Workday CEO Leadership Shift: What Bhusri's Return Means for Enterprise Software [2025]

TL; DR

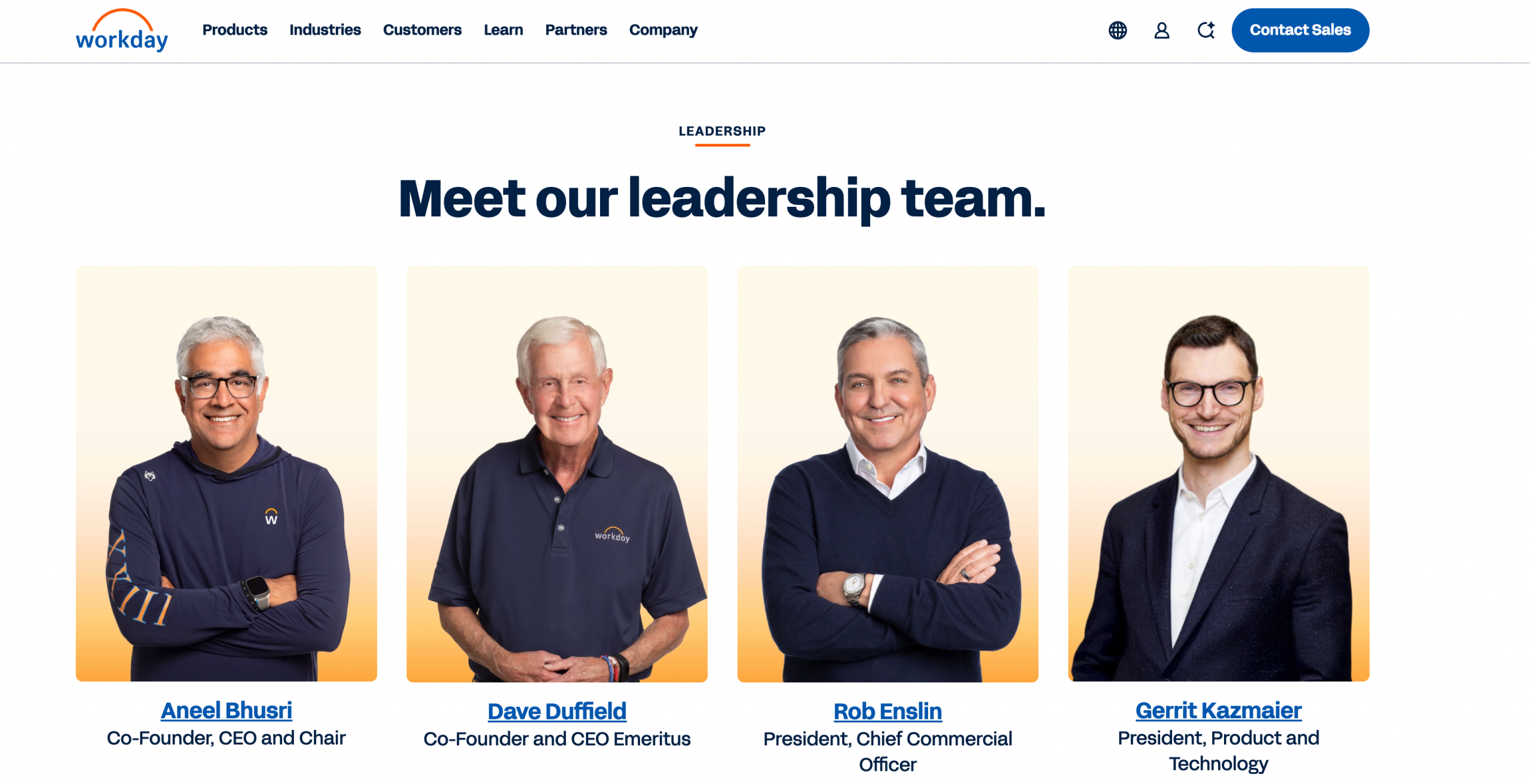

- Leadership Change: Carl Eschenbach steps down as Workday CEO after roughly two years in the role, handing leadership back to co-founder Aneel Bhusri, as noted in CNBC.

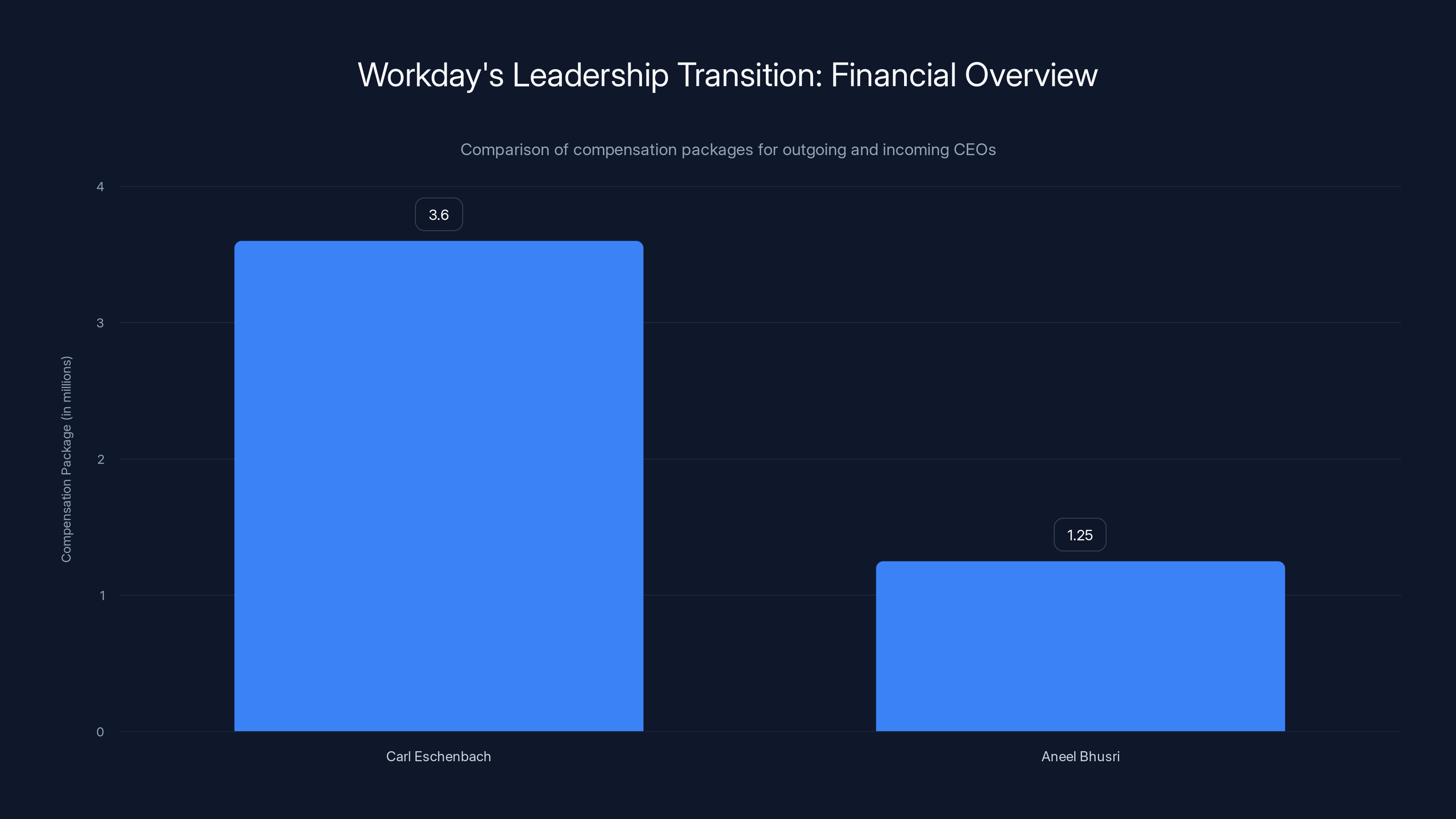

- Financial Impact: Eschenbach receives a 1.25 million base salary plus up to 200% annual bonus, according to Yahoo Finance.

- Market Context: Workday's stock has dropped 40% year-over-year, with investor concerns about AI strategy and competitive positioning, as reported by MLQ AI.

- Growth Reality: Three consecutive quarters of 12.6% revenue growth, down from 15-18% in previous periods, signaling slowdown despite operational health, as detailed in Simply Wall St.

- Strategic Focus: Both leaders position this transition as critical for navigating AI inflection point and innovation-driven future, as highlighted by People Matters.

Carl Eschenbach's severance package is higher than Aneel Bhusri's base salary, reflecting typical executive transition practices. Estimated data for Bhusri's bonuses not included.

Introduction: When Enterprise Software's Biggest Players Shuffle Leadership

Last week, the enterprise software world got another reminder that even the biggest names can pivot their leadership strategy overnight. Workday announced that CEO Carl Eschenbach has stepped down with immediate effect, and in his place comes Aneel Bhusri, one of the company's original co-founders, returning to the CEO role he previously held, as reported by TipRanks.

Now, here's the thing. This isn't some quietly managed transition buried in a regulatory filing. Both Eschenbach and Bhusri posted about it on Linked In. Eschenbach called Bhusri "nobody better to lead Workday through this moment." Bhusri talked about Workday "entering a new chapter" defined by AI and innovation.

But when you dig into the numbers—the 40% stock decline, the slowing revenue growth, the two major rounds of layoffs—you start seeing a different story. This isn't a smooth handoff between equals. This is a course correction, as highlighted by Bloomberg.

Workday is one of the largest players in cloud-based human capital management (HCM) and enterprise planning software. The company competes with giants like SAP, Oracle, Microsoft, and a constantly evolving field of specialized AI-powered tools. When Workday's CEO changes, especially in a shift back to a founder, it signals something important: the current strategy isn't hitting the mark investors expected.

Over the next few thousand words, we're going to break down exactly what happened, why it happened, what it means for Workday's future, and what it tells us about the broader enterprise software landscape right now. Because leadership changes at companies this size don't happen in a vacuum. They're windows into how the industry is reshaping itself.

The Immediate Facts: Eschenbach's Exit and Financial Terms

Carl Eschenbach didn't wake up one morning and decide to leave. The company's Form 8-K filing reveals a carefully structured exit with what amounts to a golden parachute—though not massive by enterprise software standards.

Eschenbach walks away with $3.6 million in cash severance, plus something more valuable in the long term: accelerated vesting of equity awards. When you're leaving a public company where you held significant equity, that acceleration clause matters. It means instead of waiting for stock to vest over time (typically four years with quarterly or annual vesting schedules), the remaining balance vests immediately. If Workday's stock rebounds—and investors are betting it will eventually—Eschenbach benefits retroactively.

For Bhusri, who's stepping back in, the comp structure looks different.

What's striking is how the board framed this. This isn't a "we forced him out" scenario. The language suggests a mutual decision. Eschenbach's Linked In post reads like he's stepping aside, not being pushed. He calls it "the opportunity ahead is always greater than what's behind."

But let's be real: when a CEO steps down after two years, citing a founder as "better" for the moment ahead, that's rarely how it would be phrased if Eschenbach had more runway to deliver results.

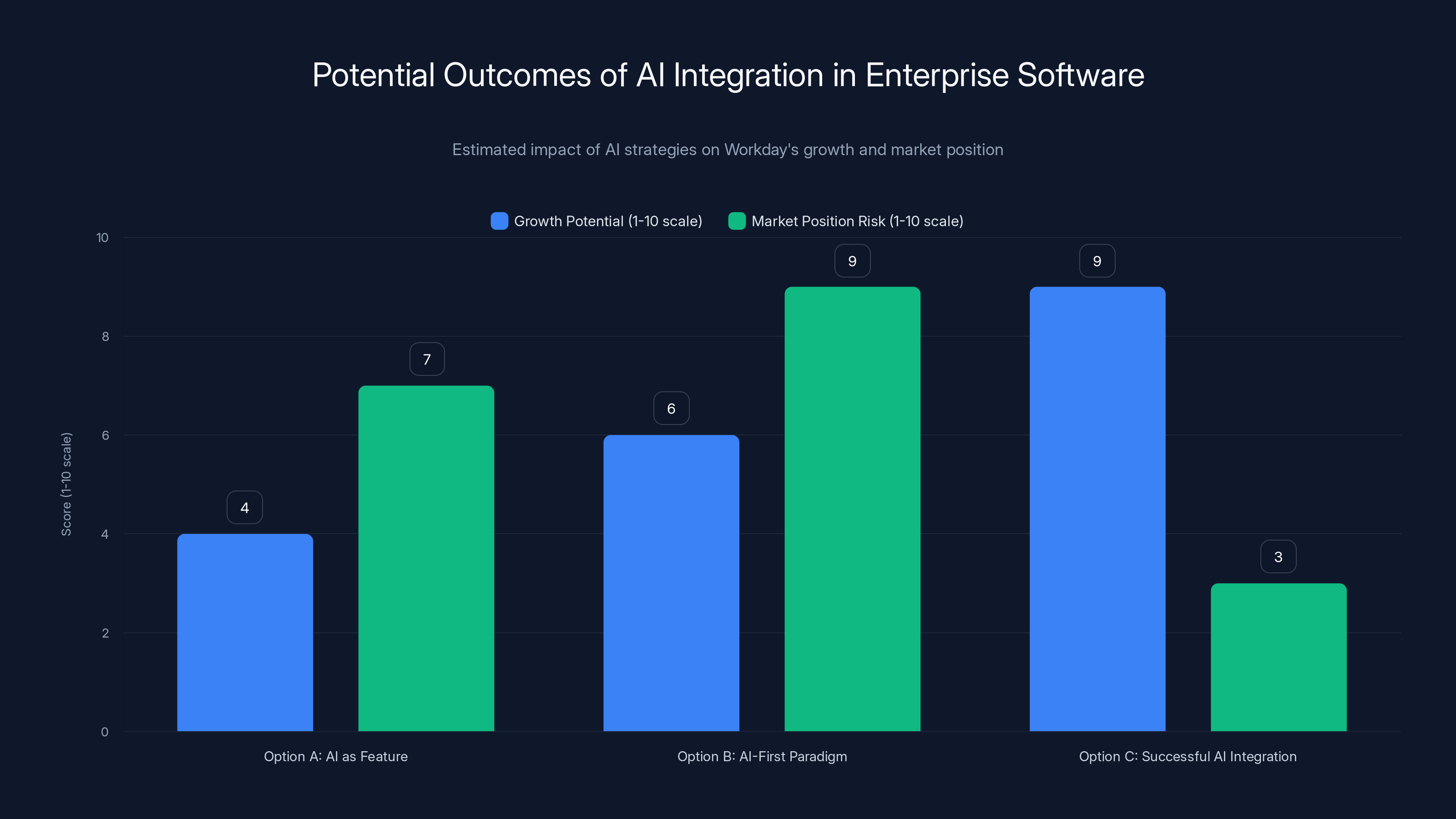

Option C presents the highest growth potential with the lowest market position risk for Workday, emphasizing the importance of successful AI integration. Estimated data.

Context: Eschenbach's Time as CEO and What Changed

Carl Eschenbach wasn't some external hire parachuted in without understanding Workday. He'd been at the company for years before becoming CEO. He spent time as co-CEO alongside Bhusri before taking the full CEO role roughly two years ago.

When Eschenbach became CEO, Workday was riding a different kind of momentum. The pandemic had accelerated cloud adoption across enterprises. Everyone needed better employee data, better HR systems, better planning tools. Workday was benefiting from that wave.

But here's what happened in the subsequent two years:

The competition intensified. Microsoft integrated AI capabilities into Office 365, Azure, and their Dynamics suite. Salesforce kept pushing deeper into enterprise workflows. Specialized AI tools started fragmenting the market—companies could now use best-of-breed AI agents and automation layers instead of relying entirely on Workday.

Investor expectations shifted. When Eschenbach took over, enterprise software was supposed to grow at 15-18% annually. That's what Workday had been delivering. Now? The market's asking harder questions. Is 12.6% growth enough? Is the company keeping pace with AI disruption?

The workforce changed. Workday was built for a world where you hired people, managed them in a central system, and optimized payroll and benefits. Now? Gig workers, contractors, AI-generated workforce planning, dynamic skill matching. The problems have gotten more complex.

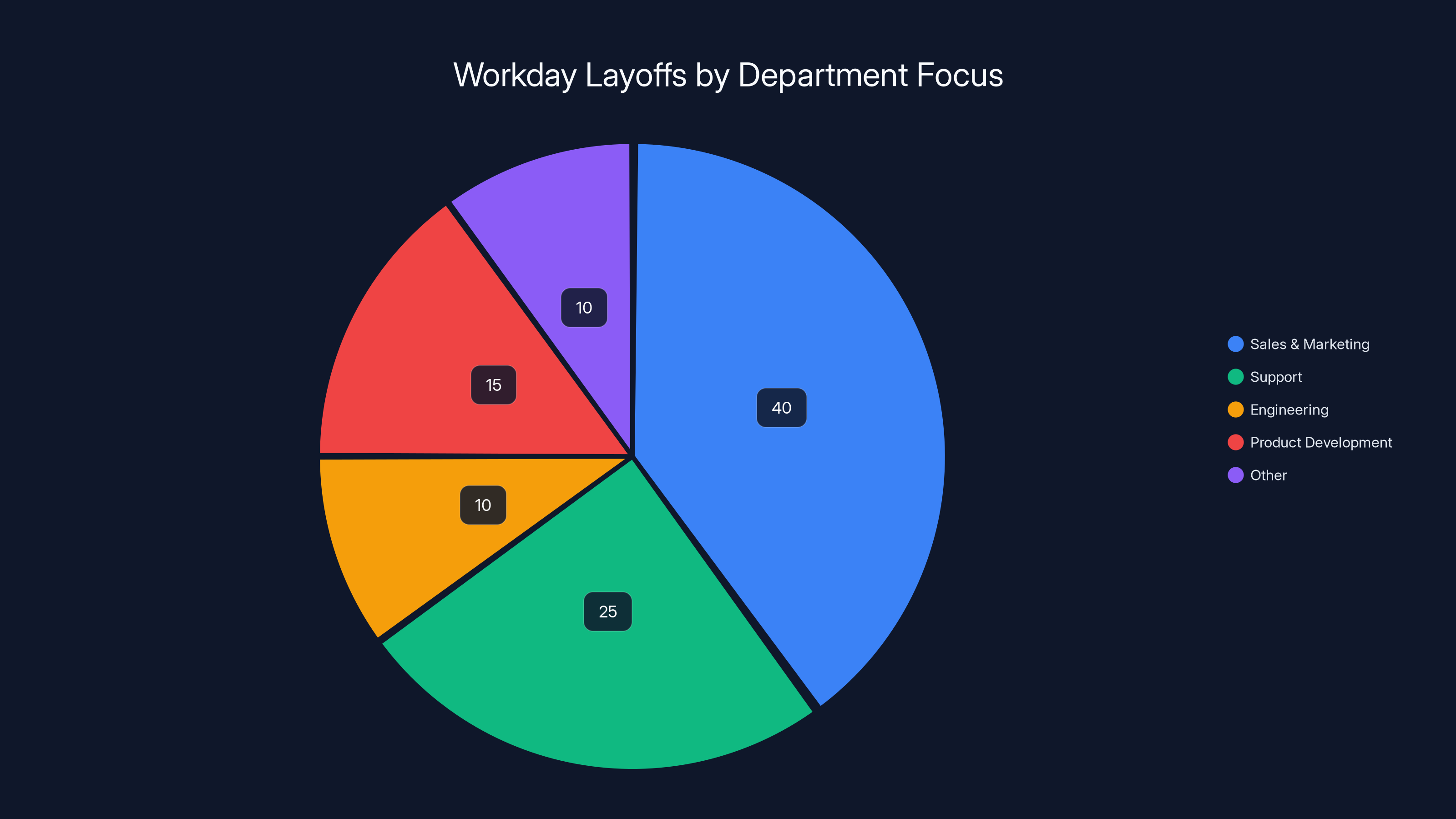

Eschenbach and the board made a strategic choice: implement major cost-cutting. In 2024, Workday cut 1,750 roles—representing 8.5% of the workforce. The messaging was "AI-driven restructuring necessity." Translation: we're repositioning to focus on AI, not scale.

Then, about a year later, another 2% reduction. That's another ~300-400 people gone, as noted by Business Insider.

These aren't small adjustments. They signal that the previous growth trajectory wasn't sustainable. And when you're cutting headcount while revenue growth is slowing, investors get nervous about execution risk.

The Stock Market Story: Down 40% Year-Over-Year

Numbers tell the story more clearly than any press release. Workday's stock is down approximately 40% year-over-year. That's not a seasonal dip. That's investors losing confidence, as reported by MLQ AI.

Why? Let's break it down:

Growth deceleration. Workday reported three consecutive quarters of 12.6% revenue growth. On the surface, 12.6% sounds solid. In enterprise software, though, it's a problem. The company had been growing at 15-18% just two years prior. For context, the S&P 500 grows at roughly 7-10% per year. Workday dropping from 18% to 12.6% means it's starting to look like the broader market, not an outperformance story.

AI uncertainty. Every enterprise software company claims to be "AI-first" now. But investors are skeptical. They're asking: Is this company actually integrating AI capabilities in ways that customers value and will pay for? Or is it just adding "AI" to its marketing?

Workday's AI story hasn't been as clear as, say, Microsoft's (with Open AI integration across everything) or Salesforce's (with Einstein AI deeply embedded). There's been positioning, announcements, some capability releases. But has it moved the needle on growth? Not visibly, based on the numbers.

Competitive pressure. Microsoft's Dynamics 365 is getting better. Salesforce's suite keeps expanding. Specialized AI tools are capturing specific use cases. Workday's moat—the idea that you'd centralize all HR and planning in one platform—is eroding as companies adopt best-of-breed solutions.

Margin concerns. The layoffs suggest that scaling at the same cost structure wasn't working. That implies either (a) the sales and implementation costs were higher than expected, or (b) growth is harder to achieve now. Either way, margins are at risk.

When a stock drops 40%, it usually takes a signal from the company to convince investors things are changing. A CEO change, especially one that brings back a founder, can be that signal.

Why Aneel Bhusri's Return Matters

Aneel Bhusri co-founded Workday in 2005. He was there for the initial product vision, the first customers, the IPO in 2012. He's the institutional memory and the strategic architect.

When you bring a founder back in a crisis moment, you're essentially saying: "We need the person who understood the original vision to recalibrate for a new era."

Here's why that matters:

Founder credibility with investors. Investors trust founders more than external CEOs in moments of transition. Founders have longer-term incentives aligned with building the company, not just hitting quarterly targets. Bhusri's return signals confidence to the market: "The co-founder believes in Workday's future enough to take the helm."

Product vision clarity. Bhusri knows every detail of how Workday's product evolved. He understands what was intentional architecture versus what was tech debt. He can probably make faster decisions about what to double down on (maybe certain AI capabilities) and what to deprioritize (maybe certain legacy modules).

Cultural realignment. A founder returning often signals a reset on company culture and priorities. Bhusri can reshape messaging from "We're growing 12% and cutting costs" to "We're repositioning for AI innovation."

Strategic autonomy. External CEOs often have boards breathing down their necks. A founder has more latitude to make bold, contrarian moves. If Bhusri decides Workday needs to pivot on product, pricing, or go-to-market strategy, he has the political capital to do it.

But there's also a risk in bringing a founder back: founder entrenchment. If Bhusri's strategic vision doesn't work, who comes in next? A board's credibility depends on being willing to make changes. If Bhusri becomes "untouchable" because he's the founder, that's a problem.

Workday's current growth rate of 12.6% is significantly lower than its historical growth rate of 15-18%, indicating a slowdown in its revenue trajectory. Estimated data.

The AI Inflection Point: What Bhusri Must Deliver

Both Eschenbach and Bhusri used the phrase "massive inflection point with AI" in their statements. That's not hyperbole. Enterprise software is genuinely at an inflection point—it's just not clear which way the arrow points.

The AI inflection point in enterprise software looks like this:

Option A: AI becomes a feature, not a moat. Every platform gets AI capabilities. They become table stakes. You can't compete without them, but nobody pays a premium for them. In this scenario, Workday needs to execute flawlessly on AI features, keep prices competitive, and compete on overall platform breadth. Growth becomes harder, margins compress.

Option B: AI-first becomes the new paradigm, and traditional platforms become legacy. Specialized AI agents and tools replace centralized platforms. Instead of "the Workday system," companies use point solutions for recruiting (powered by AI), workforce planning (powered by AI), payroll integration (powered by AI), etc. In this scenario, Workday either becomes a legacy player or successfully pivots to become an AI platform.

Option C: Workday successfully integrates AI in ways that increase switching costs and customer value. AI-powered insights that drive better business decisions. AI-assisted workflows that save 30-40% of time on certain tasks. AI that actually learns from a company's data and gets smarter. In this scenario, Workday grows faster, margins hold, and the company continues to thrive.

Bhusri's job is to bet heavily on Option C while hedging against Option B. That's hard.

Specifically, Bhusri needs to:

-

Ship AI capabilities that customers actually value. Not demo-ware. Not marketing announcements. Capabilities that reduce costs, save time, or unlock insights.

-

Integrate those capabilities deeply into existing workflows. So the switching cost goes up, not down.

-

Maintain pricing power. Workday can't compete on price. It competes on total cost of ownership (implementation, training, integration, support, outcomes). AI needs to improve all of those.

-

Move faster. Enterprise software traditionally moves slowly. AI-native competitors move fast. Bhusri needs to accelerate the product cadence.

-

Retain and recruit talent. The best AI talent wants to work at companies where they'll have impact and get compensated accordingly. Workday's layoffs might have hurt the company's ability to recruit top AI engineers.

This is the implicit bet Bhusri is making. If he delivers on these five fronts, Workday rebounds. If not, the stock decline will look like the beginning of a longer-term fade.

Workday's Revenue and Growth Reality: The Numbers Behind the Narrative

Let's dig into what "12.6% growth" actually means and why investors are concerned.

Current revenue trajectory:

- Three consecutive quarters at 12.6% year-over-year growth

- Previous standard: 15-18% annual growth

- Growth rate decline: approximately 25-30% slower than the historical baseline

For a company Workday's size (it's a $60+ billion market cap company), this might sound fine. But enterprise software is expected to grow faster than GDP plus inflation, which runs around 5-7% total. Workday growing at 12.6% is better than the economy, but it's a far cry from the "high-growth software" category.

Here's the ROI implication: If you're a Workday investor, you're essentially getting a company that grows at 12% annually. That's 1.7x the S&P 500. When enterprise software traded at 8-10x revenue multiples (pre-2022), 12% growth was acceptable. But today, multiples are lower. Software companies need higher growth multiples to justify investment.

The market is saying: "We'll buy Workday, but at a lower price, because growth is moderating."

What could reverse this?

Acceleration to 15%+ growth would reset investor expectations. That would require either (a) accelerating new customer acquisition, (b) growing faster within existing customers, or (c) entering new markets.

Demonstrable AI ROI would justify staying in the software category. If Workday can show that customers using AI features see 20-30% productivity gains (and therefore pay 15-25% more), that changes the narrative.

Margin expansion would show operational leverage. If Workday can grow at 12% but expand operating margins by 200-300 basis points, that's valuable. It suggests the business is getting more efficient even if top-line growth is slowing.

Bhusri's probably focused on some combination of all three. But growth acceleration is the hardest part.

The Layoff Context: Cost-Cutting as Strategic Signal

Workday's two rounds of layoffs—1,750 roles (8.5%) in 2024 and another 2% reduction a year later—weren't just efficiency moves. They were strategic signals, as noted by Business Insider.

What the layoffs revealed:

-

The current cost structure doesn't support the growth rate. If you're growing at 12% but you're cutting 8.5% of headcount, you're implicitly saying: "We were overstaffed for the growth rate we're achieving."

-

Engineering and product are being prioritized over growth. You don't usually cut 1,750 people evenly. You cut more from sales, marketing, support, and less from engineering. That signals a shift from "grow at all costs" to "improve product, then grow."

-

The AI transition requires different skills. The layoffs likely removed people from roles that don't exist in an AI-first version of Workday. That makes room to hire AI/ML engineers, data scientists, and folks who can build agentic features.

-

Margin protection is a priority. Maintaining 30%+ operating margins while top-line growth is moderating means cutting costs. Layoffs are the fastest way to do that.

Eschenbach implemented these layoffs. So why did Bhusri replace him?

Probably because the board felt the cuts were necessary, but the strategic vision for what comes next wasn't clear enough. Eschenbach cut costs. Bhusri's expected to cut costs and chart a compelling product roadmap.

That's a higher bar. Founders often have a clearer vision for product direction than external CEOs. The board might have felt Eschenbach was a capable operator but not a visionary. Bhusri is positioned as both.

Workday's revenue growth has decelerated from 18% two years ago to 12.6% currently, indicating a shift towards market average growth rates. Estimated data.

Competitive Landscape: What Workday Faces

Workday doesn't compete in a vacuum. Let's map out the competitive pressure:

Direct competitors in HCM and enterprise planning:

- SAP (via Success Factors and Concur): Massive installed base. Slow to move, but still dominant in mid-market and enterprise, as noted by Cloud Wars.

- Oracle (via Net Suite and Fusion): Similar story. Big customer base, legacy products, slowly modernizing.

- Microsoft (via Dynamics 365): Fast-moving, deeply integrated with Office, Azure, and Open AI. Pricing power through bundling.

- Salesforce: Expanding beyond CRM. Work.com is their HCM play. Behind Workday but growing.

Emerging and specialized competitors:

- AI-first HCM tools: There's a whole wave of startups building AI-native recruiting, workforce planning, employee engagement, etc. They're not replacing Workday yet, but they're taking share in specific verticals.

- Best-of-breed point solutions: Companies increasingly use multiple platforms instead of one monolithic suite. That's a threat to Workday's core value prop.

- Internal tools built on AI platforms: Some enterprises are building custom HCM workflows using AI agents and no-code platforms. That's a long-term threat but not immediate.

In this competitive context, Workday's growth deceleration makes sense. The market is fragmenting. Workday has the biggest piece of the pie, but the pie itself is getting divvied up more.

Bhusri's challenge: Keep the core platform defensible while building new AI capabilities fast enough to compete with specialized players.

Workday's AI Strategy: What We Know and What's Missing

Workday has announced AI capabilities. What's less clear is whether they're game-changing.

What Workday has positioned:

- Workday Skills Cloud: AI-powered skill taxonomy and matching

- Workday Orchestration Engine: Automation and workflow optimization

- Finance AI: Predictive insights for financial planning

- Recruiting AI: Resume parsing and candidate matching powered by AI

These are solid. They're table stakes in 2025. But are they differentiating?

Here's the problem: Microsoft, Salesforce, SAP, and others can all claim similar AI capabilities. The question is whether Workday's implementation is better, faster, or more integrated than competitors.

Based on the market reaction (stock down 40%), investors aren't convinced yet.

What Workday probably needs to showcase:

-

Measurable customer outcomes from AI features: "Companies using Workday AI saw 25% faster hiring cycles" or "Reduced payroll processing time by 40%." Specific, quantifiable wins.

-

Agentic capabilities that go beyond automation: Agents that don't just follow rules but reason about problems and suggest novel solutions. That's the future of enterprise software.

-

Industry-specific AI modules: Generic AI isn't valuable. Healthcare recruiting is different from tech recruiting. Workday needs to show it understands industry-specific problems.

-

Integrations with best-of-breed AI tools: Microsoft Open AI, Anthropic Claude, etc. Workday can't be everything. It should integrate deeply with the best AI models.

Bhusri's probably focused on these four areas. If he can deliver, the narrative changes from "Workday is slowing down" to "Workday is positioning for the AI era."

What This Means for Workday Customers

If you're a Workday customer (and there are thousands of you), this leadership change matters.

Short-term (next 6-12 months):

-

Expect some organizational turbulence. New CEOs often make personnel changes. Some people get promoted, others leave. You might see your account team change or your implementation partner reassigned.

-

Product roadmap might shift. Bhusri might de-prioritize certain modules and accelerate others. If you're depending on a feature that's not core to the new strategy, it might be delayed.

-

Pricing might change. Leadership changes sometimes come with pricing model shifts. Workday might move toward consumption-based pricing or AI-specific add-ons.

Medium-term (1-2 years):

-

Deeper AI integration into core workflows. The AI features that are now "add-ons" will become standard. That's good for you—more productivity, less manual work.

-

Potentially better integrations with AI tools. If Bhusri positions Workday as an AI platform (not just a platform with AI), it'll connect better with specialized AI tools you might be using.

-

Either accelerated growth or slower innovation. If Bhusri's strategy works, Workday accelerates and invests more in R&D. If it doesn't, the company might hold back on new features while maintaining current commitments.

Long-term (2+ years):

-

Workday either solidifies its position or starts losing share. This is a pivotal moment. If Bhusri's AI strategy resonates with customers and accelerates growth, Workday remains the market leader. If not, the company might find itself in a slower-growth, lower-margin business.

-

Acquisition risk might increase. If Workday's stock stays depressed, it becomes a potential acquisition target. That could be good (you get absorbed into a stronger company) or bad (another company's product roadmap replaces yours).

The bottom line: This CEO change is significant enough that existing customers should probably schedule a meeting with their account team and their Workday partner to understand what's changing.

Workday faces significant challenges, with competitive pressure and stock decline being the most impactful. Estimated data based on narrative context.

Leadership Styles: Eschenbach vs. Bhusri

This matters because CEO style affects execution.

Carl Eschenbach's approach (the past two years):

- Data-driven: Eschenbach came from a tech background where metrics rule. He likely focused on pipeline, ARR, payback periods, and expansion metrics.

- Operational discipline: He oversaw the layoffs and cost restructuring. That suggests a focus on unit economics and margin protection.

- External mindset: Eschenbach isn't a Workday original, so he probably approached the company with a strategic outsider's view. That's good for seeing opportunities but can miss institutional wisdom.

Aneel Bhusri's likely approach (going forward):

- Product-visionary: Founders usually have strong opinions about product direction. Bhusri probably wants to shape Workday's product more directly than Eschenbach did.

- Long-term thinking: Founders are less beholden to quarterly targets (though as a public company CEO, he obviously still cares about results). He can make longer-term bets.

- Customer intimacy: Bhusri probably knows Workday's customers and problems deeply. He might spend more time with key accounts directly.

- Faster decision-making: Founders often have political capital to make decisions without consensus. That can accelerate execution (good) or miss important perspectives (bad).

In practice, this probably means:

- Faster feature releases (Bhusri empowers teams to ship)

- Possibly more contrarian strategy (founder confidence in unconventional bets)

- Tighter alignment with customers (founder personally engaged with key accounts)

- Higher expectations for team execution (founders often demand more)

None of this is guaranteed, but history suggests these patterns.

Market Implications: What This Signals to the Broader Enterprise Software Industry

When a company like Workday makes a CEO change, it reverberates through the industry. Here's what this signals:

Signal #1: Growth deceleration is hitting everyone. Workday isn't unique. Every enterprise software company is facing slower growth. Workday's CEO change might be a sign that the industry is entering a new era where 15%+ growth is harder.

Signal #2: Founder returns mean strategic reset. If you see other founders coming back to CEO roles in the next 12-24 months, it'll signal that the industry is shifting directions. Founders are brought in when external CEOs can't navigate inflection points.

Signal #3: AI differentiation is table stakes. Workday's entire narrative around this change centers on "AI inflection point." That's not unique. Every software company is saying this. The market is saying: Either you have compelling AI or you're toast. Workday's betting Bhusri can deliver the AI narrative.

Signal #4: Cost structure matters more than growth rate. Workday cut costs before replacing the CEO. That signals that in this market environment, cash flow and margins matter more than revenue growth. Companies that can't grow 20% profitably need to cut costs and grow 12% super profitably.

Financial Implications: Impact on Investors, Employees, and Stakeholders

For Workday investors:

- Short-term volatility: The stock might bounce on this news (founder returning = credibility) or stay flat. If Bhusri makes positive announcements in the first 90 days, expect upside.

- Medium-term stakes: If Bhusri doesn't accelerate growth within 18-24 months, the stock will likely decline further. If he does, significant upside.

- Dividend/buyback impact: Workday doesn't pay a dividend, so investors are banking on stock appreciation. Cost-cutting + potential growth acceleration = better odds of appreciation.

For Workday employees:

- Stability with uncertainty: Leadership changes sometimes come with more changes. Employees are probably wondering if there are more layoffs coming.

- Career path implications: Different leaders prioritize different functions. Engineering probably gets more resources under Bhusri. Sales/marketing might get less.

- Compensation changes: New CEO often means new comp philosophy. Bhusri might tie more pay to product/innovation metrics vs. revenue metrics.

For Workday partners and integrators:

- Implementation demand: Faster product releases = more implementation work initially, then potentially less (if products are simpler). Net neutral to slightly positive.

- Relationship shifts: Bhusri might strengthen or weaken relationships with key partners. Wait and see.

For customers:

- Pricing: Uncertain: Bhusri might bundle AI features into existing pricing (good for you) or charge separately (bad for you). Most likely: some hybrid approach.

- Product stability: Good: Enterprise customers need stability. A founder returning signals the company is committed to the core product.

Estimated data suggests that the majority of layoffs were in sales, marketing, and support, indicating a strategic shift towards engineering and product development.

The Precedent: Other CEO Changes in Enterprise Software

This isn't the first time a software company's brought back a founder or changed course dramatically. Looking at precedents:

Steve Jobs returning to Apple (1997): The classic example. Apple was struggling. Jobs came back and completely redirected the company. Massive success, but it took 3-4 years to show results.

Satya Nadella at Microsoft (2014): Not a founder return, but a strategic reset. Microsoft was struggling with mobile and cloud. Nadella shifted to cloud-first and acquired the "growth" CEO responsibilities. Worked extraordinarily well.

Bob Iger returning to Disney (2022): Iger had been CEO, stepped down, new CEO stumbled, Iger came back to reset. Signal: the new strategy wasn't working, need a veteran's hand.

Brian Chesky expanding Airbnb (2020-2022): Different context, but Chesky held strong to his vision for the company while scaling. Suggested founder vision was valuable even as company grew.

The pattern: Founder returns work when (a) the company has lost strategic direction, and (b) the founder has clear vision for the next chapter. Bhusri's bet is that he fits this pattern.

Risks and Challenges Bhusri Will Face

Let's be honest about the headwinds:

Risk #1: AI doesn't move the needle as much as expected. Maybe AI capabilities become commoditized faster than anyone thinks. Then Workday's stuck in a slower-growth business with higher expectations and no differentiation. That's a bad spot.

Risk #2: Organizational fatigue from layoffs. Two major rounds of layoffs in a year bruise company culture. Employee retention might suffer. Recruiting talent might be harder. That compounds execution risk.

Risk #3: Competitive pressure accelerates. Microsoft is moving fast. Salesforce is moving fast. Specialized AI startups are moving fast. If Workday stumbles even slightly, it loses ground fast. There's no margin for error.

Risk #4: Customer concentration and churn. If existing customers get nervous about Workday's direction and start evaluating alternatives, it's hard to recover. Workday's defensibility comes from being hard to replace. If customers start testing replacements, that status erodes.

Risk #5: Macro economic slowdown. If the economy slows, enterprise spending slows with it. Even if Workday's strategy is perfect, macro conditions might make growth hard.

Risk #6: Bhusri's vision is clear, but execution is messy. Founders often have great visions but spotty execution at scale. If Bhusri can see the opportunity but the organization can't execute, that's a wasted opportunity.

None of these risks are unique to Workday, but they're all real. Bhusri has probably 18-24 months to show progress before investor patience runs out.

What Happens Next: A Roadmap for the Next 18 Months

If Bhusri follows a typical playbook for a founder returning in a strategic moment, here's what to watch for:

Months 1-3 (Immediate):

- Announcement of new product roadmap focused on AI

- Possibly some reorganization announcements (consolidating teams, new product groups)

- Reassurance to key customers (personal calls, quarterly business reviews)

- Possible announcements about new hires for AI/ML leadership

Months 4-6 (First quarter results):

- Earnings call messaging shifts to "AI-first" language

- New product features ship (AI-powered workflows, agentic capabilities)

- Analyst day or similar event to reset expectations with investors

- Potentially, announcement of M&A targets (acquiring AI or specific vertical expertise)

Months 7-12 (Mid-year):

- User conference or major event showcasing AI capabilities

- Evidence of customer adoption of new AI features

- Possibly, new pricing model announcements (AI à la carte or bundled)

- Evaluation of whether growth is stabilizing

Months 13-18:

- Full year results showing whether growth is accelerating

- Assessment of whether Bhusri's strategy is resonating with customers and investors

- If positive: accelerated investment in R&D and go-to-market

- If negative: potential for further course corrections

This is speculative, but it's the normal playbook.

The Broader Question: Is Enterprise Software Changing?

Step back from Workday for a second. This CEO change reflects a bigger question: Is enterprise software fundamentally changing?

I'd argue yes, and here's why:

Platform consolidation is fragmenting. Workday's original thesis was "own the entire HCM and planning stack." That thesis is breaking. Companies increasingly want best-of-breed point solutions integrated together, not monolithic platforms.

AI is changing the game. Not because AI is new (we've had ML for years), but because LLMs and agentic AI are general enough to impact workflows across the stack. That means specialized AI players have better economics than big platforms.

Faster product cycles are becoming standard. Enterprises expect monthly or quarterly feature releases. Workday's older release cadence might not keep up. Startups are faster. That's an advantage if they execute.

Price sensitivity is increasing. Software spending is under scrutiny. If Workday charges premium prices for AI features when startups offer similar capabilities cheaper, customers will leave.

Vertical expertise matters more. Generic HR solutions are less valuable. Healthcare recruiting is different from tech recruiting is different from manufacturing. Companies want solutions that understand their vertical. Workday is generalist by design.

Workday can adapt to all of this. But it requires different thinking than the traditional "buy market share, extract value" playbook. Bhusri's return suggests the board wants someone who can think differently. Whether he can execute is the open question.

Conclusion: A Pivotal Moment for Enterprise Software's Biggest Players

Workday's CEO change from Carl Eschenbach back to co-founder Aneel Bhusri is more than a leadership shuffle. It's a signal that one of the industry's biggest players is resetting its strategy.

The numbers are clear: 40% stock decline, slowing revenue growth, two rounds of layoffs, and increasing competitive pressure created a moment where the board felt a new direction was needed. Eschenbach ran a disciplined ship—he cut costs, prioritized margins, managed expectations. But the board apparently felt that wasn't enough.

Bhusri's return signals a different bet: vision over operations, long-term strategy over quarterly execution, product leadership over business operations.

Here's what's on the line:

For Workday customers: This is a moment to re-evaluate your strategy. Are you getting value from Workday's new AI capabilities? Is the company moving fast enough? If not, now's the time to explore alternatives while management is still talking.

For Workday employees: This is a moment of uncertainty. More layoffs might be coming. But there's also opportunity if you're in the right areas (AI/ML, product engineering, key customer accounts). Hang tight and see what Bhusri announces.

For Workday investors: This is a moment to watch closely. Bhusri has 18-24 months to accelerate growth and reset the narrative. If he succeeds, significant upside. If he doesn't, the stock will probably decline further.

For the industry: This is a moment that will define the next era of enterprise software. If Workday successfully navigates AI and maintains growth, the traditional platform consolidation model survives. If Workday struggles, it confirms that specialized, AI-native tools are the future and generalist platforms are declining.

Bhusri's literally betting his legacy on getting this right. He founded Workday, grew it to be a $60+ billion market cap company, and now he's back to steer it through one of the most complex transitions technology has seen.

That's either brilliant or a sign of panic. Usually, it's both. But one thing's certain: the next 18 months will tell us a lot about the future of enterprise software and whether the biggest players can adapt to a world where AI changes everything.

Watch this space.

FAQ

What exactly happened with Workday's CEO?

Carl Eschenbach stepped down as Workday CEO after approximately two years in the role. He's being replaced by Aneel Bhusri, one of Workday's co-founders, who is returning to the CEO position on a permanent basis. Both executives posted about the transition on Linked In, framing it as a strategic realignment for navigating the AI inflection point. Eschenbach receives a

Why did Carl Eschenbach leave Workday?

Eschenbach's departure reflects broader challenges Workday was facing: stock price decline of approximately 40% year-over-year, revenue growth slowing from 15-18% to 12.6%, and investor concerns about the company's AI strategy. While the announcement frames this as a mutual, positive transition, the numbers suggest the board felt a different leadership approach was needed. Eschenbach implemented significant cost-cutting measures (two rounds of layoffs totaling over 10% of the workforce) but didn't successfully reset investor confidence in Workday's growth trajectory. The board likely felt that bringing back a founder would signal strategic clarity and vision to the market, as reported by MLQ AI.

Who is Aneel Bhusri and why is his return significant?

Aneel Bhusri co-founded Workday in 2005 and served as CEO before Eschenbach took over. He has deep institutional knowledge of Workday's product, vision, and customer base. His return is significant because founders typically carry more credibility with investors during strategic transitions, and they often have clearer long-term visions for their companies. Bhusri's appointment signals that Workday is moving away from an operationally-focused strategy toward a product and innovation-focused strategy centered on AI capabilities. Founders also have more political capital to make bold strategic decisions without board interference, though this can be a double-edged sword, as noted by People Matters.

What does this mean for Workday customers?

For existing Workday customers, this transition suggests several near-term implications: possible shifts in product roadmap priorities, potential organizational changes that might affect account teams and implementation partners, and potentially new pricing models as AI capabilities are integrated. Medium-term, customers should expect deeper AI integration into core workflows, potentially better integration with third-party AI tools, and either accelerated innovation or consolidation depending on whether Bhusri's strategy succeeds. The smart move is to schedule a meeting with your Workday account team to understand what's changing and how it affects your implementation, as suggested by TipRanks.

How much is Workday's revenue growing right now?

Workday reported three consecutive quarters of 12.6% year-over-year revenue growth, which is solid in absolute terms but represents a significant slowdown from the company's historical 15-18% growth rate. This growth deceleration is a primary reason for investor concern and the stock's 40% decline year-over-year. For context, S&P 500 companies typically grow at 7-10% annually, so Workday's 12.6% is still above-market, but it's no longer in the "high-growth software" category that commands premium valuations. Bhusri's primary mandate is likely to stabilize and accelerate this growth rate back toward 15%+, as highlighted by Simply Wall St.

What is Workday's AI strategy?

Workday has announced several AI initiatives including Workday Skills Cloud (AI-powered skill matching), Workday Orchestration Engine (automation and workflow optimization), Finance AI (predictive financial insights), and Recruiting AI (resume parsing and candidate matching). However, investors haven't been convinced these capabilities are differentiated or game-changing compared to competitors like Microsoft, Salesforce, and SAP. Bhusri's challenge is to make Workday's AI story more compelling by showcasing measurable customer outcomes, building agentic capabilities, creating industry-specific AI modules, and integrating with best-of-breed AI tools like Open AI and Anthropic's Claude. The current perception is that Workday has AI features, but not an AI strategy that drives growth, as noted by Deloitte.

How do Workday's layoffs relate to the CEO change?

Workday implemented two significant rounds of layoffs: 1,750 roles (8.5% of the workforce) framed as "AI-driven restructuring" in 2024, followed by another 2% reduction approximately a year later. These layoffs signal that the cost structure couldn't support the desired growth rate and that the company was reallocating resources toward AI-focused teams (engineering, data science) while reducing other functions. Eschenbach oversaw these cuts, which were operationally sound but didn't reset investor confidence. Bhusri's appointment suggests the board believed the cost-cutting was necessary but insufficient—they also needed a visionary leader with a clear product direction for the next phase. This combination of cost discipline plus strategic vision is what Bhusri is expected to deliver, as reported by Bloomberg.

What are the biggest risks for Workday's future?

Several significant risks could derail Bhusri's turnaround strategy: (1) AI capabilities might become commoditized faster than expected, eliminating differentiation, (2) organizational fatigue from layoffs could hurt retention and recruiting, (3) competitive pressure from Microsoft, Salesforce, and AI-native startups could accelerate, (4) customer concentration and churn could increase if clients get nervous about direction, (5) macro economic slowdown could impact enterprise software spending, and (6) Bhusri might have clear vision but organizational execution might be messy. The window for showing results is probably 18-24 months before investor patience runs out and the board re-evaluates, as noted by CNBC.

What should I watch for in the next 6-12 months?

Key indicators of whether Bhusri's strategy is working: new AI product features shipping on an accelerated cadence, clear customer case studies showing ROI from AI capabilities, messaging shifts from growth-at-all-costs to AI-first positioning, analyst day or major conference announcements that reset expectations, and most importantly, whether Workday's revenue growth stabilizes and starts accelerating. On the organizational side, watch for new hires in AI/ML leadership, any announcements about M&A (acquiring AI expertise or vertical specialization), and whether key executives stick around or jump ship. By month 12, earnings results should show whether the strategy is resonating with customers and investors, as suggested by Yahoo Finance.

Quick Final Thought

Workday's leadership transition is a reminder that even the biggest enterprise software companies aren't insulated from disruption. Growth eventually slows. Competition intensifies. Strategies need refreshing. What matters is whether the company can adapt fast enough.

Bhusri's return is a bet that founder vision, combined with the operational discipline Eschenbach put in place, can position Workday for the next era. It's an interesting play. The market will judge in 18-24 months whether it worked.

Until then, everyone—customers, employees, investors, competitors—is watching.

Key Takeaways

- Workday CEO Carl Eschenbach stepped down after two years, replaced by co-founder Aneel Bhusri, signaling a strategic reset in response to growth slowdown and stock decline

- The company's stock has declined 40% year-over-year with revenue growth slowing from 15-18% to 12.6%, prompting investor concerns about competitive positioning

- Bhusri faces an 18-24 month window to accelerate growth through AI capabilities and prove Workday can compete against Microsoft, Salesforce, and AI-native startups

- Two rounds of layoffs totaling over 10% of workforce indicate cost restructuring and resource reallocation toward AI-focused teams and innovation

- The broader enterprise software industry is fragmenting from platform consolidation toward best-of-breed point solutions, requiring different competitive strategies

Related Articles

- AI Will Transform SaaS, Not Kill It: Databricks' Vision for 2025

- Intel GPU Development 2025: Strategic Hiring & Nvidia Challenge

- SaaS Revenue Durability Crisis 2025: AI Agents & Market Collapse

- Claude Opus 4.6: 1M Token Context & Agent Teams [2025 Guide]

- Own's $2B Salesforce Acquisition: Strategy, Focus & Lessons

- AI in Contract Management: DocuSign CEO on Risks & Reality [2025]

![Workday CEO Leadership Shift: What Bhusri's Return Means [2025]](https://tryrunable.com/blog/workday-ceo-leadership-shift-what-bhusri-s-return-means-2025/image-1-1770738306125.jpg)