The Gathering Storm: AI's Next Frontier Shifts to India

Something big is happening in New Delhi this February, and it's not getting enough attention. While tech media obsesses over Chat GPT's latest features and another Silicon Valley funding round, the world's most powerful AI leaders are quietly converging on India's capital for what might be the most consequential tech summit of 2026.

Sam Altman, the 38-year-old CEO of OpenAI, is planning his first visit to India in nearly a year. But this isn't just a casual trip. OpenAI is orchestrating a coordinated campaign that includes closed-door executive meetings, a private February 19 event for venture capitalists and industry leaders, and careful positioning around the India AI Impact Summit 2026, running February 16-20. This coordinated effort reveals something critical: OpenAI sees India not as a secondary market but as existential to its growth strategy.

Here's what makes this moment different. India has quietly become Chat GPT's single largest market by downloads. Yet despite this massive user base, OpenAI has struggled to convert interest into paid subscriptions, launching a budget Chat GPT Go plan under $5 just to drive adoption. That disconnect is what Altman is coming to fix. The economics are brutal. India's willingness to use AI is off the charts. India's willingness to pay for it? Stuck in the basement.

But this isn't really about subscriptions anymore. Look at the bigger picture: OpenAI announced a New Delhi office back in August, then never followed through with the promised return visit. Now they're back, hiring aggressively across sales, deployment, and regulatory roles. They're scouting for infrastructure expansion. They're meeting government officials. They're courting enterprise customers. This isn't a product launch. It's a geopolitical pivot.

The timing matters too. Google announced a multi-billion dollar India investment last year. Microsoft announced another one. India's government wants to attract $100 billion in AI investment through this summit alone. And the federal government is pushing domestic AI startups to build smaller models optimized for local use cases, deliberately trying to reduce dependency on U.S. systems. Altman's visit signals OpenAI isn't going to concede this market to competitors or to homegrown alternatives.

Over the next 5,000 words, we're going to unpack what's really happening here: why India matters for the global AI industry, what each major player is trying to accomplish, what the infrastructure challenges actually look like, and what this means for the future of artificial intelligence itself.

TL; DR

- Sam Altman is visiting India in mid-February 2026 for the first time in nearly a year, with OpenAI hosting exclusive meetings and a private event for executives and VCs

- India has become Chat GPT's largest market by downloads but OpenAI struggles to convert users to paid subscriptions, necessitating aggressive expansion strategy

- The India AI Impact Summit 2026 draws executives from Meta, Google, Anthropic, Nvidia, and Indian giants like Reliance, signaling unprecedented AI industry focus on the region

- Global AI companies are competing fiercely for market position: OpenAI is expanding hiring, Anthropic opened a Bengaluru office, Google and Perplexity partnered with telecom giants

- Infrastructure constraints are significant: power availability, energy costs, water scarcity, and data residency requirements present real obstacles to India becoming an AI hub

OpenAI focuses on government relations and enterprise adoption, Anthropic emphasizes community building, while Google prioritizes partnerships. (Estimated data)

Why India Is the Next Battle Ground for AI Dominance

India isn't just another market. It's the only country on Earth where the AI opportunity is simultaneously massive and largely untapped. Let's do the math: 850 million internet users, more than 400 million active mobile internet users, and AI adoption growing at roughly 40% annually. For context, that's triple the growth rate of the US market.

Chat GPT's download numbers make this visceral. India became the tool's largest market by sheer volume somewhere around mid-2024. Most people don't realize that. The U.S. still drives more revenue per user by an enormous margin—Americans have disposable income and subscription habits. But India has volume that makes Silicon Valley look quaint.

The real opportunity isn't subscriptions for individual users. It's enterprise adoption at a scale most Western companies can't even conceptualize. Reliance Jio alone serves over 500 million subscribers. Bharti Airtel serves another 350 million. These aren't niche players. They're among the largest telecom operators globally. When Google and Perplexity cut deals to bundle premium AI features for millions of these users, they're accessing markets that dwarf entire countries.

But here's the catch nobody talks about: most Indians don't have

Second, India has become a global center for software development, AI research, and technical talent. Engineers trained in India's top institutions are leading teams at OpenAI, Google, Meta, and Anthropic. The talent supply is absurd. A senior AI researcher in Bangalore costs a fraction of what she'd command in San Francisco, yet the capability ceiling is identical. This isn't outsourcing anymore. It's talent arbitrage at the highest levels of R&D.

Third, India's government actively wants to build sovereign AI capability. The government isn't hostile to U.S. companies—it just doesn't want to be completely dependent on them. This creates an incentive to attract investment, host summits, and position India as a hub. The $100 billion investment target? That's not pie in the sky. It's the government making a calculated bet that AI infrastructure and expertise will be as important to 21st-century economics as steel and electricity were to the 20th.

The India AI Impact Summit 2026: A Turning Point

The India AI Impact Summit 2026 running February 16-20 is shaping up to be the most significant technology gathering outside the traditional Silicon Valley conference circuit. The roster of confirmed attendees reads like a who's who of global AI leadership.

Jensen Huang, NVIDIA's founder and CEO, is attending. Sundar Pichai, Google's CEO, is there. Dario Amodei, who runs Anthropic, is confirmed. Mukesh Ambani, the chairman of Reliance Industries and one of Asia's richest businesspeople, is attending. These aren't mid-level executives or standard conference appearances. These are the people making trillion-dollar strategic decisions about AI infrastructure and capability.

The summit itself is being positioned as India's coming-out party for AI. The government narrative is clear: India is open for business, has world-class technical talent, is eager to host infrastructure, and wants to attract top-tier AI investment. In that context, Sam Altman's visit isn't casual. OpenAI is signaling it takes that message seriously.

What's interesting is what's happening on the periphery. Anthropic is hosting a separate developers' day in Bengaluru on February 16. NVIDIA is hosting an evening event during summit week. Multiple companies are running side events. This clustering effect matters because it signals coordination at the industry level. These aren't competing press conferences. They're pieces of a larger ecosystem play where everyone benefits from India's rising tide.

The summit's stated goal is to position India as a destination for AI investment and development. The economic impact goal is concrete: officials believe the summit could attract up to

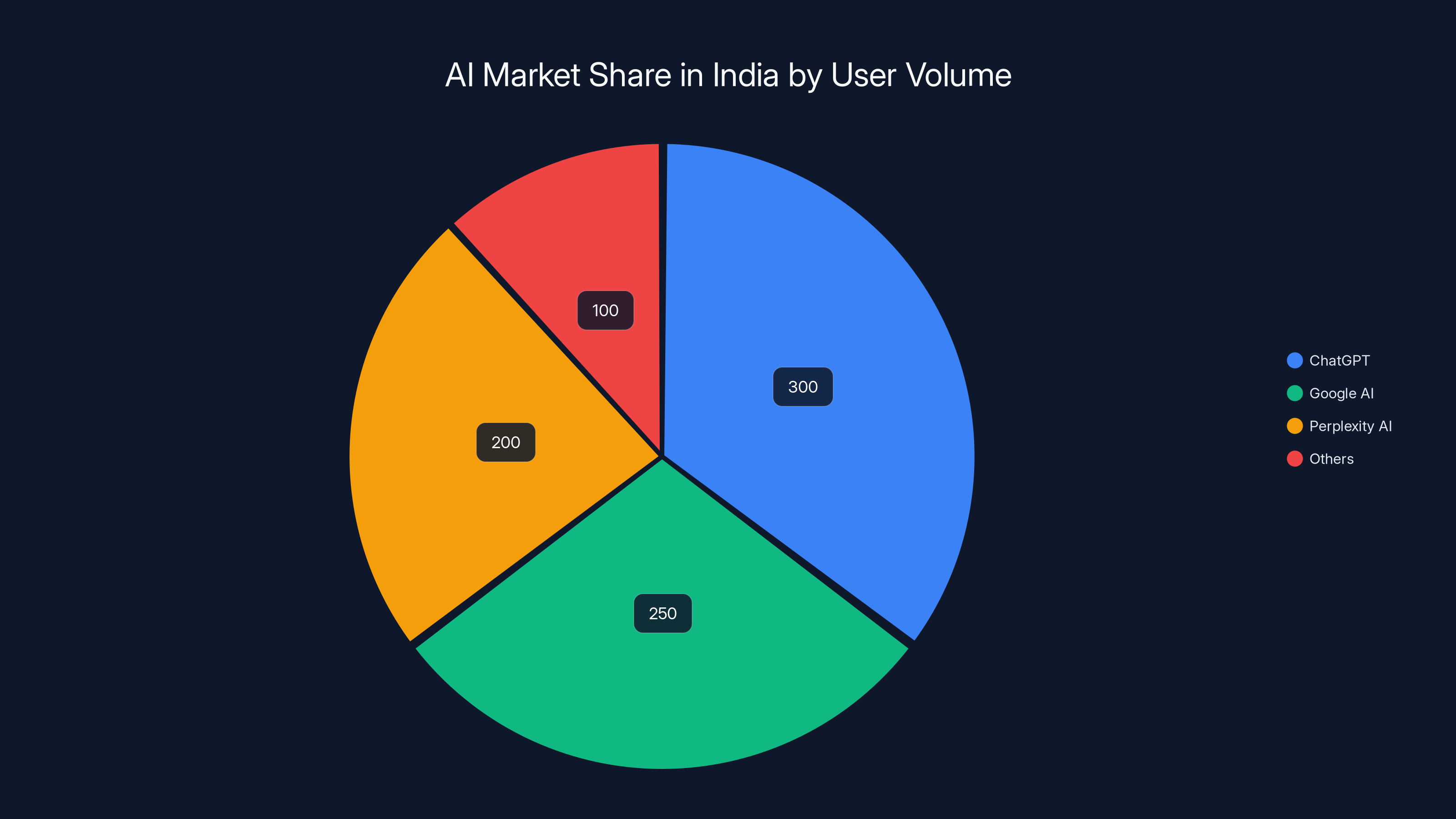

Estimated data shows ChatGPT leading in user volume in India, followed by Google AI and Perplexity AI. The market is characterized by high volume and low individual spending.

OpenAI's Strategic Expansion in India: Moving Beyond Downloads

OpenAI has been quietly aggressive in India even without Altman's high-profile visits. The company has been hiring across enterprise sales, technical deployment, and regulatory affairs roles. Job postings are active in New Delhi, Mumbai, and Bengaluru. The August 2025 announcement of a New Delhi office was important, but the follow-through—actual hiring, permanent team setup—is what signals real commitment.

The hiring pattern reveals the company's priorities. Enterprise sales people sell to corporations and government agencies. Technical deployment specialists help organizations integrate Chat GPT and related tools into their workflows. Regulatory affairs specialists navigate India's complex and evolving AI governance landscape. This isn't a customer support center. It's a beachhead for deep market penetration.

OpenAI's challenge is acute: Chat GPT has achieved massive awareness in India, but monetization lags. The company has tried several approaches. The budget Chat GPT Go plan under $5 was one attempt. Offering free access for a year to drive adoption was another. But subscriptions still aren't converting at the rate the company needs.

This is where enterprise adoption becomes crucial. A single corporation using Chat GPT across 1,000 employees generates more revenue than 500,000 individual subscriptions in India. Indian enterprises in financial services, consulting, software development, and manufacturing all have use cases for large-language models. But these deals require sales infrastructure, legal expertise, and regulatory navigation. That's exactly what OpenAI is building.

The infrastructure angle is more speculative but potentially more significant. OpenAI has been transparent about its infrastructure costs. Training large models requires enormous computational resources. The company currently relies on data centers from partners like Core Weave and others, but running its own facilities in India would provide advantages: lower power costs in some regions, proximity to the India market for reduced latency, and political goodwill from local infrastructure investment.

But here's the honest complication: India's power infrastructure isn't optimized for hyperscale data centers. Power availability is uneven across regions. Electricity costs, while lower than California, are still significant in absolute terms. Water scarcity is a real problem in many parts of India, and data centers require enormous amounts of cooling water. These constraints mean OpenAI can't just replicate its Californian playbook. It has to adapt.

Anthropic's Bengaluru Play: Building a Second Headquarters

Anthropic's strategy in India is notably different from OpenAI's. Rather than just expanding sales and operations, Anthropic is positioning Bengaluru as a genuine secondary hub. The company announced an office and named Irina Ghose, formerly Microsoft India's managing director, as local head. That's not a figurehead. That's a seasoned operator running real operations.

Bengaluru's appeal is straightforward. The city has become India's primary tech hub, hosting offices from virtually every major software and AI company. The talent pool is extraordinary. AI researchers trained at Indian Institutes of Technology and other premier institutions are world-class. The competitive talent costs are a massive advantage relative to Silicon Valley. A senior ML engineer with equivalent capabilities costs 40-50% less in Bangalore than in San Francisco.

Anthropic's developers' day event on February 16 is particularly smart positioning. Rather than competing with Altman for headline space, Anthropic is hosting a focused developer conference. This signals the company is serious about building a developer community in India, not just selling enterprise licenses. Developers are crucial because they're the ones who evangelize tools, build integrations, and create network effects.

The subtext is interesting too. Anthropic, founded by former OpenAI researchers, is clearly positioning itself as the alternative. The company has been more cautious about scaling capabilities, more focused on safety, and more transparent about limitations. In India, where the government is actively trying to reduce dependence on any single U.S. AI company, Anthropic's positioning as the more thoughtful alternative has real appeal.

Google and Perplexity: The Telecom Partnership Model

Google and Perplexity have discovered something clever: bypass direct consumer subscriptions by partnering with telecom operators who already have billing relationships with millions of users. Google cut a deal with Reliance Jio to bundle premium AI features. Perplexity did similar with Bharti Airtel. This changes the entire game.

Reliance Jio has 530 million subscribers. Bharti Airtel has 350 million. These are among the largest telecom operators on Earth. When Jio bundles Google AI features into their premium plans, suddenly Google AI features reach tens of millions of users overnight. The user already trusts the telecom operator. They already have a payment mechanism in place. The friction to adoption becomes nearly zero.

Perplexity's strategy is particularly interesting because Perplexity is a younger company without Google's brand recognition. Yet by partnering with major telecom operators, Perplexity can reach scale that would take years of traditional growth. This is India-specific product strategy at its finest. In Western markets, you build consumer demand and then sell to enterprises. In India, you partner with the distribution channels that already own the user relationship.

Google's moves are more complex because Google already dominates search in India. The partnership with Jio isn't just about extending reach. It's about protecting territory. If Google doesn't bundle AI features into the mobile experience, competitors like Perplexity establish dominant positions in that relationship. By moving first and partnering with the largest telecom operator, Google creates a defensive moat.

Nvidia's infrastructure play deserves attention here too. Nvidia is the dominant GPU provider globally, and that dominance is even stronger in India because local companies can't build competitive chips at scale. Every major AI company in India needs Nvidia GPUs. Nvidia's February summit event is partly salesmanship and partly reinforcement of that dependence.

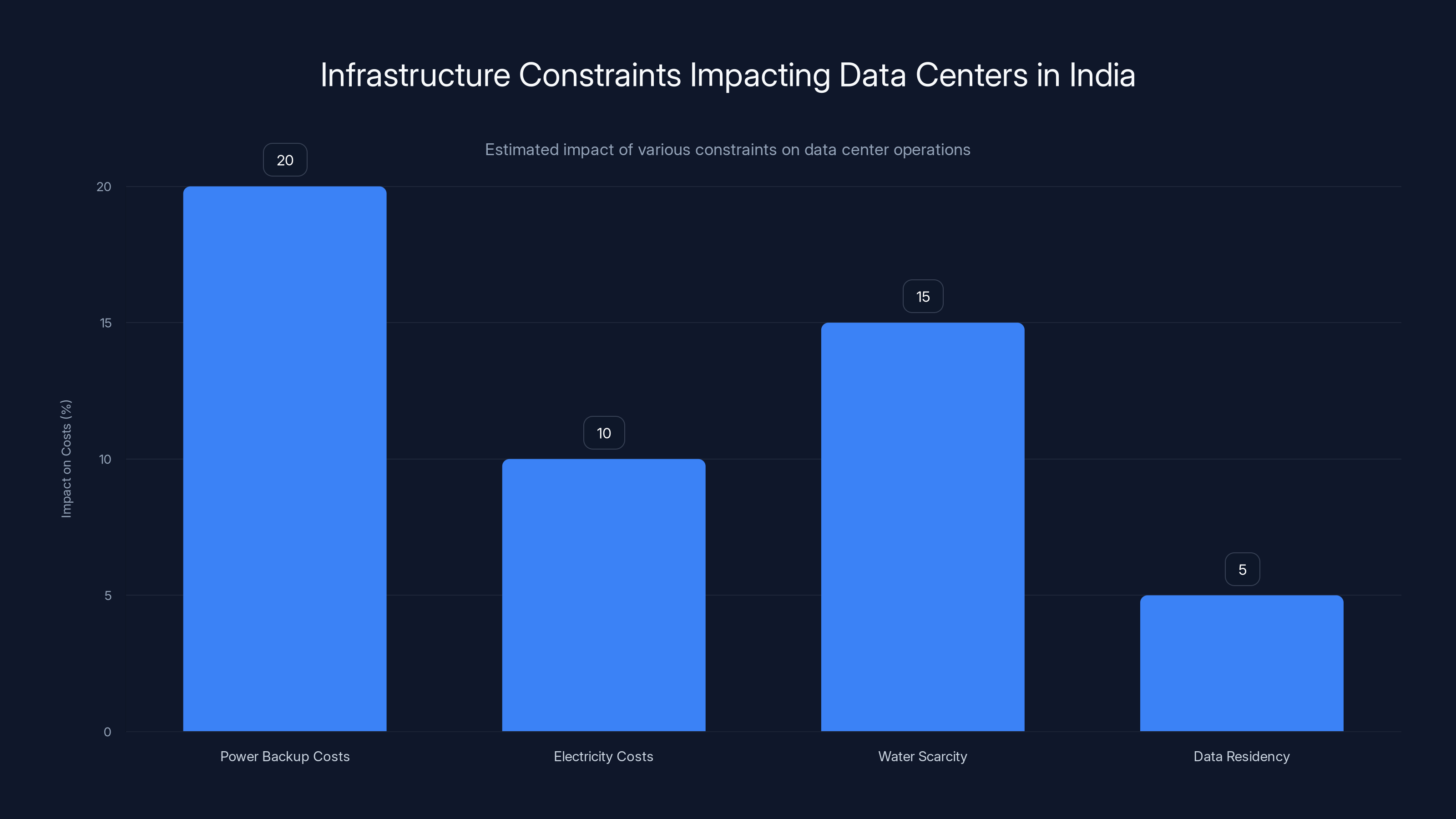

Power backup costs add 15-25% to capital costs, while electricity and water scarcity increase operational costs by 10% and 15% respectively. Data residency adds regulatory costs. Estimated data.

The Infrastructure Reality: Constraints That Can't Be Ignored

All this investment optimism obscures a critical reality: India has significant infrastructure constraints that make hyperscale AI data center deployment harder than it sounds. Let's be concrete about what these look like.

Power availability is the first issue. India's electricity grid is complex. Certain regions have reliable, abundant power. Others experience frequent outages or rolling blackouts. A hyperscale data center needs continuous, uninterrupted power. Building one in a region with grid instability requires massive backup infrastructure—generators, batteries, redundancy—that adds 15-25% to capital costs. In some cases, companies have built their own power generation capacity to ensure reliability.

Electricity costs are lower than California but higher than many expect. Industrial electricity in parts of India costs

Water scarcity is the third constraint. Data centers use enormous amounts of water for cooling. In many parts of India, water is scarce and expensive. Competition for water from agriculture, local communities, and industry creates political friction. Companies in water-stressed regions have faced protests and regulatory pressure. This limits where data centers can be built and increases costs where they are.

Data residency requirements create regulatory friction. India has been moving toward requirements that certain data must stay within Indian borders. This means AI companies need to build infrastructure in India to serve Indian users, creating capital expenses they might otherwise avoid. Combined with the power and water constraints, this makes the expansion equation more complex.

Latency and regional speed requirements also matter for real-time applications. A data center in California can serve global users adequately for most AI applications. But for applications that require sub-100ms response times—certain real-time translation, video processing, or interaction-heavy features—local infrastructure becomes necessary. This pushes companies toward actual infrastructure investment rather than just market access.

India's Sovereign AI Ambition: The Government's Play

India's government isn't sitting passively hoping foreign companies invest. The government is actively pushing a sovereign AI strategy. This isn't anti-foreign. It's pro-self-sufficiency. The objective is clear: build indigenous AI capability that doesn't depend entirely on U.S. companies for core technology.

The summit itself is part of this strategy. By hosting the event, positioning India as the destination, and having ministers publicly discuss AI investment targets, the government is signaling direction to both domestic and international capital. The $100 billion investment goal isn't a request. It's a target the government believes is achievable and is actively trying to attract.

Simultaneously, India's government is funding and encouraging domestic AI startups to build smaller models optimized for Indian languages, Indian use cases, and local deployment. The goal is to reduce reliance on English-language, Western-optimized models from OpenAI, Google, and others. This creates an interesting dynamic: foreign AI companies are welcome, but they're competing with a government-supported ecosystem.

Data localization requirements reinforce this. When India mandates that certain data stay within Indian borders, it forces companies to either build local infrastructure or lose market access. This protects domestic companies and ensures that the value created by AI processing Indian data remains in India.

Regulation is another component. India's government is developing AI governance frameworks. Companies that engage early with regulators and help shape these frameworks gain advantages. This is why OpenAI, Anthropic, and others are hiring regulatory affairs specialists. It's not just compliance. It's influence over the rules of the game.

The geopolitical dimension is hard to overstate. The U.S. has export controls on advanced AI chips and models. China has its own AI ecosystem. India, sitting in the middle and trying to build independence, sees AI as critical to its future technological sovereignty. The summit and the investment efforts aren't just economic. They're geopolitical.

The Challenge of Converting Users to Customers

Here's the brutal reality OpenAI faces: massive awareness doesn't automatically convert to revenue. Chat GPT's position in India is extraordinary. Everyone has heard of it. Millions use it regularly. Yet paid subscription penetration remains low compared to Western markets.

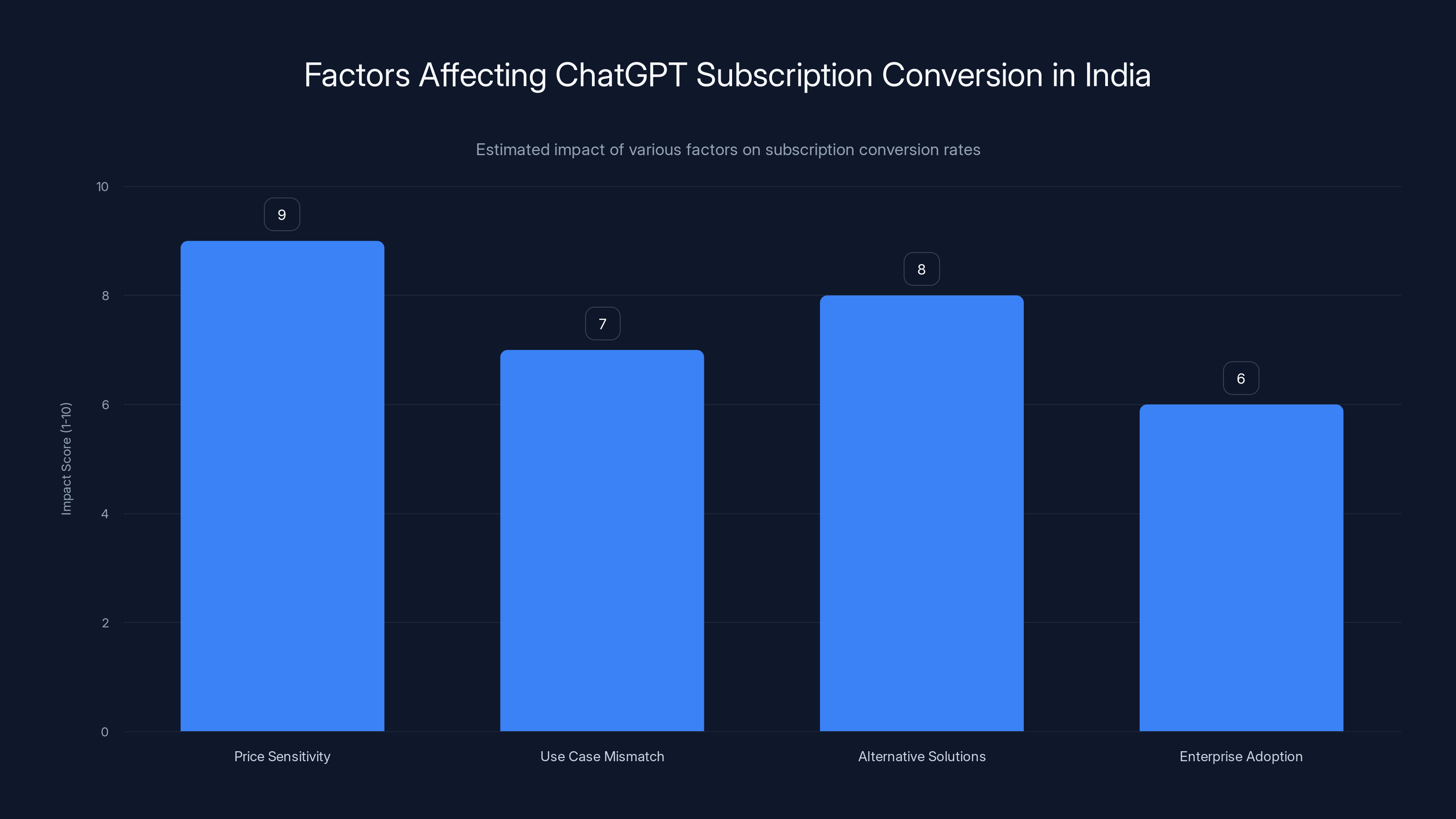

The reasons are multifaceted. First, price. Asking an Indian user to commit

Second, use case mismatch. In the U.S., professionals pay for Chat GPT to enhance productivity at work. Employers often reimburse. In India, while some professionals have similar use cases, the percentage is lower. For students, casual users, and those experimenting, the value proposition of a subscription isn't clear when the free version works reasonably well.

Third, alternative solutions are emerging. Google's bundled approach through Jio means millions get AI features without paying OpenAI directly. Perplexity, Claude, and open-source models create competition. The monopoly-like position OpenAI had in 2023 is eroding.

OpenAI's strategy to address this is threefold. First, push enterprise adoption where individual user costs are higher and the value proposition is clearer. Second, partner with platforms that already have user relationships and payment mechanisms—think apps, keyboards, and browsers. Third, build features that are so valuable that premium pricing becomes justified even at lower absolute prices.

The February visit gives Altman a chance to reinforce the enterprise message directly. Meeting with Reliance's executives, government officials, and other major corporations allows OpenAI to position Chat GPT as essential infrastructure. This is a classic enterprise sales play: get the big customers, build from there.

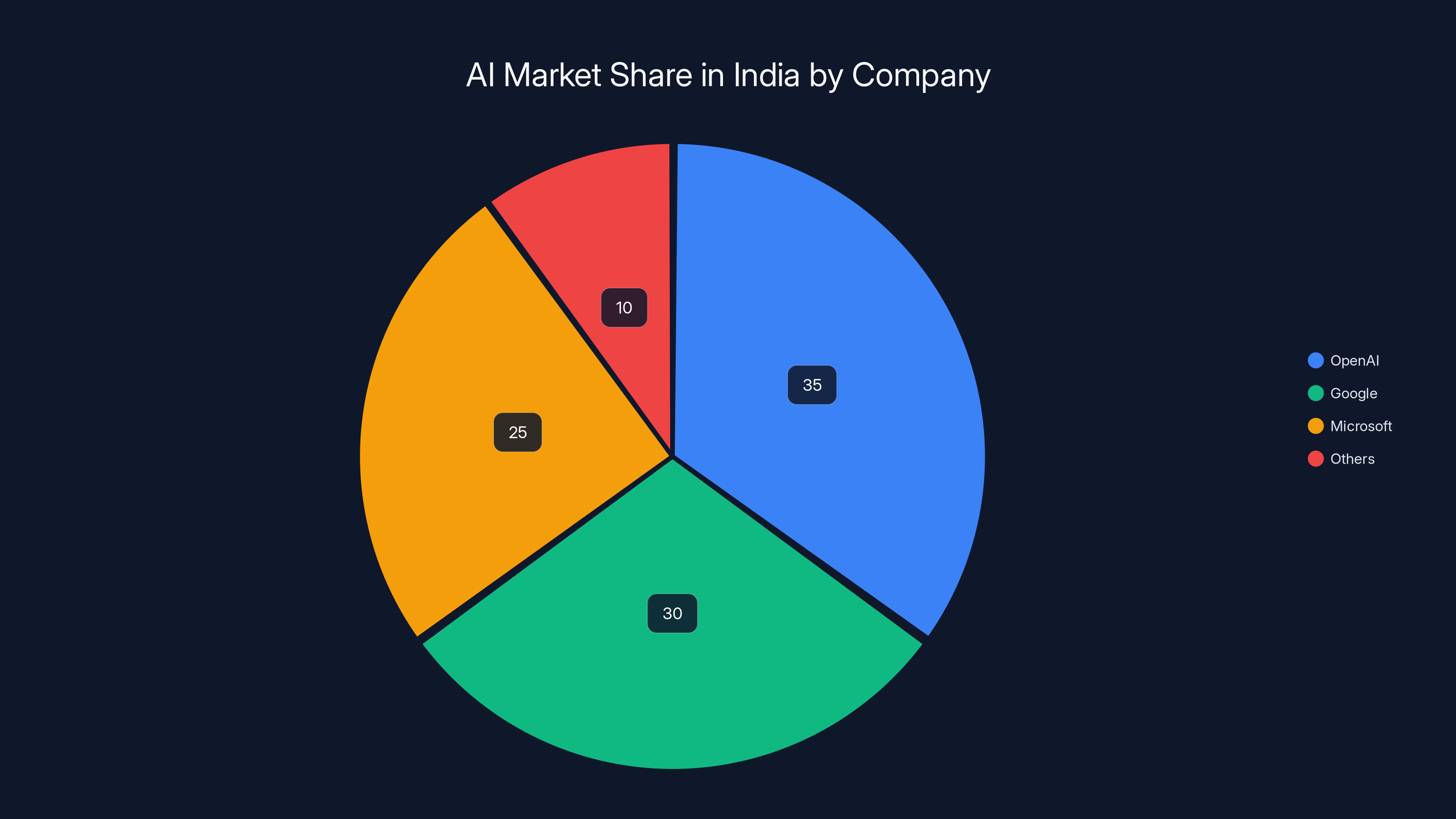

Estimated data shows OpenAI leading the AI market in India with 35% share, followed by Google and Microsoft. The AI landscape in India is rapidly evolving with major investments.

Talent and Research: India's Hidden AI Advantage

When people think about AI being created, they imagine Stanford, MIT, and OpenAI's offices. But the reality is more distributed. Significant portions of the world's AI research and development happen in Indian offices of major tech companies and increasingly in local startups.

Indian talent is extraordinary. Top-tier AI researchers from Indian institutions are leading teams at OpenAI, Google Brain, Anthropic, and DeepMind. Engineers trained in IIT have founded multiple AI startups that have become unicorns. The talent pool isn't secondary. It's world-class at a fraction of the cost.

This creates an arbitrage opportunity. A company can staff a research or development team in Bangalore at 40-50% of San Francisco costs with equivalent capability. Scale this across hundreds of engineers and you're talking about $50-100 million in annual cost savings without capability loss. For OpenAI, scaling engineering in India is a natural move.

Beyond cost, there's another advantage: perspective. Researchers and engineers in India have direct insight into Indian users' needs, India-specific problems, and cultural nuances that Western teams might miss. A team in Bangalore isn't guessing about what Indian users need. They're living it.

OpenAI's hiring across technical deployment and sales roles suggests the company is building genuine technical capacity, not just a sales office. Technical deployment specialists need to understand the product deeply. They're doing the hard work of helping Indian enterprises integrate Chat GPT into their workflows. This requires local expertise.

The subtle play here is creating a permanent presence that's hard to dislodge. Once you have 200 engineers in Bangalore building features and products, moving them or reducing that presence creates massive friction. The company becomes embedded in the local ecosystem.

Regulatory Navigation: Why the Legal Hires Matter

OpenAI's hiring of regulatory affairs specialists isn't bureaucratic window-dressing. India's AI governance landscape is evolving rapidly, and companies that get ahead of regulation gain enormous advantages. Those that fall behind face penalties and restrictions.

India has been developing AI governance frameworks for over a year. The government has published guidelines, conducted consultations, and is moving toward formal regulations. The shape of these regulations will determine what companies can and can't do in India. Regulations on data storage, privacy, bias assessment, transparency, and liability will reshape the business model.

Companies that engage early with regulators help shape these frameworks. OpenAI's regulatory team in India is doing exactly this: understanding what's being proposed, providing input, and positioning the company as a responsible actor. This influence is valuable. If you help shape the rules, you're more likely to be positioned favorably when they're implemented.

There's also the practical side. Navigating Indian administrative and legal systems requires local expertise. Different states have different rules. Labor laws are complex. Tax structures reward certain organizational approaches. A regulatory specialist understands these nuances in ways that San Francisco headquarters staff cannot.

Privacy is a particularly complex issue. India doesn't have comprehensive privacy legislation equivalent to Europe's GDPR, but it has the Digital Personal Data Protection Act and the Information Technology Act. How these apply to AI companies is still being clarified. Having local expertise ensures compliance and reduces risk.

The broader point: in regulated industries, or industries moving toward regulation, expertise in navigating that regulation becomes a competitive advantage. OpenAI's investment in regulatory capability in India is defensive play and strategic play simultaneously.

What Sam Altman's Visit Really Signals

Sam Altman's presence at the summit isn't just PR. For a CEO of Altman's level, international travel is time away from core work. The fact that he's making this trip, despite not being a confirmed speaker, signals deep strategic priority. OpenAI doesn't send its CEO halfway around the world for secondary markets.

Altman's public profile has evolved significantly. He's become the face of AI to mainstream audiences in a way that other tech CEOs typically aren't. His posts about AI progress, his comments on regulation, his statements about company direction move markets. In India, particularly, he's a recognizable figure. His presence at the summit and his meetings with government officials will be covered extensively by Indian media and business circles.

But there's a subtler signal too. Altman is known for being deeply involved in strategic partnerships and expansion decisions. The fact that he's personally meeting with executives and government officials suggests OpenAI is negotiating something significant. Large infrastructure investments, government partnerships, or major corporate deals typically involve CEO-level involvement.

His first visit in a year suggests the previous trip didn't result in clear progress. The August office announcement, without follow-through, was probably embarrassing. This visit is about delivering on promises and resetting expectations. It's about proving OpenAI is serious even if progress has been slower than hoped.

Another reading: Altman is consolidating OpenAI's position before something changes. The AI landscape is shifting rapidly. New models are emerging. Competition is intensifying. Ensuring OpenAI has strong footing in India before major market shifts happen is prudent strategy.

India's AI market could create $100-200 billion annually by 2030, with IT services and manufacturing leading the opportunity. (Estimated data)

Competing Visions: Different Companies, Different Strategies

While Sam Altman and OpenAI pursue aggressive expansion, competitors are taking different approaches tailored to their capabilities and strengths.

Google's approach emphasizes partnerships with existing distribution channels rather than building independent infrastructure from scratch. Google already has search dominance. Bundling AI features into that dominance leverages existing relationships. It's capital-light compared to building new sales and support infrastructure.

Meta, which hasn't received as much coverage in this context, is interesting because the company has been more cautious about India expansion despite having massive user bases there. The regulatory environment is trickier for Meta given concerns about data privacy and platform safety. But Meta has been investing quietly in AI infrastructure and AI tools for businesses. The India summit may prompt more visible activity.

Anthropic's Bengaluru office and developer-focused strategy reflects a company trying to build capability from the ground up rather than rapidly scaling sales. This is a longer-term play. Anthropic has raised less capital than OpenAI and is more cautious about deployment velocity. But the company's safety-first positioning could resonate well in India's regulatory environment where government concerns about AI risk are rising.

Microsoft's position is interesting because the company has been quietly building enormous infrastructure. Microsoft announced multi-billion-dollar investments in India for cloud and AI capabilities. Microsoft's bet is partly about Azure cloud services, partly about selling enterprise solutions. The company is less dependent on direct OpenAI usage than one might think.

Nvidia, sitting as the infrastructure layer, benefits from all of this. Regardless of who wins the competition for market dominance, everyone needs Nvidia GPUs. Nvidia's strategy is to host events, deepen relationships with customers, and secure long-term contracts. The company's evening event at the summit serves this purpose.

Local Indian companies are trying to build sovereign alternatives. Companies like Sarvam AI, Hume AI, and others are building models optimized for Indian languages and use cases. These companies will be funding-constrained compared to U.S. giants, but they have geographical and cultural advantages. The Indian government is actively encouraging this as part of its self-sufficiency agenda.

The Economic Opportunity: Real Numbers

How big is India's AI opportunity actually? Let's ground this in concrete economic analysis.

India's IT services industry generates roughly

Manufacturing is another massive sector. India's manufacturing is growing but lags automation adoption relative to developed economies. AI-driven automation in manufacturing could unlock enormous productivity gains. Early estimates suggest the manufacturing opportunity alone is $30-50 billion annually.

Financial services, healthcare, education, and retail all have significant AI opportunities. Add these together and conservative estimates suggest India's AI market could reach $100-200 billion annually by 2030. That's not pie-in-the-sky. It's based on scaling patterns seen in other Asian markets like China and South Korea.

For context, the global software market is roughly $700 billion annually. India's share is under 10% currently. As India moves up the value chain and AI becomes central to software development, India's share should increase. AI is a way to accelerate that shift.

Infrastructure investment is a separate opportunity. Building hyperscale data centers, training cloud infrastructure, and GPU capacity for India could require $20-50 billion in capital investment over the next five years. That's significant but achievable given the size of the opportunity.

These aren't projections. They're based on extrapolation from existing markets and economic data. The upside exists if infrastructure is built, regulation is managed thoughtfully, and companies execute properly.

Risks, Challenges, and Why This Matters

For all the enthusiasm about India's AI opportunity, significant risks could derail progress. Understanding these risks is crucial for anyone betting on India's AI future.

Regulatory overreach is the most dangerous risk. If India's government implements AI regulations that are too restrictive, require technology transfer, or favor domestic companies unfairly, foreign companies may reduce investment. The government has every incentive to be measured and balanced, but policy can shift with political winds. Companies are navigating this risk by building regulatory expertise and showing commitment to responsible AI.

Talent attrition is another risk. Indian AI talent is being aggressively recruited by companies globally. As India's tech talent becomes more expensive, some of the cost arbitrage advantage erodes. Companies need to offer compelling opportunities beyond cost savings to retain top researchers and engineers.

Infrastructure investment hasn't materialized as fast as hoped. Google and Microsoft announced multi-billion-dollar investments, but actual deployment has been slower. Power, water, and land constraints mean building data center infrastructure takes longer and costs more than initial projections. If infrastructure development slows, it constrains AI capability expansion.

Geopolitical risk is real. If US-China tensions escalate or US export controls on AI chips tighten, India's access to advanced chips could be constrained. India is trying to position itself as independent but is realistically dependent on US suppliers for cutting-edge hardware. This creates strategic vulnerability.

Data privacy and sovereignty concerns could create friction. As Indian users' data is processed through AI systems controlled by foreign companies, there will be tension between convenience and control. This could lead to regulations that benefit domestic companies or restrict foreign companies.

Despite these risks, the underlying opportunity is strong enough that companies are betting heavily. The fact that OpenAI's CEO is making this trip despite challenges shows how seriously the company takes the India opportunity.

Price sensitivity is the most significant barrier to converting users to paid subscribers in India, followed by competition from alternative solutions. Estimated data.

The Broader AI Geopolitics: India's Unique Position

To understand why the summit matters and why companies are converging, you need to understand India's unique geopolitical position in AI.

The US dominates AI capability development. OpenAI, Anthropic, Google, Meta, and others have built the largest frontier models. These companies control the technology and, to a significant extent, the narrative about what AI should do and how it should behave.

China has built an extensive AI ecosystem that's somewhat insulated from US technology. Chinese companies have developed competitive models and have achieved significant deployment scale. But Chinese AI companies face different constraints and operate in a different regulatory environment.

India sits in the middle. India has world-class research talent but isn't leading frontier capability development. India has entrepreneurial dynamism but needs capital and technology from global leaders to scale quickly. India has a supportive government interested in AI development but is also concerned about becoming dependent on any foreign power for critical technology.

This creates a unique opportunity. India needs global AI companies to invest, share knowledge, and build infrastructure. Global AI companies need India's market, talent, and geopolitical position. The opportunity for mutually beneficial partnership is genuine.

But there's an implicit competition. The country that develops the most advanced AI, or that can most effectively deploy AI to solve real problems, will gain enormous economic and geopolitical advantages. India understands this. So do the companies investing there.

The summit is partly about acknowledging this reality and creating space for partnership that benefits India without compromising global AI development. It's ambitious. Whether it succeeds depends on execution and whether all parties can balance global competitiveness with local benefit.

Timeline and What's Next

The India AI Impact Summit runs February 16-20, 2026. Altman's visit and OpenAI's private events are timed around this period. Over the next 6-12 months, we should watch for several signals about whether this expansion is working.

First, watch hiring announcements. If OpenAI, Anthropic, and others continue aggressively hiring in India, it signals continued commitment. If hiring slows, it suggests challenges or diminished priority.

Second, watch partnership announcements. Will OpenAI, Google, or others announce major enterprise partnerships with Indian companies during or after the summit? These would signal market validation and revenue momentum.

Third, watch infrastructure investments. Will any major AI companies actually build data center capacity in India? Announced investments are easy. Actual capital deployment is harder. Seeing shovels in the ground would be significant.

Fourth, watch government regulatory announcements. India's government is finalizing AI governance frameworks. How these rules treat foreign companies versus domestic ones will reveal policy direction. Favorable rules encourage investment. Unfavorable rules constrain it.

Fifth, watch funding for Indian AI startups. The summit may catalyze investment in homegrown alternatives. Seeing major funding rounds for Indian AI companies would signal ecosystem maturation and capital flow.

Sixth, watch subscription and revenue metrics. OpenAI and others will eventually discuss India-specific metrics. If paid subscription growth accelerates, the unit economics work. If growth stalls, the model needs adjustment.

The Long View: India in 2030

If the convergence of AI leaders on India leads to successful investment and execution, what does India's AI landscape look like in 2030?

Optimistically, India becomes a global hub for AI research, development, and deployment. Major AI companies have substantial operations employing thousands of engineers and researchers. Infrastructure investments mean India has world-class data center capacity. Successful Indian startups are competing globally. Education in AI is advanced across universities. Deployment of AI across industry, healthcare, and government is normalized.

This scenario requires successful navigation of infrastructure constraints, thoughtful regulation, and sustained capital commitment. It's achievable but not guaranteed.

Alternatively, progress stalls. Infrastructure challenges prove more difficult than expected. Regulations become overly restrictive. Political changes shift policy direction. In this scenario, India becomes a consumer market for AI but not a production center. Value creation still happens but accrues mostly to foreign companies and their shareholders.

Most likely, the reality is somewhere between. India becomes an important market and a significant but secondary innovation hub. Some world-class AI research happens in India, but the cutting edge remains concentrated in the US. Some infrastructure is built but maybe not as much as hoped. India's AI economy grows significantly but not transformatively.

Alman's visit and the summit are early indicators of where this is heading. How the next 12-24 months unfold will set the trajectory for the decade.

Why You Should Care About This

If you're not directly involved in AI or business in India, you might wonder why this matters. Here's why: how India develops with AI will shape global technology economics for decades. If India becomes a production center for AI capability, it shifts power dynamics. If India remains primarily a consumer market, it reinforces current concentration of technology power in the US.

For professionals in technology, AI, or business, India's development is directly relevant. Opportunities for employment, entrepreneurship, and investment are significant. The talent arbitrage and infrastructure needs create specific career and funding opportunities.

For governments and policy makers, India's AI policy has implications beyond borders. The regulatory approaches India adopts could become templates for other countries. India's ability to build sovereign AI capability while remaining open to global partnerships is a model others will watch.

For investors, India's AI opportunity is substantial. Whether in infrastructure, software, or services, capital deployment is occurring now and will accelerate. Understanding the landscape and timing entries will determine returns.

For the AI field itself, India's growth matters because it brings diverse perspectives and use cases. Indian-built AI solutions optimized for Indian problems might solve global problems better than Western-built solutions designed for Western contexts.

FAQ

Why is India becoming so important for artificial intelligence companies?

India has over 850 million internet users and is Chat GPT's largest market by downloads, yet monetization remains challenging at high price points. Simultaneously, India has world-class technical talent available at significantly lower costs than Silicon Valley, established government support for AI development, and massive enterprise adoption opportunities in finance, manufacturing, and services sectors. This combination of market scale, talent availability, and growth potential makes India existential to the long-term strategy of companies like OpenAI, Google, and Anthropic.

What is Sam Altman's main objective during his India visit?

Altman's visit combines multiple objectives: strengthening relationships with Indian government officials to influence AI regulatory frameworks, meeting major enterprise customers to accelerate commercial adoption of Chat GPT, recruiting and retaining technical talent in OpenAI's India offices, exploring infrastructure investment opportunities for data centers, and reinforcing OpenAI's commitment to India after failing to deliver on a promised 2025 return visit. The visit signals to competitors, investors, and the Indian government that OpenAI takes the market seriously despite earlier delays.

How are other AI companies like Anthropic and Google approaching India differently from OpenAI?

Anthropic is building a secondary headquarters in Bengaluru with serious operational structure, positioning itself as an alternative to OpenAI with greater emphasis on developer community building through a dedicated developers' day event. Google leverages existing distribution through partnerships with telecom giants Reliance Jio and Bharti Airtel to reach hundreds of millions of users without building parallel sales infrastructure. Perplexity follows a similar partnership model. These approaches reflect different company strategies: OpenAI building integrated enterprise presence, Anthropic building research and developer capability, and Google leveraging existing market dominance. No approach is inherently superior, but they reflect different competitive positioning and capital availability.

What are the main infrastructure challenges preventing India from becoming a full AI hub?

India faces four critical infrastructure constraints: unreliable power availability with regional blackouts that require expensive backup systems, electricity costs that are lower than California but higher than competing regions, severe water scarcity in many regions that limits data center cooling capacity, and uneven distribution of high-quality facilities across the country. These constraints don't make India non-viable but require 20-30% higher capital expenditure and longer deployment timelines than optimistic projections. Companies must build infrastructure resilience into their models or concentrate facilities in specific high-infrastructure regions like already-developed tech hubs.

How is the Indian government shaping the AI market through policy and regulation?

India's government is actively pursuing a "sovereign AI" strategy, pushing development of domestic models through funding and support for local startups, implementing data residency requirements that mandate certain data remain within Indian borders, developing AI governance frameworks that will regulate company behavior, and setting ambitious investment targets like the stated $100 billion goal through the India AI Impact Summit. This approach incentivizes foreign investment while gradually building domestic alternatives. The government isn't hostile to global companies but explicitly wants to reduce complete dependence on U.S. systems and build India's independent capability.

What's preventing Chat GPT from converting its massive India user base into paying subscribers?

Three factors constrain monetization: price sensitivity is extreme with most Indian users spending under

Will India actually become a center for AI research and development, or primarily a consumer market?

India will likely become both but with research and development concentrating in specific cities like Bengaluru and Pune where talent density is highest. The reality will probably be a secondary but significant innovation hub rather than co-equal with Silicon Valley. Indian talent will lead important projects at global companies and found some globally competitive startups, but cutting-edge frontier AI development will likely remain concentrated in the US. What India gains is substantial: a thriving AI services sector, meaningful research contributions, local solutions optimized for Indian problems, and independence from complete reliance on foreign systems. This is significant even if it doesn't match the most optimistic scenarios.

How does India's AI development affect the broader geopolitics of artificial intelligence?

India's emergence as an important AI hub complicates the binary US-China competition that has dominated AI geopolitics. India's independent development path, combined with its democracy and openness to global participation, creates a third pole. If India successfully builds meaningful AI capability while remaining open to partnership with US companies, it demonstrates that US dominance isn't inevitable while maintaining democratic governance of AI. Conversely, if India becomes overly regulated or limits foreign participation, it could accelerate fragmentation where different regions develop incompatible AI systems. The geopolitical implications will unfold over the next five years as India's regulatory frameworks crystallize and technology investment flows become clear.

What opportunities exist for professionals and investors from India's AI growth?

For professionals, opportunities span technical roles at global companies expanding India operations, product and business roles in growing AI-focused Indian startups, regulatory and policy roles advising the government and companies on compliance, and hybrid roles building solutions adapted for Indian use cases. For investors, opportunities include early-stage AI startups addressing local problems, infrastructure companies providing power and cooling solutions to data centers, and established companies acquiring AI talent and capabilities. The arbitrage between India's technical talent costs and global pricing power creates genuine opportunity for investors with knowledge and networks to navigate the space.

Conclusion: A Pivot Point for Global AI

Sam Altman's planned February visit to India isn't just another business trip. It's a moment where the trajectory of global artificial intelligence and India's role in that trajectory becomes clearer. OpenAI, along with competitors from Google to Anthropic, is making a bet that India won't remain a consumer market for AI but will become a substantial producer of AI talent, capability, and solutions.

This pivot matters because it challenges the assumption that AI development will remain concentrated in Silicon Valley indefinitely. It shows that talent, capital, and strategic intention can create genuine alternative hubs. It demonstrates that the global AI industry is sophisticated enough to pursue multiple strategies simultaneously: building consumer awareness while aggressively courting enterprises, developing frontier capability while deploying practical solutions, and expanding globally while deepening local relationships.

But it also highlights real constraints and risks that enthusiasm sometimes glosses over. Infrastructure challenges are genuine. Regulatory uncertainty is real. Talent attrition to global markets is a structural headwind. The chance that India becomes a secondary market rather than a co-equal innovation hub is substantial.

What seems likely is that India will play an increasing role in global AI, but the form that role takes is still being written. The summit in February, Altman's meetings, and the cascade of announcements from competitors will set expectations and incentivize outcomes. How actual execution proceeds—whether infrastructure is built on schedule, whether regulations encourage or constrain growth, whether Indian talent remains engaged—will determine whether these early bets pay off.

For anyone paying attention to where artificial intelligence is actually being built, deployed, and shaped, India is now essential. The companies converging on New Delhi understand this. So should you. The next few years will reveal whether the optimistic vision of India as a global AI hub becomes reality or remains aspirational. Either way, the stakes of getting it right are enormous.

Key Takeaways

- Sam Altman's February India visit signals OpenAI's strategic pivot toward India as core market despite previous delays, requiring serious enterprise and infrastructure investments

- India has become ChatGPT's largest market by downloads yet monetization struggles due to pricing constraints, forcing OpenAI to shift from consumer to enterprise adoption strategy

- Global AI companies employ distinct strategies: OpenAI builds direct presence, Google leverages telecom partnerships, Anthropic focuses on developer communities, revealing nuanced competitive approaches

- India's infrastructure constraints including power reliability, water scarcity, and energy costs require 20-30% higher capital expenditure than Silicon Valley, shaping realistic investment timelines

- India's sovereign AI strategy and regulatory frameworks are deliberately reshaping the competitive landscape to balance foreign investment with domestic capability development

Related Articles

- Realizing AI's True Value in Finance [2025]

- Enterprise AI Adoption Report 2025: 50% Pilot Success, 53% ROI Gains [2025]

- Microsoft CEO: AI Must Deliver Real Utility or Lose Social Permission [2025]

- OpenAI's 2026 'Practical Adoption' Strategy: Closing the AI Gap [2025]

- Why Asus Quit Smartphones: The Death of a Phone Maker [2025]

- Elon Musk's $134B OpenAI Lawsuit: What's Really at Stake [2025]

![Sam Altman's India Visit: Why AI Leaders Are Converging on New Delhi [2026]](https://tryrunable.com/blog/sam-altman-s-india-visit-why-ai-leaders-are-converging-on-ne/image-1-1769184618504.jpg)