WBD-Netflix Merger Battle: What Ancora's Opposition Means for Hollywood [2025]

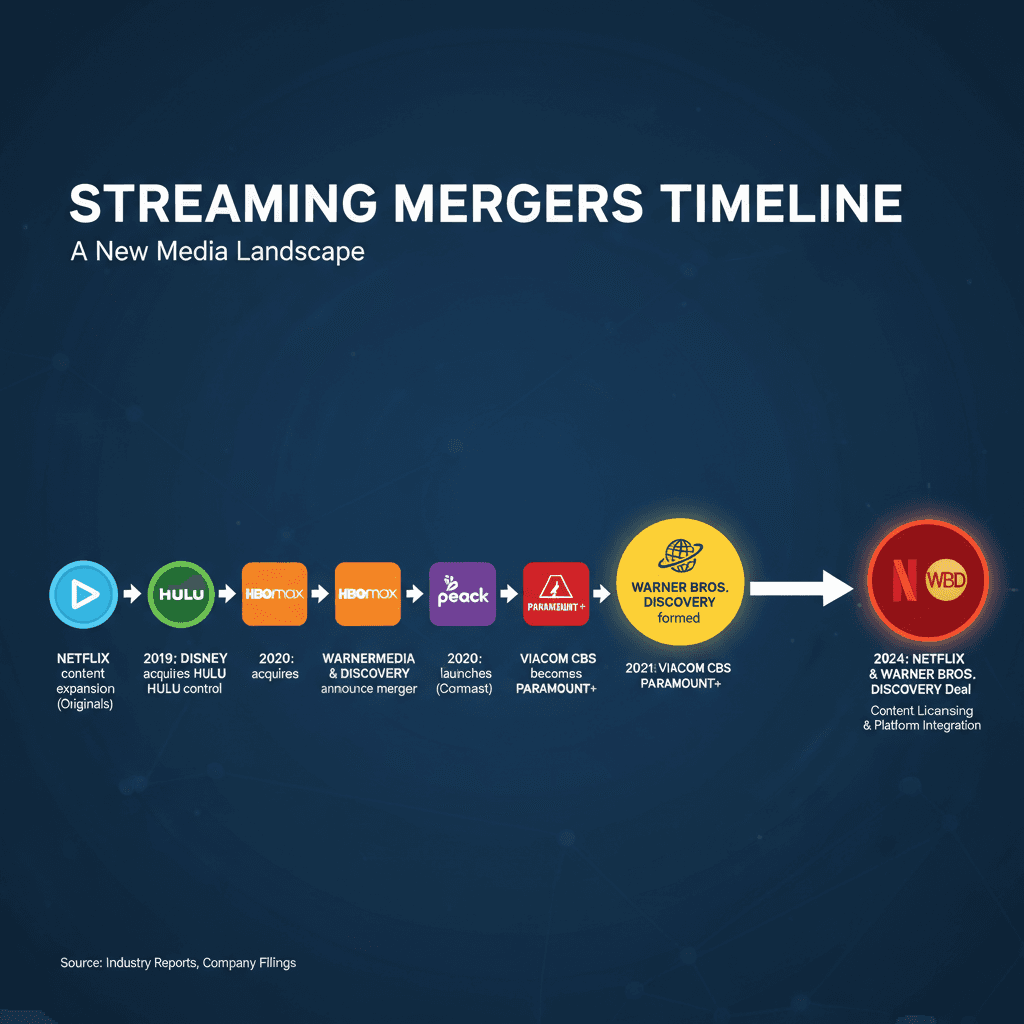

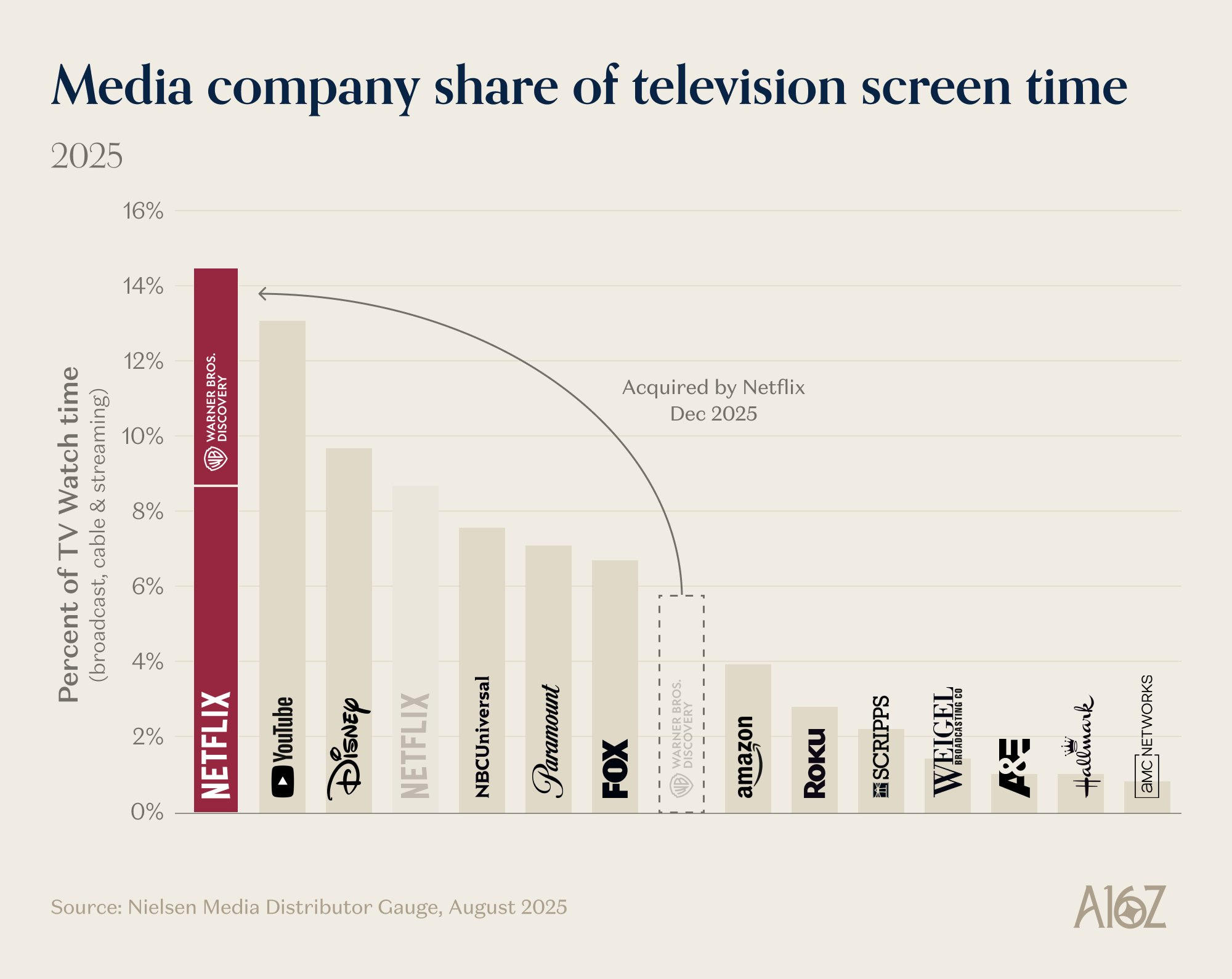

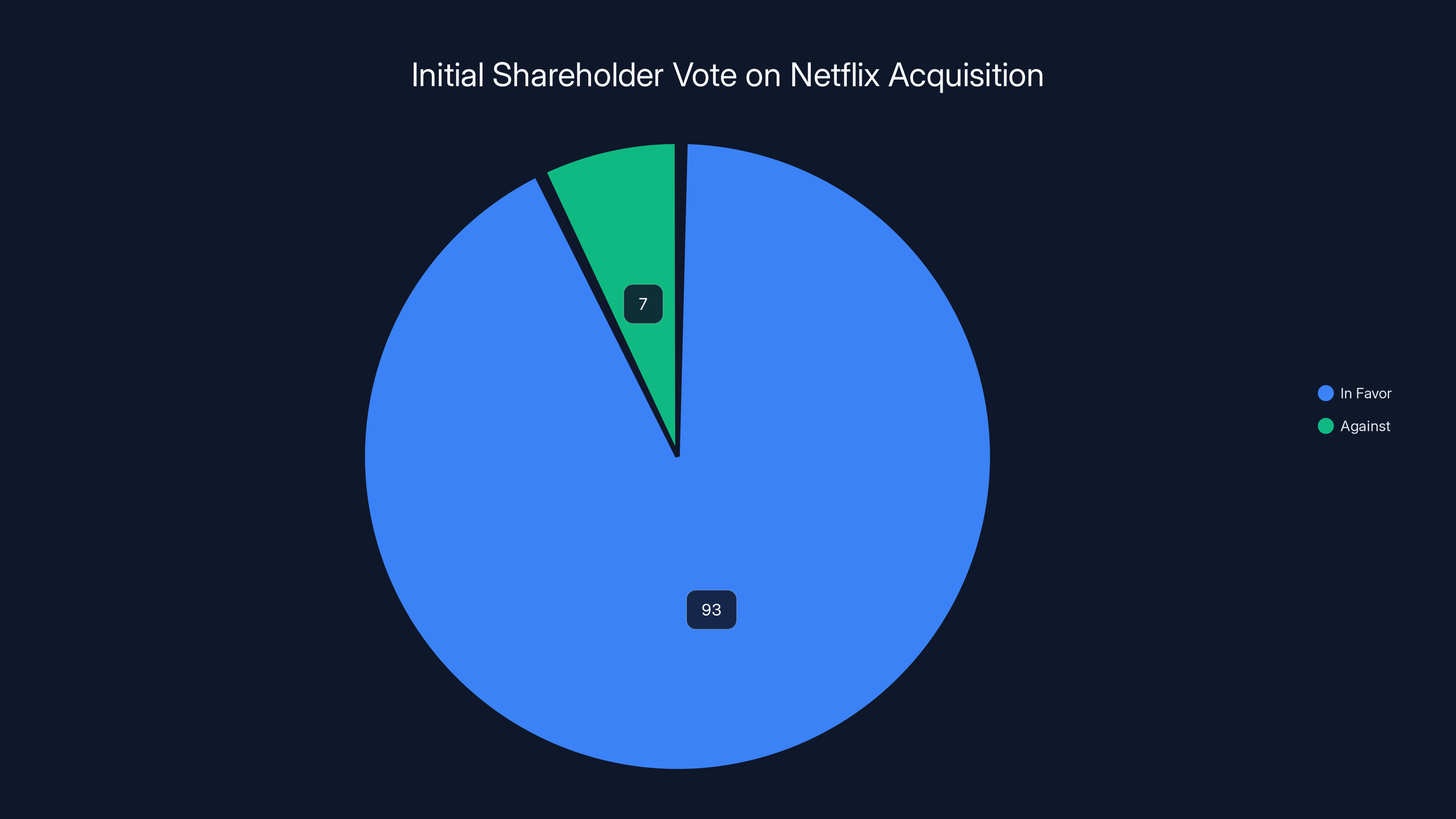

When Netflix dropped its $82.7 billion bid to acquire Warner Bros. Discovery, most observers figured the deal was essentially locked. After all, WBD shareholders had already voted overwhelmingly in favor—over 93% backing—just weeks earlier. The narrative seemed settled.

Then Ancora Holdings stepped in and flipped the entire chess board.

The activist investment group bought $200 million in WBD shares and went public with fierce opposition to the Netflix deal. More importantly, they're pushing for Paramount's competing bid instead. On the surface, this looks like a minor skirmish. But what's actually happening here is a textbook case of shareholder activism reshaping one of the biggest media deals ever attempted.

This matters because it exposes real fractures in the deal's structure—and raises serious questions about whether corporate boards genuinely serve shareholders or just go through the motions. It also reveals how quickly the streaming wars' economics can shift, making even seemingly certain megadeals suddenly uncertain again.

Let's dig into what Ancora's actually doing, why it matters, and what happens if they actually move the needle.

TL; DR

- Ancora Holdings acquired $200 million in WBD shares to position itself as a meaningful shareholder voice opposing Netflix's acquisition

- Paramount improved its competing bid with quarterly cash incentives and commitment to cover Netflix's $2.8 billion termination fee

- Initial shareholder vote favored Netflix 93% to 7%, but activist campaigns can shift outcomes when they expose legitimate deal weaknesses

- Regulatory risk remains Netflix's Achilles heel—antitrust concerns about vertical integration could still derail the transaction

- The streaming consolidation logic is deteriorating—Netflix's original case for acquisition looks weaker as Disney and others prove profitability without massive scale

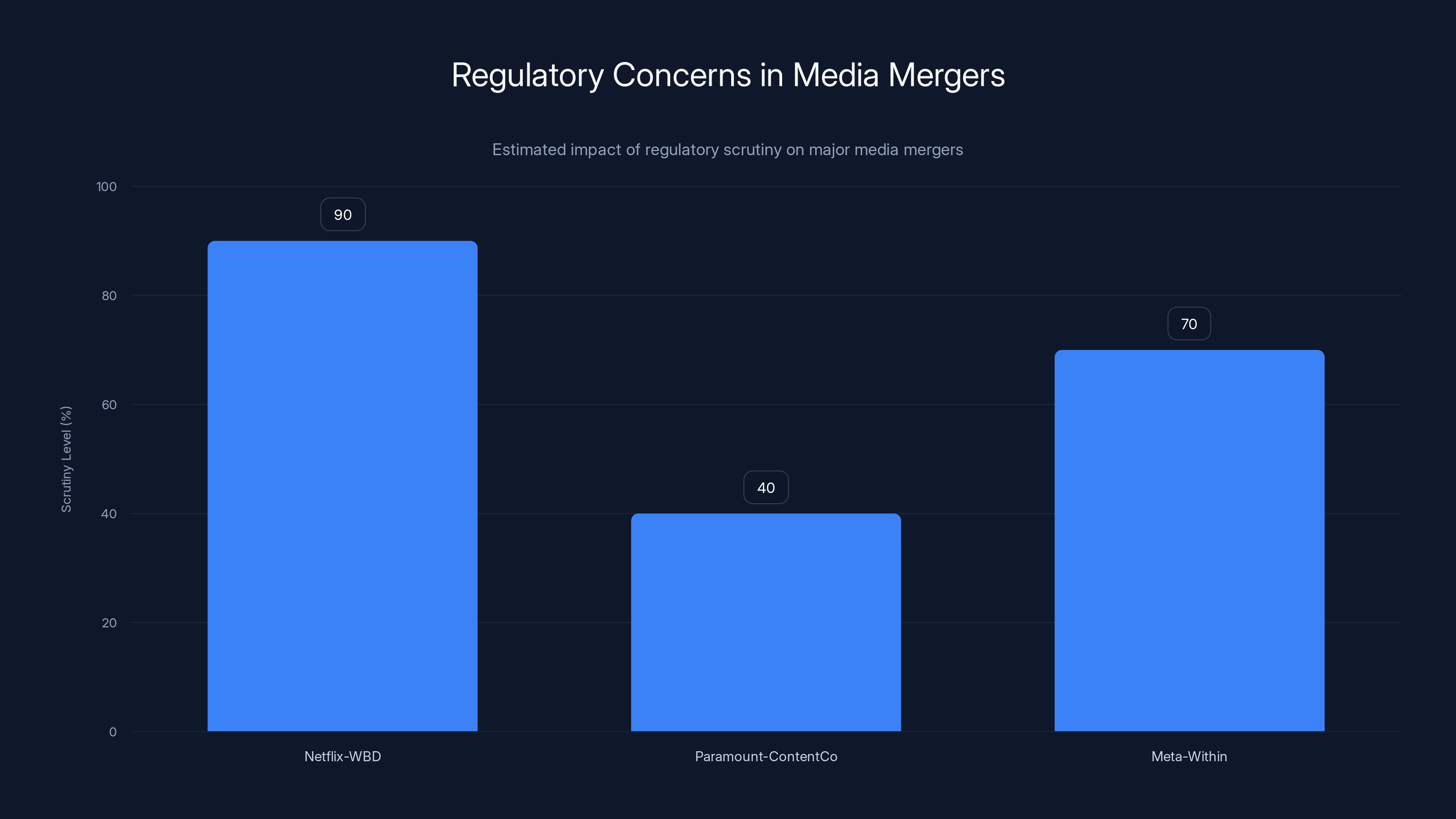

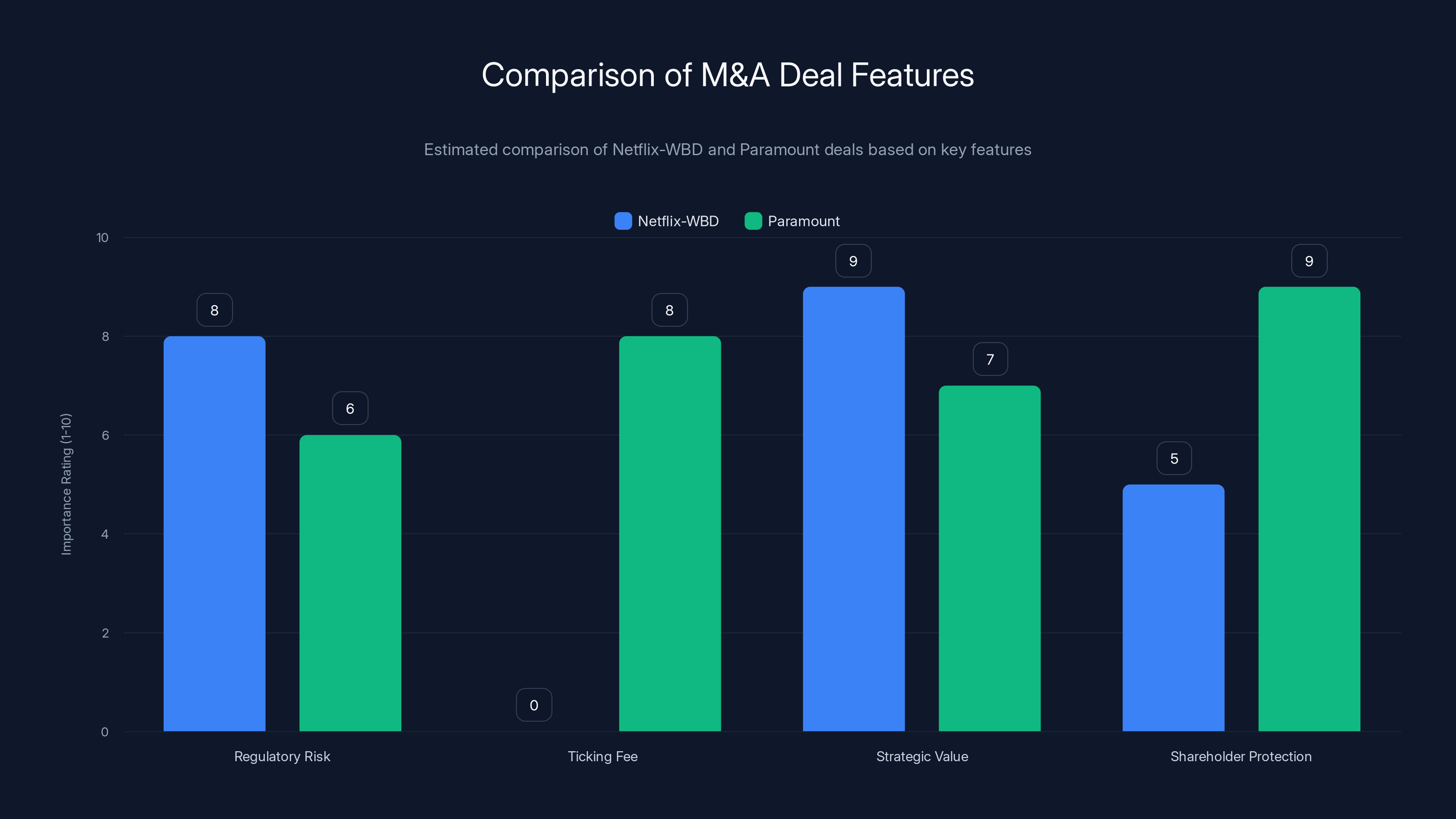

Estimated data shows Netflix-WBD merger faces the highest regulatory scrutiny due to vertical integration concerns, compared to other media mergers.

The Deal Architecture: Why Netflix Wanted Warner Bros. in the First Place

To understand what Ancora's fighting over, you need to know why Netflix decided $82.7 billion was worth spending in the first place. This wasn't an impulse purchase at a media yard sale.

Netflix's core problem became obvious around 2022-2023. The company had built the world's largest streaming subscriber base—over 200 million accounts—but discovered something uncomfortable: sheer subscriber count doesn't equal sustainable profits. Netflix kept hemorrhaging content budgets, paying studios for exclusive rights while those same studios launched competing streaming services to recapture their own intellectual property.

WBD represented something different. The company owned not just a massive content library but the production apparatus that created it. Think about this mathematically: instead of Netflix paying Warner Bros. $500 million for exclusive rights to a show, Netflix could own the studio that made it and capture the entire economic value. The math looked compelling on a spreadsheet.

WBD's library alone is staggering. We're talking about DC Comics universe properties, Game of Thrones, Friends, The Office, Harry Potter, Lord of the Rings, Dune, and thousands of hours of HBO originals. For streaming, premium content is oxygen. Netflix wanted to own the factory, not keep renting its output.

The vertical integration argument goes deeper though. Netflix could theoretically reduce content costs by eliminating middlemen, streamline production decisions, and control release windows across multiple platforms that WBD operates. Instead of negotiating licensing deals with itself, Netflix could just move shows from HBO Max's windowing strategy into Netflix's release calendar. Synergies everywhere.

On paper, it made strategic sense. In execution, it looked increasingly problematic. Netflix was betting that massive scale in premium content production would cure its margin problems. But Wall Street was starting to ask harder questions: What if the real problem wasn't the content model—it was the structural economics of streaming itself?

Ancora's Case: The Regulatory, Financial, and Strategic Arguments

Ancora isn't opposing Netflix's bid just to make noise. They've built a coherent investment thesis, and understanding their argument reveals genuine deal vulnerabilities that most initial coverage glossed over.

The Regulatory Risk Problem

Here's what keeps lawyers awake at night: Netflix acquiring Warner Bros. would create the world's largest vertically integrated entertainment company. Netflix provides the distribution (the streaming platform), and after acquisition, would control massive content production (WBD's studios). This is exactly the kind of concentration that regulators have been increasingly skeptical about.

Antitrust enforcement has shifted dramatically since 2021. The FTC under new leadership has become far more aggressive about vertical mergers—deals where a company at one level of an industry consolidates with a company at another level. When you combine a platform operator with a content supplier, you're essentially reducing competition in both places simultaneously.

Ancora's argument is straightforward: Netflix-WBD faces genuine regulatory headwinds that could extend the deal timeline indefinitely, create onerous conditions, or outright block the transaction. In a regulatory review that takes 18-24 months instead of 12, WBD shareholders lose considerable value—both in foregone dividend opportunities and in the option value of Paramount's bid.

Paramount's bid, by contrast, doesn't create the same vertical integration concerns. Paramount is primarily a content company acquiring another content company. Yes, there's overlap in production capabilities, but there's no platform dominance being consolidated. From a regulatory perspective, it's a cleaner transaction.

The Financial Terms Arbitrage

Paramount just raised its offer, and the specific terms tell you everything about why Ancora thinks Netflix's deal is suspect.

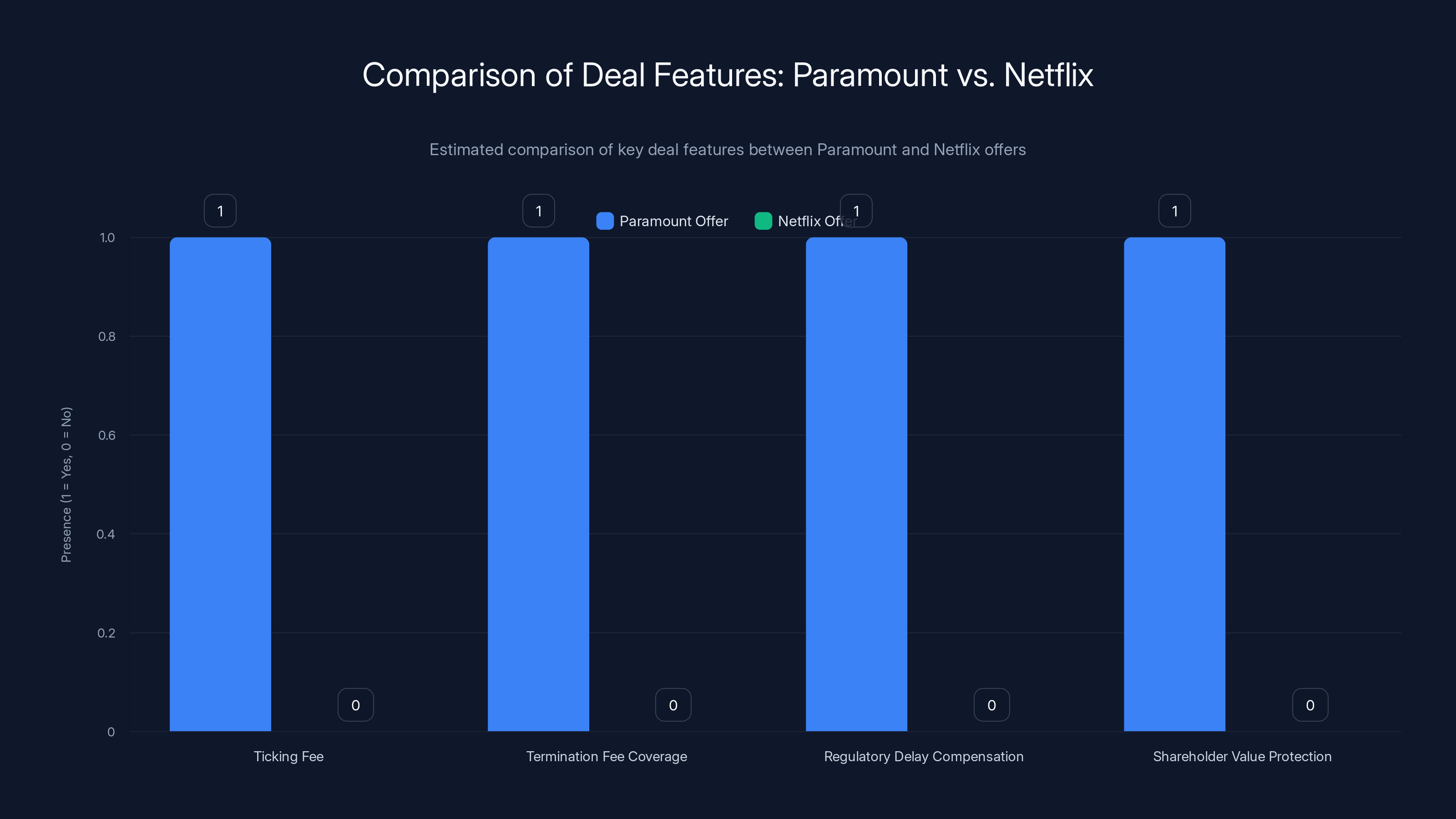

Paramount added

More strategically, Paramount committed to cover WBD's $2.8 billion breakup fee if Netflix's deal somehow collapses and WBD accepts Paramount's bid instead. Netflix, meanwhile, has no similar protection for WBD shareholders. If the Netflix deal drags through regulatory review and then gets blocked, WBD shareholders recover nothing for their months of waiting.

This is the core of Ancora's financial argument: Netflix's deal is paying for a certain outcome, while Paramount's deal is paying for the uncertainty. In M&A, uncertainty carries significant value. When deal close becomes probabilistic rather than deterministic, rational investors should demand a premium. Paramount's offering it. Netflix basically isn't.

The Strategic Deterioration Thesis

Here's the deeper concern that Ancora has articulated, though more subtly: the strategic rationale for massive streaming consolidation is getting weaker by the quarter.

When Netflix first proposed the WBD acquisition, the narrative was simple: streaming consolidation was inevitable, and whoever owned the most premium content would win. Netflix was supposed to merge with competitors, become the platform-studio hybrid that could compete with traditional media conglomerates forever.

But something changed. Disney proved that you don't need Netflix's scale to make streaming economics work. Disney+ hit profitability before Netflix's entire acquired streaming business did. Apple TV+ has minimal content spend compared to Netflix, yet delivers prestige shows like Ted Lasso and Severance that drive platform adoption. The "bigger content budget always wins" theory started looking shaky.

Netflix's own pivot toward profitability over growth reinforced this. Netflix isn't trying to be HBO anymore. It's a profitable platform that pays for select content, advertiser-supported, with a healthy margins focus. Suddenly, owning WBD's entire production apparatus looks less essential and more like a cost burden.

Ancora's argument is that the strategic logic Netflix sold to justify this deal has deteriorated. WBD's $82.7 billion price tag was justified by synergy and scale arguments that look increasingly questionable. Netflix would have been better off staying lean, cherry-picking content deals, and letting external producers compete for Netflix's attention. That's actually more efficient than vertical integration.

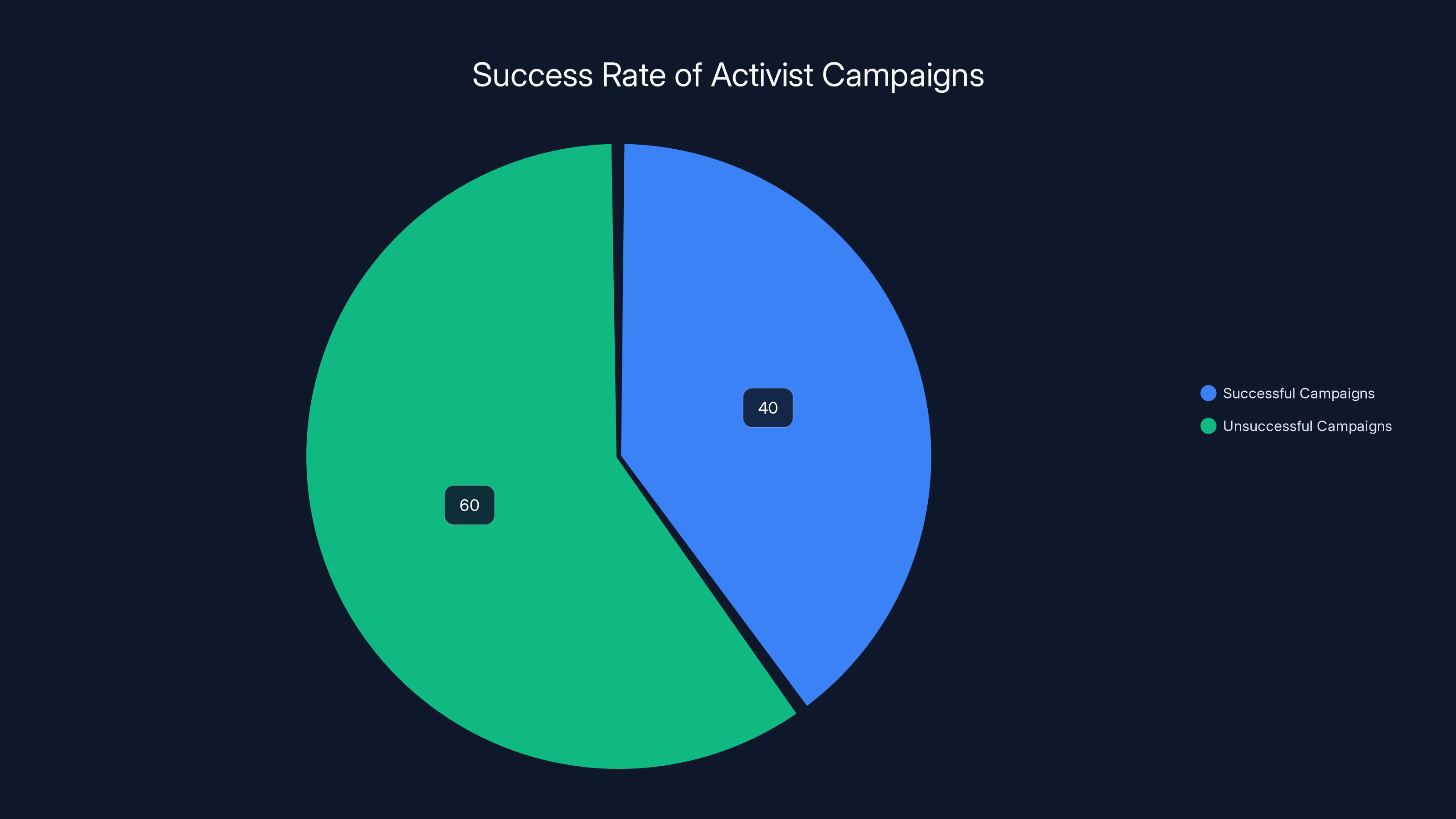

Historically, activist campaigns focused on shareholder protection succeed about 40% of the time. Estimated data.

Paramount's Counter-Offer: Better Deal or Desperate Gambit?

Paramount didn't come back with just a higher number. They restructured the entire deal architecture, and this matters for understanding where WBD shareholders' real interests lie.

The Ticking Fee Mechanism

The quarterly payment structure is brilliant because it transforms deal uncertainty into shareholder upside. Here's why: if the Netflix deal faces regulatory delays (which Ancora argues are likely), WBD shareholders get compensated with cash for each quarter they wait. That cash is immediate, tangible income—it's not dependent on deal close.

Mathematically, here's how this works out: Let's say Netflix's deal faces 18 months of regulatory review instead of Netflix's optimistic 12-month projection. That's six additional quarters at

Netflix's offer has no equivalent protection. If regulators slow-walk the review, WBD shareholders earn nothing for the delay—they're just stuck in limbo.

The Termination Fee Coverage

Paramount's commitment to cover Netflix's $2.8 billion termination fee is the most explicit signal of their deal confidence. Here's why this matters:

When Netflix's deal was announced, WBD agreed to pay Netflix $2.8 billion if WBD shareholders rejected the Netflix offer and took Paramount's bid instead. This termination fee was supposed to discourage competing offers and lock in the Netflix transaction.

Paramount's saying: we'll pay that fee for you. This transforms the economics completely. If shareholders abandon Netflix for Paramount, they won't face a $2.8 billion penalty—Paramount eats it.

Netflix's negotiators probably thought this termination fee would be impossible to overcome. It's essentially a $2.8 billion barrier to any competing bid. But Paramount looked at that fee and decided it was worth paying as a deal insurance policy. That tells you something about how much Paramount wants this asset and how confident they are in the deal's value.

Paramount's Strategic Logic

Why is Paramount willing to pay all these premiums? They're not doing it altruistically. Paramount's bet is that owning WBD makes them competitive with Netflix in a way they can't be as a standalone studio.

Paramount owns CBS, MTV, Comedy Central, and various production subsidiaries. Adding WBD would give them HBO, DC Comics, Warner Bros. studio, and all the syndication rights these properties generate. Suddenly, Paramount becomes a genuinely diversified content powerhouse.

The Paramount strategy is consolidation with an already-owned content foundation. They're not trying to buy scale from scratch like Netflix was. They're trying to merge their existing properties with WBD's properties and create an entertainment conglomerate that can compete with Disney on library depth and Amazon on content volume.

There's a real strategic case here. Paramount's debt situation and streaming losses make them vulnerable, but owning WBD would solve both problems simultaneously. WBD's profit centers would offset Paramount's streaming losses, and the combined library would be worth more than the sum of parts.

The Shareholder Vote Paradox: How 93% Support Can Still Evaporate

Here's the uncomfortable part for Netflix defenders: the initial 93% shareholder vote in favor of Netflix's deal doesn't necessarily mean that vote holds up if new information emerges or if activist investors successfully remind shareholders of material risks.

Shareholder votes aren't final judgments. They're expressions of preference based on available information at voting time. When activist investors like Ancora acquire meaningful stakes and go public with organized opposition campaigns, they can shift shareholder sentiment if their arguments have merit.

Historically, activist campaigns succeed roughly 40% of the time when focused on shareholder protection. Ancora's not trying to get them to vote for Paramount necessarily—they're trying to pressure the WBD board to reconsider whether it's actually fulfilling its fiduciary duty by supporting Netflix's deal.

The Information Asymmetry Problem

Most WBD shareholders aren't continuously monitoring the deal's risks. They voted based on the board's recommendation and general market sentiment. They probably didn't deeply analyze:

- Regulatory timeline risk: How likely is an 18+ month review versus Netflix's stated 12 months?

- Synergy probability: Which of Netflix's projected $5-7 billion in annual synergies are actually achievable?

- Content strategy shift: How much has Netflix's strategic philosophy shifted away from massive content spend?

- Alternative values: What would the business be worth if Netflix walked away and Paramount's offer succeeded?

Ancora is flooding shareholders with this information, arguing that the board made the recommendation based on incomplete analysis. If that sticks, it changes the vote calculus.

Board Accountability Threat

Ancora's explicitly threatening to vote against the Netflix deal AND challenge board members at the 2026 annual meeting. This is the real leverage. If they can convince enough shareholders that the board failed to do due diligence or properly evaluate alternatives, they can force board elections.

A board facing potential replacement has enormous incentive to reconsider or renegotiate the Netflix terms, even if they previously supported them. Netflix would have to address the Ancora concerns directly.

Regulatory Headwinds: Why Netflix's Vertical Integration Worries Antitrust Enforcers

Let's get specific about the regulatory risks that Ancora keeps citing, because this is actually where Netflix's deal has its largest vulnerability.

Current FTC Posture on Vertical Mergers

The Federal Trade Commission, under its current leadership, has made explicitly clear that vertical mergers receive significantly more scrutiny than they did a decade ago. The rationale is straightforward: while horizontal mergers (competitor acquiring competitor) are obviously anticompetitive, vertical mergers (company acquiring supplier or customer) can be more subtly harmful.

Netflix acquiring WBD is textbook vertical integration: Netflix is a streaming distribution platform acquiring a content production company. The FTC's concern is that after acquisition, Netflix could:

- Withhold content from competitors: Netflix could produce premium shows and movies and keep them exclusive rather than licensing to rivals like Disney+ or Amazon Prime Video.

- Raise rivals' costs: Netflix could charge other platforms premium licensing rates for WBD content while reserving the best content exclusively for its own platform.

- Foreclose competition: By controlling both distribution (Netflix platform) and major content supply (WBD studios), Netflix could disadvantage smaller streaming competitors that rely on licensing third-party content.

These aren't theoretical concerns. The FTC has blocked vertical mergers on exactly these grounds. When Meta tried to buy Within Fitness, the FTC argued that even though Meta's VR market share looked modest, the vertical integration of VR hardware (Meta's platform) with social VR content (Within's offerings) could foreclose competition in a market Meta was trying to dominate.

Netflix-WBD is vastly larger than Meta-Within and involves more significant competitive concerns. The FTC will almost certainly scrutinize whether Netflix's control of both content supply and distribution would harm competitors.

The International Dimension

It's not just the FTC. The UK's CMA (Competition and Markets Authority), the EU's DG Competition, and other international regulators will all review this deal. Netflix operating in multiple jurisdictions means it needs approval from multiple authorities.

The EU has been particularly aggressive on vertical integration and content exclusivity concerns. The EU fined major tech companies billions for leveraging market position across services. Netflix-WBD would combine Netflix's dominant position in European streaming with WBD's content library. Expect the EU to be highly skeptical.

International regulatory approval typically takes longer and is less predictable than US approval alone. With multiple jurisdictions involved, the deal timeline stretches. Ancora's ticking fee argument becomes even more compelling as regulators in London, Brussels, and other capitals independently review the transaction.

Timeline Probability Assessment

Netflix publicly guided shareholders toward a 12-month regulatory review timeline. But Ancora argues this is optimistic. Let's compare to historical precedent:

- Microsoft-Activision Blizzard: 20 months (involved US FTC, UK CMA, Brazil regulators)

- Broadcom-Qualcomm: Ultimately blocked after 18+ months of review

- Nvidia-Arm: Failed after 19 months, ultimately abandoned

- Elon Musk-Twitter: 6 months (minimal antitrust concerns)

Deals involving content distribution platforms and content supply companies tend to take 18-24 months, not 12. Netflix's guidance looks optimistic relative to precedent. Ancora's positioning this correctly: expect regulatory review to extend beyond Netflix's stated timeline.

Paramount's offer includes a ticking fee, providing better shareholder protection against delays, while Netflix-WBD's strategic value is higher. Estimated data.

Content Economics: Why the Synergy Case Got Weaker

Netflix's original investment thesis depended on synergies. The company projected

But Netflix's own business evolution has undermined that synergy case.

The Ad-Supported Tier Shift

When Netflix proposed WBD acquisition, the company was still in its "growth over profitability" phase. Netflix was spending huge content budgets to attract subscribers, confident that advertising eventually would cover margins.

Then Netflix got disciplined. They cut content spend, launched ad tiers aggressively, and pivoted to profitability focus. That changes everything about why you'd want to own WBD.

When Netflix planned $7 billion annual synergies, they were assuming continued massive content spend. But Netflix has since proven they can hit margin targets with substantially lower content budgets, selective show cancellations, and reliance on audience data rather than brute-force content volume.

If Netflix's now spending

The Proven Alternative Model

Disney proved that you don't need massive vertical integration to compete in streaming. Disney+ is profitable and growing while spending significantly less on content than Netflix. Apple TV+ is tiny in subscriber count yet influential in prestige content with minimal budget relative to Netflix.

The new streaming logic is: you don't need to own everything. You need to own the right properties—the ones that drive platform adoption and loyalty. Disney owns Marvel, Star Wars, and Pixar. That's enough. Disney doesn't need to own MGM or Warner Bros. on top of that.

Netflix's learning the same lesson. They don't need to own WBD's entire studio. They need to own or license the franchises that drive subscriber acquisition. A lighter-weight deal (buying specific IP rather than the entire company) would serve Netflix's actual strategic needs better than a $82.7 billion full acquisition.

Production Efficiency Questions

There's also the question of whether vertical integration actually improves production efficiency. Conventional theory says it should: if Netflix controls both production and distribution, they can streamline the process and eliminate markup layers.

But in practice, entertainment production efficiency is complicated by creative requirements, union contracts, location specificity, and individual talent relationships. Netflix couldn't just fold WBD's operations into its own and realize massive cost savings. WBD's production capabilities are tied to specific craftspeople, specific studio lots, specific union relationships.

What Ancora's hinting at: Netflix overstated how much efficiency they'd actually achieve by owning WBD. The synergies Netflix promised probably overestimated the integration benefits and underestimated the integration costs.

What This Means for Netflix's Streaming Strategy

The deeper issue here is that Netflix's entire acquisition strategy is being questioned at a moment when Netflix is rethinking its own model.

Netflix spent 2022-2024 trying to be everything: the largest content producer, the largest distributor, the largest global platform. That strategy required ongoing massive capital spending and involved substantial execution risk—you're not just competing on content quality, you're competing on everything.

Then Netflix realized they could be spectacularly profitable by being more focused. Ad-supported tiers solved the margin problem. Password sharing crackdowns solved the monetization problem. Selective content spend and aggressive show cancellations solved the bloat problem.

Suddenly, the strategic case for owning WBD looks like something Netflix wanted when they were chasing growth fantasy, not something Netflix actually needs now that they're chasing sustainable profits.

Ancora's recognizing this timing issue: Netflix is acquiring WBD based on a strategy Netflix is actively abandoning. That's poor capital allocation. Netflix should have acquired WBD in 2019 when vertical integration seemed essential. In 2025, after Netflix's own strategic pivot, the acquisition looks like a hangover from a previous era.

Paramount's Debt Problem and the M&A Logic

To understand why Paramount's willing to outbid Netflix so aggressively, you need to understand Paramount's specific financial situation.

Paramount's got roughly $15 billion in debt while streaming loses hundreds of millions quarterly. The company's traditional television and film segments are valuable, but streaming is a drag. Paramount needs to either:

- Exit streaming entirely (unlikely, cedes market)

- Merge with another company and achieve scale (current strategy)

- Separate streaming into standalone (complex, execution risk)

From Paramount's perspective, acquiring WBD isn't just about content library size. It's about debt restructuring and loss mitigation. WBD's income streams (theatrical releases, international licensing, streaming) would materially improve Paramount's financial profile.

The math: if Paramount acquires WBD and combines streaming losses, the combined company might actually be profitable on a standalone basis. WBD's higher-margin content licensing and theatrical revenue would offset Paramount's streaming losses. Suddenly, Paramount's debt becomes manageable on combined free cash flows.

Netflix doesn't have this problem. Netflix is already highly profitable. Netflix doesn't need WBD for financial restructuring—they're acquiring for strategic scale. That's a completely different cost-benefit calculation. Netflix can afford to walk away if regulators add too many conditions. Paramount probably can't.

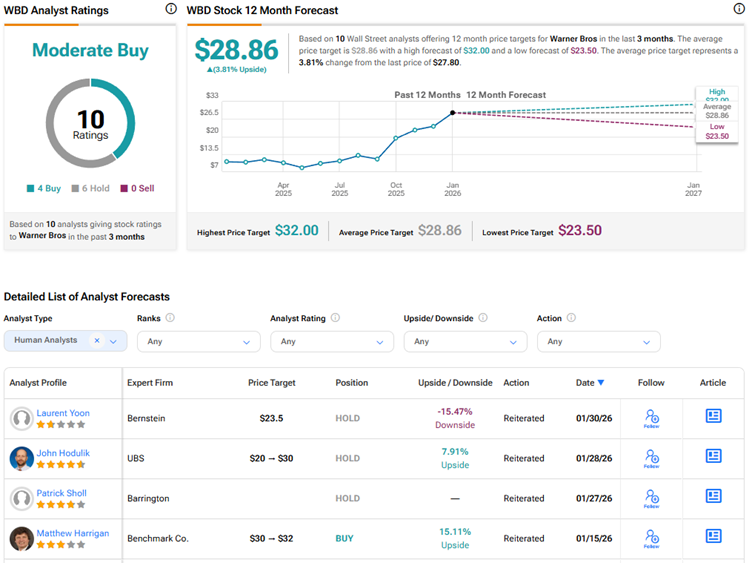

The initial shareholder vote showed a strong preference for Netflix's acquisition, with 93% in favor and only 7% against. However, activist campaigns could influence future outcomes.

The Shareholder Battle Playbook: How Ancora Wins

Activist investors don't usually win M&A battles by having better ideas. They win by organizing shareholders around the idea that management didn't properly evaluate alternatives.

Ancora's playbook is straightforward:

- Accumulate voting power (done: $200 million in shares)

- Go public with organized opposition (done: press release, media campaign)

- Frame the issue around fiduciary duty (in progress: arguing board didn't properly evaluate Paramount)

- Organize other large shareholders (ongoing: reaching out to institutions)

- Threaten board elections (leverage: willing to run proxy fight at 2026 annual meeting)

- Force renegotiation (outcome: either Netflix improves terms or board reconsiders)

Ancora probably doesn't need to flip the entire shareholder base. If they can convince 10-15% of shareholders that Netflix's deal has material flaws that the board missed, that's enough to create genuine uncertainty about deal close.

Once deal close becomes uncertain in shareholders' minds, Netflix faces a problem: they've already committed the acquisition capital, spent executive bandwidth, and faced years of regulatory uncertainty. The deal's strategic and financial case deteriorates with each week of additional review.

Regulatory Deep Dive: What FTC Review Actually Looks Like

Let's get specific about what Netflix should expect if they push forward.

The FTC's review process for a vertical merger like this typically involves:

Phase 1 (Initial Notification, 30 days)

Netflix files Hart-Scott-Rodino form with FTC. FTC has 30 days to either clear the deal or request additional information. In vertical merger cases involving platforms and content, FTC almost always requests additional information. Few deals clear Phase 1.

Phase 2 (Detailed Investigation, 30+ days)

Netflix submits extensive documentation about:

- Content licensing history and practices

- Exclusive dealing agreements with current partners

- Competitive effects modeling for rival streamers

- Integration plans post-acquisition

- Foreclosure risk analysis (would Netflix exclude rivals from WBD content?)

FTC likely brings in external economists and competitive experts. They probably hire a consulting firm to model competitive scenarios.

Phase 2 Extension (Additional 30 days)

Given the size and complexity, FTC almost certainly extends Phase 2. That's additional delay beyond the initial 30-day window.

Remedy Negotiations (30-60+ days)

If FTC's preliminary analysis finds competitive harm risks, they'll negotiate remedies with Netflix. This is where the deal gets constrained. Likely remedies include:

- Content licensing requirements: Netflix must license certain WBD content to competitors at reasonable rates

- Exclusive dealing restrictions: Netflix can't give preferential treatment to owned content over third-party content

- Monitoring obligations: Netflix submits regular reports about content allocation practices

These remedies sound minor until you realize they limit Netflix's ability to achieve the synergies that justified the acquisition. If Netflix can't prefer its own content and must license to competitors at "reasonable" rates, much of the integration benefit disappears.

Total Timeline

Phase 1: 30 days (probably extended to Phase 2) Phase 2 initial: 30 days Phase 2 extension: 30 days Remedy negotiation: 30-60 days Minimum total: 120 days or 4 months Realistic total with complications: 18-24 months

Netflix guided shareholders toward 12 months. Ancora's betting the FTC takes 18-24. That's not an unreasonable bet based on precedent.

International Regulatory Barriers: Beyond US Approval

Netflix thinks about this deal in global terms, but regulators think nationally. Each major market has its own review process.

UK CMA Review

The UK's Competition and Markets Authority has been particularly aggressive on streaming market reviews. The CMA has expressed concerns about:

- Streaming market concentration

- Exclusive content dealing

- Vertical integration in media

The CMA has literally commissioned studies on whether there are "too many" streaming services. They're clearly worried about consolidation. Netflix-WBD would immediately trigger their concern about vertical concentration in UK content and distribution.

Expect the CMA to take 12-18 months minimum. The CMA has full independence from UK politics post-Brexit, which means they can move slowly without external political pressure to speed things up.

EU DG Competition Review

The EU is even more regulatory-focused than the UK. The EU's Directorate General for Competition would review this deal through the lens of:

- European content sovereignty (is Netflix becoming too dominant?)

- Competitor protection (would rival European streamers be foreclosed?)

- Data protection and competition concerns

The EU has fined tech companies tens of billions for less obvious vertical integration concerns. They'll absolutely scrutinize whether Netflix-WBD creates unfair competitive dynamics for European competitors like Sky, Canal+, and others.

EU reviews typically take 18-24 months for complex cases. The EU can also impose conditions that differ from US conditions, creating a patchwork of obligations Netflix must satisfy.

China and Emerging Markets

China might block this deal entirely on content sovereignty grounds, regardless of competitive harm. Netflix already has limited exposure in China due to content controls, but WBD does more business in China through theatrical releases and licensing.

China's regulators might argue that Netflix-WBD creates excessive foreign content control over Chinese distribution channels. That's not an antitrust argument so much as a strategic investment control argument, but it's still a regulatory barrier.

Paramount's offer includes ticking fees and termination fee coverage, providing more protection and compensation to WBD shareholders compared to Netflix's offer. (Estimated data)

Financial Modeling: The Deal Close Probability

Here's where Ancora's argument becomes quantifiable. Let's model the deal's likely value trajectory under different scenarios.

Scenario 1: Netflix Deal Closes on Original Timeline (12 months)

WBD shareholders receive Netflix shares or cash at agreed price. Limited regulatory delay. This is Netflix's scenario.

Probability: 20% (optimistic) WBD shareholder value: 100% of stated consideration

Scenario 2: Netflix Deal Faces Moderate Regulatory Delay (18 months)

FTC and CMA review more carefully. Netflix must agree to modest conditions. Deal closes, but later than expected. This is a reasonable baseline scenario.

Probability: 40% WBD shareholder value: 85% of stated consideration (value of delay)

Scenario 3: Netflix Deal Faces Severe Delay or Conditions (24+ months)

FTC and EU take maximum time. Netflix must agree to significant content licensing and competitive conditions that reduce synergies. Deal eventually closes but heavily constrained.

Probability: 30% WBD shareholder value: 65% of stated consideration (time and condition costs)

Scenario 4: Netflix Deal Gets Blocked (5%)

Multiple regulators coalesce around blocking rationale. Netflix walks away or is forced to restructure. WBD must pivot to Paramount.

Probability: 10% WBD shareholder value: Paramount offer value (plus ticking fees for waiting period)

Expected Value of Netflix Deal = (0.20 × 100%) + (0.40 × 85%) + (0.30 × 65%) + (0.10 × [Paramount value]) = 76% (approximately) of stated consideration

Paramount's offer, meanwhile, explicitly includes ticking fees that are guaranteed regardless of deal timing. Paramount's offer probability of close is arguably higher (85-90%) because there's less regulatory concern about Paramount-WBD vertical integration.

From a risk-adjusted perspective, shareholders might actually get similar or better value from Paramount's offer because it includes explicit protections against the delay scenarios that Netflix's offer doesn't address.

This is Ancora's core financial argument made quantifiable.

The Board's Fiduciary Duty Problem

WBD's board approved the Netflix deal based on their judgment that it was superior to alternatives. But now that Paramount has improved its offer—adding ticking fees and termination fee coverage—the board faces a genuine fiduciary duty question: did they properly evaluate the alternatives?

Under Delaware law (where WBD is incorporated), boards have specific obligations:

- Duty of Care: Make informed decisions using reasonable diligence

- Duty of Loyalty: Act in shareholders' interests, not management interests

- Enhanced Scrutiny: When facing tender offers and competing bids, prove you received a fair process and a fair price

Ancora's argument is that the board failed on all three counts:

- Duty of Care failure: Board didn't adequately analyze regulatory risk or synergy probability

- Duty of Loyalty failure: Board locked in Netflix deal too quickly without properly evaluating Paramount

- Enhanced Scrutiny failure: Process wasn't fair when board rejected Paramount without properly evaluating revised terms

If Ancora can convince shareholders or courts that the board breached these duties, they have grounds to challenge the deal in Delaware Court of Chancery. Delaware courts can order negotiations to restart, impose new processes, or force reconsideration.

This is why board accountability threats matter. If Ancora can credibly argue fiduciary violations, they can force Netflix to improve terms or force the board to reconsider Paramount's offer.

Historical Precedent: When Activist Campaigns Flip M&A Deals

Activist opposition to M&A doesn't usually succeed, but when it does, the pattern is recognizable.

Example 1: Broadcom-Qualcomm (2018)

Broadcom offered $130 billion for Qualcomm. Multiple activist investors opposed on regulatory grounds (US government concerned about Chinese competition). Deal was blocked by US government pressure. Broadcom walked away. Qualcomm shareholders who listened to activists avoided a blocked deal that would have been devastating post-rejection.

Example 2: Elon Musk-Twitter (2022)

Musk wanted out of the deal, but activist shareholders who had voted "yes" initially began questioning the valuation. Shareholder pressure forced Musk to complete the deal at agreed price, but it demonstrated that activist pressure can matter even after initial votes.

Example 3: Microsoft-Activision (2022-2023)

Even with 98% of Activision shareholders voting yes, regulatory delays and activist questions about deal completion probability dragged on for 20 months. Microsoft ultimately completed the deal, but the delay hurt shareholder value significantly.

The pattern: activist campaigns that succeed do so by identifying material risks that the board underestimated. Netflix-WBD has material regulatory risks that Netflix has arguably underestimated. That's why Ancora's campaign has potential.

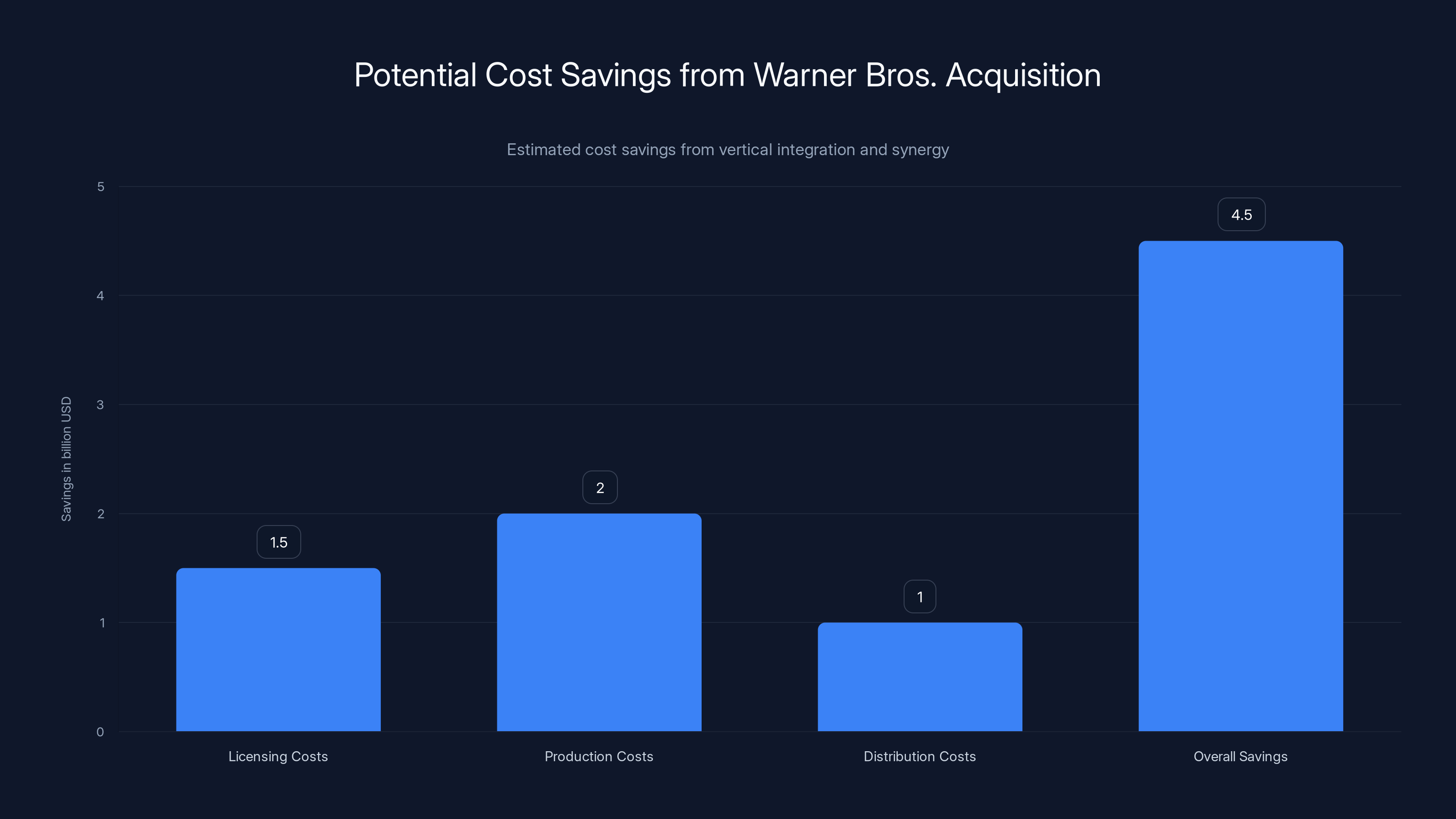

Estimated data shows potential savings of $4.5 billion through vertical integration and synergy from acquiring Warner Bros. This includes reduced licensing and production costs.

What Netflix Should Do Now

From Netflix's perspective, this situation requires strategic recalibration.

Option 1: Improve Terms

Netflix could match or beat Paramount's ticking fee structure and termination fee coverage. This would neutralize Ancora's financial argument. Cost: maybe $1-2 billion in additional consideration, but it removes deal uncertainty.

Option 2: Accelerate Regulatory Review

Netflix could proactively submit extensive FTC documentation, engage early with regulators, and push toward speed. This reduces the delay risk that Ancora is betting on. Realistically, though, FTC controls the timeline, not Netflix.

Option 3: Restructure as Asset Purchase

Instead of acquiring WBD whole, Netflix could negotiate to acquire specific properties (DC Comics, HBO brand, certain franchises) without the full studio infrastructure. This might reduce regulatory concerns and lower the price. But it abandons the full vertical integration strategy Netflix originally wanted.

Option 4: Walk Away

Netflix could decide that the regulatory uncertainty and shareholder resistance make this deal lower priority than other uses of capital. With streaming now profitable without WBD, Netflix doesn't desperately need this deal to survive. Walking away preserves optionality.

Netflix's likely path: some combination of Options 1 and 2. They'll improve terms modestly and engage aggressively with regulators to show commitment and potentially accelerate timeline.

The Streaming Consolidation Question: Is This Deal Era Over?

Ancora's opposition is really asking a deeper question: is the era of massive streaming consolidation actually over?

For years, conventional wisdom said streaming competition would consolidate to 2-3 major players, just like cable TV. Netflix, Disney, Amazon would dominate. Smaller players would be forced out or acquired.

But the actual market evolution is different. Streaming isn't consolidating toward 3 players. Instead:

- Netflix: Dominant independent streamer, profitable, growing

- Disney: Multiple streaming services (Disney+, Hulu, ESPN+), profitable at scale

- Amazon Prime Video: Bundled with Prime, not required to be profitable

- Apple TV+: Tiny service, highly profitable because they don't try to scale aggressively

- Paramount+: Struggling, trying consolidation to stay relevant

- HBO Max: WBD's streaming service, profitable, differentiated content

- Others: Specialty streamers (anime, sports, international) finding niches

The market isn't consolidating. It's fragmenting with profitable smaller players thriving in specific niches and efficient major players avoiding wasteful spending.

This market structure doesn't require Netflix-WBD consolidation. In fact, the trend suggests that Netflix's best strategy is staying focused, not acquiring massive content production capability.

Ancora's betting that shareholders will eventually realize this. The deal made sense in 2019-2022 when everyone assumed streaming would consolidate into 3 megaplayers. In 2025, after seeing Disney+ succeed without owning everything, after seeing Apple TV+ succeed without mainstream scale, and after Netflix prove profitability without massive content spend, the consolidation thesis looks outdated.

The Activist Endgame: What Happens Next?

If Ancora maintains their public opposition campaign, what actually happens?

Month 1-3: Shareholder Organizing

Ancora reaches out to other major institutional shareholders (Vanguard, Blackrock, Fidelity, etc.), asking them to reconsider their Netflix vote. They present their financial case: regulated-risk analysis, synergy probability assessment, Paramount offer comparison.

If Ancora convinces 15-20% of shareholders to flip, suddenly Netflix's 93% support looks shakier. Board starts feeling pressure.

Month 3-6: Board Negotiations

WBD board probably opens discussions with Netflix about improving terms. They might also reopen negotiations with Paramount to get final offer locked in.

This is where deal dynamics shift. If Netflix improves ticking fees and termination coverage to match Paramount, Ancora's leverage disappears. If Netflix holds terms firm, Ancora continues their campaign.

Month 6-12: Proxy Fight Threatens

Ancora explicitly threatens proxy fight at next annual meeting, proposing board replacement. Board faces choice: give Ancora meaningful concessions or face expensive proxy contest.

Most boards choose to negotiate rather than fight a proxy contest, because the public relations damage and expense often exceed the value of staying firm.

Month 12+: Deal Resolution

Deal either:

- Gets restructured with better terms (Netflix improves)

- Gets abandoned (Netflix walks away)

- Gets blocked by regulators (FTC or other authority)

- Proceeds to close as originally agreed (Ancora loses)

If deal closes as originally agreed despite Ancora's campaign, it doesn't mean Ancora failed—they forced Netflix to be more transparent about risks and probably pushed Netflix to improve terms somewhat. That's success from a shareholder protection standpoint.

Parallel Plays: What Other Streaming Companies Should Notice

The Netflix-WBD situation reveals something important about streaming consolidation strategy going forward.

For Amazon Prime Video: Don't need to acquire massive content libraries. Your bundling with Prime is enough. Stay acquisitive for specific franchises (Lord of the Rings, Expanse), not for entire studios.

For Apple TV+: Absolutely don't consolidate. Your profitability model depends on selective content spend. Scale would destroy your economics.

For Disney: Your Disney+/Hulu/ESPN+ bundling is equivalent to vertical integration. You have content + distribution already integrated. Don't need additional acquisitions at scale.

For Paramount: This is your strategic opportunity if Netflix deal falters. But also recognize that Paramount's best path forward might not be acquiring WBD but rather optimizing your current streaming structure.

The lesson: large-scale vertical integration isn't the winning strategy in streaming. Focused content + efficient distribution + selective M&A for specific franchises is the winning model.

Ancora's betting that shareholders will eventually realize this even if the WBD board doesn't. That's a sophisticated argument that relies on market learning, not just activism.

FAQ

What is activist shareholder opposition and how does it work in M&A?

Activist shareholders acquire meaningful voting stakes in companies and then publicly oppose proposed transactions. They pressure boards to reconsider deals, demand better terms, or consider competing offers. Activist campaigns work by organizing other shareholders around arguments that management underestimated risks or failed to evaluate alternatives properly. Success rates vary, but campaigns can materially impact deal timing and terms.

Why is regulatory risk more important in Netflix-WBD than other M&A deals?

Netflix-WBD involves vertical integration of a major streaming distribution platform with massive content production capability. Regulators worry this combination could let Netflix foreclose competition by withholding content from rivals or raising costs for competitors. Historical precedent shows FTC and international regulators scrutinize such vertical mergers intensely. Netflix-WBD is significantly larger than comparable deals that faced regulatory delays, making 18-24 month review timelines realistic.

What is a ticking fee and why does it matter in this deal?

A ticking fee is periodic payment from acquirer to target shareholders during the deal review period. Paramount's offer includes

How much weight should shareholders give to Ancora's arguments versus Netflix's deal recommendation?

Both present legitimate points. Netflix's argument: WBD's content library and production capability are strategically valuable at scale. Ancora's argument: regulatory delay risk is significant, synergies may be overstated, and Paramount's offer provides better shareholder protection. Shareholders should weigh: Is strategic value worth 18-24 months of regulatory uncertainty? The answer depends on individual risk tolerance and views on streaming consolidation trends.

Could regulators actually block the Netflix-WBD deal entirely?

Yes, though it's not the base case scenario. If FTC concludes that Netflix-WBD vertical integration would materially foreclose competition and that no reasonable remedies could address the concern, they could recommend blocking the deal. International regulators (EU, UK) could also block independently. Historical precedent: FTC blocked Meta-Within, Nvidia-Arm, and numerous others. Netflix-WBD's much larger size and more obvious competitive implications make blocking possible though less than 20% probability.

What would happen to WBD shareholders if Netflix's deal gets blocked?

WBD would revert to independence or pivot to Paramount's bid. If Paramount's bid remains available (and Paramount has said they'll honor it even if Netflix deal closes elsewhere), WBD shareholders would receive Paramount consideration instead. This is actually why Paramount's commitment to cover Netflix's $2.8 billion termination fee matters so much—it's insurance that Paramount will make their offer enforceable even if Netflix initially wins.

Is Ancora's campaign likely to succeed in flipping the deal?

Success requires either: (1) organizing enough shareholders to vote down the deal, (2) forcing board reconsideration through fiduciary duty pressure, or (3) regulators blocking the deal. Each is possible but not certain. Flipping the vote requires changing 5-10% of shareholders from Netflix to anti-Netflix, which is achievable if Ancora's arguments about regulatory risk and synergy overstatement stick. More likely outcome: Ancora forces Netflix to modestly improve terms while maintaining the basic deal structure.

How does Netflix's recent strategic shift affect whether WBD makes sense anymore?

Netflix spent 2019-2022 building massive content spend philosophy, justifying vertical integration. But Netflix has since proved profitability is achievable with lower content spend, selective show cancellations, and focus on efficient production. This undermines the synergy case for WBD acquisition. Netflix doesn't need to own WBD to control content—they can cherry-pick licensing deals with external producers. The original strategic thesis (vertical integration drives efficiency and margin improvement) looks weaker given Netflix's demonstrated ability to hit margin targets without that integration.

Conclusion: The Deal's Real Uncertainty

When Netflix announced the $82.7 billion WBD acquisition, it looked inevitable. Overwhelming shareholder support seemed to seal it. But Ancora's opposition reveals something important: the deal's fundamental uncertainties were never properly priced in.

Regulatory risk is real. Synergy projections are optimistic. The strategic case has deteriorated. Paramount's offer provides better protection against delay. The board's process might not have been thorough enough.

None of this guarantees Ancora succeeds. Netflix could improve terms, regulators could move quickly, or shareholders could reaffirm their support despite Ancora's campaign. But suddenly the deal that looked certain looks contingent again.

That's actually healthy market discipline. Board complacency gets interrupted. Management thinks harder about deal timing and terms. Shareholders understand that "recommended by the board" isn't the same as "definitely happening."

Streaming consolidation made sense when everyone assumed survival required massive scale and content spending. In 2025, after Disney proved streaming profitability without scale and Apple proved streaming success without mainstream volume, the consolidation thesis looks tired.

Ancora's not just opposing a deal. They're questioning whether massive vertical integration is still the right strategy at all. That's a deeper challenge than any single activism campaign. It's a question about whether Netflix correctly read where the streaming industry is actually headed.

The answer will become clear in the months ahead as regulators review the deal, boards negotiate terms, and shareholders decide what they actually believe about streaming's future. Netflix's $82.7 billion bet is now genuinely on the line—not because Ancora's campaign is brilliant, but because the underlying deal logic was shakier than most people realized.

For WBD shareholders, the situation offers unexpected leverage. A $200 million activist stake turned into billions in shareholder protection through ticking fees and improved deal terms. That's the real story here: small but organized shareholders can force boards to do better, even when supermajorities initially voted for something else.

Key Takeaways

- Ancora Holdings' 82.7B deal

- Netflix's 12-month regulatory timeline appears optimistic relative to 18-24 month precedent for vertical integration mergers in media

- Paramount's revised offer includes ticking fees and termination coverage that provide superior shareholder protection versus Netflix's unprotected deal

- Netflix's strategic rationale for vertical integration has weakened since announcement as company proved profitability without massive content spend

- Activist campaigns that succeed do so by organizing shareholders around legitimate risk factors that management underestimated; Ancora has identified real risks

Related Articles

- Netflix's Warner Bros. Acquisition: The $82.7B Megadeal Explained [2025]

- Netflix Senate Hearing: When Antitrust Meets Culture War [2025]

- Disney's Unified Hulu and Disney+ App: Late 2026 Launch and Price Hike [2025]

- Netflix vs. Paramount: The $108B Streaming War Reshaping Hollywood [2025]

- Netflix's $82.7B Warner Bros. Acquisition: What You Need to Know [2025]

- Netflix's $72B Warner Bros. Deal: How All-Cash Strategy Defeats Paramount [2025]

![WBD-Netflix Merger Battle: What Ancora's Opposition Means [2025]](https://tryrunable.com/blog/wbd-netflix-merger-battle-what-ancora-s-opposition-means-202/image-1-1770838635575.jpg)