Meta Expands Ads to All Threads Users Globally: What This Means for 2025

Meta just made an announcement that changes everything for Threads. Starting next week, ads are coming to every single Threads user worldwide. Not testing anymore. Not limited to select countries. Global rollout, full stop.

If you've been using Threads to escape the ad-heavy world of Instagram and Facebook, I've got some news that might sting a bit. If you're an advertiser, you're probably already rubbing your hands together.

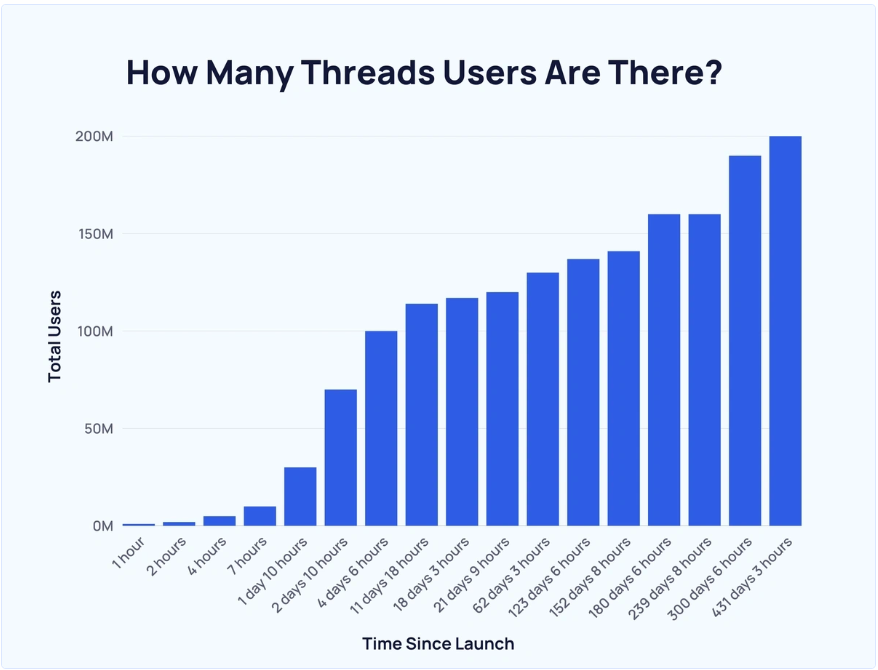

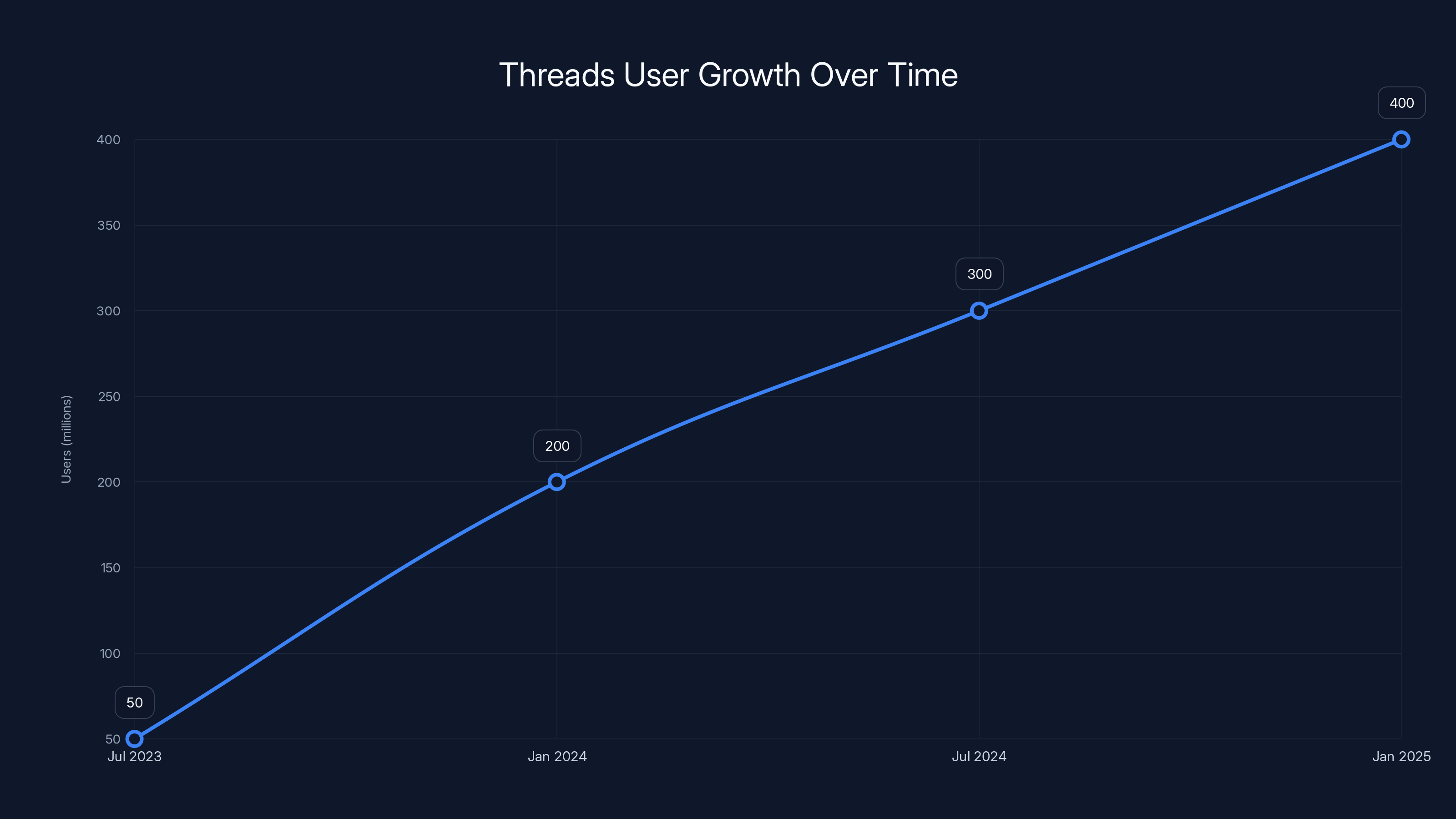

This is a massive pivot for the platform. Threads launched in July 2023 as Meta's answer to X (formerly Twitter), positioned as the ad-free alternative. Sixteen months later, here we are. The company has grown Threads to 400 million monthly active users, and now it's time to monetize.

But before you dismiss this as just another money grab, there's actually a lot more happening under the surface. Meta's making a calculated move based on AI-powered advertising technology that's gotten genuinely sophisticated. The infrastructure they're bringing from Facebook and Instagram is no joke. And for advertisers struggling with shrinking reach on other platforms, this could be a real opportunity.

Let me walk you through exactly what's changing, why Meta is doing this now, and what the actual impact will be for everyone involved.

The Current State of Threads: Growth at Escape Velocity

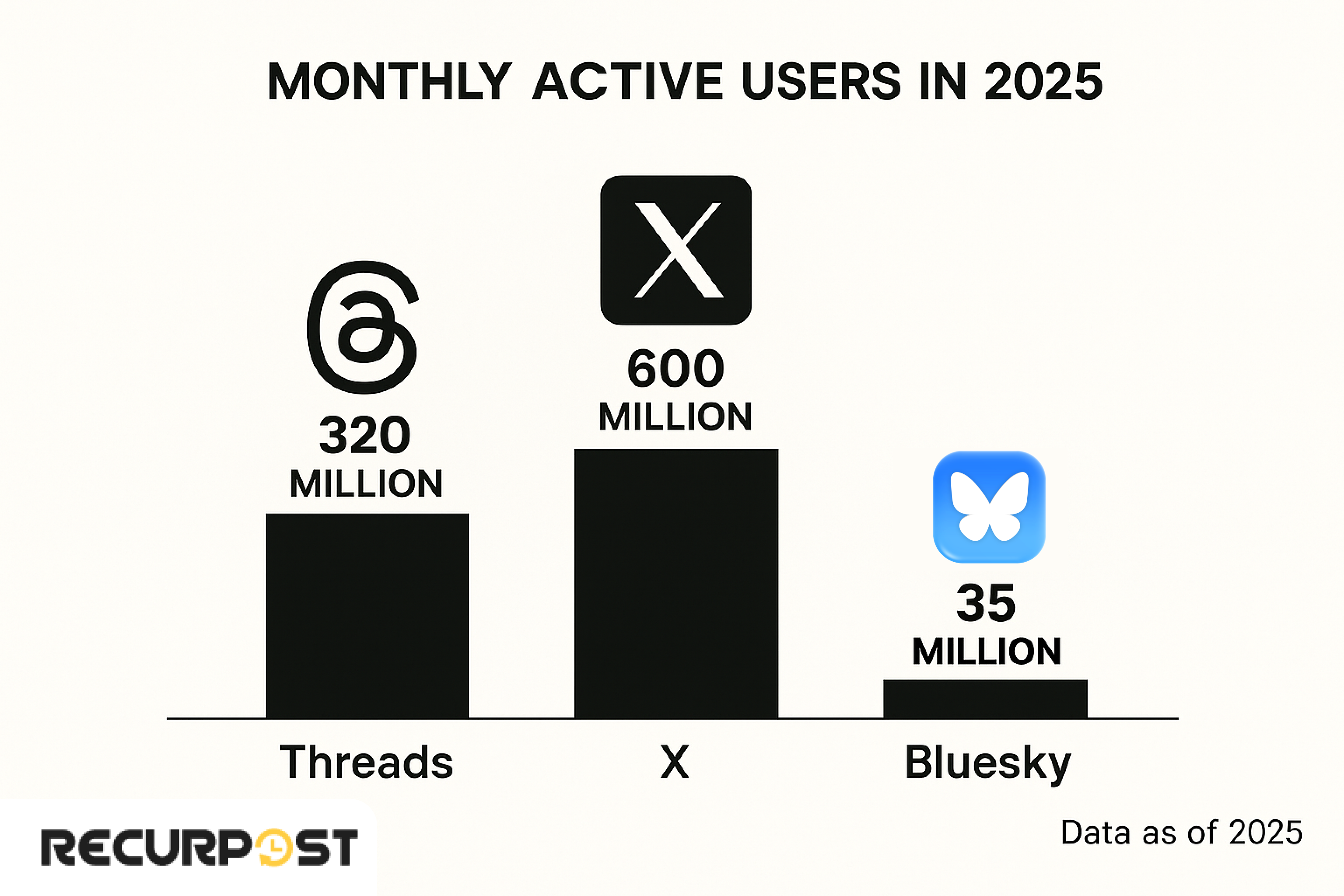

Threads hit 400 million monthly active users. That number landed like a bomb in the social media industry. For context, X was claiming around 500 million monthly active users before Elon took over. Bluesky is somewhere in the 10 million range. Mastodon sits at maybe 5 million active users across all instances.

Four hundred million in less than two years is aggressive growth. Seriously aggressive. Meta put zero dollars into advertising Threads—the app grew purely through the Facebook and Instagram user base migration. People saw a Twitter alternative and jumped.

But here's the thing about growth without monetization. It's unsustainable. Meta's spending real resources running Threads infrastructure, managing moderation, dealing with spam, and building features. The company's not in the charity business. Even with a 90% profit margin on advertising, you eventually have to extract revenue from users or the platform dies.

The timing is important too. Threads' growth rate has plateaued. After that initial surge, user growth flattened in early 2024. Daily active users are estimated around 100 to 150 million—a significant drop from launch day enthusiasm. Adding ads now is Meta's way of maximizing value from an existing user base before chasing new growth.

Meta tested ads in 30 countries starting in 2024. That gave them nine months of data on what works, what doesn't, and how users react to advertising on a Twitter alternative. The feedback was apparently positive enough to move forward globally.

Threads reached 400 million monthly active users in under two years, showcasing its rapid growth and popularity. Estimated data.

Meta's AI-Powered Advertising System: The Secret Sauce

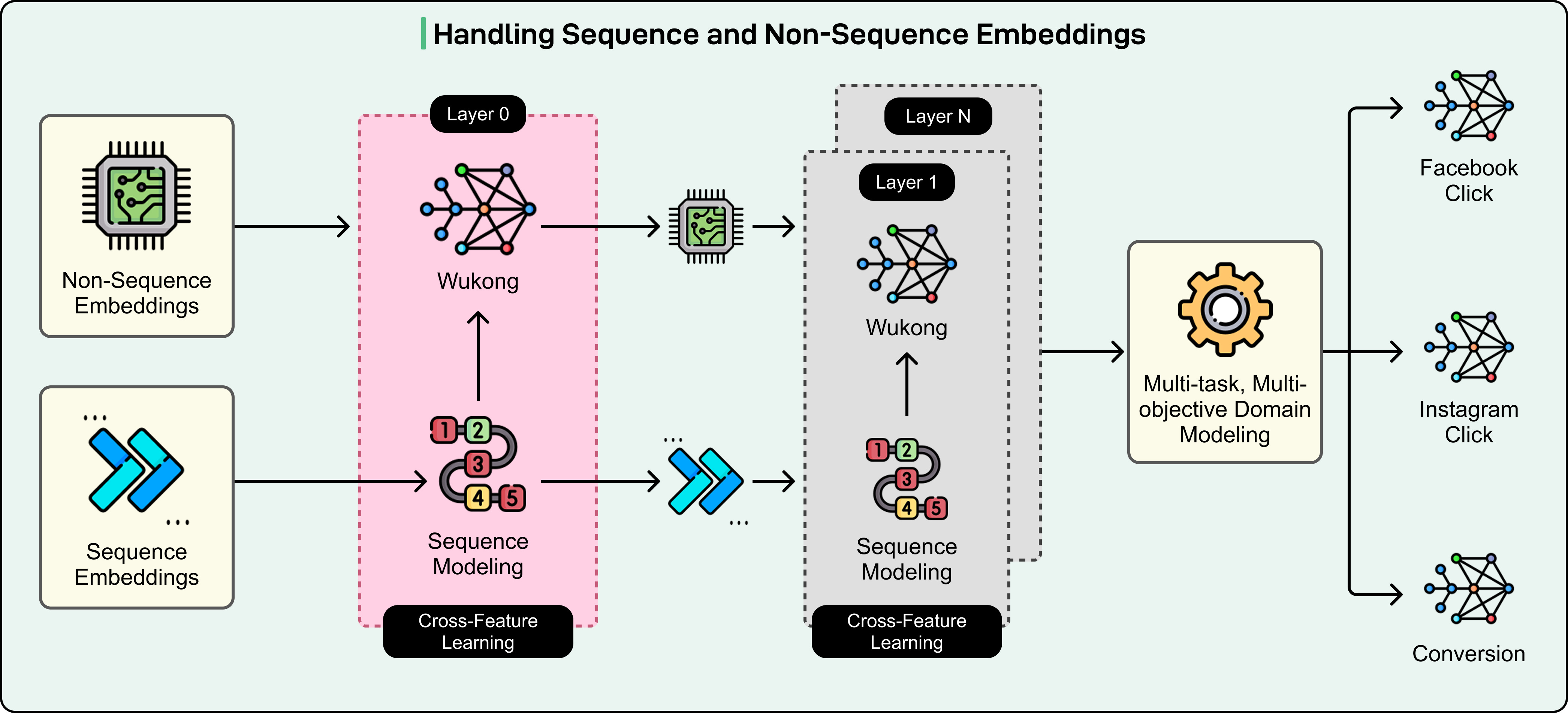

Meta's not just slapping random ads into Threads feeds and hoping something sticks. The company is bringing its full advertising arsenal to the platform. And that arsenal is powered by machine learning systems that are genuinely creepy—in both efficiency and accuracy.

Facebook's advertising system is widely considered the most sophisticated in the world. It's not even close. The company has 20 years of data, billions of users, and an AI system trained on trillions of interactions. When Meta says ads on Threads will use "the same level of personalization" as Facebook and Instagram, that means your Threads experience just became quantifiable.

Meta collects data points on you: demographics, interests, purchase history, browsing behavior across the web, engagement patterns, device information, location data, and relationship connections. The algorithm then uses this to predict which ads you're most likely to click on.

The machine learning models don't work the way most people imagine. Meta's not just categorizing you as "likes fitness" and serving you gym ads. The system is learning thousands of micro-signals about your behavior. Did you pause while scrolling past an ad? Did you click it twice? Did you click it once then go back? How long did your eyes linger on it? That's all being fed into the model.

Accuracy rates on Meta's advertising system are estimated between 70 to 85% for predicting whether you'll click on an ad. That's absurdly high. Random chance would be 1 to 2%. Most advertising platforms are in the 40 to 60% range. This is why brands spend so much money on Meta advertising.

The algorithm also factors in lookalike audiences. If someone similar to you engaged with a product, the system will show you that product. This creates a cascading effect where the algorithm gets smarter about predicting your behavior the more you use the platform.

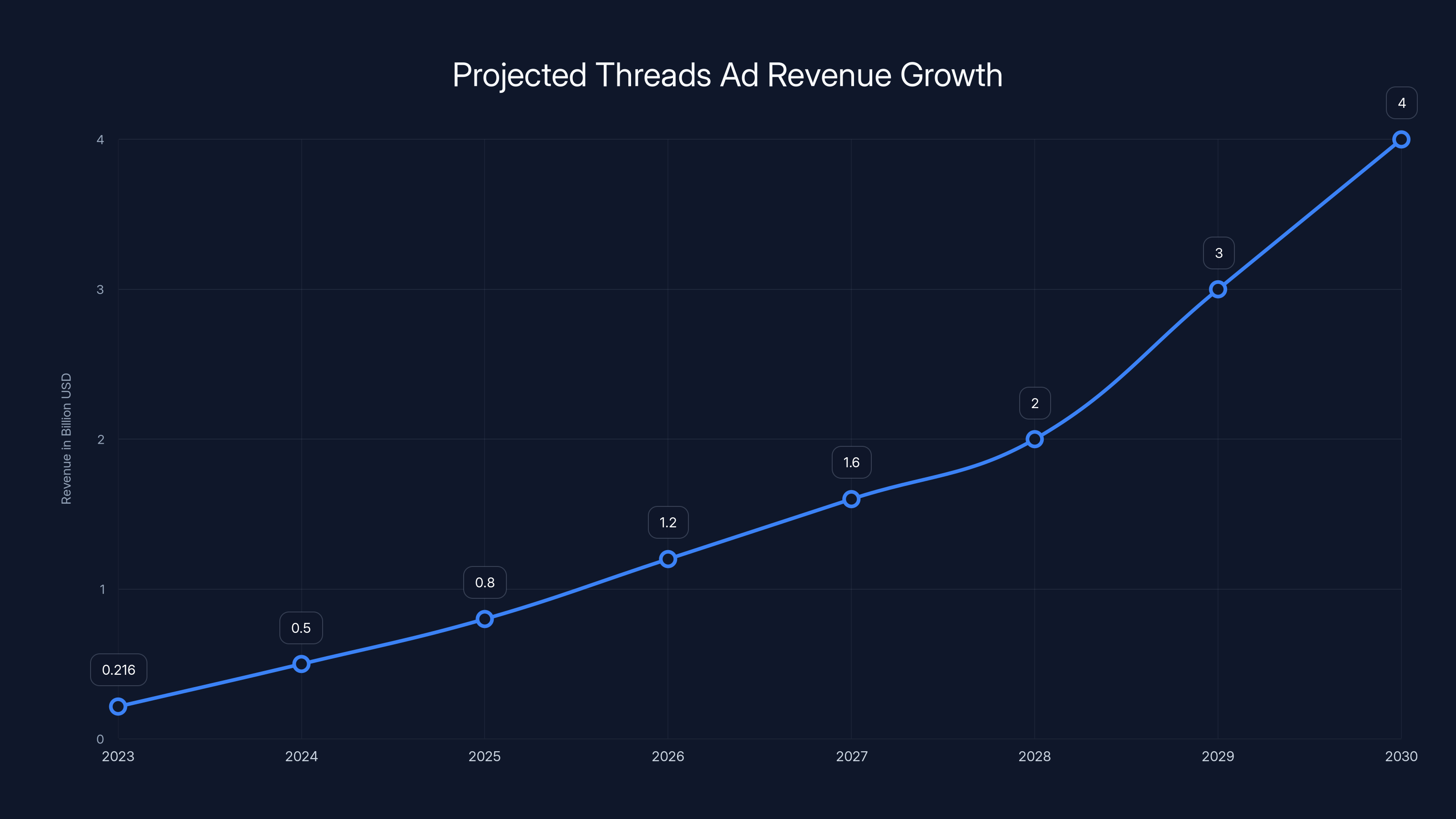

Estimated data shows Threads ad revenue could grow from

How Threads Ads Will Actually Work: Format and Placement

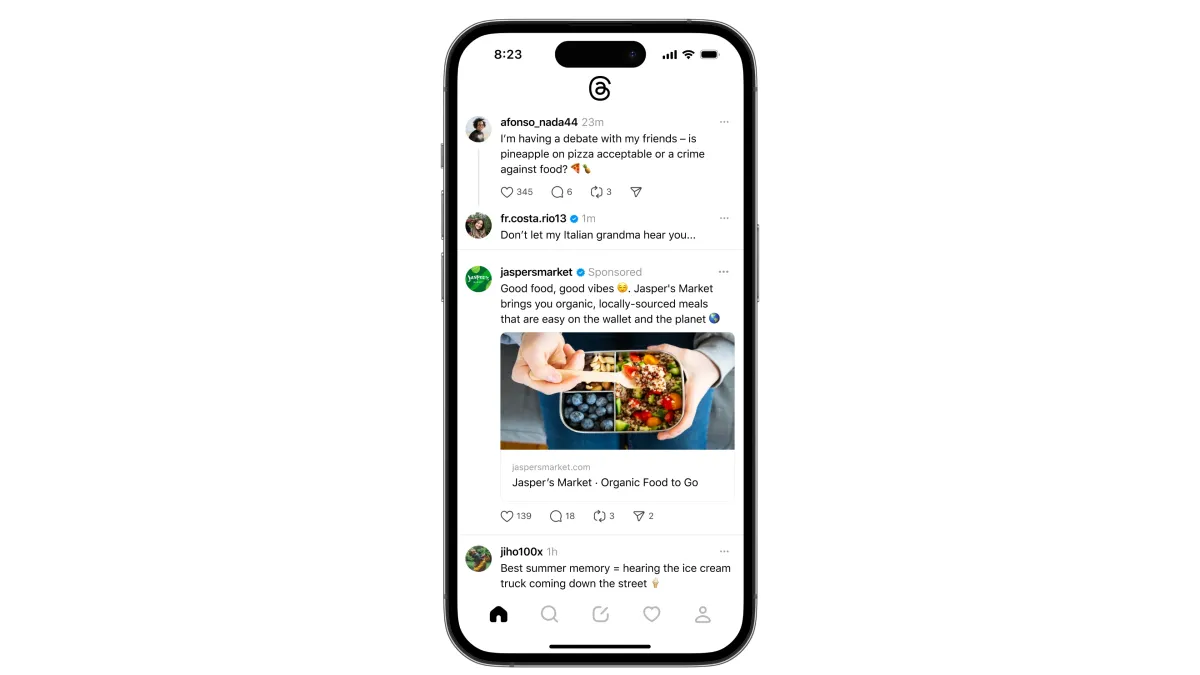

Meta's implementing image, video, and carousel ad formats natively in Threads feeds. That means ads will appear alongside regular posts in your feed, formatted to match the platform's aesthetic.

Image ads are straightforward. A single image with headline, description, and call-to-action button. Threads' design language is minimal, so these will probably look cleaner than Instagram ads, which have gotten increasingly crowded.

Video ads are where Meta makes real money. The company knows video content has 10 times higher engagement than static images. They're also pushing short-form video adoption on Threads to eventually compete with Tik Tok. Ads come first, platform features follow.

Carousel ads show multiple images or videos in a swipeable format. These perform well because they let brands showcase multiple products or features without making a single ad feel cluttered.

One crucial detail: placement in feeds. Meta hasn't specified the ad density yet. Facebook shows roughly one ad per three to five organic posts. Instagram is closer to one ad per two organic posts. Threads will probably land somewhere in between. The company mentioned "ad delivery initially remaining low," which suggests they're being cautious about user backlash.

There's also Threads' Stories feature (if they ever finish building it properly). That's where ads will eventually get more aggressive. Stories historically have higher ad loads because the format is ephemeral and feels less intrusive than feed ads.

Meta also hasn't mentioned Reels ads yet, but they're definitely coming. Reels are short-form video, and short-form video is where Meta prints money. The company is probably saving that rollout for later in 2025 once users acclimate to feed ads.

The Rollout Timeline: What "Gradual" Actually Means

Meta said the expansion starts next week but could take months for full global rollout. That's deliberately vague. Here's what the company usually means when it says something is "gradual."

Week one: Ads appear in select markets where testing happened. Probably starts in the US, maybe UK, Canada, Australia. Meta rolls out to 5 to 10 markets initially.

Week two to four: Expansion to Western Europe, developed Asian markets like Japan and South Korea. These regions have lower data privacy regulations than the EU (where GDPR complicates things).

Month two: Emerging markets in Asia, Latin America, Middle East. Africa usually comes last because those regions have lower advertiser demand and lower user purchasing power.

Month three to six: Remaining markets, including areas with regulatory complications like the EU, where data privacy laws require extra consent steps.

That timeline is based on how Meta rolled out Instagram ads, Facebook ad expansion, and Threads advertising tests. The company has this process down to a science.

What "ad delivery initially remaining low" means is that even though you'll see ads, the number of people seeing any particular ad will start small. Meta will A/B test different ad densities, formats, and placements to find the sweet spot. Too many ads too fast triggers user backlash. Too few and advertisers complain about reach.

Expect the first two weeks to feel almost normal. By month one, you'll probably notice ads appearing once per session. By month three, you're looking at ad density similar to Instagram.

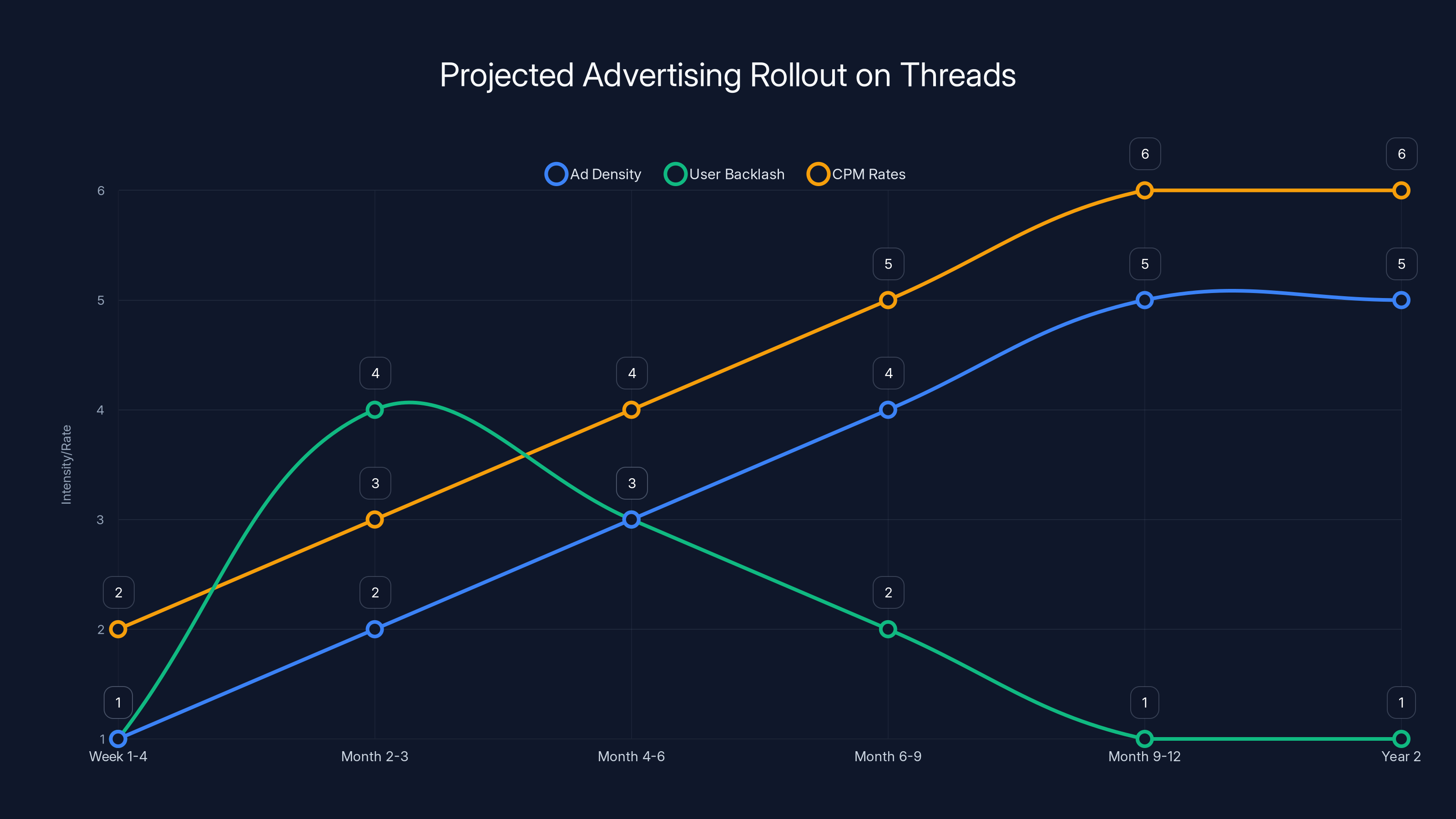

This line chart estimates the progression of ad density, user backlash, and CPM rates on Threads over the first 12 months, with projections for Year 2. Ad density and CPM rates are expected to increase, while user backlash peaks in months 2-3. (Estimated data)

What This Means for Advertisers: A New Goldmine Opens

Advertisers are getting access to 400 million users on a platform where targeting is based on Meta's 20 years of profiling data. This is genuinely valuable.

Facebook's minimum ad spend is

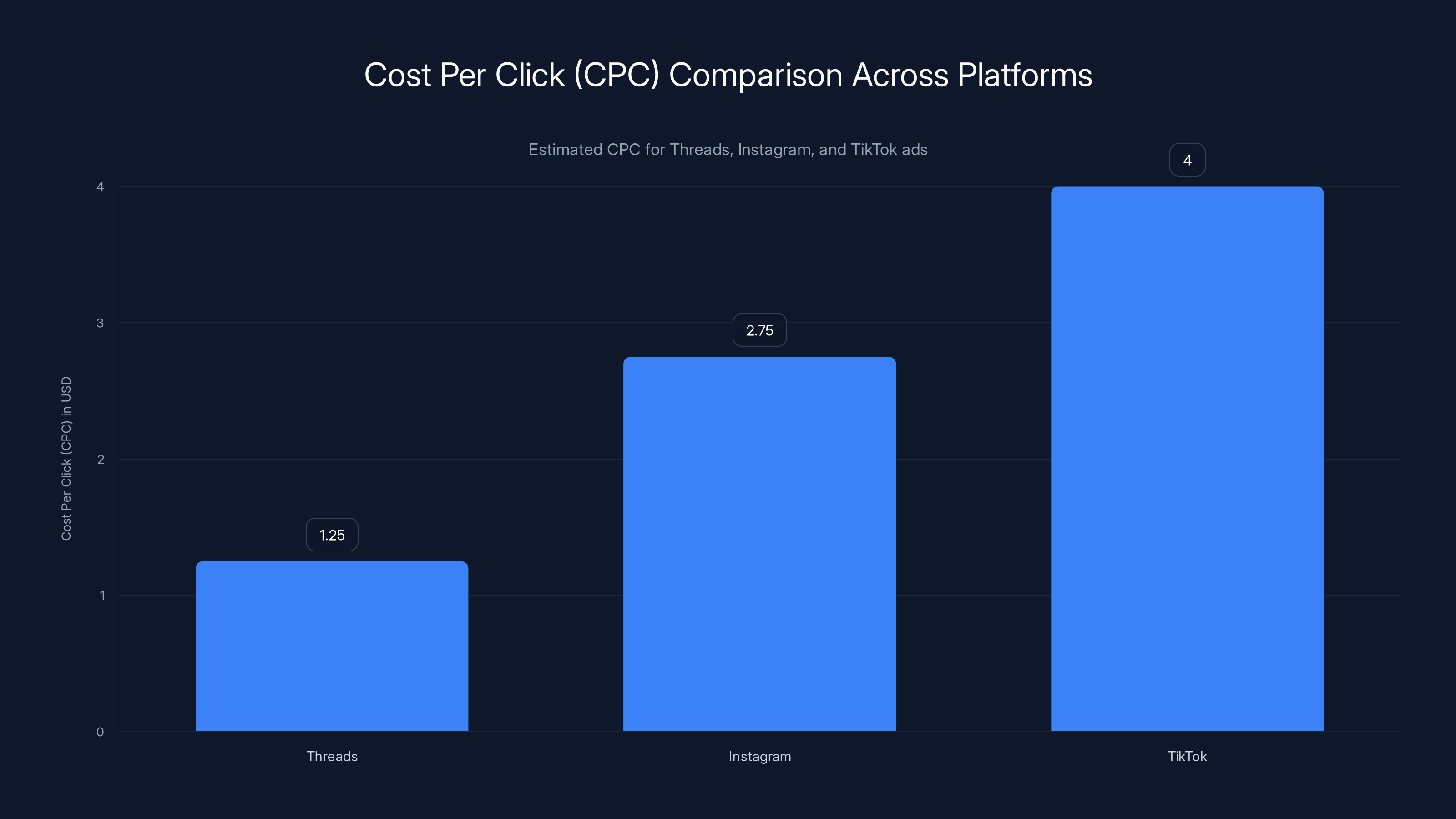

Cost per click on Threads ads is currently estimated at

The targeting options are where it gets powerful. Advertisers can target people based on:

- Demographics (age, gender, location, language, education, income)

- Interests (hobbies, entertainment, technology, fitness, fashion)

- Behaviors (purchase history, device type, operating system, browser)

- Lookalike audiences (people similar to your customers)

- Retargeting (people who visited your website or app)

- Connection-based (friends of people who like your page)

For B2C companies, this is a game changer. A fitness brand can target women aged 25-40 in major cities who engage with health content. A software company can target developers who follow tech accounts and engage with programming posts. A fashion brand can target people who recently looked at clothing on the web.

For B2B companies, it's less clear. Threads skews younger and more entertainment-focused than Linked In. But B2B companies are increasingly running ads wherever their audience is, so expect to see some B2B advertising on Threads regardless.

Small businesses are probably the biggest winners here. Facebook advertising democratized digital marketing for companies without traditional media budgets. Threads is extending that to a new generation of entrepreneurs and creators.

User Experience Impact: The Good, Bad, and Unavoidable

Let's be honest about what this means for regular Threads users. Your feed is about to become less about genuine community discussion and more about what pays Meta the most.

The upside is that Meta has gotten better at ad targeting. The ads you see will theoretically be relevant to your interests. If you're genuinely interested in fitness, you'll see fitness brands. If you like photography, you'll see camera gear. That's better than random ads for products you don't care about.

The downside is that personalization requires surveillance. Meta's system works because the company knows a shocking amount about you. That data collection is already happening on Facebook and Instagram, but being explicit about it happening on Threads is uncomfortable for users who chose the platform partly to escape that.

The other downside is visibility. As ads increase, organic posts get pushed down. A creator with 100,000 followers might have 1,000 people see their latest post without paid promotion. That's already true on Instagram, but Threads felt different because the algorithm was less aggressive.

Content creators are in an awkward position. Some are celebrating Threads ads because it opens a new revenue stream through creator funds and sponsored content. Others are frustrated because their organic reach will plummet, forcing them to pay to reach their own audience.

For discussion-based communities (the original Threads pitch), this is genuinely problematic. Threads is supposed to be where people have longer conversations about ideas. Ads interrupt that flow. They're a reminder that you're not the customer—you're the product being sold to advertisers.

Meta's probably banking on the fact that most people have accepted this trade-off on Instagram. You tolerate ads because the platform is useful. Threads will follow the same trajectory.

Threads offers a lower estimated cost per click compared to Instagram and TikTok, making it an attractive option for advertisers looking to experiment with lower budgets. Estimated data.

Data Privacy: What Gets Tracked Now

Meta collects an enormous amount of data to power its advertising system. Understanding what gets tracked is important because it affects you directly.

On Threads, Meta tracks:

Direct tracking:

- Everything you post, like, reply to, and repost

- Time spent on each post

- Which links you click

- Which videos you watch and for how long

- Search queries within Threads

- Account settings and preferences

- Device information and IP address

Cross-platform tracking:

- Your activity on Facebook and Instagram

- Websites you visit that have Meta pixel (a tracking code businesses put on their sites)

- Apps you use that integrate with Meta's system

- Your activity on Whats App if you linked your accounts

Third-party data:

- Purchase data from retail partners

- Credit card transaction data

- Demographic data from data brokers

- Offline behavior from physical stores

This is why the ad targeting is so accurate. Meta has more data on you than most governments.

The EU is specifically concerned about this. GDPR requires explicit consent for tracking. Meta's response in Europe is to either charge users for an ad-free version (which they've done with Facebook and Instagram) or show less personalized ads. Threads will probably follow the same model.

In the US, there's no equivalent to GDPR, so Meta can keep tracking without explicit consent. That's unlikely to change soon given the state of US privacy legislation.

Competitive Pressure: Why Now Was Inevitable

Meta didn't choose to monetize Threads because the company suddenly became greedy. The pressure comes from competition and the need to show growth to Wall Street.

Tik Tok has been aggressively courting advertisers. The platform's growth is unstoppable, and brands are starting to shift budgets from Instagram to Tik Tok. Meta needed a new advertising property to compete.

Bluesky is positioning itself as an ad-free, decentralized Twitter alternative. It's growing slower than Threads but attracting a very engaged user base. Meta probably looked at Bluesky's trajectory and realized it needed to monetize before another platform claimed ad-free social media as a differentiator.

X (Twitter) is a disaster for advertisers. Brand safety is a major concern. Elon's making contradictory statements about the platform's direction. Traditional advertisers are pulling budgets. That creates an opportunity for Meta to position Threads as the "responsible" version of Twitter with proper content moderation.

Google and Amazon are also getting more aggressive with advertising. Both companies are trying to capture budgets that traditionally went to Meta. Adding a new advertising surface with 400 million users is Meta's response.

Financially, Meta's stock price depends on growth. Advertising revenue growth specifically. Adding 400 million more users to Meta's advertising network is massive for shareholder value. The company reported

Threads ads might bring in

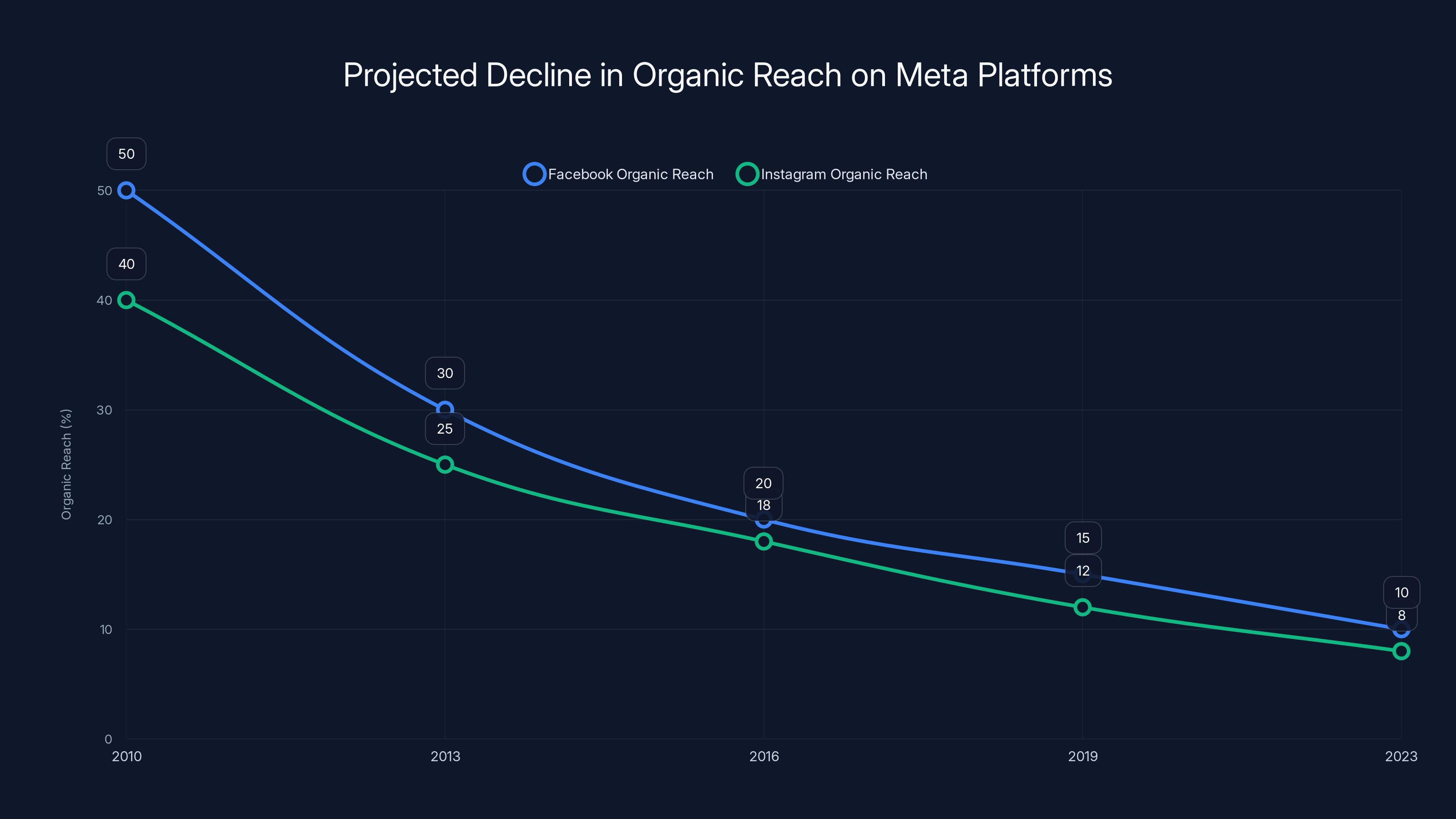

Organic reach on Facebook and Instagram has significantly declined over the years as Meta introduced more ad products. Estimated data for Threads suggests a similar trend.

Threads Ads vs. Competitors: Head-to-Head

How do Threads ads compare to other platforms?

Versus Instagram: Threads ads are cheaper (lower cost per click), but Instagram has more daily active users and higher engagement overall. Instagram ads are more proven. Threads ads are the experiment.

Versus Tik Tok: Tik Tok ads get better engagement with younger audiences (Gen Z). Threads skews older (mostly millennials). Tik Tok's ads are more expensive. Threads is cheaper.

Versus X/Twitter: X's ads are unreliable due to brand safety concerns. Threads is positioned as the safer alternative. Threads also has better ad targeting because Meta's data infrastructure is superior.

Versus Facebook: Facebook ads are more established and reach older audiences. Threads reaches younger users. Both use the same underlying targeting system, so performance should be comparable on a per-user basis.

Versus Linked In: Linked In ads are for B2B and professional services. Threads is too entertainment-focused for most B2B marketing unless you're hiring tech talent.

Advertisers will likely use Threads ads as a secondary channel. Primary budgets will stay on Instagram and Tik Tok. Threads fills a gap—it's cheaper than Tik Tok, has better targeting than X, and feels like the responsible Twitter alternative.

Small businesses will probably get the most value. They can't afford Tik Tok's higher costs and aren't established enough for Facebook's minimum requirements. Threads is the Goldilocks zone.

What This Means for Content Creators

Content creators on Threads are getting complicated feelings about this announcement.

The upside: Meta is rumored to be building a creator fund for Threads, similar to Instagram's. Creators who generate viral content could start earning money directly. The company hasn't announced this officially, but it would make sense as a retention strategy.

The downside: Organic reach will decrease. Creators rely on organic reach to build audiences. Once ads start competing for attention, each post reaches fewer people without paid promotion.

Historically, Meta reduces organic reach every time it introduces new ad products. Facebook's organic reach dropped from 50% to 10% over a decade as the company monetized more aggressively. Instagram experienced similar decline. Threads will follow the same path.

Creators with established audiences (10,000+ followers) can weather this. They can switch to paid promotion or move to Threads' direct messaging feature to build closer communities. Creators just starting out will struggle because their reach will be almost invisible.

The creator fund (if and when Meta launches it) would help. Earnings are typically

Creators should probably start diversifying revenue sources now. Build an email list on Threads. Point followers to other platforms (Patreon, Substack, Tik Tok) where you have more control. Create exclusive content on Threads to drive engagement metrics that feed the algorithm.

The creator economy is built on attention. Once attention becomes scarce (due to ads), creators who built direct relationships with audiences survive. Those who relied only on organic reach from the algorithm struggle.

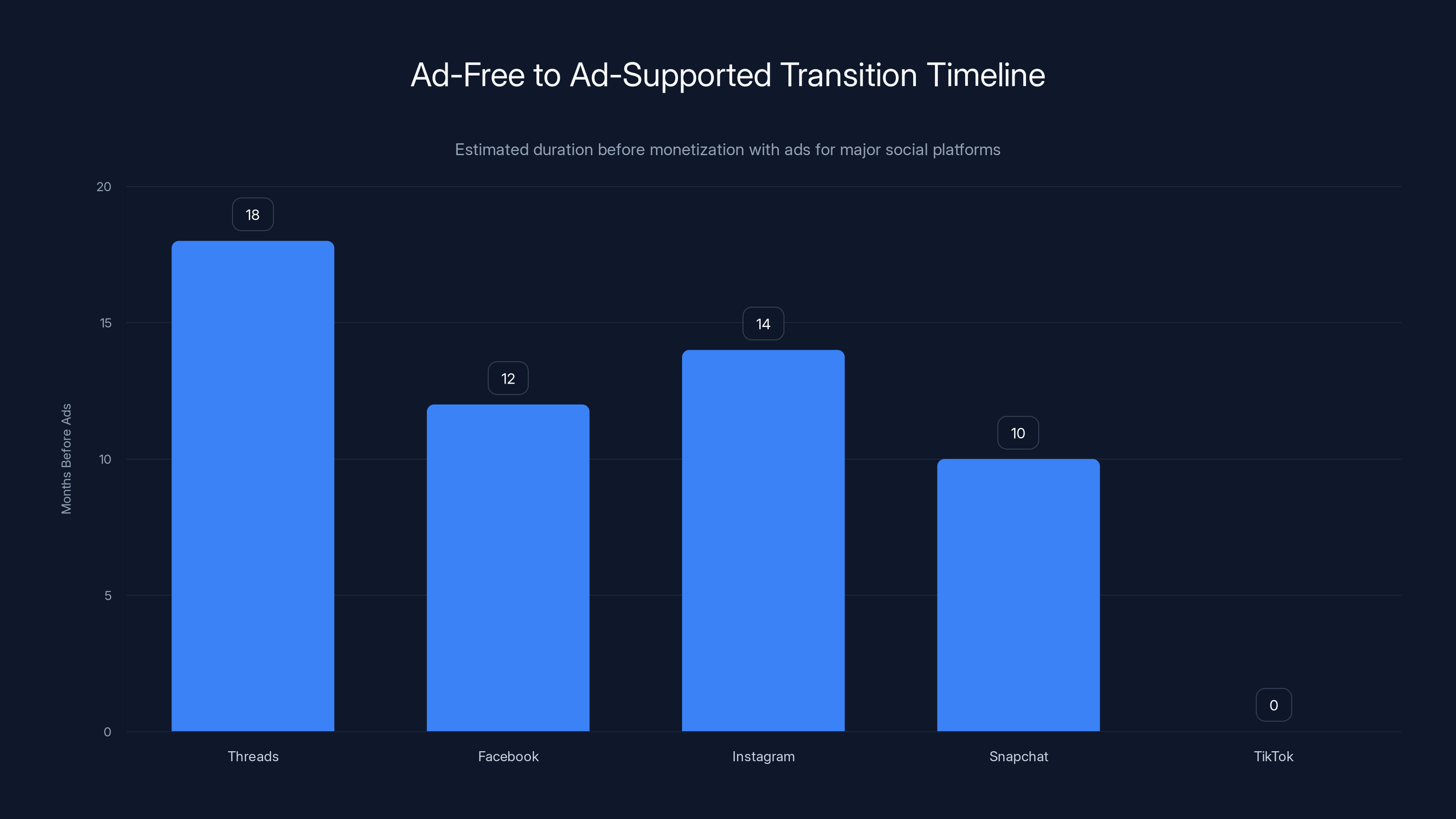

Estimated data shows Threads took longer to introduce ads compared to other platforms, reflecting Meta's strategic approach. Estimated data.

The EU Problem: Different Rules, Different Experience

The European Union has different privacy rules. This is going to create friction.

GDPR requires explicit consent before collecting personal data for advertising. Meta's response has been to offer an ad-free subscription on Facebook and Instagram (€10-15 per month) in Europe. Users either accept personalized ads or pay to avoid them.

Threads ads will probably follow the same model. European users will get a choice: see targeted ads or pay for ad-free experience. That's theoretically fairer because you're compensating Meta for not showing ads.

Practically, it creates a fragmented user experience. US users get ad-supported Threads. European users can choose. That makes the platform feel different depending on where you are.

Meta has repeatedly lobbied the EU to ease privacy regulations, arguing they're hurting the company competitively. The EU has refused. GDPR is here to stay. That means Meta has to either accept lower profitability in Europe or create different versions of its platforms.

Threads ads in Europe will probably be less targeted and less effective. That means lower advertiser demand and lower revenue. Meta will probably accept this as the cost of operating in Europe.

Other regions are watching Europe closely. The UK (post-Brexit) has similar GDPR-aligned laws. Canada is moving toward stronger privacy regulations. Australia has been toying with regulating tech companies for years. If other regions follow Europe's lead, Meta's global advertising revenue growth slows significantly.

This is why Meta is aggressively monetizing Threads now while it can. Revenue diversity means the company isn't entirely dependent on US advertising revenue.

The Ad-Free Dream Is Dead (And That's Okay)

Threads was positioned as the ad-free social network. That promise lasted longer than most—about 18 months. That's actually impressive in social media terms.

Facebook promised ad-free, got ads. Instagram promised ad-free, got ads. Snapchat promised ad-free (more or less), got ads. Tik Tok always had ads. The pattern is consistent: venture capital funding, growth, monetization, users adapt or leave.

Threads isn't different. It was just slower to monetize because Meta was still learning what the platform should be.

Users who are upset about this should be realistic about alternatives. Every platform that scales beyond 100 million users eventually monetizes with advertising. There are no exceptions. Bluesky and Mastodon haven't done it yet because they're small. Once they reach critical mass, they'll face the same pressure.

The choice isn't between "ad-supported Threads" and "ad-free Threads." The choice is between "ad-supported Threads," "ad-free paid Threads," or "no Threads." Meta hasn't announced pricing for ad-free Threads yet, but expect something in the

Some users will pay. Most won't. Most will tolerate ads because the alternative is abandoning their social graph. That's how Facebook and Instagram maintain 3 billion users collectively despite privacy concerns and aggressive monetization.

The bright side is that Threads is probably the most transparent Meta product at launch. The company is explicitly saying "ads are coming" instead of hiding the move like Facebook did in 2009. That's growth in corporate honesty, even if it feels like a consolation prize.

Revenue Potential: How Much Money Will This Actually Make

Estimating Threads ad revenue requires some math.

400 million monthly active users. Let's estimate 100 million daily active users (a conservative estimate based on leaked data). If each user sees an average of two ads per day, that's 200 million ad impressions daily. Over a month, that's 6 billion impressions.

Meta's average cost per 1,000 impressions (CPM) on Instagram is

6 billion impressions ×

That's on the low end. As the platform matures and advertisers compete more aggressively, CPM will increase. Once Threads stabilizes, expect

That's significant but not transformative. It's roughly 0.3% to 0.5% of Meta's total advertising revenue. Meaningful growth, not a game-changer.

But there's upside. If Threads grows to 500 million monthly users (matching X's pre-Elon user base) and daily active users increase to 200 million, revenue could double. If Meta increases ad density to match Instagram levels, revenue triples.

Five-year projection: Threads ads could generate

The Advertising Ecosystem Effect

Threads ads don't exist in isolation. This move affects the entire Meta advertising ecosystem.

Advertisers now have three Meta platforms for social advertising: Facebook, Instagram, Threads. Meta bundles them together in their campaign manager. A brand can run one campaign across all three platforms with unified targeting.

This is powerful. It means brands can reach people across different demographics, interests, and usage patterns. Gen Z on Threads and Tik Tok. Millennials on Instagram. Older users on Facebook.

It also means Meta is further entrenching its advertising dominance. The company already controls 50% of global digital advertising. Adding Threads strengthens that position.

For independent social platforms trying to compete, this is bad news. Threads being integrated into Meta's advertising ecosystem makes it harder for alternatives to gain traction. Why should advertisers bother with Bluesky or Mastodon if they can reach massive audiences on Meta properties?

This is why regulators worry about Meta's power. The company isn't competing on features. It's competing on scale and data infrastructure. No startup can match Meta's advertising technology.

What to Expect: A Realistic Roadmap

Here's what's likely to happen over the next 12 months.

Week 1 to 4: Ads launch in US, UK, Canada, Australia. Users notice but aren't overwhelmed. Ad density is light.

Month 2 to 3: Expansion to Western Europe, Japan, South Korea, other developed markets. EU users get offered ad-free subscription option ($10-15/month). Ad density increases slightly.

Month 4 to 6: Expansion to Asia, Latin America, Middle East. Ad density approaches Instagram-like levels. Organic reach starts noticeably declining for creators.

Month 6 to 9: Meta rolls out Stories ads, Reels ads, and expanded ad formats. Meta launches creator fund for top creators. Threads integrates more deeply with Facebook and Instagram advertising.

Month 9 to 12: First major advertiser reports show Threads ads are working. More companies allocate budgets to Threads. Competition increases, CPM rates rise.

Year 2: Threads reaches profitability on advertising. User growth plateaus. Meta focuses on engagement metrics and monetization.

This timeline is based on how Meta rolled out advertising on previous platforms. The pattern is consistent.

User backlash will spike in month 2 to 3 when ads become more visible. Reddit and Twitter will fill with people complaining. Some will switch to alternatives. Most will stay.

By month 6, the novelty of the complaint wears off. Users accept ads as inevitable. Growth continues at a slower pace.

By year 2, Threads feels like a normal Meta property. It's ad-supported, slightly personalized, and optimized for engagement. The original vision of an ad-free Twitter alternative is officially dead.

Lessons from Facebook and Instagram: History Repeating

Meta's done this dance twice before.

Facebook launched in 2004 as an ad-free social network. By 2009, the company needed revenue. Ads launched quietly, with minimal disclosure. Users didn't like it, but they adapted.

By 2015, Facebook's organic reach for pages had dropped to single digits. Brands had to pay to reach their audiences. Organic reach continued declining until it hit 5-10% in 2020.

Instagram launched in 2010 as ad-free. The company was acquired by Facebook in 2012 for $1 billion (at the time, considered overpaying). Ads launched in 2013. Users complained. By 2020, Instagram was a crucial part of Meta's advertising business.

Threads is following the same playbook. Ad-free launch, user excitement, monetization through ads, organic reach decline, complaints, adaptation.

The lesson: social platforms are never truly ad-free. They're ad-deferred. The business model demands eventual advertising. Understanding this upfront prevents disappointment later.

Meta's being more transparent about this on Threads than it was with Facebook or Instagram. That's progress. But the outcome is the same.

Users who remember Facebook's transition should prepare for similar changes on Threads. It's not nefarious. It's just how these businesses work. Free products require monetization at scale.

The Bigger Picture: Platform Consolidation

Threads ads represent a broader trend in tech: consolidation.

Meta, Google, Tik Tok, and Amazon dominate digital advertising. Smaller platforms struggle because advertisers prefer consolidated dashboards and large audiences.

Threads is Meta expanding its consolidated advertising empire. The company is trying to become the definitive platform for social advertising, whether you're selling fitness products, B2C Saa S, or consumer goods.

This creates winners and losers. Small platforms that don't have advertising products lose ability to generate revenue. Creators on those platforms make less money. Brands can't reach as many people efficiently.

Meanwhile, Meta's position strengthens. The company becomes more essential to businesses. Regulatory pressure increases. Antitrust concerns grow. The EU is actively investigating Meta for monopolistic practices.

Threads ads accelerate this consolidation. It's not great for competition. But it's profitable for Meta and (arguably) good for advertisers who want unified platforms.

Final Thoughts: Adapting to Monetized Threads

Threads ads are inevitable and soon. Users, creators, and advertisers all need to adapt.

For regular users: start thinking about whether you want to see targeted ads or pay for ad-free Threads. Manage your privacy settings to limit what data Meta collects. Understand that organic reach will decline, so if you follow creators, you might miss their posts.

For creators: diversify revenue sources now. Don't rely exclusively on organic reach from Threads. Start building email lists, Patreon communities, or You Tube channels. Build direct relationships with your audience so you're not dependent on platform algorithms.

For advertisers: Threads is a new opportunity at lower cost than more established platforms. Start testing with small budgets. Learn how the audience behaves before scaling. Remember that early adopters (right now) get better pricing.

For Meta: this is a necessary move. The company needs revenue from Threads to justify the investment. The question is whether they can grow Threads revenue to match Instagram while maintaining user satisfaction. That's the real challenge.

Threads with ads is Meta's statement that the platform is here to stay. It's not an experiment anymore. It's a permanent part of the social media ecosystem.

Adapt accordingly.

FAQ

What is Threads and why does it matter?

Threads is Meta's Twitter alternative platform launched in July 2023. It matters because it reached 400 million monthly active users in under two years, making it one of the fastest-growing social platforms ever. The platform is now Meta's secondary social networking property alongside Facebook and Instagram, with plans to become a major part of the company's advertising business.

When are ads coming to Threads globally?

Meta announced ads are expanding globally starting next week (from the announcement date), but the full rollout will take several months. The initial rollout begins in major markets like the US, UK, Canada, and Australia, then expands to Europe, Asia, Latin America, and finally emerging markets. Meta is deliberately pacing the rollout to avoid overwhelming users and to test different ad formats and densities.

How does Meta's AI advertising system work on Threads?

Meta's AI-powered advertising system analyzes billions of data points about your behavior, including your posts, engagement patterns, clicks, time spent on content, device information, and cross-platform activity across Facebook, Instagram, and Meta-tracked websites. Machine learning models trained on this data predict which ads you're most likely to engage with, achieving accuracy rates of 70-85% compared to random chance of 1-2%. This same system powers Facebook and Instagram ads, making it one of the most sophisticated advertising targeting systems in the world.

What types of ads will appear on Threads?

Image, video, and carousel ad formats will appear natively in Threads feeds. Image ads are single images with headlines and calls-to-action. Video ads are short-form videos optimized for mobile viewing. Carousel ads display multiple images or videos in a swipeable format. Meta will eventually add Stories ads and Reels ads, but these are coming later. Ad placement will initially be light (about one ad per 3-5 organic posts) and gradually increase.

How much will Threads ads cost advertisers?

Cost-per-click on Threads ads is estimated at

Will there be an ad-free option for Threads?

Meta hasn't officially announced pricing for ad-free Threads, but based on the company's model with Facebook and Instagram, expect a paid ad-free subscription in the $5-15 monthly range. EU users will probably get this option first due to GDPR privacy regulations. US users will likely follow in subsequent months.

How will Threads ads affect organic reach for creators?

Organic reach will decline as ad inventory increases, following the pattern established on Facebook and Instagram. Facebook's organic reach dropped from 50% to 10% over a decade. Creators will need to pay for promotion to reach their full audiences. Meta may launch a creator fund where popular creators earn money based on engagement, but this is not yet officially announced.

What data does Meta collect from Threads users for advertising?

Meta collects direct data (posts, likes, comments, views, search queries, device information) and cross-platform data (activity on Facebook, Instagram, websites with Meta pixel, purchase history from retail partners). The company also purchases third-party demographic data from data brokers and uses offline behavior from physical stores. This comprehensive data collection enables the precise ad targeting.

How does this compare to ad practices on other social platforms?

Threads ads use Meta's superior data infrastructure, making them more targeted than X/Twitter ads but available to a smaller audience. Threads is positioned as a safer alternative to X due to better content moderation and more reliable brand safety. Compared to Tik Tok, Threads ads are cheaper but reach an older audience. Tik Tok dominates with Gen Z, while Threads appeals more to millennials and older users.

Why is Meta monetizing Threads now?

Meta is monetizing Threads now because user growth has plateaued, the company needs to demonstrate revenue growth to investors, and competition from Tik Tok requires new advertising surfaces. Monetizing after 18 months allows the platform to establish a user base before introducing ads. The move also demonstrates that Threads is a permanent part of Meta's strategy, not an experiment.

Key Takeaways

- Threads reaches 400 million monthly active users and becomes Meta's next major advertising platform, with global ad rollout starting next week

- Meta's AI advertising system achieves 70-85% accuracy in predicting user engagement by analyzing cross-platform data including browsing history, purchase behavior, and content preferences

- Threads ads start at 2.00 cost-per-click, significantly cheaper than Instagram (4.00) and TikTok (5.00), attracting budget-conscious advertisers

- Organic reach for creators will decline from current 15-20% to 5-10% within 3-5 years, following the pattern established on Facebook and Instagram

- Image, video, and carousel ad formats will appear natively in Threads feeds with initial low ad density gradually increasing over the coming months

Related Articles

- Threads Ads Global Rollout: What It Means for Users and Creators [2025]

- Why We're Nostalgic for 2016: The Internet Before AI Slop [2025]

- Instagram's AI Problem Isn't AI at All—It's the Algorithm [2025]

- Netflix Vertical Video Mobile App Redesign: What's Coming in 2025-2026 [2025]

- YouTube's SRV3 Captions Disabled: What Creators Need to Know [2025]

- Complete Guide to Content Repurposing: 25 Proven Strategies [2025]

![Meta Expands Ads to All Threads Users Globally [2025]](https://tryrunable.com/blog/meta-expands-ads-to-all-threads-users-globally-2025/image-1-1769022448144.jpg)