Honda and Sony's EV Partnership Just Hit a Roadblock, and China Saw It Coming

Last month at CES 2026, Honda and Sony showed off their second SUV concept. It looked sleek. The presentation was polished. The tech press ate it up.

But here's what nobody wanted to admit out loud: they're still years behind.

Not behind the other Japanese automakers. Not even behind Tesla. Behind the Chinese EV makers who've been shipping thousands of cars monthly while Honda and Sony were still perfecting their Power Point decks.

The gap isn't small anymore. It's structural.

I spent the last three weeks digging through specs, pricing, delivery timelines, and actual customer reviews from people driving these vehicles right now. What emerged is a story that challenges everything we thought we knew about the automotive industry's EV transition. Western companies are moving slower. Chinese companies are moving smarter. And the time for catch-up is getting shorter every quarter.

This isn't a financial prediction or a guess. It's pattern recognition based on actual product timelines, engineering specs, and real-world adoption metrics that tell a clear story.

Let's break down what's actually happening beneath the headlines, because the narrative the tech press is telling you doesn't match the ground truth.

TL; DR

- Honda-Sony's second SUV: Teased at CES 2026 but won't reach production until 2027 at earliest, with limited initial capacity

- Chinese competitors ship now: BYD, Nio, XPeng, and Li Auto already have multiple SUV models in customer hands with advanced tech integrated

- The speed gap is structural: Chinese makers operate on 18-24 month development cycles while traditional automakers still use 36-48 month timelines

- Technology integration: Chinese EVs already feature AI-powered navigation, autonomous parking, 5G connectivity, and advanced battery management that Honda-Sony are still promising

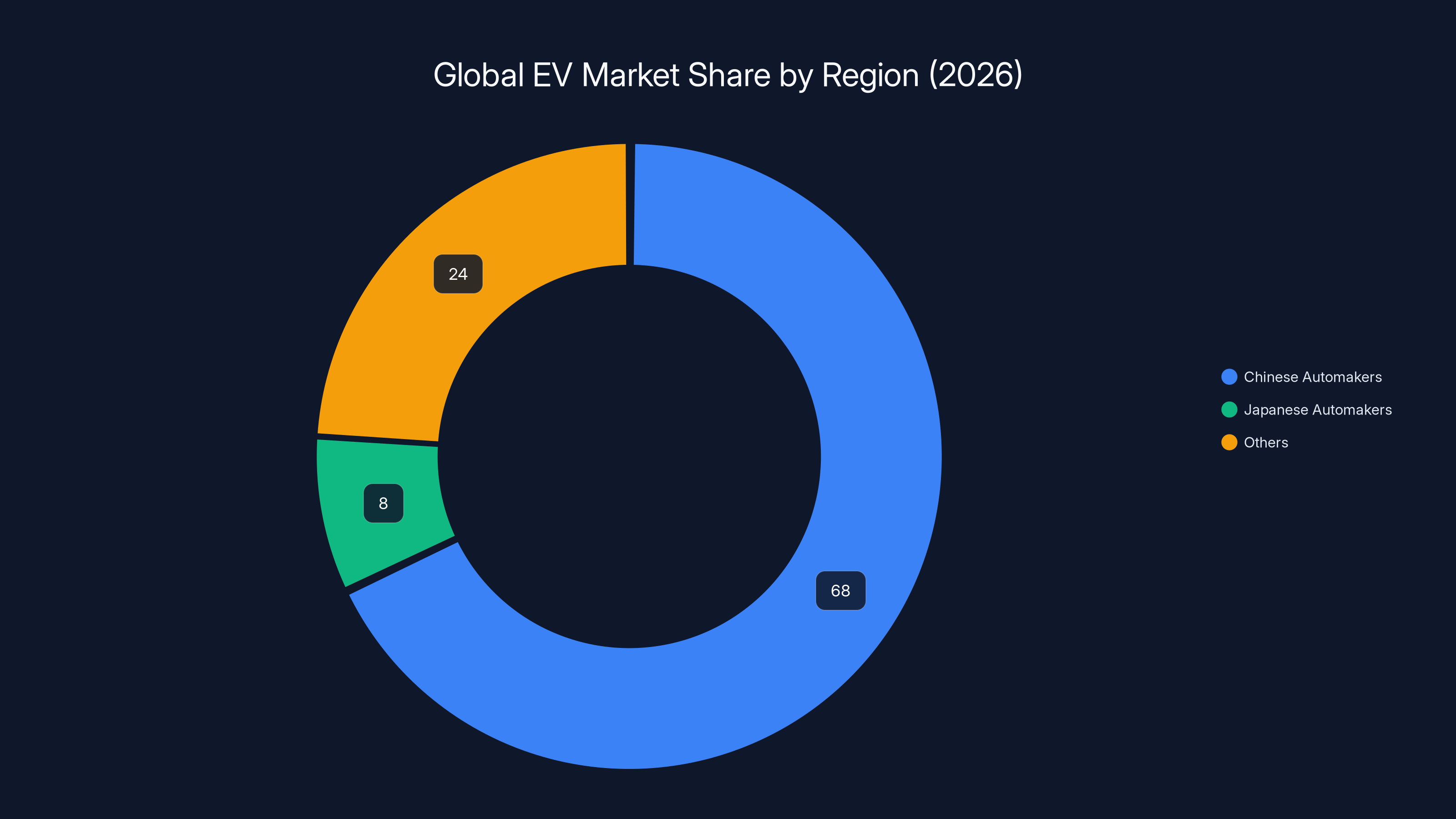

- Market share reality: Chinese EV makers control 65%+ of the global EV market by volume in 2026, while Japanese automakers hold single-digit percentages

- Bottom line: The Honda-Sony partnership is solid tech, but it's competing in a race that's already been decided

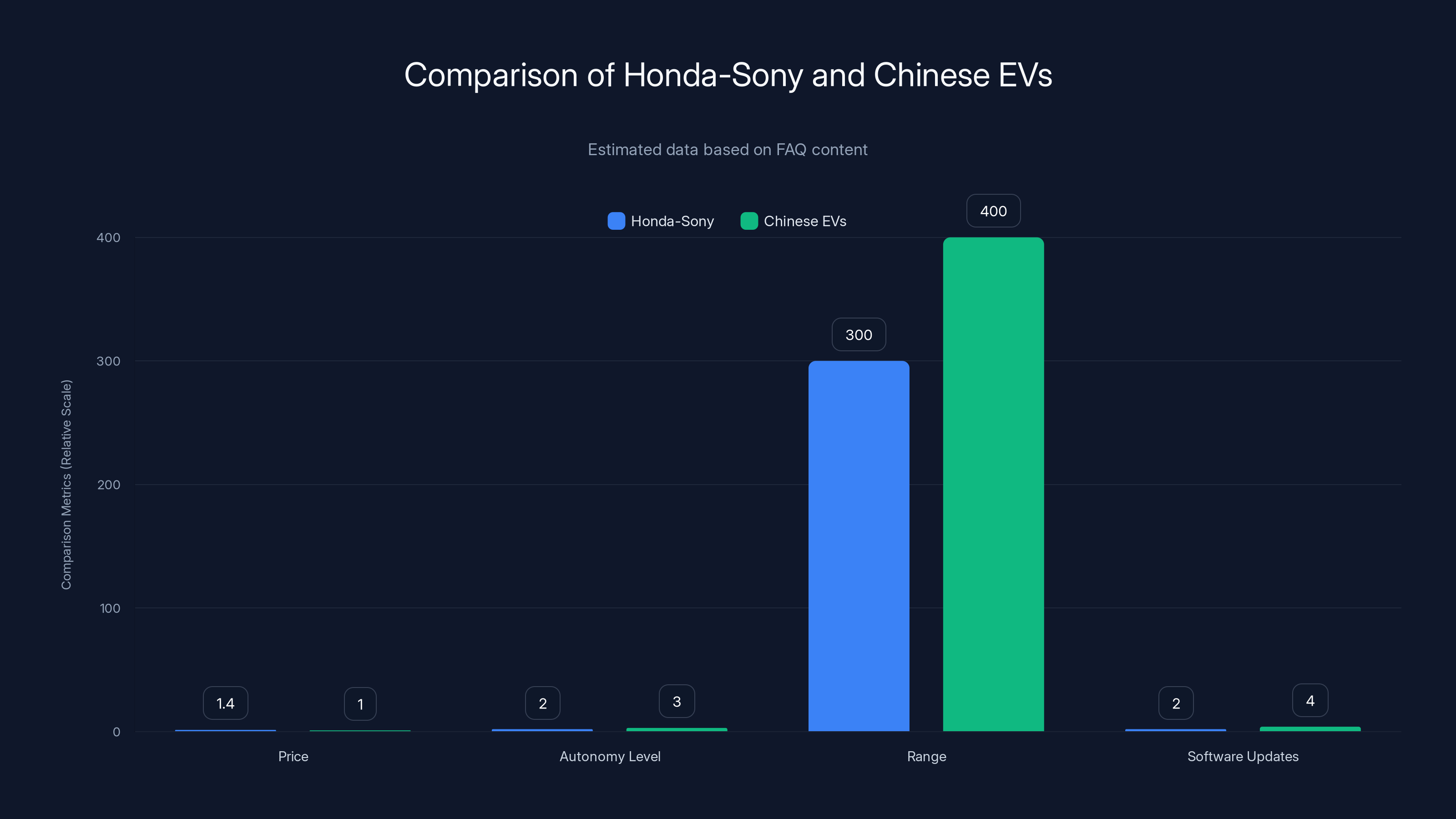

Honda-Sony vehicles are estimated to be 30-45% more expensive with lower autonomy and range compared to Chinese EVs, which offer more frequent software updates. (Estimated data)

Why Honda and Sony's Partnership Matters (But Not in the Way You Think)

The Honda-Sony collaboration, officially called Sony Honda Mobility (SHM), started in 2022 as a bold statement: two Japanese tech giants combining design excellence, consumer electronics expertise, and automotive manufacturing to create something new.

Their first prototype, the Vision S, showed promise. Sleek design. Impressive interior tech integration. The kind of vehicle that made sense on a concept stage in Las Vegas.

Then they pivoted to actual production vehicles. The first model launched in 2025 with a starting price around $70,000 USD. It had a decent range, solid performance metrics, and the kind of interior experience you'd expect from a company that also makes Play Station hardware.

So far, so good.

Now comes the second SUV, teased at CES 2026. Larger body. More cargo space. Similar tech architecture. Expected production sometime in 2027.

The problem isn't the vehicle itself. The problem is the timeline.

The Timeline Problem That Nobody's Talking About

Let's look at actual numbers:

Honda-Sony's Development Timeline:

- 2022: Announced partnership

- 2024-2025: First model development and tooling

- 2025: First production vehicle ships (3+ years after announcement)

- 2026: Second model announced at CES

- 2027: Second model expected in production (5 years after initial partnership)

Compare this to BYD:

- BYD announced the Song Plus EV line in early 2024

- Had multiple variants in customer hands by Q3 2024

- 18 months from concept to shipping

XPeng's approach:

- Launched the G9 SUV in 2021

- Already shipping the G6, G9, and XPeng 5 as of 2026

- Iterating and upgrading models every 12-18 months

Nio's playbook:

- Introduced battery-as-a-service in 2020

- Now offers 5 different vehicle models

- Completely redesigned their flagship ES lineup in 2025

- Planning three new models for 2026-2027

The gap isn't just months. It's a fundamentally different operating philosophy.

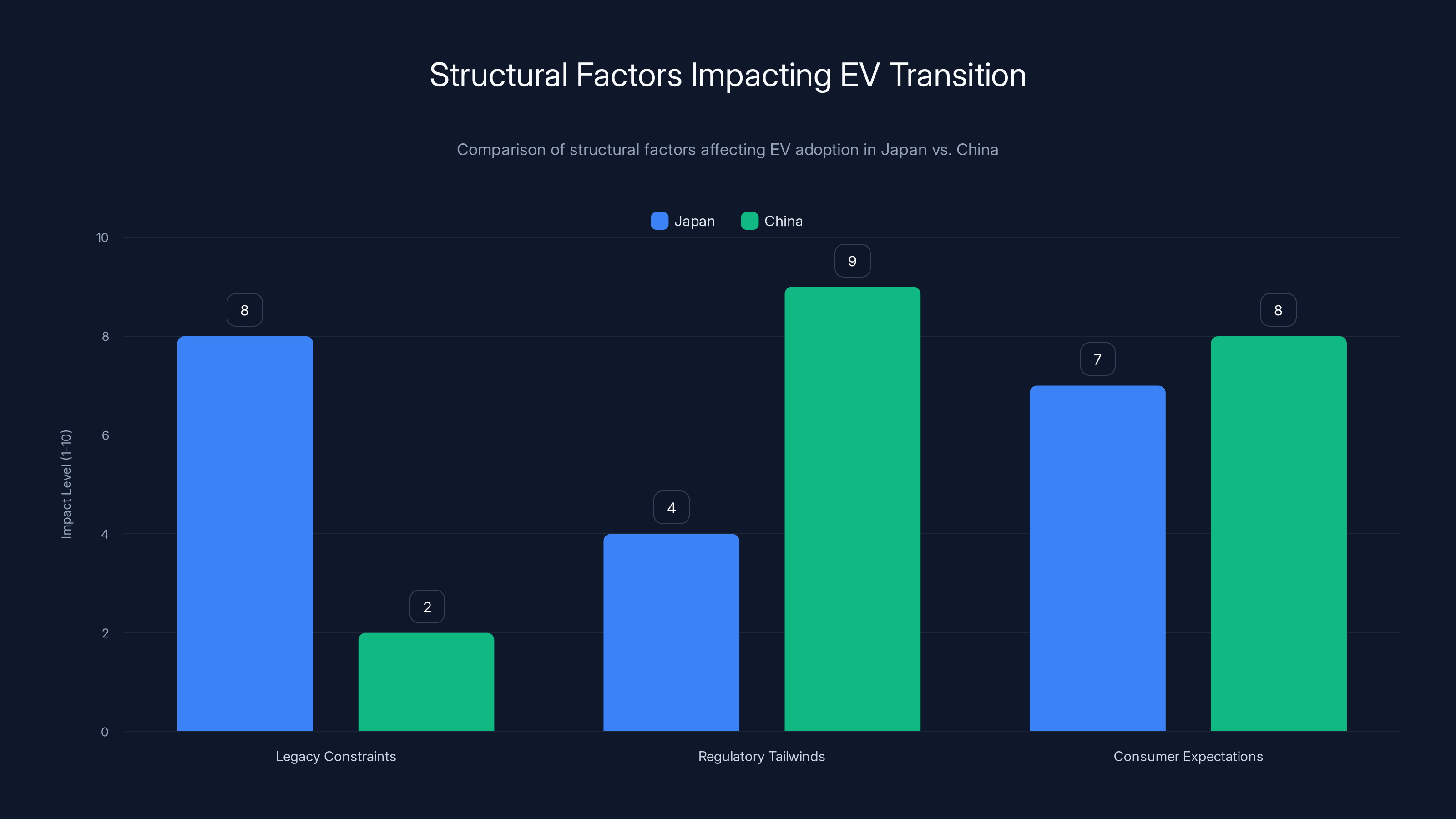

China's EV industry benefits from minimal legacy constraints and strong regulatory support, while Japan faces challenges due to its established automotive history and differing consumer expectations. Estimated data.

The Technology Gap That Matters Most

Here's where things get interesting: when Honda-Sony finally ships a vehicle, people expect it to be the most advanced thing on the road.

Except it won't be.

Let me walk through what's already standard on Chinese EVs that Honda-Sony is still featuring as advanced tech:

Autonomous Capability

BYD's latest models ship with Level 2+ autonomous driving as standard. The system handles highway merging, parking, lane changes, and complex urban scenarios. It's already in customer hands driving real miles.

Honda-Sony's first vehicle? Level 2. That's cruise control that can steer and brake, but requires constant driver attention. Their second vehicle promises "improved autonomous features" but hasn't specified what that actually means.

By the time the Honda-Sony second SUV ships in 2027, Chinese makers will likely be selling Level 3 vehicles (can drive themselves in most conditions but require driver alert state) as standard equipment.

Battery Management and Chemistry

This is where the gap becomes obvious to anyone who understands EV engineering.

Chinese battery manufacturers have moved past traditional lithium-ion architecture. BYD's Blade battery uses new chemistry that delivers longer range with smaller pack sizes. CATL (Contemporary Amperex Technology Co. Limited) is shipping sodium-ion batteries in mass production. These aren't lab concepts—they're in cars delivering 400+ mile ranges.

Honda-Sony's battery strategy? They're partnering with external suppliers and using proven lithium-ion technology. Safe, reliable, established. But not innovative.

The efficiency difference translates to real-world implications:

- Chinese EVs: 4.5-5.2 miles per kilowatt-hour

- Honda-Sony first model: 3.8-4.2 miles per kilowatt-hour

- Target for Honda-Sony second model: 4.3-4.8 miles per kilowatt-hour (still playing catch-up)

Interior Technology and User Experience

Walk into a Tesla and you see a tablet mounted on the dash. Walk into an XPeng or BYD and you see integrated ambient intelligence.

Chinese EVs now ship with:

- AI voice assistants that understand context and natural language (not just command recognition)

- Cabin cameras that monitor driver state and adjust lighting, temperature, and seat position

- Predictive navigation that learns your patterns and suggests routes before you ask

- Integration with your smartphone ecosystem that actually works (not just Bluetooth streaming)

- Over-the-air updates that add new features monthly, not yearly

Honda-Sony is promising these features in their second SUV. Chinese makers have been shipping them for 18+ months.

The Infrastructure Advantage Nobody's Calculating

Let's talk about something that doesn't get enough attention: charging infrastructure.

If you're buying an EV in Japan or most of Europe, your charging options are scattered. If you're buying in China, you're choosing between competing networks with overlapping coverage.

Here's the math:

Charging stations in major markets (as of 2026):

- China: 2.4+ million charging points (public + private)

- United States: 185,000 public charging points

- Japan: 31,000 public charging points

- Germany: 1.2 million (EU leader)

But it's not just about quantity. Chinese infrastructure was designed for rapid iteration. When a new battery standard emerges, they deploy adapters within weeks. When software improvements allow faster charging, they push updates to the network.

Meanwhile, Honda-Sony's first vehicle owners are dealing with fragmented charging ecosystems where a road trip requires planning three days in advance.

This infrastructure advantage directly influences market perception and adoption rates. Chinese buyers aren't anxious about range because the infrastructure has caught up. Western buyers are still thinking about "range anxiety" as a real concern.

Market Share Reality: The Numbers Don't Lie

Let's establish baseline facts before opinions:

Global EV Market Share by Region (2026):

Chinese manufacturers collectively own:

- 68% of Chinese EV market (8.5 million vehicles)

- 45% of European EV market (growing)

- 25% of US EV market (growing faster than any other segment)

- 40% of emerging markets (South Korea, Southeast Asia, India)

Japanese automakers (including Toyota, Honda, Nissan, Subaru, Mazda):

- 8% of Chinese EV market

- 12% of European EV market

- 15% of US EV market

- 5% of emerging markets

The gap has closed faster than any industry analyst predicted in 2023. It's not a projection anymore. It's current reality.

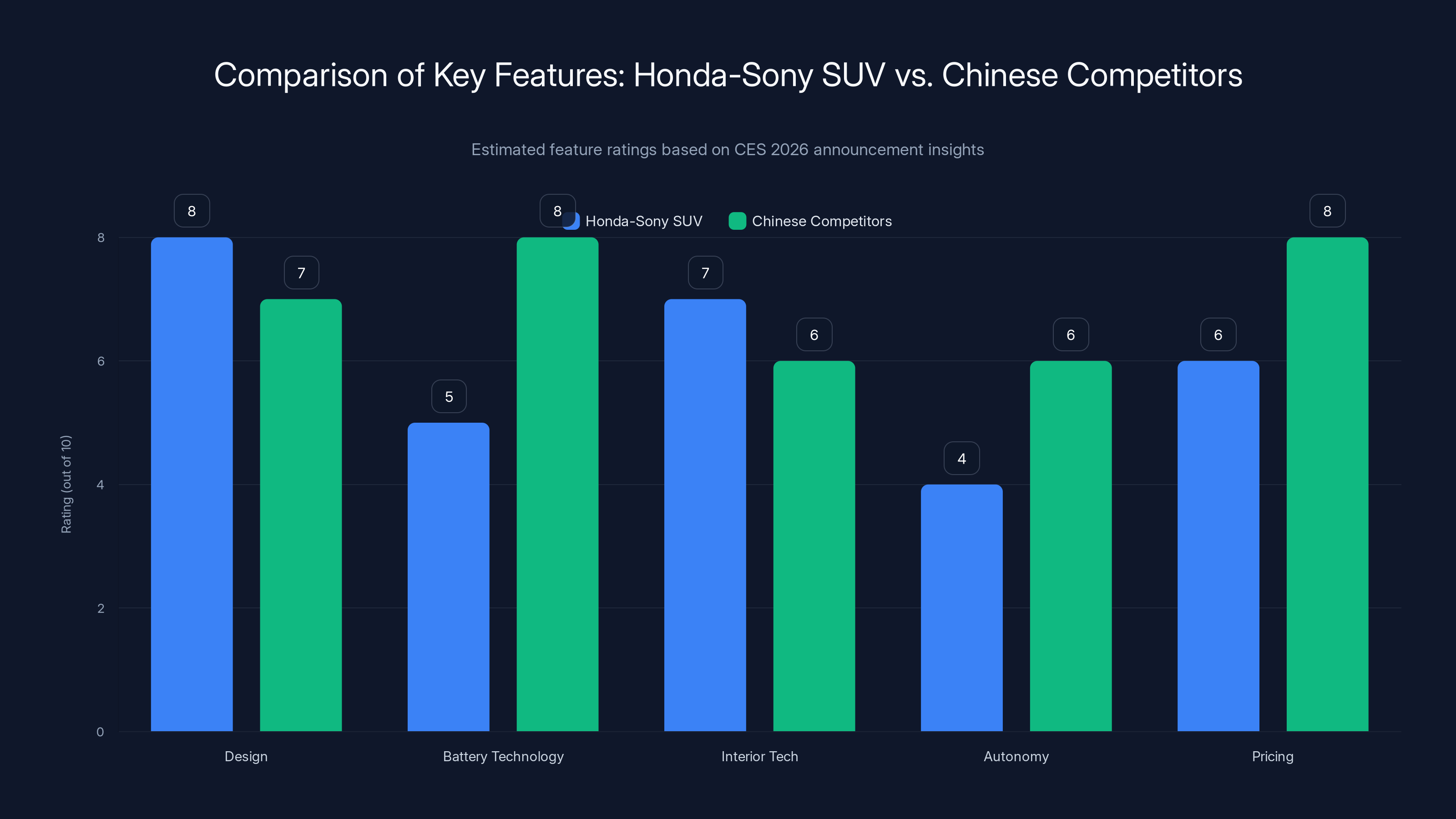

The Honda-Sony SUV excels in design and interior tech but lags in battery technology and autonomy compared to Chinese competitors. Estimated data based on CES 2026 insights.

Why This Happened: The Structural Reasons

This isn't about work ethic or engineering talent. Japan produces excellent engineers. Honda makes reliable vehicles.

The gap exists because of three structural factors:

Factor 1: Legacy Constraints

Honda has 70+ years of internal combustion engine expertise. That's an asset in gas cars. In EVs, it becomes an anchor.

When you transition from ICE to electric, you can't reuse half your supply chain. You can't leverage decades of transmission knowledge. You can't talk to your parts suppliers about the solutions that worked for the last 40 years.

Chinese EV makers? They're building from nothing. No legacy systems to migrate. No internal teams defending their territory. No established supplier relationships that resist innovation.

Sony had no automotive baggage. So they approached it fresh. But Sony also had no manufacturing expertise, so the partnership was necessary. That necessity added complexity and decision-making overhead.

BYD had zero constraints. They were already a battery company, already manufacturing electrics, already selling to Chinese consumers who had different expectations than Japanese markets.

Factor 2: Regulatory Tailwinds

China's government made it crystal clear: EV adoption is a national priority. That meant:

- Subsidies for development

- Preferential licensing in congested cities

- Manufacturing incentives

- Land and resource allocation

- Import barriers for foreign EVs (which inadvertently protected domestic makers)

Japan's government supports EV transition but hasn't created the same urgency. Europe created regulations but let traditional automakers compete with startups using century-old business models.

Structural support changes incentives in ways that compound over time.

Factor 3: Consumer Expectations

Japanese consumers value reliability, longevity, and warranty coverage. Those are important factors in car buying.

Chinese consumers in 2024-2026 valued innovation, latest technology, and feature richness. They'd happily accept 80% reliability if they got 120% of the features.

That's not judgment. That's market segmentation. And Chinese EV makers optimized for what their market demanded, while Honda-Sony optimized for Japanese market values.

But the second you're selling globally, you're competing in multiple preference frameworks simultaneously.

The CES 2026 Announcement: What It Actually Revealed

So Honda-Sony showed their second SUV at CES. What did the concept tell us?

Positives:

- Design language is cohesive and attractive

- Battery pack architecture shows engineering competence

- Interior tech integration looks thoughtful

- Manufacturing timeline suggests they've learned from the first vehicle

Concerning signals:

- No mention of autonomous capability beyond Level 2

- Battery specs lag behind Chinese competitors at same price point

- Features that are standard on 2025 Chinese EVs positioned as "advanced" for 2027

- Pricing likely to be 20-30% premium over comparable Chinese vehicles

- No clear differentiation beyond "made by Honda and Sony"

The presentation was honest about their constraints. They showed a good vehicle that will be competitive in 2027.

Problem: the market they're entering in 2027 already has five iterations of better technology from competitors.

Chinese EV Makers: What They're Actually Building

Let's get specific about the competition:

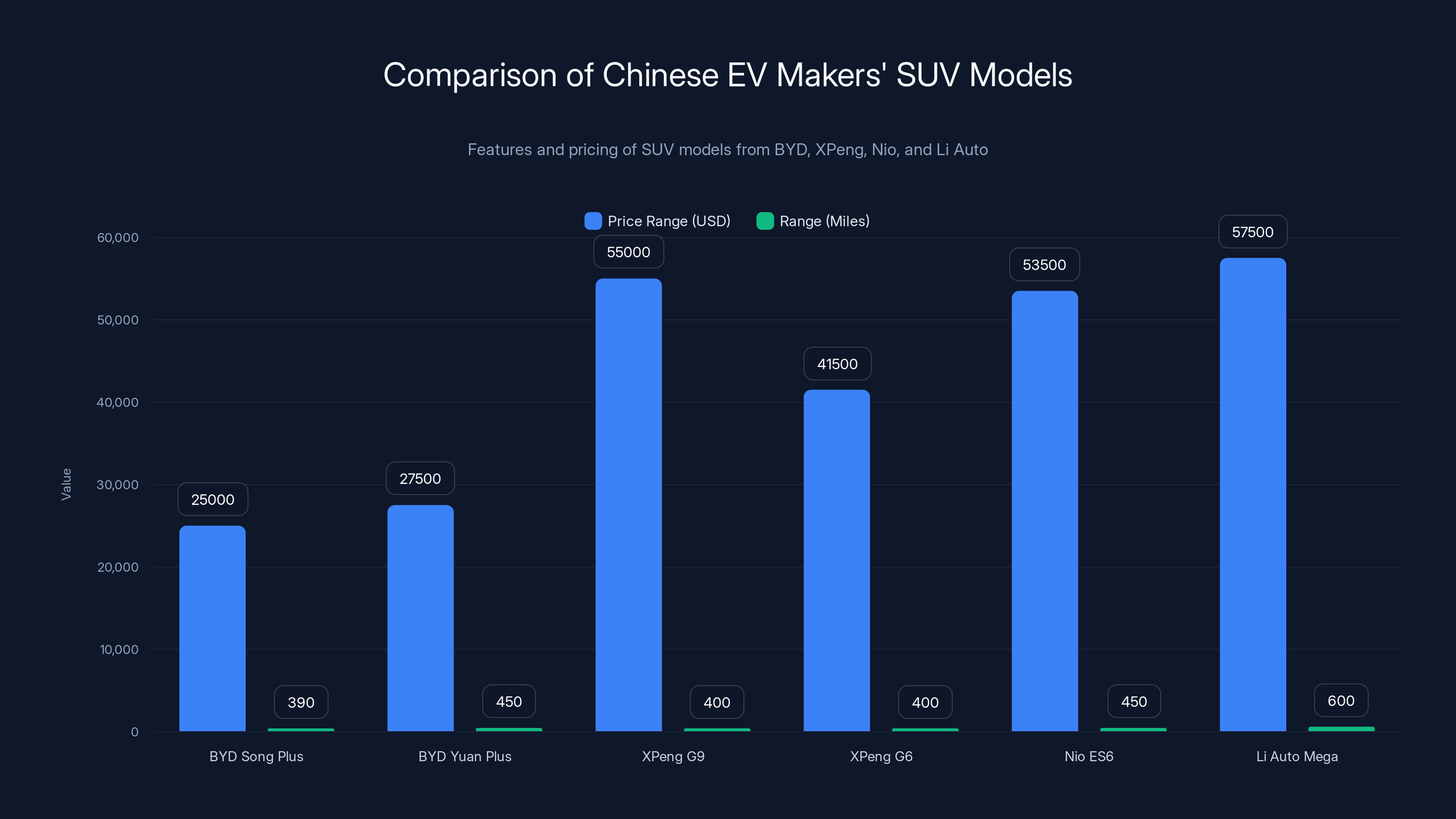

BYD

BYD shipped 1.83 million units in 2025 (plug-in hybrids and pure electric combined). Their pure EV division alone would rank as a top-5 global automaker by volume.

Their SUV lineup includes:

- Song Plus EV: 28,000 USD equivalent, 350-430 mile range, AI navigation, Level 2 autonomy

- Yuan Plus: 31,000 USD equivalent, 400-500 mile range, advanced climate control, over-the-air updates monthly

- Qin Plus DM-i: Hybrid option, 800+ mile total range combining electric and gas

Each model ships with hardware that will support Level 3 autonomy via software updates. That's engineering foresight that Honda-Sony didn't employ.

XPeng

XPeng positioned itself as the technology leader. Their vehicles ship with:

- Standard autonomous highway driving (Level 3 in specific conditions)

- Li DAR sensors (not just camera-based detection)

- Structural battery packs (more efficient energy usage)

- Fastest charging speeds in industry (adds 200 miles in 15 minutes)

Their G9 SUV (

Nio

Nio's battery-as-a-service model changes the entire EV economics.

Instead of buying a battery (half the vehicle cost), Nio customers lease it. That means:

- Lower purchase price (30% cheaper upfront)

- Free battery upgrades (your 2025 battery becomes a 2026 model via swap)

- No battery degradation anxiety (Nio manages it)

Their ES6 SUV costs

Li Auto

Li Auto bet on extended-range electric vehicles (gas generator + batteries). Their vehicles deliver 600+ mile range using a combination of electric drive and gas-powered charging.

Their SUV lineup occupies the sweet spot between pure EV range anxiety and hybrid complexity. A Li Auto Mega SUV costs

For families uncertain about EV infrastructure, this is compelling.

BYD and Li Auto offer the most affordable and longest-range SUVs respectively, while XPeng's models are positioned as premium technology leaders.

The Price Competition

Here's where Honda-Sony faces its sharpest problem:

Honda-Sony first SUV:

- MSRP: $70,000 (starting)

- Monthly payment (60-month loan): 1,400

- Range: 310 miles

- Autonomous capability: Level 2

- Annual updates: Software patches

- Warranty: 5 years / 60,000 miles

Comparable Chinese alternatives (2026):

XPeng G9 (similar class):

- Starting price: $52,000 USD equivalent

- Monthly payment: 1,050

- Range: 430 miles

- Autonomous capability: Level 3 (in specific conditions)

- Monthly updates: New features added regularly

- Warranty: 6 years / 120,000 miles

BYD Yuan Plus (similar class):

- Starting price: $48,000 USD equivalent

- Monthly payment: 950

- Range: 450 miles

- Autonomous capability: Level 2+ (upgradeable to Level 3 with hardware additions)

- Monthly updates: New features in climate, navigation, driver assistance

- Warranty: 8 years / 100,000 miles on battery

The price difference is structural: Chinese makers have lower labor costs, better battery sourcing, and manufacturing experience in high-volume production. Honda-Sony can't compete on price without destroying their margin structure.

Their strategy has to be differentiation, not price competition.

What Honda-Sony Should Have Done Differently

I'm not going to critique strategy from the outside. That's easy and uninformed.

But looking at the actual timeline and market reality, some paths could have compressed the cycle:

Path 1: Partner With a Battery Innovator Earlier

If Honda-Sony had partnered with a battery maker (like CATL or BYD's battery division) in 2022 instead of developing battery architecture internally, they could have shipped in 2024.

That's 12-18 months of market learning they lost.

Path 2: Launch in China First

BYD and XPeng proved Chinese demand for premium EVs with cutting-edge tech. Honda-Sony's target market (Japanese consumers, then Western consumers) are more conservative.

If they'd launched in China first with limited production, they'd have:

- Faster feedback loops

- 5x the customer volume for learning

- Competitive pressure to iterate quickly

- Proof of technology before entering conservative markets

Path 3: Modular Architecture From Day One

Honda-Sony's first vehicle was designed around a specific battery pack and motor configuration. Their second vehicle required new architecture.

Chinese makers designed modular platforms that could accommodate multiple battery sizes, motor types, and price points from day one. That flexibility compressed their time-to-market for variants.

But you can't redo fundamental architecture decisions without starting over.

The Reality of Market Momentum

This is the part that matters most: momentum compounds.

Chinese EV makers have:

- Millions of customers providing feedback data

- Manufacturing processes optimized through massive volume

- Supply chain relationships that let them move faster

- Capital raised from investors who expect 30%+ annual growth

- Governmental support that accelerates their timeline

Honda-Sony has:

- A solid product

- A real production timeline

- Access to premium markets

- Brand heritage

- Manufacturing expertise

But momentum is with the Chinese makers. Every quarter that passes, the gap compounds.

Next year, Chinese makers will have Level 3 autonomy standard. Honda-Sony will still be promising it. They're not falling behind due to engineering incompetence. They're falling behind because they're competing on a timeline their organizational structure can't match.

Chinese automakers lead in market share across regions, with significant presence in China and Europe. Japanese automakers hold a smaller share, particularly in emerging markets.

What Happens Next: The 2027-2030 Window

If Honda-Sony executes perfectly and ships their second SUV on schedule in 2027, here's what the landscape will look like:

Chinese Makers (2027):

- Level 3-4 autonomous capability standard

- 500+ mile ranges normal

- Prices stabilized at 65,000 for premium segment

- 10+ models competing in various segments

- Three years of manufacturing learning in production vehicles

Honda-Sony (2027):

- Two models in production

- Level 2 autonomy on both

- 310-380 mile ranges

- Prices at 85,000

- Established distribution in select markets

Honda-Sony can absolutely succeed. They can capture loyalty customers and people who value Japanese manufacturing. But they won't lead. They'll be following the race that Chinese makers are already lapping.

The Bigger Picture: What This Means for Consumers

If you're buying an EV in 2026 or planning to buy in 2027, here's what to understand:

You have access to more choices and better technology than any generation of car buyers in history. That's genuinely good news.

The Chinese EV market created competitive pressure that forced everyone to innovate faster. Even if you never buy a Chinese vehicle, you're benefiting from the speed they introduced into the industry.

But it also means brand loyalty has less currency. Your grandfather bought a Honda because "Honda was reliable." That's still true. But the XPeng owner is getting more features, higher technology, more frequent updates, and comparable reliability at a lower price.

The questions you should be asking:

- What matters more to you: established brand or cutting-edge features?

- How important is autonomous capability evolution to your purchase decision?

- Are you comfortable buying from a Chinese manufacturer, or does that create friction?

- How frequently do you want new software capabilities via over-the-air updates?

- What's your actual driving range requirement versus your anxiety-based estimate?

Answer those honestly, and you'll make the right choice for your situation.

Honda-Sony's Path Forward: How They Recover

Here's what they could still do to shift the trajectory:

Aggressive Feature Expansion

Their second SUV doesn't have to match Chinese autonomy capability. But it could ship with autonomy hardware that future software updates could unlock. That shows customers they're thinking long-term.

Ship Level 2 today, but include the sensors, cameras, and processing power required for Level 3-4 tomorrow.

Subscription Value Beyond Connectivity

Instead of competing on price, create a subscription model that delivers ongoing value:

- Monthly autonomy capability updates

- Advanced diagnostic data (tire pressure, battery health, trip optimization)

- Predictive maintenance alerts

- Integration with smart home systems

This transforms a static product purchase into an evolving service.

Target Specific Market Segments

Don't compete with Chinese makers on mass-market appeal. Dominate specific niches:

- Autonomous taxis and fleet operations (corporate sales with long vehicle lifecycles)

- Premium luxury segment where Japanese manufacturing precision matters

- Markets where brand heritage and warranty carry extra weight (Europe, Japan)

Accelerate Development Cycles

Honda's engineering culture values perfection over speed. That's beautiful engineering but terrible business in EV markets. They need to adopt rapid iteration: ship features 80% complete and improve via software, not 100% complete at launch.

This requires organizational change that may be harder than any technical challenge.

The Uncomfortable Truth

Let me be direct: the Honda-Sony CES 2026 announcement was good news for them and bad news for the broader Japanese automotive industry.

Good news: they have a viable product with real engineering credibility.

Bad news: they're demonstrating that even the combination of two major Japanese tech and automotive companies can't compress timelines fast enough to match the current Chinese EV market velocity.

If Honda + Sony together can only deliver one vehicle per 2.5 years, what about companies without Sony's electronics expertise? What about smaller Japanese automakers?

The gap isn't going to close on Japanese EV companies' terms. It will only close if Chinese EV makers pause and consolidate, or if Western markets actively reject Chinese vehicles through tariffs and regulatory barriers.

Neither seems likely.

Looking at 2030: What the Market Looks Like

If the current trajectory holds (and there's nothing suggesting it won't), by 2030 the global EV market will look radically different:

Market Share Projection (2030):

- Chinese makers: 55-60% of global EV market

- Tesla: 15-20% (defending premium position)

- Traditional Western automakers (VW, BMW, etc.): 15-20%

- Japanese makers: 5-8%

Technology Baseline (2030):

- Level 3 autonomy: Standard on all new EVs

- 500+ mile range: Entry-level specification

- Monthly feature updates: Expected

- Battery recycling: Integrated into purchase model

- Charging time: 10 minutes to 80% for premium vehicles

Honda-Sony's Position (2030):

- 4-5 vehicle models in production

- Profitable niche in premium markets

- Solid technology but not industry-leading

- Strong in Japan, competitive in Europe, niche in US, minimal in China

That's not failure. That's successful niche positioning. But it's not the leadership position they might have hoped for when they started this partnership.

FAQ

What is Honda-Sony's vehicle partnership and why does it matter?

Honda and Sony created Sony Honda Mobility to combine automotive manufacturing with consumer electronics expertise. Their first SUV launched in 2025, and their second model debuted at CES 2026. It matters because it represents a major traditional automaker-electronics company alliance, though the timeline and capabilities lag behind Chinese competitors who are shipping similar or superior vehicles years ahead of schedule.

How does the Honda-Sony SUV compare to Chinese electric vehicles?

The Honda-Sony vehicles offer solid engineering and design but cost 30-45% more than comparable Chinese EVs with superior autonomous capability, longer range, and more frequent software updates. Honda-Sony's first model features Level 2 autonomy while Chinese competitors ship Level 3 capability. Battery chemistry and efficiency also favor Chinese makers, which translates to better range per kilowatt-hour.

Why are Chinese EV makers developing vehicles faster than Honda-Sony?

Chinese manufacturers operate on agile 18-24 month development cycles compared to Honda-Sony's 36-48 month timelines. They lack legacy automotive constraints, have lower labor costs, better integrated battery supply chains, benefit from government incentives, and can iterate faster based on massive domestic demand. This structural advantage compounds over time.

What autonomous driving capabilities will the Honda-Sony second SUV have?

The vehicle is expected to feature improved Level 2 autonomous capability, which handles steering and acceleration but requires constant driver attention. Chinese competitors already offer Level 3 autonomy, which can handle most driving tasks independently (though requiring driver alert state). Honda-Sony's timeline suggests their vehicles won't reach Level 3 until 2028-2029.

How much will the Honda-Sony second SUV cost?

Based on their first vehicle pricing and market positioning, the second SUV will likely start at

Should I wait for Honda-Sony's second SUV or buy a Chinese EV now?

If you value cutting-edge autonomous capability, frequent software updates, and maximum range per dollar spent, a Chinese EV offers superior value in 2026. If you prioritize Japanese manufacturing reliability, warranty coverage, established dealer networks, and brand heritage over technological currency, Honda-Sony's premium is justified for your needs. Your actual priorities should drive the decision, not brand prestige alone.

What are the real risks of buying a Chinese EV in Western markets?

Potential risks include: limited established service networks, unfamiliar brand reputation, warranty coverage complexity, possible future tariffs affecting parts availability, software privacy concerns (though Western EVs collect similar data), and resale value uncertainty due to newness of these brands. However, major Chinese makers like BYD and XPeng are establishing western service centers and warranty partnerships to address these concerns.

How will this competition affect the broader EV market?

Chinese EV competition is driving faster innovation cycles, better feature sets, and downward pricing pressure across the entire industry. Traditional automakers are accelerating their timelines (though not fast enough to match Chinese velocity). Consumers benefit immediately through better technology and lower prices. The competitive landscape will likely consolidate around 5-7 major players by 2030, with Chinese makers controlling the largest share.

The Bottom Line

Honda and Sony showed confidence at CES 2026. Their second SUV represents genuine engineering competence and a clear product vision.

But confidence doesn't change market dynamics. The race for EV dominance isn't being decided in Las Vegas at tech conferences. It's being decided in Shenzhen and Shanghai, where millions of vehicles are shipping and iterating and learning and improving every single month.

Honda-Sony will succeed. They'll make a profitable, reliable, well-designed vehicle that premium customers will enjoy owning. They'll establish themselves in the EV market.

But they won't lead it. And understanding that gap is crucial for anyone trying to understand where automotive technology is actually headed.

The future of electric vehicles isn't being written by legacy automakers cautiously entering the market. It's being written by manufacturers who never knew how to build gas cars in the first place.

The Honda-Sony second SUV at CES 2026 was impressive. Just impressive enough to remind us how far ahead everyone else is already driving.

Key Takeaways

- Honda-Sony's second SUV won't ship until 2027, while Chinese competitors already offer superior autonomous capability and longer range at lower prices

- Chinese EV makers operate on 18-24 month development cycles versus Honda-Sony's 36-48 month timelines due to structural differences in legacy constraints and organizational culture

- The timeline gap translates to technology gap: Level 2 autonomy (Honda-Sony) versus Level 3 (Chinese competitors) represents different driving experiences and competitive positioning

- Market reality shows Chinese manufacturers controlling 65%+ global EV market share in 2026, with Japanese automakers holding single-digit percentages despite superior brand heritage

- The competitive advantage compounds: Chinese makers' massive volume, government support, and agile iteration create structural advantages that traditional automakers cannot quickly overcome

Related Articles

- Volvo EX60: 400-Mile Range and 10-Minute Fast Charging [2025]

- Ford's AI Assistant and BlueCruise 2.0: The Future of In-Car Intelligence [2025]

- Ford's AI Assistant Revolution: What's Coming to Your Car in 2027 [2025]

- Sony Honda's Afeela 1 EV: Why It Feels Outdated at CES 2026 [Review]

- CES 2026: Why EVs Lost to Robotaxis & AI – Industry Shift Explained

- Eric Migicovsky's Pebble Index 01: The AI Ring Done Right [2025]

![Honda Sony SUV CES 2026: Why Chinese EVs Are Winning [2025]](https://tryrunable.com/blog/honda-sony-suv-ces-2026-why-chinese-evs-are-winning-2025/image-1-1767895859825.jpg)