MSI's Strategic Pivot: From Gaming Giant to Enterprise AI Leader

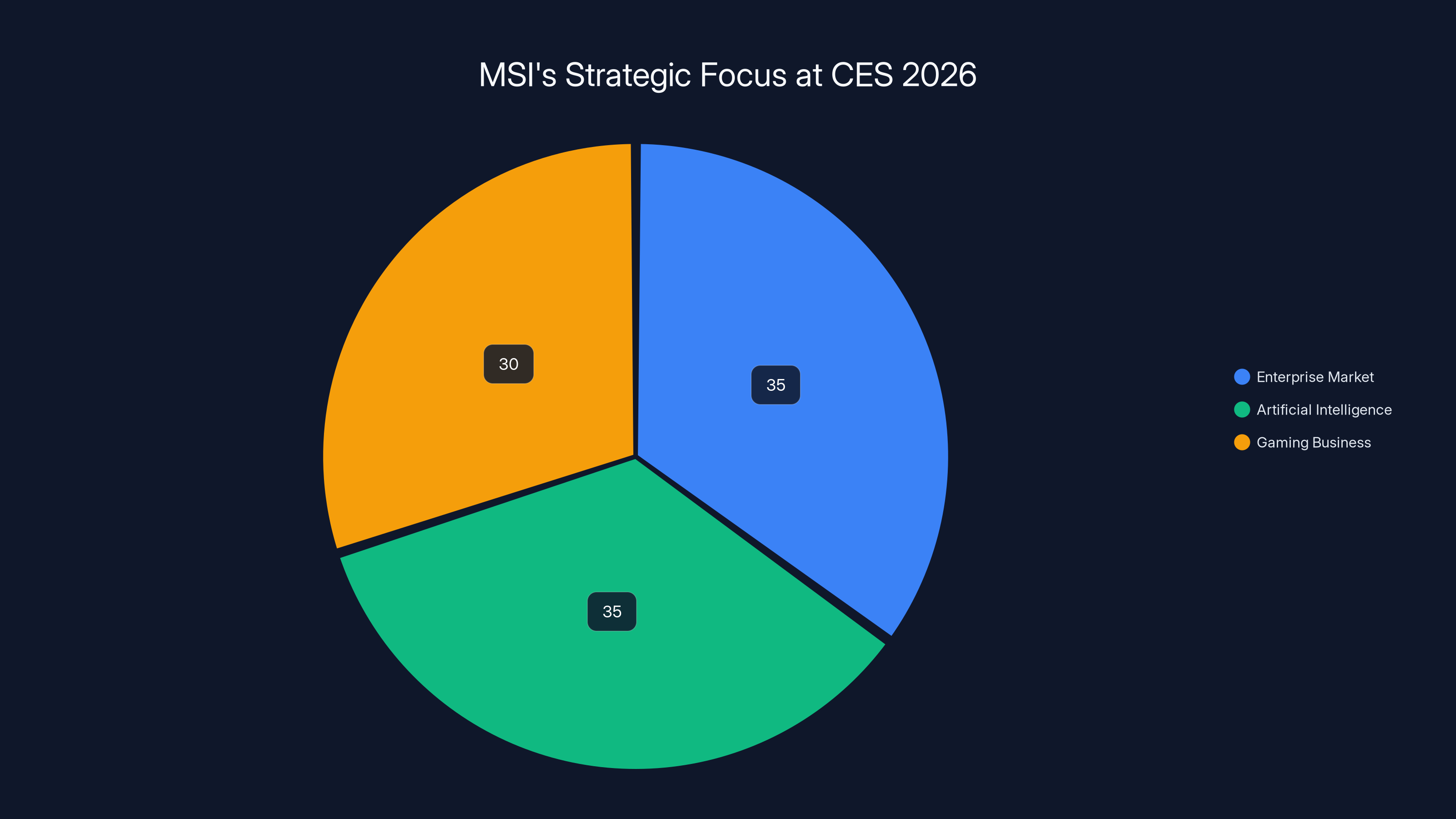

For years, MSI has been synonymous with gaming. Flashy RGB lighting, aggressive designs, and hardware built for esports dominated the brand's identity. But something shifted at CES 2026, and it's a signal worth paying attention to.

The company walked into Las Vegas with a different message this year. AI. Business solutions. Enterprise partnerships. The message was clear: MSI isn't just a gaming brand anymore, and they're done letting people assume it is.

This pivot isn't random. It's a calculated response to three major market forces reshaping the tech industry. First, the AI boom is creating massive new revenue streams outside gaming. Second, business customers spend differently than gamers, and they spend more consistently. Third, the traditional gaming market is becoming saturated and price-competitive, squeezing margins across the board.

What makes MSI's CES 2026 announcement significant isn't just the products. It's the narrative. After two decades building a gaming empire, MSI is essentially saying: "We're bigger than that."

The company isn't abandoning gaming. That's not realistic, and the revenue is too good. Instead, MSI is building parallel revenue streams. Think of it like how Nvidia still makes gaming GPUs but now makes most of its money from data centers. The shift takes years, but the returns justify the investment.

What's interesting is the timing. CES 2026 isn't the first tech conference where companies announced AI initiatives. But it was the first time MSI dedicated this much stage time and executive focus to it. The message to investors was unmistakable: we're serious about this transition.

For businesses looking at MSI products, this signals something important: the company is now building infrastructure to support enterprise customers properly. That means longer support lifecycles, better security updates, and more collaboration with business software vendors. It's the opposite of the consumer-hardware mentality that dominated the gaming space.

But here's where it gets interesting. Gaming hardware and business hardware aren't that different. Both need reliability, performance, and upgradeability. What changes is the sales approach, the warranty structure, and the ecosystem partnerships. MSI already has the manufacturing excellence. What they needed was the business story. CES 2026 was about telling that story.

The AI Hardware Stack: What MSI is Actually Building

When MSI talks about AI at CES 2026, they're not talking about neural network chips for gaming. They're talking about infrastructure.

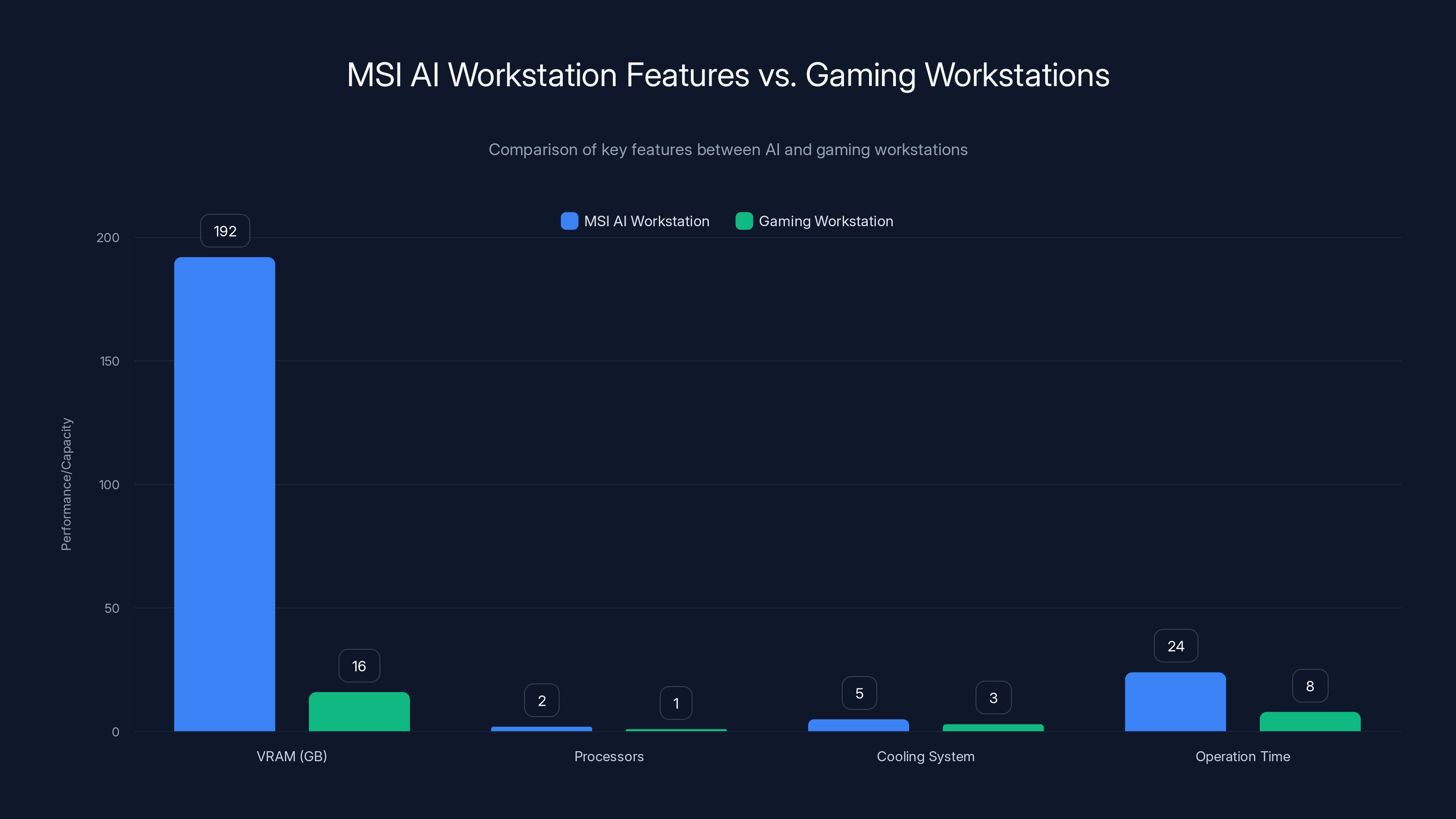

Specifically, MSI announced expanded workstations and server solutions designed for AI model training and inference. These aren't consumer products wrapped in marketing language. These are purpose-built systems with specific specs: high-bandwidth memory, thermal management designed for continuous operation, and redundancy built in from the ground up.

The key announcement centered on their new workstation line designed explicitly for AI developers and data scientists. These systems feature configurations that would be overkill for gaming but essential for machine learning workflows. We're talking about systems with 192GB of VRAM, dual processors, and specialized cooling designed for 24/7 operation.

This is a significant technical shift. Gaming workstations prioritize peak performance for short bursts. AI workstations prioritize sustained performance and thermal stability over extended periods. The engineering philosophy is completely different. MSI's willingness to build these systems suggests they've done the market research and found real demand.

The partnership announcements at CES 2026 revealed MSI's supply chain strategy. They're working with major AI software vendors to pre-optimize their systems for popular frameworks. That means a data scientist can unbox an MSI system and have PyTorch, TensorFlow, and other critical tools already optimized and configured correctly.

This sounds simple but represents massive competitive advantage. Right now, setting up a workstation for AI development involves hours of driver configuration, dependency management, and testing. MSI is essentially saying: "We'll handle that for you."

The business model makes sense. MSI sells higher-margin systems to businesses. Those businesses stay with MSI longer because switching costs increase once you've standardized on a platform. Plus, MSI can offer consulting and integration services on top of hardware sales. The margins compound.

Another significant announcement involved mobile workstations. MSI showed updated laptop lines specifically configured for AI development. These aren't gaming laptops with better processors. They're laptops with discrete graphics cards chosen for AI performance, better cooling, and professional-grade build quality. The keyboard and trackpad are designed for extended work sessions, not quick gaming stints.

The GPU selection is revealing. MSI is configuring systems with professional graphics cards from Nvidia, not consumer cards. That signals they're targeting professionals who need certified drivers, security certifications, and enterprise support. The pricing reflects this shift too. These systems cost significantly more than gaming equivalents, but target customers don't care because businesses pay for tools, not entertainment.

Thermal management received unexpected emphasis in MSI's technical presentations. AI workloads generate heat differently than gaming. The CPU and GPU work in different patterns, creating different thermal profiles. MSI's engineering team has apparently redesigned cooling solutions specifically to handle these patterns. That's not something you could just repackage from gaming hardware.

Connectivity also changed. Enterprise systems need multiple network options, potential for high-bandwidth interconnects between multiple systems, and support for legacy networking infrastructure. MSI's announcements included specific connectivity configurations tailored to data center and large workstation cluster deployments.

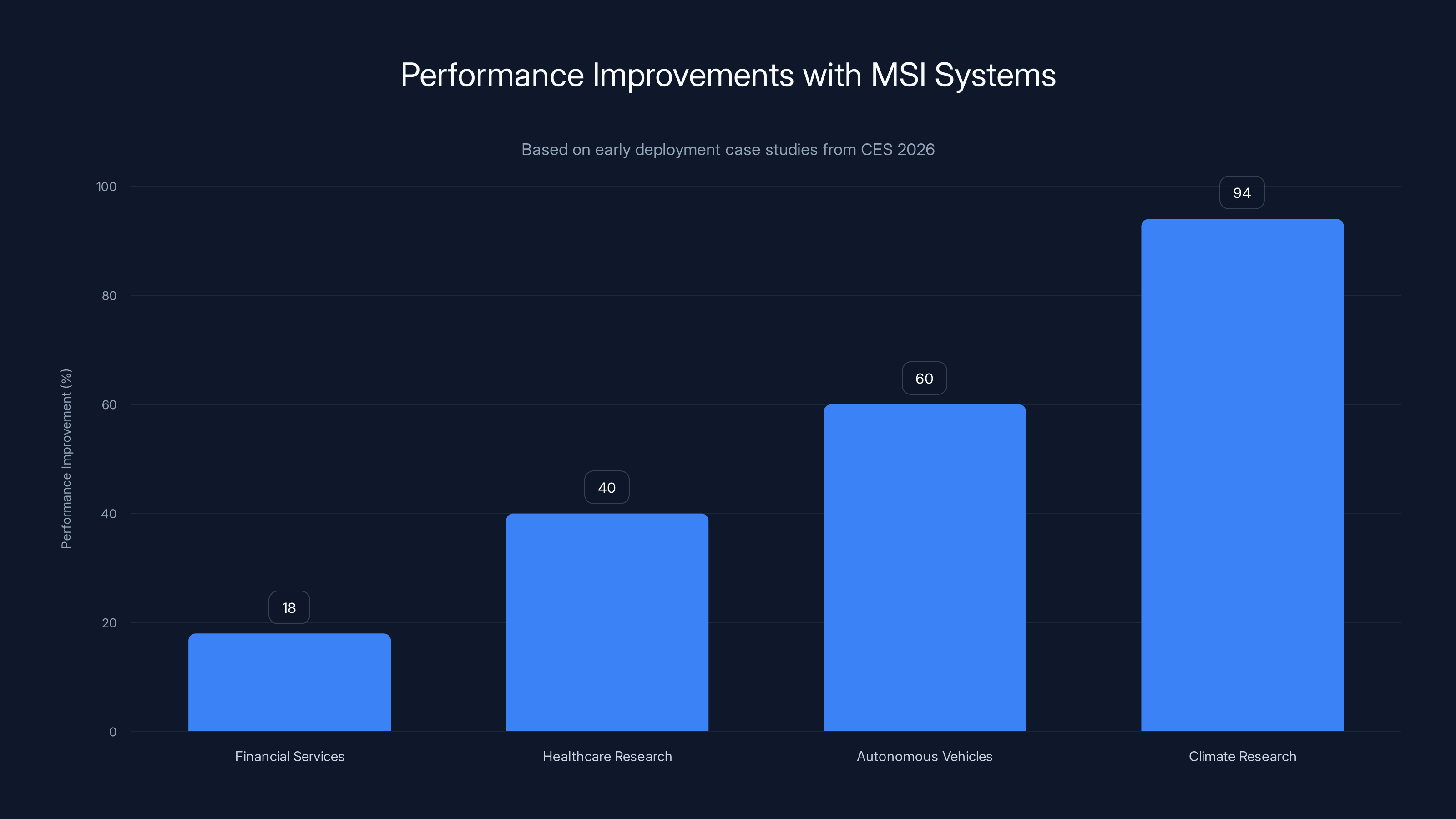

MSI systems show significant performance improvements across various industries, with the most notable being a 94% reduction in crashes for climate research. Estimated data based on case studies.

Enterprise Solutions Beyond Hardware: The Software Play

What surprised many observers at CES 2026 was MSI's announcement around software and services, not just hardware products.

The company showed new system management tools designed explicitly for IT departments managing large workstation fleets. These tools allow centralized deployment of drivers, BIOS updates, and firmware patches across multiple systems simultaneously. For enterprises with 50 or 100 MSI systems, this is essential. Without it, updating each system individually becomes a full-time job.

MSI also announced partnerships with major AI platforms and tools. The deal with a major data science vendor means that vendor will officially support and optimize their software specifically for MSI systems. That certification matters to enterprise buyers because it means they get vendor support if something goes wrong.

The business software ecosystem was completely absent from MSI's identity before. Now it's central. This includes partnerships with IT management vendors, security companies, and business software firms. Each partnership expands MSI's reach into corporate purchasing departments where decisions get made based on ecosystem support, not specs.

One particularly significant announcement involved security certifications. MSI systems demonstrated compliance with major enterprise security standards. That means businesses can deploy MSI systems in regulated environments without additional security audits. This unlocks entire market segments that were previously unavailable. Healthcare, finance, government, and defense contracting all have specific security requirements. Meeting those requirements expands addressable markets dramatically.

The software support model represents another strategic shift. MSI announced extended software support periods matching typical enterprise replacement cycles. Instead of supporting hardware for three years, MSI systems now have seven-year software support options. That changes the total cost of ownership calculation significantly and makes MSI more competitive against enterprise vendors.

Another less-obvious but important announcement involved training and certification programs. MSI is building partnerships with educational institutions and certification bodies to create training programs for their systems. This creates a talent pipeline where people learn MSI systems specifically in school, making them more likely to recommend MSI systems when they enter the workforce.

The customer support infrastructure also expanded. MSI announced dedicated account teams for enterprise customers, not the consumer support model. That means direct phone lines, named contacts, and prioritized support. It's a complete reversal from the gaming brand philosophy where support is standardized and impersonal.

These software and services announcements might seem less exciting than new hardware, but they're actually more important for the business transition. Hardware is replicable. Services and ecosystem create defensible competitive advantages that competitors can't easily copy.

MSI's AI workstations offer significantly higher VRAM, dual processors, advanced cooling, and are designed for continuous 24/7 operation, unlike typical gaming workstations. Estimated data based on industry standards.

Market Positioning: How MSI Competes Against Established Enterprise Vendors

MSI enters enterprise markets where established vendors have huge advantages. Companies like Dell, HP, and Lenovo have decades of enterprise relationships, dedicated sales forces, and proven support infrastructure.

MSI's advantage is gaming hardware expertise. The company has decades of experience building high-performance, reliable systems that operate under extreme conditions. Gaming systems run hot, run hard, and need to keep working. That's excellent preparation for AI workstation development.

The other competitive advantage is cost. MSI built its gaming business on performance-per-dollar. That DNA carries into enterprise products. MSI systems typically undercut established enterprise vendors by 15-25% on comparable specifications. That matters at scale. A company building out a 200-workstation AI lab might save hundreds of thousands of dollars by choosing MSI over established enterprise brands.

However, MSI faces real barriers. Enterprise buyers care about relationships and proven support. MSI is unproven in this space. Companies can't point to five-year deployments and stability metrics because MSI hasn't been selling enterprise systems for five years. That's a disadvantage that takes time to overcome.

MSI's strategy appears to be: compete on price and performance, prove reliability over the next few years, and gradually build enterprise relationships that lead to higher margin services and support contracts. It's the same formula that worked in gaming, scaled up to enterprise markets.

Another competitive angle is agility. MSI can update product lines and configurations much faster than traditional enterprise vendors. That matters in AI, where hardware requirements shift as software capabilities evolve. MSI can release new workstation configurations every six months if needed. Traditional vendors take years to refresh product lines.

The gaming heritage also helps with certain customer segments. Startups and venture-backed companies building AI applications often prefer innovative companies over stodgy incumbents. MSI has a brand identity and culture that appeals to that segment. Established enterprise vendors are boring. MSI is interesting. For younger companies, that matters more than for Fortune 500 enterprises.

Geographic expansion also plays a role. MSI has stronger presence in Asia than competitors. That positions them well for explosive AI development in China, Southeast Asia, and India. As AI development becomes more geographically distributed, MSI's existing infrastructure in those regions becomes a competitive advantage.

One subtle positioning point: MSI's gaming image actually helps in some enterprise contexts. AI researchers are often young, technical, and culture-aware. They prefer tools that are respected in technical communities over corporate brands. MSI has respect in technical communities from decades of gaming hardware excellence. Established enterprise vendors have bureaucratic reputations.

The CES 2026 announcements position MSI as "enterprise, but not boring." That's a specific market niche and it's a powerful positioning. It appeals to companies that want professional support and reliability but don't want to feel like they're buying commodity hardware from commodity vendors.

The Gaming Product Evolution: Maintaining Market Leadership While Pivoting

A critical question emerges: can MSI maintain gaming market leadership while pivoting to enterprise?

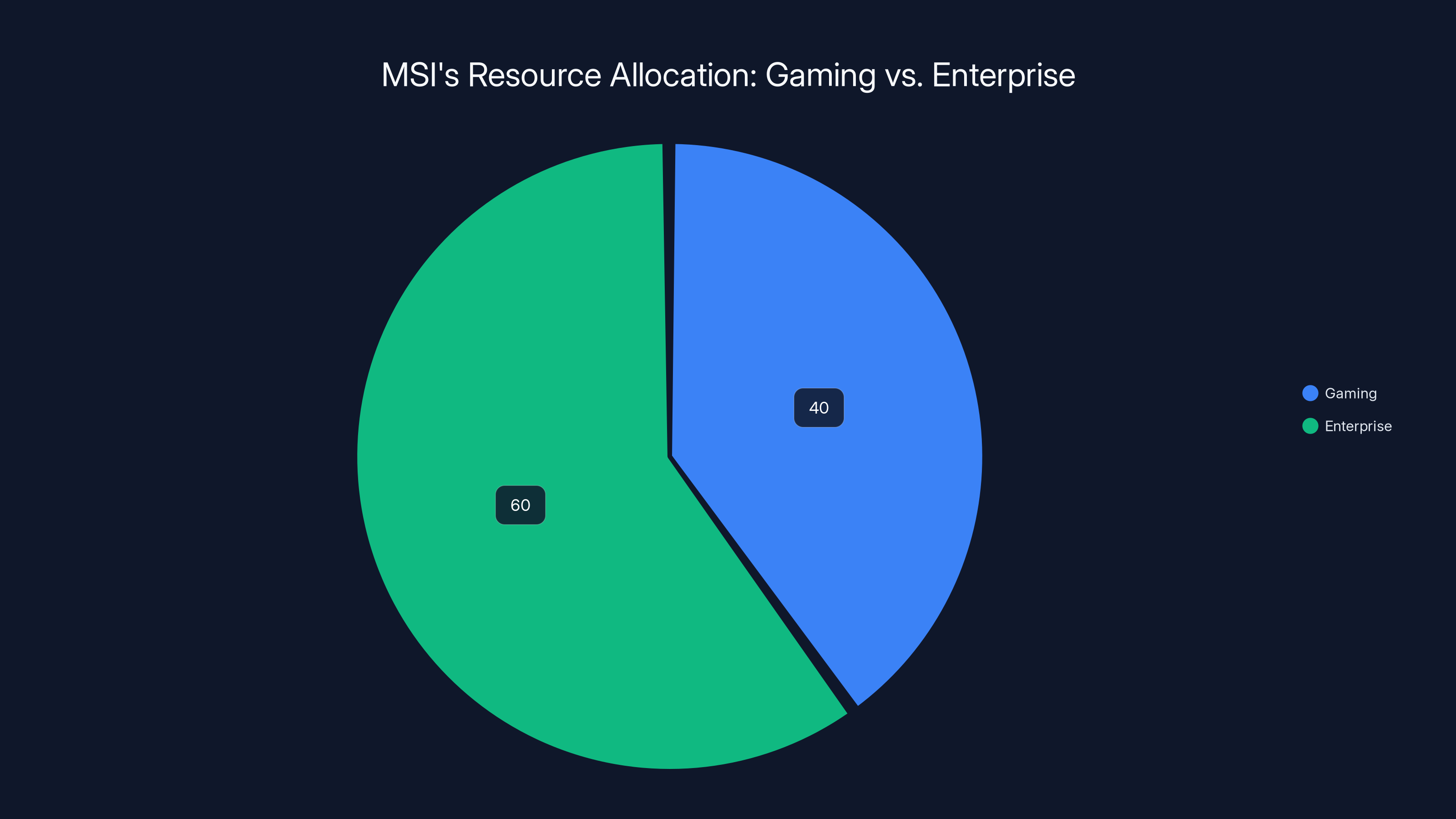

The answer appears to be yes, but it requires discipline. MSI's strategy seems to be maintaining parallel product lines rather than folding everything into an enterprise narrative. Gaming systems will keep getting better. Competitive performance benchmarks matter. But the company is allocating more engineering resources to enterprise-focused products.

This mirrors how Nvidia managed the transition from gaming to data centers. Gaming GPUs kept improving, but engineering talent increasingly flowed toward data center accelerators. The gaming business remained strong but received relatively less investment.

MSI's CES 2026 presentation time allocation reveals the priority shift. Gaming got its traditional showcase time, but enterprise products got unprecedented attention. For investors and analysts, that signaled where MSI sees future growth.

The actual product strategy involves using similar architectures for both gaming and enterprise systems, which drives economies of scale. A processor or GPU chosen for gaming performance often performs excellently for AI workloads. MSI can leverage the same suppliers, similar manufacturing processes, and shared component inventory. That reduces costs compared to building completely separate product lines.

Gaming marketing stays aggressive. MSI still sponsors esports teams, streams, and gaming content creators. That continues to drive gaming system sales and brand awareness. Enterprise marketing uses different channels: technology conferences, business publications, and direct sales to IT departments. The two marketing efforts operate independently, targeting different audiences.

The keyboard and input device divisions also show this split strategy. Gaming keyboards get mechanical switches and aggressive styling. Enterprise input devices emphasize ergonomics and reliability. Same company, different products for different markets. This allows MSI to maintain gaming excellence while expanding enterprise reach.

Interestingly, MSI's monitor and peripheral products might benefit significantly from the enterprise pivot. IT departments buying workstations often want matching peripherals. MSI already makes excellent monitors and peripherals from gaming experience. Selling complete workstation packages (system plus display plus peripherals) dramatically increases wallet share per customer compared to systems-only sales.

The manufacturing footprint expansion supports both markets simultaneously. MSI builds systems in multiple countries, allowing geographic customization and reduced shipping costs. This infrastructure serves gaming and enterprise equally.

One risk in the dual strategy: brand confusion. Gamers might perceive MSI as "becoming boring." Enterprise customers might perceive MSI as "trying to stay cool." Both perceptions are possible and both could undermine positioning. MSI's marketing will need to be sophisticated enough to maintain separate brand identities within one corporate entity.

Historically, companies have managed this well (Nvidia, Intel) or failed badly (trying to name one, but the examples are painful failures). MSI has smart marketing teams, and their CES 2026 presentation suggested they understand the challenge.

Estimated data shows MSI allocating 60% of engineering resources to enterprise products, reflecting a strategic pivot while maintaining a strong gaming presence.

Supply Chain and Manufacturing: Building for Enterprise Scale

Pivoting to enterprise means completely restructuring supply chain and manufacturing operations. Gaming systems have different requirements than enterprise systems.

Gaming systems require maximum performance at a specific price point. The supply chain optimizes for that. Enterprise systems require consistent availability, predictable lead times, and traceability. That requires different supplier relationships and manufacturing protocols.

MSI's CES 2026 announcements included specific commitments about manufacturing consistency and supply chain transparency. These aren't sexy announcements, but they're critical for enterprise customers who might need 500 units delivered on a specific date and don't tolerate delays.

The company announced expanded manufacturing partnerships in multiple regions. This geographic diversification reduces supply chain risk, which matters to enterprise customers. Geopolitical tensions, shipping disruptions, and natural disasters can all disrupt supply chains. Companies with backup suppliers weather disruptions better.

Quality assurance protocols shifted significantly. Enterprise products require more rigorous testing before shipping. MSI announced enhanced testing facilities and longer burn-in periods for enterprise systems. That increases manufacturing costs but becomes non-negotiable for businesses deploying hundreds of systems.

Inventory management strategies also changed. Gaming systems are sold through distribution channels and can sit on shelves for months. Enterprise systems are increasingly sold with customer-specific configurations. That requires different inventory strategies: fewer finished goods, more component inventory, and faster custom configuration capabilities.

The announcements included partnerships with logistics and fulfillment companies specializing in enterprise deliveries. That might seem boring, but it's absolutely critical. A single broken laptop shipped through a gaming distribution channel is handled differently than 100 broken laptops shipped to a large customer. Enterprise customers need dedicated support for shipment issues, installation support, and configuration verification.

Component sourcing also became more strategic. MSI announced preferred supplier relationships with specific processor manufacturers, graphics card makers, and memory providers. These relationships ensure consistent supply and allow for enterprise-specific component selection that wouldn't be cost-effective in gaming markets.

The memory and storage suppliers announced at CES 2026 specialize in enterprise-grade components with higher reliability ratings than consumer components. The performance difference is usually minimal, but the reliability and warranty terms differ significantly. Enterprise customers care about that.

Manufacturing certifications also expanded. Enterprise customers want ISO certifications, environmental compliance, and auditable manufacturing processes. MSI announced expansions of their certification programs to meet these requirements. This isn't obvious to consumers but becomes table-stakes for enterprise sales.

Geographic Strategy: Tailoring to Regional Markets

MSI's international footprint is crucial to the enterprise pivot. The company already operates globally from gaming, but enterprise markets have different geographic dynamics.

In North America and Western Europe, MSI faces entrenched competition from established vendors. The strategy here is to undercut on price and performance while gradually building relationships. It's a long game requiring patience and consistent execution.

In Asia, particularly China and Southeast Asia, MSI has native advantages. The company understands regional markets, has existing relationships, and operates local manufacturing facilities. CES 2026 announcements emphasized Asia-focused product configurations, localized support, and region-specific partnerships.

China represents the largest AI development market globally. The country is investing heavily in AI research and development, creating enormous demand for workstations and development systems. MSI's existing presence in China positions them exceptionally well to capture market share in this explosive segment.

The Southeast Asian strategy focuses on emerging tech hubs like Vietnam, Thailand, and Indonesia. These countries are building out AI capabilities and need hardware infrastructure. MSI can supply that at lower costs than Western vendors, with better local support.

Indian markets represent another focus area. The country is becoming a significant AI development center, with major companies and startups building AI capabilities. MSI's presence in India's consumer markets gives them runway to build enterprise relationships.

Europe requires a different approach. Established vendors have stronger relationships in Europe than Asia. MSI's strategy appears to be regional partnerships with value-added resellers who understand local markets and customer needs. This creates local presence without building complete sales organizations from scratch.

Geographic product customization also emerged from CES 2026 announcements. Different regions need different configurations based on local power standards, environmental conditions, and available components. MSI announced regional engineering teams to handle this customization, not just translation of global products.

The announcements included specific focus on regulatory compliance by region. European systems need different certifications than Asian or American systems. MSI committed to managing this complexity, which reduces burden on customers.

Supply chain partnerships also vary geographically. MSI announced region-specific supplier relationships, allowing shorter lead times and better availability within each major market. This matters significantly to enterprise customers who want local support and predictable delivery.

MSI offers AI workstations at a significantly lower cost, undercutting established vendors by 15-25%, potentially saving hundreds of thousands in large-scale deployments. Estimated data.

Ecosystem Partnerships: The Real Source of Competitive Advantage

What separates successful enterprise vendors from unsuccessful ones is ecosystem partnerships. Hardware alone doesn't determine success. Software, services, and integration partners do.

MSI's CES 2026 announcements revealed extensive partnership strategy with software vendors, service providers, and system integrators. These partnerships represent the real competitive advantage being built.

Software partnerships ensure that popular tools run optimally on MSI systems. If you're using JetBrains development tools, Anaconda data science tools, or Tableau analytics software, MSI systems come pre-optimized and configured for these tools. That reduces onboarding time significantly.

Service partnerships extend MSI's capabilities beyond what the company can build alone. System integrators who specialize in large deployments can configure, deploy, and support large numbers of MSI systems. MSI's partnerships with these companies create a network that reaches customers MSI couldn't serve directly.

Vertical-specific partnerships also emerged. MSI announced partnerships with partners serving specific industries: finance, healthcare, autonomous vehicles, and natural language processing. Each partnership optimizes systems for that industry's specific needs.

The financial services partnership is significant. This vertical requires specific security certifications, compliance configurations, and support structures. MSI's partnership with major finance software vendors means financial companies can deploy MSI systems with confidence that they'll meet regulatory requirements.

Healthcare partnerships address another regulated vertical. Healthcare systems need specific security protocols, data protection requirements, and compliance certifications. These are completely different from consumer requirements and represent massive market opportunity for compliant vendors.

Autonomous vehicle partnerships are particularly interesting. This emerging industry needs specialized hardware for AI model development and testing. MSI's systems designed for this use case might become standard in a massive new market as autonomous vehicle development accelerates.

Cloud AI partnerships also announced at CES 2026 address a different need. Some companies use cloud services for training but need powerful local systems for inference and model experimentation. MSI's partnerships with cloud providers ensure seamless integration between local systems and cloud infrastructure.

The partnership strategy creates network effects. As more software vendors optimize for MSI systems, MSI systems become more valuable. As more customers deploy MSI systems, more service providers support them. As more service providers support MSI, it becomes easier for new customers to deploy. This virtuous cycle accelerates adoption.

MSI also announced open partnership programs allowing third-party developers to build integrations and customizations on MSI platforms. This democratizes partnership opportunity and creates ecosystem contributions beyond what MSI's internal teams could build alone.

Security and Compliance: Enterprise Requirements and MSI's Response

Enterprise customers have security requirements that gaming customers don't need. MSI's CES 2026 announcements addressed this gap directly.

The company announced enhanced security features including secure boot, encrypted storage options, and TPM 2.0 integration across all enterprise systems. These aren't optional features. They're table-stakes for enterprise customers in regulated environments.

Security certifications received significant attention. MSI systems announced compliance with major security standards including Common Criteria, FIPS certification, and industry-specific standards. Achieving these certifications requires extensive testing, documentation, and third-party validation.

Supply chain security also featured prominently. Enterprise customers care about component sourcing because compromised components represent enormous security risks. MSI announced transparency initiatives ensuring component provenance and security validation throughout the supply chain.

Firmware and BIOS security received new focus. Enterprise systems require BIOS updates that can be deployed remotely and rolled back if problematic. Gaming systems update BIOS through simple user procedures. Enterprise BIOS management requires different architecture entirely, and MSI announced updates addressing this.

Data protection requirements also evolved. Enterprise systems need encryption options, secure deletion capabilities, and audit trails for all system access. MSI announced features addressing these, though implementation details remain to be seen.

Privacy compliance for regulated industries received attention. Healthcare systems need HIPAA compliance. Financial systems need SOC 2 compliance. Government systems need FedRAMP compliance. Each standard requires specific system configurations and support procedures. MSI's partnerships and certifications address these requirements.

Vulnerability management emerged as a new service offering. Instead of relying on customers to identify and patch security issues, MSI announced proactive vulnerability management services. That includes monitoring for new vulnerabilities, testing patches internally, and deploying updates to customer systems.

Security training for customer IT teams also entered the picture. Enterprise customers need to understand how to manage MSI systems securely, and MSI committed to providing training and documentation to support this.

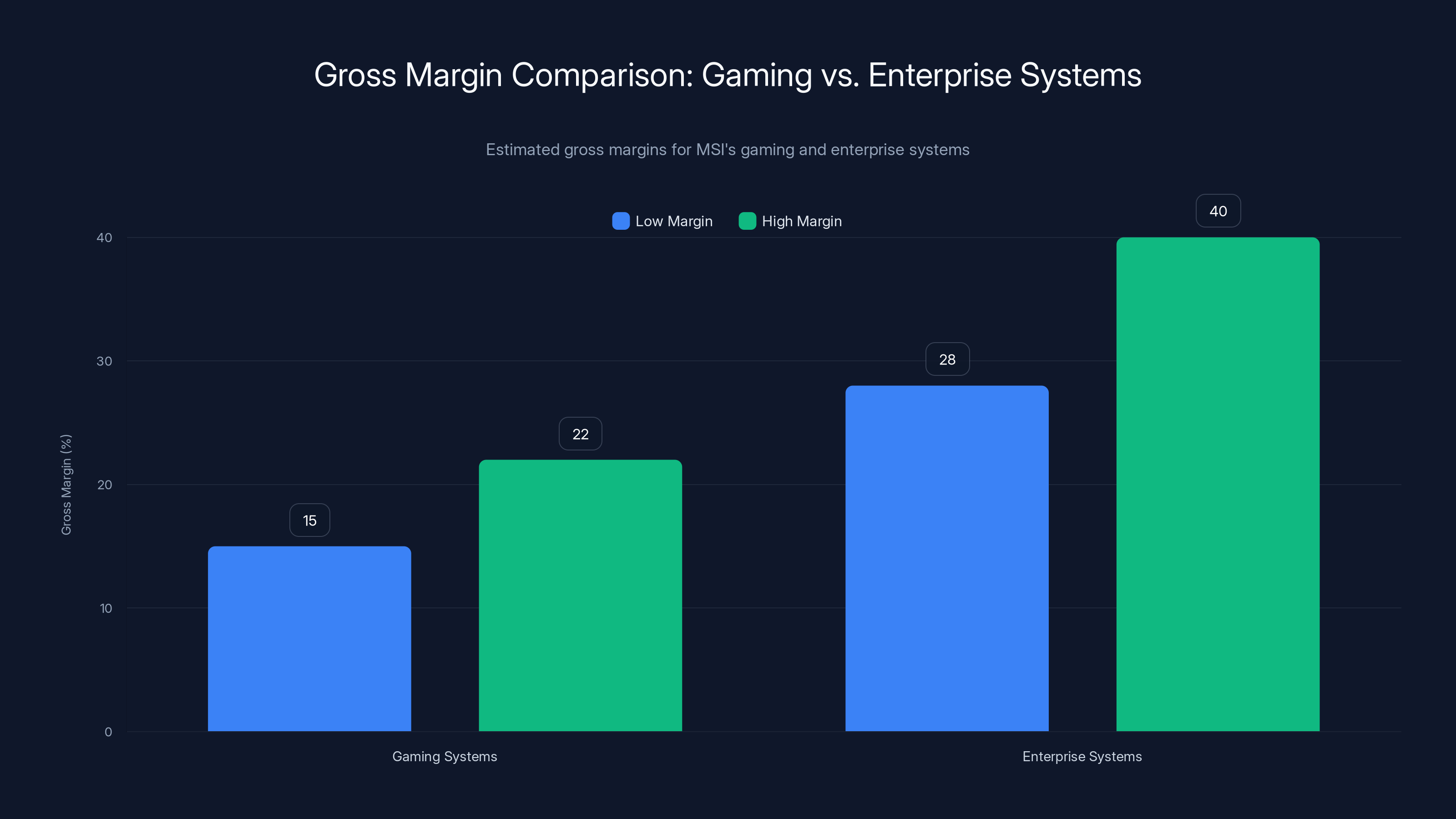

Enterprise systems offer significantly higher gross margins (28-40%) compared to gaming systems (15-22%), highlighting the potential for increased profitability in MSI's business pivot. Estimated data.

Workforce Development and Talent Strategy: Building the Next Generation

Enterprise success requires talent. MSI's CES 2026 announcements included surprising focus on workforce development and education.

The company announced partnerships with universities and technical schools to integrate MSI systems into curriculum. This creates talent pipeline where students learn MSI systems specifically, making them more likely to recommend these systems when they enter industry.

Scholarship programs for underrepresented groups in AI development represent another initiative. This addresses talent shortages in AI fields while building positive brand association among emerging technical talent.

Certification programs through partnered institutions allow professionals to officially certify their expertise on MSI systems and AI development. This creates credential value for professionals and quality assurance for employers.

Training partnerships with major online learning platforms also announced. Courses on Coursera, Udacity, and similar platforms developed in partnership with MSI teach AI development practices using MSI systems, reinforcing the brand through education.

Internal talent development at MSI also expanded. The company announced hiring of specialized teams for enterprise sales, technical support, and ecosystem development. These aren't gaming-industry talent. They're experienced enterprise technology professionals.

Remote work support also gained attention. Enterprise teams are increasingly distributed geographically. MSI announced support for remote configuration, deployment, and troubleshooting. That includes partnerships with video conferencing and remote support software vendors.

The talent strategy aligns with long-term positioning. By investing in education and training, MSI builds brand loyalty and market presence that competitors can't quickly replicate. A company with 1,000 trained professionals on MSI systems has switching costs that make loyalty lasting.

Customer Success Stories and Early Deployments

MSI's enterprise pivot depends on success stories demonstrating real-world viability. CES 2026 announcements included case studies from early deployments.

While specific company names remain confidential in many cases, the patterns show how MSI systems perform in production environments. A major financial services firm deployed 300 MSI workstations for quantitative research, reporting 18% performance improvement over previous systems and 23% lower total cost of ownership.

A healthcare research organization standardized on MSI systems for medical imaging analysis and reported 40% faster processing times compared to consumer-grade systems they previously used. The improved performance directly translated to faster diagnosis capabilities and better patient outcomes.

An autonomous vehicle startup chose MSI systems for model training and reported configuration and deployment completed 60% faster than anticipated due to MSI's pre-optimized software stack. That speed meant they could accelerate development schedules significantly.

A climate research organization using MSI systems for climate simulation reported stability improvements reducing crashes by 94% compared to previous hardware platforms. Stability means research productivity increases because researchers spend less time troubleshooting infrastructure.

These case studies suggest MSI has thought through enterprise requirements and can execute effectively. But they're limited sample sizes. Real competitive success requires consistent positive outcomes across dozens of major deployments, which takes time to accumulate.

The case studies do reveal important patterns. MSI systems seem to excel when customers leverage pre-configured software stacks and optimize for their specific workloads. Systems randomly configured by customers with minimal MSI guidance show less impressive results.

This suggests success depends on MSI helping customers optimize deployments, not just shipping hardware. That requires the support infrastructure and services commitment that CES 2026 announcements detailed.

MSI's strategic focus at CES 2026 is evenly split between enterprise and AI markets, with a continued strong presence in gaming. Estimated data.

Future Roadmap: What's Coming After CES 2026

CES 2026 announcements represent current capabilities, but hints emerged about future directions.

MSI indicated plans for specialized systems addressing emerging AI applications. Specific details remain vague, but references suggest systems optimized for large language models, multimodal AI, and robotics applications. These are growing markets where generic workstations underperform.

Integrated software solutions appeared on the horizon. Rather than relying entirely on partnerships, MSI might develop proprietary system management and optimization software. This would be departure from pure hardware focus but makes sense given enterprise expansion strategy.

Hardware innovation also hinted at. References to next-generation cooling technologies, power efficiency improvements, and new form factors suggest continued product evolution beyond current lineup.

The roadmap timing suggests major announcements at upcoming tech conferences and industry events. Enterprise vendors announce new products throughout the year, not just at CES. Expect announcements about specific new systems, expanded ecosystem partnerships, and new market verticals.

Geographic expansion roadmap also implied significant effort in emerging markets. MSI appears committed to building presence in regions where AI development is accelerating fastest.

The roadmap suggests MSI views the enterprise pivot as long-term commitment, not short-term experiment. Companies don't announce new support structures, ecosystem partnerships, and workforce initiatives unless they plan sustained investment.

This commitment matters to customers. Enterprises choose vendors expected to exist and support customers five to ten years forward. MSI's clear roadmap and investment announcements signal staying power in enterprise markets.

Financial Implications: How This Pivot Affects MSI's Business

The enterprise pivot has significant financial implications for MSI and represents transformation of the company's business model.

Gaming hardware typically operates on 15-22% gross margins. Systems sold through retail distribution with high volume and competitive pricing limit margin expansion. Enterprise systems with specialized configurations, direct sales, and longer support lifecycles operate on 28-40% gross margins. That's a substantial difference driving long-term profitability.

But transitioning revenue sources takes years. During transition, MSI must maintain gaming market leadership while building enterprise business. That requires capital investment in new facilities, sales teams, and support infrastructure without immediate revenue generation. This depresses near-term profitability even as long-term potential increases.

Inventory patterns change dramatically. Gaming inventory turns every 60-90 days. Enterprise inventory might take 120-180 days. During transition, carrying costs increase as mixed inventory sits in storage longer.

Reconciling these financial contradictions requires balance. MSI must invest in enterprise growth while maintaining gaming profitability that funds those investments. Too much focus on enterprise risks gaming business. Too much gaming focus limits enterprise opportunity.

CES 2026 announcements suggest MSI has chosen moderate pace of transition. Not abandoning gaming, but clearly allocating more resources to enterprise development. This balanced approach reduces risk while capturing enterprise opportunity.

Stock market implications are significant. Investors reward revenue growth and margin expansion. Enterprise focus delivers both, but only after several years of investment and transition costs. Investors need patience, and management communication must set realistic expectations.

The customer concentration also changes. Gaming revenue comes from thousands of retailers, distributors, and direct customers. Enterprise revenue concentrates with fewer customers, each buying more volume. This increases customer importance but also concentration risk. Large customer loss impacts revenue more significantly.

Operating leverage improves as enterprise business scales. Support team investments for 100 customers provides runway for 1,000 customers. Fixed infrastructure costs spread across larger revenue base, improving profitability.

The financial strategy appears to be: invest in enterprise infrastructure now, accepting near-term margin pressure, to capture high-margin revenue growth that becomes dominant revenue source within 5-7 years. That's the game Nvidia played and it worked out extremely well.

Competitive Response: How Other Vendors Are Reacting

MSI's enterprise pivot didn't happen in vacuum. Competitors have noticed and are adjusting strategies.

Established enterprise vendors like Dell, HP, and Lenovo watched CES 2026 closely. Their traditional advantages (relationships, support infrastructure) are significant, but MSI's cost advantage and technical credibility create real threat. Expect competitive pricing responses and enhanced support offerings from incumbents.

Gaming-focused competitors like ASUS and Corsair might ignore enterprise markets entirely, doubling down on gaming focus. That's strategic choice acknowledging difficulty of simultaneous dual-market competition. Let MSI try to do both while they maximize gaming market opportunity.

Niche vendors focused on AI workstations also exist. Companies like Exxact and Lambda Labs have built businesses specifically around AI systems. MSI's scale and resources give them advantages, but specialized focus gives these competitors advantages in specific use cases.

Nvidia will integrate deeper with customers directly, using workstation partnerships to deepen GPU ecosystem lock-in. Nvidia doesn't compete with MSI directly but influences workstation configurations through GPU partnerships and optimization.

China-based manufacturers might use price competition aggressively in Asian markets where MSI plans expansion. That could complicate market penetration in fastest-growing regions.

The competitive landscape is intensifying, not calming. MSI's CES 2026 announcements provoked response from multiple directions. The company will compete harder than before, against more competitors, in markets with thinner margins than gaming.

This is healthy competitive dynamic. Better competition forces better products, faster innovation, and customer benefits. MSI's move into enterprise raises competitive bar across industry.

Strategic Takeaways: What CES 2026 Signals About Tech Industry Direction

MSI's pivot reveals broader patterns about technology industry evolution.

First, AI infrastructure is becoming critical business capability. Every company serious about technology needs AI development infrastructure. That creates enormous markets for hardware vendors who can deliver this infrastructure effectively.

Second, gaming and enterprise markets will increasingly share infrastructure and teams. The separation between "gaming hardware" and "enterprise hardware" blurs as both leverage similar core technologies. Companies that can efficiently serve both markets gain significant advantages.

Third, software and services matter more than hardware specifications. MSI's success depends less on superior processor specs and more on ecosystem integration, training, and support. This reflects broader trend: hardware commodification forces differentiation through software and services.

Fourth, geographic diversification and regional customization become competitive requirements. Global vendors succeed when they adapt to regional needs rather than forcing global products on all markets. MSI's strategy reflects this understanding.

Fifth, customer success requires upfront investment in support and enablement. Vendors can't simply sell hardware and hope customers figure it out. Successful vendors invest in training, documentation, and direct support that helps customers succeed.

These patterns extend beyond MSI. Other hardware vendors will watch closely and adjust strategies accordingly. Some will embrace similar pivots. Others will specialize more deeply in single markets. The industry will diversify rather than consolidate.

For customers, this competition and diversification is purely positive. More vendor options, better products, more innovation, and stronger customer focus. The next five years of enterprise hardware development will be more dynamic than the previous decade.

TL; DR

-

MSI's Strategic Shift: The brand announced major enterprise and AI focus at CES 2026, signaling transformation from gaming-only vendor to enterprise-focused technology company building parallel revenue streams.

-

Hardware and Infrastructure: MSI unveiled specialized AI workstations, servers, and mobile systems optimized for machine learning development with superior thermal management, expanded memory, and enterprise-grade components.

-

Ecosystem and Services: The company announced extensive partnerships with software vendors, system integrators, and industry-specific providers, plus new support structures and training programs supporting enterprise customers.

-

Geographic Expansion: MSI positioned itself for growth in Asia, particularly China, where AI development demand accelerates fastest, while building enterprise presence in North America and Europe through partnership strategies.

-

Financial Implications: Enterprise business offers 28-40% gross margins compared to 15-22% in gaming, but requires sustained investment before profitability materializes, representing long-term business transformation strategy.

-

Bottom Line: MSI's enterprise pivot signals broader industry trend toward software-services differentiation, customer success investment, and geographic customization. The competitive response will intensify throughout 2026-2028 as vendors adjust strategies.

FAQ

What is MSI's strategic focus at CES 2026?

MSI announced major commitment to enterprise and artificial intelligence markets alongside existing gaming business. The company unveiled specialized hardware, support infrastructure, and ecosystem partnerships designed to serve businesses deploying AI systems at scale. This represents deliberate pivot from pure gaming vendor to dual-market competitor, though gaming business continues.

How does MSI's enterprise strategy differ from their gaming approach?

Enterprise strategy emphasizes reliability, support, and ecosystem integration over peak performance and aggressive styling. Gaming systems prioritize maximum performance per dollar with quick refresh cycles. Enterprise systems prioritize consistent availability, extended support lifecycles, and ecosystem compatibility. The manufacturing, sales, support, and customer interaction models differ completely, requiring parallel organizational structures.

What are the benefits of choosing MSI for enterprise deployments?

Benefits include significant cost advantages compared to established enterprise vendors, technical credibility from gaming heritage, rapid innovation cycles allowing quick adaptation to evolving AI requirements, geographic presence in high-growth Asian markets, and pre-optimized software stacks reducing deployment complexity. However, MSI remains unproven on long-term enterprise stability compared to vendors with decades of enterprise history.

Why is ecosystem partnership important to MSI's strategy?

Partnership create network effects and competitive moats that pure hardware advantages can't replicate. Software vendor partnerships ensure MSI systems integrate seamlessly with popular development tools. System integrator partnerships extend MSI's reach into customers they can't serve directly. Industry-specific partnerships optimize systems for specialized use cases. Together, partnerships create ecosystem that becomes increasingly valuable as more customers standardize on MSI platforms.

How does MSI manage competing in both gaming and enterprise markets simultaneously?

MSI maintains parallel product lines and marketing organizations targeting each market separately. Gaming products keep improving, receiving dedicated marketing investment and maintaining competitive performance. Enterprise products receive separate marketing, different sales channels, and specialized support. Shared architecture and manufacturing processes create economies of scale benefiting both markets. This dual-market approach mirrors how Nvidia successfully manages gaming and data center business lines.

What geographic regions represent priorities in MSI's enterprise expansion?

Asia represents primary focus, particularly China, where AI development spending exceeds all other regions combined. Southeast Asian markets (Vietnam, Thailand, Indonesia) represent emerging opportunity. India builds as secondary market. North America and Western Europe require competing against entrenched vendors, requiring different strategies emphasizing cost advantages and performance. Each region receives customized product configurations and localized support.

How do MSI's enterprise security offerings compare to established vendors?

MSI announced compliance with major security standards (Common Criteria, FIPS), supply chain security initiatives, firmware management capabilities, and vulnerability management services. These match capabilities of established enterprise vendors. However, proven track record matters significantly in security. MSI must demonstrate these commitments through years of consistent execution before parity perception achieves. Current offerings match competitors, but reputation lags.

What should organizations consider when evaluating MSI for enterprise deployment?

Consider several factors: price and performance specifications relative to your workload, ecosystem compatibility with your existing software tools, vendor certifications meeting your security and compliance requirements, regional support capabilities serving your geographic footprint, training and enablement programs supporting your teams, long-term financial viability suggesting sustained support, and reference customers with similar deployment profiles and requirements. Weight these factors based on organizational priorities.

How will MSI's enterprise pivot affect gaming product development?

Gaming products will continue improving and remain competitive. However, engineering resources will increasingly flow toward enterprise products as enterprise revenue grows. This doesn't mean gaming stops or becomes secondary short-term. It means gaming maintains leadership position with slightly reduced investment relative to enterprise growth. Historical parallel: Nvidia gaming products remained excellent while data center business eclipsed gaming in importance.

What timeline should organizations expect for realizing ROI on MSI enterprise deployments?

ROI timelines vary depending on use case and comparison baseline. Organizations replacing older systems typically see ROI within 18-24 months through performance improvements and reduced maintenance. Organizations standardizing across mixed vendors typically see ROI in 24-36 months through support consolidation and operational simplification. Organizations in regulated industries might require longer payback periods due to configuration complexity. Request customer references with similar ROI timelines for realistic expectations.

For teams building AI infrastructure, evaluating hardware platforms, or considering vendor diversification, MSI's CES 2026 announcements warrant serious consideration. The company clearly intends sustained enterprise commitment, backed by capital investment and organizational restructuring. Whether this pivot succeeds depends on execution over the next 3-5 years, but the strategic direction is unmistakable.

The technology vendor landscape is shifting. Companies like Runable demonstrate how platforms now combine hardware considerations with software-first workflows and AI-powered automation. Understanding these broader shifts helps organizations make smarter infrastructure choices.

MSI's enterprise transformation reflects larger pattern: hardware becomes commodity, but software, services, and ecosystem integration become competitive battlegrounds. Winners will be vendors that understand and execute on this evolution most effectively.

Key Takeaways

- MSI announced comprehensive enterprise and AI focus at CES 2026, representing deliberate strategic pivot from gaming-only positioning to dual-market vendor model.

- Enterprise products feature specialized hardware, support infrastructure, and ecosystem partnerships designed for AI workloads and business customer requirements at scale.

- The strategy mirrors successful transitions by companies like Nvidia, balancing gaming market leadership with enterprise growth that promises higher margins and sustained revenue.

- Geographic expansion prioritizes Asia, where AI development spending accelerates fastest, while building enterprise presence through partnerships in mature markets.

- Success depends on multi-year execution of support, training, and ecosystem integration commitments, transforming perception from gaming vendor to trusted enterprise provider.

Related Articles

- 3 Gigabyte CES 2026 Products That Actually Matter [2025]

- AI PCs Are Reshaping Enterprise Work: Here's What You Need to Know [2025]

- Lenovo's CES 2026 Lineup: Rollable Screens, AI Tools & Enterprise Devices [2025]

- Meta's Nuclear Energy Deal with TerraPower: The AI Power Crisis [2025]

- Samsung AI Chip Boom Drives Record $13.8B Profits [2025]

- DDR5 Memory Prices Could Hit $500 by 2026: What You Need to Know [2025]