How to Get Into a16z's Speedrun Accelerator: Insider Strategies [2025]

You've probably heard the stories. A founder gets accepted into a16z's Speedrun accelerator, closes a Series A within months, and suddenly they're on every podcast. But here's what you don't hear about: the 19,000+ applications they reject every year.

Speedrun isn't just another accelerator. It's one of the most selective startup programs in the world, with an acceptance rate sitting below 1%. We're talking about a program that's pickier than Harvard's graduate school. And yet, thousands of founders keep applying, hoping their startup will be the one that breaks through.

The weird part? Most of them are doing it wrong.

I've spent time understanding what makes Speedrun different, how it actually works, and more importantly, what separates the startups that get in from the thousands that don't. The program's leadership has been surprisingly open about what they're looking for, and the insights they've shared are goldmines if you know how to interpret them.

This isn't about luck. It's about understanding a specific institution's values, priorities, and decision-making framework. And then structuring your application to speak directly to those priorities.

Let's break down exactly what you need to know to have a real shot at getting into Speedrun.

Understanding the Speedrun Accelerator Landscape

Speedrun launched in 2023 as a focused gaming accelerator, but it's evolved dramatically. What started as a vertical program targeting a narrow slice of the startup ecosystem has transformed into something broader and more ambitious. Today, it's explicitly horizontal, meaning any founder with any type of startup can apply.

But don't let that fool you into thinking the program has gotten less selective. If anything, it's the opposite. More founders applying means the threshold for acceptance has gone up, not down.

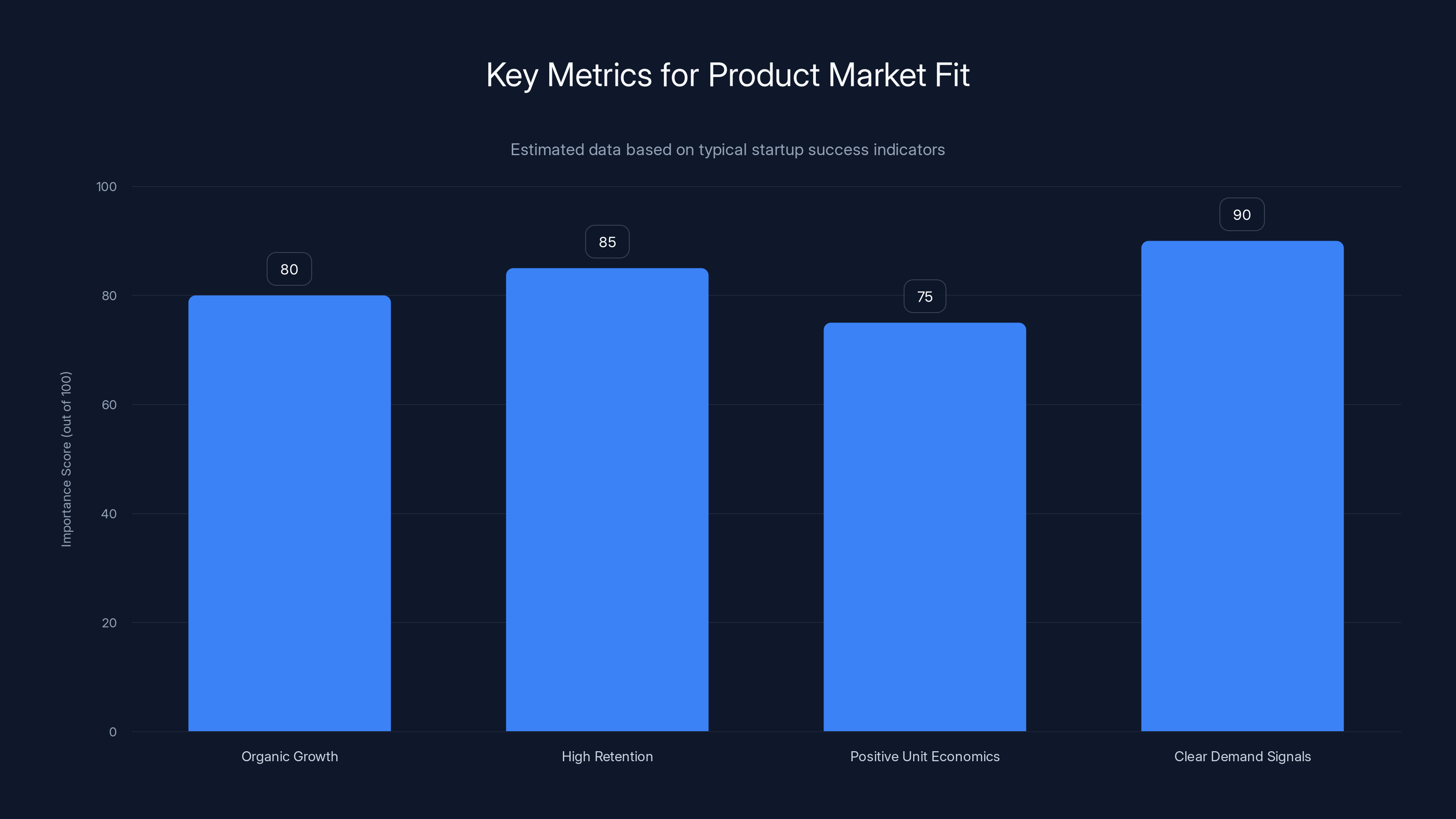

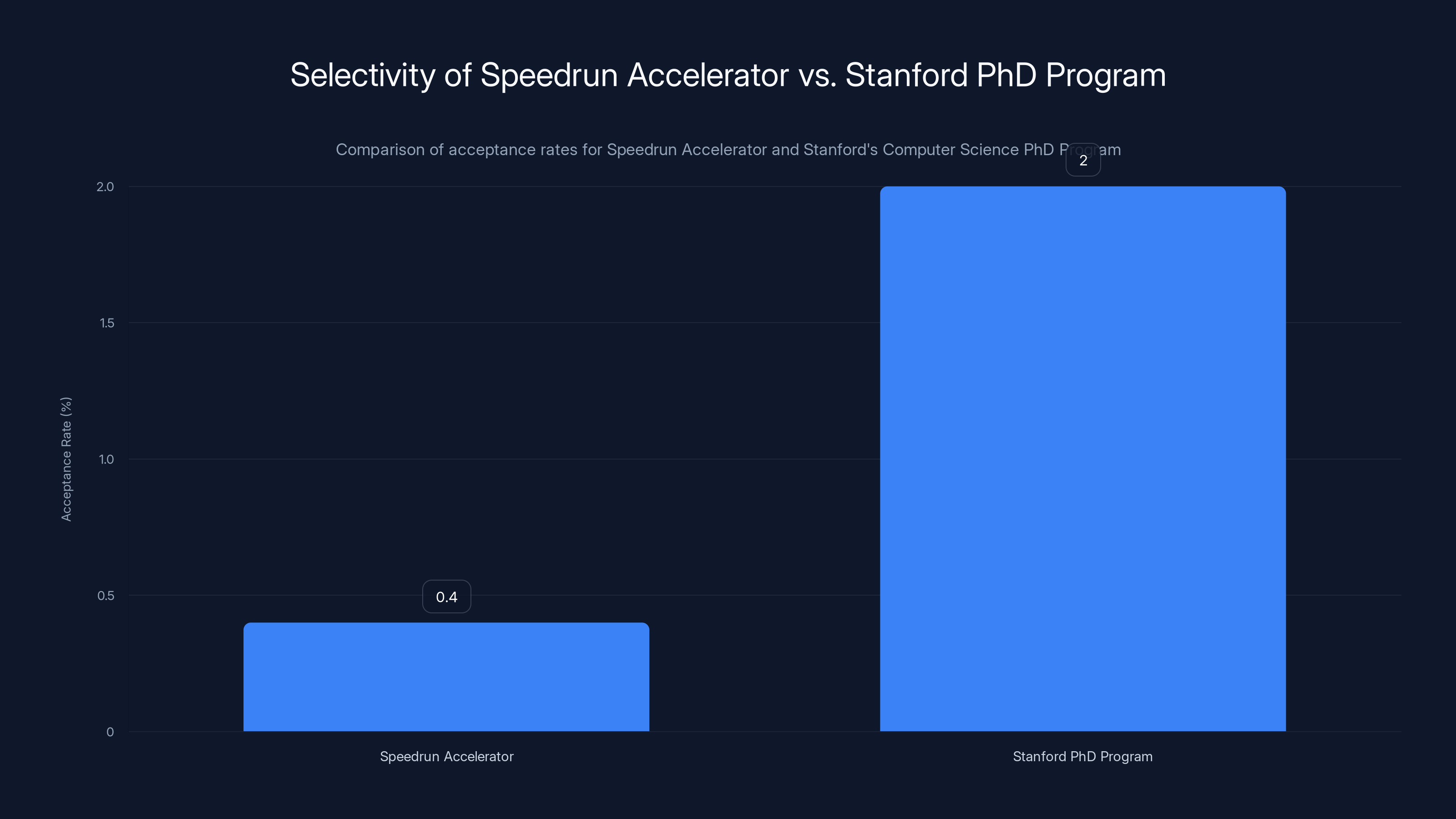

The numbers tell the story. In a recent cohort, Speedrun received 19,000+ applications. Fewer than 80 startups made it in. That's a 0.4% acceptance rate. For context, Stanford's computer science PhD program accepts about 2% of applicants. Speedrun is roughly four times more selective.

The program invests up to

The program runs for 12 weeks, based in San Francisco. Two cohorts per year, 50 to 70 founders per cohort. Applications for the next cohort typically open in April, though the program looks at off-season applications year-round.

Understanding these mechanics matters because it tells you something important: Speedrun is betting heavily on each company. The investment is substantial, the support is deep, and the commitment from the firm is real. They can't afford to get this wrong. This means their selection process isn't about finding the most impressive thing you've done. It's about finding the founding team most likely to turn a small spark into a roaring fire with Speedrun's help.

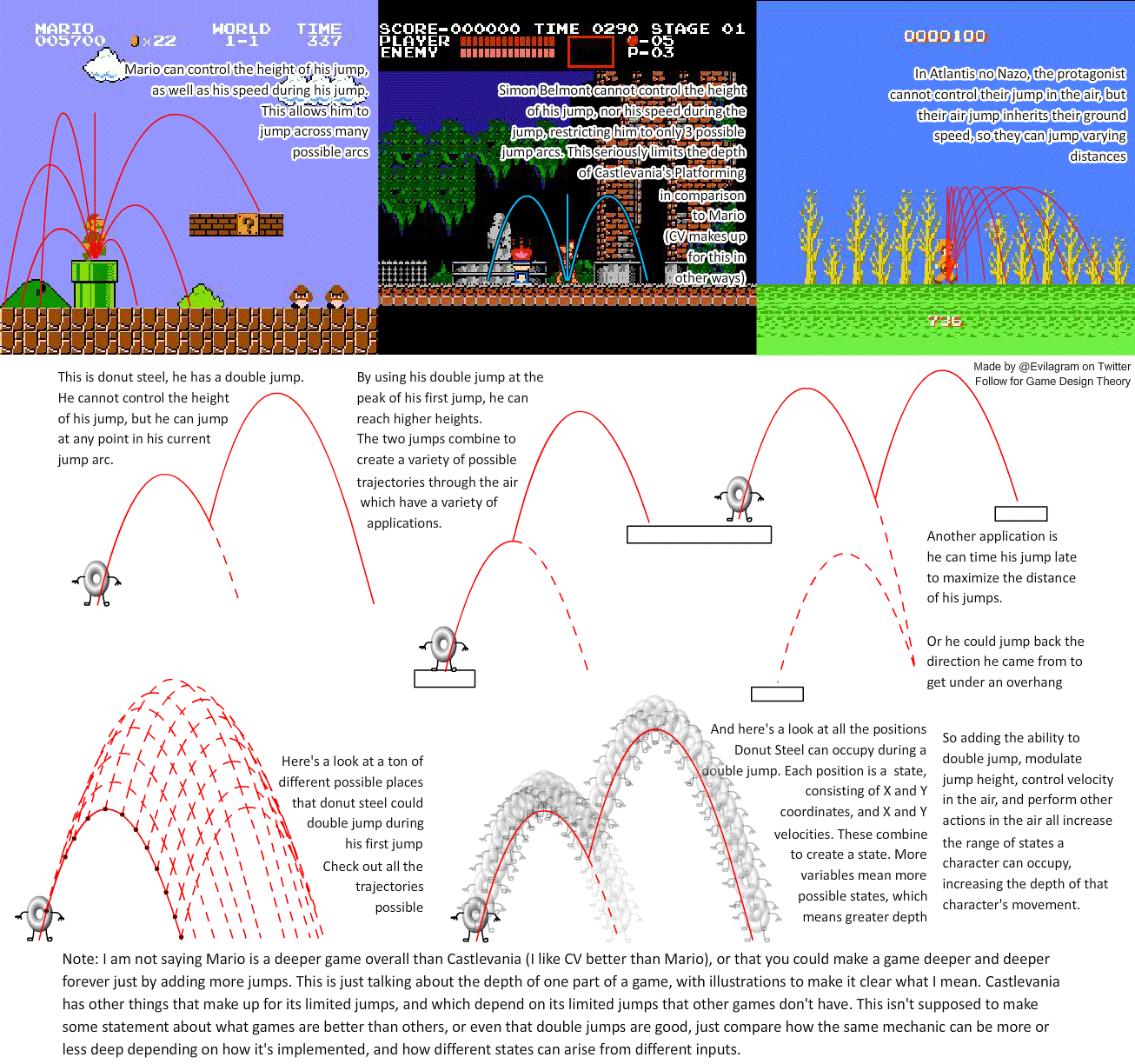

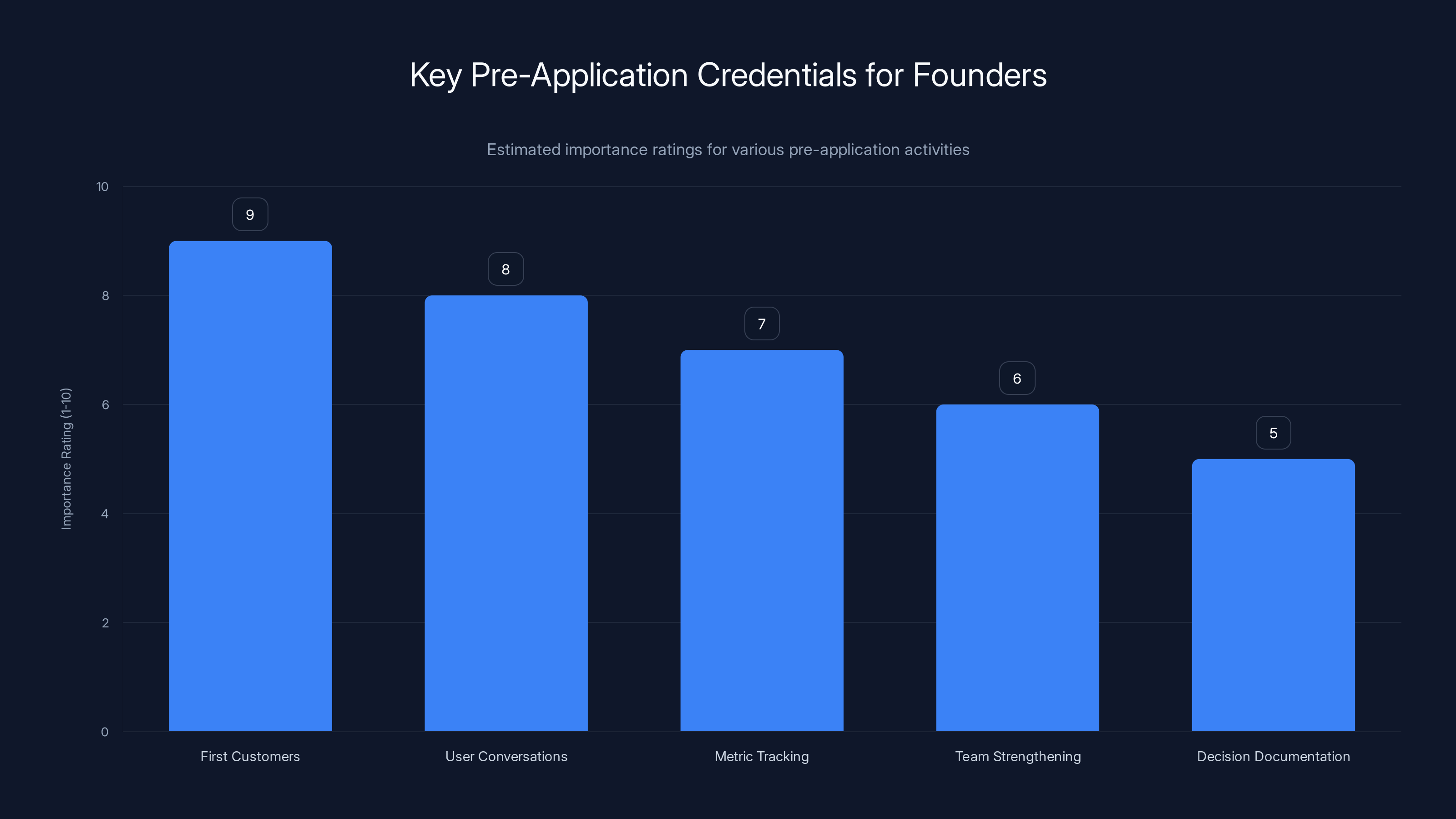

Achieving product market fit involves excelling in organic growth, retention, unit economics, and demand signals. Estimated data highlights their relative importance.

The Founding Team Obsession

If you want to understand how Speedrun thinks, start here: they don't invest in ideas. They invest in teams.

This isn't some generic startup advice. This is the specific, stated priority of the program. When evaluating applications, Speedrun's partners look first at who's doing the building. And they're incredibly specific about what they're evaluating.

The first thing they look for is complementary skills. But here's where most founders misunderstand this. A lot of people think complementary skills means one technical cofounder, one business cofounder, one marketing cofounder. Nice, neat, organized.

That's not what Speedrun means. They're looking for founding teams with genuine diversity in capabilities and perspectives, but without huge gaps. If your team has collectively seen a problem from multiple angles, worked through complex problems before, and understands how to leverage each other's strengths, that matters infinitely more than checking boxes.

What they're really looking for is evidence of functional teamwork. Founders who have worked together before have a massive advantage. Not because there's some magic in pre-existing relationships, but because pattern recognition matters. Teams that have navigated disagreements together, resolved conflicts, and come out the other side stronger have already proven something fundamental: they can work under pressure.

Speedrun's due diligence process is designed to identify red flags in team dynamics. They'll have conversations with each cofounder separately. They'll probe on how decisions get made, how conflict is handled, how disagreements are resolved. If there's tension, they'll find it. If there's one person dominating all conversations, they'll notice. If there's unclear accountability, it becomes obvious quickly.

The implication here is that your founding team's ability to communicate, collaborate, and execute is not ancillary to your application. It's central. Everything else flows from this.

One more critical element: technical capability. AI has lowered the barriers to building software dramatically, but Speedrun still sees deep technical strength as valuable. Not because you need to build something complicated, but because velocity matters. A technically strong team can experiment faster, validate hypotheses quicker, and iterate on feedback in real-time. That speed compounds over 12 weeks.

The Speedrun accelerator program is highly selective, with only 0.4% of applicants accepted, 10% reaching the video interview stage, and the remaining 89.6% rejected based on their written application. (Estimated data)

The Early Traction Expectation

Speedrun is explicitly looking for teams that have already begun building and validating their idea. This is crucial. They're not interested in pure concepts or well-researched market opportunities. They want evidence that you've done something.

That something can be small. But it needs to exist.

What kind of traction? It varies wildly depending on your vertical. For a B2B SaaS play, it might mean you have your first three customers. For a mobile app, it might be 5,000 downloads and reasonable retention metrics. For a content or creator platform, it might be meaningful engagement from early users. For an AI tool, it might be demonstrable improvements over existing solutions, tested by real users.

The pattern here is simple: you've moved beyond theory. You've built something. You've put it in front of people. You've learned something from that process. You can articulate what you learned and how it's informing your next moves.

Why does Speedrun care about this? Because it reduces risk. A team that has already done the hard work of validating whether anyone actually wants what they're building is more likely to succeed during the 12-week program. You're not going to waste time solving the wrong problem. You're going to waste time solving the right problem better.

The program's value proposition is interesting here. As the leadership has said, Speedrun is great at helping teams pour gasoline on a very small spark. They're not trying to ignite fires from nothing. They're looking for that initial spark—evidence that something is working, even if it's small. Then their job is to amplify it.

This has massive implications for how you should prepare your application. Don't spend months building the perfect product. Spend weeks building something that works, validating it with users, and having real data about what people think. Then apply. That early traction is often worth more than perfection.

Market Theory: The Trap Most Founders Fall Into

Here's something that might surprise you: Speedrun doesn't want to hear a lengthy market analysis in your application.

I know. Counterintuitive, right? But think about it from their perspective. They're reading thousands of applications. Each one typically includes some version of the same narrative: here's a massive market that everyone's ignoring, here's why that market is broken, here's why our solution is the obviously correct fix.

Most of this is speculation. And it's often wrong.

The investors at Speedrun have seen this pattern play out hundreds of times. Founders show up with a compelling narrative about why a market works a certain way. Then they launch, and reality doesn't match the theory. The market behaves differently than expected. Customer priorities shift. Competitive dynamics emerge. The founding team pivots.

This doesn't mean the company fails. In fact, most successful startups pivot at least once. But it means the founders' initial theory about the market wasn't accurate. And if that theory was the cornerstone of their application, what does that tell you about the quality of the application's analysis?

So Speedrun has figured this out. Instead of investing time in evaluating your market theory, they focus on something much harder to fake: your team's ability to figure things out when your initial assumptions are wrong.

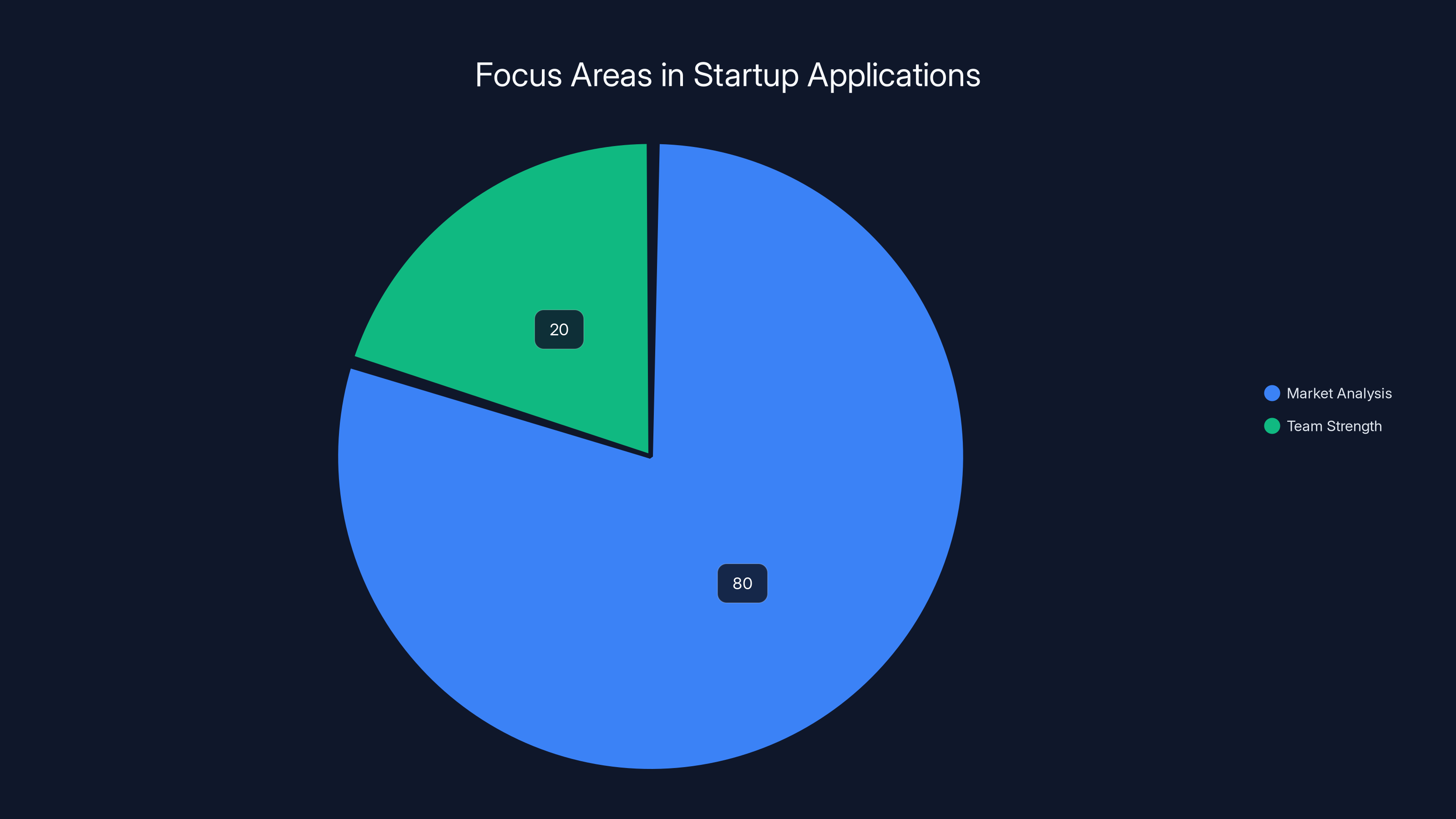

Where most applications fail is here: they spend 80% of their energy explaining the market and 20% explaining the team. The inversion of this ratio is exactly what Speedrun wants to see.

What should your application actually focus on? Why this founding team, specifically, is uniquely positioned to figure out this problem. What experience do your cofounders have that's relevant? What skills do they bring? Have they navigated surprising market conditions before? Can they adapt?

The product matters, sure. Your market analysis matters, fine. But what really matters is answering this question: if everything you believe about the market turns out to be partially wrong—which it will—is this the team that will figure out what to do about it?

That's the bet Speedrun is making. Your job is to convince them you're worth that bet.

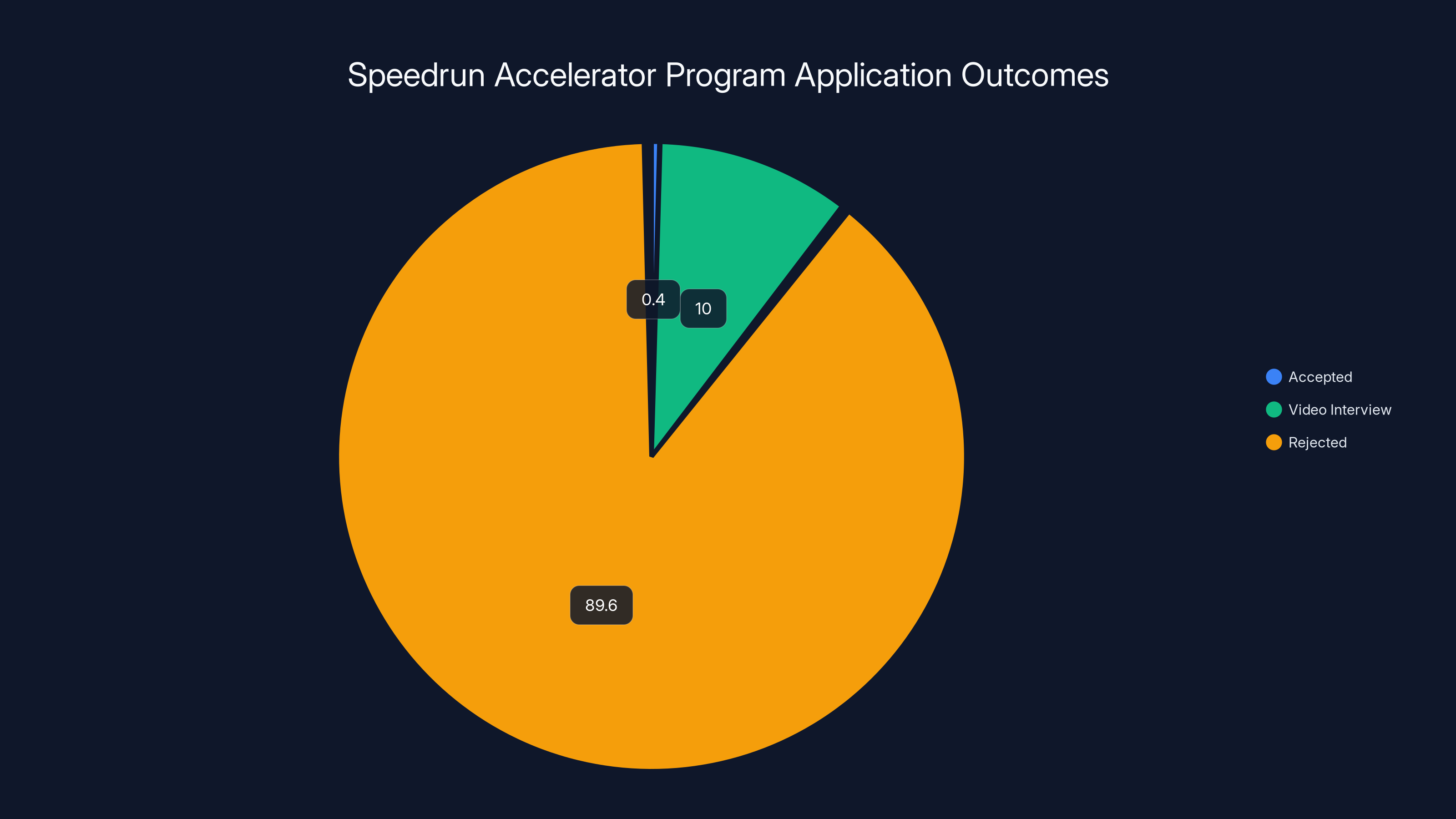

Crafting a compelling application involves focusing on clear problem definition, impactful solutions, quantifiable traction, and strong team dynamics. Estimated data based on narrative advice.

The Application Itself: Crafting Your Narrative

You've got limited space to tell your story. Speedrun's application form isn't a novel. It's a structured set of questions designed to extract specific information about your team, your problem, your approach, and your early progress.

Every word needs to work. You don't have room for filler, corporate jargon, or unnecessary explanation.

Start with clarity about the problem. Not a 500-word market analysis. A clear, specific description of what's broken and why it matters. If you can do this in three sentences, do it in three sentences. Specificity is your friend. "Small businesses struggle with invoicing" is vague. "Freelance photographers spend 3-4 hours per week chasing invoice payments, which often arrive 30-60 days late" is specific. One of these is memorable. The other is forgettable.

Your solution should be described in terms of what it actually does, not what you think it means for the market. "We've built an AI-powered invoicing system that reduces payment collection time by 40% and integrates with the top 12 accounting platforms" is better than "We're revolutionizing how freelancers manage cash flow."

Traction goes next. And this should be numbers-focused. Not "we have a strong user base" but "we have 247 active users with a 35% weekly retention rate." Not "customers love our product" but "our NPS score is 62 and we've had 4 customers pay us $5,000+ annually."

The founding team section is where you differentiate from 95% of other applicants. Most applications list credentials: "Founder A worked at Google, Founder B has an MBA from Stanford." These are data points, but they're not the story.

What Speedrun wants to understand is why this specific combination of people is good together. What problems have you solved together before? How do you complement each other? What's the evidence that you work well as a team? Have you navigated disagreement successfully? Do you have pattern recognition from previous experiences that applies to this new problem?

If you haven't worked together before, acknowledge it. But explain how you've de-risked it. Have you spent weeks working on the problem together first? Have you done a trial period where you tested collaboration? Be real about this.

Where you're headed matters too, but frame it as a specific near-term goal, not a moonshot. "We're aiming to get to 1,000 paying customers in the next six months" is a better goal than "We want to be a billion-dollar company." The first is measurable and grounded. The second is generic.

The AI Question: When It Helps and When It Hurts

Speedrun's leadership has been explicit about this: use AI to clean up your application. Grammar errors, unclear sentences, redundancy—AI tools are great at fixing these things. There's no excuse for sloppy writing in 2025.

But here's the critical distinction: there's a massive difference between using AI as an editing tool and having AI write your entire application.

If AI has cleaned up your grammar and made your sentences more concise, that's fine. Investors expect quality writing. But if an AI system has written the entire narrative about why your team is great together or why this problem matters to you, that's a problem.

Why? Because the next stage of the process is a live video interview. If you make it past the written application, you'll have a conversation with someone at Speedrun. They'll ask you to explain your startup, walk them through your thinking, talk about your early learnings. If your written application was AI-generated, your live explanation will likely sound different—less polished, less coherent, less impressive. The disconnect will be obvious. And it'll be a red flag.

Accelerators care about two things in that video call: can you articulate clearly what you're building and why, and do you understand your market and your customers? If you can't do these things in live conversation, you can't do them in a pitch. And if you can't pitch, you can't raise money.

So the rule is simple: use AI as a writing assistant. Use it to find typos, improve clarity, make complex ideas simpler. But the voice, the story, the core narrative—that has to be yours. When an interviewer asks you to explain something in depth, you need to be able to do it. If you can't, you don't understand it well enough yet. And you're not ready to apply.

One more thing: Speedrun reads a lot of applications. A lot. If your application reads like it was generated by GPT, it will feel like background noise. The applications that stand out are the ones where you can hear a human voice—a specific human with a specific perspective and specific insights. That voice is hard to fake. And it's impossible to AI-generate if you're trying to sound like yourself.

Speedrun Accelerator is significantly more selective than Stanford's Computer Science PhD program, with an acceptance rate of just 0.4% compared to Stanford's 2%.

The Two Cohorts Per Year: Timing Your Application

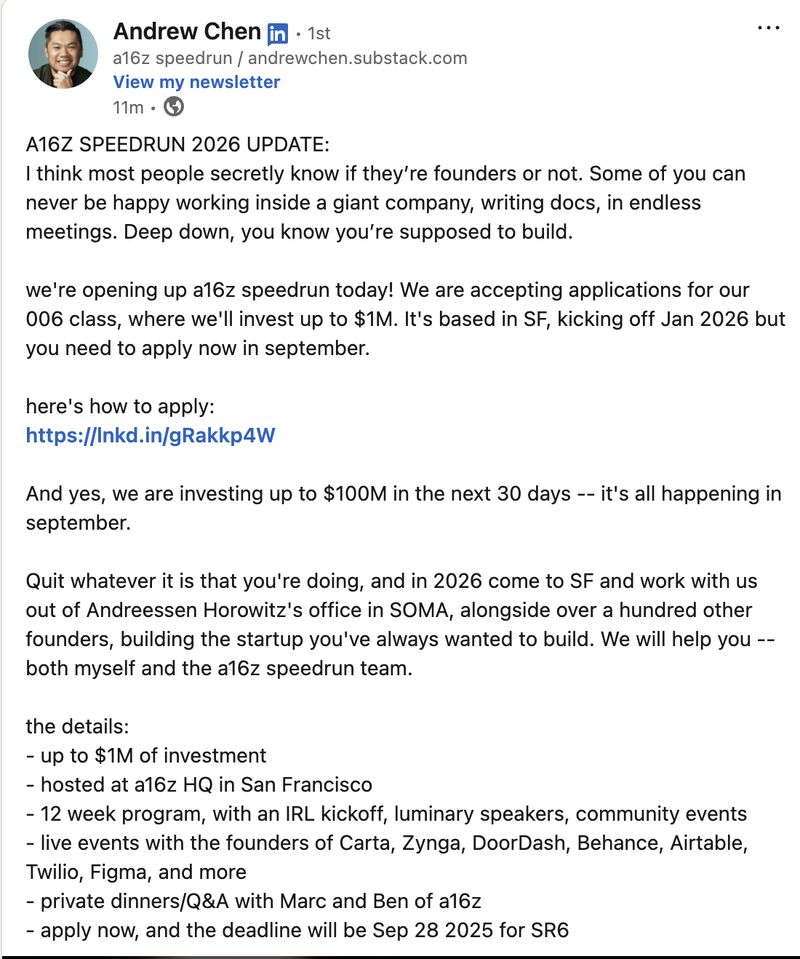

Speedrun runs two cohorts annually, with applications typically opening in April for the next cycle. But here's something important: the program looks at off-season applications year-round.

This is a critical detail that most founders miss. You don't have to wait for an official application window. You can apply whenever you're ready. But you need to understand how that impacts your chances.

Speedrun's acceptance rate is below 1% no matter when you apply. But there's strategy in timing. If you apply during an off-season application window, your application might sit in a queue and get reviewed when there's more time. Alternatively, it might get lumped in with a future cohort's applications, where it's competing against a fresh wave of other startups.

If you apply during an official application window, you're competing directly against all the other founders who prioritized that specific deadline. Some of them will have been working on their applications for weeks. Others will have incorporated feedback from mentors or investors. The quality bar might be higher.

The strategic choice depends on your specific situation. If you're almost ready—you've got early traction, your team is solid, your story is tight—waiting for the official application window might make sense. You can spend time polishing your application, getting feedback, and submitting your best work to a cohort that explicitly makes decisions on a fixed timeline.

If you're ready now and you've got something real to show, applying in the off-season means you get reviewed sooner. There's less crowding. Your application might get more careful attention.

The worst approach is rushing your application to hit a deadline. If you're not ready, an extra month or two of building and validating is worth more than submitting too early.

Building Your Pre-Application Credentials

Speedrun is looking for founders who've already done some real work. And there are specific things you can do before applying that dramatically improve your chances.

First, get your first customers. This is non-negotiable. Don't wait for your product to be perfect. Find the person who has the problem most acutely—probably someone you know—and charge them money to solve it. Even if your solution is imperfect or partially manual, getting someone to pay you for what you're building is the best possible signal. It proves you understand the problem. It proves people care enough to exchange money for the solution. It proves you can close a sale.

Second, get to know your users deeply. Not surveys. Conversations. Talk to 20-30 people who have the problem you're solving. Understand their workflows, their constraints, their workarounds. Document what you learn. Be ready to cite specific quotes and behaviors in your application. Real qualitative insights from real conversations are worth infinitely more than aggregated survey data.

Third, measure what matters. Depending on your business model, this might be retention rates, cohort analysis, customer acquisition cost, lifetime value, or net promoter score. Whatever metric tells the story of whether people actually want what you've built, start tracking it now. Early numbers matter less than the trend. If your retention is improving, that's a story. If your NPS is rising, that's evidence.

Fourth, strengthen your team's capabilities in whatever areas are weakest. If one cofounder has never closed a customer before, spend time helping them close one. If another has never managed engineering projects at scale, work on that. Speedrun is investing in people. The stronger those people are across diverse capabilities, the better your odds.

Fifth, document your decision-making process. Not in a formal way, but be able to articulate why you've made specific choices—why you chose this customer segment, why you prioritized this feature, how you validated that your approach is better than alternatives. This demonstrates judgment, which accelerators care about deeply.

Speedrun prefers applications that focus 80% on team strength and 20% on market analysis, contrary to the typical 80% focus on market analysis.

Avoiding the Narrative Trap

One thing founders consistently do wrong is over-indexing on a specific story about why this market is huge. "There are 50 million freelancers in the US, so if we capture 1% in year three, we'll have 500,000 customers." This math is comforting. It's also usually wrong.

Market sizing from the top down is intellectually satisfying, but it doesn't tell you anything about whether you can actually acquire customers. A 1% market share of a

Speedrun knows this. So they don't care if your market is technically huge. They care if you're starting by finding one customer who desperately needs what you're building and will tell 10 of their friends about it. That's how growth actually works.

This is why early traction is so powerful in your application. It proves you're not operating in theory. You're operating in reality. Reality is messier and less romantic than theory. But it's also a much better predictor of success.

The narrative trap catches you when you spend more time on your investor pitch than on your customer conversations. Your investor pitch should be a product of deep customer conversations, not the other way around.

The Interview Stage: Video Call Preparation

If your application is strong enough, you'll be invited to a video interview. This is where roughly 10% of applicants make it. The other 90% never get this conversation.

Prepare obsessively for this. The interview isn't a surprise. It's a test of whether you can explain your startup clearly to someone intelligent who doesn't know anything about it.

You'll probably get asked to walk through your startup from the beginning. Start with the problem. Be specific. "When I was freelancing, I spent Thursday evenings chasing invoice payments. Most were still unpaid after 60 days. I realized everyone I knew had the same problem, so I started asking around." That's much better than "There's a massive market for invoicing solutions."

Walk through your solution. Again, be specific. What does it actually do? How does a user interact with it? What problem does it solve that existing solutions don't?

Then talk about your traction. Numbers. Not impressions. Actual customers, or actual users if you're not charging yet, with concrete metrics about how they're behaving.

Be prepared for hard questions. Why do you think you can do this when these other companies already exist? What would make you pivot? How would you respond if a big player entered your market? What's the biggest assumption you're making, and how will you test it?

The investors asking these questions aren't trying to stump you. They're trying to understand whether you think deeply about your business. If you've thought through these questions before the interview, your answers will be solid. If you haven't, your answers will be defensive or generic.

One final thing: practice speaking about your startup without slides. Speedrun's video interviews might involve sharing your screen, but the core of the conversation is you explaining yourself. You need to be able to do that clearly and compellingly. If you stumble when describing your own business, that's a massive red flag.

Securing first customers is the most crucial pre-application step, followed by deep user conversations and metric tracking. Estimated data based on typical startup advice.

Understanding a16z's Portfolio Philosophy

Speedrun is a program from Andreessen Horowitz, one of the most successful venture firms in history. And Speedrun's investment decisions reflect a16z's broader philosophy about what makes companies successful.

a16z has a specific playbook. They invest in teams that can execute relentlessly. They invest in large markets with some degree of defensibility. They invest in founders who understand their customers deeply. They invest in companies that can grow virally or that have strong unit economics. And they invest heavily in the team's ability to adapt when their initial assumptions are wrong.

Speedrun is a compression of this philosophy. The program is explicitly designed to find early-stage companies that fit a16z's investment criteria, give them 12 weeks of focused support, and then fund their Series A. The best-case scenario for Speedrun is that one of their cohort companies raises $20-50 million in their next round and then goes on to massive scale.

Knowing this matters because it tells you what Speedrun is optimizing for. They're not trying to be the most helpful accelerator or the most founder-friendly program. They're trying to find the next exceptional company and help it get to Series A faster.

This means they care about things that predict future success: team quality, market understanding, execution speed, and the ability to learn from reality. They don't care about things that don't predict success: perfect product design, comprehensive market analysis, or a fully built-out business plan.

Your application should be calibrated to this. Show them a team that executes. Show them evidence that you understand your market deeply through customer conversations, not research. Show them that you're building something real and testing it in the market. Show them that you can learn and adapt.

That's Speedrun's definition of promising.

The Post-Acceptance Reality

If you get accepted, congratulations. But now the real work begins.

Speedrun's 12 weeks are intense. You'll have office hours with experienced operators. You'll have access to a16z's partner network. You'll have structure and accountability. And you'll have a clear deadline: Demo Day in 12 weeks.

The program works because it removes distractions. You're not fundraising (you're already partially funded). You're not trying to figure out strategy (you have experienced people helping). You're focused on one thing: building, learning, and getting to product-market fit or as close as possible.

Many founders come in with a specific product vision and leave having built something entirely different. That's not a failure. That's the whole point. The program is designed to compress a year's worth of learning into 12 weeks. That learning usually involves discovering that your initial assumptions were partially wrong and figuring out what's actually right.

The most successful Speedrun companies are the ones where founders show up ready to be aggressive learners. They test, iterate, get feedback, and adapt. They're not wedded to their initial vision. They're wedded to finding product-market fit.

This is important context as you're preparing your application. Speedrun isn't looking for founders with a perfect vision. It's looking for founders who can adapt and learn faster than anyone else. If your application shows that you've already done this once—you had an assumption, tested it, learned something, and adjusted—that's incredibly powerful.

Specific Vertical Strategies

While Speedrun is now horizontal, different verticals have different dynamics. If you're building in a crowded vertical like AI-powered SaaS, your bar for traction is higher. You need to show not just that people want your solution, but why your solution is better than the five other AI tools that just launched this month.

If you're building in a less crowded vertical, your traction bar might be lower, but your market understanding needs to be higher. You need to convincingly explain why you think this market is worth pursuing despite the fact that nobody else is.

For B2B software, focus on customer conversations and retention metrics. For consumer, focus on engagement and organic growth. For marketplaces, focus on two-sided adoption and transaction metrics. For AI companies, focus on accuracy improvements, cost reduction, or speed improvements compared to existing approaches.

The application shouldn't be generic. It should be specific to your vertical and specific to the metrics that matter most for your type of business.

Common Rejection Reasons (And How to Avoid Them)

Speedrun doesn't publicly share why they reject applications, but based on investor feedback patterns and common startup advice from a16z, you can infer some of the most common rejection reasons.

Team conflict or unclear roles: If cofounders have different ideas about the direction or if responsibilities are unclear, that becomes obvious in the application and in reference checks. Solve this before applying.

No traction despite having time to build it: If you've been working on this for six months and have zero customers or users, that's a signal that you either don't understand your customers or your solution doesn't address a real need. Both are red flags.

Market story without customer validation: If your application is a compelling narrative about a large market but you have zero evidence that customers actually want what you're building, it's all theory. Investors don't invest in theory.

No clear differentiation: If what you're building is almost identical to something that already exists, and you haven't explained why customers would choose you, that's a problem.

Founding team doesn't have relevant experience: If you're building a B2B SaaS company but you have no sales experience and no technical experience between your cofounders, that's a gap worth addressing before you apply. It doesn't have to be perfect, but it needs to be solid.

Poor communication: If your application is rambling, unclear, or uses buzzwords instead of clear language, it's easy to reject. Clarity is a competitive advantage.

Final Application Checklist

Before you submit:

Team section: Can I name three things each cofounder has done that prepared them specifically for this problem? Do I have clear, complementary roles? Do I have evidence that we work well together?

Problem section: Can I explain the problem in a single sentence? Can I cite specific behaviors or quotes from customers that demonstrate this is a real problem? Does someone care enough about this problem to pay for a solution?

Product section: Does the product description match how customers would describe it? Is it clear what it does and who benefits? Am I using technical jargon that's unnecessary?

Traction section: Are these numbers real? Can I explain them in detail? Do they show a positive trend or at least clear learning?

Market section: Am I making a specific claim about who the customer is or am I being generic? Do I understand the customer's buying process? Have I talked to these customers recently?

Vision section: Is my vision grounded in what I've learned from customers, or is it pure speculation? Do I have a near-term goal that I genuinely believe I can hit?

Writing: Does this sound like me, or does it sound like I'm trying to sound impressive? Would I say these things in conversation? Have I checked for typos and unclear sentences?

If you can answer all of these confidently, your application is likely strong. If you can't, you have more work to do before you submit.

Timeline and Strategic Positioning

If you're planning to apply to Speedrun, you should be thinking about timing now. Ideal timeline: you have 8-12 weeks before you apply. During that time, you should be obsessively focused on three things: building something real, getting your first customers, and understanding deeply what those customers think.

If you're already past that stage—you have traction, you have customers, you have a tight team with clear roles—then you're ready to apply now. The best application comes from a team that has already done meaningful work.

The worst application comes from a team that's still theorizing about what to build and is hoping an accelerator will help them figure it out. That's not what Speedrun does.

The Broader Accelerator Landscape

Speedrun isn't the only accelerator worth applying to, but it's one of the most selective and well-regarded. Other programs like Y Combinator, Techstars, and industry-specific accelerators all have different selection criteria and different support models.

Speedrun is specific: 12 weeks, deep a16z support, relatively small cohorts, clear path to Series A fundraising. If that matches your goals, it's worth pursuing.

But you should also be realistic about your odds. Less than 1% acceptance rate means you should apply as part of a broader fundraising strategy, not as your only path to funding. Apply to Speedrun, but also apply to other accelerators, talk to angels, and consider other paths to your first institutional capital.

The best founders I know treat accelerator applications the same way they treat fundraising in general: they're opportunities, not destinies. You're trying to find the right fit, but the wrong accelerator can actually slow you down. Some founders are better off just raising from angels and customers and skipping accelerators entirely.

Speedrun is worth pursuing if it aligns with your strategy and timeline. But it shouldn't be your only option.

FAQ

What is the Speedrun accelerator program?

Speedrun is an accelerator program launched by Andreessen Horowitz (a16z) in 2023. Originally focused on gaming startups, it has expanded to be a horizontal program accepting founders from any vertical. The program runs for 12 weeks in San Francisco, accepts 50-70 founders per cohort (with two cohorts annually), and invests up to $1 million per company. It has an acceptance rate below 1%, making it one of the most selective startup accelerators in the world.

How competitive is it to get into Speedrun?

Speedrun is extremely competitive. The program receives 19,000+ applications annually and accepts fewer than 80 founders, resulting in a 0.4% acceptance rate. For perspective, this is roughly four times more selective than Stanford's PhD program. Only about 10% of applicants make it to the video interview stage, and the rest are rejected based solely on their written application.

What does Speedrun invest, and what do you give up in return?

Speedrun invests up to

What does Speedrun actually look for in founders?

Speedrun prioritizes founding teams with complementary skills, a history of working together successfully, and early evidence of product-market fit. The program emphasizes team quality over ideas—investors evaluate whether cofounders work well together, communicate clearly, resolve conflicts productively, and can adapt when assumptions prove wrong. Technical capability is valued, but so is the ability to understand customers deeply and validate assumptions through real conversations.

Do I need to have traction before applying to Speedrun?

Yes, early traction significantly strengthens your application. This could mean your first paying customers, meaningful user engagement metrics, positive customer feedback, or clear evidence that people want what you've built. Speedrun looks for teams that have already begun building and validating their idea, even if the traction is small. The program is great at helping teams pour gasoline on a very small spark, but you need to have that spark first.

When should I apply to Speedrun?

Applications typically open in April for the next cohort, but Speedrun reviews off-season applications year-round. The strategic decision depends on your readiness. If you need a few more weeks to build traction or refine your story, wait for the official application window. If you're ready now with something real to show, applying in the off-season might give you faster review and less competition. Either way, don't rush your application to hit a deadline.

How important is it that I use AI to write my application?

Use AI as a writing assistant to clean up grammar, improve clarity, and reduce wordiness. However, the core narrative, voice, and story should be authentically yours. If AI writes your entire application and interviewers ask you to explain your startup in detail, the disconnect will be obvious. Your voice and authentic perspective are competitive advantages that are impossible for AI to replicate convincingly.

What happens if I make it to the video interview stage?

About 10% of applicants get video interviews. These are live conversations where you'll be asked to explain your startup, walk through your early learnings, and answer questions about your team, market, and strategy. Prepare by practicing your explanation repeatedly without slides. Be specific about your problem, your solution, your traction, and your thinking. Expect hard questions about competition, market fit, and potential pivots.

How long is the Speedrun program, and what does it involve?

Speedrun runs for 12 weeks in San Francisco. During this time, you'll have office hours with experienced operators, access to a16z's partner network, strategic guidance, and accountability. The program culminates in Demo Day where you pitch to investors and the broader startup community. The 12 weeks are intense and designed to compress a year's worth of learning into a compressed timeline.

Can I apply to Speedrun if I'm based outside the United States?

Speedrun's program is based in San Francisco, and participation requires being in SF for the 12-week duration. International founders can apply, but you need to be willing to relocate for the program. This is a practical consideration that affects your decision to apply.

What's the best way to prepare my application?

Spend 8-12 weeks before applying obsessively focused on building something real, acquiring your first customers, and understanding what those customers think. Get into detailed conversations with 20-30 people who have your problem. Document specific behaviors, quotes, and metrics. Build enough of a solution to test your assumptions. Only apply once you have real data about customer demand. Your application will be 10x stronger based on this work than based on any amount of writing polish.

Getting into Speedrun isn't about luck or perfect pitch decks. It's about doing the hard work of understanding a real problem, building something that solves it, validating that people care, and assembling a team that can execute even when assumptions prove wrong.

Most founders skip these steps and apply anyway, hoping their compelling story will convince investors. It doesn't work. The applications that stand out are the ones where founders have already done meaningful work and are applying from a position of early traction.

Start there. Build something real. Talk to customers. Get traction. Then apply. If you do this, your odds are dramatically better than if you apply based on theory and a great narrative.

That's not just how you get into Speedrun. That's how you build a company worth funding.

Key Takeaways

- Speedrun has a 0.4% acceptance rate, making it roughly 4 times more selective than Stanford's PhD program, with 19,000+ applications annually for fewer than 80 spots

- The program obsessively evaluates founding team quality, complementary skills, and evidence of successful collaboration rather than the startup's specific idea or market narrative

- Early customer traction is critical: Speedrun looks for 'that small spark' of validated demand they can amplify, not theoretical market opportunities

- Most founders waste application space explaining market theory when they should focus on why their specific founding team is uniquely positioned to solve this problem

- Only 10% of applicants make it to the video interview stage, so your written application needs to be clear, voice-driven, and grounded in evidence rather than speculation

Related Articles

- Amazon Pharmacy Same-Day Delivery Expansion to 4,500 Cities [2026]

- WBD-Netflix Merger Battle: What Ancora's Opposition Means [2025]

- Nothing Ear (a) Earbuds Review: Why They're Game-Changing [2025]

- StreamFast SSD Technology: The Future of Storage Without FTL [2025]

- Trenchant Exploit Sale to Russian Broker: How a Defense Contractor Employee Sold Hacking Tools [2025]

- Samsung Galaxy S26 Trade-In Deal: Get Up to $900 Credit [2025]

![How to Get Into a16z's Speedrun Accelerator: Insider Strategies [2025]](https://tryrunable.com/blog/how-to-get-into-a16z-s-speedrun-accelerator-insider-strategi/image-1-1770840411495.jpg)