Hardware Shortage Crisis Spreads to GPUs and SSDs [2025]

Your computer just became a lot more expensive. Not because manufacturers raised prices arbitrarily, but because the entire PC hardware supply chain is buckling under the weight of artificial intelligence.

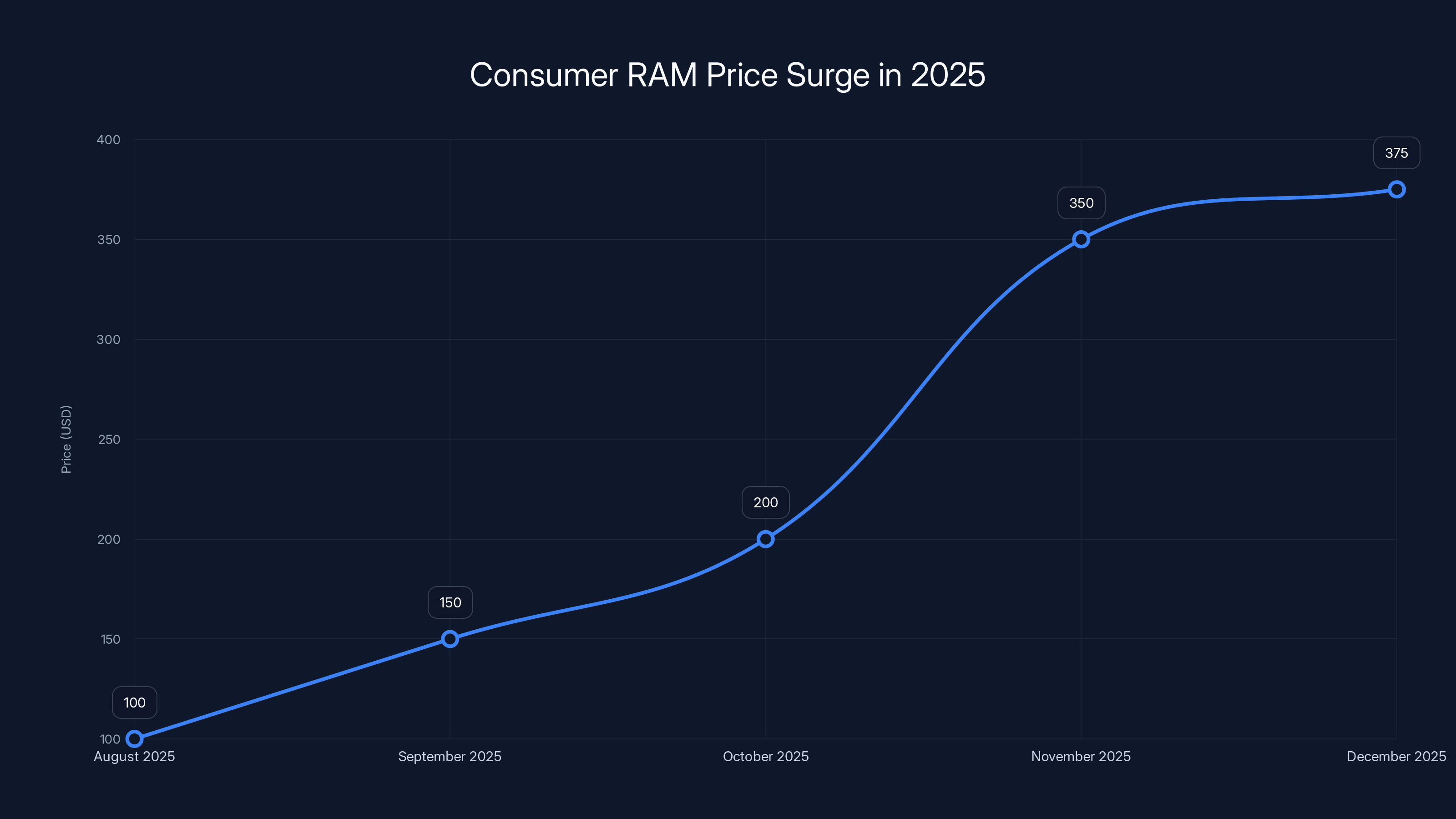

By the end of 2025, something peculiar happened in the tech world. RAM kits that should've cost

What started as a RAM shortage is metastasizing. It's spreading to GPUs, storage drives, and everywhere else that memory chips live. Tech companies building massive AI infrastructure bought up every memory chip they could get their hands on, and consumers are paying the price. Literally.

Here's what's happening, why it matters, and what it means for your next PC upgrade.

TL; DR

- RAM prices spiked 300-400% by end of 2025, with direct-to-consumer kits hit hardest

- GPU shortages are forcing manufacturers to discontinue mid-tier cards and prioritize expensive models

- High-capacity SSDs are becoming scarce, with 2TB and 4TB drives jumping from 240 to440

- Storage drives are climbing slowly but noticeably, signaling broader supply pressure

- The crisis will define PC pricing through 2026 and beyond as supply chains struggle to catch up

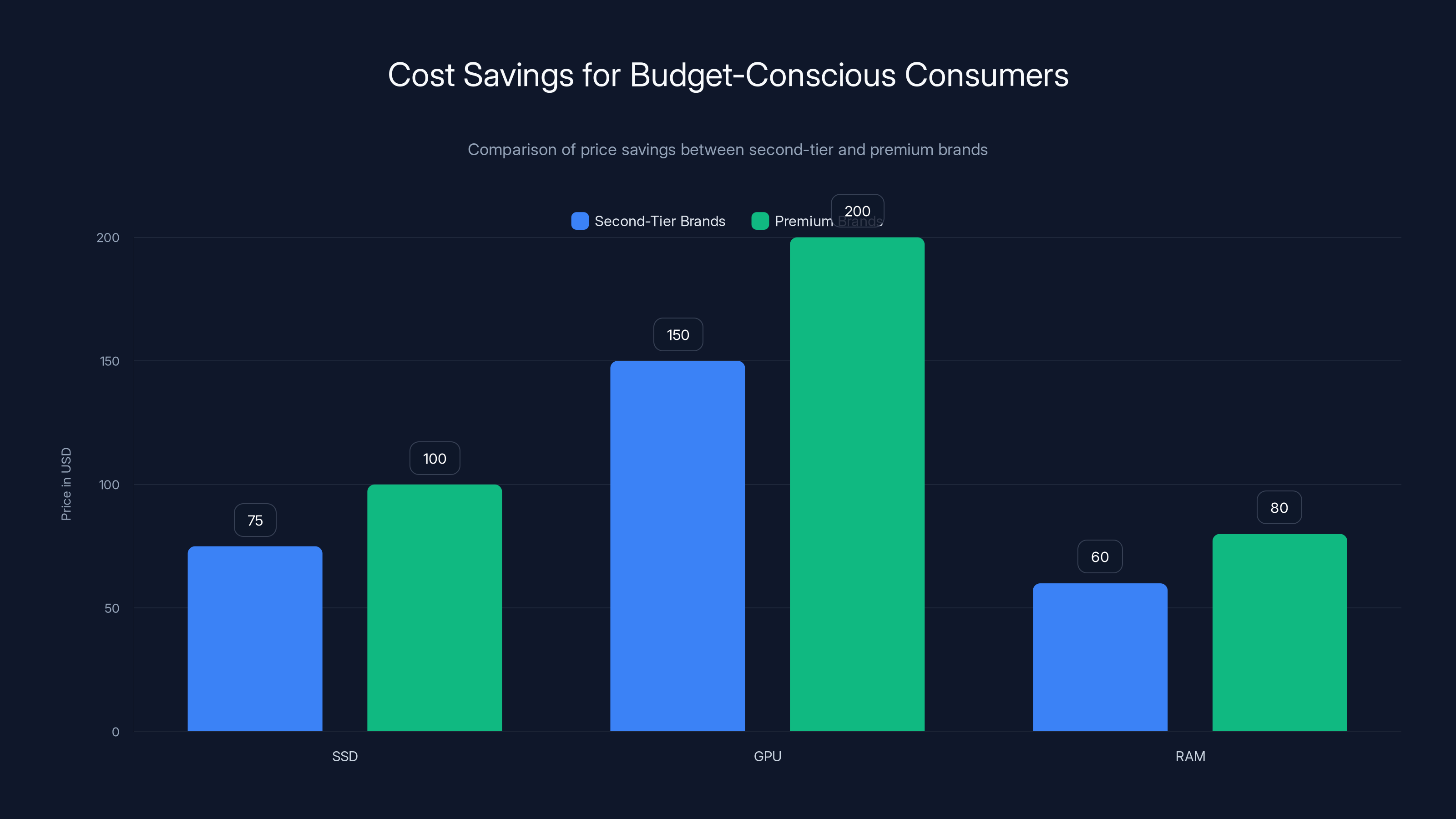

Budget-conscious consumers can save 15-25% by choosing second-tier brands over premium ones, with minimal performance differences. Estimated data.

The AI Memory Crunch That Started It All

This whole mess traces back to one simple reality: large language models, AI training, and machine learning infrastructure need obscene amounts of memory. When OpenAI released GPT-4, when companies started building multimodal AI systems, when every tech company decided they needed their own foundation model, they all needed the same thing: RAM.

Lots of it. Hundreds of thousands of gigabytes, in some cases.

Data centers ordered memory in bulk. Then they ordered more. Then they ordered even more because demand kept accelerating. NVIDIA, eager to support these workloads, started requesting specialized memory from chip manufacturers. Suddenly, memory became the constraint instead of the GPU silicon itself.

Consumer-grade RAM kits bore the brunt of this initially. In August 2025, a decent 32GB DDR5 kit cost around

Here's what happened: manufacturers prioritized data center orders because that's where the money was. Enterprise customers buying thousands of modules at once get better pricing and faster fulfillment than some guy on Newegg buying 16GB for a gaming PC. Manufacturers had to choose, and they chose the lucrative contracts.

Consumer RAM inventories dried up. Amazon listed out-of-stock notices. Best Buy's shelves got thin. Smaller retailers started canceling backorders. And prices soared because the people who did want RAM urgently had to pay premium prices to find it anywhere.

The data center frenzy has since moderated slightly, but memory remains tight. The shortage that started in Q4 2025 is expected to persist well into 2026, maybe longer. This is what we're dealing with.

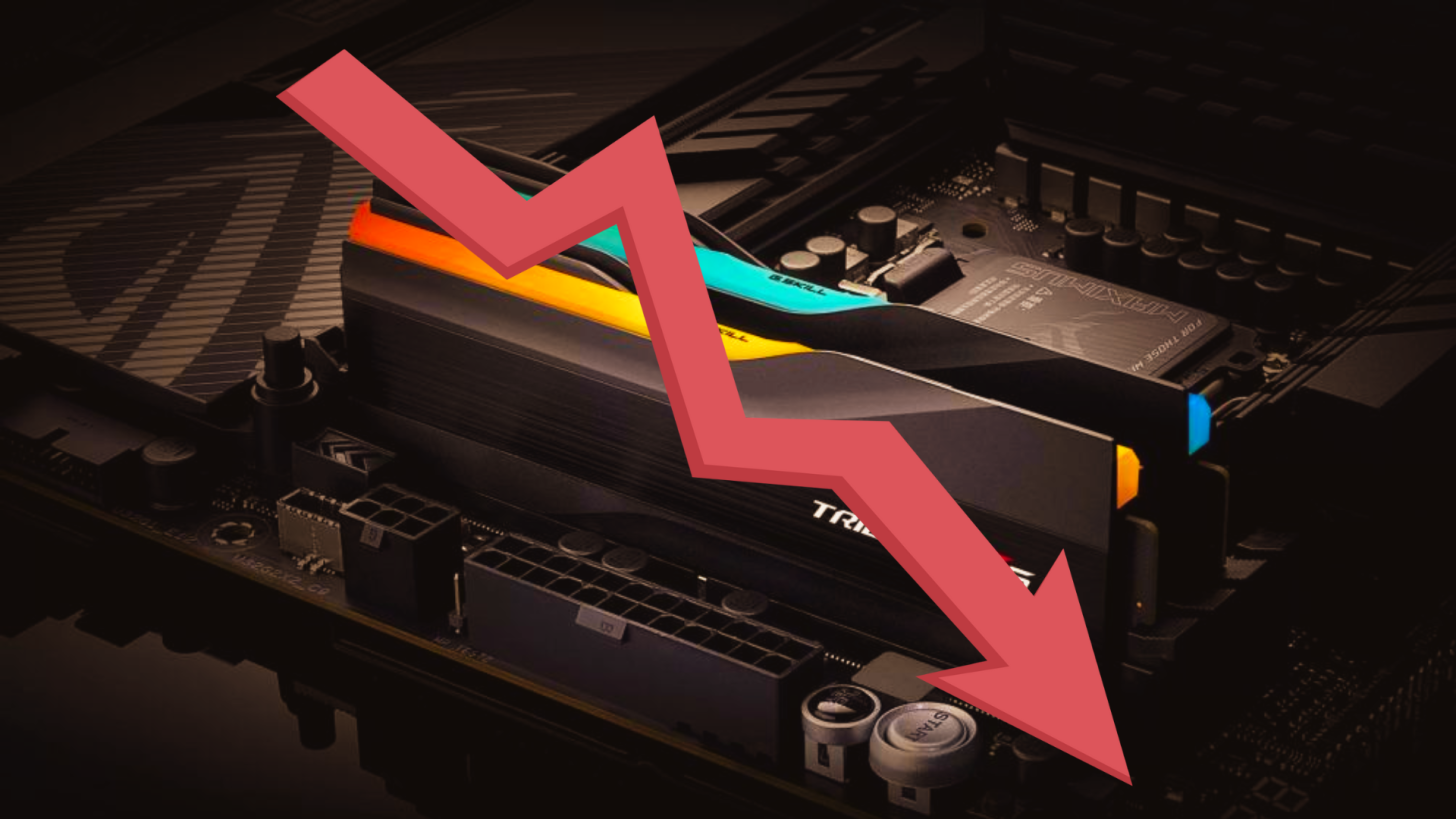

SSD prices have skyrocketed between December 2025 and January 2026, with 2TB drives experiencing a 148% increase, highlighting severe market pressure. Estimated data.

GPU Shortage Signals: Why the RTX 5070 Ti Is Disappearing

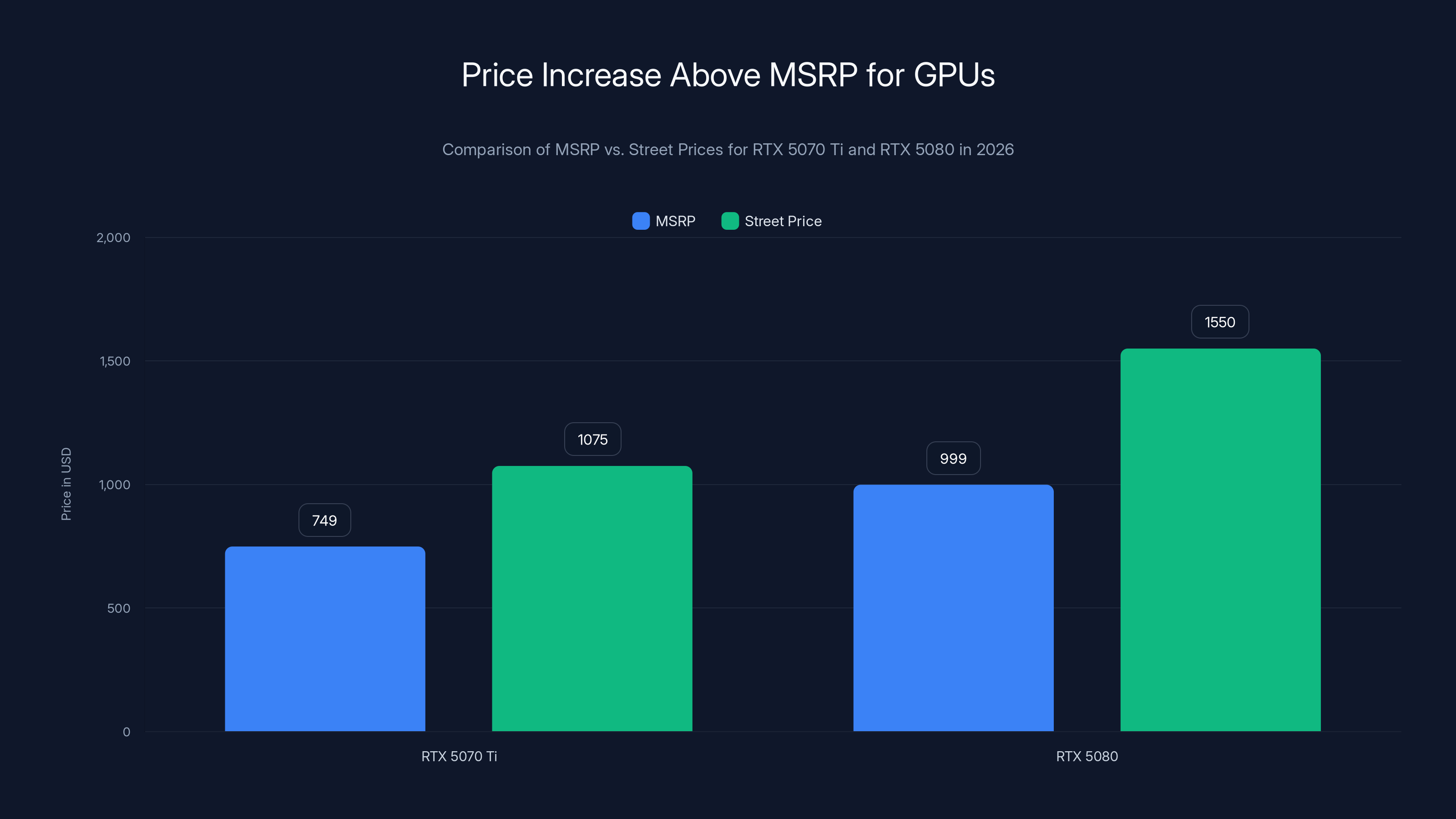

The GPU market is the clearest indicator that the RAM shortage is metastasizing beyond consumer awareness. A few weeks into 2026, ASUS accidentally announced it was discontinuing the GeForce RTX 5070 Ti. The company tried to walk back the statement, but the damage was done—and the logic behind it reveals something uncomfortable about how GPU makers think during shortages.

Here's the brutal math: The RTX 5070 Ti and RTX 5080 both use the same core GPU silicon (the GB203 chip) and the same amount of memory (16GB of GDDR7). The only real differences are frequency bins, power delivery, and cooling solution. The 5070 Ti has an MSRP of

From a GPU manufacturer's perspective during a memory shortage, the decision is obvious: put that 16GB of GDDR7 into the

Check current street prices and the incentive becomes undeniable. RTX 5070 Ti cards are selling for

This has created a weird bifurcation in the GPU market. If you want 1080p or 1440p gaming, you're actually fine. The RTX 5070 regular version sits around

But jump to mid-tier or high-tier cards? You're entering scalp territory. The RTX 5070 Ti is effectively being phased out or at minimum deprioritized. The RTX 5080 is premium pricing. The Radeon RX 9070 XT sits at MSRP

The long-term concern is whether GPU manufacturers will maintain production of lower-margin cards once the immediate shortage pressures ease. Discontinuation is easier than re-launching a product. If ASUS actually kills the 5070 Ti permanently, that eliminates consumer choice in the mid-high segment. Other manufacturers might follow suit. You could end up with a market where the only options are ultra-budget (

The SSD Market Collapses Under Pressure

SSDs have been climbing in price for months, but January 2026 marked the point where things got genuinely concerning. We're not just seeing small increases anymore. We're seeing wholesale unavailability of capacity alongside dramatic price jumps.

Start with the baseline: 1TB M.2 SSDs from reputable manufacturers now cost

But move up to 2TB, and the situation deteriorates sharply.

A 2TB WD Blue drive that cost

Samsung's 2TB 990 Evo Plus?

Capacity tiers are cascading in scarcity. 4TB SSDs show the same pattern: reputable models from big names are either out of stock or priced at multiples of what they cost months ago. You can find cheaper alternatives—Silicon Power, Crucial, other secondary brands—but the first instinct of most buyers is to reach for Samsung or WD because those brands have proven reliability. That trust allows them to command higher prices during shortages.

The Crucial P310 at $345 for 4TB is actually reasonable in this market. But the minute you're looking at Samsung or WD 4TB drives, you're back to paying 2-3x what seemed normal in late 2025.

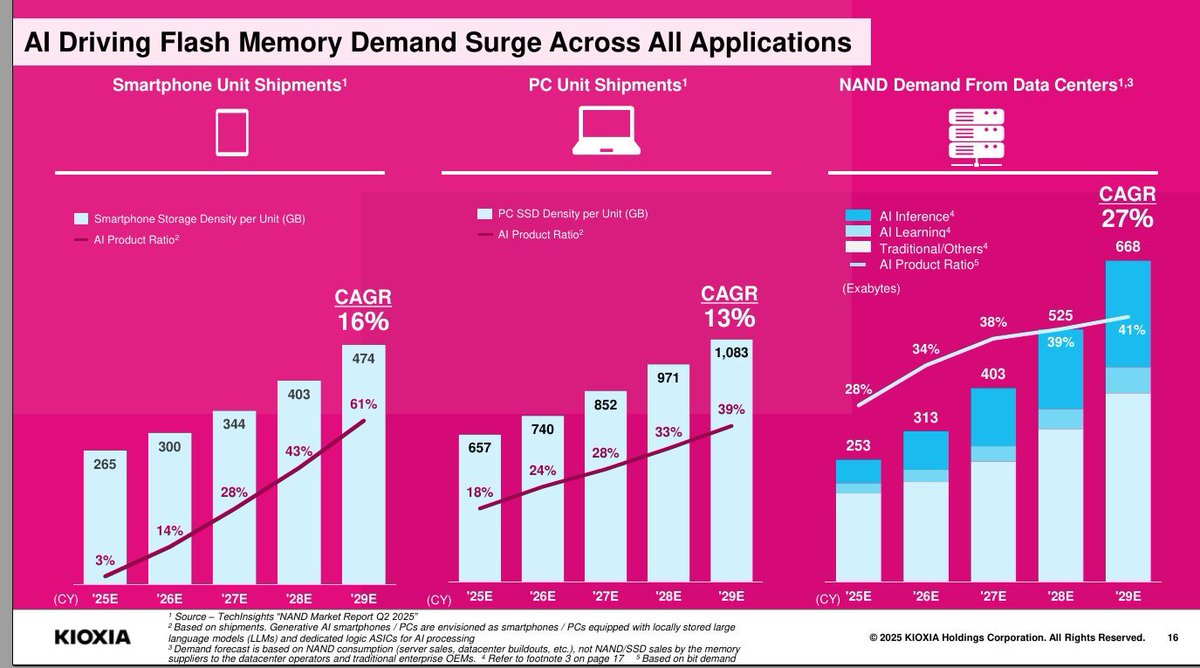

Why are SSDs affected? NAND flash memory is the constraint. SSDs use high-density NAND chips, and those chips are in competition with smartphone NAND, data center NAND, and consumer device NAND. AI servers aren't demanding NAND the way they demand DRAM, but general supply tightness means allocation is competitive. Manufacturers would rather allocate NAND to smartphones (higher profit margin per chip) than to SSD manufacturers (more commodity-like pricing).

High-capacity drives are hit harder because they require more NAND dies, and those are scarcer than lower-capacity options. A 2TB drive needs roughly double the NAND of a 1TB drive. During shortages, manufacturers prioritize whichever products move volume fastest. Single terabyte drives move fast in the consumer market. 2TB drives? Also popular, but slightly fewer people buy them. 4TB drives are niche. As scarcity increases, the niche product gets de-allocated first.

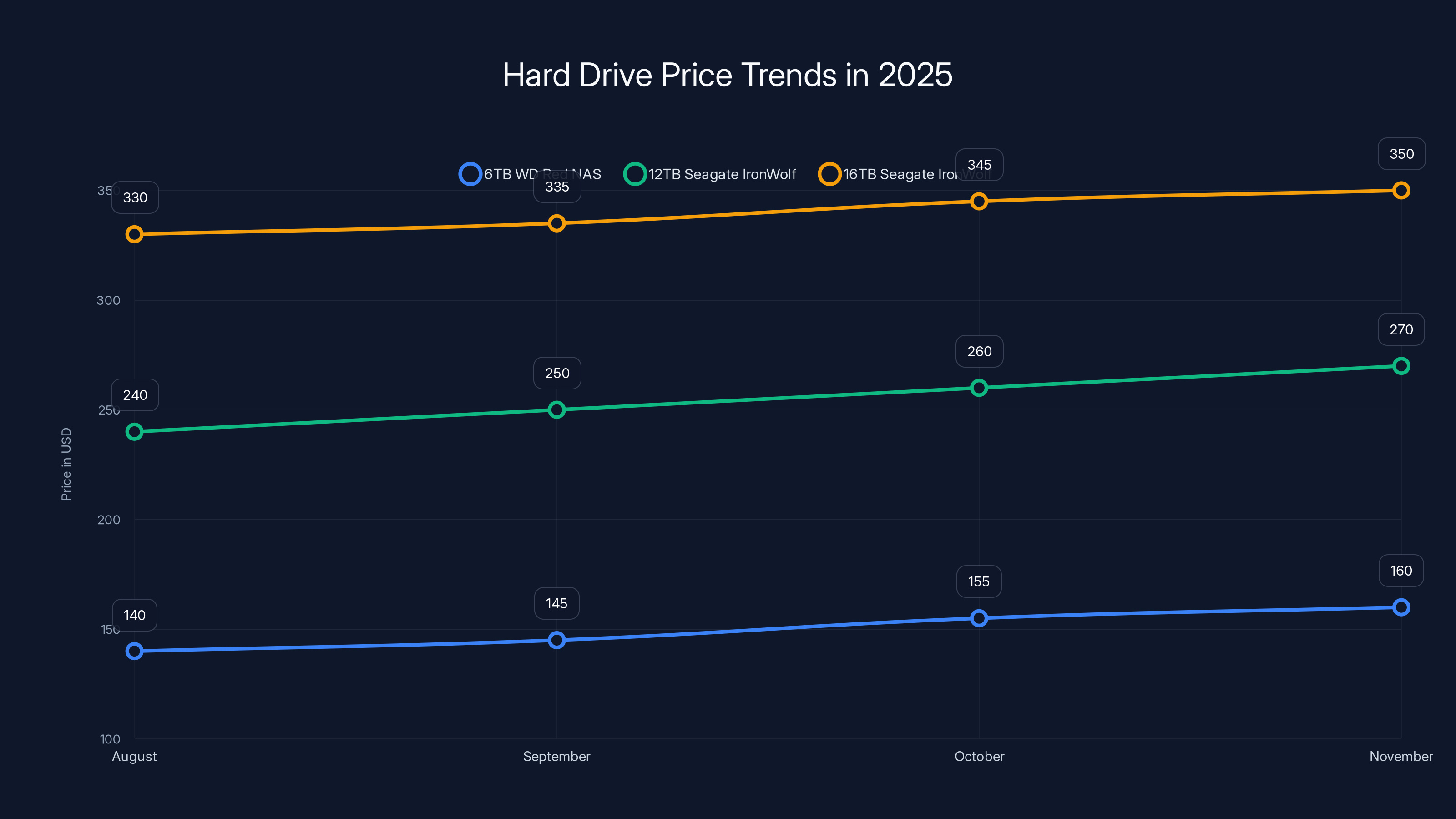

Hard drive prices have shown a steady increase from August to November 2025, with the 6TB WD Red NAS drive rising by 11% and larger drives also experiencing consistent price hikes. Estimated data.

Hard Drive Prices Finally Start to Climb

You'd think hard drives would be immune to a RAM and NAND shortage. They don't use much of either. They're spinning magnetic platters, a technology as old as the personal computer itself. Surely hard drives would escape this mess.

They haven't.

Prices are climbing, albeit more slowly than RAM and SSDs. A 6TB WD Red NAS drive that retailed for

For larger drives, the trend is clearer. A 12TB Seagate Iron Wolf that used to list at

Why are hard drives affected when they shouldn't be? The answer is supply chain complexity. Hard drive manufacturers don't exist in isolation. They use controllers, firmware, PCBs, and other components that compete for manufacturing capacity with SSDs and other electronics. When the entire component ecosystem is strained, even seemingly unrelated products feel the pressure.

Also, demand patterns matter. During the AI boom, data centers are building out with NVMe storage and high-capacity SSDs. They're not building out with spinning media. But smaller deployments, NAS boxes, and archival scenarios still rely on hard drives. With supply capacity directed elsewhere, hard drive pricing edges upward.

Manufacturers aren't aggressively pushing hard drive supply anyway. Margins are thin. A 12TB drive might generate

Why Data Centers Won the Memory Lottery

This entire situation exists because data centers have leverage that consumer buyers don't. When a major hyperscaler like Meta, Google, or Amazon places an order for 100,000 units of memory at once, chip manufacturers jump. Those companies guarantee volume, offer long-term contracts, and provide visibility that a retail customer never can.

Consumers buy when they need something. Data centers have planning cycles measured in years. A hyperscaler might sign a contract with Samsung in Q1 guaranteeing they'll buy a certain amount of memory through Q4. That kind of stability is worth money to chip manufacturers. It means guaranteed revenue, predictable manufacturing loads, and happy shareholders.

Retail RAM contracts? Those shift with market demand. A retailer might order 10,000 units expecting to sell them in 60 days. If demand drops or competitors undercut, that retailer suddenly has excess inventory. Chip manufacturers don't want that volatility. They'd rather serve customers with stable demand curves.

So when memory became scarce, it flowed to data centers first. Consumer supply shrank. Consumer prices spiked. Data center prices remained more stable because those agreements locked in pricing months ago.

This creates a strange inverse relationship where enterprise buyers are actually insulated from shortages through long-term contracts, while consumers pay the premium. In normal supply conditions, this wouldn't matter much. In shortage conditions, it creates massive divergence.

Large companies buying SSDs also have advantages. They can negotiate with manufacturers directly. Samsung will give a better price to a customer buying 5,000 units at once than to a retail distributor. Cloud providers and enterprises get preferred allocation. They get it at better pricing. By the time SSDs filter down to retail, allocation is tight and pricing is inflated.

Consumers get the leftovers at the worst prices. That's the hierarchy of tech shortages.

The RTX 5070 Ti and RTX 5080 are selling significantly above their MSRPs, with the 5080 reaching 60% above MSRP. Estimated data.

The Downstream Supply Chain Effect

We've now entered the phase where shortage impacts trickle downstream. OEMs that build PCs, laptops, and prebuilts have existing contracts with component suppliers. Those contracts, signed months or years ago, often lock in pricing. A laptop manufacturer might have a contract guaranteeing them a certain allocation of memory at a negotiated price through all of 2026.

So if you buy a prebuilt PC from a major OEM, you're potentially getting better pricing than if you buy components separately and assemble it yourself. The OEM's existing contracts shield them from the worst of the price spikes. But they're not completely immune. If those contracts are running out or if they need components beyond their allocated amounts, they're paying the same inflated prices as everyone else.

This creates a temporary window where prebuilt PCs offer better value than DIY builds. That window will close. Manufacturers will renegotiate contracts at new, higher prices. Once those new contracts take effect, prebuilts will become more expensive too.

For smartphone manufacturers, the situation is slightly better. Apple, Samsung, and other phone makers have even more supply chain leverage than PC OEMs. They're getting decent allocations of NAND and DRAM. Phone prices haven't spiked the way PC components have. But if memory shortages persist through 2026, even smartphones could see pricing pressure.

Market Segmentation and the Death of the Mid-Range

One of the more troubling aspects of this shortage is how it's reshaping market segmentation. In normal times, you have clear tiers: budget, mid-range, high-end. Each tier serves a different customer with different needs. During a shortage, that structure collapses.

Manufacturers have to make allocation decisions. Do we make 100,000 budget units or 10,000 premium units? If the premium unit has higher margins and guaranteed demand from customers willing to pay inflated prices, the choice is obvious. You make the premium unit.

With GPUs, we're seeing this play out in real time. The RTX 5070 Ti is being de-prioritized in favor of the 5080. Fewer options exist in the

The same could happen with SSDs. Manufacturers might prioritize 500GB and 1TB drives for budget consumers, then jump to 4TB+ drives for professionals and data centers. The 2TB sweet spot—the capacity most people actually want—gets squeezed.

Over time, this reshapes consumer expectations. If 2TB SSDs stay expensive and hard to find for long enough, people will adjust their buying patterns. They'll buy 1TB drives with external storage, or they'll spring for 4TB even if they don't need it. Either way, the shortage has changed behavior in ways that persist after supply normalizes.

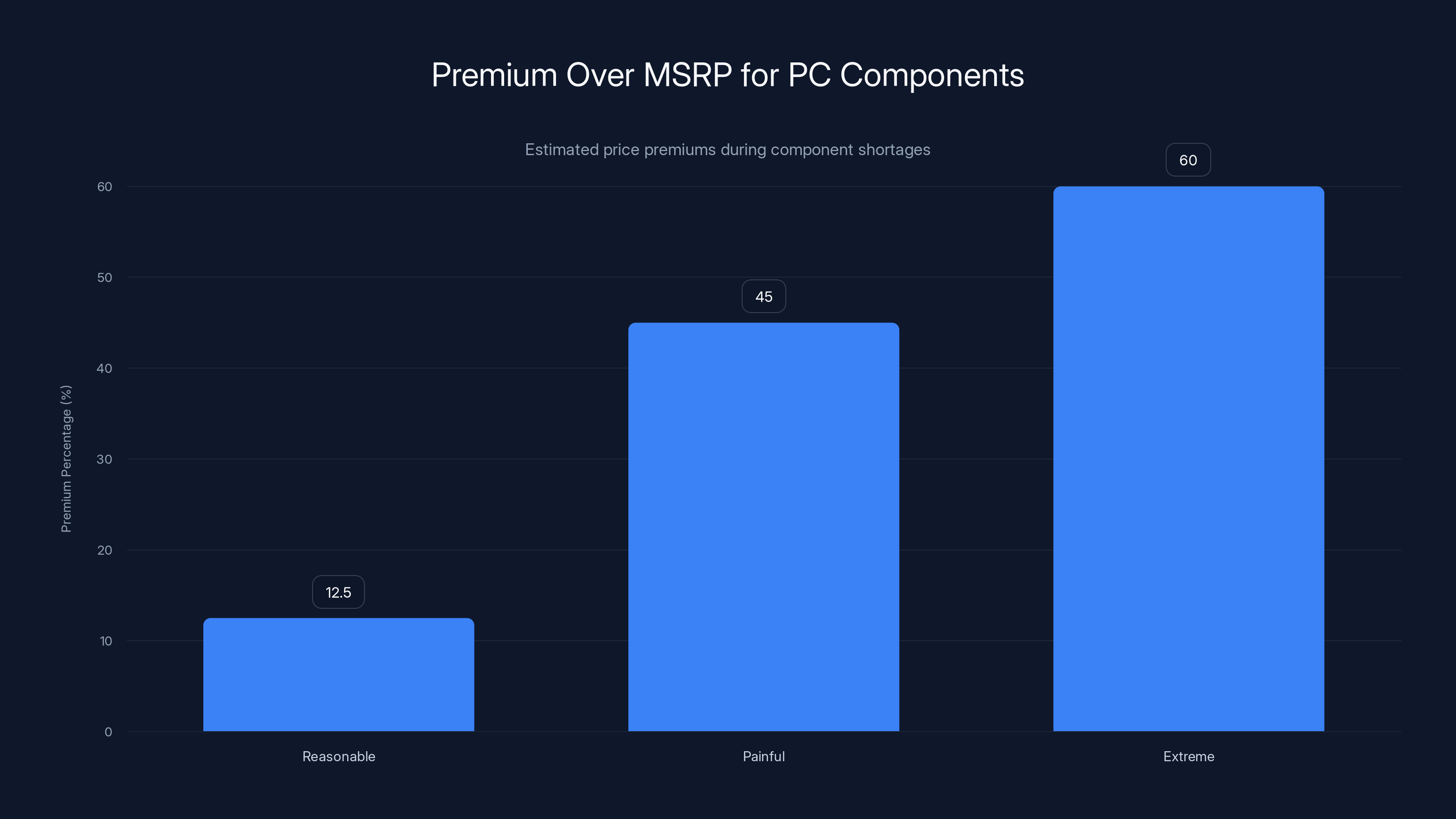

Estimated data shows that a 10-15% premium is reasonable, while a 60%+ premium is extreme and suggests waiting or finding alternatives.

When Will Prices Actually Return to Normal?

This is the question everyone's asking, and the answer is uncomfortable: probably not soon.

Memory fabrication takes time. Samsung, SK Hynix, Micron, and other manufacturers can't just flip a switch and double production. Building a new fab costs billions. Retooling existing fabs takes months. You can't magic new production capacity into existence overnight.

Data center demand for AI isn't cyclical like gaming demand. It's structural. Companies aren't going to stop building AI infrastructure because component prices normalize. Demand will remain elevated. Manufacturers will keep allocating memory to the highest bidders. Consumer prices might ease slightly, but they're unlikely to crash back to 2024 levels.

We're probably looking at 18 to 36 months before supply catches up to demand in a meaningful way. Some components might normalize sooner. Others might stay tight through 2027.

During that time, buying decisions have to account for the new reality. Don't buy expecting prices to drop. Buy when you actually need the component. If you're price-sensitive, focus on second-tier brands that offer reasonable value. Avoid premium brands if you're only paying for the logo.

For serious upgrades, consider whether it's worth doing now or waiting. A gaming PC upgrade in January 2026 when GPU prices are 40-60% over MSRP is a worse buy than waiting 12 months for prices to stabilize, assuming you can go without the upgrade. But if you genuinely need the hardware now, waiting isn't an option. In that case, make peace with paying the premium and buy from retailers with good return policies.

Strategic Recommendations for Different Buyer Types

Budget-Conscious Consumers

If cost is your primary concern, focus on smaller capacity components. A 1TB SSD is reasonably priced. A budget GPU handles 1080p gaming fine. 16GB of RAM is still functional for most workloads. You're not going to get screaming performance, but you'll save significant money.

Buy from second-tier brands. Kingston, Crucial, Gigabyte, EVGA—these companies make solid products at better prices than the premium brands. Performance differences are marginal. Reliability is solid. You save 15-25% compared to Samsung or Corsair.

Consider used components from reputable sellers. A year-old GPU from eBay is cheaper than a new mid-tier card, and it's had a year of real-world testing. As long as it's not a mining rig that's been pushed to the limit, used can be great value.

Professional Users

If you're using components for work—content creation, software development, design—you need reliability more than savings. Buy from manufacturers with good support and proven track records. Pay the premium for Samsung SSDs and established GPU brands. The difference in price is small compared to your lost productivity if a component fails.

Consider buying through professional channels. Workstation suppliers often have better allocations than retail channels. Dell's workstations might use premium components at better pricing than buying them separately.

Gamers

For 1080p and 1440p gaming, the current market is reasonable. Mid-range GPUs are priced close to MSRP. 1TB SSDs are fine for a game library. You don't need to wait for prices to drop further.

For 4K gaming, prices are painful. You're looking at $1,500+ for a decent GPU. If you can't justify that, stick with 1440p. The visual difference between 1440p and 4K isn't worth the 3x price premium right now.

Data Center and Enterprise

You've probably already got contracts locked in at decent pricing. Your concern is making sure you're getting fair terms in your next renewal. If your contracts are expiring in the next 12 months, get in front of those negotiations now. Prices are high, but they might be higher in six months.

The price of 32GB DDR5 RAM kits increased dramatically by 300-400% from August to December 2025 due to high demand from data centers, highlighting a significant memory crunch in the market.

The Broader Implications for Tech Industry Structure

This shortage is revealing something important about how the tech industry actually works. Data centers have institutional power that consumers don't. That power isn't evil or shocking—it's just how supply chains work when demand exceeds supply. The people with long-term contracts and high volume get preferential treatment.

But it also shows that consumer hardware is treated as a secondary priority when supply is constrained. The AI boom matters more than your GPU upgrade. That's a reality we need to accept.

Long-term, this might drive consumers toward different buying patterns. More rentals. More subscription services. More willingness to use older hardware longer because replacing it is expensive. These changes in consumer behavior will reshape the market structure.

Manufacturers will respond by building more capacity, which takes years. Companies will diversify their supplier bases, which takes negotiation and investment. The entire supply chain will adjust. But that adjustment happens slowly. We're not going back to 2024 conditions anytime soon.

What This Means for Your Next Computer Purchase

Here's the practical reality: your next computer will likely cost more than you'd like it to. Whether that's a prebuilt, a laptop, or a DIY build, components are expensive. Prices might ease by 10-15% in the next six months, but they're not returning to 2024 levels.

If you're planning a purchase, the window isn't "wait for better prices." The window is "buy when you genuinely need it, and make smart choices about which components matter most for your use case."

For gaming, focus on GPU. Everything else is secondary. A mid-range GPU with older RAM and slower storage will game better than new RAM with an old GPU.

For content creation, prioritize storage capacity and CPU. You'll have plenty of fast storage and a fast processor. GPU matters less unless you're doing 3D work or AI training.

For general computing, RAM and SSD speed matter most. You don't need a premium GPU. You don't need the fastest CPU. But you do need enough RAM to multitask and an SSD that won't make you wait 30 seconds to open an application.

Make those choices based on your actual needs, not based on what you'd like to spend. Acknowledge the shortage reality and plan accordingly.

Industry Responses and Future Supply Planning

Chip manufacturers are aware of the shortage. They're building capacity. TSMC is investing heavily in new fabs. Samsung is expanding memory production. Intel is retooling factories. These investments take years to materialize, but they're happening.

GPU manufacturers are working with memory suppliers to secure dedicated allocations. NVIDIA has leverage to request priority access. AMD is negotiating similarly. These companies understand that memory is the constraint and they're trying to lock in supply.

SSD manufacturers are doing the same with NAND suppliers. Partnerships are being formed. Long-term contracts are being signed. Eventually, supply will increase enough to meet demand. The question is when.

My best estimate: by Q1 2027, memory prices should start easing noticeably. By Q4 2027, they might approach something resembling normalcy. But that's a guess. If AI demand accelerates faster than supply capacity can increase, the shortage persists longer.

Historically, tech shortages swing hard. They go from "impossible to find" to "flooding the market" in a matter of months. When production catches up, prices crash. We could see a dramatic flip from expensive shortage to cheap glut by late 2026 or early 2027. At that point, the people who bought in January 2026 at inflated prices will have overpaid.

That's the gamble of buying during a shortage. You might pay premium prices for components, then watch them drop 30-40% in the next quarter. But if you don't buy and prices stay elevated, you've wasted months on outdated hardware.

How to Allocate Your Upgrade Budget During a Shortage

If you have a fixed budget for upgrades, here's how to allocate it during a shortage:

40% on GPU (or processor for non-gaming uses). This is the component that has the biggest performance impact. Don't cheap out here.

30% on Storage. You need enough capacity for your workflow. Don't sacrifice too much storage to save money on other components.

20% on RAM. 16GB is enough for most workloads. 32GB is overkill unless you're doing professional work. Don't overspend on RAM just because it's a luxury.

10% on Everything Else. Motherboard, power supply, case, cooling. These matter for stability and longevity, but they don't drive performance.

This allocation assumes you're building a balanced system. Adjust based on your needs. If you're a content creator, bump storage to 40% and reduce RAM to 10%. If you're a developer, RAM becomes 25% and storage becomes 25%. The principle is the same: spend more on components that matter for your actual use case.

FAQ

Why are RAM and SSD prices spiking so dramatically?

Artificial intelligence infrastructure requires massive amounts of memory. Data centers are buying memory in unprecedented quantities, consuming most available supply. Consumer purchases get the remainder at inflated prices. The shortage is structural, not temporary, because AI demand is growing faster than manufacturing capacity can expand.

Will GPU shortages eventually cause gaming GPUs to disappear?

Unlike RAM, GPUs won't completely disappear, but manufacturer portfolios will shrink. Mid-range GPUs like the RTX 5070 Ti are at risk because they share memory with higher-margin alternatives. If you want a mid-range GPU, buying soon is safer than waiting. Budget and entry-level GPUs will likely remain available throughout the shortage because they use less memory overall.

Is it better to buy a prebuilt PC or build my own during a shortage?

Prebuilt PCs typically offer better value during shortages because manufacturers have existing supply contracts at negotiated prices. Component availability from retail channels is tighter and more expensive. However, this advantage will disappear once manufacturers renegotiate contracts at higher prices, likely in late 2026. If you're buying now, a prebuilt is the smarter choice. If you're buying in late 2026, advantages will be minimal.

How much should I pay over MSRP for components?

A 10-15% premium is reasonable. A 40-50% premium is painful but sometimes unavoidable for high-demand components. A 60%+ premium means you should seriously consider waiting or finding an alternative. GPU prices have hit 60% over MSRP, which is extreme. Wait if you can, or buy a less desirable model at a lower premium.

When will component prices return to normal?

Most realistic timeline is 18-36 months for meaningful normalization. Memory prices specifically could ease sooner if data center demand plateaus, but that's unlikely. Storage prices might ease faster because NAND production is more flexible than DRAM. The earliest we might see near-normal pricing is Q1 2027, but that's optimistic. More likely is Q3-Q4 2027.

Should I buy used components to save money?

Used GPUs are safe if they haven't been mining. Used SSDs are fine if they have reasonable health metrics. Used RAM is generally safe. The risk is that you're buying something without a warranty, and if it fails, you're stuck. Buying used makes sense for expensive components like GPUs where you can save 25-35%. For cheaper items like RAM, the warranty is worth more than the savings.

Are certain brands more affected by shortages than others?

Premium brands like Samsung, Corsair, and NVIDIA feel shortages differently than secondary brands. Premium brands command higher prices during shortages because people trust them. Secondary brands offer better value. Both are affected by shortages, but premium brands can raise prices more aggressively and still sell due to brand loyalty. If you're budget-conscious, secondary brands are smarter during shortages.

Should I upgrade my entire computer or just specific components?

Upgrade only what you need. A CPU and GPU bottleneck each other, so if you upgrade one, consider the other. But don't upgrade RAM just because it's available, and don't upgrade storage unless you need capacity. Targeted upgrades are cheaper than full system replacements and let you spread costs across multiple purchases.

How do I know if a component shortage is temporary or structural?

Temporary shortages resolve within months as manufacturing capacity responds. Structural shortages persist for years because demand growth exceeds capacity growth. The current AI-driven memory shortage is structural. You can tell because manufacturers are investing in new capacity worldwide and demand is still outpacing supply. Plan on 18-36 months minimum.

Can I do anything to future-proof against component shortages?

Buy components with longer lifespans. A more expensive SSD that lasts 10 years costs less per year than a cheap one you replace every 5 years. Buy reliable brands even at premium prices. Avoid buying during shortage peaks. Keep your components longer before upgrading. These strategies won't prevent shortages from affecting you, but they'll minimize the financial impact.

The Bottom Line: Accept the Shortage and Plan Accordingly

This isn't the first tech shortage and it won't be the last. The smartphone boom created shortages. The mining boom created shortages. Every major technology transition seems to come with a period where demand exceeds supply and prices spike.

The AI boom is no different, except it's bigger and it's affecting more components simultaneously. That's unfortunate, but it's the reality we're in.

You have three options: buy now at inflated prices, buy later and hope prices have eased, or don't buy at all and make do with what you have. There's no fourth option where prices are low and components are available. That window closed in August 2025.

If you need hardware now, buy from reputable retailers with good return policies. Set a budget you can afford and stick to it. Focus on components that matter most for your use case. Accept that you're probably paying more than you'd like. It sucks, but that's where we are.

If you can wait, 12-18 months from now the situation will be noticeably better. Supply will have increased, prices will have eased, and you'll have more options. That's the realistic timeline based on manufacturing capacity, fab construction, and historical shortage recovery patterns.

Until then, welcome to the new normal. Component pricing is elevated. Availability is constrained. That's the cost of the AI revolution filtering down to consumer hardware. It'll pass eventually. But it won't pass quickly.

Key Takeaways

- RAM kits that should've cost 160

- The data center frenzy has since moderated slightly, but memory remains tight

- QUICK TIP: If you absolutely must upgrade your RAM right now, buy from retailers with price-matching guarantees

- That's a $250 gap for essentially the same memory footprint

- The long-term concern is whether GPU manufacturers will maintain production of lower-margin cards once the immediate shortage pressures ease

Related Articles

- The Daily Reality of Vibe Coded Apps at Scale [2025]

- Claude Code MCP Tool Search: How Lazy Loading Changed AI Agents [2025]

- Venezuela's X Ban Still Active: Why VPNs Remain Essential [2025]

- NYT Strands Game #684 Hints, Answers & Spangram [January 16, 2025]

- Euphoria Season 3 2026: Why This HBO Max Trailer Changed Everything [2025]

- Bandcamp's AI Music Ban: What It Means for Artists and the Industry [2025]

![Hardware Shortage Crisis Spreads to GPUs and SSDs [2025]](https://tryrunable.com/blog/hardware-shortage-crisis-spreads-to-gpus-and-ssds-2025/image-1-1768593984698.jpg)