Harmattan AI Reaches Unicorn Status: How a French Defense Startup Became Europe's AI Weapons Crown Jewel

Less than two years after launch, Harmattan AI just crossed a milestone that typically takes defense contractors decades to reach. The French startup hit unicorn status, raising

But here's what makes this different from typical venture funding announcements. This isn't a Silicon Valley chatbot startup or another computational efficiency play. This is a bet on the future of air combat itself. Harmattan AI builds autonomy and mission-system software for defense aircraft. Think of them as the neural network powering the next generation of fighter jets and autonomous drones that NATO armies desperately need as the Ukraine war exposes critical gaps in military technology.

The funding reflects something deeper happening in global defense strategy. After watching drone swarms dominate recent conflicts, Western militaries realized they can't win modern wars with yesterday's weapons. They need AI-powered autonomous systems that can make split-second decisions at speeds humans can't match. Harmattan AI built exactly that, and now has backing from one of Europe's most prestigious aerospace manufacturers.

This isn't just business news. It's a signal about where military innovation is heading, how Europe is fighting back against American dominance in defense tech, and why startup founders should be paying attention to the defense sector right now. Let's break down what just happened and why it matters.

The Rise of a European Defense Unicorn: Context You Need

Harmattan AI entered a market with a specific gap. European defense contractors are world-class at building mechanical systems, aerodynamics, and weapons platforms. But when it comes to embedded AI, autonomous decision-making, and real-time software systems for combat aircraft, they were behind. American companies like Anduril Industries were already eating into this space with sleeker technology and venture funding.

Harmattan AI's founders, including CEO Mouad M'Ghari and CTO Martin de Gourcuff, saw an opportunity. They could build AI software that would work inside Rafale fighters and autonomous drones, giving European militaries indigenous technology without depending on American suppliers. This touches on something called "strategic autonomy" in European policy circles. It's the idea that the EU shouldn't rely on US technology for critical military systems.

The timing couldn't have been better. Ukraine changed everything. When Russia invaded, military planners watched drones become the dominant weapon system. They saw commercial quadcopters modified with explosives defeating multi-million-dollar tanks. They realized autonomous systems weren't science fiction anymore—they were operational necessity. NATO armies scrambled to understand drone swarms, electronic warfare, and AI-powered interception. Harmattan AI had solutions.

In July 2025, barely one year after founding, Harmattan AI won a multi-million-dollar contract from a NATO government for AI-enabled small drones. That single contract validated everything about their approach. You don't get government contracts that fast unless you're solving a problem politicians and generals are losing sleep over.

Now with Dassault backing them, the company moves from "promising startup" to "critical infrastructure partner." Dassault isn't a venture capital firm looking for exits. It's a defense prime with €7 billion in annual revenue that needs AI to stay competitive. This partnership means Harmattan AI's technology will likely be integrated into next-generation Rafales and potentially exported to allied nations.

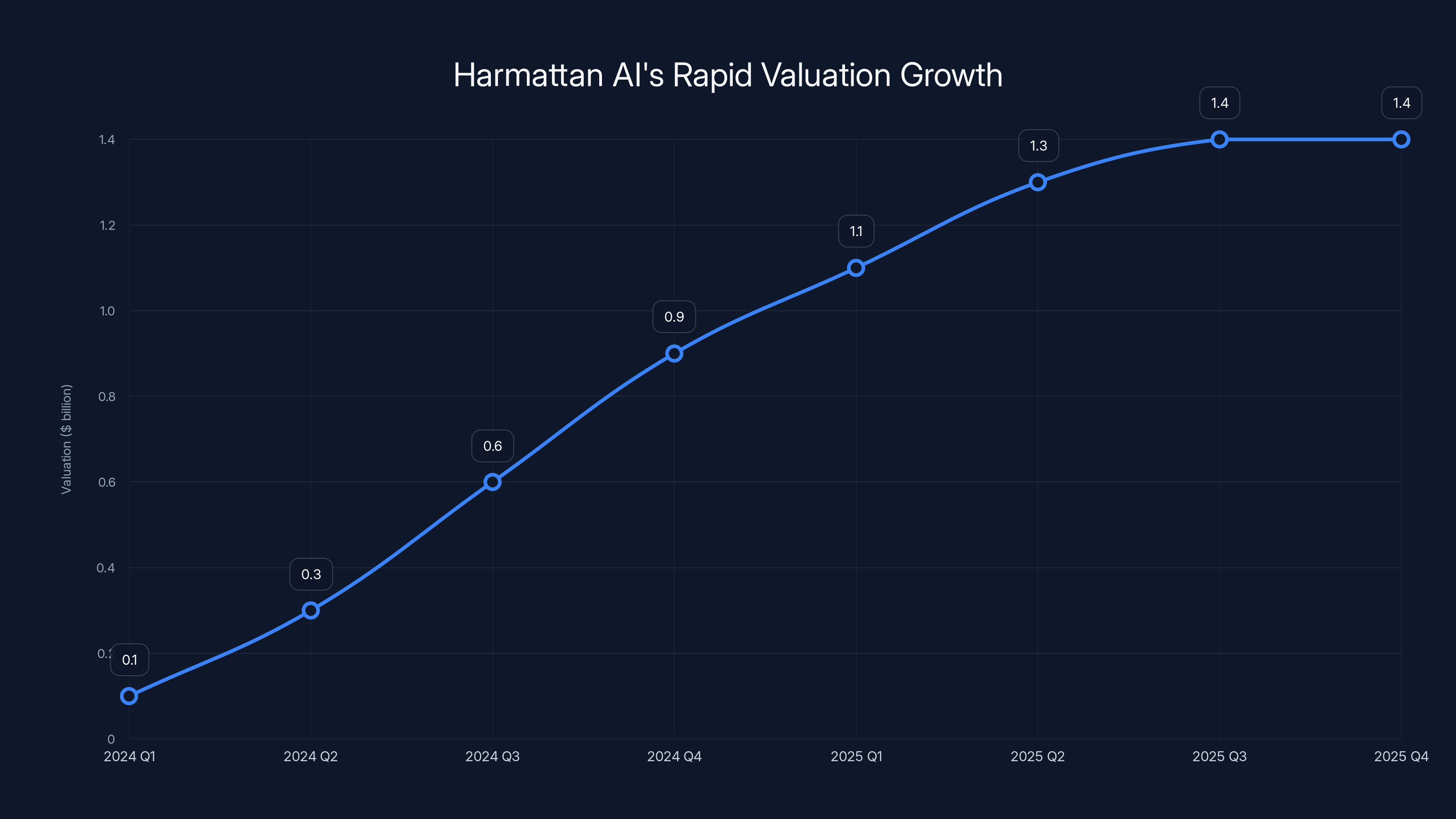

Harmattan AI achieved a $1.4 billion valuation in less than two years, showcasing rapid growth driven by strategic partnerships and market demand. Estimated data.

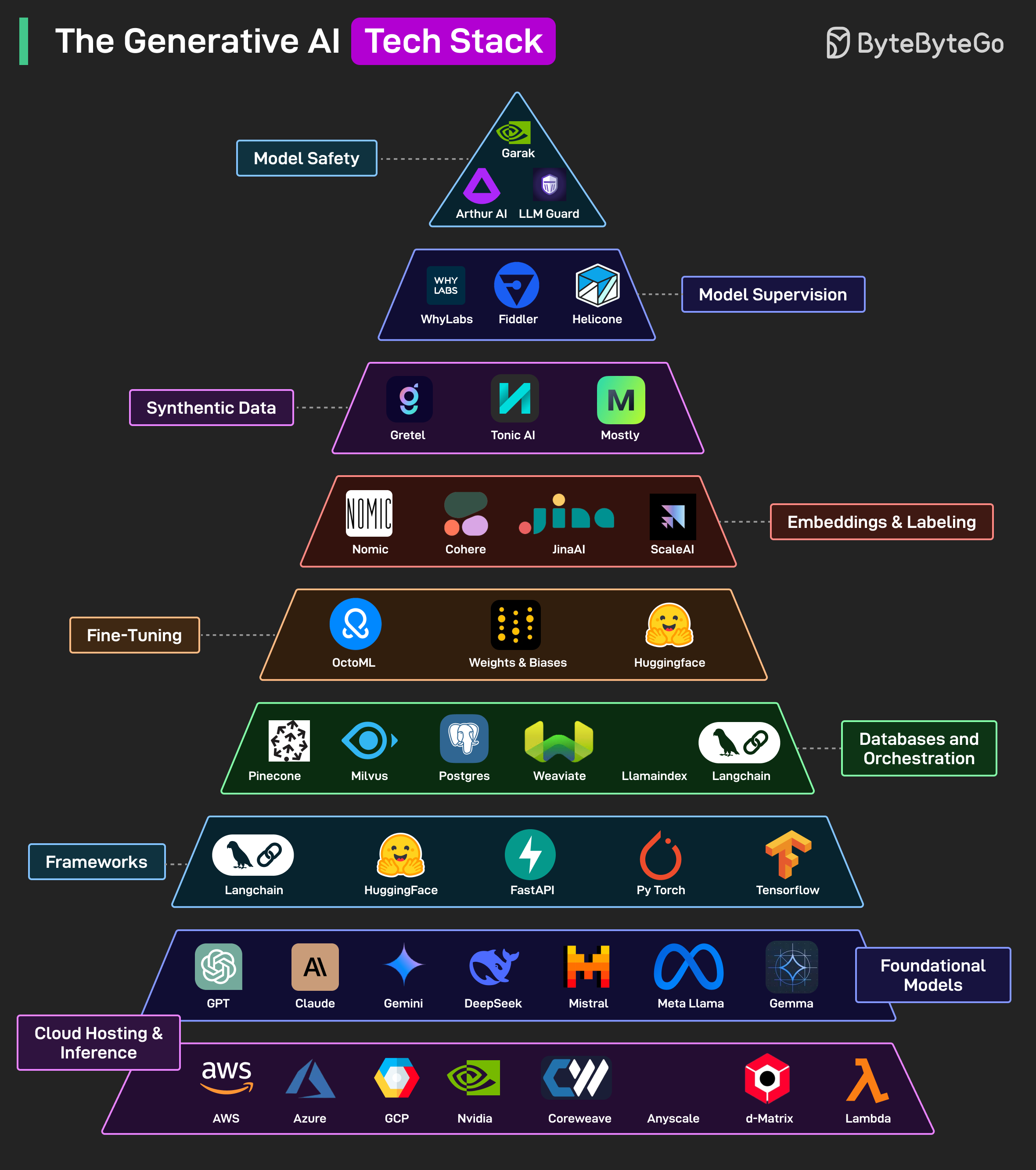

Understanding Harmattan AI's Core Technology Stack

What exactly does Harmattan AI build? The company describes itself as developing "autonomy and mission-system software for defense aircraft." That's deliberately vague corporate language, but let's decode what it actually means.

At the core, they're building AI systems that can be embedded directly into aircraft hardware. Unlike cloud-based AI services, embedded military AI must work in real-time, offline, without relying on satellite communications that can be jammed or disabled. The system needs to make lethal autonomous decisions in milliseconds while running on aircraft-grade hardware with strict power and cooling constraints.

This is exponentially harder than building Chat GPT. You can't just run an LLM on a fighter jet's onboard computer. The systems must be deterministic, explainable, and verifiable. Military auditors need to understand exactly why the AI made a specific decision. If a Rafale's autonomous system misidentifies a target, the consequences are catastrophic.

Harmattan's technology stack likely includes several interconnected systems:

Autonomy Layer: Algorithms that allow aircraft to fly, navigate, and execute tactics without human control. This includes path planning, obstacle avoidance, and threat response.

Target Recognition and Classification: Computer vision systems trained to identify military targets, classify threat levels, and distinguish between allies and adversaries. This is where precision matters most.

Electronic Warfare Integration: Systems that can detect, classify, and respond to radar, communications jamming, and electronic attacks. Think of this as the aircraft's immune system.

Mission Planning: Real-time optimization of flight paths, weapon deployment, and tactical decisions based on battlefield conditions. The AI needs to adapt instantly when conditions change.

Inter-aircraft Communication: If Harmattan is building drone swarm technology, individual drones need to coordinate autonomously without human intervention. This distributed decision-making is exponentially more complex than single-aircraft control.

Each of these systems has to integrate seamlessly while maintaining security, redundancy, and human oversight. Military leaders aren't comfortable with fully autonomous killing machines, so Harmattan's systems likely maintain human control over lethal force. But they can suggest targets, execute defensive maneuvers, and manage complex multi-platform operations without waiting for human approval on every decision.

The company also mentioned developing technology for "drone interception and ISR (Intelligence, Surveillance, and Reconnaissance)." This means Harmattan is likely building AI systems that can detect incoming drones, classify threats, and coordinate interception. As drone warfare becomes ubiquitous, this technology becomes as critical as air defense systems.

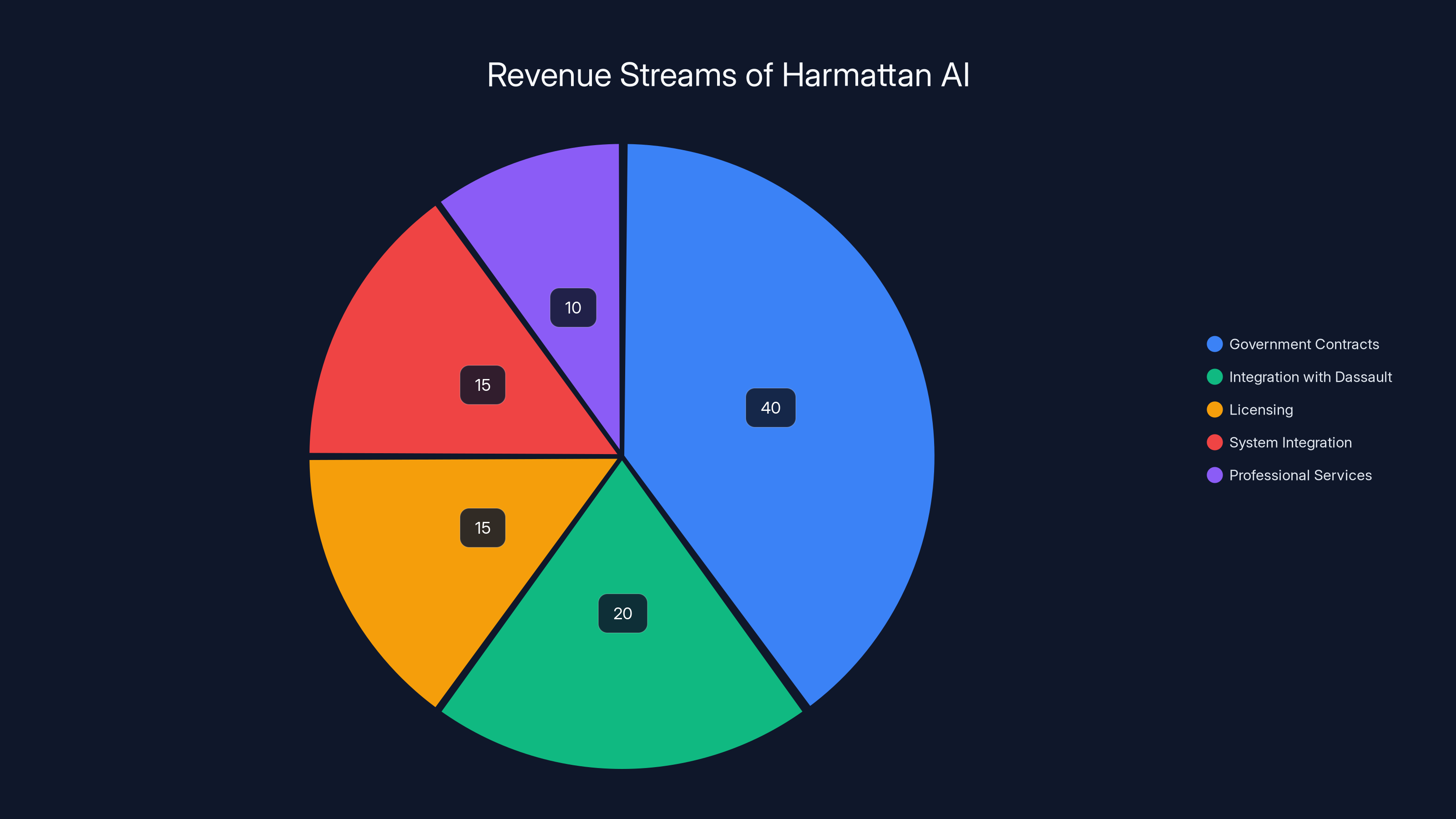

Estimated data shows that government contracts are the largest revenue stream for Harmattan AI, followed by integration and licensing fees. Estimated data.

The Dassault Partnership: Why This Matters More Than You Think

Dassault Aviation isn't just another investor. It's one of Europe's crown jewels in aerospace and defense. The company has been building military aircraft since before World War II. The Rafale represents France's engineering excellence and is used by multiple allied nations including India, Greece, and Egypt.

When Dassault leads a funding round, it signals something specific: this startup has technology the defense prime actually needs for future products. This isn't strategic investing to hedge risk. This is Dassault saying "we want to integrate your AI into the next Rafale variants we're building."

For Harmattan AI, the partnership provides several concrete advantages:

Manufacturing Scale: Dassault operates factories producing sophisticated aircraft. These same facilities can help Harmattan scale drone production and hardware integration. The $200 million funding explicitly mentions scaling manufacturing, which Dassault can facilitate.

Supply Chain Access: Dassault has relationships with suppliers for military-grade components. Harmattan needs certified hardware, secure communications links, and ruggedized systems that commercial companies don't supply.

Regulatory Navigation: Military aviation has byzantine certification requirements. French, European, and NATO standards require extensive testing. Dassault knows every regulator and every requirement.

International Sales: Dassault exports Rafales to multiple nations. Harmattan's technology can be integrated into these aircraft and sold internationally, expanding beyond France and Europe.

R&D Collaboration: Dassault's engineers have decades of air combat experience. Harmattan can tap this expertise to design AI systems that actually work in real military operations, not just in simulations.

The financial terms matter too. Harmattan's previous funding came from traditional venture capital. Atlantic and First Mark brought

There's also a geopolitical angle. French President Emmanuel Macron personally praised the announcement, calling it "excellent news for our strategic autonomy." This signals government support at the highest levels. Harmattan AI will likely receive favorable regulatory treatment, government contracts, and policy support. This isn't a normal startup—it's now a strategic national asset.

The Broader Context: Why NATO Needs Harmattan AI Right Now

Understanding why this funding happened requires understanding what's happening on the battlefield in Ukraine and the broader European security situation.

For the first time in 75 years, a near-peer military power invaded a neighboring European country without significant military resistance from NATO. Russia launched a full-scale invasion, and Ukraine's response surprised everyone. They didn't fight the way analysts expected. Instead, Ukrainian forces used commercial drones, armed with explosives and targeting systems, to disable Russian armor worth millions of dollars.

What started as a technological curiosity became the dominant weapon system. Drone operators could see targets in real-time, coordinate strikes, and adapt instantly. No jets, no missiles, just ubiquitous small drones changing warfare. NATO militaries watched and had a collective realization: we're not ready for this kind of war.

The problem is scale. A fighter pilot can engage maybe four targets in a mission. An autonomous drone swarm could engage hundreds. Training humans to operate swarms takes years. Building AI to coordinate them takes months. The gap became obvious.

Europe suddenly faced a strategic problem. American drone technology dominates the market. Companies like i Robotics and DJI supply most of the world's commercial drones. For military applications, Europe was dependent on American technology. That dependency became a vulnerability.

Harmattan AI offered a solution. A European company building European AI for European aircraft and drones. No American dependencies. No export controls blocking sales to NATO allies. Just indigenous technology that NATO countries could develop together.

The timing with Dassault is strategic too. France chairs the European Union in 2025. Macron has been pushing for "European sovereignty" in technology. Harmattan AI becoming a unicorn under Dassault's wing sends a message: Europe can compete in cutting-edge defense technology.

But Europe isn't the only player watching. The company mentioned exhibiting at the World Defense Show in Riyadh next month and expanding its US team. This signals Harmattan AI's ambitions extend beyond France. Middle Eastern allies and the United States both have interest in next-generation autonomous aircraft. Dassault's backing gives Harmattan the credibility to play in that market.

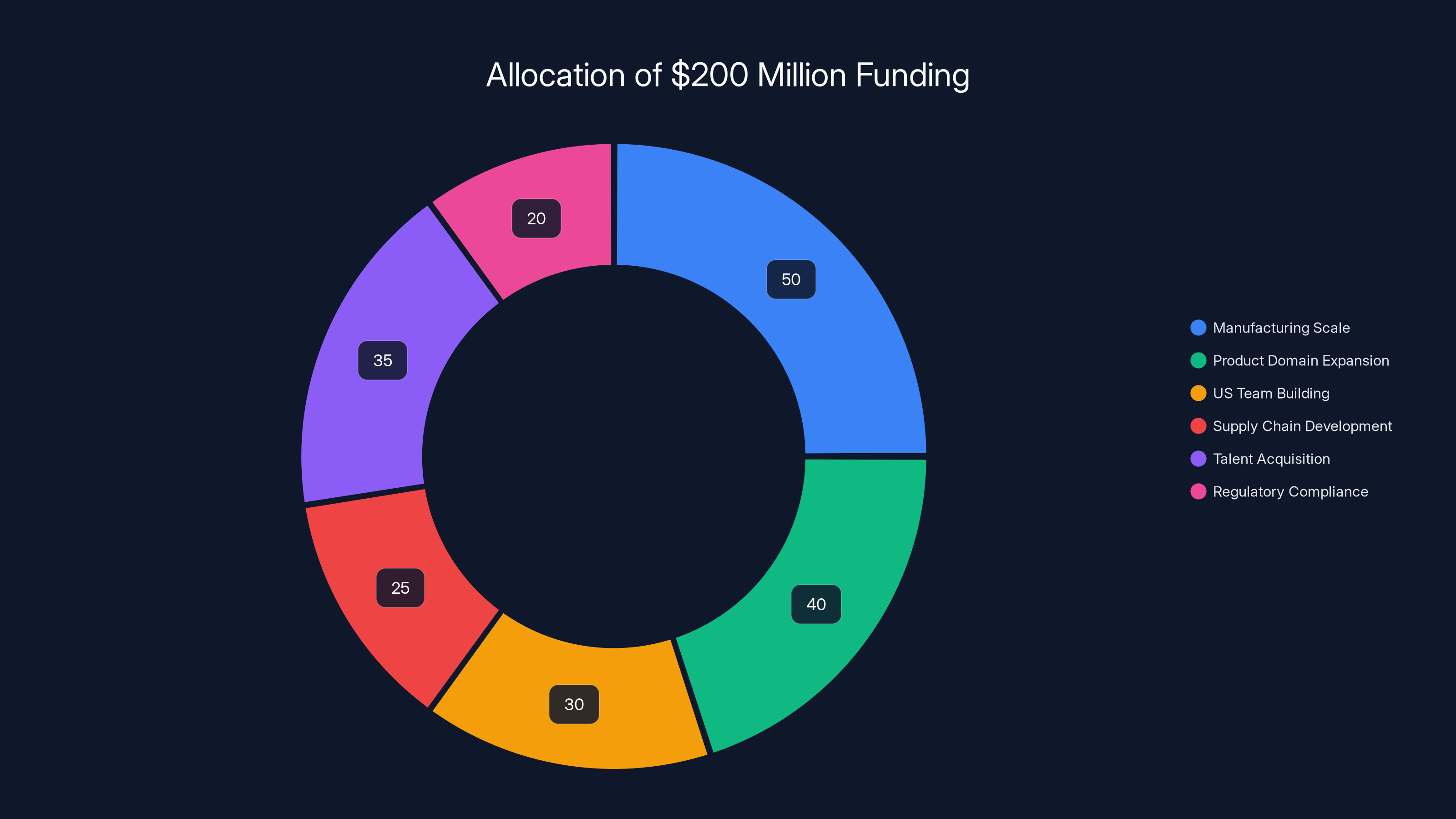

The $200 million funding is primarily allocated towards manufacturing scale and product domain expansion, with significant investments in team building and talent acquisition. (Estimated data)

Breaking Down the $200 Million Funding: Where the Money Goes

Raising

According to the company's announcements, funding priorities include:

Manufacturing Scale: This is explicit. Harmattan AI needs to produce drones, electronic warfare systems, and integrated AI hardware at scale. Current production probably runs at hundreds of units annually. Military demand likely requires thousands. Setting up manufacturing facilities for defense-grade hardware costs tens of millions alone.

Product Domain Expansion: Harmattan started with aircraft autonomy. Now they're expanding into drone interception, electronic warfare, and ISR systems. Each requires dedicated R&D, different hardware configurations, and separate certification processes. $200 million funds this parallel development.

US Team Building: The company is expanding operations in the United States. This isn't cheap. Hiring defense industry experts, establishing US headquarters, navigating American export controls, and building relationships with US Department of Defense all require significant capital and personnel.

Supply Chain Development: Defense-grade hardware components cost more and require longer lead times. Harmattan needs working capital to maintain inventory of ruggedized processors, secure communications modules, and military-certified sensors.

Talent Acquisition: Building a team that understands both AI and military operations is hard. You need Ph D-level researchers and experienced military operators. Competitive compensation requires significant capital.

Regulatory Compliance and Certification: Getting military AI systems certified is expensive. Each platform requires testing, documentation, security audits, and government approval. These processes cost millions.

The remaining capital likely goes to R&D for next-generation systems, working capital for growth, and strategic reserves. Dassault's stake means they're not expecting Harmattan to return capital quickly. This is long-term strategic investing.

Harmattan AI's Business Model: How Defense Tech Makes Money

Unlike consumer software companies that scale infinitely through APIs and subscriptions, Harmattan AI's business model is different. They make money through:

Government Contracts: NATO governments pay for specific capabilities. The "multi-million-dollar NATO contract" mentioned earlier is likely a multi-year program where the government funds development in exchange for exclusive rights to the technology.

Integration with Dassault Products: Harmattan AI's software will be embedded in Rafale aircraft and Dassault drones. The company likely receives royalties or integration fees for each unit sold.

Licensing to Other Manufacturers: Once proven, other aircraft manufacturers might license Harmattan's autonomy software. This scales the business without requiring Harmattan to build hardware.

System Integration Contracts: Military customers don't just buy software. They need integration, testing, training, and ongoing support. Harmattan can offer these high-margin services.

Professional Services: Implementation, customization, training military operators, and ongoing support generate recurring revenue similar to enterprise software.

The business model is fundamentally different from venture-backed consumer software. Growth comes from winning contracts and relationships, not from viral adoption. Customer acquisition takes years, not months. But customer lifetime value is enormous. A single NATO government contract for a multi-year program can be worth hundreds of millions.

This is why traditional VC metrics don't apply. Harmattan AI's $1.4 billion valuation isn't based on projected Saa S ARR or user growth. It's based on addressable market size—the total value of military aircraft and drone systems that will exist over the next 20 years.

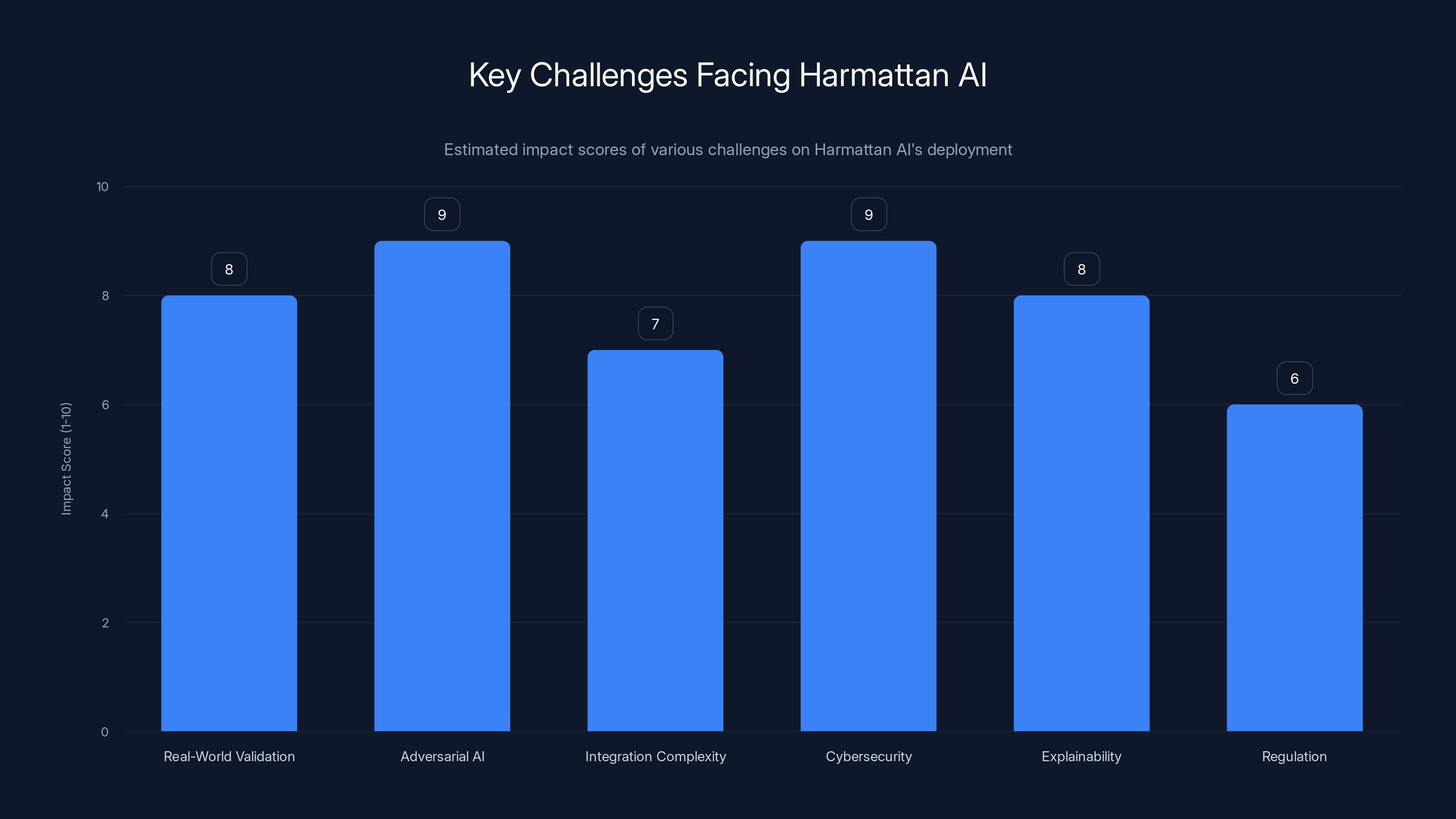

Adversarial AI and Cybersecurity are estimated to have the highest impact on Harmattan AI's deployment, highlighting the need for robust defenses and continuous R&D. (Estimated data)

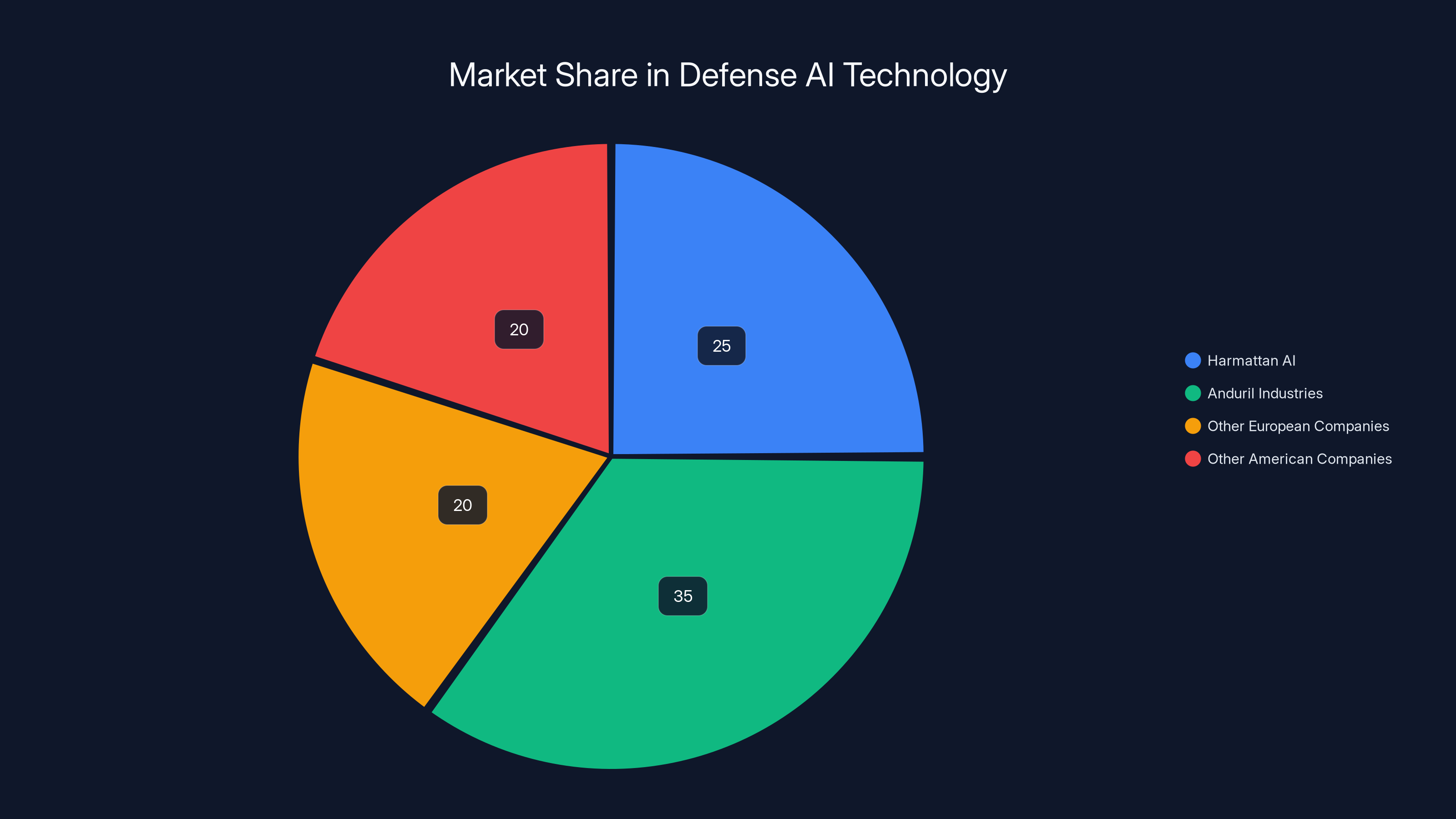

Harmattan AI in the Competitive Landscape

Harmattan AI isn't operating in a vacuum. Several other companies are building similar technology, though few have achieved unicorn status this quickly.

Anduril Industries, the American comparison most people make, is probably the closest parallel. Founded in 2017 by Palmer Luckey (formerly of Oculus), Anduril has been building autonomous defense systems including drones and aircraft. The company has raised significant capital and is backed by major defense contractors. But Anduril is focused primarily on the US market and American military needs. Harmattan AI's European approach is complementary rather than directly competitive.

Axon Enterprise and other defense contractors are building AI for law enforcement and military applications, but their focus is different. They're primarily in imaging, evidence management, and field operations rather than aircraft autonomy.

Smaller European startups like those incubated through European defense technology programs are building specialized capabilities, but few have the manufacturing scale or strategic backing that Harmattan AI now has through Dassault.

The competitive advantage Harmattan AI holds isn't just the technology. It's the combination of European regulatory approval, NATO government validation, and now Dassault's manufacturing and distribution. Competing on AI algorithms alone would be possible. Competing against Harmattan's complete package—AI plus manufacturing plus government relationships plus international credibility—is much harder.

The Technology Challenges Harmattan AI Still Faces

Raising $200 million is impressive, but it doesn't solve all problems. Harmattan AI faces significant technical challenges ahead.

Real-World Validation: Simulations and government testing are one thing. Real combat deployment is another. Military systems need to work reliably under conditions that never occur in testing. Weather, electronic warfare, unexpected threats—all create edge cases. Harmattan's systems need to be proven in operational environments.

Adversarial AI: As Harmattan AI deploys systems, adversaries will develop countermeasures. Russian and Chinese AI systems will specifically target how Harmattan's algorithms work. The company needs continuous R&D to stay ahead of adversarial learning.

Integration Complexity: Every aircraft variant, every drone model, every country's requirements are slightly different. Harmattan's software needs to be flexible enough to integrate across diverse platforms without losing performance or security.

Cybersecurity: Military AI systems are high-value targets. Hackers, state actors, and adversaries will attempt penetration. The systems need robust defenses, secure update mechanisms, and immunity to known attack vectors. This is an ongoing arms race.

Explainability and Accountability: Militaries want to understand why their autonomous systems made specific decisions. AI explainability in real-time scenarios is still an unsolved problem. Harmattan needs to make systems transparent enough for military audits while fast enough for combat operations.

Regulation and Compliance: International weapons treaties, NATO guidelines, and national regulations all constrain what autonomous systems can do. As Harmattan's technology becomes more capable, regulatory frameworks may lag, creating uncertainty.

These aren't insurmountable obstacles. They're just the normal challenges of deploying critical technology in adversarial environments. But they explain why Dassault's backing and Harmattan's $1.4 billion valuation still require continued execution.

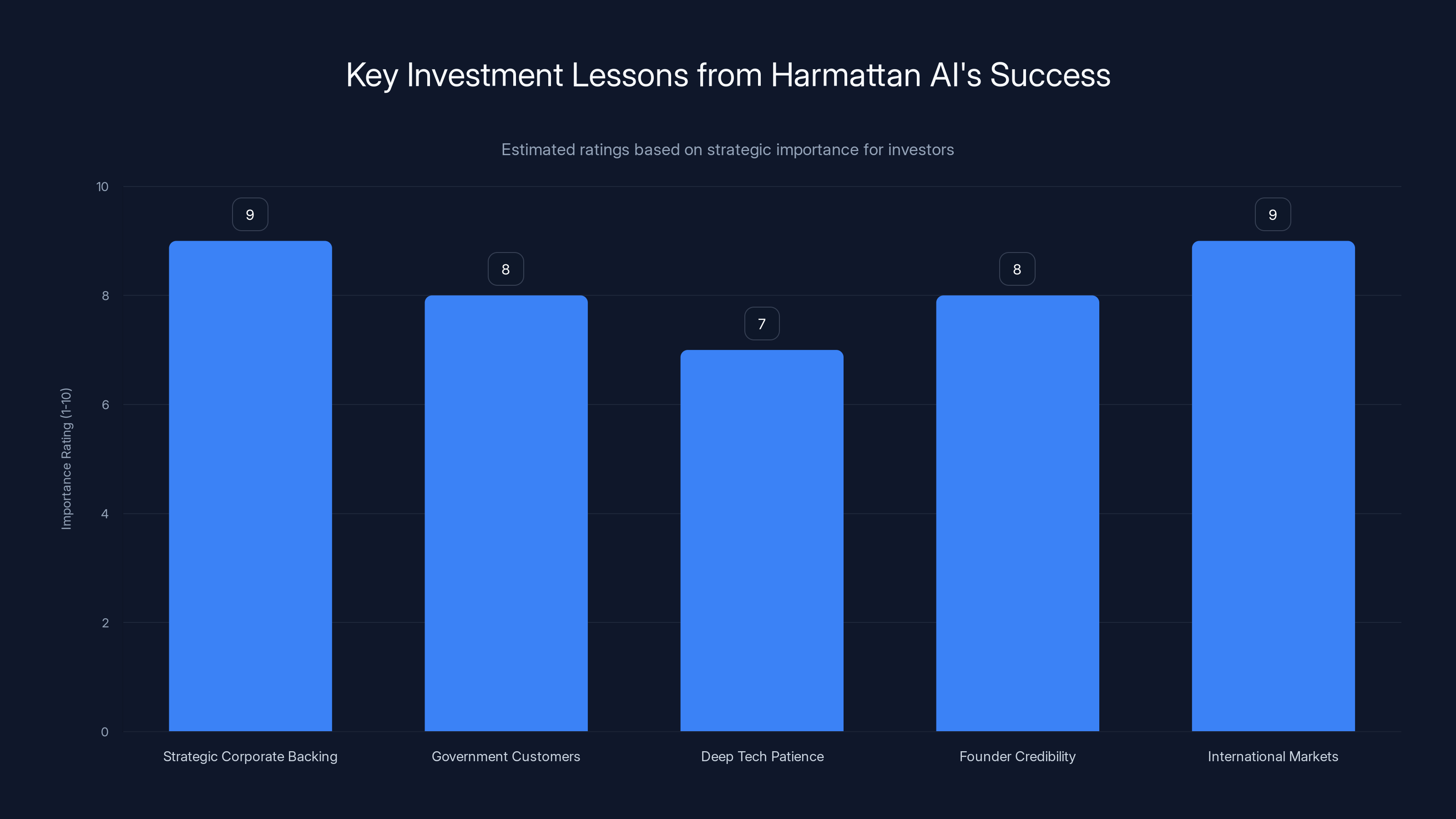

Strategic corporate backing and international market focus are rated highest in importance for Harmattan AI's success. Estimated data based on qualitative insights.

Strategic Implications for European Defense Independence

Harmattan AI's funding reflects a broader strategy in Europe. The continent spent 75 years relying on American military might through NATO. But that arrangement is increasingly questioned, especially as American political attention shifts toward the Pacific and potential conflicts with China.

European leaders realize they need indigenous military technology that doesn't depend on American supply chains or American political permission. Harmattan AI contributes to this goal in AI-powered aircraft and autonomous systems.

The broader strategy includes:

European Defense Budgets: Germany, France, Italy, and Poland have dramatically increased military spending since 2022. This creates demand for European-made systems.

Technology Sovereignty: Initiatives like the European Innovation Council and strategic funding for defense tech aim to develop European capabilities rather than importing from the US.

Industrial Consolidation: Dassault's backing of Harmattan AI signals that major European defense contractors are consolidating with smaller tech companies. This creates larger, more capable players.

NATO Standardization: European countries are working to standardize on compatible systems that can interoperate, reducing dependence on American command and control infrastructure.

Harmattan AI sits at the center of this strategy. A successful European autonomous aircraft company could be worth tens of billions over the next decade. But it requires sustained government support, technology excellence, and geopolitical stability.

The Founder Story: Who Built Harmattan AI

CEO Mouad M'Ghari and CTO Martin de Gourcuff founded Harmattan AI with specific expertise. While public information is limited, their background suggests deep experience in both military operations and advanced technology.

M'Ghari's Linked In post about the funding emphasized "scaling" and "ramping up manufacturing." This suggests a founder focused on practical deployment rather than just research. Someone with manufacturing experience, perhaps from previous roles in defense or aerospace.

De Gourcuff's post took a more philosophical tone, emphasizing that Harmattan exists "to protect our values" in a world where "power precedes law." This suggests a founder motivated by geopolitical implications, not just financial returns. This kind of purpose-driven founding often indicates deep roots in the military or intelligence community.

Neither founder publicized themselves extensively before founding Harmattan AI. They let the work speak for itself. This is different from American defense tech founders who often have high profiles before launch. The European approach seems more focused on building rather than talking.

Their ability to raise $42 million before Harmattan AI was two years old suggests they had credibility in the defense community. You don't get NATO contracts and VC backing without relationships and reputation. These founders likely came from within the French or European defense establishment, not from typical startup backgrounds.

Estimated data suggests Harmattan AI holds a 25% market share in defense AI technology by 2025, indicating significant growth and competition with American companies like Anduril Industries.

What This Means for Other Defense Tech Startups

Harmattan AI's trajectory provides a template for defense tech startups, especially in Europe:

Find a Specific Problem: Don't build general military AI. Solve a specific, pressing problem that military customers will fund. Harmattan focused on aircraft autonomy, a capability NATO desperately needed.

Get Early Government Validation: Traditional VC funding helps, but government contracts provide real validation. Harmattan won a NATO contract within one year. This proved the technology actually works operationally.

Partner with Strategic Corporates: After proving the concept with government, partnership with established defense contractors accelerates growth exponentially. Dassault's backing is worth more than the capital alone.

Build Indigenous Capabilities: European defense contractors can compete with American companies by offering independence from US supply chains and export controls. This is a sustainable competitive advantage.

Hire from Within: Recruiting people with actual military experience and deep domain knowledge is critical. This isn't software where smart engineers can learn the domain quickly. Military systems require specialized understanding.

Stay Patient on Growth: Defense sales cycles are measured in years, not quarters. Harmattan AI's founders seem comfortable with this. They're building for long-term value, not chasing hockey stick growth.

Geopolitical Risks and Future Uncertainty

For all its promise, Harmattan AI faces geopolitical risks that traditional startups don't encounter.

Trade War Escalation: If US-EU relations deteriorate further, American companies might be restricted from supplying components to European defense contractors. Harmattan needs to source all critical hardware from allied nations.

China's Competing Technology: China is investing heavily in autonomous aircraft and drone swarms. If Chinese systems prove superior, it could undermine demand for European alternatives.

Political Changes: Macron's personal endorsement helps, but French politics shift. Future governments might prioritize different priorities. Harmattan AI's success depends on sustained government support across multiple election cycles.

Regulatory Restrictions: As autonomous weapons systems become more capable, international pressure may increase for restrictions on fully autonomous systems. Regulations could constrain what Harmattan can deploy.

Acquisition Risk: If another defense contractor acquires Harmattan AI, the technology might be absorbed into a larger organization. This would still be a profitable exit for investors, but would reduce Harmattan's independence.

None of these risks are disqualifying. Every defense contractor faces similar challenges. But they're worth noting for anyone investing or building in this space.

The Broader AI and Defense Convergence

Harmattan AI is just one node in a much larger trend: the convergence of AI and military technology.

Every major military power is racing to integrate AI into warfare. The USA, Russia, China, and now Europe are all investing in autonomous systems, AI-powered decision-making, and networked military operations. The country that figures this out first will have a decisive advantage in the next major conflict.

This isn't hypothetical. Ukraine proved that drone swarms with minimal AI beat traditional military formations. Future conflicts will likely feature:

Autonomous Drone Swarms: Hundreds or thousands of small drones coordinating autonomously to overwhelm air defenses. Harmattan's technology is directly relevant here.

AI-Powered Command Systems: Military commanders will have AI advisors providing real-time tactical recommendations based on battlefield data. This requires the kind of decision-making systems Harmattan is building.

Electronic Warfare at Scale: Cyber attacks and electronic warfare will be as important as kinetic weapons. AI systems need to defend against and deploy electronic countermeasures automatically.

Networked Operations: Individual soldiers, vehicles, aircraft, and drones will be connected into unified tactical networks with AI coordinating operations. This requires the kind of embedded systems Harmattan develops.

Companies that master these technologies will dominate future warfare. Harmattan AI is betting that France and Europe can compete in this domain. The $200 million funding suggests they might be right.

Investment Lessons from Harmattan AI's Success

For venture capitalists, angel investors, and founders, Harmattan AI offers several lessons:

Strategic Corporate Backing Beats Venture Metrics: Traditional VCs look at growth rates, user acquisition, and unit economics. Strategic corporate partners like Dassault look at strategic fit and market size. When building hardware or critical systems, strategic backing often trumps pure VC returns.

Government Customers Are Underrated: Consumer internet startups are sexier to pitch. But government customers are more reliable, have larger budgets, and create defensible competitive advantages. Harmattan AI proved this.

Deep Tech Takes Time: Harmattan AI took less than two years to reach unicorn status, but that's because it had exceptional timing, a specific problem, and government funding. Most deep tech companies take 5-10 years to reach this point. Patience is required.

Founder Credibility Matters in B2B Tech: Harmattan's founders likely had significant industry experience before launching. You don't get government contracts and strategic backing without proven credibility. This is different from consumer internet where first-time founders succeed frequently.

International Markets Are Huge: Harmattan AI isn't just targeting France. They're targeting all of NATO, Middle Eastern allies, and potential US partnerships. International expansion is built into the plan from day one, not an afterthought.

What's Next for Harmattan AI

With $200 million in the bank and Dassault's backing, what comes next?

Scaling Manufacturing: The company will need to establish production facilities for drones and integrate AI into existing aircraft. This requires hiring manufacturing experts, setting up supply chains, and potentially opening factories in France.

Product Expansion: Beyond aircraft autonomy, Harmattan AI will expand into drone interception and electronic warfare. Each product line requires dedicated development, customer relationships, and regulatory approval.

International Expansion: The plan to expand the US team suggests targeting American defense contracts. The World Defense Show appearance in Riyadh signals Middle Eastern partnerships. Over the next 3-5 years, expect Harmattan AI to be a truly international company.

Technology Leadership: With significant funding, Harmattan can invest in next-generation AI capabilities. This could include multi-agent systems, adversarial robustness, and real-time optimization algorithms.

Potential IPO: Eventually, Harmattan AI might go public. French and European defense companies don't have the same public market access as American counterparts, but a global IPO could unlock significant value.

The next chapter for Harmattan AI is execution. The funding and partnerships are in place. Now comes the hard part: building products that work reliably in combat, scaling manufacturing, and maintaining technology leadership while competitors emerge.

Conclusion: A Watershed Moment for European Defense Tech

Harmattan AI's $200 million Series B isn't just a funding announcement. It's a watershed moment for European defense technology. For decades, Europe relied on the United States for military innovation. Harmattan AI suggests that Europe can compete in the most critical defense technology of the era: autonomous AI systems.

The company's success required several things to align. A specific military need (aircraft autonomy), government willingness to fund development (NATO contracts), venture capital interest (Atlantic, First Mark), and strategic corporate backing (Dassault). When these elements combine, exceptional companies emerge.

For founders and investors, Harmattan AI proves that significant venture value exists outside consumer internet. Defense, aerospace, healthcare, and other regulated industries can produce billion-dollar companies. These companies take longer to build, require different skills, and have different risk profiles. But the rewards are proportionally larger.

For geopolitical observers, Harmattan AI signals that Europe is serious about military independence. After 75 years of American security guarantees, European powers are building their own advanced military technology. This has implications for NATO, European industrial policy, and global military technology competition.

The defense tech era has begun. Harmattan AI is among the first European companies to achieve unicorn status in this space. But it won't be the last. Over the next decade, expect to see more European defense tech companies raising massive capital, winning government contracts, and potentially competing globally with American defense contractors.

Harmattan AI just proved it's possible.

FAQ

What is Harmattan AI and what do they do?

Harmattan AI is a French defense technology startup founded in 2024 that builds autonomy and mission-system software for defense aircraft and autonomous drones. The company develops embedded AI systems that enable aircraft like the Rafale fighter jet to operate autonomously, make real-time decisions, and coordinate complex military operations without constant human intervention. Their technology focuses on aircraft autonomy, target recognition, electronic warfare integration, and drone interception systems.

Why did Dassault Aviation lead Harmattan AI's funding round?

Dassault Aviation, the company that manufactures the Rafale fighter jet and other military aircraft, led the funding because Harmattan AI's technology directly addresses capabilities Dassault needs for next-generation aircraft and drones. As a strategic corporate partner, Dassault isn't investing purely for financial returns but to integrate Harmattan's AI capabilities into future Rafale variants and drone systems. This partnership also gives Harmattan access to Dassault's manufacturing capabilities, supply chains, and international sales networks that would take years to develop independently.

What is the significance of Harmattan AI reaching unicorn status in less than two years?

Reaching $1.4 billion valuation in under two years is exceptionally fast, even for venture-backed startups. For Harmattan AI, this speed reflects several factors: severe military demand for autonomous aircraft capabilities (demonstrated by Ukraine's drone dominance), government contracts validating the technology, and strategic backing from an established defense contractor. It signals that European defense technology can move at startup speed while maintaining institutional credibility, challenging the traditional model of slow defense contractor innovation.

How does Harmattan AI's technology work in real military operations?

Harmattan AI develops embedded systems that run directly on aircraft hardware, operating independently without cloud connectivity or satellite links that could be jammed or disabled. The systems use machine learning for target recognition, autonomous flight decision-making, electronic threat detection, and multi-aircraft coordination. Unlike consumer AI, military AI must be deterministic, explainable, and verifiable for regulatory compliance. The company integrates its software into platforms like Rafale fighters and autonomous drones, enabling them to execute complex tactical missions with minimal human intervention while maintaining final human control over lethal force deployment.

What is Harmattan AI's competitive advantage compared to other defense AI companies?

Harmattan AI's advantages include European origin (enabling NATO partnerships and independence from US supply chains), validation through NATO government contracts, technology tailored specifically for aircraft and drone systems, and now strategic partnership with Dassault Aviation. This combination of validated technology, government relationships, manufacturing scale, and international credibility creates barriers that pure AI competitors would struggle to replicate. While American companies like Anduril Industries build similar technology, Harmattan AI's European positioning allows it to serve markets prioritizing supply chain independence.

How does military AI differ from commercial AI applications?

Military AI must operate in real-time with minimal latency, function offline without cloud connectivity, be deterministic enough for military auditing, explain decisions in ways commanders understand, and maintain security against adversarial attack. Military systems can't simply run large language models on aircraft—they require purpose-built algorithms optimized for specific tactical problems. Additionally, military AI must work reliably under extreme conditions (electronic warfare, unexpected threats, degraded hardware) that never occur in commercial deployments. This creates fundamentally different technical requirements than consumer or enterprise AI.

What does Harmattan AI's funding mean for European defense independence?

Harmattan AI's success demonstrates that Europe can develop advanced military technology independently of American suppliers. The company's European focus, government backing, and integration with Dassault represents Europe's strategic push toward military autonomy. As NATO countries decrease reliance on US military systems and develop indigenous alternatives, companies like Harmattan AI become strategically important. This funding signals European commitment to competing in defense technology and potentially exporting capabilities to allied nations, reducing European military dependence on American technology.

What are the regulatory challenges Harmattan AI faces?

Military AI systems require certification from multiple regulatory bodies across NATO countries, France specifically, and potentially the EU. Each jurisdiction has different standards for autonomous weapons, cybersecurity, and export controls. International weapons treaties may eventually restrict fully autonomous systems, creating regulatory uncertainty. Additionally, as Harmattan AI's technology becomes more capable, regulators may impose stricter oversight. The company must navigate these complex requirements while maintaining technology leadership and manufacturing scale, making regulatory strategy as important as technical development.

How will Harmattan AI use the $200 million Series B funding?

According to company announcements, primary uses include scaling drone manufacturing to meet military demand (moving from hundreds to thousands of units annually), expanding product lines into electronic warfare and drone interception systems, establishing US operations and hiring American team members, developing supply chains for military-grade components, investing in next-generation AI research, and maintaining working capital for growth. Notably, manufacturing and scaling infrastructure consume more of the budget than pure R&D, reflecting the capital-intensive nature of defense hardware production.

What geopolitical risks could impact Harmattan AI's future?

Key risks include US-EU trade tensions that could restrict component sourcing, Chinese advancement in competing autonomous systems, political changes reducing European government defense spending, international regulations restricting autonomous weapons development, and potential acquisition by larger defense contractors that could reduce independence. Additionally, sustained government support across multiple election cycles is required for long-term success. Unlike consumer tech startups that can pivot quickly, Harmattan AI's success depends on geopolitical stability and sustained NATO military investment over decades.

Key Takeaways

- Harmattan AI reached $1.4 billion valuation in under two years through exceptional military demand and strategic backing from Dassault Aviation

- The company addresses NATO's critical capability gaps in autonomous aircraft and drone technology, validated through government contracts

- Embedded military AI requires fundamentally different engineering than consumer AI—deterministic, real-time, offline-capable systems for combat operations

- Dassault's partnership provides manufacturing scale, supply chains, and distribution networks worth more than capital alone in defense tech

- Harmattan AI represents Europe's broader strategy to achieve military technology independence and reduce reliance on American defense suppliers

Related Articles

- Articul8 Series B: Intel Spinoff's $70M Funding & Enterprise AI Strategy

- The 7 Top Space and Defense Tech Startups from Disrupt Startup Battlefield [2025]

- Wing's Drone Delivery Expansion: 150 More Walmarts by 2027 [2025]

- SandboxAQ Executive Lawsuit: Inside the Extortion Claims & Allegations [2025]

- Cyera's $9B Valuation: How Data Security Became Tech's Hottest Market [2025]

- Niko Bonatsos Launches New VC Firm After 15 Years at General Catalyst [2025]

![Harmattan AI Defense Unicorn: $200M Series B, Dassault Aviation [2025]](https://tryrunable.com/blog/harmattan-ai-defense-unicorn-200m-series-b-dassault-aviation/image-1-1768228627929.jpg)