Europe's Sovereign Cloud Revolution: Investment to Triple by 2027

Europe's betting big on cloud independence. And I mean really big.

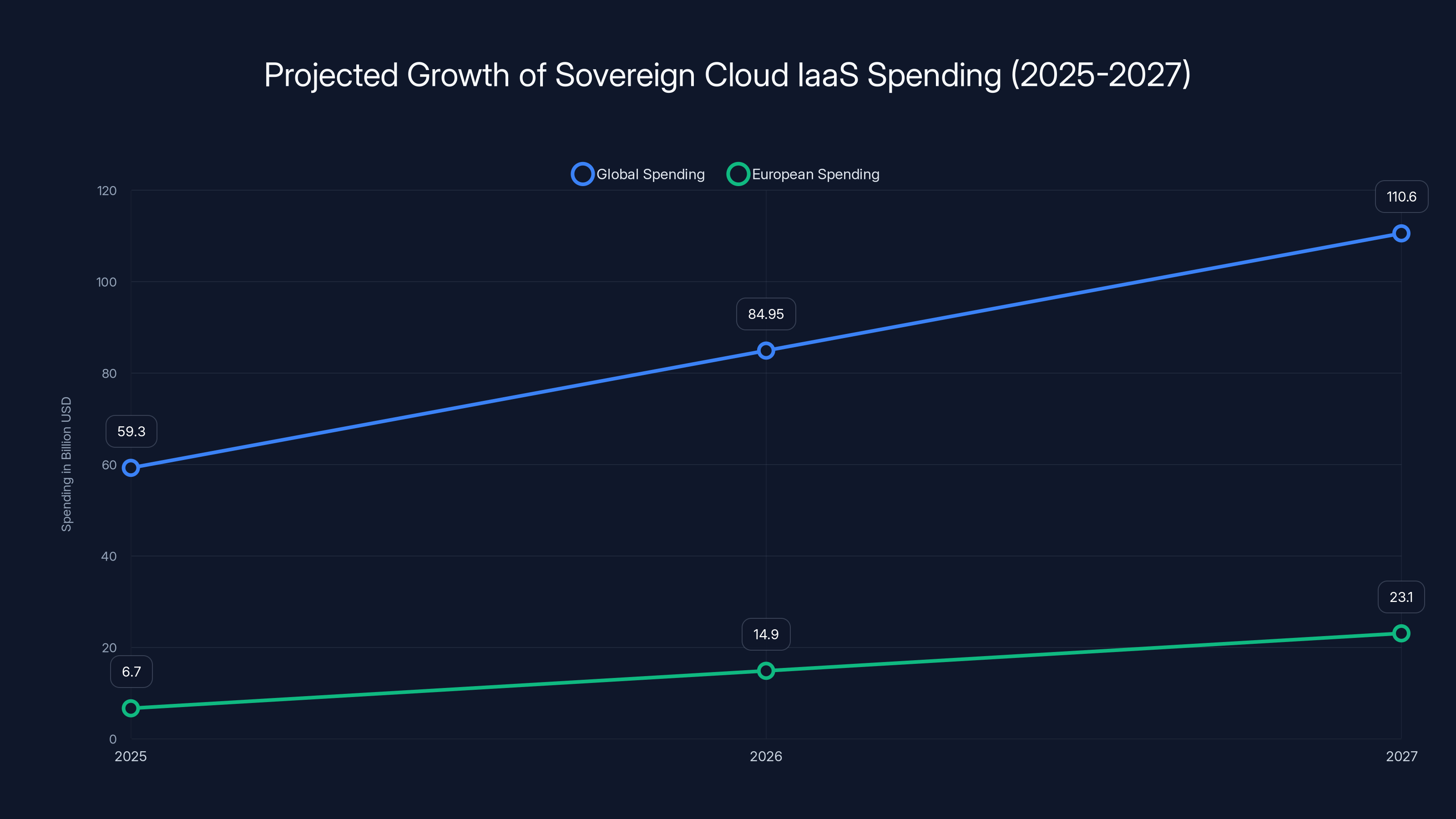

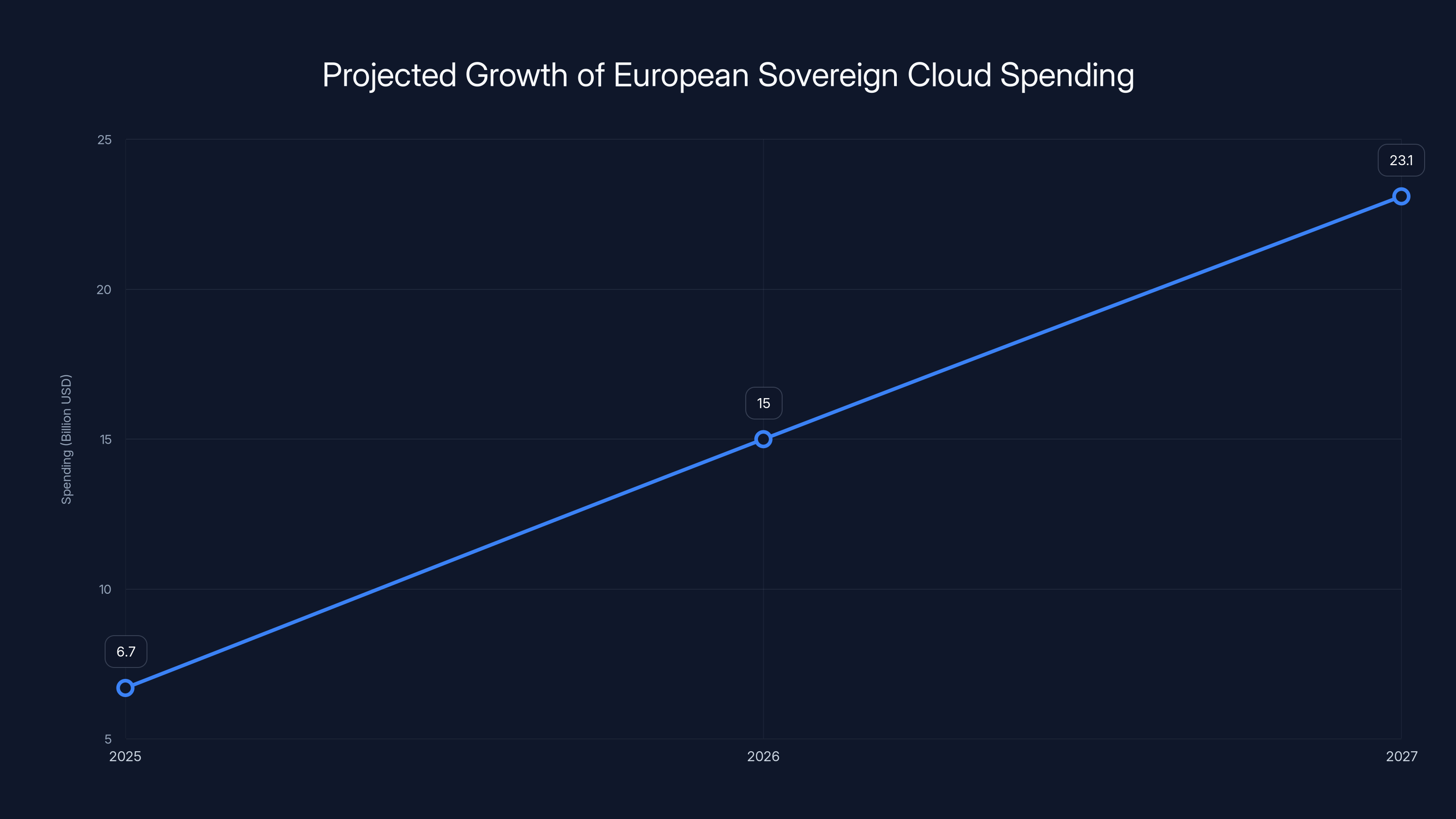

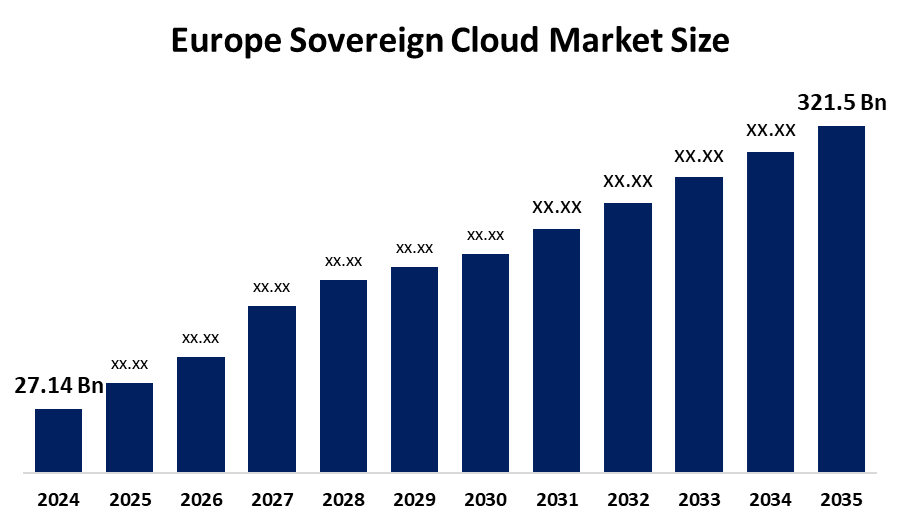

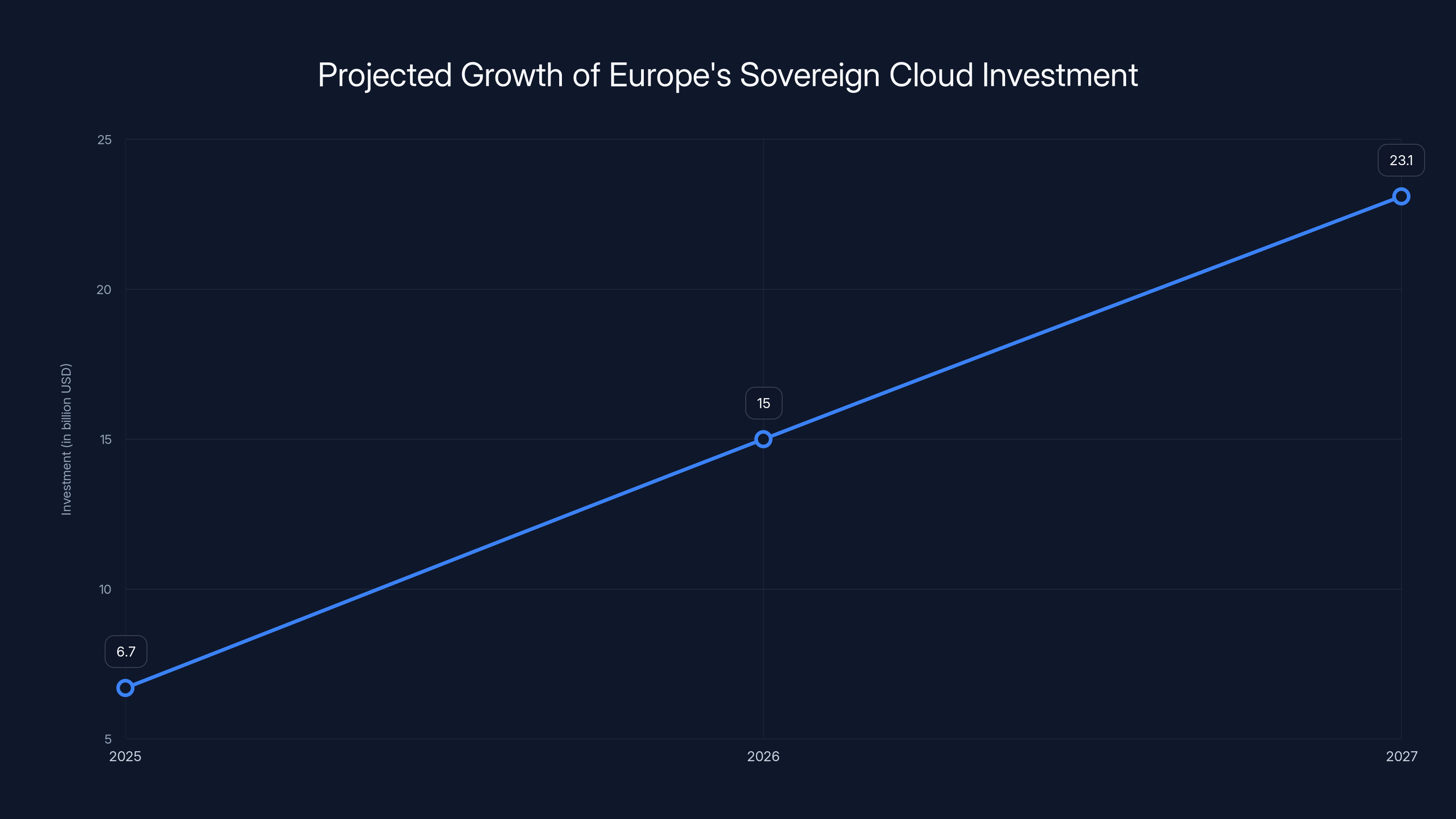

While the rest of the world's sovereign cloud spending barely doubles between 2025 and 2027, Europe is planning to triple its investment. We're talking about a shift from

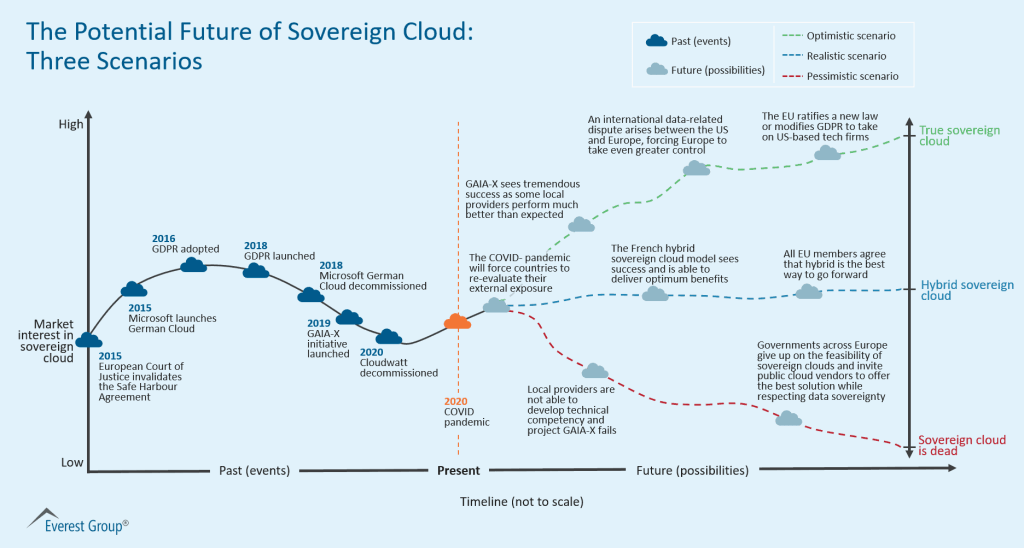

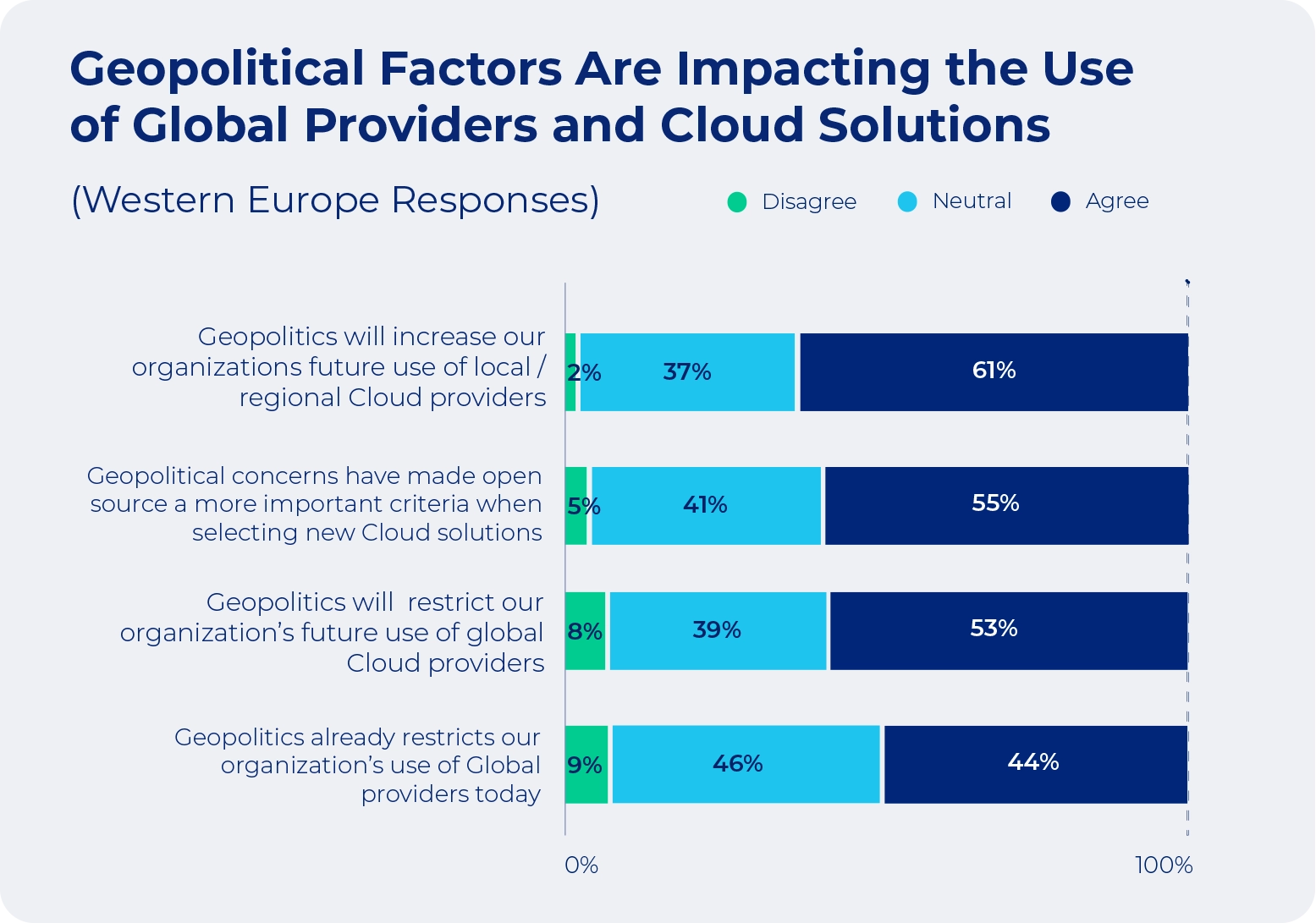

This isn't some niche trend either. Governments, financial institutions, healthcare systems, and critical infrastructure operators across Europe are all making the same calculation: keeping data and operations under sovereign control matters. The geopolitical tensions around data, recent regulatory tightening, and concerns about US dominance in cloud computing are forcing a reckoning that started years ago but is now hitting an inflection point, as noted by CIO Dive.

Here's the thing—this shift has massive implications. For European businesses, it means new vendor options and potentially better data residency guarantees. For global cloud providers, it means adapting their strategies or risking market share. For IT teams across the continent, it's forcing conversations about infrastructure, compliance, and long-term vendor relationships that weren't happening five years ago.

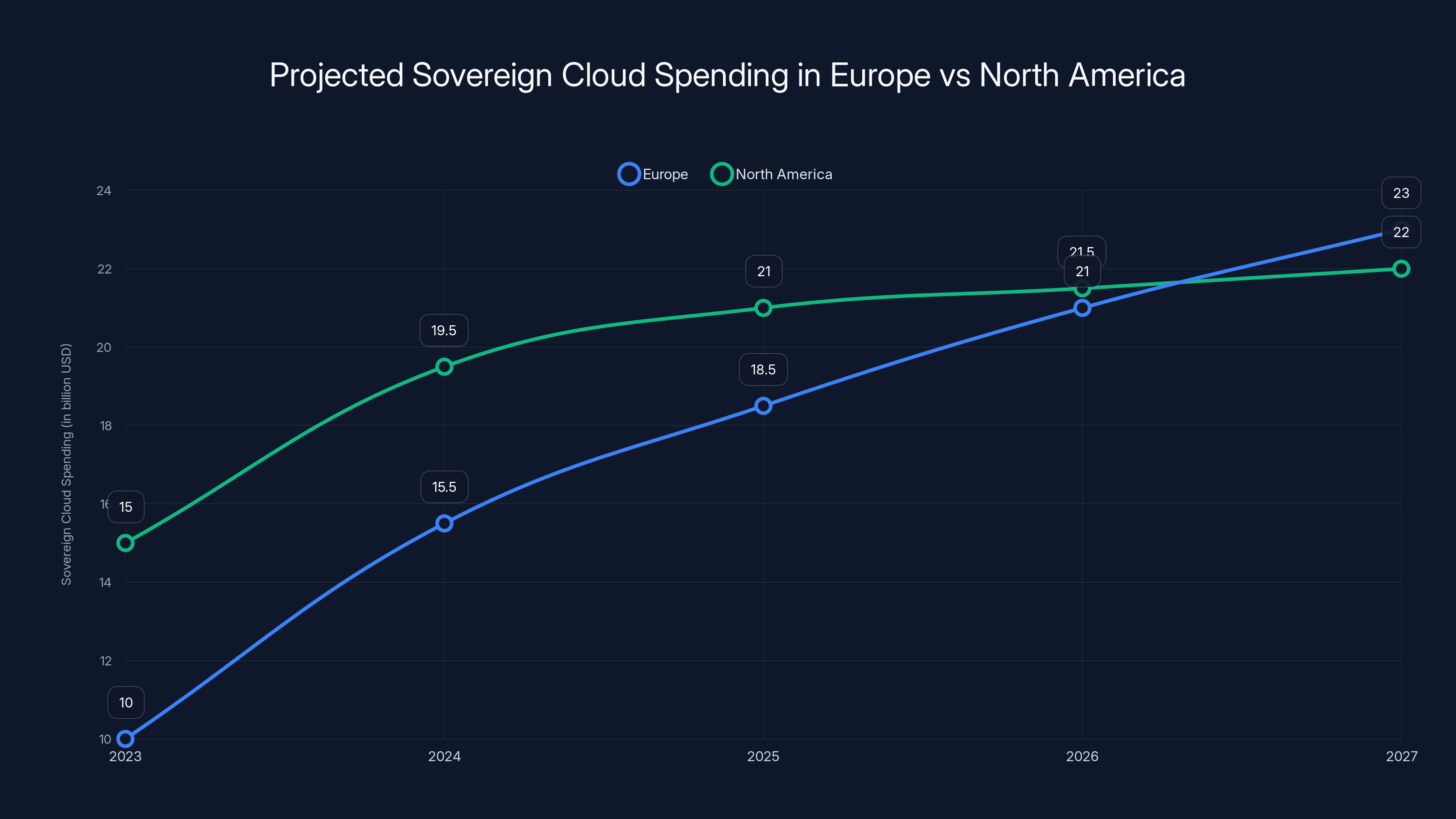

The scale of this movement is almost hard to overstate. Europe will likely overtake North America as the second-largest sovereign cloud market by 2027, right behind China. That's a dramatic reordering of the global cloud landscape, driven by regulatory pressure, geopolitical concerns, and a genuine appetite for local alternatives to the American hyperscalers that have dominated for the past decade. MSN reports that this shift is largely due to Europe's strategic autonomy goals.

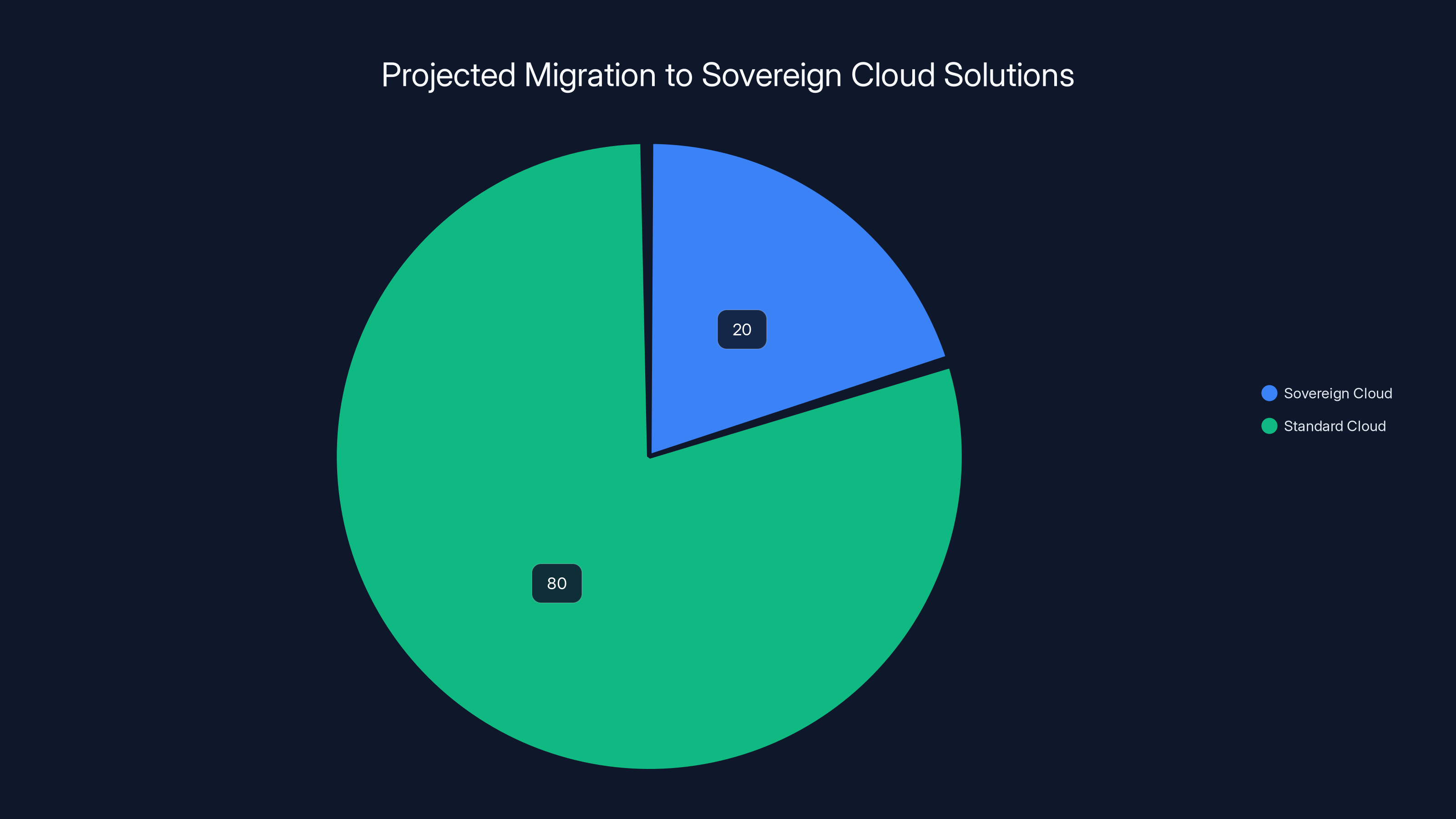

But here's the complexity—only about 20% of current workloads are expected to migrate to sovereign or regional providers in the near term. That means the bulk of European enterprise workloads will still sit with AWS, Azure, and Google Cloud, even as sovereign spending explodes. It's less about a wholesale abandonment of US cloud providers and more about a strategic split: use hyperscalers where it makes sense, but keep critical systems, sensitive data, and regulated workloads under tighter control.

Let's break down what's driving this, what it actually means, and what happens next.

TL; DR

- European sovereign cloud spending will triple from 23.1B by 2027, far exceeding global growth rates

- Europe will overtake North America as the second-largest sovereign cloud market by 2027, behind only China

- Only 20% of workloads will migrate, meaning most enterprises will maintain a hybrid approach with hyperscalers handling general workloads

- Regulatory drivers including GDPR, data residency requirements, and geopolitical tensions are accelerating adoption

- New vendors and regional providers are emerging, but hyperscalers are also launching sovereign offerings to compete

- Industries like finance, healthcare, and government are leading the migration, driven by compliance and security requirements

Estimated data suggests that only 20% of European enterprise workloads will migrate to sovereign cloud solutions, with the remaining 80% continuing on standard cloud platforms.

What Sovereign Cloud Actually Means (And Why It's Not What You Think)

Sovereign cloud is one of those terms that gets thrown around with a lot of different definitions. Let me be specific about what we're actually talking about here.

Sovereign cloud doesn't necessarily mean domestic cloud. It's about legal control and data residency. In practice, it means cloud infrastructure operated by entities that have to comply with a specific nation's laws—not American laws, not international standards that might favor US interests, but the laws of the country where the data lives. As highlighted by WebProNews, data sovereignty is crucial amid geopolitical tensions.

That's the whole point. When a European bank or government agency runs workloads on "sovereign cloud," they're buying the right to have their data physically located within their borders, subject to their jurisdiction, and handled by operators who must comply with EU law. They're also buying the assurance that the US government can't, through mechanisms like the Cloud Act or CFAA, simply demand access to that data. It's about sovereignty in the literal sense—the power to make decisions about your own data.

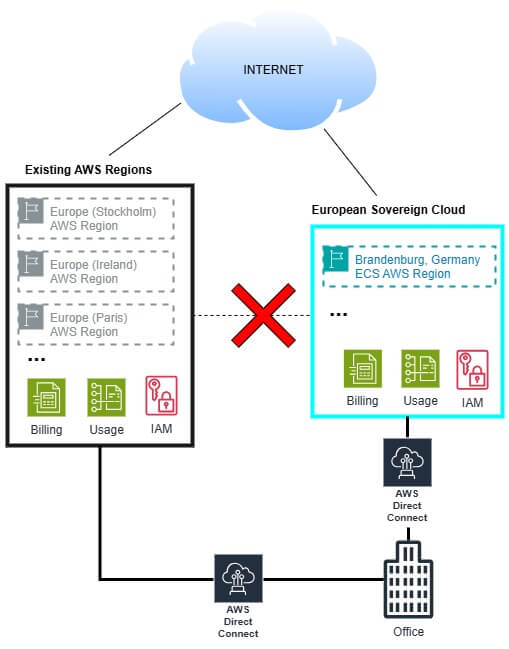

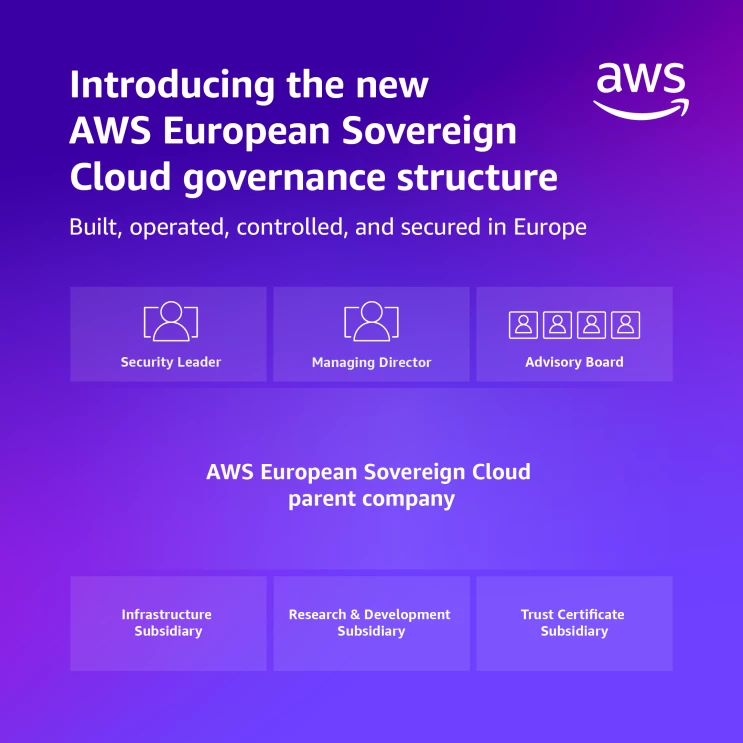

But here's where it gets murky. Sovereign cloud can mean different things depending on the provider. AWS's new Sovereign Cloud offering, for example, operates within Europe but still involves some level of AWS involvement. European regional cloud providers like OVHcloud, Scaleway, and various government-backed initiatives offer something different—complete operational control under European management. Then you've got country-specific solutions, like Germany's Gaia-X initiative, which tries to create a federated cloud architecture across European borders.

The regulations driving this are equally important. GDPR requires that personal data of EU citizens be processed in a way that respects EU law, but it doesn't mandate data residency. However, national laws in countries like Germany and France do impose stricter residency requirements for certain data types. The Digital Sovereignty Package and the broader EU push for strategic autonomy in critical technologies are creating regulatory momentum. And frankly, geopolitical paranoia (not entirely unfounded) about US surveillance and control over key infrastructure is influencing procurement decisions at the highest levels of government, as discussed in Forrester's blog.

So when we talk about European companies tripling their sovereign cloud spending, we're really talking about three things happening simultaneously: increased regulatory pressure, heightened geopolitical consciousness, and the emergence of viable European alternatives that actually work.

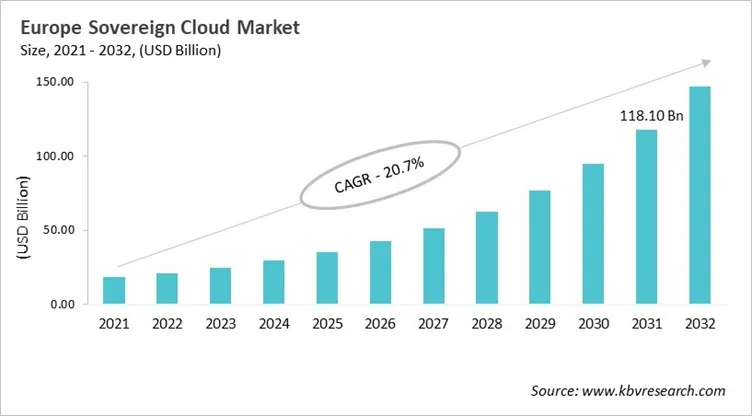

Europe's sovereign cloud IaaS spending is projected to grow by 245% from 2025 to 2027, significantly outpacing the global growth rate of 87%. Estimated data.

The Growth Differential: Why Europe Is Outpacing Everyone

Let's get into the numbers because they're genuinely striking.

Global sovereign cloud IaaS spending is growing from

Europe, on the other hand, is growing from

Why? Several factors are converging.

First, regulatory density. Europe has more compliance requirements per square kilometer than anywhere else on Earth. GDPR alone created baseline requirements that other continents never implemented. Add country-specific data residency laws, sector-specific regulations (banking, healthcare, critical infrastructure), and you get a regulatory environment where sovereign cloud isn't optional—it's sometimes mandatory. A bank in Frankfurt processing German customers' data faces regulatory pressure that a bank in Singapore doesn't. That creates direct demand for sovereign solutions.

Second, geopolitical consciousness. The conversations about US data surveillance that were fringe discussions ten years ago are now mainstream. Governments across Europe are explicitly worried about US control of critical data infrastructure. That's not paranoia—that's policy. It's reflected in procurement mandates, security requirements, and strategic directives coming from national governments and EU institutions.

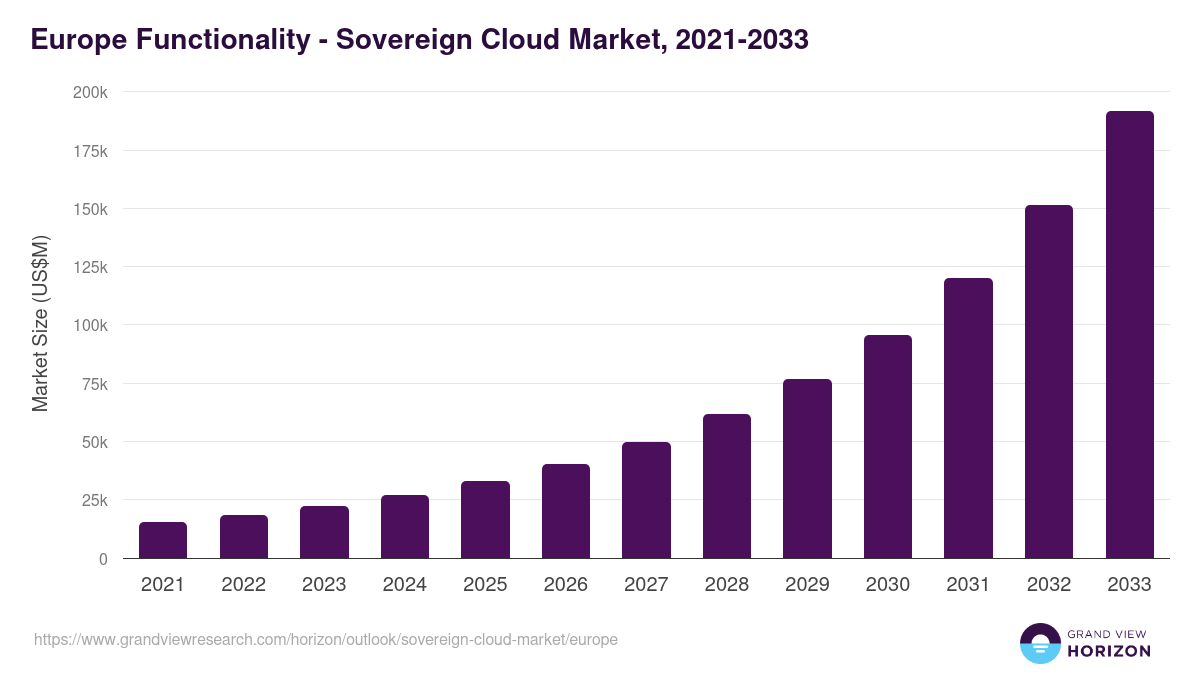

Third, vendor maturity. Five years ago, the European sovereign cloud market was fragmented and immature. OVHcloud was solid but limited. Most alternatives were regional players with limited capabilities. Today, there are multiple credible options, and critically, the hyperscalers themselves (AWS, Microsoft, Google) are launching sovereign offerings. That means organizations that want or need to stay with established providers can now do so while meeting sovereignty requirements. This removes a barrier to adoption.

Fourth, budget availability. European governments and large enterprises are actually allocating money to this transition. It's not speculative growth—there are budgets being set aside, procurement processes happening, and migration projects launching. The European Commission's strategic autonomy agenda is translating into actual spending.

The result is a market that's growing fast enough to reshape the entire cloud landscape. By 2027, Europe's sovereign cloud spending will represent 21% of global sovereign cloud spending despite being only about 8% of global cloud infrastructure spending overall. That's a concentration of sovereign adoption that dwarfs every other region.

Europe's Path to Overtaking North America (And What That Actually Means)

Here's a projection that deserves some unpacking: Europe will likely overtake North America in sovereign cloud spending by 2027.

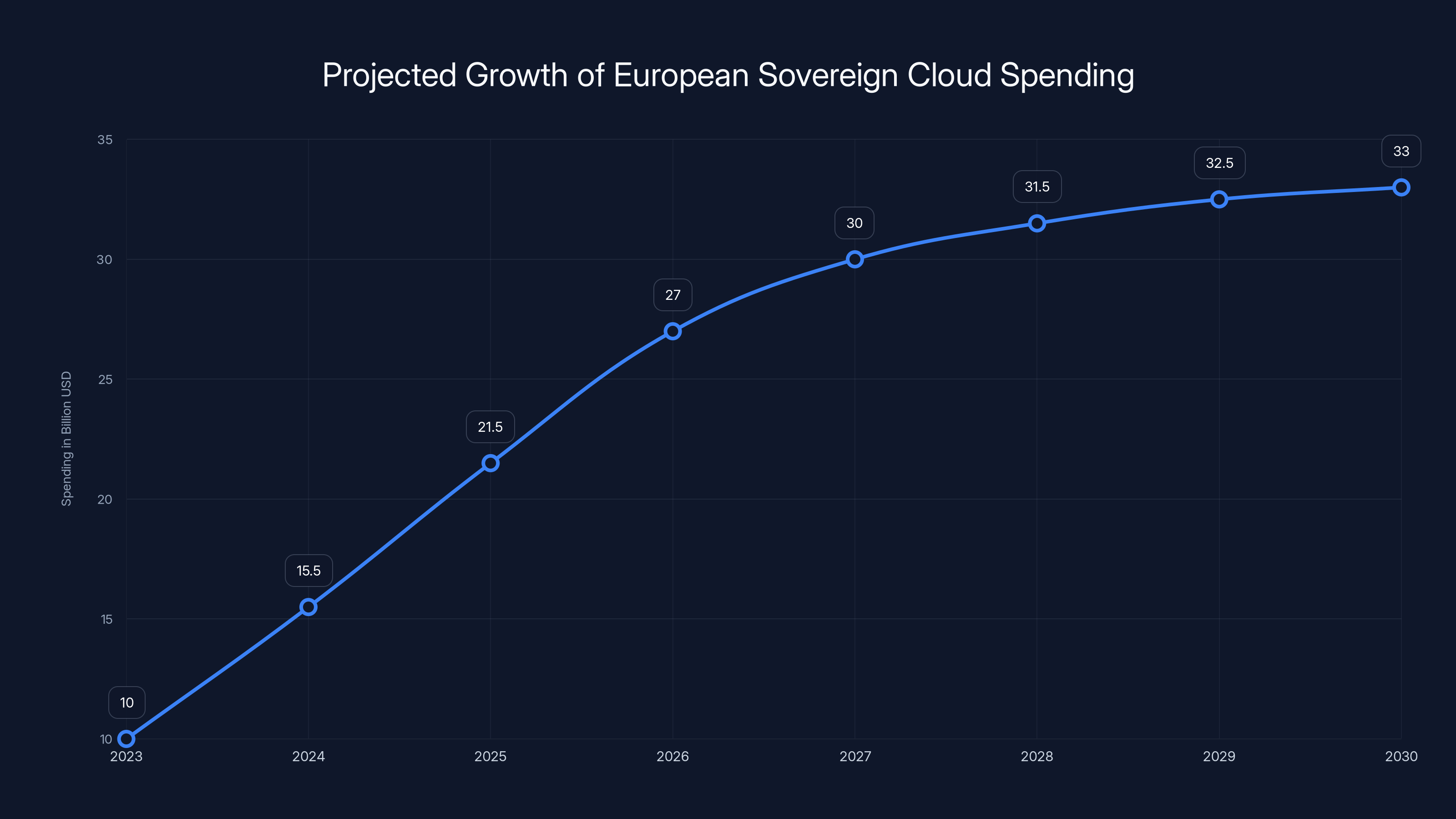

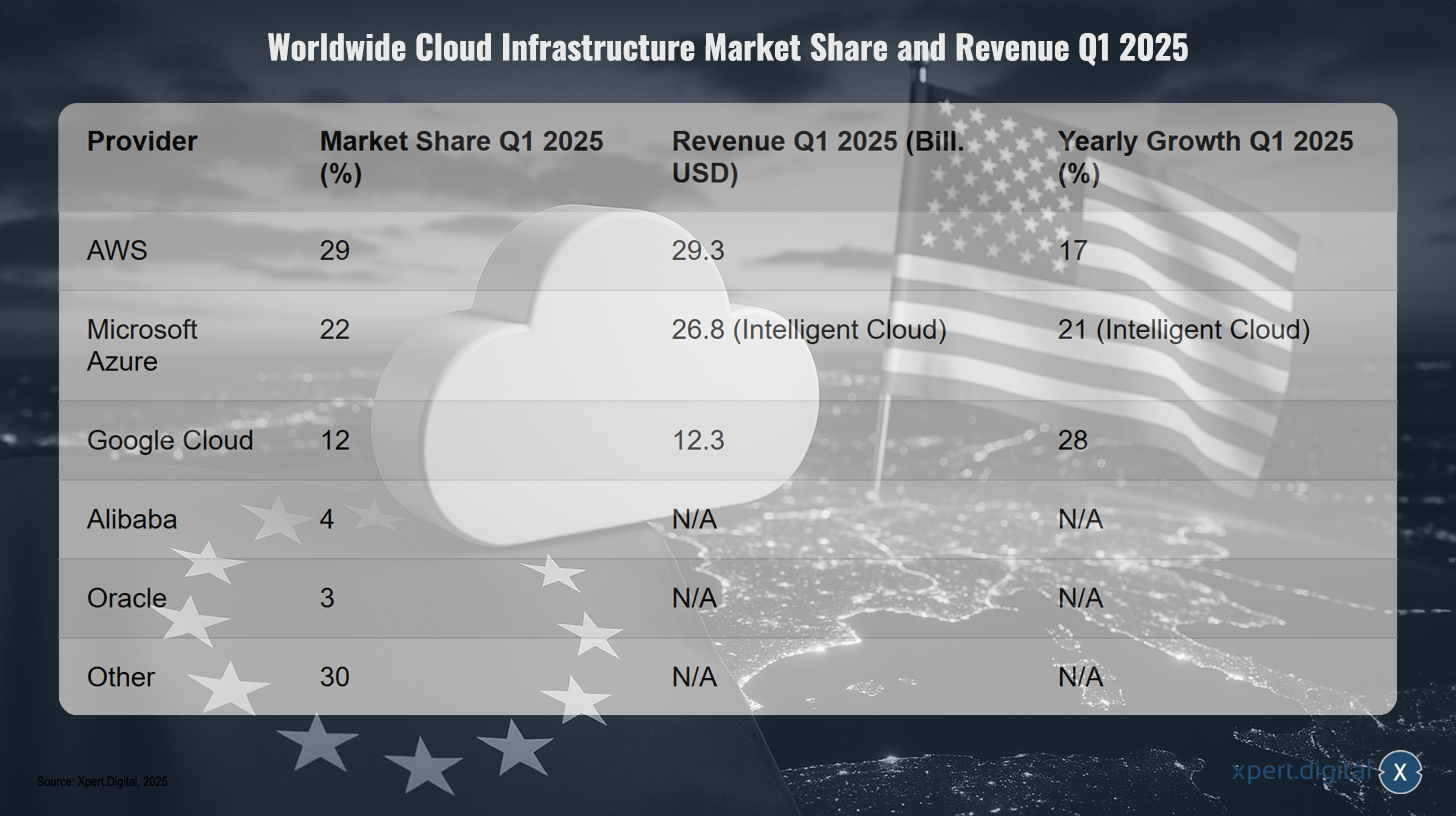

North America's sovereign cloud spending is growing too, but more slowly. The US has sovereign cloud initiatives—AWS Isolated Regions, Azure Government Cloud, various national security offerings. But they're growing off a different base. The US has way less regulatory pressure driving adoption, less geopolitical motivation, and less appetite for moving critical data away from AWS and Microsoft. So North American sovereign cloud growth is maybe 30-40% year-over-year, compared to Europe's 55%+.

The math is straightforward: if Europe grows faster for long enough, it overtakes a slower-growing competitor. By 2027, Europe could be spending around

But what does this actually mean for enterprises?

For European companies, it means more vendor options, potentially better local support, and infrastructure that's optimized for European compliance needs. It also means these solutions are increasingly competitive with hyperscaler offerings. A few years ago, choosing a European sovereign cloud provider meant accepting performance trade-offs or feature limitations. That gap is closing rapidly.

For North American providers, it's a warning. AWS, Microsoft, and Google can't ignore the European market, but they're fighting with one hand tied. Their business model is based partly on data aggregation and centralization. They're offering sovereign solutions, but there's inherent tension between being a global cloud provider and a truly sovereign provider. European competitors don't have that tension.

For Chinese providers, they're already winning at sovereign cloud domestically. Now they're watching European competitors eat the European market. This doesn't directly threaten their position, but it proves that regional/sovereign cloud architectures can be competitive.

The geopolitical implications are worth noting. If Europe successfully builds a sovereign cloud infrastructure that meets most enterprise needs while maintaining regulatory compliance, it changes the calculus for smaller countries and regions. It proves that breaking away from US cloud dominance is technically feasible. That could accelerate sovereign cloud adoption globally.

By 2027, Europe is projected to surpass North America in sovereign cloud spending, reaching

The 20% Workload Migration: Why Most Stuff Still Stays With Hyperscalers

Here's the number that keeps a lot of people confused: Only about 20% of current European workloads are expected to migrate to sovereign or regional cloud providers in the near term.

If sovereign cloud spending is tripling but only 20% of workloads are moving, how does that math work?

Multiple factors. First, the 20% represents the initial wave—government, finance, healthcare, and other heavily regulated sectors. These workloads tend to be smaller and more specialized than the massive, distributed workloads running on hyperscalers. A bank running its core trading systems on sovereign cloud is a smaller operation than that same bank running customer-facing services on AWS.

Second, workload migration is gradual. You don't move everything at once. You move critical systems, sensitive data, and regulated workloads first. General compute, development environments, and non-sensitive applications stay where they are. Over five to ten years, that 20% number could grow to 40% or 50%, but right now, most enterprises are running a hybrid model: hyperscalers for most things, sovereign cloud for things that require it.

Third, sovereign cloud platforms are optimizing for specific use cases, not trying to be a 1:1 replacement for hyperscalers. OVHcloud isn't trying to beat AWS at global scale. It's trying to be the best choice for European enterprises that need compliance, residency, and control. That's a different market.

What this tells you is that the tripling of sovereign cloud spending isn't about hyperscalers losing dominance. It's about a new category of infrastructure gaining importance alongside existing providers. Microsoft, AWS, and Google will still handle most European workloads. But an increasing percentage of critical, sensitive, and regulated workloads will live elsewhere.

Which Industries Are Leading the Sovereign Cloud Charge

The workload distribution matters because not every sector needs sovereign cloud equally.

Government and public sector is the obvious leader. EU governments are explicitly mandating sovereign infrastructure for public data. National governments are building or contracting for sovereign capabilities. This includes everything from administrative systems to intelligence operations. The spending here is driven by policy, not market forces.

Financial services is next. Banks, insurance companies, and payment processors face both regulatory pressure and existential concern about depending on US infrastructure. A major bank's payments system is a national security asset. Central banks are particularly sensitive to this. Finance sector spending on sovereign cloud is driven by a combination of regulatory requirements (within the EU and sometimes at the national level) and competitive pressure. If your competitor is running sovereign infrastructure, you need to at least evaluate it.

Healthcare and life sciences are growing fast. Patient data is highly regulated, sensitive, and often subject to strict residency requirements. Healthcare providers are moving core systems and patient records to sovereign infrastructure. Medical device manufacturers are doing the same. This sector has both regulatory drivers and liability concerns.

Telecommunications and critical infrastructure are significant spenders. Telecom companies are moving core network infrastructure. Energy companies are doing the same. These sectors are explicitly defined as critical to national security in most European countries, which means regulatory pressure is intense.

Manufacturing and industrial are moving slower, but adoption is accelerating. Large manufacturers with sensitive IP are evaluating sovereign options. The push toward Industry 4.0 and IoT means more data living in cloud infrastructure, which means more pressure to keep sensitive operational data under sovereign control.

Smaller sectors and SMEs are mostly watching for now. They don't have the regulatory pressure that drives adoption in finance or healthcare. They don't have the strategic importance that drives adoption in critical infrastructure. They're waiting for sovereign solutions to become cost-competitive with hyperscaler offerings. As sovereign cloud platforms scale and optimize, this will change.

The spending distribution roughly follows this pattern: government (35%), finance (25%), healthcare (20%), infrastructure and utilities (15%), other (5%). This concentration in regulated sectors explains why only 20% of workloads are migrating—those sectors represent about 20% of total enterprise workloads.

European sovereign cloud spending is projected to triple from

The Regulatory and Geopolitical Drivers Behind the Growth

None of this happens without regulatory and geopolitical pressure. Let's get specific about what's driving this.

GDPR set the baseline. It didn't mandate data residency, but it made compliance everyone's problem. Every company handling EU citizens' data has to comply with GDPR, which means documenting data flows, understanding jurisdictional issues, and taking responsibility for third-party processors. This created awareness that you couldn't just ignore where your data lived.

Country-specific laws are more aggressive. Germany's national security laws impose strict requirements on which infrastructure can store certain types of data. France has similar rules. These aren't theoretical—companies have been fined for violating them. This creates hard regulatory drivers, not soft guidance.

The Cloud Act and CFAA are the real catalysts for European paranoia. The US Cloud Act allows the US government to demand data from US cloud providers, even if that data is stored overseas. The CFAA makes it illegal for non-US entities to access US cloud infrastructure without authorization, even for maintenance. These laws mean that a European company storing data on AWS in Ireland is still subject to US legal jurisdiction. That's the uncomfortable reality that's driving the push for sovereignty, as explained by Orrick.

Geopolitical tensions with the US and China are also relevant. The US has restricted exports of advanced semiconductors, AI models, and certain technologies to China. Europe sees this as a warning—you can't depend entirely on US technology providers if the US government can decide to cut you off. Similarly, concerns about Chinese technology and state involvement in companies creates pressure to avoid Chinese infrastructure. This leaves European infrastructure as the middle ground that everyone feels okay about.

Strategic autonomy messaging from EU institutions is turning into actual policy and spending. The EU Commission explicitly talks about the need for European technology independence. This translates into procurement preferences, grant money for European tech companies, and political support for sovereign infrastructure initiatives. It's not just private sector demand—it's government-driven demand.

Schrems II and data transfer mechanisms created specific technical pressure. The European Court of Justice ruled that the EU-US Privacy Shield was invalid, and then raised concerns about whether standard contractual clauses were sufficient. This forced companies to actually think about data transfer mechanisms and where data was located. Sovereign cloud is a clean solution to this problem—if data never leaves Europe, transfer mechanisms don't matter.

All of these factors combine into something that looks like organic market demand but is actually partially driven by regulatory and geopolitical reality. A European bank can't ignore sovereignty because regulators are asking questions. A government agency can't pick AWS without justifying it. A healthcare provider can't move patient data overseas without legal risk. These aren't aspirational preferences—they're operational constraints.

How Hyperscalers Are Responding to the Sovereign Cloud Challenge

AWS, Microsoft, and Google aren't sitting still. They're developing sovereign cloud offerings, but their approaches vary in interesting ways.

AWS's approach is the most interesting. They launched AWS Sovereign Cloud in Europe, which is effectively a regional offering where AWS retains some operational involvement but restricts access to AWS personnel based on nationality and citizenship. It's not fully sovereign in the sense that a European company operates it, but it's more sovereign than standard AWS regions. The structure allows AWS to maintain technical control (which they need for reliability and support) while giving customers the assurance that data isn't accessible to just any AWS employee. It's a compromise that acknowledges European concerns without completely surrendering the AWS model.

Microsoft's strategy involves leveraging Azure's regional presence and compliance certifications. Microsoft has taken a different approach by building partnerships with local infrastructure providers and positioning Azure as the cloud for regulated enterprises. They've invested heavily in compliance certifications and have been working with European governments on cloud initiatives. The strategy is less about sovereign infrastructure and more about demonstrating compliance and local presence.

Google's approach is less developed than AWS or Microsoft. Google Cloud is smaller in Europe and hasn't launched a Sovereign Cloud equivalent yet. They're focusing on specific compliance certifications and regional offerings, but they're further behind in addressing European sovereignty concerns. For enterprises that need true sovereignty, Google is often not even evaluated.

The hyperscaler strategy is basically this: offer enough sovereignty and compliance to keep customers from leaving entirely, but maintain enough control to protect the underlying business model. It's a delicate balance. They can't fully cede control without losing operational efficiency, but they can't ignore sovereignty concerns without losing market share.

Estimated data shows European sovereign cloud spending could exceed $30 billion annually by 2028-2029, with growth slowing as the market matures.

The European Sovereign Cloud Ecosystem: Who's Actually Building This

If hyperscalers are compromising, who's actually building true sovereign cloud infrastructure?

OVHcloud is the most established European cloud provider. They've got a genuine pan-European infrastructure footprint, billions in annual revenue, and a real commitment to European data residency. They're not as feature-rich as AWS, but for many European enterprises, they're good enough. They've been improving their offerings and competing on price and compliance, not just on sovereignty.

Scaleway (part of Iliad/Iliadis) is another credible European player. Smaller than OVHcloud but with a strong European presence and a focus on open-source and transparent infrastructure. They're more developer-focused than OVHcloud and have been gaining traction with startups and mid-market companies that value sovereignty.

Deutsche Telekom and Telefónica are telecom giants that have cloud arms. Deutsche Telekom's T-Systems runs substantial cloud infrastructure in Germany. Telefónica has cloud offerings in Spain. These are national champions with deep government relationships and regulatory support.

Gaia-X is a different model. It's not a cloud provider but a federation standard for sovereign cloud. The idea is that multiple providers can offer Gaia-X-compliant services, which means data is European-controlled, operated under European law, and portable across providers. It's more ambitious than individual cloud providers—it's trying to create an interoperable ecosystem. But it's also more complex and further from maturity.

Government-backed initiatives in countries like France (with state investment in cloud sovereign capabilities) and Germany (strategic support for European tech) are significant. Some of these are building actual infrastructure, others are providing funding and political support for private providers.

Smaller regional players exist in almost every European country. Italy has Aruba, the Netherlands has various providers, and so on. Most are smaller and have limited capabilities compared to OVHcloud or hyperscalers, but they serve specific national needs.

The ecosystem is fragmented compared to the hyperscaler duopoly (AWS and Azure dominate most of the world), but fragmentation is kind of the point. Sovereignty means no single provider controls everything. The growth in European sovereign spending is distributed across many providers, each with geographic or sectoral focus.

Why Migration Is Hard (And Why Only 20% Are Moving)

If sovereign cloud is so important, why aren't enterprises moving faster? Why is the migration limited to 20% of workloads?

The answer is that migration is hard, expensive, and risky.

Operational lock-in is real. A large enterprise has thousands of workloads on AWS, Azure, or Google Cloud. They're using multiple services from the same provider—compute, storage, databases, machine learning, security services. Moving means rebuilding across all of these. It's not just infrastructure; it's the entire operational model. That's a multi-year effort for any large organization.

Cost isn't always better on sovereign platforms. Hyperscalers have achieved economies of scale that make their pricing competitive with or better than regional providers. A migration that costs millions in engineering time and operational disruption is hard to justify if it doesn't actually save money. Some European providers are cheaper; many aren't. You're usually buying sovereignty and compliance, not cost savings.

Vendor consolidation is attractive. Running on a single hyperscaler means standardized tools, single vendor support, unified billing, and predictable operational models. Moving to a multi-vendor model means operational complexity. Different APIs, different support models, different management tools. That's technically doable but organizationally messy.

Skill availability is limited. The cloud industry has spent fifteen years building expertise on AWS, Azure, and Google Cloud. Expertise on OVHcloud or other European providers is rare. That creates an adoption barrier. Enterprises know how to run AWS; they don't know how to run OVHcloud. Changing that requires training and hiring.

Regulatory requirements are the actual forcing function. A bank doesn't move to sovereign cloud because it's better—it moves because regulators are pushing it or because it's the only way to achieve specific compliance requirements. Same with government agencies and healthcare providers. Regulatory pressure drives moves; technical preference doesn't.

The result is that most enterprises migrate only what they must. Critical systems, sensitive data, and regulated workloads move to sovereign infrastructure. Everything else stays put. This explains why spending can triple while only 20% of workloads move—the 20% are consolidated into fewer, larger workloads that cost more per unit.

Europe's investment in sovereign cloud is projected to triple from

Data Residency, Compliance, and the Regulatory Environment

Let's get into the actual regulatory mechanisms that are driving this.

Data residency is more specific than most people realize. It doesn't just mean data is stored in a specific country; it means data is legally within that country's jurisdiction and subject to that country's laws. Practically, it means that if a country's government subpoenas data, the hosting provider must comply with that country's legal process, not any other country's. This matters for sensitive data because it means European data stays subject to European law.

Industry-specific regulations are where residency gets enforced. Banking regulations in most European countries require that financial data be processed within the country or within the EU. Healthcare regulations are similarly strict. Government data is even more restricted. These aren't guidelines; they're legal requirements. Banks that violate them face fines and license suspension. That's enforcement with teeth.

GDPR enforcement has gotten more serious. The Irish Data Protection Commissioner (DPC) has issued billions in fines for GDPR violations. Most of those fines have been against US tech companies for data transfer and processing issues. Companies take GDPR seriously now because enforcement is real.

Upcoming regulations will tighten things further. The EU's Data Act and proposed regulations on AI are adding more restrictions on data flows and non-EU entity access. These are designed to further incentivize data keeping data European. The EU is explicitly building a regulatory framework that makes sovereignty economically advantageous.

The regulatory environment is the foundation under all of this. Without regulatory pressure, most enterprises would stick with hyperscalers because they're good enough and well-understood. With regulatory pressure, sovereign alternatives become mandatory for specific workloads.

The Cost Equation: Sovereign vs. Hyperscaler

When enterprises evaluate sovereign cloud, one question keeps coming up: Is it worth the cost?

The honest answer is that it depends entirely on the workload and the regulatory environment.

For regulated workloads, sovereignty can actually be cheaper than the alternative. If you have to run workloads somewhere (government mandate, healthcare requirement, etc.), sovereign providers are often less expensive than hyperscalers, and they come with compliance built in. You're not paying for hyperscaler features you don't need. A European healthcare provider might find that OVHcloud is more cost-effective than AWS once you factor in compliance overhead.

For general workloads, hyperscalers are usually cheaper. They've achieved economies of scale that regional providers can't match. A startup running compute and storage might find AWS significantly less expensive than alternatives. Unless there's a regulatory reason, cost will drive the decision toward hyperscalers.

Migration costs are usually significant. Moving a workload from one cloud to another typically costs 2-4x the workload's annual operating cost. So if a workload costs

Long-term costs depend on scaling patterns and discount negotiations. Hyperscalers offer enterprise discounts that regional providers often can't match. But if you're building new infrastructure, sovereign providers are sometimes competitive. The equation changes year by year as the providers improve and the market matures.

The practical answer most enterprises reach is this: sovereign for mandatory workloads (compliance, government mandate, security-critical systems), hyperscaler for everything else. This hybrid model minimizes total costs while meeting regulatory requirements.

The Technical Architecture of European Sovereign Cloud

How does sovereign cloud actually work, technically speaking?

Physical infrastructure is located within European borders. Servers, storage, networking equipment—it's all in data centers within EU member states (or countries with adequately protective data laws). This is straightforward but also a significant cost. Building European-specific infrastructure means duplicating capabilities that hyperscalers have built globally.

Legal structure matters as much as physical location. The provider has to be European (or under European control) and subject to European legal jurisdiction. This means the company is governed by European law, employees are subject to European legal process, and the company can't be forced to violate European law by non-European governments. It's not foolproof, but it's meaningful.

Data sovereignty architecture varies by provider but typically involves:

- Encryption at rest and in transit, so data is protected even if accessed

- Key management under European control, meaning encryption keys aren't accessible from outside Europe

- Access controls and audit logging, so you can see who accesses your data and when

- Compliance certifications (ISO 27001, C5, etc.) that guarantee specific security and operational practices

- Legal protections and contracts that explicitly commit to data residency and European jurisdiction

Interoperability is a challenge. OVHcloud's APIs are different from AWS's APIs. Scaleway uses different APIs still. This is partly because European providers are smaller and can't match AWS's breadth, and partly because there's no unified European standard (yet—Gaia-X is trying to create one). For enterprises, this means workloads built on OVHcloud don't easily move to Scaleway. Once you choose a provider, you're somewhat locked in, just like with hyperscalers.

Performance and reliability have gotten better but are still not always as good as hyperscalers. A European provider with infrastructure in three countries can't match AWS's global network effects. But for European-only workloads, the difference is shrinking. European providers are improving their uptime, response times, and service quality. OVHcloud and others are now running at hyperscaler-comparable reliability levels.

The technical architecture is increasingly competent. Five years ago, the gap between hyperscalers and European providers was massive. Today, it's manageable for most workloads. This is why adoption is accelerating—the technical barrier to switching is lower than ever.

What This Means for IT Leaders and Enterprise Architecture

If you're responsible for cloud strategy in a European organization, here's what the sovereign cloud wave means for you.

Multi-cloud is now required, not optional. You need to plan for workloads on hyperscalers and workloads on sovereign platforms. That means standardizing on platform-agnostic technologies where possible (containers, Kubernetes, open APIs). It means treating infrastructure abstraction as a strategic priority. It means your architecture needs to accommodate portability.

Compliance becomes a strategic differentiator. Organizations that can easily demonstrate that data is European-resident and legally protected will have advantages in regulated markets. This is already happening in finance and healthcare. It's going to spread to other sectors. If your infrastructure is sovereign by design, you can market it as a feature.

Vendor relationships change. Instead of relying on a single hyperscaler, you need relationships with multiple providers. That's operationally messier but strategically safer. It also changes negotiating dynamics—you're not locked into one vendor's pricing.

Skill development becomes important. You need people who understand OVHcloud, Scaleway, or other European providers. You need architects who can design across multiple clouds. You need security people who understand European data protection law. These skills are rare now but will become standard.

Cost models shift. You might spend more on infrastructure (sovereign providers aren't always cheaper), but you spend less on compliance consulting and regulatory risk. You might spend more on engineering (multi-cloud complexity) but less on vendor audits (because you have more control). The total cost equation changes in ways that aren't always obvious.

Strategy becomes more complex but more resilient. Multi-cloud strategy is harder to execute than single-vendor strategy. But it's also more resilient—you're not betting your entire operation on AWS's reliability or Amazon's business decisions. If AWS has an outage, you can failover to sovereign infrastructure. If regulatory requirements tighten, you're already prepared. That resilience has value, even if it costs more upfront.

The organizations that will thrive in the next few years are those that start planning for multi-cloud architecture now, before they're forced to migrate under pressure.

The Gaia-X Initiative: Building a European Cloud Standard

Gaia-X deserves its own discussion because it represents a different approach to sovereignty than building individual cloud providers.

The basic idea is clever: instead of each European country building its own sovereign cloud or each company choosing among European providers, what if Europe created a federation standard that any provider could comply with? Data would still be European, still subject to European law, but providers could be competitive through standardization rather than each building proprietary infrastructure.

In practice, Gaia-X is a set of technical standards and legal/governance frameworks that providers can adopt. If you host on a Gaia-X-compliant provider, you get certain guarantees about data location, legal jurisdiction, operational practices, and (importantly) portability. Gaia-X providers are supposed to be interoperable, meaning you could theoretically move data from one Gaia-X provider to another more easily than between non-compliant providers.

The initiative involves major companies (SAP, Siemens, Deutsche Telekom, Telefónica, etc.), smaller providers, and European governments. It's well-funded and strategically important to the EU.

But Gaia-X is also proving to be harder than expected. Getting competitors to agree on technical standards is difficult. Getting legal frameworks right across multiple European countries is complex. Many providers have adopted Gaia-X in limited ways or haven't fully implemented it. The vision of a unified, portable, interoperable European cloud hasn't materialized in the way original proponents hoped.

Despite these challenges, Gaia-X is influencing the market. It's creating pressure on providers to be more transparent and interoperable. It's establishing standards that are slowly being adopted. Over five to ten years, as compliance improves, Gaia-X could genuinely simplify European multi-cloud architectures. But we're not there yet.

Security and Trust in the Sovereign Cloud Model

Much of the sovereign cloud narrative is built on trust—trust that European providers won't allow US government access to data, trust that European legal protections are real, trust that sovereignty means security.

It's worth being honest about the limitations.

Physical access to infrastructure can be obtained by governments in any country if they decide national security requires it. European countries have intelligence agencies. Europe has terrorism threats. A European government can potentially force a European cloud provider to hand over data if they consider it a security matter. It's less likely than US government overreach, but it's possible. Sovereignty is better than US dependence, but it's not absolute security.

Supply chain vulnerabilities exist everywhere. A piece of hardware might have a backdoor. Telecommunications infrastructure might be compromised. Employees might be compromised. These risks exist for every provider, in every country. Sovereignty reduces (but doesn't eliminate) the risk of large-scale systemic access.

Encryption provides real protection. If data is encrypted with keys that the provider doesn't control, then physical access to infrastructure doesn't give data access. This is important for both European providers and hyperscalers. The organizations most serious about security are encrypting data and controlling keys themselves, which means they're trusting neither their provider's promises nor their provider's good will—they're protecting themselves through cryptography.

Trust and verification are important. The security benefit of sovereign cloud isn't the magic of sovereignty itself; it's the combination of limited jurisdiction (one country's legal system rather than US global reach), transparency (you can audit what you're allowed to see), and encryption (technical protection regardless of trust). Organizations using sovereign cloud should still verify their provider's security practices, still audit compliance, still monitor for unauthorized access.

The honest version is that sovereign cloud provides real security and compliance benefits for regulated data and strategic systems. It's genuinely better than putting sensitive European data on US infrastructure if you're concerned about US government access. But it's not perfect security, and no provider can guarantee absolute protection. The benefit is reducing risk and adding legal control, not eliminating risk entirely.

Market Predictions: What Sovereign Cloud Looks Like by 2030

If the current trajectory holds, here's what I expect.

By 2028-2029, European sovereign cloud spending likely exceeds $30 billion annually. Growth will slow somewhat from the current 55% year-over-year (as the market matures), but will still outpace global growth. Europe will be firmly established as the world's second-largest sovereign cloud market.

Regulatory consolidation will happen. The fragmented landscape of different European providers and national initiatives will slowly consolidate into maybe five to eight major players (OVHcloud, state-backed providers in major countries, hyperscaler sovereign offerings, and maybe one or two surprise winners). Smaller providers will either exit or be acquired.

Hyperscaler adaptations will continue. AWS, Azure, and Google Cloud will increasingly offer sovereign solutions, whether through isolated regions, regional partnerships, or direct operations in Europe. They'll position themselves as the compliant option for enterprises that want scale and sovereignty. They won't dominate sovereign spending, but they'll capture a significant share.

Workload migration will accelerate but remain concentrated in regulated sectors. By 2030, maybe 25-30% of European enterprise workloads will be on sovereign or regional providers, up from the current 20%. The growth will be fastest in finance, healthcare, and government. General-purpose workloads will remain mostly on hyperscalers.

Gaia-X will either become real or fade. If Gaia-X achieves genuine portability and interoperability across providers, it will accelerate European multi-cloud adoption. If it remains aspirational without operational capability, it will have limited impact. The market will likely bifurcate: some organizations will succeed with multi-vendor strategies, others will stick to single sovereign providers because multi-cloud is too complex.

Costs will normalize. Sovereign providers will achieve better economies of scale, bringing costs closer to hyperscaler parity (at least for core services). This will remove cost as a barrier to adoption, letting regulatory and strategic requirements drive decisions more cleanly.

Global impact will emerge. If Europe successfully builds a thriving sovereign cloud ecosystem, other regions (India, Japan, Brazil, Middle East) will try to replicate it. This could fragment the cloud market from today's hyperscaler-dominated duopoly into a more regionally balanced market. That's not necessarily bad—it could mean better security, more competition, and genuinely distributed cloud architecture globally.

The most likely outcome is something like this: a genuinely multi-vendor European cloud market that coexists with hyperscaler dominance. Most organizations will use both, choosing based on workload requirements rather than trying to be pure hyperscaler or pure sovereign. The balance will gradually shift toward more sovereignty as regulations tighten and providers mature, but hyperscalers will remain significant.

The Strategic Imperative: Why European Enterprises Need to Act Now

If you're running a European company, here's why you should start planning for multi-cloud architecture now, before you're forced to.

Regulatory timing is uncertain. You don't know exactly when compliance requirements will force migration. Regulations evolve quickly—GDPR seemed speculative before 2018, and now it's a decade of operational reality. The Data Act and other upcoming regulations could create hard requirements faster than expected. Being prepared is cheaper than scrambling.

Vendor decisions have long lifespans. Cloud architecture, once locked in, is expensive and disruptive to change. The decisions you make now about what runs where will shape your technology landscape for five to ten years. Making good architectural decisions now is easier than rearchitecting after regulatory pressure forces it.

Procurement advantages go to early movers. As sovereign cloud adoption accelerates, competition for resources and talent will increase. Providers that build customer relationships and integrate into architecture early will have advantages. If you wait until you're forced to migrate, you'll be one of thousands trying to buy sovereign capacity at the same time.

Skill development takes time. Training teams on new platforms, building expertise, and establishing operational practices doesn't happen overnight. If you start now, by the time you need to migrate, you'll have teams that know the platforms. If you wait, you'll be training under deadline pressure, which is expensive and risky.

Cost optimization is possible only with foresight. Building efficient multi-cloud architecture requires deliberate design. If you're forced to migrate quickly, you'll do it inefficiently, probably overspending on migration and underperforming operationally. Planned migration lets you optimize.

Competitive advantage can emerge from being an early adopter of sovereign infrastructure. If you're the first in your market segment to run on sovereign cloud, you can market it as a competitive advantage—"all your data stays in Europe, subject to European law." By the time everyone's doing it, that advantage disappears.

The enterprises that win in the next few years will be those that started planning sovereign cloud strategy a year or two ago and are executing now. Those that wait until they're forced will spend more, move slower, and end up chasing the market.

Conclusion: The Sovereign Cloud Future Is Arriving

Europe's tripling of sovereign cloud investment between 2025 and 2027 isn't just growth—it's a structural shift in how cloud infrastructure is organized and operated in the world's largest regulated market.

It's driven by genuine concerns—regulatory compliance, geopolitical risk, data security—not by vendor marketing or speculative technology trends. It's happening slowly enough that most enterprises have time to adapt, but fast enough that waiting becomes increasingly risky. It's creating new vendors and opportunities while maintaining the dominance of existing providers. It's making the cloud market more complex while potentially making it more secure and more resilient.

The companies and organizations that will thrive are those that understand this transition, plan for it strategically, and start making architectural and vendor decisions now. Waiting for regulations to force you into sovereignty is possible, but expensive. Understanding the trend, building multi-cloud readiness, and making deliberate choices about what runs where gives you options and reduces risk.

Sovereign cloud isn't replacing global cloud providers. It's becoming a critical part of the ecosystem alongside them. The question for European enterprises isn't whether sovereign cloud matters—it clearly does. The question is how to integrate it into strategy, architecture, and operations in a way that balances compliance, cost, capability, and resilience.

That balance is the work of the next few years. And the organizations that get it right will have genuinely more secure, more compliant, and more resilient infrastructure. Those that get it wrong will be scrambling to migrate under deadline pressure, overspending, and accepting operational pain. The difference between those outcomes is starting the work now.

The sovereign cloud transition isn't coming. It's here, it's growing fast, and it's reshaping European enterprise infrastructure. The smart move is getting ahead of it.

FAQ

What is sovereign cloud and how does it differ from regular cloud?

Sovereign cloud refers to cloud infrastructure that's legally controlled by, operated within, and subject to the jurisdiction of a specific country or region (typically Europe in this context). Unlike standard cloud providers like AWS or Microsoft Azure that operate globally, sovereign cloud prioritizes data residency—keeping data physically and legally within specified borders. This means data is subject to that country's laws rather than US law, and governments can't access it through mechanisms like the Cloud Act. The key difference is jurisdictional control and legal protection, not just physical location.

Why is Europe investing so heavily in sovereign cloud infrastructure?

Europe's surge in sovereign cloud spending is driven by multiple converging factors: strict regulatory requirements like GDPR and country-specific data residency laws, geopolitical concerns about US government surveillance and control of critical data, the Cloud Act which allows US authorities to demand data from US providers even when stored overseas, national security interests in critical infrastructure, and strategic autonomy goals set by the European Union. Governments, financial institutions, healthcare providers, and critical infrastructure operators face either regulatory mandates or competitive pressure to keep sensitive data under European control. It's both a regulatory necessity and a strategic imperative.

What percentage of enterprise workloads will actually migrate to sovereign cloud solutions?

Current projections estimate that only about 20% of current European enterprise workloads will migrate to sovereign or regional cloud providers in the near term. This includes heavily regulated sectors like banking, insurance, healthcare, government, and critical infrastructure. The remaining 80% of workloads—general-purpose computing, development environments, non-sensitive applications—will likely remain on hyperscalers like AWS and Microsoft Azure. However, this percentage will gradually increase as sovereign solutions mature, costs become more competitive, and regulatory pressure intensifies. Many enterprises are adopting a hybrid approach: hyperscalers for most workloads, sovereign providers for compliance-critical systems.

What are the main regulatory drivers behind sovereign cloud adoption?

Several regulations are pushing European adoption of sovereign cloud. GDPR established baseline requirements for protecting EU citizens' data and created awareness of jurisdictional issues. Country-specific laws in Germany, France, and other nations impose strict data residency requirements for certain data types. The US Cloud Act allows American authorities to demand data from US providers globally, creating a major concern for European organizations. Industry-specific regulations for finance, healthcare, and critical infrastructure mandate local control of sensitive data. Upcoming regulations like the EU's Data Act will further restrict non-EU access to European data. These regulations create both legal requirements and compliance risks that drive enterprises toward sovereign solutions.

How do costs compare between sovereign cloud providers and hyperscalers?

The cost comparison depends on the workload type. For regulated workloads where sovereignty is mandatory, European providers like OVHcloud are often competitive with or cheaper than hyperscalers when you factor in compliance overhead. For general-purpose workloads, hyperscalers (AWS, Azure, Google Cloud) are usually more cost-effective due to their economies of scale and pricing flexibility. Migration costs are typically significant—usually 2-4x the workload's annual operating cost—which makes moving general workloads economically difficult to justify. However, as European providers scale and optimize their offerings, and as regulatory enforcement increases, the cost differential is narrowing. Many enterprises find that the total cost of sovereignty (including compliance benefits) justifies a modest price premium for critical workloads.

Which industries are leading the sovereign cloud adoption wave?

Government and public sector organizations are the clear leaders, driven by explicit regulatory mandates for sovereign infrastructure. Financial services follow closely, motivated by regulatory requirements and strategic concerns about operational independence. Healthcare and life sciences are rapidly growing due to strict patient data protection regulations and data residency requirements. Telecommunications and critical infrastructure (energy, utilities) are significant adopters because they're defined as strategically important to national security. Manufacturing and industrial sectors are moving more slowly but accelerating as they accumulate more sensitive operational data in cloud infrastructure. SMEs and general business sectors are the slowest to adopt, as they face less regulatory pressure and are cost-sensitive.

What is Gaia-X and why does it matter?

Gaia-X is an initiative to create a European cloud federation standard that any provider can comply with, rather than building individual sovereign cloud platforms. The idea is to establish technical standards and governance frameworks that ensure data stays European, subject to European law, and portable across compliant providers. This would theoretically allow organizations to use multiple providers while maintaining sovereignty and interoperability. While well-funded and strategically important to the EU, Gaia-X has faced challenges in achieving technical standardization and operational implementation. It influences the market by promoting transparency and interoperability, but full portability between Gaia-X providers hasn't yet materialized. The initiative remains important for long-term European cloud strategy but shouldn't be relied upon as a current solution for multi-cloud portability.

Will hyperscalers lose significant market share to European sovereign providers?

Unlikely in the near term. AWS, Microsoft Azure, and Google Cloud will continue to dominate the majority of European enterprise workloads because they offer scale, features, maturity, and cost advantages that European providers can't match. However, hyperscalers are responding by launching sovereign offerings (like AWS Sovereign Cloud) that attempt to offer compliance and European residency while maintaining their operational model. The more likely scenario is market segmentation: hyperscalers retain dominance for general workloads while losing share in compliance-critical workloads to European providers and their own sovereign offerings. By 2030, Europe might see 25-30% of workloads on sovereign or regional providers, up from 20% now, but hyperscalers will remain the dominant provider. The market will become more multi-vendor, but not fundamentally different in leadership.

What are the main technical challenges in adopting sovereign cloud?

The primary technical challenges include operational lock-in (sovereign providers use different APIs and tools than hyperscalers, making migration difficult), limited ecosystem and third-party tool support compared to hyperscalers, smaller service portfolios (European providers don't offer the breadth of AI, analytics, and specialized services that AWS does), skill gaps in the market (there's far less expertise with sovereign providers than with major hyperscalers), interoperability issues between different sovereign providers (no unified standard exists yet), and performance or reliability concerns in some cases (though this gap is closing). Organizations typically address these through careful workload selection, accepting that they won't migrate everything, standardizing on abstraction layers (like containers), and investing in multi-cloud expertise.

How should European enterprises approach multi-cloud strategy now?

The recommended approach is to start planning multi-cloud architecture immediately rather than waiting for regulatory pressure to force migration. This involves assessing which workloads must be sovereign (regulated data, government requirements, strategic systems) versus which can remain on hyperscalers, designing cloud-agnostic architectures where possible (using containers, Kubernetes, standardized APIs), building relationships with sovereign providers and hyperscalers, developing expertise in multi-cloud operations, and establishing governance frameworks that can manage workloads across providers. Early movers gain advantages in vendor selection, cost negotiation, talent availability, and operational maturity. Organizations that wait until forced to migrate will pay more and move less efficiently.

Try Runable for automating your multi-cloud architecture documentation and compliance reporting across Europe's sovereign cloud landscape.

Use Case: Generate compliance documentation and infrastructure reports automatically across multiple sovereign cloud providers and hyperscalers.

Try Runable For Free

Key Takeaways

- European sovereign cloud IaaS spending will triple from 23.1B by 2027, representing 55% year-over-year growth versus 35% global average

- Europe will overtake North America as the second-largest sovereign cloud market by 2027, behind only China, reshaping global cloud infrastructure geography

- Regulatory drivers including GDPR, data residency laws, and the US Cloud Act are forcing enterprises toward sovereign solutions for compliance and strategic control

- Only 20% of current European workloads will initially migrate to sovereign providers; most enterprises are adopting hybrid multi-cloud strategies with hyperscalers handling general workloads

- European sovereign cloud providers like OVHcloud are now technically competitive with hyperscalers, removing the primary technical barrier to adoption

- Organizations starting multi-cloud planning now will have cost and operational advantages over those forced to migrate under regulatory deadline pressure

Related Articles

- Why Startups Are Prime Targets for Hackers in 2025

- Substack Data Breach: What Happened & How to Protect Yourself [2025]

- Flickr Data Breach 2025: What Was Stolen & How to Protect Yourself [2025]

- Why Companies Won't Admit to AI Job Replacement [2025]

- Quishing: The QR Code Phishing Scam Taking Over [2025]

- Data Center Services in 2025: How Complexity Is Reshaping Infrastructure [2025]

![Europe's Sovereign Cloud Revolution: Investment to Triple by 2027 [2025]](https://tryrunable.com/blog/europe-s-sovereign-cloud-revolution-investment-to-triple-by-/image-1-1770721938278.jpg)