How Chinese EV Batteries Conquered the World and What It Means for Your Next Car

There's a moment in geopolitical theater that tells you everything about how the world has shifted. In June 2023, Emmanuel Macron, the President of France, stood inside a battery factory in Douai, a former coal mining city in northern France. He held up a sleek lithium battery in one hand and a mining lamp in the other. The symbolism was unmissable: France was moving from fossil fuels to clean energy.

But here's the thing that matters more than the photo op. Standing beside Macron was Zhang Lei, founder of Envision, a Chinese company. Envision wasn't just investing money. They were bringing the actual expertise needed to manufacture batteries at scale. They signed the first battery together, markers in hand, like kids signing a yearbook. Macron said, "Thank you, Chairman, because you trusted us and because you did exactly what you said you would do."

This moment captures something most people in the West haven't fully grasped: the battery revolution isn't being led from Silicon Valley or Stuttgart. It's being led from Beijing, Shanghai, and Shenzhen.

Five years ago, you probably thought about batteries the way you thought about cheap phone chargers. They came from China, they were disposable, and you didn't lose sleep over them. But lithium batteries aren't $5 gadgets anymore. They're the foundation of the entire global energy transition. They power electric vehicles that are dismantling the automotive industry. They stabilize renewable energy grids. They just won a Nobel Prize in Chemistry. The US government now classifies lithium as a "critical mineral."

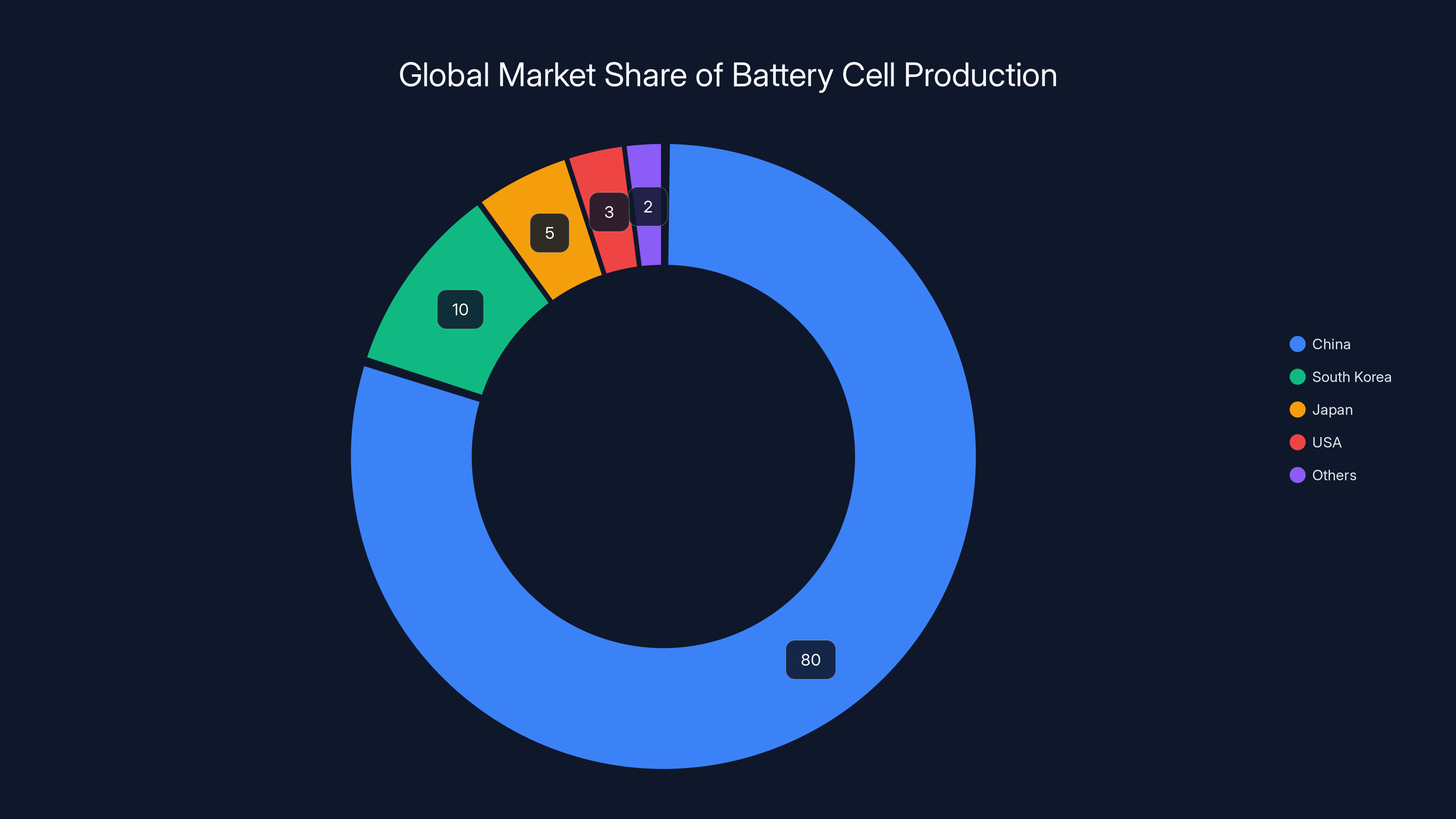

And Chinese companies control about 80% of global battery cell production right now, according to China Global South.

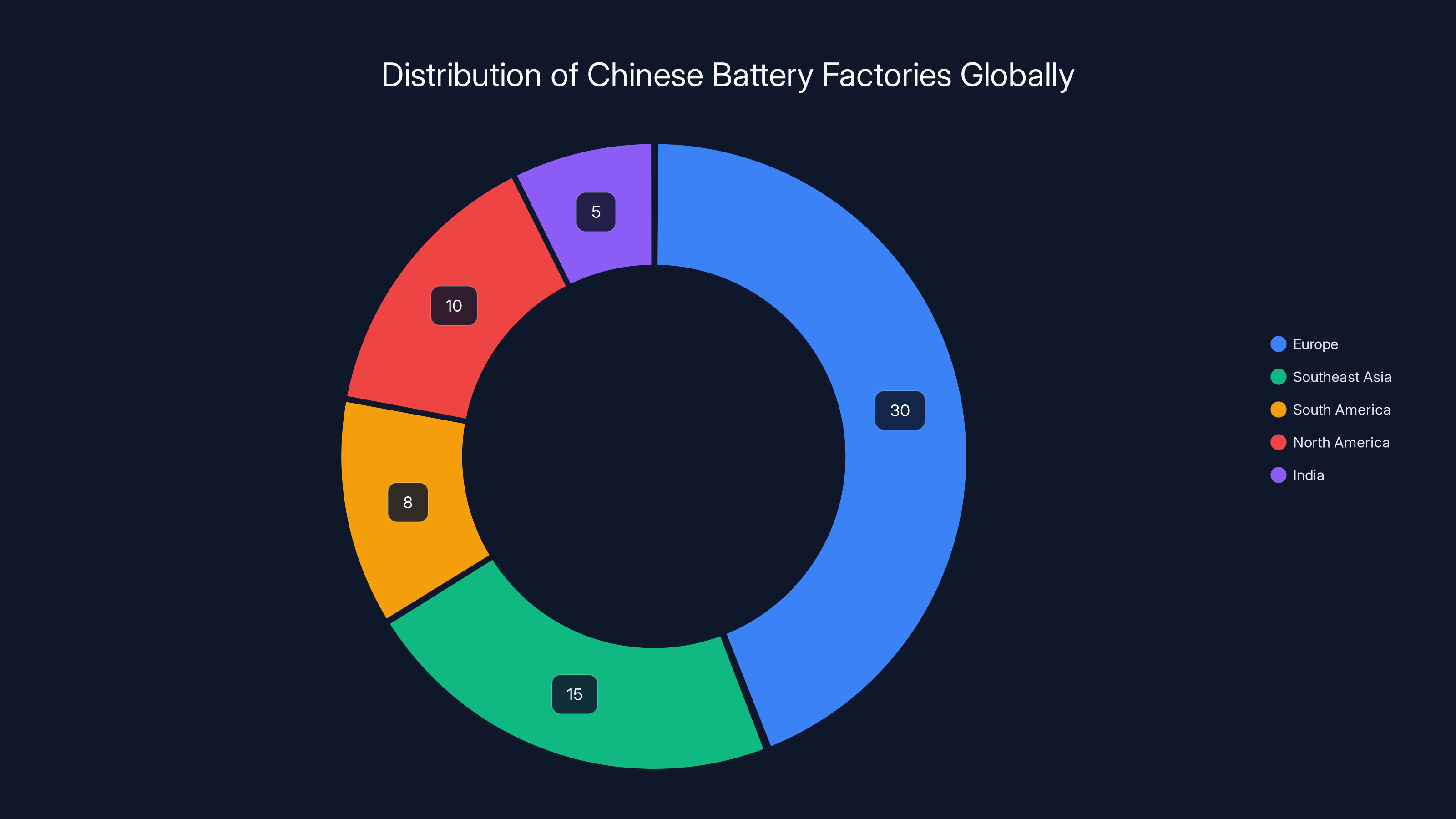

This isn't about cheap labor anymore. This is about technological dominance. Chinese battery makers have built factories on nearly every continent. In the past decade alone, they've announced or constructed at least 68 factories outside China, representing over $45 billion in investment. They're hiring local workers, training engineers, and moving technology that was developed in Chinese labs to Europe, North America, Southeast Asia, and beyond.

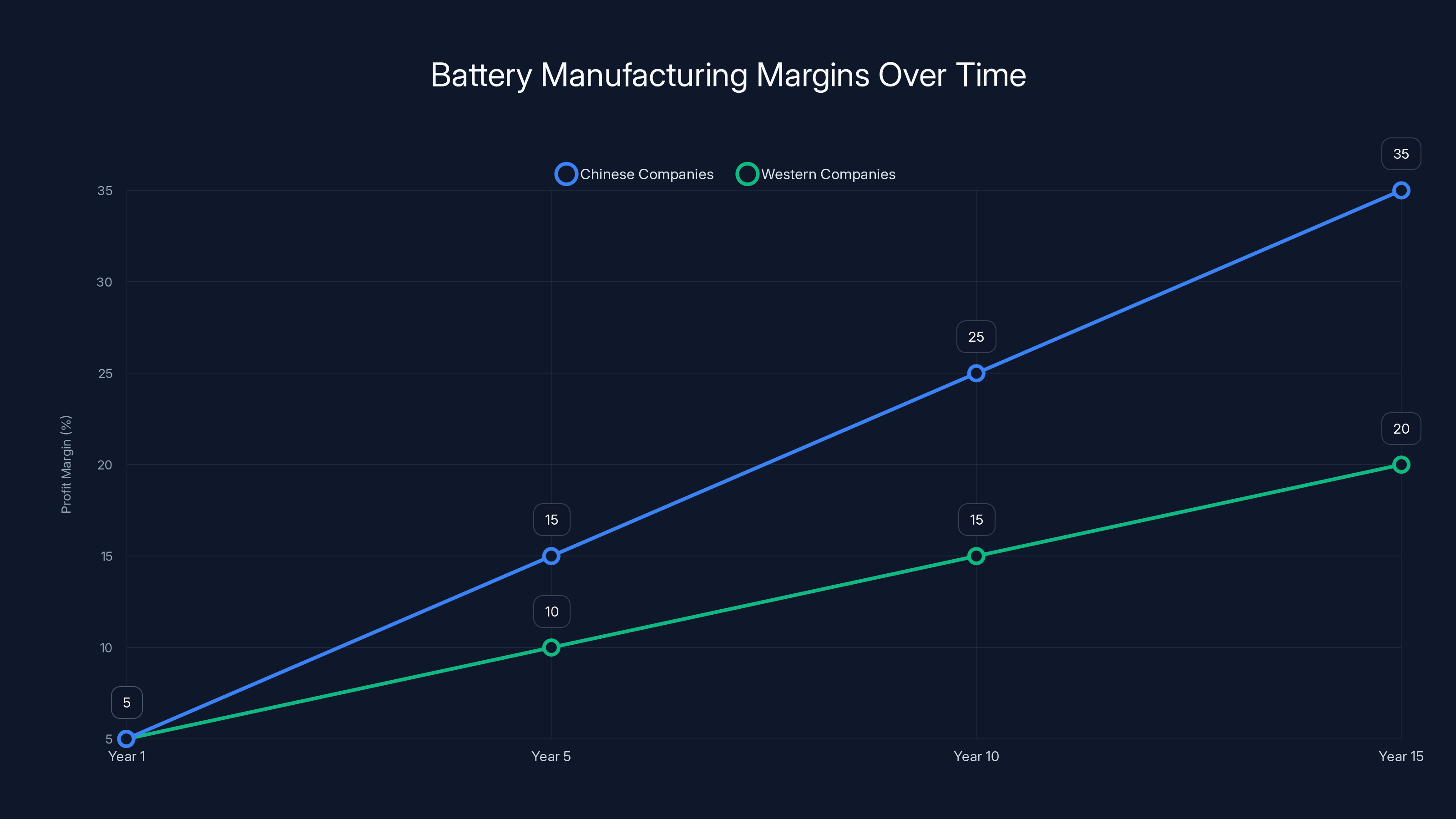

The story gets weirder from here. Local incentives and shipping costs have flipped the economics completely. Chinese battery manufacturers now report higher profit margins on factories built overseas than they do at home. CATL, the world's largest lithium battery maker, pulls in 29% profit margins internationally versus 23% in China. These aren't marginal differences. They're the kind of numbers that change where companies choose to build next.

What's happening is a complete inversion of how manufacturing dominance used to work. When Apple outsourced production to China in the 2000s, "Made in China" became shorthand for cheap and disposable. Now Chinese companies are the ones building cutting-edge factories worldwide, transferring advanced technology, and training local workforces. The power dynamic has flipped.

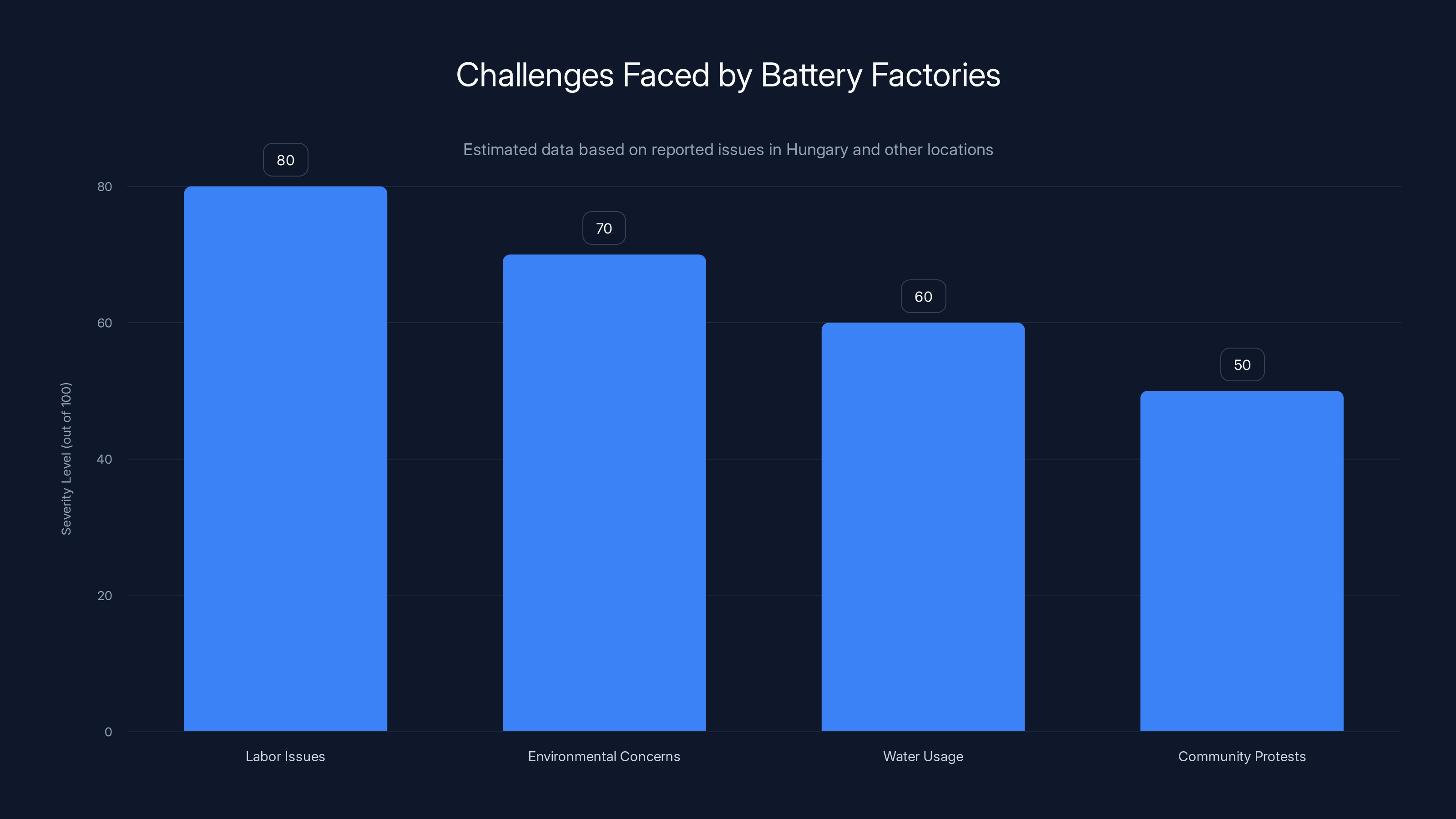

But there's a problem underneath all the success stories. These battery factories don't always play by the rules of their host countries. In Hungary, CATL faced protests and legal battles over water use and environmental impact. Workers reported being laid off, replaced by migrant labor. Local governments have launched investigations. Environmental groups are raising questions about pollution and resource consumption.

So the real question becomes: as Chinese battery technology takes over the global economy, who actually benefits? And who gets left behind?

TL; DR

- China controls 80% of global battery cell production, with companies like BYD, CATL, Envision, and Gotion leading the charge

- 68+ battery factories have been built outside China in the past decade, representing $45 billion in overseas investment

- 2024 marked a turning point where Chinese battery companies spent more building factories internationally than domestically

- Profit margins are higher overseas, with CATL reporting 29% margins outside China versus 23% domestically

- Environmental and labor concerns are emerging, with factories facing water use disputes, layoffs, and community pushback in Hungary, Europe, and other regions

Chinese companies have strategically expanded battery factories globally, with Europe hosting the largest share due to its significant EV market. Estimated data.

Why Batteries Matter More Than You Think

Let's get something straight: batteries are boring until they're not. Most people scroll past battery news the way they ignore software updates. "It's just a battery," you think.

But batteries are literally the reason the energy transition is possible at all. Without lithium batteries, solar and wind power are just... intermittent. The sun doesn't always shine. The wind doesn't always blow. Grid batteries store that energy, releasing it when you need it. They're the bridge between renewable energy and 24/7 power.

Then there are EV batteries. They're why Elon Musk became the richest person on Earth. They're why every single car manufacturer from Ferrari to Ford is scrambling to figure out electric powertrains. They're why gas stations are slowly becoming obsolete.

In 2024, roughly 18 million electric vehicles were sold globally. That's nearly 25 million battery cells needed. And about 20 million of those came from Chinese manufacturers, either directly or through partnerships, as reported by CNBC.

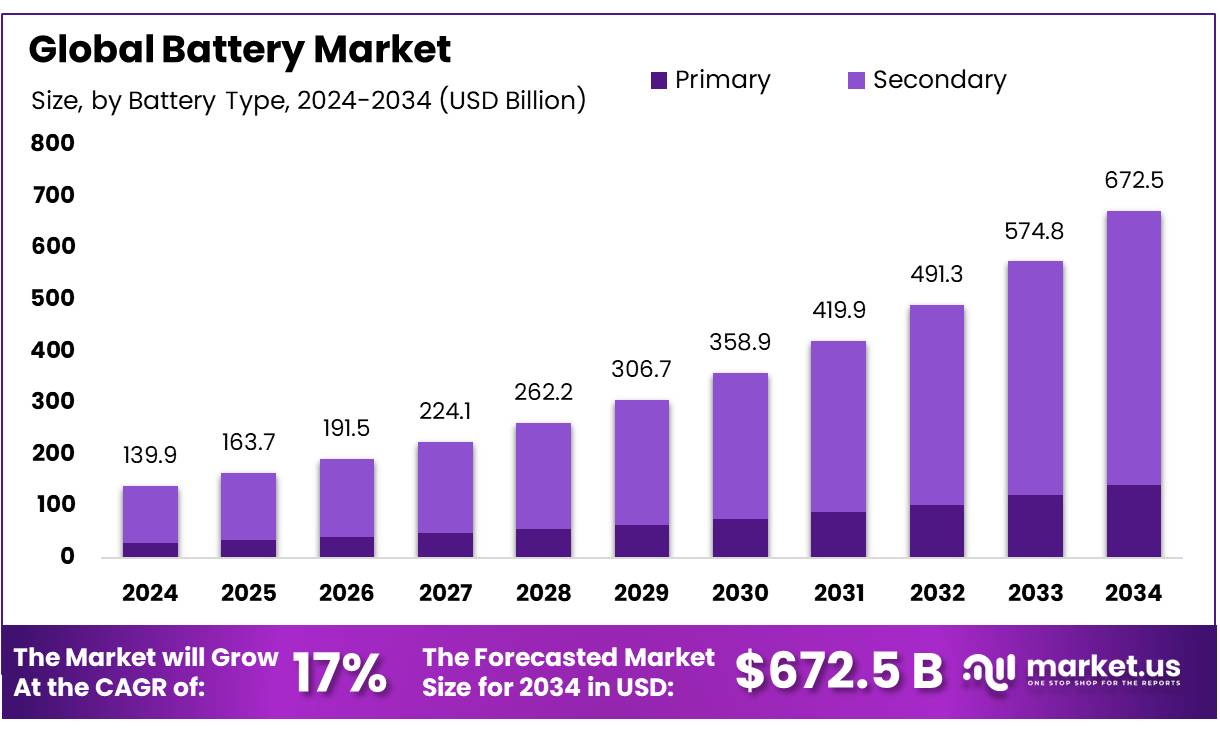

The numbers keep getting more dramatic. Battery capacity in EV sales has grown from about 150 gigawatt-hours in 2018 to over 1,000 gigawatt-hours projected by 2030. That's not incremental growth. That's a seven-fold explosion in less than a decade.

When the Nobel Prize in Chemistry went to lithium battery researchers in 2019, it wasn't just an academic award. It was recognition that this technology fundamentally changed human civilization. This is the same category that has recognized antibiotics, DNA structure, and quantum mechanics. That's the league batteries are now playing in.

And here's the uncomfortable reality: if you care about climate change, electric vehicles, or renewable energy, you need to understand Chinese batteries. Because without them, the transition doesn't happen at scale. The technology is there. The manufacturing is there. The expertise is concentrated in Chinese companies.

Estimated data shows Chinese companies have significantly increased their margins over 15 years due to scale and efficiency, while Western companies lag behind.

The Rise of Chinese Battery Dominance: How It Happened So Fast

This didn't happen by accident. There's a reason why China captured the battery industry, and it wasn't just "cheap labor." The real story is much more interesting.

Back in 2009, the Chinese government made a strategic bet. They decided that batteries would be central to the future economy. So they started funding research. They built labs. They offered tax incentives to battery companies. They created entire industrial parks dedicated to battery manufacturing.

When Brian Engle, the chairman of NAATBatt International, visited a top engineering school in China in 2019, he was stunned. The lab had more than 60 graduate students focused specifically on battery research. He asked an American academic on his tour how many American universities combined would have that many battery researchers. "We couldn't," she said. "We simply couldn't."

That's not a throwaway anecdote. That's the infrastructure gap quantified. China didn't just build better factories. They built better research institutions. They invested in talent. They created an ecosystem where battery technology was the focus.

Meanwhile, Western countries were still thinking of batteries as a commodity. Detroit was focused on gas engines. European automakers were skeptical about EV timelines. The US was fragmented, with some states pushing EVs and others defending fossil fuels. Nobody coordinated a national battery research strategy the way China did.

By the time Western companies realized the battery industry was critical, Chinese companies were already dominant.

The Key Players: Who Controls What

Let's talk about the actual companies. There are four Chinese battery makers that matter at the global scale.

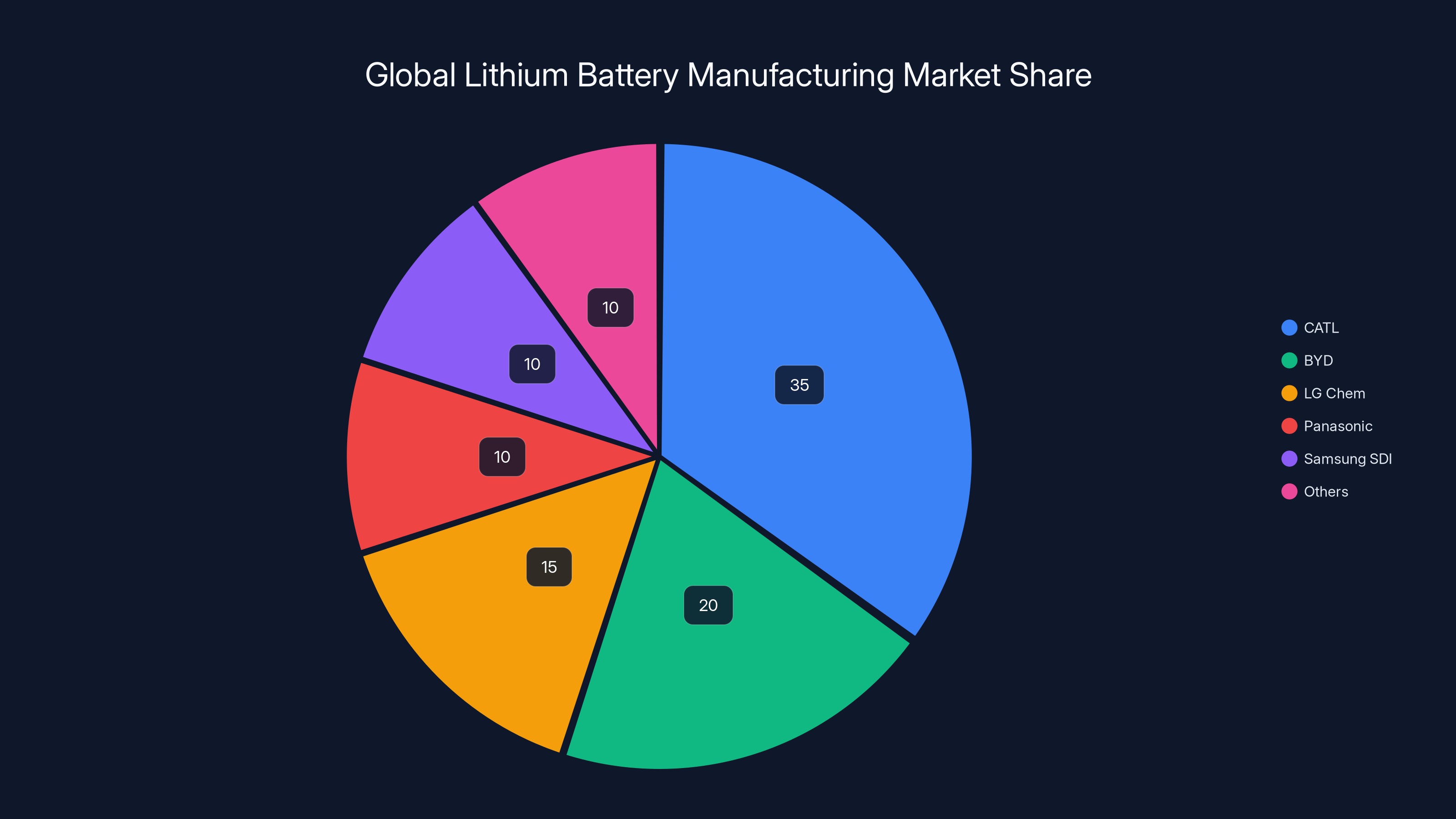

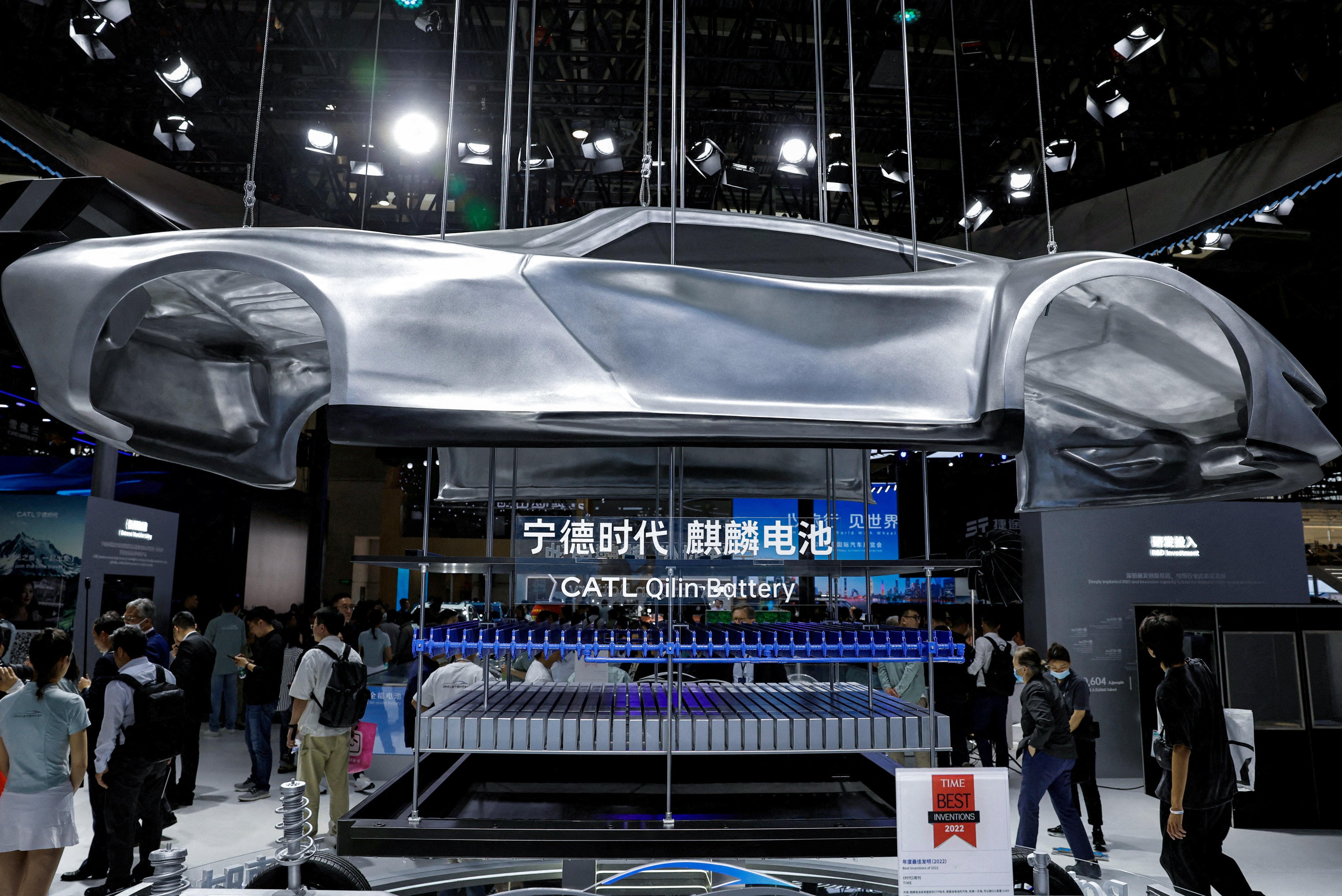

CATL (Contemporary Amperex Technology Co. Limited) is the largest. They control about 35% of the global battery market. They supply Tesla, BMW, Volkswagen, and countless EV startups. Their factories are in China, Europe, Thailand, Indonesia, and beyond, as noted by Reuters.

BYD is the second player. They're massive. BYD doesn't just make batteries—they make complete electric vehicles. They're one of the world's largest EV manufacturers. Warren Buffett's investment company bought into BYD years ago, which says something about how serious investors view the company.

Envision is smaller but growing. They're the company that partnered with Macron in France. They focus on both wind turbines and batteries, giving them a unique angle on the energy ecosystem.

Gotion High-Tech is the fourth major player. They're aggressive about international expansion. They've built factories in Hungary, Brazil, and the United States.

Together, these four companies control the majority of global battery manufacturing. And they're all expanding simultaneously.

The Global Factory Expansion: Where Chinese Batteries Are Actually Made

Here's where the story gets really interesting. Chinese battery companies aren't just exporting batteries from factories in China. They're building factories everywhere.

In the past ten years, data collected by researchers shows at least 68 battery factories have been announced or constructed outside China by Chinese companies. Sixty-eight. That's not a small number of strategic outposts. That's a systematic takeover of global manufacturing, as highlighted by Bloomberg.

The distribution tells you something important about strategy. Europe got hit first and hardest. Hungary, Poland, Germany, and France all have major Chinese battery factories now. That makes sense because Europe is the second-largest EV market after China itself, and European regulations require a certain amount of local manufacturing to avoid tariffs.

But China didn't stop there. They built factories in Thailand, Indonesia, and Vietnam to serve Southeast Asian markets and manufacture for export. They're in Brazil to serve South America. They've built facilities in India. And they started coming to North America, which is why Gotion announced a factory in Illinois.

The timing matters too. The wave of announcements accelerated dramatically starting in 2021. By 2024, the pace reached a fever pitch. Companies started announcing multiple factories in multiple countries simultaneously.

Why Overseas Factories Make Financial Sense

The most cynical interpretation would be that Chinese companies are exporting their model of cheap labor and loose regulations. That interpretation is incomplete.

The actual financial logic is more nuanced. Local manufacturing cuts shipping costs dramatically. A battery factory serving the US market costs 3-4x less to ship from Illinois than from Shanghai. Energy costs matter too. Some regions have cheaper electricity, especially countries with hydroelectric power or abundant natural gas.

But the bigger factor is local incentives. European governments offered massive subsidies to battery manufacturers who built locally. The US did the same through the Inflation Reduction Act. These weren't small incentives—we're talking billions of dollars in tax breaks and direct grants.

CATL's profit margins tell the story. When they operate a factory in Europe or Southeast Asia, they report 29% profit margins. In China, it's 23%. That 6 percentage point difference doesn't sound huge until you realize it means their overseas factories are generating significantly more profit per unit produced.

Other Chinese battery makers reported similar patterns. Gotion and EVE Energy both showed higher profit margins on international factories.

This flips the entire "offshoring" narrative on its head. Historically, companies moved manufacturing overseas to save money by exploiting cheaper labor. That was the textile industry model. That was the early tech manufacturing model.

Chinese battery companies aren't doing that primarily. They're moving manufacturing overseas because it's literally more profitable. Better logistics. Lower shipping costs. Local incentives. Cleaner margins.

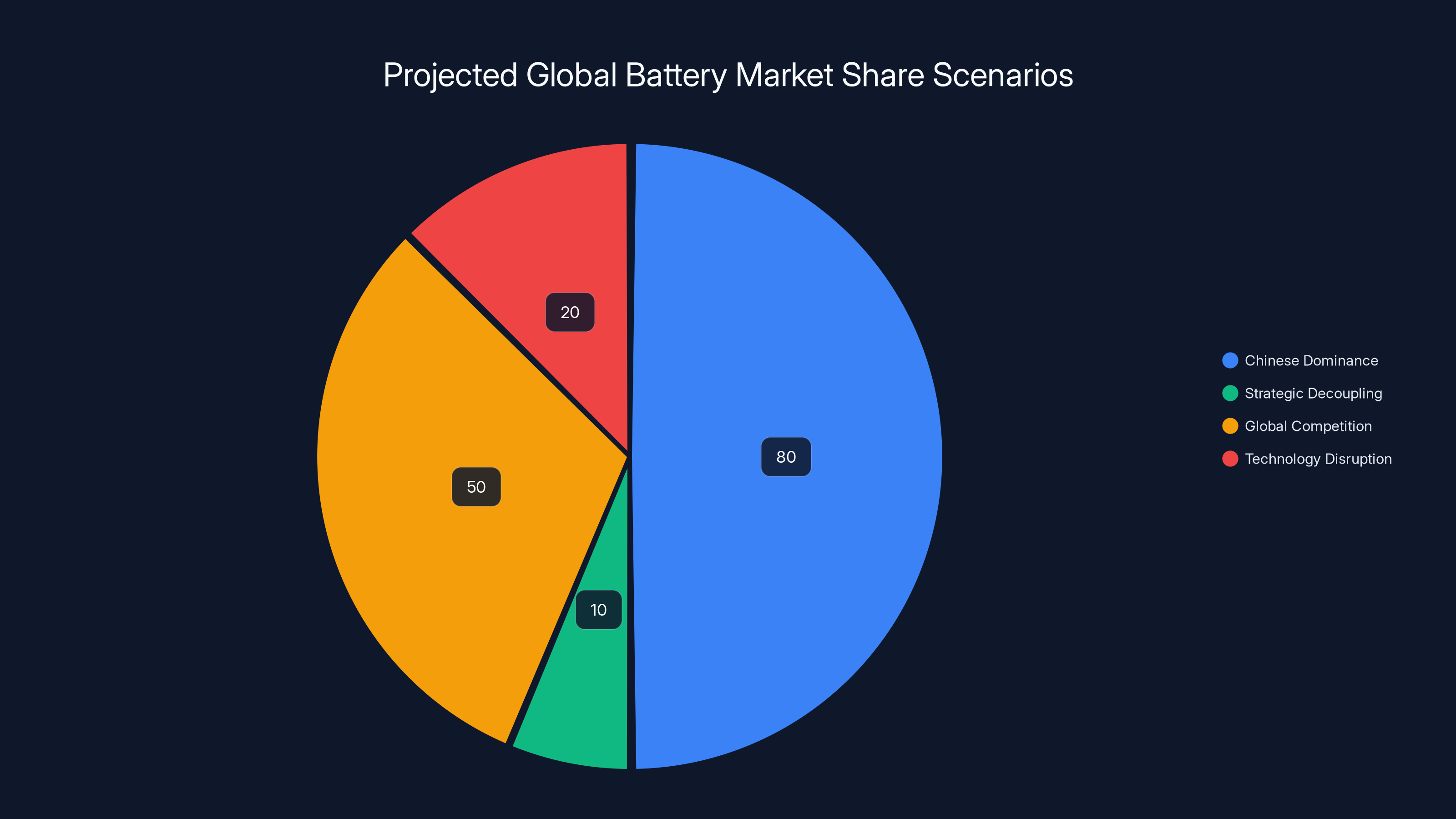

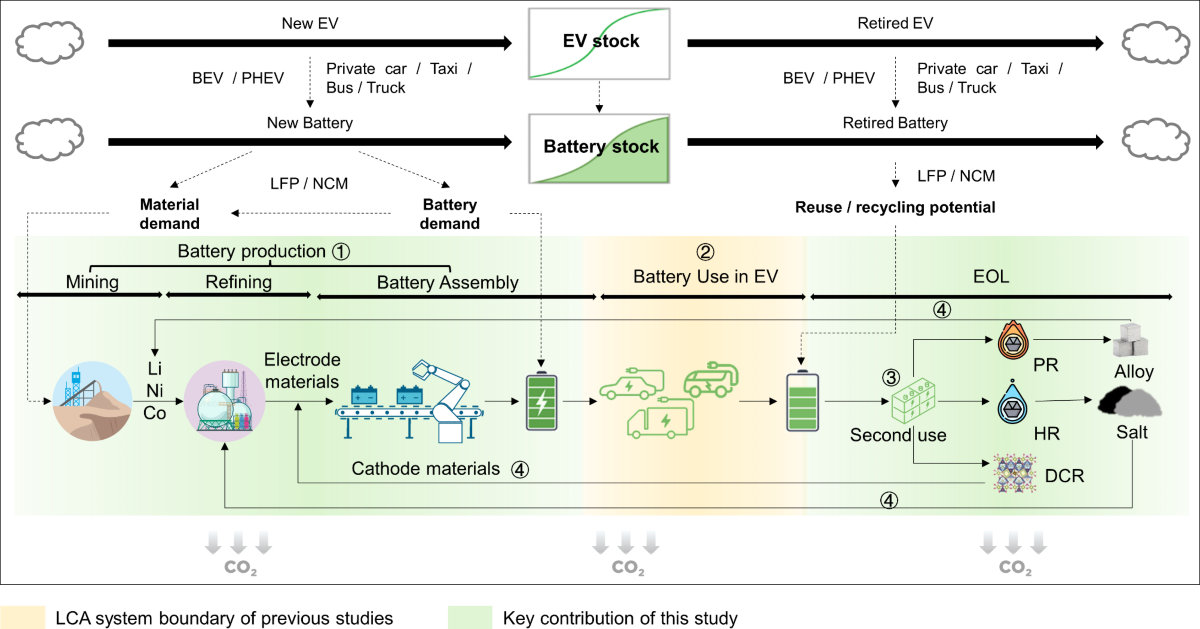

This pie chart illustrates potential future scenarios for global battery market share. Chinese dominance could maintain an 80% share, while strategic decoupling might reduce it to 10%. Global competition could stabilize at 50%, and technology disruption might lead to a 20% share shift. Estimated data based on current trends and hypothetical outcomes.

The Technology Transfer: What China Is Actually Bringing to the World

There's a narrative that goes like this: China makes cheap copies of Western technology. It's a convenient story, and it was true for consumer electronics. But it's completely backwards for batteries.

Chinese battery companies aren't importing technology from the West. They're exporting their own cutting-edge innovations.

When Envision arrived in France to build that factory in Douai, they brought manufacturing processes developed in Chinese labs. Not processes developed by Western companies and brought to China. The other direction.

This is a fundamental shift in how global technology flows. For the past 40 years, if you wanted to understand the future of manufacturing, you looked west. Now you need to look east.

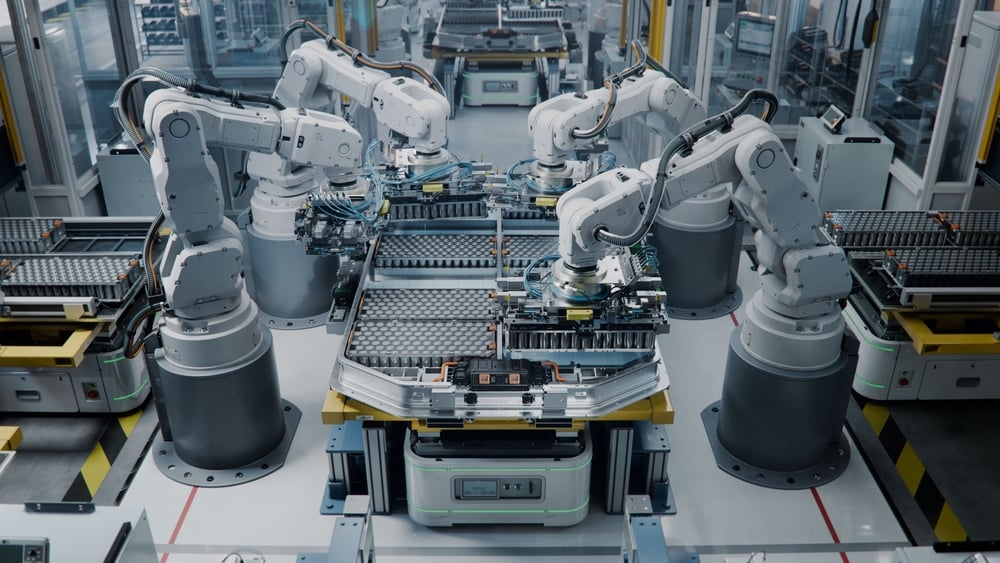

The efficiency of Chinese battery factories is genuinely remarkable. They've optimized production workflows to a level of precision that Western factories sometimes haven't matched. They've invested in automation and robotics. They've streamlined supply chains. The result is that they can produce batteries at scale with margins that Western competitors struggle to match.

When BYD announced they'd built a factory in Brazil, they didn't just show up with money. They brought engineers, production managers, and entire teams trained in their manufacturing processes. They taught local hires how to operate the factory according to Chinese specifications and efficiency standards.

This creates an interesting dynamic. Local governments get a modern factory with advanced technology. But they also become dependent on Chinese expertise and Chinese supply chains. The local engineers learn from Chinese manufacturers. The factory operates with Chinese management structures. Over time, that region's battery industry becomes integrated into the Chinese ecosystem.

It's manufacturing dominance through knowledge transfer, not through colonial resource extraction.

The Research Advantage

The technology gap extends to pure research. Chinese universities and battery companies are now publishing cutting-edge battery research at rates that exceed Western institutions.

This happened because China made deliberate investments in battery science. Graduate programs expanded. Research funding flowed to battery labs. Companies partnered directly with universities. There's now a robust feedback loop where academic research leads to commercial innovation, which leads to new research directions.

Western battery researchers will tell you privately that they're sometimes surprised by innovations coming out of Chinese labs. New cathode materials. Novel electrolytes. Manufacturing techniques that seemed impossible. The innovations keep coming.

This wasn't inevitable. It was the result of strategic investment, political will, and decades of sustained focus on battery technology as a national priority.

The Environmental and Labor Complications: What Happens When Factories Actually Open

This is where the story gets darker. Political leaders love battery factory announcements. They mean jobs. They mean investment. They mean being part of the energy transition.

But when those factories actually start operating, the complications emerge.

Hungary: A Case Study in What Goes Wrong

Hungary provides the clearest example. In 2021, CATL announced it would build a massive battery factory in Debrecen, Hungary's second-largest city. This was presented as a victory for Hungary. A state-of-the-art factory. Thousands of jobs. Billions in investment.

Local politicians were thrilled. Viktor Orban's government was delighted. European officials praised it as proof that battery manufacturing could happen in Europe, not just in China.

But by mid-2024, things were falling apart. Local media reported that CATL laid off more than 100 workers at the factory. Most of them were Hungarian. The company had brought in migrant workers, primarily from China, and the local workforce started getting cut.

The municipality launched an investigation. They raided the facility. There were complaints about labor practices, about promises made and broken, about wages and working conditions.

Separately, CATL faced protests from environmental groups and local communities over water usage. Battery factories are thirsty for water. They need it for cooling systems, for processing chemicals, for the entire manufacturing process. In a region where water is a concern, a massive battery factory becomes a flashpoint.

The company also faced a lawsuit related to the environmental footprint. Emissions, waste disposal, pollution. The standard issues that emerge when heavy industrial operations move into communities that aren't prepared for them.

The Pattern Repeats

Hungary isn't unique. Similar issues have emerged in other locations where Chinese battery factories opened.

In Brazil, environmental groups raised concerns about BYD's factory and its impact on local ecosystems. In Thailand, there were questions about labor practices and migrant workers. In Indonesia, initial enthusiasm for factory announcements eventually gave way to local skepticism about actual working conditions.

None of this is unique to Chinese companies. Western battery manufacturers have faced similar criticism. But the dynamics are different when it's a foreign company with limited previous experience in the host country, dealing with language barriers and unfamiliar regulatory frameworks.

The Broken Promises Problem

Most factory announcements include hiring commitments. "We'll employ 5,000 local workers," companies promise. Politicians hold press conferences. Local media celebrates. Communities prepare.

But when factories open, companies often find it easier to bring in specialized workers from China who already know their processes. Or they find that the local talent pool isn't quite what they expected. Or they just decide that migrant workers are cheaper and easier to manage.

When Gotion announced a factory in Illinois, there was excitement about bringing manufacturing jobs to the Midwest. The reality has been more complicated. Hiring timelines slipped. The ramp-up was slower than expected.

It's not deliberate fraud usually. It's more that factory projections made during the honeymoon phase of negotiations don't survive contact with reality. Labor markets are tighter than expected. Supply chains are more complex. Communities have environmental concerns that emerge once construction actually starts.

Chinese companies control approximately 80% of global battery cell production, highlighting their dominance in the industry. (Estimated data)

The Political Dynamics: How Countries Are Responding

Western governments are starting to wake up to what's happening. And they're not happy.

For years, political leaders in Europe and North America treated battery manufacturing as a nice-to-have. A way to create jobs. A contribution to the green energy transition.

Now they're realizing it's strategic infrastructure. If China controls battery manufacturing, China controls the energy transition. And if China controls the energy transition, China has enormous geopolitical leverage.

That realization has led to a series of policy responses, most of them defensive.

The Tariff Approach

The US, under Biden administration policy, imposed tariffs on Chinese EVs and batteries. The logic was clear: protect domestic manufacturing. The effect was immediate. Chinese companies accelerated plans to build US factories because batteries made in the US avoid the tariffs.

So the tariff policy partly worked (it encouraged domestic manufacturing investment) and partly didn't (Chinese companies are now building the factories anyway, they're just paying higher taxes on the investment).

Europe considered tariffs too. But Europe's answer was already complicated because Envision and other Chinese companies have such deep integration into European supply chains. You can't simply block Chinese batteries when European car manufacturers depend on them.

The Local Content Rules

Most jurisdictions that attracted battery factory investment required a certain percentage of local content. You want to build here? You have to use local materials, hire local workers, transfer technology to locals.

It sounds good in theory. But it's difficult to enforce. What counts as "local"? If a Chinese company builds a factory in Hungary with Chinese equipment and Chinese managers, is that local manufacturing? Technically yes. But the economic benefits don't flow as heavily to locals as intended.

The Coordination Challenge

The real problem is that Western governments are reactive, not coordinated. China made a 15-year strategic bet on battery dominance and executed methodically. Western countries are responding ad-hoc, factory by factory, country by country.

If you tried to design a system to let one player capture an entire industry, you couldn't do better than current Western policy: no coordination, no long-term strategy, competing regional incentives that drive bidding wars.

Some European leaders are starting to push for EU-wide battery policy. A coordinated approach. Joint investment in battery research. But coordination is slow. Politics gets in the way. By the time Western governments get their act together, Chinese companies have already built 20 more factories.

The Supply Chain Vulnerability: Why Batteries Matter Strategically

Imagine the US had controlled 80% of the world's oil production during the Cold War. Imagine the geopolitical leverage that would create. China now has something analogous with batteries.

Every EV sold in Europe might contain Chinese battery cells. Every renewable energy storage system deployed in the US might have Chinese battery components. The entire clean energy transition, in a very real sense, is mediated through Chinese manufacturing.

That creates vulnerabilities.

The Rare Earth Element Problem

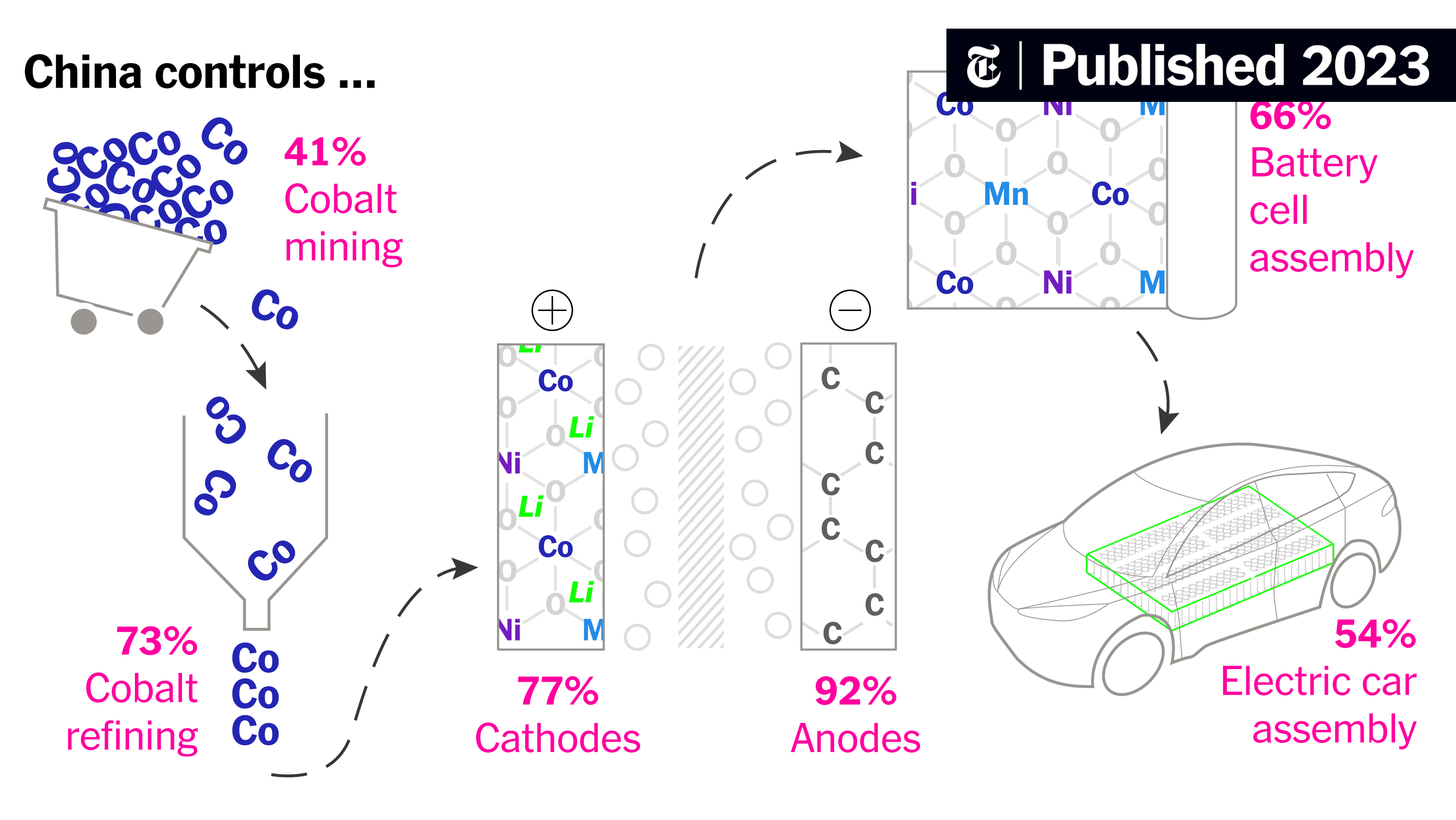

Batteries require specific materials. Lithium. Cobalt. Nickel. Manganese. Some of these are abundant. Some are rare. And China controls significant portions of global supply chains for these materials.

China doesn't necessarily control the raw mining (although it does own stakes in mines across Africa, South America, and Southeast Asia). But China controls the processing. They control the refining. They control the conversion into battery components.

So even if you build a battery factory in Illinois, if the materials flow through Chinese supply chains, you're still dependent on Chinese decisions about whether to restrict supply or manipulate pricing.

The Monopoly Trap

Once one player controls the majority of manufacturing, they can set terms. They can slow-roll innovation to others. They can create exclusive supplier relationships. They can invest in proprietary processes that make switching costs enormous.

This is similar to what happened with rare earth elements when China tightened exports in the late 2000s. Western countries suddenly realized their entire technology sector was dependent on Chinese materials. The shock took years to recover from.

With batteries, the dependency is even more comprehensive because batteries are larger, more important, and harder to substitute.

The Technology Lock-In

When factories in Hungary, Europe, and North America operate using Chinese processes and Chinese management structures, the local regions get locked into Chinese technological standards.

If you want to modify a process, you need approval from the Chinese parent company or engineers. If you want to optimize the supply chain, you run into Chinese partnerships. If you want to develop local expertise, you're training people in Chinese methods, not developing independent capacity.

It's not malicious usually. It's just the inevitable result of one player controlling the core technology and infrastructure.

Chinese companies CATL and BYD lead the global lithium battery market with a combined estimated share of 55%, highlighting their dominance in the industry. Estimated data.

The Economics of Battery Manufacturing: Why Margins Keep Growing

Let's talk dollars. Understanding the economics of battery manufacturing explains why Chinese companies are so aggressive about international expansion.

The Learning Curve Economics

Battery manufacturing has what economists call a steep learning curve. The first factories you build are relatively expensive per unit. As you build more, efficiency improves. Costs drop. Margins expand.

Chinese companies have been building factories for 15 years. They're way out on the learning curve. Their processes are optimized. Their supply chains are efficient. Their workers are trained.

Western competitors are earlier on the learning curve. They're still figuring out how to make batteries efficiently at scale. Their costs per unit are higher. Their margins are lower. Sometimes they're not profitable at all.

This creates an interesting dynamic: the more factories Chinese companies build, the better they get, and the harder it becomes for competitors to catch up. It's a self-reinforcing cycle.

The Scale Advantage

Battery manufacturing benefits enormously from scale. When you're building hundreds of millions of cells per year, you can afford to invest in specialized equipment, proprietary processes, and advanced automation.

Chinese companies have achieved that scale. Their factories hum with robots. Their processes are optimized to the decimal point. They've invested in automation that would be uneconomical at smaller scales.

Western companies are still building that scale. Which means they can't yet afford the same level of optimization.

The Pricing Power

As Chinese battery makers have become more dominant, they've gained pricing power. They can charge more and still undercut competitors because their costs are lower and their margins are maintained.

This doesn't mean they're charging exorbitant prices. Battery prices have actually dropped significantly over the past decade. But at any given price point, Chinese manufacturers are more profitable because their costs are lower.

That profitability funds more factory expansion, which increases scale, which decreases costs further. It's a virtuous cycle for Chinese companies.

The 2024 Inflection Point

According to research data, 2024 was the first year Chinese battery companies collectively spent more money on factory construction outside China than inside China. That's a significant inflection point.

It means Chinese companies believe they've already captured the domestic market. Now they're focused on global expansion. They're building factories to serve markets that previously depended on imports from China.

This isn't a temporary strategy. This is a long-term commitment to global manufacturing dominance.

The Regulatory Maze: How Different Countries Are Responding Differently

There's no global battery industry regulation. Each country has its own approach. This creates problems and opportunities.

Europe's Balance Act

Europe wants to be green, but it also doesn't want to give up manufacturing capability entirely to China. So they've created a middle path.

Local manufacturing of batteries is encouraged through subsidies. Chinese companies are allowed to build factories if they meet certain standards. But there are increasingly stringent environmental requirements and labor protections.

Hungary's experience shows how this tension plays out. The government wanted the investment. But once environmental and labor issues emerged, political pressure mounted to enforce stricter standards.

Europe is also moving toward battery recycling requirements. Batteries are becoming recyclable products with regulated materials flows. This complicates manufacturing but also creates opportunities for local companies in the recycling business.

America's Nationalist Turn

The US has taken a more nationalist approach. The Inflation Reduction Act explicitly favors US battery manufacturing. Tax credits phase out if too many components are made in China.

The effect is clear: Chinese companies must build factories in the US to serve the US market profitably. And they're doing it. CATL has partnership deals with US companies. Gotion built a factory in Illinois. BYD is considering US expansion.

But the protectionist approach has downsides. It raises EV costs for consumers. It slows the transition because batteries become more expensive. And it forces Chinese companies to work through partnerships and joint ventures rather than wholly-owned subsidiaries, which often makes those enterprises less efficient.

China's Open Door

Inside China, the government allows fierce competition among battery manufacturers. CATL, BYD, Gotion, EVE Energy, and dozens of smaller players compete aggressively.

This competition drives innovation and cost reduction. But it also means that Chinese domestic battery prices have fallen faster than overseas prices because manufacturers are fighting for share in the world's largest EV market.

This domestic price competition actually increases incentives for overseas expansion. If your home market is hyper-competitive and margins are thin, building factories overseas where margins are higher makes strategic sense.

India's Emerging Role

India is an interesting wildcard. It has enormous EV potential but limited domestic battery capacity. Chinese companies are investing heavily in Indian battery factories.

India has been welcoming because it wants EV manufacturing capability and it's not hostile to Chinese investment the way Western countries are becoming. But Indian officials are also trying to develop domestic battery champions.

The outcome in India will shape the global battery industry for decades because India's EV market could eventually rival China's.

Battery factories often face significant challenges, including labor issues and environmental concerns. Estimated data reflects typical severity levels.

The Environmental Footprint: What Battery Factories Actually Cost

Here's the uncomfortable truth: battery factories are environmentally intensive. That doesn't mean the energy transition is bad—EVs are still better than gas cars over their lifetime. But it means the transition has costs that sometimes get glossed over.

Water Usage

Battery manufacturing is water-intensive. Factories use water for cooling, for chemical processing, for washing components, for countless industrial processes.

In water-stressed regions, this becomes a serious issue. When CATL expanded in Hungary, water usage became controversial because Hungary has seasonal water stress in certain regions.

Similarly, in parts of Brazil and Southeast Asia where Chinese companies are building factories, water availability is becoming a limiting factor. You can't build a battery factory without water, and in some regions, there's competition for limited water resources.

Energy Requirements

Battery manufacturing is energy-intensive. You need electricity for the entire process. The good news: if a factory runs on renewable energy, that's genuinely clean. The bad news: many factories run on whatever electrical grid they're connected to.

In Europe, most grids are increasingly green, so a battery factory there has a decent environmental profile. In Southeast Asia, grids are often coal-heavy, which means the environmental benefit is questionable.

This creates a weird incentive structure. A battery factory in a region with clean electricity is genuinely green. The same factory in a region with dirty electricity is less impressive environmentally.

Chemical Waste

Battery manufacturing produces chemical waste. Lithium compounds. Cobalt waste. Electrolyte residues. Managing this waste is critical, and it's expensive.

In China, factories have dealt with stricter environmental regulations as the country modernized its environmental standards. Chinese battery makers have gotten better at managing waste over time.

When Chinese factories expand to other countries, they typically bring their own environmental management standards. Which usually means better than local baseline but sometimes less rigorous than the most advanced facilities.

The Carbon Debt

Here's the thing that's sometimes forgotten: every battery has an embedded carbon cost from manufacturing. It takes energy and materials to build a battery.

That carbon cost is paid back over the battery's use in an EV. Usually within 1-2 years of driving. After that, the EV is genuinely cleaner than a gas car.

But that initial carbon debt is real. And when you multiply it across millions of batteries being manufactured, the manufacturing footprint is significant.

This is actually an argument for building batteries closer to where they'll be used (reduces transportation carbon) and for building them efficiently (Chinese factories are more efficient, lower carbon per battery).

The Recycling Question

Batteries are increasingly viewed as recyclable products. That's genuinely important because it means batteries aren't just end-of-life waste.

But recycling infrastructure is still limited. Most old batteries don't get recycled. They get stored or disposed of. As EV adoption accelerates, the recycling problem will become critical.

Some Chinese battery companies are investing in recycling businesses. CATL has announced recycling facilities. BYD has recycling programs. Over time, this could become a major part of the battery business.

But right now, recycling is early-stage. Most batteries aren't recycled. The full circular economy for batteries doesn't exist yet.

The Future: What Happens Next in Battery Dominance

If you're thinking about where this goes, here are the realistic scenarios.

Scenario One: Chinese Dominance Continues

China maintains 80%+ market share globally. Factories keep multiplying. Eventually, there are battery factories in every major market region operating on Chinese processes with Chinese supply chains.

Western companies become Tier 2 players. They compete in niches. They build batteries for premium segments. They maintain regional presence. But they don't challenge Chinese dominance meaningfully.

This seems like the base case. It's where current trends point. Chinese companies have every advantage: experience, scale, margins, technology.

The only thing that breaks this scenario is a geopolitical shock or a technological breakthrough by Western competitors.

Scenario Two: Strategic Decoupling

Western governments decide Chinese battery dependence is too risky. They invest massively in domestic capacity. They implement strict restrictions on Chinese factories. They try to build independent supply chains.

This is expensive and potentially inefficient. Battery costs might rise. Innovation might slow. But countries would have strategic autonomy over their energy transition.

You can see hints of this in US and European policy. But so far, governments aren't willing to pay the price. Decoupling would require industrial policy at a scale not seen since WWII.

Scenario Three: Global Competition Stabilizes

Chinese companies maintain dominance but face increasing competition. Western companies eventually get competitive (maybe in 5-10 years after enough learning curve progression). Markets stabilize with Chinese players at maybe 50-60% market share, Western players at 25-30%, and everyone else competing for the remainder.

This seems more realistic than total Western decoupling but less certain than continued Chinese dominance.

Scenario Four: Technology Disruption

Somebody invents solid-state batteries or some other technology that makes current lithium batteries obsolete. If that happens, the learning curves reset. Advantages level out. New players could emerge.

This is the wildcard. If it happens, the battery industry might look completely different in 10 years.

The Most Likely Path

Honestly? Scenario One (continued Chinese dominance with global presence) seems most likely. Chinese companies have built structural advantages that are hard to overcome. Western governments talk about alternatives but don't commit the resources. And by the time decoupling becomes politically viable, it might be too late.

That doesn't mean Western companies disappear. They'll compete. They'll win some contracts. They'll maintain presence in their home markets. But they're unlikely to close the gap to Chinese market share in the next decade.

Why Western Companies Are Struggling to Compete

It's worth asking why Western battery companies haven't kept pace. The answer isn't that they're stupid. It's that they made different strategic choices at critical moments.

The Timing Problem

When Chinese companies were making massive battery investments in the 2010s, Western car companies were still skeptical about EV viability. They thought EVs were a niche market. They thought gas engines would dominate longer.

Meanwhile, Chinese companies were already betting their futures on batteries. It's easier to be early and wrong if you're betting on growth. It's harder to catch up once you're running 10 years behind.

The Vertical Integration Gap

Chinese companies like BYD are vertically integrated. They make EVs, batteries, and components. That integration creates synergies. It creates information flows. It creates economies of scale.

Western car companies traditionally outsourced batteries. They let Tier 1 suppliers handle it. That arms-length relationship meant less incentive for deep battery innovation by car companies themselves.

By the time Western automakers realized batteries were critical, Chinese companies had already built vertically integrated ecosystems that were hard to match.

The Government Support Gap

Chinese battery companies got government support. Research funding. Tax breaks. Industrial policy support. Western battery companies competed with less government backing and more restrictive regulations in some cases.

This isn't corruption. It's just different industrial policy approaches. China treated batteries as strategic infrastructure. Western countries treated them as just another industry.

The Organizational Gap

Chinese battery companies are newer, so they don't have legacy baggage. They're not defending old technology. They're not protecting old profit streams.

Western companies have legacy structures. They have pension obligations. They have commitments to existing technologies and supply chains.

It's easier to transform a startup into a battery company than to transform a 100-year-old car company into a battery-focused company.

The Labor Question: Who Benefits From Battery Manufacturing?

This is the uncomfortable question underneath the whole story. Battery manufacturing is moving to new regions. But are local workers actually benefiting?

The Training Promises

When factories announce, they promise to train local workers. "We'll hire 3,000 people and train them to manufacture batteries." It sounds great. Communities get excited. Local government provides subsidies.

But training takes time. It costs money. It's easier to bring in experienced workers from China who already know the processes.

So what often happens: initial hiring targets slip. Promises about local employment take longer to materialize than expected. Or they don't materialize at all.

When Gotion was ramping up the Illinois factory, initial hiring goals weren't met on the promised timeline. The company blamed labor market conditions, supply chain delays, demand fluctuations. The result: fewer jobs than promised, later than promised.

The Wage Question

Battery factory jobs are supposed to be good-paying manufacturing jobs. And they are... compared to some alternatives.

But compared to jobs in traditional automotive manufacturing, they're often not as well-paid. And compared to what workers were promised, they're sometimes disappointing.

There's also the question of durability. These are new industries in new regions. Companies haven't been in these markets for decades. If the battery industry faces a downturn, what happens to workers who were hired into new factories?

The Skills Gap

Manufacturing batteries at scale requires specific technical skills. Electronics. Automation. Chemical processes. Not every local labor market has those skills readily available.

So companies either train workers (expensive, time-consuming) or they bring in experienced workers from elsewhere (faster, cheaper, but breaks the local employment promise).

This creates a class divide where immigrant or temporary workers operate the most specialized parts of the factory while local workers get less-skilled jobs.

It's not unique to Chinese companies. Western battery companies have dealt with similar issues. But the effect is the same: promises of local employment don't fully materialize.

The Community Question

Beyond jobs, communities ask: do we benefit from this factory?

Factory revenue mostly goes to the company and its shareholders. Taxes go to the government. Some spending circulates locally (workers spend salaries at local businesses). But often, factories are relatively self-contained. They have company cafeterias. They source specialized supplies from company-approved suppliers outside the local region.

The Hungary situation showed this clearly. The factory was supposed to transform the region. But when layoffs came and labor practices were questioned, the community realized the relationship was more transactional than they thought.

The Alternative

But here's the thing: compared to the alternative (no battery factory at all), having the factory is usually still better for communities. Jobs exist that wouldn't otherwise. Investment happens that wouldn't otherwise. Tax revenue flows that wouldn't otherwise.

It's not that battery factories are bad for communities. It's that the benefits are often less than promised, and the costs (environmental, social, logistical) are often higher than expected.

The Geopolitical Implications: What Battery Dominance Actually Means

Let's zoom out from manufacturing and think about what this means globally.

Energy has always been a source of geopolitical power. Oil-producing countries gained influence. Nuclear energy became a strategic tool. Natural gas flows shaped international relationships.

Batteries are becoming the same kind of strategic infrastructure. Whoever controls battery production shapes energy systems globally.

Right now, that's China. And it's creating interesting dynamics.

Energy Transition Control

Every country that wants to transition to renewable energy needs batteries. Grid batteries. EV batteries. Industrial batteries. Without batteries, the transition stalls.

If China controls batteries, China controls the pace and shape of global energy transitions. Not explicitly (China can't tell a country "you can't build solar without our permission"), but implicitly through supply, pricing, and availability.

EV Market Leverage

Similarly, every company that wants to build electric vehicles needs batteries. If batteries are expensive or scarce, EV adoption slows. If China controls batteries, China influences global EV adoption rates.

This is already visible. Chinese EV makers like BYD have advantages because they have secure battery supply. Western EV makers compete for battery supply and pay more.

The Supply Chain Leverage

Beyond batteries themselves, China controls much of the supply chain for battery materials. Lithium processing. Cobalt refining. Nickel processing.

If China restricts supply, battery makers worldwide feel the squeeze. It's similar to rare earth element control that China wielded in the 2000s and 2010s.

The Technology Control

Battery technology is advancing rapidly. Solid-state batteries. New cathode materials. Faster-charging technologies. Most of this innovation is happening in Chinese labs.

If Western companies want access to advanced battery technology, they often need to license from or partner with Chinese companies. That's leverage.

The Strategic Vulnerability

For Western countries, this creates a vulnerability. You can't have a green energy transition without batteries. You can't have a modern automotive industry without batteries. And batteries are increasingly under Chinese control.

That's why Western governments are starting to invest heavily in battery research and domestic manufacturing. It's not just economics. It's strategy.

The Response Dynamics

As Western countries recognize the strategic importance, you can expect:

- More government investment in battery research

- Tighter restrictions on Chinese battery company expansion

- Tax breaks and subsidies for domestic manufacturers

- Attempts to diversify battery supply chains

- Investments in recycling to reduce material dependence

- Strategic partnerships to reduce individual country vulnerability

But all of this takes time. In the next 5-10 years, Chinese dominance is likely to increase, not decrease.

The Investment Angle: Who's Making Money

If you're thinking about where investment opportunities are, understand the battery industry's profit dynamics.

The Hardware Play

Chinese battery companies are making strong profits on hardware. CATL reported 29% margins on overseas operations in 2024. BYD's battery arm is profitable and growing.

Investing in these companies gives you exposure to the growth of the energy transition. As EV sales grow, as grid storage grows, these companies grow.

But Western investors have limited access to most Chinese battery companies. They're not publicly traded globally. Joint ventures and partnerships exist, but they're not the same as direct ownership.

The Supply Chain Play

Materials companies benefit from battery growth. Lithium miners. Cobalt processors. Nickel producers.

These are more accessible to Western investors. They're often public companies with global access.

But they face commodity price volatility. And they face long-term exposure to recycling, which will eventually reduce virgin material demand.

The Technology Play

Companies developing new battery technologies or processes might unlock value. Solid-state battery companies. Alternative chemistry companies. Manufacturing process innovators.

But these are speculative plays. Most fail. A few succeed. Returns are lumpy.

The Infrastructure Play

Companies involved in charging infrastructure, power management, or grid integration benefit from battery growth.

These are more stable plays. Less likely to be disrupted by Chinese competition. More stable cash flows.

The Recycling Play

As batteries age out, recycling becomes valuable. Companies that build battery recycling capacity will eventually control a meaningful revenue stream.

This is early-stage now. But 5-10 years out, battery recycling could be a significant business.

What This Means for Your Car, Your House, and Your Energy

Let's bring this back to real world implications. What does Chinese battery dominance mean for you?

For Your Next Car

Your next car will probably have a Chinese battery. Not necessarily a Chinese car, but a Chinese battery. CATL supplies Tesla. BYD supplies Ford. Envision supplies BMW.

This doesn't mean your car will be worse. Chinese batteries are excellent. It just means you're reliant on Chinese manufacturing for critical components.

If Chinese companies face supply disruptions or geopolitical restrictions, EV availability will be affected. Prices could rise. Availability could tighten.

For Your Home Battery

If you're considering a home battery system (common if you have solar panels), you might have a Chinese battery without realizing it. BYD, CATL, Gotion all produce home batteries globally.

Again, these are quality products. The implications are about dependence and strategic vulnerability, not product quality.

For Energy Stability

As grids integrate more renewables, they need more storage. That storage is almost certainly Chinese batteries. Which means global energy infrastructure is increasingly dependent on Chinese supply chains.

If something disrupts Chinese battery supply (war, sanctions, natural disaster), global energy systems could face instability.

For Electricity Costs

In markets where Chinese battery factories compete aggressively, battery costs have dropped. This has made energy storage cheaper, which makes solar and wind more viable, which helps drive the energy transition.

But Chinese dominance also means less competition, which could eventually lead to higher prices and less innovation.

For Employment

If you live in a region with a battery factory, you or someone you know might work there. These are real jobs with real wages. But they're also vulnerable to industry consolidation and Chinese company decisions.

For Environmental Impact

Battery dominance has mixed environmental implications. On one hand, batteries enable the clean energy transition. On the other, battery manufacturing is environmentally intensive. Where factories are built, environmental impact matters.

The net environmental effect is positive (EVs and renewables are better than fossil fuels), but locally, factories create real environmental costs.

The Counterargument: Why Chinese Dominance Might Be Okay

Before we conclude, let's acknowledge the counterargument. Maybe Chinese battery dominance isn't a disaster. Maybe it's just how global manufacturing works.

The Competition Drives Innovation

Chinese companies compete aggressively among themselves. That competition drives innovation. Battery technology improves faster when companies are fighting for market share.

Western companies, for all their resources, often move more slowly. Chinese companies are iterating faster, improving faster, innovating faster.

Maybe that's good for the global energy transition. Maybe you want the players most focused on battery innovation leading the industry.

The Cost Reductions Help Scale

Chinese manufacturing efficiency has driven down battery costs dramatically. As batteries got cheaper, EV adoption accelerated. Solar and wind storage became viable.

Without Chinese cost reductions, the transition would be slower and more expensive. Maybe Chinese manufacturing dominance is actually accelerating the global energy transition.

The Global Production Is Decentralized

While Chinese companies lead, they're building factories globally. Battery production is increasingly distributed. That's less vulnerable than everyone relying on batteries shipped from China.

As Chinese companies build more international factories, Chinese production concentration might actually decrease as a percentage of total global production.

The Technology Transfer Benefits Locals

When Chinese companies build factories overseas, they transfer technology and expertise. Local workers learn modern battery manufacturing. Local engineers get trained. Local communities gain technical knowledge.

That's a real benefit, even if it's not as large as local communities sometimes hope.

The Alternative Might Be Worse

What if Chinese companies didn't dominate? What if battery manufacturing remained fragmented across dozens of smaller players? Or what if Western companies with less efficiency maintained control?

Battery costs might be higher. Innovation might be slower. The energy transition would advance more slowly. Maybe Chinese dominance, while strategically uncomfortable for Western countries, is actually better for global climate outcomes.

FAQ

What is lithium battery manufacturing and why does it matter?

Lithium battery manufacturing is the industrial process of creating lithium-ion cells that power electric vehicles and energy storage systems. It matters because batteries are foundational to the global energy transition from fossil fuels to renewable energy. Without efficient battery manufacturing, EVs would be expensive and rare, renewable energy would remain intermittent and unreliable, and climate change mitigation would slow dramatically.

How do Chinese battery makers maintain their dominance over Western competitors?

Chinese battery companies like CATL and BYD maintain dominance through several mechanisms: they started earlier and moved along the manufacturing learning curve faster, they've scaled production to millions of units annually which enables efficiency Western companies haven't matched, they invested in research decades ago so they control cutting-edge battery technology, they benefit from 15+ years of experience optimizing processes, and they have lower production costs enabling higher profit margins that fund continued innovation. Chinese government support through research funding and industrial policy also accelerated their growth.

What are the main benefits of having battery factories in local regions?

Local battery factory benefits include job creation in manufacturing and related industries, tax revenue for local governments, technology transfer and skills training for local workers, reduction in shipping costs for batteries entering the region, and acceleration of local EV adoption and clean energy deployment. However, these benefits often fall short of initial promises because hiring timelines slip, wage levels are sometimes lower than expected, and economic activity concentrates within company operations rather than spreading broadly through local communities.

Why are Chinese battery companies building factories outside China if manufacturing costs are lower at home?

Chinese companies build overseas factories because profit margins are higher internationally (29% overseas vs 23% in China for CATL), local manufacturing avoids import tariffs that Western governments have imposed, shipping costs are dramatically lower when batteries are made locally, local incentives like tax breaks and subsidies are substantial, and local market access is easier and faster. By 2024, Chinese battery companies collectively spent more money building international factories than domestic ones for the first time, indicating they view overseas expansion as more profitable than expanding at home.

What environmental concerns emerge from battery factory operations?

Battery factories create several environmental challenges: they're water-intensive and in water-stressed regions this creates conflicts over resources, they require significant electricity which increases environmental impact if grids are coal-powered, they produce chemical waste from lithium and cobalt processing that must be carefully managed, and they have localized air quality impacts. Additionally, battery manufacturing embeds carbon costs that are paid back during the EV's usage, but that initial manufacturing carbon footprint is substantial when multiplied across millions of batteries globally.

How are Western governments responding to Chinese battery dominance?

Western governments are responding through multiple strategies: the US imposed tariffs on Chinese EVs and batteries and offered tax incentives for domestic battery manufacturing through the Inflation Reduction Act; European countries offer subsidies for battery factories that meet local content requirements and environmental standards; regulations increasingly require minimum local content percentages; and countries are investing directly in battery research and domestic manufacturing capacity. However, these responses are fragmented rather than coordinated, which limits their effectiveness compared to China's 15-year coordinated strategy.

What does Chinese battery dominance mean for global energy security?

Chinese dominance creates strategic vulnerability for other countries: the global energy transition depends on Chinese manufacturing, countries pursuing EV adoption and renewable energy deployment rely on Chinese battery supply, geopolitical disputes or supply disruptions could affect global energy infrastructure, and China's control of battery material processing (lithium, cobalt refining) provides additional leverage. This is why Western governments view battery manufacturing as strategic infrastructure similar to oil during the 20th century.

Are Chinese-made batteries for vehicles and home energy systems reliable and safe?

Yes, Chinese-made batteries are generally reliable and safe. Companies like CATL and BYD meet international safety standards, their batteries power vehicles from Tesla to Ford to BMW, and their home batteries are used globally. Chinese batteries have actually driven costs down while maintaining quality standards. The concerns about Chinese dominance are geopolitical and strategic, not about product quality or reliability.

What's the most likely future for battery manufacturing in the next decade?

The most likely scenario is that Chinese companies maintain significant dominance (50-60%+ market share) while Western companies compete in niches and maintain regional presence. Chinese companies will continue building global factories, supply chains will integrate further, technology innovation will likely remain concentrated in Chinese companies though Western companies will gradually improve. Battery recycling will emerge as a major industry that could shift some advantage toward Western companies. Geopolitical friction is likely to increase, but the cost of decoupling from Chinese batteries is so high that most countries will accept dependence rather than pay for independence.

How can Western companies compete more effectively with Chinese battery makers?

Western companies could improve competitiveness through increased government investment in battery research (to match Chinese research scale), building scale faster (establishing multiple factories simultaneously rather than incrementally), vertical integration (like BYD does, combining battery and vehicle manufacturing), strategic partnerships to share R&D costs, focusing on advanced battery chemistries rather than competing on current lithium-ion, investing in recycling to reduce material dependence, and accepting lower margins for market share to accelerate down the learning curve faster. However, many Western companies haven't committed to these strategies, which is partly why the gap persists.

Conclusion: Adapting to a Battery-Powered World

There's a temptation to read the story of Chinese battery dominance as a story of Western decline. That's too simplistic.

What's actually happened is that different countries made different strategic bets at crucial moments. China bet early and big on batteries as the infrastructure of the future. They invested in research, manufacturing, expertise, and scale. That bet is paying off.

Western countries were slower to recognize batteries as strategic infrastructure. They treated batteries as just another component of cars or grids, outsourced to whoever made them cheapest, assumed Western companies would maintain tech leadership.

That assumption was wrong. And the lag is now 5-10 years in some dimensions.

But the story isn't over. Western companies are investing. Western governments are waking up. New technologies are emerging. Recycling will eventually matter. Supply chains will diversify.

In 20 years, the battery industry will look different than it does today. Chinese dominance might persist, might decline, might evolve. But the current landscape is clearly established: China leads, Western countries are catching up, and the rest of the world is choosing sides.

The practical implications are real. Your next car will probably have a Chinese battery. Your home energy system might. Your electricity will flow through grids increasingly dependent on Chinese battery infrastructure. Your energy future is intertwined with Chinese manufacturing decisions.

That's not inherently bad. Chinese batteries are good products. Chinese companies are efficient. Chinese innovation is real. But it does mean Western countries are dependent on a supply chain they don't control, and that has strategic implications that will play out over the next decade.

The energy transition is happening. Batteries are enabling it. And Chinese companies are the primary builders of that infrastructure.

Understanding that, accepting it, and adapting to it is increasingly important whether you're investing in energy, building cars, developing policy, or just trying to understand the world your kids will inherit.

Key Takeaways

- Chinese battery companies control approximately 80% of global lithium battery cell production in 2024, establishing dominant market position

- 68+ battery factories built or announced outside China by Chinese companies represent $45 billion in international investment over past decade

- Chinese manufacturers report significantly higher profit margins overseas (29% for CATL) compared to domestic operations (23%), driving expansion strategy

- 2024 marked inflection point where Chinese battery companies collectively invested more in international factories than domestic expansion for first time

- Environmental and labor concerns emerge as battery factories scale in Hungary, Europe, and other regions despite initial governmental enthusiasm

- Western governments responding with tariffs, subsidies, and local content requirements but lack coordinated strategy to compete with Chinese dominance

- Technology innovation increasingly concentrated in Chinese companies and universities, creating structural competitive advantage in battery chemistry and manufacturing

Related Articles

- Next-Gen Battery Tech Beyond Silicon-Carbon [2025]

- China's Megawatt Airborne Wind Turbine: The S2000 Revolution [2025]

- Best Gear & Tech Releases This Week [2025]

- Amazon's Bacterial Copper Mining Deal: What It Means for Data Centers [2025]

- Electric Vehicles in the Mille Miglia: Racing's Toughest EV Challenge [2025]

- Microsoft's Community-First Data Centers: Who Really Pays for AI Infrastructure [2025]

![How Chinese EV Batteries Conquered the World [2025]](https://tryrunable.com/blog/how-chinese-ev-batteries-conquered-the-world-2025/image-1-1768909561916.jpg)