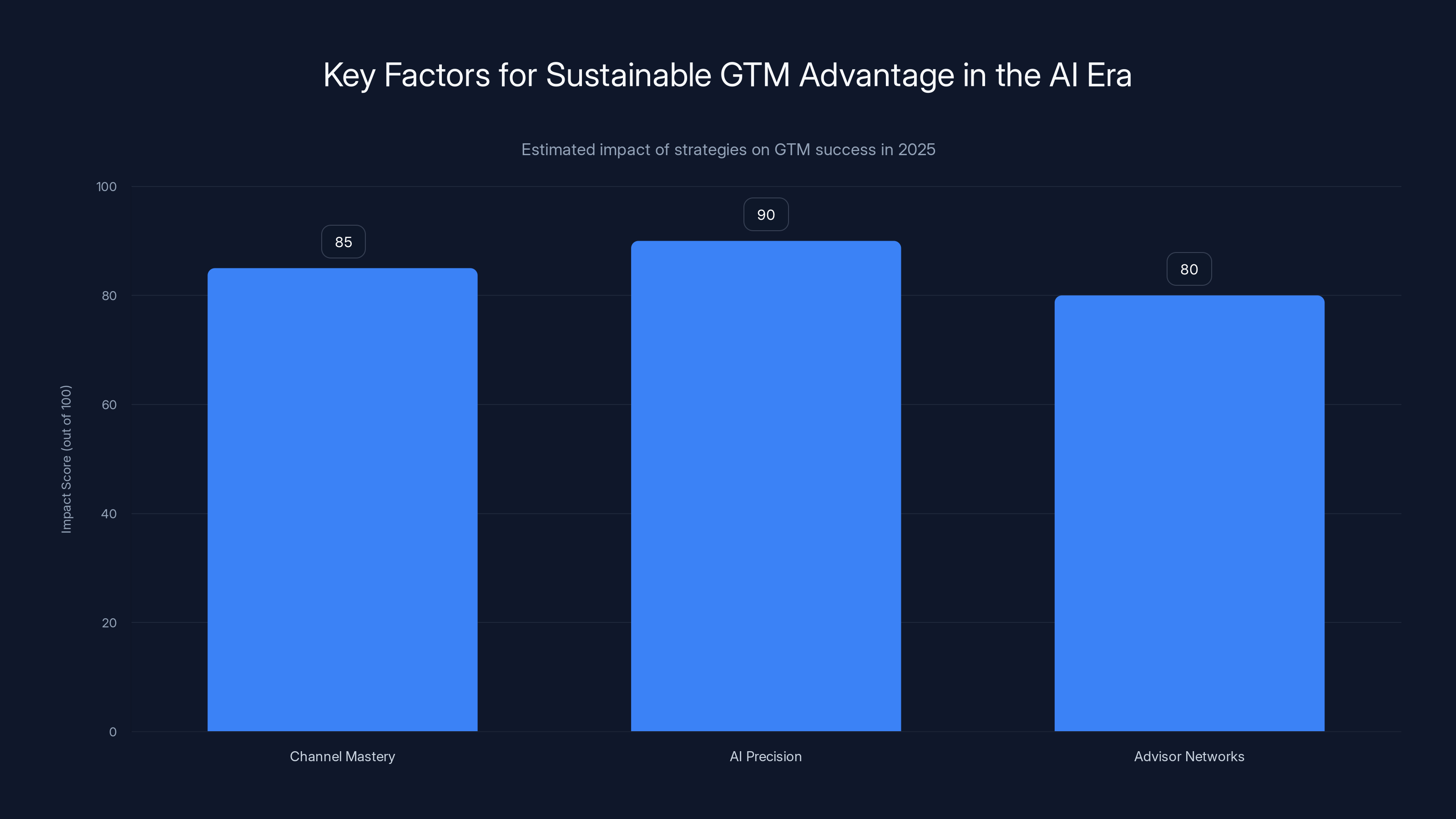

Estimated data suggests AI precision and personalization have the highest impact on GTM success, followed closely by mastering specific channels and building advisor networks.

Building Data-Driven Feedback Loops into GTM

Instrumentation and Metrics that Drive Decisions

GTM strategy without rigorous measurement is theater. You cannot optimize what you don't measure, and vague metrics drive vague decisions. The companies that win systematically instrument their GTM motion and use data to drive weekly optimization.

Key metrics depend on your GTM channel, but the principle is universal: define leading indicators that predict downstream revenue, measure them obsessively, and iterate based on patterns. For outbound sales, this might include outreach volume, response rate, meeting conversion rate, meeting-to-qualified-conversation rate, time-to-first-meeting. Each metric isolates a specific stage of the funnel. If response rate drops, you know it's a messaging problem. If meeting conversion rate drops, it's a qualification problem. Without isolation, you can't diagnose root cause.

The best GTM teams maintain a simple dashboard visible to everyone: what's the weekly status of each leading metric? Where are we ahead or behind plan? What's the hypothesis for why we're ahead or behind? What's our plan to optimize? This ritualized review ensures GTM becomes dynamic—continuously improving—rather than static.

The Virtuous Cycle: Data → Insight → Optimization → Growth

Data becomes truly valuable when it drives insight, which drives optimization, which drives growth. This cycle should operate at weekly or bi-weekly frequency in high-growth companies.

Start with observation: which customer segments convert faster? Which messaging resonates? Which channels produce lowest-cost customers? Which product features correlate with retention? Which advisor relationships produce highest-quality introductions? These observations come from studying your data carefully—not just topline metrics but distributions and correlations.

Observations become insight when you develop a hypothesis about why a pattern exists. Don't stop at "technical customers convert faster than business customers." Ask why. Is it because technical customers understand the product faster? Is it because they have lower switching costs? Is it because they evaluate internally rather than requiring committee consensus? Different whys suggest different optimizations.

Insight drives optimization when it informs specific changes. If technical customers convert faster because they understand the product faster, maybe your positioning should emphasize technical depth. Maybe you should make free trials more hands-on and technical. Maybe you should shift outreach toward technical personas. Each hypothesis suggests specific changes.

Optimization drives growth when changes are actually implemented and measured. This requires discipline. It's easy to identify what should change. It's harder to actually change it, measure the impact, and share the learning with the team. The companies that capture exponential growth are disciplined about this cycle.

Sales Processes Optimized for AI-Driven Insight

From Sales Gut Feel to Sales As Data Science

Traditionally, sales success relied heavily on sales talent: charisma, intuition, relationship-building skill. These factors still matter, but increasingly they're supplemented by data that makes sales more predictable.

Modern sales systems combine human skill with AI-driven insight. AI identifies which prospects are likely to convert and why, optimizing sales team time allocation. Data surfaces objection patterns: what are the most common reasons prospects don't move forward? What questions do they ask? Where do they get stuck? Sales teams who study objection patterns can proactively address them, reducing sales friction.

AI also enables sales customization at scale. Rather than all sales conversations following a similar pattern, conversations adapt based on the prospect's responses. If a prospect signals budget concerns early, the sales motion shifts to emphasize ROI and implementation speed. If they signal technical concerns, it emphasizes integration and data security. This customization can only happen at scale through AI guidance.

Discovery as a Competitive Advantage

The best sales conversations start with profound customer understanding. Most sales conversations start with the sales pitch: "Here's what we do, here's why it's great." This is precisely backward. Optimal sales conversations start with discovery: deep understanding of the prospect's situation, challenges, priorities, and timeline.

Effective discovery is rigorous. It involves structured questions designed to surface specific information: What's your current approach to this problem? What's working about it? What's not working? What's the impact of the gap? What have you tried to address it? Who else cares about solving this? What's your timeline? Discovery should take 30-50% of sales conversation, not 5-10%.

Discovery also functions as qualification. Many prospects sound promising until you understand their situation deeply. Discovery reveals whether the prospect has sufficient pain, budget, and timeline to move forward. It prevents wasted sales effort on low-probability opportunities while identifying high-probability ones that might look less obvious.

Managing Sales and Marketing Alignment as a GTM Function

The Alignment Problem in Modern GTM

Most companies have sales and marketing organizations that operate according to different incentives, use different metrics, and pursue different strategies. Sales wants leads now. Marketing wants to build brand and thought leadership over time. Sales blames marketing for low-quality leads. Marketing blames sales for not following up. This alignment failure cripples GTM effectiveness.

Effective modern GTM requires genuine integration between sales and marketing. This doesn't mean they're the same function—different skills are required—but they share GTM vision, operate toward shared metrics, and design motion together.

Start with shared definitions. Define exactly what constitutes a "qualified lead" together. What criteria must a prospect meet to be handed to sales? Without this definition, marketing sends early-stage prospects to sales, who reject them as not qualified, who blame marketing for wasting their time. With clear definitions, everyone understands expectations.

Define shared metrics. Typically these include customer acquisition cost, customer lifetime value, time from lead to close, and conversion rate at each stage. Both sales and marketing optimize these metrics together rather than pursuing contradictory metrics.

Define shared motion. How does a prospect move from awareness to decision? What's marketing's role at each stage? What's sales' role? What tools and content support each stage? When both functions contribute to design, both execute well because they understand their role and how it connects to others' roles.

The competitive advantage timeline has compressed from 36 months in 2000 to just 8 months in 2023. (Estimated data)

The Economics of GTM: CAC, LTV, and Unit Economics

Understanding and Optimizing Customer Acquisition Cost

Customer acquisition cost—the fully-loaded cost to acquire a customer—should be your north star metric. It determines whether your business model is sustainable.

Calculating true CAC requires honesty. It's not just salesperson salary divided by customers closed. It's all sales and marketing headcount, all tools and technology, all overhead allocations, divided by net new customers acquired. For a

Optimizing CAC requires understanding its components. Most CAC comes from sales and marketing headcount. Channel cost comes second. The highest-leverage optimization usually involves improving sales efficiency: reducing time-to-close, improving close rates, and reducing sales overhead.

A framework that works: if your enterprise sales cycles are long (9-18 months) and complex (multiple stakeholders), you may need a 4:1 ratio of sales to marketing to make the model work. If your sales cycles are medium-length (3-6 months) and moderately complex, a 2:1 ratio often works. If your sales cycles are short (1-2 months) and simple, a 1:1 or even 1:2 ratio can work with heavy marketing and self-service elements.

The LTV: CAC Ratio and Sustainable Growth

Customer lifetime value—the total profit you'll extract from a customer over their lifetime—should be significantly higher than CAC. The industry standard is LTV: CAC ratio of 3:1 or higher. This means if you spend

LTV depends on several factors: how long does the customer stay (retention)? What's the average revenue per customer? Does the customer expand over time (expansion revenue)? Do they have high churn or high retention? Do they stay at the same spend level or increase spending as their usage grows?

Improving LTV often has more leverage than reducing CAC. A company might spend months optimizing sales to reduce CAC by 15%. But improving retention from 85% to 90% might increase LTV by 20-30%. For a 5-year customer lifetime, 90% annual retention compounds to 59% retention after 5 years, while 85% retention compounds to 44% retention after 5 years. This difference is enormous.

Unit economics often reveal whether a GTM strategy is fundamentally sound. If your CAC is

Scaling GTM Without Losing Efficiency

The Predictable Scaling Curve

Early-stage startups typically achieve high efficiency: founder-led sales with 40%+ close rates, because the founder understands customers deeply and can customize solutions dramatically. Marketing is low-cost and high-efficiency because the founder is the brand and all outreach is authentic and personalized.

As GTM scales, this efficiency inevitably declines unless you actively manage the process. A company with

This declining efficiency is predictable and doesn't mean you're failing. It reflects mathematical reality: it's easier to close the first

The key is maintaining efficiency gains while scaling. This requires building systems and playbooks that capture what made early GTM effective and replicate it across a larger team. If early sales success came from founders having deep customer conversations and customizing solutions, scale through hiring sales people who can have equally deep conversations and creating systems that support customization. If early marketing success came from authentic thought leadership, scale through creating systems that distribute thought leadership across multiple voices.

When to Introduce Sales Leadership and Process

Most founders resist hiring their first VP Sales because they fear introducing process will kill the authenticity and relationship-building that drove early success. This fear is understandable but misplaced. The right sales leader amplifies what worked, not destroys it.

The right hire for first VP Sales is someone who has built similar sales motions at companies in similar positions. They should appreciate the founder's relationship capital and use it as leverage, not replace it. They should build process around what's working rather than imposing external process. They should hire sales people who can have authentic customer conversations rather than hiring generic closers.

When to hire this person? When you have 5+ enterprise customers paying $50K+ annually and can clearly articulate why they bought. When you have a pipeline of 10+ qualified opportunities. When sales have become unpredictable—some months strong, some months weak—suggesting you need more systematic approaches. When you have customer feedback suggesting your solution is strong but you're leaving money on the table because you can't manage the full sales process.

Hiring too early creates overhead without leverage. Hiring too late means leaving substantial revenue on the table while scaling through heroic effort.

GTM Strategy for AI Infrastructure and Developer Products

Specific Dynamics of Developer Product GTM

Developer products operate differently than traditional B2B products. Developers are the users, not the buyers. The person evaluating and implementing the solution is different from the person writing the check. This creates specific GTM challenges and opportunities.

Developers discover and evaluate products through technical channels: GitHub, technical documentation, open-source communities, conference talks, technical blogs. Marketing through sales channels is significantly less effective than traditional B2B because developers actively avoid sales channels and trust peer recommendations more than vendor claims.

Developer product GTM typically follows this motion: build exceptional technical documentation and quickstart guides; enable developers to experience value in under 15 minutes; build community where developers help each other; become visible in technical communities through authentic participation; create content that teaches domain expertise alongside subtle product promotion; support open-source contributions from customers; enable easy integration with ecosystem tools.

Monetization often comes later in the developer product journey. Developers start with free tier, expand usage, and eventually expand to paid accounts when their organization grows or their needs exceed free tier constraints. This requires disciplined free tier design: valuable enough to drive adoption and demonstrate value, constrained enough that expansion to paid is obvious.

The Viability of Community as Primary GTM Channel

Community-driven GTM works for developer products in specific circumstances. When community is the primary GTM channel, success metrics include community size, community engagement, community generation of educational content, and community-to-customer conversion.

Building a viable developer community requires investment in infrastructure (Discord, Slack, or equivalent), moderation and engagement, and customer input on product direction. Communities fail when they're treated as marketing tools rather than genuine spaces for practitioner exchange. Developers quickly sense inauthenticity and abandon communities that exist primarily to sell them something.

When executed authentically, communities generate 30-40% of new customer growth for developer products, often at significantly lower CAC than paid channels because customers arrive through relationship capital within the community.

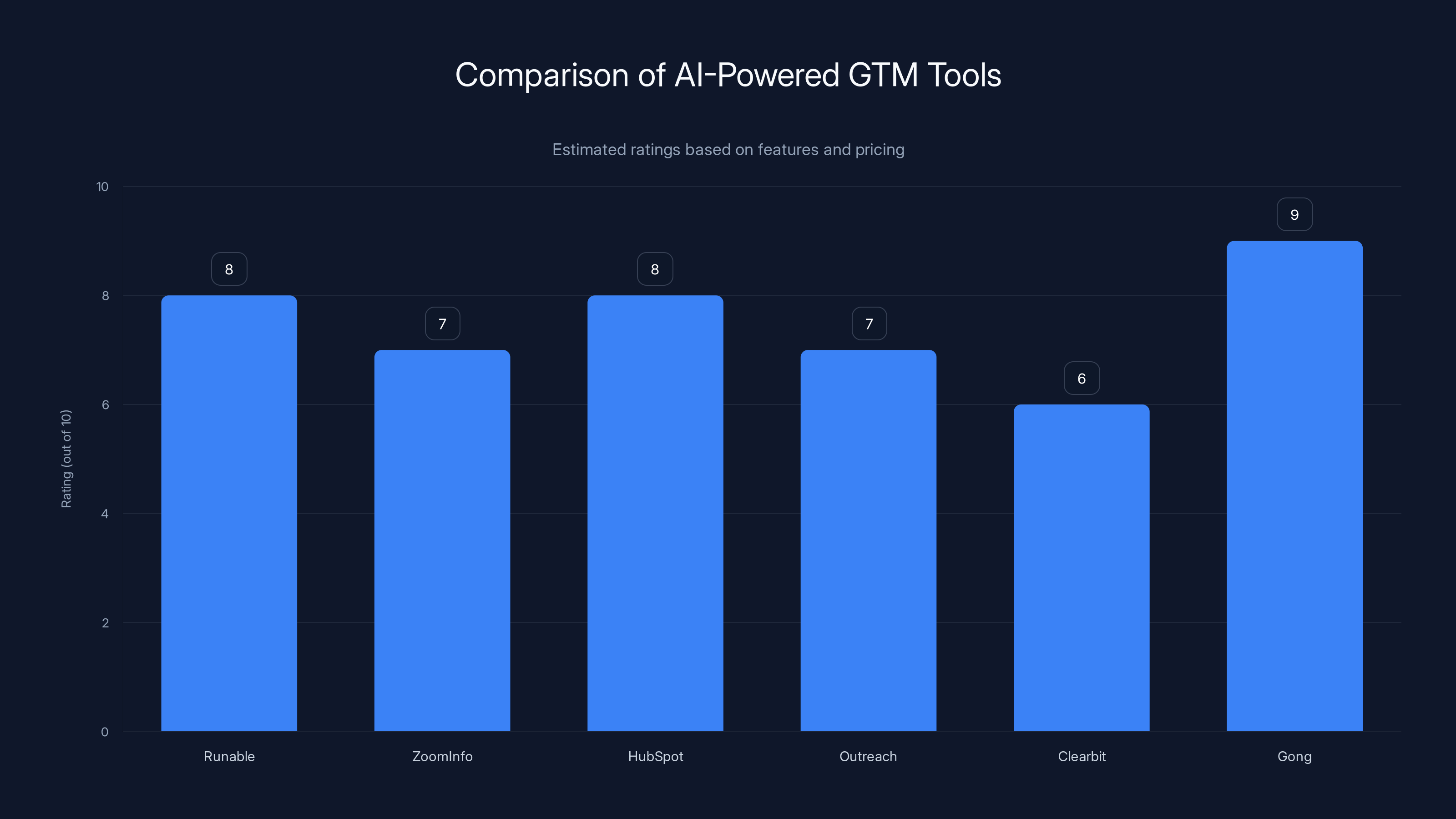

Runable and Gong lead in feature and pricing effectiveness for AI-powered GTM solutions. Estimated data based on typical market offerings.

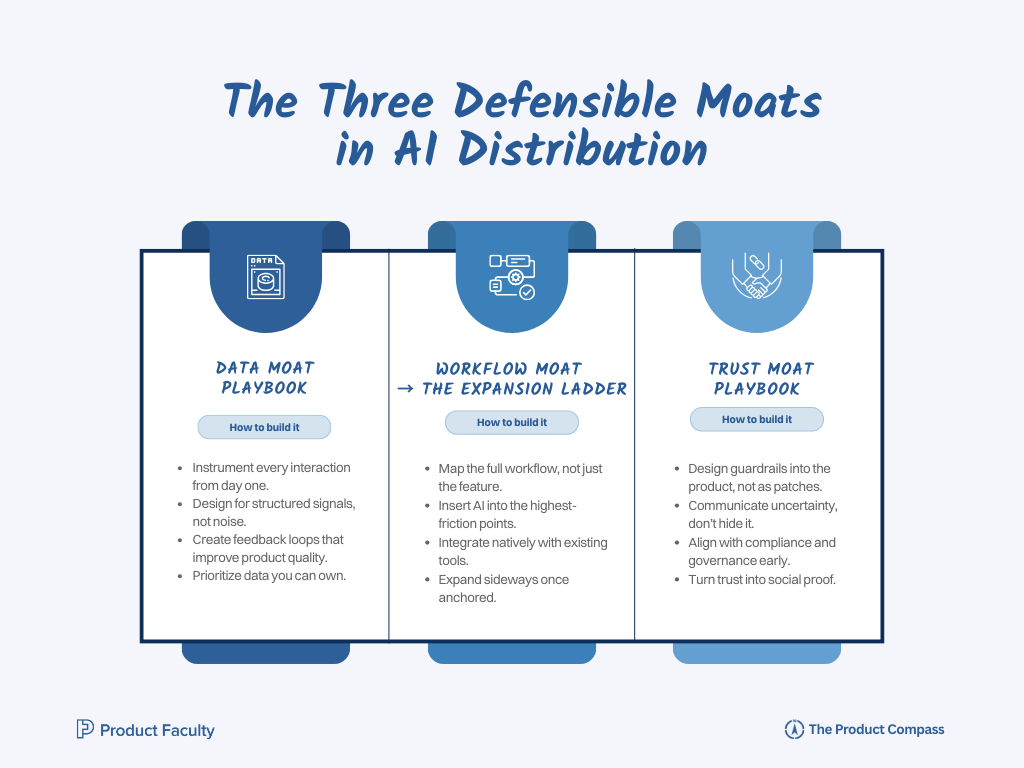

Navigating the AI Era: Building Defensible GTM Moats

Why Distribution Will Remain Defensible When Technology Won't

Distribution moats are harder to replicate than technical moats because they depend on accumulated relationship capital, community trust, and established processes. When a competitor can replicate your technology in weeks, they cannot replicate your distribution in weeks.

Consider two scenarios. Company A invests 80% of resources in engineering and 20% in distribution. In six months, they have superior technology but limited customer relationships. Company B invests 50% in each. In six months, Company B has equal technology and substantially stronger customer relationships. When markets turn and customer concentration becomes critical, Company B's distribution advantage compounds. They expand faster because they reach customers faster. They have lower churn because relationships are stronger. They have more data about customer needs because they have more conversations.

Over two years, Company B likely produces 5-10x more revenue than Company A despite A's superior engineering. This differential widens over time because distribution advantages compound while technology advantages erode.

Creating Intentional GTM Moats

Instead of hoping distribution advantages emerge organically, design them intentionally. This might include:

Relationship density in specific segments - Become the default solution in specific verticals through accumulated relationships and segment expertise. Healthcare startups selecting from five equally capable options usually choose the vendor whose team has 20 years of healthcare experience and knows the regulatory landscape and implementation challenges.

Community network effects - Build communities where practitioners in your domain gather, trust each other, and recommend vendors. These communities become distribution channels because practitioners who trust the community trust recommendations from within it.

Data and insights advantage - Collect data that customers value, synthesize it into insights, and share findings with the community. Companies like Stripe and Twilio have built insight distribution channels by publishing annual reports about trends in their domains. These insights become valuable to practitioners and build authority.

Ecosystem integration - Build deep integrations with tools your customers already use. Make your solution a default add-on to popular infrastructure. Integration depth becomes a moat because switching costs increase with integration breadth.

Educational content leadership - Become the trusted source of education in your domain. This might be through books, conferences, certification programs, or educational content. Customers learn from your educational content, build expertise partially defined by your frameworks, and naturally preference your solution when the time comes.

Each of these moats takes time to build—12-24 months minimum to become significant. But once built, they're far more defensible than technology because they depend on human relationships and community trust rather than code.

The Psychology of Modern GTM: Trust, Authority, and Authenticity

Building Authority Through Asymmetric Value Sharing

Modern GTM succeeds through building authority before asking for business. Authority emerges from genuinely sharing valuable knowledge without immediate expectation of return.

This principle operates at multiple levels. At the personal level, founders who share their thinking about problems they're solving, lessons learned from failures, and insights about market dynamics build authority. This might be through writing, podcasts, or conference talks. The vulnerability of sharing honest perspective creates credibility that polished marketing cannot match.

At the organizational level, companies build authority by creating content, tools, and resources that benefit the community beyond customers. GitHub companies that publish open-source tools benefit practitioners who never become customers. Data platforms that publish industry benchmarks benefit non-customers alongside customers. This asymmetric value sharing—giving away things of genuine value—builds relationship capital that eventually converts to customers.

The Role of Narrative and Story in GTM

Effective GTM tells stories that connect with customers' aspirations and anxieties. Stories are more persuasive than facts because they create emotional connection and demonstrate proof through narrative rather than claims.

The most effective stories in modern GTM are customer success stories that show real progression. Not "Company X got 30% ROI" but "Company X was spending 200 hours per month on manual processes. They implemented our solution. After 3 months, they reduced that to 40 hours per month. They reallocated the 160 saved hours to strategic planning. Within 6 months, their team had identified a new revenue stream that generated $2M in annual revenue." This narrative structure shows problem, solution, and outcome while creating an aspirational vision of what's possible.

Stories also work because they transmit complexity through narrative rather than explanation. Explaining why your solution is superior requires the reader to evaluate technical factors. Telling a story about a company that solved problems through your solution requires only that the reader visualize themselves in the company's position.

Adapting GTM Strategy for Different Stages and Markets

Seed and Early Stage: Building Repeatable Motion

Seed-stage GTM is about finding product-market fit for your go-to-market approach. You're not trying to scale yet. You're trying to discover what actually works by talking to lots of potential customers and learning what resonates.

The playbook at this stage is founder-intensive outreach: cold emails, warm introductions, conference participation, content that attracts your target customer. Everything is personalized because volume isn't yet important. You're looking for patterns in what works.

You measure differently at this stage. You're not measuring revenue growth. You're measuring learning: Are we finding customers interested in our problem? Are they seeing our solution as the right approach to solving it? Do they have budget? Are they willing to help us think through the problem? Can we articulate why they should use our solution rather than alternatives?

Series A: Scaling the Motion

Once you've found repeatable motion at seed stage, Series A is about scaling that motion. If warm intros worked at seed, you now build a process that generates warm intros at scale. If a specific content strategy worked, you scale content production. If a specific sales message resonated, you test that message across larger audiences.

This stage is about replacing founder effort with process and hiring. Every dollar you spend on building systems and hiring is investment in replacing bottlenecks. You're not tripling the founding team. You're hiring one or two people who can multiply the impact of the team.

You also start diversifying channels at this stage. What worked at seed was your single best channel. At Series A, you test a second channel while scaling the first. If referrals worked, you now add some outbound. If content worked, you now add targeted advertising. But you maintain focus: typically two channels, not ten.

Series B and Beyond: Building Sales and Marketing Organizations

At Series B, you have product-market fit and repeatable GTM motion. Now the challenge is scaling that motion across larger organizations while maintaining efficiency and quality. This requires building actual sales and marketing functions with specialization and process.

You likely hire a VP Sales, Head of Marketing, and Director of Customer Success. You build processes around sales, marketing campaigns, customer onboarding. You implement CRMs and marketing automation. You define sales methodologies and marketing frameworks.

The challenge at this stage is maintaining the authenticity and relationship-building that drove early success while adding organizational structure. The most common failure is hiring traditional sales and marketing leaders who implement traditional processes that destroy what made early GTM work.

The solution is hiring leaders who understand your specific motion and who hire teams who understand building authentic customer relationships rather than running generic campaigns. A Series B software company that grew through thought leadership and community should hire a Head of Marketing who can scale that authenticity, not someone who believes all GTM comes down to demand generation funnels.

Future Trends in GTM as AI Capabilities Expand

AI-Native GTM Operations

As AI capabilities expand, GTM operations will become increasingly AI-native. This doesn't mean AI replaces humans—it means humans and AI collaborate in ways that neither could achieve independently.

AI-native GTM might look like: AI systems continuously analyze customer conversations and identify patterns, then surface these patterns to humans for interpretation and decision-making. Sales teams receive AI-generated personalization suggestions that they customize with their human judgment. Marketing teams use AI to generate initial content drafts that they refine into their actual voice. Sales leaders use AI systems to identify which leads are likely to convert and when, enabling focus on high-probability opportunities.

The advantage isn't that AI is better than humans at these tasks—it's that AI handles the routine work at machine speed while humans focus on judgment, creativity, and relationship-building where they have irreplaceable value.

Hyper-Personalization at Massive Scale

Current personalization at scale is generic at the edges: "Hi [First Name], we help companies like [Company] solve [Problem]." Future personalization will be exponentially more specific: not just acknowledging the company and industry, but specific technical architecture decisions, specific recent strategic announcements, specific team compositions, specific implementation challenges likely given their specific situation.

This level of personalization is only possible at scale through AI systems trained on extensive data. The companies that build these systems will have CTR and conversion advantages that leave competitors far behind.

Community as Infrastructure

Community will increasingly function as GTM infrastructure rather than a nice-to-have. Companies will invest substantially in building communities where their customers gather, help each other, and recommend solutions. These communities will become as important to GTM as sales teams.

The companies that win will be those that can make community feel organic while actually designing it strategically. This requires genuinely serving the community first and leveraging community for business advantage second—but doing it intentionally.

FAQ

What is go-to-market strategy in the AI era?

Go-to-market strategy in the AI era is the systematic process of identifying, reaching, and acquiring customers when technical differentiation no longer provides sustainable advantage. With product features replicating in weeks rather than months, successful GTM now focuses on distribution channels, customer relationships, and community as defensible competitive advantages. This includes identifying where ideal customers naturally congregate, building authentic relationships through consultative approaches, and using AI to enable personalization at scale.

Why has distribution become more important than technology in modern GTM?

Distribution has become more important than technology because AI and open-source innovation have made technical features reproducible within 4-8 weeks instead of 12-24 months. When every company can match your technical capabilities quickly, the differentiator becomes who reaches customers first, who builds deeper relationships, and who owns community trust in their domain. Distribution compounds over time—relationships deepen, community networks strengthen, and expertise accumulates—while technical advantages erode. Companies that focus on distribution alongside product development produce 3-5x more revenue over 24 months than those optimizing purely for engineering excellence.

What are the benefits of focusing on one or two GTM channels instead of ten?

Focusing on 1-2 channels instead of 10 produces several compounding benefits. First, concentration enables mastery—you understand channel mechanics deeply, build authentic presence, and develop reputation within that channel. Second, focused teams can achieve quality your diverse team cannot—personalization improves, messaging consistency increases, and resource allocation becomes efficient. Third, focused channels generate better data for iteration—you can isolate what's working and why, rather than operating 10 parallel experiments where results blur. Fourth, team focus reduces context-switching and increases accountability. Companies that master 1-2 channels typically achieve 2-3x better conversion rates and 30-50% lower customer acquisition costs than those spreading efforts across 10 channels.

How does AI enable unprecedented specificity in customer outreach?

AI enables specificity through several mechanisms. First, AI systems can analyze vast amounts of public data about target companies—recent hires, public repositories, funding announcements, conference talks, job postings, competitive positioning—and synthesize this into personalized outreach. Second, AI can map ideal customer profiles by analyzing which customers converted fastest and identifying common signals across them, then applying these patterns to prospects. Third, AI can generate personalized message variants at scale—thousands of unique emails, each tailored to the recipient's specific situation. Fourth, AI can continuously learn which personalization approaches work, enabling optimization of outreach effectiveness over time. What might take a human 30 minutes to research and personalize for a single prospect, AI can do for 50+ prospects in the same time.

What is warm-introduction mapping and why does it matter for GTM?

Warm-introduction mapping is the systematic process of identifying introduction paths from your existing network to decision-makers at target companies. It involves creating a database of everyone you know and their current roles, identifying which people are at target companies or connected to people at target companies, and prioritizing which introduction paths are strongest. Warm introductions matter because they dramatically increase response rates and trust compared to cold outreach—someone personally vouching for your credibility is worth months of relationship-building. Most founders underestimate their network density and miss 50+ potential introductions that could generate significant pipeline. Systematic mapping typically reveals 30-50+ high-quality introduction paths that a founder could activate to build pipeline quickly.

What makes a go-to-market channel ideal for your specific company?

The ideal GTM channel matches where your ideal customer profile actually congregates, makes buying decisions, and builds trust. It's not where you hope they spend time or where marketing theory says they should be. Identify ideal channels through direct research: interview target customers about where they discovered solutions in your category, what communities they trust, what influencers they follow, what events they attend. Map these patterns across 20-30 conversations. You'll find that 2-3 channels emerge as clearly dominant. These are your ideal channels. If you're building developer tools and 70% of target customers mentioned GitHub and technical forums as discovery channels, these should be primary focus areas even if social media is easier to execute on. Channel-customer fit matters more than channel ease.

How do you measure success in modern AI-era GTM?

Success metrics in modern GTM differ by channel but share core principles: measure leading indicators that predict revenue (outreach volume, response rates, meeting conversion, opportunity qualification), not just lagging indicators (revenue), so you can diagnose problems quickly; isolate metrics by stage of funnel to understand where breakdowns occur; track indicators that reveal channel efficiency (customer acquisition cost, time to close, customer lifetime value), not just vanity metrics (meetings scheduled, opportunities created); measure quality alongside quantity (customer fit score, retention, expansion revenue) because low-quality customers created quickly destroy unit economics. Most companies should maintain a simple dashboard with 8-12 key metrics, reviewed weekly, with clear targets and diagnosis of variance.

Why does content strategy matter more in the AI era GTM?

Content strategy matters more because information asymmetry is how startups overcome capital disadvantage. When a well-funded competitor can match your product capabilities, scale your sales team, and outbid you for talent, content becomes one area where a smaller, focused team can win. Content that genuinely educates a community, advances thinking about problems your target customers face, and demonstrates expertise builds authority that sales teams cannot build alone. Additionally, content drives discovery because it's the only way early-stage companies control visibility in competitive information environments. Enterprise buyers research for weeks before contacting vendors. Developer audiences discover tools through GitHub, documentation, and technical content. Content is not a marketing tactic in modern GTM—it's distribution infrastructure.

How should sales and marketing alignment work in modern GTM?

Sales and marketing alignment in modern GTM requires more integration than traditional structures. Rather than marketing generating generic leads and sales rejecting them, effective alignment means both functions share vision (what customer segments are we winning), operate toward shared metrics (customer acquisition cost, time to close, customer lifetime value), and design motion together (how does a prospect move from awareness to decision and what's each function's role). This requires regular collaboration: weekly or bi-weekly meetings where both functions discuss pipeline, customer feedback, and strategy changes; shared CRM data visible to both teams; and mutual accountability for outcomes. When sales and marketing operate independently, marketing generates leads nobody closes and sales complains about quality. When they integrate properly, marketing focuses on attracting genuinely qualified opportunities and sales focuses on systematically moving them forward.

Conclusion: Building Sustainable GTM Advantage in the AI Era

The go-to-market landscape has fundamentally shifted. The playbook that worked in 2015—build superior technology, hire a sales team, scale aggressively—no longer works in 2025. Technical superiority no longer provides sustainable advantage because it no longer takes 12-24 months for competitors to match features. It takes 4-8 weeks. The sales playbook based on traditional B2B sales practices no longer works because buyers increasingly make research and evaluation decisions before speaking with sales. Enterprise buyers want to understand vendors deeply before first contact. Developers want to experience your product and evaluate it themselves without sales involvement.

What works now is distribution and customer relationships refined by AI-driven precision. Companies that win are those that:

Master one or two channels rather than spreading resources across ten. They achieve depth of expertise, authentic presence, and data clarity that scattered approaches cannot match. The companies with the best product-customer fit converge on the 1-2 channels where that fit exists, not the channels that marketing theory suggests.

Leverage AI for precision and personalization, not to replace human relationships. AI systems identify which prospects are likely to convert and why, enable personalization at unprecedented scale, and surface patterns in customer data that humans can interpret. But the relationship-building and judgment remain human domains. The best GTM teams are those that amplify human judgment through AI rather than trying to automate judgment through AI.

Build authentic advisor networks and warm-introduction infrastructure that compound over time. Relationships become more valuable with investment—advisors who understand your market for 12+ months are worth more than transactional connections. Warm introductions from trusted sources convert at 5-10x the rate of cold outreach. These assets take time to build but become increasingly defensible over time.

Focus on specific customer segments or use cases where you can build genuine expertise. Horizontal solutions that try to serve many use cases well typically serve all use cases poorly. Vertical or use-case focus enables product decisions, customer understanding, and positioning that generalists cannot match.

Maintain ruthless focus on unit economics. Not all growth is good growth. Growth that costs more to acquire than the customer generates in profit is expensive destruction. The companies that survive downturns and thrive in upturns are those that maintain disciplined CAC, optimize for LTV, and track the full economic picture of growth.

Build authentic communities where your customers congregate, help each other, and organically recommend your solution. Communities built for genuine practitioner value become powerful distribution channels. Communities built primarily to sell inevitably fail because practitioners sense inauthenticity and leave.

Use data to drive continuous optimization rather than executing static plans. The GTM landscape changes rapidly in the AI era. Competitors iterate at speed. Customer preferences shift. The companies that win are those that monitor leading indicators obsessively and adapt strategy weekly based on data rather than executing plans designed months ago.

Invest in relationship and distribution early, even when it feels inefficient relative to engineering. This is the hardest pattern for technical founders to embrace because distribution investment lacks the intellectual satisfaction of engineering investment. But over 24 months, the founder who invests equally in product and distribution typically builds 3-5x larger company than the founder who invests 80/20 toward engineering. By the time the technical founder realizes distribution matters, the distribution-focused founder is 18 months ahead.

The AI era creates tremendous opportunity alongside unprecedented competition. Anyone can build competitive AI solutions. Few companies can build distribution that actually reaches customers. Few companies can build community that functions as genuine value exchange rather than marketing disguise. Few companies can maintain relationships that compound over time. These asymmetries create the conditions for smaller, scrappier teams to defeat well-funded competitors—but only if they execute GTM with the same rigor and intentionality that technical teams apply to engineering.

The final insight: go-to-market is not a marketing function. It's a strategic function that touches product, engineering, sales, marketing, and customer success. The most successful companies in the AI era are those that treat GTM as a business priority equivalent to product development and organize accordingly. If your CEO spends 30% of time on GTM, your company will likely build sustainable advantage. If your CEO spends 5% of time on GTM and delegates it entirely to the Head of Marketing, your company will likely struggle to reach its potential regardless of product quality.

The companies that win the next five years won't be those with the best AI or the most capital. They'll be those that combine good product with exceptional GTM execution—distribution that reaches customers where they actually congregate, relationships that deepen over time, and communities that function as genuine value rather than marketing vehicles. These advantages take time to build but become increasingly defensible as they compound. Start now.

Alternative Solutions Worth Considering

While building a foundation of strong go-to-market fundamentals, many teams also leverage specialized tools to automate and enhance specific GTM components. For teams seeking AI-powered automation capabilities across outreach, personalization, and workflow management, platforms like Runable offer comparable features at cost-effective pricing ($9/month), providing AI agents for document generation, report creation, and workflow automation that can support GTM initiatives—from creating personalized proposals to automating follow-up workflows.

Other platforms tackle specific GTM challenges: Zoom Info provides AI-driven lead intelligence and segmentation; Hub Spot offers integrated sales and marketing platforms; Outreach specializes in sales automation; Clearbit provides company intelligence; and Gong delivers conversation intelligence for sales teams. The right combination of tools depends on your specific GTM motion and which components you want to systematize versus keep human-driven.

Key Takeaways

- Technical advantages now evaporate in 4-8 weeks, making distribution the final sustainable moat

- Mastering 1-2 GTM channels outperforms diversified approaches by 2-3x in conversion rates and efficiency

- AI enables unprecedented personalization at scale, moving beyond demographic segmentation to behavioral-intent targeting

- Warm-introduction mapping typically reveals 30-50+ introduction paths within existing networks most founders never activate

- Authentic advisor networks that compound over time become more valuable than transactional business relationships

- Channel-customer matching requires research to identify where ideal customers actually congregate, not where marketing theory suggests

- Building specific segment expertise creates defensible positioning when technology becomes commoditized

- Sales and marketing alignment requires shared vision, shared metrics, and collaborative GTM motion design

- Content strategy functions as distribution infrastructure rather than marketing tactic in modern GTM

- Unit economics discipline (CAC, LTV, payback period) determines sustainability of growth more than revenue growth rate