The Rise of Microdrama: A Billion-Dollar Phenomenon Nobody Expected

Emily is a college student by day. By night, she works at a strip club to pay tuition. Nobody knows her secret—until her English teacher shows up at the club. Did he recognize her? Will her world collapse?

To find out, you can watch an ad. You can pay 60 tokens. Or you can buy a VIP pass for $20 per week to skip the drama entirely. The story itself is pulpy. The acting is cringeworthy. The writing feels like it was generated by someone who learned English from romance novels and TikTok comment sections.

Yet somehow, this format is making billions.

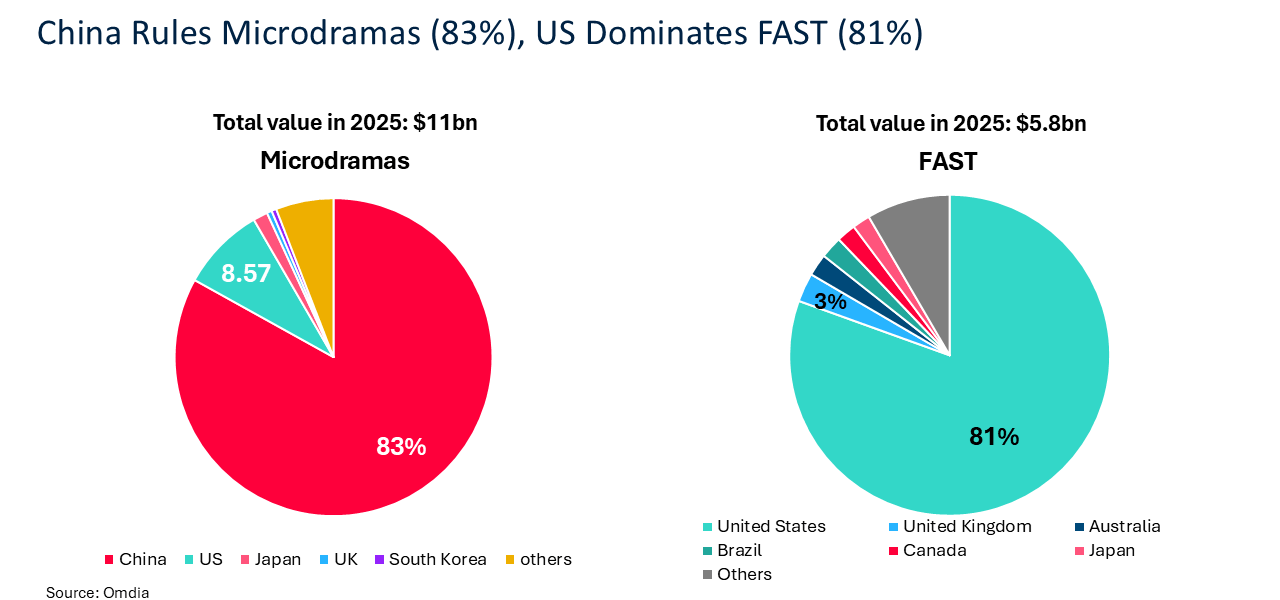

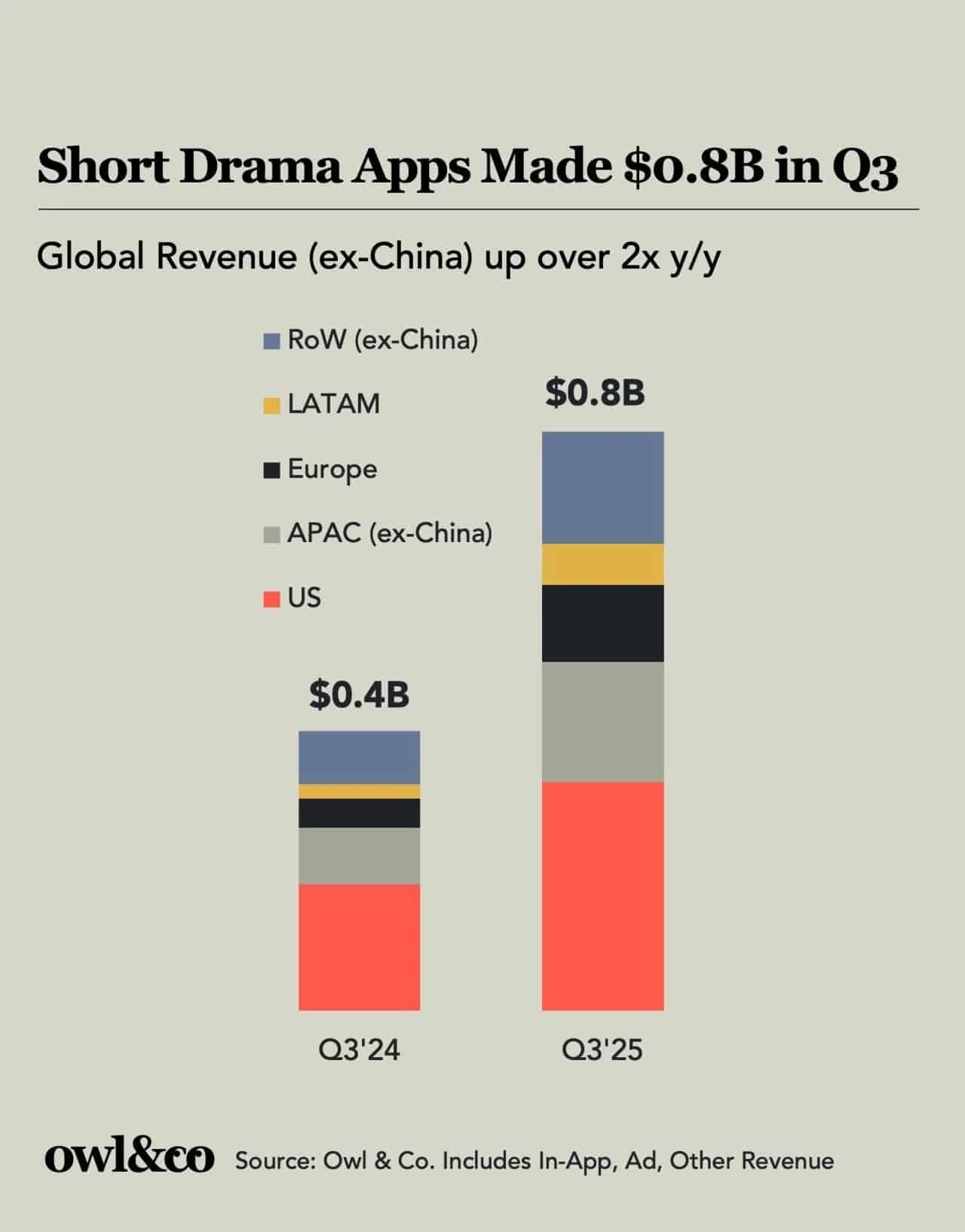

Microdramas are short-form scripted shows, typically one to three minutes per episode, designed for vertical viewing on phones. They're not new. They exploded in China years ago, where apps like iQIYI and Bilibili figured out the monetization formula. Now they're having a breakout moment in the United States, and the numbers are staggering.

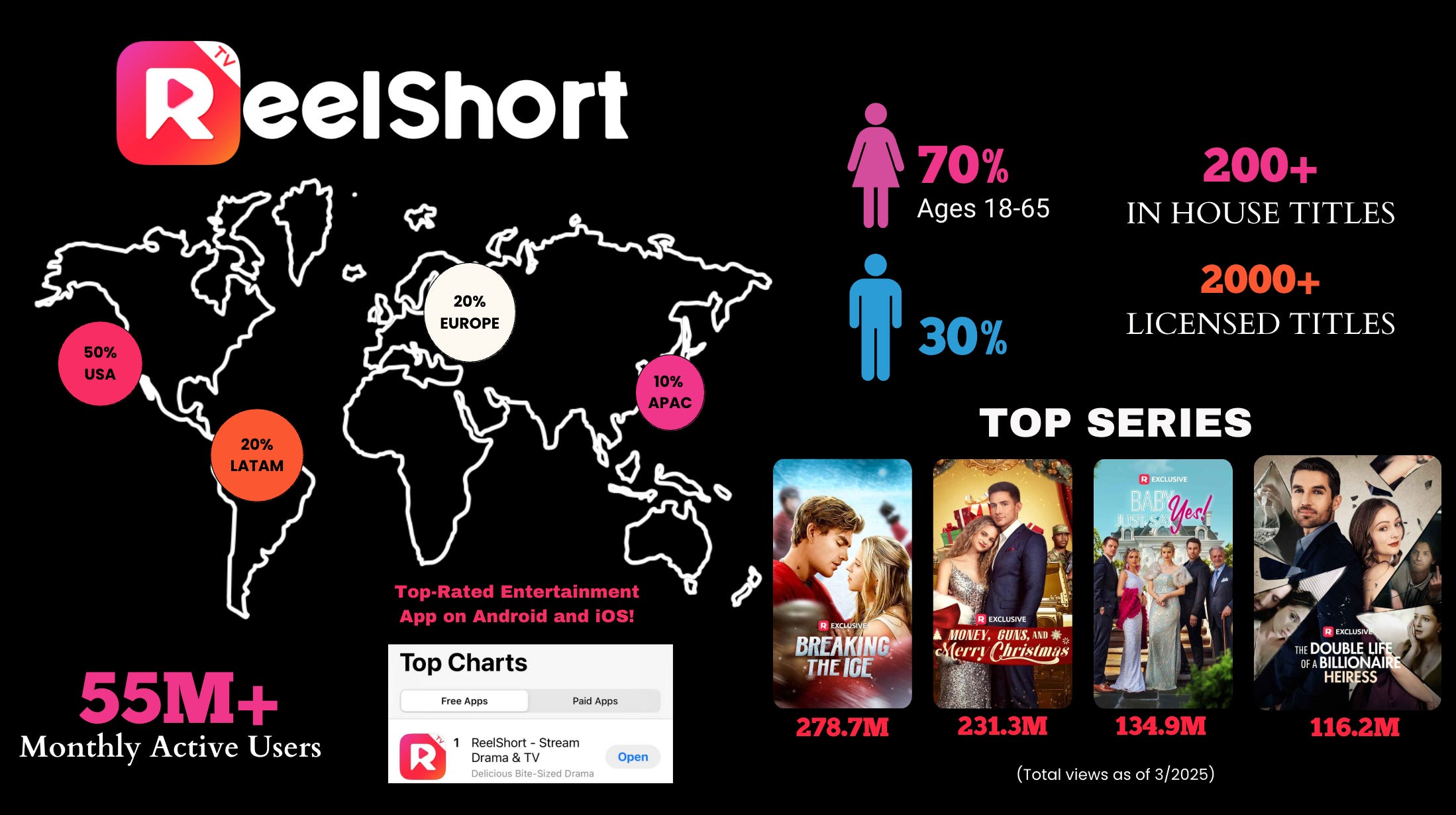

Reel Short, one of the leading microdrama apps, hit roughly

TikTok just launched its own standalone microdrama app called Pine Drama. Gamma Time, a newcomer from Hollywood veterans, raised $14 million in funding from high-profile angels including Alexis Ohanian, Kris Jenner, and Kim Kardashian. The market is accelerating, not slowing down.

This is genuinely surprising. Why? Because we're only five years removed from the catastrophic implosion of Quibi, which might be the biggest failure in Silicon Valley history.

Quibi wanted to build Netflix but with 10-minute episodes for mobile. It had backing from major studios, celebrity talent, and founder Jeffrey Katzenberg, the co-founder of DreamWorks Animation. The vision was pristine. The execution was a disaster. The product nobody wanted.

Reel Short, by contrast, has shows with titles like "My Sister is the Warlord Queen" and "In Love with a Single Farmer-Daddy." The production quality is questionable at best. Yet it's succeeding spectacularly where Quibi failed spectacularly.

The question haunting the industry is simple: How? What's different? The answer reveals something uncomfortable about human psychology, addiction mechanics, and how the entertainment industry has learned to weaponize behavioral economics against you.

Why Quibi Failed and Microdramas Succeeded: The Fundamental Difference

Quibi's fundamental mistake was assuming quality content automatically converts to engagement. The app's leadership believed that if you packed short episodes with Hollywood talent and cinematic production values, people would watch. They were wrong.

Quibi failed because it tried to be prestige entertainment in a 10-minute format. It brought in directors like Sam Esmail and Lena Dunham. The cinematography was polished. The scripts were written by seasoned professionals. But the content was fundamentally misaligned with how people actually consume media on phones.

People don't want prestige dramas on their phones. They want dopamine hits. They want to feel something—attraction, jealousy, triumph—without having to think too hard or commit 50 hours to a narrative arc. Quibi offered sophisticated storytelling. The market wanted something much more primal.

Microdramas understand this. They don't aspire to prestige. They aim for exactly one thing: keeping you watching the next episode. The formula is so predictable you could write it yourself. Girl gets humiliated. Mysterious hot guy saves her. They exchange glances. Cliffhanger. Payment required.

According to creator economy experts, the genius of microdramas isn't storytelling. It's market positioning. One way to think about Reel Short and its competitors: they're essentially "OnlyFans for the female gaze." The content is primarily designed for women and features romantic scenarios, sexual tension, and power dynamics that appeal to fantasy, not reality.

This insight reframes everything. These aren't entertainment apps trying to compete with Netflix. They're fantasy apps monetizing desire through narrative. The story isn't the product. The fantasy is the product. The story is just the delivery mechanism.

Quibi's creators were obsessed with production quality. Microdrama creators are obsessed with conversion metrics. That's the philosophical gulf between the two approaches. One prioritizes the art. The other prioritizes the business model.

The business model, by the way, is extremely profitable once you understand it.

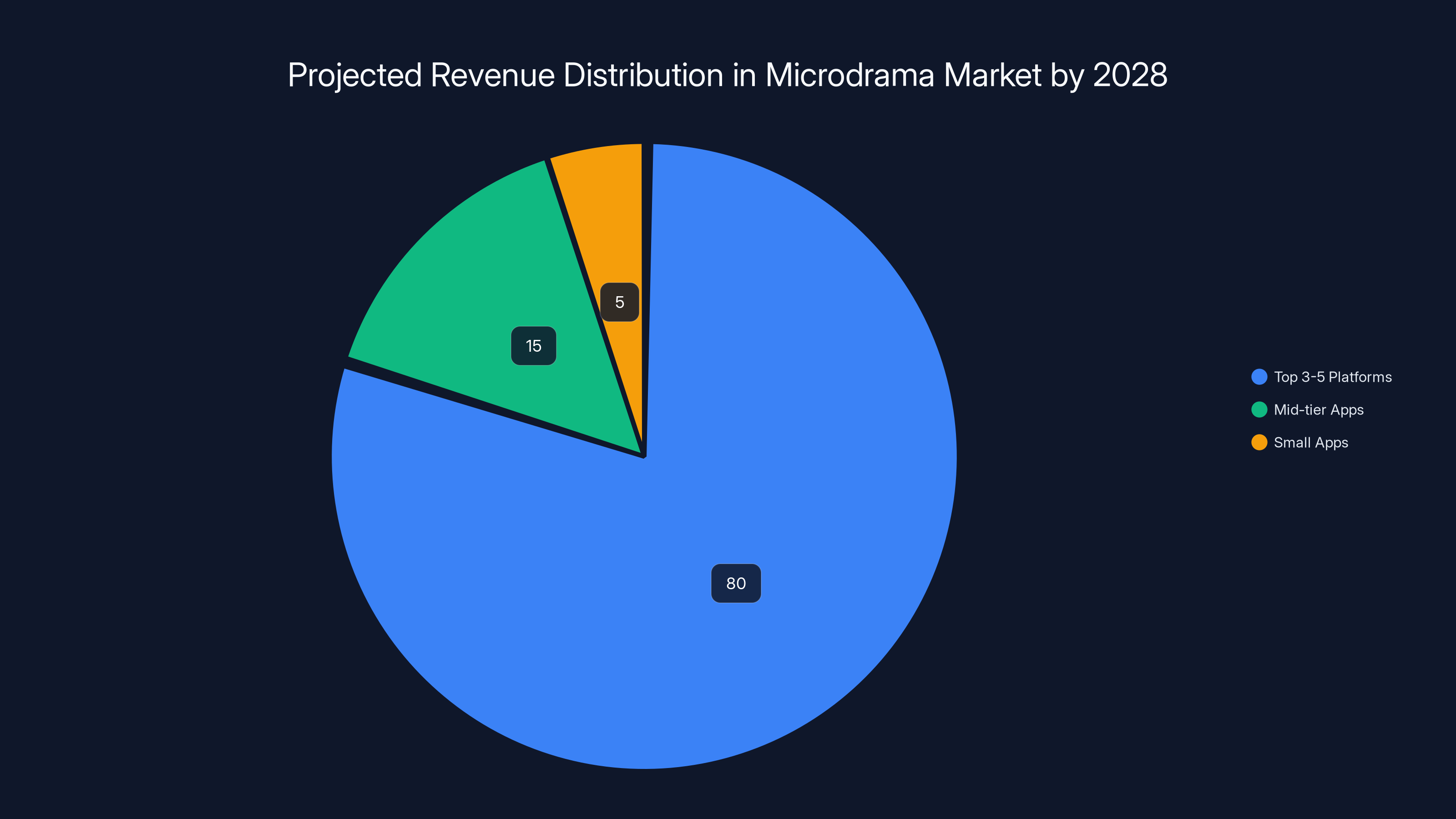

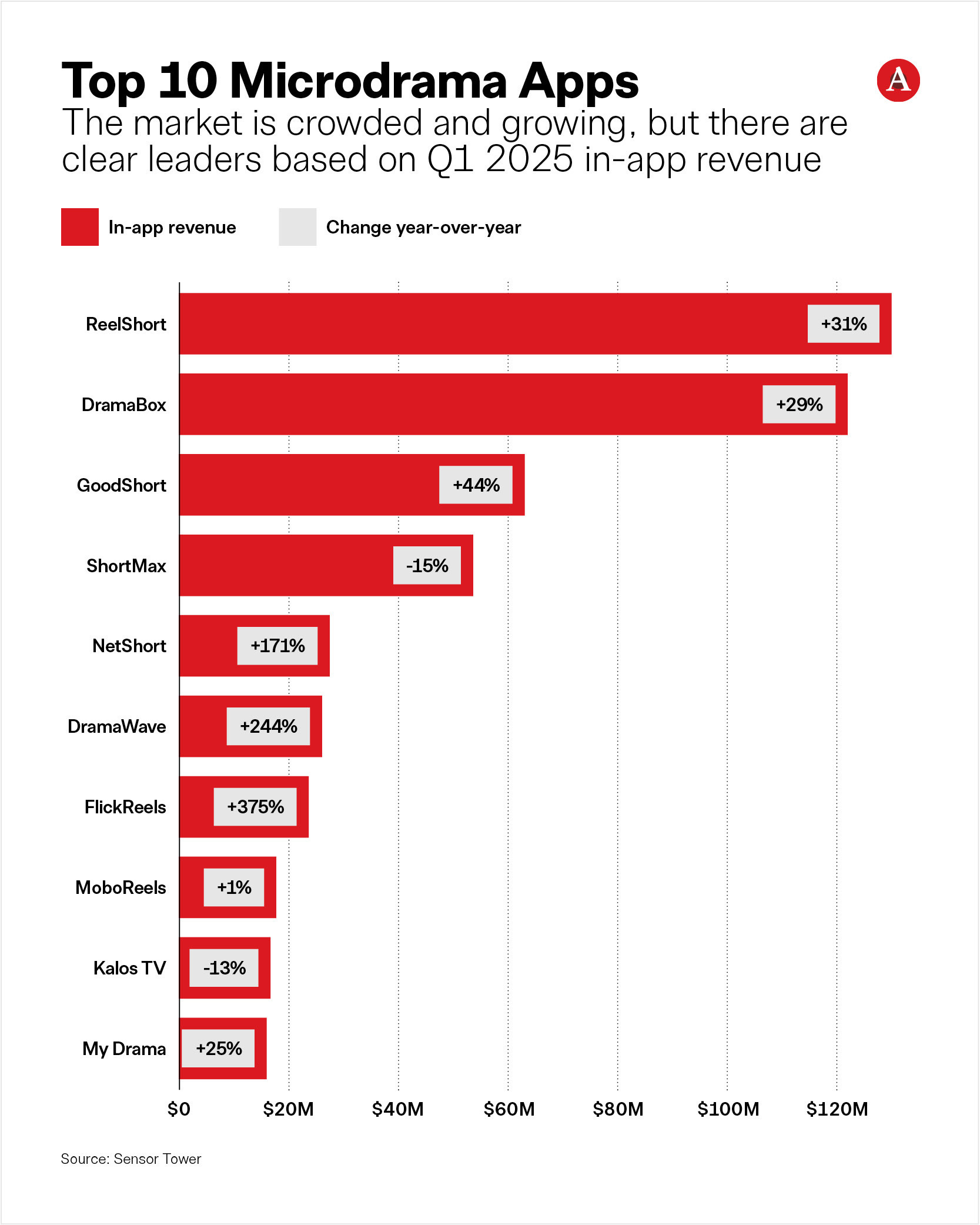

By 2028, the top 3-5 platforms are expected to control over 80% of the microdrama market revenue, with mid-tier apps capturing 15% and small apps only 5%. (Estimated data)

The Dark Patterns: How Microdramas Use Mobile Game Mechanics to Drive Spending

The monetization engine behind microdramas is borrowed directly from the mobile gaming industry. It works like this: hook the user with free content, create artificial scarcity through in-app currency, and use psychological pressure to drive purchases.

When you open Reel Short or Drama Box, you're not entering an entertainment app. You're entering a conversion funnel optimized by teams of engineers who've spent years perfecting behavioral addiction mechanics.

The Free Tier Strategy: Every user gets free in-app currency just for logging in each day. This is designed to create habit formation. Open the app, collect your coins, watch an episode or two. Soon, logging in becomes automatic. The app is already on your home screen. The habit is already forming.

The Artificial Scarcity Mechanic: Watching an episode costs tokens. The number of free tokens you get daily is carefully calibrated to be just barely not enough. If you're mildly interested in a story, you'll run out of tokens before finishing the episode. This creates friction. The story stops mid-cliffhanger, exactly when emotional engagement is highest.

The Escalating Payment Pressure: At this point, you have choices. You can watch ads to earn more tokens (the app gets ad revenue). You can buy tokens with real money. Or you can upgrade to a weekly VIP pass for $20.

Here's where it gets insidious: if you're watching multiple stories simultaneously—which the app encourages—the

And here's the thing: $80 per month is more than a subscription to HBO Max, Netflix, Hulu, Disney+, and Paramount+ combined. You're spending more on microdramas than on every major streaming service in existence. For content that costs a fraction as much to produce.

Interactive Choice Architecture: Some microdramas offer the illusion of choice. "Do you want Sarah to stand up to her abusive boyfriend, or stay silent?" The empowering choice—standing up for herself—costs tokens. The disempowering choice—accepting the abuse—is free.

This is behavioral psychology disguised as interactivity. It's training you to make the tokenized choice. Over time, you internalize the message: the good outcome costs money. The bad outcome is free. So you pay.

The behavioral economics here would make a mobile game designer proud. Every element is designed to create a psychological path toward payment. The friction points, the daily login bonuses, the limited currency, the premium tiers—all of it exists to maximize lifetime customer value.

This is the model that made Candy Crush and Clash of Clans billions. Microdramas are just applying it to narrative instead of puzzles.

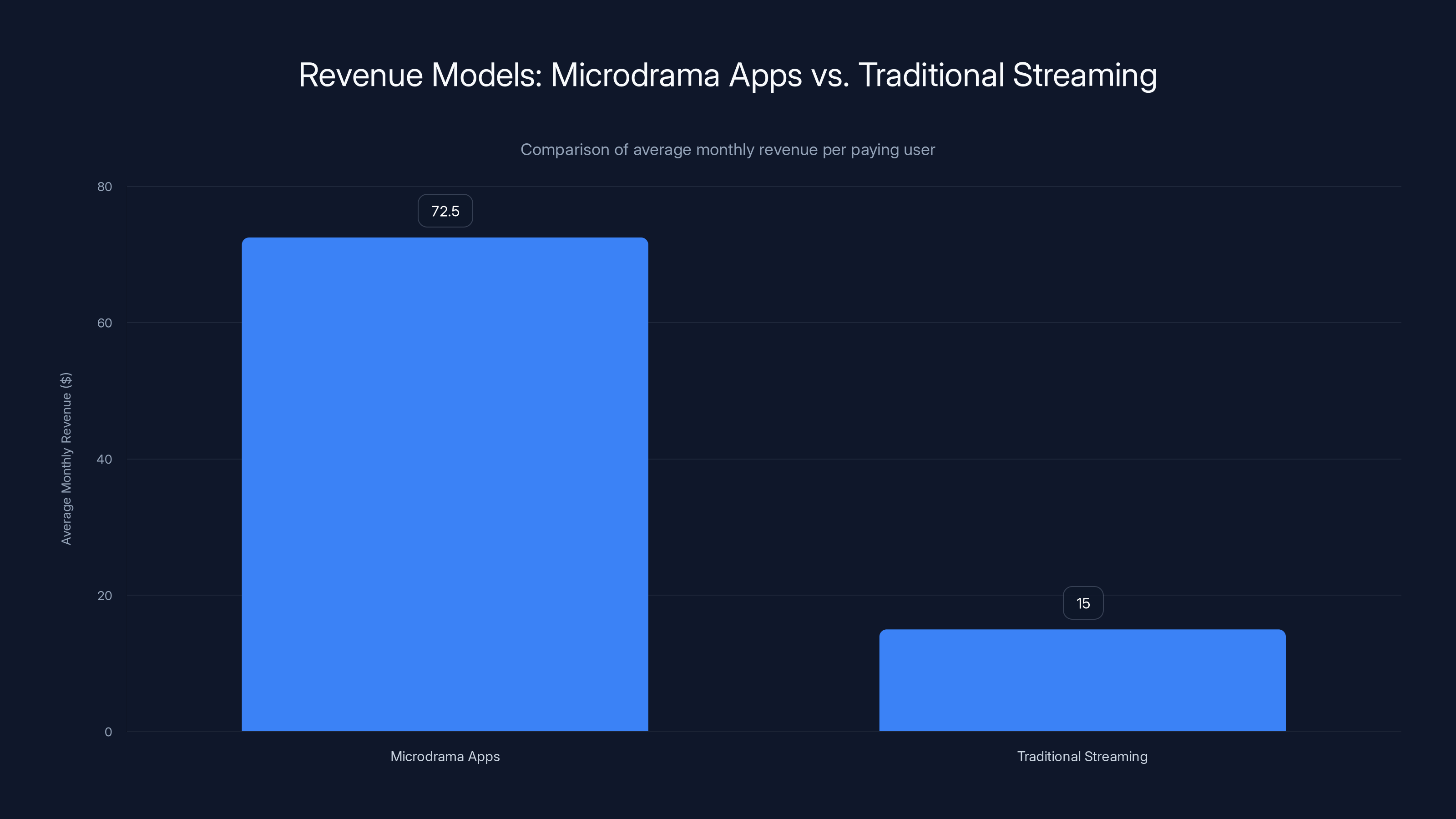

Microdrama apps generate significantly higher average monthly revenue per paying user (

Content as a Commodity: Why Quality Doesn't Matter Anymore

One of the most honest observations about microdramas comes from Dhar Mann Studios CEO Sean Atkins: "Short-form is lower overhead than long-form, and vertical is even lower overhead." Translation: these shows are cheap to make, easy to produce at scale, and don't require significant creative talent.

The microdrama format has achieved something remarkable: it's made storytelling so formulaic that it no longer requires human creativity. The beats are predictable. The archetypes are unchanging. The plot twists are telegraphed.

Think about how many microdramas start with the exact same scene: A girl wearing glasses gets pushed down by mean classmates. A popular jock notices her, realizes she's beautiful underneath the glasses, and saves her. It's such a common trope that it might as well be a template.

Once you recognize the formula, you start seeing it everywhere. Girl is poor, guy is rich, they meet by accident, class conflict, sexual tension, reconciliation. Girl is bullied, guy is powerful, he defends her, attraction, conflict, resolution.

The predictability isn't a bug. It's a feature. It's designed to be satisfying without being challenging. Your brain knows what's coming, and it wants it anyway. That's the addiction mechanism. You're not watching because you're surprised. You're watching because your brain has learned to expect the dopamine hit.

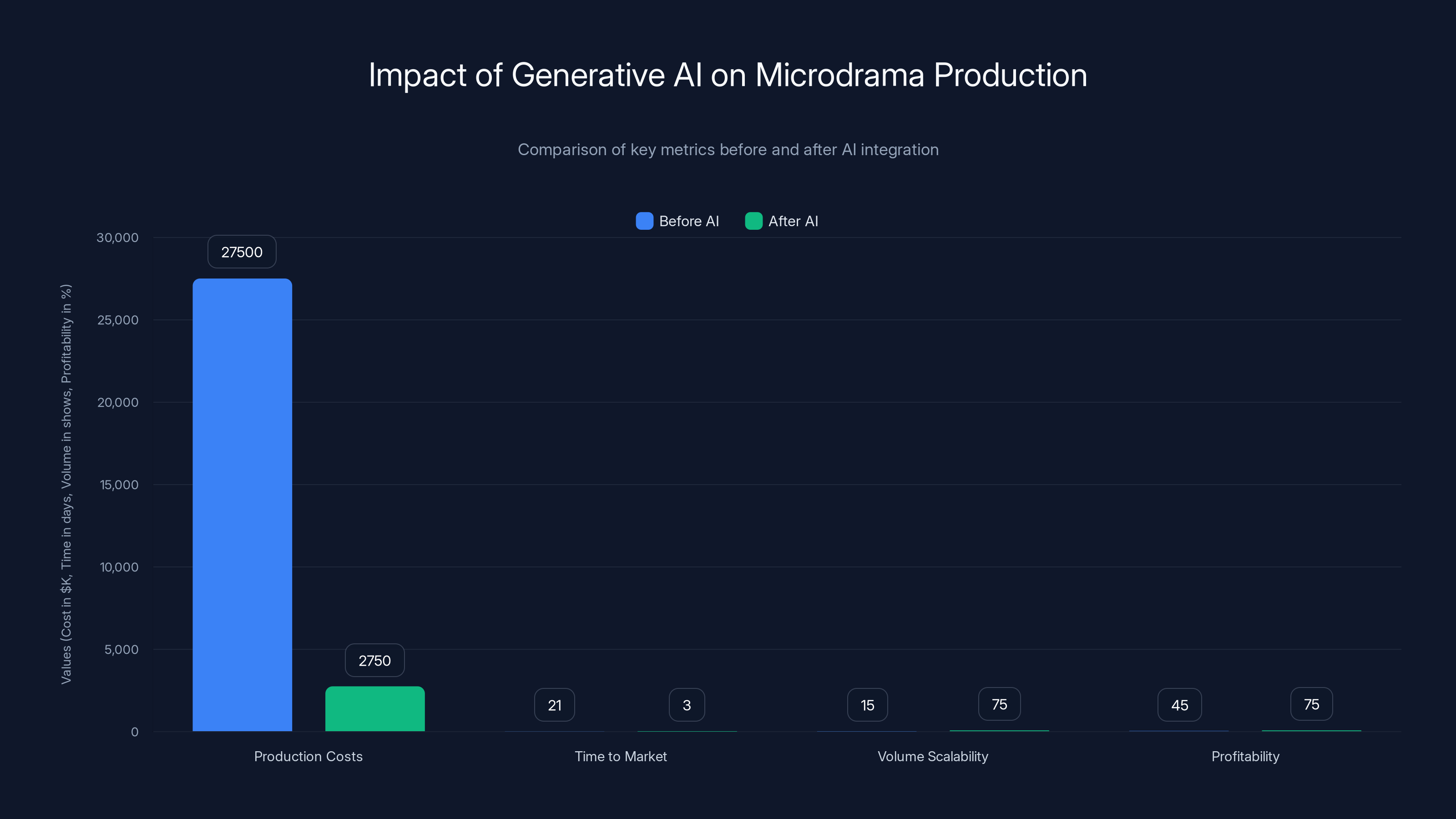

With artificial intelligence entering the picture, this commodity-fication of content is accelerating. Large language models can't write prestige drama—they don't have the nuance, the wit, or the emotional depth that makes shows like Succession memorable. But microdramas don't need wit. They need templates.

Pocket FM, the audio drama platform backed by Lightspeed Ventures, already released a tool called Co Pilot. It's trained on thousands of hours of microdrama content to understand the "beats" of formulaic storytelling. It can predict where to add cliffhangers, where to insert plot twists, and where to create artificial scarcity moments that make viewers reach for their wallets.

Holywater, a Ukrainian company, raised $22 million to build My Drama, which it describes as an "AI-first entertainment network." The term is revealing. It's not positioning itself as a story-first platform. It's story-second. Efficiency and scale come first.

Here's what this means: as AI gets better at generating these stories, production costs approach zero. A creator can now make 10 shows simultaneously, each with slightly different characters and settings but identical narrative architecture. The marginal cost of producing another story drops from thousands of dollars to hundreds.

When production cost approaches zero, margin approaches infinity. That's the financial logic driving the expansion of microdrama platforms.

The Economics: How Billions Flow from Billions of Micro-Transactions

Let's do the math on how microdrama apps are generating such staggering revenue.

Reel Short's $1.2 billion in 2025 spending breaks down roughly like this: The app has approximately 8-10 million monthly active users (based on app store data). Not all are paying, but those who are paying are spending substantially.

Let's assume a generous estimate: 15% of users are paying customers. That's roughly 1.2-1.5 million paying users. If the app made

That's about $65-85 per paying user per month. For a story about a girl and a rich guy. For content that costs a fraction of what Netflix spends per hour of content.

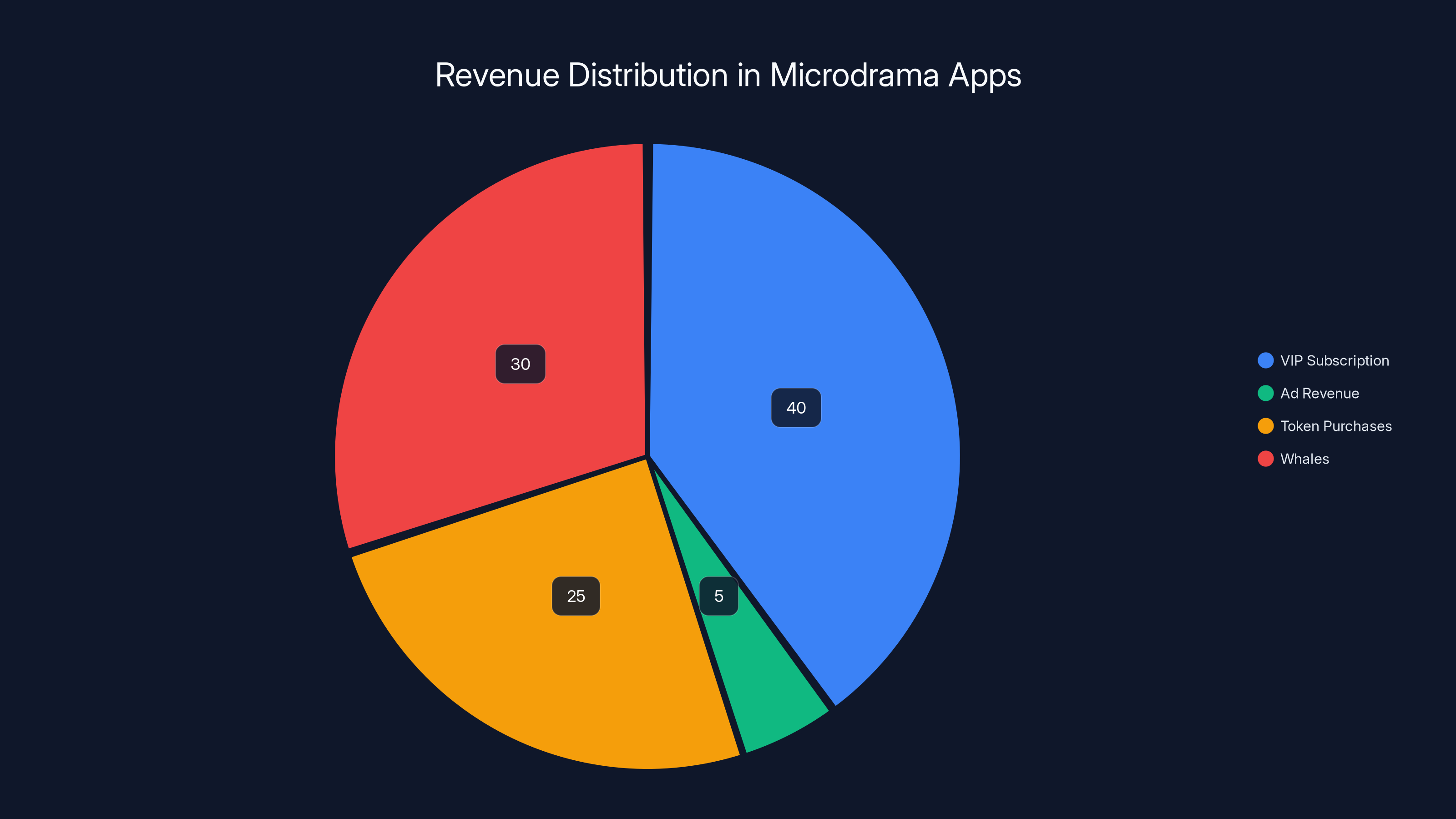

The Revenue Breakdown Looks Like This:

- VIP Subscription (Weekly): 1,040/year per subscriber

- Ad Revenue: Free users watching ads generate estimated $2-5 per user annually

- Token Purchases: Average paying users spend 360-600/year

- Whales (Top 1% Spenders): Estimated 2,400-6,000/year

The revenue distribution follows what's called the "80/20 rule" in mobile apps: 80% of revenue comes from 20% of users. In microdramas, the distribution is even more extreme. Top 5% of users probably generate 60-70% of revenue.

These "whale" users—people who spend excessively—are the key to profitability. A single user spending $300/month on tokens generates more revenue than 100 casual users combined. Entire app design is optimized to identify whales early and create personalized experiences that maximize their lifetime value.

The AI Advantage: With AI handling content creation, the unit economics become absurd:

- Production cost per show: 200,000+ (traditionally made)

- Revenue per show (given audience of 100K views at 2% conversion): $10,000-100,000+

- Payback period: 1-7 days, vs. months for traditional content

Once a show is proven to convert, you clone it. Different characters, same story. Different setting, same narrative beats. Multiply by 100-500 variations per year.

This is the business model. It's not revolutionary. It's just mobile gaming applied to narrative.

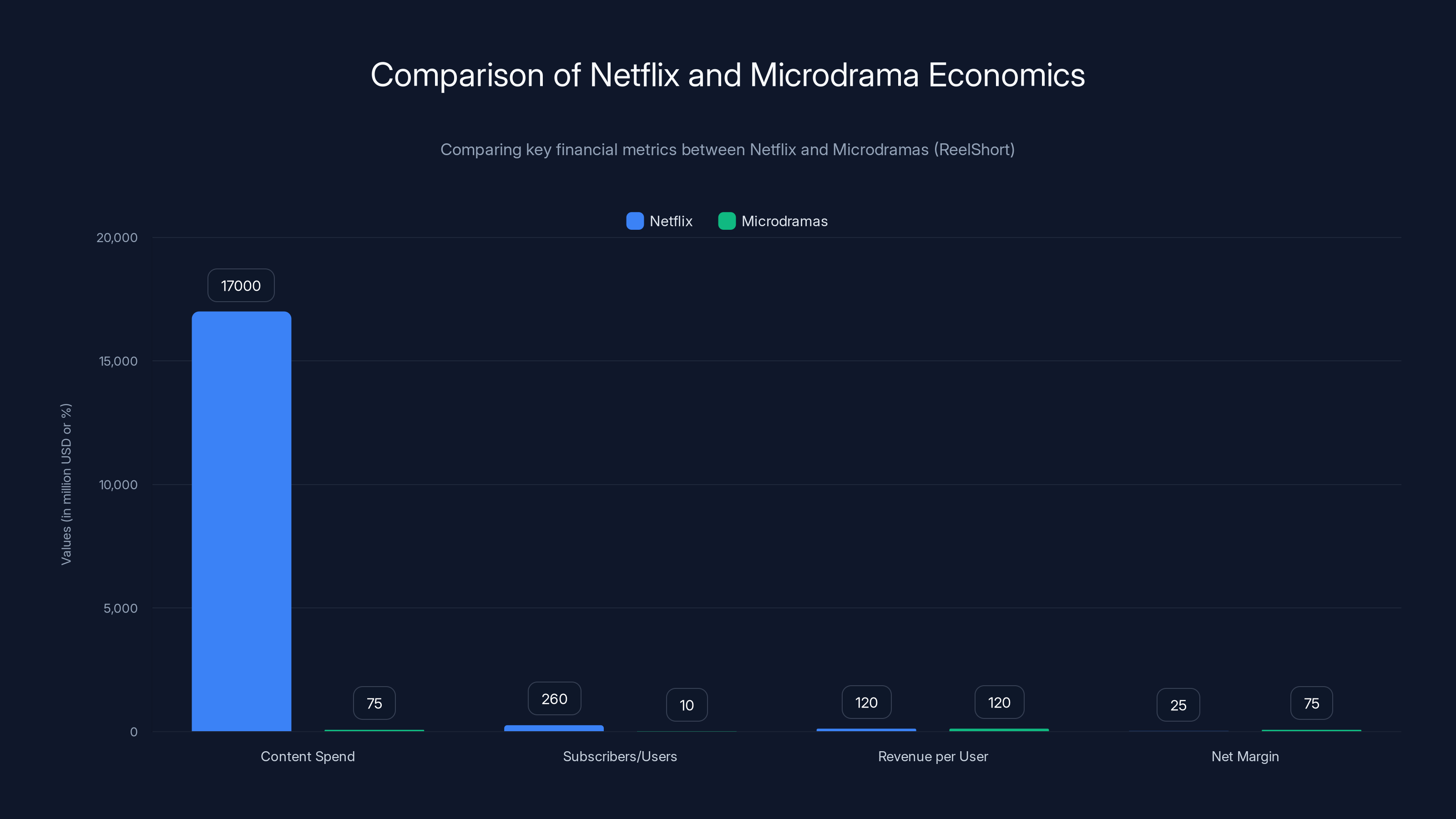

Microdramas boast significantly higher net margins (70-80%) compared to Netflix (20-30%), despite lower content spend and user base. Estimated data for Microdramas.

Comparing Microdramas to Streaming: Why the Revenue Math Looks Insane

To understand how profitable microdramas are, compare them directly to Netflix and streaming services.

Netflix Economics:

- Content spend: ~$17 billion annually

- Subscribers: ~260 million

- Cost per subscriber per year: ~$65

- Average revenue per subscriber: ~$120/year

- Net margin: ~20-30%

Microdrama Economics (Reel Short):

- Content spend: Estimated $50-100 million annually (with AI efficiency)

- Monthly active users: ~10 million

- Revenue per user (annual, all users averaged): ~$120

- But revenue is concentrated in payers (15% of users): ~$800/user

- Net margin: Estimated 70-80%

The margin comparison is shocking. Netflix operates on 20-30% net margins. Microdramas operate on 70-80%. This is because:

- Content is cheaper: AI-assisted production reduces costs

- Distribution is free: Apps distribute directly to users

- Unit economics are better: Fewer subscribers (10M vs. Netflix's 260M), but higher ARPU (average revenue per user)

- Retention is higher: Users stay because of addiction mechanics, not content quality

From a pure business perspective, microdramas are a superior business model to streaming. Higher margins, lower content costs, more engaged users. The only constraint is addressable market size, which is still enormous.

Why would any investor fund a traditional streaming service when microdramas prove such superior unit economics?

The Psychology of Compulsion: Why Users Keep Spending

The genius of the microdrama business model is that it weaponizes specific psychological vulnerabilities.

Cliffhanger Mechanics: Every episode ends mid-story. This creates what researchers call "cognitive closure" desire—your brain literally wants to know what happens next. It's not a preference; it's a psychological need. The brain finds unresolved narratives uncomfortable. Closing the loop feels good.

Microdramas end every episode mid-climax. Literally. The most emotionally intense moment is cut short. You must either wait until tomorrow (inconvenient, you'll forget), watch an ad (annoying), or pay (immediate relief).

Variable Reward Schedules: Behavioral psychologists have known for decades that unpredictable rewards are more addictive than predictable ones. This is why slot machines work. Sometimes you win big, sometimes you lose, sometimes you break even. The unpredictability keeps you engaged.

Microdramas use variable rewards: sometimes the free tokens are enough for an episode, sometimes not. Sometimes an ad awards bonus coins, sometimes not. The unpredictability keeps you coming back. You never know if today's tokens will be enough.

Sunk Cost Fallacy: If you've already spent

Social Proof and Fear of Missing Out: Microdramas have community features. You see what other users are watching. Trending shows are highlighted. Your friends are likely watching popular microdramas. Exclusion feels bad. The social pressure to join drives adoption.

Intermittent Reinforcement: Some users get lucky and find a story that genuinely is compelling. This happens rarely, but it happens enough to keep people searching. The occasional hit story mixed with dozens of mediocre ones creates a slot machine dynamic.

The psychological manipulation is sophisticated. Each mechanic compounds the others. Cliffhangers create urgency. Artificial scarcity creates friction. Variable rewards create habit. Sunk costs create commitment. The combination is remarkably effective.

ReelShort led the microdrama market with $1.2 billion in revenue, showcasing significant growth and mainstream appeal. Estimated data for PineDrama and GammaTime.

The Regulatory Challenge: Are These Apps Predatory?

The question regulators are asking with increasing urgency: Are microdrama apps predatory? Should they be regulated like gambling or addictive substances?

The honest answer is complicated. Microdramas aren't technically gambling—there's no element of chance in the outcome. But they are engineered for compulsive use. They deliberately exploit psychological vulnerabilities. They're designed to be as addictive as possible while staying technically legal.

Several regulatory frameworks could apply:

Loot Box Regulation: Some jurisdictions are treating randomized in-app purchases (especially in games) as gambling. Belgium banned loot boxes. Some U.S. states are considering similar regulations. Microdramas don't use randomized rewards, so they probably fall outside this category, but the spirit of the regulation could apply.

Consumer Protection Laws: Deceptive advertising is illegal. If apps advertise as "free" but have aggressive paywalls, is that deceptive? The FTC has already begun investigating mobile apps for dark patterns. Microdramas likely fall into this category.

Age Verification: Many microdramas feature adult content (sexual scenes, violence). If they're being marketed to teenagers, that creates legal liability. Current regulations require age verification for adult content apps. Most microdrama apps claim they require 18+ verification, but enforcement is weak.

Addiction Accountability: Some countries are exploring whether apps that deliberately engineer addiction should face restrictions similar to nicotine or alcohol products. This is the regulatory frontier. It's unclear what will happen, but momentum is building.

The microdrama industry is operating in a regulatory grey zone. The apps are legal today, but that's probably not permanent. Once regulators fully understand the mechanics, restrictions are coming.

Industry insiders expect that within 2-3 years, microdrama apps will face significant regulatory restrictions in major markets. Spending limits, addiction warnings, and stricter age verification are likely coming. This could materially impact the business model.

The Creator Economy Angle: Is There Legitimate Opportunity Here?

Not everyone in microdramas is getting exploited. Creators are making real money.

A successful microdrama series can generate $10,000-500,000+ depending on audience size and platform revenue sharing. For creators without Hollywood connections or studio backing, this is life-changing money.

The appeal to creators is obvious: dramatically lower production costs than long-form content, faster turnaround times, and direct monetization without needing studio backing or agent representation.

According to industry observers, the next wave of microdrama success won't come from studios or tech companies. It'll come from individual creators who understand the formula and can execute at scale with AI assistance.

A creator with 500K followers and basic video editing skills can now make more per month from microdramas than they could from YouTube, TikTok, or Instagram combined. That's unprecedented.

The economics create a perverse incentive structure: creators are incentivized to optimize for addiction, not quality. But from the creator's perspective, that's just smart business.

The Creator Opportunity Breakdown:

- Initial investment: Minimal ($500-5,000 for basic equipment and software)

- Time to profitability: 1-3 months with decent audience

- Scaling potential: Can produce multiple series simultaneously

- Revenue per series: $500-50,000+ depending on performance

- Total addressable market: Millions of potential creators globally

This is why Gamma Time raised $14 million from major venture investors. The platform is betting on creator supply, not traditional talent acquisition. It's a creator-first platform designed to onboard millions of content makers.

Generative AI significantly reduces production costs and time to market while increasing volume scalability and profitability for microdramas. Estimated data based on industry trends.

Market Size and Projections: How Big Can This Get?

The microdrama market is growing explosively. Current projections suggest it could surpass $3-5 billion annually in the U.S. alone within 2-3 years.

This assumes continued growth rates of 100-150% annually. That sounds aggressive until you realize the market penetration is still tiny—maybe 5-10% of heavy social media users. The addressable market is potentially 50-100 million users in North America alone.

Market Size Projections:

- 2025: $1.5-2 billion in U.S. app store revenue

- 2026: $3-4 billion (estimated)

- 2027: $5-7 billion (projected)

- 2028: $8-12 billion (speculative, but plausible)

At those revenue levels, microdrama apps would rival streaming services in annual revenue generation. This is a meaningful shift in entertainment economics.

Several factors could accelerate growth:

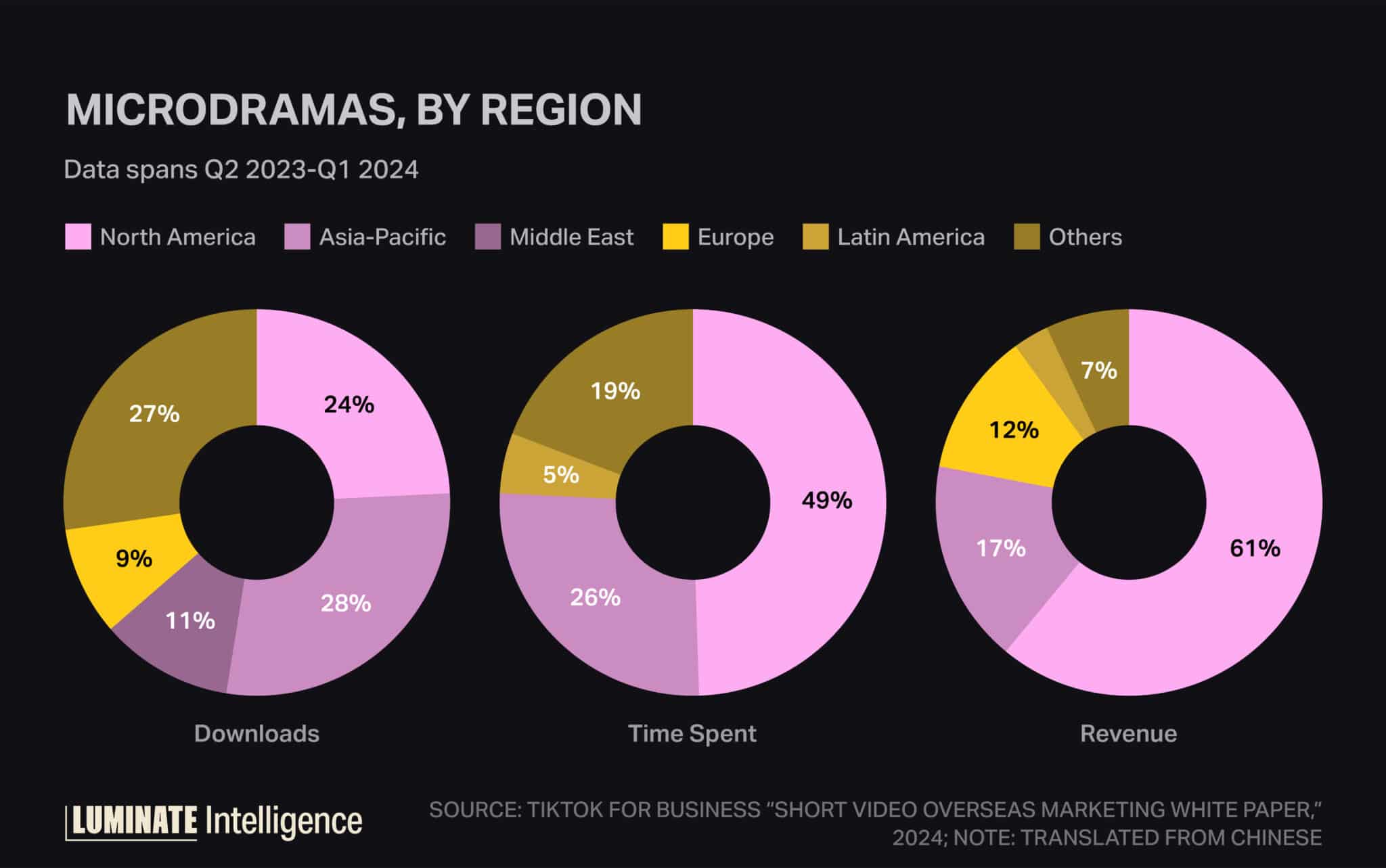

- International expansion: Microdramas are primarily English-language U.S./Canada focused today. Spanish, Mandarin, and Indian markets are much larger

- AI-driven personalization: Apps are getting better at predicting which stories hook which users

- Creator supply: As more creators understand the economics, content quality and variety will improve

- Network effects: As more friends use the apps, social pressure drives adoption

- Integration with major platforms: TikTok's Pine Drama is just the beginning. Instagram, YouTube, and Snapchat will likely launch competing products

Competition and Consolidation: Who Wins?

The microdrama space is rapidly consolidating. Major tech platforms are building competing products. Traditional media companies are either partnering with microdrama platforms or launching their own.

Key Players:

- Reel Short: Dominant market position, proven monetization, $1.2B revenue

- Drama Box: Second-largest player, fast-growing, international expansion

- Pine Drama: TikTok's official entry, huge distribution advantage

- Gamma Time: Well-funded, Hollywood backing, creator-focused

- Small independent apps: Hundreds of competitors trying different niches

The space is likely to follow typical tech market consolidation: a few large platforms will capture 70-80% of the market, smaller players will either get acquired or disappear, and the remaining landscape will be increasingly competitive.

Who wins? Probably the platform that figures out personalization first. Machine learning algorithms that can predict exactly which story will hook which user, and serve it at the exact moment of maximum receptivity.

This is where AI truly becomes differentiating. Not in content creation (everyone will have AI), but in content discovery and recommendation. The platform that can predict user preferences with 80%+ accuracy will dominate.

Estimated data shows that 'whale' users contribute significantly to revenue, with VIP subscriptions and token purchases also playing major roles. Ad revenue is minimal in comparison.

The Comparison to Other Addictive Platforms: Lessons from Gaming, Social Media, and Gambling

Microdramas aren't actually a new business model. They're a hybrid of three existing, extremely well-understood industries: mobile gaming, social media, and online gambling.

From Mobile Gaming: The free-to-play model with in-app purchases, the use of artificial currency (tokens/coins), the variable reward schedules, the daily login bonuses, the progression systems that demand payment to advance. Everything that makes Candy Crush so profitable is deployed in microdramas.

From Social Media: The addiction mechanisms (variable rewards, social proof, FOMO), the algorithm that surfaces content likely to generate engagement, the network effects that make the platform more valuable as more friends join, the communities and comment sections that create social accountability.

From Online Gambling: The targeting of emotional desires (fantasy, romance, power), the psychological manipulation of decision-making, the optimization for maximum spending among high-value users, the false sense of control or choice, the narrative structure designed to create hope and desire.

Microdramas successfully combined the most profitable elements of all three industries. The result is uniquely effective at generating revenue.

Comparative Addiction Metrics:

| Platform | Addiction Mechanism | Revenue Model | Primary User | Risk Level |

|---|---|---|---|---|

| Candy Crush | Variable rewards, progression | IAP, ads | Casual gamers | Medium |

| Social proof, FOMO | Ads, sponsorship | Broad audience | Low-Medium | |

| Draft Kings | Gambling desire, fantasy sports | Direct wagering | Sports fans | Very High |

| Microdramas | Romance fantasy, cliffhangers | IAP, subscriptions | Women 18-45 | High |

Microdramas rank higher on addiction potential than most gaming or social media, though lower than direct gambling. This is intentional. The platform is hitting psychological hot buttons with precision.

Content Quality and the Race to the Bottom

One inescapable reality: as these platforms scale, content quality incentives point downward, not upward.

Here's why: A high-quality story that costs

Moreover, the highest-converting stories aren't necessarily the best-written or best-acted. They're the stories that trigger the strongest emotional responses at the exact moment of paywall. Often, that means trashy content designed to be vapid but compelling.

The industry is genuinely running an experiment to find the absolute minimum quality threshold where content remains engaging enough to convert. Once found, that becomes the quality baseline for 90% of output.

This creates a content ecosystem resembling a worst-case-scenario internet: millions of stories optimized for addiction rather than artistry, produced at minimal cost with AI assistance, designed specifically to exploit psychological vulnerabilities.

For users, especially young users, the cultural impact is unclear. But it's probably not zero.

The AI Revolution: How Generative AI Makes Microdramas Even More Profitable

Generated AI isn't going to replace skilled human writers anytime soon. But it's already replacing mediocre ones, which is exactly the tier of talent that dominates microdrama production.

Large language models are getting shockingly good at generating formulaic narrative. They can write plot summaries, dialogue, and scene descriptions for stories that follow predictable patterns. For content like microdramas, which deliberately follow predictable patterns, LLMs are nearly good enough today and will be completely sufficient within 12-18 months.

The implications are dramatic:

- Production costs drop from 500-5,000

- Time to market drops from weeks to days

- Volume scalability increases from 10-20 shows per year to 50-100+ shows per year per creator

- Profitability increases from 40-50% to 70-80%+

Instead of a creator making 5 stories per year, they can make 50. Instead of each story needing 10,000 viewers to break even, they need 1,000. The economics become absurdly favorable.

Companies like Pocket FM are already using AI to optimize story beats and predict cliffhanger moments that maximize viewer retention. This is just the beginning. Within 2 years, probably 50%+ of microdrama content will be substantially AI-generated.

This creates a concerning dynamic: AI removes the barrier to entry for content creation, which floods the market with mediocre content, but also massively improves platform profitability and user engagement (because the algorithms can optimize at scale).

The winner in this scenario is the platform with the best recommendation algorithm. The loser is the user, drowning in increasingly formulaic, AI-generated content designed purely for addiction.

Ethical Concerns and Responsibility Questions

The microdrama boom raises genuine ethical questions that the industry hasn't seriously addressed.

Targeting Young Users: While apps technically require 18+ users, enforcement is weak and many teenagers use these apps. Content featuring sexual scenarios, violence, and abusive relationships is being consumed by users who lack critical perspective. The long-term effects are unknown.

Predatory Economics: These platforms are designed to maximize spending, especially among users with limited financial literacy. High school and college students are literally spending tuition money on stories. This is predatory, even if technically legal.

Normalized Unhealthy Relationships: The narrative templates in microdramas often normalize unhealthy relationship dynamics: power imbalances, controlling behavior, jealousy, possessiveness. These are presented as romantic rather than concerning.

Addiction by Design: Unlike slot machines or casinos, which at least disclose odds and have some regulatory oversight, microdrama apps deliberately hide their monetization mechanics and optimize for addiction without any guardrails.

Creator Exploitation: Junior creators making content for these platforms often receive minimal revenue share while the platform captures 70-80% of spending. It's a new form of gig economy exploitation.

The industry response to these concerns has been minimal. No platform has seriously implemented spending limits, addiction warnings, or revenue-sharing improvements for creators. The financial incentives to ignore these issues are simply too strong.

This is a regulatory gap waiting to be filled.

What Happens Next: The 3-Year Outlook

Based on current trends, here's what the microdrama landscape probably looks like in 2028:

Market consolidation: The top 3-5 platforms will control 80%+ of revenue. Hundreds of small apps will shut down. Remaining mid-tier apps will either get acquired or pivot to niches.

Regulatory pressure: Most major jurisdictions will have implemented spending limits, addiction warnings, and stricter age verification. This won't kill the industry, but it'll reduce spending-per-user by 20-30%.

AI integration: Probably 60-70% of new content will be substantially AI-generated. Production costs will be 80-90% lower than today. Human creators will be valued only for unique creative direction.

Market size: The U.S. microdrama market will likely reach

Creator ecosystem: Hundreds of thousands of creators will be making full-time income from microdramas. A few will become celebrities. Most will struggle with declining revenue as market saturation increases.

Platform integration: Major social platforms (TikTok, Instagram, YouTube, Snapchat) will all have microdrama features or standalone apps. This will drive competition and accelerate market growth.

Content evolution: Stories will become even more formulaic and addiction-optimized. Sexual content will push further toward acceptable limits. Psychological manipulation will become more sophisticated.

The trajectory is clear. Microdramas are going to become a major entertainment category, generating tens of billions in annual revenue, while simultaneously becoming more addictive, more manipulative, and more harmful to vulnerable populations.

The industry is betting that maximizing profit is more important than minimizing harm. So far, the bet is paying off.

How Creators Are Actually Making Money: Realistic Income Expectations

Let's be concrete about what creators actually make from microdramas.

Tier 1: New/Small Creators (0-50K followers)

- Revenue per show: $100-1,000

- Monthly income: $200-2,000

- Realistic hours per month: 20-40

- Effective hourly rate: $5-50/hour

Tier 2: Growing Creators (50K-500K followers)

- Revenue per show: $2,000-20,000

- Monthly income: $3,000-30,000

- Realistic hours per month: 30-60

- Effective hourly rate: $50-500/hour

Tier 3: Popular Creators (500K+ followers)

- Revenue per show: $20,000-200,000+

- Monthly income: $30,000-150,000+

- Realistic hours per month: 40-80

- Effective hourly rate: $375-3,750/hour

The distribution is heavily skewed. 80% of creators make under

For context: Most YouTube creators with 100K subscribers make $2,000-5,000/month from AdSense. Most TikTok creators make nearly nothing. Microdrama monetization is actually more generous than most platforms, which is why the creator interest is so high.

But here's the reality check: for most creators, it's not sustainable income. As the market saturates, conversion rates decline, revenue per story drops, and the barrier to success increases. This is the standard tech industry pattern.

Conclusion: The Uncomfortable Truth About the Microdrama Boom

Microdramas are going to make billions. Maybe tens of billions. This isn't speculation. The revenue numbers are already here. The growth trajectory is already established. The business model is already validated.

But here's the uncomfortable part: they're going to make that money by being deliberately addictive, psychologically manipulative, and often predatory.

They succeeded where Quibi failed not because they're better entertainment. It's because they stopped trying to be entertainment at all. They became something else entirely: addiction machines disguised as storytelling platforms.

The comparison to mobile games is apt, but incomplete. Microdramas are actually more dangerous than most mobile games because they operate on the emotional vulnerability and fantasy desires of the human brain. They're not just optimizing for clicks. They're optimizing for desperate, emotionally charged decisions.

Will they be regulated? Almost certainly, eventually. But by then, the damage will be substantial. Millions of users will have developed problematic relationships with these apps. Billions of dollars will have been extracted from people who couldn't afford it.

Will creators benefit? Some will, enormously. But most will struggle, then quit, only to be replaced by the next cohort of hopeful creators who don't realize the market is already saturating.

Will the quality of content improve? No. It will decline. Because better content is more expensive to produce, and mediocre content that exploits addiction is more profitable. The incentive structure points in the wrong direction.

Microdramas represent a genuinely troubling moment in technology history. Not because the technology is new or surprising, but because it represents the mature weaponization of behavioral psychology against human nature. We know exactly how to make these addictive. We know exactly how to extract maximum spending. We know exactly how to normalize harmful relationship dynamics.

And we're doing it anyway, at scale, to millions of people, because it's legal and profitable.

That's the real story. Not that microdramas are making billions. But that we've built a system where the most profitable thing is often the most harmful thing, and we've collectively decided that's acceptable as long as nobody breaks the law.

The microdrama boom isn't a tech story. It's a story about the limits of our ethical guardrails in a world where technology can measure and manipulate human behavior with unprecedented precision.

What happens next depends on whether we decide to build better guardrails, or accept that addiction and exploitation are just the cost of innovation.

FAQ

What exactly are microdramas and how do they differ from streaming shows?

Microdramas are short-form scripted video stories, typically 1-3 minutes per episode, designed for vertical viewing on mobile phones. Unlike streaming services like Netflix which feature 30-60 minute episodes and focus on production quality, microdramas prioritize rapid episode turnover, emotional cliffhangers, and monetization through in-app purchases. They originated in China and are now experiencing explosive growth in North America through apps like Reel Short and Drama Box.

How do microdrama apps make money if users can watch for free?

Microdrama apps use a freemium model combined with aggressive in-app monetization. While initial episodes are free, advancing further requires in-app currency (tokens or coins). Users get limited free currency daily (encouraging daily logins), but the amount is carefully calibrated to be insufficient for most stories. Users must either watch ads for more currency, purchase tokens directly (

Why did Quibi fail while microdramas are succeeding when both target mobile viewing?

Quibi failed because it prioritized production quality and celebrity talent, creating prestige content that didn't align with how people actually consume mobile media. Microdramas succeed because they abandoned quality aspirations entirely and instead optimized for addiction, emotional manipulation, and rapid monetization. Quibi tried to be Netflix for phones. Microdramas became slot machines for narrative, which proved far more profitable. The fundamental difference is that Quibi designed for engagement, while microdramas design for compulsion.

What dark patterns do microdrama apps use to encourage spending?

Microdrama apps employ sophisticated behavioral manipulation tactics borrowed from mobile gaming, including: daily login bonuses that create habit formation, artificial scarcity through limited free currency, cliffhangers that end exactly when emotional engagement peaks, variable reward schedules that make outcomes unpredictable, sunk cost fallacy (more likely to spend additional money on a story you've already invested in), and interactive choices where the better option costs currency while the worse option is free. These patterns are deliberately designed to bypass rational decision-making and trigger compulsive spending.

How much revenue are the top microdrama apps actually generating?

Reel Short generated approximately

Are microdramas regulated like gambling or other addictive products?

Currently, microdramas exist in a regulatory gray zone. Most jurisdictions haven't specifically addressed microdrama apps, though general consumer protection laws regarding deceptive advertising and dark patterns may apply. Unlike gambling, which has strict regulations and odds disclosure requirements, microdramas aren't required to disclose their monetization mechanics or provide spending limits. However, several countries including Belgium and some U.S. states are exploring regulations for addictive app mechanics, and significant regulatory restrictions likely within 2-3 years.

Can creators actually make sustainable income from making microdramas?

Yes, but with caveats. Top-tier creators (with 500K+ followers) can earn

How is artificial intelligence changing microdrama production?

AI is dramatically reducing production costs and timelines. Platforms like Pocket FM's Co Pilot use language models trained on thousands of hours of microdrama content to predict optimal cliffhanger placement and narrative beats. AI can now generate complete story scripts, dialogue, and scene descriptions for formulaic content at minimal cost (

What are the actual psychological effects of microdrama consumption on users?

Microdramas deliberately exploit psychological vulnerabilities including variable reward schedules (making outcomes unpredictable to increase engagement), cliffhanger mechanics that trigger cognitive closure desires, sunk cost fallacy (investment in stories encourages continued spending), and normalization of unhealthy relationship dynamics. While long-term effects are still being studied, these apps demonstrate measurable addiction characteristics comparable to some gambling products. Vulnerable populations, particularly adolescents and young adults, appear at higher risk for problematic use.

What's the timeline for when microdramas will be regulated?

Most industry observers expect significant regulatory action within 2-3 years in major markets. Likely regulations include mandatory spending limits, addiction warnings, stricter age verification, and revenue-sharing improvements for creators. Regulatory pressure is building from consumer protection agencies investigating dark patterns, parent advocacy groups concerned about adolescent usage, and precedents from loot box regulations in games. However, regulation will likely reduce but not eliminate the business model's profitability.

Key Takeaways

- ReelShort generated 276 million, proving microdramas are a viable multi-billion dollar category

- Microdramas succeed where Quibi failed by abandoning quality and embracing addiction mechanics from mobile games, not prestige streaming models

- The business model combines dark patterns from three industries: variable rewards from gaming, social proof from social media, and fantasy-based targeting from gambling

- Average paying users spend $60-85/month on microdramas, more than bundled Netflix/Disney+/HBO/Hulu subscriptions combined, driven by psychological manipulation

- AI is reducing production costs 80-90%, enabling creators to produce 50-100+ stories annually instead of 10-20, accelerating market growth and content commodification

- Regulatory restrictions (spending limits, addiction warnings, age verification) are likely within 2-3 years, potentially reducing revenue by 20-30% but not eliminating the model

- Creator income distribution follows the 80/20 rule with 80% earning under $500/month, making sustainable income unlikely for most as market saturates

- The global microdrama market is projected to reach $8-12 billion by 2028, rivaling streaming services in revenue while operating on fundamentally predatory mechanics

Related Articles

- Freecash App: How Misleading Marketing Dupes Users [2025]

- Substack's TV App Launch: Why Creators Are Torn [2025]

- The 4 Forces Shaping Social Media in 2026 [2025]

- Hi-Res Music Streaming Is Beating Spotify: Why Qobuz Keeps Winning [2025]

- Boycott Apps Surge in Denmark: Why Consumer Activism Goes Mobile [2025]

- Instagram's AI Problem Isn't AI at All—It's the Algorithm [2025]

![How Microdrama Apps Became a Billion-Dollar Industry [2025]](https://tryrunable.com/blog/how-microdrama-apps-became-a-billion-dollar-industry-2025/image-1-1769184618428.jpg)