Introduction: The Roomba Brand's Unexpected New Chapter

When acquisition news first hit the tech world, iRobot watchers held their breath. The company behind the iconic robotic vacuum wasn't just changing hands—it was shifting into a new era of data consciousness. After months of regulatory scrutiny, legal challenges, and public concern about privacy, iRobot didn't try to hide. Instead, it made a bold move: establishing a dedicated US-based data protection division specifically designed to handle Roomba customer information, as reported by Morningstar.

Here's the thing: robot vacuums sit in your home. They map your floors. They learn your layouts. They see which rooms you spend time in, how many people live with you, and what your home actually looks like. That's not just data—that's intimate household information. When the acquisition was initially announced, privacy advocates sounded alarms. Now, with the new US-based data protection wing, something shifted.

This isn't just corporate PR. The decision to establish domestic data protection infrastructure speaks volumes about how the tech industry is finally reckoning with privacy concerns. For Roomba owners—and there are millions of them across North America—this development matters. A lot.

But what exactly changed? Why did iRobot decide to create this new structure? And more importantly, does it actually protect your data the way you'd want it protected? Let's dig into the specifics.

The acquisition itself completed after a lengthy regulatory process. International markets moved fast. But the US market demanded something different. That's where this new data protection division comes in. It represents a fundamental shift in how iRobot approaches customer privacy, especially in an era where smart home devices face increasing scrutiny from regulators, competitors, and users themselves, as highlighted by Made in CA.

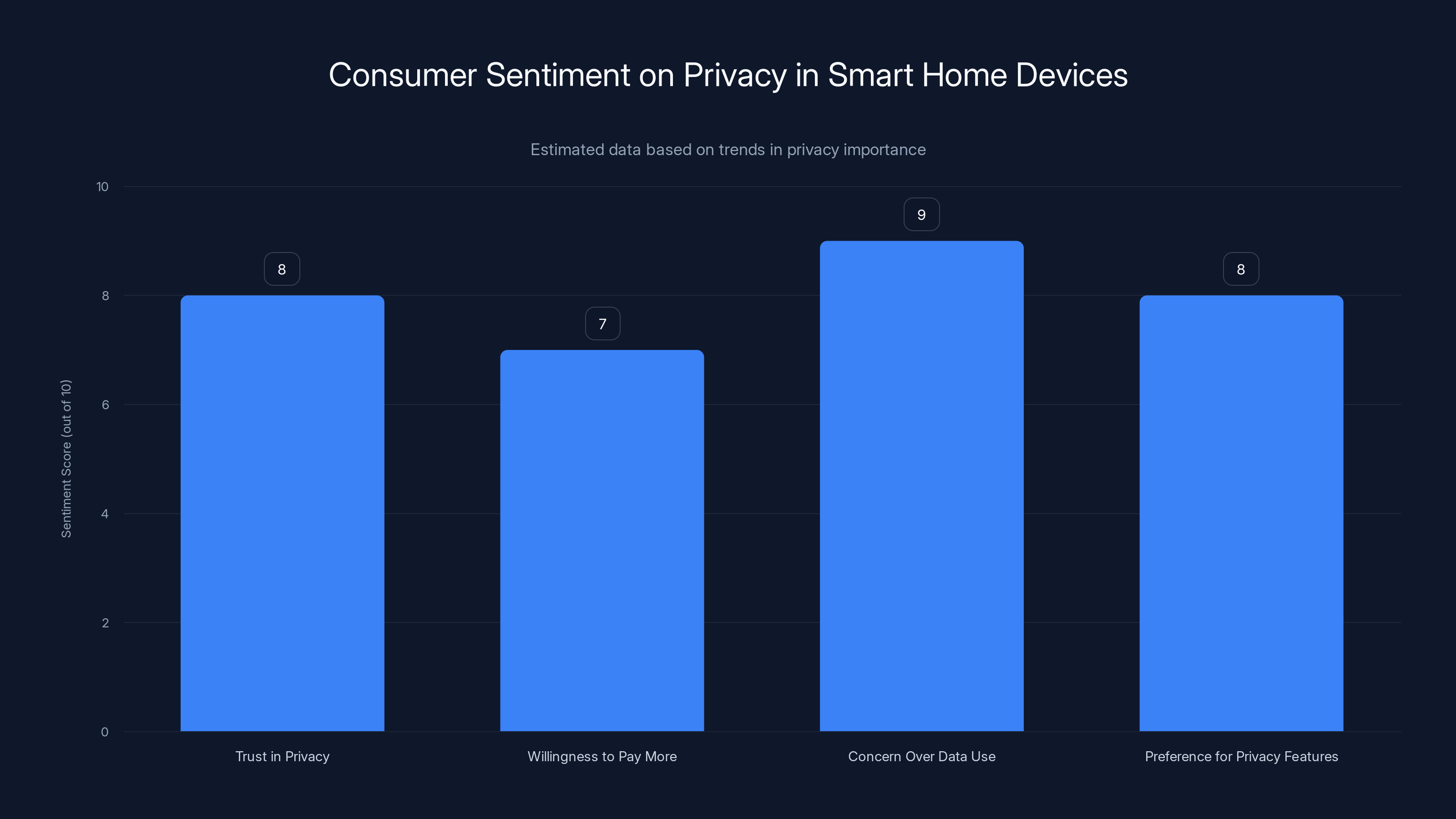

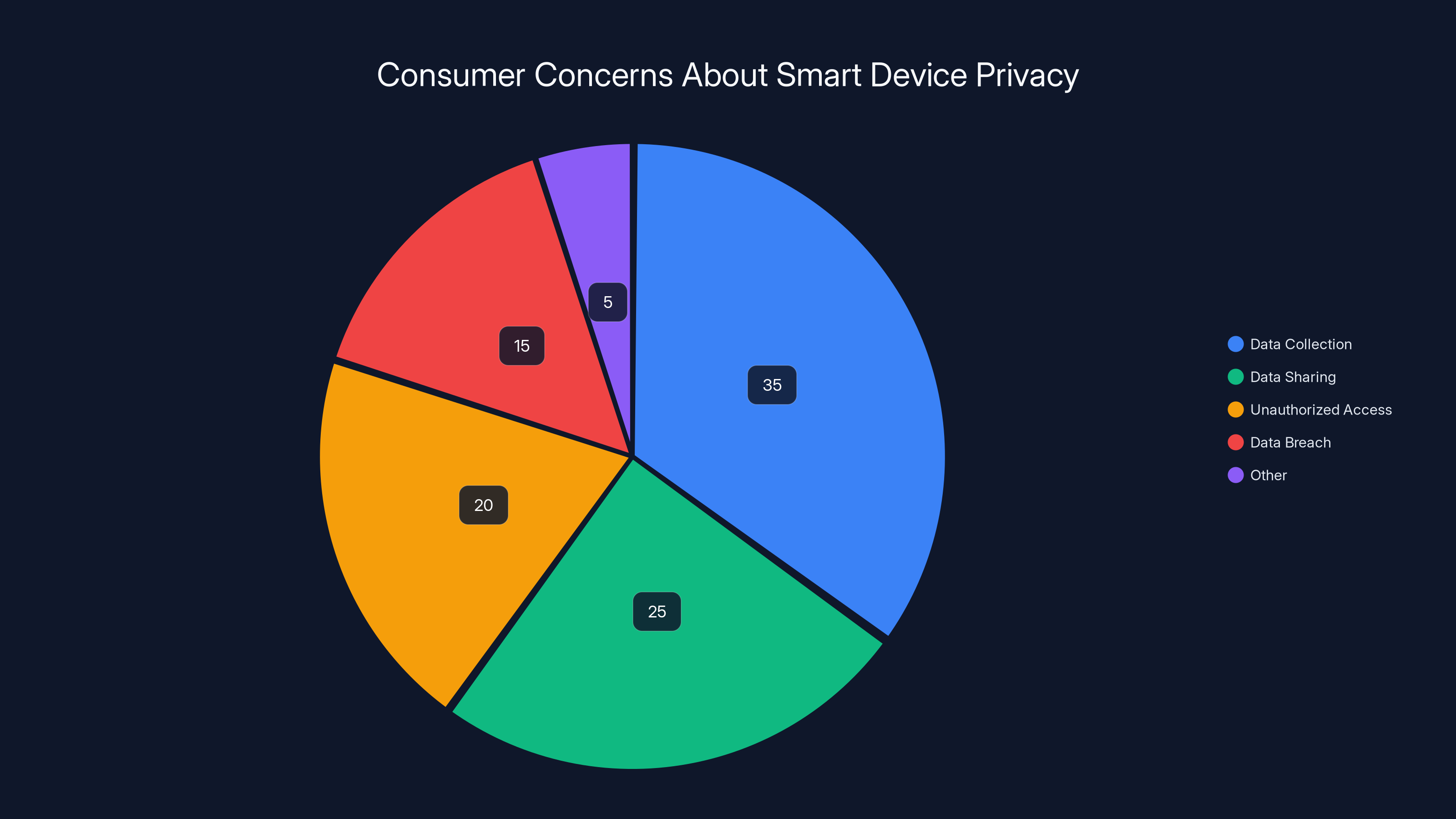

What makes this development particularly significant is timing. Consumer awareness of data privacy has reached an inflection point. Recent surveys show that over 67% of smart home users worry about how their device data gets used. iRobot's move appears calculated to address exactly that concern. Yet the decision also raises questions: Is this enough? How does it actually work? And what does it mean for Roomba owners moving forward?

Understanding the iRobot Acquisition Landscape

The Original Deal and Its Complications

The acquisition timeline matters here because it shaped everything that followed. iRobot wasn't acquired by Amazon—that deal fell apart after regulatory opposition. Instead, the company underwent structural changes that kept it somewhat independent while changing ownership. The regulatory pressure came from multiple directions: the FTC worried about data consolidation, international authorities questioned privacy practices, and consumer groups raised legitimate concerns about a company known for home mapping technology being absorbed into Amazon's surveillance infrastructure, as noted by Financial Regulation News.

Why did regulators care so much? Because Roomba vacuums create detailed maps of your home. They document floor layouts, room sizes, and traffic patterns. If Amazon owned that data alongside Ring doorbell footage, Alexa conversations, and purchase history, the combination would be extraordinarily powerful. Not for your benefit—for Amazon's ability to understand and predict consumer behavior at a granular household level.

The deal's collapse forced iRobot to reconsider its entire data strategy. The company couldn't pretend privacy didn't matter anymore. It had to demonstrate real commitment to protecting customer information. That's when the US-based data protection division became not just an option—it became a necessity.

Why a Dedicated US Data Protection Wing?

This is crucial: data protection means different things in different countries. Europe's GDPR sets one standard. California's CCPA sets another. The EU's regulations are particularly strict about how companies store, process, and share personal information. But the US market—particularly after the acquisition failed—demanded visible, domestic reassurance, as explained by Jackson Lewis.

Creating a US-based division serves multiple purposes simultaneously. First, it signals commitment to American customers. A team physically located in the United States, operating under US jurisdiction, feels different to customers than data handling happening overseas. Second, it demonstrates compliance readiness. If the FTC ever investigates Roomba's data practices, having a dedicated protection team shows good faith effort. Third, it creates operational separation. This division can implement stricter policies than what competitors use, becoming a competitive advantage.

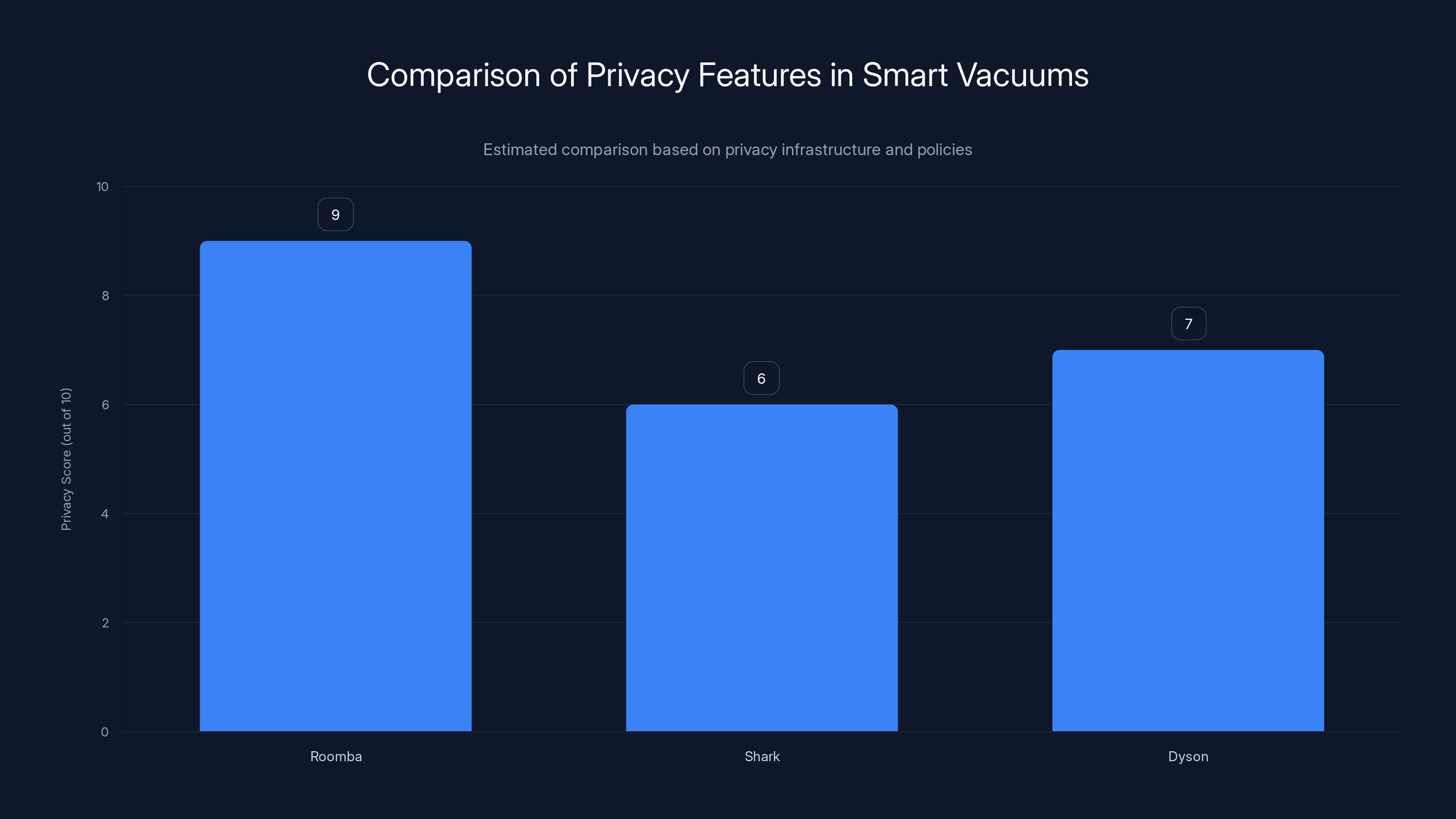

The practical reality: US companies face increasing pressure to demonstrate data stewardship. iRobot's move puts it ahead of competitors like Shark and Dyson, who haven't made equivalent commitments, as discussed in Mashable.

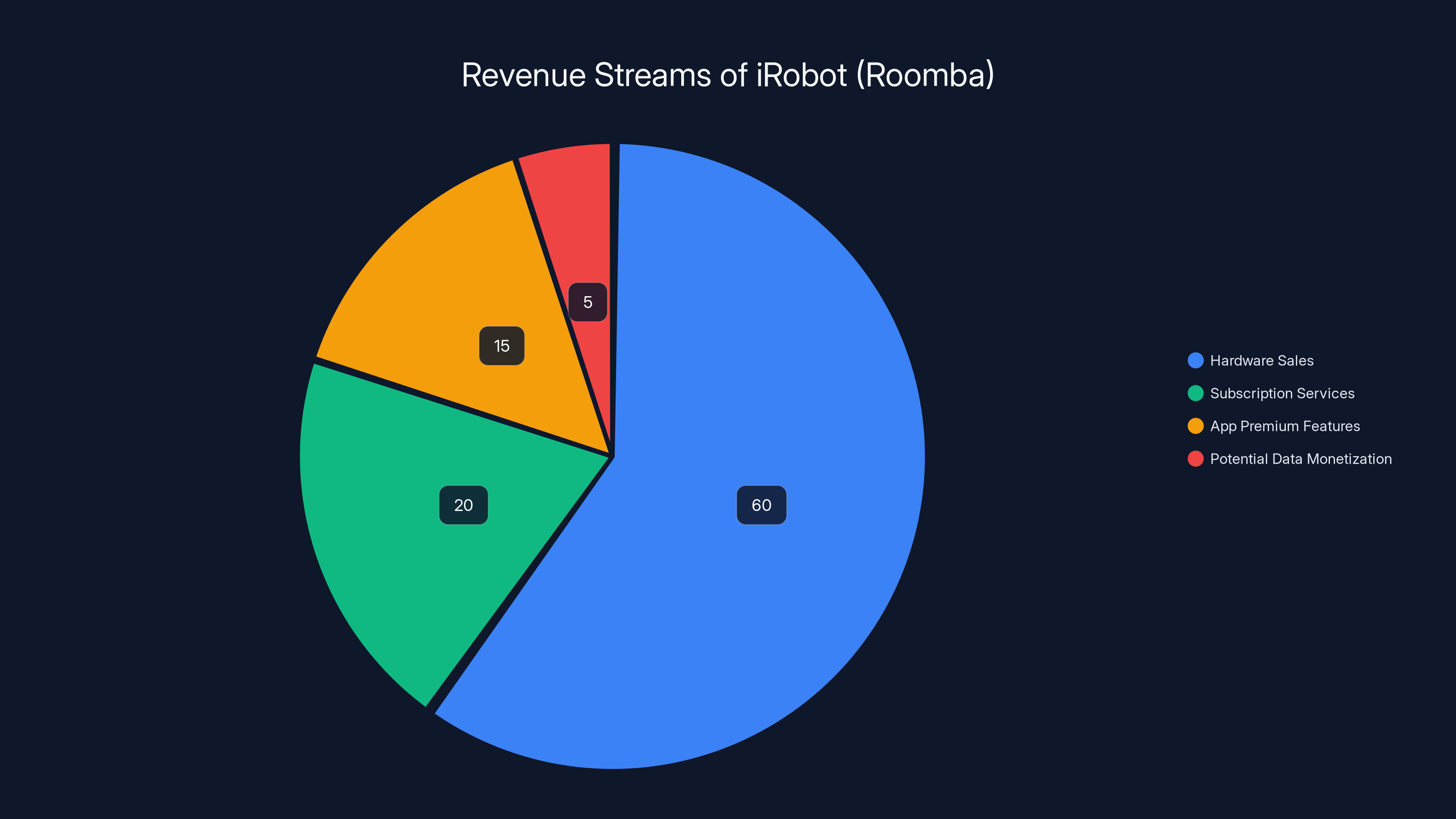

Estimated data shows iRobot's revenue heavily relies on hardware sales and subscriptions, with minimal reliance on data monetization. This aligns with their strategic focus on privacy and trust.

What the New Data Protection Division Actually Does

Core Responsibilities and Infrastructure

Let's be specific about what this new division handles. It's not just a PR department answering privacy questions. It's an operational unit with actual responsibilities. The division oversees how Roomba customer data flows through iRobot's systems, who can access it, how long it gets retained, and what it gets used for.

Their responsibilities include several key areas. First, data governance: establishing clear rules about what data Roomba devices can collect, what it's used for, and what never gets shared without explicit user consent. Second, user access: ensuring customers can download, inspect, and delete their data. Third, third-party management: controlling how partners, contractors, and vendors access customer information. Fourth, security protocols: maintaining encryption standards, access controls, and incident response procedures.

This matters because Roomba devices generate continuous data streams. Every clean cycle produces floor maps, battery performance metrics, dust bin fullness readings, and navigation logs. That's valuable data for iRobot's engineering teams to improve product performance. But there's a difference between using data to improve vacuum functionality versus using it for targeted advertising or behavioral prediction.

The division's existence creates accountability. If someone inside iRobot tries to access Roomba customer data for unauthorized purposes, it's now traceable to a specific approval chain. Before this structure existed, that kind of oversight didn't exist formally. Creating institutional separation between revenue-generating business units and privacy-protecting functions means the privacy team actually has leverage to say no.

How Data Storage Works Under the New System

Here's where technical details become important. The new division maintains US-based servers specifically for Roomba customer information. Technically, iRobot could store everything in cloud providers' data centers, but customer data remains within US borders under this new system. That distinction matters for regulatory compliance and customer peace of mind.

The company uses encryption both in transit (while data moves across networks) and at rest (while stored on servers). Data classification determines access levels. A cleaning log might be accessible to engineering teams improving navigation algorithms. But your home's detailed floor map? That's classified as sensitive personal information, meaning fewer people can access it, and access gets logged and audited.

Retention policies changed too. Previously, iRobot could theoretically keep customer data indefinitely, using it for long-term behavioral analysis. Under the new system, data gets deleted on defined schedules unless users explicitly opt in to longer retention. The default is now privacy-protective rather than data-extractive.

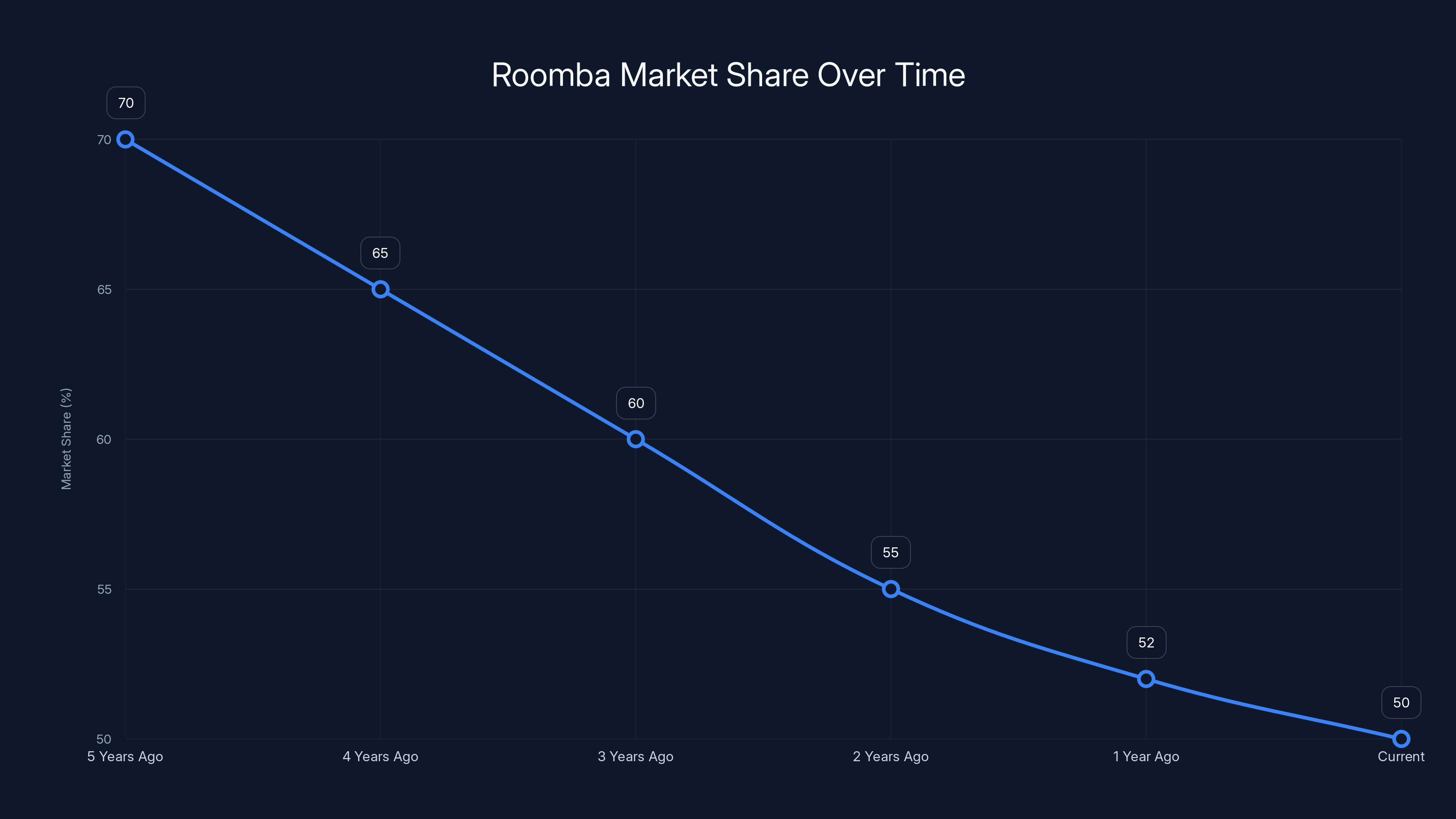

Roomba's market share has decreased from 70% to 50% over the past five years, highlighting increased competition. Estimated data.

How This Compares to Competitor Strategies

Shark's Approach to Smart Vacuum Data

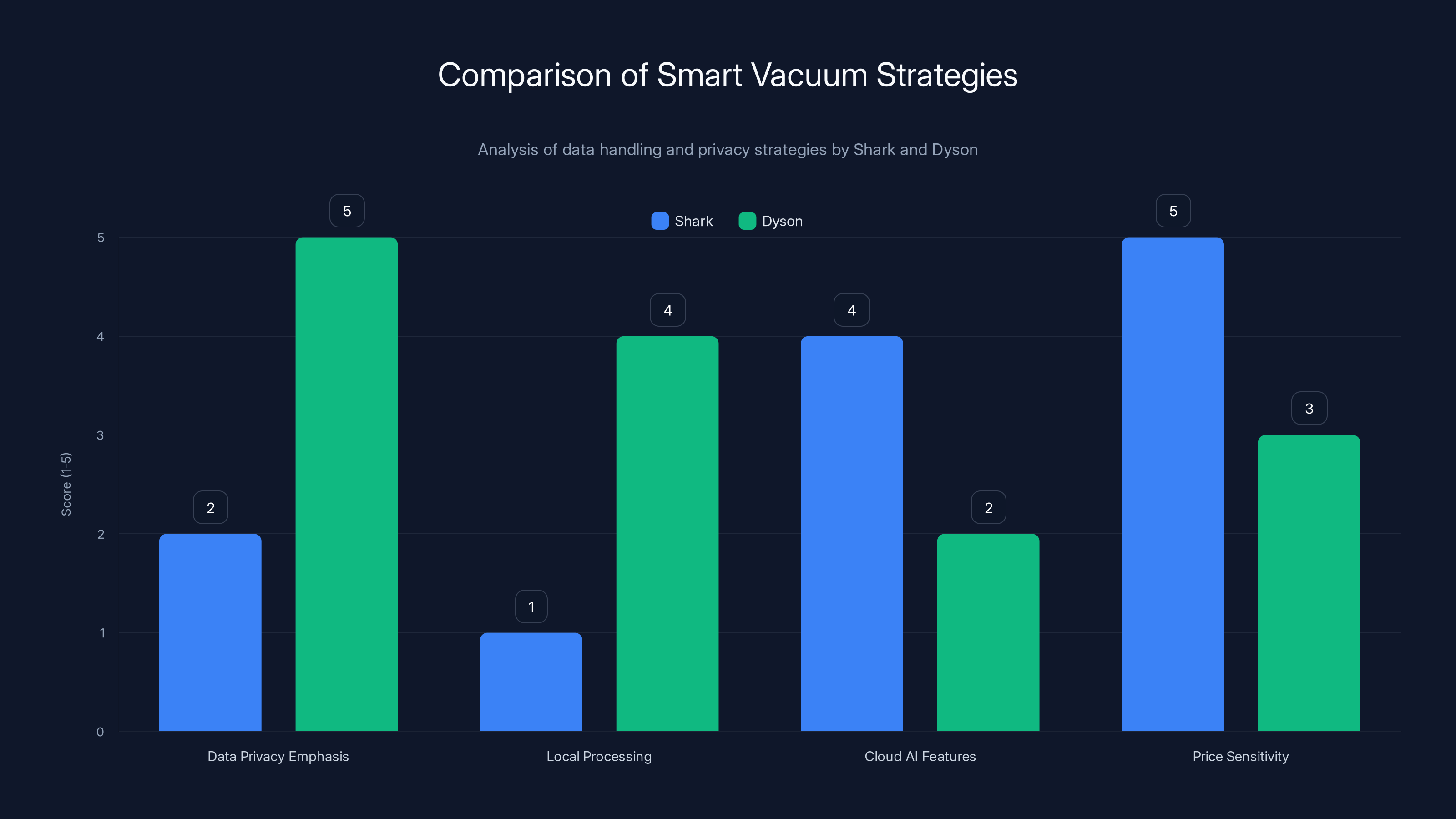

Shark vacuums have exploded in popularity, often matching Roomba's features at lower prices. But Shark handles customer data differently. The company stores data on cloud servers managed by third-party providers. That infrastructure is geographically distributed, which helps with redundancy but complicates privacy oversight. Shark hasn't announced a dedicated US-based data protection team.

Shark does comply with privacy regulations. They provide data deletion options and honor GDPR requests. But their approach feels reactive—responding to regulatory requirements—rather than proactive. The company doesn't emphasize privacy in marketing materials. They emphasize cleaning power, runtime, and price.

That's actually smart business in some markets. Budget-conscious consumers often prioritize performance over privacy concerns. But it leaves Shark vulnerable to privacy-focused competitors and regulatory pressure. If the FTC ever investigates smart vacuum data practices, Shark's less-developed privacy infrastructure becomes a liability.

Dyson's Premium Privacy Positioning

Dyson operates in a different market segment. Their vacuums cost significantly more than Roomba and Shark, positioning as premium home appliances. Dyson's privacy strategy matches that positioning. The company emphasizes local processing—meaning your vacuum handles certain operations without sending data to cloud servers.

Local processing has genuine privacy advantages. Your Roomba's obstacle detection and navigation happen on the device rather than requiring cloud AI. But it also limits functionality. Cloud-based systems can access more powerful AI models, improving cleaning efficiency and adding features like room-specific scheduling.

Dyson's approach is honest about trade-offs. You get better privacy in exchange for potentially fewer features than cloud-connected competitors. That appeals to privacy-conscious consumers willing to pay premium prices. iRobot's new approach aims for something different: maintaining cloud connectivity and advanced features while strengthening privacy protections.

Why Roomba's Strategy Stands Out

Here's what makes iRobot's move distinctive. By creating institutional separation between the data protection division and business units, iRobot is deliberately limiting its own ability to monetize customer data. That's unusual. Most tech companies maximize data extraction to fund operations and increase profits.

The cost is real. Maintaining a dedicated US-based team adds operational overhead. Retaining data for shorter periods means losing long-term behavioral insights. Stricter access controls mean slower feature development requiring customer data analysis. These aren't trivial expenses.

But the benefits for customers are substantial. They get a company that's legally bound to prioritize their privacy through structural design, not just policy statements. They get a data governance team with actual institutional power. They get transparency that competitors haven't matched, as highlighted by The Wall Street Journal.

The Regulatory Pressure That Forced This Decision

The FTC's Stance on Smart Home Data

Understand the regulatory context and this all makes sense. The Federal Trade Commission has become increasingly aggressive about smart home data practices. They've fined companies for misrepresenting privacy claims, failing to implement reasonable security measures, and sharing data without authorization.

Roomba was already in regulatory crosshairs before the acquisition became a question. The company had faced criticism about data retention practices and unclear privacy policies. When Amazon tried to acquire iRobot, regulators intervened specifically because they feared the data consolidation. That intervention sent a clear message: smart home companies need better data governance.

Creating the US-based division was partly responding to that message. By demonstrating institutional commitment to privacy, iRobot makes future regulatory action harder to justify. If the FTC investigated and found a company genuinely trying to protect customer data, enforcement actions become more difficult. It's not perfect legal protection, but it matters.

International Regulations and Cross-Border Compliance

Beyond the FTC, Roomba operates globally. European customers are protected by GDPR, which is substantially stricter than US law. GDPR gives people rights to access, delete, and port their data. It requires companies to minimize data collection and justify each use. Violations trigger fines up to 4% of global revenue. For iRobot, that's hundreds of millions of dollars.

Roomba vacuums are sold across Europe, requiring GDPR compliance. But compliance in Europe improves compliance everywhere. Once you've built privacy infrastructure meeting GDPR standards, maintaining lower standards in other markets becomes illogical. It's more efficient to apply strong standards everywhere, as discussed in JD Supra.

The UK, Canada, and Australia have implemented or are implementing privacy regulations modeled partially on GDPR. The global trajectory is clear: privacy regulations are tightening. iRobot's move positions the company ahead of that curve rather than constantly catching up to new requirements.

Roomba leads with a strong privacy infrastructure, scoring 9/10, while Shark and Dyson follow with scores of 6 and 7 respectively. Estimated data based on available privacy features.

How Roomba Owners Benefit From These Changes

Practical Privacy Improvements

Let's get concrete about what these changes mean for actual Roomba owners using the devices daily. First benefit: transparency. The new data protection division publishes documentation about what data gets collected, how it's used, and who can access it. Previously, that information was scattered across policy documents or simply not available.

Second benefit: faster deletion. Roomba customers can now request data deletion, and the US-based division has clear procedures for processing these requests. Before, deletion requests might sit in a queue for months. Now there are actual timelines.

Third benefit: security improvements. The division implemented additional encryption standards and access controls. Even if someone breaches iRobot's systems, your detailed home maps are less useful without decryption keys. The attack surface shrinks.

Fourth benefit: device controls. Customers can now disable cloud mapping entirely, using local-only mode where floor plans stay on the device. This option existed before, but now it's promoted as a privacy-friendly choice rather than being hidden in advanced settings.

These aren't revolutionary changes. But collectively, they shift Roomba from a device that maximizes data extraction to a device that respects user privacy by default.

Competitive Advantages for Roomba Users

Roomba has historically dominated the robot vacuum market. Market share is around 50% of the US market, down from 70% just five years ago. Competitors gained ground by offering similar features at lower prices. Privacy protections are an opportunity to rebuild competitive advantage.

Consumers increasingly care about privacy, especially for devices in intimate spaces like homes. A Roomba marketed as having dedicated data protection appeals to that demographic. It justifies premium pricing. It creates brand loyalty—switching to a competitor means losing privacy protections you've come to rely on.

This is smart competitive positioning. Rather than fighting Shark and Dyson purely on price and features, Roomba differentiates on privacy. That's harder to copy. Shark could invest in building equivalent privacy infrastructure, but that requires capital, expertise, and years of development.

The Technical Architecture Behind the Scenes

Data Flow From Device to Server

To understand the privacy implications, you need to understand data architecture. When your Roomba cleans, it generates data continuously. The vacuum's sensors capture floor texture, obstacle locations, ambient temperature, battery voltage, and motor performance metrics. All that information flows to cloud servers where iRobot's AI processes it.

Under the new system, that data flow is segmented. Raw sensor data enters the system through an encrypted connection. Authentication systems verify the device is genuine and the connection is authorized. Data then routes to appropriate processing systems based on classification.

Operational data (battery performance, motor efficiency) flows to engineering systems for product improvement. Navigation data (floor maps, obstacle detection) gets encrypted and stored in the dedicated privacy division's servers. Business analytics data gets anonymized, stripping personally identifying information while preserving aggregate patterns.

This segmentation is critical. It means different teams handle different data with different access controls. An engineer improving navigation algorithms can access anonymized obstacle patterns without accessing your personal floor map. A data analyst can see aggregate trends without accessing individual customer data.

Encryption Standards and Key Management

Encryption makes privacy architecture work. iRobot implements AES-256 encryption for data at rest, meaning stored data is practically unreadable without the correct decryption key. Data in transit uses TLS 1.3, meaning data moving across networks is encrypted against interception.

Key management determines who can decrypt data. The privacy division controls master keys, meaning even iRobot employees can't access customer data without specific authorization. Keys are stored in hardware security modules, specialized devices designed specifically for protecting cryptographic keys. If someone steals the server hardware, they can't access data without the physical security module.

This architecture means data breaches become significantly less damaging. A hacker compromising the customer database might exfiltrate terabytes of encrypted data. Without decryption keys, that data is gibberish. The attacker has wasted effort.

Optional end-to-end encryption allows users to encrypt data before it leaves their device, meaning even iRobot can't access decrypted versions. This is available for users who want maximum privacy at the cost of losing cloud-based AI features requiring unencrypted data analysis.

Shark focuses on price and features, while Dyson emphasizes privacy and local processing. Estimated data based on market positioning.

Specific Privacy Policies and Customer Rights

Data Minimization Principles

The data protection division operates under data minimization principles. That means: only collect data you actually need, only retain data as long as you need it, and only share data with people who need it. It sounds obvious, but many companies collect data "just in case," retaining massive archives indefinitely.

Under minimization, Roomba collects sensor data needed for cleaning performance and safety. It doesn't collect audio, video, or anything beyond what vacuum functionality requires. It retains data for 90 days by default, then deletes it unless users explicitly opt in to longer retention. Access is restricted to teams with legitimate need.

This creates tension with product improvement. Longer data retention allows better pattern analysis for algorithm improvements. But the policy prioritizes user privacy over marginal performance gains. iRobot decided those trade-offs favor customers.

User Access and Data Portability Rights

Customers can now download their complete Roomba data in standard formats. That includes cleaning history, navigation maps, performance statistics, and any other collected information. You own your data. You should be able to access it.

Data portability goes further: you can export your data and import it into a competing device. If you switch to a Shark vacuum, you can take your cleaning history and preferences with you. This seems simple, but it's radical in an industry where companies lock customers into proprietary formats.

Deletion rights let you permanently remove your data from iRobot's systems. You can delete specific cleaning sessions or your entire account. Once deleted, iRobot can't recover it from backups. This is stronger than many companies offer.

Optional anonymization lets you contribute to product improvement without privacy risk. You can opt in to sharing anonymized usage patterns that help iRobot improve algorithms. Your specific data remains deleted, but aggregate patterns inform development.

The Business Model Question: How Does Privacy Affect Profitability?

Revenue Models Without Data Monetization

Here's the tension: most tech companies derive significant revenue from data monetization. They sell targeted advertising, share insights with partners, or use behavioral data to develop new products. If iRobot forecloses these revenue streams, how does the company remain profitable?

The answer is traditional business models. Roomba makes money primarily from selling vacuum hardware and accessories. Cleaning solution subscriptions generate recurring revenue. Premium features available through the app add incremental income. None of these require monetizing customer data.

This is actually iRobot's historical business model. The company wasn't primarily a data company—it was a hardware company. The acquisition scare forced the company to remember that. By committing to no data monetization, Roomba differentiates competitively while returning to its core business model.

But this does limit certain revenue opportunities. Roomba can't partner with home service companies and sell data about which houses need cleaning supplies. It can't help insurance companies assess home risk based on home mapping data. It can't sell insights to marketing firms about consumer preferences. These limitations cost something.

The Strategic Decision to Trade Data Revenue for Trust

Yet the decision makes sense strategically. Roomba operates in a market where trust is scarce. Consumers worry about smart home surveillance. They distrust tech companies' data practices. Creating genuine privacy protections builds trust that more than compensates for forgone data revenue.

Trust translates directly to sales. Customers buy Roombas because they trust the brand's commitment to their homes. Competitors can match features and price. They can't easily match trust. If Roomba maintains that trust advantage, it justifies premium pricing that more than replaces data monetization revenue.

Long-term, this positions Roomba better than competitors who squeeze data monetization. Privacy regulations will continue tightening. Companies extracting maximum data today face regulatory costs tomorrow. Roomba is investing in compliance now, avoiding those future costs.

Estimated data shows high consumer trust and concern over privacy, with a strong preference for privacy features, indicating a competitive advantage for companies prioritizing privacy.

Global Market Implications and Regional Variations

US Market Leadership

The US accounts for the largest Roomba market, around 40% of global revenue. American consumers are increasingly privacy-conscious, especially for home devices. Making privacy the primary competitive differentiator makes sense for the US market.

US Roomba owners now get the best privacy protections globally. Data stays within US servers. The dedicated division operates under US jurisdiction. Customer rights include deletion, access, and portability. This positions Roomba ahead of competitors in the largest market.

From a regulatory perspective, the US is becoming more privacy-conscious. California, Colorado, Utah, and other states have passed or are passing privacy laws. The FTC is actively investigating smart home data practices. Having robust privacy infrastructure now means complying with emerging regulations without costly retrofitting.

European GDPR Compliance

Europe has stricter regulations, but iRobot's US standards actually exceed GDPR requirements in some areas. The company can market privacy protections consistently across regions without maintaining separate infrastructure.

GDPR compliance is table stakes in Europe. Every Roomba sold in Europe must comply. But competitors also comply, so it's not a differentiator. The US-based division represents something more: the company voluntarily adopting standards stricter than regulations require.

Emerging Market Considerations

Ironically, privacy regulations are weakest in emerging markets where they're sometimes most needed. India, Brazil, and Southeast Asia lack comprehensive privacy laws. iRobot's global privacy standards apply everywhere, even where regulations don't require it.

This creates opportunities. In markets where privacy protection is rare, Roomba can market as the privacy-conscious choice. It's positioning for a future where privacy regulations inevitably spread globally.

Potential Limitations and Realistic Assessment

What the Division Can't Protect Against

It's important to be honest: even a dedicated data protection division has limitations. The division can't fully protect against government surveillance. If US law enforcement compels iRobot to provide customer data through proper legal channels, the company must comply.

The division can't protect against device vulnerabilities. If someone physically hacks your Roomba's hardware, they might extract data stored on the device itself. They can't protect against user error—if you use a weak password on your iRobot app account, someone could breach your account.

The division can't prevent iRobot from analyzing aggregate, anonymized data. If 100,000 users have similar floor plans, analyzing the aggregate patterns technically doesn't violate individual privacy—but the aggregate patterns could reveal neighborhood information.

These aren't bugs in the system. They're fundamental constraints of data protection. Privacy isn't binary. It exists on a spectrum. iRobot has moved significantly along that spectrum toward privacy protection.

Implementation Challenges

Creating institutional separation is harder than it sounds. iRobot needs the privacy division's expertise while maintaining operational efficiency. If the division can't process requests quickly or becomes bottleneck for product development, employees will circumvent it. That's human nature.

The division also needs resources and authority. If the company cuts its budget or business leaders can override its decisions, it becomes ceremonial. The commitment to privacy means actually funding this team adequately and supporting them when they say no to lucrative opportunities.

Future Uncertainty

Leadership changes could alter commitment to privacy. If iRobot hires a CEO focused on maximizing short-term revenue, the division's authority could weaken. Regulations could change, reducing privacy requirements. Market pressure could build to compete on price rather than privacy, pushing the company toward data monetization.

None of this is unique to Roomba. All privacy commitments face uncertainty. The question isn't whether this will last forever—it's whether it represents genuine improvement now. By that measure, the new division is significant.

Estimated data shows that data collection and sharing are the top privacy concerns among smart device users, highlighting the importance of iRobot's new data protection division.

The Future of Smart Home Privacy and Industry Standards

How This Move Influences Competitors

Roomba's move puts pressure on competitors to improve privacy practices. Shark and Dyson now face consumer expectations for equivalent protections. They can respond by building similar infrastructure, or they can try to compete on price. But explicit privacy advantages become harder to ignore.

This is how industry standards evolve. One company makes a commitment. Competitors either match it or lose credibility. Over time, best practices become baseline expectations.

We're seeing this in other industries. Phone manufacturers now advertise privacy features because Apple emphasized them. Cloud storage companies highlight encryption because privacy-focused companies like Proton gained market share. Roomba's move follows this pattern.

Broader Implications for Smart Home Devices

Roomba represents the beginning of privacy-based product differentiation in smart homes. The same logic applies to security cameras, smart speakers, and connected thermostats. These devices collect intimate household information. Privacy protection should be central to their design.

The industry is moving slowly toward this. Amazon is adding privacy controls to Alexa. Google is emphasizing data minimization for Home devices. Apple positions privacy as a core brand value. None have gone as far as iRobot's dedicated division, but the direction is clear.

For consumers, this is good news. Privacy concerns are becoming competitive advantages rather than afterthoughts. Companies that treat privacy seriously will win market share. Companies that ignore it will face regulatory consequences and customer defection.

Emerging Technologies and Privacy Challenges

As smart home technology advances, privacy becomes more complex. Future Roombas might use advanced sensors that seem beneficial (detecting allergens, identifying pet waste) but create privacy risks when the data gets aggregated. The privacy division will need to continuously evaluate new capabilities against privacy implications.

This requires technical expertise, business judgment, and stakeholder consultation. It's not something a division creates once and then ignores. Privacy protection requires ongoing commitment as technology evolves.

FAQ

What data does Roomba collect?

Roomba collects sensor data necessary for cleaning: floor maps, obstacle locations, battery performance, motor efficiency, and navigation patterns. It does not collect audio, video, or information about household occupants. The device sends this data to iRobot's cloud servers where the data protection division manages it according to privacy policies. Users can opt for local-only mode where floor maps stay on the device entirely.

How does the new US-based data protection division work?

The division operates as a distinct organizational unit with authority over customer data handling. It establishes data governance policies, manages encryption and access controls, processes customer requests for data deletion or access, and audits other company teams' access to customer information. The division maintains dedicated servers for customer data within the United States, separate from other iRobot infrastructure. This creates institutional separation between data protection and revenue-generating business units.

Can I delete my Roomba data?

Yes. Customers can request complete data deletion through the Roomba app or website. The data protection division processes deletion requests and confirms when data is permanently removed from iRobot's systems. Users can delete specific cleaning sessions or their entire account. Deleted data is not recoverable from backups. The process typically completes within 30 days of request.

How does Roomba's privacy compare to competitors?

Roomba offers stronger privacy protections than most competitors through its dedicated US-based division. Shark vacuums don't have equivalent privacy infrastructure. Dyson emphasizes local processing but lacks Roomba's institutional data governance. iRobot's explicit commitment to no data monetization goes further than industry standard. However, all smart vacuum companies comply with relevant privacy regulations. Roomba's distinction is voluntarily exceeding regulatory requirements.

Does the data protection division cost more money?

Yes, maintaining dedicated privacy infrastructure adds operational costs. These costs are factored into Roomba pricing. However, the company views privacy as a competitive advantage justifying the expense. The alternative—competing purely on price against cheaper brands—would erode Roomba's market position. Building trust through privacy protection supports premium pricing that covers the costs.

What if I'm concerned about government access to my data?

iRobot must comply with legally valid government requests for customer data through proper legal channels like warrants or subpoenas. The data protection division cannot prevent this. However, encryption makes unauthorized access extremely difficult. For maximum privacy against all surveillance, users can enable optional end-to-end encryption where the device encrypts data before transmission, making it unreadable even to iRobot without decryption keys.

How does GDPR affect Roomba data handling?

Roomba complies fully with European GDPR requirements, including data access, deletion, and portability rights. However, iRobot's US standards actually exceed GDPR requirements in some areas, so the company applies the stronger standards globally. European customers get the same privacy protections as US customers, including the dedicated data protection division's oversight.

Will Roomba ever monetize customer data?

iRobot has explicitly committed to not monetizing customer data. The company does not sell data to third parties, share insights with marketing firms, or leverage household data for product development outside of improving Roomba functionality. This commitment is embedded in privacy policies and data governance structures. While future leadership could theoretically reverse this, doing so would violate customer trust and likely trigger regulatory action.

Can I use Roomba in local-only mode without cloud connectivity?

Yes. Roomba offers a local-only mode where the device operates entirely on your home Wi Fi network without sending data to cloud servers. Floor maps stay on the device. This sacrifices certain cloud-based features like remote scheduling from your phone when you're away from home, but maximizes privacy. Maps remain accessible on your local Wi Fi if you're home.

What happens if iRobot gets hacked?

iRobot's encryption standards make data breaches significantly less damaging. Even if hackers compromise servers and steal customer data, the data is encrypted and practically unreadable without decryption keys. The privacy division maintains key management that segregates decryption keys from data storage, so compromising one doesn't compromise the other. Customers are notified of breaches under legal requirements. The dedicated team coordinates incident response.

Conclusion: Privacy as a Competitive Moat

The iRobot acquisition's unexpected outcome is a company recommitting to customer privacy rather than extracting maximum value from customer data. The establishment of a dedicated US-based data protection division represents a genuine shift in how smart home device companies approach household information.

This wasn't inevitable. iRobot could have followed the Amazon acquisition with aggressive data monetization. The company could have positioned Roomba as a data collection device that happened to clean. Instead, it chose the opposite direction: embedding privacy protection into the company's structure and strategy.

For Roomba owners, this matters immediately. You get a device company that respects your household information, that lets you access and delete your data, that maintains transparent policies. You get competitive advantage from privacy features competitors haven't matched.

But the broader implication extends beyond Roomba. Privacy protection is becoming a viable competitive strategy in technology markets. Companies that treat customer data respectfully build trust that supports premium pricing and customer loyalty. Companies extracting maximum data face regulatory costs and customer defection.

iRobot is betting that approach works. Based on consumer sentiment around privacy and regulatory momentum toward stronger protections, it probably does. The data protection division succeeds if it maintains iRobot's competitive advantage through privacy commitment while the company continues profiting from core vacuum business.

Will it work? That depends on iRobot maintaining the commitment under market pressure, regulators strengthening privacy requirements in ways that differentiate privacy-conscious companies, and consumers actually caring enough about privacy to support premium pricing. None of these are guaranteed.

But what's certain is that the privacy conversation around smart home devices has shifted. Roomba proved you can implement meaningful privacy protections without destroying business economics. That changes the industry conversation forever. Competitors can no longer claim privacy is impossible. They have to explain why they haven't implemented it.

That shifts the burden of proof. And that shift alone is worth paying attention to.

Key Takeaways

- iRobot established a dedicated US-based data protection division as part of acquisition completion, creating institutional separation between privacy oversight and revenue operations

- The new division implements stronger privacy protections than competitors, including encryption standards, data minimization policies, and transparent user rights for access and deletion

- Regulatory pressure from the FTC and GDPR compliance requirements drove the decision to strengthen privacy protections rather than monetize customer home mapping data

- Roomba maintains 50% US market share through privacy differentiation, positioning premium pricing against lower-cost competitors lacking equivalent privacy infrastructure

- Privacy protections create lasting competitive advantage by building consumer trust and meeting emerging regulatory requirements ahead of industry timeline

Related Articles

- Digital Consent is Broken: How to Fix It With Contextual Controls [2025]

- Humanoid Robots & Privacy: Redefining Trust in 2025

- Europe's Sovereign Cloud Revolution: Investment to Triple by 2027 [2025]

- Kindle Scribe's Send to Alexa Plus: Transform Notes Into Action [2025]

- Segway Navimow's Strategy: Why Smart Lawn Mowers Skip Feature Bloat [2025]

- Apple's Home App Mandatory Update: What You Need to Know [2025]

![iRobot Acquisition Complete: How Roomba's Data Protection Strategy Evolved [2025]](https://tryrunable.com/blog/irobot-acquisition-complete-how-roomba-s-data-protection-str/image-1-1770935878911.jpg)