Introduction: The Copper Shortage Nobody's Talking About

There's a quiet crisis brewing in the world of data centers, and it has nothing to do with electricity prices or cooling systems. It's about copper.

Copper is the nervous system of modern computing. It runs through every data center cable, every circuit board, every GPU that powers the artificial intelligence revolution. The stuff is absolutely essential. And right now, the world is running out of it.

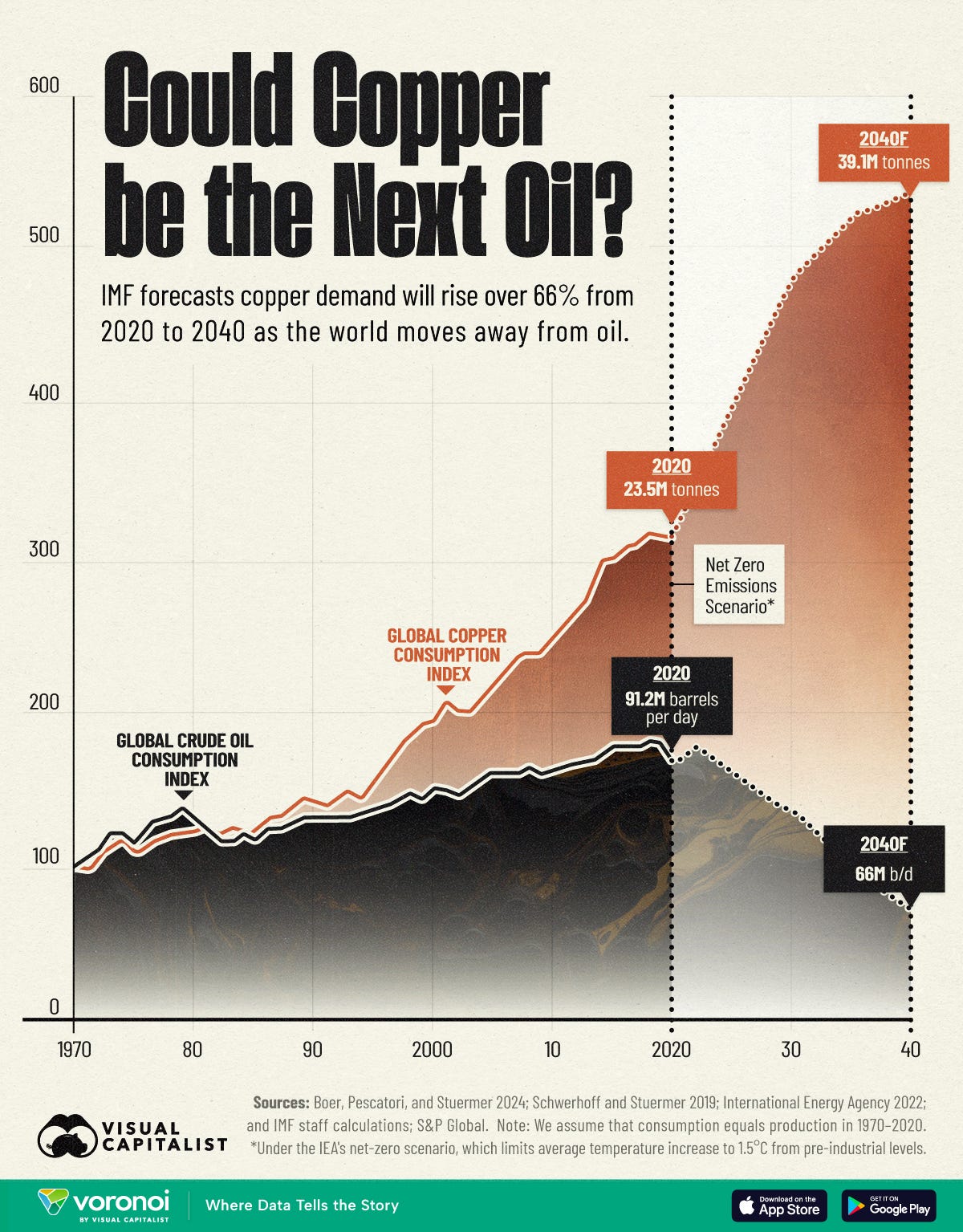

The AI boom has turbocharged demand for copper in ways that nobody predicted five years ago. Every new data center needs tons of it. Every supercomputer requires miles of it. Every chip fabrication plant depends on it. But here's the problem: mining copper the traditional way is expensive, slow, environmentally destructive, and increasingly unable to keep up with demand.

This is where Amazon Web Services just made a fascinating bet.

In late 2024, Amazon announced it would purchase copper from a reopened mine in Arizona called Johnson Camp. But this isn't just any mining operation. This mine is using living microorganisms to extract copper from ore in a process called bioleaching. It's low-carbon, water-efficient, and fast enough to reopen mines that were previously abandoned as unprofitable. It's also totally real technology that actually works.

I'll be honest: when I first read about this, I thought it sounded like science fiction. Bacteria harvesting metal? That seemed like something out of a cyberpunk novel, not something actually happening in the American Southwest. But after digging into the technology, talking to people in the mining industry, and understanding why copper has become such a critical constraint, it started making perfect sense.

This deal reveals something bigger about where technology is heading. The AI boom isn't just driving demand for computing power, GPUs, and data centers. It's trickling down into the raw materials supply chain in unexpected ways. Companies like Amazon aren't just building better chips or faster networks anymore. They're now securing the actual elements they need by investing in entirely new mining technologies.

Let's break down what's actually happening here, why it matters, and what it tells us about the future of AI infrastructure.

TL; DR

- Bioleaching is real: Amazon is buying copper harvested using naturally occurring microorganisms that extract metal from low-grade ore, reducing water use and carbon emissions versus traditional mining

- AI drove the deal: The explosion in AI computing demands enormous quantities of copper for data centers, chips, and infrastructure, creating supply bottlenecks

- Speed advantage: Reopening existing mines with bioleaching is faster and cheaper than developing new mining sites, allowing supply to keep pace with demand

- Environmental gain: This method uses 80-90% less water than conventional mining and produces significantly lower carbon emissions

- Supply chain control: Major tech companies are now directly investing in mining technologies to secure critical materials, a major shift in how Silicon Valley operates

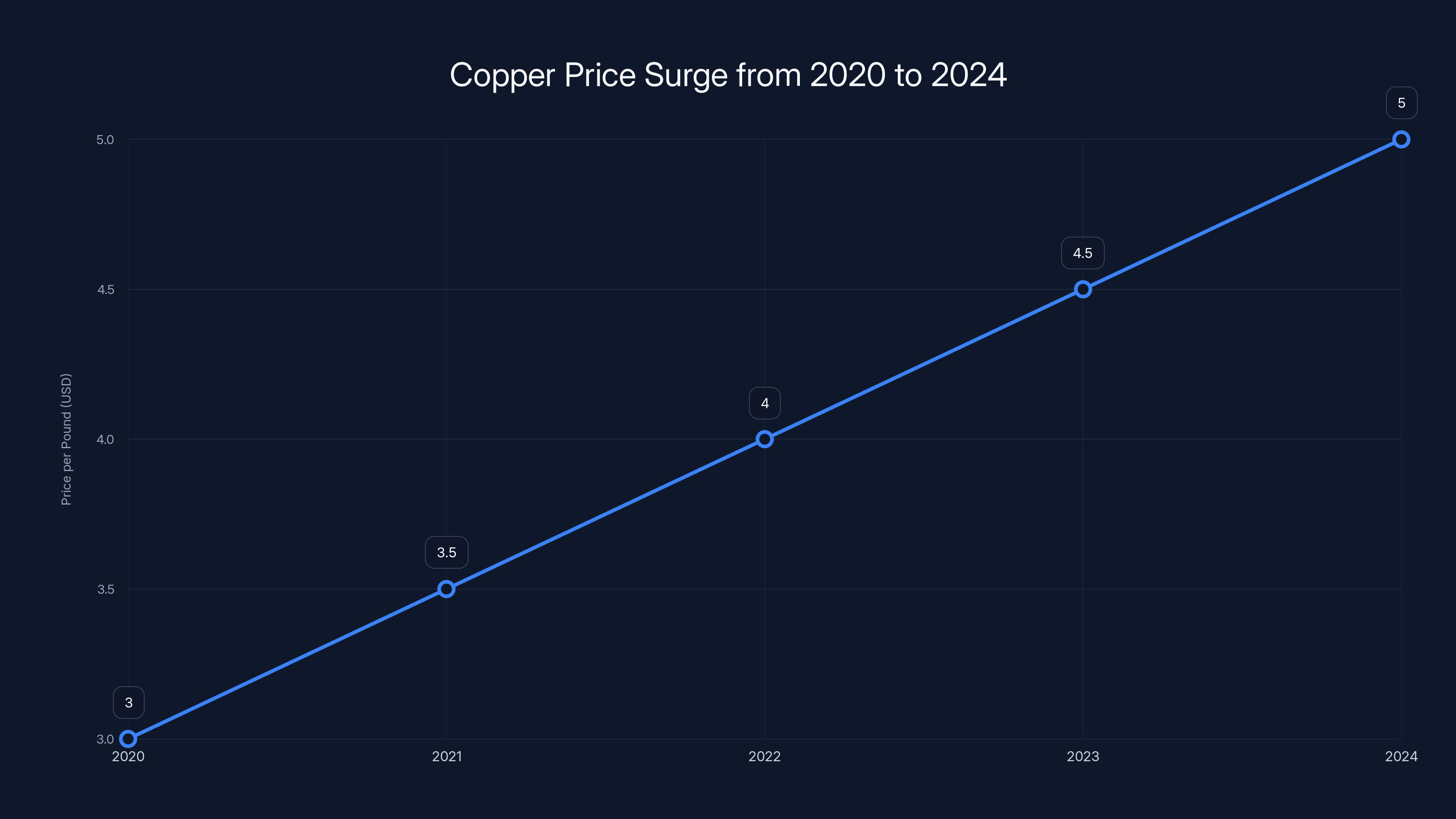

Copper prices doubled from 2020 to 2024, driven by increased demand from AI data centers. Estimated data.

Why Copper Has Become the Bottleneck Nobody Expected

Let's start with a basic fact that most people don't realize: copper is the third most consumed metal on Earth, behind iron and aluminum. But unlike those metals, copper has a very specific problem. There's a finite amount of it in the ground, and we're using it faster than ever.

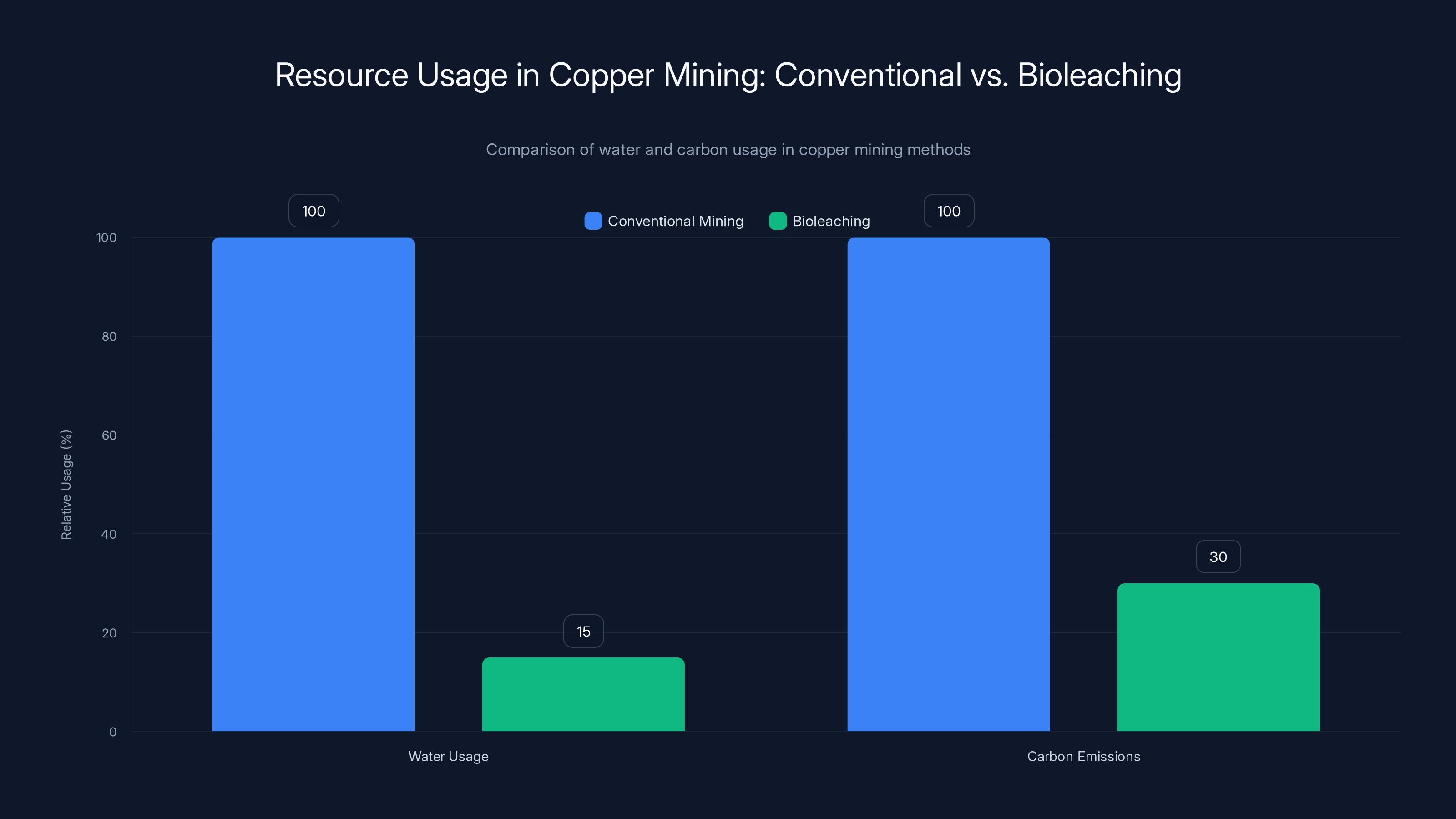

Traditional copper mining is brutal work. You dig enormous holes in the earth, blast out rock containing tiny percentages of copper, crush that rock into powder, and then chemically process it to extract the actual metal. The process consumes massive amounts of water, requires toxic chemicals, and produces mountains of waste rock. A single large copper mine can process 100,000 tons of ore per day and still only extract 0.5% copper by weight. The rest becomes environmental damage.

But here's where it gets interesting: there's actually an enormous amount of copper still in the ground at abandoned mine sites. Mines that were shut down decades ago as "unprofitable" still contain tons of copper. The problem was always extraction cost. The ore grades were too low. The traditional mining methods made it uneconomical.

Enter the AI boom.

When Chat GPT hit 100 million users in two months, it didn't just create demand for GPUs and data center space. It created demand for everything that goes into data centers. Power infrastructure. Cooling systems. Networking equipment. And all of it requires copper. Lots of copper.

A single modern data center can require hundreds of tons of copper just for electrical distribution. A warehouse-scale AI training facility? We're talking thousands of tons. Multiply that across hundreds of new data centers being built or expanded worldwide, and suddenly you have a copper shortage that's not theoretical anymore, it's real and immediate.

Copper prices have already responded to this. Prices doubled between 2020 and 2024, moving from roughly

Which is exactly why bioleaching is so attractive right now.

Traditional mining also has a carbon problem that tech companies increasingly can't ignore. Mining one pound of copper generates roughly 2-3 pounds of CO2 equivalent when you factor in all the energy, chemicals, and processing. When you're trying to hit net-zero carbon targets as a major company, that math doesn't work anymore. You need a better solution.

Bioleaching offers one.

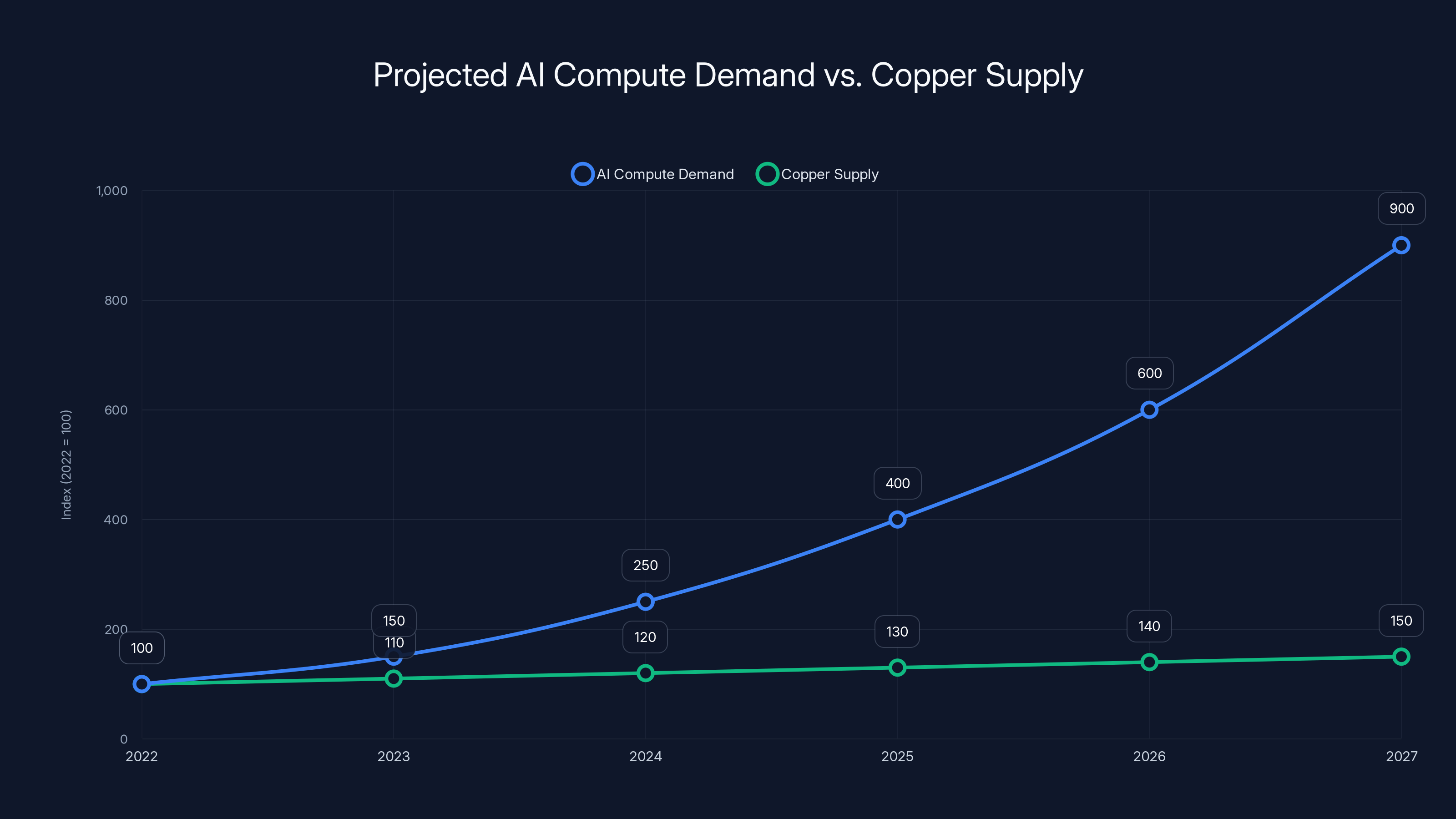

Estimated data shows AI compute demand growing nearly exponentially, while copper supply increases at a much slower rate. This divergence could lead to significant supply constraints by 2026-2027.

What Is Bioleaching and How Did We Get Here?

Bioleaching isn't a new discovery. Humans have known about it for decades. But using it at scale for copper extraction? That's relatively new.

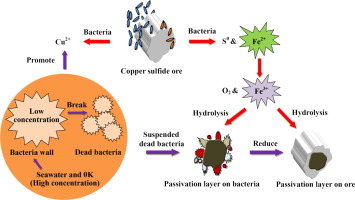

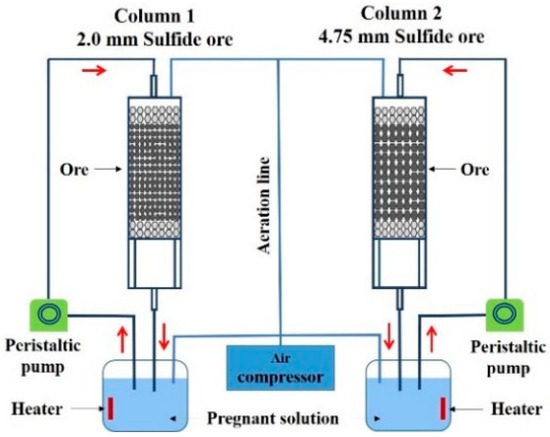

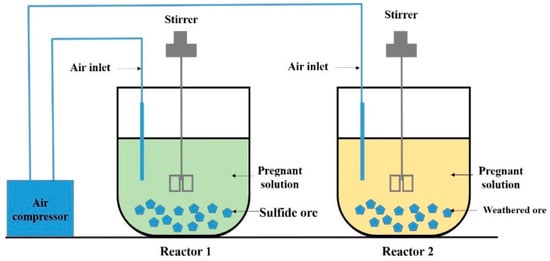

The basic principle is surprisingly elegant. Certain naturally occurring bacteria and other microorganisms produce sulfuric acid as a byproduct of their metabolism. If you take low-grade copper ore and expose it to these microorganisms in the right conditions, the bacteria's acid slowly dissolves copper minerals out of the rock. The copper ends up in solution, which you can then concentrate and purify through additional chemical processes.

The reason this works is chemistry. These bacteria exist naturally in mining environments. They've been there for millions of years, slowly breaking down rocks and minerals. What modern mining engineers figured out is how to accelerate this natural process and harness it for industrial extraction.

The technology isn't actually that complicated. You basically need the right ore (which you have at abandoned mine sites), the right bacteria (which naturally occur in those sites), water, and time. The bacteria do most of the hard work. They multiply, produce acid, dissolve copper, and the process keeps going as long as conditions stay favorable.

Nuton Technologies, the company operating the Johnson Camp mine for Amazon, developed specific engineering approaches to optimize this process. They figured out how to maintain the right temperature, pH, nutrient balance, and bacterial populations to maximize copper extraction rates. They've also solved the downstream chemistry problem: once copper is in solution from bioleaching, you still need to recover it in pure cathode form suitable for industrial use.

In December 2024, Nuton produced its first copper cathode from bioleaching at the Johnson Camp mine. That's the proof point that the technology actually works at scale, not just in laboratory conditions.

Here's what makes this particularly clever: Johnson Camp was an active mine in the past, meaning the infrastructure already exists. The pit is already dug. The equipment is in place (or can be). The mine already had successful mining operations with geological understanding of the deposit. So Nuton didn't have to start from scratch. It could take an abandoned operation and reactivate it with new technology.

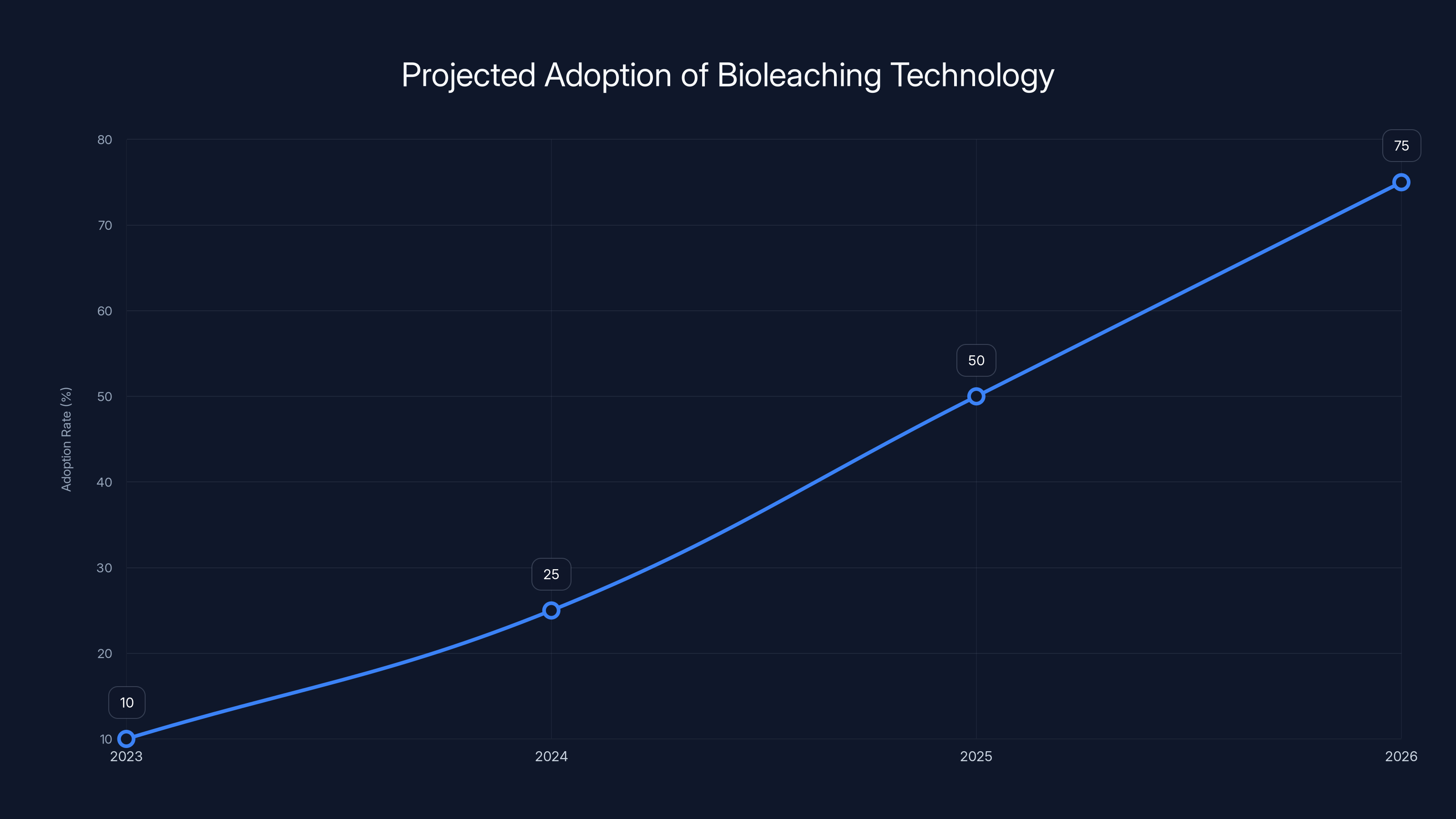

This is why the timeline works so well for Amazon's needs. A brand new copper mine takes 10-15 years from discovery to first production. Reopening an existing mine with bioleaching? Probably 2-4 years. That's a massive advantage when you're trying to secure supply right now, not sometime in 2035.

The bacteria involved aren't genetically modified or specially engineered in most cases. They're naturally occurring species like Acidithiobacillus ferrooxidans and other thermophilic bacteria that thrive in acidic, mineral-rich environments. Some operations do use selected strains that have been isolated and cultured because they're particularly good at the extraction process, but we're not talking about creating new organisms.

This is important because it makes the technology much more acceptable from regulatory and public opinion perspectives. You're not deploying GMO bacteria into the environment. You're creating conditions for bacteria that already exist to do what they do naturally, just in a controlled, managed way.

Amazon's Specific Deal: What We Know and What It Signals

Let's get concrete about what Amazon actually committed to.

AWS signed a two-year supply agreement with Nuton Technologies for copper produced at the Johnson Camp mine in Arizona. The exact volume isn't publicly disclosed, but industry estimates suggest it could be hundreds of tons annually. AWS is also providing cloud-based data and analytics support to help Nuton optimize the mining process itself, which is a clever move: Amazon gets access to the copper supply, and Nuton gets free computing resources and expertise from the team that literally builds and operates the world's largest data centers.

That AWS involvement isn't just symbolic. Data analytics and machine learning can actually help mining operations significantly. You can use sensors throughout the mining process to monitor temperature, pH, bacterial activity, copper concentration, and a hundred other parameters. Feed all that data into machine learning models, and you can start optimizing the process in real time. Maybe you find that copper extraction improves at specific times of day. Maybe you discover that certain nutrient ratios accelerate bacterial activity. Maybe you identify early warning signs of process failures before they happen.

This is exactly the kind of problem that Amazon's cloud AI capabilities can help solve. And it creates a feedback loop: as Nuton gets better at extracting copper through data-driven optimization, it becomes more profitable, which incentivizes them to increase production, which benefits Amazon's supply.

It's worth noting that Amazon didn't lead a funding round or take an equity stake in Nuton (at least not publicly). This is a straightforward supply agreement, not a major investment. Amazon is essentially saying: "We'll commit to buying your copper, which gives you enough revenue certainty to scale up production." That's powerful in its simplicity.

But the real signal here is deeper. This move tells you that Amazon has looked ahead at the next decade of AI expansion and determined that copper supply is a real constraint. They're not just hoping that traditional mining will scale up enough. They're actively hedging by securing alternative supply sources. If other tech companies wake up to the same problem, we'll probably see Microsoft, Google, and Meta doing similar deals.

In fact, this might be exactly what needs to happen. If a handful of hyperscalers each secure dedicated bioleaching capacity, it could remove pressure from the traditional mining market and allow those suppliers to focus on other applications. It's not a complete solution to the copper shortage, but it's smart resource allocation.

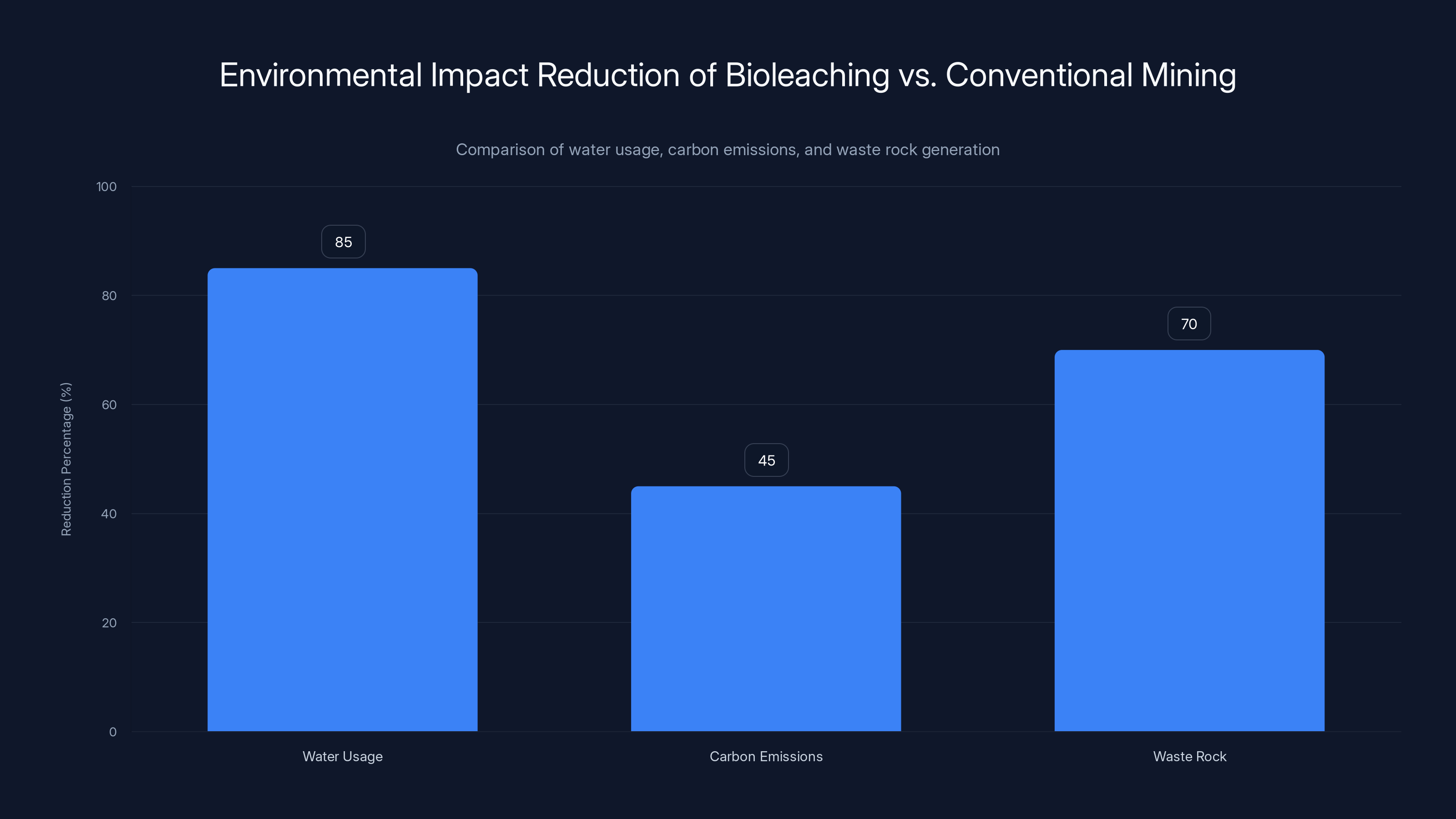

Bioleaching significantly reduces environmental impacts: 80-90% less water usage, 40-50% lower carbon emissions, and much less waste rock compared to conventional mining. Estimated data.

The Environmental Advantage: Water, Carbon, and Waste Reduction

This is where bioleaching really shines compared to conventional mining.

Traditional open-pit copper mining is water-intensive in ways that few people appreciate. A large-scale conventional copper mine requires roughly 500-1,000 gallons of water per ton of ore processed. For a mine producing 200,000 tons of ore daily (which is typical for major operations), you're looking at 100+ million gallons of water per day. That's water that gets polluted with copper, sulfides, and other minerals, requiring expensive treatment before it can be released or reused.

Bioleaching? Drastically different profile. You need water to maintain moisture in the ore and to control bacterial growth, but you're using 80-90% less of it compared to conventional methods. The water that does get used stays cleaner throughout the process because you're not running harsh chemical leaching operations. The waste water is much easier to treat and recycling it back into the process is feasible.

For a mine operating in the Arizona desert, where water is already scarce, this difference is meaningful. Johnson Camp is in Pinal County, Arizona, an area that has faced serious water stress in recent years. The Colorado River allocations keep shrinking. Groundwater is being depleted. Opening a new water-intensive mining operation in that region would face significant environmental and regulatory pushback. But a bioleaching operation? Much more palatable.

The carbon profile is similarly superior. Conventional copper mining requires extensive crushing, milling, and processing of ore, all energy-intensive operations. You're moving massive quantities of material, heating it, chemically processing it, and managing the waste. All of that requires energy, most of which historically came from fossil fuels.

Bioleaching lets the microorganisms do the heavy chemical lifting. You're not running energy-intensive pressure leaching or roasting operations. You're creating conditions where naturally occurring bacteria work for you. The energy requirements are significantly lower.

Estimates suggest that bioleaching produces roughly 40-50% lower CO2 emissions per pound of copper compared to conventional methods. For a company like Amazon that's committed to net-zero operations by 2040, this makes a massive difference when you multiply it across thousands of tons of copper annually.

There's also the waste rock consideration. Traditional mining generates enormous piles of waste rock—the stuff that's removed but doesn't contain enough copper to extract economically. A single large mine might generate billions of tons of waste rock over its lifetime. This waste can leach heavy metals and sulfides into groundwater, creating long-term environmental damage. It also requires perpetual management: the waste piles need to be stabilized, monitored, and potentially remediated.

Bioleaching changes the economics of waste rock. Ore that was previously considered too low-grade to process becomes economically viable. You extract copper from material that would have just been left as waste. This means fewer waste piles, less ongoing environmental liability, and potentially even revegetation of previously barren mine areas.

The ecosystem impact is real. Mining is already one of the most environmentally destructive industries on Earth. Better methods matter.

Why This Timing Matters: The AI Supply Chain Crunch

There's a specific reason why Amazon made this deal now, and it has everything to do with the AI boom's timing.

We're in year two of the GPT era. Chat GPT launched in late 2022. By 2024, enterprise AI adoption was accelerating dramatically. Every major cloud provider—AWS, Azure, Google Cloud—was racing to build out AI infrastructure. Every company was either building or expanding data centers to support AI workloads. The demand curve was (and still is) nearly vertical.

This demand immediately translated to hardware constraints. Nvidia couldn't make GPUs fast enough. AMD's MI300 chips faced similar shortages. But the GPU shortage is temporary. Nvidia and AMD are ramping production. Eventually, GPU supply will normalize.

But the underlying materials? That's a different story. You can't just "ramp production" of copper in six months. Copper is mined from ore that comes from specific geographies. Major deposits are concentrated in a handful of countries: Chile (30% of world production), Peru (10%), China (8%), and then Australia, Russia, and others. Most developing mining projects are facing environmental resistance, funding constraints, or permitting delays.

Meanwhile, demand just keeps accelerating. Every new GPU requires copper in its packaging and circuitry. Every data center cooling system requires thousands of pounds of copper piping. Every networking cable, every power distribution infrastructure, every circuit board—copper, copper, copper.

Amazon ran the numbers and probably found something like this: "If AI compute demand keeps growing at current rates, and if copper supply can't scale accordingly, we're going to have a constraint by 2026 or 2027." That's not acceptable for a company betting its future on being the leading cloud AI provider.

So they looked for alternative sources. Bioleaching at Johnson Camp became viable specifically because the technology had matured enough, the location was suitable, and the timeline could support it.

It's worth noting that this is a defensive move. Amazon isn't trying to corner the copper market or become a major producer. They just want to ensure their own supply. They're doing what every major manufacturing company does when facing input constraints: securing dedicated supply sources.

This might be the beginning of a broader pattern. Other hyperscalers might make similar deals with bioleaching operations, or with emerging battery recycling companies that recover copper from old electronics, or with other alternative supply chains. The goal is to de-risk the AI expansion against material constraints.

Bioleaching significantly reduces water usage by 80-90% and lowers carbon emissions compared to conventional copper mining. Estimated data based on typical reductions.

How Bioleaching Actually Works at Scale

Understanding the technical process helps explain why this is actually quite brilliant.

At Johnson Camp, the operation probably works something like this: dump low-grade copper ore into a massive pile. The ore contains minerals like chalcocite, chalcopyrite, or other copper sulfides, but in concentrations too low for traditional mining economics. Expose the pile to native soil and water containing the bacteria that naturally occur in mining environments.

The bacteria start reproducing. They oxidize iron and sulfur compounds as part of their metabolic process, producing sulfuric acid. This acid dissolves copper minerals out of the solid rock, which sounds simple but is genuinely clever chemistry. The acid basically eats away at the copper-bearing minerals, leaving the copper in solution.

This process can take weeks or months, depending on conditions. The ore pile is essentially a giant bioreactor. Workers monitor copper concentration in drainage water leaving the pile. Once it reaches a certain threshold, they stop adding ore to that pile and start the copper recovery process.

Recovery is where traditional chemistry takes over. You've got water containing dissolved copper ions. You need to get pure copper metal from that. This is done through solvent extraction and electrowinning, similar to what's used in traditional mining. But the scales are different because the input is already pre-processed by the biological step.

Solvent extraction uses organic chemicals to selectively bind copper ions from the water. You mix the water with the solvent, the copper binds to it, and you separate the organic phase from the aqueous phase. This concentrates the copper in a smaller volume. Then electrowinning—applying electrical current to force copper metal to precipitate out—produces copper cathodes that meet industrial purity standards.

The result is pure copper metal that meets the same specifications as copper from traditional mining. It works in the same circuits, the same power systems, the same equipment. From a functionality perspective, it's identical.

This is important because it means you don't need customers to change anything. Copper is copper. AWS's systems don't care where the copper came from.

The Scalability Question: Can Bioleaching Meet Global Demand?

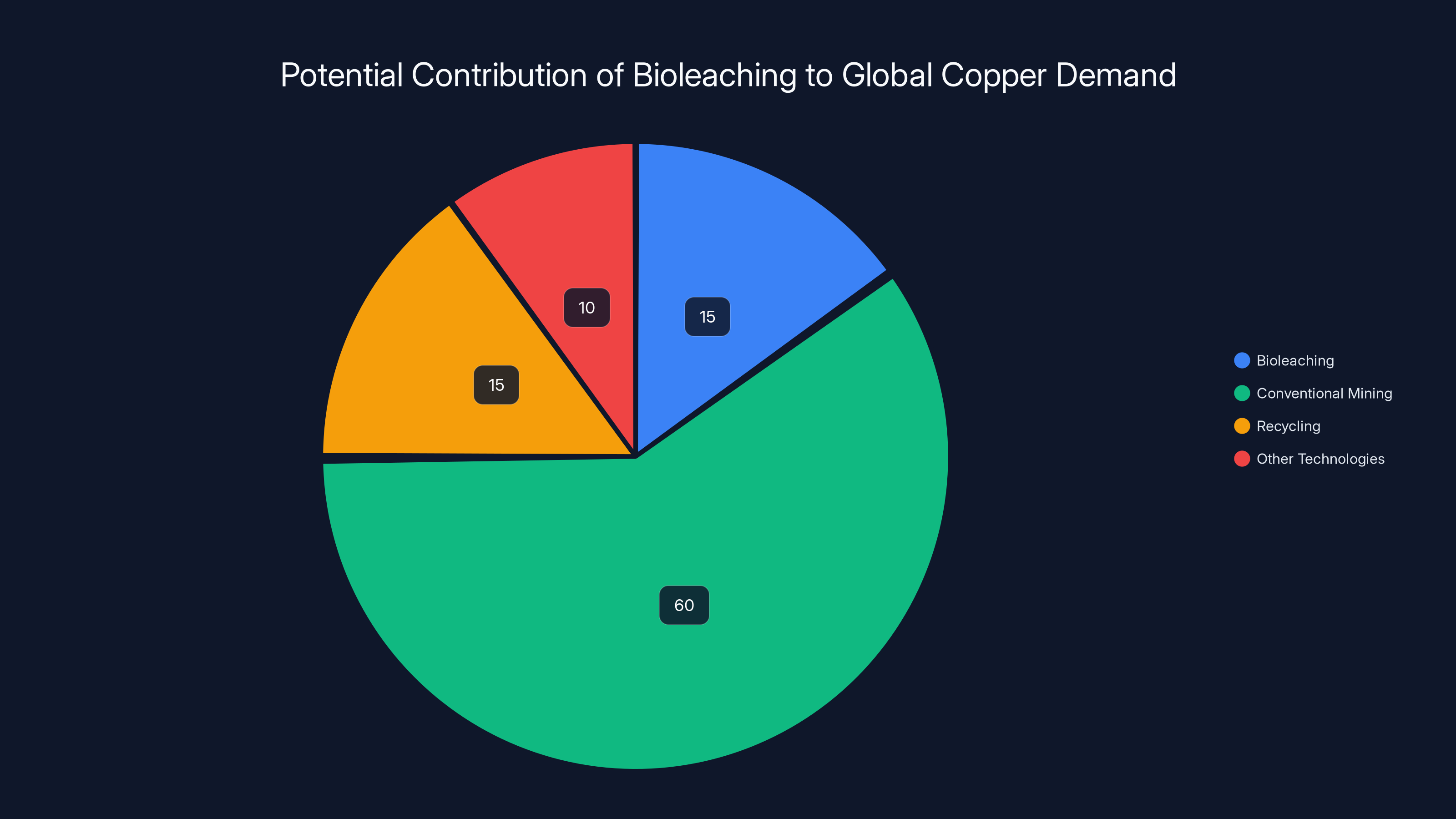

Here's the honest assessment: probably not as the only solution, but as one important part of the portfolio, absolutely.

Bioleaching has limitations. The process is slower than conventional mining, so throughput depends on ore characteristics and environmental conditions. Not all copper deposits are suitable for bioleaching—you need certain ore types and deposit geometries. The process also depends on reliable microorganisms, which means you need the right climate and geological conditions.

But there are literally hundreds of abandoned copper mines around the world. Many of them still contain significant copper reserves that were left behind because extraction wasn't economical at the time. If bioleaching can reactivate even 50 of these sites globally, that's massive capacity.

Chile has abandoned copper mines that could potentially be bioleached. So does Peru. Australia. Even in the United States, there are old copper mines that could be reopened with this technology. The engineering and microbiological challenges are solved. The remaining question is just: which sites make sense economically?

I'd estimate that bioleaching could realistically supply 10-20% of global copper demand within the next decade if companies actively pursue it. That's not a solution to the entire shortage, but it's meaningful. And it buys time for conventional mining to catch up, for recycling infrastructure to scale, and for copper-saving technologies to deploy more widely.

It also creates price pressure on conventional mining. If bioleaching becomes a reliable, lower-cost source, traditional mines need to become more efficient to compete. That's good for market dynamics.

Bioleaching technology is expected to see significant adoption growth by 2026, driven by its environmental benefits and economic viability. (Estimated data)

Supply Chain Implications: Why Tech Companies Are Now Mining Investors

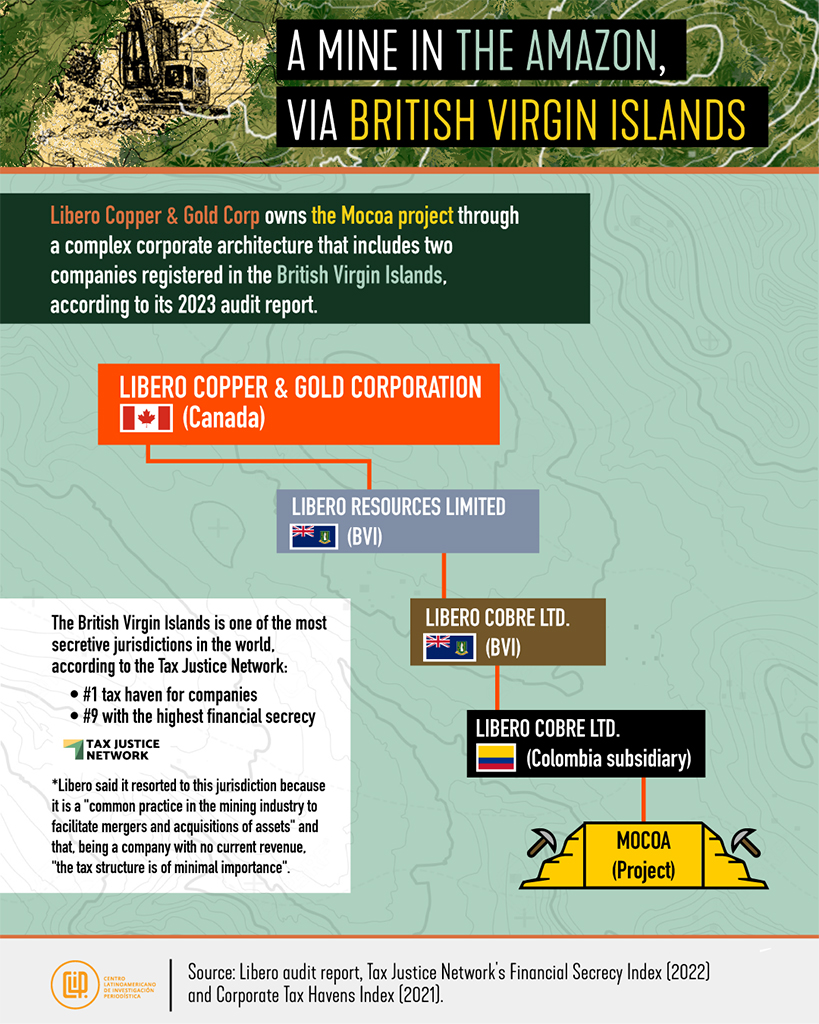

This deal also signals a major shift in how tech companies think about supply chains.

Traditionally, tech companies buy materials from suppliers. They didn't think about the extraction or production process much. They just specified what they needed and paid for it. Copper, silicon, rare earths, whatever—that was someone else's problem.

But critical material shortages have changed the calculation. When your business depends on certain inputs and supply is constrained, you start getting involved in ensuring supply.

Amazon's move fits into a broader trend. Tesla invested heavily in battery recycling because it needs lithium and cobalt. TSMC is building plants in Arizona because Taiwan faces geopolitical risks. Apple is investing in rare earth refining because it worries about China supply dependencies. Every major tech company is now thinking: "What materials do we absolutely need, and how can we secure them?"

Bioleaching is perfect for this because it requires relatively modest capital investment compared to conventional mining. You don't need enormous capital equipment, you don't need massive crushing and milling infrastructure, and you can often reuse existing mine facilities. The barriers to entry are lower than traditional mining.

It also creates partnership opportunities. Amazon doesn't need to own mines. It just needs to partner with companies that do and that have the technical expertise. AWS provides cloud computing and data analytics, Nuton provides mining expertise and operational execution, and both benefit.

This model is likely to replicate. We'll probably see more hyperscalers making similar deals with bioleaching operations, battery recycling companies, and other alternative supply sources. It's not about controlling the market, it's about risk management.

The Regulatory and Environmental Approval Pathway

One question that immediately comes up: isn't mining heavily regulated? How did this get approved?

The answer is nuanced. Mining is heavily regulated, but bioleaching, being less environmentally damaging than conventional mining, often gets more favorable treatment.

Arizona has environmental regulations governing mining, water use, and waste management. Bioleaching facilities still need to comply with all of these. But because the environmental footprint is smaller, the regulatory burden is lower. There's less waste rock to manage, less water to treat, lower carbon emissions to account for.

For a state like Arizona that wants mining economic activity but also cares about environmental impact, bioleaching is genuinely a better option. It's not perfect, but it's demonstrably superior to open-pit mining.

The EPA doesn't distinguish between copper from conventional mining and bioleaching—the output is the same, so the regulations are the same. But the input side of the equation (water use, waste generation, energy consumption) gets scrutinized, and bioleaching wins those comparisons.

Water use is probably the most important regulatory factor in Arizona. The Colorado River Compact limits how much water Arizona can use. Water is precious. Any new industrial operation needs to justify its water use carefully. Bioleaching's 80-90% lower water requirement is a major advantage in the permitting process.

This probably explains why Johnson Camp specifically was chosen and why Amazon was willing to make this deal. The site has existing infrastructure (so less environmental impact), it's in Arizona where water efficiency matters, and the technical approach (bioleaching) aligns with environmental values.

Regulatory approval won't be a blocker for scaling bioleaching. If anything, environmental regulations are more likely to encourage it.

Bioleaching could supply an estimated 10-20% of global copper demand within the next decade, providing significant capacity and market pressure on conventional mining. Estimated data.

Competitive Dynamics: Will Others Follow?

Amazon is first, but they almost certainly won't be last.

Microsoft has its own data center expansion plans and faces the same copper constraints. Google's AI infrastructure growth is equally aggressive. Meta's Llama model training requires enormous GPU capacity. All of them need copper. All of them will start thinking about supply security.

The interesting question is whether companies will partner with existing bioleaching operations (like Amazon/Nuton) or whether they'll develop their own. Partnering is faster and requires less capital. Going solo means more control but also more risk and complexity.

I'd guess we see a mix. Some companies partner. Some invest in existing bioleaching companies. Maybe one tries to build its own. Within 2-3 years, we'll probably know if other hyperscalers have made similar deals.

This could also attract other investment capital to the bioleaching space. Venture firms might start looking at this as an opportunity. Climate tech investors see it as lowering environmental impact of mining. Mining companies see it as a way to reopen unprofitable sites. From multiple directions, there's incentive to develop and scale the technology.

The other factor is competition from recycling. As electronics accumulate, recycled copper becomes an increasingly important source. Companies are investing in battery recycling, e-waste processing, and other recovery methods. Over time, recycled copper could supply a meaningful percentage of demand.

Bioleaching plus recycling plus continued conventional mining growth could actually address the copper constraint without requiring entirely new mine development. That's a much more realistic scenario for global supply than hoping conventional mining alone scales fast enough.

Technical Challenges and Remaining Uncertainties

Let me be honest about what we don't know.

Bioleaching has been proven at small and medium scales. Nuton producing its first copper cathode in December 2024 is significant, but it's not the same as operating at full commercial scale continuously. Real-world mining conditions are messier than controlled experiments.

Weather affects the process. Unexpected ore geology affects the process. Bacterial populations can crash or mutate. Contamination happens. Real operational mining will likely encounter problems that didn't show up in pilots.

The timeline from where Nuton is now to producing meaningful volumes for Amazon over a 24-month agreement is tight. They need to solve scaling problems, production consistency, and product specification issues all while ramping production. That's ambitious.

There are also downstream process uncertainties. The solvent extraction and electrowinning steps are mature, proven technologies. But optimizing them for bioleaching feedstock might reveal unexpected issues. Maybe the copper solution has trace elements that interfere with cathode production. Maybe flow rates are incompatible with existing equipment. These are engineering problems, not showstoppers, but they take time to solve.

From an environmental perspective, there are also questions about long-term management of bioleached ore piles. Once you extract the copper, you're left with processed ore that still contains other minerals. How does this material behave in the environment over decades? What's its acid potential? How does it weather and leach over time? These are questions that conventional mining has 100+ years of experience with. Bioleaching is newer, so there's less data.

None of this suggests bioleaching won't work. But there are legitimate uncertainties that will only resolve through operational experience.

The Bigger Picture: Material Constraints in the AI Era

Copper is just one example. Look at the supply chains for any technology-critical metal or mineral, and you find similar stories.

Lithium for batteries is becoming constrained. Cobalt (for electronics) supply is geopolitically concentrated. Rare earths (for permanent magnets used in efficiency motors) depend almost entirely on China. Tungsten, tantalum, tin—the list goes on.

The AI boom accelerates all of these constraints. Every GPU needs rare earth magnets. Every data center needs copper and aluminum. Every cooling system needs specialized materials. As demand explodes, supply pressures mount.

The companies that win in the AI era won't just be the ones with the best algorithms and the most GPUs. They'll also be the ones that successfully secure critical material supplies. That might mean investing in mining companies, backing new extraction technologies, building recycling infrastructure, or finding substitutes for scarce materials.

Amazon's bioleaching deal is early in what's likely to be a broader pattern. Tech companies will increasingly take direct action to secure material supply. This is a healthy development because it creates incentives for innovation in extraction technology, recycling, and resource efficiency.

The pessimistic view says material constraints will limit AI growth. The optimistic view says constraints will drive innovation in supply. History suggests the optimistic view is usually right.

Key Takeaways and What Comes Next

Let's wrap up what this really means.

Amazon's commitment to buying copper from a bioleaching operation at Johnson Camp is significant not because it's huge in absolute terms, but because it signals future direction. It says that material supply is part of the strategy for operating at hyperscale in the AI era.

Bioleaching technology is genuinely promising. It's not vaporware or overhyped. It works. It produces real copper that meets real specifications. It uses less water, produces less waste, and generates fewer emissions than conventional mining. The engineering challenges are solvable. The economics are getting better as copper prices stay elevated and bioleaching efficiency improves.

The timeline is important. We're not talking about 2040. We're talking about 2025-2026. Nuton is producing copper now. Amazon is committing to buying it over the next two years. This is happening in real time, not theoretical future scenario.

For the broader industry, the implication is clear: secure your material supply chains now. Companies that start building relationships with alternative supply sources and novel extraction technologies will have advantages over companies that assume traditional mining can scale fast enough.

For climate and environment advocates, there's genuine good news here. Bioleaching demonstrably reduces environmental damage compared to conventional mining. If it scales, it means less water pollution, fewer waste rocks, lower carbon emissions. That's not speculation—it's how the chemistry and physics work.

For investors and entrepreneurs, there's opportunity. The mining tech space is full of hard problems that constrain global supply. Solutions that increase supply while reducing environmental impact will attract capital and find customers. Bioleaching is one example. Recycling infrastructure is another. Substitute materials are a third. There's money and impact in all of these directions.

The next 18-24 months will be telling. If Nuton successfully delivers copper to Amazon on schedule, and if other companies start announcing similar deals, then we'll know bioleaching has moved from promising pilot to industrial reality. If production stalls or encounters major technical obstacles, we'll have learned something about the limitations.

Either way, we're watching the early stages of how the AI boom trickling down into material supply chains. It's less exciting than talking about GPUs and inference speeds, but it might matter more for whether the AI expansion actually sustains.

FAQ

What is bioleaching and how is it different from conventional copper mining?

Bioleaching is a process where naturally occurring microorganisms extract copper from low-grade ore by producing sulfuric acid that dissolves copper minerals. Unlike conventional mining, which requires energy-intensive crushing, milling, and chemical processing, bioleaching lets bacteria do the chemical work. This uses 80-90% less water, produces 40-50% fewer carbon emissions, and generates significantly less waste rock than traditional methods.

Why is Amazon interested in this specific technology?

Amazon Web Services is ramping massive data center expansion to support AI growth, which requires enormous quantities of copper. With global copper demand accelerating faster than traditional mining can scale supply, AWS secured a dedicated source by partnering with Nuton Technologies. The deal also lets AWS provide cloud analytics to optimize Nuton's extraction process, creating a win-win partnership that benefits both companies.

Can bioleaching scale to meet global copper demand?

Bioleaching probably can't be the sole solution, but it can realistically supply 10-20% of global copper demand within a decade. There are hundreds of abandoned copper mines worldwide that could be reopened with bioleaching. The technology works best with certain ore types and locations, but there's enough suitable capacity globally to make a meaningful contribution alongside conventional mining and recycling.

What are the environmental benefits of bioleaching?

Bioleaching dramatically reduces the environmental footprint of mining compared to conventional methods. It requires 80-90% less water, produces 40-50% lower carbon emissions, generates far less waste rock requiring perpetual management, and creates significantly lower risk of acidic mine drainage that can persist for decades after mine closure. For water-stressed regions like Arizona, these differences are substantial.

How does Nuton make pure copper from bioleaching?

Bioleaching dissolves copper from ore into solution, but the copper needs additional processing to achieve industrial purity. Nuton uses solvent extraction to concentrate the copper from the water, then electrowinning (applying electrical current) to precipitate pure copper metal into cathode form. This final copper meets the same specifications as copper from traditional mining.

Will other tech companies make similar bioleaching deals?

Microsoft, Google, and Meta face identical copper supply constraints and will likely pursue similar strategies. Some companies will partner with existing bioleaching operations like Amazon did. Others might invest in new bioleaching ventures. Within 2-3 years, we should see whether this becomes an industry-wide pattern or remains limited to Amazon and a few others.

What are the remaining technical challenges for bioleaching?

While bioleaching is proven in pilots, scaling to continuous commercial production at Nuton's planned volumes presents real challenges. Bacterial populations must remain stable, contamination must be prevented, ore geology variations must be managed, and downstream processing must integrate seamlessly. The 24-month timeline for Amazon's first deliveries is ambitious and will likely surface problems that require engineering solutions.

How does bioleaching affect the environment of abandoned mine sites over decades?

This is an area where long-term data is limited since bioleaching is newer than conventional mining. After copper extraction, processed ore piles remain and could potentially leach other minerals into groundwater over time. However, because bioleaching removes copper more completely than conventional methods, the remaining ore chemistry is different and potentially less problematic. More operational experience is needed to fully understand long-term environmental outcomes.

Conclusion: A Practical Pathway Forward

When you zoom out from the specifics of bacterial extraction chemistry and regulatory approval processes, what Amazon's deal really represents is pragmatism meeting innovation.

The AI boom isn't slowing down. Compute demand will keep accelerating. Data centers will keep expanding. That's a given. The constraint isn't algorithmic anymore, it's material and physical infrastructure.

Smart companies recognize this and take action. Amazon looked at the copper shortage problem, found an emerging technology that could help solve it, and made a strategic partnership. It's not a complete solution to global copper constraints, but it's smart hedging. It reduces risk. It signals to suppliers and partners that Amazon takes long-term resource security seriously.

This is probably a template for the next few years. We'll see more announcements of tech companies securing dedicated supply sources for critical materials. Some will involve bioleaching. Others will involve recycling, mining in new geographies, or developing substitute materials. The common thread will be: major technology companies taking direct action to secure the physical inputs their business depends on.

For entrepreneurs and investors, this is interesting because it means billions of dollars flowing into materials science, extraction technology, and supply chain innovation. The problems are real, the customer base is powerful (hyperscalers with essentially unlimited budgets), and solutions create genuine value.

For environmental advocates, the opportunity is to ensure that solutions like bioleaching actually deliver environmental benefits and don't just move problems around. Oversight and transparency matter. But if implemented well, these technologies can genuinely reduce the environmental damage from meeting global material demand.

For the mining industry itself, this is disruption. Traditional open-pit mining is getting competition from novel extraction methods. The companies that adapt—by investing in technologies like bioleaching, by partnering with innovators, by improving efficiency—will thrive. The ones that don't will find their market share shrinking.

The story isn't finished. We're watching it unfold in real time. Nuton is producing copper. Amazon is buying it. Scale and competition will determine whether this becomes the future of mining or remains a niche solution.

But one thing is certain: the AI boom isn't just changing software, algorithms, and digital infrastructure. It's reaching down into the Earth itself, changing how we extract the physical materials that enable that technology.

That's worth paying attention to.

Related Articles

- Prebiotics for Copper Mines: How One Startup is Solving a Critical Shortage [2025]

- Microsoft's Community-First Data Centers: Who Really Pays for AI Infrastructure [2025]

- Probiotics for Mining: How Microbes Could Solve the Copper Shortage [2025]

- Trump's 25% Advanced Chip Tariff: Impact on Tech Giants and AI [2025]

- Wikipedia's Enterprise Access Program: How Tech Giants Pay for AI Training Data [2025]

- Meta Compute: The AI Infrastructure Strategy Reshaping Gigawatt-Scale Operations [2025]

![Amazon's Bacterial Copper Mining Deal: What It Means for Data Centers [2025]](https://tryrunable.com/blog/amazon-s-bacterial-copper-mining-deal-what-it-means-for-data/image-1-1768502300862.jpg)