Introduction: When Infrastructure Becomes a $1 Billion Opportunity

There's a moment in every major technology shift when you realize the real money isn't in the flashy consumer app. It's in the foundation underneath it.

Live Kit just hit that moment. The five-year-old startup announced a

That's exactly the point.

Live Kit built the invisible plumbing that powers real-time voice AI applications. Their infrastructure sits behind Open AI's Chat GPT voice mode, handles emergency 911 calls, powers mental health platforms, and processes voice data for companies like Tesla, x AI, and Salesforce. If you've had a voice conversation with an AI in the past year, there's a decent chance it ran through Live Kit's servers.

But what makes this funding round significant isn't just the number. It's what it signals about the market. Voice AI isn't a novelty anymore. It's becoming the primary interface between humans and artificial intelligence. And building that interface at scale? That requires infrastructure companies that most people will never see but every major tech company will eventually need.

In this article, we'll break down what Live Kit does, why this valuation matters, how the voice AI infrastructure market got here, and what comes next. By the end, you'll understand why a company most developers haven't heard of is now worth the same as a mid-sized public tech company.

What Live Kit Actually Does

Let's start with the basics, because the name alone tells you nothing.

Live Kit is a platform for building real-time voice and video applications. Founded in 2021 by Russ d'Sa and David Zhao, it started as an open-source project. The original problem was straightforward: building video conferencing software is hard. Really hard. You need to handle network congestion, codec negotiation, bandwidth optimization, echo cancellation, and a dozen other problems that most developers aren't trained to solve.

During the pandemic, when everyone was on Zoom, the founders realized something. There were dozens of startups trying to build their own video infrastructure instead of using an existing platform. They were duplicating work. Solving the same problems over and over.

So Live Kit built infrastructure that could be reused. Open-source infrastructure, initially. That meant any developer could download it, run it on their own servers, and build voice and video applications without becoming a networking expert.

But here's where the business model evolved. While the open-source project solved the technical problem, it created a new one for enterprises. Running your own real-time communication infrastructure is like running your own data center. Theoretically possible. Practically a nightmare. You need to manage servers across geographic regions, handle failover, optimize latency, ensure quality of service. Most companies don't want to do that.

So Live Kit built a managed cloud version. Upload your code, they handle everything else. That's where the money comes from. That's where the $1 billion valuation comes from.

The platform handles the core infrastructure challenges:

- Low-latency audio and video transmission: Compressing data in real-time while maintaining quality

- Intelligent routing: Sending data through the fastest path available, accounting for network conditions

- Scalability: Managing thousands of simultaneous connections without quality degradation

- Media processing: Encoding, decoding, and manipulating audio and video streams on the fly

- Reliability: Handling network failures gracefully with automatic fallbacks

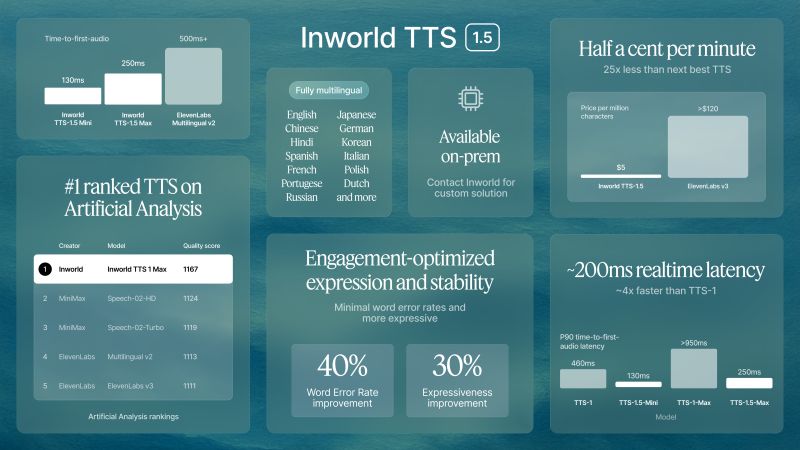

What makes Live Kit specifically suited for AI applications is the combination of these capabilities with voice processing. When you talk to Chat GPT's voice mode, your audio needs to be captured, sent to the server, processed by the AI model, and sent back as audio. All in near real-time. The latency budget is tiny. You get roughly 300 milliseconds before it feels weird. That's not easy to achieve.

Live Kit also supports features that AI applications specifically need. Room-level isolation (so different conversations don't interfere). Agent mode (so an AI can participate in a conversation like a participant). Egress (recording and exporting conversations). Integration with AI models for real-time processing.

They've also released Live Kit Agents, which is a framework for building AI-powered voice and video agents that can handle real-time conversations. This is what powers the 911 dispatch systems and mental health providers mentioned in the funding announcement. Imagine a system that can answer a 911 call, understand the emergency, extract location information, and connect the caller to the right dispatcher. All in seconds. Live Kit Agents makes that possible.

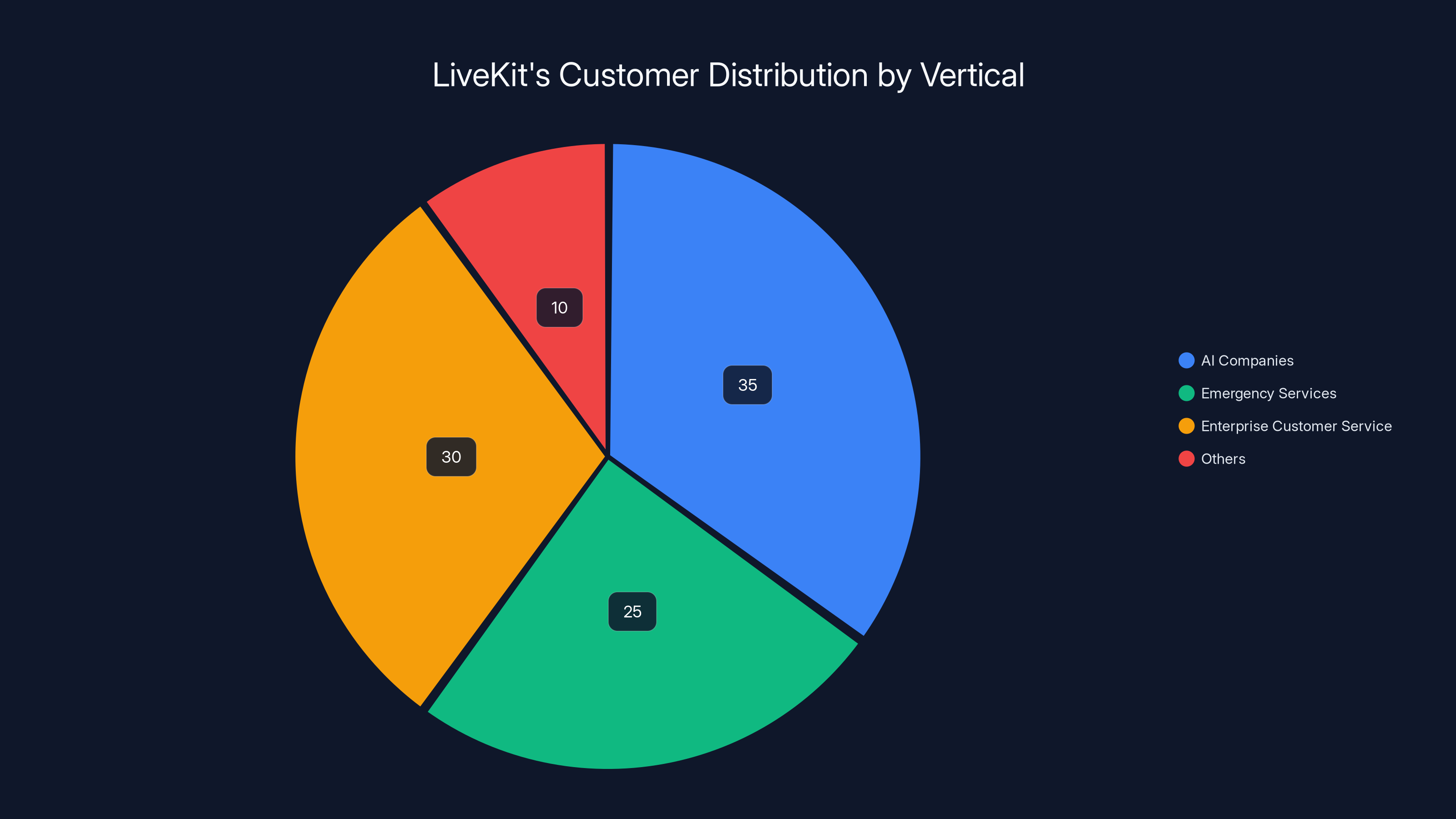

Estimated data suggests AI companies, emergency services, and enterprise customer service are major users of LiveKit, reflecting its versatility in real-time communication.

The Market Context: Why Voice AI Infrastructure Now?

Timing is everything in startup investing. Live Kit's previous funding round was ten months ago. So why are they raising again so quickly?

The answer is simple: voice AI happened faster than anyone expected.

For years, AI researchers talked about voice as the future of human-computer interaction. But it was theoretical. The models weren't good enough. The latency was too high. The cost was too expensive. That changed dramatically over the past 18 months.

Open AI released GPT-4o with real-time voice capabilities. Not perfect transcription followed by text. Real-time, streaming voice interaction. You could have a conversation with an AI that responds like a human would. That wasn't possible before. Or rather, it was possible at extremely high cost and latency.

Once Open AI proved it was possible, the market moved fast. Anthropic released Claude with voice. Google released Gemini with voice. Meta released Llama with voice capabilities. Every major model provider is now racing to add voice as a first-class feature.

But here's the problem: building real-time voice infrastructure is hard. Most AI companies are focused on models. They're not experts in network engineering, codec optimization, or geographic load balancing. So they need a platform.

That's the market Live Kit found itself in. Suddenly, not just startups building voice applications, but the biggest AI companies in the world, needed their infrastructure. That creates explosive demand.

Consider what's happening with enterprise adoption. If you're a Fortune 500 company, you might want to deploy a voice AI agent to handle customer service calls. But you don't want to build the infrastructure from scratch. You need something battle-tested, reliable, and secure. Live Kit fits that profile.

The same is true for AI companies building new products. When Anthropic released voice features, they could either build the infrastructure themselves or use an existing platform. Building from scratch would have delayed the launch by months. Using Live Kit meant they could launch immediately and focus on model quality instead.

That's the hidden advantage of infrastructure plays in a fast-moving market. Companies will pay a premium to avoid building something themselves. Not because they couldn't do it. But because speed to market matters more than marginal cost savings.

LiveKit is likely to allocate 35% of its $100 million funding to product development, followed by 25% each to sales/marketing and operations/infrastructure, and 15% to team building. Estimated data based on typical industry practices.

The $1 Billion Valuation: What Does It Mean?

A billion-dollar valuation is a milestone. It means Live Kit is now in the territory of successful, scaled companies. But what does that number actually represent?

Valuation is a bet on future revenue. The investors who led this round (Index Ventures is one of the most respected venture firms in the world) are betting that Live Kit will eventually generate enough revenue to justify a $1 billion company valuation.

For a B2B infrastructure company like Live Kit, that usually means one of three things:

1. High-volume, low-margin usage Think AWS S3. Billions of API calls per month, but charged per GB. Low margin per customer, but enormous total revenue because the volume is so high.

2. High-margin, medium-volume enterprise deals Big tech companies and large enterprises pay $10 million+ per year for infrastructure they trust with critical workloads. A few dozen of these customers can drive massive revenue.

3. Eventual acquisition by a larger company The investors might be betting that a company like Microsoft, Amazon, or Google will eventually acquire Live Kit to integrate into their cloud offerings.

Live Kit's business model seems to be a blend of the first two. They charge based on usage (minutes of audio/video processed, storage, egress bandwidth) with volume discounts for large enterprises. That's similar to how Twilio built its business (though Twilio focused on SMS and voice calls rather than real-time video).

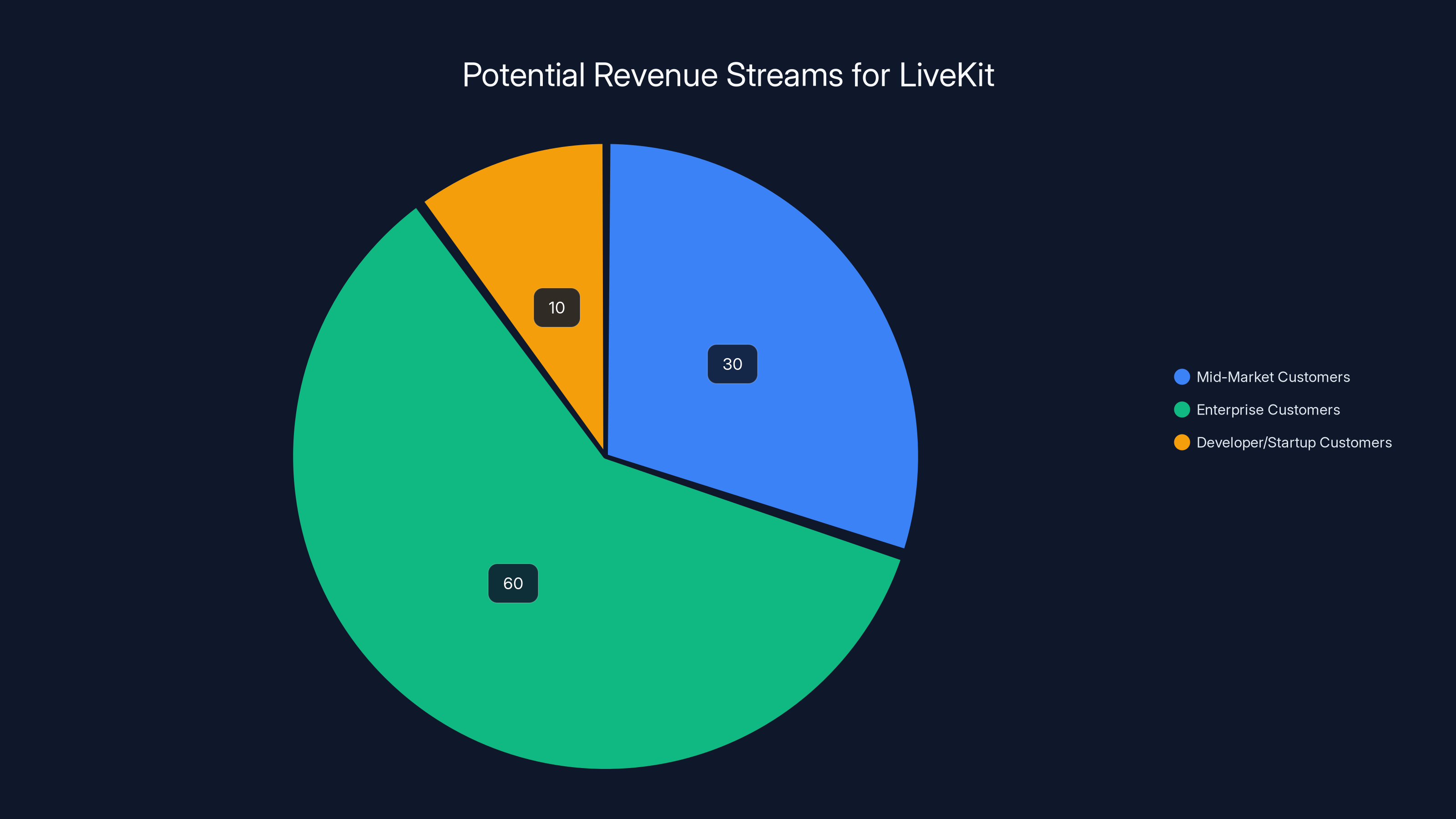

Here's the revenue math. If we assume:

- Average revenue per user (ARPU) of $100-500/month for mid-market customers

- Enterprise customers paying $1-10M annually

- Developer/startup customers on free or low-cost tiers (high churn, eventually graduate to paid)

Then a

But here's another way to think about the valuation. Live Kit's main competitor is AWS and Google Cloud's real-time communication services (both offer basic video conferencing infrastructure). But those are generic offerings, not optimized for AI.

When you compare to specialized platforms like Twilio (which is now a public company worth **

The main question is whether Live Kit can grow into that valuation. That depends on:

Market size: How many companies will build voice AI applications? If it's just a few thousand, the market is limited. If it's hundreds of thousands, the market is huge.

Customer retention: Once a company chooses an infrastructure provider, switching costs are high. If Live Kit can acquire customers and keep them, margins improve over time.

Pricing power: As voice AI becomes standard, Live Kit can potentially raise prices. Or they can maintain prices and grow volume.

Competition: Will AWS, Google, or Microsoft build better real-time communication services? If so, Live Kit's advantage erodes.

Right now, the investors are betting that Live Kit wins on these factors. Time will tell if that bet pays off.

The Open AI Connection: What Does It Mean?

The biggest detail in the funding announcement is buried in the second paragraph. Live Kit powers Chat GPT's voice mode.

That's not a small thing. Open AI is arguably the most important AI company in the world. Their products drive billions in revenue. The fact that they chose Live Kit (rather than building or using another platform) is a massive endorsement.

But it also raises questions. How much revenue does Open AI generate for Live Kit? Is it a significant portion of their business? Or just one customer among many?

Typically, when a startup has a single customer that generates a huge portion of revenue, investors worry. What if that customer leaves? What if they decide to build their own solution? It's a concentration risk.

But in this case, there are a few mitigating factors:

First, Open AI is locked in. They shipped Chat GPT voice mode months ago. The cost of migrating to a different platform would be enormous. They'd have to retest everything, potentially deal with service disruptions. Unless Live Kit made serious mistakes, Open AI isn't going anywhere.

Second, the Open AI partnership validates the product. It tells other companies: if Live Kit is good enough for Open AI, it's probably good enough for us. That validation is worth millions in reduced sales friction.

Third, it's an existence proof. Before Chat GPT voice mode launched, some companies doubted whether real-time voice AI was even practical. Open AI proved it works. That creates market demand that didn't exist before.

Here's the thing about infrastructure deals with major tech companies. They're usually smaller than you'd expect on a percentage basis, but they're extremely sticky. Microsoft doesn't negotiate hard or churn vendors. They commit to a platform, integrate it deeply, and live with that choice for years.

So the Open AI partnership is both a customer win and a market validation. It's probably worth more to Live Kit than the raw revenue from Open AI's usage.

The bigger question is: will this pattern repeat? If Live Kit powers Open AI's voice mode, and Anthropic uses a different platform for Claude's voice, and Google builds their own solution, then no single company dominates voice AI infrastructure. The market fragments.

But if Live Kit becomes the default choice (the way Stripe became the default for payments or Twilio became the default for SMS), then it's a much bigger business.

Right now, the smart bet is that Live Kit will become a default for AI voice infrastructure the way Twilio is for SMS. That's what the $1 billion valuation implies.

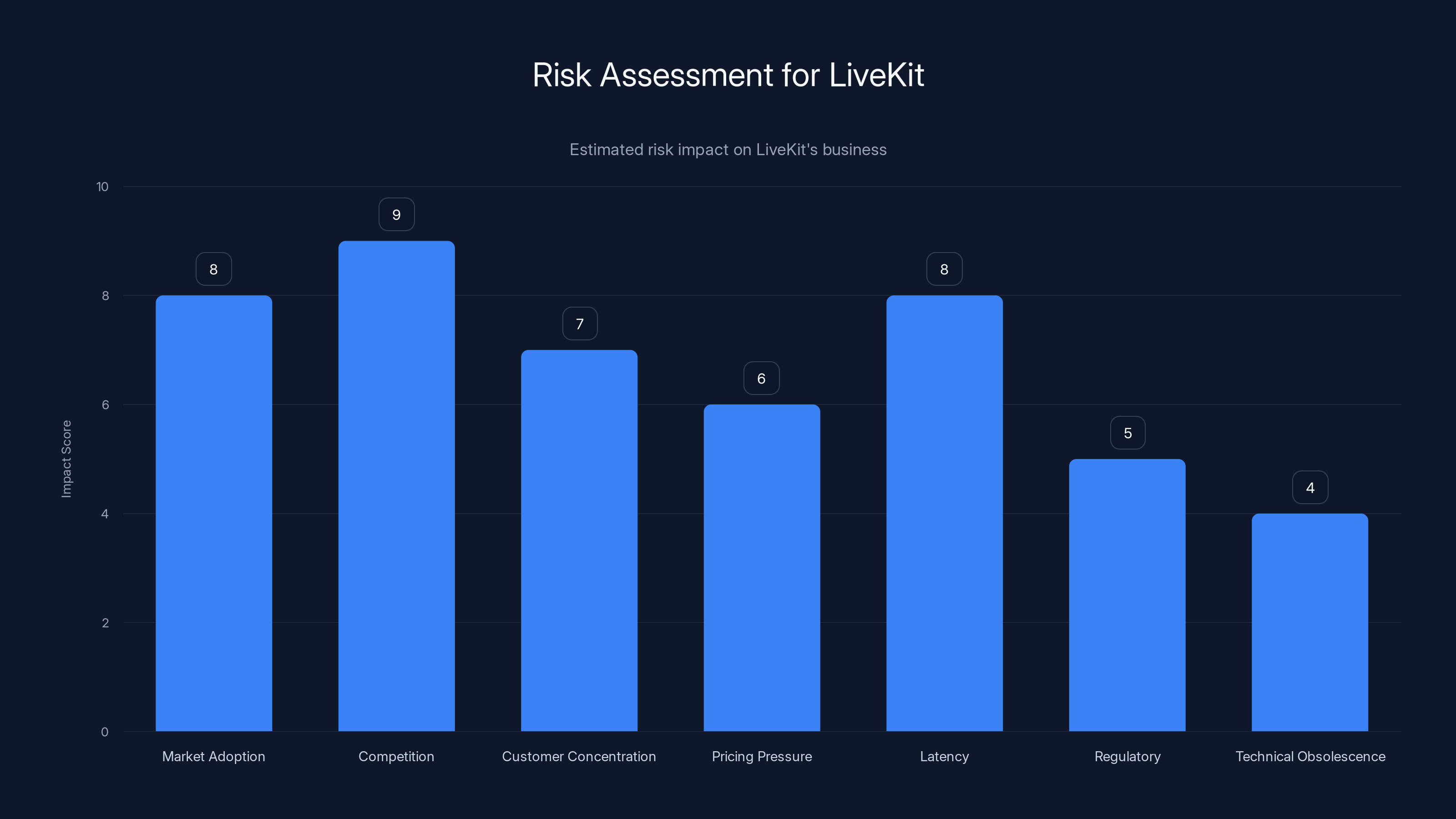

Competition and market adoption pose the highest risks to LiveKit, with scores of 9 and 8 respectively. Estimated data based on industry analysis.

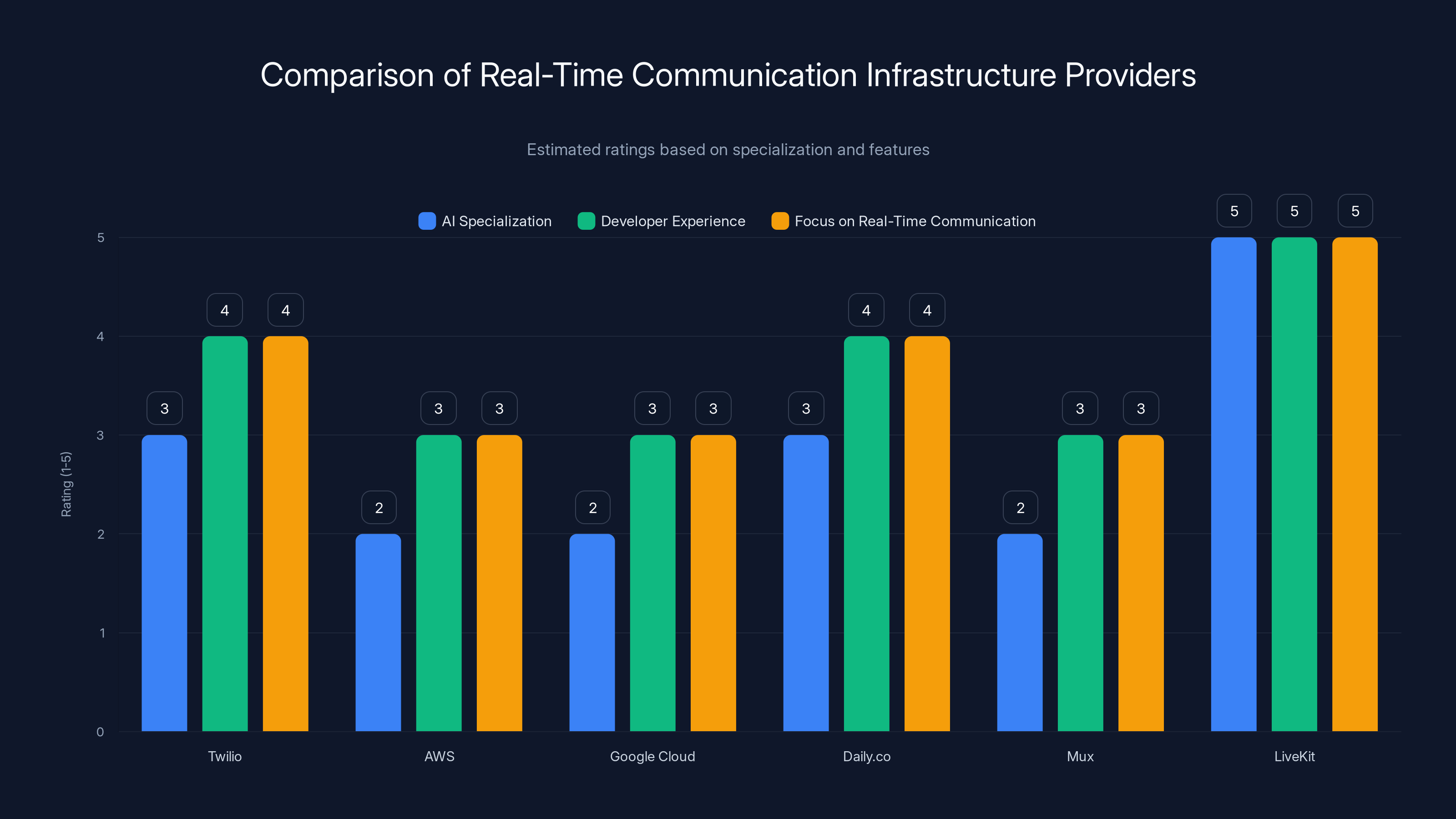

The Competitive Landscape: Who Else Is Building This?

Live Kit isn't the only company building real-time communication infrastructure. There's meaningful competition.

Twilio is the 800-pound gorilla in the room. They're a public company worth $10+ billion and they offer voice, video, and messaging services. But their infrastructure is more general-purpose. They weren't designed specifically for AI. And their pricing model is optimized for SMS, not real-time video.

AWS and Google Cloud offer basic video conferencing and real-time communication services, but they're not specialized. If you're building a voice AI application, you'd need to cobble together multiple services from AWS. That's possible but painful.

Daily.co is another player in the space. They focus on video conferencing infrastructure and are growing fast. But they're smaller than Live Kit and less focused on AI-specific features.

Mux offers video infrastructure but is more focused on streaming and playback than real-time interaction.

Where Live Kit has an advantage:

1. AI-first design Live Kit was built from the ground up with AI applications in mind. Things like Agent mode (where an AI can participate in a conversation) and real-time voice processing are native, not bolted on.

2. Open source credibility Live Kit has an open-source version that developers can self-host. That creates a funnel. Developers start with the free, open-source version. As their usage grows, they migrate to the managed cloud version. That's a classic Saa S growth pattern.

3. Developer experience For infrastructure companies, developer experience matters enormously. If the SDK is well-documented, the API is clean, and integration is painless, developers will choose you over a competitor. Live Kit has a reputation for good developer experience.

4. Focused customer base Live Kit is focused specifically on voice and video. They're not trying to be AWS (which does everything). That focus means they can optimize specifically for real-time communication, rather than optimizing for a thousand different use cases.

But Twilio has advantages too. They have massive scale, an existing customer base, and proven profitability. They could allocate engineering resources to AI and become a major competitor within a year.

The competitive dynamic will likely play out over the next 3-5 years. In that window, Live Kit needs to:

- Cement relationships with major AI companies (Open AI, Anthropic, etc.)

- Build features that competitors will find hard to replicate

- Achieve profitability or path to profitability

- Expand enterprise adoption

If they succeed, they could be acquired by a larger company (likely one of the major cloud providers) at a significant premium to their current valuation.

If they struggle, a well-funded competitor could outpace them.

Use Cases: Where Voice AI Infrastructure Gets Used

Understanding the market requires understanding the applications. Where is voice AI being deployed?

Customer Service and Support This is the biggest use case. Companies are deploying voice AI agents to handle first-level support calls. Instead of waiting for a human agent, a customer talks to an AI that understands their problem and either resolves it or transfers them to a human. This reduces wait times and improves customer satisfaction. It also reduces labor costs, which is a huge driver for enterprises.

Companies like Salesforce are building this into their service cloud. Imagine a customer calls your phone number, an AI agent answers, understands their issue, and either provides a solution or routes them to the right department. That's voice AI.

Sales Assistance and Lead Qualification Before a salesperson talks to a prospect, an AI agent can qualify the lead, understand their needs, and gather information. This increases conversion rates and makes salespeople more efficient. Salesforce is one of Live Kit's customers, suggesting they're building this into their platform.

Emergency Services (911 Dispatch) This is where the stakes get really high. Imagine a 911 dispatcher who's backed by an AI that listens to every call, extracts key information (address, type of emergency, severity), and presents it to the dispatcher in real-time. This saves lives. It also handles call volume spikes more gracefully. Live Kit powers this application for some 911 services.

Mental Health and Wellness Mental health providers need to scale to meet demand. Voice AI agents can provide initial assessment, therapy guidance, or crisis intervention. They can also monitor patients between visits. Live Kit powers applications in this space.

Accessibility Voice AI can help people with disabilities. Imagine a blind person using voice AI to navigate the web. Or a person with speech impediments using voice AI as a translator. The applications are endless.

Real Estate and Retail AI agents can answer questions about properties, schedule viewings, or provide product information. Think of it as an always-on sales assistant that never gets tired or frustrated.

Education Voice AI tutors can provide one-on-one instruction at scale. A student can have a conversation with an AI tutor about chemistry or history. No waiting for human teacher availability.

The common thread in all these applications is scale + quality + latency. Companies need to:

- Handle thousands of simultaneous voice conversations

- Maintain high quality (no drops, clear audio, natural responses)

- Keep latency under 300ms (so conversations feel natural)

- Do all of this reliably, without outages

That's incredibly hard to do. That's why Live Kit exists. That's why they command a premium.

Estimated data suggests that enterprise customers contribute the largest share of revenue for LiveKit, followed by mid-market and developer/startup customers.

The Funding Details: What's Being Spent and Why

Live Kit raised $100 million in this round. That's a significant amount of capital. Where will it go?

For an infrastructure company approaching a $1 billion valuation, the capital typically flows to:

Product Development (30-40%) Building new features, improving performance, expanding to new use cases. Live Kit will likely invest in:

- AI model integration (making it easier to connect to Claude, GPT, etc.)

- Analytics and monitoring (helping customers understand their usage)

- Reliability improvements (reducing latency, improving quality)

- New capabilities (recording, transcription, AI agent frameworks)

Sales and Marketing (20-30%) An infrastructure company needs customers, and acquiring enterprise customers is expensive. Live Kit will likely invest in:

- Field sales teams (hiring sales engineers who can talk to technical stakeholders)

- Marketing (thought leadership, conference presence, content)

- Customer success (ensuring customers are successful, reducing churn)

- Partnerships (working with AWS, Google Cloud, major AI providers)

Operations and Infrastructure (20-30%) Running infrastructure at scale requires investment in:

- Data centers and cloud compute costs

- Redundancy and failover systems (so the service never goes down)

- Security and compliance

- Customer support

Team Building (10-20%) Growing from 50 employees (typical for a funded startup at this stage) to 100-150 employees requires budget for:

- Engineering hiring

- Product management

- Operations

- Finance and administrative staff

The specific breakdown will depend on Live Kit's strategy. If they're betting on rapid growth, they'll spend heavily on sales and marketing. If they're betting on maintaining margins, they'll invest more in product and efficiency.

Given that they just raised $100 million after raising capital 10 months ago, the market is clearly bullish. Infrastructure investors (like Index Ventures) wouldn't deploy that much capital unless they believed in the TAM (total addressable market) and Live Kit's ability to capture it.

Here's a simple analysis of the economics:

If Live Kit reaches

$50M ARR is achievable if:

- They acquire 100-200 enterprise customers at $100K-500K/year each

- Plus 10-50 large customers (Fortune 500 types) at $1M+ per year

- Plus thousands of smaller customers using the free or low-cost tiers

That's ambitious but feasible given the market timing.

How Voice AI Infrastructure Works (The Technical Side)

To understand the value Live Kit creates, you need to understand the technical challenges they solve.

Building a real-time voice conversation system requires solving multiple hard problems simultaneously:

Audio Capture and Transmission When you speak into a microphone, the audio is sampled at a rate (typically 48,000 samples per second). That's a lot of data. You need to compress it without losing quality (using codecs like Opus or AAC), add error correction (so network loss doesn't cause audio glitches), and send it across the internet.

The naive approach: send everything to a central server, process it, send it back. But that adds latency. The server processes your audio, your AI model responds, the response is compressed and sent back. That round trip takes time.

Live Kit's approach uses edge servers and intelligent routing. Your audio goes to the closest server (reducing latency), gets processed there, and is routed to the AI model. The model's response comes back through the same path. This cuts latency in half compared to centralized processing.

Network Adaptation Network conditions change constantly. Wi Fi is congested, 4G signal drops, broadband is slow. You can't send the same bitrate all the time. You need to adapt.

Live Kit monitors network conditions and adjusts the audio bitrate in real-time. If network conditions are poor, it reduces quality (lower bitrate). If network improves, it increases quality. All without dropping the connection or causing noticeable artifacts.

Echo Cancellation and Noise Reduction When you talk to an AI, the AI's response comes through your speaker. Your microphone picks that up and sends it back to the AI (which is confusing). Echo cancellation removes the AI's response from the audio stream, so the AI only hears you, not itself.

Noise reduction removes background noise (traffic, typing, ambient sound) so the AI only hears your voice.

Both of these are complex signal processing problems. Do them wrong and the conversation becomes unintelligible. Live Kit has to do them perfectly, in real-time, on thousands of connections simultaneously.

Media Processing and AI Integration Once the audio is captured and transmitted, it needs to be fed to an AI model. That AI model might be GPT, Claude, or a custom model. The AI generates a response, which needs to be synthesized to speech (text-to-speech) and sent back.

Live Kit provides SDKs and frameworks that make this integration easy. You can write something like:

room.connect()

agent = room.add_agent(model=GPT4)

agent.listen_for_utterances()

agent.generate_response()

agent.synthesize_to_speech()

Under the hood, Live Kit handles all the complexity: capturing audio, sending it to the model, synthesizing the response, managing latency, etc.

Scalability A single Web RTC connection can handle one conversation. But Live Kit needs to handle thousands simultaneously. That requires:

- Load balancing (distributing traffic across multiple servers)

- Session management (tracking which server handles which conversation)

- Failover (if a server fails, rerouting conversations to another server)

- Resource management (ensuring no single server gets overloaded)

This is essentially the same problem that AWS solves for cloud compute. But specialized for real-time communication.

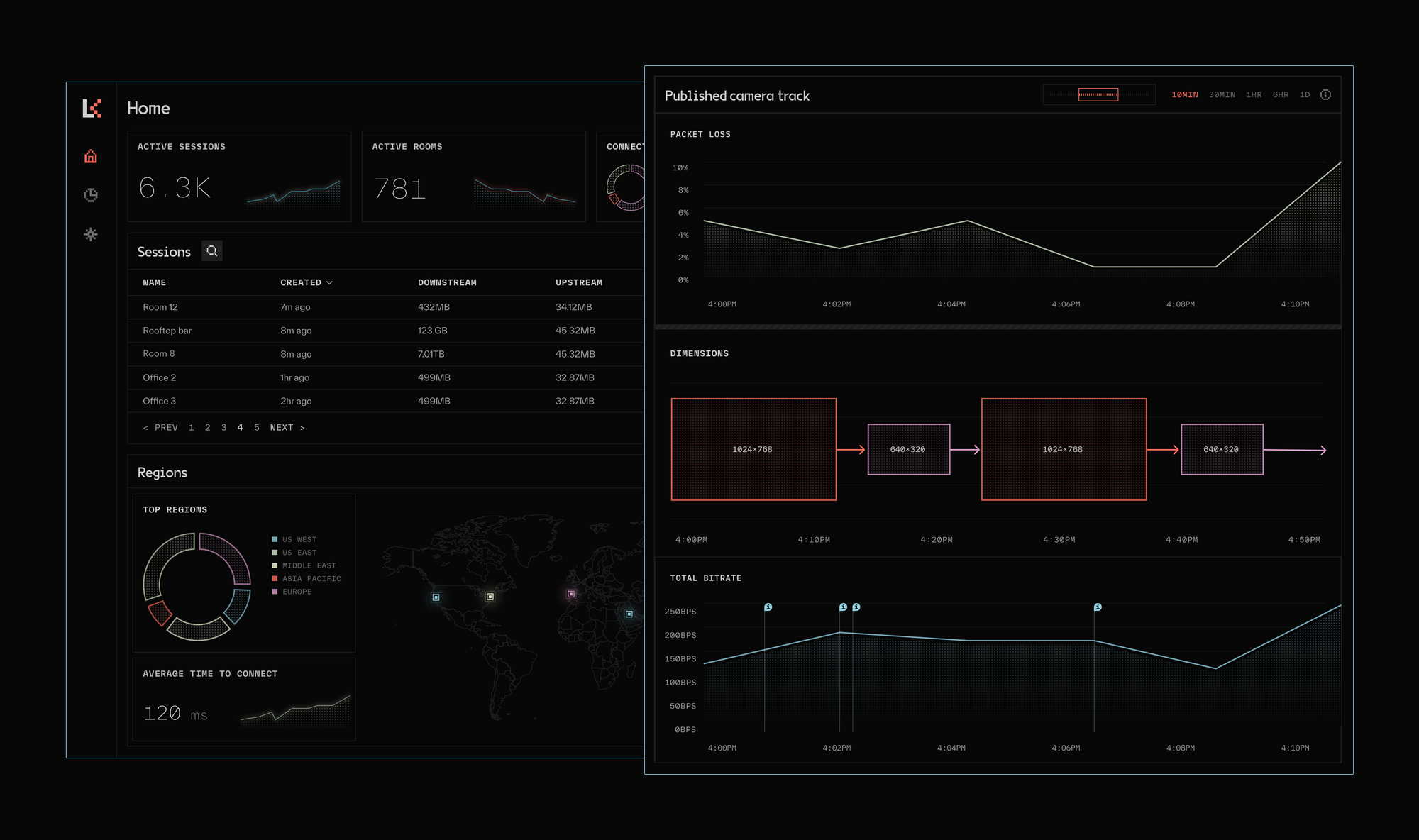

Metrics and Observability When something goes wrong, you need to know why. Is it the network? The AI model? The client application? Live Kit provides metrics and logging so customers can diagnose issues.

Think of it as giving customers visibility into a black box. That visibility is incredibly valuable for support and debugging.

All of this happens transparently to the end user. From their perspective, they just talk to an AI. But the infrastructure underneath is doing extraordinary things to make that conversation feel natural.

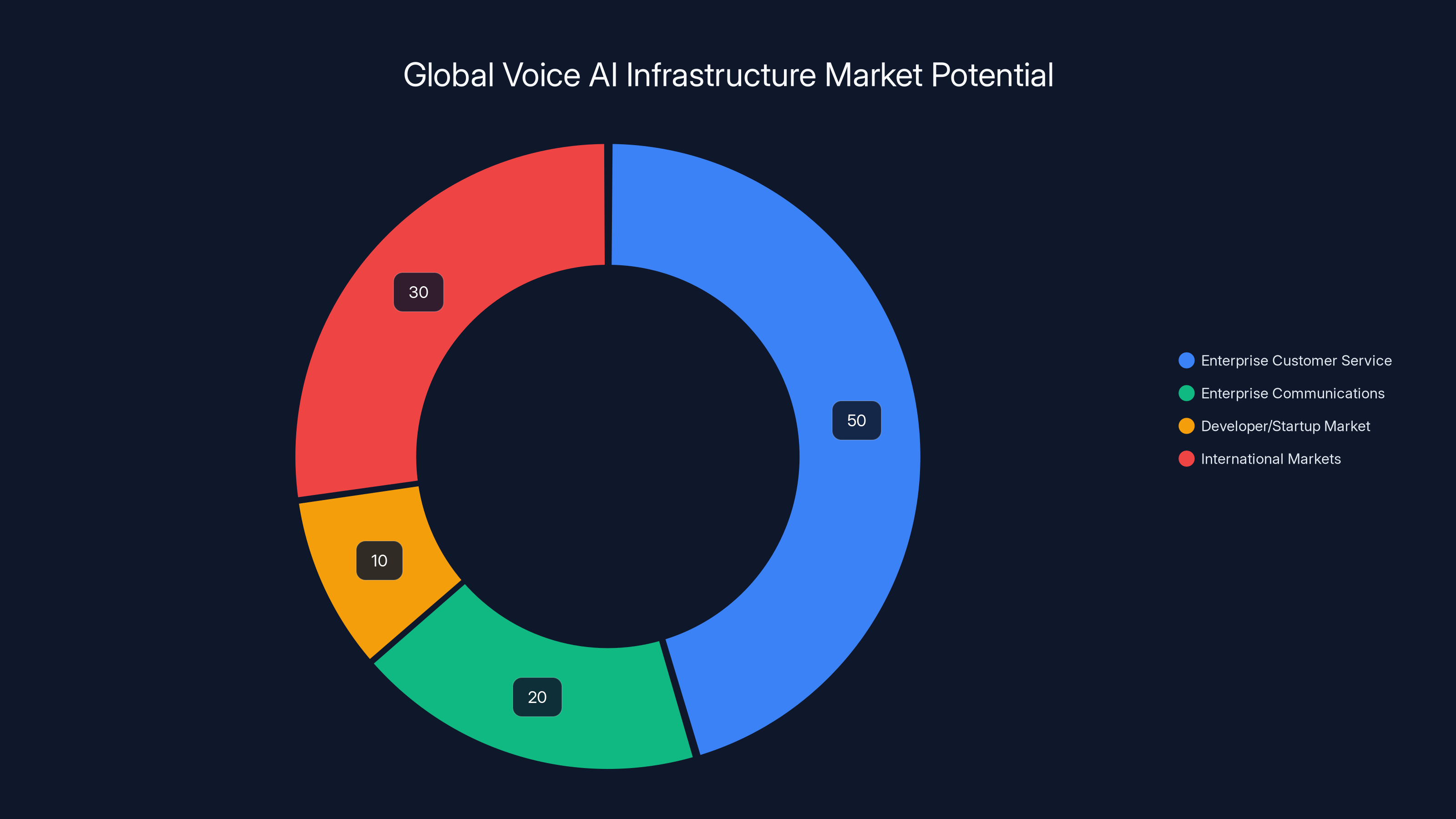

The global TAM for voice AI infrastructure is estimated at $10-75 billion, with significant contributions from enterprise customer service and international markets. Estimated data.

Market Size and Growth Projections

How big can voice AI infrastructure become?

To estimate this, we need to think about addressable markets:

Enterprise Customer Service

There are roughly 10,000 companies in the US with significant customer service operations (50+ agents). Each company might spend

Voice AI could capture 20-30% of that market over the next 5 years, as companies migrate from human-only support to AI-assisted support. That implies a $1-15 billion market opportunity for voice AI infrastructure.

Enterprise Communications Every large company uses voice and video conferencing infrastructure. Cisco Web Ex, Microsoft Teams, Google Meet, Zoom. That market is worth $20+ billion annually. If voice AI integration becomes standard, infrastructure providers who specialize in AI (like Live Kit) could capture a meaningful slice.

Developer/Startup Market

The long tail of companies building voice AI applications. There might be 50,000-100,000 startups and SMBs building voice AI products. Each might spend

International Markets Everything above is US-focused. Voice AI for customer service, emergency response, and healthcare is relevant worldwide. That at least 2-3x the TAM.

Adding these up: $10-75 billion TAM for voice AI infrastructure globally.

Live Kit's share of that market is what matters. If they capture 5-10%, that's

A company with

So the path from

- Capture market share in the categories above

- Achieve profitability

- Grow revenue faster than competitors

That's a big "just," but it's achievable if they execute well.

The Role of Artificial Intelligence in Voice Infrastructure

Here's a meta point: voice AI infrastructure is itself starting to use AI.

Live Kit is investing in AI to optimize their own infrastructure. For example:

Predictive load balancing Using historical patterns and real-time signals, AI can predict which servers will need more capacity and pre-scale them. This reduces latency spikes.

Intelligent codec selection Different audio codecs work better in different network conditions. AI can select the optimal codec based on network characteristics.

Anomaly detection When something goes wrong (a server fails, a network link becomes congested), AI can detect it faster than traditional monitoring and trigger failover automatically.

Route optimization Voice traffic can take multiple paths through the internet. AI can optimize routing in real-time to minimize latency.

Quality prediction Before a call happens, AI can predict whether network conditions will support high-quality audio and proactively adjust configuration.

This creates a virtuous cycle. As Live Kit uses AI to optimize their infrastructure, they become a better product, which attracts more customers, which generates more data, which trains better AI models. Competitors without this loop fall behind.

It's similar to what happened with Stripe and fraud detection. Stripe processes billions of transactions. That gives them massive data about fraud patterns. They can build better fraud models than competitors. Better fraud detection attracts more customers. That compounds over time.

Live Kit is at the beginning of that flywheel. If they execute well, the advantage compounds.

LiveKit stands out with its AI-first design and excellent developer experience, making it a strong competitor in the real-time communication space. (Estimated data)

Challenges and Risks

The investment thesis is compelling, but there are real risks:

Market Adoption Risk Voice AI could fail to achieve mainstream adoption. Enterprise customers are conservative. They might prefer traditional support (human agents) for another 5-10 years. Or they might use voice AI but prefer to build their own infrastructure rather than use a third party.

Competition Risk Amazon, Google, or Microsoft could decide voice AI infrastructure is important and invest heavily in their own solutions. They have scale, brand, and distribution advantages. Live Kit would struggle to compete.

Customer Concentration Risk If Open AI represents a large percentage of Live Kit's revenue, and Open AI decides to build their own infrastructure, Live Kit's business could crater. Investors would be watching this carefully.

Pricing Pressure Risk As the market matures, prices could fall. If competitors undercut Live Kit's pricing, Live Kit might be forced to lower prices (and margins) to stay competitive.

Latency Risk If Live Kit's infrastructure can't achieve sub-200ms latency at scale, the product won't be viable. Building reliable, low-latency infrastructure is extremely hard.

Regulatory Risk As voice AI becomes prevalent in customer service and emergency response, governments might impose regulations. Privacy laws, data residency requirements, consent requirements could increase compliance costs.

Technical Obsolescence Risk New audio codecs, network protocols, or processing techniques could emerge that make Live Kit's approach obsolete. (Lower risk since Web RTC is an open standard, but still possible.)

Each of these risks is real. But infrastructure investors have been betting on similar companies (Twilio, Stripe, Datadog) for years, and those bets have generally paid off. The pattern is: find a market that's too hard for individual companies to build, create a platform that solves the hard part, capture 10-20% of the market, and exit for $10-20B.

Live Kit is executing that playbook. Whether it works depends on execution, timing, and luck.

The Future of Voice AI Infrastructure

What does the landscape look like in 2027-2028?

Most likely scenario:

Specialization Live Kit and competitors will specialize further. Some will focus on AI-specific use cases (what Live Kit is doing). Others will focus on general video conferencing. Others will focus on high-security use cases (government, defense).

Consolidation There won't be room for 20 companies in voice infrastructure. The market will consolidate to 3-5 major players. Live Kit is well-positioned to be one of them.

Integration with AI Platforms Open AI, Anthropic, Google, and Meta will increasingly bundle voice infrastructure with their models. This makes it easier for customers but reduces the addressable market for independent infrastructure companies.

AI-Native Features New features specific to AI (agent frameworks, multi-modal processing, real-time reasoning) will become standard. Companies that move fastest on this will win.

Enterprise Adoption Voice AI will become standard in customer service, sales, and support. That's where the big revenue comes from.

International Expansion Voice AI will expand to non-English languages and non-Western markets. That creates new growth.

In this scenario, Live Kit could be a

The next 2-3 years are critical. Live Kit needs to:

- Land major enterprise customers (beyond Open AI)

- Build features that competitors can't easily replicate

- Achieve profitability or clear path to profitability

- Expand into new use cases (beyond customer service)

If they succeed, the valuation will compound. If they struggle, the hype will fade and the company will be seen as a missed opportunity.

That's the nature of venture investing. You make bets on companies in high-growth markets, knowing that many will fail but the winners will be worth billions.

The Bigger Picture: Why This Matters Beyond Live Kit

Live Kit's $1 billion valuation isn't just a win for one startup. It signals something bigger about the technology landscape.

For the past decade, the narrative in tech has been all about consumer apps. Instagram, Tik Tok, Snapchat. Everyone wants to build the next viral consumer app that reaches 100 million users.

But the money (and the value creation) is increasingly in infrastructure. The boring software that nobody sees but every company needs.

Think about the major wins of the past 15 years:

- AWS revolutionized cloud computing. Nobody wakes up excited about EC2. But every startup uses it. AWS generates $80+ billion in annual revenue for Amazon.

- Stripe made payments programmable. Nobody uses Stripe directly (it's behind the scenes). But Stripe is worth $95+ billion.

- Twilio made SMS and voice programmable. Boring use cases (SMS alerts, phone verification). Twilio is worth $10+ billion.

- Datadog monitors software infrastructure. Invisible to users. Worth $30+ billion.

The pattern is clear: if you can identify a hard technical problem that lots of companies face, and you can solve it in a general way, you can build a very large business.

Live Kit is betting they've identified the next such problem: real-time voice AI infrastructure.

If they're right, the company will eventually be worth $10-20+ billion. If they're wrong, they'll be acquired or will struggle to find product-market fit.

But either way, the fact that a $1 billion valuation is justified shows how important voice AI infrastructure is becoming.

Key Takeaways

-

Voice AI is no longer theoretical. With Chat GPT's voice mode, Claude's voice, and other releases, voice AI is becoming a primary way humans interact with AI. That requires infrastructure.

-

Live Kit powers critical applications. From Chat GPT to 911 dispatch to mental health platforms, Live Kit's infrastructure is handling increasingly important use cases.

-

Infrastructure is underappreciated. Most people don't know Live Kit exists. But it's worth $1 billion because it solves a hard problem that lots of companies need solved.

-

The market is enormous. The total addressable market for voice AI infrastructure could be $10-75 billion. Live Kit is just at the beginning.

-

Timing is everything. Live Kit is raising capital now because voice AI is hitting an inflection point. In another 2-3 years, this market will be oversaturated with competitors. Being first matters.

-

This is a venture bet, not a sure thing. Live Kit could be a $20 billion company or they could struggle to compete against better-funded rivals. The next 2-3 years will determine which scenario plays out.

-

Infrastructure creates lasting value. Consumer apps are fun and get more press. But infrastructure companies create more lasting value and larger exits.

FAQ

What is Live Kit and what does it do?

Live Kit is a platform for building real-time voice and video applications. Founded in 2021, it started as an open-source project and evolved into a managed cloud service. The company provides infrastructure that handles the technical complexity of real-time communication: audio/video compression, network optimization, codec selection, echo cancellation, and integration with AI models. Live Kit powers Open AI's Chat GPT voice mode, 911 emergency services, and enterprise customer service platforms.

How does real-time voice AI infrastructure work?

Real-time voice AI infrastructure captures audio, compresses it using codecs (like Opus), transmits it across the internet through optimized routing paths, feeds it to an AI model for processing, synthesizes the AI's response to speech, and transmits the response back to the user—all while maintaining latency under 300 milliseconds. Live Kit handles this by using edge servers near users, adapting to network conditions, canceling echo, removing noise, and managing thousands of simultaneous connections across geographic regions.

Why is the $1 billion valuation significant?

The

Who are Live Kit's customers and what do they use it for?

Live Kit's customers span multiple verticals: AI companies (Open AI, x AI), enterprise software companies (Salesforce), automotive (Tesla), emergency services (911 dispatch centers), mental health providers, and countless startups building AI voice applications. Primary use cases include customer service voice agents, sales assistant AI, emergency dispatch support, accessibility tools, education tutoring, and real estate/retail virtual assistants.

How does Live Kit compete with AWS, Google Cloud, and Twilio?

Live Kit competes by specializing in real-time voice and video applications (rather than being a general cloud provider), optimizing specifically for AI use cases (agent frameworks, real-time model integration), maintaining an open-source version that creates a developer funnel, and providing superior developer experience. AWS and Google Cloud offer generic solutions requiring integration of multiple services. Twilio is a direct competitor but focuses more on legacy telephony. Live Kit's advantage is being purpose-built for the voice AI era.

What is the addressable market for voice AI infrastructure?

The total addressable market for voice AI infrastructure is estimated at

What are the main risks to Live Kit's business?

Key risks include: market adoption risk (enterprises may stick with human agents longer than expected), competition risk (AWS/Google/Microsoft investing heavily in voice infrastructure), customer concentration risk (if Open AI represents large revenue percentage), pricing pressure risk (competitors undercutting prices), latency risk (inability to maintain sub-200ms response times at scale), regulatory risk (privacy/compliance requirements increasing costs), and technical obsolescence risk (new protocols or technologies making current infrastructure outdated).

What does the future of voice AI infrastructure look like?

The voice AI infrastructure market is likely to see specialization (different providers focusing on different use cases), consolidation (reducing from many players to 3-5 major ones), increasing integration with AI platforms (Open AI, Google, Meta bundling infrastructure), adoption of AI-native features (agent frameworks, multi-modal processing), massive enterprise adoption in customer service, and expansion to international markets and non-English languages. By 2030-2032, successful infrastructure companies like Live Kit could be worth $10-20+ billion.

How does Live Kit's funding round impact the broader AI and infrastructure markets?

Live Kit's

What are the technical advantages of Live Kit's infrastructure?

Live Kit's advantages include edge server architecture (reducing latency by processing near users), intelligent network adaptation (adjusting quality based on conditions), real-time media processing (echo cancellation, noise reduction), AI integration frameworks (making it easy to connect to GPT, Claude, etc.), built-in scalability (handling thousands of concurrent connections), comprehensive observability (metrics and logging for debugging), and failover reliability (ensuring service continuity). These advantages compound because they require specialized expertise that's hard for competitors to replicate.

For teams building with AI-powered automation platforms, solutions like Runable can help streamline workflows that depend on voice infrastructure. Teams using Live Kit might automate documentation, reporting, or presentation generation through Runable's AI agents to manage the output from voice applications more efficiently.

Use Case: Automatically generate customer interaction reports and summaries from voice AI conversations powered by Live Kit

Try Runable For Free

Related Articles

- Humans& AI Coordination Models: The Next Frontier Beyond Chat [2025]

- Startup Battlefield 2025: Glīd Founder Kevin Damoa's Winning Strategy [2025]

- Wellness Fund Boom: Inside Jenny Liu's $5M Venture Play [2025]

- Why Microsoft Is Adopting Claude Code Over GitHub Copilot [2025]

- General Fusion's $1B SPAC Merger: Fusion Power's Survival Strategy [2025]

- Telly's Free TV Strategy: Why 35,000 Units Matter in 2025

![LiveKit Hits $1B Valuation: Voice AI Infrastructure Boom [2026]](https://tryrunable.com/blog/livekit-hits-1b-valuation-voice-ai-infrastructure-boom-2026/image-1-1769123265607.jpg)