The Breakneck Speed of Data Security's Rise

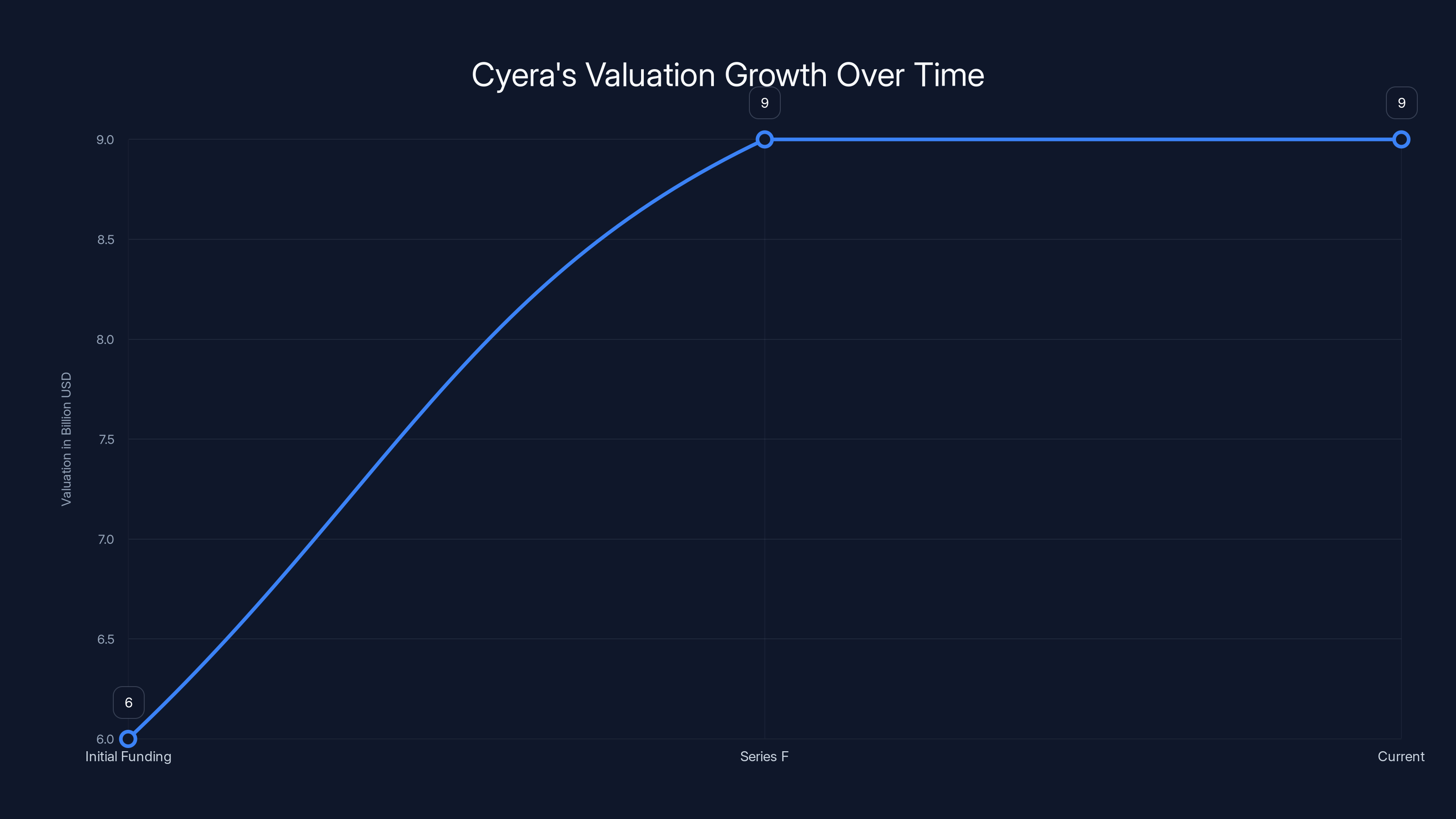

Six months. That's how long it took for Cyera to jump from a

On the surface, it's just another funding announcement. A New York-based startup raises $400 million in Series F. The usual cast of investors shows up: Blackstone (leading), Sequoia, Accel, Coatue, Lightspeed. The usual platitudes get trotted out. But this isn't just another deal.

This is a signal. A really loud one.

Data security has moved from "nice to have" to "existential." And Cyera isn't just riding that wave. It's become the poster child for why enterprises will spend billions to keep their data safe in an era where breaches can end companies.

Let's talk about what's actually happening here, why it matters, and what it means for the future of enterprise software.

TL; DR

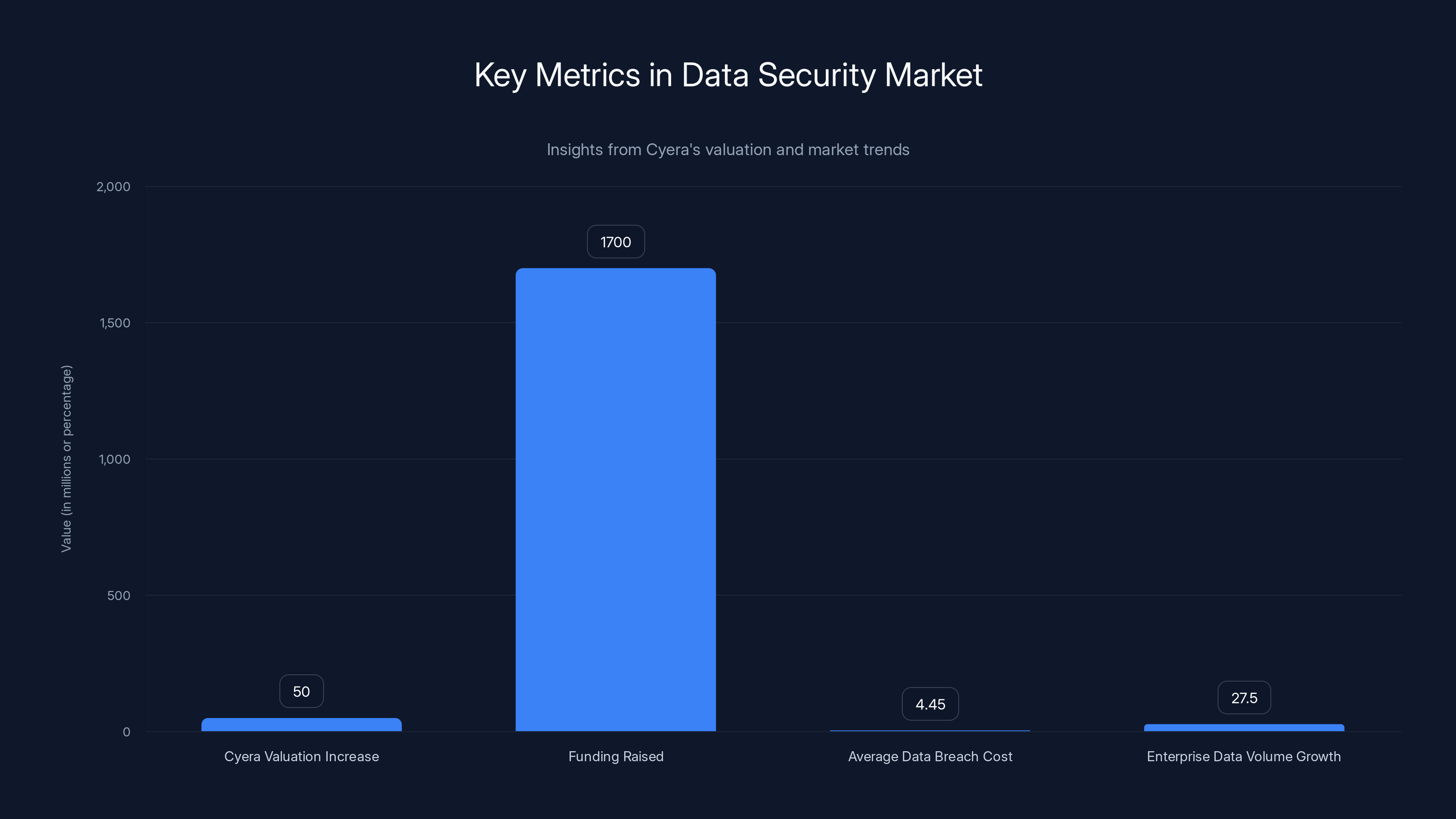

- Cyera's $9B valuation represents a 50% increase in just six months, signaling explosive demand for data security solutions

- Over $1.7 billion raised across six funding rounds shows sustained investor confidence in the data governance market

- Data breaches cost companies an average of $4.45 million, creating urgent buyer motivation and massive TAM

- Enterprise data volumes are growing 25-30% annually, making data discovery and protection increasingly critical

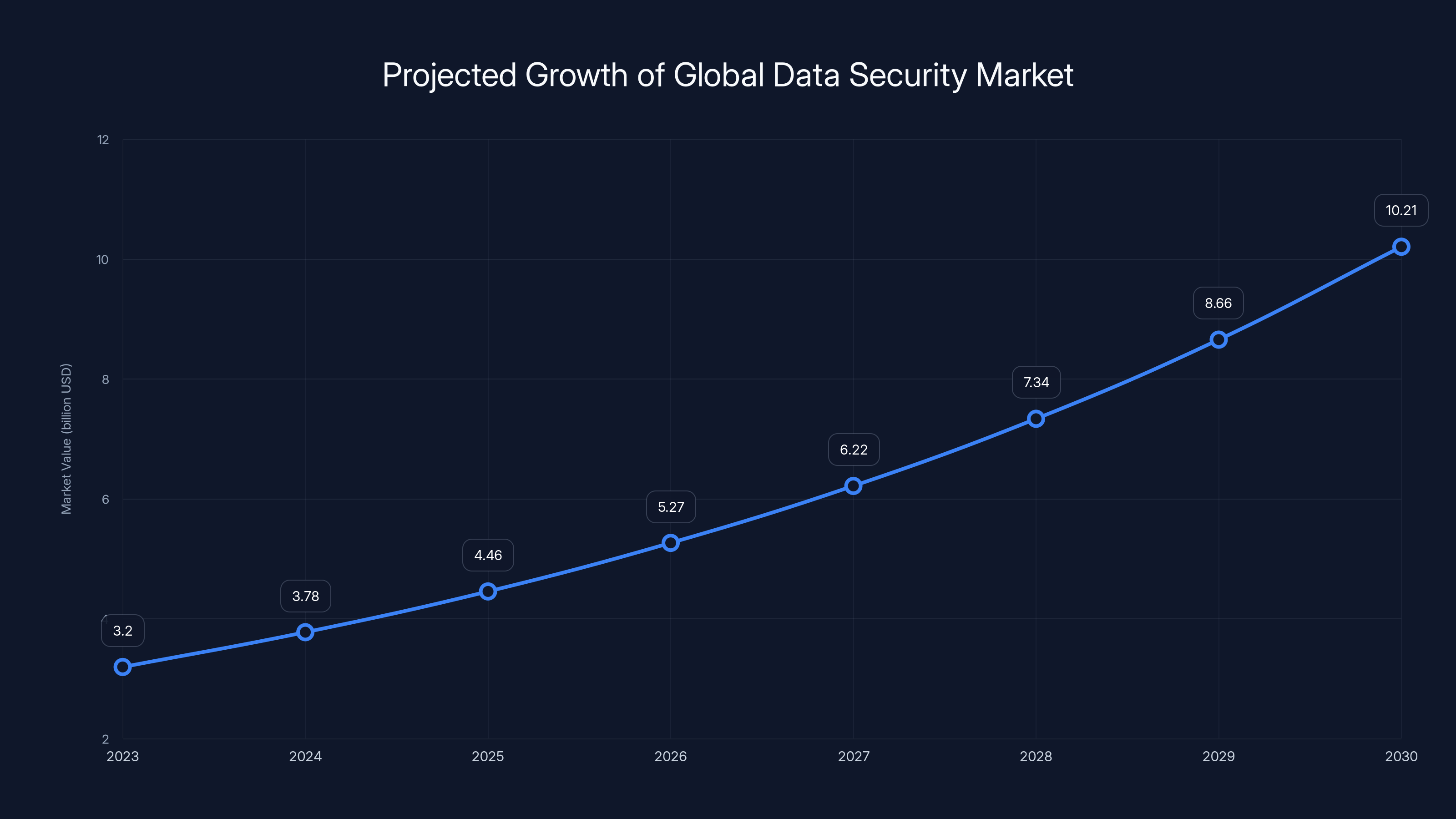

- Cyera's approach to data intelligence positions it as a category leader in a market projected to reach $12-15 billion by 2030

Cyera's valuation increased by 50% from

Why Data Security Just Became a $9 Billion Problem

Here's the thing about enterprise data: companies don't actually know where it lives anymore.

You've got data in cloud storage. Data in databases. Data scattered across SaaS applications that nobody remembers subscribing to. Data in backups, APIs, legacy systems that won't die, and employee laptops that should've been wiped three years ago.

When a company can't see its own data, it can't protect it. And that's where the $9 billion opportunity comes from.

The average company now stores data across 137 different cloud applications. I'm not making that up. That's not hyperbole. Most IT leaders I talk to say that number feels low. They've probably got more.

So when a ransomware attack hits, the company doesn't even know what was exposed. When compliance auditors ask "where is customer data stored," the answer is "somewhere, probably." When a breach happens, the forensics take months because nobody has a map.

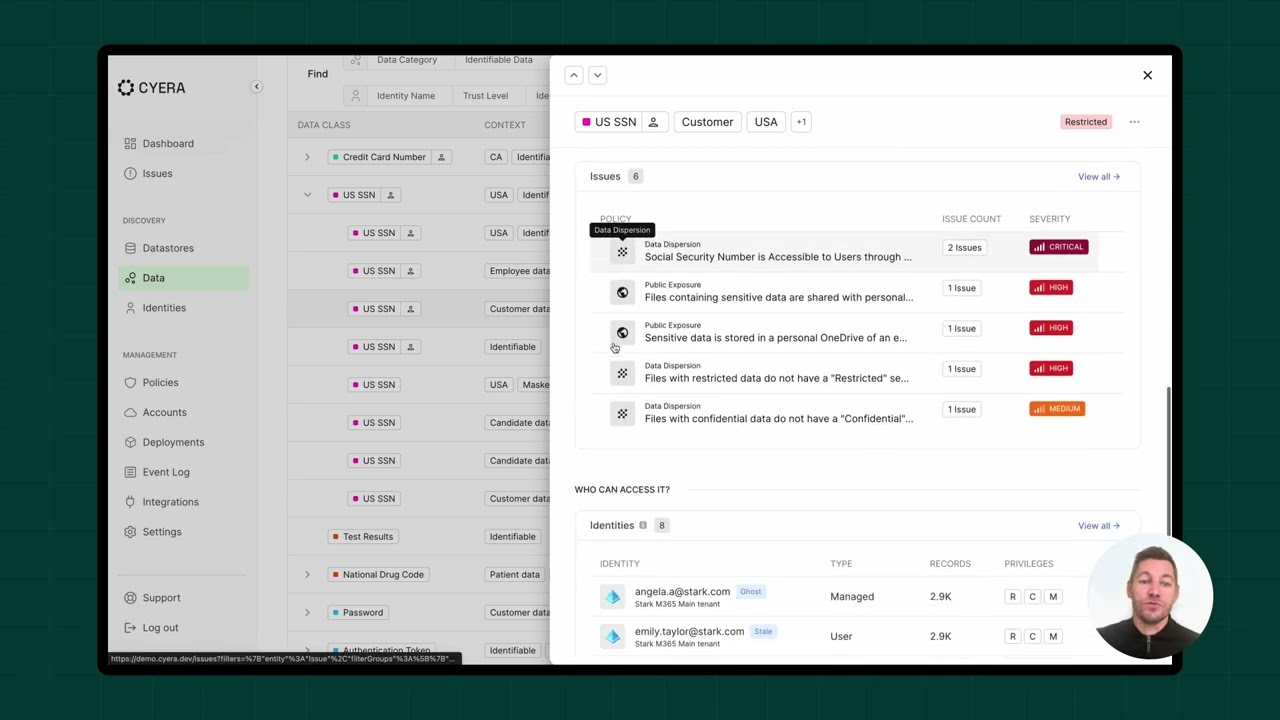

Enter Cyera. The startup's core value proposition is deceptively simple: find all your data, understand what it is, figure out who can access it, and tell you when something's wrong.

That might sound basic. It's not. Doing this at scale, across hundreds of cloud platforms and data stores, with real-time threat detection and compliance automation, is genuinely hard. And enterprises will pay nine figures to get it right.

The global data security market is projected to grow from

The Market Expansion That Nobody Expected

Data security isn't new. Data governance isn't new. But the urgency around data security is new.

Three things happened simultaneously:

First, the regulatory blizzard arrived. GDPR was 2018. That felt manageable. But then came CCPA, HIPAA enforcement teeth, SOX for cloud, DORA, UK data protection rules, and about forty other frameworks depending on your industry. Every board now has a "data compliance" line item that needs an answer.

Second, cloud adoption exploded. During the pandemic, companies moved workloads to AWS, Azure, and Google Cloud at an unprecedented pace. That created thousands of new data stores that security teams didn't have tools to manage. Legacy security tools? They don't understand cloud-native data structures.

Third, breaches got expensive. A successful ransomware attack now costs enterprises an average of $4.45 million per incident. That's not just the ransom, either. That's downtime, forensics, notification costs, regulatory fines, litigation, and the soul-crushing drop in stock price.

Companies used to debate whether data security was worth the investment. They don't anymore. The question is whether they can afford not to.

Understanding Cyera's Value Proposition

Let's get specific about what Cyera actually does, because the marketing descriptions aren't always helpful.

Cyera's platform sits across your cloud environment and builds a real-time map of all sensitive data. Where is it? What type is it (PII, financial records, health data, trade secrets)? Who has access? Where did it come from? Where is it being copied to?

Then it watches for threats. Unusual data access patterns. Suspicious downloads. Lateral movement that looks like an attacker escalating privileges. Misconfigured cloud storage that's publicly readable. Data that shouldn't be where it is.

When something's wrong, it doesn't just alert you. It contextualizes the threat. "This user accessed 50,000 customer records in 12 minutes." Or "This data moved to an external AWS account." Or "This data repository has no encryption key."

For large enterprises, this is a game-changer. Not because it's impossible to do manually, but because doing it manually is impossible. You'd need a team of people constantly monitoring. Cyera automates it.

The other piece is compliance automation. When regulators ask "prove you have controls around sensitive data," Cyera provides that evidence. Automated reports. Audit trails. Control evidence. All the stuff that used to require consulting firms and six months of manual work.

That combination—visibility plus threat detection plus compliance—is why enterprises pay attention.

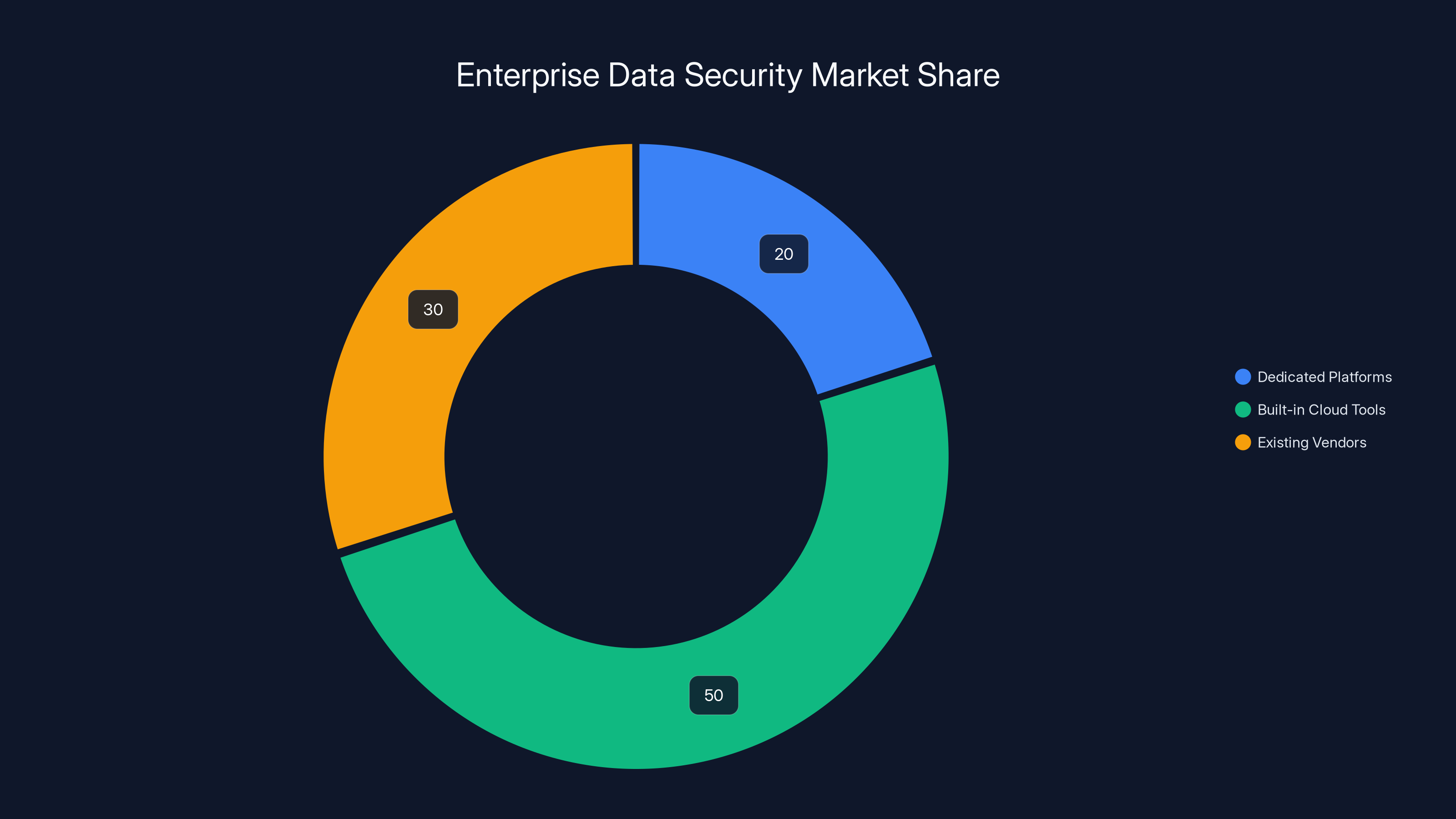

Estimated data shows that dedicated data security platforms capture about 20% of the market, while built-in cloud tools and existing vendors cover the remaining 80%.

The Funding Narrative and What It Reveals

Let's talk about the actual fundraise, because the numbers are telling a story.

$400 million in Series F. That's not a mid-stage round. That's not growth funding. That's late-stage, pre-IPO scale funding. You don't raise that amount unless (a) you have massive revenue, (b) you have massive growth, or (c) you have both with a clear path to IPO.

Cyera raised that in January 2026, just six months after raising

That 50% valuation jump in six months tells us several things:

First, growth is accelerating. Venture investors don't jack up valuations on flat metrics. A 50% bump means revenue grew meaningfully, ARR growth is impressive, or customer acquisition accelerated.

Second, demand is not cyclical. Data security is recession-proof. Breaches happen whether the economy is booming or busting. In fact, during downturns, breaches often increase because companies cut security staff.

Third, this is a genuine category expansion. The investor consortium is impressive: Blackstone, Sequoia, Accel, Coatue, Lightspeed, Redpoint, Sapphire. These aren't specialty VCs. These are generalist firms that write massive checks. Blackstone leading a $400M round signals institutional capital, not just venture capital.

When Blackstone—a firm that manages

The $1.7 Billion War Chest

Cyera has now raised $1.7 billion across six rounds. That's a lot of capital for a company that went public? No, wait. It hasn't.

That raises an important question: Why is Cyera still private? Why hasn't it IPO'd?

The answer is probably: they don't need to. Not yet.

When you raise $1.7 billion, you don't have capital constraints. You have customer acquisition constraints. You have hiring constraints. You have market expansion constraints.

Cyera's founders and board likely have a few options:

Option 1: Keep raising until it's so valuable that IPO becomes inevitable. This is the Figma strategy. Stay private, keep growing, raise mega-rounds, build a legend. Then IPO at a valuation that makes headlines.

Option 2: Merge up into a larger security company or tech firm. Think about how many times we've seen late-stage data companies acquired by enterprise software giants for outsized multiples. Splunk was private for years before going public, then got acquired by Cisco for $28 billion.

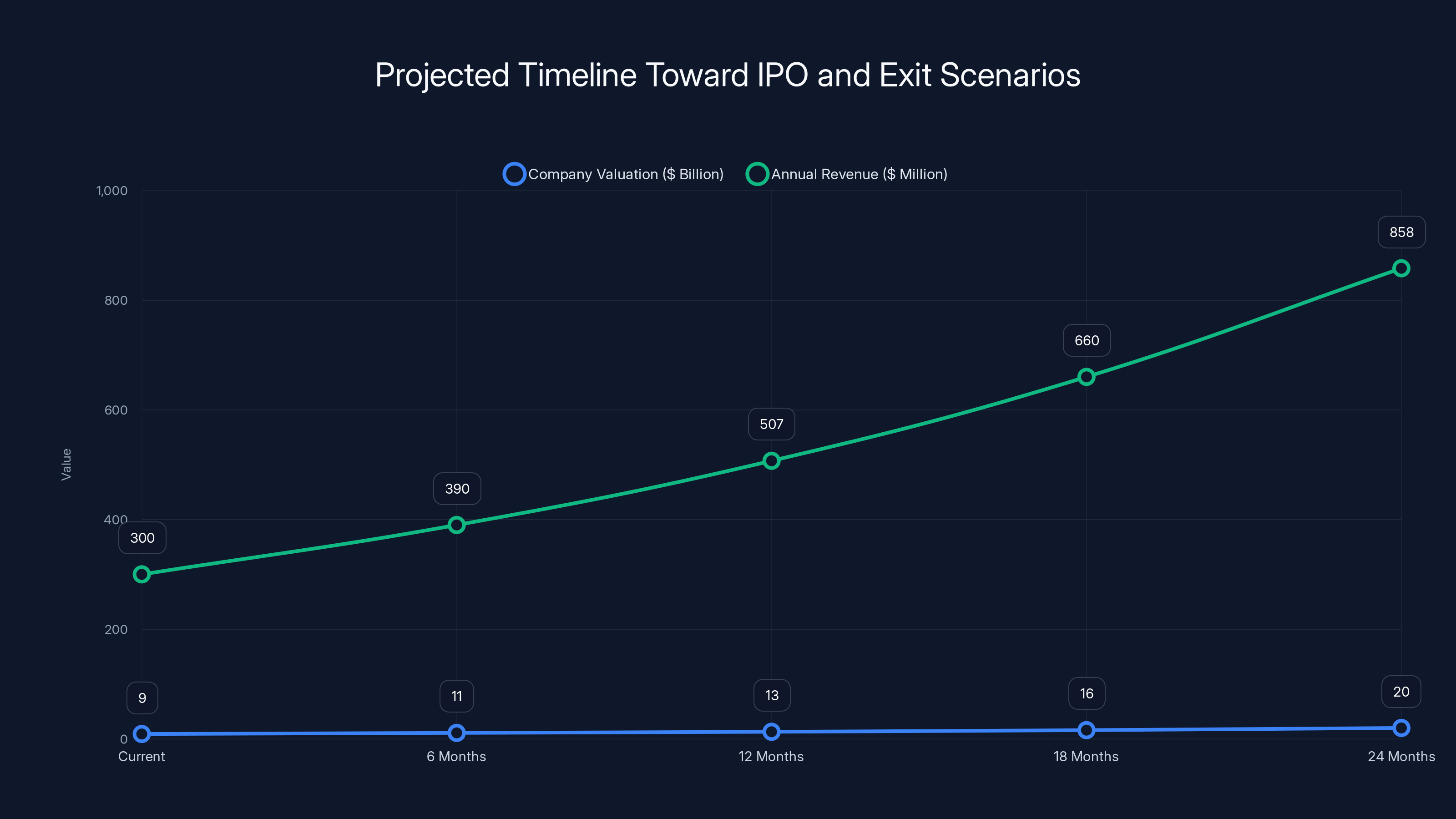

**Option 3: IPO within the next 12-24 months at a

Regardless, the capital raise signals confidence. If investors are putting $400 million into a single round, they believe the company will exit (through IPO or acquisition) at a significantly higher valuation.

Estimated data suggests Cyera could reach a valuation of

The Competitive Landscape and Why Cyera Stands Out

Cyera didn't invent data security. The space has competitors.

Qlik acquired Attunity (a data integration and quality company). Salesforce owns Tableau (business intelligence, not pure security). Microsoft integrated data governance into Azure. AWS built comprehensive data catalog and security services. Varonis went public years ago and focuses on data access governance.

But here's why Cyera is ahead:

Most competitors approach data security from a single angle. Varonis focuses on access control. Tableau focuses on data understanding. AWS focuses on encryption and compliance.

Cyera built an integrated platform that handles discovery, classification, threat detection, access governance, and compliance reporting all together. That integration is worth paying for because it eliminates the need to stitch together five different tools.

Second, Cyera was built for cloud-native environments from day one. Varonis emerged when data was mostly on-premises. AWS services are good, but they require customers to build on AWS specifically. Cyera works across AWS, Azure, Google Cloud, and on-prem. That flexibility matters to enterprise customers.

Third, Cyera has the funding to move fast. With $1.7 billion in capital and a trajectory that suggests profitability is close, Cyera can outspend competitors on R&D, go-to-market, and customer success.

Enterprise Demand and Total Addressable Market

Let's do some math on the actual opportunity.

There are roughly 350,000 companies with 1,000+ employees globally. These are Cyera's core TAM. Not all 350,000 will use Cyera specifically, but virtually all need some form of enterprise data security.

Each of these companies stores sensitive data somewhere. Either in cloud, on-prem, or both. The average enterprise has data in 40+ cloud applications and 5+ on-premise data stores.

The annual cost of a data breach for these companies is material. For a company with 10,000 employees, average breach costs are

Take some quick math:

But not all enterprises will buy. Many will use built-in cloud tools or consolidate with existing vendors. So realistic TAM is probably $15-25 billion for dedicated data security platforms.

That

Venture investors aren't bad at math. They see that opportunity, which is why they keep funding it.

Cyera's valuation increased by 50%, with

The Role of AI in Data Security

Here's something that doesn't get talked about enough: data security is becoming an AI problem.

Traditional rules-based security doesn't scale anymore. You can't write a rule for every way a human might exfiltrate data. You can't write rules for every potential misconfiguration.

But machine learning can spot patterns. It can learn what normal data access looks like (user A accesses files on Tuesday mornings, user B accesses at night). When something deviates from normal, it flags it.

Cyera reportedly uses machine learning extensively. Not just for threat detection, but for data classification. Instead of humans manually tagging data as "sensitive" or not, AI can learn from context, naming conventions, content analysis, and historical patterns.

This is important because it changes the unit economics. Manual data classification at enterprise scale costs millions of dollars and takes years. AI-driven classification costs much less and delivers results in weeks.

When you combine AI classification with AI-powered threat detection and AI-assisted compliance reporting, you suddenly have a platform that does work that used to require teams of people.

That's a massive competitive moat. Competitors trying to build similar capabilities from scratch will take years and spend hundreds of millions. Cyera gets to iterate and improve continuously.

Regulatory Tailwinds and Compliance Driving Adoption

Let's be honest: nobody gets excited about compliance tools. But compliance tools are profitable because they're mandatory.

Cyera's compliance automation layer is a major part of its value proposition. Here's why that matters:

GDPR fines can reach 4% of global revenue. For a company with

HIPAA violations in healthcare run

SOX compliance for public companies requires continuous control verification. That's why companies spend millions on compliance infrastructure.

Cyera automates a lot of that burden. Instead of hiring compliance consultants and security analysts to manually verify controls, Cyera does it continuously. That saves money and reduces risk.

As regulations tighten (and they will), demand for compliance automation increases. Companies don't have a choice. They have to be compliant. Vendors that make compliance easier win.

What Hyper-Growth in Data Security Means for Customers

When a startup raises

First, it signals staying power. With $1.7 billion raised, Cyera isn't going out of business. It's not getting acquired by someone weird. It's going public in a few years. That matters to enterprises buying products that are supposed to last decades.

Second, it signals dominance. When investors bet that aggressively on a company, it usually means they think it'll be the market leader. Enterprises see that signal too.

Third, it creates a self-fulfilling prophecy. When a vendor has overwhelming capital and is perceived as the leader, customers feel safer buying from them. That drives more adoption, which justifies the valuation, which attracts more investors.

For customers, this is mostly good news. The company has resources to improve the product, expand support, and ensure long-term viability. The risk is that growth capital sometimes creates pressure to hit ambitious targets, which can mean feature creep and complexity.

But in data security, customers generally prefer a company that's well-funded and moving fast over a scrappy startup that might be great but might disappear.

The Broader Venture Capital Narrative

Cyera's funding round tells us something about where venture capital is flowing in 2025-2026.

It's not flowing to general-purpose AI. Too crowded. Margins are being compressed. The Open AI and Anthropic camps have won.

It's not flowing to consumer apps. The market is mature. Growth is hard. Valuations aren't exciting.

It's flowing to enterprise infrastructure and security. Specifically to companies that:

- Solve material problems (data breaches cost millions)

- Have defensible competitive positions (Cyera's integrated platform)

- Serve large, sticky customers (enterprises with high switching costs)

- Have clear paths to profitability (not just growth at all costs)

- Address regulatory/compliance requirements (non-negotiable buying)

Cyera checks all those boxes, which is why capital keeps showing up.

Other beneficiaries of this trend include companies in observability, cloud security, API security, supply chain risk, and application security. The pattern is the same: material problems, defensible solutions, stable enterprise customers.

Timeline Toward IPO and Exit Scenarios

Given that Cyera has raised

Most likely scenario: IPO within 18-24 months. With that capital, the company likely has:

- Annual revenue of $200-400 million (estimated based on funding rounds)

- Annual growth rate of 30-50% (fast enough for venture darling status)

- Path to profitability within 2-3 years (typical for security companies at this scale)

That's a credible IPO candidate. Not mandatory—plenty of companies stay private longer—but likely.

Alternative scenario: Acquisition by larger security conglomerate. Companies like Palo Alto Networks, Crowd Strike, or Fortinet might view Cyera as a strategic acquisition. The price would probably be $15-25 billion, which is a significant premium but well within strategic buyer budgets.

Third scenario: Continue raising capital privately and become the next Stripe or Figma. Stay private longer, keep raising mega-rounds, build legendary status, then IPO at an even higher valuation. But this seems less likely given the maturity of the company and the natural exit window for a $9B company.

For investors in this round, the expected return is probably 2-3x over 3-4 years (IPO at $20-25B or acquisition). That's meaningful but not extraordinary for venture. But for Blackstone and mega-funds, what matters is that they write nine-figure checks and actually return capital. This checks that box.

How Enterprises Are Responding to the Urgency

Data breach costs have gotten so material that enterprise CISOs now have board-level attention and budget authority they never had before.

Ten years ago, a CISO had to justify every dollar. Now CISOs go to their board and say "prevent a $5 million breach," and they get funding.

This has created a buying spree in enterprise security. Companies that spent nothing on data security two years ago are now spending seven figures annually.

Cyera is well-positioned to capture that budget. When a CISO has $2-5 million annually to allocate to data security infrastructure, Cyera can position itself as a central platform that replaces point solutions.

Instead of buying a separate tool for:

- Data discovery

- Data classification

- Threat detection

- Access governance

- Compliance reporting

Enterprises buy Cyera as an integrated platform. That's valuable from a vendor management, budgeting, and operational perspective.

What's Next for the Data Security Category

We're heading toward a world where data-aware security is table stakes.

Right now, most security tools don't understand data. Firewalls don't care what's in the packets. Endpoint protection doesn't know which files are sensitive. Network monitoring doesn't understand the context of data flows.

The next generation of security will be data-centric from the ground up. Tools will understand:

- What data exists

- Where it is

- Who should access it

- Who actually is accessing it

- How it's moving

- When something's wrong

Cyera is an early leader in that paradigm shift. If the shift happens (and it will), then Cyera's current valuation looks reasonable in retrospect.

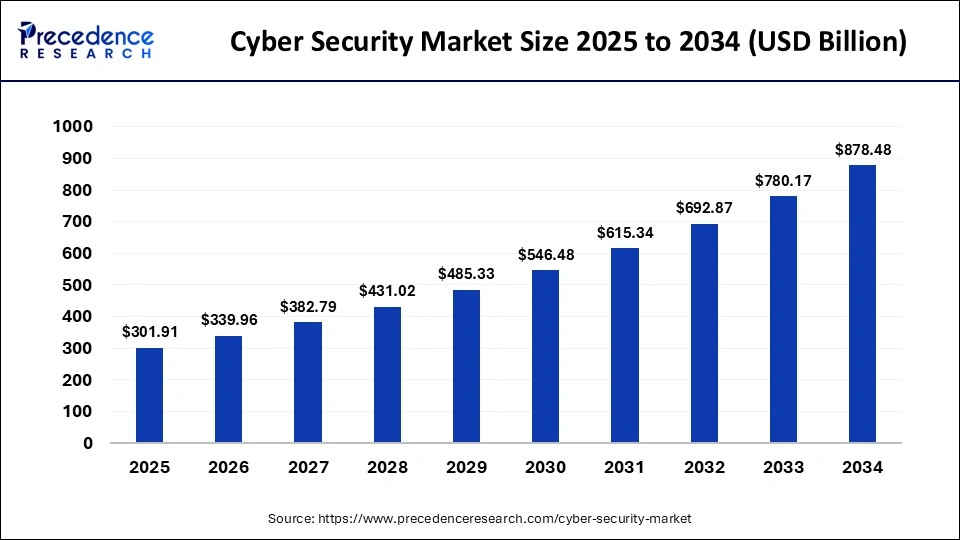

The broader implication: security as a category is moving upstream in enterprise software budgets. Security used to be 5-8% of IT budgets. It's heading toward 12-15%. When that happens, security companies that solve material problems, at scale, with integrated platforms, will be worth a lot of money.

Cyera's valuation is betting that it will be one of those companies. Based on the funding velocity and investor confidence, that's a reasonable bet.

FAQ

What is Cyera and what does it do?

Cyera is a New York-based data security startup that helps enterprises find, understand, protect, and monitor sensitive data across their entire cloud and on-premise environment. The platform uses AI-powered discovery to identify all data locations, classifies sensitive information automatically, detects threats in real-time, and automates compliance reporting. Essentially, it solves the problem that most large enterprises face: they don't know where all their sensitive data is, who can access it, or whether that access is appropriate.

How did Cyera achieve a $9 billion valuation?

Cyera hit a

Why is data security becoming such an important investment area?

Data security has moved from a "nice to have" to an existential business requirement due to four factors: (1) regulatory pressure from GDPR, CCPA, HIPAA, and other frameworks that carry massive fines, (2) the explosion of cloud adoption that created thousands of new data stores without proper security controls, (3) the skyrocketing cost of breaches—averaging $4.45 million per incident—which makes prevention financially mandatory, and (4) enterprises storing sensitive data across hundreds of cloud applications without visibility into where it actually lives. These factors combined create a massive, urgent market opportunity that's attracting venture capital at unprecedented levels.

What makes Cyera different from competitors like Varonis or cloud-native security tools?

Cyera differentiates through several mechanisms: (1) it was built cloud-native from inception, unlike older vendors like Varonis which emerged from on-premise security roots, (2) it works across AWS, Azure, Google Cloud, and on-prem simultaneously, whereas cloud vendors' built-in tools lock customers into specific platforms, (3) it integrates discovery, classification, threat detection, access governance, and compliance automation in a single platform, eliminating the need for multiple point solutions, and (4) its AI-powered approach to data classification and threat detection automates work that competitors require manual effort or dedicated teams to accomplish. This integration and automation create a meaningful productivity advantage that justifies the premium pricing.

What is the realistic market opportunity for data security companies like Cyera?

The addressable market is enormous and growing. There are approximately 350,000 companies globally with 1,000+ employees, all of which need some form of data security. If each company spends an average of

When might Cyera go public or be acquired?

Based on typical venture timelines and capital raise patterns, Cyera is likely to exit within 18-24 months through either an IPO or strategic acquisition. With

How does machine learning play a role in modern data security?

Machine learning is transformative in data security for two critical reasons: (1) automated data classification, where AI learns from context, naming conventions, and content patterns to identify sensitive data without manual tagging—a process that used to cost millions and take years but now takes weeks, and (2) anomaly detection for threat identification, where algorithms learn normal data access patterns and flag deviations that might indicate a breach or unauthorized access. This automation fundamentally changes the unit economics of data security, allowing platforms like Cyera to deliver capabilities that previously required large dedicated teams, making those capabilities accessible to enterprises of all sizes.

How should enterprises choose between data security vendors?

When evaluating data security platforms, enterprises should prioritize several factors: (1) vendor funding and stability—well-funded vendors like Cyera can afford long-term R&D and won't disappear or get acquired disruptively, (2) integration depth—does the platform integrate discovery, classification, threat detection, and compliance, or do you need multiple point solutions, (3) multi-cloud support—can the tool work across AWS, Azure, Google Cloud, and on-premise, or is it locked to one ecosystem, (4) automation level—how much manual work is required versus AI-powered automation, and (5) compliance support—does the platform automate the specific compliance frameworks your industry requires (HIPAA, PCI, SOX, GDPR, etc.). Additionally, start by inventorying your actual data landscape before selecting a vendor—most enterprises discover they have significantly more sensitive data than they realized and in more locations than they authorized.

What happens to existing customers as Cyera scales rapidly?

Rapid scale and high funding can be double-edged for customers: on the positive side, well-funded companies invest heavily in product quality, customer success, and long-term roadmaps, and Cyera's resources enable it to support enterprise-grade implementations at scale. On the negative side, hyper-growth sometimes leads to product complexity, sales-driven feature additions that don't align with customer needs, and occasional service disruptions during rapid scaling. To mitigate risk, enterprises should ensure they have strong contractual SLAs, work with dedicated customer success teams, and maintain regular business reviews with Cyera to ensure their needs are being met as the company evolves.

How does the enterprise buying process work for platforms like Cyera?

Enterprise data security deals typically follow this pattern: (1) initial discovery with the CISO's team to understand current data landscape and pain points, (2) proof-of-concept phase where Cyera scans a subset of the customer's environment to demonstrate capability, (3) ROI discussion where the vendor quantifies breach prevention value (typically

What are the regulatory drivers that make data security non-negotiable?

Multiple regulatory regimes now make data security investments mandatory rather than optional: GDPR (European Union) imposes fines up to 4% of global revenue, CCPA (California) created the U. S. regulatory template with significant privacy penalties, HIPAA (United States healthcare) carries per-record fines of

The Bigger Picture: What Cyera's Rise Means for Enterprise Security

Cyera's $9 billion valuation isn't just about one startup doing well. It's a signal about where enterprise technology is heading.

The data security market is consolidating around integrated platforms that solve problems at scale. Point solutions are becoming obsolete. Fragmented stacks are becoming liabilities. Enterprises want vendors who understand their complete data landscape, not just one aspect of it.

Cyera positioned itself perfectly at the intersection of three massive market forces: regulatory compliance that's become mandatory, cloud adoption that's created new security challenges, and breach costs that have become board-level concerns.

For other security startups, the lesson is clear: solve material problems, build for cloud-native environments from day one, and integrate rather than specialize.

For enterprises, the signal is equally clear: invest in data visibility and protection now. The costs of waiting are measured in millions of dollars per breach. The solutions exist. The capital is deployed. The market is moving.

Cyera's next chapter will be interesting to watch. If the company executes well on its

But here's what won't change: the fundamental problem that Cyera is solving. Enterprises will always have more data than they realize, in more places than they authorized, with more people accessing it than they approve. The only question is whether they'll have visibility into that problem and tools to fix it. Cyera is betting its future on being the platform that provides both.

Key Takeaways

- Cyera raised 9B valuation in just six months, signaling explosive market validation for data security solutions

- Enterprise demand is driven by the $4.45M average cost per data breach and regulatory requirements like GDPR and HIPAA that carry massive penalties

- The data security market is projected to reach $12-15B by 2030, growing 18-22% annually—faster than cloud and AI infrastructure markets

- Cyera's integrated platform approach (discovery, classification, threat detection, compliance) differentiates it from point solutions and cloud vendor tools

- With $1.7B in capital and strong growth metrics, Cyera is likely to go public or face strategic acquisition within 18-24 months

Related Articles

- Illinois Data Breach Exposes 700,000: How Government Failed [2025]

- Data Sovereignty for SMEs: Control, Compliance, and Resilience [2025]

- GenAI Data Policy Violations: The Shadow AI Crisis Costing Organizations Millions [2025]

- Articul8 Series B: Intel Spinoff's $70M Funding & Enterprise AI Strategy

- Iran's Internet Collapse: What Happened and Why It Matters [2025]

- Illinois Health Department Data Breach: 700K+ Exposed [2026]

![Cyera's $9B Valuation: How Data Security Became Tech's Hottest Market [2025]](https://tryrunable.com/blog/cyera-s-9b-valuation-how-data-security-became-tech-s-hottest/image-1-1767917214530.jpg)