When Success Becomes a Problem: Mouse Computer's Unprecedented Sales Halt

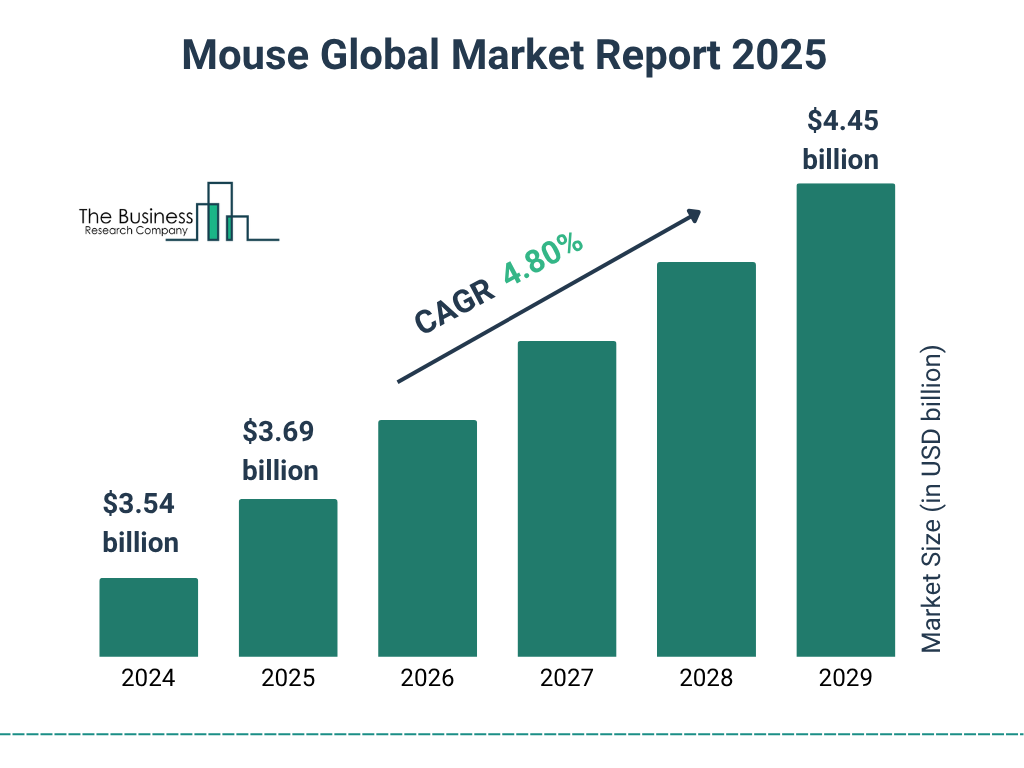

Imagine being so successful that you have to stop taking orders. It sounds absurd, but that's exactly what happened to one of Japan's largest PC manufacturers in late 2025. Mouse Computer, a brand that's quietly dominated the Japanese market for years, made a decision that sent shockwaves through the entire computing industry: they shut down all sales, across all brands and platforms, for nearly two weeks.

Not because of a disaster. Not because of bankruptcy or a recall. But because demand completely overwhelmed their ability to deliver.

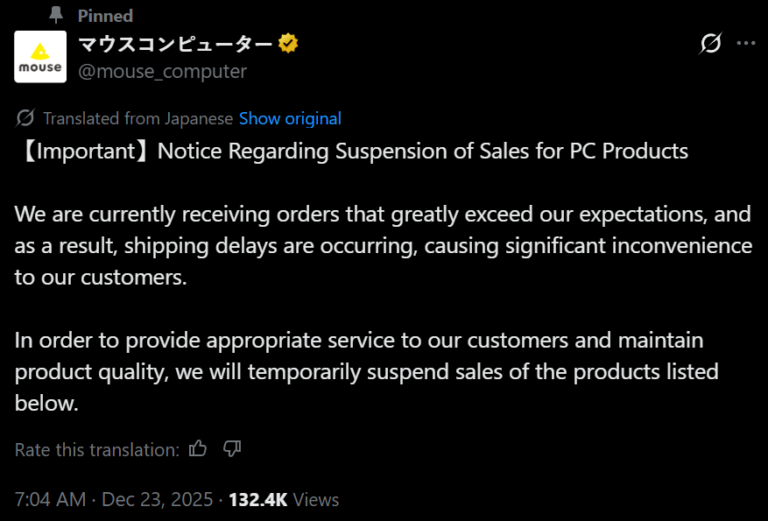

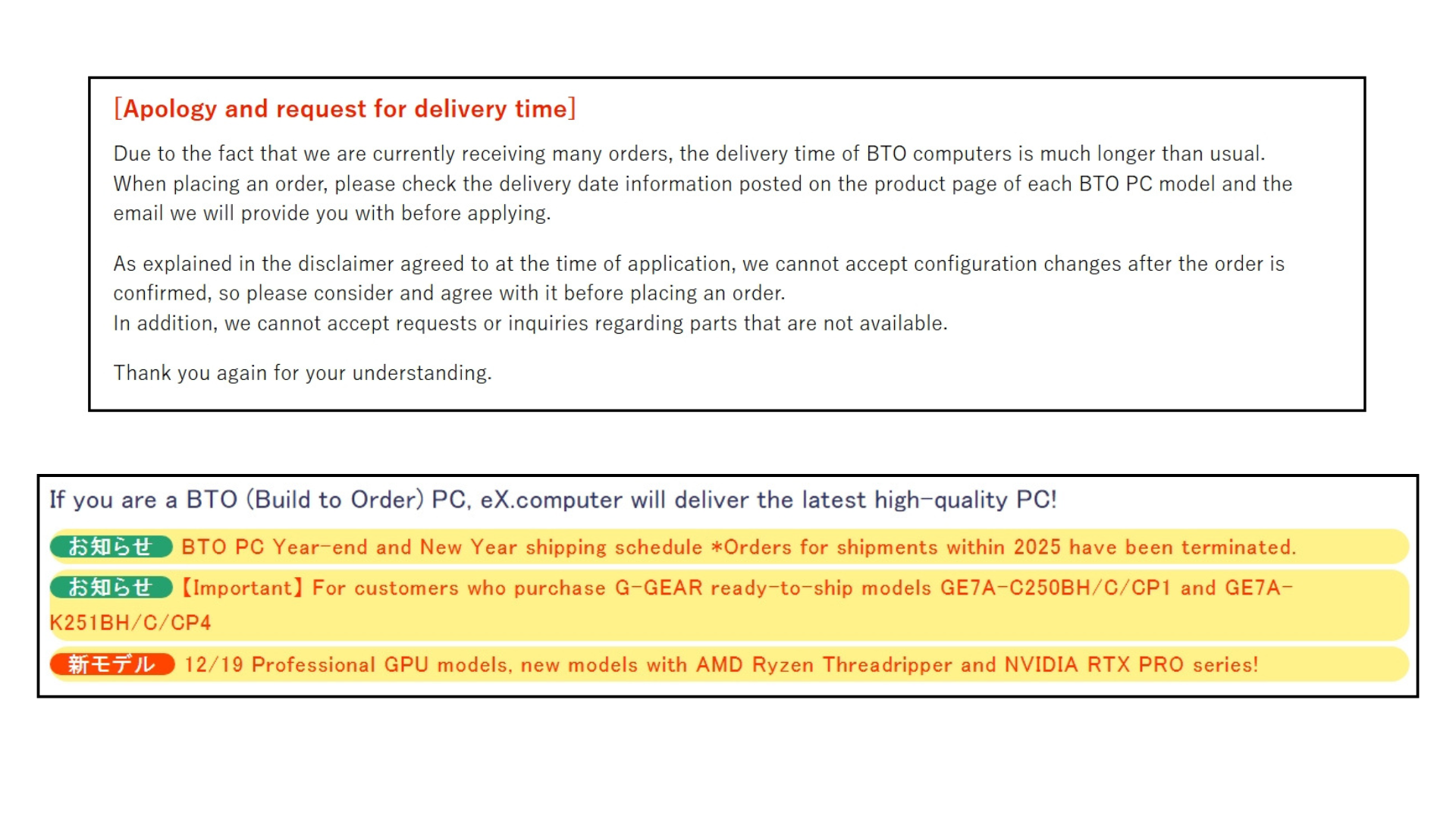

On December 23, 2025, Mouse Computer announced a sales suspension affecting every single product line: Mouse-branded systems, NEXTGEAR gaming rigs, DAIV workstations, and GTUNE laptops. Direct retail locations would also close. The pause would last until January 5, 2026, with no guarantee of immediate inventory when doors reopened.

This isn't just a supply chain hiccup. It's a rare window into how modern manufacturing works, where demand can spike so dramatically that even a well-established company with decades of experience hits an operational wall. And the story behind it reveals something deeper: the entire PC manufacturing ecosystem is under unprecedented pressure from multiple directions simultaneously.

The timing made it worse. This suspension canceled Mouse's planned New Year's in-store sale, one of the biggest shopping events of the year in Japan. It's the kind of decision a company makes only when continuing to take orders would actively harm customer satisfaction and the brand's reputation.

But here's the real story. This wasn't a sudden disaster. It was a perfect storm of market forces colliding at exactly the wrong moment.

TL; DR

- Mouse Computer halted all PC sales from December 23, 2025 through January 4, 2026 across four major brands and retail locations

- Demand exceeded projections so dramatically that production capacity became the bottleneck, not available customers

- Component shortages in memory and SSDs were exacerbated by AI data center demand, creating artificial scarcity

- Price increases loomed, causing customers to rush purchases before January 2026 rate hikes

- Factory margins are dangerously thin, meaning Mouse operates with almost no buffer for demand spikes

- This reveals systemic weakness in how PC makers manage supply chains when conditions change rapidly

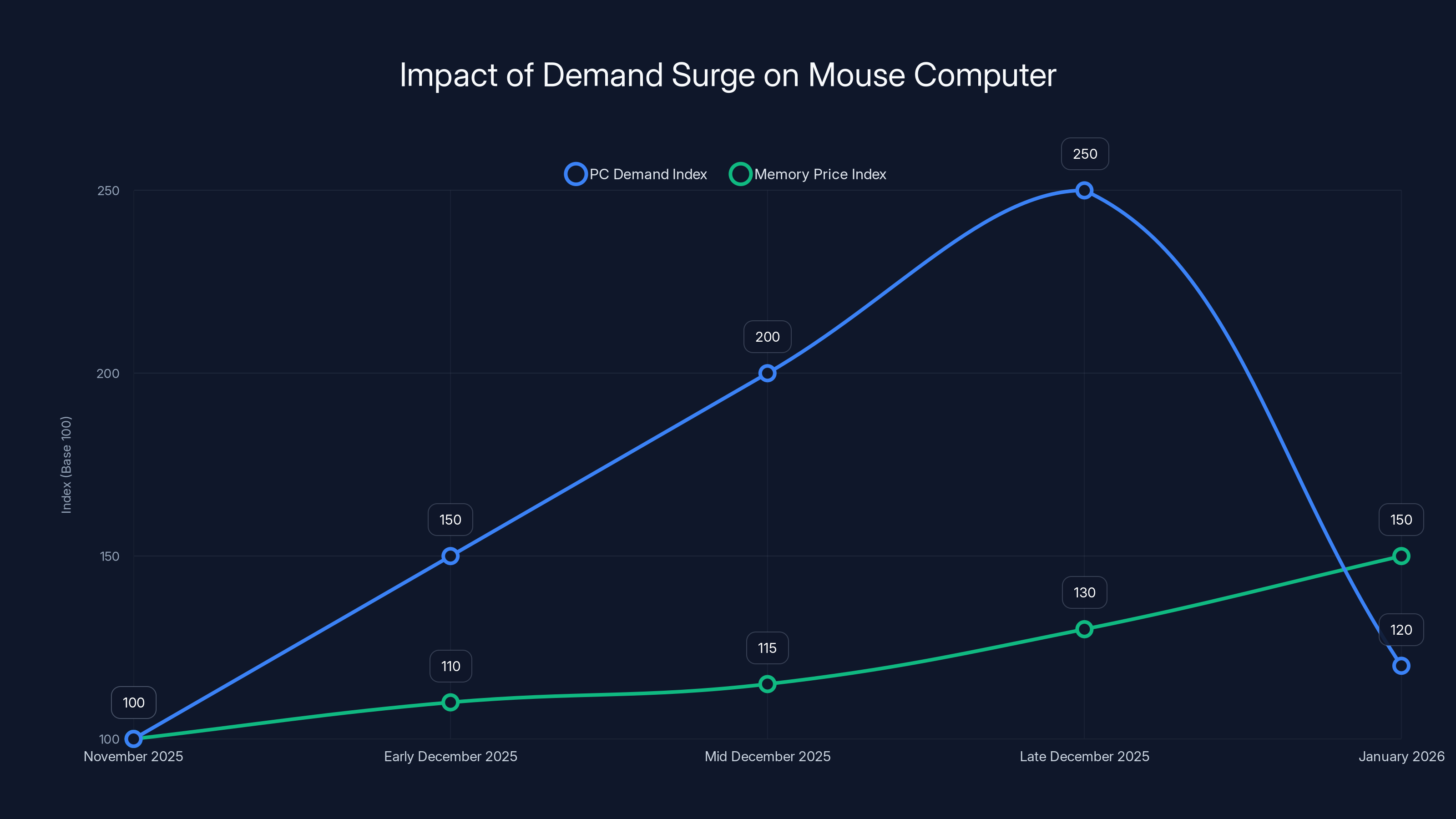

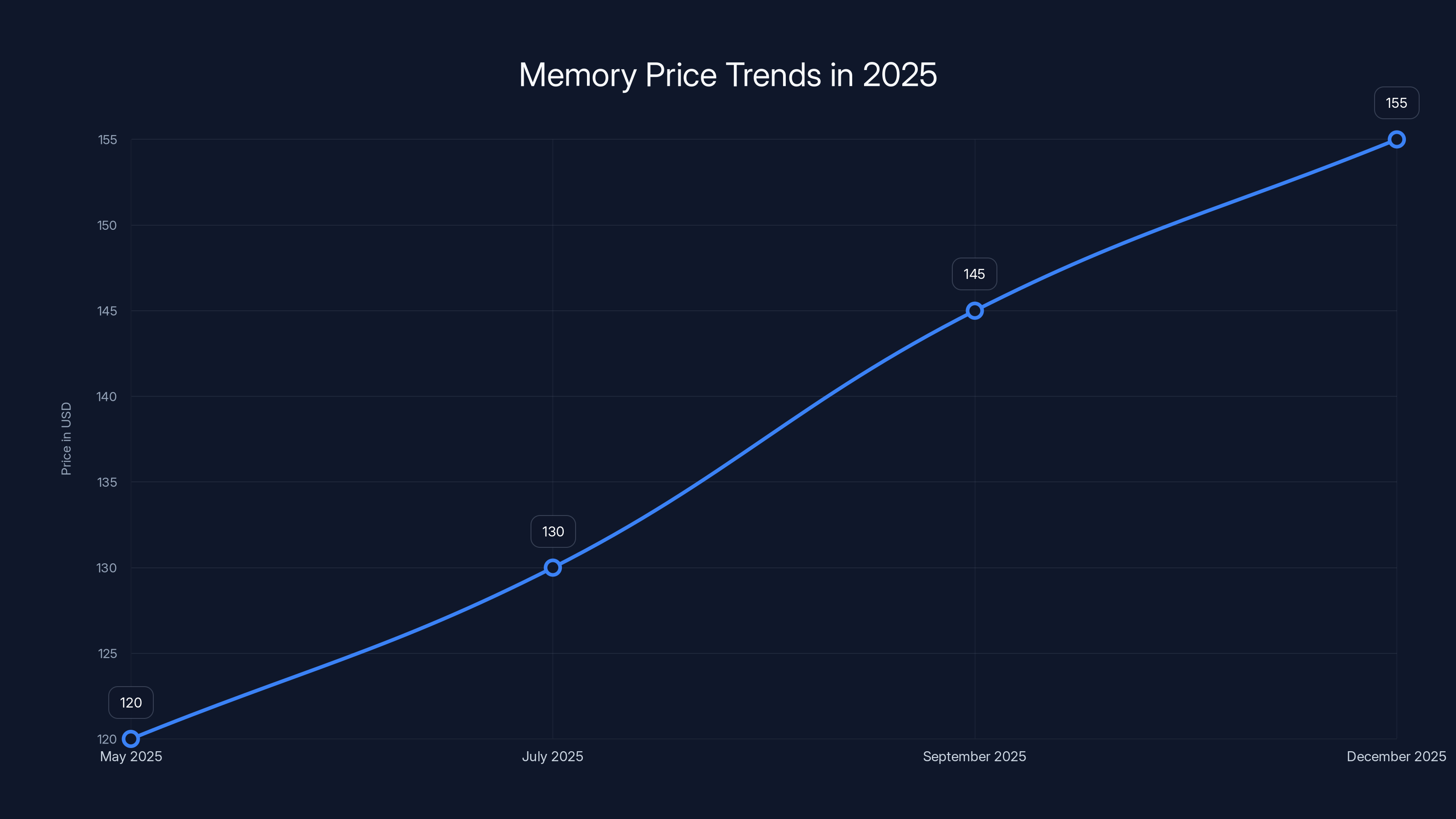

Estimated data shows a significant spike in PC demand and memory prices in December 2025, driven by panic-buying before anticipated price hikes.

The Perfect Storm: How Demand Spiraled Out of Control

Mouse Computer's sales suspension didn't happen in a vacuum. It was the result of three distinct pressures hitting the company simultaneously, each one manageable alone but devastating in combination.

First, there's the simple reality of the holiday season. Every PC maker expects December to be their biggest month. It's when students buy gaming rigs, professionals upgrade workstations, and companies purchase systems for year-end projects. Mouse definitely anticipated this. They would have increased production runs, adjusted staffing, and prepared their supply chain accordingly.

But then something else happened: customers started panic-buying.

Industry insiders had been signaling for weeks that component prices would spike starting in January 2026. Memory manufacturers and SSD makers were preparing price increases. The reason? Demand from artificial intelligence data centers had created a supply shortage, pushing costs higher. Suddenly, holding off on a PC purchase became financially risky. Every potential customer knew that the system they wanted to buy next month would cost

So they didn't wait. They purchased in December instead.

This created a demand surge that was fundamentally different from normal holiday shopping. It wasn't organic market growth. It was artificial acceleration as customers tried to buy before prices changed. When you compress several months of purchases into a few weeks, even a well-staffed factory can't keep pace.

The third factor was component availability itself. Mouse Computer doesn't make memory chips or SSDs. They source these components from suppliers. And those suppliers were already experiencing shortages due to AI data center demand. Memory prices had risen approximately 15-30% in the months leading up to the suspension, depending on the specific type and configuration. SSDs were experiencing similar constraints.

What this meant in practical terms: Mouse couldn't simply order more components to fulfill orders faster. The components weren't available at any price point. So they had to make a choice. Either keep accepting orders they couldn't fulfill for weeks or months, damaging customer relationships and their reputation. Or pause sales temporarily, work through the backlog, stabilize their supply chain, and reopen when they could actually promise reasonable delivery times.

They chose option two.

The Snowball Effect of Holiday Demand

During normal months, Mouse Computer likely ships orders within 2-4 weeks of purchase. Customers expect this timeline. But as orders piled up in December, that window stretched to 6, 8, maybe 10 weeks. Every day of delays meant more customers calling support, more refund requests, more negative reviews on retail sites.

From a business perspective, this is poison. In the PC market, which is increasingly commoditized, reputation is one of the few differentiators left. Once customers start complaining about delivery delays, other customers take notice. They choose a competitor instead. Mouse Computer saw the writing on the wall.

The company explicitly stated that the suspension was necessary to "maintain product quality and provide adequate customer support." This might sound like corporate speak, but it reflects a real concern: continued sales at the rate they were happening would have actually damaged the brand more than a temporary shutdown would.

Another factor that amplified this: Mouse Computer's product portfolio is diverse. They don't just make generic office PCs. They have gaming systems under the NEXTGEAR brand, which are highly customized and have longer build times. They have DAIV workstations, which are configured for specific professional applications. They have GTUNE high-end gaming laptops. Each product line operates on different build schedules, has different component requirements, and competes for factory floor space.

When demand surges, you can't just spin up production on everything equally. You have bottlenecks at the assembly stage, the testing stage, the packaging stage. You have limited technicians who can build custom configurations. You have shipping logistics that cap how many units can go out per day.

Add all of this together, and suddenly a sales volume that's 150% of normal capacity becomes literally impossible to manage without destroying the company's operations and customer satisfaction simultaneously.

The cost of purchasing a PC system increased by 23% from December 2025 to January 2026, prompting a rush in purchases before the price hike. Estimated data.

Component Shortages: The Invisible Killer

On the surface, it's easy to miss the significance of component shortages in Mouse Computer's decision to halt sales. The press release mentions them, but doesn't emphasize them. That's actually a mistake. The component shortage is arguably the most important factor in this entire situation.

Memory (RAM) and SSDs are the two most expensive components in any modern PC after the CPU and GPU. They're also the items that require the longest lead times from suppliers. When you order a batch of memory chips, you might have to wait 8-12 weeks for delivery. SSDs have slightly better availability, but not by much.

For the first eleven months of 2025, this wasn't a major issue. Memory prices had stabilized somewhat after the inflation of 2023-2024. Supply was relatively stable. Manufacturers could plan their production runs confidently.

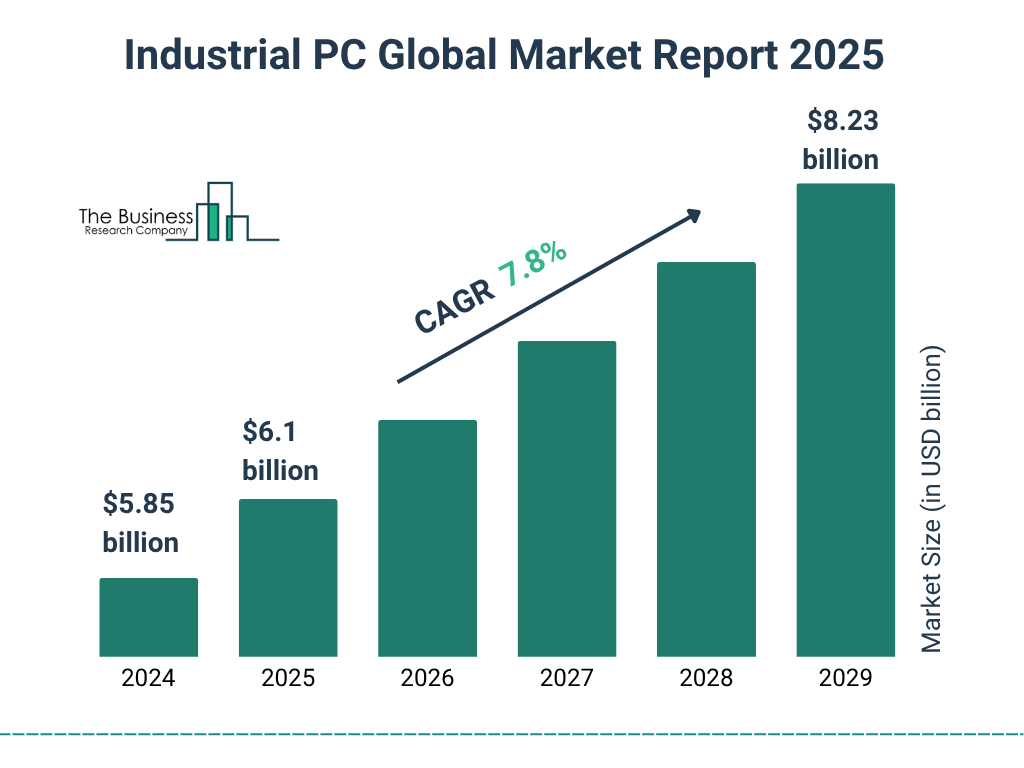

Then AI happened. More specifically, the escalating investment in AI data center infrastructure happened.

Artificial intelligence models, particularly the large language models that power Chat GPT, Claude, and similar services, require enormous amounts of memory and storage. A single GPU cluster for training an AI model can require terabytes of high-speed memory. Data centers running inference (using trained models to generate responses) need even more storage capacity. The demand from technology companies building out AI infrastructure became insatiable.

Memory chip manufacturers like SK Hynix, Samsung, and Micron started allocating more of their production capacity to high-end server memory. This meant less capacity for consumer and workstation memory. Simple supply-and-demand economics: less supply drives higher prices.

By late 2025, memory prices had risen again. A 32GB DDR5 kit that might have cost

For a PC manufacturer, this creates a brutal situation. You have two choices:

Option 1: Lock in component prices now, even though they're elevated, so you can fulfill orders at your current price points. This erodes your profit margins significantly.

Option 2: Refuse orders until component prices normalize, betting that prices will eventually come down. This loses current sales but protects margins.

Mouse Computer basically chose option 2, but not by choice. They didn't refuse orders proactively. They accepted orders they couldn't fulfill because their suppliers couldn't provide the components at acceptable lead times.

Here's where it gets interesting: Mouse Computer sources components on what's called an "indirect" supply model. They don't buy directly from Samsung or SK Hynix. They buy from distributors, who buy from manufacturers. This means Mouse is several steps away from the actual supply source. When distributors start rationing supplies, companies like Mouse feel the impact hardest.

Some of the largest PC manufacturers, like Dell or Lenovo, have enough scale and negotiating power to secure direct allocations from component makers. Mouse Computer, while large in Japan, doesn't have that global clout. So when distributors run low on inventory, Mouse runs out first.

The Mathematics of Component Inflation

Let's put numbers to this problem. Assume Mouse Computer's average gaming system has:

- 32GB DDR5 RAM: 120 earlier)

- 1TB NVMe SSD: 75 earlier)

- Other components: $800

Total cost increase: $50 per system

Now imagine Mouse Computer has 5,000 units in backlog. That's $250,000 in additional costs that weren't budgeted. For a smaller manufacturer, that's not a marginal rounding error. That's a significant hit to quarterly profitability.

But the real problem isn't the current cost increase. It's the uncertainty. If you're Mouse Computer, you don't know whether component prices will stay elevated or drop. You don't know whether your supplier can deliver 500 units of memory this month or 200. You don't know whether an order placed today will actually be fulfillable in 4 weeks.

That uncertainty kills efficiency. Factories need predictability to run smoothly. When you can't predict what components you'll have available, you can't plan production schedules. You can't make promises to customers about delivery dates. Everything grinds into chaos.

The solution, from Mouse Computer's perspective, was to stop accepting orders until the supply situation stabilized and they could accurately predict component availability again.

Price Increases: The Catalyst Nobody Talks About

Here's the sentence from industry sources that should have gotten more attention: "Customers seeking new systems have reportedly rushed to purchase hardware ahead of expected price revisions set to take effect from January 2026."

This is the sentence that explains everything. This is the catalyst that transformed normal holiday demand into panic buying.

PC manufacturers had publicly announced that prices would increase starting January 1, 2026. This wasn't a vague warning. It was specific. Companies like ASUS, MSI, and others had quietly informed retailers and integrators that price increases would go into effect. Memory manufacturers had made similar announcements.

For a potential buyer, the math was simple:

- Buy a system in December at current prices: $1,500

- Buy the same system in January at new prices: $1,850

- Savings by buying before January: $350

That's real money. That's not a 5% increase that people can shrug off. That's a 23% jump. For students or small businesses, that's the difference between "I can afford this" and "I need to wait another year."

So what happened? Everyone who was even remotely considering a PC purchase suddenly decided they needed to buy right now, before prices went up.

Mouse Computer saw this coming. They likely prepared for higher-than-normal December demand. But they couldn't have predicted how severe it would be because the announcement of price increases was relatively recent. Companies typically announce price changes only a few weeks before they take effect to avoid customers sitting on purchases for months.

This created a timing problem. Demand spiked harder and faster than factories could scale production. Component suppliers couldn't deliver fast enough. Shipping and logistics had already been stretched thin from normal holiday demand. Everything snapped simultaneously.

Why Price Increases Happen

Before we move on, it's worth understanding why PC manufacturers increase prices at all. It's not pure greed. There are actual economic pressures:

Component costs rise: As we discussed, memory and SSD prices were increasing due to AI data center demand. Manufacturers need to pass these costs along or absorb them (which destroys profitability).

Shipping costs increase: After the massive volatility in shipping and logistics from 2022-2024, prices have remained elevated. A PC shipped globally costs more than it did five years ago.

Labor costs increase: Wages in manufacturing regions, particularly Southeast Asia where many PC components are assembled, have increased year-over-year.

Regulatory costs increase: Battery regulations, safety certifications, and environmental compliance get more stringent every year, adding costs.

So price increases are somewhat inevitable. But the timing of announcing them is critical. Announce too early, and you lose sales as customers delay purchases. Announce too late, and you lose profit margin by not capturing the higher prices.

Mouse Computer's competitors had timed their announcements for late November/early December, which gave customers just enough time to panic-buy before prices went up. This worked exactly as intended from a business perspective—it drove December sales higher. The unintended consequence was that one manufacturer (Mouse Computer) hit their capacity wall and had to shut down.

Would other manufacturers have made the same decision? Possibly. Dell and Lenovo have more production flexibility due to their scale, so they probably could have absorbed the surge. But a focused manufacturer like Mouse Computer, with operations primarily in Japan, had less flexibility.

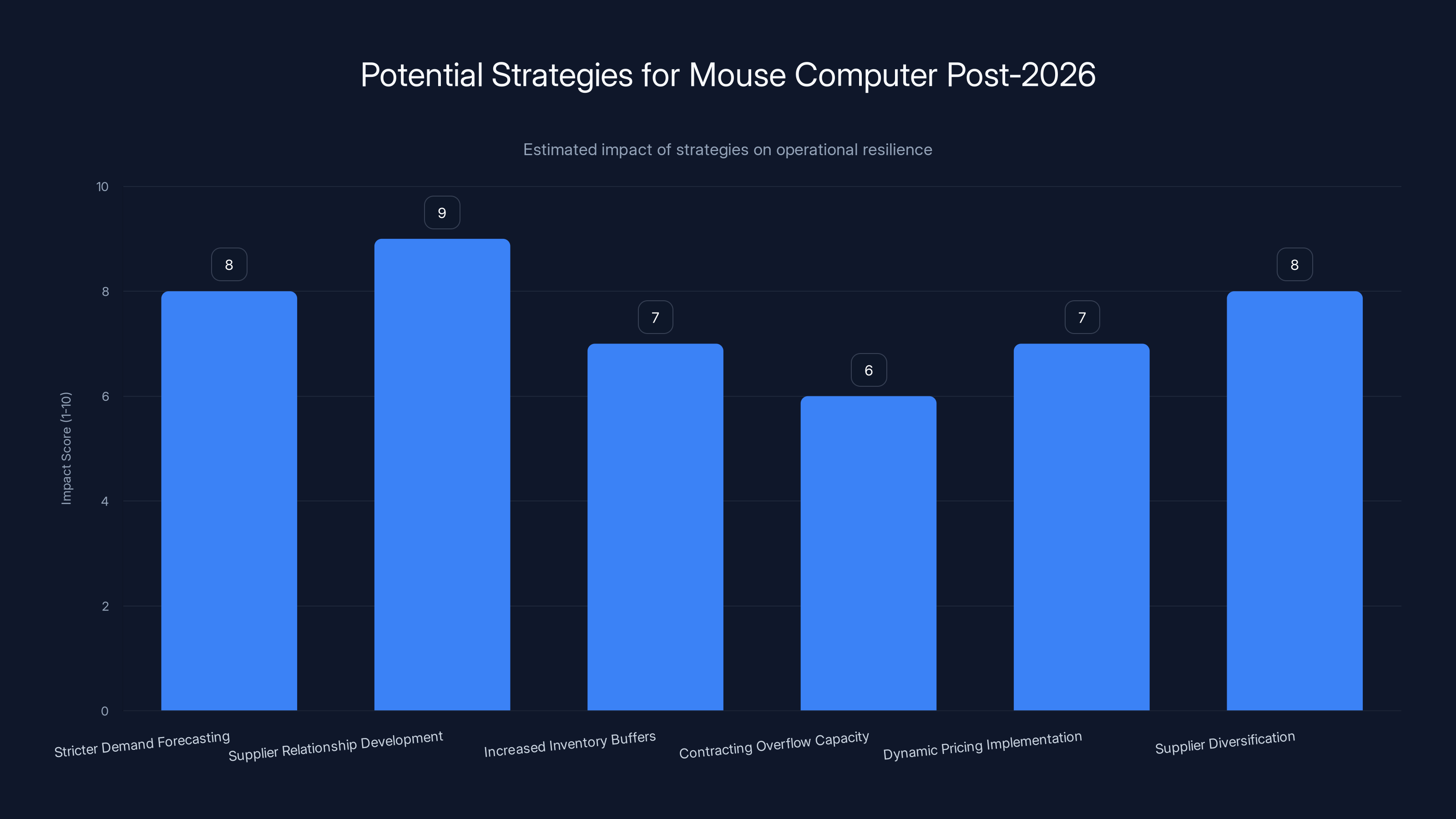

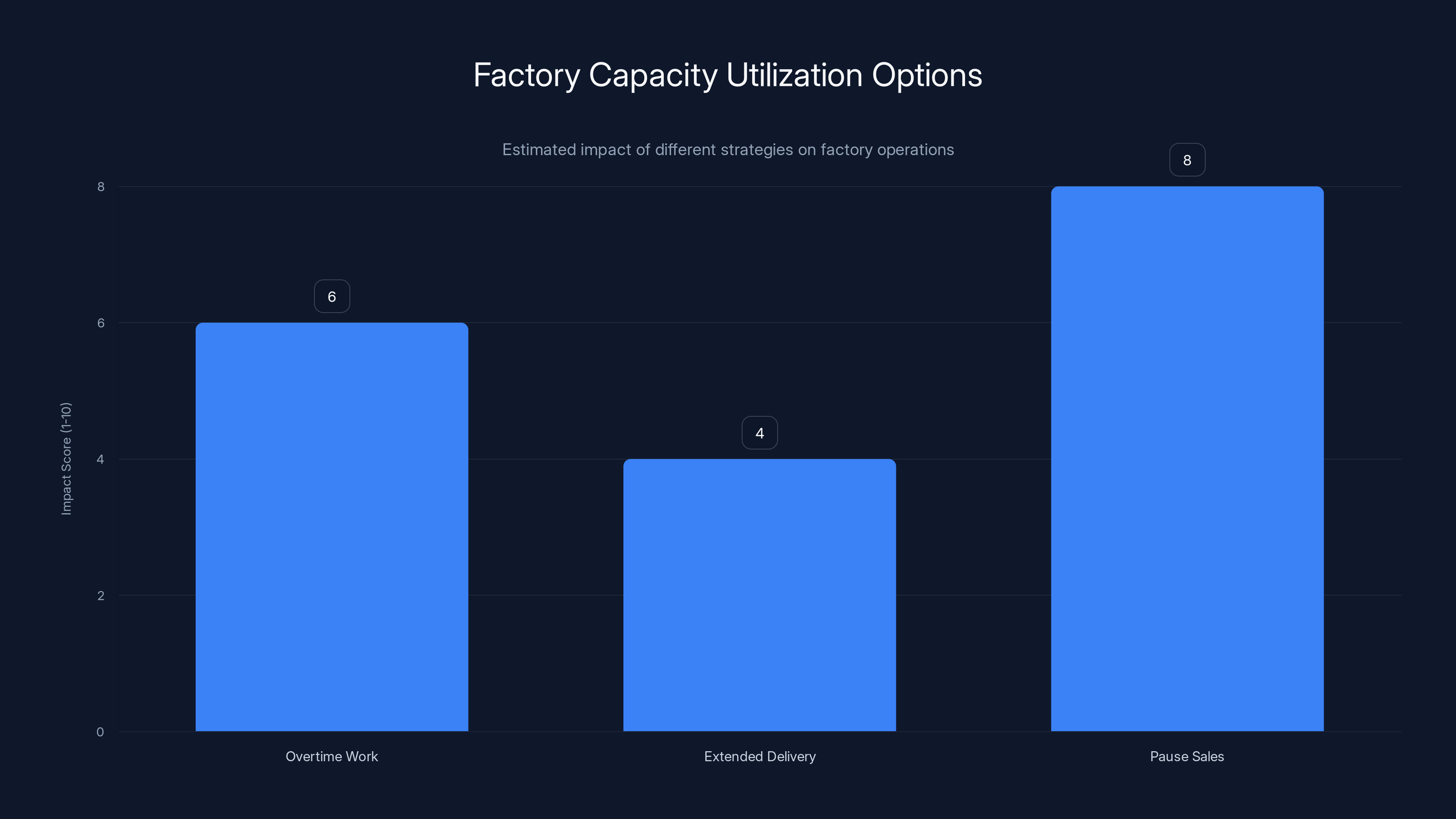

Implementing these strategies could significantly enhance Mouse Computer's resilience to future supply chain disruptions. Estimated data based on potential impact.

Factory Capacity: The Hard Limits of Manufacturing

This is where the real story becomes clear. Mouse Computer didn't suspend sales because they didn't want money. They suspended sales because their factories physically couldn't produce more units than they were already producing.

A PC factory has hard physical limits. You have a certain number of assembly stations. Each station can build a certain number of PCs per day. You have a certain number of testing stations. You have a certain number of shipping bays. You have a certain number of technicians.

If demand exceeds these hard limits, you have three options:

Option 1: Work overtime constantly, run the factory 24/7, hire temporary workers. Option 2: Accept longer and longer delivery times for new orders. Option 3: Stop accepting new orders until you can catch up.

Mouse Computer chose option 3.

Why not option 1? Factories already work significant overtime during the holiday season. Pushing beyond that point hits diminishing returns. Worker fatigue increases defects. Quality drops. You start shipping systems with problems, and then you deal with returns, warranty issues, and negative reviews. That's worse than not shipping at all.

Why not option 2? We covered this. Customers hate waiting. If delivery times stretch to 12 weeks, they cancel orders and buy from competitors. The backlog becomes counterproductive.

So option 3: pause sales, work through the backlog at normal capacity, reopen when you've got inventory buffer again.

The Economics of Factory Utilization

Here's the uncomfortable truth that most people don't talk about: PC manufacturers operate with surprisingly thin margins. For a gaming PC that sells for

These aren't huge margins. In manufacturing, 15-20% is considered respectable, but not exceptional. It means that if you suddenly have excess capacity (machines sitting idle, workers with nothing to do), your profitability can drop dramatically.

Conversely, if you overshoot capacity and incur massive overtime and logistics costs, profitability also drops. The sweet spot is running the factory at about 85-90% capacity, optimized for steady, predictable production.

When demand spikes to 150% or 170% of normal capacity, you're no longer in the sweet spot. You're in a range where the unit economics break down.

Mouse Computer's decision to halt sales was actually a conservative play to protect profitability. By pausing, they avoid:

- Massive overtime costs

- Quality control problems from rushing production

- Logistics bottlenecks as the shipping industry gets overwhelmed

- Customer dissatisfaction from long delays

- The need to hire and train temporary workers (expensive and problematic for quality)

They absorb the cost of reduced December sales, but they preserve margin on the orders they do fulfill and protect their brand reputation.

What a Factory Shutdown Looks Like

During the suspension period (December 23, 2025 through January 4, 2026), Mouse Computer's factories didn't literally shut down. Workers still came in. Production continued. But the focus shifted from "maximize output" to "clear the backlog and stabilize operations."

Key activities during the suspension:

- Building and shipping systems that had already been ordered but not yet fulfilled

- Performing quality control testing on backlog units

- Restocking critical components when suppliers delivered

- Conducting maintenance on assembly equipment (difficult to do during peak production)

- Analyzing production bottlenecks and optimizing workflows

- Planning the ramp-back to normal production when sales resumed January 5

This is actually valuable work. Most factories are too busy hitting production targets to do this kind of improvement work during busy periods. The suspension period gives Mouse Computer a chance to optimize their operations.

Supply Chain Visibility: Where the System Failed

One key insight from Mouse Computer's suspension: their supply chain apparently had poor visibility into component availability ahead of time.

A sophisticated PC manufacturer should be able to forecast demand 6-8 weeks out based on order patterns, historical data, and market signals. They should also have close relationships with component suppliers that give them advance warning of supply constraints.

Mouse Computer either didn't have this visibility, or they had it but underestimated how severe the constraints would be.

This is actually pretty common. Even large companies like Apple and Dell have had supply chain surprises that required operational adjustments. But it's still a gap.

The lesson here is that supply chain management has become incredibly complex. You're not just dealing with production bottlenecks. You're dealing with:

- Component supplier capacity and allocation priorities

- Logistics partners' bandwidth during peak seasons

- Currency fluctuations affecting input costs

- Regulatory changes affecting sourcing

- Geopolitical tensions affecting specific regions or countries

- End-customer demand signals that are increasingly unpredictable

Mouse Computer, as a mid-sized manufacturer, probably doesn't have a dedicated supply chain analytics team like Dell or Apple does. They likely rely more on relationships and historical patterns. When patterns change dramatically (like AI data center demand for memory), they catch you off-guard.

Memory prices increased significantly in 2025 due to AI infrastructure demands, with a 32GB DDR5 kit rising from

The Ripple Effects: Who Gets Hurt by the Shutdown

Mouse Computer's sales suspension affected various groups differently:

Direct Consumers

Customers who wanted to buy a custom-configured Mouse Computer system in late December had to wait. Some probably shifted to competitors. Some probably just accepted a 4-6 week delay and reordered after January 5.

For people who specifically wanted a Mouse Computer system for its quality, design, or specific configurations, this was frustrating but manageable. For price-sensitive customers, it was an opportunity to explore alternatives.

Retailers and Distributors

Retailers who sell Mouse Computer systems couldn't fulfill customer orders. This is bad for several reasons:

- Loss of commission on sales they could have made

- Customer complaints and negative reviews

- Pressure to recommend competitors

- Damaged relationships with customers who feel let down

Some retailers probably shifted their promotional focus to other brands during the suspension. Once Mouse reopened, those customers had already moved on.

Component Suppliers

This is interesting. Component suppliers might actually have benefited from Mouse's shutdown. Without large orders from Mouse during December 23 through January 4, suppliers could allocate those components to other customers or increase inventory. When Mouse resumed orders on January 5, it probably helped clear supplier backlogs.

Competitors

Dell, ASUS, Lenovo, and other PC manufacturers probably saw an uptick in demand during Mouse's closure. Customers who wanted to buy a PC didn't wait for Mouse to reopen. They bought from available manufacturers instead.

Logistics and Shipping Companies

With one major customer (Mouse Computer) essentially silent during the shutdown window, logistics companies had slightly easier capacity management. When Mouse resumed, order volumes returned, but it was a deliberate ramp rather than a sudden spike.

Manufacturing Insights: What Mouse Computer's Situation Reveals

Mouse Computer's suspension is actually a window into how fragile modern manufacturing is. Here's what it reveals:

Narrow Operational Margins

Mouse Computer chose to lose revenue rather than sacrifice quality or customer experience. This suggests they operate with very tight margins. A company with fat margins could absorb long delays, overtime costs, and customer dissatisfaction more easily.

This is the reality of modern manufacturing. Globalization has driven margins down. Capital efficiency is king. Companies operate at the edge of capacity by design, not accident.

Limited Flexibility

A truly flexible manufacturer could have:

- Contracted with other PC makers to use their unused capacity

- Negotiated emergency component shipments from alternative suppliers

- Temporarily increased pricing to reduce demand

- Offered delayed delivery discounts to slow order intake

Mouse Computer apparently wasn't able or willing to do these things. This suggests limited negotiating power with suppliers and limited alternative sourcing options.

Demand Unpredictability

PC demand used to be relatively predictable. Seasonal patterns were stable. Now, a single announcement about price increases can double demand in a week. Add in AI-driven component shortages, geopolitical tensions affecting chip production, and currency fluctuations, and you get an environment that's almost impossible to forecast.

Mouse Computer's shutdown is partly a failure of forecasting, partly a result of genuine unpredictability in the market.

The AI Factor

The most under-reported aspect of this story: AI data centers have become so dominant that they're reshaping the entire computing hardware industry. AI companies are ordering memory and storage at such volume that consumer and professional markets are getting squeezed.

This isn't temporary. As long as there's massive investment in building out AI infrastructure, consumer prices will remain elevated and supplies will remain constrained.

Pausing sales (Option 3) is estimated to have the least negative impact on factory operations, balancing capacity and customer satisfaction. Estimated data.

The Pricing Dilemma: Pass-Through Costs vs. Margin Pressure

PC manufacturers are in a bind. Component costs are rising. Shipping costs are elevated. Labor costs are increasing. But they can't simply pass all of these costs to consumers because demand is price-elastic. Raise prices too much and people postpone purchases.

So manufacturers have to optimize the timing and magnitude of price increases carefully.

Mouse Computer's competitors had clearly decided that the risk of demand loss from price increases was outweighed by the benefit of pushing sales into December before the increases took effect. They announced increases for January and drove demand forward.

Mouse Computer wasn't ready for the surge this created. If they'd had better supply chain visibility, they might have anticipated the demand spike and increased production capacity ahead of time. Or they might have announced their own price increase earlier, spreading the demand shock over a longer period.

Instead, they got blindsided by the perfect storm of holiday demand, price-increase-driven panic buying, component shortages, and factory capacity limits.

The Broader Pattern

This dynamic—manufacturers announcing price increases to drive forward demand—is becoming common in the PC industry. It's an equilibrium strategy:

- When prices are about to go up, customers move their purchases forward

- This creates predictable demand spikes that manufacturers can prepare for

- Manufacturers who are ready for the spike capture market share

- Manufacturers who aren't ready lose sales to competitors

Mouse Computer wasn't ready. Whether that's due to poor planning or genuine unpredictability is unclear. Probably a mix of both.

Market Share and Competitive Positioning

Mouse Computer's suspension could have long-term consequences for their market position. Here's why:

When consumers want to buy a PC and can't get the one they want, they don't usually wait months. They buy a competitor's model instead. If they have a good experience with that competitor, they might become a repeat customer.

Losing customers during peak season is particularly damaging because it establishes patterns of purchasing behavior that can persist for years.

On the flip side, Mouse Computer might have gained some respect for prioritizing quality and customer experience over short-term revenue. The shutdown message essentially said: "We'd rather lose sales than disappoint customers with long delays."

In a market where customer satisfaction and brand loyalty matter, this could be a positive signal. Time will tell whether customers see it that way or whether they've just moved on to competitors.

The suspension also affects how Mouse Computer is perceived by tech reviewers and industry analysts. A manufacturer that suspends sales due to overwhelming demand sounds better than a manufacturer that suspends sales due to quality problems or financial distress. This narrative helps.

Mouse Computer faces significant challenges due to narrow margins, limited flexibility, unpredictable demand, and the AI industry's impact. Estimated data based on narrative insights.

Looking Ahead: Lessons for 2026 and Beyond

Mouse Computer will reopen for sales on January 5, 2026. But the conditions that created this crisis won't disappear immediately. Component prices will still be elevated. Supply constraints will still exist. Demand will still be elevated (at least through January).

What will Mouse Computer do differently?

They might:

- Implement stricter demand forecasting based on market signals

- Develop better supplier relationships for advance warning of shortages

- Increase inventory buffers during peak seasons

- Consider contracting with other manufacturers for overflow capacity

- Implement dynamic pricing to smooth demand (charging more during peak periods)

- Diversify their component suppliers to reduce vulnerability to single-supplier constraints

All of these require investment and operational change. Whether Mouse Computer actually implements these changes is unclear. Sometimes companies experience a crisis, survive it, and then revert to old patterns once the crisis fades.

The broader question for the industry: is the current environment one of temporary disruption or a new normal?

If AI data center demand continues to grow (which it almost certainly will), memory and storage will remain constrained and expensive indefinitely. That means PC manufacturers will need to adapt their supply chains to accept higher component costs as permanent. They'll need to either accept lower margins or pass costs to consumers and accept lower demand.

This is particularly challenging for manufacturers focused on price-sensitive markets like Japan. Consumer PC demand in Japan has been declining for years (as people favor notebooks and smartphones). The margin for error is slim.

Mouse Computer's suspension might be a one-time event, or it might be a preview of more disruptions to come.

The Deeper Story: Manufacturing in an Age of Volatility

Mouse Computer's sales suspension isn't really about one company's logistical failure. It's about the inherent fragility of modern global manufacturing when you optimize purely for efficiency without building in resilience.

For decades, manufacturing best practices have emphasized just-in-time delivery, lean inventory, and minimal slack. These practices reduce costs and improve capital efficiency. But they also reduce flexibility.

When conditions are stable and predictable, lean manufacturing is beautiful. Factories hum along at optimal efficiency. But when conditions become unpredictable (due to geopolitical disruption, climate events, unexpected demand spikes, or pandemic), lean manufacturing breaks down.

Mouse Computer's situation reflects this tradeoff. They were probably operating with inventory levels that were optimal for normal conditions. When demand spiked 50% and component availability dropped 30% simultaneously, they hit a wall.

The lesson for manufacturers going forward: you need to build some slack back into your operations. Not so much slack that you destroy profitability, but enough that you can absorb surprises without shutting down.

This is easier said than done, especially in competitive markets where your competitor might steal market share if you operate with higher costs. It requires industry-wide agreement on the value of resilience, which is hard to achieve.

Mouse Computer's suspension shows what happens when you don't have that slack. And unfortunately, the economics of the PC market suggest that it will be hard for manufacturers to build in resilience without sacrificing competitiveness.

The Role of Communication and Transparency

One thing that worked in Mouse Computer's favor: clear, honest communication about why they were suspending sales.

If they'd just said "sorry, we're out of stock," customers would have assumed poor management and potentially switched competitors permanently.

Instead, Mouse explained the situation clearly: unprecedented demand + component shortages + quality concerns = temporary suspension to protect customer experience.

This is the kind of communication that builds long-term loyalty, even at the cost of short-term sales. Customers respect honesty. They understand that global supply chains are complicated. They're willing to wait if they believe the company is being straight with them.

Compare this to companies that oversell capacity, deliver late, and then blame everything on "unprecedented supply chain challenges." Those companies lose trust.

Mouse Computer's approach—closing sales to prevent disappointing customers—is a bet that integrity will be rewarded with loyalty. It's the right bet, both ethically and from a business perspective.

Why This Matters for the Broader PC Industry

Mouse Computer's suspension is a canary in the coal mine for the entire PC manufacturing industry.

If a major Japanese manufacturer can be disrupted this badly by a combination of demand volatility and component constraints, what about smaller manufacturers? What about manufacturers in other regions with less developed supply chains?

The answer is that many of them are probably experiencing similar disruptions silently. They're not announcing sales suspensions, but they're likely struggling with:

- Longer delivery times than they want

- Margin compression from component inflation

- Customer dissatisfaction from delays

- Competitors stealing market share during supply constraints

Mouse Computer just chose to stop accepting orders rather than silently suffer. That's actually a refreshingly honest approach to the problem.

For consumers, the implications are: PC availability and pricing are likely to remain volatile for the foreseeable future. The AI boom has permanently changed how components are allocated, and that's unlikely to reverse.

If you want a new PC, it's worth ordering sooner rather than later. Delivery times and prices are unlikely to improve significantly in 2026.

FAQ

Why did Mouse Computer suspend all sales?

Mouse Computer suspended all sales across its brands from December 23, 2025 through January 4, 2026 due to an unprecedented surge in orders combined with component shortages. Demand exceeded production capacity by such a margin that continuing to accept orders would have resulted in unacceptable delivery delays and compromised customer service quality. The company explicitly stated the suspension was necessary to maintain product quality and provide adequate support to existing customers.

What brands were affected by the sales suspension?

The suspension affected all of Mouse Computer's major product lines: the Mouse brand, NEXTGEAR gaming systems, DAIV workstations, and GTUNE laptops. Additionally, all of Mouse Computer's direct retail locations closed during the suspension period. This was a comprehensive halt, not limited to specific product categories or regions.

How long did the sales suspension last?

The sales suspension lasted from December 23, 2025 through January 4, 2026, a total of 13 days. Mouse Computer announced that sales would resume gradually starting January 5, 2026, though there was no guarantee of immediate inventory availability or standard delivery times upon reopening.

What caused the order surge?

The order surge resulted from three factors converging simultaneously. First, normal holiday season demand. Second, panic buying from customers aware that memory and SSD prices would increase starting January 2026. Third, component shortages related to artificial intelligence data center demand, which drove prices higher and availability lower. Together, these factors created demand that exceeded the manufacturer's capacity to fulfill orders in reasonable timeframes.

How do component shortages contribute to price increases?

Component shortages directly cause price increases through basic supply-and-demand economics. When memory chip makers allocate more production to high-margin server chips for AI data centers, less capacity remains for consumer-grade memory. Lower supply of a critical component means higher prices. PC manufacturers must either absorb these cost increases (reducing profits) or pass them to consumers (reducing demand). Mouse Computer's suspension was partly due to the difficulty of absorbing sustained component cost increases while maintaining profitability.

Could Mouse Computer have handled this differently?

Potentially. Larger manufacturers like Dell have more supply chain flexibility and could theoretically have managed the same demand spike without suspending sales. Mouse Computer could have negotiated emergency component supplies, contracted with competitors for overflow production capacity, or implemented dynamic pricing to reduce demand spikes. However, these solutions require either substantial negotiating power (which smaller manufacturers lack) or acceptance of lower margins (which pressures profitability). The suspension was arguably the most operationally sound choice given the constraints.

What are the broader implications for PC manufacturing?

Mouse Computer's suspension reveals that modern PC manufacturers operate with dangerously thin margins and minimal capacity buffers. When demand spikes or component supplies are disrupted, manufacturers hit hard limits on production. This suggests future disruptions are likely unless manufacturers build more resilience into their supply chains. The AI boom's impact on component availability is likely permanent, meaning PC manufacturers will need to permanently adapt to higher component costs and lower supply certainty.

Will this happen to other PC manufacturers?

Mouse Computer's situation was severe enough to warrant a complete sales halt, but other manufacturers are likely experiencing similar supply chain strain silently. They might have longer delivery times, reduced model availability, or margin pressure without publicly announcing suspensions. Dell and Lenovo, with greater scale and negotiating power, are better positioned to absorb disruptions. Smaller or regional manufacturers are more vulnerable to the same kind of crisis Mouse Computer experienced.

What should consumers do if they want to buy a PC?

Order sooner rather than later. Delivery times and prices are likely to remain volatile throughout 2026 due to ongoing component constraints and the elevated prices driven by AI data center demand. If you've been considering a PC purchase, waiting for prices to drop or availability to improve is probably not a wise strategy. Additionally, research manufacturer supply chain stability before purchasing, as some brands have proven better at managing disruptions than others.

How does this affect PC pricing going forward?

PC pricing is likely to remain elevated compared to 2020-2022 levels. Component costs will stay higher due to persistent AI data center demand. Shipping costs remain elevated. Labor costs continue to increase. Manufacturers will try to absorb some of these costs, but consumers should expect that price decreases are unlikely. Any price decreases would represent a return to the abnormally low prices of the early 2020s rather than a "real" discount relative to current cost structures.

Conclusion: When Growth Becomes a Liability

Mouse Computer's sales suspension is ultimately a story about the paradox of success. They were so successful at selling PCs that they had to stop selling them.

But it's also a story about how fragile modern manufacturing is when you optimize for efficiency at the expense of resilience. It's a story about how unexpected events (in this case, AI data center demand) can ripple through entire industries, disrupting companies far removed from the original source of the disruption.

For Mouse Computer, the suspension was a difficult but necessary business decision. For the broader PC industry, it's a warning sign. For consumers, it's a reminder that the PC market is more volatile and less predictable than it was a decade ago.

The company will reopen sales on January 5, 2026, likely with some inventory built up and with a bit more humility about their ability to forecast demand in an increasingly chaotic market. They might implement better supply chain management practices. They might build higher inventory buffers. Or they might just hope that conditions stabilize and this becomes a one-time event.

Either way, Mouse Computer's decision to prioritize customer experience over short-term revenue deserves respect. In an industry often criticized for prioritizing profit over people, choosing quality over growth is refreshingly honest.

The real question is whether other manufacturers, and the industry as a whole, will learn from this. Will they build more resilience into their supply chains? Will they accept lower margins in exchange for better stability? Or will they continue optimizing for pure efficiency until the next crisis hits?

Based on how industries typically behave, my guess is they'll mostly continue doing what they've always done until the next shock forces change. But Mouse Computer at least showed that there's a better way: honest communication, quality prioritization, and willingness to sacrifice short-term gains for long-term relationships.

That's a lesson worth remembering, whether you're in manufacturing or any other business.

Key Takeaways

- Mouse Computer halted all PC sales December 23-January 4, 2026 due to overwhelming demand combined with component shortages and factory capacity limits

- Three factors converged: normal holiday demand, panic buying ahead of price increases, and AI data center-driven component shortages pushing prices up 20-30%

- PC manufacturers operate with dangerously thin margins (15-20%), leaving zero buffer when demand spikes 50-70% beyond normal capacity

- Smaller manufacturers like Mouse Computer lack negotiating power to secure emergency component allocations, forcing production halts rather than delays

- AI infrastructure buildout has permanently reshaped hardware component allocation, making consumer PC supply constrained and expensive indefinitely

Related Articles

- NucBox K15 Mini PC: Intel Ultra CPU & GPU Expansion at $360 [2025]

- Samsung Music Studio 5 & 7 Speakers: Design Meets Audio [2026]

- OpenAI's Head of Preparedness Role: AI Safety Strategy [2025]

- SCX-LAVD: How Steam Deck's Linux Scheduler is Reshaping Data Centers [2025]

- CIOs Must Lead AI Experimentation, Not Just Govern It [2025]

- Amazon Echo Dot Smart Home Setup Guide [2025]

![Japanese PC Maker Halts All Sales After Order Surge [2025]](https://tryrunable.com/blog/japanese-pc-maker-halts-all-sales-after-order-surge-2025/image-1-1766878545822.png)