AI Bubble or Wave? The Real Economics Behind the Hype [2025]

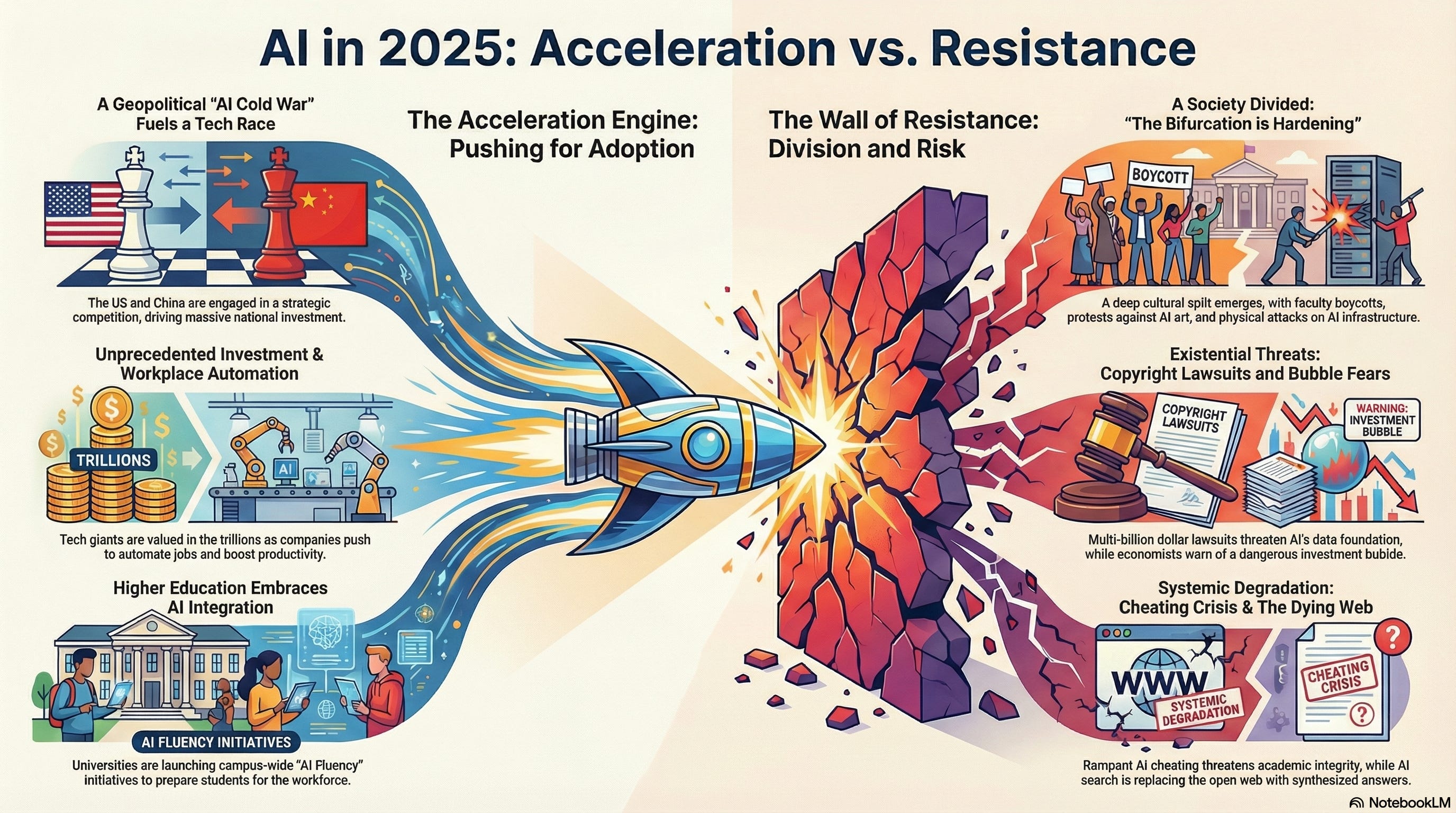

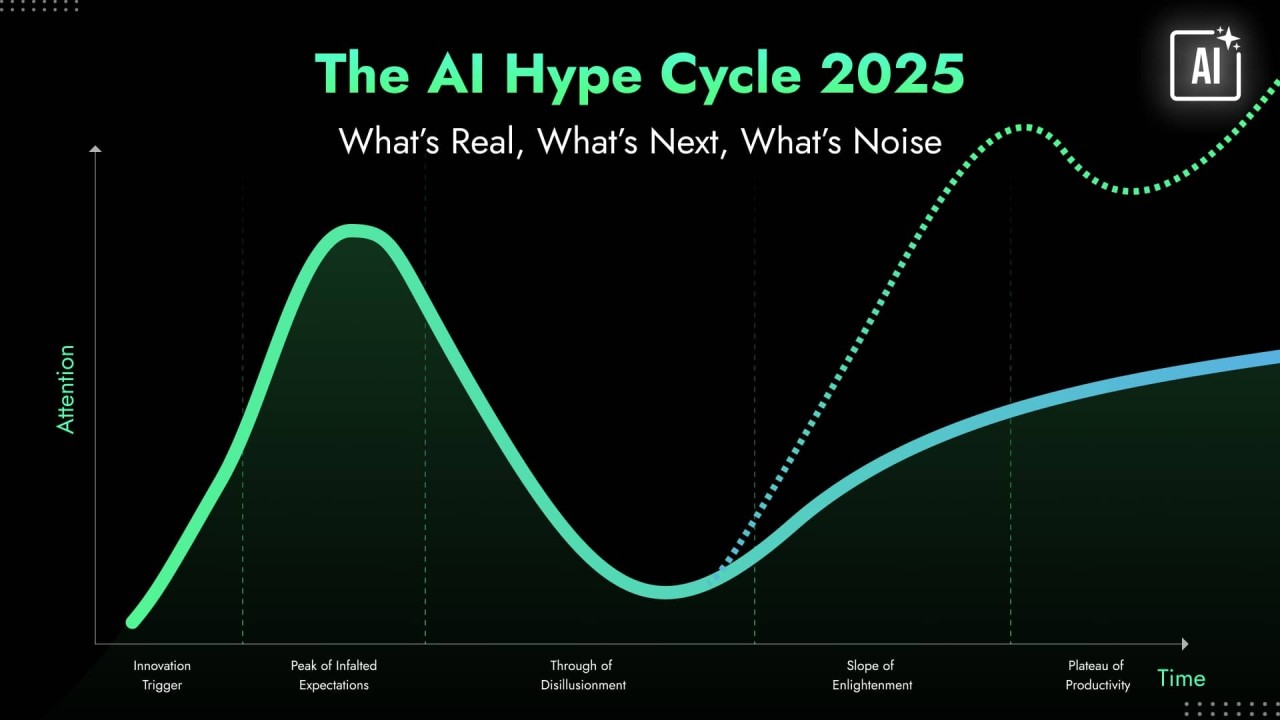

Here's the thing: every five to ten years, tech does this thing where it becomes the answer to every problem. We get caught up in the enthusiasm, investors pour billions into the space, and suddenly you hear people at coffee shops talking about technologies they don't understand. Then either two things happen: the bubble pops spectacularly, or the technology actually sticks around and changes everything.

Right now, we're in the thick of it with AI.

The question everyone's asking isn't really "Is AI real?" anymore. It's "How much of this valuation is real, and how much is pure speculation?" That's not a trivial distinction. If you're a CTO deciding whether to build AI into your product roadmap, or a CFO trying to figure out where to allocate your innovation budget, the answer matters enormously.

The narrative's been bouncing around like crazy. One week you read about how AI will create trillions in economic value and usher in a new era of human productivity. The next week someone publishes a think piece about how we're recreating 1999 and the whole thing's going to come crashing down. Both narratives have some truth to them. But they're not the complete picture.

What's actually happening is messier and more interesting than either extreme suggests.

TL; DR

- The scale is real: Big tech companies are committing **20 billion in 2025 revenue—these aren't speculative bets, they're structural investments.

- Some overvaluation exists: Early-stage AI startups are definitely trading on hype, and many will fail—this part does echo the dot-com era.

- But underlying demand is genuine: Organizations are moving from pilots to production deployments, reporting measurable productivity gains and operational improvements.

- The difference from the bubble: This time, the large players have profitable business models (search advertising, cloud infrastructure, enterprise software) that subsidize their AI bets.

- Bottom line: We're surfing a powerful wave that will reshape computing, but specific companies and early-stage players will crash along the way.

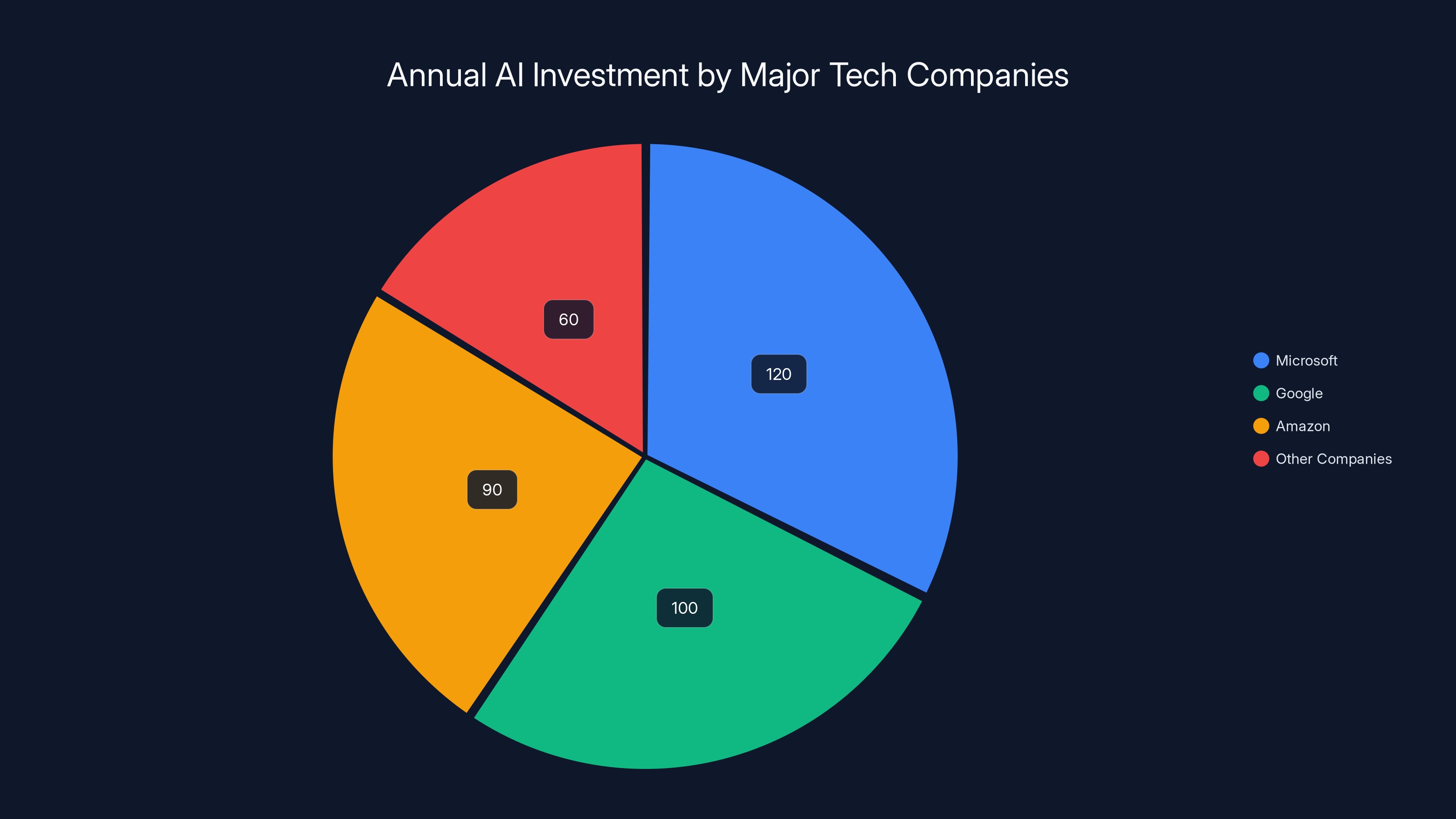

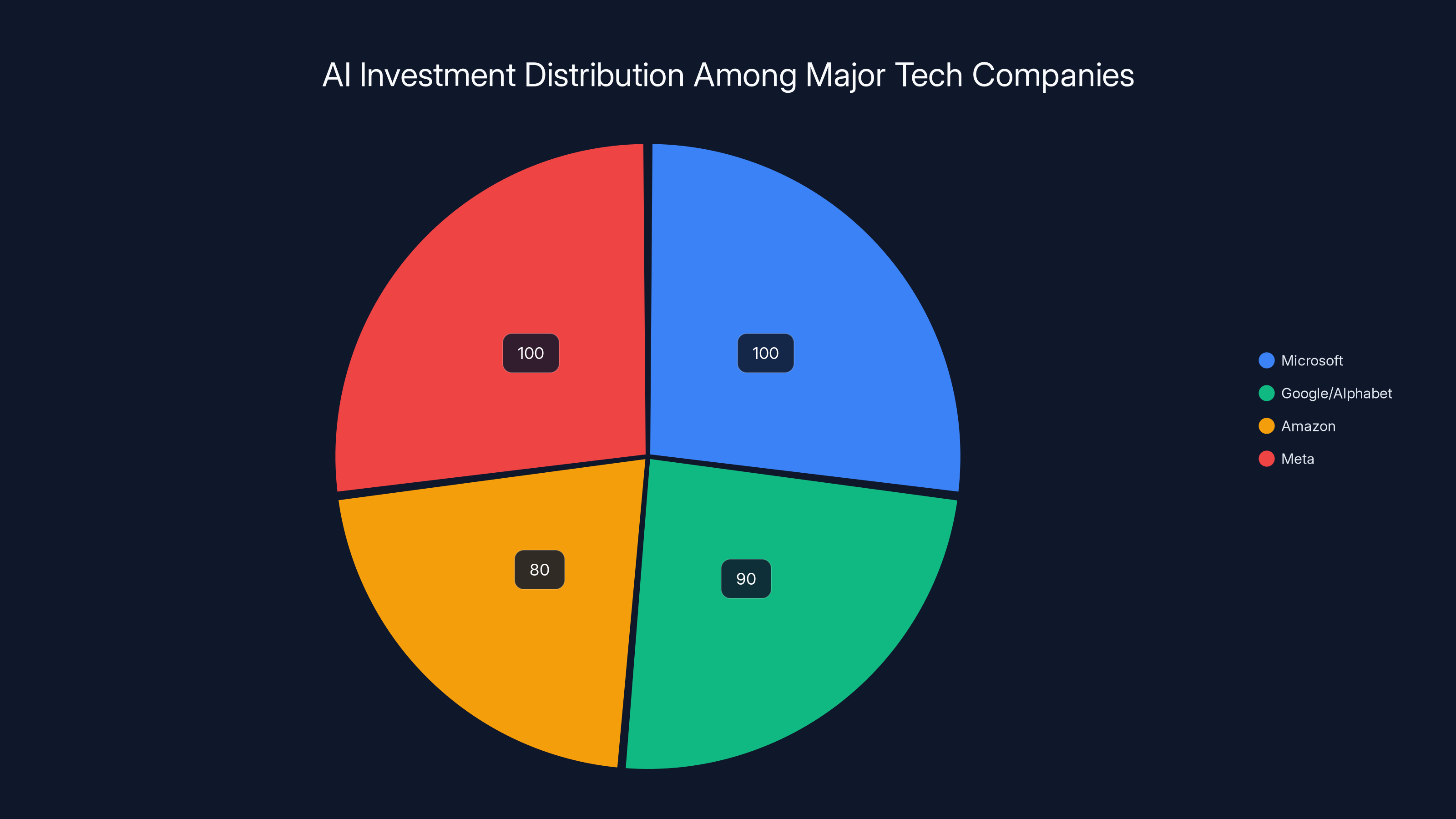

Major tech companies like Microsoft, Google, and Amazon collectively invest approximately $370 billion annually in AI, indicating a strong belief in AI's long-term potential. (Estimated data)

Understanding Tech Bubbles: What Makes One, Actually

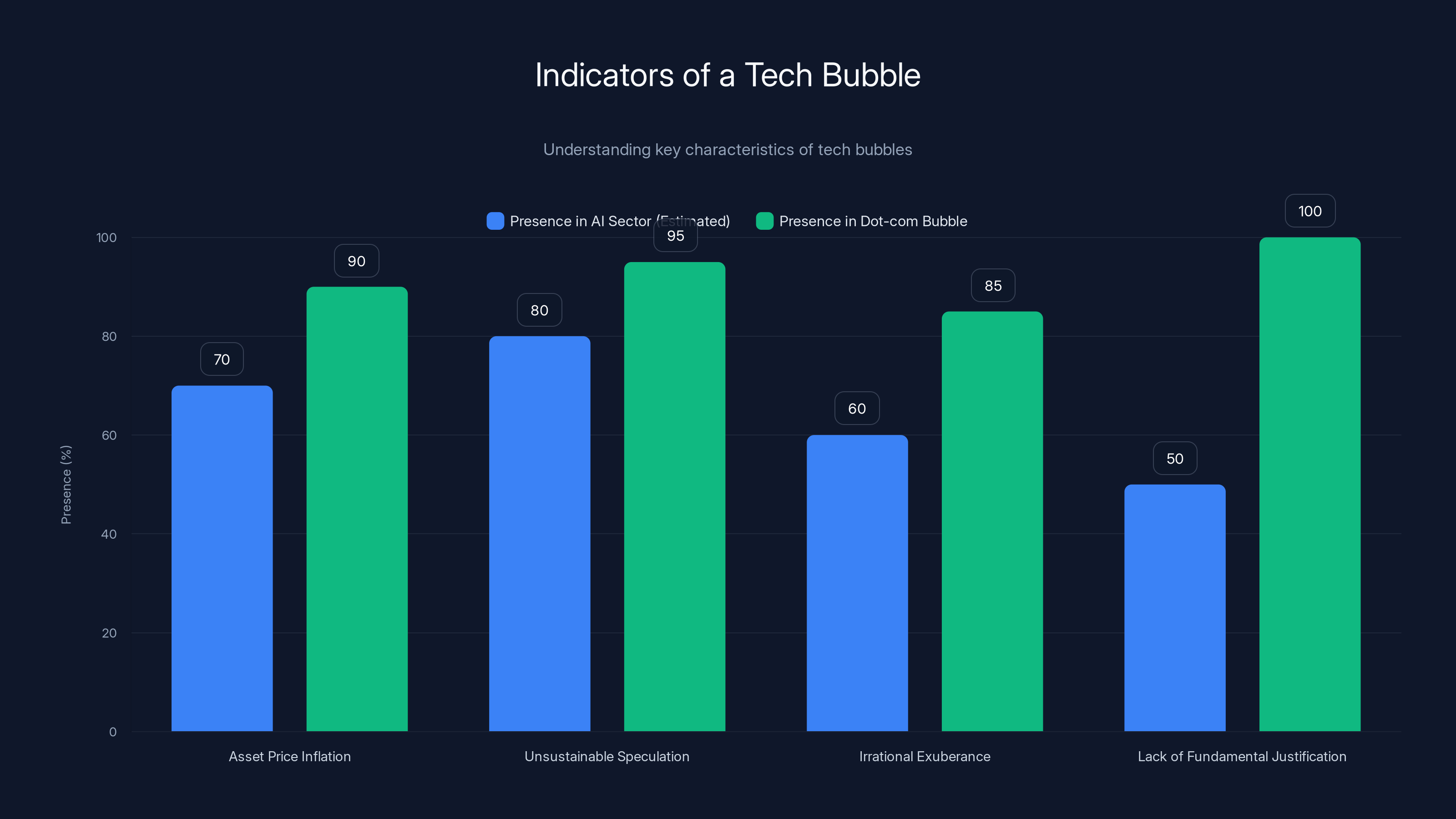

Before we can diagnose whether we're in an AI bubble, we need to be honest about what a bubble actually is. It's not just when prices get high. It's when prices become fundamentally disconnected from underlying value or cash flows.

The classic example is the dot-com bubble around 2000. Companies with no revenue, no path to profitability, and increasingly absurd business models went public and commanded billion-dollar valuations. Pets.com became a household name despite losing money on every single transaction. That's a bubble. Prices detach completely from reality, speculation replaces analysis, and at some point the math just stops making any sense.

The hallmark indicators are: asset prices inflating faster than earnings, unsustainable speculation, irrational exuberance, and most importantly, a complete lack of fundamental justification for valuations.

So when you hear comparisons to 1999, it's worth asking: do we actually see those same dynamics with AI, or are we pattern-matching to historical trauma?

The answer is complicated. We're seeing some bubble dynamics with AI, especially in early-stage startups. But the core infrastructure and the big players driving adoption show very different characteristics.

The Bubble Dynamics That Are Real

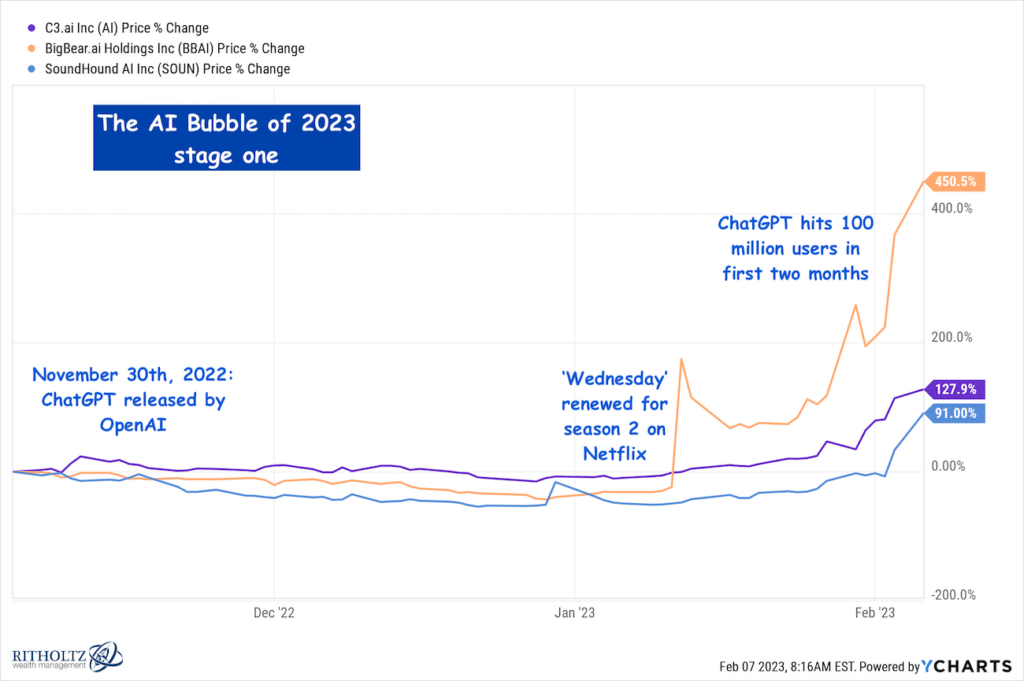

Let's start with what does look bubble-ish. There are definitely AI startups getting funded at astronomical valuations with business models that aren't fully baked. Some are solving problems nobody actually has at the scale required to justify their fundraising.

Investor enthusiasm is creating a kind of gravitational pull. If you're a VC and your portfolio competitors are all backing AI startups, there's pressure to do the same or risk being left behind. That's a classic bubble dynamic: fear of missing out driving investment decisions instead of fundamentals.

Media hype amplifies this. Every announcement from the major players gets breathless coverage. Smaller players can ride that wave to funding and valuations that don't match their actual business performance.

You're also seeing a pattern where companies slap "AI-powered" onto existing products and suddenly their valuations expand. That's not new—companies did the same thing with "blockchain" and "web 3" and "metaverse." Sometimes the label actually reflects something real. Often it doesn't.

The Bubble Dynamics That Don't Apply

But here's where the comparison to the dot-com era starts breaking down. The big players funding the AI wave aren't speculative. They're not startups betting their futures on unproven technology. They're established technology companies with profitable core businesses that generate enormous cash flows.

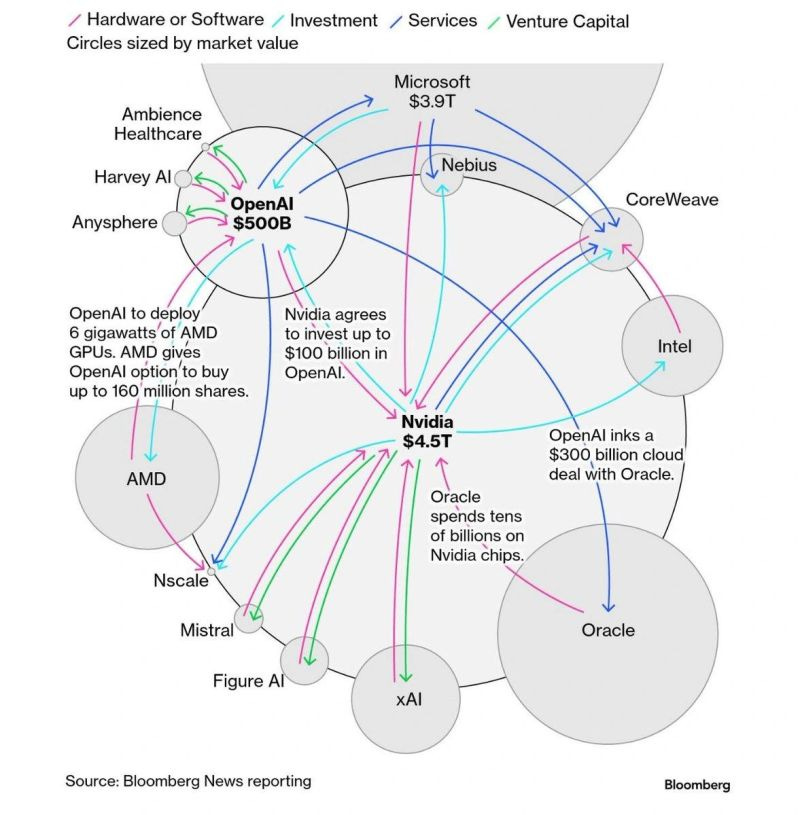

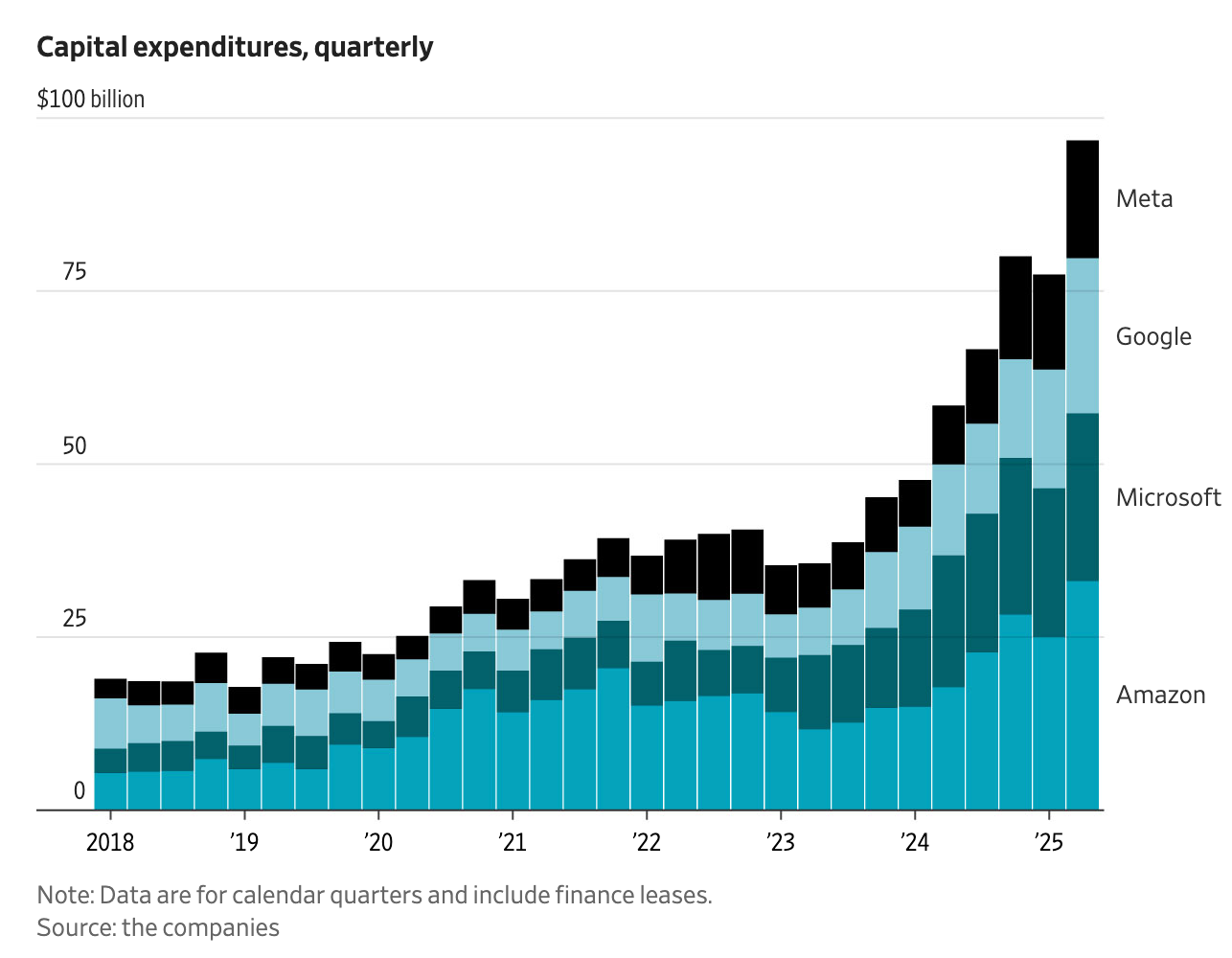

Microsoft, Alphabet, Amazon, and Meta are together committing nearly $370 billion annually to AI infrastructure and development. These are real capital expenditures, not speculative bets. They're building data centers, purchasing chips, and funding research teams.

They can afford to do this because their core businesses (advertising, cloud services, e-commerce) generate the cash flow to sustain large, expensive bets on emerging technology. During the dot-com era, most major players couldn't say that. They didn't have multi-billion-dollar profit machines subsidizing their internet initiatives.

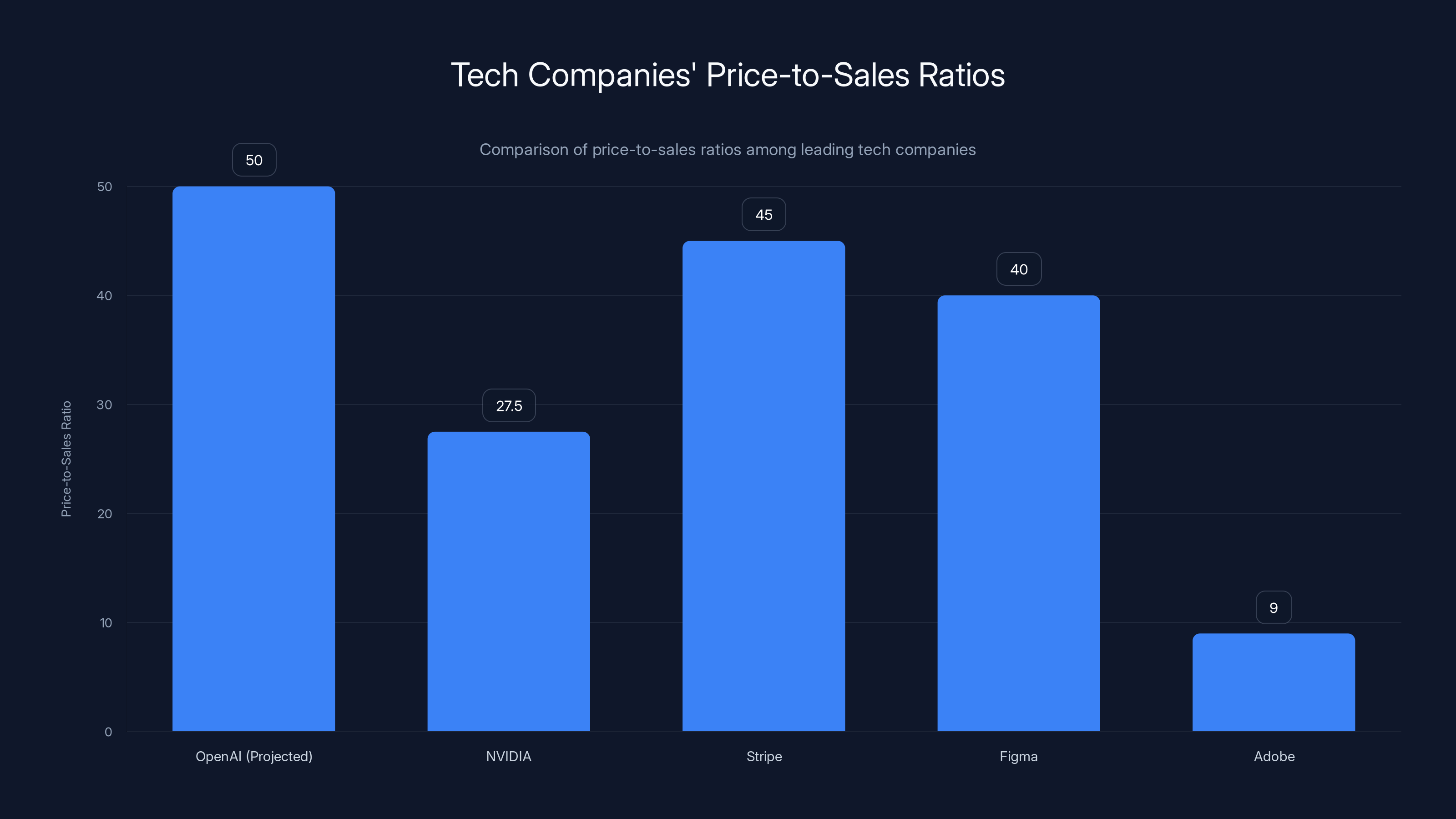

Also, valuations for these companies, while high, are starting to reflect real AI-driven revenue. OpenAI is reportedly on track to hit **

For context, companies like Figma and Stripe have commanded enterprise multiples in that range based on their growth trajectory and market position. It's high, but not unprecedented.

Estimated data suggests that while some bubble dynamics are present in the AI sector, they are not as pronounced as during the dot-com bubble. Estimated data.

The Historical Parallel: Why Dot-Com Comparisons Make Sense (And Why They Don't)

People invoke the dot-com bubble because the superficial similarities are striking. Rapidly rising valuations, intense hype, venture capital flowing freely, and technology that promises to transform everything. It's natural to feel like we're seeing a repeat.

But the differences matter more than the similarities.

What's Similar

The hype cycle is real and reminiscent of the late 1990s. You had Pets.com and You had Web Van and all these companies that got billion-dollar valuations despite having no sustainable business model. Today you have AI startups raising hundreds of millions for solutions that might solve problems at scale, or might not.

The media narrative is also similar. In 1999, every mainstream publication was running stories about how the internet would transform everything and traditional companies were doomed. Today, every publication is running stories about how AI will transform everything and companies that don't adopt it are doomed. Same energy, different technology.

Investor FOMO is present. The fear that you'll miss the next big thing if you don't deploy capital into AI is very real in boardrooms and VC firms.

Early-stage company valuations are definitely stretched. An AI startup with a working prototype and no revenue can still raise at a $100 million valuation if the investor narrative is compelling enough.

What's Radically Different

Here's the crucial part: the underlying infrastructure and demand dynamics are completely different.

In the dot-com era, the internet existed, but most of the economy wasn't digitized. Building a web company meant finding customers who weren't yet online, convincing them the internet was worth using, and then building a business around them. That's hard. Many tried. Most failed. The ones that survived were the ones providing genuine value at a cost that made sense.

But here's the thing: most businesses in 1999 could survive without the internet. Your grocery store didn't need the internet. Your bank didn't need the internet. Your manufacturer didn't need the internet. They might benefit from it eventually, but it wasn't essential.

AI is different. If you're a software company in 2025, AI isn't optional. It's not a feature you might add someday. It's becoming fundamental to how software gets built, deployed, and scaled.

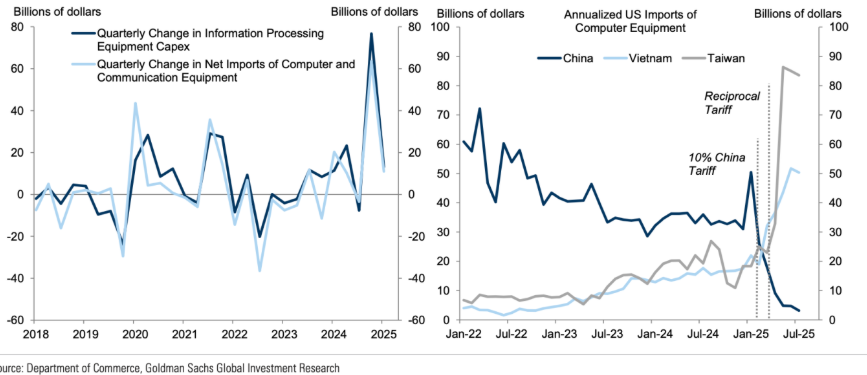

NVIDIA's financials reflect this. Their revenue is up because there's genuine, sustained demand for compute infrastructure to train and run AI models. This isn't speculative. Companies are buying their chips because they need them to deliver AI capabilities. The demand isn't hypothetical—it's in orders and revenue.

The other key difference: established players have profitable core businesses. Microsoft doesn't need Copilot to succeed for the company to survive and thrive. But Copilot succeeding would add a whole new revenue stream to a company that already generates enormous profit. That's not desperation. That's optionality.

During the dot-com era, traditional companies were scrambling to figure out the internet because they felt like their core business was under threat. Tech companies of today are calmly deploying billions into AI because they're making money hand over fist and can afford to take the long view.

The Investment Scale: $370 Billion Annually and What It Means

When we talk about the AI wave, the scale needs to sink in. We're not talking about money. We're talking about capital allocation at a scale that shapes the entire technology industry.

$370 billion per year. That's what the major technology companies are collectively spending on AI-related initiatives in 2025. For context, that's roughly equivalent to the entire GDP of Greece. It's the annual operating budget of most governments outside the largest economies.

Let's break this down by company to get a sense of the commitment:

- Microsoft is spending tens of billions annually on AI infrastructure, Azure expansion, and OpenAI investment.

- Google/Alphabet is similarly committed across search integration, Gemini, and infrastructure.

- Amazon is investing heavily in bedrock services and infrastructure.

- Meta is building LLa MA and infrastructure for their product ecosystem.

These aren't experimental budgets. These are structural capital commitments. You don't spend this kind of money on a hunch. You spend it when you believe the market is shifting in a direction that will define the next decade of computing.

The Chip Crunch and Real Constraint

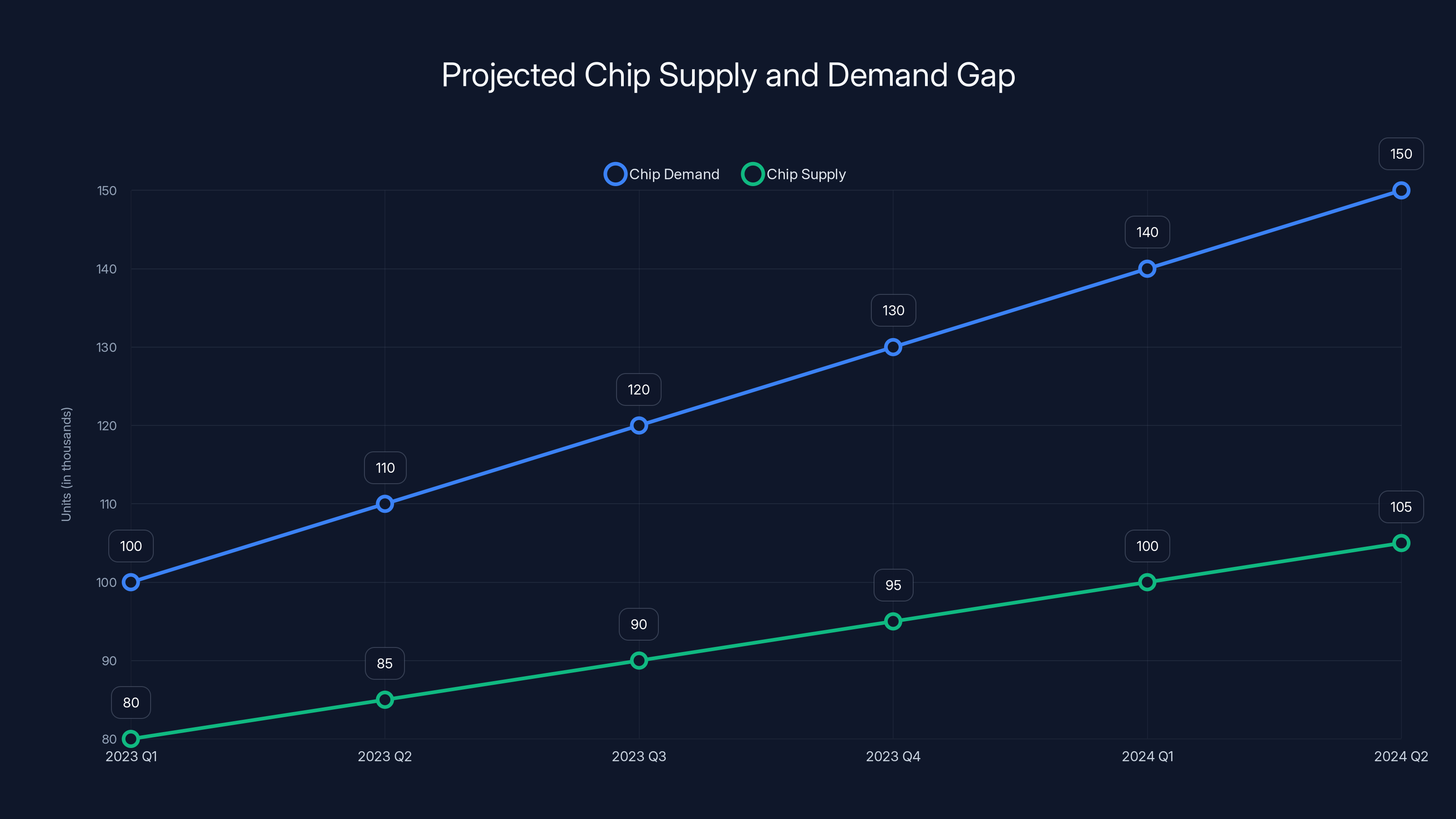

One indicator that this is real rather than speculative: there's an actual physical constraint limiting how fast the AI infrastructure can expand.

Every major player is competing for the same resource: advanced semiconductor chips. NVIDIA produces the H100 and H200 chips that are essential for training and running large language models. Demand for these chips has exceeded supply for over a year. Companies are waiting months to receive orders.

In a speculative bubble, you don't typically see this kind of physical constraint. You see unlimited supply meeting unlimited demand (sometimes at any price). Here, you see customers competing for limited supply and paying premium prices to secure chips.

This is a real bottleneck. It's slowing down the buildout of AI infrastructure. Companies have money but can't spend it fast enough because they're waiting for chips.

That constraint is actually healthy for valuations. It prevents overexpansion. It forces capital discipline.

ROI Expectations vs. Reality

Now here's where it gets interesting. Investment at this scale usually has some expectation of return. You don't commit $370 billion annually without expecting that to generate economic value.

According to Slalom Consulting's research, 62% of UK and Ireland executives expect a return on their AI investment within two years. That's important. That's not a "wait ten years and see" attitude. That's an expectation of measurable business impact relatively quickly.

Some of that will be met. Some won't. Early adopters who implement AI thoughtfully are already reporting productivity gains. But expecting 62% of all AI investments to generate ROI within 24 months might be optimistic.

This is where some of the bubble dynamics do apply. The pressure to show ROI quickly could lead to poor decision-making. It could lead to AI implementations that are more about checking a box than solving a real problem. Some companies will waste money on AI solutions they don't need.

But the existence of that pressure and some resulting waste doesn't invalidate the underlying trend.

OpenAI's projected 50x price-to-sales ratio is significantly higher than other leading tech companies, indicating a high valuation expectation. Estimated data.

From Hype to Production: Where AI Is Actually Delivering

Here's what's easy to miss when you're focused on the hype cycle and valuation debates: AI is actually delivering measurable value in production environments right now. This isn't theoretical. This is happening at real companies, on real problems.

The shift from experimentation to production is happening faster than almost anyone predicted two years ago.

Specific Use Cases With Measurable Impact

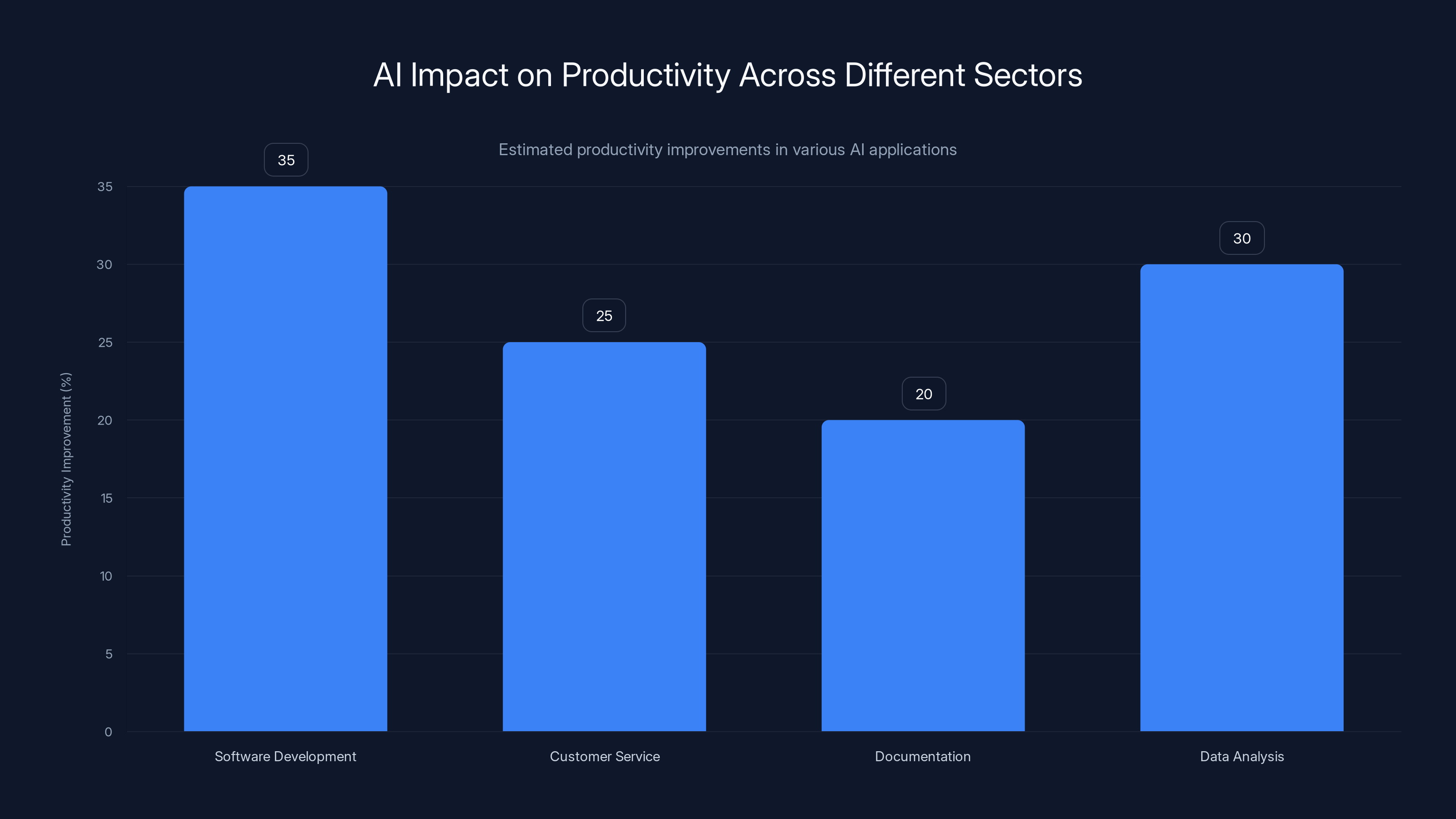

Software development is the clearest example. Companies using AI coding assistants like Git Hub Copilot are reporting faster development cycles. Code review times are down. Time to market for new features is compressed. This isn't a small effect. Some organizations are seeing 30-40% productivity improvements in specific tasks.

Now, not all coding tasks benefit equally. The more structured and pattern-based the work, the more AI helps. Writing boilerplate code? AI is excellent and saves significant time. Architecting a complex system? AI helps but doesn't replace human judgment.

Customer service is another area seeing real impact. Companies using AI chatbots and support automation are reducing response times and handling more tickets with the same staff. They're also reducing the burden on human agents by filtering out the easy questions so humans can focus on complex issues.

Documentation and knowledge management is increasingly AI-powered. Companies are using AI to generate documentation from code, summarize meeting notes, and help employees find information faster. These aren't flashy applications, but they're delivering concrete time savings.

Data analysis is being transformed. Analysts can now ask questions of their data in natural language using AI tools. Instead of needing to write SQL queries, you can describe what you want to know and AI translates that into analysis. That's genuinely useful for decision-making.

The common thread: AI is most valuable where it augments human capabilities rather than replacing them entirely. Where it handles routine, high-volume work and surfaces interesting exceptions for humans to investigate.

Adoption Patterns Show Real Demand

The companies reporting the most success with AI aren't the ones that treat it as a revolutionary technology that will change everything overnight. They're the ones that treat it as a powerful tool that can improve specific, well-defined workflows.

Adoption is moving along a predictable curve. Early adopters are now transitioning to broad deployment. That's a healthy sign. It means we've moved past the phase where every company needs to have an "AI strategy" and into the phase where they're implementing AI solutions that solve real problems.

Slalom's research also found that 64% of UK and Ireland organizations are creating or planning new AI-related roles, not eliminating existing ones. This contradicts the fear-mongering narrative that AI will simply automate away jobs en masse. Instead, we're seeing organizational structures adapt to incorporate AI. New roles are emerging: prompt engineers, AI trainers, AI ethicists, responsible AI officers.

This pattern is consistent with the "Luddite Fallacy" that economists have observed throughout history. Technological transitions do displace workers in specific roles, sometimes causing real hardship. But they also create new opportunities and expand the total number of jobs over time. The transition period is messy and uneven, but the long-term trajectory is toward more work, not less.

The Valuation Question: Is 50x Revenue Unreasonable?

OpenAI's reported path to a $1 trillion valuation requires some unpacking, especially given the revenue projections involved.

If OpenAI reaches

For comparison, here's where some well-known tech companies trade:

- NVIDIA trades around 25-30x forward sales.

- Stripe is valued at roughly 45x revenue in recent funding rounds.

- Figma has traded at 40x+ revenue.

- Adobe trades around 8-10x revenue.

So a 50x multiple for OpenAI would be at the high end of what fast-growing software companies command, but not completely unprecedented. It's in the range of what you'd expect for a company with:

- Strong proprietary technology with competitive moats

- Accelerating revenue growth

- High gross margins

- Dominant market position in an emerging category

- Optionality for expanding into multiple revenue streams

The question is whether OpenAI actually fits that profile. That's where reasonable people disagree.

On the bullish case: OpenAI has built the most advanced language model available. They're the go-to choice for enterprises implementing AI. They have relationships with major technology companies and enterprise customers. The technology is improving rapidly. Revenue growth is accelerating.

On the bearish case: Competitors are catching up quickly. Google has Gemini. Open-source models are becoming more capable. Enterprise adoption might slow if customers develop in-house capabilities. The path from $20B to hundreds of billions in annual revenue isn't clear.

Both cases are defensible. But the key point is: the valuation isn't completely detached from reality. It's based on real revenue and real growth. That's different from the dot-com era, where many companies had no revenue at all.

The Margin Compression Risk

Here's a risk factor that doesn't get enough attention: AI services have potential margin compression built in.

When you're running inference (answering user queries using a trained model), your costs scale directly with usage. More API calls = more compute = more costs. This is fundamentally different from traditional software, where you can often double revenue with minimal additional costs.

If competition drives down prices for AI API access, margins could compress significantly. You could end up with a situation where revenue is growing but profit is flat or declining because costs are growing just as fast.

OpenAI and others are aware of this and developing strategies (training efficiency, custom models, enterprise bundles) to maintain margins. But it's a structural risk to the high-multiple valuation story.

Estimated data shows Microsoft and Meta leading with $100 billion each in AI investments, reflecting their strategic focus on AI infrastructure and development.

The FOMO Factor: Why Board-Level Mandates Drive Bad Decisions

One of the most interesting dynamics in the current AI wave is fear of missing out driving organizational behavior that doesn't always make sense.

A board member reads about AI and insists the company needs an "AI strategy." A CEO worries that competitors are moving faster and pushes for AI adoption across the organization. A team lead hears about AI success at another company and wants to implement it in their domain without clear business justification.

This is real. It's happening at thousands of companies right now.

The danger is that this dynamic leads to poor capital allocation. Companies build AI solutions to problems they don't actually have. They implement AI in workflows where it doesn't meaningfully improve outcomes. They create the perception of activity and progress without actual business value.

When companies do this at scale, you get a situation that does look bubble-ish. Lots of money being spent. Lots of activity. But the underlying value creation is questionable.

Separating Signal From Noise

The companies that will thrive through the AI transition are the ones that resist this pressure and implement AI thoughtfully.

They start with a specific problem that they can measure. They pilot a solution with a small team. They measure the impact carefully. They scale what works and discontinue what doesn't.

They avoid the trap of implementing AI just to have an "AI strategy." They implement AI solutions where the business case is clear.

This approach is harder. It requires discipline. But it's how you actually create value instead of chasing hype.

Companies doing this well are already pulling ahead of their competitors. Not because they're moving faster. Because they're moving smarter.

The Competitive Landscape: Big Players vs. Scrappy Startups

One of the most important dynamics to understand is how the competitive landscape is shaping up. This is where the difference between bubble and sustained wave becomes most apparent.

The large technology companies (Microsoft, Google, Amazon, Meta) have structural advantages that smaller competitors simply can't match:

- They can amortize AI investments across massive customer bases

- They have profitable core businesses to subsidize long-term AI development

- They have direct distribution channels

- They have data advantages

- They can attract top talent with equity compensation

For a startup to compete, they need to:

- Find a narrow problem where they can outcompete the big players

- Build technology that's better enough to justify switching costs

- Generate revenue quickly to fund operations

- Retain customers even as the big players add AI capabilities

That's possible. It's happened before. But it's hard. Many startups will try. Most will fail.

Where Startups Can Win

The startups that will survive are those focused on specific verticals or use cases where deep expertise matters. Companies building AI solutions for legal research, medical imaging, or financial analysis have advantages if they understand their domain deeply.

Specialized models that are better at specific tasks than general-purpose models also have a chance. If you train a model specifically on legal documents and it outperforms a general model on legal questions, that has value.

There's also value in the "picks and shovels" layer. Companies building infrastructure, tools, and platforms that make it easier for others to build AI applications have a shot.

But pure competitors to OpenAI or Google's AI capabilities? Those are fighting a losing battle. The big players have too many advantages.

The Open-Source Wildcard

One factor that complicates the competitive picture: open-source models.

Models like LLa MA, released by Meta, have become capable enough that organizations don't always need proprietary models. You can fine-tune an open-source model for your specific task and run it on your own infrastructure.

This creates competition for the closed, proprietary models. It also creates an alternative path for companies that don't want to depend on a single vendor.

For OpenAI and others, this is a competitive threat. For organizations and startups, it's an opportunity.

AI is delivering significant productivity improvements, with software development seeing the highest estimated gains at 35%. Estimated data based on industry reports.

Infrastructure Constraints: The Chip Bottleneck That's Holding Everything Back

To understand whether the current AI trajectory is sustainable, you need to understand the hardware constraints.

Training large language models and running them at scale requires specialized chips. GPUs from NVIDIA are the most common choice, though Google and others are developing their own accelerators.

The demand for these chips vastly exceeds supply. Companies have been waiting 6-12 months to receive large orders. Prices have inflated significantly above list price as customers compete for limited inventory.

This creates an interesting dynamic. On one hand, it's a constraint that's slowing down the AI infrastructure buildout. Companies have money but can't spend it because they can't get the chips.

On the other hand, this scarcity is actually healthy for the market. It prevents the kind of unlimited overexpansion that characterized bubble markets. It creates a natural brake on how fast things can move.

The Chip Supply Picture

New chip capacity is coming online. NVIDIA is increasing production. New entrants like Cerebras and Graphcore are building alternatives. Custom accelerators from tech companies are in development.

But building a new chip fab takes time. Years. The shortage isn't going away in the next 12-18 months. This creates sustained pricing power for chip manufacturers and sustained frustration for companies trying to build AI infrastructure.

The shortage is also creating investment opportunities. Suppliers to the chip ecosystem (cooling systems, packaging materials, etc.) are seeing increased demand.

Energy Constraints

Beyond chips, there's another constraint: energy.

Training large models and running inference at scale requires enormous amounts of electricity. A single training run for a frontier model can consume as much power as a small city. Running an AI service at scale requires data center infrastructure that can handle massive power demands.

This is creating infrastructure investment opportunities for companies that can provide renewable energy to data centers. It's also creating environmental questions about whether AI can scale sustainably.

The energy constraint is real and growing. As AI adoption increases, so does power consumption. This is a limiting factor on how fast the infrastructure can expand.

The Business Model Question: How Do These Companies Make Money?

Underlying all the valuation discussion is a more fundamental question: what's the sustainable business model for AI companies?

The Subscription Model

Most commercial AI services operate on a subscription model. You pay monthly or annually for access to an API or service. OpenAI offers Chat GPT Plus at $20/month. Companies offer enterprise subscriptions for customized models or dedicated infrastructure.

This is a proven model for software. It works. It creates recurring revenue that's predictable and scales.

But the unit economics need to work. If you're spending more on infrastructure and compute to serve a customer than you're collecting in subscription revenue, the business doesn't work at scale.

The Usage-Based Model

Some AI services charge based on usage. You pay per API call or per token processed. This aligns costs with revenue in a direct way.

The challenge: this makes it hard to build a large enterprise business. Enterprise customers want predictable costs. If they don't know what their bill will be next month, that's a problem.

The Bundled Model

Most successful tech companies eventually move toward a bundled model. You integrate AI capabilities into your existing products (search, productivity tools, etc.) and charge for the overall bundle.

This is what Microsoft is doing with Copilot. It's built into Office and Windows, and you pay for those subscriptions. The AI is a feature, not a standalone product.

This model often has better economics. You're amortizing the AI costs across a large customer base that's paying for multiple things.

The Data and Insight Model

Some companies might eventually build business models around providing insights derived from AI analysis of data. Instead of selling access to a model, you're selling the value of what the model finds.

This is harder to implement and requires domain expertise, but it has the potential for high margins.

Which Model Will Dominate?

Likely the tech industry will eventually settle on a combination. Subscription models for consumers and basic enterprise access. Usage-based models for power users. Bundled models for companies that already have deep customer relationships.

But the transition period is where things get tricky. Companies are experimenting. Some pricing will be wrong. Some business models won't work. Companies will adjust and consolidate.

The demand for specialized chips is projected to outpace supply over the next 18 months, highlighting ongoing constraints in AI infrastructure development. Estimated data.

The Policy and Regulatory Landscape: Will Government Kill the Wave?

One factor that could either accelerate or interrupt the AI wave: policy and regulation.

Governments around the world are grappling with AI. Some are moving toward strict regulation. Some are trying to stay hands-off and let the market move. Most are somewhere in between.

The uncertainty creates risk. If a major market (like the EU) imposes regulations that make it much harder or more expensive to develop or deploy AI, that changes the equation.

However, most policymakers aren't trying to kill AI. They're trying to manage the risks while allowing the benefits. Federal Reserve Chair Jerome Powell recently characterized the AI investment wave as "the beginning of real, profitable businesses" rather than speculation. That kind of framing from a major policymaker suggests the political environment is more supportive than skeptical.

The regulatory landscape will likely create compliance costs and limit certain applications (especially around bias, privacy, and autonomous weapons). But it's unlikely to stop the wave entirely.

The Competitive Angle

Another policy dynamic: countries are competing to be leaders in AI development. China is investing heavily. The US is maintaining dominance through large tech companies and research institutions. Europe is trying to develop its own AI capability.

This competitive dynamic actually accelerates investment. Countries fear that falling behind will have strategic consequences. That's a powerful driver of resource allocation.

Distinguishing Real Progress From Hype Cycles

One of the most important skills right now is being able to separate genuine AI progress from hype and marketing.

Real progress looks like: reproducible improvements on meaningful benchmarks, real customers adopting at scale, companies building profitable business models, measurable productivity gains in production environments.

Hype looks like: impressive demos that don't generalize, press releases about partnerships, vague commitments to "leverage AI," announcements of AI strategies without concrete plans.

The Test

Here's a useful test: Would this capability still be impressive if it wasn't AI?

If you have a tool that helps customer service representatives respond to emails faster, that's useful. The fact that AI powers it is interesting but not crucial. If the tool works and customers pay for it, it's a real business.

If you have a tool that generates acceptable customer service responses automatically, that's more impressive. It's actually doing work that humans would otherwise have to do.

If a company is spending millions on AI infrastructure to generate capabilities that aren't actually used or valued, that's hype.

Following the Money

Another useful indicator: follow the money. Who's actually spending real resources on AI, and where?

If major enterprises are integrating AI into their core operations and budgeting for it, that's real. If startups are raising billions specifically because they have AI as a feature, that might be more hype.

If infrastructure spending is accelerating, that suggests the underlying demand is real. If it's plateauing, that might signal we're hitting the peak of the cycle.

What Happens If Some Things Fail: A Healthy Correction vs. A Collapse

One scenario that's worth considering: some AI companies and initiatives will definitely fail. That's not a sign of a bubble. That's a sign of a healthy market.

In any emerging field, you get some winners and many losers. The winners create value that persists. The losers consume capital and disappear. On average, the winners more than make up for the losers, leading to net value creation.

The question is whether the failure rate is normal or extreme.

Normal would look like: 30-50% of AI startups fail within 5 years, but the survivors generate enormous value and attract continued investment. Some AI projects fail to generate ROI, but the aggregate ROI across all AI investments is positive.

Extreme (bubble-like) would look like: 80-90% of AI startups fail, only a handful of survivors, aggregate ROI is negative, and investor appetite for AI dries up completely.

We're not at the extreme yet. We're probably still in the normal-to-euphoric range. Some failures are coming. That's fine. It's part of the process.

What matters is whether the core infrastructure, the demand from enterprises, and the profitability of the leading players remains intact. If it does, then the wave continues even if some surfers wipe out.

The Long View: What Happens Over the Next Five Years

Here's what I think is likely (emphasis on likely, not certain):

In the next 2-3 years, we'll see a partial correction. Some AI startups will shut down or get acquired at down valuations. Some AI projects will be recognized as overambitious or poorly executed and scaled back. Media coverage will become less euphoric. Some companies will announce that their AI investment hasn't generated expected ROI.

This will feel scary to people who've bought into the "AI is going to change everything" narrative. It will be used as evidence that the whole thing was a bubble.

It won't be.

Because at the same time, the big players will continue to see strong adoption of AI capabilities. Cloud infrastructure revenue will grow. Developer tools with AI built in will become standard. Organizations will move from asking "should we do AI?" to asking "which AI technologies are working for us and how do we scale them?"

The companies that survive the correction will be the ones with real business models and real customers. That's actually good. It means the field is maturing.

Five years from now, AI will likely be as foundational to computing as the cloud is today. It will be normal. Integrated. Expected. The hype will have largely dissipated because AI won't be novel anymore.

That's not a collapse. That's the wave continuing to build, even as the hype cycle subsides.

The Pragmatist's Guide: What This Means for Organizations

If you're trying to figure out what to do about AI in your organization, here's my practical take:

Don't rush. But don't wait either. The time for experimentation is now. Pick specific, well-defined problems that could benefit from AI. Run pilots. Measure results carefully.

Invest in your people's AI literacy. Everyone in your organization should understand what AI can and can't do, what the real use cases are, and how to evaluate AI tools critically.

Build with open-source and widely-available models first. You don't need to build your own models from scratch or sign exclusive partnerships. Many of the best solutions are built on off-the-shelf technology.

Focus on outcomes, not hype. The companies that will thrive are those that ask "does this AI solution generate measurable business value?" not "what's our AI strategy?"

Be ready to adapt. The landscape is moving fast. Solutions that are state-of-the-art today might be commoditized in two years. Keep learning.

For Investors

If you're investing in AI companies, the same logic applies. Look for real revenue and real customers, not just impressive tech.

Be skeptical of valuations that require continued exponential growth to make sense. The sustainable winners will eventually settle into more reasonable multiples.

Prioritize companies with defensible competitive advantages. That might be data, network effects, regulatory approval, or relationships. Avoid companies that are only differentiated on "we use the latest AI model."

For Employees

If you work in tech, understand AI enough to have an informed opinion about it, but don't assume you need to become an AI specialist to remain relevant. The skills that will remain valuable are domain expertise, judgment, and the ability to solve real problems.

The people who will be most affected by AI are those who do highly repetitive, pattern-based work. If that describes your job, it's worth thinking about how to develop skills that are harder to automate.

The Verdict: Wave, Not Bubble

After looking at all of this, here's what I believe: we're surfing a powerful wave of technological transformation, not inflating a bubble.

The wave will have crashes and corrections. Some companies will wipe out. Some innovations won't pan out. But the underlying fundamentals are sound.

The big tech companies are making real capital commitments. Enterprise customers are adopting AI at scale. Business models are beginning to work. Infrastructure constraints are creating natural discipline.

Most importantly, AI is solving actual problems and creating measurable value. It's not a hypothetical technology anymore. It's real. It's working. It's generating revenue.

Will there be a correction? Almost certainly. Will some investors and companies get hurt? Absolutely. Will certain AI applications and business models fail to materialize? Yes.

But the wave continues. The transformation continues. In five years, we'll look back and realize that 2025 was still the early innings of AI adoption, not the peak.

The real question isn't whether we're in a bubble. It's whether you're positioned to benefit from the wave.

FAQ

What is an AI bubble, and how is it different from the dot-com bubble?

An AI bubble would be a situation where valuations become completely disconnected from underlying cash flows or revenue, driven purely by speculation rather than fundamentals. The dot-com bubble saw companies with no revenue commanding billion-dollar valuations. The AI wave is different because the largest players generating the valuations (Microsoft, Google, Amazon) already have profitable core businesses and are deploying capital into AI based on real demand and emerging revenue streams from AI services.

How much money is being invested in AI annually, and what does that signify?

Major technology companies are collectively committing approximately $370 billion annually to AI-related initiatives. This level of structural capital commitment from established, profitable companies suggests real belief in the long-term potential rather than pure speculation. You don't allocate this kind of money based on hype alone—you do it when you believe the market is fundamentally shifting.

Why are early-stage AI startups at higher risk than the large tech companies?

Startups lack the diversified revenue streams that allow large tech companies to subsidize long-term R&D bets. They need to reach profitability quickly and prove their business model works in a crowded market where the tech giants have enormous advantages. Many will compete on narrow use cases or specialized knowledge, but the failure rate will likely be high. Established companies can afford to experiment; startups cannot.

Is AI actually delivering measurable business value right now, or is it mostly hype?

AI is delivering genuine value in production environments today, though unevenly. Software developers using AI coding assistants report 30-40% improvements in specific tasks. Customer service organizations are reducing response times. Data analysts can query information faster. However, not all AI implementations generate positive ROI—some solve non-existent problems or don't meaningfully improve over existing solutions. The key is matching AI to specific problems where it genuinely adds value.

What does Jerome Powell's statement about "real, profitable businesses" mean for the AI market?

When the Federal Reserve Chair describes the current AI investment wave as the "beginning of real, profitable businesses" rather than speculation, it carries significant weight. It suggests policymakers view this as a structural shift in the economy rather than a speculative bubble. This kind of framing from major institutions generally precedes sustained infrastructure investment rather than market collapse.

What happens if OpenAI fails to achieve $20 billion in annualized revenue by 2025?

If OpenAI misses revenue projections significantly, it would validate concerns about overvaluation and hype. However, even if OpenAI specifically stumbles, it wouldn't necessarily invalidate the broader AI wave. Other companies like Microsoft, Google, and emerging competitors are building AI capabilities independently. The wave continues even if individual companies underperform.

How do I evaluate whether an AI implementation makes sense for my organization?

Before implementing AI, ask three questions: (1) Does this solve a specific, well-defined business problem? (2) Can we measure the impact clearly? (3) What's the realistic timeline and ROI? If you can't answer "yes" to all three, you're likely chasing hype rather than solving a real problem. Start with pilots on high-confidence opportunities, measure results carefully, and scale what works.

What's the realistic timeframe for the next correction in AI valuations?

A partial correction is likely within 2-3 years as the initial hype settles and some companies fail to deliver. However, this would be a healthy correction within a sustained wave, similar to corrections in cloud computing or mobile technology. The big players would likely remain strong while early-stage startups face the most pressure. Don't mistake a 30-40% correction in overvalued startups for a complete collapse of the AI wave.

Will open-source AI models like LLa MA threaten companies like OpenAI?

Open-source models create real competition for proprietary services, especially for organizations that want to avoid vendor lock-in. This compresses margins and limits pricing power for companies offering closed models. However, there's likely room for both. Open-source models handle general tasks well; specialized models and proprietary versions with superior performance capture premium pricing. It's similar to how Android and iOS both succeed despite competing in the same space.

What infrastructure constraints might slow down AI development?

Two major constraints: semiconductor chip availability (demand for advanced GPUs exceeds supply by months) and electricity capacity (training large models consumes enormous amounts of power). These physical constraints actually help prevent bubble-like overexpansion by creating natural scarcity and pricing power. New capacity is coming online, but these bottlenecks will persist for 18-24 months, which shapes the timeline for AI infrastructure buildout.

Automate Your AI Workflow Analysis

Generate AI reports, dashboards, and documentation automatically to track your organization's AI adoption metrics and ROI in real-time.

Key Takeaways

- Major tech companies committing $370B annually to AI represents structural investment, not speculation driven by FOMO.

- Unlike dot-com era, big players have profitable core businesses subsidizing AI bets, creating fundamentally different risk dynamics.

- OpenAI's $20B revenue run rate and potential 50x valuation is defensible compared to historical tech multiples for high-growth software.

- Actual measurable value is being delivered: 30-40% developer productivity gains, reduced support response times, accelerated legacy modernization.

- Early-stage startups will fail at high rates, but the underlying wave of AI adoption in enterprise continues regardless.

Related Articles

- Why CEOs Are Spending More on AI But Seeing No Returns [2025]

- Nvidia's $1.8T AI Revolution: Why 2025 is the Once-in-a-Lifetime Infrastructure Boom [2025]

- Enterprise AI Adoption Report 2025: 50% Pilot Success, 53% ROI Gains [2025]

- Google's Hume AI Acquisition: The Future of Emotionally Intelligent Voice Assistants [2025]

- LinkedIn's Small Models Breakthrough: Why Prompting Failed [2025]

- Kioxia Memory Shortage 2026: Why SSD Prices Stay High [2025]

![AI Bubble or Wave? The Real Economics Behind the Hype [2025]](https://tryrunable.com/blog/ai-bubble-or-wave-the-real-economics-behind-the-hype-2025/image-1-1769096360989.jpg)