The Reality Check Behind Meta's Reality Labs Cutbacks

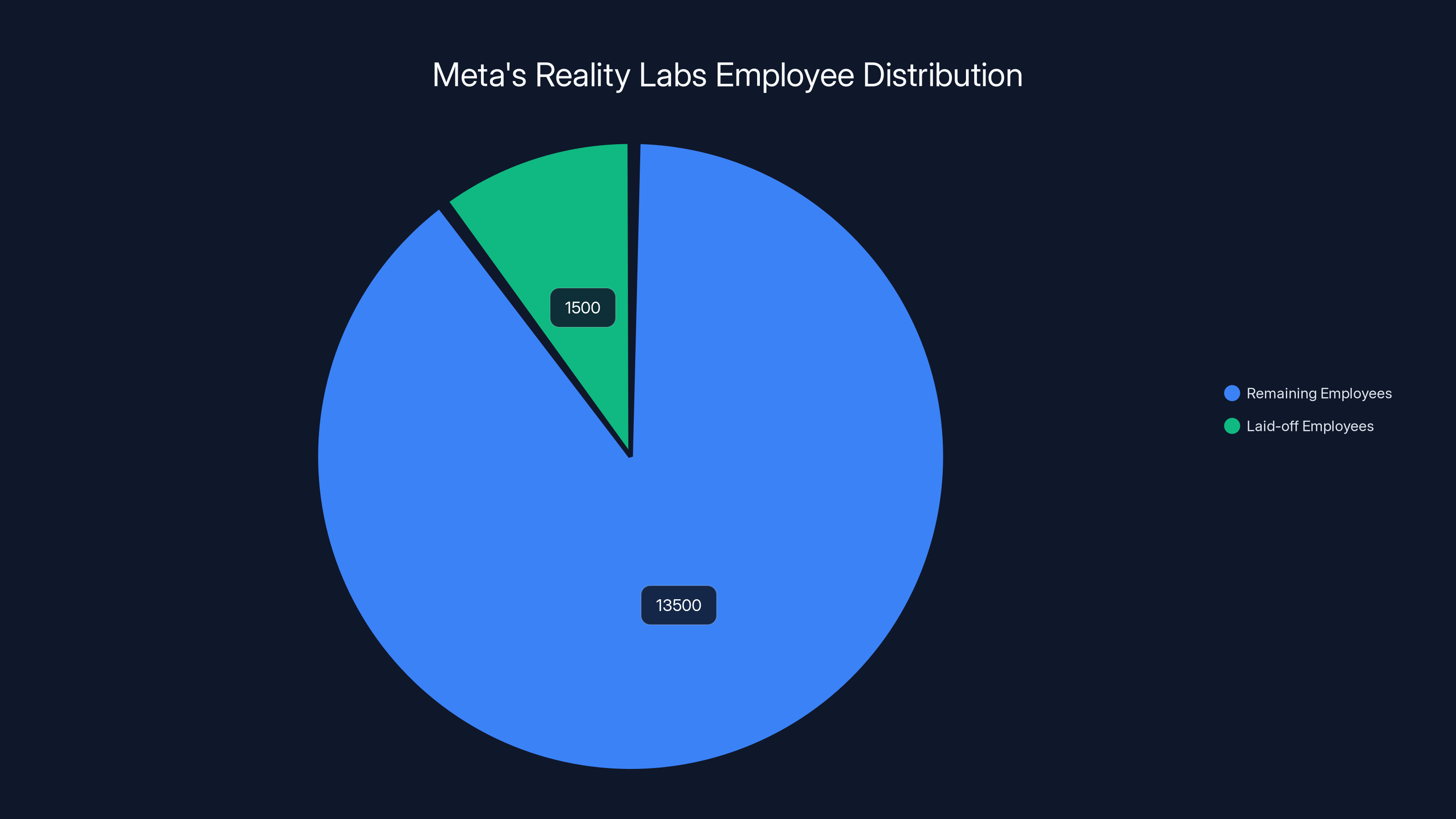

It's January 2025, and Meta just quietly announced what amounts to a seismic shift in its multi-billion-dollar gamble on the metaverse. The company is laying off 10% of its Reality Labs division—that's over 1,000 people from a workforce that started the year at roughly 15,000. For context, that's not just a minor trim. That's a meaningful recalibration of one of the most expensive bets in tech history, as reported by The New York Times.

If you've been following Meta's journey since 2021, when Mark Zuckerberg declared the company would rebrand entirely around the metaverse concept, you know this moment hits different. Back then, Meta was all-in on virtual worlds, spatial computing, and building the next evolution of the internet. VR headsets were going to be the future. Oculus was going to dominate. The metaverse was coming, and Meta was going to own it.

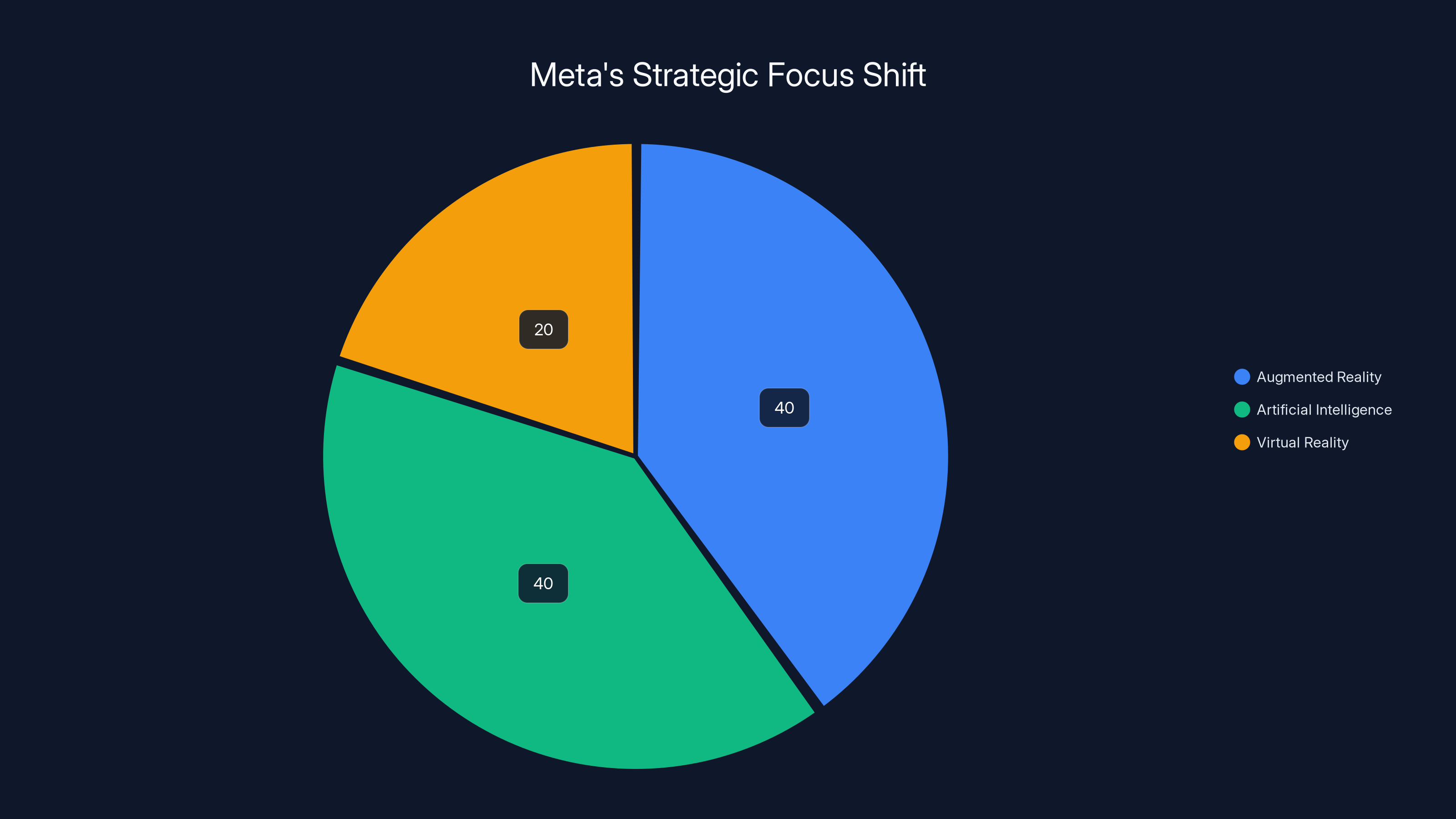

But here's what's actually happening now: Meta isn't abandoning VR entirely. Instead, it's making a calculated bet that augmented reality—actual glasses you wear in the real world—is where the real money and innovation lies. And more importantly, the company is pivoting hard toward artificial intelligence as its core competitive advantage. This layoff isn't a failure announcement. It's a strategy reset, and understanding it matters if you care about where tech is actually heading, as detailed by Bloomberg.

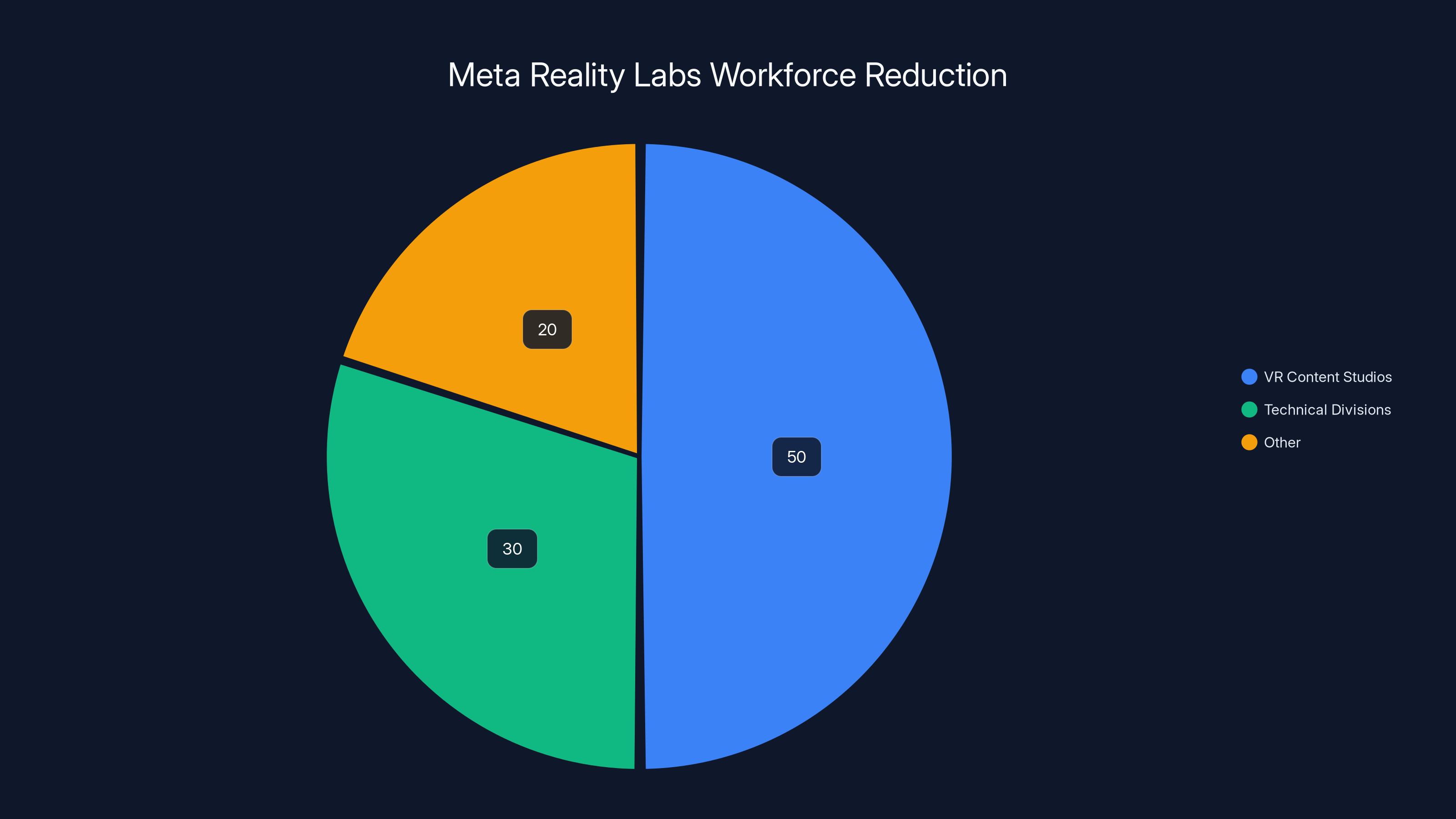

The layoffs specifically target VR content creation studios and certain technical divisions. Meta is shutting down Armature Studio, Twisted Pixel, and Sanzaru Games—studios that were building games and experiences for VR platforms. It's also consolidating what was called Oculus Studios Central Technology. The human cost is real and significant, but the strategic signal is what's worth examining, as covered by UploadVR.

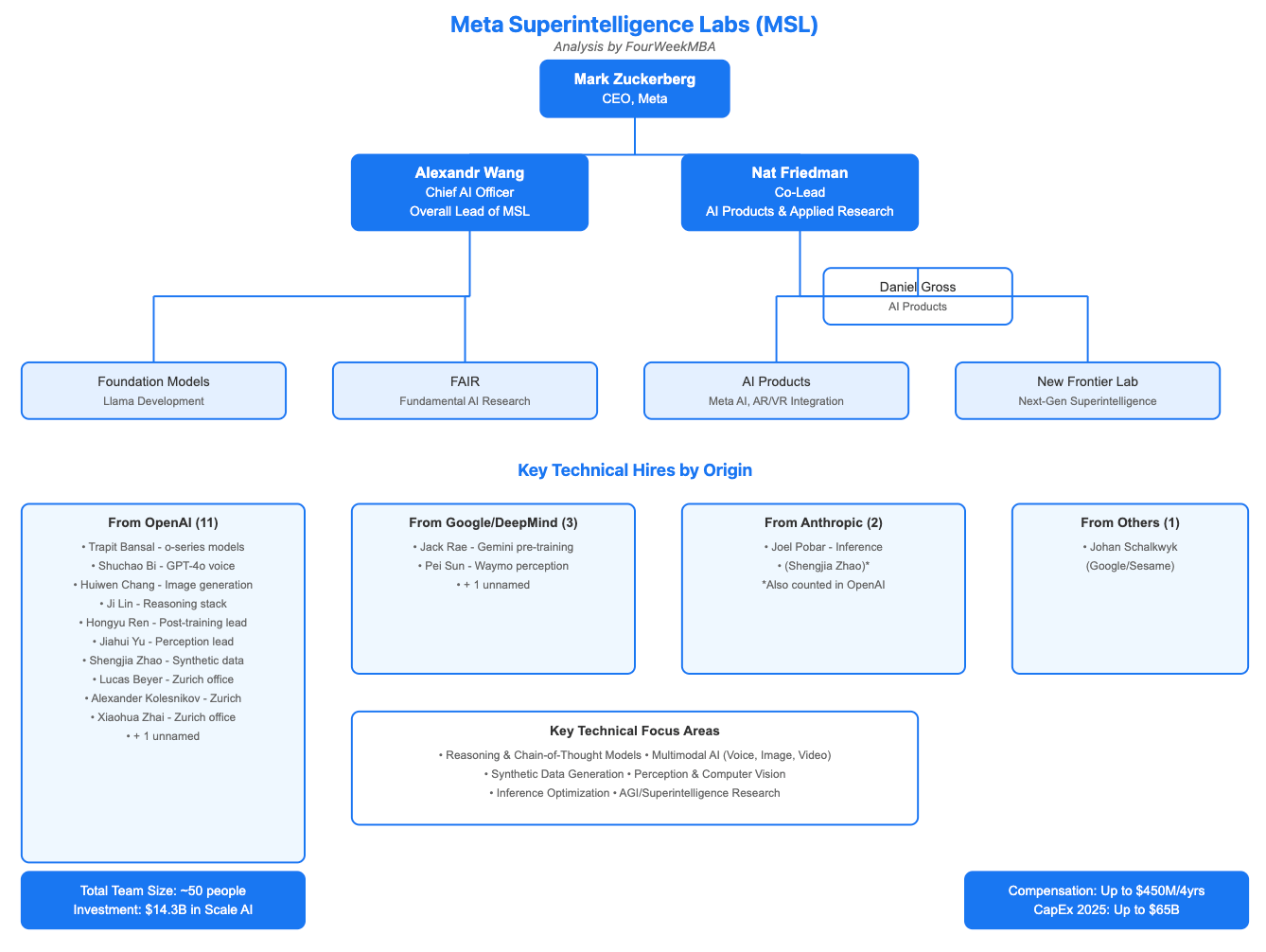

What makes this moment particularly interesting is the timing. Meta has simultaneously been aggressively recruiting AI researchers and engineers, including poaching talent from competitors and setting up its Superintelligence Labs. The company moved Vishal Shah, who was overseeing the metaverse, to lead AI products instead. That's not a coincidence. That's a directional arrow, as noted by Seeking Alpha.

This article breaks down exactly what Meta's Reality Labs restructuring means for the VR industry, the metaverse narrative, and what this tells us about where Meta—and potentially the entire tech industry—is actually betting its future.

TL; DR

- The Cut: Meta is laying off 10% of Reality Labs (1,000+ employees) and shutting down VR game studios including Armature, Twisted Pixel, and Sanzaru, as reported by TechBuzz.

- The Pivot: Money and talent are shifting toward AR glasses development and AI research, not VR experiences, as highlighted by Fast Company.

- The Context: This happens as Meta aggressively recruits AI talent and downplays the metaverse narrative that defined 2021-2022, as noted by Business Insider.

- The Reality: VR hardware isn't dying, but Meta's focus on building a metaverse through pure VR is being deprioritized, as discussed by Virtual Reality News.

- Bottom Line: The metaverse as Meta envisioned it isn't dead—it's just being redefined around AR and AI-powered experiences rather than standalone virtual worlds, as analyzed by Decripto.

Following a 10% layoff, Reality Labs retains approximately 13,500 employees, reflecting a strategic pivot towards AR and AI. Estimated data.

Meta's Metaverse Bet: The Setup

Let's rewind to October 2021. Mark Zuckerberg announced that Facebook Inc. was rebranding to Meta Platforms. It was a shocking declaration—the entire company, one of the world's most valuable technology firms, was pivoting around a single vision: the metaverse.

The metaverse, as Zuckerberg described it, was the next evolution of the internet. Instead of scrolling feeds on 2D screens, you'd exist as an avatar in 3D virtual spaces. You'd work in virtual offices, hang out with friends in digital worlds, attend concerts that didn't exist in physical reality, and buy digital goods that had no counterpart in the real world. It was intoxicating as a vision. It was also, in retrospect, aggressively ambitious.

To make this happen, Meta committed roughly

The bet had internal logic. If everyone eventually uses VR headsets as their primary computing device, then whoever controls the platform controls the next generation of advertising, social interaction, and commerce. Meta had lost ground to Tik Tok on short-form video. It was facing increasing regulatory pressure on Facebook. The metaverse was the ultimate escape hatch—a new frontier where Meta could own the platform layer.

But here's the problem with betting billions on a vision that doesn't materialize on your timeline: you eventually have to confront reality. And by 2024-2025, the reality was clear. VR adoption wasn't accelerating toward mainstream. Quest headsets were selling reasonably well, but they weren't approaching smartphone-level penetration. Developers weren't rushing to build metaverse experiences. The general public wasn't excited about putting on headsets to do things they could already do on their phones or laptops.

Most importantly for Meta's bottom line: the metaverse wasn't generating the revenue density that other tech segments offered. Meanwhile, artificial intelligence exploded. Chat GPT hit 100 million users in two months. Every major tech company pivoted to AI. Investors started asking Meta why it was still burning $15 billion a year on VR when there were trillion-dollar opportunities in AI infrastructure and large language models, as noted by Bloomberg.

So Meta made a choice: continue the metaverse bet at the same intensity, or reallocate resources toward the opportunity that's actually generating traction and investment momentum. They chose the latter.

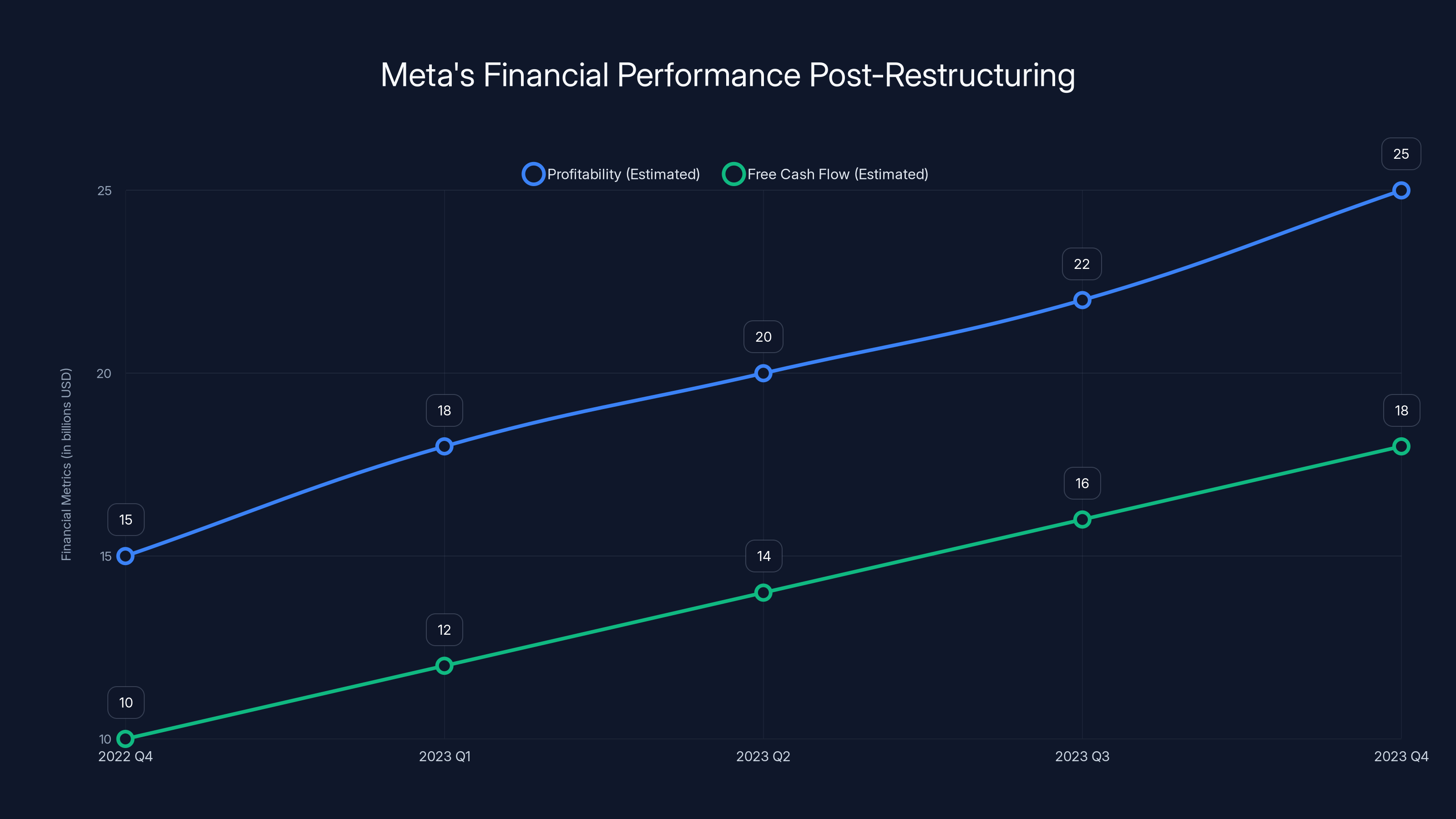

Estimated data suggests Meta's restructuring efforts are likely to improve profitability and free cash flow over the next year, reflecting positive investor sentiment.

The Specific Cuts: What's Actually Changing

Let's get specific about what Meta is actually shutting down and why it matters.

The layoffs target primarily VR content creation and support infrastructure. Armature Studio, which was developing VR titles, is being shut down entirely. Twisted Pixel, another game studio working on VR experiences, is gone. Sanzaru Games, acquired by Meta specifically for VR game development, is being consolidated or shut down. Oculus Studios Central Technology, the technical unit responsible for developing core VR capabilities, is being merged or eliminated, as reported by UploadVR.

This is significant because it reveals what Meta is deprioritizing: the software ecosystem and creative content layer of VR. Game studios exist to create experiences that make hardware valuable. When you shut down game studios, you're essentially saying the VR content layer isn't a priority anymore.

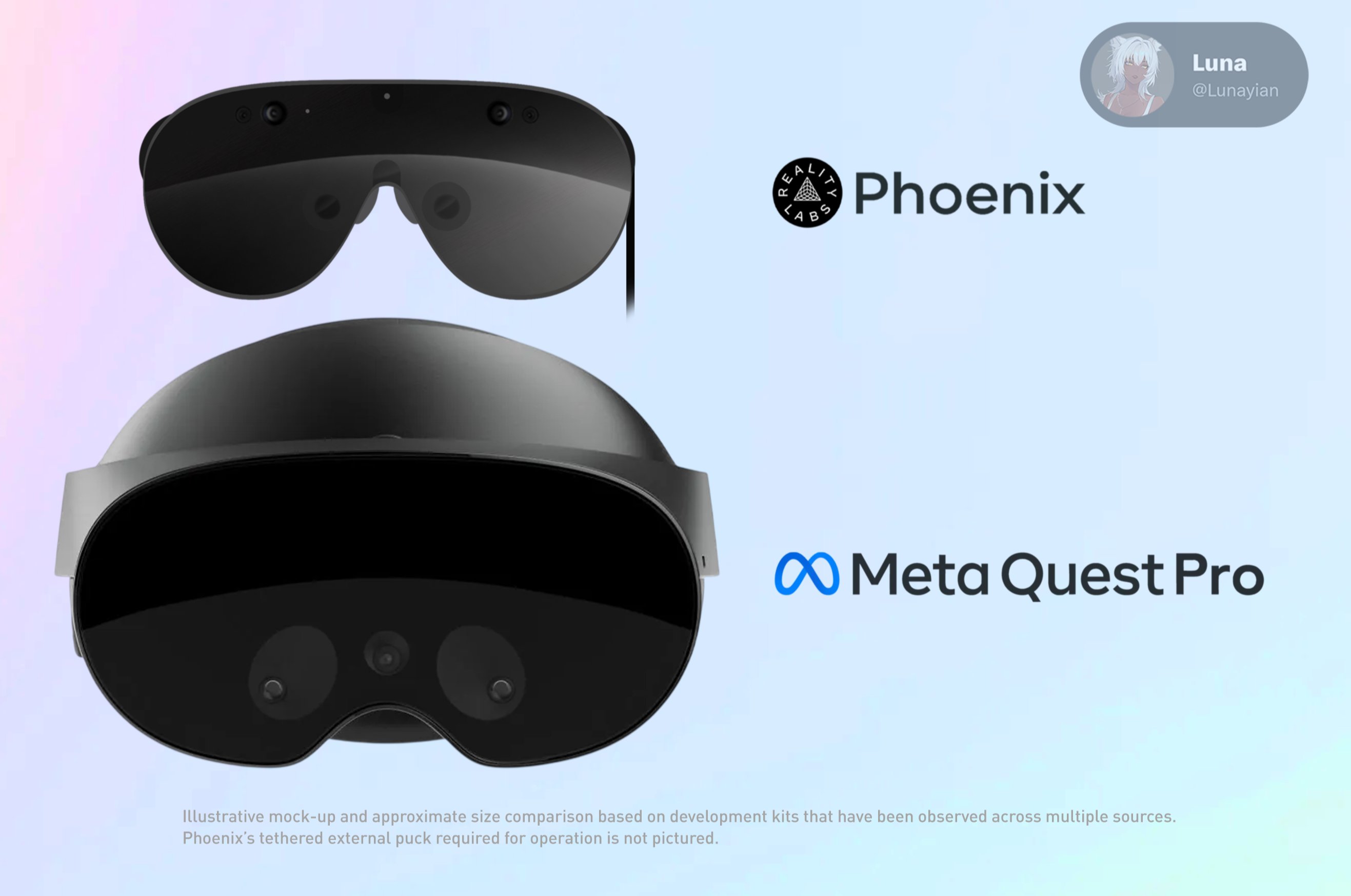

But here's what's crucial to understand: Meta is explicitly not cutting AR development. The company's head of Reality Labs, Andrew Bosworth, made clear that augmented reality glasses development is accelerating, not slowing. The money being saved from VR cuts is being redirected to AR glasses and related technology, as highlighted by Fast Company.

This distinction is enormous. VR and AR are not the same thing. VR requires a complete headset that covers your eyes and replaces your visual field with a digital environment. AR overlays digital information onto the physical world you're already seeing. One requires you to put on a device and step away from reality. The other lets you stay in reality while enhancing it.

Meta is betting that AR glasses—lightweight devices that display useful information on the world around you—are closer to mainstream adoption and have clearer use cases. Navigation, information lookup, communication, context-aware notifications—these are things people actually want to do while maintaining awareness of their physical surroundings. Standing in a virtual room with an avatar, less so.

The consolidation of teams also signals internal reorganization around clearer product priorities. Rather than having separate studios each building different VR titles, Meta is centralizing what remains of VR development. It's making the operation leaner, more focused, and more aligned with profitable use cases, as noted by The New York Times.

The AI Pivot: Where Meta's Real Attention Is

But the VR cuts alone aren't the full story. The real strategic signal comes from what Meta is doing with the freed-up resources: pouring them into AI research and development.

In October 2024, Meta moved Vishal Shah, who was leading metaverse strategy and products, to oversee AI initiatives instead. The company established Superintelligence Labs with an explicit mission to build artificial general intelligence. Last year, Meta recruited Alexandr Wang from Scale AI, one of the leading AI infrastructure companies, to accelerate this effort, as reported by Seeking Alpha.

Most tellingly, Meta has been offering premium packages to AI researchers and engineers to leave other labs and join Meta specifically. When a company like Meta—with its massive resources and brand power—has to actively recruit talent away from universities and competitors, it signals that competition for AI talent has become fierce. It also signals where the company believes the future competitive advantage actually lies, as noted by Business Insider.

Consider the numbers. Meta spent roughly $15 billion annually on metaverse development at its peak. Now, how much is the company spending on AI research and infrastructure? There's no clean public number, but consider that Meta is building massive new data center capacity specifically to support AI training and inference. The company is investing in GPUs, custom silicon, and AI talent at a scale that suggests annual AI spending is approaching or exceeding what it spent on metaverse efforts at their peak, as analyzed by Bloomberg.

This is a fundamental reallocation of strategic attention. The company that spent years telling investors and the public that the metaverse was the future is now making clear through actions—layoffs, studio shutdowns, talent recruitment, infrastructure investment—that artificial intelligence is where Meta sees the actual future.

Why? Because AI has clearer paths to value generation. AI can enhance advertising targeting, which is Meta's core business. AI can power recommendation algorithms for feeds and content discovery. AI can enable new products like AI-powered search and research tools. AI can optimize infrastructure and reduce costs. The ROI on AI spending is visible and measurable. The ROI on building metaverse content libraries is... well, still theoretical, as discussed by Decripto.

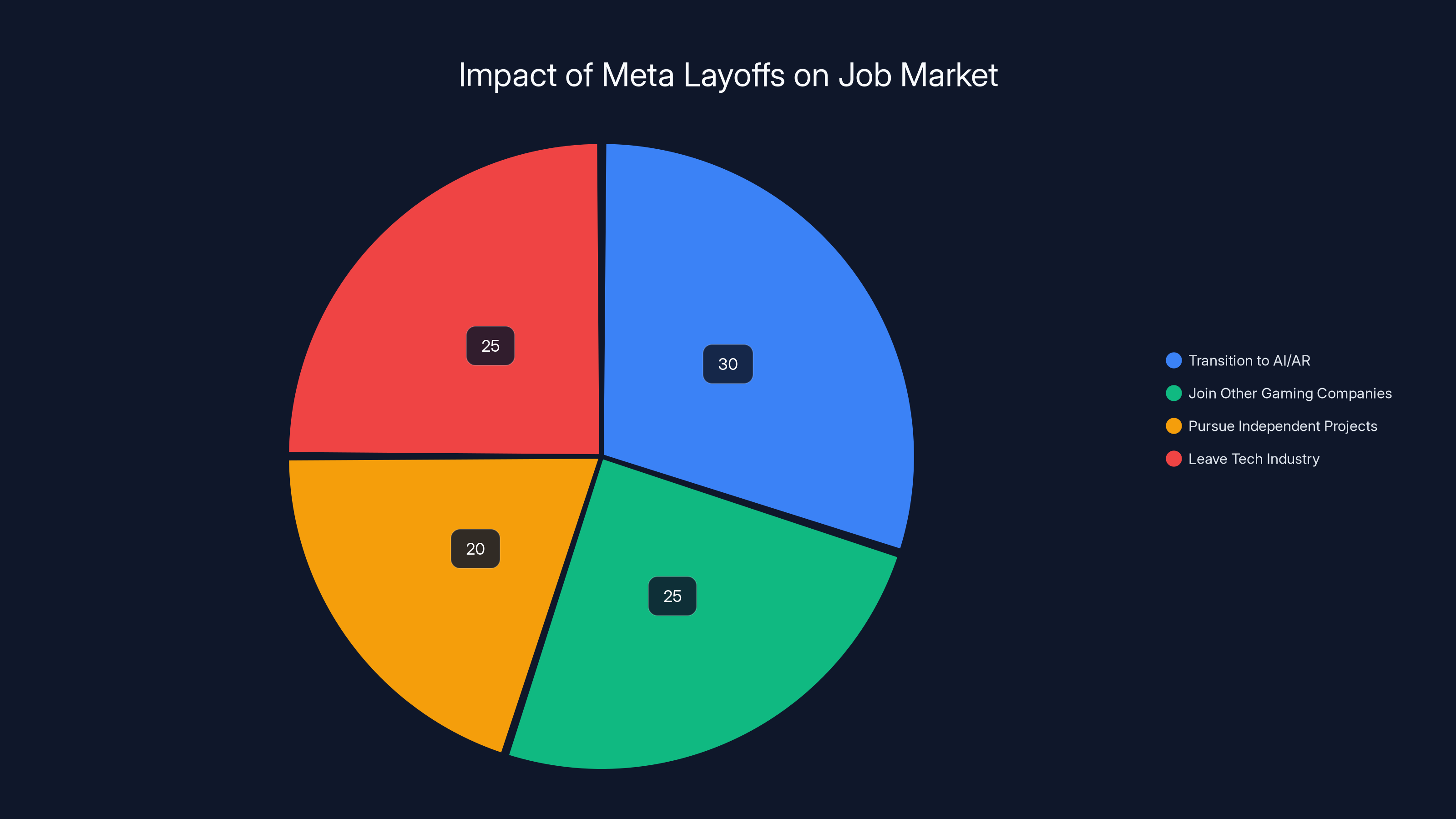

Estimated data shows that affected employees may transition to AI/AR (30%), join other gaming companies (25%), pursue independent projects (20%), or leave the tech industry (25%).

The Metaverse Isn't Dead—It's Repositioned

Now, here's where it gets important to avoid misinterpreting this move: Meta is not saying the metaverse is dead. The company is not abandoning virtual worlds. It's repositioning what the metaverse means.

Instead of a purpose-built virtual world that you enter via VR headset, Meta is increasingly looking at the metaverse as AR-enhanced experiences layered onto the physical world, powered by AI. Imagine AR glasses that use AI to provide context-aware assistance, enable immersive remote collaboration, and create new forms of social interaction—all while you remain grounded in physical reality, as noted by Virtual Reality News.

This is actually a smarter bet than the original 2021 vision. It addresses the adoption friction of VR (you have to be willing to fully immerse yourself) while still delivering on the core promise of spatial computing and new forms of human-computer interaction.

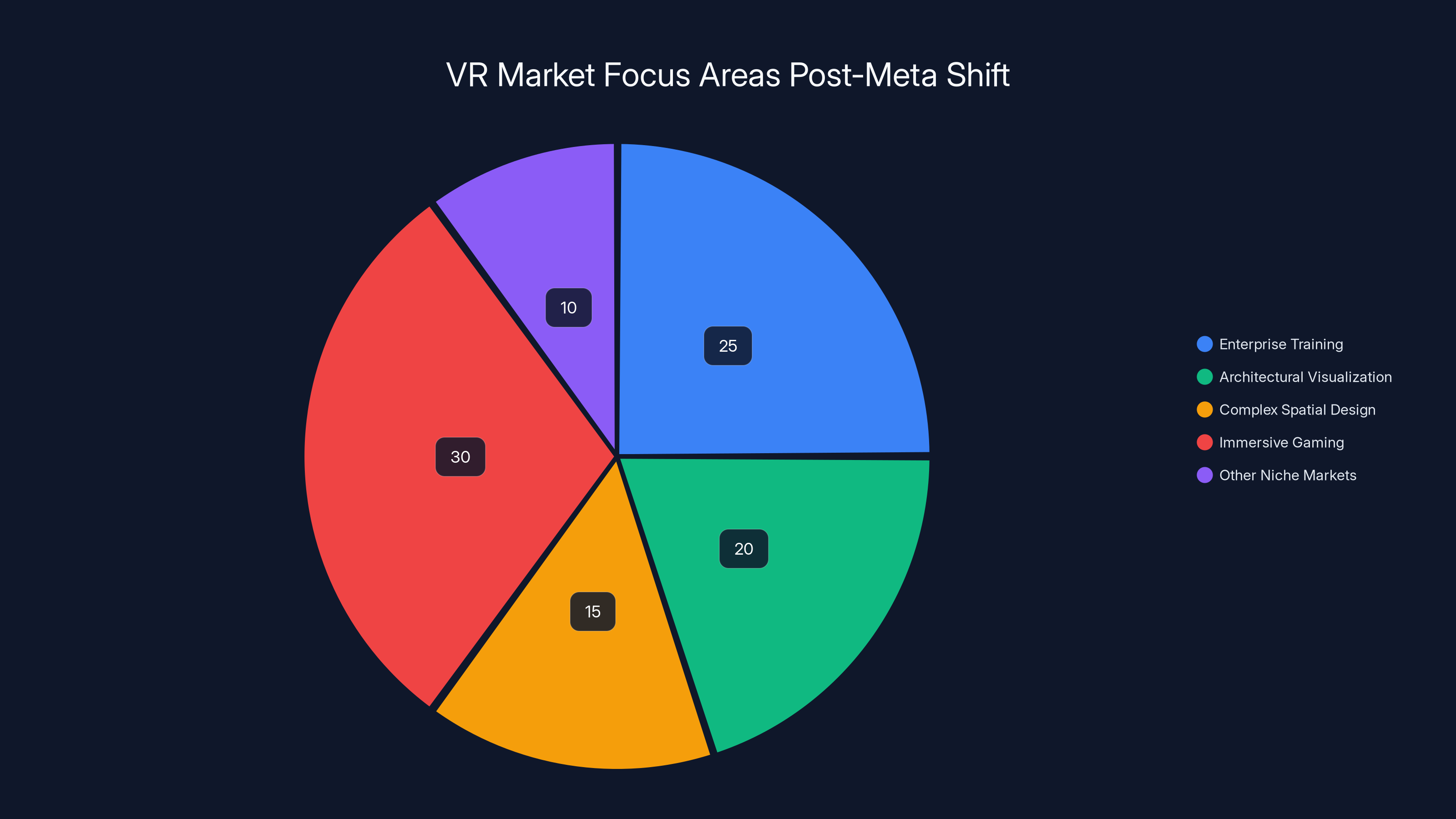

Also, Meta's VR hardware strategy isn't collapsing. The company will continue selling Quest headsets. VR will persist as a category for gaming, training simulations, architectural visualization, and other specialized use cases. But it's being repositioned from "the future of computing" to "a useful tool for specific applications." That's a significant psychological and strategic shift, but it's not the same as abandonment, as discussed by Fast Company.

The key insight: Meta's metaverse vision is evolving from "replace physical reality with virtual reality" to "enhance physical reality with digital information and AI-powered assistance." The former required everyone to buy headsets and spend hours in virtual worlds. The latter is closer to something people actually want to use every day.

What This Means for VR Game Developers and Studios

For the people working in VR game studios and VR development more broadly, this pivot is consequential and immediate.

First, the direct impact: if you worked at Armature, Twisted Pixel, or Sanzaru, you're now looking for a new job. Meta has historically handled layoffs with severance packages and transition support, but that doesn't change the fact that your project—the game or experience you were building—is no longer a priority for the company. Other VR studios outside Meta will likely face questions from investors about the long-term viability of their market. If Meta, with its resources and scale, is deemphasizing VR content creation, what does that mean for smaller independent studios, as reported by UploadVR?

Second, the funding landscape. VR startups that were pitching to investors on the thesis that "Meta is betting huge on VR, so there's a massive market emerging" now have a more complicated funding story. Not impossible—there are still niche markets where VR makes sense—but more complicated.

Third, the talent and resource allocation. VR game developers now know that major tech companies are not building game studios anymore. That sends people toward either independent development, platforms that are still committed to VR (like Play Station VR2), or entirely different sectors. It's a negative signal for consolidation around VR game development, as discussed by Business Insider.

That said, VR isn't going anywhere. The technology is genuinely useful for specific applications. Enterprise training, architectural visualization, complex spatial design tasks, immersive gaming for dedicated enthusiasts—these are all legitimate VR use cases that will continue. But they're not the mass-market, replace-everything-else trajectory that Meta was betting on.

Estimated data shows that post-Meta's strategic pivot, immersive gaming and enterprise training are leading focus areas in the VR market.

The Augmented Reality Opportunity

So if Meta is de-emphasizing VR, what's the actual opportunity it's pursuing with AR glasses?

Augmented reality glasses are conceptually simpler but technologically harder than VR headsets. The simplicity: overlay digital information on the world you're seeing. The difficulty: do that in a lightweight form factor, with sufficient processing power, realistic visual fidelity, and without terrible battery life.

But the use cases are compelling. Navigation without looking at your phone. Real-time language translation appearing on the faces of people you're talking to. Information context on objects and places you're looking at. Immersive remote collaboration where colleagues appear to be in the same room despite being on different continents. These are things people would actually want to use regularly, as noted by Fast Company.

Meta isn't alone in pursuing this. Apple released the Vision Pro, which is technically an immersive computing device (somewhere between VR and AR), though at a premium price point. Other companies are quietly working on AR glasses too. Whoever figures out the form factor, processing, and software stack first has an enormous opportunity.

Here's the strategic bet Meta is making: AR glasses are closer to consumer adoption than full VR immersion ever was. People are more comfortable with devices they can wear while remaining aware of their surroundings. AR has clearer use cases tied to productivity and information access, not just entertainment. The market for AR glasses could be genuinely massive—comparable to smartphones in scale, as analyzed by Decripto.

The Reality Labs restructuring is essentially Meta saying: "We're reallocating resources from building content for a product category that's not gaining mainstream traction (VR games and experiences) to building the actual glasses themselves and the AI systems that make them useful."

It's a rational strategy. Whether it works depends entirely on whether Meta can actually ship AR glasses that are consumer-friendly and whether they can build software and services compelling enough to create demand. That's still an open question. But strategically, it's a clearer bet than continuing to pour resources into VR content for headsets that most people don't own and have no intention of buying.

The Broader AI Reallocation Strategy

The cuts to Reality Labs can't be understood separately from Meta's broader AI strategy. These aren't isolated decisions. They're part of a coordinated shift in how Meta allocates capital and talent across the entire company.

Meta is essentially consolidating its AI bets. Instead of spreading resources across AI research, AI infrastructure, metaverse content, and other initiatives, the company is creating clearer lines of investment. AI is the priority. Everything else gets evaluated based on how it contributes to AI capabilities and applications, as reported by The New York Times.

This makes sense for a company of Meta's scale and ambition. AI is genuinely transformative technology with clear paths to value. Every application of AI—search, recommendation, content moderation, advertising optimization, data analysis—directly impacts Meta's core business and competitive position. By contrast, VR content creation and metaverse development have much more uncertain ROI.

The executives making these decisions are essentially saying: "We can either continue moderate investment across multiple bets, or we can concentrate our resources on the area with the highest potential impact." They're choosing concentration, as noted by Bloomberg.

This also affects the rest of Meta's organization. Teams working on other initiatives are likely facing similar scrutiny. If your project doesn't contribute to AI capabilities, scale, or value, it's going to be difficult to get resources or funding. This creates pressure throughout the organization to align with the AI-first strategy.

Estimated data shows Meta's strategic focus is now equally on AR and AI (40% each), with VR receiving reduced attention (20%).

What This Tells Us About the Tech Industry's Priorities

Meta's Reality Labs restructuring isn't just about one company recalibrating its strategy. It's a signal about the entire tech industry's priorities in 2025 and beyond.

For roughly three years (2021-2024), the metaverse was a major talking point in tech. Companies were investing in it, investors were funding it, and it was presented as the next major platform shift. But as we've seen with Meta—the company with the most resources and conviction on metaverse development—the reality is that this vision didn't progress fast enough or powerfully enough to justify ongoing massive investment, as discussed by Business Insider.

Instead, the industry has moved on. AI is where the attention and capital are now. Every major tech company is racing to deploy AI capabilities, build AI infrastructure, and capture value from AI applications. Meta is one example of this broader shift, but not an isolated one, as noted by The New York Times.

What does this mean for other technology bets being made right now? It suggests a healthy skepticism is warranted. Technology that's presented as the future but doesn't show clear paths to value or mass adoption will eventually face scrutiny. Investment will move toward what's actually working and generating value.

For technologists and entrepreneurs, the lesson is clear: having a compelling vision isn't enough. You need evidence that people actually want what you're building, and you need a reasonable path from current state to value creation. The metaverse had a compelling vision but struggled on both other fronts. AI doesn't have that problem, as analyzed by Decripto.

The Financial Impact and Meta's Bottom Line

What does this restructuring actually mean for Meta's financial performance and investor confidence?

In the short term, positive. Cutting costs improves profitability and free cash flow. Meta has been on an efficiency drive since 2022 when the company cut 13% of its workforce in November of that year. The company is improving margins and increasing operating leverage. Every billion dollars reallocated from speculative metaverse spending to profitable AI operations improves Meta's financial metrics, as reported by The New York Times.

Investors generally respond well to companies that demonstrate discipline in capital allocation, even when that means shutting down impressive-sounding initiatives. Betting big on something, realizing it's not working, and course-correcting is more impressive than persisting with losing bets out of ego or stubbornness.

The real test will be whether Meta's AI investments generate sufficient return to justify the spending. The company is building enormous AI infrastructure capacity. If that capacity gets productized effectively—in the form of better ads, stronger recommendations, new products, or services that generate revenue—then the investment was correct. If Meta builds massive AI capability but struggles to monetize it effectively, that's a different story, as noted by Bloomberg.

Longer term, Meta's core business is advertising. AI is strategically valuable because it can improve targeting, creative optimization, and user engagement—all of which increase advertising value. As long as Meta can maintain its position in social media and digital advertising, the capital reallocation toward AI makes sense.

But it also reveals something important: Meta isn't confident it can build a new consumer platform or entertainment phenomenon the way it did with Facebook and Instagram. The company is betting on optimizing its existing position rather than creating new categories. That's a more modest vision than "build the metaverse," but it's probably more achievable, as discussed by Decripto.

Estimated data suggests that 50% of layoffs are from VR content studios, 30% from technical divisions, and 20% from other areas. This indicates a strategic shift towards augmented reality and AI.

Implications for Hardware Strategy and the Quest Line

One question people have: does this mean Meta is abandoning VR hardware and the Quest product line?

The answer is no, but with important caveats. Meta will continue making and selling Quest headsets. The company has millions of active Quest users, and there's a real market for VR devices for gaming and entertainment. Shutting down Quest entirely would be wasteful and would alienate existing customers, as noted by UploadVR.

However, Meta's hardware investment strategy is clearly shifting. Instead of treating Quest as the flagship consumer device that will eventually replace smartphones (the original vision), the company is likely treating it more as a niche consumer device for gaming and entertainment enthusiasts, plus a platform for enterprise training and specialized applications.

Meanwhile, AR glasses get positioned as the real moonshot. That's where the long-term research investment and product development cycles are being focused. That's where Meta is recruiting top talent and building new capabilities, as reported by The New York Times.

This is similar to how many tech companies treat their various hardware lines. Companies like Microsoft have the Surface line, but it's not the company's primary focus anymore. The primary focus is cloud infrastructure and AI services. Meta is moving in a similar direction: Quest will continue as a product line, but it's no longer the strategic center of gravity.

For consumer VR enthusiasts, this might actually be okay. Instead of VR being forced into a "replace everything" narrative, it can settle into being what it actually is: a fun technology for specific use cases. That might be better for the long-term health of the VR market than Meta's original all-in approach, as discussed by Bloomberg.

The Human Cost and Job Market Impact

We should acknowledge the real human impact of these layoffs, not just the strategic implications.

Over 1,000 people are losing their jobs or facing reorganization as a result of these cuts. These aren't abstract resource reallocations. They're people who were building things they believed in, working in the VR industry because they were excited about the metaverse vision. Now that vision is being deprioritized, and they're paying the price, as reported by The New York Times.

For Meta, layoffs of this scale come with severance packages and transition support. The company has experience managing large workforce reductions. But for individuals, especially in high-cost-of-living areas where Meta's major offices are located, job loss is serious.

From a job market perspective, these cuts will have ripple effects. VR developers, game designers, and other specialists will be looking for new roles. Some will transition to other tech sectors (AI, AR, other gaming companies). Some will pursue independent projects. Some will leave tech entirely, as noted by Business Insider.

The broader VR job market will likely contract as a result. Companies considering whether to hire VR specialists now have a clearer signal that the VR market might not grow as quickly as hoped. That affects hiring plans and salary negotiations.

But human labor is also resilient. Tech workers affected by these layoffs will find other opportunities, though finding a new role always takes time and effort. The tech industry is large enough that layoffs in one division don't typically cause economy-wide problems. But individually, these changes are disruptive and difficult.

Competitive Implications: What About Other VR Companies?

Now consider what Meta's pivot means for other companies in the VR space.

Play Station VR2 from Sony is still being developed and marketed. Sony has a different strategic position than Meta—the company is not betting its entire future on VR or the metaverse. Play Station VR2 is positioned as a premium gaming accessory, not a replacement for smartphones or computing devices. This is actually a smarter positioning, and Sony's continued investment in VR is not directly threatened by Meta's pivot, as noted by Bloomberg.

Vive (owned by HTC) and other VR platforms will also continue because they serve niches where VR is genuinely valuable: enterprise training, architectural visualization, specialized gaming. These niches don't require mainstream adoption or the transformative market shift that Meta was betting on.

Where the impact is felt most is in VR game development and entertainment experiences specifically built for VR. When Meta was positioning itself as the platform for immersive virtual worlds, game studios had reason to believe VR would become mainstream and build ambitious titles. With Meta deprioritizing this market, that narrative evaporates, as reported by UploadVR.

Game Dev studios that were betting on VR as a growth market now have to recalibrate. Some will pivot to other platforms or technologies. Some will double down on VR but acknowledge it's a niche market, not a mass market. Some will shift toward enterprise applications where VR adoption is stronger.

For consumers, this is actually clarifying. Instead of overpromising that VR is the future of everything, the industry can settle on what VR is actually good for. That's healthier than maintaining unrealistic expectations, as discussed by Business Insider.

Future of Meta's XR (Extended Reality) Strategy

Meta's internal terminology shifted from "metaverse" to "XR" (extended reality) over the past couple years. This is significant. XR is an umbrella term covering both VR and AR, positioned as a spectrum rather than a binary choice.

Meta's actual strategy, as revealed by these organizational changes, is XR with an emphasis on AR. The company will continue VR research and development for specific use cases, but AR glasses are the consumer focus, as noted by Fast Company.

The integration of AI into XR is where Meta's future lies. AR glasses powered by AI that can understand the world around you, provide contextual assistance, and enable new forms of interaction—that's the product vision Meta is pursuing. Not a metaverse you escape into, but technology that enhances the world you're already in.

This evolution makes sense. It's more aligned with how technology actually gets adopted (incrementally useful additions to everyday life) rather than requiring a wholesale shift in how people use computing devices.

The question now is whether Meta can execute on AR glasses as well as it executed on building Facebook and Instagram. The company has strong track records in building platforms and ecosystems, but hardware is different. The company's AR glasses efforts are several years behind where they need to be from a product perspective. Whether Meta can catch up and build something truly consumer-friendly remains uncertain, as analyzed by Decripto.

Industry Lessons: What Not to Do

Meta's metaverse saga offers several lessons for the tech industry and for individual companies making strategic bets.

First lesson: momentum matters, but so does evidence. Meta had amazing momentum on the metaverse narrative in 2021-2022. Investors were excited. Employees were energized. Media was covering it extensively. But momentum without evidence of demand is just enthusiasm. The market eventually forces reality to reassert itself, as noted by The New York Times.

Second lesson: diversification of bets is often smarter than betting-the-company. If Meta had treated the metaverse as one bet among several, rather than the core strategic direction, the pivot would be less dramatic and less costly. Companies that make multiple smaller bets can shift direction without wholesale restructuring.

Third lesson: technology adoption timelines are notoriously difficult to predict. Things that seem inevitable often take much longer than expected. Things that seem far away sometimes arrive faster than expected. Betting billions on a specific timeline is risky. Building optionality is smarter.

Fourth lesson: value realization is as important as technological capability. Meta can build VR technology. That's not in question. But VR technology doesn't automatically translate to value unless you can find customers willing to pay for it. Overestimating the market demand for your technology is a dangerous position.

Fifth lesson: executive conviction matters, but so does organizational feedback. Zuckerberg's conviction on the metaverse was genuine, but eventually organizational feedback (employees, investors, market signals) provided sufficient pressure to reconsider. Listening to these signals before making a complete pivot would have been wise, as discussed by Bloomberg.

The 2025 Tech Narrative Shift

We're now clearly in a new narrative phase in tech. From 2016-2020, it was cloud computing and data. From 2020-2024, it was the metaverse and Web 3. Now, it's AI and large language models.

Each of these narratives attracts investment and attention. Some prove durable, creating real value. Others turn out to be more hype than substance. Meta's metaverse pivot suggests that narrative has moved into "real value, but not a consumer mass market" territory, as noted by The New York Times.

The AI narrative, by contrast, is showing genuine signs of durability. Companies are actually deploying AI and seeing measurable returns. Business models are forming around AI services. Adoption is happening across enterprises and consumer products. This narrative has legs, as discussed by Decripto.

But we should probably maintain some healthy skepticism. The history of tech is littered with narratives that seemed unstoppable but eventually normalized. Blockchain will revolutionize everything. The Internet of Things will connect everything. Virtual reality will replace physical presence. These were all reasonable-sounding bets that didn't play out as envisioned.

AI will likely follow a similar arc: genuine utility and value creation in specific domains, mainstream adoption in some areas, massive hype in other areas, eventual normalization as the technology becomes infrastructure rather than frontier. Meta's pivot toward AI is sound strategy. But don't be surprised if AI, too, eventually finds its actual level rather than becoming the world-changing technology some current narratives suggest, as analyzed by Decripto.

What Happens to Reality Labs Long Term

So what is Reality Labs actually going to focus on going forward?

Based on the current strategy, three areas:

First, AR glasses development. This is the hardware moonshot. Meta will continue research and development toward shipping consumer-grade AR glasses. This is multi-year effort involving optics, display technology, processing, battery, and software. The company has talented teams working on this, and the investment continues, as noted by Fast Company.

Second, AI-powered experiences and applications. This is about using AI to enhance social experiences, communication, and productivity. How can AI make video calls more immersive? How can AI help people collaborate in spatial contexts? What new interactions become possible when you combine AR and AI?

Third, enterprise and training applications. VR is actually quite useful for training simulations, architectural visualization, and enterprise use cases. These markets have proven demand and are growing. Meta likely will continue to serve these niches with VR technology even as it deprioritizes consumer VR content, as discussed by UploadVR.

Notably absent: building a metaverse of immersive virtual worlds that everyone will live in. That vision is being shelved, at least for the foreseeable future. If Meta eventually ships successful AR glasses and builds a compelling software ecosystem around them, the company might revisit virtual world building as one possible application. But it won't be the core strategy, as noted by The New York Times.

This is a dramatic shift from 2021's vision. But it's a more realistic and achievable strategy.

Timeline and Gradual Implementation

These changes aren't happening overnight. The layoffs are immediate, but the strategic repositioning is gradual.

Over the next year or so, we'll see Meta:

- Wind down VR game studio operations

- Consolidate VR development teams

- Redirect AR glasses development efforts

- Expand AI research and infrastructure

- Release new AR research and prototypes

- Potentially announce new AR-focused products

The Quest product line will continue, but growth expectations have likely moderated internally. Teams that were focused on metaverse narratives and VR content ecosystems will be reorganized or moved to different projects.

Meanwhile, the AI infrastructure buildout accelerates. New data centers come online. New AI models are developed and deployed. AI capabilities get integrated deeper into Meta's core products.

This is a multi-year transformation, not a sudden reversal. But the direction is clear.

FAQ

What exactly is Meta's Reality Labs division?

Reality Labs is Meta's division responsible for developing virtual reality, augmented reality, and extended reality technologies. Founded initially as Oculus when Meta acquired that company in 2014, Reality Labs encompasses hardware development (Quest headsets), software ecosystems, content creation studios, and research into future spatial computing technologies. The division has roughly 15,000 employees and has been the primary vehicle for Meta's metaverse vision and investments, as reported by The New York Times.

Why is Meta laying off 10% of Reality Labs staff?

Meta is cutting 10% of Reality Labs (over 1,000 employees) because the division's original focus on building VR content and metaverse experiences has not generated the consumer adoption and value the company expected. Instead, Meta is reallocating resources toward augmented reality glasses development and artificial intelligence research, which the company sees as having clearer paths to mainstream adoption and business value. The layoffs reflect a strategic pivot rather than a complete abandonment of spatial computing, as noted by Bloomberg.

Does this mean Meta is abandoning VR completely?

No, Meta is not abandoning VR entirely, but it is deprioritizing VR as the primary focus. The company will continue selling Quest headsets and supporting VR applications for gaming and enterprise training. However, VR is no longer positioned as the future of computing or the core of the metaverse strategy. Instead, augmented reality glasses and AI-powered experiences are becoming Meta's primary research and product focus, as highlighted by Fast Company.

What are augmented reality glasses and why is Meta prioritizing them?

Augmented reality glasses are wearable devices that overlay digital information and experiences on top of the physical world you're seeing, rather than replacing your view with a virtual environment like VR headsets do. Meta is prioritizing AR glasses because they have clearer use cases (navigation, information lookup, communication) that people want to use daily while staying aware of their physical surroundings. AR adoption barriers are lower than VR, as users don't need to fully immerse themselves or move to dedicated virtual spaces, as discussed by Decripto.

How much money has Meta spent on the metaverse and Reality Labs?

Meta has spent roughly

What does this layoff reveal about tech industry priorities in 2025?

Meta's Reality Labs restructuring signals a broader shift in tech industry priorities away from speculative, long-term bets on new platforms (like the metaverse) and toward artificial intelligence, which has demonstrated clear value and market adoption. The decision to cut metaverse spending reflects industry recognition that technology adoption timelines are difficult to predict and that building on proven demand is safer than speculating on transformative new platforms. This mirrors how other major tech companies are allocating resources and talent toward AI research and applications, as noted by Bloomberg.

What happens to developers who were working on VR games for Meta?

Developers employed by Meta-owned studios like Armature, Twisted Pixel, and Sanzaru are facing layoffs and will need to find new employment opportunities. Independent VR game developers and studios not owned by Meta are facing an uncertain market, as the largest investor and platform proponent for VR gaming (Meta) is deprioritizing this sector. Some developers will transition to other platforms like Play Station VR2, some will pursue independent projects, and some will move to different technology sectors like AI or Web 3 development, as reported by UploadVR.

Will Meta continue supporting existing VR games and experiences?

Meta will likely maintain basic support for existing Quest games and VR experiences already published on its platform, but the company is no longer actively developing new VR titles internally. Third-party developers can still create VR content, but they should expect that Meta will not be investing heavily in marketing, distribution, or platform development specifically designed to grow the VR gaming market. The company's focus on supporting existing VR infrastructure will be more maintenance-oriented than growth-oriented, as noted by The New York Times.

How does this compare to Meta's 2022 layoffs?

In November 2022, Meta laid off 13% of its total workforce (about 11,000 employees) as part of a broader efficiency drive. The Reality Labs cuts are more targeted, hitting specifically the division focused on VR content and game development rather than being a company-wide reduction. However, both rounds of layoffs reflect Meta's efforts to improve financial discipline and reduce spending after overexpanding during years of rapid growth and optimistic metaverse investment, as discussed by Bloomberg.

What does Andrew Bosworth's role change mean for Reality Labs?

Andrew Bosworth has been the Chief Technology Officer and head of Reality Labs. His continued leadership of the division, combined with the strategic shifts being implemented, suggests that the company's direction is not changing due to leadership failure but rather due to deliberate strategic recalibration. Bosworth's involvement in both VR and AR development means the architectural vision is coming from experienced technical leadership making calculated bets about where technology development should focus for maximum impact and value generation, as noted by Fast Company.

How long will it take for Meta to develop consumer AR glasses?

Meta has been researching AR glasses for several years and publicly discussed the technology multiple times. However, bringing consumer-grade AR glasses to market likely still requires multiple years of development. The company needs to solve challenges around optics, display technology, processing power, battery life, and software ecosystem before shipping a consumer product. Industry observers estimate this could take anywhere from 2 to 5 years from the current date, though timelines are always uncertain with new hardware categories, as analyzed by Decripto.

Conclusion: A Strategic Reckoning

Meta's Reality Labs restructuring is one of the most significant strategic pivots in recent tech history. Just three years after committing to rebrand the entire company around the metaverse vision, Meta is acknowledging that this vision didn't materialize according to plan and is reallocating resources toward augmented reality and artificial intelligence.

For Meta specifically, this is pragmatic strategy. The company has the resources and technical talent to pursue multiple major initiatives simultaneously, but doing so requires confidence in each initiative's potential. By culling VR content development and game studios while accelerating AR glasses development and AI research, Meta is consolidating its bets around areas where the company believes it can generate real competitive advantage and consumer value, as noted by Bloomberg.

For the VR industry, this is a mixed signal. VR is not dead, and Meta is not exiting the space entirely. But VR is no longer the central strategic focus of the most well-resourced company working on spatial computing. That's a significant downgrade from the trajectory that seemed assured in 2021-2022, as discussed by UploadVR.

For the tech industry more broadly, Meta's pivot reflects lessons learned about technology adoption, narrative risk, and capital allocation. The metaverse narrative was compelling, but compelling narratives don't automatically translate to market adoption. Companies that make billion-dollar bets on technological futures need evidence that users actually want what they're building, not just faith that the vision will eventually materialize, as analyzed by Decripto.

The shift toward AI as the central strategic priority reflects more durable foundations for investment. AI is already being deployed and generating measurable value. The question is not whether AI works, but how to best apply it and monetize it. That's a fundamentally easier strategic question than "will the metaverse become the primary platform for human interaction."

Looking ahead, watch three things: whether Meta actually ships consumer AR glasses on a timeline that makes sense, whether the company's massive AI infrastructure investment generates sufficient returns to justify the spending, and whether other tech companies learn from Meta's metaverse experience or repeat similar patterns with their own speculative bets.

For now, the metaverse vision of 2021 is dead. What emerges instead will likely be more modest, more pragmatic, and ultimately more useful. That might not be as grand a vision, but it's probably more likely to succeed, as noted by The New York Times.

Key Takeaways

- Meta is cutting 10% of Reality Labs (1,000+ employees) and shutting down VR game studios, signaling a strategic pivot from VR-focused metaverse development

- The company is reallocating resources toward augmented reality glasses and AI research, which Meta sees as having clearer paths to mainstream adoption and business value

- This restructuring reveals that VR adoption didn't progress fast enough to justify $15 billion annual investment, while AI has shown more tangible returns and applications

- Augmented reality glasses (which overlay digital information on the physical world) offer stronger use cases than full VR immersion, making them more likely to achieve mass adoption

- Meta's pivot reflects broader tech industry lessons about technology adoption timelines, capital discipline, and the dangers of betting a company's entire future on speculative new platforms

- The decision signals that VR is valuable for specific niches (gaming, training, enterprise) but unlikely to become the primary computing platform as originally envisioned

Related Articles

- Apple Vision Pro: Why This $3,500 Headset is Actually Dying [2025]

- Xreal 1S AR Glasses: Specs, 3D Conversion, and Value [2026]

- LEGO Smart Brick: Inside the Best-in-Show Demo at CES 2026 [2025]

- The 11 Biggest Tech Trends of 2026: What CES Revealed [2025]

- Lumus Smartglasses FOV Revolution at CES 2026 [2025]

- Best Smart Glasses CES 2026: AI, Phoneless Designs, HDR10 [2025]

![Meta's Reality Labs Layoffs: What It Means for VR and the Metaverse [2025]](https://tryrunable.com/blog/meta-s-reality-labs-layoffs-what-it-means-for-vr-and-the-met/image-1-1768396375221.jpg)