Microsoft's AI Strategy Under Fire: Open AI Reliance Threatens Investor Confidence

Microsoft just posted record numbers.

Instead, stock prices dropped 6% in after-hours trading.

That's not a glitch. That's a market signal that something deeper is broken. And it has everything to do with how the company is betting its entire AI future on a single partner: Open AI.

Here's what happened, what it means, and why it matters for anyone watching the AI arms race unfold.

TL; DR

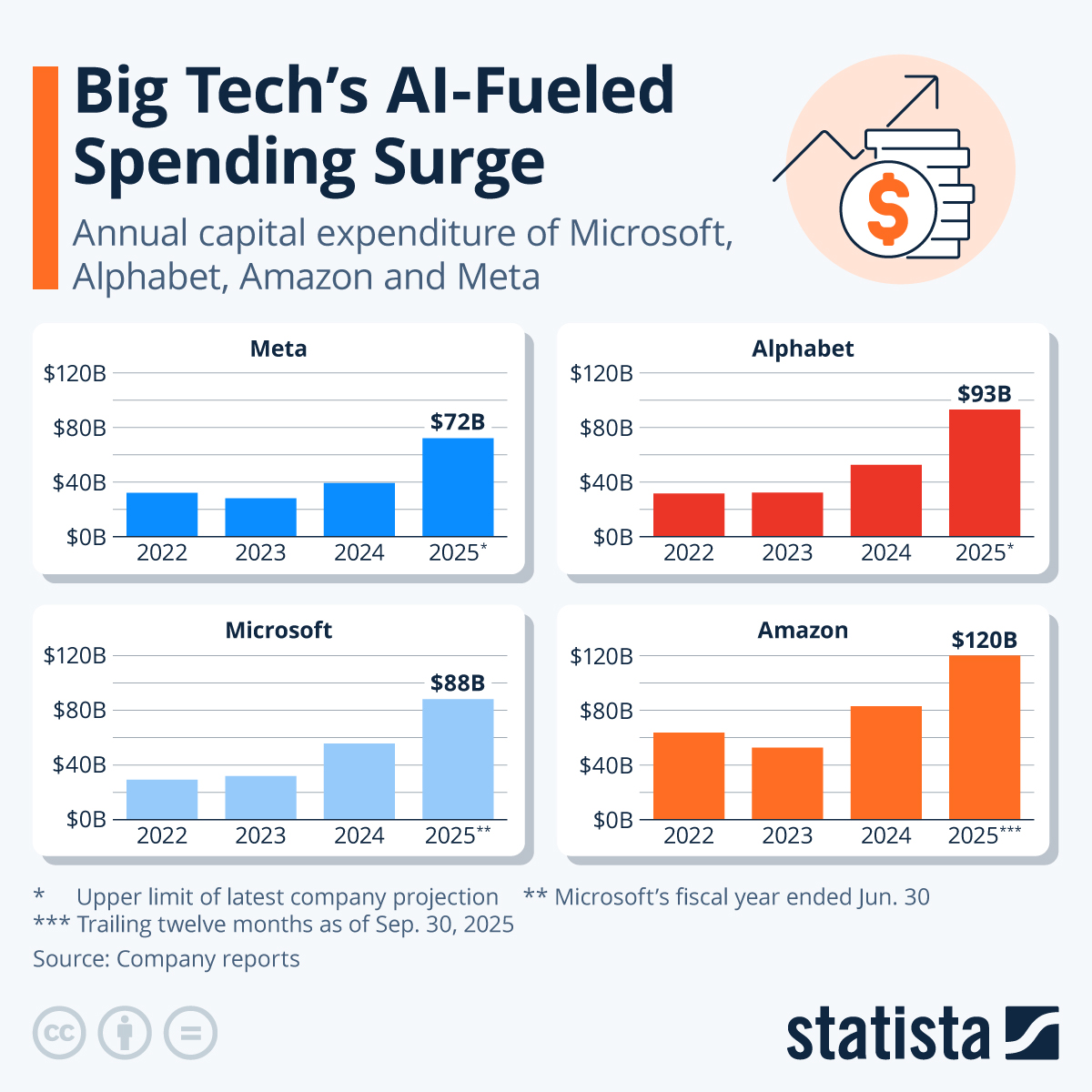

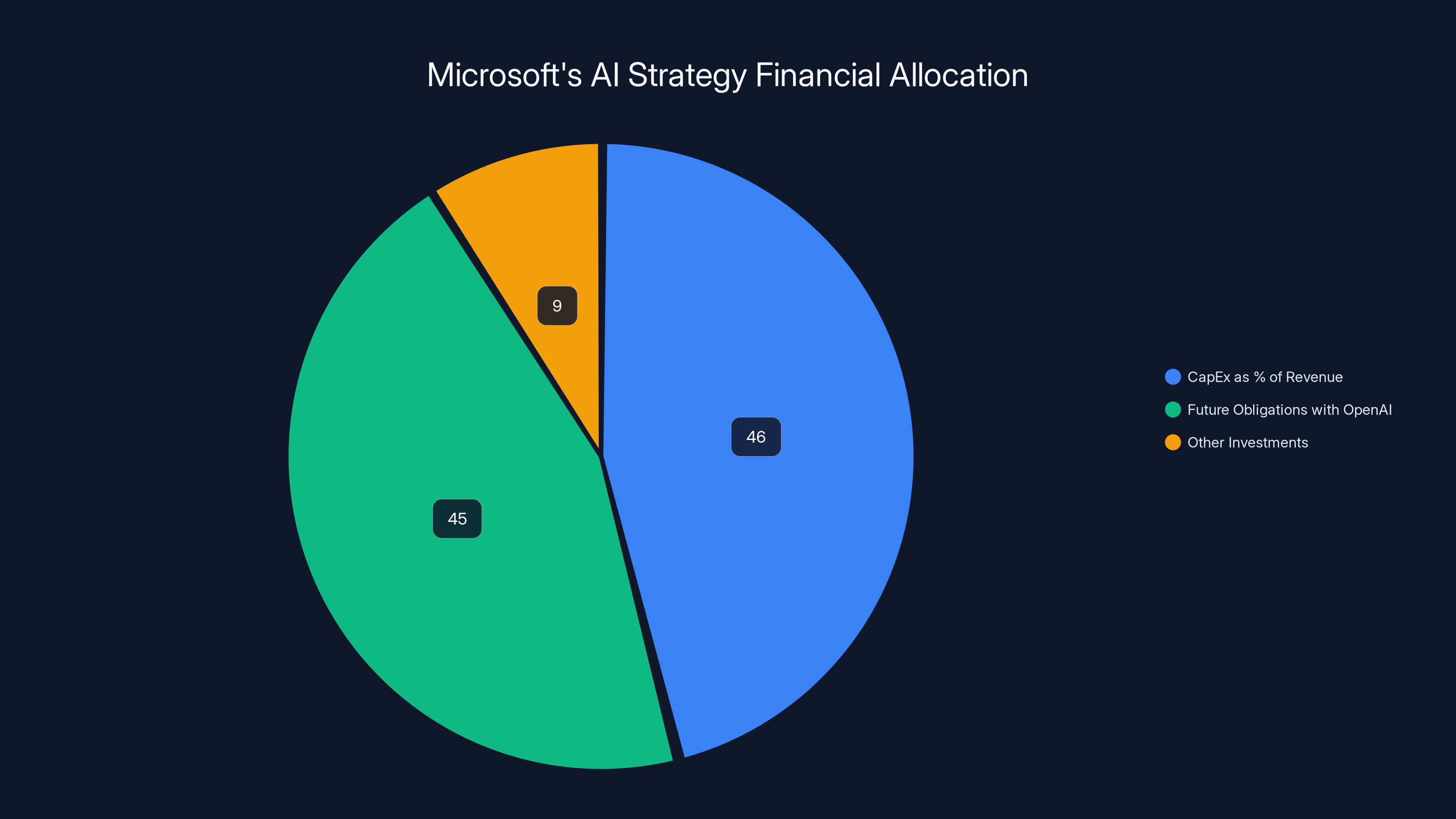

- Revenue growth masks structural risk: Microsoft's 37.5B in capital expenditure (46% of revenue) burning through cash

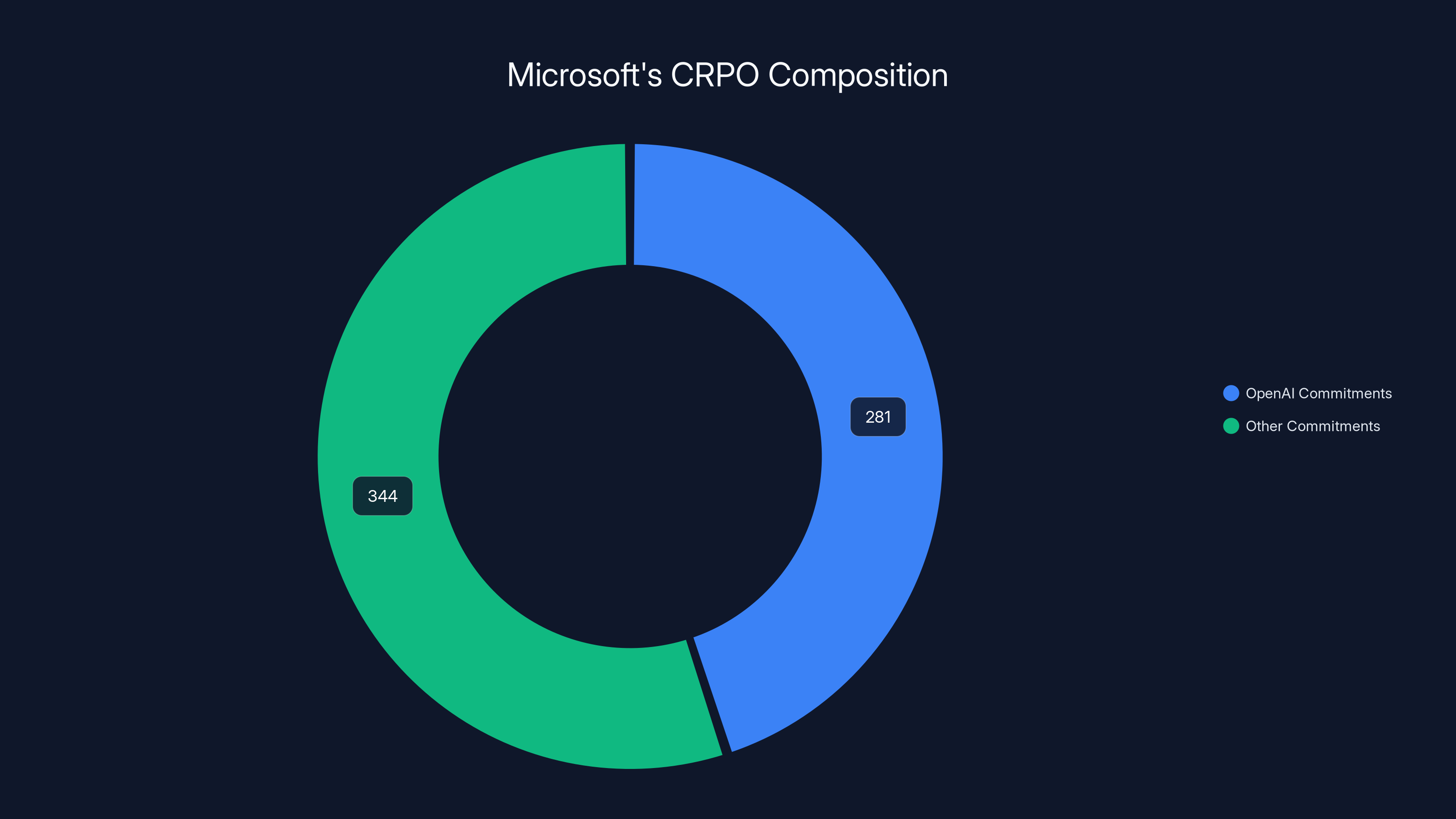

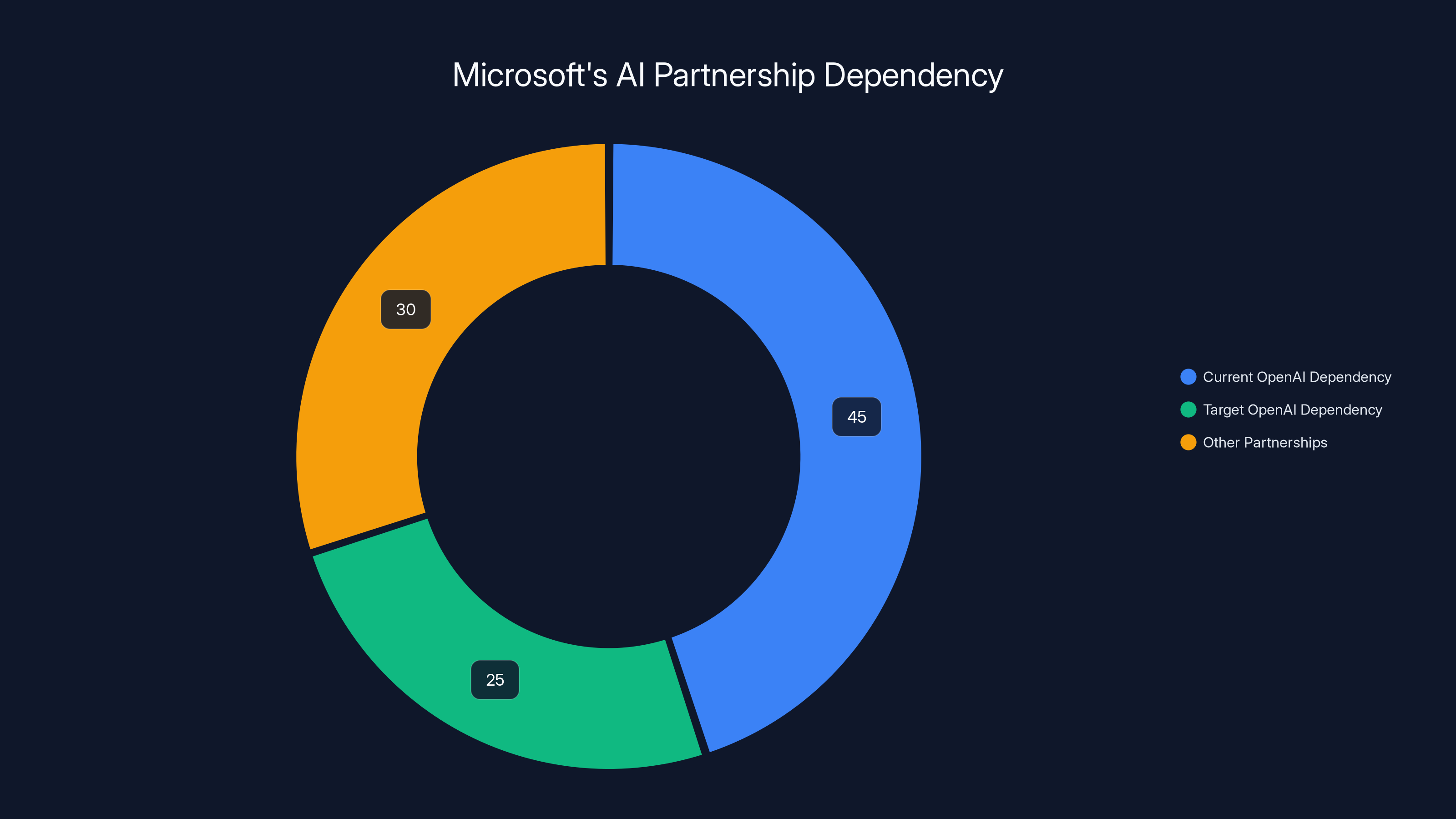

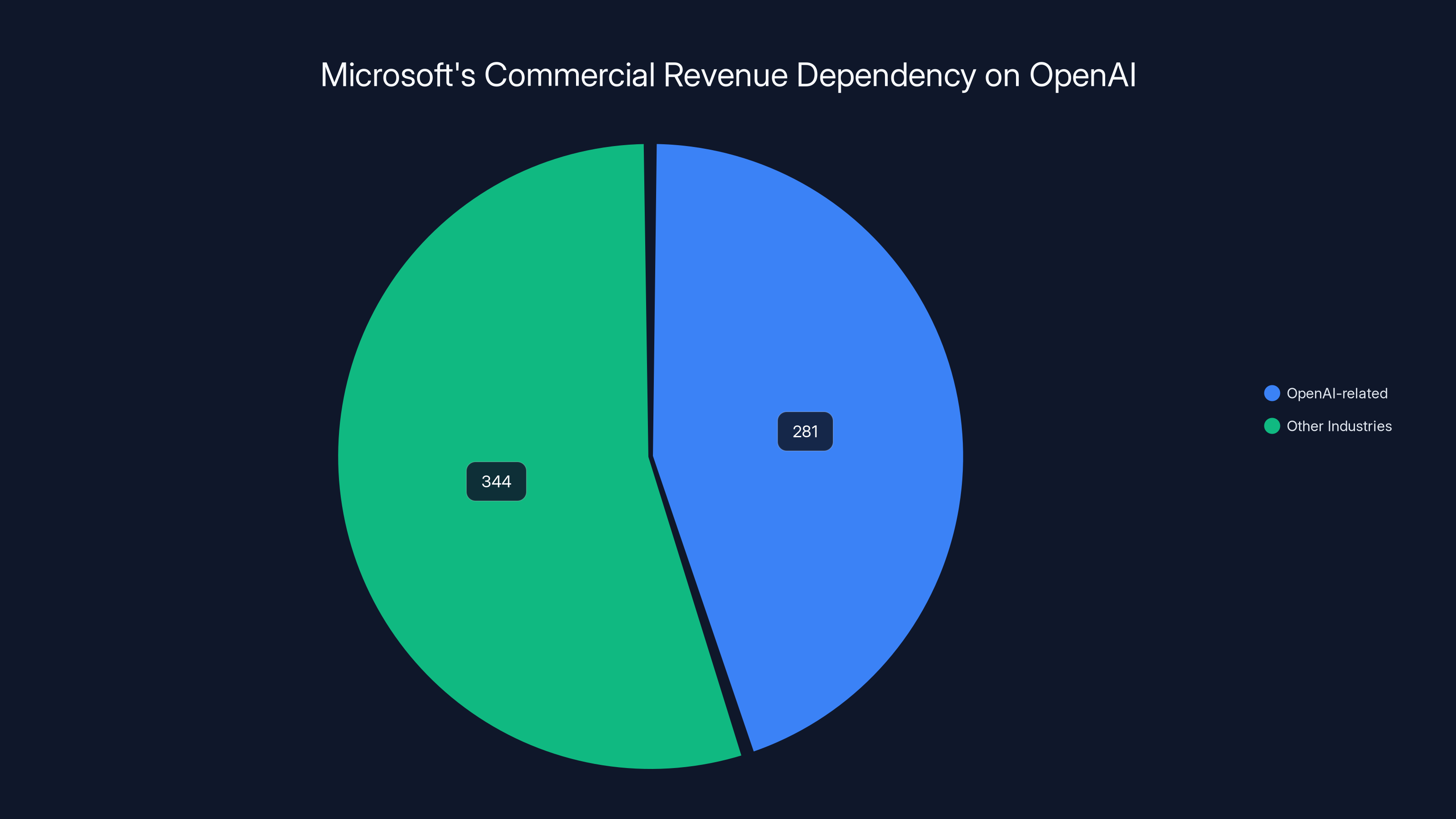

- Open AI dependency is real: 45% of Microsoft's $625B commercial remaining performance obligation is tied to Open AI commitments, creating concentration risk

- Investor skepticism isn't about numbers: The 6% after-hours stock decline reflects concerns about long-term strategy, not quarterly earnings surprises

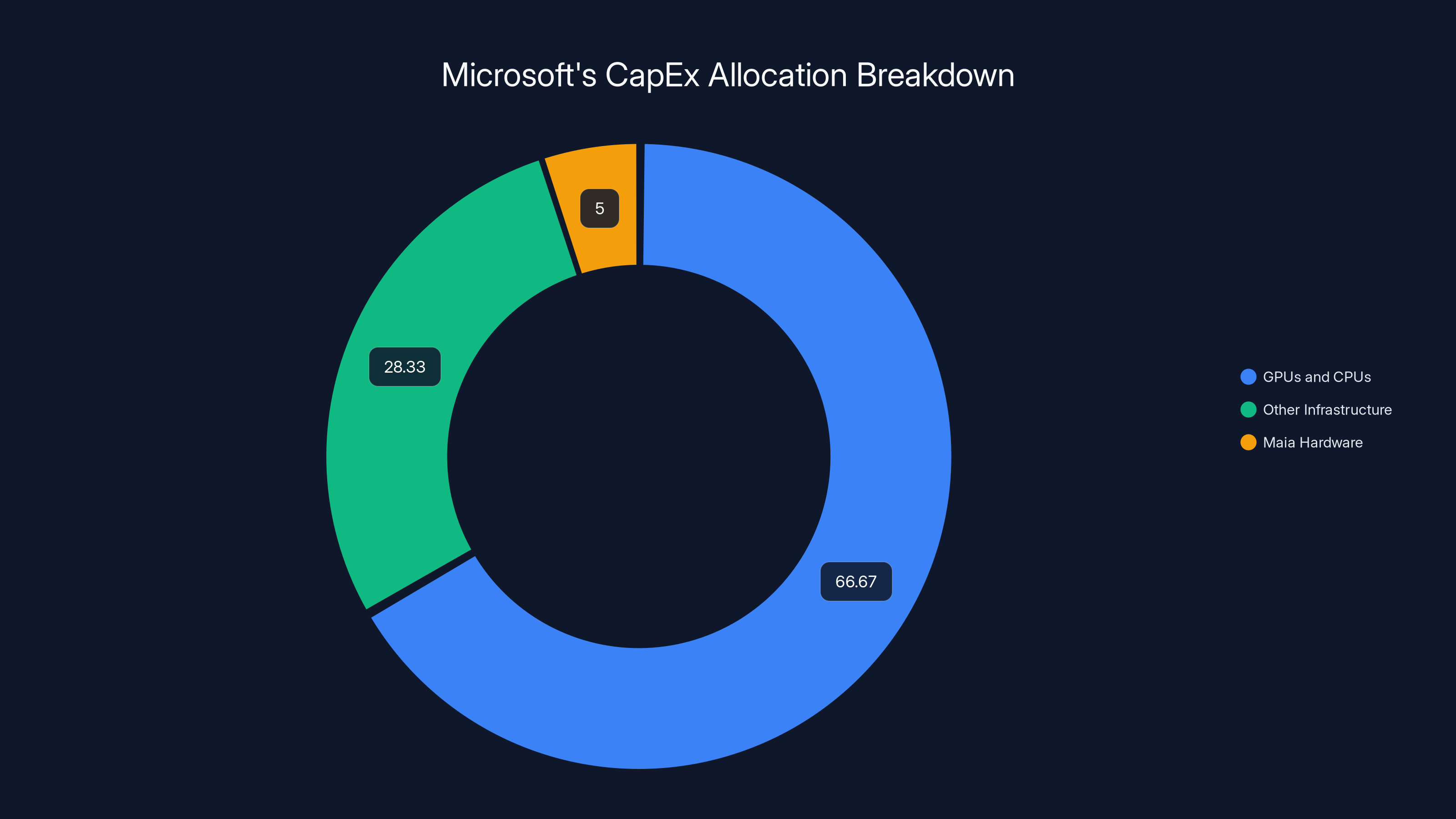

- Nvidia remains essential: Despite building Maia chips in-house, Microsoft still depends heavily on Nvidia hardware, with roughly two-thirds of Cap Ex going to GPUs and CPUs

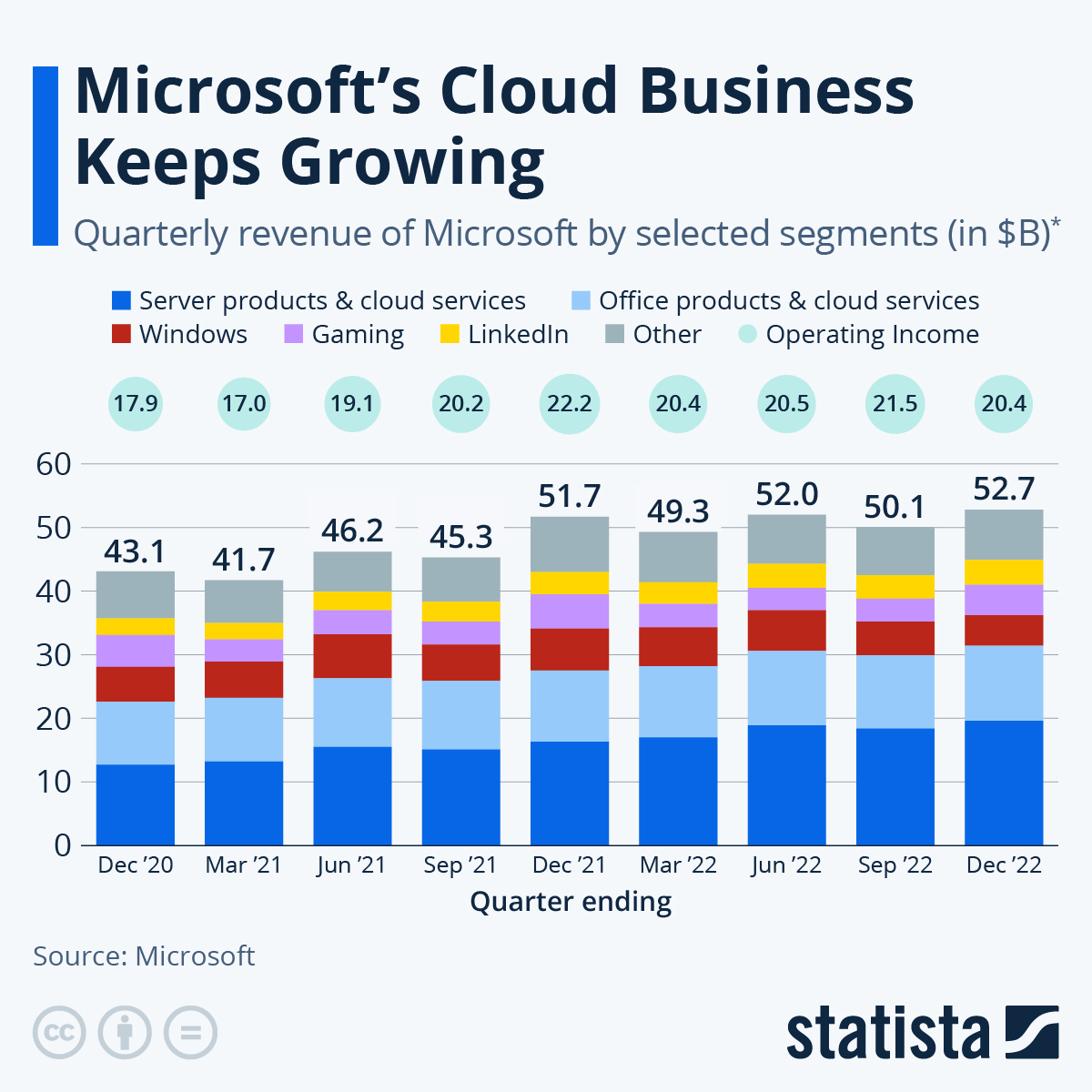

- Cloud diversification is critical: Microsoft Cloud now represents 63% of total company revenue, a massive concentration that could amplify downside if AI adoption slows

Approximately 45% of Microsoft's $625 billion CRPO is tied to OpenAI, highlighting significant concentration risk.

The Numbers That Look Good on Paper (But Hide Complexity)

Let's start with what sounds impressive because it genuinely is.

Microsoft's quarterly revenue hit

Microsoft Cloud revenue crossed $50 billion in a single quarter. Let that sink in. One division, pulling in annual revenue that would make most Fortune 500 companies look modest. This cloud business grew because of AI adoption. Enterprise customers are paying premium prices for cloud infrastructure because they need compute for language models, image generation, and increasingly specialized AI workloads.

So why did investors panic?

Because they did the math.

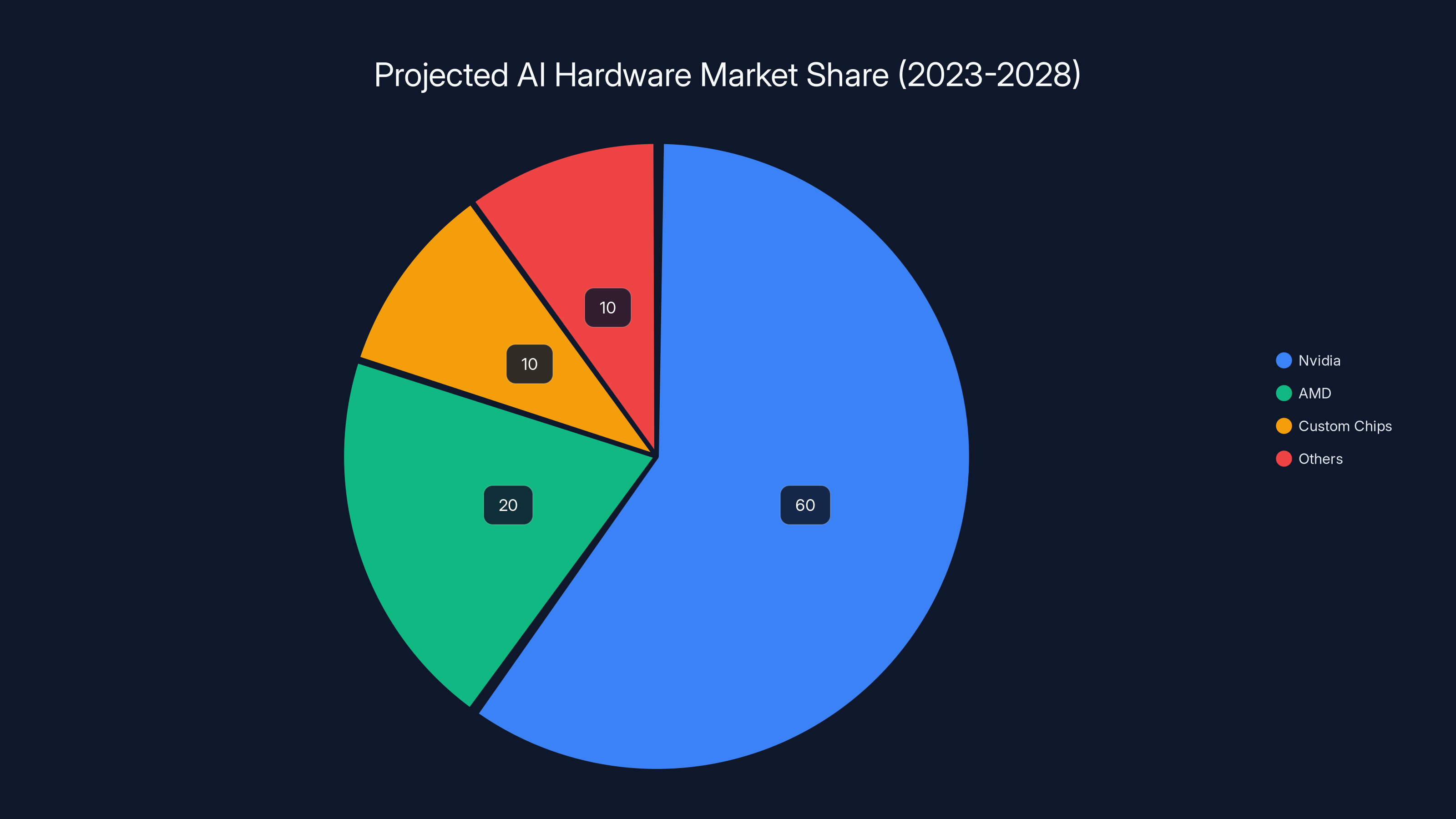

Estimated data suggests Nvidia will maintain a dominant 60% market share in AI hardware over the next 5 years, despite emerging competition from AMD and custom chips.

The Cap Ex Problem Nobody Wants to Talk About

Here's the uncomfortable conversation happening in investment firms right now.

If you're spending

The question keeping investors up at night: will it?

Microsoft CFO Amy Hood broke down the Cap Ex allocation during earnings. Approximately two-thirds of that spending goes to GPUs and CPUs. That's $25 billion per quarter going to buy chips to build data centers. Most of those chips come from Nvidia. Some come from AMD. A smaller portion comes from Microsoft's own Maia hardware project, which is still years away from reaching scale.

This creates a cascading set of risks.

First, there's the supplier concentration. Nvidia controls the GPU market with an estimated 80-90% market share for AI training hardware. If Nvidia has supply issues, or if better chips emerge, Microsoft's infrastructure spending could become stranded assets. The company has already spent tens of billions on Nvidia hardware that might be obsolete before it finishes depreciating.

Second, there's the utilization problem. You can build a massive data center, but if customers don't consume the compute you're offering, you're just burning cash. Azure services need to be purchased and used at scale to justify the infrastructure spend. If AI adoption slows, or if enterprises find ways to do AI inference more efficiently, utilization drops. Margins compress. The entire model breaks.

Third, there's the competitive acceleration. If Microsoft is spending $150 billion annually on infrastructure, what are Google, Amazon, and other cloud providers spending? If competitors are matching or exceeding that spend, the competitive advantage of scale evaporates. Microsoft needs to be not just keeping pace, but pulling ahead. At these investment levels, there's no room for moderate returns.

The Open AI Concentration Problem Is Real

Let's talk about the elephant in the room.

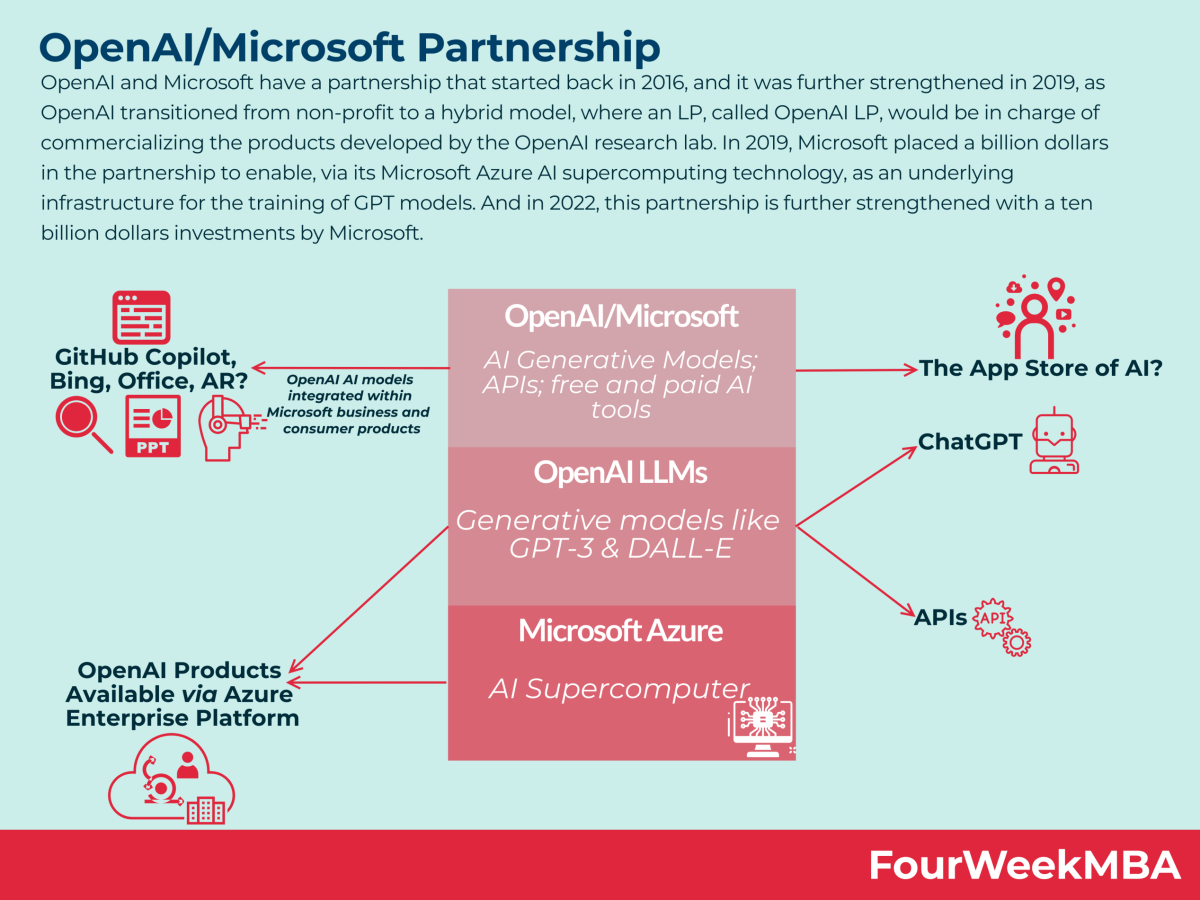

Microsoft has invested roughly

Sounds great until you look at the numbers.

Of Microsoft's

Microsoft CFO Amy Hood tried to downplay this in the earnings call, emphasizing that the remaining 55% is "spread across various industries, geographies and customers." Translation: we know this looks bad, so let's reassure investors that we have other revenue.

But here's what that framing misses. The $281 billion in Open AI-related obligations represents the highest-margin, fastest-growing revenue segment in the portfolio. If that revenue evaporates, Microsoft isn't just losing 45% of future obligations. It's losing the most profitable, strategically important segment.

Consider the risks:

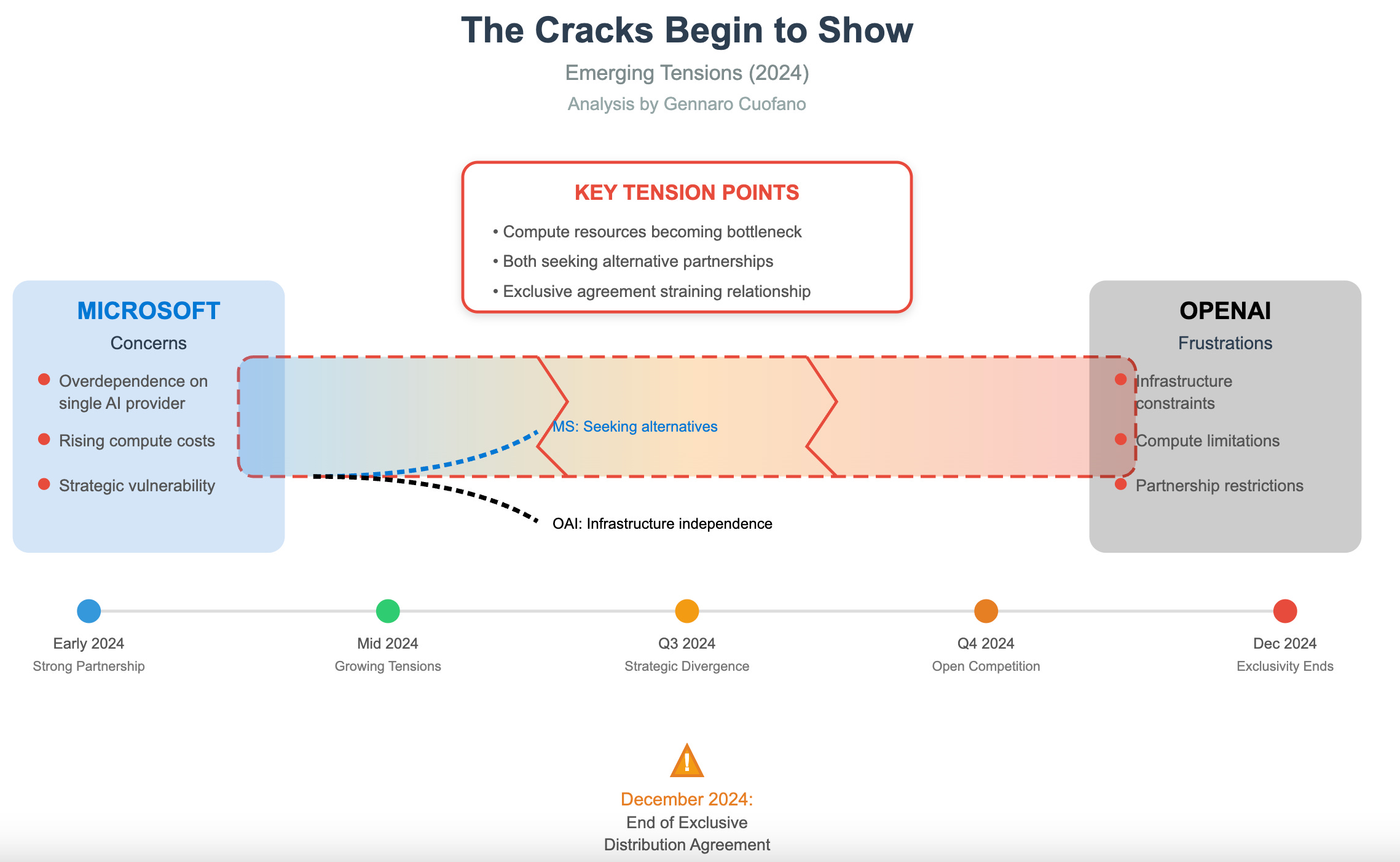

Regulatory Risk: Open AI faces potential regulatory action in the EU, UK, and increasingly in the US. If regulators restrict Open AI's operations, or mandate certain limitations on model capabilities, the value of that compute spending drops. Open AI might need to operate with lower-cost infrastructure or more efficient models.

Leadership Risk: Sam Altman is Open AI's public face and strategic driver. The company has already experienced one dramatic leadership transition. Any future instability could trigger a reassessment of Open AI's Azure commitment, particularly if new leadership has different infrastructure preferences or partnership priorities.

Technological Risk: What if Open AI's models plateau? What if competitors like Anthropic, Google, or open-source initiatives like Meta's LLa MA produce models that are comparable to GPT-4 or GPT-5 at lower cost? Open AI's competitive moat is eroding faster than most investors realize. If Open AI loses market share, Azure's utilization for Open AI workloads drops proportionally.

Competitive Risk: Google's Gemini, Anthropic's Claude, and open-source models are improving rapidly. If Open AI's models become commoditized, the value of exclusive access diminishes. Microsoft's $13 billion investment becomes a sunk cost.

Microsoft is hoping that Open AI remains the market leader indefinitely. That's a bet, not a strategy. And the market is starting to price in the probability that this bet might be wrong.

Microsoft aims to reduce its dependency on OpenAI from 45% to 25-30% of its AI obligations, diversifying with other partnerships. Estimated data.

Microsoft Cloud: Impressive Scale, Terrifying Concentration

Here's a statistic that should make analysts uncomfortable: Microsoft Cloud represents 63% of total company revenue.

Sixty. Three. Percent.

That's not diversification. That's concentration risk masquerading as growth.

Compare that to Microsoft's revenue mix ten years ago. Back then, Office and productivity software dominated. Server products and cloud services were growing but represented a minority of revenue. The company had multiple revenue pillars: Windows licensing, Office subscriptions, Enterprise Services, Server Products, and Intelligent Cloud.

Today? Two divisions drive everything: Microsoft Cloud (63%) and Productivity & Business Processes (28%). That leaves only 9% of revenue from other sources.

This concentration made sense when cloud growth was accelerating and reaching new geographies. But when cloud growth stalls, or when AI adoption proves slower than expected, Microsoft's entire revenue model becomes fragile.

The risk is amplified because Microsoft Cloud's growth is almost entirely driven by AI. Azure growth is acceleration because customers are buying compute for AI workloads. Copilot adoption is driving Office 365 expansion. When customers ask for discounts because AI capabilities aren't delivering ROI yet, Microsoft has fewer places to shift revenue.

CEO Satya Nadella tried to spin this positively: "We are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises."

But here's the uncomfortable truth. If we're "only at the beginning phases," that means adoption could slow as the market matures. AI isn't a perpetual growth engine. It's a wave. And Microsoft is betting the entire company on the continuation of that wave at current acceleration.

The Nvidia Dependency Nobody Wants to Acknowledge

Microsoft talks about building Maia, its custom AI chip. The company has made real progress. Maia chips are now used in Azure data centers for certain workloads. This is the right strategic move: reduce dependency on Nvidia, build custom silicon, improve margins.

The problem? It's still years away from meaningfully reducing Nvidia spending.

Nvidia's H100 and H200 GPUs remain the best-performing hardware for training and inference of large language models. They're not the only option. Alternatives exist from AMD, custom chips from competitors, and Microsoft's own efforts. But for the next 3-5 years, Nvidia hardware will continue to be the dominant choice for cutting-edge AI workloads.

Which means Microsoft will continue spending roughly $25 billion per quarter on Nvidia chips, give or take.

Here's where it gets complicated. Nvidia's stock price has become a leading indicator of AI investment confidence. When Nvidia trades down, it signals that investors believe AI infrastructure spending is slowing. Microsoft is therefore indirectly exposed to Nvidia's valuation, even though the two companies compete in some areas.

Further, Nvidia's gross margins on GPUs are extraordinary. Around 75% gross margin on some products. Microsoft buys $25 billion of that per quarter, paying premium prices for the highest-performance hardware available. Meanwhile, AMD is trying to build alternatives that are cheaper and almost as performant. If AMD gains meaningful share, Microsoft could reallocate some spending and improve its unit economics.

But that assumes Nvidia allows its market share to erode. The company has financial incentive to cut prices, bundle services, or negotiate volume deals directly with Microsoft to maintain share. This creates a complex negotiation dynamic where Microsoft has leverage (enormous volume) but limited alternatives (quality and availability constraints).

The net result: Microsoft is structurally dependent on Nvidia for the foreseeable future, limiting its ability to negotiate pricing power and forcing continued heavy Cap Ex commitments.

Approximately two-thirds of Microsoft's quarterly CapEx, or $25 billion, is spent on GPUs and CPUs, primarily sourced from Nvidia. Estimated data.

Why Investors Panicked: The Strategic Uncertainty

The stock drop wasn't a reaction to earnings. It was a reaction to strategic uncertainty.

Here's what investors heard in the earnings call:

- We're spending $150 billion per year on infrastructure (half of our annual profit)

- 45% of our future contracted revenue is tied to one partner (Open AI)

- That partner faces regulatory, competitive, and leadership risks

- We're dependent on Nvidia for 2/3 of that infrastructure spending

- We don't know if AI adoption will sustain at current levels

- We're not reducing Cap Ex even though utilization data suggests some overcapacity

That's not a winning combination.

Investors are fundamentally asking: what's the endgame? Does Microsoft become the dominant AI infrastructure provider, capturing enormous margins? Or does Microsoft become a commodity cloud provider with customer concentration risk and declining margins?

The earnings call didn't answer that question convincingly.

Nadella's statement that "we are pushing the frontier across our entire AI stack" is true but vague. Microsoft is building AI models, infrastructure, applications, and integrations. But the company hasn't articulated a clear differentiation strategy. Why should enterprises choose Microsoft for AI instead of building on Google Cloud with Gemini, or AWS with Bedrock, or running open-source models on commodity infrastructure?

The answer seems to be: "We invested in Open AI, so you should use us." That's not a sustainable competitive advantage. That's a dependency.

The Broader AI Market Timing Risk

Microsoft is betting on AI adoption accelerating across every industry, every company size, and every geography.

That might happen. Large language models are genuinely useful for certain tasks. Enterprise customers are finding ROI in some AI applications. Copilot features in Office are starting to see adoption.

But there are signs that the acceleration might be slowing.

Enterprise customers are asking harder questions about AI ROI. The hype cycle has moved from "AI will revolutionize everything" to "show me the specific business case for your AI solution." Companies that rushed to deploy Copilot or AI chatbots are now evaluating whether those deployments are actually delivering measurable productivity improvements.

Covid-era remote work adoption drove cloud growth as companies needed infrastructure immediately. There was clear urgency. AI adoption is different. It's optionality, not necessity. Which means adoption curves will follow different patterns.

Further, the cost of AI inference is dropping. Better optimization, more efficient models, and improved hardware means AI is becoming cheaper to run. That's great for consumers but terrible for infrastructure providers. Lower margins on AI workloads compress the economics of the Cap Ex-heavy infrastructure business.

Microsoft is positioned well to win in AI, but the company's financial model depends on AI adoption being a once-in-a-decade growth inflection. If adoption is meaningful but moderate, or if the efficiency improvements compress margins faster than expected, Microsoft's current Cap Ex strategy becomes unsustainable.

OpenAI-related obligations account for 45% of Microsoft's commercial revenue, highlighting significant dependency on OpenAI's success.

Cloud Margins Are Compressing, and It's Going to Get Worse

Microsoft's Microsoft Cloud division has incredibly high margins. Azure, for example, reportedly runs at 60%+ gross margin, among the highest in enterprise software.

But cloud margins have been compressing for years. Competition from AWS and Google Cloud has driven down prices. Customers with large volume commitments negotiate aggressive discounts. And as cloud becomes more commoditized, pricing pressure increases.

Now add AI into the mix.

AI workloads have different cost structures than traditional cloud workloads. They're compute-intensive (meaning high GPU/CPU costs), memory-intensive (requiring expensive high-bandwidth memory), and energy-intensive (requiring power-hungry infrastructure). All of that compresses margins relative to traditional cloud workloads.

Further, customers expect AI to be priced cheaper than traditional cloud because they see it as becoming commoditized. They'll shop around. They'll pressure vendors on price. The days of 60%+ margins on cloud are ending.

Microsoft's current Cap Ex strategy assumes margins will hold or improve. If margins compress while utilization grows slower than expected, cash generation becomes severely constrained. The company could be stuck with expensive infrastructure generating modest returns.

The Maia Chip Strategy: Too Late, Too Uncertain

Microsoft's Maia processors represent the company's attempt to reduce Nvidia dependency. The strategy is sound: build custom silicon optimized for Azure workloads, reduce costs, improve margins, gain leverage in negotiations with Nvidia.

The problem is timing.

Maia chips are still years away from reaching the performance level of Nvidia's latest generation hardware. The company is in the early stages of designing the next generation. Meanwhile, Nvidia is advancing H100, H200, and working on next-generation products. By the time Maia is ready for prime time, Nvidia will be years ahead.

Further, developing competitive AI hardware requires expertise in deep learning, hardware architecture, manufacturing relationships, and software optimization. Microsoft has some of these capabilities but isn't a hardware company. Nvidia spent decades building expertise. Microsoft is playing catch-up.

Yet the company has no choice. Allowing Nvidia to maintain monopolistic pricing power is untenable long-term. So Microsoft will continue investing billions in Maia, hoping that eventually it can shift meaningful workloads away from Nvidia.

But for the next 3-5 years, Maia is a backup plan, not a primary strategy. Microsoft's Cap Ex remains heavily dependent on Nvidia pricing and availability.

Microsoft's AI strategy heavily invests in CapEx and OpenAI, with 91% of resources focused on these areas. Diversification could mitigate risks. (Estimated data)

Regulatory Uncertainty: The Wild Card Nobody Wants to Price In

AI regulation is coming. The EU has already passed the AI Act. The UK has published AI frameworks. The US Congress is considering various AI regulations.

How does regulation affect Microsoft?

Direct impact: If regulators restrict certain AI capabilities, or require significant testing and documentation, Microsoft might need to modify its AI products or services. Open AI-powered products like Chat GPT might need to comply with new requirements. That increases costs.

Indirect impact: If regulators restrict Open AI's operations, Microsoft's investment thesis changes dramatically. The company's $13 billion investment in Open AI, plus the infrastructure commitments, become contingent on regulatory approval.

Market impact: Investors don't know how regulation will affect AI companies. That uncertainty gets priced into stock valuations. Until regulation becomes clear, expect continued volatility in AI company stocks, including Microsoft.

The current situation is asymmetrical: if regulation is less restrictive than feared, Microsoft's stock pops. If regulation is more restrictive, the stock drops. That volatility creates opportunity for traders but uncertainty for long-term investors.

What CEO Nadella Is Really Saying

Nadella's comment about "pushing the frontier across our entire AI stack" is worth unpacking.

What he means: Microsoft is building AI into everything. Models (with Open AI partnership), infrastructure (Azure), applications (Office, Dynamics), developer tools (Copilot), and services (consulting, support). It's an integrated stack designed to be sticky and create lock-in.

What he's avoiding: Microsoft doesn't have a clear differentiation strategy beyond "we partner with Open AI and we have scale." The company hasn't articulated why customers should choose Microsoft over competitors, except for the fact that Open AI uses Azure.

What investors hear: we're betting the company on AI, we don't have a backup plan, and we're hoping adoption sustains.

The CEO's job is to convince investors that the company has a winning strategy. Nadella hasn't done that with clarity. Instead, he's given investors confidence that the company is investing heavily in AI but uncertainty about whether that investment will generate adequate returns.

The Real Risk: What Happens If AI Adoption Slows?

Let's game out a downside scenario.

Suppose AI adoption plateaus. Enterprises implement Copilot in Office, use Git Hub Copilot for coding, deploy some AI chatbots, then stop. Adoption reaches a comfortable but moderate level.

In this scenario:

- Azure AI workloads grow 30-40% annually instead of 100%+ annually

- Utilization of Microsoft's infrastructure remains below 70%

- Pricing pressure on AI workloads increases as the market matures

- Gross margins compress from 60%+ to 45-50%

- Microsoft's Cap Ex becomes excessive relative to incremental revenue growth

- Free cash flow declines despite revenue growth

- The stock re-rates downward as investors reassess the ROI of infrastructure spending

This isn't a catastrophe scenario. Microsoft remains profitable. The company continues growing. But the 10-20% annual stock appreciation that investors expect evaporates. The company becomes a slow-growth dividend stock instead of a high-growth core holding.

Is that likely? Probably not. But it's possible enough that it should concern investors.

And that's why the stock dropped 6% after strong earnings.

Microsoft's Path Forward: What Needs to Change

If I were advising Microsoft's board, here's what I'd recommend:

First, reduce the Open AI dependency. This doesn't mean ending the partnership. It means diversifying. Microsoft should aggressively develop its own AI models. The company should partner with other model makers like Anthropic. The company should support open-source models. The goal: reduce Open AI's share of the $625 billion remaining obligations from 45% to 25-30% within three years.

Second, improve Azure utilization. Stop the relentless Cap Ex increase and focus on efficiency. Can Microsoft generate more revenue from existing infrastructure? Can the company optimize workloads to reduce GPU requirements? Can utilization be improved from current levels to 80%+? These efficiency gains would dramatically improve unit economics.

Third, articulate a clear differentiation strategy. Why should enterprises choose Microsoft for AI instead of AWS, Google Cloud, or on-premise solutions? The answer can't be "we partner with Open AI." It needs to be about specific solutions, vertical expertise, integration capabilities, or pricing advantages. Nadella needs to give investors a reason to believe Microsoft wins on its own merits, not just because of the Open AI relationship.

Fourth, prepare for margin compression. Assume that AI workloads will generate lower margins than traditional cloud. Plan accordingly. Diversify into higher-margin services like consulting, managed services, and support. Don't rely entirely on infrastructure margins to fund the business.

Fifth, accelerate Maia and custom silicon. Get Maia-based products into production faster. The longer Microsoft waits, the more expensive Nvidia hardware becomes. Investing more aggressively in custom silicon, even if expensive, could pay off quickly in the form of margin improvements.

Sixth, communicate with investors more clearly. Nadella's strategy is sound but poorly communicated. Give investors specificity about utilization rates, margin expectations, and revenue growth timelines. The market hates uncertainty. Clarity, even if the news isn't perfect, is better than vagueness.

The AI Infrastructure Bubble Risk

Let's talk about the elephant in the room: what if there's an AI infrastructure bubble?

Microsoft, AWS, Google, and other cloud providers have collectively spent hundreds of billions on AI infrastructure. All of this spending is justified by the belief that AI adoption will accelerate across the economy, driving massive demand for compute.

What if that belief is wrong?

What if AI adoption plateaus at a much lower level than expected? What if the productivity gains from AI aren't as dramatic as marketing suggests? What if enterprises find that they can do AI inference on cheaper, more efficient hardware?

In that scenario, infrastructure spending contracts. Data centers built to support AI workloads sit underutilized. The companies that spent the most on infrastructure suffer the most pain.

Is this likely? Probably not. AI is genuinely useful, and adoption is real. But the magnitude of adoption is uncertain. The market has clearly underestimated the success of large language models. Could it now be overestimating the sustained adoption and monetization?

Investors are starting to wonder. And that uncertainty is priced into Microsoft's stock.

What This Means for Your AI Strategy

Microsoft's situation is a cautionary tale for any company betting heavily on AI.

The lesson: don't concentrate your entire strategy on a single technology or partnership. Microsoft did both. The company bet the company on AI (Cap Ex is 46% of revenue). The company concentrated that bet on Open AI (45% of future obligations).

If you're building an AI strategy, remember:

Diversification matters. Don't rely on a single model provider, vendor, or technology. Build optionality. Support multiple model options. Partner with different providers. This hedges your risk.

Unit economics are everything. Can you generate revenue from AI that exceeds the cost of infrastructure? If not, you're just building a beautiful data center. Focus on actual, measurable ROI from AI applications, not just volume of compute sold.

Margin compression is inevitable. As AI becomes commoditized, pricing pressure increases. Plan for margins to decline over time. Build recurring revenue streams beyond infrastructure sales.

Customer relationships matter more than technology. Microsoft's real advantage isn't the AI models or the infrastructure. It's the existing relationships with enterprises who already use Office, Azure, and Dynamics. Leverage those relationships, but don't overly depend on them.

Communicate clearly about uncertainties. Investors hate surprises more than they hate bad news. Be transparent about adoption timelines, margin expectations, and competitive risks. Build credibility through honest communication.

For developers and teams looking to build AI applications without the infrastructure risk, platforms like Runable offer an alternative approach. Rather than managing your own infrastructure, you can use Runable's AI-powered automation platform to generate presentations, documents, reports, images, and videos at $9/month. This eliminates the Cap Ex burden while still enabling you to leverage AI for productivity.

The Bottom Line: Growth Doesn't Fix Everything

Microsoft's earnings were excellent. Revenue up, profit growing, cloud business accelerating. By any traditional metric, the company is firing on all cylinders.

But the stock dropped 6%.

That's the market saying: "We don't care about your historical growth. We care about whether your strategy makes sense going forward."

And right now, Microsoft's strategy looks like:

- Spend $150 billion per year on infrastructure

- Hope that AI adoption justifies that spending

- Depend on Open AI to drive that adoption

- Hope Nvidia doesn't raise prices too aggressively

- Hope margins don't compress

- Hope regulation doesn't restrict AI

- Hope competitors don't move faster

That's not a strategy. That's a bet.

Microsoft has the financial resources to make bold bets. The company has the customers, the partnerships, and the talent to execute. But the company needs to give investors a reason to believe the bet will pay off.

Right now, it hasn't. And until it does, expect continued volatility in the stock and skepticism from the investment community about whether Microsoft's AI strategy is sustainable or reckless.

The next few quarters will be critical. If Azure utilization improves, gross margins hold up, and Open AI doesn't face serious regulatory headwinds, Microsoft's narrative improves and the stock likely re-rates upward. If any of those conditions deteriorates, the stock could face significant pressure.

The market is watching carefully. So should you.

FAQ

What is Microsoft's commercial remaining performance obligation (CRPO)?

Commercial remaining performance obligation represents contractual revenue that Microsoft has committed to deliver but hasn't yet recognized as revenue. Microsoft's $625 billion CRPO means the company has signed contracts worth that amount over future periods, typically 1-3 years. This metric indicates revenue visibility and customer commitment levels. A 110% increase year-over-year signals strong customer demand, but the 45% concentration in Open AI-related services creates concentration risk.

Why did Microsoft's stock drop 6% despite strong earnings?

Investor concerns about strategic risk drove the stock decline, not earnings disappointment. The market is pricing in concerns about Open AI dependency, massive capital expenditure requirements (46% of quarterly revenue), potential margin compression in cloud services, and uncertainty about whether AI adoption will sustain at current acceleration rates. Investors are essentially saying that while numbers are good, the underlying business model has concerning structural risks.

How much of Microsoft's revenue is tied to Open AI commitments?

Approximately 45% of Microsoft's

What is the impact of Microsoft's $37.5 billion quarterly Cap Ex spending?

Microsoft's capital expenditure of

What is Microsoft's strategy to reduce Nvidia dependency?

Microsoft is developing custom AI chips called Maia to reduce reliance on Nvidia hardware. While Maia chips are now deployed in some Azure workloads, they remain several years behind Nvidia's latest generation in performance. Full diversification away from Nvidia likely requires 5+ years of development. In the near term, Microsoft will continue spending roughly $25 billion per quarter on Nvidia hardware, giving Nvidia significant pricing power in negotiations.

How does cloud margin compression affect Microsoft's business model?

Traditional cloud workloads (like virtual machines and databases) generate 60%+ gross margins. AI workloads are compute, memory, and energy-intensive, compressing margins to potentially 45-50%. As AI becomes commoditized and competitive, pricing pressure will accelerate margin compression further. Microsoft's current Cap Ex strategy assumes maintained or improving margins, so compression would materially impact the ROI of infrastructure investments.

What regulatory risks does Microsoft face from AI operations?

Regulation from the EU (AI Act), UK, and potential US regulations could restrict AI capabilities, require additional testing and documentation, or impose limitations on model training and deployment. Open AI specifically faces regulatory scrutiny regarding training data, privacy, and potential copyright issues. Any regulatory action against Open AI could directly impact Microsoft's compute commitments and revenue from AI-powered products.

Is Microsoft's AI strategy sustainable long-term?

Microsoft's strategy is sustainable if AI adoption accelerates as expected, utilization of AI infrastructure reaches 75%+, gross margins remain above 50%, and the Open AI partnership remains stable. However, the strategy has significant risks around adoption plateau, margin compression, Open AI instability, and competitive alternatives. Investors are appropriately concerned about concentration risk and the magnitude of infrastructure spending required to sustain current growth rates.

What would improve investor confidence in Microsoft's AI strategy?

Clear communication about Azure utilization rates, margin expectations, and customer ROI metrics would help. Diversification away from Open AI (to 25-30% of obligations instead of 45%) would reduce concentration risk. Articulation of specific differentiation advantages beyond Open AI partnership would clarify why Microsoft should win in AI. Acceleration of Maia chip deployment to reduce Nvidia dependency would improve unit economics.

How does Microsoft Cloud's 63% revenue concentration compare to historical standards?

Historically, successful software companies maintain revenue diversification across multiple segments (typically no single segment exceeding 40% of revenue). Microsoft Cloud's 63% concentration is extremely high and reflects the company's pivot to cloud/AI as primary growth engines. This concentration amplifies downside risk if cloud growth slows or if AI adoption plateaus, as the company has fewer revenue pillars to offset cloud weakness.

Key Takeaways

- Microsoft's 37.5B CapEx spending (46% of revenue) and 45% concentration in OpenAI-dependent future revenue

- The 6% after-hours stock drop reflects investor concerns about OpenAI dependency, margin compression, and uncertain AI adoption sustainability rather than earnings disappointment

- Microsoft Cloud now represents 63% of total company revenue, creating dangerous concentration risk if AI adoption plateaus or pricing pressure increases

- Nvidia hardware remains essential despite Maia chip development, with two-thirds of CapEx ($25B per quarter) going to GPU/CPU purchases, limiting Microsoft's pricing leverage

- Cloud gross margins will likely compress from current 60%+ to 45-50% as AI workloads commoditize, threatening the unit economics of Microsoft's infrastructure-heavy strategy

Related Articles

- Microsoft's $7.6B OpenAI Windfall: Inside the AI Partnership [2025]

- Microsoft Q2 2026 Earnings: Cloud Dominance, Gaming Struggles [2025]

- Claude Interactive Apps: Anthropic's Game-Changing Workplace Integration [2025]

- Enterprise Agentic AI Risks & Low-Code Workflow Solutions [2025]

- The AI Adoption Gap: Why Some Countries Are Leaving Others Behind [2025]

- Sam Altman's India Visit: Why AI Leaders Are Converging on New Delhi [2026]

![Microsoft's AI Strategy Under Fire: OpenAI Reliance Threatens Investor Confidence [2025]](https://tryrunable.com/blog/microsoft-s-ai-strategy-under-fire-openai-reliance-threatens/image-1-1769693910580.jpg)