The End of Amazon's Grocery Store Experiment

Amazon just pulled the plug on one of its boldest retail experiments. The company announced it's shutting down every single Amazon Go and Amazon Fresh physical store location. This isn't a gradual phase-out or market consolidation. It's a complete strategic reversal on a grocery retail vision that Amazon spent years and billions building. According to Amazon's official announcement, the decision reflects a shift in focus towards expanding Whole Foods Market.

When Andy Jassy took over as CEO in 2021, Amazon had already launched hundreds of Go locations and was aggressively expanding Fresh. The strategy seemed straightforward: use proprietary technology to eliminate friction from grocery shopping, bypass traditional checkout processes, and capture an entirely new market segment. Fresh stores were supposed to compete directly with Whole Foods (which Amazon already owned) and challenge the entire grocery industry's economics. However, as reported by Investors.com, the stores didn't scale the way Amazon expected.

But something happened between that vision and 2025. The technology was impressive but not profitable. Customer acquisition costs exceeded lifetime value. Amazon's own Whole Foods brand was already capturing grocery shoppers more efficiently. So instead of doubling down, Amazon's leadership decided the better play was to double down on what was actually working: Whole Foods Market itself. This pivot reveals something important about Amazon's retail strategy. It's not afraid to kill promising-looking businesses when data shows they're not the right path forward. But it also shows that even Amazon's technology advantage doesn't guarantee success in every market it enters.

TL; DR

- Nationwide Shutdown: Amazon is closing every Amazon Go and Fresh store location, ending a multi-year brick-and-mortar experiment as detailed in Amazon's company news.

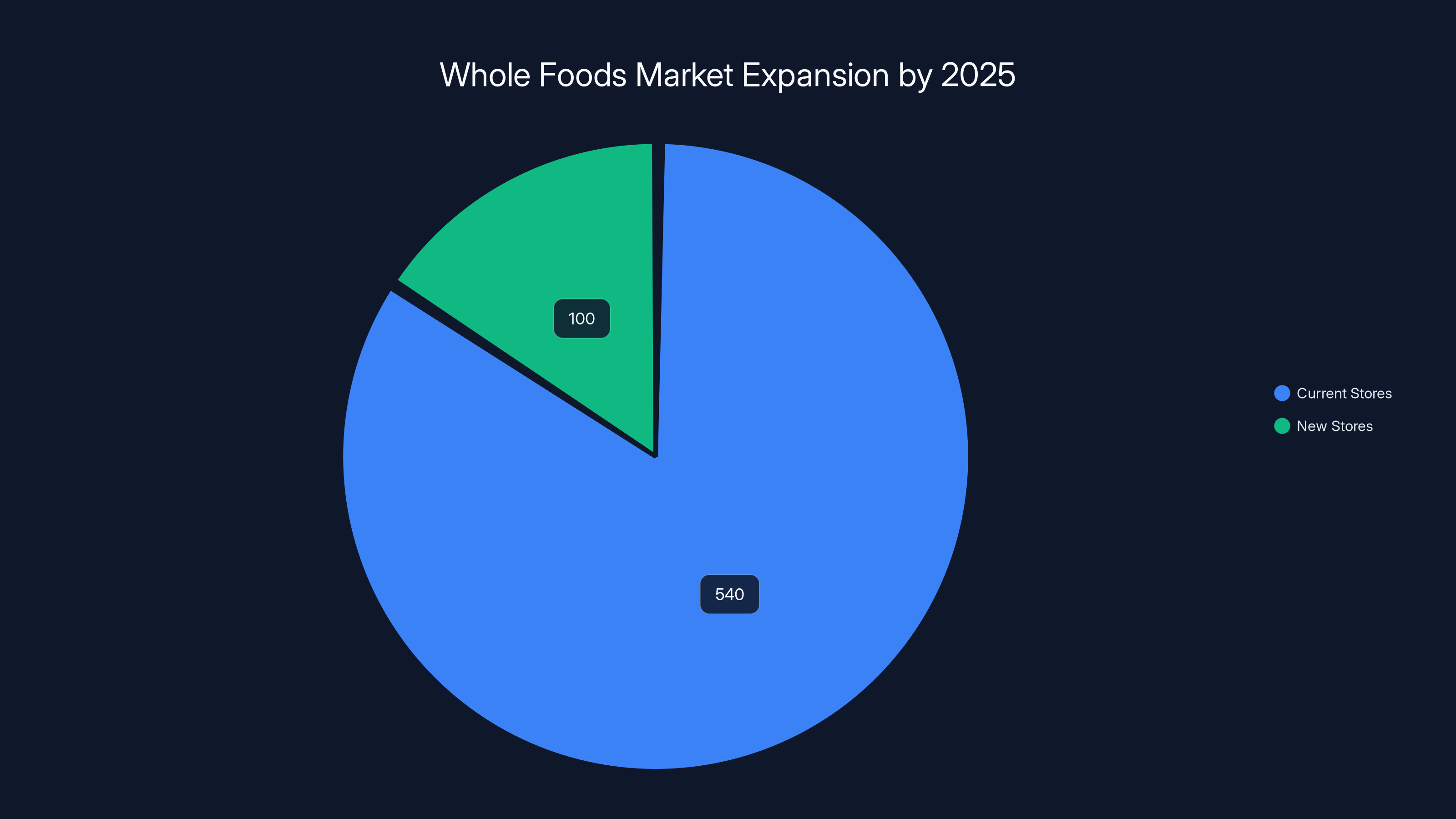

- Whole Foods Focus: The company is redirecting investment to expand Whole Foods Market with 100+ new locations planned, according to Grocery Dive.

- Online Delivery Continues: Amazon Fresh grocery delivery service remains available online, just not in physical stores.

- Technology Remains: Amazon continues testing new store concepts like Amazon Grocery in Chicago and specialty Whole Foods locations.

- Strategic Lesson: Even with advanced technology, profitability matters more than innovation in retail.

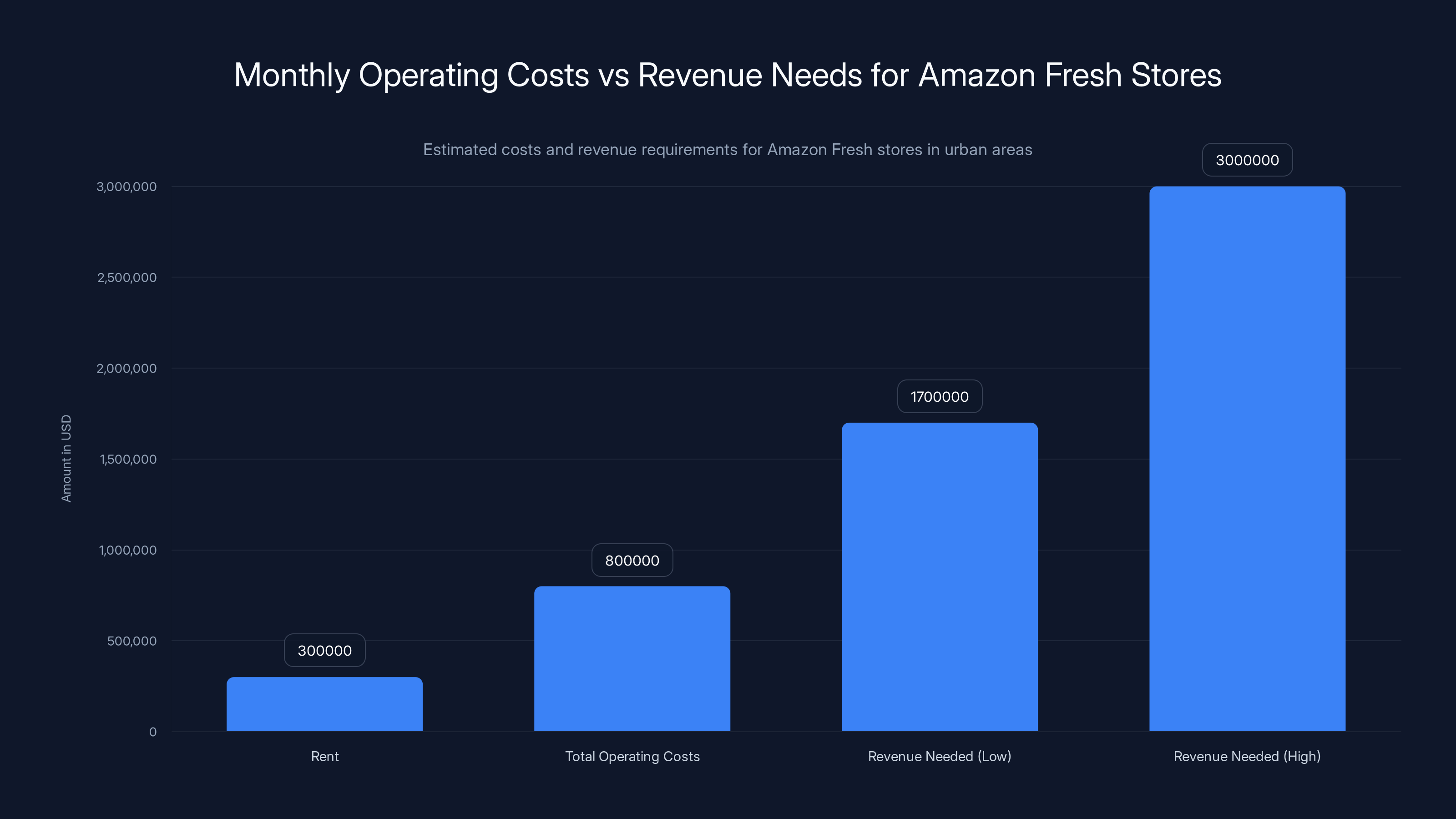

Amazon Fresh stores face high monthly operating costs, with rent alone ranging from

The Rise of Amazon Go: When Checkout-Free Seemed Revolutionary

Amazon Go launched in Seattle in 2018, and the tech world absolutely lost its mind. Here was a store with no checkout lines, no cashiers, no traditional point-of-sale systems. You walked in with your phone, grabbed items, and walked out. Computer vision, weight sensors, and machine learning tracked what you took. The bill appeared on your Amazon account later.

It was genuinely innovative. The experience was frictionless in a way that no physical grocery store had ever achieved. Walk in, take what you need, leave. No waiting. No scanning items. No fumbling with payment. For busy urban professionals, it felt like the future. Amazon expanded aggressively. By 2024, the company operated around 600 Go locations across major US cities. They were in New York, Los Angeles, San Francisco, Seattle, Chicago, Boston. The stores were small, convenience-focused, priced premium compared to traditional grocery. You could grab a sandwich, coffee, snacks, prepared items. Not a full grocery experience, but targeted at the on-the-go urban customer.

The company filed patents for the technology, published research papers about it, and positioned Go as proof that Amazon could innovate in physical retail. Wall Street analysts speculated about massive expansion potential. Tech journalists called it a game-changer. Amazon seemed to be proving that physical stores weren't dead—they just needed Amazon's technology to survive in the age of e-commerce.

But there was a catch that became more obvious over time. The small footprint meant low transaction volume. The premium pricing meant lower frequency of repeat visits from price-sensitive customers. The technology, while impressive, required constant maintenance, updates, and error correction. And most importantly, the unit economics never quite worked at scale.

Amazon Fresh: The Whole Foods Competitor That Backfired

Amazon Fresh was supposed to be different from Go. While Go was convenience-focused, Fresh was designed as a full-service grocery store that could compete with Walmart, Kroger, and regional grocery chains. The stores were bigger, carried more inventory, offered the complete grocery experience with one critical addition: Amazon's technology and efficiency.

Amazon Fresh launched in 2017 in Los Angeles and quickly expanded to dozens of cities. The company promised competitive pricing, quality selection, and the efficiency gains from Amazon's supply chain and technology. Fresh stores ranged from 30,000 to 40,000 square feet, positioning them somewhere between traditional supermarkets and the convenience model of Go.

The stores looked modern and well-designed. They featured Amazon technology like just-walk-out shopping, though customers could also use traditional checkout. Amazon integrated its own services at the physical location, offering Prime Now delivery, advertising space for brands, and various Amazon services. But here's where the strategy started showing cracks. Fresh stores were expensive to operate. Grocery retail operates on razor-thin margins, typically 2-4% net profit. Fresh couldn't sustain those margins while offering competitive pricing and absorbing the cost of premium technology. The locations that Amazon chose turned out to be expensive real estate in dense urban areas, which made rent a massive burden.

Customer adoption was slower than Amazon anticipated. Fresh stores required education—people needed to understand the checkout-free technology, figure out the app, trust the accuracy of computer vision systems. In grocery shopping, people want to inspect produce, feel meat quality, read labels carefully. The friction-free checkout model, which worked great for grabbing a coffee at Go, felt less valuable when buying a week's worth of groceries.

Amazon was also competing against itself. The company already owned Whole Foods Market, which had a loyal customer base, established brand equity, and real profit margins. Why invest billions in Fresh when Whole Foods was already capturing high-income grocery shoppers that Amazon wanted to reach? The brand confusion and cannibalization became obvious internally.

By 2023 and 2024, Amazon started closing Fresh locations. The company wasn't explicitly calling them failures, but the numbers spoke clearly. Unprofitable stores in expensive markets were getting shuttered. The company had learned what happens when you prioritize innovation over profitability in a business where margins don't support experimentation.

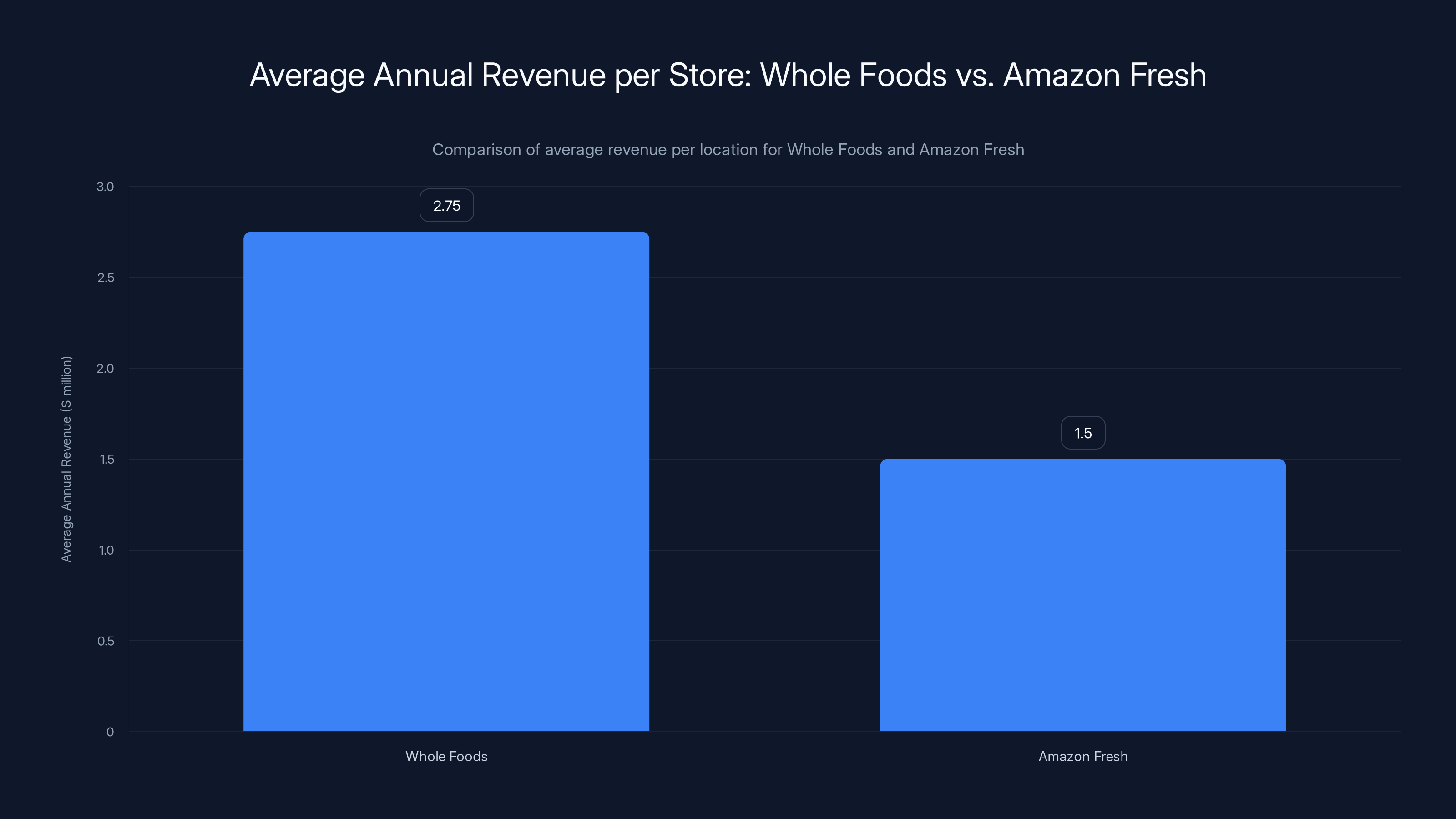

Whole Foods stores average

The Economics That Killed Amazon's Grocery Dreams

Underlying the failure of Go and Fresh was brutal math. Let's break down why even Amazon's advantages couldn't make these models work.

First, the real estate problem. Amazon built these stores in dense urban locations where commercial rent is extremely expensive. A 40,000 square-foot Fresh store in a major metro area costs

Grocery stores operate on 30-35% gross margins. So to break even on that rent, you need

Second, the labor problem. While Amazon's checkout-free technology reduces some labor at the registers, you still need store associates to stock shelves, manage inventory, handle customer service, and maintain the technology systems. Grocery stores are labor-intensive businesses. The technology Amazon invested in didn't fundamentally reduce labor costs, it just redistributed them. You're paying engineers to maintain computer vision systems instead of cashiers, but the total headcount doesn't decrease proportionally.

Third, the inventory problem. Grocery retail requires sophisticated supply chain management. Produce needs freshness rotation. Meat and dairy have short shelf lives. Pricing must be competitive across thousands of SKUs. Amazon's supply chain strengths in hard goods don't translate directly to perishable items. The company had to build new distribution networks, new vendor relationships, new quality control processes. This was expensive and slow to optimize.

Fourth, the customer acquisition problem. Launching a new grocery brand in a market where Whole Foods, Trader Joe's, Kroger, and Costco already have established loyalty is expensive. You need to advertise heavily, offer introductory discounts, build trust in produce and meat quality. Amazon couldn't leverage its Prime membership as effectively as you'd think—Prime members didn't automatically want to switch their grocery shopping just because Amazon had a fresh store. They had established routines, preferred stores, and trusted brands.

Fifth, the technology maintenance problem. Computer vision systems need constant updates. New products require training the AI models. Error rates need to stay below certain thresholds or customers stop trusting the technology. This ongoing investment in technology is perpetual. You can't build it once and let it run. Amazon had to continually invest in R&D teams, data labeling, model training, and infrastructure just to maintain current functionality.

The math was simple: Amazon's costs were too high, gross margins were too low, and customer adoption was too slow to ever reach profitability at scale.

Why Whole Foods Was the Better Play All Along

Amazon acquired Whole Foods in 2017 for $13.7 billion. At the time, people questioned the move. Whole Foods had been independent, had strong brand equity, but also carried the reputation of being expensive. The acquisition seemed expensive.

But here's what Amazon realized over the subsequent years: Whole Foods didn't need to be transformed. It needed to be integrated and optimized. Whole Foods already had loyal customers, established store locations, real profitability, and brand recognition. All Amazon needed to do was apply operational efficiency and pricing advantages.

Whole Foods customers were already the exact demographic that Go and Fresh were trying to attract: affluent, urban, health-conscious, willing to pay premium prices for quality. These people didn't need "checkout-free" to justify their grocery spending—they cared about product quality and selection. Whole Foods offered both.

Amazon started integrating Prime benefits into Whole Foods. Prime members got discounts on sale items. Amazon started optimizing supply chains and reducing costs, allowing Whole Foods to lower prices slightly without reducing margins. The company maintained Whole Foods' brand integrity while improving the economics underneath.

The results were clear: Whole Foods is profitable. Whole Foods customers are loyal. Whole Foods stores in major markets have real transaction volume. You don't need revolutionary technology when you have customer loyalty and a strong brand.

Amazon's announcement that it would open 100+ new Whole Foods locations over the coming years makes perfect sense now. Instead of building Go and Fresh from scratch, Amazon is deploying capital to expand a brand that's already proven successful. It's more efficient, lower risk, and better returns than continuing to pour billions into experimental concepts.

This is the key insight: sometimes the most profitable strategy isn't the most innovative one. The Go and Fresh stores were impressive technologically, but Whole Foods is impressive commercially. Amazon chose profits over patents.

The Technology Wasn't the Problem—The Business Model Was

It's important to note that Amazon isn't abandoning the technology behind Go. The company will continue testing it in new contexts. Amazon Grocery, a small specialty store in Chicago, is testing various convenience formats. Whole Foods concept stores in Pennsylvania are experimenting with integrated Amazon product offerings.

So why shut down Go and Fresh if the technology works?

Because the technology was never the bottleneck. The bottleneck was the business model. Computer vision at checkout is genuinely useful. The problem is that useful technology doesn't automatically create a profitable business when you're competing in a market with 2% margins, expensive real estate, and entrenched competitors.

Amazon's strategy shift reflects a mature understanding of retail economics. The company has learned that in grocery, you need one of three things:

-

Extreme cost leadership (Walmart, Costco model) - You build scale by competing on price, which requires efficient operations and high volume. Amazon couldn't achieve this because it was using premium real estate and premium pricing.

-

Strong brand equity and customer loyalty (Whole Foods, Trader Joe's model) - You build premium pricing and margins through brand strength. Whole Foods already had this; Go and Fresh were trying to build it.

-

Extreme convenience and accessibility (convenience store model) - You charge premium prices because people value convenience. Go attempted this but couldn't scale to profitability.

Amazon was trying to create a fourth category: technology-driven grocery that was profitable despite not winning on any of these three dimensions. It turns out that category doesn't exist at scale.

Whole Foods is set to expand by approximately 18% with the addition of 100 new stores, increasing its global presence significantly. Estimated data based on current and projected store counts.

What This Means for Retail Technology Innovation

The Amazon Go and Fresh shutdowns might look like a failure, but they're actually valuable lessons in how innovation and profitability have to align.

Amazon spent years and billions developing checkout-free grocery technology. The technology genuinely works. Computer vision systems accurately track inventory. The customer experience is smooth. The infrastructure is impressive. But none of that mattered when the business model didn't work.

This has implications for other tech companies trying to disrupt retail. Instacart, for instance, focused on delivery rather than trying to build its own stores. Ironically, this might have been the smarter play from the start. Instacart doesn't have to own real estate or operate stores. It just needs the logistics layer on top of existing retailers.

Other startups that tried to build technology-driven grocery experiences (like Bodega, the robot convenience store concept, or various other ventures) have similarly struggled. The problem isn't the technology. It's that grocery retail has structural constraints that technology alone can't overcome.

What works in tech-driven retail are categories with higher margins, faster inventory turns, or lower real estate costs. Hardware retail (Best Buy still survives), specialty retail (Nordstrom, Sephora), and convenience formats without complex inventory (coffee shops) can sustain technology investments. Grocery, with its thin margins and complex supply chain, is actually one of the hardest retail categories to disrupt technologically.

Amazon's pivot to expanding Whole Foods rather than continuing with Go and Fresh suggests the company understands this constraint. It's choosing to work within grocery's structural realities rather than trying to fundamentally change them with technology.

The Whole Foods Expansion Strategy

Amazon's announcement of 100+ new Whole Foods locations represents a clear strategic direction. This isn't speculation about the future—it's where Amazon is actually deploying capital right now.

Whole Foods Market operates approximately 540 stores globally as of 2025. Adding 100+ stores would represent about an 18% expansion of the chain. That's significant growth, but achievable for a company with Amazon's resources and supply chain capabilities.

The locations Amazon chooses will be critical. Whole Foods has traditionally focused on affluent urban neighborhoods and wealthy suburbs. These areas support premium pricing and have the demographic that values the brand. Amazon will likely continue this strategy while perhaps expanding into some secondary markets where Whole Foods has less saturation.

The integration strategy is also key. Amazon has already begun integrating Prime benefits into Whole Foods, offering exclusive discounts and deals to Prime members. The company has also started offering Amazon credit card benefits in stores. This integration deepens the ecosystem and creates switching costs. If you're a Prime member who shops at Whole Foods, you get used to the benefits. You're less likely to switch to competing grocery stores.

Amazon is also testing smaller formats. Whole Foods Market Daily Shop locations are convenience-focused versions of the full-size stores. These are cheaper to open and operate than full Whole Foods Market locations, allowing Amazon to reach more neighborhoods and customer segments. Think of it as filling the gap that Amazon Go was supposed to occupy, but with an already-established brand.

The economics of expanding Whole Foods are dramatically better than building Go or Fresh from scratch. Whole Foods has supplier relationships, brand equity, operational procedures, and loyal customers. Amazon can leverage all of these assets. The company is essentially applying its operational expertise to an existing successful business rather than trying to invent a new business category.

The Broader Retail Strategy Shift

The Go and Fresh shutdowns fit into a larger Amazon retail evolution. The company has already shut down other experimental retail concepts: Amazon Books (the bookstore concept), Amazon 4-Star (curated product store), Amazon Style (try-before-you-buy fashion), Amazon Pop Up Shops, and various other location experiments.

What's interesting is that Amazon isn't abandoning physical retail entirely. The company is being very selective about which physical store concepts work. Whole Foods works. Amazon is testing specialized formats like Amazon Grocery in Chicago. The company is also exploring integrated concept stores that blend Whole Foods with Amazon services.

This suggests that Amazon's retail strategy is maturing. The company is moving away from "what if we applied our technology to retail?" thinking and toward "where does our brand and capability genuinely create value in physical retail?" thinking.

For Amazon, the answer appears to be: we're very good at operating Whole Foods profitably, and we should expand that. We're not particularly good at building new grocery brands from scratch that compete on technology alone.

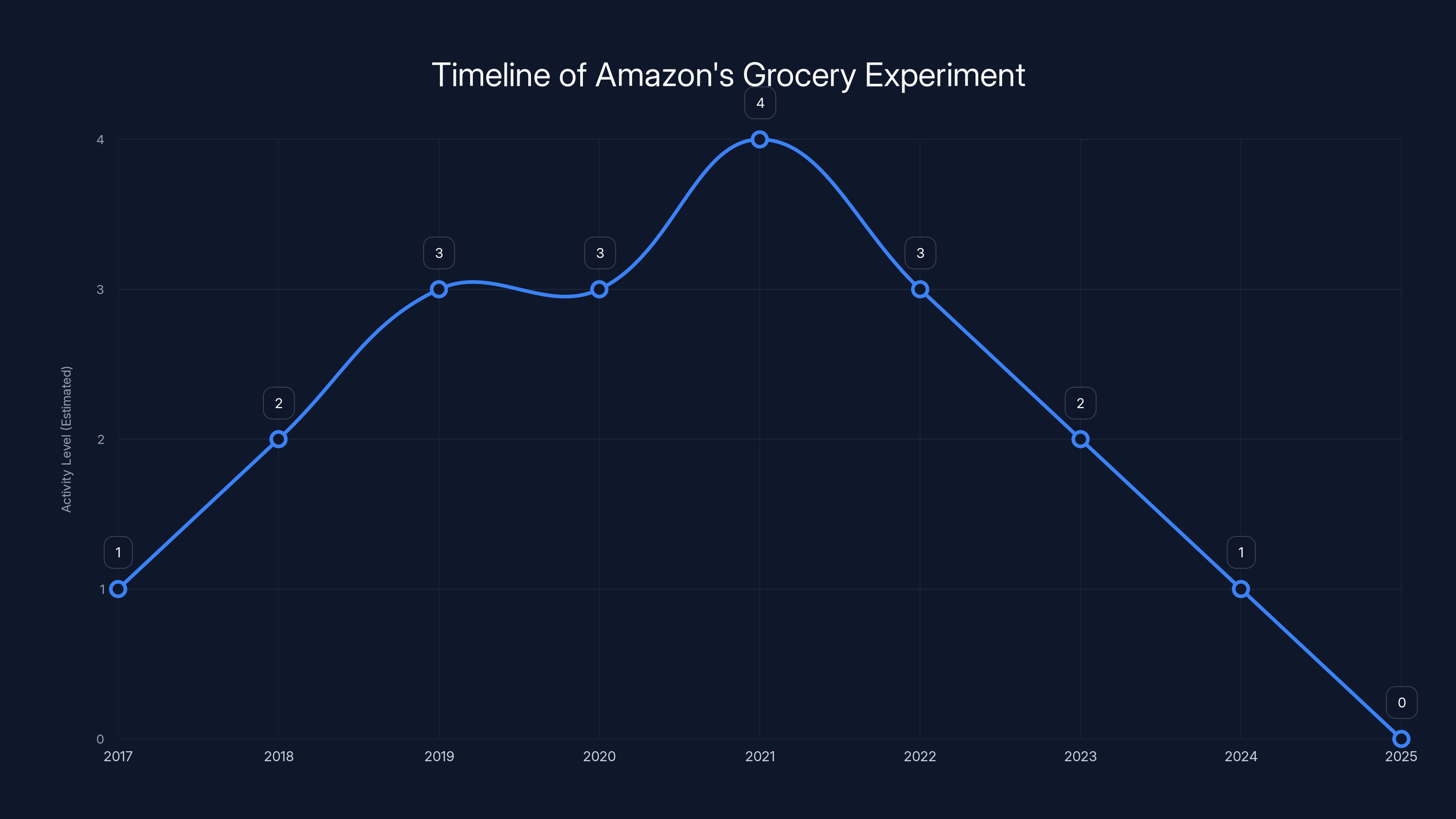

The timeline illustrates Amazon's strategic shifts in its grocery experiment, peaking in 2020 and gradually declining as the company refocuses on Whole Foods by 2025. Estimated data based on narrative.

Amazon Fresh Online: Still Available, Still Relevant

One thing people miss in news coverage of the Go and Fresh shutdowns: Amazon Fresh as an online grocery delivery service isn't going away. The company will continue operating Amazon Fresh as a delivery-only service.

This makes sense. Amazon Fresh online eliminates the biggest problems with the physical stores: expensive real estate, labor-intensive operations, and customer acquisition friction. You don't need a building if customers order online. You don't need checkout-free technology if customers never visit a physical location. You just need efficient fulfillment and delivery.

Amazon Fresh online operates differently from Whole Foods delivery. It's faster and more price-competitive, positioning it as Amazon's answer to traditional grocery delivery competitors like Instacart. The service integrates with Prime membership, offering free delivery to Prime members who meet minimum order amounts.

The online-only model for Amazon Fresh sidesteps all the economics that killed the physical stores. No expensive retail real estate. No complex store operations. No checkout technology needed. Just logistics and fulfillment.

For Amazon, this strategy allows the company to maintain a grocery delivery presence without the capital and operational burden of physical stores. It's a smarter move than keeping the physical Fresh locations open.

The Role of Amazon's Supercenter Plans

An often-overlooked detail in Amazon's retail strategy is the approval for an Amazon supercenter in Orland Park, Illinois. This isn't a Whole Foods location. It's something new.

The approval suggests Amazon hasn't given up on the idea of operating its own large-footprint retail locations that combine general merchandise with grocery. A supercenter would be Amazon's attempt to build a Walmart-like store: large, comprehensive, combining grocery with other retail categories.

This is interesting because it suggests Amazon is still exploring diverse retail formats beyond just expanding Whole Foods. The supercenter could be a testing ground for integrated retail experiences that combine grocery with other product categories, leveraging Amazon's supply chain and selection advantages.

It's unclear whether supercenter experiments will succeed where Go and Fresh struggled. But the fact that Amazon is pursuing this alongside the Whole Foods expansion shows the company is taking a portfolio approach: expand proven concepts (Whole Foods), test new ones (supercenter), and maintain delivery-only services (Amazon Fresh online).

What Employees and Communities Face

Behind the strategic shift are real consequences for employees who worked at Go and Fresh locations. The closures represent job losses in multiple cities across the US.

Amazon announced severance packages and job placement assistance for affected employees, but losing a job is disruptive regardless of the support offered. Many employees will transition to other roles within Amazon or find positions at other retailers, but the transition is stressful and creates uncertainty.

For communities, the closures mean losing local retail options. Go locations were particularly convenient for downtown workers and urban residents. Fresh stores provided a grocery option in neighborhoods that might have limited choices. While Whole Foods can fill some of this gap, it doesn't serve all the same customers. Whole Foods skews toward affluent shoppers; Amazon Go and Fresh had broader appeal.

Communities that lose these stores have to rely more heavily on delivery services or travel further to find grocery options. This affects food access, which is a real equity issue in many neighborhoods.

Amazon's focus on Whole Foods expansion does mean new stores in some markets, but not necessarily in the same locations as shuttered Go and Fresh stores. The company is likely to put new Whole Foods in affluent areas where the brand can thrive, not in neighborhoods where Go was popular but Fresh didn't reach critical mass.

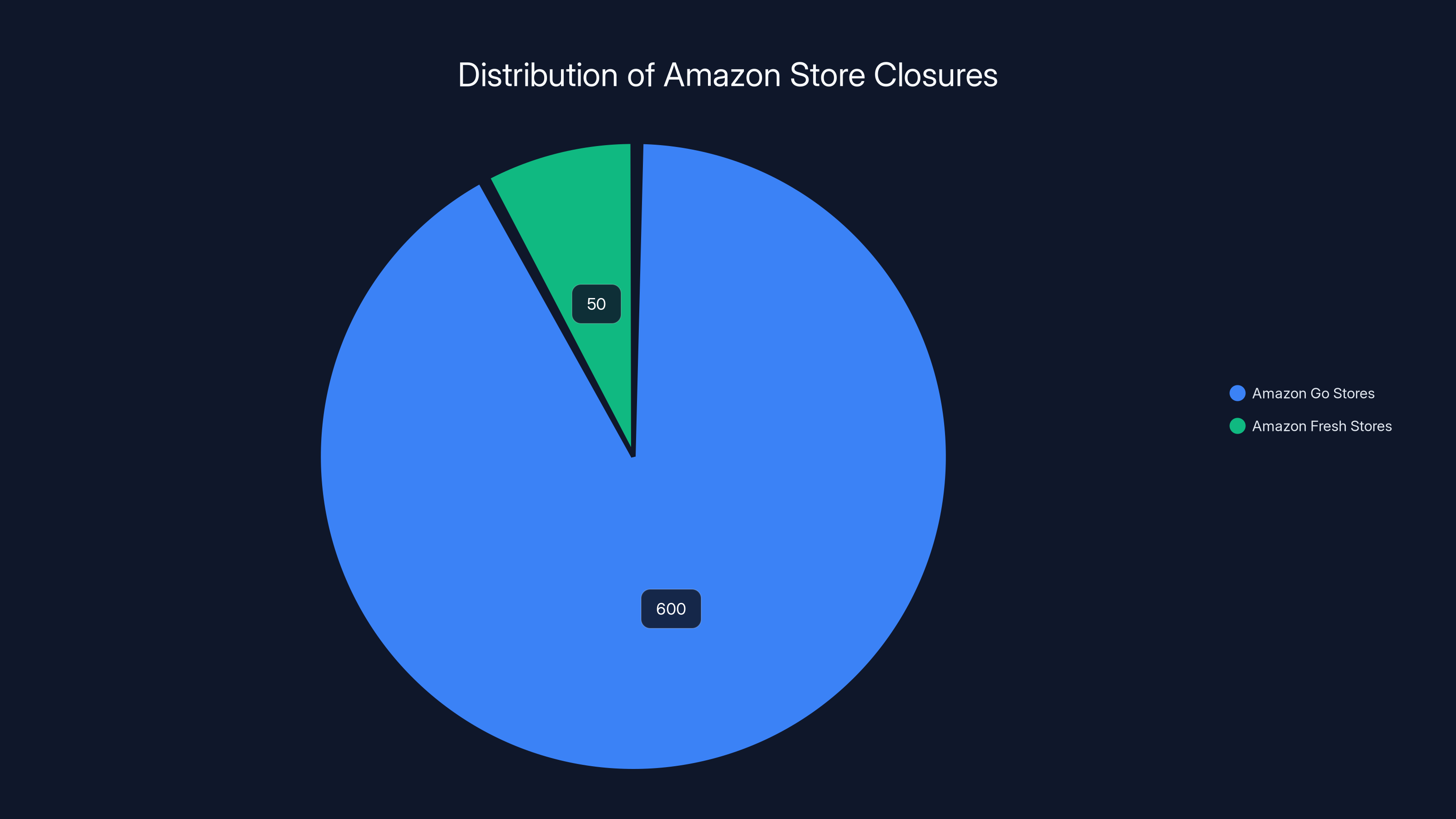

Amazon is closing approximately 600 Go stores and 50 Fresh stores, marking a significant shift in its physical retail strategy. Estimated data.

Learning from Failure: What Go and Fresh Teach Us

The Go and Fresh shutdowns offer valuable lessons for anyone thinking about disrupting established industries with technology.

First lesson: margins matter more than innovation. Go and Fresh had genuinely innovative technology, but grocery's margin structure couldn't support the cost of maintaining that innovation at scale. This is a hard truth that impacts many tech-forward business ideas. Impressive technology meeting low-margin business models creates losses, not profits.

Second lesson: existing brand loyalty is underrated. Whole Foods' success despite being "expensive" shows that brand loyalty and customer preferences are more durable than disruption theorists expect. People shop where their friends shop, where they've built relationships with staff, where they trust the quality. Building that trust from scratch is much harder than optimizing an existing trusted brand.

Third lesson: real estate costs are structural constraints. Go and Fresh tried to operate in expensive urban locations to reach customers. But expensive real estate forces high revenue targets. If you can't hit those targets, you lose money immediately. This is why Instacart focused on delivery instead of owning stores—it sidesteps the real estate problem entirely.

Fourth lesson: customer acquisition in established categories is expensive. In grocery, where most people have strong existing preferences, winning market share requires heavy advertising and discounts. Amazon underestimated how expensive it would be to convince people to switch their grocery shopping to a new brand and format.

Fifth lesson: sometimes the best return on investment is optimizing existing successes, not inventing new categories. Amazon bought Whole Foods for $13.7 billion. Instead of trying to create new grocery categories, Amazon is spending capital expanding Whole Foods. The return on investment from expanding a profitable, proven business is often better than the return from incubating new concepts.

The Future of Physical Retail in the Amazon Era

Amazon's retreat from Go and Fresh doesn't mean physical retail is dead. It means that not every retail category works the same way, and physical retail requires different strategies in different sectors.

Amazon dominates in categories where delivery and convenience are paramount. Fashion, electronics, books, general merchandise—Amazon's ability to deliver to your door, combined with price and selection, is compelling. Physical retail in these categories has struggled.

But grocery is different. Grocery benefits from immediacy (people want food today, not in three days), from inspection (produce, meat, dairy quality matters and people want to see it), and from habit (people build routines around their grocery stores). Physical grocery stores will exist as long as people need food, which is basically forever.

Amazon's evolution reflects this reality. The company is expanding its strongest grocery asset (Whole Foods) rather than trying to fundamentally transform grocery through technology. This is a more mature strategy than the "disrupt everything with our innovation" mindset that launched Go and Fresh.

For other retailers watching this play out, the lesson is clear: if Amazon isn't winning through pure innovation in your category, there's probably a reason. Defend your category through brand, customer loyalty, operational excellence, and understanding your customers' actual needs. Technology is useful as a supporting tool, not as the primary competitive advantage.

Timeline: The Rise and Fall of Amazon's Grocery Experiment

Understanding the timeline helps contextualize this strategic shift:

2017: Amazon acquires Whole Foods for $13.7 billion. Same year, Amazon Fresh pilot begins in Los Angeles. Amazon Go opens first convenience store in Seattle.

2018-2020: Rapid expansion of Go locations to multiple cities. Fresh stores begin rolling out beyond Los Angeles. Investors and analysts become optimistic about Amazon's retail future. Amazon dominates tech headlines for "disrupting" grocery.

2021: Andy Jassy becomes Amazon CEO, replacing founder Jeff Bezos. Focus shifts to profitability over growth. Amazon begins quietly auditing the economics of various retail experiments.

2022: Amazon begins closing underperforming Fresh locations. The company shuts down Amazon Books, Amazon 4-Star, and other experimental retail concepts. Fresh and Go continue operating but profitability questions mount.

2023: Amazon closes additional Fresh stores. The company seems to be in a quiet consolidation phase, managing down the experiments while figuring out next steps.

2024: Continued closures. Amazon announces it will invest heavily in expanding Whole Foods instead. The strategic direction becomes clearer.

2025: Amazon announces complete closure of all Go and Fresh physical locations. The experiment is officially over. The company announces 100+ new Whole Foods locations and continues testing specialty formats like supercenter concepts.

This timeline shows a company learning from experience and adjusting its strategy based on data. That's actually a sign of healthy organizational decision-making, even though it means admitting that the earlier strategy wasn't working.

Amazon Fresh faced significant challenges, with high operating costs and competitive pricing being the most impactful. Estimated data.

Implications for Tech Workers and Entrepreneurs

The Go and Fresh shutdowns have implications for how tech companies and entrepreneurs think about disruption.

For years, the prevailing narrative in Silicon Valley was that technology could disrupt any industry. Cloud computing, machine learning, automation—apply these to any existing category and you'll win. Go and Fresh embodied this thinking: apply computer vision and logistics to grocery, and you'll transform the industry.

But there's a difference between "possible" and "profitable." Amazon proved that checkout-free grocery is technically possible. It's genuinely impressive engineering. But it's not profitable at scale in the grocery context. That distinction matters.

For tech entrepreneurs, this should be a humbling lesson. The most impressive technology isn't always the path to business success. Sometimes the best business decision is to work within existing margins and leverage existing assets rather than trying to transform an entire industry.

For tech workers at companies considering retail technology investments, this shows the importance of understanding unit economics, not just technical possibilities. The best engineers at Go and Fresh did excellent work. But excellent engineering couldn't overcome the fact that the business model didn't work. When choosing which company to join or which product to build, understanding the business model matters as much as understanding the technology.

The Competitive Landscape After Go and Fresh

With Amazon exiting the proprietary grocery store business, the competitive landscape shifts.

Traditional grocers like Kroger, Albertsons, and regional chains don't have to worry about Amazon trying to compete on technology and price in physical locations. Amazon will be a competitor through Fresh (online delivery) and potentially through supercenters, but not through a massive network of Go-style convenience stores.

Whole Foods actually benefits from this shift. With Go and Fresh gone, Whole Foods will be Amazon's primary physical grocery brand. This gives Whole Foods more resources and attention from Amazon, which could strengthen the brand and improve locations and selection.

Delivery services like Instacart and traditional grocery e-commerce operations have less competition from Amazon Fresh physical stores (though Fresh online delivery remains competitive). These services might actually benefit slightly from Amazon's strategic shift.

Tech companies trying to disrupt grocery (like Instacart, Door Dash, or other emerging platforms) learned from Amazon's experience that the most viable disruption is in delivery and convenience, not in building new proprietary stores. This validates the business model approaches taken by these companies.

Broader Questions About Amazon's Future

The Go and Fresh shutdowns raise bigger questions about Amazon's role in brick-and-mortar retail going forward.

Will Amazon continue experimenting with new retail formats, or is the company focusing on specific proven models like Whole Foods? The supercenter approval suggests continued experimentation, but at a smaller scale than the Go/Fresh expansion.

Will Amazon's experience in grocery influence its approach to other retail categories? The company has tested and closed bookstores, fashion stores, and electronics stores. There's a pattern here of Amazon trying to apply its tech and logistics advantages to physical retail, finding that the advantages don't necessarily translate to profitability, and then shifting strategy.

Is Amazon fundamentally a technology and logistics company that happens to sell physical goods, or is it trying to become a physical retailer? The evolution suggests the former. Amazon is very good at e-commerce, delivery, and logistics. Physical retail is harder. The company is learning where to focus its unique strengths and where to accept that existing models (like Whole Foods) are actually better than trying to reinvent everything.

What Shoppers Should Expect

For consumers, the Go and Fresh shutdowns mean changes in how and where they can shop for groceries.

In cities that had Go or Fresh stores, shoppers lose convenient local options. They'll need to switch to other grocery stores, use delivery services, or travel further for groceries. For busy people who valued the convenience of Go's checkout-free format, this is a loss.

Whole Foods becomes Amazon's main in-store grocery play. Prime members will continue to get discounts and benefits there, which is an advantage if you have access to a Whole Foods location. But Whole Foods isn't present in every neighborhood, so this option isn't universally available.

Amazon Fresh online delivery continues, so online grocery ordering remains available in Amazon-served areas. This option is particularly useful if you want competitive pricing and Amazon's fast delivery, but don't want to visit a physical store.

For most shoppers, this probably means adjusting established routines. Which is annoying, but not catastrophic. Grocery shopping is one of those needs where multiple options exist, and people are generally willing to switch between them.

FAQ

Why did Amazon close all Go and Fresh stores?

Amazon closed all physical Go and Fresh locations because these stores weren't profitable at scale. The convenience store format generated insufficient revenue to justify expensive real estate costs, technology maintenance, and operations. The company found that expanding its already-profitable Whole Foods brand was a better use of capital than continuing to invest in unprofitable new grocery concepts. Even with advanced technology, unit economics matter more than innovation in retail.

Can I still order from Amazon Fresh online?

Yes, Amazon Fresh as an online grocery delivery service continues operating. Customers can still order groceries online from Amazon Fresh, which is distinct from the physical Fresh store locations that are closing. This delivery-only model is much more profitable than operating physical stores because it eliminates expensive retail real estate and labor-intensive store operations. Amazon Fresh online primarily competes with Instacart and traditional grocery delivery services.

How many Amazon Go and Fresh stores are closing?

Amazon is closing all of its Amazon Go and Amazon Fresh physical store locations nationwide. At the time of the announcement, there were approximately 600 Amazon Go locations and dozens of Amazon Fresh locations across the United States. Some of these locations are being converted to Whole Foods Market locations, while others are simply shutting down. The exact number of locations affected is significant, representing a substantial retreat from Amazon's physical grocery retail strategy.

Will Amazon continue testing new store concepts?

Yes, Amazon continues testing new store formats, though at a smaller scale than the Go and Fresh expansion. The company is exploring Amazon Grocery locations in Chicago and specialty Whole Foods concept stores in Pennsylvania that combine grocery with Amazon products. Amazon also received approval for a supercenter project in Illinois, suggesting the company will continue experimenting with new retail formats, but more selectively than before. However, all new major investment is focused on expanding existing Whole Foods locations rather than building new Amazon-branded grocery concepts from scratch.

What happens to employees from closed Go and Fresh stores?

Amazon provided severance packages and job placement assistance to employees affected by the Go and Fresh closures. Many employees are eligible to transition to roles at Whole Foods or other Amazon locations. However, job losses are inevitable, and not all employees will be able to find equivalent roles. Amazon's announcement included commitments to support affected workers, but the practical impact on individual employees varies depending on location and circumstances.

Is Whole Foods replacing Amazon Fresh and Go?

Whole Foods is expanding as Amazon's primary physical grocery presence, with 100+ new locations planned. However, Whole Foods doesn't operate the same way as Go or Fresh. Whole Foods focuses on premium organic products and upscale neighborhoods, while Go was designed as a convenience store and Fresh was a full-service grocery chain competing on price and selection. Whole Foods serves a different customer segment, so the expansion addresses Amazon's grocery strategy but doesn't fully replace the geographic reach or customer base that Go and Fresh served.

What was wrong with Amazon's checkout-free technology?

Amazon's checkout-free technology itself wasn't the problem—it genuinely worked and represented impressive engineering. The problem was that the technology couldn't overcome grocery's structural economics. Grocery operates on thin margins (2-4%), which don't support the cost of maintaining advanced computer vision systems, managing complex produce and perishable inventory, and operating expensive urban real estate. The technology was innovative but not profitable at the scale Amazon needed to achieve to justify the investment.

Why didn't Amazon compete on price if it wanted to win in grocery?

Amazon attempted to compete on price with Fresh by leveraging its supply chain and efficiency advantages, but even these weren't enough to overcome the margin constraints of grocery. Amazon's cost structure—which included premium real estate locations to reach customers, expensive technology to maintain, and the need to build a new brand from scratch—was too high. Whole Foods, despite being perceived as expensive, actually maintains healthier margins through customer loyalty and brand value. For Amazon, expanding a profitable brand was smarter than trying to out-price established competitors in a low-margin category.

What does this mean for grocery delivery services like Instacart?

Amazon's exit from physical grocery stores actually validates Instacart's business model. Instacart avoided the capital-intensive and unprofitable model of owning stores, instead creating a logistics platform on top of existing retailers. This approach sidesteps the margin problems and real estate costs that made Go and Fresh unprofitable. For Instacart and similar services, Amazon's shutdown of physical grocery stores removes a major competitive threat and confirms that delivery-focused models are more viable than trying to build proprietary grocery brands.

What This Really Reveals About Amazon and Retail

The Go and Fresh shutdowns might feel like Amazon "giving up" on grocery disruption. But that's not actually what's happening. Amazon is being pragmatic. The company is acknowledging that some industries resist disruption through technology alone, and that sometimes the better strategy is to optimize existing winning models rather than trying to reinvent entire categories.

This is actually more sophisticated than the original Go and Fresh strategy. A company that can admit when something isn't working and pivot to something that is working demonstrates genuine business discipline. It's harder than continuing to throw billions at a failing strategy hoping something clicks.

Whole Foods is thriving under Amazon ownership. The company has access to Amazon's supply chain, logistics, and capital while maintaining the brand identity and premium positioning that customers value. Expanding Whole Foods is a lower-risk, higher-return strategy than continuing to build Go and Fresh locations.

For consumers, employees, and competitors, this shift has real consequences. But it's also a reminder that in business, the trajectory that matters is profit, not innovation for innovation's sake. Amazon learned that lesson with Go and Fresh. The company is now allocating resources based on that learning.

The grocery market isn't disrupted by Amazon Go and Fresh. But it will continue to evolve through Whole Foods expansion, Amazon Fresh online delivery, and whatever the supercenter experiments reveal. Evolution, not disruption. That's actually how most industries change—not through revolutionary new models, but through continuous optimization of what works.

Key Takeaways

- Amazon closed all Go and Fresh physical stores to refocus on expanding profitable Whole Foods brand

- Even advanced technology like checkout-free systems cannot overcome grocery's thin 2-4% profit margins

- Unit economics matter more than innovation: high real estate costs and labor requirements made these stores unprofitable

- Whole Foods expansion is strategically smarter because it builds on existing customer loyalty and profitability

- Amazon Fresh online delivery continues despite store closures, proving the delivery model is more viable than physical retail

- The failure shows that disrupting some industries requires working within structural realities, not transforming them

Related Articles

- Amazon Go & Fresh Closures: Why Amazon is Ditching Cashierless Retail [2025]

- Amazon's Buy for Me AI: The Controversy Shaking Retail [2025]

- How Trump's Tariffs Are Creeping Into Amazon Prices [2025]

- Telly's Free TV Strategy: Why 35,000 Units Matter in 2025

- GameStop Outage January 2026: Everything You Need to Know [2026]

- How Donghai Became the Crystal Capital: China's $5.5B Livestream Empire [2025]

![Why Amazon Shut Down Go and Fresh Stores [2025]](https://platform.theverge.com/wp-content/uploads/sites/2/2026/01/gettyimages-2252647807.jpg?quality=90&strip=all&crop=0%2C15.232329842932%2C100%2C69.535340314136&w=1200)