How Lunar Energy's $232M Funding Round Is Reshaping Grid Storage

The energy storage market just got serious. Lunar Energy, a six-year-old startup building residential battery systems, announced it closed two significant funding rounds that most of the industry didn't even know about until they were already done. That kind of quiet execution usually signals something important is happening.

The company raised a previously unannounced

What's driving this aggressive investment isn't hype. It's something more fundamental: the grid is breaking, and stationary batteries have become one of the few practical solutions that actually scale.

Here's what's really happening beneath the headlines, why this matters for the energy landscape, and what it tells us about where distributed power is heading in the next three to five years.

TL; DR

- **Lunar Energy raised 130M Series C +500M

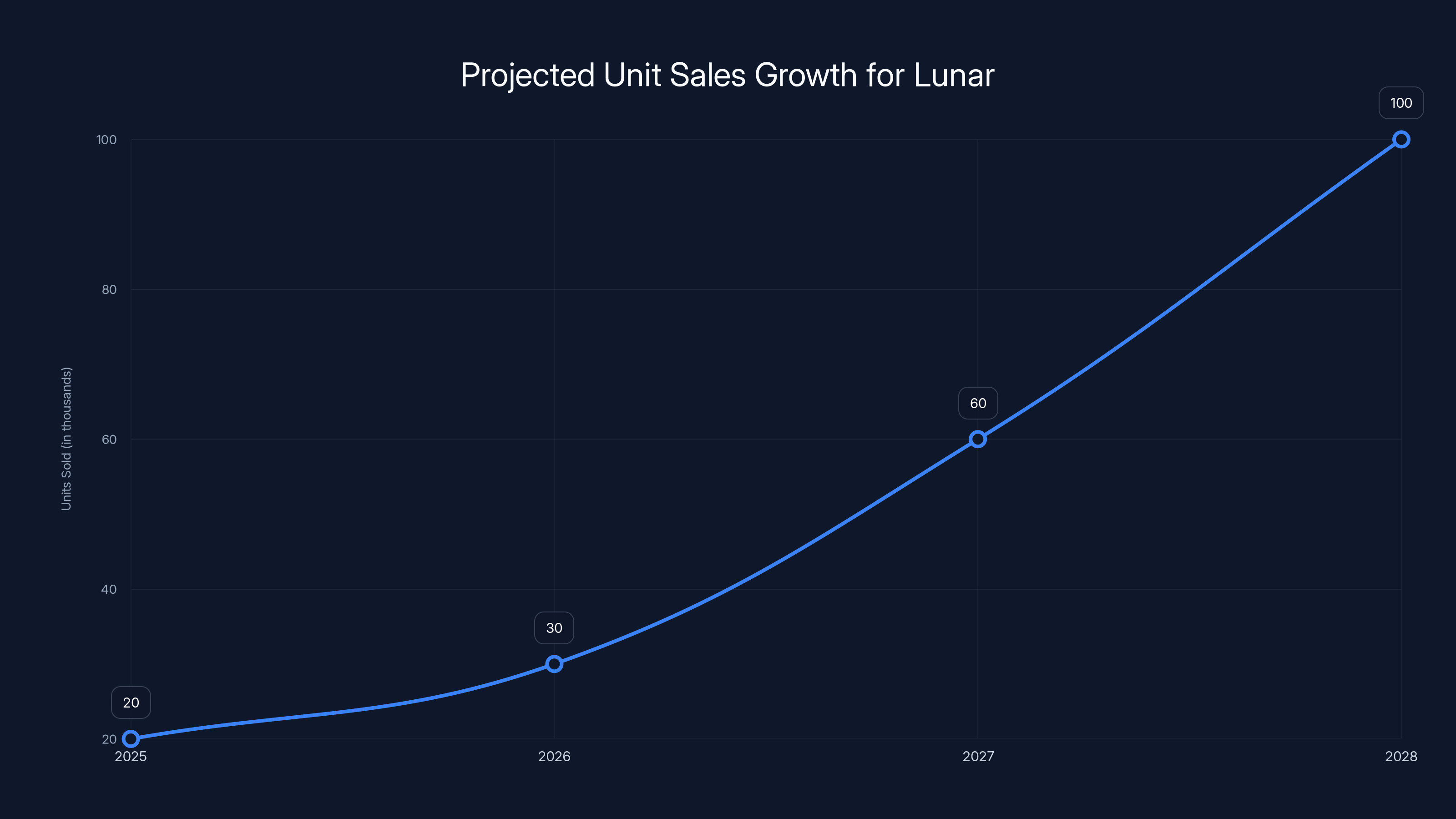

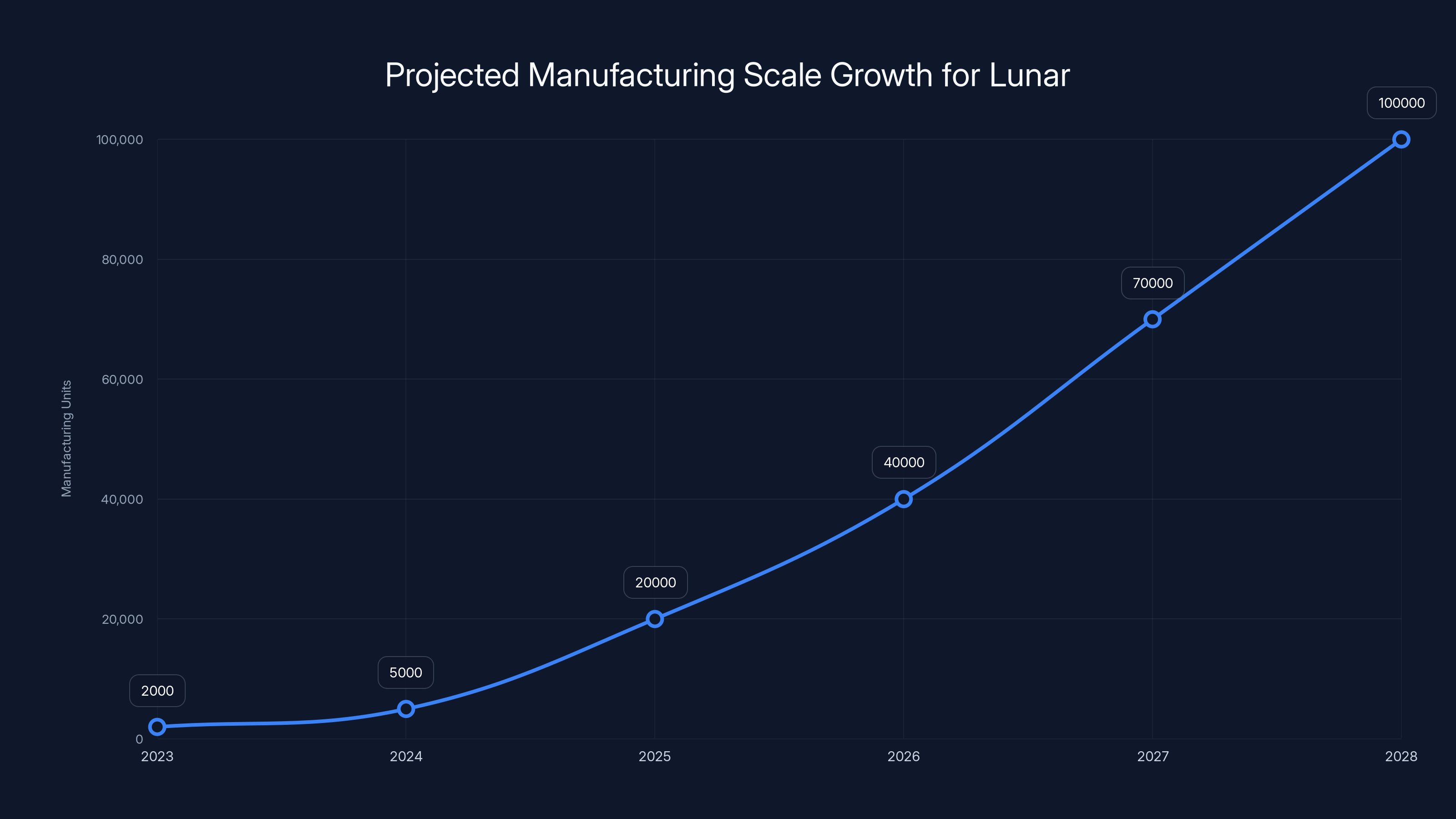

- Manufacturing scale: Company plans 20,000 units by end of 2025, scaling to 100,000 by end of 2028

- Virtual power plant model: Home batteries can discharge to grid when needed, replacing peaking power plants

- Policy tailwind: Inflation Reduction Act incentives drive U.S. battery manufacturing despite recent policy uncertainty

- Competitive heating up: Base Power raised $1B, Tesla operates Powerwall VPPs, making this a crowded but growing market

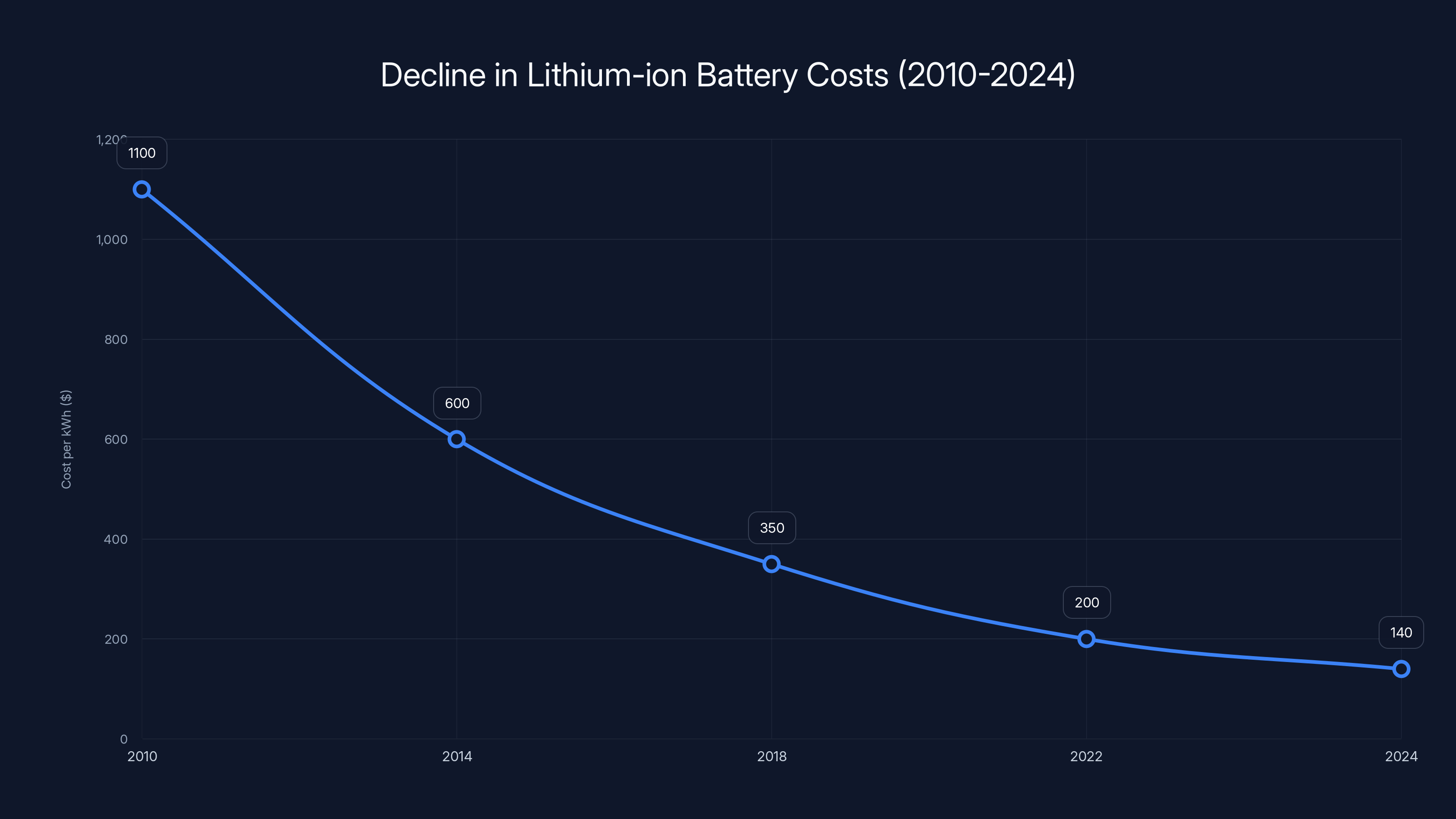

Lithium-ion battery costs have decreased by 87% from 2010 to 2024, reshaping the economics of stationary storage. Estimated data.

The Grid Is Straining Under New Pressure

You probably haven't thought much about what happens to the electrical grid when millions of people plug in their electric vehicles simultaneously. Or when a heat wave spikes cooling demand across an entire region. Or when you try to run an AI data center that consumes as much electricity as a small city.

The grid wasn't designed for this.

Traditional power infrastructure was built around predictable, relatively flat demand. A coal plant runs at steady output. You have peaking plants that fire up during demand spikes. The system works because demand patterns repeat like clockwork: morning ramp up, evening peak, night valley.

That's completely broken now.

Electrification is accelerating demand in ways the grid can't keep up with. Electric vehicles are coming online faster than projected. Data centers are multiplying. Heat pumps are replacing gas furnaces. And critically, renewable energy sources like solar and wind create unpredictable generation patterns that don't align with demand.

The result? Grid operators face a crisis of flexibility. They need massive amounts of power available on demand, but traditional peaking plants (mostly natural gas turbines) are expensive to build, increasingly opposed by communities, and worse for the environment.

This is where stationary batteries change the equation entirely.

A battery sitting in someone's garage in California isn't just storing power for that household. It's a grid asset. It can discharge instantly when the grid needs it. It responds faster than any combustion plant. And critically, it costs less to deploy than building new fossil fuel infrastructure.

Why Stationary Storage Is The Overlooked Winner

Everyone talks about electric vehicles. The media loves EV stories: shiny Teslas, Rivian trucks, emerging Chinese competitors. But stationary storage—batteries that sit in homes, businesses, and utility installations—has quietly become the faster-growing, more capital-intensive, and potentially more impactful segment.

Here's the structural reason: EV batteries have slowed down due to regulatory whiplash. The Trump administration and GOP-controlled Congress gutted large portions of the Inflation Reduction Act, which had been the main incentive driving U.S. battery manufacturing for automotive supply. Companies that bet on building EV battery factories in America suddenly faced collapsing demand from domestic automakers.

Stationary storage? That incentive structure actually strengthened.

As grid strain increases, utilities, state regulators, and grid operators are willing to pay for solutions that improve resilience. A residential battery that can pump power back to the grid during emergencies has clear, measurable value. There's no policy ambiguity. There's a concrete problem needing a concrete solution.

Lunar's business model reflects this reality. The company installs 15 kilowatt-hour and 30 kilowatt-hour battery modules in homes across California, Georgia, and Washington. That's a strategic geographic distribution that covers multiple grid operators and regulatory environments. Each installation becomes part of what the industry calls a Virtual Power Plant, or VPP.

Here's where Lunar's technology gets interesting. They're not just selling batteries to homeowners who want backup power. They're deploying grid infrastructure. The company's software controls not just the batteries but also EV chargers and appliances in those homes. When the grid signals need, Lunar can simultaneously:

- Discharge stored energy to the grid

- Stop charging electric vehicles

- Adjust water heater setpoints

- Defer non-essential appliance operation

This multi-pronged approach is what transforms a collection of home batteries into actual grid infrastructure.

Lunar aims for a 50% compound annual growth rate from 2025 to reach 100,000 units by 2028. Estimated data.

The Virtual Power Plant Model Explained

Virtual power plants are becoming the most practical way to replace traditional peaking plants. And understanding why requires understanding the economics of the old system first.

A natural gas peaking plant is incredibly expensive. Building one costs hundreds of millions of dollars. Operating one requires staff, maintenance contracts, supply chain management for fuel. But here's the kicker: these plants sit idle most of the time. They run maybe 5 to 10% of the year, only during peak demand periods.

That's a terrible return on investment. You've built a half-billion-dollar asset that generates revenue for a fraction of the year. But utilities build them anyway because they need them for grid stability.

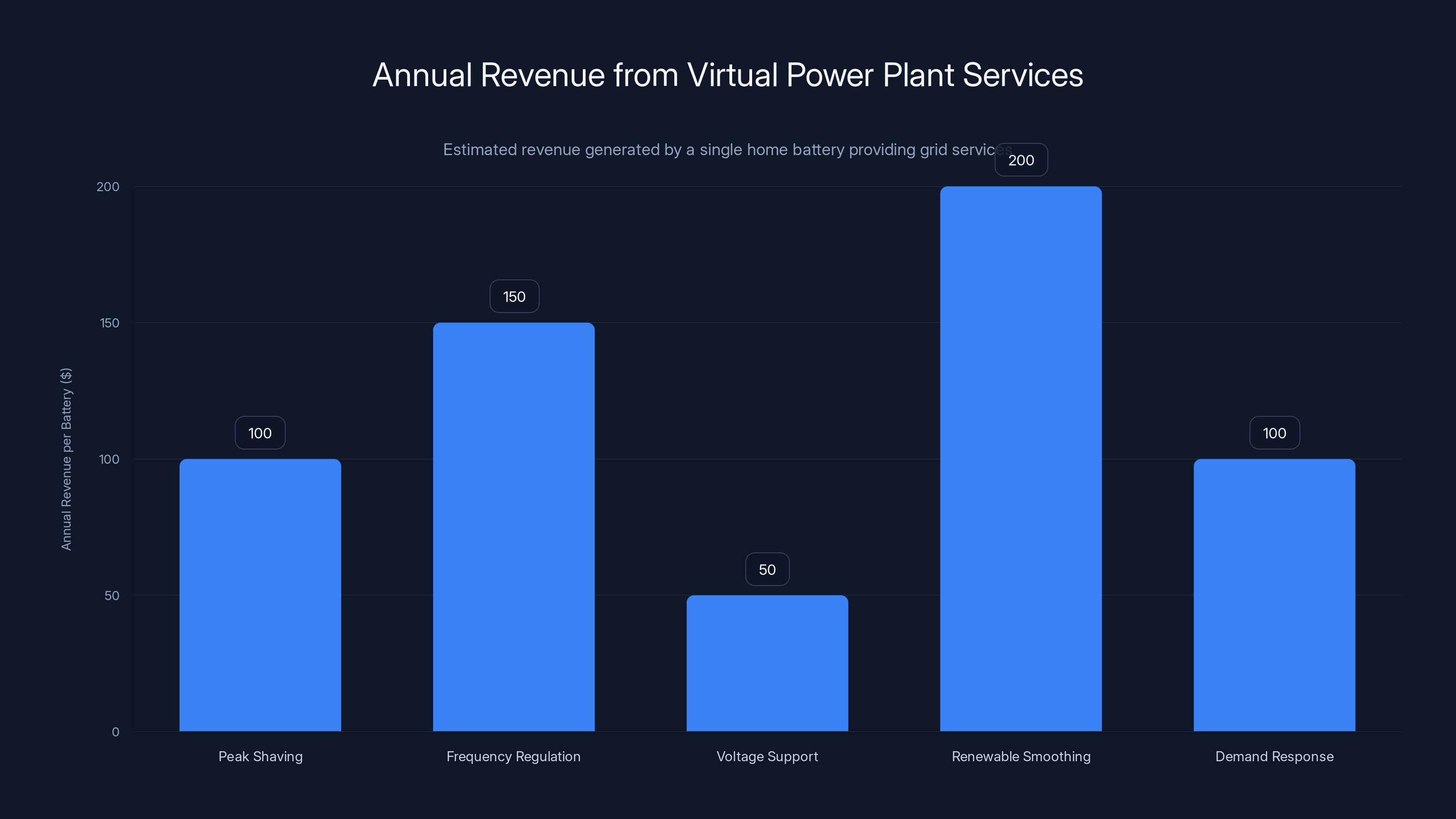

A VPP inverts this model. Instead of one centralized plant sitting idle most of the year, you distribute the resources across thousands or tens of thousands of locations. Each individual home battery generates value every single day through several mechanisms:

Peak shaving: When demand peaks, batteries discharge to reduce the grid load, preventing the need to spin up expensive peaking plants.

Frequency regulation: The grid operates at exactly 60 Hz (in North America). When demand and supply misalign even slightly, frequency drifts. Batteries can inject or absorb power instantly to correct this, a service utilities pay for.

Voltage support: Batteries can inject reactive power to maintain voltage stability, preventing cascading failures.

Renewable smoothing: When solar output drops suddenly due to clouds, batteries can fill the gap seamlessly.

Demand response: The software can shift consumption patterns to low-demand periods.

Each of these services generates revenue. A single home battery might generate

But there's a critical constraint: software coordination. You can't get these benefits from batteries that operate independently. You need them orchestrated. You need real-time communication with the grid. You need algorithms that optimize across all the resources simultaneously.

This is precisely the moat Lunar is building. They're not just selling hardware. They're building the software backbone that turns residential batteries into a coherent grid resource.

Manufacturing Scale Is The Real Constraint

Lunar's capital raise isn't primarily about R&D or market development. It's about manufacturing scale. The company plans to manufacture 20,000 units by the end of this year, accelerating to 100,000 units by the end of 2028.

Let's put that in perspective. Today, Lunar probably manufactures a few thousand units per year. Reaching 20,000 by end of 2025 means 5x-10x growth. That requires massive capital investment in manufacturing infrastructure, supply chain development, and working capital.

This is where the $232 million round becomes crucial. You can't scale manufacturing this aggressively with venture capital that arrives in small chunks over time. You need coordinated, large funding to simultaneously:

- Build or acquire manufacturing facilities

- Secure supply contracts for battery cells and componentry

- Train assembly workforces

- Establish distribution and installation networks

- Build out software infrastructure

- Acquire the customers to absorb production

Every one of these must happen in parallel, not sequence. If you build factories but can't source batteries, the factories sit idle. If you source batteries but can't train installers, the batteries pile up. If you have all the components but no customers, you're burning cash with no revenue.

Manufacturing scale in battery storage works differently than it does in, say, software. There's no marginal cost advantage to shipping bytes. But there are enormous advantages to efficient physical production. Companies that hit scale first often become unbeatable on cost, which matters enormously in hardware.

Lunar's previous investors—Activate, B Capital, Prelude—clearly believe the company has figured out how to execute this scaling process. All three are sophisticated investors who've seen hardware startups fail at scale transitions. Their willingness to deploy $232 million suggests confidence in execution.

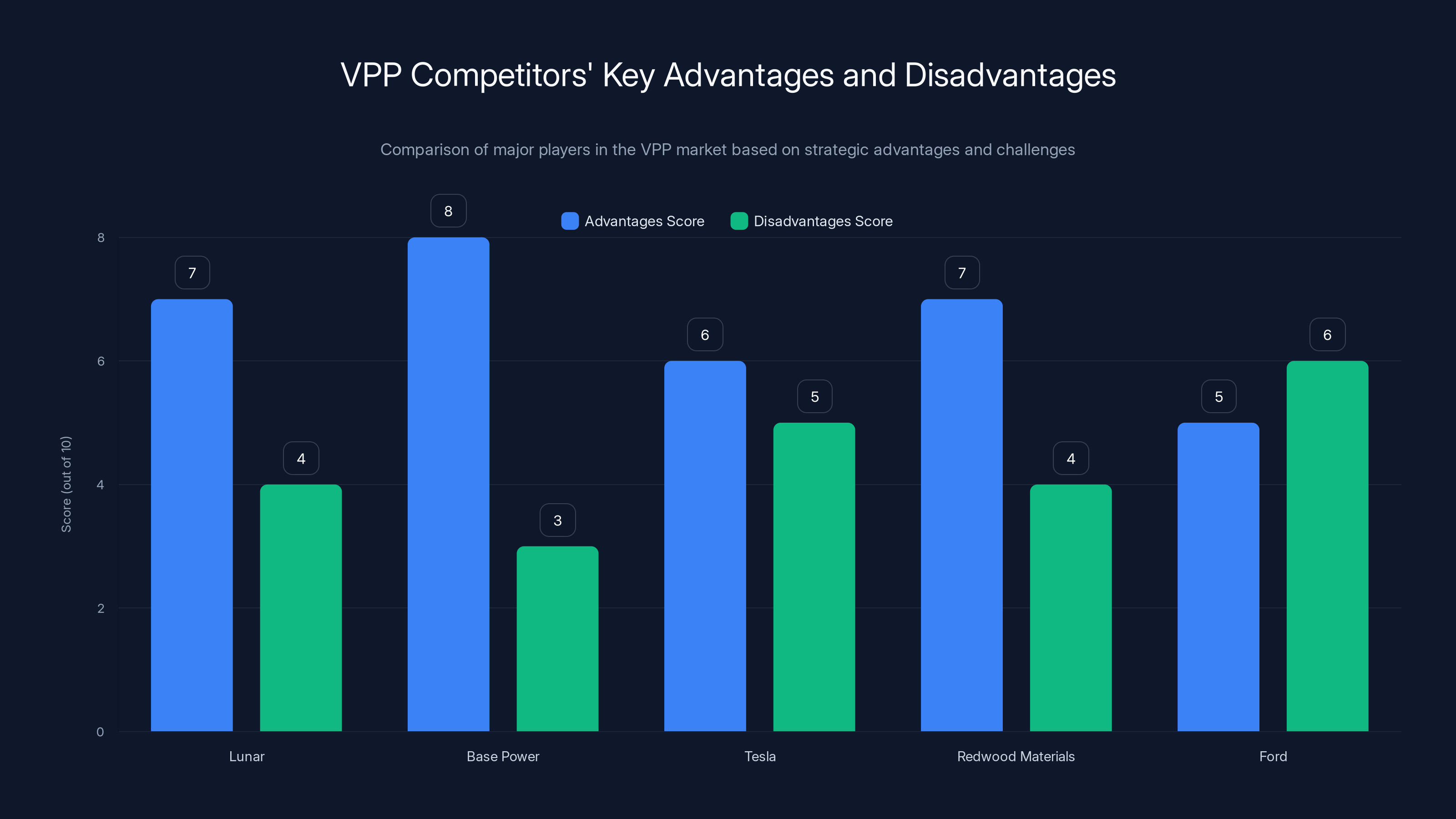

The Competitive Landscape Just Got Intense

Lunar isn't operating in a vacuum. The VPP space is heating up with capital and competitors.

Base Power, arguably Lunar's most direct competitor, raised

Tesla is operating its own Powerwall-based VPP, which has some interesting advantages and disadvantages. Tesla owns the customer relationship (people buy Powerwalls for the brand). But Tesla's incentive structure isn't purely focused on grid services—they're selling cars first, energy products second. Their Powerwall pricing reflects that: a 13.5 kWh Powerwall costs around

Redwood Materials, founded by former Tesla executive J.B. Straubel, has entered the energy storage business by acquiring battery recycling operations and adding manufacturing. Redwood has a different angle: they're positioning as the battery supplier and service provider, not the installer. This vertical integration might give them cost advantages long-term.

Ford is exploring residential battery offerings as part of its broader electrification strategy. Ford's advantages are dealer networks and manufacturing expertise. Their disadvantages are late entry and lack of grid software sophistication.

Outside residential, Tesla's utility-scale storage business has grown dramatically. The company deployed over 14 GWh of storage in 2023, more than the entire stationary storage market just five years prior. But utility scale is different from residential—higher technical barriers, longer sales cycles, but larger individual deals.

The competitive intensity is real. But the market is large enough that multiple winners can emerge. Here's the thing about infrastructure markets: they tend to support regional dominance. Lunar's focus on California, Georgia, and Washington makes sense because each state has different grid operators, different regulatory environments, and different customer acquisition costs.

A company that becomes dominant in California's CAISO region might not have advantages in Texas's ERCOT region, which operates completely independently. The fragmentation that makes the U.S. grid frustrating to operate might actually protect companies like Lunar from total market dominance by Tesla or other mega-competitors.

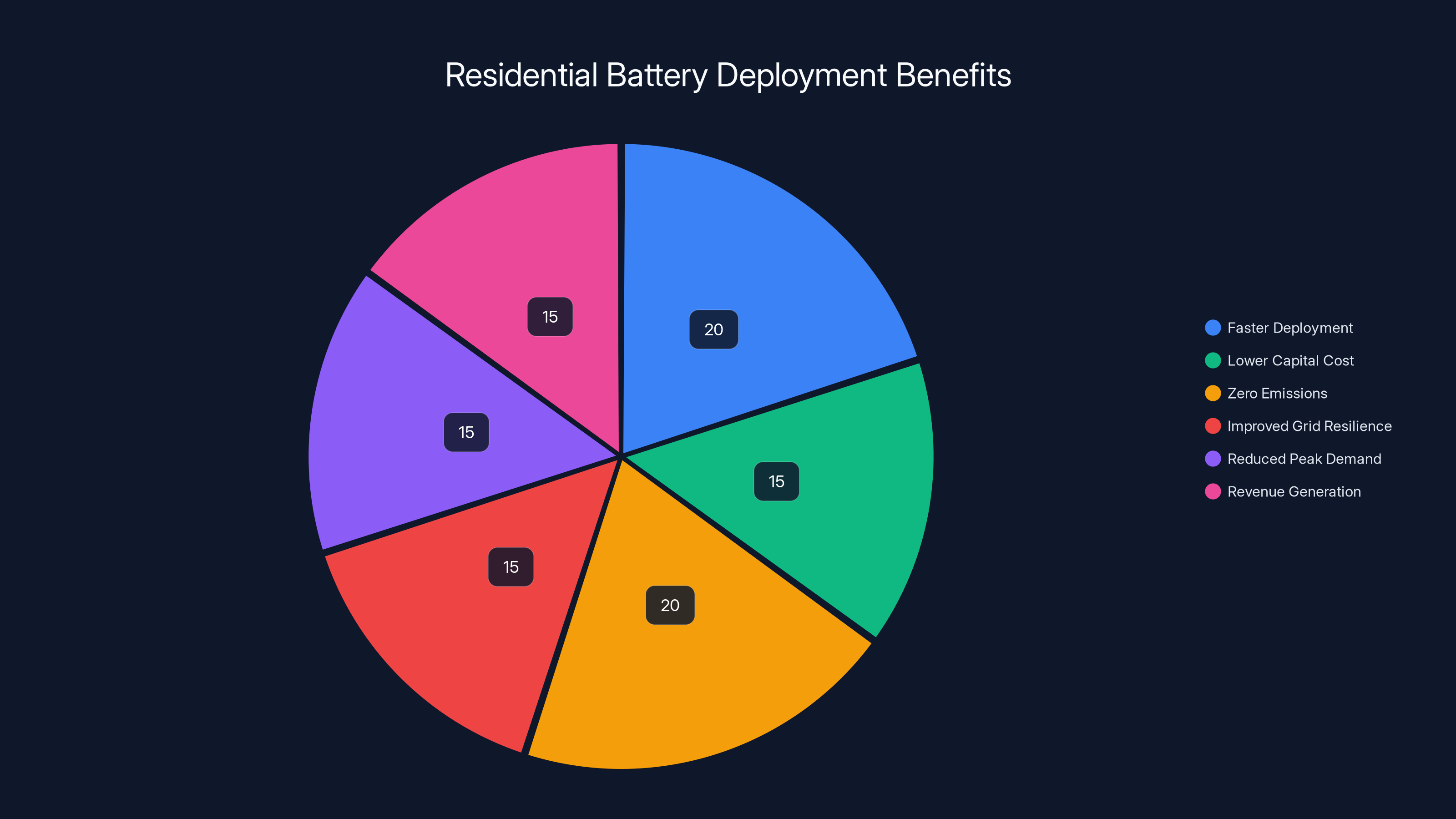

Residential battery VPPs offer significant benefits, including faster deployment and zero emissions, making them a valuable grid infrastructure solution. (Estimated data)

Policy Uncertainty Creates Both Risk And Opportunity

Investment in energy infrastructure is political investment. Policies shift with administrations. Incentives evaporate overnight. The EV battery sector just got hammered by this reality.

But the current policy uncertainty actually benefits stationary storage in subtle ways. Here's why.

The Inflation Reduction Act, despite recent cuts, still provides substantial incentives for battery manufacturing in the U.S. The residential clean energy credit provides up to $3,600 for battery installation. These incentives aren't being completely eliminated, though their scope has narrowed.

More importantly, grid resilience has become a genuinely bipartisan issue. When the power goes out during a heat wave, nobody cares about partisan politics. People want power. States are investing in grid modernization regardless of federal policy. California, Texas, and other large states are deploying billions in battery storage to improve reliability.

This creates a structural floor under the market. Even if federal incentives disappear, state-level policies and utility procurement mandates will sustain demand.

The uncertainty cuts both ways, though. If policy shifts further—if the Trump administration decides battery incentives are "picking winners" in the clean energy space—companies might face sudden demand destruction. Investors in stationary storage are betting that grid reliability concerns outweigh ideological objections to clean energy incentives.

Lunar's geographic diversification helps here. California has its own mandates. Georgia's utilities are actively procuring storage. Washington has aggressive emissions reduction targets. This geographic spread means Lunar isn't dependent on any single policy regime.

How Battery Costs Are Reshaping Economics

Battery prices have fallen so far that the economics of stationary storage have fundamentally shifted. And this trend is likely to continue.

Lithium-ion battery pack costs have dropped from around

This cost trajectory matters enormously for stationary storage because the battery cell cost is the dominant component of total system cost. When battery cells cost

At

Here's the math: assume a 15 kWh home battery system costs

Suddenly the project is economic. It's not a huge return, but it's positive. And many households in high-rate areas or with good solar potential might see much better returns.

Battery cost declines have another implication: Lunar's manufacturing cost structure today might be 30-40% higher than optimal. As volumes increase, Lunar should achieve manufacturing cost reductions just from scale. But they also benefit from exogenous battery cell price declines. This creates a virtuous cycle where economics improve over time.

Competitors face the same dynamic, but first-movers with scale have advantages. Lunar's 100,000 unit target by 2028 suggests the company is betting they can outpace competitors on manufacturing efficiency gains.

The Software Layer Is Where Real Moats Form

Battery hardware is becoming commoditized. Any competent manufacturer can build a safe, reliable battery system. The differentiators are increasingly software-based.

Lunar's VPP software is the critical asset. It needs to:

Predict grid conditions: Using weather data, solar forecasts, demand patterns, and grid operator signals, predict when the battery will be valuable to discharge.

Optimize discharge timing: Batteries have limited cycles. A well-written algorithm might increase grid service revenue by 20-30% just by optimizing when and how much to discharge.

Coordinate across thousands of devices: A single battery is worthless to the grid. You need algorithms that coordinate across tens of thousands of devices simultaneously.

Respond to grid signals in milliseconds: When the grid operator signals a frequency event, the software needs to respond in real-time without human intervention.

Manage customer experience: Homeowners want battery available for their own backup power needs. The software needs to balance grid services with homeowner requirements.

Integrate with other systems: EV chargers, solar inverters, heat pumps, smart thermostats all need to be coordinated under the same control system.

Building this software correctly is hard. It requires domain expertise in power systems, controls theory, optimization algorithms, and software architecture. It's not something you can outsource or import from another domain.

Lunar has had six years to develop this. Newer entrants like Base Power are building it from scratch. This is a genuine competitive advantage, though not one that persists forever. Eventually, specialized software companies will emerge, or open-source VPP control platforms will mature, and the software moat erodes.

For now, though, Lunar's control software is probably worth 30-50% of the company's value to investors. The hardware manufactures the revenue. The software manufactures the margins.

Estimated data shows that a single home battery can generate between

Regulatory Challenges Are Real But Solvable

Utilities and grid operators have legitimate concerns about distributed batteries. Giving homeowners—via aggregators—the ability to inject power back into the grid requires new regulatory frameworks.

Traditional grid operations assume resources are centralized and controllable by the utility. Now utilities are asked to trust a third-party aggregator (Lunar) to control thousands of distributed resources. If Lunar's software malfunctions, the consequences could affect grid stability.

There are also questions about market design. Should homeowner batteries participate in wholesale markets? Demand response programs? Frequency regulation markets? Different grid operators have different answers, creating regulatory fragmentation.

But none of these are blockers. They're technical problems with engineering solutions. California already allows VPPs to participate in certain wholesale markets. Georgia's regulatory structure is shifting to accommodate distributed storage. This is an emerging market where regulations are being written in real-time based on what works.

Lunar's capital and focus on specific regulatory jurisdictions suggest the company is betting on moving through these regulatory challenges faster than competitors. Their partnerships with utilities and grid operators (implied by their placement in California, Georgia, and Washington) suggest they're not operating at odds with regulators.

Financing Strategy And Investor Confidence

A $232 million funding round for a six-year-old company deploying residential batteries is notable. It's not unicorn-level capital, but it's substantial and signals serious investor confidence.

The investor lineup is telling. Activate Capital has deep expertise in energy startups, having backed companies that went public or sold for significant premiums. B Capital is Accel's energy-focused fund, bringing access to operational expertise and networks. Prelude Ventures focuses on climate and energy, giving them conviction on the market fundamentals.

These aren't trend-chasing VCs betting on hype. They're specialists who understand the energy sector's peculiarities.

The fact that Lunar raised a Series C and Series D simultaneously suggests aggressive capital markets positioning. This dual closing is usually a signal that demand for the company's equity exceeded supply. Multiple investors wanted in at the same valuation, so the company absorbed more capital than originally planned.

This also provides runway. With $232 million in fresh capital, Lunar can fund manufacturing buildout, customer acquisition, and working capital for 18-24 months without additional fundraising. That's time to hit manufacturing milestones and prove out the economics.

If Lunar hits its 20,000 unit target by end of 2025 and demonstrates that each customer is profitable on a unit economics basis, the next fundraise (likely Series E) will be significantly easier. Success compounds quickly in capital markets.

The Path To 100,000 Units By 2028

Lunar's stated goal of reaching 100,000 units by end of 2028 is ambitious but not unrealistic. It represents roughly 50% compound annual growth rate from 2025 onwards.

Hit those numbers and the company is generating roughly

At profitability, the company could be valued at 8-12x revenue (typical for growing, profitable hardware/software hybrids), putting enterprise value at $10-15 billion. That's a 20x+ return from current implied valuation.

But there are execution risks. Manufacturing at scale is hard. Customer acquisition costs might exceed projections. Regulatory changes might limit grid services revenue. Competitors might out-execute on cost.

However, the market fundamentals are strong. Grid capacity constraints are real and worsening. Stationary storage is the most practical solution. Costs are falling. Policies (despite uncertainty) still support the space. Investor capital is flowing in.

Lunar's bet is that they can build the operational capability to capture meaningful market share before dominant competitors (Tesla, or well-funded newcomers like Base Power) lock up the market.

Timing matters enormously in infrastructure markets. First movers don't always win, but early movers with capital, distribution, and software superiority often do. Lunar has capital now. Whether they have distribution and software superiority we'll know in two to three years when unit volumes ramp.

Lunar aims for a significant increase in manufacturing scale, from a few thousand units in 2023 to 100,000 units by 2028. Estimated data based on company goals.

Why This Matters Beyond Energy Geeks

If you don't work in energy, you might wonder why a startup's battery funding round deserves attention. Here's why it matters to you.

The grid is how modern civilization functions. Every aspect of your life depends on reliable, affordable electricity. Blackouts aren't just inconvenient. They're economically catastrophic, health-threatening, and increasingly frequent as climate change intensifies heat waves and extreme weather.

The transition to clean energy requires solving the storage problem. You can't run a grid on solar and wind alone. The sun doesn't shine at night. Wind is unpredictable. You need massive amounts of storage to shift energy from high-generation periods to high-demand periods.

Lunar and companies like it are solving this problem by decentralizing storage. Instead of building massive batteries in substations, they're putting smaller batteries in homes and coordinating them via software. This approach is faster to deploy, cheaper to build out, and potentially more resilient than centralized infrastructure.

If Lunar succeeds, electricity prices likely become more stable and decline long-term. Grid reliability improves. Renewable energy becomes a viable replacement for fossil fuels, not just a supplementary source.

If Lunar fails but others succeed, the outcome is similar. The specific company matters less than whether the category wins. The energy sector is at an inflection point where stationary storage transitions from niche to essential infrastructure.

Lunar's $232 million funding round is one data point suggesting that inflection is happening. The capital, the team, and the investors all point toward this being a market-defining category over the next five to ten years.

Market Size And Total Addressable Market

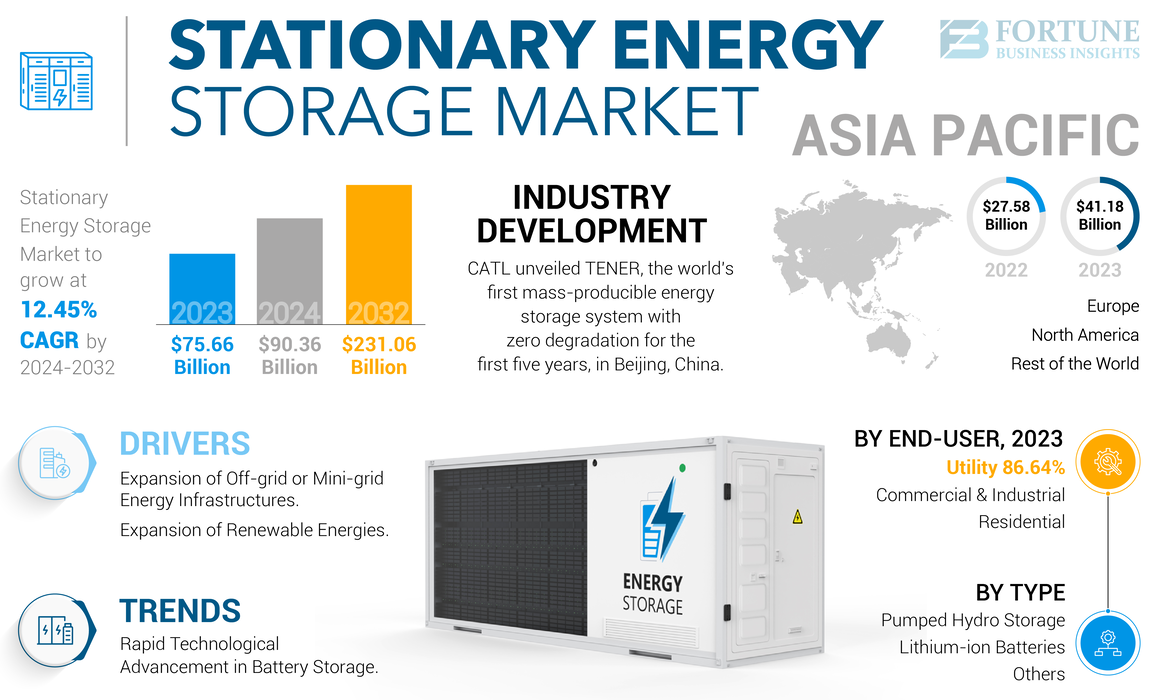

How big is the stationary storage market really?

Starting with residential: There are approximately 140 million households in the U.S. Not all are suitable for battery installation (renters, apartments, houses in poor grid regions). Maybe 30% are viable, or 42 million households. If 25% of viable households install batteries by 2035, that's 10.5 million units.

At

Then add commercial and utility-scale storage. Commercial buildings (office, retail, industrial) represent another 6 million buildings, of which maybe 20% are viable for battery storage. Utility-scale storage—large installations owned by utilities or independent power producers—represents the fastest-growing segment.

Total addressable market for stationary storage is likely

Lunar's 100,000 units by 2028 would represent maybe 10-15% of the U.S. residential market by that year, if the market reaches 600,000-700,000 annual installations. That would make Lunar a billion-dollar revenue company.

But the market is growing so fast that even 10% market share would be losing to competitors capturing 20%, 30%, or 40% shares. This is a winner-take-most market, likely to consolidate to 3-5 major players within a decade.

Lunar's capital raise is their bet that they can be one of those survivors.

The Integration With Renewable Energy Sources

Stationary storage and renewable energy are symbiotic. You can't deploy solar and wind at scale without storage. Conversely, storage creates valuable revenue streams only when coupled with renewable generation.

A home with solar but no battery just exports excess power to the grid during the day, accepting whatever price the grid pays (often near-zero). A home with solar and a battery can store that excess and either use it personally at night, or sell it during peak hours when prices are high, or sell it to the grid operator for grid services.

Lunar's geographic focus in California, Georgia, and Washington makes sense here. All three states have high solar penetration or potential. California has the most aggressive solar adoption: roughly 30% of households have solar, and that number is climbing. Georgia is emerging as a solar hotspot due to falling costs and improving policies. Washington has less solar (too cloudy) but significant hydroelectric capacity, which creates different storage use cases.

The integration of solar + batteries creates a more valuable product than solar alone. A solar + battery system is partially self-sufficient and generates grid services revenue. Solar alone is dependent on utility grid services and produces commodity power.

Companies like Tesla deliberately bind solar installations with battery installations because they understand this dynamic. Lunar's ability to offer batteries for solar and non-solar homes gives them flexibility that pure solar-battery integrators might lack.

Base Power leads with strong capital backing and manufacturing capabilities, while Ford faces challenges due to late entry and lack of software expertise. Estimated data based on qualitative analysis.

Customer Acquisition And Distribution Challenges

Here's where Lunar faces its biggest challenge: getting batteries into homes costs money.

A typical residential battery installation costs

Lunar's value proposition is partly based on grid services revenue. A homeowner gets a battery, and in exchange for allowing Lunar to discharge it to the grid sometimes, the homeowner receives credits that help pay for the system. This is a clever way to monetize grid services while de-risking the homeowner's investment.

But customer acquisition still requires sales and marketing. You need installers to visit homes, complete design work, permit applications, and physical installation. You need financing options so homeowners can afford it. You need customer service to handle inevitable problems.

Lunar's $232 million capital raise has to fund all of this. Manufacturing is only part of the spend. Customer acquisition might be 30-40% of capital deployment, with manufacturing and working capital splitting the remainder.

Successful residential battery companies will look a lot like successful solar companies. Vivint Solar, Solar City (now Tesla), and other solar installers built massive distribution networks over years. Lunar probably needs to do something similar, either by hiring installers directly or partnering with HVAC and electrical contractors who already visit homes.

This is capital intensive and time-consuming. It's not clear Lunar has solved this yet, which is a risk to their 100,000 unit target.

Financial Modeling: Unit Economics And Path To Profitability

Let's model Lunar's potential path to profitability.

Assume:

- Average selling price: $12,000 per unit

- Manufacturing cost: $6,000 per unit (improving with scale)

- Installation/service cost: $2,000 per unit

- Customer acquisition cost: $1,000 per unit

- Software and overhead: $800 per unit

- Gross profit per unit: 6,000 = $6,000 (50% gross margin)

- Operating cost per unit: 1,000 +3,800

- Operating profit per unit: 3,800 = $2,200 (18% operating margin)

For 100,000 units annually:

- Revenue: $1.2 billion

- Gross profit: $600 million

- Operating expenses: $380 million

- Operating profit: $220 million

- Operating margin: 18%

These are aspirational assumptions. Early on, Lunar probably has negative unit economics due to startup overhead. Manufacturing costs are higher. Customer acquisition costs are higher. Software margins are minimal.

But this shows the financial potential. If Lunar can reach scale with these margin profiles, the company becomes highly profitable. At 18% operating margins, the company might be valued at $15-20 billion enterprise value.

This is why investors are willing to deploy $232 million. The financial upside is enormous if execution succeeds.

The Climate Impact Angle

Battery storage enables renewable energy at scale. Without storage, renewable electricity is intermittent and unreliable. With storage, it becomes a dependable grid resource.

Every kilowatt-hour of storage capacity deployed is capacity that no longer needs to come from fossil fuel peaking plants. If Lunar deploys 100,000 units at 15 kWh average, that's 1.5 million kWh of storage capacity. Operating conservatively at 0.5 full cycles per day (discharging fully every other day, roughly), that's 750,000 kWh per day of stored and released energy.

At an average grid carbon intensity of 400 grams CO2 per kWh, that's 300 tons of CO2 avoided per day, or roughly 110,000 tons per year per 100,000 units.

For context, the average American emits about 16 tons of CO2 per year. Lunar's 100,000 unit deployment would offset the annual emissions of about 7,000 people.

This is climate impact at meaningful scale. It's also why climate-focused investors (like Prelude Ventures on Lunar's latest round) are enthusiastic. The company is solving a genuine climate problem while building a profitable business. This alignment of incentives makes climate tech valuable in ways traditional climate solutions aren't.

What Could Go Wrong

Optimism bias is real, especially in venture capital. Lunar's capital raise and aggressive growth targets are bullish, but multiple risks could derail execution.

Manufacturing execution: Scaling from 5,000 to 100,000 units annually is hard. Supply chain disruptions, quality control issues, or labor shortages could slow production. Manufacturing margins could compress if costs don't decline as fast as expected.

Customer acquisition: Getting batteries into homes is expensive and logistically complex. If customer acquisition costs exceed $1,500 per unit, unit economics deteriorate quickly. Large sales organizations are hard to build and easy to mismanage.

Competitive pressure: Tesla, Base Power, and other well-funded competitors could gain share faster. A price war would compress margins industry-wide. Lunar's advantage in software and VPP control might not prove as durable as investors believe.

Grid services revenue uncertainty: The ability to monetize grid services depends on regulatory frameworks that haven't fully settled. If regulators decide to limit aggregator access to wholesale markets, or set prices that are too low, a key revenue stream evaporates.

Financing risk: If capital markets freeze or investor appetite for climate hardware cools, raising subsequent rounds could become expensive. Lunar probably can't reach profitability and 100,000 units without additional capital beyond what they just raised.

Regulatory risk: An adverse policy change—restrictions on VPPs, elimination of battery incentives, new safety regulations—could reduce addressable market dramatically.

Lunar is aware of these risks. The geographic diversification, the experienced investor base, and the focus on profitable unit economics all suggest management is thinking about failure modes. But execution risk remains high.

The Broader Significance For Energy Infrastructure

Lunar Energy's $232 million funding round is significant not because of the company specifically, but because it represents a broader shift in how energy infrastructure gets built.

For a century, power generation and distribution was centralized. Large power plants, transmission lines, distribution networks all owned and operated by utilities. This model made sense when you couldn't store electricity efficiently. The utility controlled everything to ensure reliability.

Battery storage breaks this model. Suddenly storage is economical at small scale. Distributed storage means distributed control. It means consumers (homeowners) become partial producers and operators of the grid.

This shift from centralized to distributed infrastructure is happening across multiple domains (computing went from mainframes to cloud to edge; communication went from landlines to cellular to mesh networks). Energy is following the same pattern.

Lunar is one of dozens of companies betting on this transition. Some will succeed, most will fail, but enough will succeed that the cumulative effect is a fundamental restructuring of how electricity gets generated, stored, and distributed.

Investor capital flooding into companies like Lunar suggests the market believes this transition is real and near. The question isn't whether it happens, but how fast and which companies capture value.

Expert Perspectives On Distributed Storage Future

The inflection toward distributed storage has specialists in the field bullish on the next decade.

Utility executives increasingly see distributed batteries not as a threat but as a necessity. The economics of centralized peaking plants don't work if you can get equivalent functionality from distributed resources at lower cost. This realization is starting to shift utility capital allocation toward storage procurement rather than plant construction.

Grid operators' perspective is more nuanced. They recognize storage improves reliability and flexibility. But they're concerned about cybersecurity, control, and system stability with thousands of distributed devices responding to control signals. These are solvable problems, but they require new protocols, standards, and regulatory frameworks.

Venture capital's enthusiasm for storage companies is clearly visible in funding patterns. In the last three years, stationary storage startups have raised over $15 billion in venture and growth equity. That capital is concentrated among a handful of companies (Lunar, Base Power, Redwood, and some utilities' own ventures) but demonstrates real conviction.

What's notably absent is strong opposition. Fossil fuel generators obviously prefer that storage doesn't scale. But they have limited ability to block a market that's economically advantageous. The most reasonable fossil fuel strategy is to own storage themselves (which some are doing) or transition to becoming energy services companies rather than pure generation companies.

Looking Ahead: 2026-2030 Timeline

Lunar's funding and growth targets suggest a clear timeline for the next few years.

2025: Reach 20,000 units manufactured annually. Demonstrate profitable unit economics. Expand to 4-5 states.

2026: Reach 50,000 units annually. Achieve profitability. Complete Series E fundraise if needed. Consider potential IPO or acquisition.

2027-2028: Reach 100,000 units annually. Dominate residential battery market in core regions. Expand nationally or internationally.

If Lunar hits these milestones, the company will be one of the dominant players in residential battery storage. If the company misses, it becomes a regional player or gets acquired by a larger energy company.

Big picture, the 2026-2030 period is when stationary storage transitions from startup phase to scaled infrastructure. Lunar's bet is that they'll be among the leaders when that transition completes.

FAQ

What is Lunar Energy's core business model?

Lunar Energy manufactures and installs residential battery systems (15 kWh and 30 kWh modules) in homes across California, Georgia, and Washington. The company monetizes these installations through two channels: homeowners who want backup power and resilience, and grid services revenue by aggregating batteries into a virtual power plant (VPP) that discharges to the grid during peak demand periods or when grid operators request.

How does a Virtual Power Plant (VPP) work technically?

A VPP uses software to coordinate thousands of distributed energy resources (batteries, solar panels, EV chargers, smart appliances) as if they were a single large power plant. When the grid needs power, Lunar's software can simultaneously discharge stored battery energy, stop charging electric vehicles, reduce HVAC operation, and defer non-essential appliance use across its entire fleet. This coordinated response provides grid services like peak shaving, frequency regulation, and voltage support.

What are the main benefits of deploying residential batteries as grid infrastructure?

Residential battery VPPs provide several advantages over traditional power plants: faster deployment (months vs. years for new generation), lower capital cost per megawatt, zero emissions, improved grid resilience, reduced peak demand without brownouts, and revenue generation for participating homeowners. Unlike centralized peaking plants that sit idle 90% of the year, distributed batteries provide value every single day through multiple services.

Why is stationary storage attracting more investment than EV batteries right now?

The Inflation Reduction Act provided incentives for both EV and stationary battery manufacturing, but policy uncertainty gutted the EV segment when the Trump administration and GOP-controlled Congress limited electric vehicle tax credits. Stationary storage benefits from continued policy support because grid reliability is increasingly bipartisan (nobody wants blackouts), and the economic case doesn't depend entirely on government incentives anymore as battery costs have declined 87% since 2010.

What is Lunar Energy's manufacturing scale-up strategy?

Lunar plans to manufacture 20,000 units by end of 2025 (5-10x growth from current run rate) and 100,000 units by end of 2028. The

How does Lunar compete against Tesla's Powerwall and other established players?

Lunar competes on total cost of ownership (Powerwall at

What grid services revenue can a typical residential battery generate?

A single 15 kWh home battery might generate

What is the payback period for a residential Lunar battery system?

Assuming

How does battery cost decline affect Lunar's competitive position?

Battery cell costs have fallen 87% since 2010 and continue declining. Lunar's manufacturing costs today probably exceed optimal by 30-40%. As volumes increase and cells get cheaper, Lunar's cost structure improves faster than competitors' because of scale advantages. First movers to 100,000 unit production typically achieve 20-30% cost advantages over followers, creating durable competitive moats.

What regulatory risks threaten Lunar's growth?

Key regulatory risks include: changes to wholesale market access for aggregated batteries, limitation of grid services compensation, elimination of residential battery tax credits, new safety/cybersecurity requirements that increase costs, and state-level policy shifts that reduce incentives. Geographic diversification across multiple grid operators and state regulatory regimes helps mitigate concentrated regulatory risk.

Is Lunar Energy profitable today?

The company has not disclosed profitability status, but six-year-old hardware startups are typically still accumulating losses, especially while building manufacturing scale. Lunar likely becomes unit-profitable in 2026-2027 (meaning each battery sold generates positive gross margin after manufacturing and installation costs) and company-profitable by 2028-2029 once production reaches 50,000+ units and overhead spreads across higher volume.

What is the total addressable market for residential batteries?

There are approximately 140 million U.S. households, of which roughly 30% (42 million) are viable for battery installation. If 25% of viable households install batteries by 2035, that's 10.5 million units at

Conclusion

Lunar Energy's $232 million funding round isn't just capital deployment into a promising startup. It's institutional validation that stationary battery storage has crossed an inflection point from niche to critical infrastructure.

The company is betting it can scale from current production levels to 100,000 units by 2028. That's ambitious, but achievable for a well-executed hardware company with adequate capital. More importantly, it's the right bet. The fundamental drivers are undeniable: the grid needs storage, distributed storage is economically superior to centralized peaking plants, battery costs are falling, and investors see genuine 10-20x returns possible if execution succeeds.

The competitive landscape is intense—Tesla, Base Power, and others are all raising billions to pursue similar strategies. But the market is large enough that multiple winners can emerge. Lunar's focus on software-driven VPP control, geographic diversification, and capital efficiency give them reasonable odds of being among the survivors.

If Lunar succeeds, what does that mean for you? Electricity grids become more resilient. Renewable energy becomes genuinely viable as a primary grid source. Energy costs stabilize and decline long-term. Climate change gets incrementally addressed through infrastructure transformation rather than behavioral change.

The next two to three years will determine whether Lunar achieves those outcomes or becomes one of dozens of plausible-but-failed hardware startups. Based on the capital raised, the investor quality, and the fundamental market dynamics, betting on success seems reasonable. But execution in hardware is hard, and many seemingly well-capitalized startups have failed at scale.

Watch Lunar's 2025 results carefully. If they hit 20,000 units with positive unit economics, the company likely succeeds. If they miss on volume or unit economics deteriorate, the odds shift sharply downward. Either way, the storage revolution is coming. The question is which companies capture the value when it arrives.

Try Runable to automate your research and analysis of emerging companies and funding rounds. Generate detailed investment theses, market analysis reports, and competitive intelligence automatically with AI-powered document creation starting at $9/month.

Key Takeaways

- Lunar Energy raised 130M Series C +500M, signaling serious investor conviction in residential battery storage

- Virtual power plants that aggregate distributed batteries are economically superior to traditional peaking power plants, costing less and requiring less deployment time

- Battery costs have fallen 87% over 14 years, making residential stationary storage profitable with dual revenue streams from homeowners and grid services

- Lunar plans aggressive scaling to 20,000 units by 2025 and 100,000 units by 2028, betting on cost advantages from manufacturing scale and software moat

- Stationary storage is attracting more investment than EV batteries due to policy stability and grid reliability concerns that span political divides

Related Articles

- AI vs AI: How Machine Learning Solves Data Center Energy Crisis [2025]

- EPA Closes Generator Loopholes: AI Data Center Expansion Hits Federal Wall [2025]

- US Offshore Wind Court Orders: Construction Restart [2025]

- SpaceX's 1 Million Satellite Data Centers: The Future of AI Computing [2025]

- SpaceX's Million Satellite Data Centers: The Future of Cloud Computing [2025]

- AI Data Centers Drive Historic Gas Power Surge [2025]

![How Lunar Energy's $232M Funding Round Is Reshaping Grid Storage [2025]](https://tryrunable.com/blog/how-lunar-energy-s-232m-funding-round-is-reshaping-grid-stor/image-1-1770228503896.jpg)