Monarch Money Deal: 50% Off One Year Subscription for Just $50

If you're starting 2025 with a resolution to finally get your finances under control, there's a surprisingly easy way to make it happen without spending a fortune on tools. Monarch Money, one of the best personal finance apps available right now, is offering new users a jaw-dropping deal: an entire year of premium access for just

The catch? You need the code NEWYEAR2026 at checkout, and you have to be a new subscriber to qualify. But if you've been thinking about finally getting serious about budgeting, this deal removes the barrier to entry in a major way. Most people assume budgeting apps are expensive or require a financial advisor-level commitment. They're not. They're tools. And this particular tool happens to be really, really good at what it does.

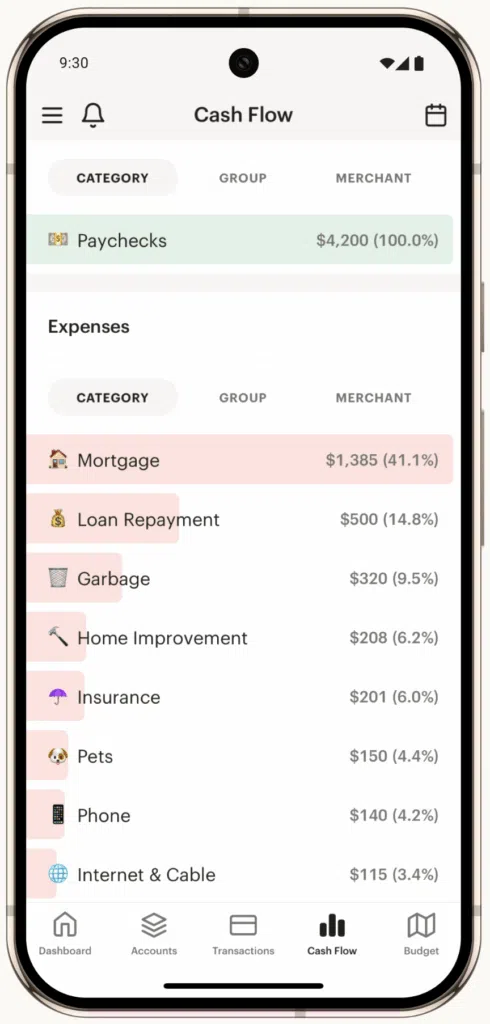

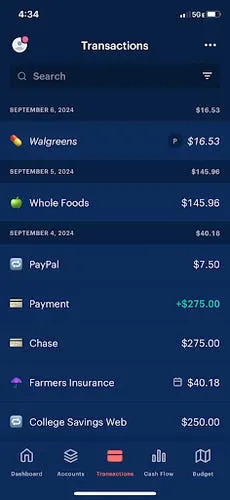

Here's what you're actually getting for $50: a comprehensive platform that connects to your bank accounts, tracks spending across multiple categories, creates visual dashboards that actually make sense, and lets you collaborate with a partner if you're splitting finances. It's not just about seeing where your money goes, though that's certainly part of it. It's about taking control of the narrative around your spending. Most people have no idea where their money actually disappears to each month. Monarch Money fixes that in a way that feels less like punishment and more like discovery.

The timing of this deal isn't random either. January is when people are most motivated to change their financial habits. Gyms know this. Money apps know this. That's why the offer exists. But the fact that it's 50% off speaks volumes about what Monarch Money thinks about converting new users. They'd rather have you on the platform at half price than not at all, probably betting that once you experience what a decent budgeting system actually does for your financial confidence, you'll stay beyond the first year. And they're probably right.

What Makes Monarch Money Different From Other Budgeting Apps

There are dozens of budgeting apps out there. You've probably heard of at least a few: YNAB, Every Dollar, Mint (now defunct), Albert, and plenty of others. So what makes Monarch Money worth your attention specifically? The answer comes down to philosophy and execution. Monarch Money treats budgeting as something that should inform your decisions in real time, not just show you what you spent after the fact.

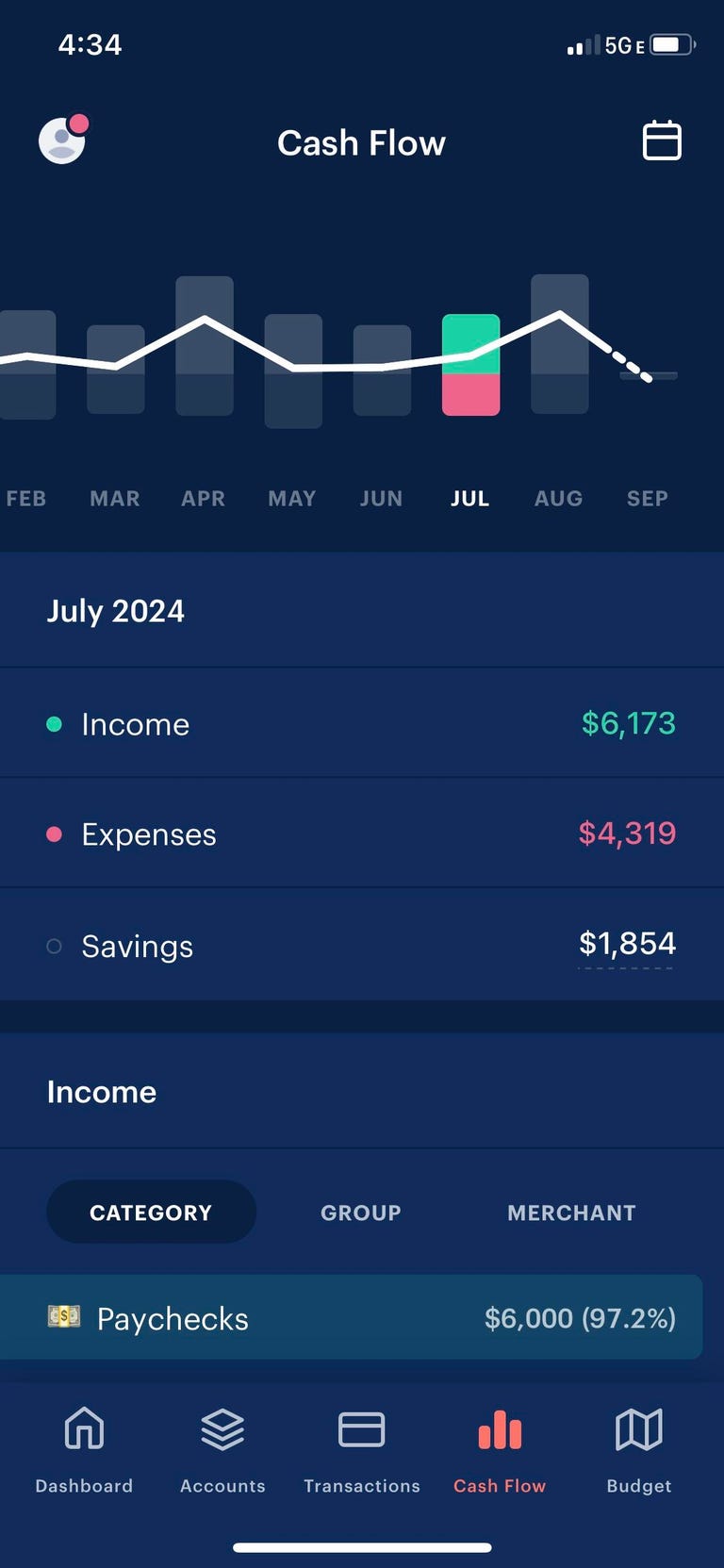

The app works across iOS, Android, iPadOS, and web browsers, meaning you're never locked into one device or platform. That flexibility matters because financial management isn't something you do once a week at a desk. It's something you need access to in the parking lot of a grocery store when you're wondering if you can afford that organic produce upgrade, or at a restaurant when your friend suggests going somewhere fancier than planned.

What really sets Monarch apart is the Chrome extension that integrates with Amazon and Target specifically. Look, most apps just pull in transaction data and call it a day. Monarch goes further by automatically categorizing transactions from these two massive retailers, which is huge because these are shopping habits that most people need to monitor closely. The automation takes work out of the equation, which means you're more likely to actually use the system instead of abandoning it after three weeks.

The app offers two distinct approaches to budgeting, recognizing that different people have different financial philosophies. Some people thrive with traditional category-based budgeting, where you allocate specific amounts to groceries, entertainment, utilities, and so on. Other people prefer flexible budgeting, where you set an overall spending limit and adjust as needed. Monarch supports both approaches, which means you're not forcing your financial personality into a system that fights against your natural instincts.

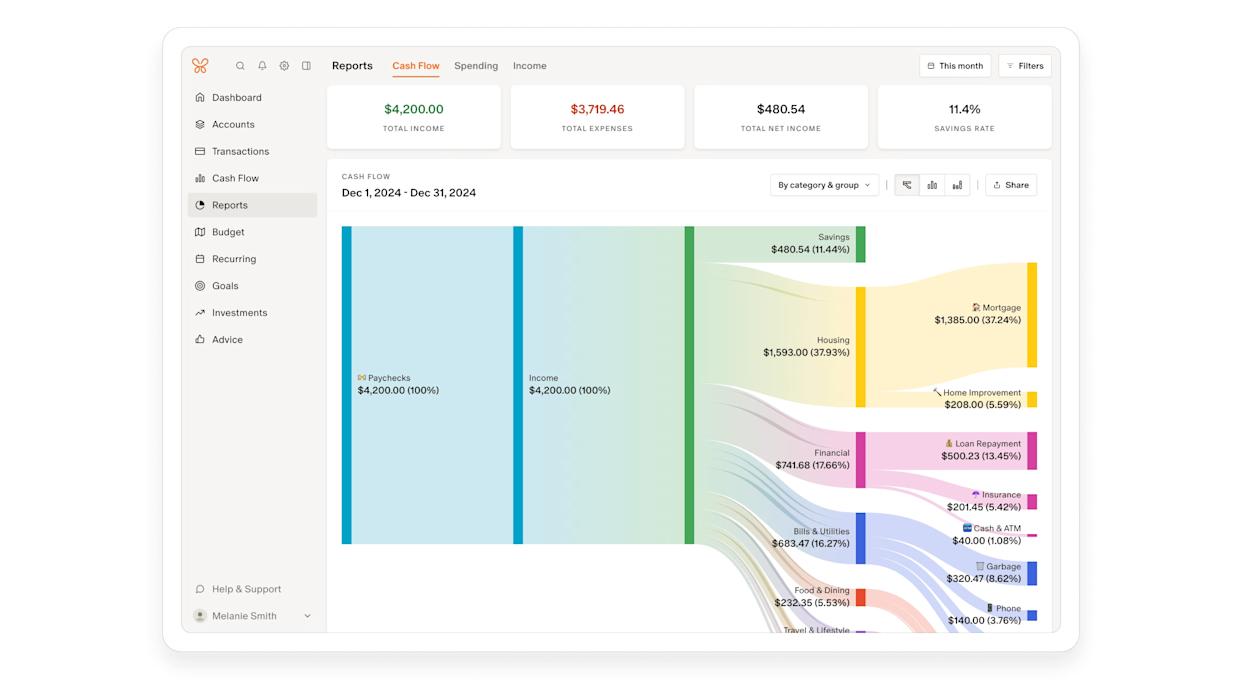

Visualization is where budgeting apps really prove their worth or fail completely. Staring at raw transaction lists numbs the brain. But seeing your spending patterns as graphs and charts that you can actually understand at a glance? That creates an emotional connection to your money that spreadsheets never could. Monarch Money delivers this through multiple visualization options. You can look at spending trends over time, see where specific categories are going, compare your investments, or create custom views based on how you've labeled expenses. The flexibility here is important because different people care about different metrics.

If you're managing finances with a partner or spouse, Monarch Money includes collaborative features that let you both see the same data in real time. That transparency removes a lot of the friction from financial conversations because you're always looking at the same numbers. No more "I thought we were being careful" followed by "Wait, YOU spent that?" conversations. Just facts on a dashboard that both of you agreed to track.

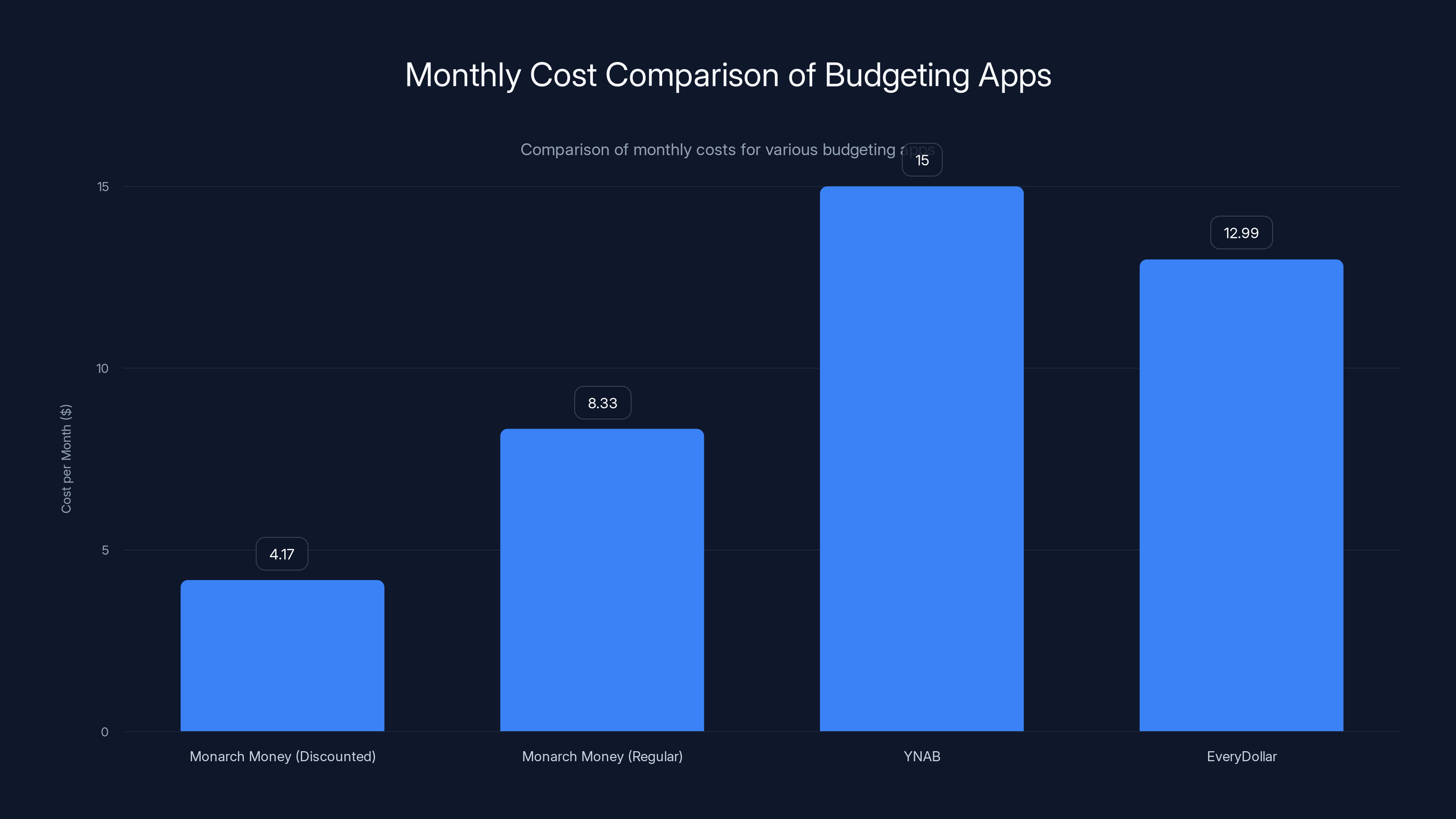

Monarch Money's discounted rate of $4.17/month is significantly lower than its regular price and other popular budgeting apps, making it an attractive option for new users.

The Pricing Reality: Why $50 for a Year Is Actually a Good Deal

Let's talk about the math here because it helps explain why this deal is worth taking advantage of. Normally, Monarch Money costs

To put this in perspective, you could spend more than

For comparison, YNAB (You Need A Budget), which is arguably the most well-known budgeting app, costs about

What's important to understand is that the

The discount code NEWYEAR2026 works at checkout and automatically applies the reduction. There are no hidden steps or requirements beyond being a new subscriber. The offer seems designed to run through the New Year period, which is why it's named what it is. Whether it extends beyond January or disappears is unknown, but the general pattern with these promotional codes is that they're time-limited. They're meant to create a sense of urgency because they do actually work. People are more likely to take action when they believe an offer expires soon.

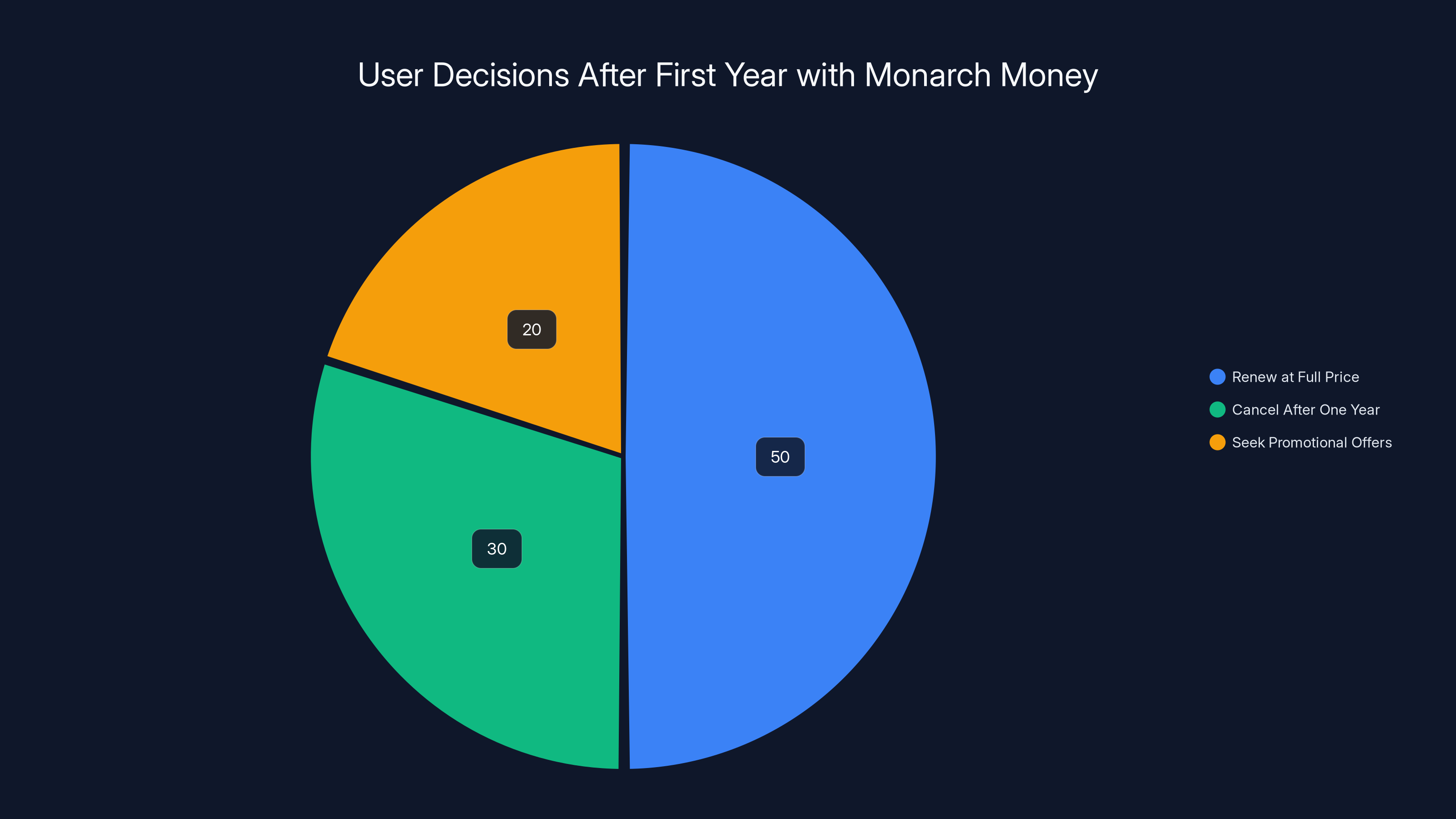

One thing to understand: this is a one-year subscription price. After that year ends, renewal would be at the standard rate unless Monarch Money offers another promotional code. That's not necessarily a bad thing because once you're in the system and seeing results, you're more likely to find value in continuing. But it's worth knowing that the second year wouldn't cost just $50 unless another deal emerges.

The Monarch Money deal offers a substantial 50% discount, reducing the annual cost from

How Monarch Money's Automation Features Actually Work

Automation in personal finance is both powerful and slightly terrifying. You're essentially giving a system permission to categorize your money without your explicit approval for every transaction. But when it works well, automation saves hours of manual data entry that most people would skip anyway, defeating the entire purpose of using a budgeting app.

Monarch Money's connection to your financial institutions happens through secure API connections. The app doesn't store your passwords or directly access your accounts in a way that's vulnerable. Instead, it uses the same kind of secure connection that major financial institutions already use to talk to each other. Your bank authorization happens once, and then Monarch Money can regularly pull in transaction data from that point forward.

The specifically useful automation comes through the Chrome extension, which monitors your activity on Amazon and Target. When you make a purchase on either platform, the extension captures that transaction and can automatically categorize it based on what you bought. This matters because Amazon and Target are basically black holes for spending. You buy a phone charger, then three other items end up in your cart, and suddenly you've spent $80 on stuff you didn't plan to buy. The fact that Monarch Money's extension is watching this and categorizing it means you get real data about your impulse purchasing patterns on these two platforms specifically.

The automatic categorization extends to other connected accounts as well. When a transaction comes in from your bank, Monarch Money's algorithm looks at merchant names, amounts, and transaction history to guess what category it belongs to. Early on, the algorithm might get things wrong occasionally. Your grocery store also has a fuel pump, so a transaction might be categorized as gas when you actually bought groceries. But the system learns from your corrections. Over time, it gets better at understanding your spending patterns because it's actually studying what you do.

What's interesting is that this automation creates a feedback loop. The more transactions you make, the more data the system has, the better it becomes at categorizing future transactions. This means the app actually improves the more you use it, which is the opposite of tools that get worse as they accumulate data and become slower or more cluttered.

You can also set up transaction rules manually. If there's a particular merchant that never gets categorized correctly despite the algorithm's best efforts, you can tell Monarch Money "Every transaction from this company is always groceries" and the system will apply that rule going forward. This degree of control matters because your spending categories are personal. What one person categorizes as entertainment might be self-care, which someone else might categorize as wellness spending.

The Widget System: Budget Tracking at a Glance

Smartphones are where most of us spend our attention now. That's not a judgment, it's just reality. So if a budgeting app can put useful information on your home screen or lock screen, it creates a daily reminder that makes you more conscious of your spending. Monarch Money's widget system is designed with this in mind.

The widgets available include budget progress indicators that show you how much of your monthly allowance you've spent in various categories. So you can glance at your phone and see "Groceries: 45% used" or "Entertainment: 78% used" without opening the full app. This is more useful than you'd think because it means you're making spending decisions with up-to-date information rather than guessing.

There's also an overall spending widget that shows your total spending for the current month against your budget. This acts as a reality check when you're considering a purchase. If you know you've already spent 80% of your overall budget with a week left in the month, you're going to think twice about that new game or book or whatever discretionary item is tempting you.

The widget system is available on both iOS and Android, though the iOS version typically has more options because Apple's widget framework is more mature and flexible than Android's (though this gap has narrowed significantly in recent years). The point is that Monarch Money understands that modern personal finance is mobile-first. The web app is useful for deep dives and complex analysis, but the mobile experience is where the actual financial decisions get made.

What makes widgets particularly valuable for budget tracking is the friction reduction element. Opening an app takes conscious effort. Even though it's a small effort, it's an effort that creates hesitation. A widget on your home screen removes that friction. You see the information whether you planned to check it or not. This passive awareness actually changes behavior over time because you're constantly reminded of your budget status without having to remember to look at it.

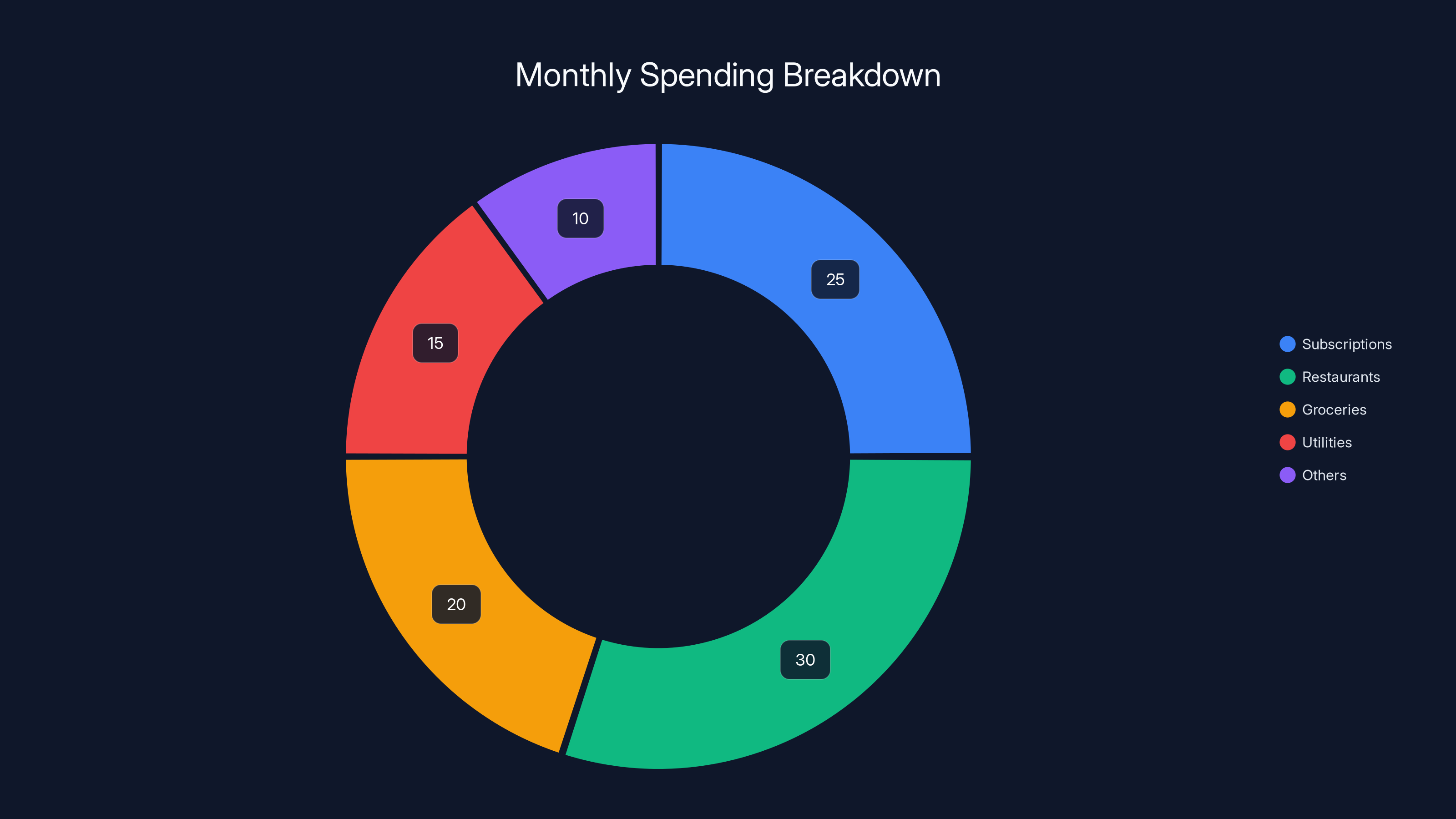

Estimated data shows that restaurants and subscriptions make up the largest portions of monthly spending, highlighting potential areas for budget adjustments.

Multi-Account Aggregation: Seeing Your Complete Financial Picture

Most people have money in multiple places. There's the checking account at one bank, the savings account at another, maybe investments in a third place, credit cards from various companies, and potentially other financial accounts. Trying to manage money when your accounts are scattered across different institutions is like trying to see a complete picture when you've divided it into pieces and put them in different rooms.

Monarch Money's ability to connect multiple financial accounts and display them all in one place is fundamental to how the system works. When you first set up Monarch Money, you go through a process of connecting your accounts. The system supports thousands of financial institutions, so whether you use a big bank or a credit union or some fintech-only bank, odds are good that Monarch Money can connect to it.

Once your accounts are connected, Monarch Money aggregates all your transactions into a unified view. You can see spending across all your cards and accounts, sorted by merchant, category, date, or any other filter you want to apply. This unified view is powerful because it shows you patterns that would be invisible if you were looking at accounts in isolation. Maybe you have one credit card where you buy groceries and another where you buy gas. Seeing both of those expense streams merged together shows you your total spending on food and transportation. Seeing them separately hides the actual scope of those categories.

The aggregation also matters for goal-setting and tracking. If you set a goal to spend less than $300 on groceries this month, the system needs to look at every grocery transaction across every one of your accounts to calculate whether you're on track. With fragmented accounts, you'd have to manually add up numbers from multiple places. With aggregation, the app does it automatically.

Account security is a legitimate concern when you're connecting multiple financial institutions to a third-party app. Monarch Money doesn't store your login credentials. Instead, it uses OAuth and other secure authentication methods that are industry standard. When you connect an account, you're authorizing Monarch Money to access certain data from that account, but you retain control over permissions. You can disconnect an account at any time, which cuts off the data feed immediately.

Collaborative Budgeting: Managing Money With a Partner

If you're in a relationship where you share finances, budgeting becomes a conversation between two people rather than a solo activity. That adds complexity, but it also creates an opportunity for better financial alignment. Monarch Money's collaborative features are designed to make this conversation easier.

When you add a partner to your Monarch Money account, they see the same transactions and budget data that you see. This means you're always working from the same information. No more situations where one person thinks the budget is under control and the other person is shocked to learn about a large purchase. Transparency isn't a feature, it's a requirement for collaborative financial management to work.

The system allows both partners to make purchases and see them reflected in real time. One partner can be monitoring the overall budget while the other person is out shopping. If the shopper needs to verify they're still within budget for a category, they can check the app and see exactly how much spending room remains. This reduces impulse purchases because the shopper has instant access to accurate budget information.

Funding also becomes clearer in a collaborative setup. If one partner is employed and the other is self-employed or manages household finances differently, Monarch Money can track those income streams and show how they flow into expenses. Some couples split expenses equally, others split them proportionally based on income, and others use a completely different system. Whatever arrangement you've made, Monarch Money can reflect it.

The collaborative features don't create accountability in a judgmental way. Instead, they create shared responsibility. Both people see the budget, so both people understand the constraints. Both people understand the goals, so both people can work toward them. This is fundamentally different from one person controlling the money and reporting to the other person.

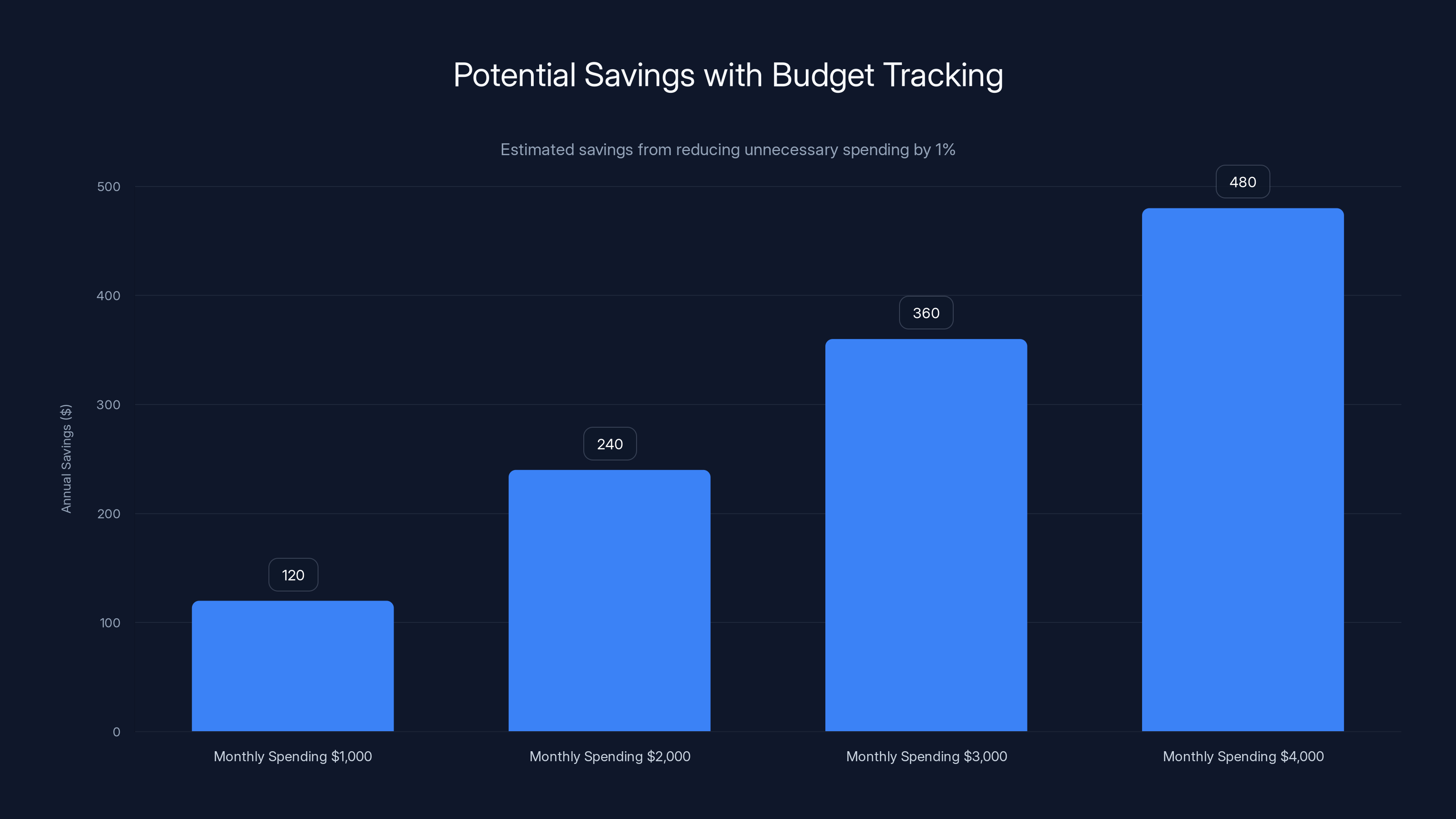

Estimated data shows that reducing unnecessary spending by 1% can lead to significant annual savings, easily covering the $50 investment in a budgeting tool.

Monarch Money's Visualization Dashboard: Making Data Understandable

Raw data is useless. A list of transactions from the past month tells you nothing except individual actions. But when you visualize that data effectively, patterns emerge. You suddenly see that you're spending way more on subscriptions than you realized, or that your restaurant visits are adding up to a shockingly large number.

Monarch Money's dashboard offers multiple ways to visualize your financial data. There are traditional pie charts that show what percentage of your spending goes to each category. There are line graphs that show spending trends over time, which lets you spot whether you're increasing or decreasing spending in particular categories month over month. There are category breakdowns that drill into individual spending areas in detail.

The dashboard is customizable, which matters because different people care about different metrics. A frequent investor might care mostly about tracking their portfolio performance. Someone focused on budget discipline might care most about seeing their progress toward spending limits. Monarch Money lets you create views that emphasize what matters to you.

One particularly useful visualization is the spending comparison view, which shows you how much you spent in each category during different time periods. So you can compare January to January from the previous year, or compare any month to your average, or create custom comparisons. This historical perspective is how you actually spot behavioral changes. You might not realize you're spending more on delivery food until you see that February's food delivery spending is 40% higher than January's.

Investment tracking is also visualized, which matters because having money in the market is only useful if you actually understand your allocation and performance. Monarch Money pulls in investment account data and shows you what you own, how it's performing, and what your overall investment portfolio looks like across accounts.

The visualization options also include custom categories and tags, which means you can create spending breakdowns that match how you actually think about money rather than forcing your data into rigid default categories. Maybe you want to track your "self-improvement" spending separately from entertainment. Or you want to see how much you're spending on your hobbies. Monarch Money lets you define those categories and then see visualizations based on them.

The Learning Curve: Is Monarch Money Hard to Use?

Here's the honest part that matters: Monarch Money has a learning curve. It's not as simple as opening the app and immediately understanding everything. The feature set is robust, which means there are more options than you might initially think you need. Some people see that as a feature, others see it as a bug.

The initial setup process requires you to connect your accounts, which takes time. You need to log in to your financial institutions through Monarch Money's secure interface, authorize access, and then wait for the system to pull in your historical transaction data. For someone with accounts across multiple banks, this process can take 20 to 30 minutes. It's not complicated, but it is time-consuming.

Once accounts are connected, you need to decide how you want to approach budgeting. Do you want traditional category-based budgets, or flexible budgets? What categories matter to you? For someone who's never used a budgeting app before, these decisions can feel paralyzing. There are no wrong answers, but there are definitely better answers for your specific financial situation. Monarch Money provides guidance through onboarding, but you're still making choices about your own financial system.

The categorization system itself has a learning curve. The automatic categorization might get things wrong initially. You'll need to spend some time correcting it and setting rules so the app learns your preferences. This is actually a one-time investment though. After a few weeks of using the app and making corrections, the automatic categorization becomes quite accurate.

The feature richness also means there are multiple ways to accomplish the same task. You can view your spending through the dashboard, through detailed reports, through custom views, or through filtered transaction lists. More options are generally good, but they also mean it takes some exploration to figure out which approach works best for you.

Monarch Money offers tutorials and documentation to help with the learning curve. There's also an active community where users share tips and best practices. The company is responsive to user feedback and regularly updates the app based on how people are actually using it.

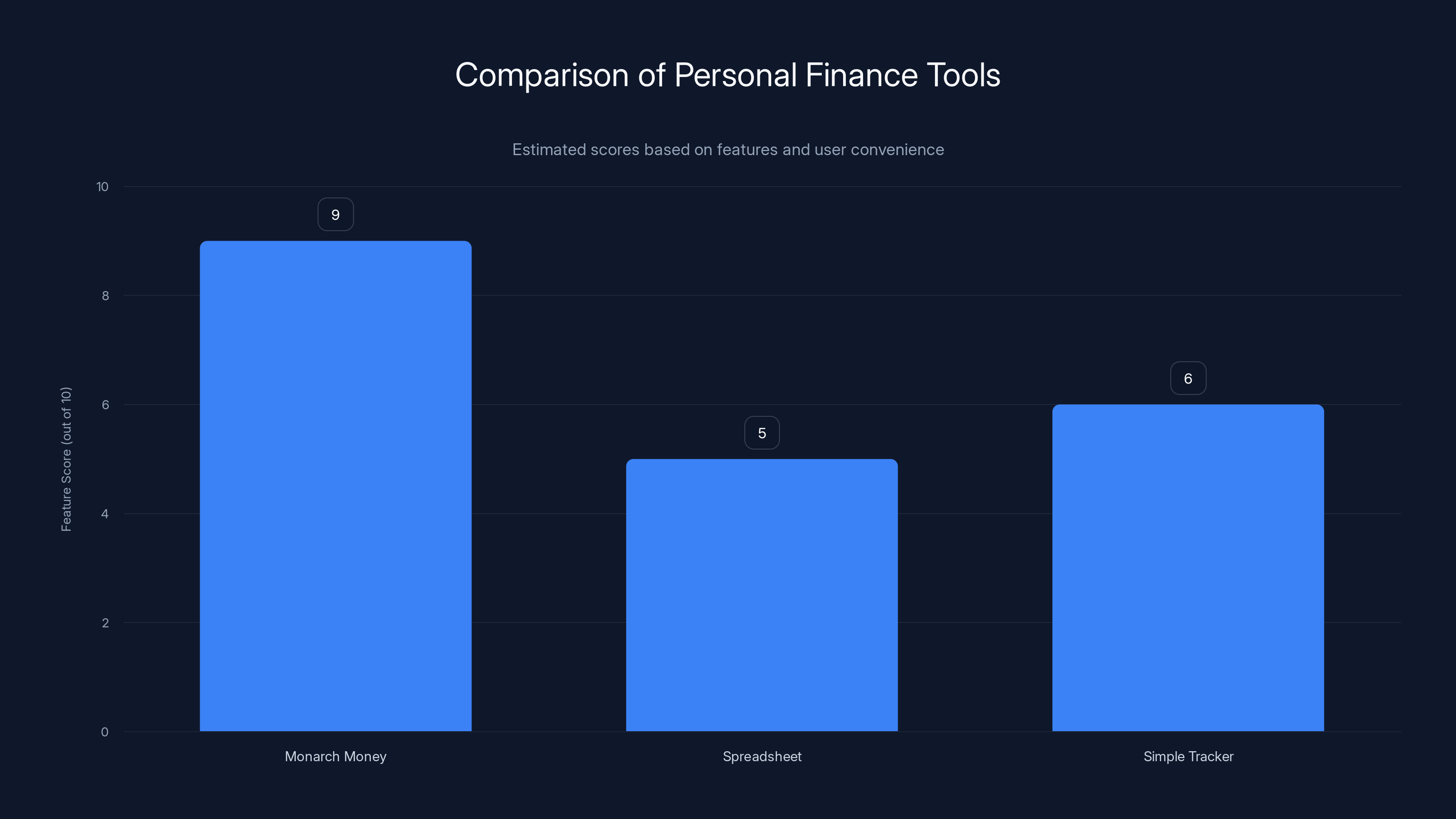

Monarch Money scores higher due to automation, visualization, and security features compared to traditional spreadsheets and simple trackers. Estimated data based on typical feature offerings.

Web vs. Mobile: Where the Feature Parity Breaks Down

Monarch Money works across web and mobile platforms, but they're not identical experiences. This is a common issue with apps that support multiple platforms, but it's worth understanding what it means for your actual usage.

The web version of Monarch Money is more feature-complete. You get access to all the reporting options, all the visualization tools, and all the settings. The web interface is where you'd go to do serious budget planning, set up complex rules, or dive deep into financial analysis. For someone sitting at a computer with a keyboard and mouse, the web version gives you everything.

The mobile versions (both iOS and Android) are more streamlined. They're designed for quick access and real-time budget checking rather than deep analysis. You can view your spending, check your budget progress, see transactions, and make basic adjustments. But some of the more detailed reporting features are either not available or are simplified versions on mobile.

During testing, there have been reports of occasional bugs that appear on the mobile version but not on the web version, or vice versa. These are typically minor issues like display formatting problems or occasional crashes. Monarch Money's development team addresses these regularly, but the existence of separate codebases for web and mobile means there will always be some divergence between the platforms.

For actual usage, this doesn't mean the app is broken. It means you might occasionally need to open the web version to accomplish something that doesn't work smoothly on mobile, or vice versa. This is a minor inconvenience rather than a dealbreaker, but it's worth knowing about before committing to the platform.

The team is actively working on improving consistency between platforms. Recent updates have focused on bringing mobile features closer to feature parity with the web version. But the reality of software development is that perfect parity between multiple platforms requires constant effort.

How Monarch Money Compares to Its Main Competitors

If you're considering Monarch Money, you're probably comparing it to other options. Understanding how it stacks up against competitors helps you make an informed decision.

YNAB (You Need A Budget) is probably the most direct competitor. YNAB focuses heavily on the budgeting philosophy and teaches a specific approach to money management called the "four rules." YNAB is more expensive at about $15 per month, but it includes budgeting education and has an active community. If you want a system that teaches you how to think about money differently, YNAB is excellent. If you just want a tool that tracks your money without the education component, Monarch Money is more straightforward.

Every Dollar is another competitor aimed at people who want traditional category-based budgeting. It's simpler than both YNAB and Monarch Money, which appeals to people who find those other options overwhelming. The tradeoff is less functionality and less flexibility.

Personal Capital is focused on investment tracking and wealth management alongside budgeting. If you have significant investment accounts, Personal Capital offers detailed portfolio analysis that Monarch Money doesn't match. But it's also more complex and arguably overkill if you're not particularly interested in investment details.

The reborn Mint (now owned by Intuit) offers basic budgeting for free, but with limitations. The free version is useful for casual budget tracking, but serious budgeters will hit limitations. Intuit has been pushing users toward paid features, so the free version's value proposition has diminished over time.

Compared to these options, Monarch Money sits in a sweet spot: more feature-rich than basic tools like Every Dollar, less expensive and less opinionated than YNAB, and more accessible than Personal Capital unless you're heavily focused on investment management. At the $50 promotional price, it's genuinely hard to beat.

Estimated data suggests that 50% of users renew at full price, 30% cancel after one year, and 20% seek new promotional offers.

Setting Up Monarch Money: The Step-by-Step Process

If you decide to take advantage of the $50 deal, here's what the actual setup process looks like. Understanding this beforehand can help you prepare.

First, you'll visit the Monarch Money website and create an account. You'll need an email address and password, plus some basic personal information. This takes about two minutes.

Next comes the account connection phase. Monarch Money provides a search interface where you can find your financial institutions. You search for your bank, credit card company, investment account, or whatever financial institution you want to connect. When you find it, you click to connect.

Monarch Money then takes you to a secure login interface for that institution. This is important: you're not giving Monarch Money your password. Instead, you're logging in directly to your bank's or institution's system through a secure interface that Monarch Money has set up. Your credentials never touch Monarch Money's servers. This is standard OAuth-style authentication.

Once you've authorized the connection, Monarch Money begins pulling in your transaction history. How far back this goes depends on the institution, but most will provide at least 90 days to one year of history. Some provide longer.

As transactions come in, Monarch Money's categorization system automatically assigns them to categories. You can review these categorizations and correct them as needed. This is where spending an extra 15 to 20 minutes upfront paying attention to the categories pays off later.

Finally, you'll set up your budgets. You decide whether you want category-based or flexible budgeting, and then you set spending limits for each category. If you're not sure what limits to set, Monarch Money shows you historical spending averages, which can guide your decision.

The entire process takes 30 to 45 minutes if you do it carefully. You can rush through it in 15 minutes, but that usually means spending more time correcting things later.

Why January Is the Right Time to Start Budgeting

The timing of this deal is intentional. January is when people are most motivated to change their financial habits. New Year's resolutions are a thing, and while most resolutions fail by February, the initial motivation is real.

From a psychological perspective, January represents a fresh start. The calendar resets. You haven't yet established spending patterns for the year. This is actually the ideal time to put a new system in place because you're starting from a clean slate. By the time you're three months into the year, your spending patterns are established. Trying to change them at that point requires overriding habits. Starting on January 1st means you're establishing habits in a new system from the beginning.

The financial motivation is also real. People look at their January credit card statements in February and think "I'm never doing that again." Holiday spending is typically higher than normal. New Year's provides a psychological reboot moment where people genuinely want to be more financially responsible.

From a software perspective, January is also when budgeting apps get the most usage. Monarch Money knows this. That's why the promotional code is time-limited and named NEWYEAR2026. The company is capitalizing on this motivational moment.

If you're going to start using a budgeting system, January is genuinely the best time. You have the highest motivation, the best circumstances for establishing new habits, and you'll have clear visibility into your spending for the entire calendar year. By December, you'll have 12 months of data that shows your real spending patterns across all seasons and circumstances.

The Dollar Amount: How $50 Compares to Your Actual Spending

One way to evaluate whether the

Obviously not everyone spends $3,000 per month. But whatever your spending level, the math is similar. If a budgeting app helps you cut 1% of unnecessary spending, it pays for itself many times over. And most people who seriously track their spending find more than 1% in waste.

The $50 cost also needs to be weighed against the opportunity cost of not using a system. Every month that passes without a budget is a month where you're spending money on autopilot. For many people, that autopilot spending includes subscriptions they forgot about, slightly too expensive services they could negotiate down, or simply categories where they're spending more than they realize.

Another way to think about it: Most people save more than

The $50 investment in a year of Monarch Money is likely the most ROI-positive purchase you'll make all year. That's worth taking seriously.

Security and Privacy Considerations

When you're connecting financial accounts to a third-party app, security is a legitimate concern. You're essentially giving Monarch Money access to see all your transactions and account balances. The company needs to handle that data responsibly.

Monarch Money uses industry-standard encryption and security practices. Data in transit is encrypted with SSL/TLS protocols. Data at rest is encrypted. The company undergoes regular security audits and complies with financial industry standards.

One important distinction: Monarch Money doesn't store your financial institution login credentials. Instead, it uses OAuth and secure APIs to authenticate with your financial institutions. This means if Monarch Money's systems were somehow breached, your actual banking credentials couldn't be stolen because they're not stored there.

Monarch Money has a clear privacy policy that explains what data the company collects, how it's used, and with whom it's shared. The company doesn't sell your financial data to advertisers or third parties. That's a key differentiator from some other financial apps.

You maintain control over your connected accounts. If you decide to stop using Monarch Money, you can disconnect all your accounts immediately. The company doesn't store historical transaction data beyond your subscription period. When you close your account, your data is deleted.

Like any service that touches financial data, Monarch Money isn't risk-free. But the risks are comparable to using other financial aggregation services. If you're comfortable with tools like Personal Capital or Intuit's suite of products, Monarch Money operates at a similar security level.

Making the Decision: Is Monarch Money Right for You

So should you buy a year of Monarch Money for $50? Here's the framework for deciding.

You should buy it if you're someone who wants to understand where your money goes and you're willing to spend 30 to 45 minutes setting up the system. The visual dashboards and automatic tracking will show you patterns you probably don't currently see.

You should buy it if you share finances with a partner and want a tool that lets both of you see the same data. The collaborative features genuinely reduce financial friction in relationships.

You should buy it if you're the type of person who responds well to data and visualization. If numbers and charts help you make better decisions, Monarch Money provides plenty of both.

You might skip it if you're looking for a budgeting app that will teach you a specific financial philosophy. YNAB is better for that because the company makes financial education part of the product.

You might skip it if you need deep investment tracking and portfolio analysis. Personal Capital is more focused on that.

You should absolutely skip it if you're looking for a completely free option. The

For most people though, especially people who've been meaning to get their finances together but haven't taken action yet, the $50 deal removes the last barrier to entry. The price is right. The product is solid. The timing is perfect. It's worth trying.

Taking Action: How to Claim the Deal Before It Expires

If you've decided to take advantage of the Monarch Money deal, here's exactly what you need to do.

First, you'll go to the Monarch Money website. Don't go through a link from another site or a social media post. Go directly to the official website to ensure you're getting the legitimate deal.

You'll create an account and go through the initial setup steps we discussed earlier. When you reach the payment step, you'll see the pricing options. The promotional code box is typically on the checkout page.

Enter the code NEWYEAR2026 in the promotional code field. The system should immediately apply the discount, showing the reduced price of

Complete the purchase with your payment method. You'll get a confirmation email, and your subscription will be active immediately.

Then you'll go through the account setup process: connecting your financial institutions, categorizing transactions, and setting up your budgets.

One important detail: The promo code is specifically for new users. If you've had a Monarch Money account before, even if you canceled it, you might not qualify for the new user pricing. But if you've never had an account, you're good to go.

The deal is time-limited, though the exact expiration date hasn't been announced. With promotional codes tied to New Year's promotions, odds are good it runs through January and maybe into February. But don't wait to test it out. Promotional codes can disappear without notice, and you don't want to miss out because you were waiting for the perfect time to sign up.

What Happens After the First Year: Understanding the Renewal Process

One question worth asking: What happens when this discounted year ends? Do you get renewal options? What's the pricing going forward?

After your promotional year expires, Monarch Money will ask if you want to renew. The renewal pricing would be the standard $100 per year (or possibly a different price if Monarch Money has changed its pricing structure, though that's not common).

You're under no obligation to renew. You can simply let your subscription lapse, and your account will become inactive. You won't lose your historical data immediately, but eventually it will be deleted according to the company's retention policy.

Many people who use Monarch Money for a year find it genuinely useful enough that they're willing to pay the full

Some people use Monarch Money for a year, accomplish their goal of understanding their spending patterns, and then cancel. That's fine. The value proposition of Monarch Money isn't that you have to use it forever. It's that it provides useful financial information and tools for whatever period you decide to use it.

If you're thinking about this as a one-year experiment, that's a reasonable way to approach it.

The Bigger Picture: Why Budgeting Matters in 2025

Beyond the specific deal, it's worth stepping back and thinking about why budgeting actually matters. Financial stress is one of the leading causes of anxiety and relationship problems. Many people feel out of control with their money, but they're not actually sure where the problem is because they've never carefully tracked it.

Budgeting systems like Monarch Money shine light into that darkness. They show you exactly what's happening with your money. That information alone is valuable because you can't solve a problem you don't fully understand.

The economy in 2025 continues to be challenging in some ways. Inflation has cooled from its peak, but costs for essentials like housing, food, and healthcare remain elevated. Having clear visibility into your spending and setting intentional budgets becomes more important when money is tighter.

At the same time, the tools for managing money have never been better. Technology has made it possible to track your finances with a level of detail and ease that would've been impossible 20 years ago. Taking advantage of those tools is just being smart about the resources available to you.

If you've been thinking about getting your finances under control, 2025 is a good year to do it. And the Monarch Money deal at $50 for a year is a good way to get started. The combination of timing, price, and product quality creates a compelling opportunity.

FAQ

What is Monarch Money exactly?

Monarch Money is a personal finance app that helps you track spending, manage budgets, and understand your financial patterns. It connects to your bank accounts and credit cards, then automatically categorizes transactions and visualizes your spending through charts and dashboards. The app works on iOS, Android, web browsers, and includes a Chrome extension for enhanced Amazon and Target tracking.

How does Monarch Money differ from a spreadsheet or simple tracker?

Manual tracking requires you to enter every transaction by hand, which most people abandon quickly. Monarch Money automates data collection by connecting directly to your financial institutions, pulling in transactions automatically. The visualization features also matter significantly because charts and graphs make patterns obvious in ways that lists of numbers never can. The app also handles multi-account tracking and collaborative features that would be extremely tedious to manage in a spreadsheet.

Is my financial data actually secure with Monarch Money?

Monarch Money doesn't store your banking credentials, using OAuth authentication instead, which is the same technology used by major financial institutions. The company encrypts data in transit and at rest, undergoes regular security audits, and complies with financial industry standards. Your data isn't sold to advertisers or third parties. That said, connecting financial accounts to any third-party app carries some risk, though Monarch Money's security practices are comparable to other legitimate financial aggregation services.

What happens if I don't like Monarch Money after setting it up?

You can cancel your subscription at any time and disconnect all your accounts immediately. Monarch Money doesn't charge cancellation fees or require you to commit beyond your subscription period. You won't get a refund for the year you've already paid, but there's no penalty for stopping use. Your historical data will eventually be deleted according to the company's retention policy.

Can I use Monarch Money with my partner or spouse?

Yes, Monarch Money includes collaborative features that let both partners see the same transactions and budget data in real time. Both people can add expenses, monitor budget progress, and review spending patterns together. This transparency is particularly useful for couples who share finances and want to reduce conflict around money.

Why is the promotional code only available for new users?

Monarch Money uses the $50 promotional pricing as a way to convert new users. Existing customers are already committed to the platform, so they don't need the same incentive to renew. The code is time-limited and tied to New Year's because that's when people are most motivated to make financial changes. This is standard practice across the SaaS industry for driving new customer acquisition during peak motivation periods.

What's the difference between Monarch Money and YNAB (You Need A Budget)?

YNAB costs more (

Does Monarch Money work with all banks and financial institutions?

Monarch Money supports connections to thousands of financial institutions, which includes most major banks, credit unions, investment firms, and credit card companies. If you use a mainstream financial institution, Monarch Money almost certainly supports it. For smaller or regional institutions, there might be occasional compatibility issues, but you can check Monarch Money's institution list before signing up to verify your banks are supported.

How quickly will I see my financial information in Monarch Money after connecting my accounts?

Automation starts immediately, but the initial data pull takes time depending on your institution and how much history you're pulling in. Bank connections typically take 5 to 15 minutes to establish. Transaction history from the past few months to a year begins appearing in your Monarch Money dashboard within an hour of connecting. Real-time transaction updates happen automatically whenever you make a purchase on a connected account.

Key Takeaways: Why You Should Consider This Deal

The Monarch Money deal offering one year of access for

The product itself is solid. While it has a learning curve during setup and some feature inconsistencies between the web and mobile versions, most users find that the transparency it provides quickly pays for itself through identified spending waste and improved financial decision-making. For new users specifically, the promotional pricing removes the barrier to trying the platform.

The timing matters. January is when people are most motivated to improve their financial habits. Starting a budgeting system at the beginning of the year means you establish good tracking habits early and have full-year visibility into your spending patterns. By December, you'll have 12 months of data that shows your actual spending across all seasons and life circumstances.

If you've been thinking about getting serious about budgeting but haven't taken action, the

The promotional code has a limited time frame, though the exact expiration date hasn't been announced. If you're interested, the safest approach is to take action sooner rather than later. Promotional codes can disappear without notice. Missing out because you were waiting for the perfect time would be unfortunate, especially at a price this attractive.

Related Articles

- Best Budgeting Apps 2025: Complete Guide After Mint Shutdown

- Monarch Money 50% Off Deal: Complete Guide to Annual Budgeting [2025]

- Best Mint Alternatives in 2025: Complete Guide to Top Budgeting Apps

- TurboTax Discount Codes & Coupons: Save Up to 54% [2026]

- Argos January Sale 2025: Best Tech & Appliance Deals Up to 50% Off

- Walmart Promo Codes & Coupons: Save Up to 65% [2025]

![Monarch Money Deal: $50 for One Year (50% Off) [2025]](https://tryrunable.com/blog/monarch-money-deal-50-for-one-year-50-off-2025/image-1-1768399629128.jpg)