The AI Video Generation Moment We Didn't See Coming

Somewhere between September and January, the world changed its mind about AI video. What started as a fringe use case barely worth mentioning is now powering billion-dollar companies. And the company at the center of that shift is Higgsfield, an AI video generation startup that just closed a $1.3 billion valuation through an extension to its Series A round.

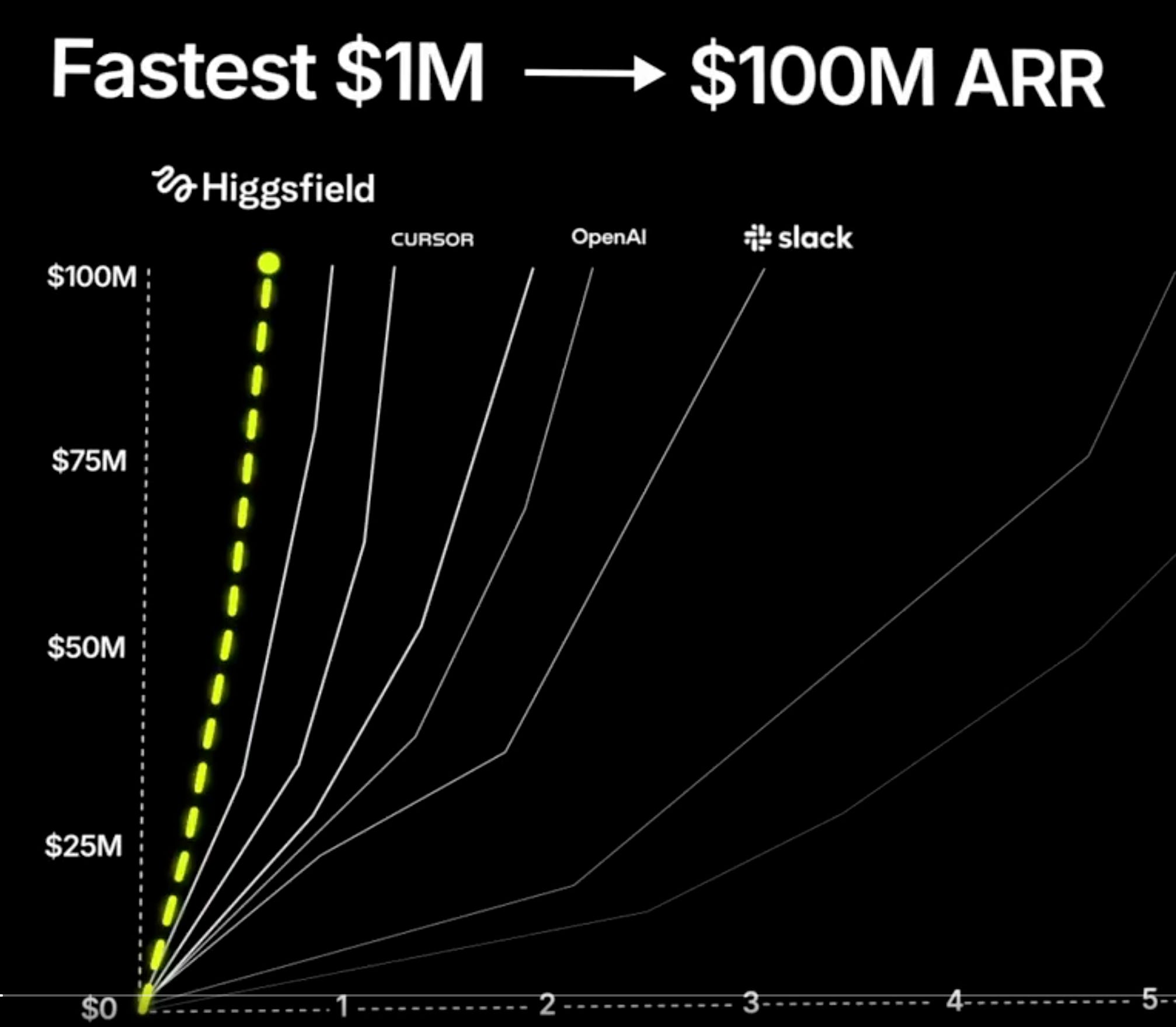

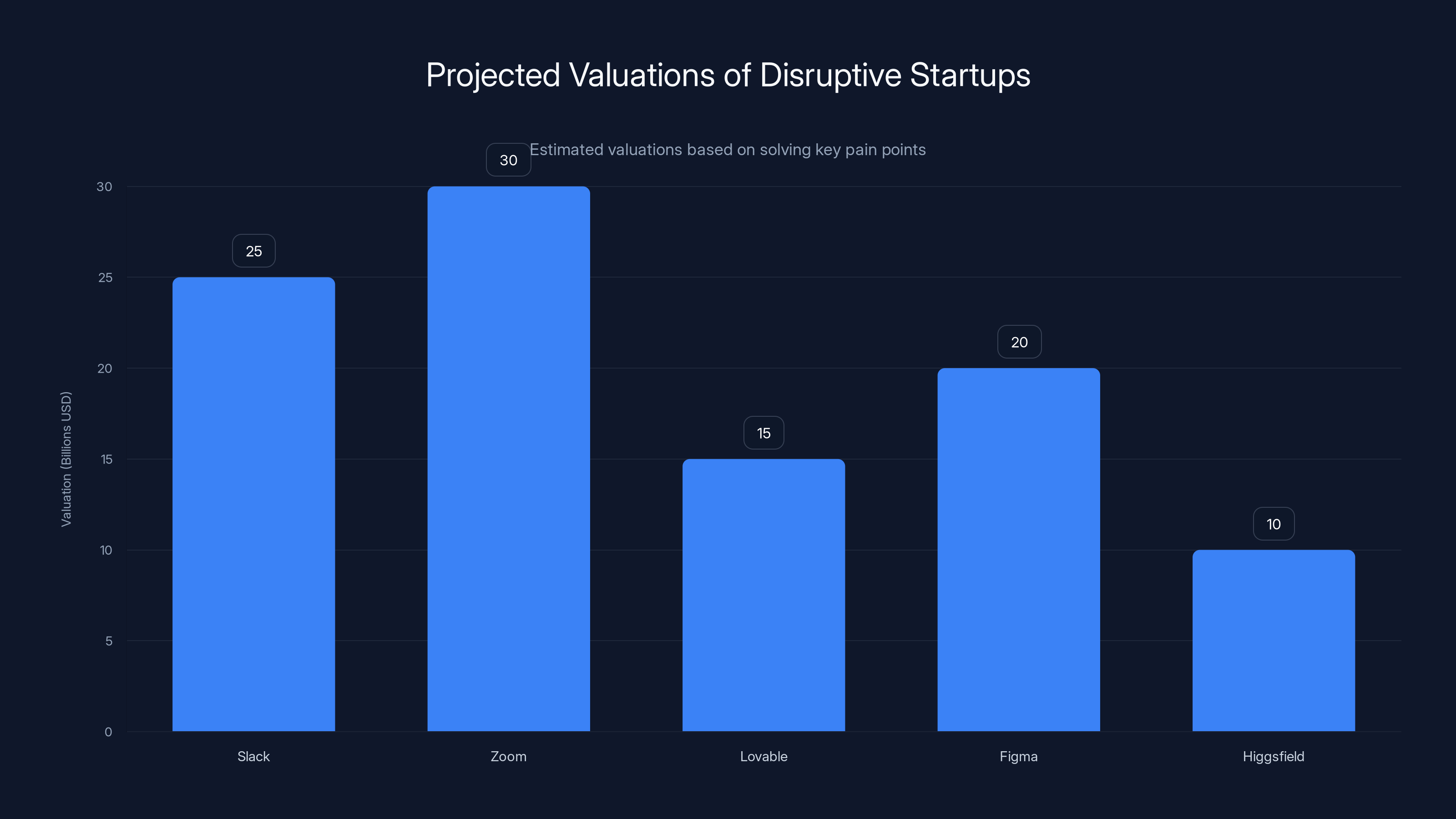

This isn't hype. The numbers are genuinely unusual. Nine months after launch, Higgsfield claims to be running at a $200 million annual revenue run rate. That's not projected revenue. That's money coming in right now, this month, from 15 million users. For context, Slack took years to hit these numbers. Zoom wasn't close to this velocity. Even OpenAI, the poster child for AI adoption, didn't explode quite this fast.

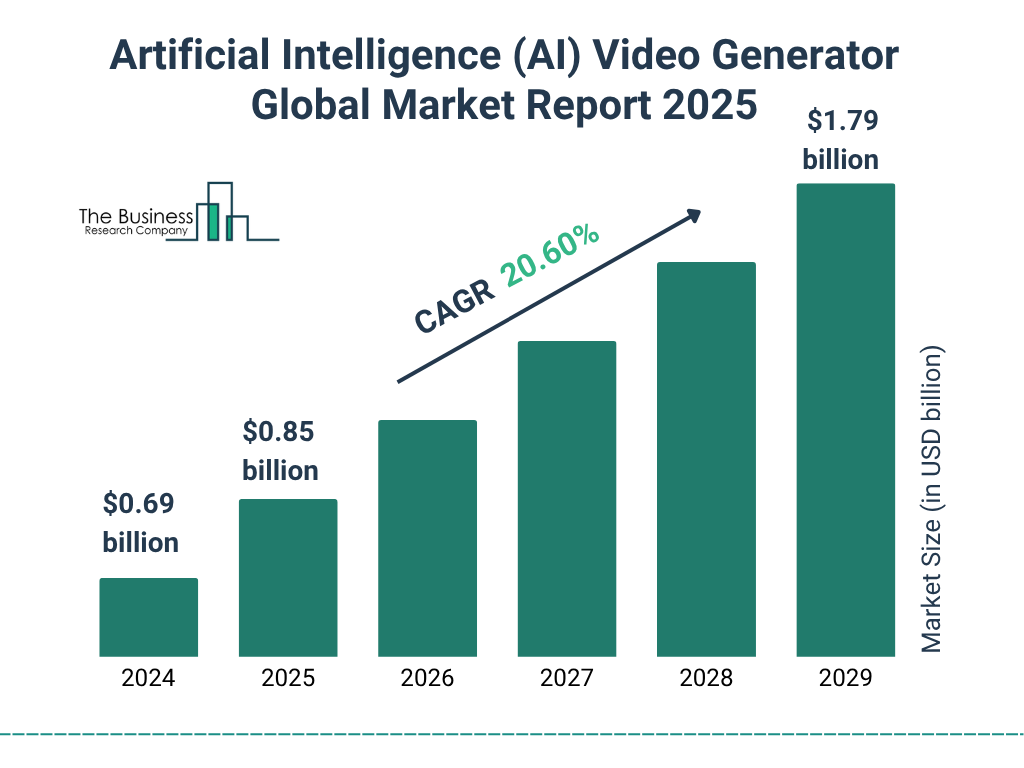

What makes this moment significant isn't just the valuation or the revenue. It's what it says about where the market is right now. AI video generation moved from "neat demo" to "actual product people pay for" in less than a year. That's a compression of the adoption timeline that we usually see span 24 to 36 months. The question isn't whether AI video is real anymore. The question is how much value will consolidate around the winners.

Highsfield's founder, Alex Mashrabov, understands this better than most. He was the Head of Generative AI at Snap before launching Higgsfield. Before that, he co-founded AI Factory, which Snap acquired for $166 million in 2020. He's not new to this space. He's watched AI integration happen at scale across a platform with hundreds of millions of users. He knows what works and what doesn't.

This article breaks down what Higgsfield actually is, why the growth numbers matter, and what this funding round tells us about the future of AI video generation. We'll look at the competitive landscape, the funding dynamics, and the real risks that come with this kind of hypergrowth. Because while the revenue numbers are impressive, they also come with some serious questions about sustainability and market maturity.

What Actually Is Higgsfield?

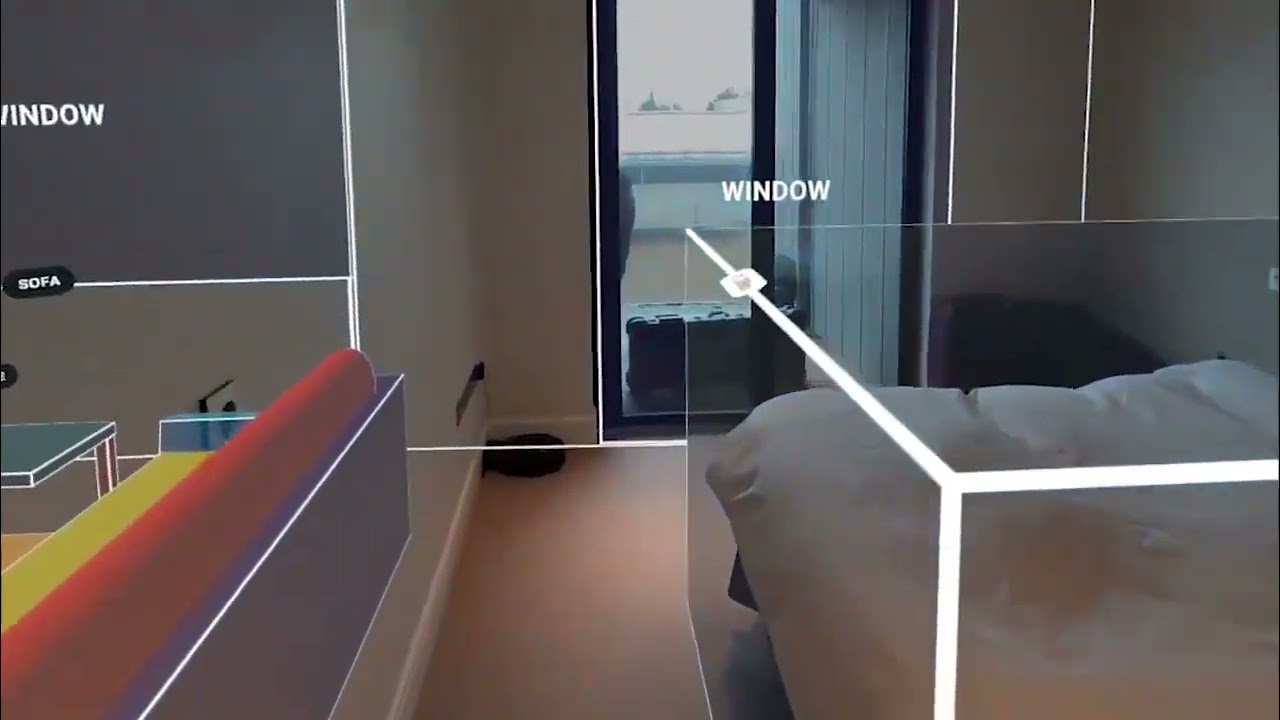

Highsfield is fundamentally a video generation tool. You describe what you want—"a woman running through a forest at sunset" or "a product unboxing video with a tech enthusiast vibe"—and the AI generates it. But like most successful tools, the simplicity of the interface masks genuine complexity underneath.

The product isn't trying to replace professional video production. It's designed for creators, social media marketers, and content teams who need to produce volume. Imagine you're running a fashion brand's Instagram account. You need 15 posts a week. Shooting all of that requires models, locations, equipment, and hours of editing. Or you can describe what you want in Higgsfield and iterate until it feels right. The economics are dramatic. You go from

What's interesting about Higgsfield's positioning is how much they've moved away from the "AI slop generator" framing. Early coverage focused on whether the tool would be used to create misleading or offensive content. There was an incident involving an AI-generated video using Epstein's name and island imagery. That's the kind of thing that kills companies if they're not careful. Higgsfield's response was to emphasize the professional use case. The narrative shifted to "social media marketers choose Higgsfield" rather than "anyone can generate videos at scale."

That positioning matters because it affects who buys and how much they're willing to pay. A casual creator might spend

The Funding Round That Broke the Script

Highsfield's funding journey is unusual in structure. In September 2025, the company closed a Series A round at

This isn't normal. Most Series A rounds close and stay closed. Reopening one suggests either remarkable growth between closing and now, or investors who wanted in but missed the window. Probably both.

The investors in the extension include Accel, AI Capital Partners, Menlo Ventures, and GFT Ventures. That's a solid list, not the tier of investors who make mistakes about valuations. Accel in particular has a track record of betting on platform shifts early and scaling them aggressively. They were early on Slack, Dropbox, and Atlassian. If they're piling capital into Higgsfield, they're likely seeing something real in the unit economics.

What makes the funding round interesting from a strategic perspective is the timing. The AI video space is getting crowded. Runway, OpenAI's video model, Google's generative video tools, and a dozen others are all shipping capabilities. But Higgsfield had a head start with user adoption. They hit 11 million users in the first five months. They're now at 15 million. That's not random—that's compounding adoption from product-market fit. The funding round appears designed to capitalize on that momentum before competitors catch up.

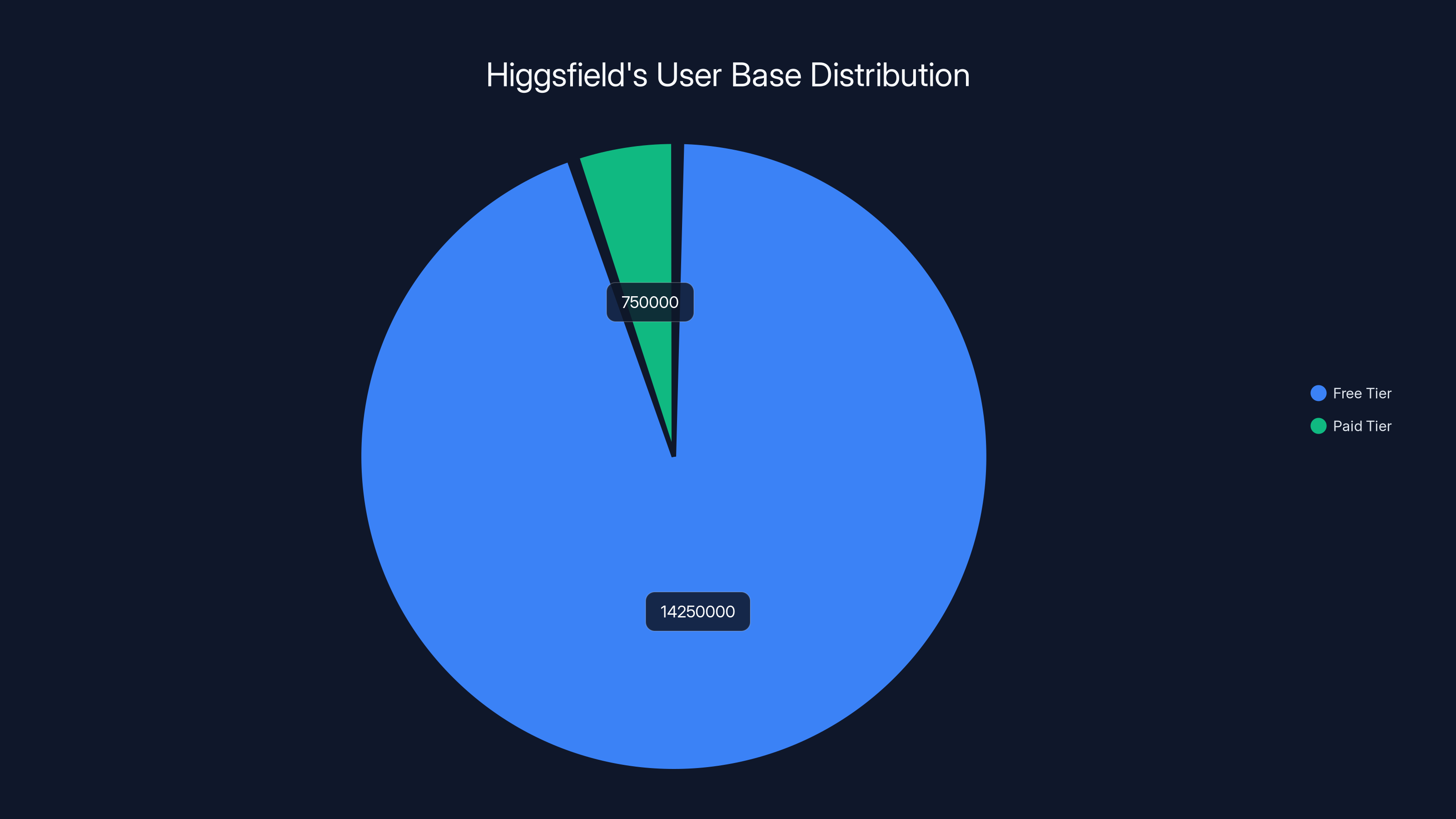

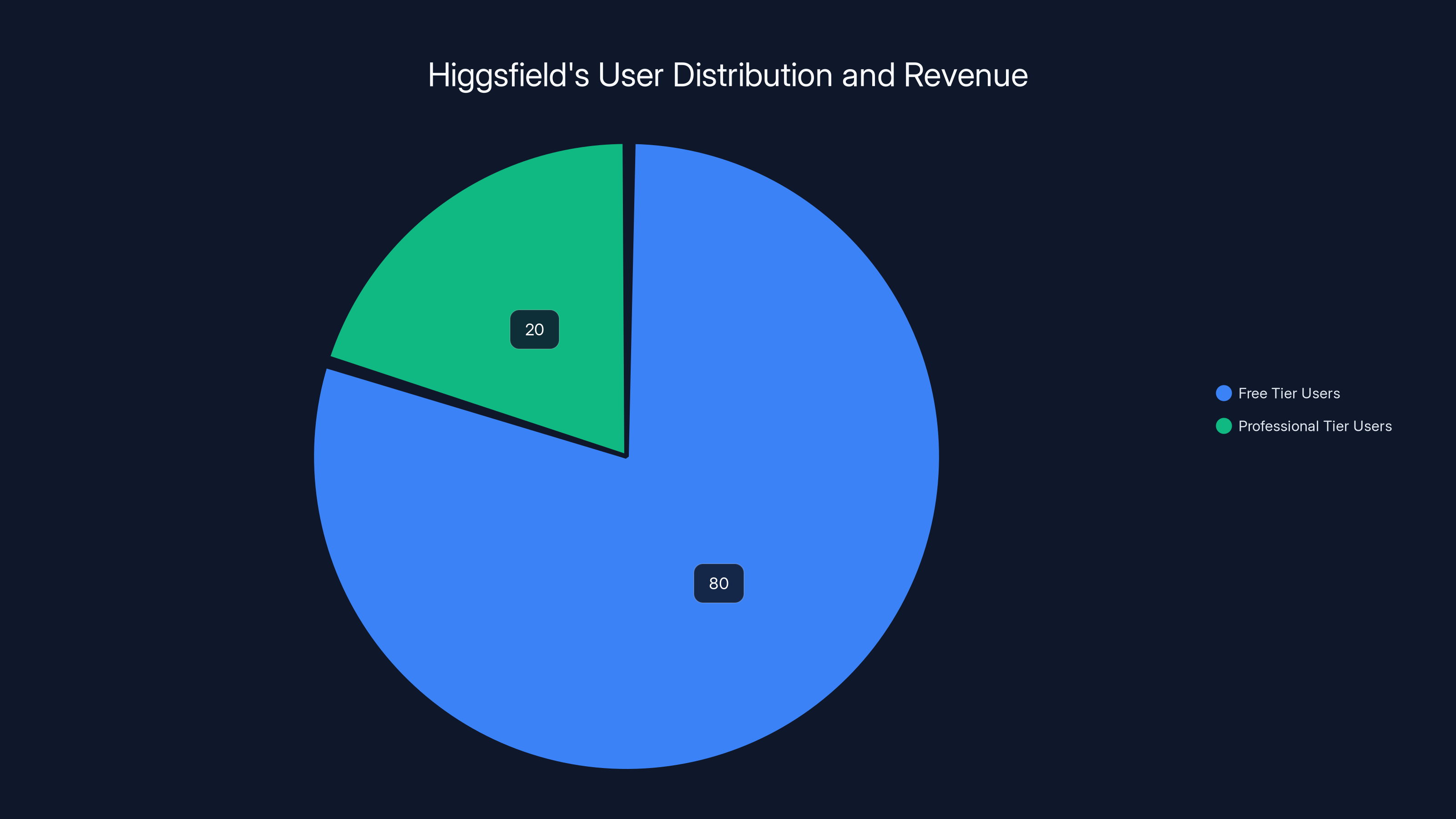

Estimated data shows that 95% of Higgsfield's 15 million users are on the free tier, while 5% are paid users, aligning with typical SaaS conversion rates.

The $200 Million ARR Number and What It Actually Means

Let's talk about the $200 million annual run rate because it's the number that breaks people's brains. For a nine-month-old company with a consumer-facing product, this is legitimately unusual. But before we get too excited, let's understand what this number represents.

Annual run rate is calculated by taking your current monthly revenue and multiplying it by 12. If you're doing

What's remarkable is how fast that number got to

But here's the thing about ARR numbers from private companies: they're audited only to the extent that investors verify them. We should assume they're real and that the investors believed them. But we also shouldn't assume they're perfectly calculated or that they'll hold steady. A 50% churn rate would destroy the math entirely. If your user base is growing 40% month-over-month but 35% of monthly revenue is from users who cancel, your ARR is not actually $200 million—it's the revenue of a company with a serious retention problem.

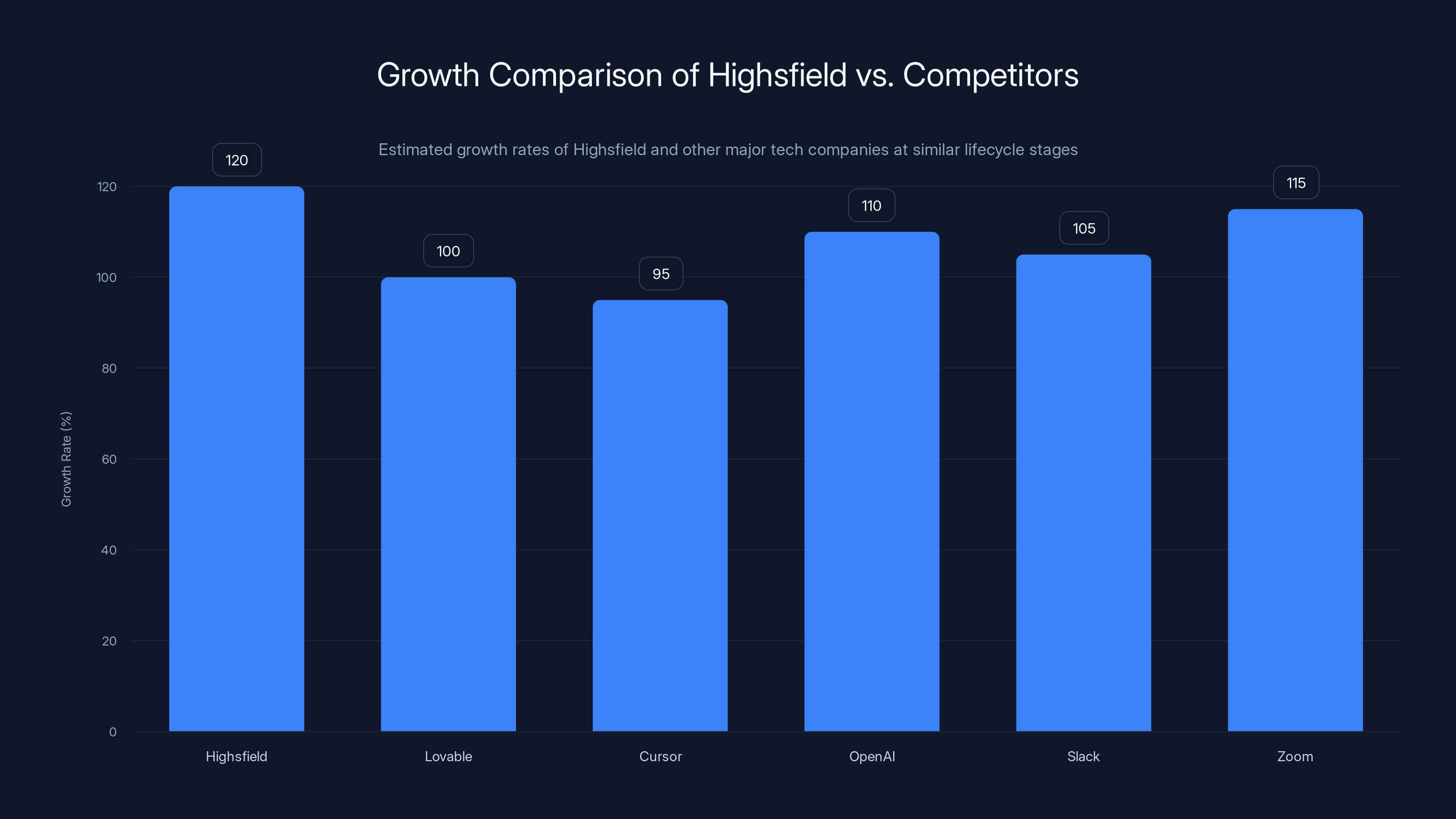

Highsfield's growth comparison is interesting. They claim to be growing faster than Lovable, Cursor, OpenAI, Slack, and Zoom at similar points in their lifecycle. That's not an arbitrary list. Those are all companies that achieved massive scale and didn't need to wait for the rest of the market to catch up. Lovable and Cursor are AI coding tools that grew explosively in 2024 and 2025. OpenAI obviously had the advantage of ChatGPT's network effect. Slack basically created the category it dominated. Zoom exploded during the pandemic. The pattern is companies that hit a nerve so strong that adoption becomes self-reinforcing.

If Higgsfield is actually in that category, the valuation makes sense. If it's not, it's expensive.

Market Positioning: Professional vs. Casual

One of the smartest moves Higgsfield made was repositioning itself as a professional tool. Early AI video generators were built for hobbyists. The assumption was that individual creators would be the primary user base. Higgsfield inverted that. They built for teams.

What does that mean in practice? Professional social media teams have budgets. They have KPIs. They measure output and efficiency. They have workflow integration points. A creator who spends 10 hours per week on TikTok is a lovely user but unpredictable. A team managing content for Nike or Glossier or Adidas across 47 different markets? That's predictable revenue. That scales. That justifies enterprise pricing.

Highsfield's claim that professional marketers now drive the majority of their business is the key to understanding their revenue velocity. If 70% of revenue comes from professional teams and only 30% from casual creators, the unit economics tell a very different story than if it's the reverse. Professional teams also have lower churn. They integrate the tool into their workflow. They build institutional reliance. Switching costs become real.

The company hasn't released numbers on their user split, but you can infer it from the fact that they're willing to talk about it. If casual creators were still the primary segment, they'd probably emphasize virality and user growth. Instead, they're talking about professional adoption and retention. That messaging choice suggests confidence in their professional business.

Competing on the professional side also means competing against better-funded, more established players. Adobe can add video generation to Creative Cloud and reach millions of professionals overnight. Runway has been focusing on professional creators and filmmakers. But Higgsfield seems to have found a niche: faster, cheaper, easier than the alternatives, and good enough for most social media content production needs. That's not a huge niche, but it's profitable.

Highsfield is reportedly growing faster than its peers like Lovable, Cursor, OpenAI, Slack, and Zoom at similar lifecycle stages. (Estimated data)

The Competitive Landscape and Why It's Heating Up

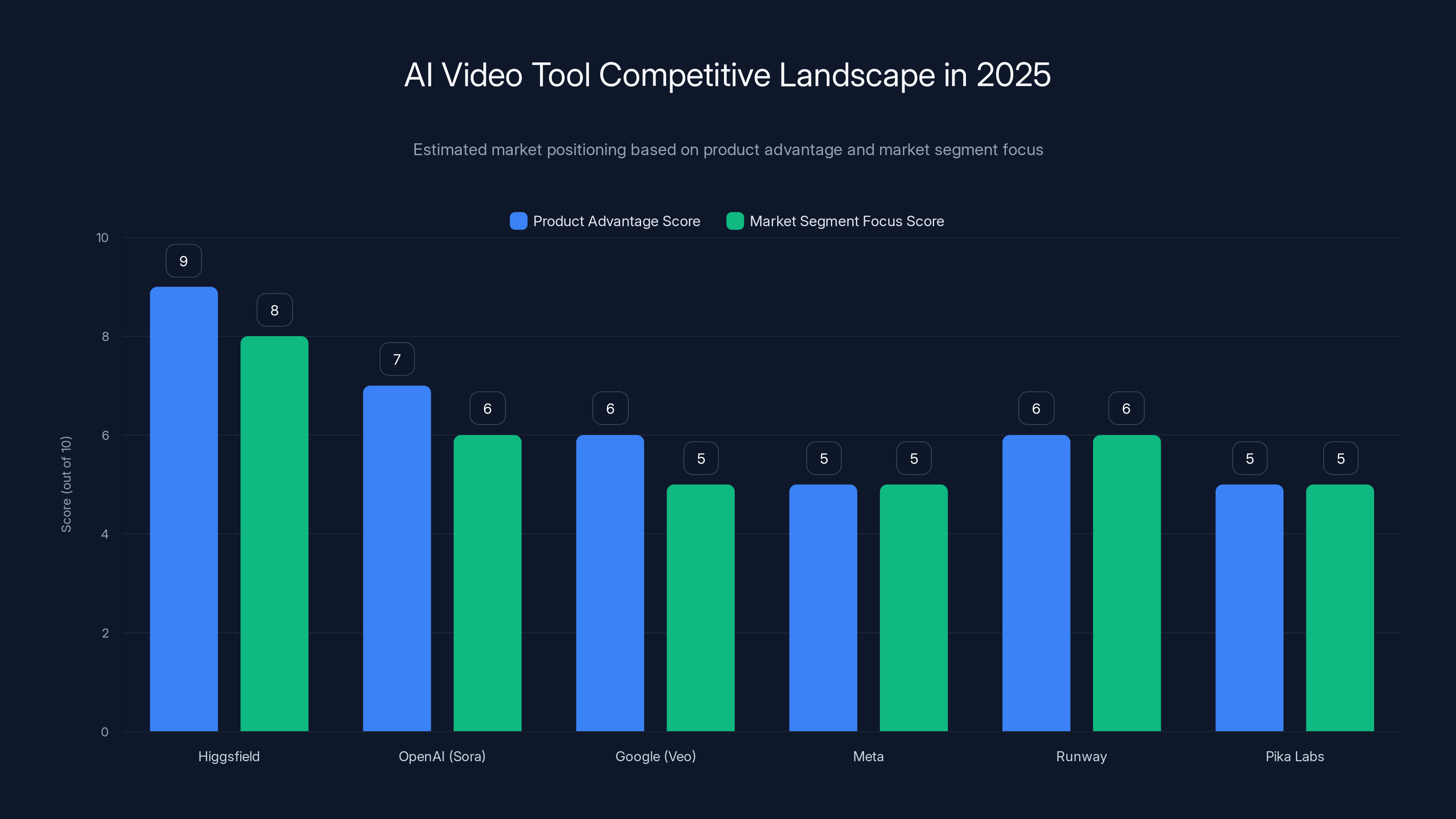

The AI video space went from zero real competition in 2024 to absolute carnage in 2025. OpenAI released Sora. Google released Veo and earlier variants. Meta has been integrating video generation into its platforms. Runway, which was basically alone in this space for years, now has real competition. Pika Labs launched a competitive product. Even established video software companies started adding generative features.

What's interesting is that Higgsfield is winning despite having less funding and less brand recognition than most competitors. OpenAI has unlimited resources and the ChatGPT user base. Google has YouTube and can distribute tools to billions. Meta controls Instagram and TikTok's primary competitors. But Higgsfield has users, product-market fit, and growth that's apparently outpacing all of them.

This usually means one of two things: either Higgsfield has a legitimate product advantage that other companies don't, or they found a market segment that others are ignoring. Probably both.

The product advantage angle is worth exploring. Higgsfield's generation model is built on their own architecture, separate from the large foundation models everyone else is using. That means they can optimize for speed, cost, and quality in their specific use case without being constrained by someone else's API limits or pricing. If you're generating a short-form video for Instagram, you don't need the absolute best video quality in the world. You need good enough, fast, and cheap. Higgsfield optimized for that tradeoff. Competitors optimized for maximum quality and flexibility, which made them slower and more expensive.

The market segment angle is also clear. Social media content creators and professional marketing teams is a huge segment that wasn't well served by existing tools. Sora is positioned as a creative tool for filmmakers. Google's tools are spread across different products. Runway is focused on creators who understand video production. Higgsfield came in and said, "What if we just made it dead simple for marketing teams to generate content at scale?" Simple and scalable beats fancy and flexible in most markets.

But the competitive landscape is getting dense, and that's a real risk. One of the biggest competitors isn't another startup. It's the incumbents. Adobe could ship video generation in Premiere Pro and Firefly. Microsoft could integrate it into Office. Apple could add it to Final Cut and Motion. If the incumbent software companies move aggressively, they could crush specialized competitors through distribution alone. Higgsfield's scale advantages become less important if Adobe offers the same capability to their Creative Cloud subscribers.

Growth Velocity and Sustainability Questions

Let's talk about what happens next, because that's where the story gets complicated. Higgsfield is growing at a pace that doesn't have many historical comparisons. If we take the $200 million ARR number at face value, they're doing revenue that took most SaaS companies five to seven years to hit. They did it in nine months.

That kind of growth is exciting to investors but terrifying from an operational perspective. You need to scale everything simultaneously: infrastructure, support, engineering, sales. Miss one thing and the company breaks.

The infrastructure challenge is real. Video generation is computationally expensive. Higgsfield is running billions of tokens through their model every day. The cost structure is brutal. If they're generating 100 million videos per month for users, and each video costs them

But margins are the real question. Higgsfield hasn't released profitability numbers, and private companies rarely do until they're forced to. Most high-growth SaaS companies operate at substantial losses in their early stage. They're willing to lose money to buy market share and lock in users. Higgsfield's funding round suggests they have enough capital to maintain that strategy for at least another year. But if they're losing money on revenue, the valuation only makes sense if investors believe they can eventually flip to profitability. That's a big bet.

The sustainability question also involves retention. We don't know what Higgsfield's churn rate is. In most SaaS businesses, early-stage products have churn rates between 3% and 8% per month. That sounds low until you do the math. At 5% monthly churn, you need to add enough new revenue every month to replace 5% of what you had the month before, plus achieve growth. If you're at

The Founder's Advantage and Snap's Legacy

Alex Mashrabov's background matters more than it might appear. He spent years at Snap as the Head of Generative AI, which means he worked on content creation tools that hundreds of millions of people use every day. Snap's strengths are speed, mobile optimization, and making AI features feel natural rather than awkward. Those strengths show up in Higgsfield.

Before Snap, Mashrabov co-founded AI Factory, which Snap acquired in 2020 for $166 million. That acquisition wasn't just about talent. Snap wanted Mashrabov's knowledge of how to build AI products that regular people actually use, not just products that researchers find interesting. That's a specific skillset, and it's rarer than you'd think. A lot of AI researchers can build technically impressive products. Far fewer can build products that scale to tens of millions of users and keep them happy.

Highsfield's product philosophy seems to reflect that background. The tool is not trying to be the most sophisticated video generation platform in the world. It's trying to be the easiest, fastest, and most cost-effective. That's a Snap-like way of thinking about products. Build for speed. Don't compromise on UX. Make the hard thing feel simple.

Mashrabov also has credibility with investors. Founders with successful exits, especially exits to big tech companies, tend to get the benefit of the doubt. An investor who's skeptical about video generation AI in general might still say yes to a Mashrabov pitch because they trust his judgment about products. That's not entirely rational, but it's how capital allocation works.

The Snap connection also matters for the product itself. Snap's Snapchat platform has 500+ million users, mostly young, mostly in markets where short-form video is already the dominant content format. If Higgsfield can get distribution through Snap—either through integration, investment, or eventual acquisition—the growth story becomes exponential. Snap isn't mentioned as an investor in this round, but they probably should be thinking about it.

Higgsfield's rapid growth to

The Revenue Model and Pricing Strategy

Highsfield's pricing isn't fully public, but we can infer some things from the growth numbers and user base. They likely have a freemium model with free tiers for casual users and paid tiers for professionals and teams. The free tier is probably generous enough to get people hooked, and the paid tier is probably positioned at a price point where professional teams say yes without extensive procurement process.

SaaS pricing usually follows a pattern: free tier gets you adoption and viral growth, basic tier (

What's particularly smart about the pricing strategy is where it positions the product in the market. It's cheaper than hiring a video production company (

The pricing strategy also creates a lock-in effect. Once a team is generating 50 videos per month through Higgsfield, switching to a competitor means losing all their templates, settings, and workflow optimizations. That kind of switching cost is worth money. It's why Higgsfield can probably raise prices on existing users without losing too many.

What the Valuation Actually Says

A

But context matters. Slack and Zoom hit their IPO multiples after proving they could scale profitably or at least toward profitability. Higgsfield is unproven on that front. They're a nine-month-old company with explosive growth and no disclosed path to profitability. If they're burning cash at

The valuation also depends on TAM (total addressable market). If the global market for AI video generation software is

Highsfield's investors are betting that video generation becomes as essential to content creation as photos and text are now. That's probably true. But they're also betting that Higgsfield is the winner in a category where competitors are shipping constantly and incumbents are watching carefully. That's a much bigger bet.

The Content Moderation and Trust Question

We mentioned the Epstein incident earlier, but it deserves more attention because it gets at a fundamental challenge for AI video generation companies. As soon as you ship a tool that can generate realistic video, you've created an infrastructure that can be used to create deepfakes, misinformation, and harmful content.

Highsfield's response was to emphasize professional use and position themselves as a business tool rather than a consumer entertainment tool. That's smart positioning, but it doesn't solve the problem. Professional teams have budgets and accountability, but they can also be sources of misinformation. Imagine a political campaign using Higgsfield to generate videos of an opponent saying things they never said. Or a competitor using it to generate videos of a CEO making statements they didn't make.

Other AI video companies have thought about this. Runway has invested in watermarking and provenance tools. OpenAI is cautious about Sora's release, limiting it to creative professionals. Pika Labs does watermarking and has reporting tools. The technology to detect AI video exists but isn't perfect, and the detection tools need to stay ahead of the generation tools.

Highsfield's current stance seems to be content moderation through ToS enforcement and abuse reports. That works to a degree but isn't foolproof. If the company scales to hundreds of millions of users, they'll inevitably face pressure to do more. There might be regulation coming. There are definitely advocacy groups who will push for it. Building trust in the AI video space requires something more than just not being the worst actor.

From a business perspective, this is actually an advantage for Higgsfield if they move proactively. If they become known as the responsible player in the space—the company with serious content moderation, watermarking, and provenance tools—they become the default choice for companies that care about legitimacy. That's a moat. It's also harder for competitors to compete on those dimensions once they're established.

Estimated data shows that while the majority of Higgsfield's users are on the free tier, the professional tier significantly contributes to the company's revenue, highlighting the importance of professional adoption.

The Venture Capital Perspective and Follow-On Funding

Why are VCs putting money into Higgsfield at $1.3 billion valuation? This is the question that separates people who understand venture from people who think VCs are making random bets.

The venture thesis is roughly: the market for AI video generation is going to be much larger than anyone currently thinks, and Higgsfield is demonstrating proof points that make it the most likely winner in the space right now. That's not a guarantee. It's a bet. But it's a bet on something real—actual users, actual revenue, actual growth—rather than a bet on speculation.

From an investor's perspective, Higgsfield has several advantages. First, they have distribution. Fifteen million users is a real distribution advantage. That's not easy to replicate. Second, they have founder-product fit. Mashrabov has built products at scale before. He understands the market. Third, they have a clear business model. They're not trying to figure out how to monetize. They're already doing it successfully. Fourth, they have capital efficiency. They're generating $200 million in ARR on apparently less capital than competitors needed to get to similar scale.

The follow-on funding question is interesting. Can Higgsfield raise at a higher valuation? Almost certainly. SaaS companies growing 40%+ year-over-year can typically raise at higher multiples. Series B could be at

AI Video Generation as a Category

Highsfield's success is forcing everyone to take AI video seriously as a category. Six months ago, video generation AI was interesting but not critical. Now it's potentially transformative.

What's interesting about the category is how fast it's maturing. A year ago, AI-generated video looked obviously fake. The motion was wrong. The lighting was inconsistent. You could spot AI video from the first frame. Now? It's not always obvious. Quality is improving fast. What took image generation 2-3 years to go from obviously fake to "could be real" is happening in months for video.

The category maturity also means pricing is becoming commodified. If every AI video tool is roughly equivalent in quality, then the winner is whoever is fastest and cheapest. That's a race Higgsfield seems to be winning so far. But it's a race that prices can get brutal. Eventually someone will offer good-enough video generation for $5 per month, and the entire market resets.

That's why the professional positioning is so important. If Higgsfield can establish itself as the tool professionals use, they can charge more and grow more slowly but sustainably. If it turns into a commodity race, only a few players with massive scale can survive.

What Could Go Wrong

For all the positive momentum, there are real risks:

Incumbent Competition: Adobe, Google, or Meta shipping competitive features could flatten growth overnight. Their distribution advantage is enormous.

Churn Discovery: If Higgsfield's actual monthly churn is much higher than 5%, the growth narrative breaks down.

Pricing Resistance: Professional teams might be happy with free tiers or competitor offerings and resist paying more.

Regulation: Governments might impose restrictions on AI video generation or require extensive labeling and provenance tracking, which would slow adoption and add costs.

Model Degradation: As more people generate videos on Higgsfield's infrastructure, the quality of training data might degrade, reducing quality and competitive advantage.

Founder Risk: Mashrabov is the CEO. If something happens to him or if there's a management disagreement, the company could stumble.

Category Overheating: If everyone and their cousin is generating AI video, the novelty wears off and adoption slows.

Estimated data shows that companies solving significant pain points can reach valuations in the tens of billions, with Higgsfield potentially reaching $10 billion.

The Broader Implications for AI and Startups

Highsfield's trajectory tells us something important about where AI is in its development. We're past the phase where anything AI-powered is interesting just because it's AI. We're in the phase where AI is starting to become an invisible layer in products people actually use. That's a more competitive phase but also a more real phase.

It also tells us that the venture market is rewarding real metrics over hype. Higgsfield didn't raise at

For startups, the Higgsfield story is both encouraging and discouraging. Encouraging because it shows that founders with real product-market fit can still move fast and raise capital at meaningful valuations. Discouraging because it also shows that competing in AI categories requires either unique technical advantages or clear market positioning. There's less room for mediocre products.

Where AI Video Is Heading

The next 12-24 months will determine whether Higgsfield's growth is sustainable. If they can maintain 30%+ year-over-year growth while improving margins, they're on a path to either IPO or acquisition by a major tech company. If growth slows to 10-15% or churn becomes an issue, they might get caught in a dead zone where they're too big to fail but too limited to thrive.

The broader category is heading toward integration and standardization. Video generation will probably become a standard feature in creative software, similar to how filters became standard in Instagram or effects became standard in TikTok. The companies that win will be either the incumbents with distribution or the specialists who became indispensable to specific use cases before consolidation happened.

Highsfield's bet is that they can become indispensable to professional content creation before Adobe or Google move aggressively. If they pull that off, they're building a multi-billion dollar company. If they don't, they might get acquired for $2-5 billion in 2027, which would still be a massive return for investors but a missed opportunity for what could have been.

Key Takeaways

Highsfield's

Higgsfield leads in both product advantage and market segment focus, outpacing larger competitors like OpenAI and Google. Estimated data based on market trends.

How AI Video Generation Actually Works

Understanding Higgsfield's technical advantage requires understanding how AI video generation works at a basic level.

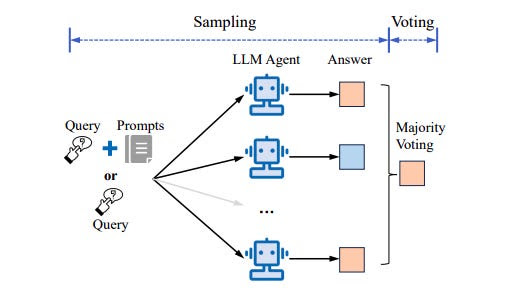

The simplest explanation: AI video generation works by predicting the next frame in a sequence. You start with a prompt (text describing what you want), the model encodes that into a mathematical representation, and then it generates a sequence of images pixel by pixel, predicting what makes sense given the previous frames and the overall description. Modern approaches use diffusion models or transformer architectures, which let the model learn the statistical patterns of how video frames relate to each other.

The challenge is that video has way more information than images. A single frame might be 1920x1080 pixels = 2,073,600 pixels. A 10-second video at 24fps is 240 frames = 497,664,000 pixels. Generating all of that in high quality in a few seconds is computationally expensive. That's why most AI video tools either generate lower resolution video, shorter clips, or require more computation time.

Highsfield's approach appears to emphasize speed and practical quality over maximum fidelity. That's a smart trade-off for professional social media use. A 1080p 15-second video for Instagram doesn't need the quality of a 4K cinema production. Speed matters more.

The technical advantage Higgsfield has built is probably some combination of: better training data that's optimized for short-form video, optimized inference that runs faster, and architectural choices that prioritize speed over absolute quality. Those advantages are real but also replicable. A better-funded competitor can catch up on technology relatively quickly. Higgsfield's durable advantage is more likely to be distribution, user base, and product-market fit than pure technology.

The Creator Economy Context

Highsfield's growth is riding on broader trends in the creator economy. More people are creating content for social media than ever before. TikTok, Instagram Reels, YouTube Shorts have all driven demand for short-form video production. Brands and creators are spending more on content than they did five years ago.

In that environment, any tool that makes content production faster and cheaper gains immediate traction. Higgsfield benefits from three forces: the rise of short-form video as the dominant content format, the professionalization of creator work (people now do this for revenue, not just hobby), and the increasing reliance on AI-assisted tools across the creative process.

Those trends aren't stopping. If anything, they're accelerating. That's why investors are comfortable with Higgsfield's valuation. The tailwinds are real, and Higgsfield is positioned in the middle of them.

Comparison to Previous Startup Explosions

When we compare Higgsfield to companies like Slack, Zoom, and Lovable, the pattern that emerges is consistent: explosive growth happens when a tool solves a real pain point faster and cheaper than the alternatives.

Slack solved the pain of email for internal communication. Zoom solved the pain of unreliable video conferencing. Lovable solved the pain of needing to know how to code to build a web app. Higgsfield is solving the pain of needing to spend hours and thousands of dollars to produce professional video content.

All of these solutions involved a significant shift in how people work. That kind of shift can drive 40%+ year-over-year growth for years. The question for each company is whether they can maintain that growth as the market matures and competition shows up. Most can't. Most hit a growth ceiling when the category saturates or when incumbents show up. The ones that do manage it become trillion-dollar companies. Slack and Zoom are worth tens of billions. Figma, which is a similar story in design tools, is worth $20+ billion.

If Higgsfield can maintain their position as the leading AI video generation platform for professional content creation, they're on a path to $10+ billion valuation. That's not guaranteed. But it's possible.

The Series A Extension as a Signal

The fact that Higgsfield's Series A was reopened and extended with $80 million in new capital is actually a strong positive signal that's easy to miss. Investors don't reopen rounds unless the company is crushing it. Reopened rounds mean there's scarcity of allocation, which only happens when demand exceeds supply.

This also suggests there are investors who wanted in but didn't get allocation in the original $50 million round. That's FOMO, but it's FOMO backed by reasonable concern that they're missing out on something real. FOMO can be a bad reason to invest, but it's also often accurate. People who are good at investing tend to feel FOMO about things that actually matter.

The extension also gives Higgsfield ammunition for the next 18-24 months. With $130 million in new capital, they can afford to spend on infrastructure, hiring, and customer acquisition without worrying about runway. That's a competitive advantage. Competitors who are still in earlier funding rounds need to be more conservative.

Final Thoughts: Is This the Real Deal or a Beautiful Bubble?

That's the question everyone's asking. The answer is: it's probably both. Higgsfield is demonstrating real product-market fit with real revenue. That's not a bubble dynamic. Bubbles involve hype exceeding reality. In Higgsfield's case, the reality is holding up. But the valuation also assumes they'll maintain growth and defend against serious competition. That's not guaranteed.

The most likely scenarios: (1) Higgsfield maintains category leadership, grows to

Scenario 1 is what the $1.3 billion valuation is pricing in. Scenarios 2 and 3 are also rational outcomes and would still represent massive success. The thing about venture capital is that even a "failure" that returns 5x is considered success. Higgsfield would have to actually fail—revenue goes to zero, users churn out, product quality collapses—for this to be a bad investment.

So yes, this is probably the real deal. Whether it's worth $1.3 billion in this exact moment is the more interesting debate.

FAQ

What is Higgsfield?

Highsfield is an AI video generation platform that allows users, creators, and professional marketing teams to generate and edit AI-generated videos from text descriptions. The company was founded by Alex Mashrabov, former Head of Generative AI at Snap, and has achieved 15 million users and $200 million annual revenue run rate in just nine months of operation.

How does Higgsfield generate videos?

Highsfield uses AI models trained on video data to predict sequences of frames based on text prompts. Users describe what they want (e.g., "a product unboxing video"), and the platform generates video content by predicting what each frame should look like based on the description and the previous frames. The system is optimized for speed and quality in short-form video production for social media, rather than maximum fidelity in all cases.

What are the main use cases for Higgsfield?

Highsfield is primarily used by professional social media marketing teams to produce content at scale for platforms like Instagram, TikTok, and YouTube. Individual creators also use the tool, but the company emphasizes professional adoption because it drives higher-value subscriptions and more predictable revenue. Teams can generate multiple versions of content quickly without expensive production equipment or hiring videographers.

How much does Higgsfield cost?

Highsfield uses a freemium model with a free tier for casual users and paid subscription tiers for professionals. While exact pricing hasn't been publicly disclosed, the company's

Why did Higgsfield's Series A reopen for an $80 million extension?

The Series A was reopened because investor demand exceeded allocation in the original

How does Higgsfield compete with OpenAI's Sora and Google's video generation tools?

Highsfield differentiates through speed, cost efficiency, and user experience optimized for professional social media content creators. While Sora and Google's tools target filmmakers and creative professionals requiring highest quality, Higgsfield focuses on marketing teams and brands that prioritize rapid iteration and content volume over maximum quality. This market positioning allows Higgsfield to move faster and charge less than competitors focused on premium quality.

Is Higgsfield profitable?

Highsfield has not disclosed profitability metrics publicly. The company is likely operating at a loss as a growth-stage startup, reinvesting revenue into infrastructure, hiring, and customer acquisition. Most high-growth SaaS companies with $200+ million ARR eventually become profitable, but it typically requires 2-3 more years of maturation and operational optimization.

What are the main risks to Higgsfield's growth?

Key risks include incumbent competition (Adobe, Google, Meta adding video generation to existing products), churn uncertainty in the professional user base, regulation of AI-generated content, pricing pressure in a commoditizing market, and the challenge of maintaining growth as the market matures. The company also faces founder dependency risk given Alex Mashrabov's central role in the product vision and investor confidence.

Could Higgsfield get acquired?

Yes, acquisition is a plausible outcome if the company's growth slows or if larger tech companies decide to buy their way into market leadership. Previous acquisition prices for high-growth companies at similar revenue levels range from $2-10 billion. Snap, given its connection to founder Mashrabov, would be a logical potential acquirer, though competition from Adobe, Google, or Meta is possible.

What does Higgsfield's success mean for the broader AI market?

Highsfield's growth validates that AI tools with clear product-market fit, real revenue, and measurable user value can scale aggressively and attract significant capital. It also demonstrates that the venture market is rewarding real metrics over hype, suggesting a maturing AI market focused on practical applications rather than pure speculation. The success of AI video generation suggests similar explosive growth patterns may emerge in other AI categories with similar pain point solutions and incumbent competition.

Related Articles

- Google Veo 3.1: AI Video Generation with Vertical 4K Upscaling [2025]

- Google Veo 3.1 Vertical Videos: Reference Images Game-Changer [2025]

- How People Use ChatGPT: OpenAI's First User Study Analysis [2025]

- Rockstar's Cfx Marketplace Explained: The Future of GTA Modding [2025]

- Is Alexa+ Worth It? The Real Truth Behind AI Assistant Expectations [2025]

- Why Grok's Image Generation Problem Demands Immediate Action [2025]

![Higgsfield's $1.3B Valuation: Inside the AI Video Revolution [2025]](https://tryrunable.com/blog/higgsfield-s-1-3b-valuation-inside-the-ai-video-revolution-2/image-1-1768505834648.png)