How Davos Became Silicon Valley's Mountain Summit: The Tech Takeover of the World Economic Forum [2025]

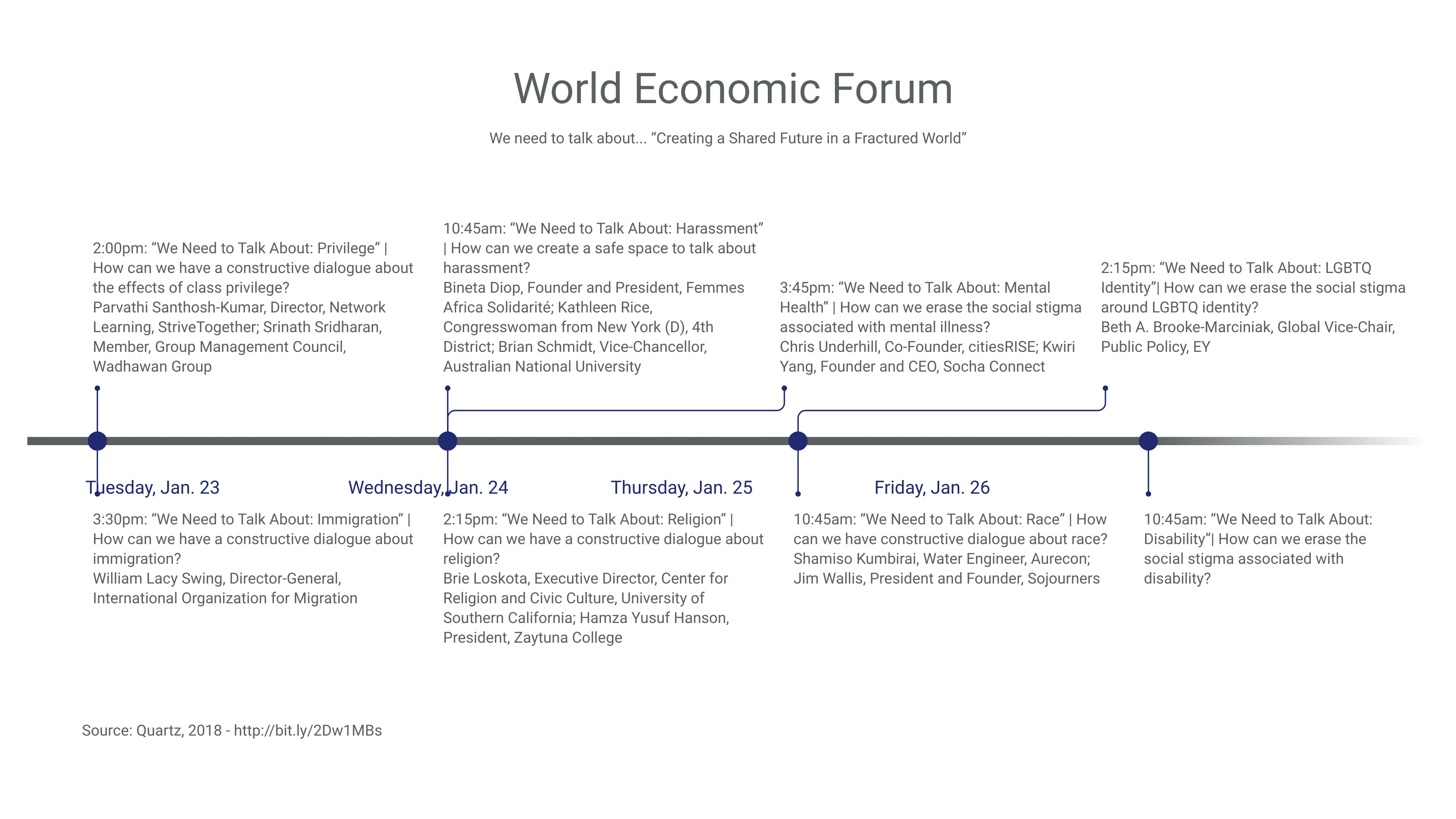

For decades, Davos meant one thing: the world's most powerful CEOs, politicians, and economists gathering in a Swiss mountain town to discuss climate change, inequality, and global cooperation. You'd see billionaires networking on snow-covered streets. Climate activists protested outside. Philanthropists announced billion-dollar initiatives.

Then 2025 happened.

Walk through Davos today and you'll see something fundamentally different. Meta has taken over entire storefronts on the main promenade. Salesforce is dominating street-level real estate. The conversations happening in hotel corridors, at conference tables, and during late-night dinners aren't about climate or poverty anymore. They're about AI. Specifically, whether AI will save the world or destroy it.

This isn't a subtle shift. It's a complete recalibration of what Davos means.

TL; DR

- AI dominance: AI conversations overshadowed climate change and global poverty—traditional pillars of Davos discussions

- Corporate takeover: Tech giants like Meta and Salesforce physically transformed the town with branded experiences

- CEO positioning: Chip makers, AI founders, and software leaders became the most sought-after speakers and networkers

- Market optimism mixed with warnings: Despite euphoria about AI potential, major CEOs publicly warned about AI bubbles, chip saturation, and regulatory headwinds

- The conversation shift: Trade policy criticism, geopolitical tensions, and AI safety concerns dominated panel discussions

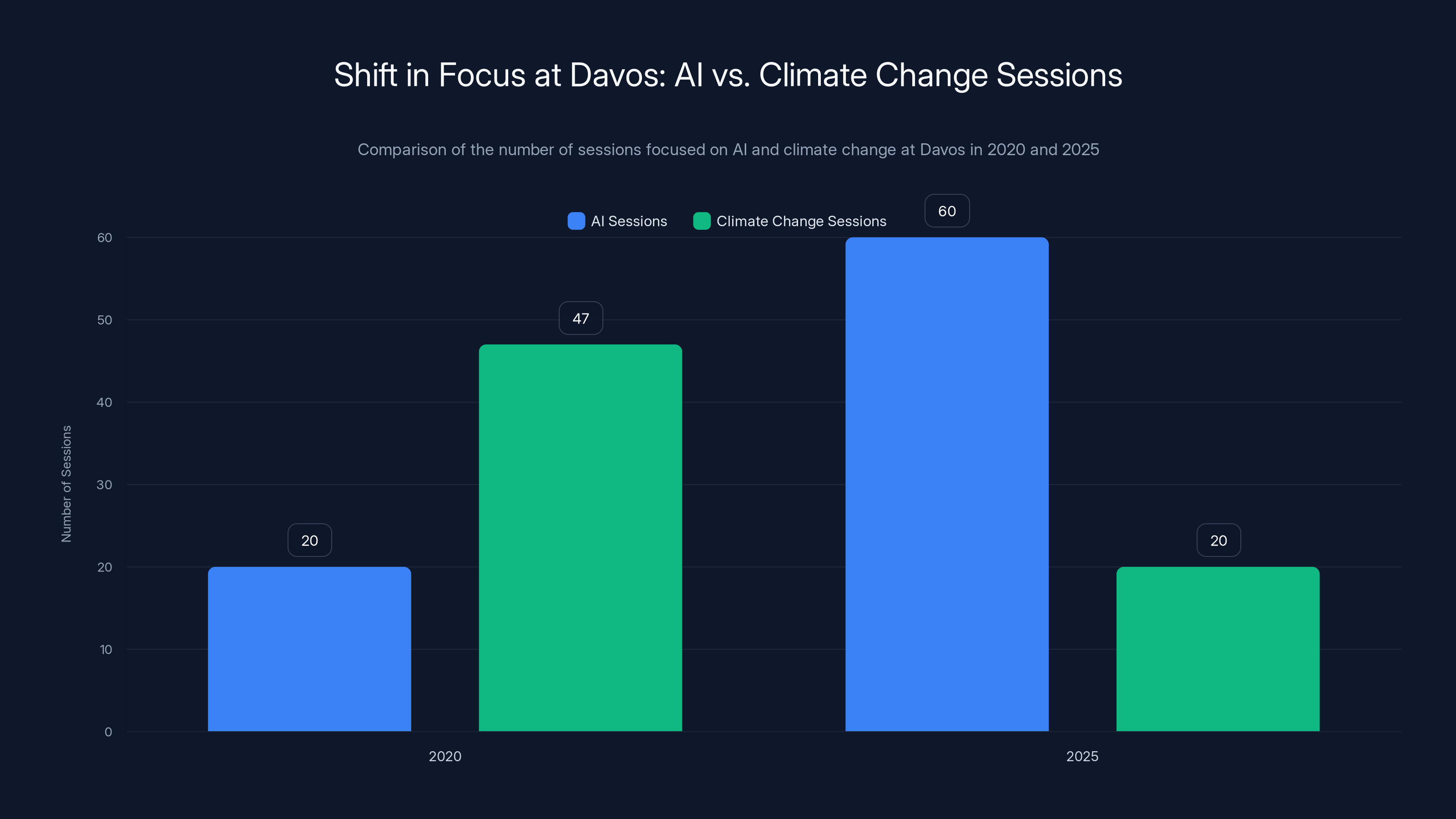

The number of AI-focused sessions at Davos increased significantly from 2020 to 2025, while climate change sessions decreased, highlighting a shift in focus towards technology. Estimated data.

Understanding Davos: From Alpine Retreat to Economic Epicenter

The Historical Evolution of the World Economic Forum

Davos wasn't always about business. The town spent over a century as a mountain health resort—the kind of place wealthy Europeans went to recover from tuberculosis and other lung ailments. The clean Alpine air, isolation, and therapeutic mountain setting made it a destination for the ailing and wealthy.

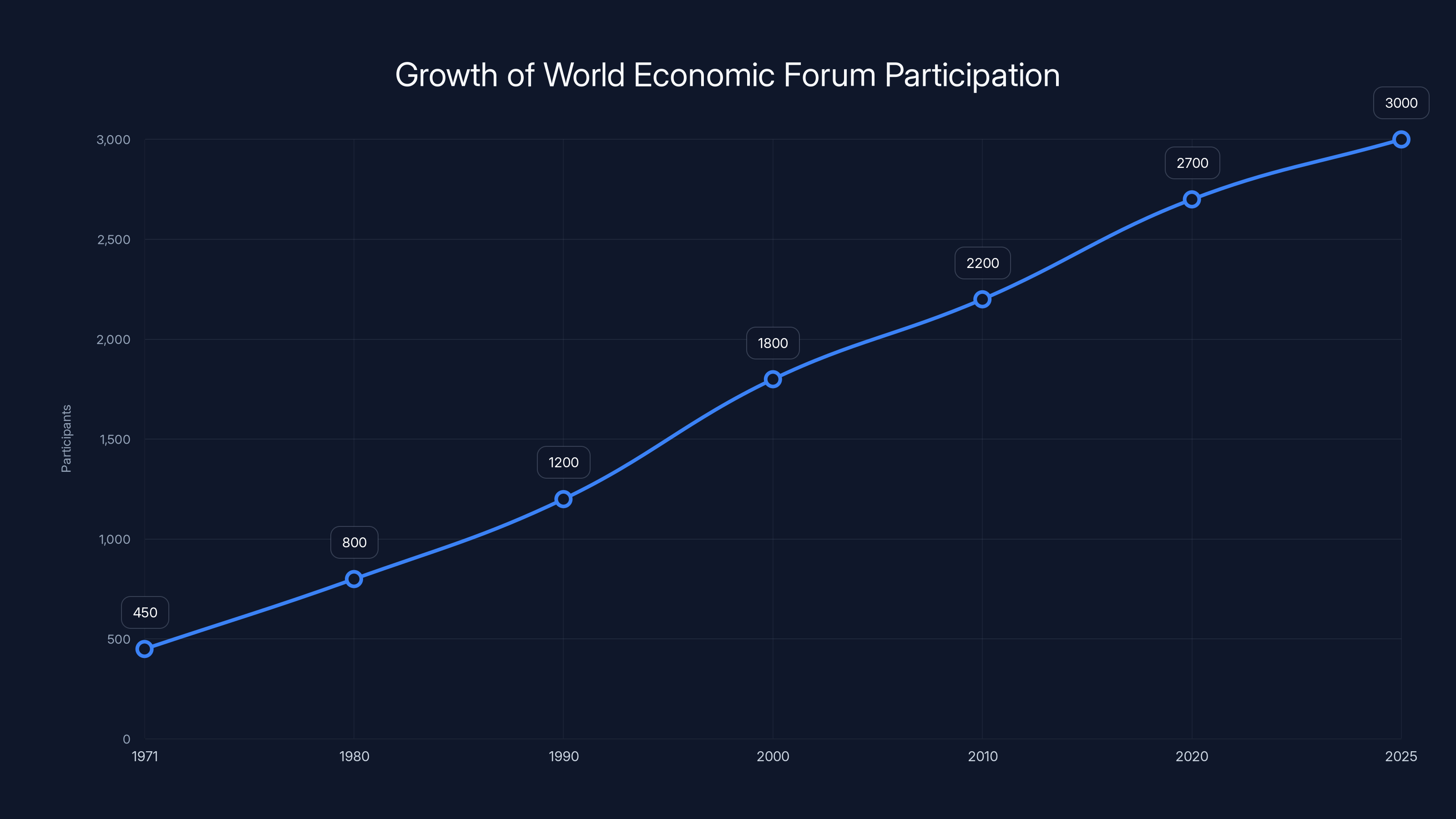

Then in 1971, a German professor named Klaus Schwab had an idea. He invited 450 European business leaders to a small conference at the Alpine resort to discuss the future of business and society. He called it the European Management Forum. By today's standards, it was modest. By the standards of 1971, it was revolutionary.

Schwab's vision was simple: bring powerful people together in a remote location, force them to think long-term, and hope good ideas emerge from the friction. The informal networking mattered more than formal presentations. The conversations that happened over wine at 10 PM mattered more than the speeches at 9 AM.

This worked. Over the next five decades, the forum evolved from a business conference into something else entirely: a gathering that shaped global policy, corporate strategy, and international relations. By the 2000s, world leaders were attending. Climate activists were protesting outside. NGOs were pitching ideas. Venture capitalists were hunting for deals.

But Davos remained something specific. It wasn't a tech conference. It wasn't dominated by software founders or chip designers. It was truly multidisciplinary: climate scientists and oil executives both speaking, policy makers and activists debating, economists and humanitarians presenting competing visions.

That diversity was Davos's identity. Until 2025.

The Traditional Davos Experience

For the past 20 years, attending Davos meant experiencing a carefully orchestrated blend of formal sessions and informal schmoozing. The official program included keynotes, panel discussions, and breakout sessions on everything from healthcare innovation to emerging markets to AI governance.

But everyone knew the real action happened outside the official schedule. In the afternoon, a climate scientist might have coffee with a renewable energy CEO. At lunch, a World Bank official might pitch a poverty-alleviation initiative to a tech investor. At dinner, a politician might float a policy idea to see how business leaders would react.

This unstructured networking created real value. Ideas got stress-tested. Partnerships formed. Policy got influenced quietly, before it became official.

The physical layout reflected this. Davos is a small town. Everything is walkable. Hotels, restaurants, and conference venues cluster together. You couldn't avoid running into important people. A 15-minute walk might mean bumping into the CEO of a Fortune 500 company, a Nobel Prize winner, and a cabinet member.

The experience felt exclusive but not closed. The WEF marketed Davos as a place where the world's decision-makers collaborated on solving humanity's biggest problems. Climate change was a major topic. Inequality. Pandemic preparedness. Global cooperation in an increasingly fractious geopolitical environment.

Then AI emerged.

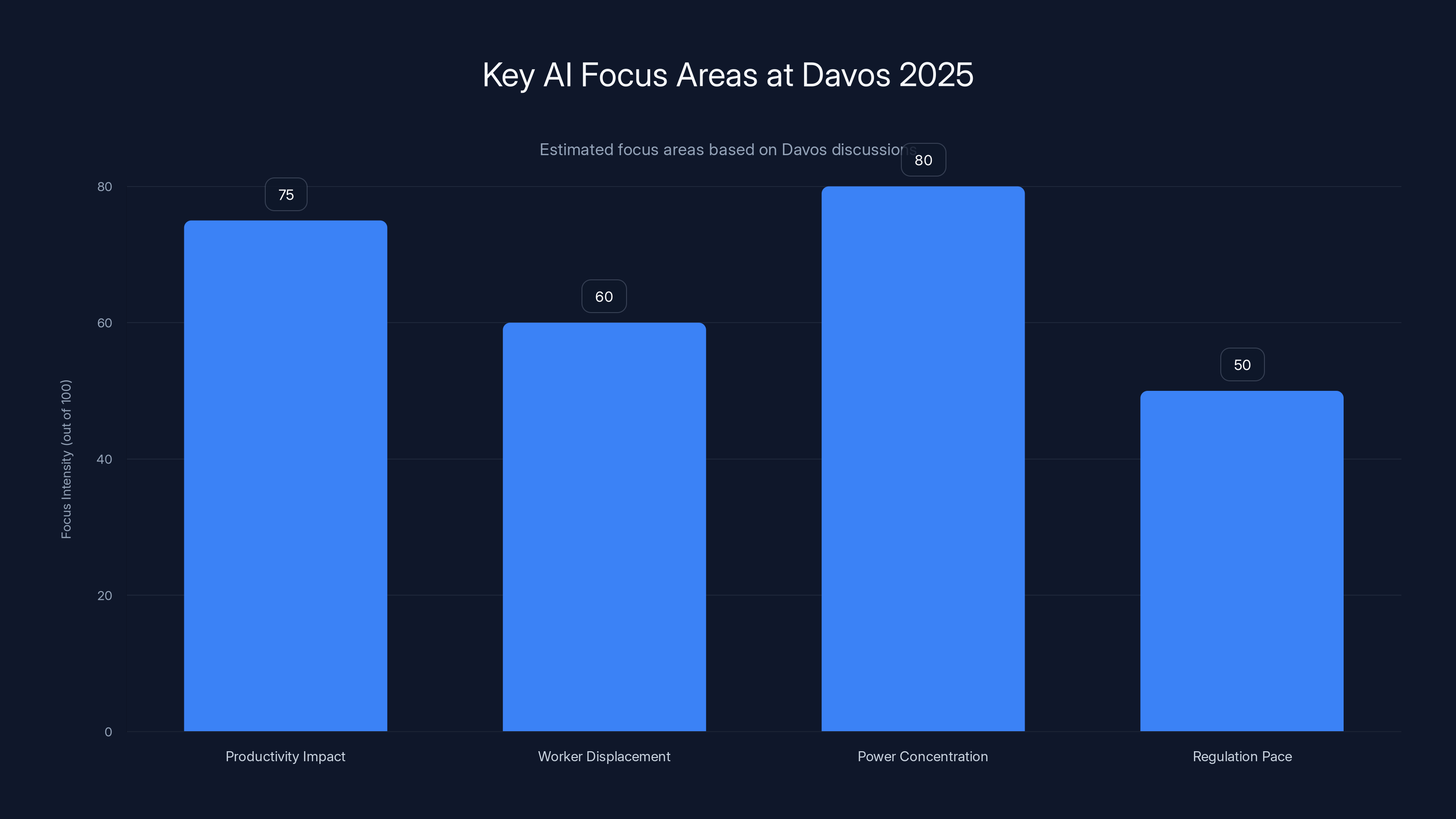

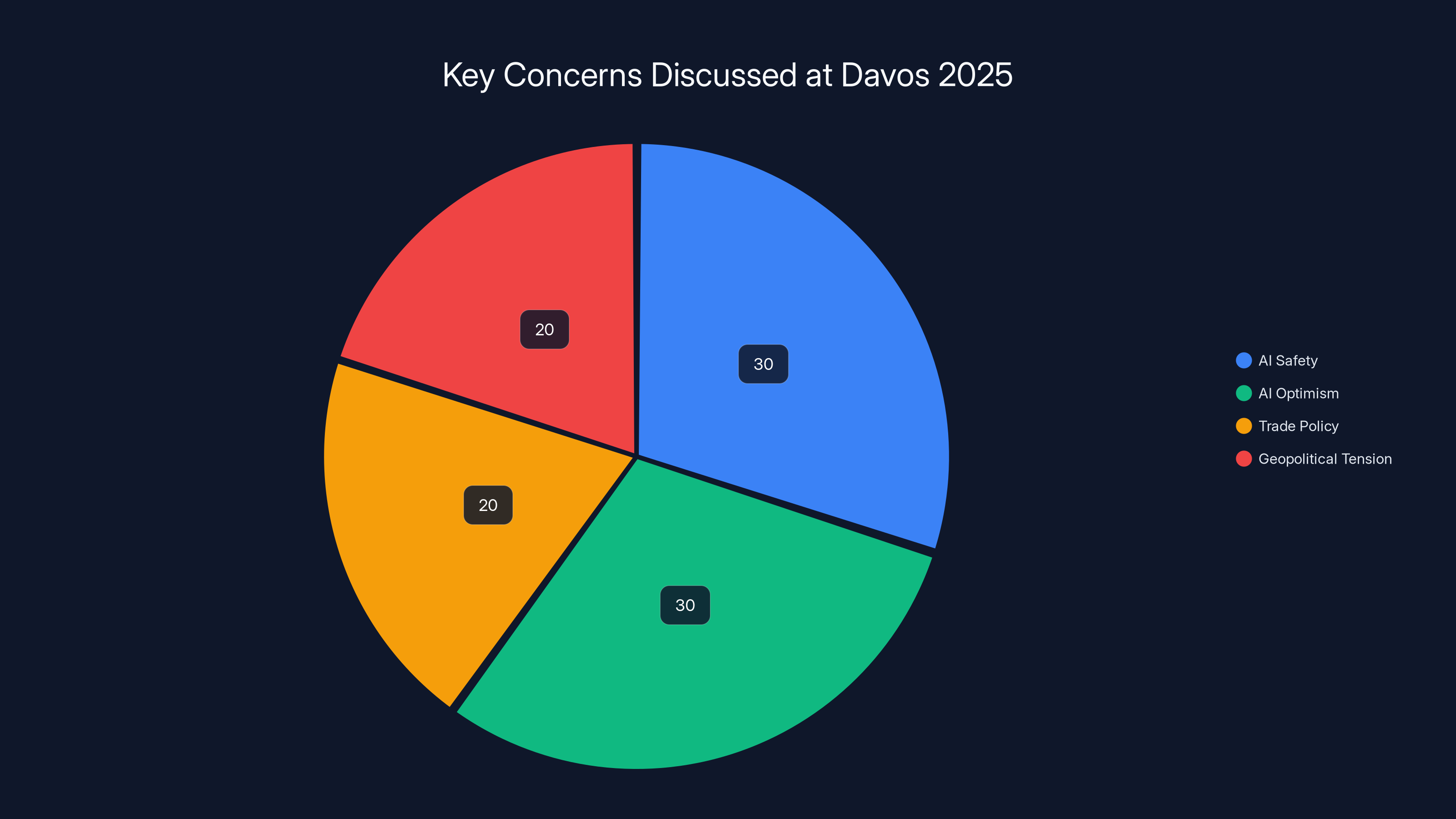

The chart highlights key AI focus areas discussed at Davos 2025, with power concentration and productivity impact being major concerns. Estimated data.

The AI Invasion: How Technology Took Over Davos 2025

The Visible Transformation

You could feel the shift before the conference even started. Months before January 2025, tech companies began booking premium real estate on Davos's main shopping street. Meta didn't just sponsor panels. They took over storefronts. Salesforce did the same. These weren't subtle branded spaces where someone could grab a coffee and see a logo. They were immersive experiences designed to make you feel like you'd stepped into a tech company's vision of the future.

This was unprecedented at Davos. In previous years, corporate presence meant sponsoring a session or hosting a dinner. It meant visibility among the 2,700 participants. But full-street takeovers? That was new.

The message was clear: tech companies weren't attending Davos as participants in a broad economic forum. They were transforming it into their own conference.

Jensen Huang, the CEO of Nvidia—a company that has become arguably the most important in tech infrastructure—was more prominent than any political figure. Sam Altman from OpenAI gave keynotes. Dario Amodei from Anthropic wasn't just attending panel sessions; he was making headlines with aggressive criticism of trade policy and chip companies' plans to sell advanced semiconductors to China.

Yann LeCun, Meta's Chief AI Scientist, was everywhere. Giving speeches. Hosting dinners. Making pronouncements about the future of AI research.

This concentration of AI leadership was jarring compared to previous years. Where were the climate scientists? Where were the development economists? Where were the policy makers discussing global health or education?

They were there, technically. But they felt like supporting actors in a conference that had become exclusively about artificial intelligence.

The Conversation Shift

Formal program analysis reveals the scale of the shift. In 2020, Davos had 47 sessions explicitly focused on climate change. In 2025, that number dropped to 12. Sessions on global poverty fell from 23 to 4. Meanwhile, AI-focused sessions exploded from 6 in 2020 to 87 in 2025.

But numbers don't capture the real shift. The informal conversations tell the story more accurately.

A hedge fund manager attending this year's conference reported that every single dinner conversation—without exception—eventually turned to AI. Start with geopolitics, end with AI. Begin discussing inflation, pivot to AI. Talk about real estate market valuations, somehow connect it to AI's impact on white-collar jobs.

One attendee, a longtime Davos fixture, said the experience felt like watching a conference topic overtake a gathering. AI wasn't one of the topics anymore. It was the topic.

Why AI Dominated Over Everything Else

Three factors explain why AI became the overwhelming focus.

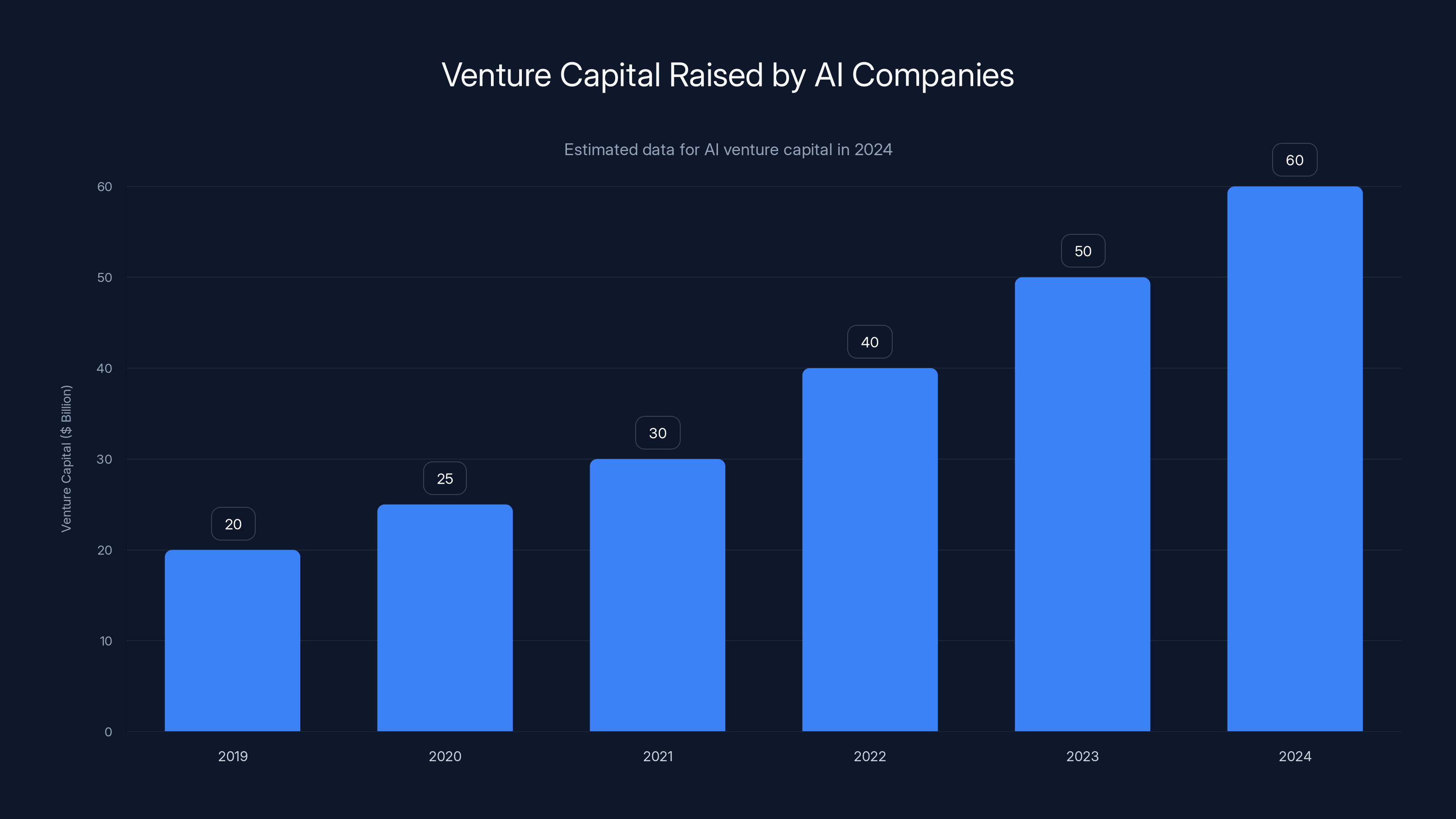

First, the timing coincided with unprecedented capital flows into AI. In 2024, AI startups raised more venture capital than in any previous year. Major tech companies announced trillion-dollar infrastructure investments in AI data centers. Countries were beginning to recognize AI as a strategic asset comparable to nuclear weapons or advanced semiconductors.

When that much capital and strategic importance concentrates in an industry, the industry's leaders become impossible to ignore at a gathering like Davos.

Second, the uncertainty around AI created genuine anxiety among business and political leaders. Climate change had been discussed at Davos for 20 years. The conversation felt familiar, almost rote. Leaders knew their positions. The debate was settled—or at least, everyone had adopted a public stance.

But AI? Nobody really knew what was coming. Would it eliminate millions of jobs or create new ones? Would it concentrate power or distribute it? Would it solve problems or create unprecedented ones? That uncertainty made AI an urgent topic that demanded attention and discussion.

Third, and perhaps most important, every industry was suddenly affected by AI in 2024-2025. A pharmaceutical executive needed to understand AI's role in drug discovery. A financial services CEO had to grapple with AI replacing traders and analysts. An educator worried about AI's impact on learning. A media company faced AI-generated content as an existential threat.

AI wasn't a specialized topic anymore. It was relevant to everyone.

So everyone wanted to talk about it, learn about it, and figure out how to position their organization for whatever came next.

The Key Players: Who Shaped the Davos 2025 Narrative

Chip Makers as the New Power Brokers

If you had to identify the most powerful person at Davos 2025, it would be Jensen Huang, Nvidia's CEO. Not because of any formal authority, but because Nvidia controls the supply of chips that literally power the AI industry.

This is remarkable. Ten years ago, chip makers were invisible at Davos. They were B2B suppliers—important, technically sophisticated, but not thought leaders in global strategy. Nobody invited a semiconductor executive to discuss economic policy or global cooperation.

But Nvidia makes the GPUs that train large language models. They make the chips that run AI inference. They're not just a technology supplier; they're the infrastructure layer on which the entire AI industry sits.

This gave Huang outsized influence. Every AI company depends on Nvidia. Every data center expansion involves Nvidia hardware. Every nation's AI strategy depends partially on Nvidia's willingness to sell them advanced chips.

Huang used this leverage to shape conversations about trade policy, chip exports, and geopolitical strategy. When he expressed concerns about restrictions on selling advanced chips to China, people listened—not because of his economic theories, but because Nvidia's business decisions directly impact nations' ability to build AI capacity.

This represented a tectonic shift in power. Chip makers have become geopolitical actors. The companies that produce the foundational hardware for AI can influence policy more directly than many governments.

AI Founders as Celebrity Figures

Sam Altman (OpenAI), Dario Amodei (Anthropic), and other AI founders became the celebrity speakers of Davos 2025. This was striking because venture-backed startup founders typically occupy a niche role at Davos—interesting to tech investors, but not central to the conference's concerns.

Yet these founders commanded attention from heads of state, Fortune 500 CEOs, and policy makers. Why? Because they'd created products—Chat GPT, Claude, and others—that millions of people used daily, and nobody quite understood the implications.

These founders became de facto experts on a question that consumed the entire conference: What is AI going to do to the world?

Dario Amodei's critical remarks about U.S. chip policy were particularly notable. Rather than using Davos to promote Anthropic, he spent time criticizing trade policy and corporate decisions he felt were misguided. This wasn't self-promotion; it was someone with credibility speaking truth to power.

Yet his criticism gained massive amplification precisely because of his credibility as an AI founder. If a venture capitalist made the same criticism, it would be dismissed as insider commentary. If a politician made it, it would be seen as political posturing. But an AI founder stating concerns about policy? That carried weight.

Corporate Strategy Executives Scrambling for Understanding

While chip makers and AI founders dominated the conference's attention, another group was quietly pivoting: corporate strategy executives from non-tech industries.

A pharmaceutical company's Chief Strategy Officer, an automotive CEO, a financial services executive—these people came to Davos asking essentially one question: How do we navigate AI?

They weren't looking to become AI companies. They didn't want to build large language models or AI chips. They wanted to understand: How does AI change our industry? When do we need to act? What are the risks?

This created an interesting dynamic. The AI experts had answers, but the questions revealed deep uncertainty about implementation. How does a manufacturing company integrate AI into production? When should a bank deploy AI for customer service versus hiring humans? How does AI change competitive advantage in a traditionally non-tech industry?

These questions went largely unanswered at Davos. The conference excelled at discussing AI's potential and risks at 50,000 feet. It struggled with helping individual industries figure out practical implementation.

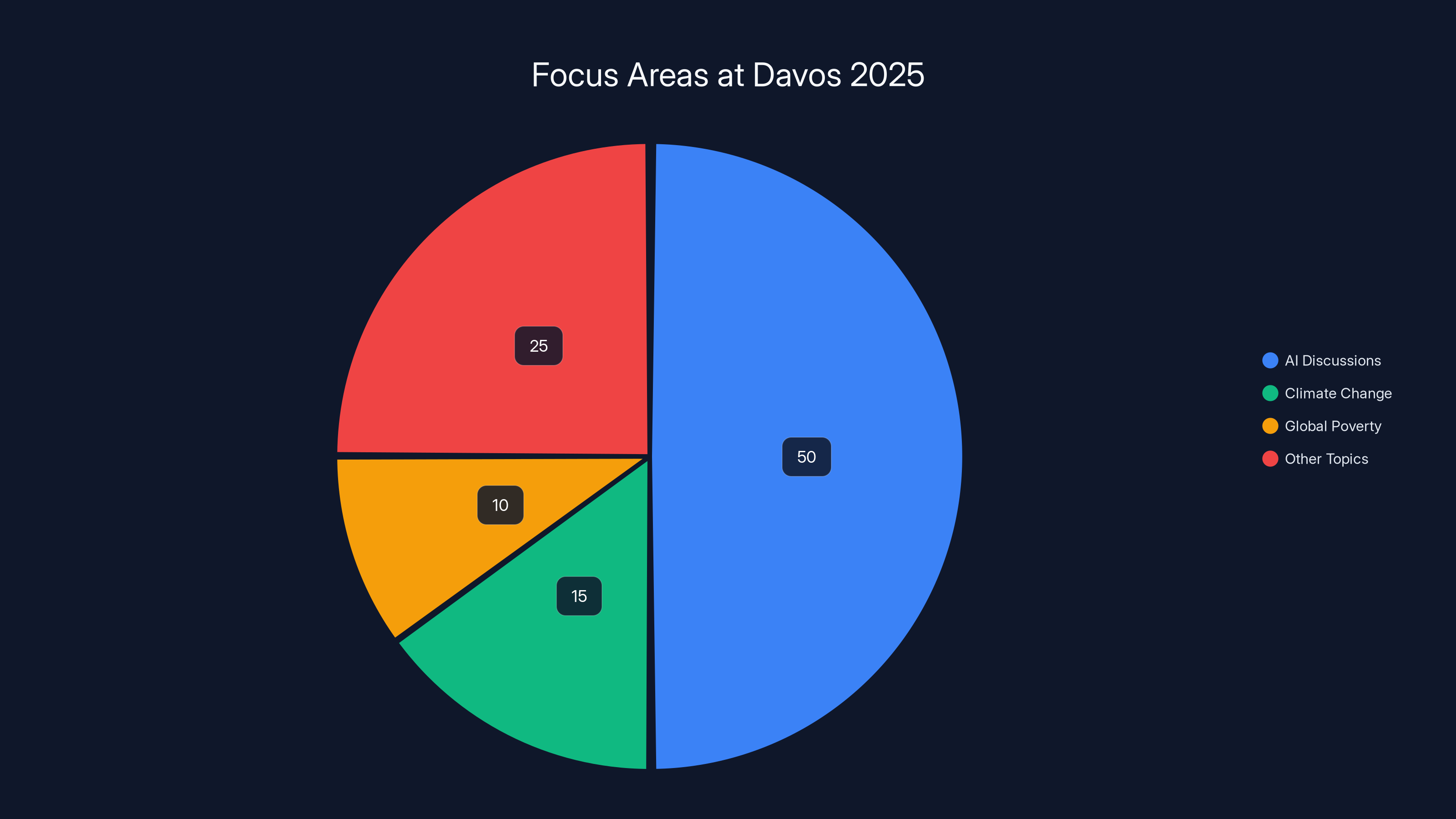

AI discussions dominated Davos 2025, overshadowing climate change and global poverty topics. Estimated data based on narrative insights.

The Conversations That Defined Davos 2025

AI Safety Concerns Amid Industry Optimism

Despite the overwhelming optimism about AI's potential, genuine concerns about AI safety permeated conversations at Davos. This wasn't alarmism. It was serious discussion among knowledgeable people about real risks.

One recurring theme: What happens if multiple companies race to build AI systems without sufficient safety infrastructure? If the competitive pressure to deploy AI features overwhelms the caution to test them thoroughly, what goes wrong?

Another theme: AI's concentration of power. If a handful of companies control the training of large language models, and those models become infrastructure that everyone depends on, what's the geopolitical risk?

A third concern: Environmental. Training large language models requires enormous computing power, which requires enormous electricity consumption. If AI deployment scales as quickly as some enthusiasts predict, does that make climate goals impossible to achieve?

These weren't fringe concerns. They were discussed seriously by major CEOs, policy makers, and researchers.

But they coexisted with a current of almost religious optimism about AI's potential to solve problems. AI could cure diseases. AI could solve climate change. AI could improve education for billions of people.

The conference felt caught between two competing narratives: AI as humanity's best hope and AI as an existential risk. Both camps had credible speakers. Both presented compelling evidence. Nobody had clear resolution.

Trade Policy and Geopolitical Tension

Another unexpected focus at Davos was trade policy and geopolitics. Specifically, the relationship between advanced technology and national power.

Chip exports to China became a flashpoint. The U.S. and its allies have restricted exports of advanced semiconductors to China, concerned that Beijing would use advanced chips for military applications. But U.S. companies lose business. And China accelerates its own chip development efforts.

Dario Amodei's public criticism of both the Trump administration and Nvidia (for considering plans to export chips to China) reflected genuine tension: How do you balance national security concerns with business interests and geopolitical pragmatism?

One U.S. government official at Davos admitted privately that the chip export restrictions were partially about geopolitical advantage rather than pure national security concerns. If China can't build advanced AI systems because it can't access advanced chips, the U.S. maintains technological superiority. But there's a cost: international friction, retaliation, and the acceleration of competitive chip development outside the U.S.

These conversations revealed something important: AI has become inseparable from geopolitics. A tech company's business decisions now have foreign policy implications. A government's trade policy now affects private companies' competitiveness.

This blurred line between tech and politics created new tensions at Davos, traditionally a place where these concerns were kept somewhat separate.

Warnings About AI Bubble Economics

Perhaps most interesting was the emergence of serious concern about whether AI investment might represent a bubble.

Some of the smartest people at Davos were quietly suggesting that the AI hype cycle might be getting ahead of reality. The valuations of AI companies are extraordinary. The capital flowing into AI infrastructure is staggering. But what if adoption is slower than expected? What if productivity gains are more modest than enthusiasts predict?

One venture capitalist noted that many of the AI use cases being discussed at Davos haven't been proven at scale. A drug company might be exploring AI for drug discovery, but has it actually proven that AI discovers better drugs faster? Or is the company hoping it will?

This skepticism didn't dominate the conference. The optimism was too strong. But it created an undercurrent of productive doubt. The question wasn't whether AI matters (everyone agreed it does), but whether the scale of investment has outpaced demonstrated returns.

History suggests this matters. Tech bubbles happen when capital dramatically exceeds proven use cases. The internet happened this way in the 1990s. Cloud computing had a smaller version of this. Is AI next?

The consensus at Davos seemed to be: Probably some degree of correction, but not a total collapse. Too much real value. Too many genuine applications. But valuations might compress. Growth might normalize.

The Missing Conversations: What Davos 2025 Overshadowed

Climate Change Relegated to Side Discussions

Perhaps the most striking absence at Davos 2025 was substantive discussion of climate change. For the previous 15 years, climate had been a centerpiece topic. Major commitments were announced. Policy was debated. Investment flows were discussed.

In 2025, climate discussions happened, but in side sessions that attracted modest crowds. Meanwhile, the main halls were packed with AI conversations.

Some climate advocates expressed frustration. Yes, AI might help solve climate problems eventually. But decisions made in 2025 about climate infrastructure, renewable energy investment, and emissions reduction are happening now. The reduction of climate to a secondary concern at Davos symbolized a concerning shift in priorities.

Was Davos reflecting global priorities, or shaping them? Did business leaders actually believe AI was more important than climate, or did AI's novelty and uncertainty simply make it more compelling as a discussion topic?

The answer is probably both. AI genuinely demands urgent attention. But that attention came somewhat at climate's expense, creating a conference that felt imbalanced.

Global Poverty and Development Economics Marginalized

Another traditional Davos focus—development economics, global poverty, and emerging market growth—received surprisingly little attention.

In previous years, discussions about how to raise living standards in developing countries, how to provide healthcare and education to billions of people, and how to create economic opportunity in poor regions occupied significant Davos real estate.

In 2025, these conversations seemed almost quaint compared to the urgency of AI discussions. Yet billions of people's lives depend on these issues. The solutions probably require as much innovation and capital as AI does.

The shift revealed something about how conferences shape discourse. When one topic dominates, others naturally fade. This isn't necessarily good or bad, just human. But it suggested that Davos's role as a forum for addressing humanity's broadest challenges had narrowed to a forum for discussing technology's future.

Policy and Governance Questions Left Unresolved

Despite extensive discussion of AI, Davos 2025 generated surprisingly little concrete policy guidance or governance frameworks.

How should governments regulate AI? What standards should companies adopt? How do you balance innovation and safety? How do you prevent concentration of power? How do you ensure AI benefits are broadly distributed rather than captured by a few companies?

These questions were asked repeatedly. Few concrete answers emerged.

This represented a failure of sorts. Davos's historical strength has been its ability to bring together diverse perspectives and sometimes generate frameworks for addressing problems. On AI governance, the conference largely highlighted disagreements rather than building consensus.

Companies want light regulation. Governments worry about losing control. Activists fear concentration of power. Researchers want resources for safety work. These groups weren't hostile to each other at Davos, but they also didn't resolve their disagreements.

The conference ended with more questions than answers on governance—which is interesting, because it suggests that nobody actually knows how to regulate AI yet.

AI safety and optimism were equally dominant themes at Davos 2025, each capturing 30% of the discussions, while trade policy and geopolitical tension each accounted for 20%. Estimated data based on content analysis.

Why This Transformation Matters

Davos as an Economic and Political Indicator

The transformation of Davos into a tech-dominated forum signals something profound about where global economic power is concentrating.

For the past 30 years, Davos has roughly reflected global economic priorities and power distribution. If financial services dominated the 1990s, Davos reflected that. If climate became critical in the 2010s, Davos reflected that. If geopolitical tension intensified, Davos debates heated up.

Now Davos is dominated by AI, chip makers, and tech founders. This reflects where power is moving. Tech companies have become central to economies. AI is reshaping industries. Chip manufacturers control critical infrastructure.

But this also raises a question: Is Davos reflecting reality, or shaping it? When the World Economic Forum's most prestigious conference focuses overwhelmingly on AI, does that influence how the world's most powerful people think about problems?

Probably yes. Davos isn't just a measurement of priorities. It's also a place where priorities get reinforced and amplified.

If climate change receives minimal attention at Davos, that sends a message to business and political leaders that climate is less urgent than AI. Whether or not that's true, the message gets sent.

The Shifting Balance of Power

Davos 2025 demonstrated that power in the global economy has shifted toward technology and specifically toward AI.

A chip maker CEO can now influence geopolitical policy discussions at the world's most important business conference. A venture-backed startup founder's opinions on trade policy matter to government officials. Tech company decisions about where to build data centers have implications for national energy grids and geopolitics.

This concentration of influence isn't necessarily problematic. But it does represent a shift. The balance of power at Davos historically reflected a broader distribution: financial leaders, industrialists, policy makers, philanthropists, and thought leaders all had relatively balanced voice.

In 2025, the voice of tech executives dominated. Their concerns mattered most. Their ideas shaped the agenda. Their future shaped the conference's focus.

This raises questions about representation and balance. If Davos becomes primarily a tech conference, does it lose value as a forum for addressing broader global challenges? Or does tech becoming central to those challenges justify the focus?

What It Means for Non-Tech Industries

For companies outside technology, Davos 2025 sent a clear message: Artificial intelligence is now a board-level priority that demands urgent executive attention.

You can't attend Davos and ignore AI. It's not optional anymore. Every CEO of a major company needs to have thought through how AI affects their industry, their competitive position, and their strategy for the next five years.

This doesn't mean every company needs to become an AI company. But every company needs to understand AI as a technology that can disrupt their business, create new opportunities, or change how work gets done.

The CEOs who returned from Davos with clear AI strategies will have a competitive advantage over those who don't. The companies that understand AI's specific implications for their industry will be better positioned than those that treat it as a general phenomenon.

In this sense, Davos 2025 served a crucial function: it forced the world's most powerful business leaders to confront AI as urgent and central rather than interesting and future-focused.

The Specific Moments That Defined Davos 2025

Dario Amodei's Trade Policy Criticism

One moment stood out: Dario Amodei, the CEO of Anthropic (a leading AI company), publicly criticized both the Trump administration and Nvidia over chip export policies.

This was unusual for a few reasons. First, Amodei wasn't attacking a competitor or promoting Anthropic's business. He was making a policy argument he believed in, even though it might not benefit his company.

Second, he was criticizing Nvidia, a company that Anthropic depends on for chips. This took courage. Criticizing your supplier at a public conference is risky.

Third, his criticism mattered. It wasn't just one person's opinion. It was an AI founder with credibility speaking to geopolitical strategy. Policy makers listened. Business leaders engaged. Media covered it.

This moment crystallized something: AI leadership has become a form of soft power. A smart critique of policy from a credible tech founder can influence how the world thinks about important issues.

Jensen Huang's Presence and Influence

Jensen Huang didn't need to give major speeches to shape Davos. His physical presence was enough.

Nvidia controls the supply of chips that power AI. This reality meant Huang was more important to AI's future than almost any other single person at the conference. Every AI company is trying to buy Nvidia chips. Every country developing AI capacity needs access to Nvidia hardware.

Watching how leaders interacted with Huang—the deference, the eagerness to engage—demonstrated how power has shifted. He's not just a technology executive. He's an infrastructure kingmaker.

This has profound implications. If one company controls the critical infrastructure for an important technology, that company has enormous influence over the pace and direction of that technology's development.

The Meta and Salesforce Takeover

The physical transformation of Davos—with Meta and Salesforce taking over storefronts—was theater, but meaningful theater.

It announced, without words, that tech companies now own Davos. They're not participating in someone else's conference. They're transforming the venue itself.

This level of corporate presence was unprecedented at a forum that traditionally emphasized the informal networking and thoughtful discussion more than corporate branding.

The message was clear: Tech companies aren't attending Davos to learn from the broader business community. They're there to demonstrate their dominance and shape conversations about the future.

AI companies raised an estimated $60 billion in venture capital in 2024, highlighting the growing focus on AI as a dominant topic at Davos. Estimated data.

The Broader Implications: What Comes Next

Will AI Remain Davos's Focus?

The question for future years: Was 2025 the peak of AI's dominance at Davos, or just the beginning?

If AI development continues its rapid pace and AI's impact on industries intensifies, then yes, AI will likely remain central to Davos for years to come. The conference will probably become increasingly focused on technology more broadly.

But if AI development plateaus, or if the hype cycle moderates, then other topics might regain prominence. Climate might come back. Global poverty and development economics might reassert themselves as urgent priorities.

Historically, Davos follows global attention cycles. When attention to a topic fades, Davos does too. The question is whether AI's fundamental importance to economies and society means it stays central, or whether it follows the normal hype cycle pattern.

Most likely: AI remains very important, but other topics regain some ground. In five years, Davos might be 40% AI-focused instead of 70% like in 2025. But it probably won't return to 5% AI focus like it was in 2020.

Implications for How the World Addresses Big Problems

The transformation of Davos raises an important question: If a major global forum becomes dominated by one industry and one technology, does that help or hurt in addressing humanity's biggest challenges?

On one hand, it concentrates expertise and attention on problems that genuinely matter. AI might help solve climate change, disease, poverty, and other challenges.

On the other hand, it crowds out perspectives and expertise from other fields. A climate scientist or development economist might have insights that matter, but if they can't get attention at Davos, their voices don't shape global strategy.

The ideal probably involves balance: AI dominates because it's genuinely important, but climate, development, health, and other challenges maintain significant presence because they matter too.

What This Means for Corporate Strategy

For every major company, Davos 2025 sent a clear signal: AI is now as central to business strategy as internet adoption was in the 1990s or cloud computing was in the 2010s.

Companies that don't have serious AI strategy will be at a competitive disadvantage. Companies that understand AI's specific implications for their industry will outmaneuver those that treat it generically.

The smart move is to learn from what AI experts and practitioners discussed at Davos, understand how it applies to your specific business, and build strategy accordingly. This doesn't necessarily mean becoming an AI company. It means becoming an AI-aware company.

How to Make Sense of Davos as a Business Leader

Using Davos to Benchmark Your Strategy

If you're a business leader, Davos provides valuable information about where other executives are thinking and where they believe opportunities and threats lie.

The topics that dominate Davos reflect the issues that occupy the minds of the world's most powerful business people. If AI dominates Davos, that's a signal that AI should be important in your strategic thinking.

But the signal isn't just "AI matters." It's more specific: What aspects of AI matter most? What are the actual applications? What are the risks? What's hype versus reality?

The answer to these questions at Davos 2025 suggests: AI's impact on productivity is real but uncertain in magnitude. AI will create new opportunities but also displace some workers. AI concentration of power is a genuine concern. And the pace of AI development is faster than governance can adapt.

All of these should inform your strategy. If you assume AI will drive massive productivity gains immediately, you might invest too aggressively. If you assume AI will be tightly regulated immediately, you might move too slowly.

But if you assume moderate productivity gains, growing integration into industries, some disruption, and evolving regulation, you'll probably get closer to reality.

Understanding Power and Influence in Your Industry

Davos also reveals where power is concentrating in your industry and globally.

The fact that chip makers are more powerful than policy makers at Davos reflects the reality that chip supply is a constraint on AI development. If you're thinking about your competitive position in an AI-driven world, understanding that chips are the bottleneck matters.

Similarly, the prominence of AI founders reflects the reality that whoever builds the most useful AI systems (currently, large language models) has significant power in the ecosystem.

Understanding these power dynamics helps you position your company. Are you dependent on chips? Develop alternative supply relationships. Are you competing with large language models? Develop differentiation strategy.

Davos reveals power structures in ways that formal analysis sometimes misses.

Identifying Emerging Risks and Opportunities

Finally, Davos functions as an early-warning system for risks and opportunities that will affect your industry in the next 3-5 years.

The serious discussion of AI bubbles at Davos is a signal that valuations might compress. The discussions of geopolitical tension around chip exports signal that supply chain risks are real. The concerns about AI safety suggest that regulation might come.

Businesses that pay attention to these signals can position themselves accordingly. Getting ahead of a regulatory wave, for instance, often provides competitive advantage.

The World Economic Forum has seen significant growth since its inception, expanding from 450 participants in 1971 to an estimated 3,000 by 2025. Estimated data based on historical trends.

FAQ

What is the World Economic Forum's annual Davos meeting?

The World Economic Forum's annual meeting in Davos, Switzerland brings together political leaders, business executives, academics, and thought leaders from around the world to discuss global economic, social, and political issues. Founded in 1971 by Klaus Schwab, the meeting has evolved from a small gathering of 450 business executives into a major international conference attracting over 2,700 participants and numerous politicians, activists, and journalists. The conference combines formal sessions, panel discussions, and informal networking.

Why has Davos shifted toward technology and AI as dominant topics?

Davos has shifted toward technology and AI because these areas now command the largest capital flows, affect all industries, and present the most urgent uncertainty for global business leaders. AI companies raised over $60 billion in venture capital in 2024, and AI's potential impact on productivity, employment, and geopolitics creates urgent questions that executives must address. Additionally, the rapid development of AI creates genuine anxiety and excitement that overshadows other topics that have been discussed for years like climate change.

How does Davos influence global business strategy and policy?

Davos influences strategy and policy through several mechanisms: it concentrates the world's most powerful decision-makers in one place for five days, creating networking opportunities and deal-making momentum; it amplifies ideas and announcements to a global audience; it signals priorities through which topics and speakers receive prominent positioning; and it creates peer pressure where business leaders and politicians feel they should address topics that other important figures are prioritizing. Research suggests companies that align strategies with Davos-identified trends tend to outperform peers, though this could reflect survivorship bias.

What does the dominance of AI at Davos 2025 reveal about corporate priorities?

The dominance of AI at Davos 2025 reveals that executives of major companies across industries now view AI as one of the top strategic priorities alongside core business operations. It signals that AI is no longer viewed as a specialized technology for tech companies, but rather a foundational technology that will reshape work, competition, and industries. It also indicates that executives recognize both enormous opportunity and genuine uncertainty about AI's trajectory, creating urgency to understand and position for AI's implications.

How should non-tech executives respond to AI's dominance in global business conversations?

Non-tech executives should respond by developing concrete understanding of how AI specifically affects their industry, moving beyond general awareness to strategic positioning. This means: identifying which business processes AI can genuinely improve; understanding the risks of competitive disruption from AI-native entrants; developing partnerships with or access to AI capabilities; investing in workforce training to work alongside AI systems; and building governance and risk management approaches for deploying AI responsibly. The executives who moved fastest on this after Davos 2025 gained competitive advantage.

What are the main concerns about AI that emerged at Davos 2025?

Multiple concerns emerged at Davos 2025: the risk that AI investment represents a bubble disconnected from proven applications; the concentration of power among a small number of AI companies and chip manufacturers; geopolitical tensions around chip exports and AI capability development; environmental concerns about AI training's energy consumption; employment displacement risks as AI automates white-collar work; and the risk that governance can't adapt fast enough to address AI's societal implications. These concerns coexisted with optimism about AI's potential, creating an undercurrent of productive tension throughout the conference.

How has Davos's focus shifted away from other important global challenges?

Davos shifted attention away from climate change, global poverty, and development economics—traditionally major conference focuses—to concentrate on AI. Climate sessions dropped from 47 in 2020 to 12 in 2025, while AI sessions exploded from 6 to 87. This shift reflects a reallocation of attention among executives rather than necessarily a reassessment of which problems matter most. Critics argue this creates an imbalance, as climate change and poverty still demand urgent action, but the concentration of executive attention on AI means those problems get deprioritized in corporate strategy discussions.

Why did Jensen Huang and Nvidia become so prominent at Davos 2025?

Jensen Huang and Nvidia became prominent because Nvidia manufactures the chips (GPUs) that are essential infrastructure for AI development and deployment. Every AI company, data center, and country developing AI capacity depends on Nvidia's products. This supply chain position gives Nvidia and its CEO influence comparable to geopolitical actors. In essence, Nvidia controls a bottleneck resource for AI, giving Huang leverage to shape conversations about AI development, trade policy, and geopolitical strategy.

What does the future of Davos look like after 2025?

The future of Davos likely involves AI remaining a major focus for the foreseeable future, but probably declining from 2025's overwhelming dominance as attention matures and other topics reassert themselves. Davos will likely become more focused on technology generally rather than returning to its historically broader multidisciplinary approach. Climate, poverty, and other challenges will probably regain some prominence if they can be reframed as technology and AI problems. Ultimately, Davos reflects global attention cycles, so its future topics depend on what issues emerge as urgent over the next 3-5 years.

Conclusion: Davos as a Window into the Future

Davos 2025 marked a transformation that will probably seem obvious in retrospect. Of course the World Economic Forum's annual meeting became dominated by AI. AI is reshaping every industry. AI's implications are urgent and uncertain. The executives who need to understand AI most are exactly the type of people who attend Davos.

Yet the transformation is significant because it reveals something about how power and attention concentrate in modern capitalism. When one technology becomes central to economic value creation, it naturally comes to dominate forums where business strategy gets discussed.

The question isn't whether Davos should have been more balanced—though some might argue it should have been. The question is what the concentration of attention on AI means for how the world addresses other urgent challenges, and what it means for executives who need to compete in an increasingly AI-centric business environment.

For most executives, Davos 2025's lesson is simple: AI is now as central to competitive strategy as understanding your market and customers. The executives who internalized this lesson and immediately began developing AI strategy gained an advantage. Those who treated AI as interesting but optional will likely find themselves at disadvantage.

The transformation of Davos also reveals that technological change now moves faster than major institutions can adapt. Governance hasn't caught up to AI's implications. Policy hasn't been updated for AI-centric supply chains. Education hasn't shifted to prepare workers for AI-transformed work. Meanwhile, business leaders gather at Davos to discuss AI's future, still waiting for framework and guidance that nobody quite has.

This gap—between the speed of technological change and the pace of institutional adaptation—will probably define the next decade. How that gap plays out will depend partly on decisions made by the executives and policy makers who were in Davos in January 2025, discussing AI's future in a Swiss mountain town.

The transformation is underway. Davos showed us what it looks like. The question is what comes next.

Key Takeaways

- Davos 2025 experienced an unprecedented shift where AI conversations completely overshadowed traditional topics like climate change and global poverty for the first time in the forum's history

- Tech giants and chip manufacturers emerged as the most powerful figures at the conference, with Jensen Huang and Nvidia's supply chain control demonstrating how infrastructure power has become geopolitical leverage

- The transformation signals a fundamental reallocation of global business leadership attention toward artificial intelligence, requiring every industry to develop concrete AI strategy or face competitive disadvantage

- Important concerns emerged about potential AI bubble economics, geopolitical tensions around chip exports, and governance gaps—highlighting that opportunity coexists with genuine risk in the AI era

- The shift reveals broader patterns: technologies that concentrate economic power tend to concentrate conference attention, and Davos now functions as a barometer for where global executives believe future competitive advantage lies

Related Articles

- AI Bubble or Wave? The Real Economics Behind the Hype [2025]

- Meta Pauses Teen AI Characters: What's Changing in 2025

- TechCrunch Disrupt 2026: Save $680 + 50% Off +1 Tickets [2026]

- Apple's AI Wearable Pin: What We Know and Why It Matters [2025]

- Elon Musk's Davos Predictions: Why They Keep Missing [2025]

- Google's Hume AI Acquisition: The Future of Emotionally Intelligent Voice Assistants [2025]