Netflix's Big Theater Pledge: What Actually Changed

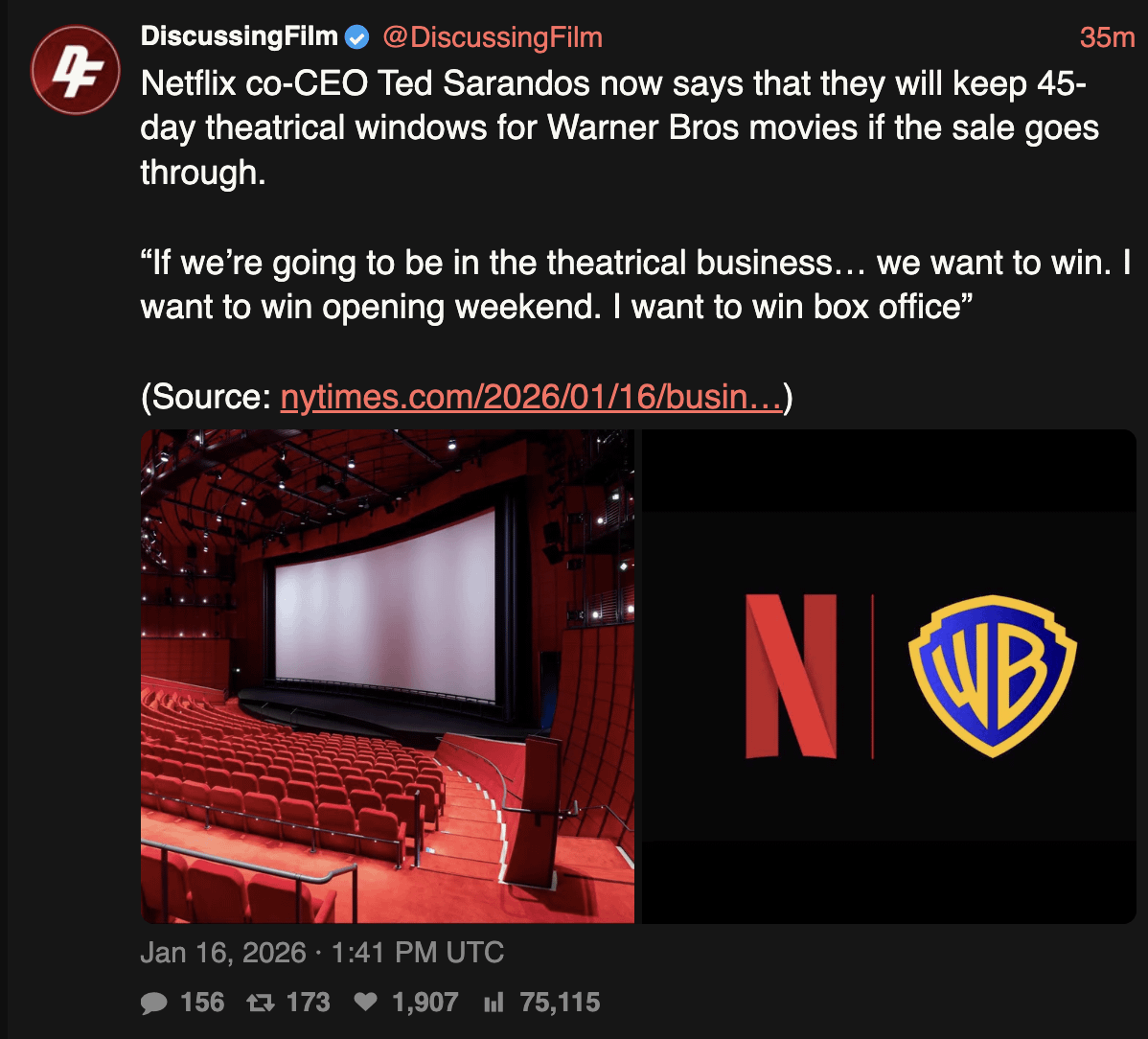

Ted Sarandos stood before reporters and made a promise that's been making theater chains nervous for years. Netflix, the streaming giant that's spent a decade disrupting Hollywood's traditional release calendar, would commit to 45-day theatrical windows for Warner Bros. Discovery films if the acquisition goes through. It sounds straightforward. It's not.

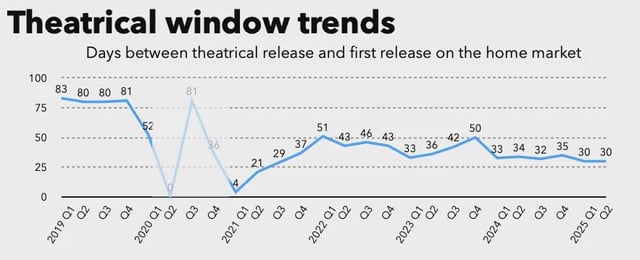

The math seems simple enough: 45 days in theaters, then it moves to Netflix. But here's what matters. This pledge arrives at a moment when movie theaters are already bleeding. The pandemic accelerated trends that were already happening. Streaming services were already shortening windows, day-and-date releases were becoming normal, and audiences were asking themselves the hard question: why go to a theater when a movie comes home in 30 days anyway?

Sarandos has been walking a tightrope. He needs to convince theater operators that Netflix isn't planning to kill them. He also needs to convince Wall Street that this acquisition makes business sense. Those two goals can actually contradict each other. And that's where this story gets interesting.

The commitment to 45 days is simultaneously a genuine concession and a carefully worded corporate statement. The specificity matters. "I'm giving you a hard number," Sarandos said in his New York Times interview. But numbers can be deceptive when the context shifts. Netflix isn't saying this applies to all releases. It's not saying the window applies to theatrical-exclusive releases versus streaming debuts. It's not saying what happens when Warner Bros. films underperform in theaters after 45 days.

Think about what Netflix actually controls. They control the marketing spend. They control the release dates. They control whether a film gets promoted as a theatrical event or as "coming to Netflix in 45 days." A movie that's positioned as temporary theater fodder before its real home on streaming is going to have a very different box office performance than one positioned as a major theatrical event.

The acquisition itself signals something powerful to audiences and investors alike. When a streaming giant acquires one of Hollywood's major studios, it sends a message: we don't see theaters as our future. We see them as our past. Even if Sarandos commits to 45 days, the underlying economics haven't changed. Netflix's profit model is subscription revenue, not box office receipts. The acquisition doesn't reverse that.

The Context Behind the 45-Day Window

The number 45 didn't come out of nowhere. Michael O'Leary, CEO of Cinema United, a theatrical trade association, had already been pushing for exactly this baseline. When major theater operators and trade groups are defending their existence, they don't ask for 60 days or 90 days anymore. They ask for 45. It's become the survival number.

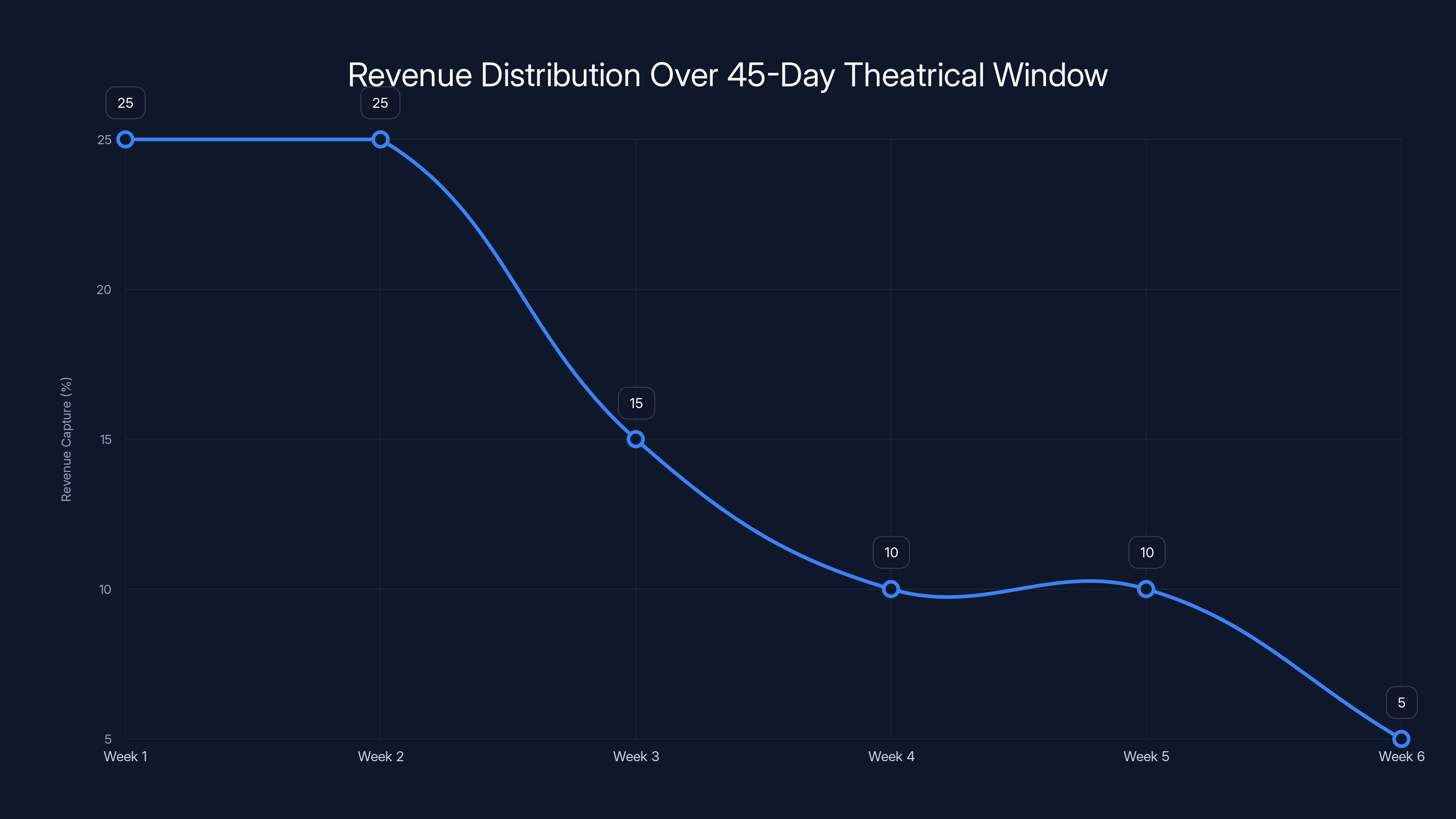

Why 45? The math is brutal. Movie theaters need roughly six to eight weeks to recoup their investment on a major release. Their revenue model depends on that window. The first two weeks capture 40-50% of a film's total theatrical revenue. The next two to three weeks capture another 20-30%. After 45 days, most theatrical grosses have already peaked. The question is whether those 45 days are enough to keep theaters financially healthy.

They probably aren't. Theater chains have been operating on razor-thin margins for years. The pandemic, streaming's acceleration, and changing audience habits have all compressed their economics. A 45-day window was never meant to be a lifeline. It was meant to be a baseline floor. The assumption was that studios would maintain much longer windows for major releases—90 days was once standard—and shorter windows like 45 days would only apply to lower-tier releases.

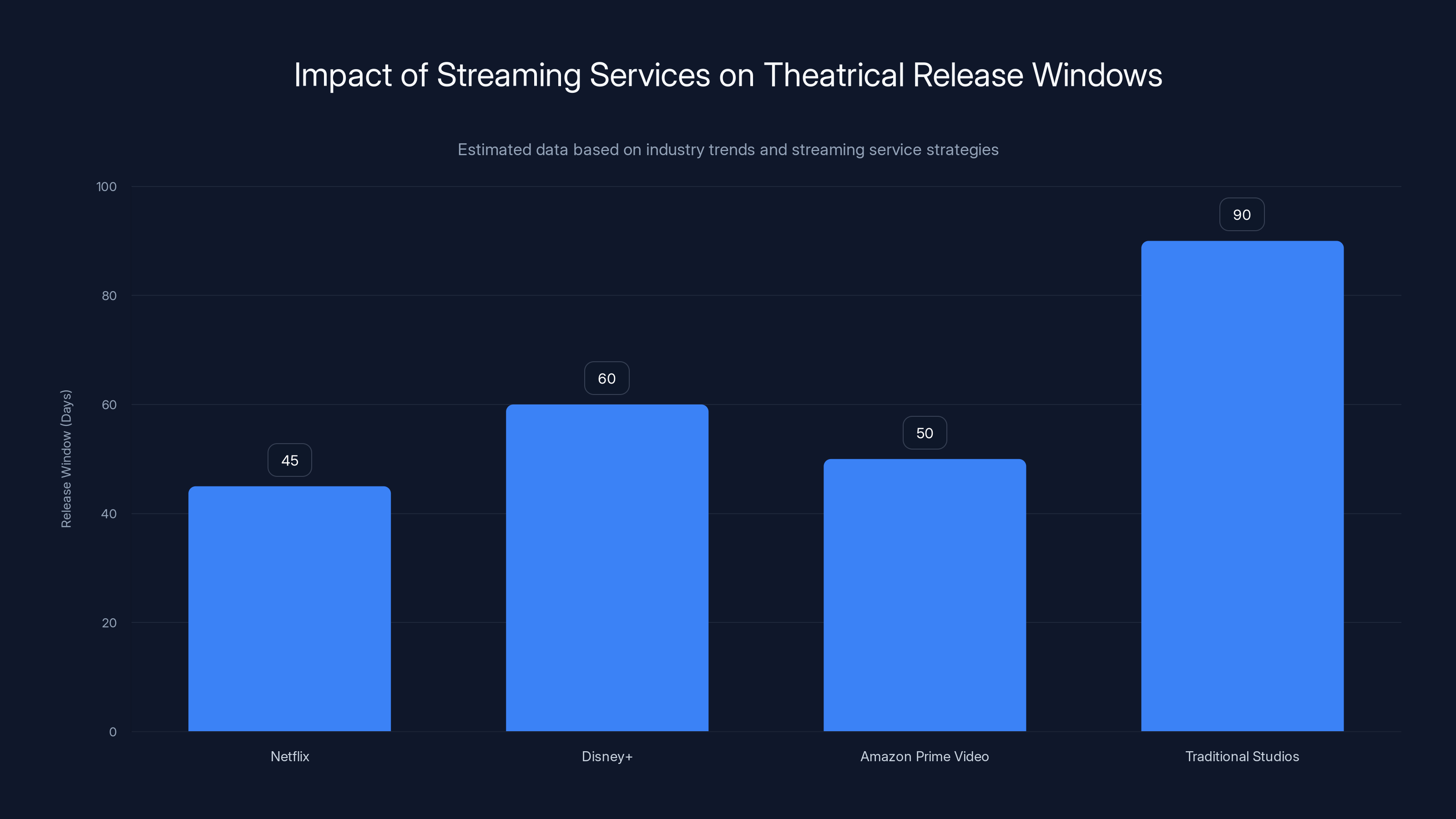

But here's the problem. If Netflix uses 45-day windows as their standard, every other studio will eventually feel pressure to match it. When one of the biggest content producers in the world normalizes shorter windows, the entire industry shifts. It's not that one film loses 45 days of exclusivity. It's that the entire theatrical window gets compressed across the board.

Sarandos says he wants to win opening weekends. That sounds great for theaters. More competition theoretically means bigger opening weekends. But Netflix has advantages that traditional studios don't. They have direct relationships with hundreds of millions of paying subscribers. They can market films through their own platform without spending the advertising dollars traditional studios need to spend. They control the narrative in a way other studios can't.

Consider the math. A traditional studio spends $50-100 million marketing a major film to get people into theaters. Netflix can notify 200 million subscribers with a notification. Which is more cost-effective? Which generates more opening weekend interest? The playing field looks level when you're talking about 45 days, but the economics underneath are completely different.

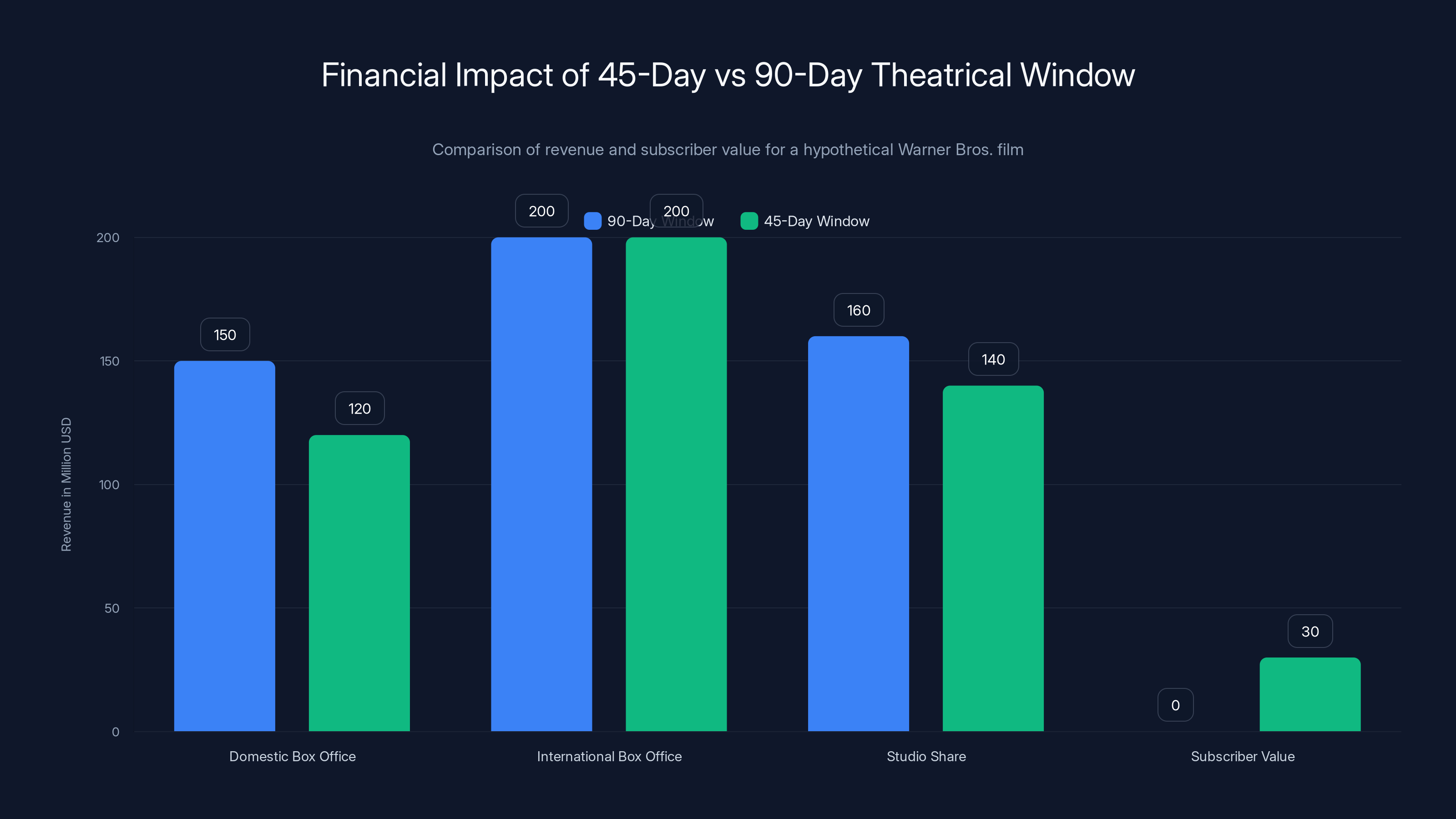

The 45-day window results in a 20% reduction in domestic box office revenue, but potential subscriber value from streaming may offset this loss. Estimated data.

Why Movie Theaters Are Actually Worried Despite the Promise

Theater operators read between the lines. They understand that a commitment to 45 days is better than no commitment at all. But they also understand what it doesn't say. It doesn't say Netflix won't acquire more studios. It doesn't say Netflix won't eventually consolidate its release strategy across all its theatrical releases, independent of where the content comes from. It doesn't address the fundamental issue: Netflix's business model doesn't require theatrical success.

Traditional studios have skin in the theatrical game. Universal makes money from box office receipts. Disney's theatrical division is a legitimate profit center. But Netflix's theatrical releases are loss leaders for their streaming service. They exist to provide content to their subscription base. If a Warner Bros. film makes

This creates a perverse incentive. Netflix will be motivated to market films in ways that emphasize their streaming arrival date. "This summer's biggest event... coming to Netflix in 45 days." That's not a marketing message designed to maximize box office. It's a marketing message designed to drive streaming sign-ups.

Theater owners remember what happened with other deals. When Amazon acquired MGM, people worried. When Apple started releasing films theatrically, people worried. But Netflix is different in scale. Netflix has the resources to fundamentally reshape how film distribution works. One studio using 45-day windows is one thing. Netflix using 45-day windows as their standard is another.

The worry isn't irrational. It's based on observable patterns. Streaming services have consistently shortened windows wherever they've gained leverage. Disney+ shortened windows for Disney content. Amazon Prime Video has done the same. The pattern is clear: streaming services use theatrical releases as a loss leader, create financial pressure on theaters, then over time, further compress windows and reduce theatrical exclusivity.

Sarandos says he was taken out of context when he called movie theaters "outmoded." But here's what context doesn't change: the underlying technological and economic forces. More people are comfortable watching films at home. More households have large screens and decent sound systems. More people have limited free time and prefer to consume content on their schedule. Theaters aren't outmoded because Sarandos said so. They're challenged because consumer behavior shifted.

The real question is whether a 45-day window changes that trajectory. Theater chains are betting it will. They're betting that this commitment, even with its caveats and limitations, is better than the alternative. But they're also preparing for the possibility that it doesn't work.

Estimated data shows that the first two weeks capture 50% of revenue, with diminishing returns in subsequent weeks. This highlights the importance of the initial 45-day window for theaters.

What the Acquisition Actually Changes About Hollywood's Release Calendar

The acquisition is significant because Warner Bros. Discovery isn't a small player. It's one of the so-called "Big Six" studios. The studio responsible for the DC Universe, the Harry Potter franchise, The Lord of the Rings films, and a massive catalog of library content. This isn't Netflix acquiring a mid-tier film distributor. It's Netflix acquiring a major pillar of traditional theatrical distribution.

Historically, Warner Bros. has been relatively protective of theatrical windows. They've invested heavily in large-format releases, IMAX partnerships, and theatrical marketing. The studio understood that its brand identity was tied to theatrical excellence. That philosophy is about to change.

Netflix's approach to release strategies is fundamentally different. They look at their complete content calendar as an ecosystem. Some content is designed for theaters. Some is designed for television. Some is designed for festivals and prestige. But it's all designed to serve Netflix's core business: subscriber growth and retention. The theatrical window isn't sacred. It's tactical.

This distinction matters enormously for how content gets made and positioned. When Warner Bros. Development executives make decisions, they've historically thought about theatrical potential first. After acquisition by Netflix, they'll think about how content serves Netflix's subscriber base. That doesn't mean no theatrical releases. It means theatrical releases become a tool for larger strategic goals.

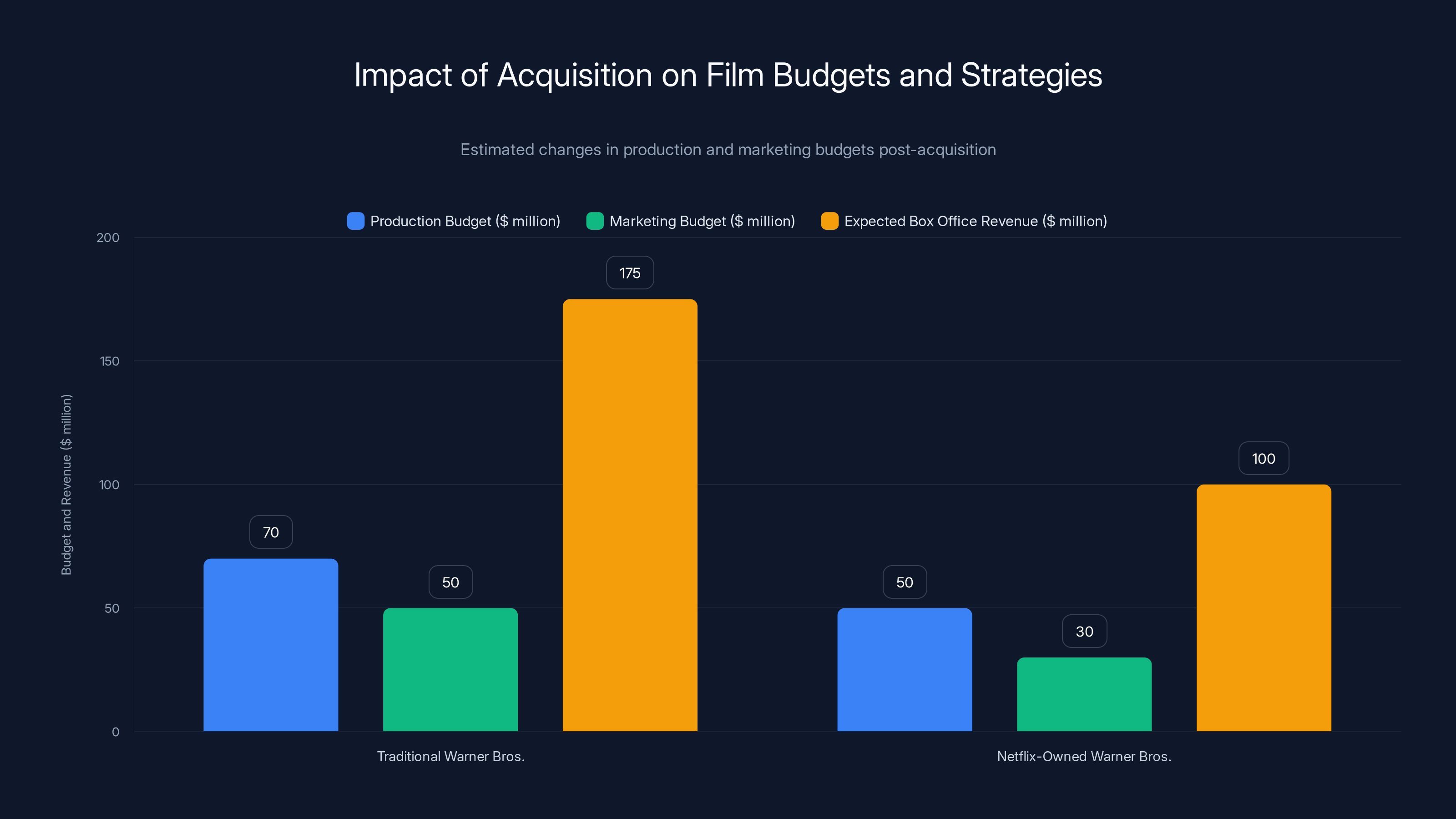

Consider the production and marketing implications. A Warner Bros. film under traditional studio leadership might get a

This cascades through the entire industry. If major studio films are increasingly being evaluated against streaming metrics rather than theatrical metrics, it changes greenlight decisions. It changes casting decisions. It changes where writers, directors, and producers focus their best work. The theatrical ecosystem doesn't just compete with streaming—it competes for creative resources within the same parent company.

Warner Bros.' film slate is enormous. The studio releases 15-20 films per year across all brands and imprints. That's a significant portion of Hollywood's total annual theatrical output. When those release decisions shift from theatrical-first to streaming-first, the entire industry feels it.

The 45-day window is Netflix saying: "We'll play the theatrical game, but on our terms and timeline." It's not a promise to maintain theatrical as a priority. It's a tactical move to manage regulators, theater operators, and legacy industry stakeholders while Netflix completes its transformation into vertically integrated entertainment company.

The Business Case for Netflix's Theatrical Commitment

Despite all the cynicism, there is a genuine business case for Netflix to commit to theatrical releases. It's not purely a PR move, though PR is certainly part of it. Understanding the actual strategy matters because it explains what Netflix will actually do versus what they're promising.

First, prestige. Theatrical releases get awards consideration that streaming releases don't—yet. Streaming films are increasingly winning major awards, but there's still a prestige advantage to theatrical releases. If Netflix wants to be seen as a major Hollywood player, not just a streaming service, theatrical releases help establish that credibility. The awards attention drives media coverage, which drives subscriber interest.

Second, windows into consumer behavior. Netflix learns enormous amounts from theatrical performance. Box office numbers, demographic breakdowns, opening weekend velocity, legs—all of this data tells Netflix which films resonate with which audiences. That intelligence feeds back into their content strategy. A theatrical release is partially a data collection exercise.

Third, marketing leverage. A theatrical release generates news, reviews, and cultural conversation that a streaming release doesn't. Critics take theatrical releases more seriously. Audiences discuss them differently. The theatrical window is worth something as a marketing tool, even if it's not the primary profit driver. Netflix can market a film theatrically, generate buzz, then transition it to streaming while awareness and interest are still high.

Fourth, content diversity. If Netflix wants to attract major talent and creative teams, the ability to make theatrical releases matters. Top-tier directors don't want to make streaming movies. Top-tier actors want theatrical vehicles. If Netflix restricts itself to streaming-only releases, it limits the talent pool it can access. Theatrical releases are partially about talent acquisition and retention.

Fifth, regulatory and political capital. Theater operators and exhibitors have political influence. Local governments care about theater preservation. If Netflix is aggressive about shuttering theatrical windows and destroying the theater business, it generates political opposition, potential antitrust scrutiny, and long-term brand damage. Committing to reasonable theatrical windows buys Netflix political peace.

These are all legitimate business reasons to maintain theatrical windows. None of them require Netflix to actually prioritize theatrical releases or view them as strategic profit centers. They can all be true while Netflix's underlying strategy remains focused on streaming subscriber growth.

Estimated data shows a shift in budget allocation and expected revenue under Netflix ownership, with reduced emphasis on theatrical box office performance.

How Other Streaming Services Have Handled Theatrical Release Windows

Netflix isn't inventing this playbook. Other streaming services have been navigating the theatrical space for years. Looking at how those deals have played out provides clues about how Netflix's acquisition will likely unfold.

Disney's approach is instructive. When Disney acquired Fox, they inherited Fox's theatrical slate. They also had their own theatrical division. Disney's solution has been relatively consistent: major releases get 90-day windows, mid-tier releases get 45-day windows, and lower-tier content goes straight to Disney+. The windows are real, but they're also tactical. Disney uses theatrical releases to drive Disney+ sign-ups and engagement.

Disney's 45-day window for mid-tier releases has compressed the theatrical marketplace. Exhibitors have had to adjust their business models accordingly. But Disney's financial performance has been strong, which suggests they've found the optimal balance between theatrical and streaming revenue.

Amazon's approach is less coordinated. After acquiring MGM, Amazon hasn't fully integrated the studio into its streaming strategy. MGM films still get traditional theatrical releases with longer windows. But Amazon has also released original content straight to Prime Video and experimented with simultaneous theatrical and streaming releases. There's less clear strategic positioning than Disney's approach.

Apple's theatrical ambitions have been modest. Apple releases select films theatrically, but primarily to drive press and prestige, not box office revenue. Apple's real ambition is getting people to subscribe to Apple TV+. Theatrical releases are a marketing channel, not a revenue stream.

Apple's restraint is interesting. Despite having vastly more financial resources than Netflix, Apple has chosen not to aggressively pursue theatrical dominance. That's partly because Apple doesn't see entertainment as core to their business. It's also because Apple understands that theatrical supremacy requires a different mindset and different economics than streaming supremacy.

Netflix's position is somewhere between Disney and Amazon. Netflix has the scale of Disney but the streaming-first focus of Amazon. Netflix also has less legacy theatrical infrastructure than either Disney or Amazon. When Disney acquired Fox, they acquired an existing theatrical distribution team. Netflix doesn't have that institutional knowledge and experience. They're building it as they go.

The pattern across all these deals is clear: streaming services acquire studios or theatrical assets, make initial commitments to preserve theatrical releases, then gradually shift emphasis toward streaming as market conditions allow. It's not conspiracy. It's just economics. Streaming companies generate revenue from subscriptions. Theatrical companies generate revenue from box office. When you combine both, you have incentive misalignment.

Netflix's 45-day commitment fits this pattern. It's stronger than Apple's approach and potentially weaker than Disney's, depending on how consistently Netflix enforces it. But the underlying direction of travel is the same: theatrical as a secondary consideration to streaming priorities.

The Mathematical Economics of a 45-Day Window

Let's run some actual numbers because the math tells a story that press releases don't. These numbers are approximate based on industry standards, but they illustrate the actual financial implications of a 45-day window versus longer theatrical runs.

Consider a hypothetical mid-tier Warner Bros. film with a

That film, under a 90-day window, might earn

But here's where the Netflix strategy enters. That same film, released on Netflix after 45 days, generates additional value through subscriber growth, improved retention, and long-term catalog value. How much is that worth? It depends on Netflix's subscriber lifetime value (LTV) calculation.

Netflix's average subscriber pays roughly

But that's a generous interpretation. It assumes the film drives significant subscriber movement, and it doesn't account for the cost of other content Netflix could have produced with that $60 million production budget.

The real math for Netflix looks like this: theatrical release = PR, data collection, talent attraction, and incremental subscriber movement. Expected value: $20-50 million in incremental subscriber value. Expected cost: some fraction of the theatrical marketing budget (Netflix can market internally). Expected benefit: all the non-monetary benefits of being perceived as a legitimate major studio player.

For theater operators, the math is different. A 45-day window means 45 days of potential revenue. If the film earns

The problem is volume. Theaters need multiple releases per year to stay profitable. If studios compress windows and reduce the number of theatrical releases, theaters can't make up the revenue shortfall with higher per-film earnings. It's a volume business, and Netflix's commitment to 45-day windows, even with strict enforcement, still represents less theatrical output than legacy studios provided.

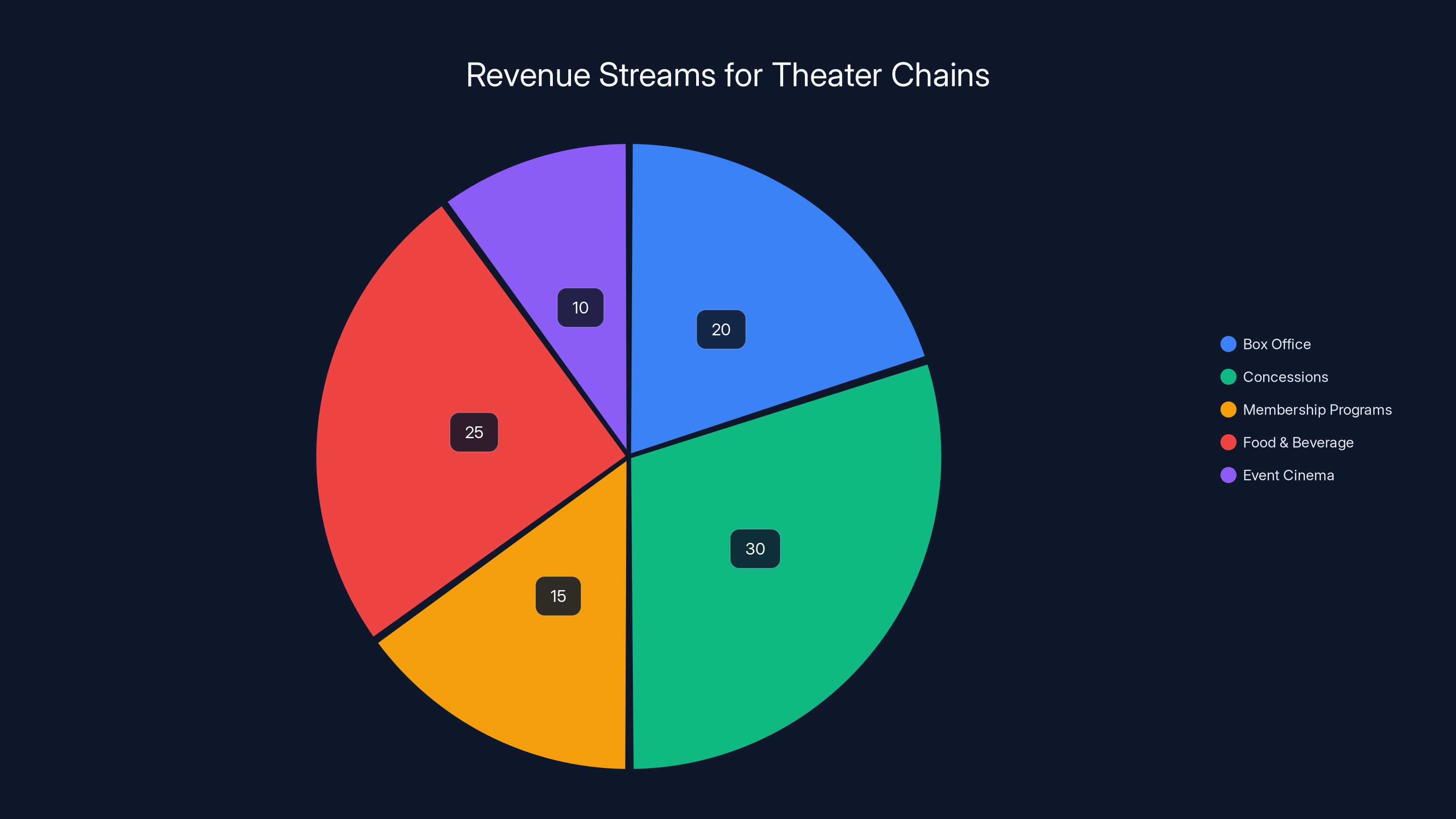

Estimated data shows that concessions and food & beverage sales are becoming significant revenue streams for theaters, highlighting their shift from traditional box office reliance.

What Happens to Non-Warner Bros. Films in the Streaming Wars

Here's the part that theater operators should really worry about: Netflix's 45-day commitment is specific to Warner Bros. Discovery content. It doesn't apply to Netflix's own original productions. It doesn't apply to acquisition strategy. It doesn't apply to third-party films Netflix might acquire and distribute.

Netflix has been buying distribution rights to third-party films for years. Some are theatrical releases, some are streaming-only. When Netflix acquires a film that already has a distribution deal, they often honor the existing theatrical windows. But when they acquire a film fresh, they make independent decisions about whether theatrical release makes sense.

This matters because it means Netflix has two different categories of films: Warner Bros. films (45-day window) and everything else (at Netflix's discretion). That creates a perverse incentive structure. Netflix's filmmaking teams, working on original productions or acquired content, know that if their film generates box office interest, it'll be limited to a 45-day window before streaming. Warner Bros. filmmaking teams, post-acquisition, will have the same reality imposed on them.

The effect is to make theatrical success less valuable as a strategic objective for Netflix's filmmaking teams. Why build a film designed to maximize opening weekend box office when you know it'll be on streaming 45 days later? It's better to build a film optimized for streaming, then use theatrical as a marketing tool.

When traditional studios make that decision—prioritize streaming over theatrical—they're making a deliberate choice about their creative strategy. When Netflix makes it, they're just being economically rational. Netflix's business model is built around streaming. It's not built around theatrical box office. The 45-day window is a concession to theater operators, not the foundation of Netflix's actual strategy.

This is where theater operators' real vulnerability emerges. It's not that Netflix will aggressively pull Warner Bros. films from theaters. It's that Netflix will gradually restructure how content is made, financed, and distributed in a way that prioritizes streaming. The 45-day window is real, but it's a symptom of a larger shift, not a solution to theater industry challenges.

The Regulatory Angle and Antitrust Concerns

The Netflix-Warner Bros. acquisition isn't just a business deal. It's also a regulatory question. The Federal Trade Commission has been scrutinizing tech company consolidation more carefully than in previous decades. An acquisition that effectively gives one company control of a major studio and a major streaming platform creates antitrust questions that regulators care about.

Sarandos' commitment to 45-day theatrical windows is partially a regulatory play. By demonstrating that Netflix will maintain commitments to theater operators and respect existing distribution norms, he's attempting to assuage regulatory concerns. The message is clear: "Netflix isn't trying to kill theatrical distribution. We're actually committing resources to support it."

But regulators are increasingly sophisticated about these commitments. They understand that voluntarily made commitments by companies are worth roughly what they're printed on. And they understand that market dynamics, not company promises, ultimately determine outcomes.

The real regulatory concern isn't whether Netflix breaks its 45-day commitment. It's whether Netflix, by controlling both production and distribution, can create advantages for its own content that disadvantage competitors. For example, Netflix could theoretically favor its own theatrical releases with better release dates, more aggressive marketing, or better theater placements. That's a competition issue that goes beyond just window length.

Regulators are also concerned about Netflix's relationship with theater operators post-acquisition. Will Netflix, as a company that owns both a streaming service and a major studio, negotiate theatrical terms in a way that favors its streaming service? Will Netflix use its dual leverage to extract better terms than competitors? Will Netflix gradually shift its content strategy in ways that make theatrical less viable for everyone?

These aren't novel concerns. The FTC blocked AT&T's acquisition of T-Mobile years ago partly because of concerns about how vertical integration would affect competition. The Netflix-Warner Bros. deal creates similar questions, just in entertainment rather than telecommunications.

Sarandos' commitment to 45-day windows helps Netflix's regulatory case. It shows good faith. It shows Netflix isn't planning immediate changes. It buys Netflix time to complete the acquisition. But it doesn't fundamentally address the underlying regulatory concern about vertical integration and market power.

Streaming services like Netflix have shortened theatrical release windows to around 45 days, impacting traditional theater revenue models. Estimated data.

What Theater Owners Are Actually Doing in Response

Theater chains aren't just sitting around hoping Netflix keeps its promise. They're actively adapting their business strategies to account for shorter windows and streaming competition. The 45-day window is one signal, but it's not the only factor shaping theater economics.

First, theater operators are diversifying revenue beyond box office. Concessions revenue has always been important, but operators are now emphasizing it more than ever. Premium concessions, subscription services like Alamo Drafthouse's membership programs, and food-and-beverage revenue are growing segments. If each ticket only generates

Second, theaters are investing in experience differentiation. IMAX screens, Dolby Cinema, premium large format, luxury recliners, alcohol service, and event cinema (live performances, sporting events, concerts) are all ways theaters are trying to create experiences that viewers can't replicate at home. The question is whether these investments can offset box office pressure created by shorter windows.

Third, theater operators are consolidating. Smaller chains are struggling more than larger chains because they lack the resources to invest in upgrades and diverse revenue streams. We've seen significant consolidation in the theater industry over the past five years. That trend will likely accelerate if windows continue to compress.

Fourth, theaters are negotiating more aggressively. When studios committed to 45-day windows, theater operators celebrated. But they're also negotiating harder on other terms. Better release date placement, percentage splits, exclusive content, and commitments to larger marketing spend are all part of the negotiation now.

Fifth, theaters are exploring alternative distribution models. Some theaters are experimenting with day-and-date releases (theatrical and streaming simultaneously) in exchange for higher revenue share. Others are negotiating exclusive output deals. Some are exploring relationships with streamers as alternative content sources.

The underlying reality is that theater operators understand the structural economic challenge they face. The 45-day window isn't a solution. It's a modest improvement to a deteriorating situation. They're adapting accordingly by building more diversified business models.

The question is whether these adaptations will be enough. Theater operations are capital-intensive. A theater screen that used to be occupied by theatrical films 300 days per year that generate

The Broader Implications for Hollywood's Production Ecosystem

The Netflix-Warner Bros. deal, and particularly the 45-day commitment, signals something important about how Hollywood is restructuring. We're witnessing a transition from a theatrical-distribution-first model to a streaming-distribution-first model. The transition isn't abrupt, but it's structural.

This reshapes which projects get greenlit, how they're financed, and what talent wants to work on them. Consider a screenwriter developing a project. Traditionally, they'd think about theatrical potential. Is this story suited for a 100-minute theatrical release? Will it have theatrical legs? The writing would reflect theatrical thinking.

Now, that same screenwriter needs to think about streaming potential. Does this story work as a 120-minute streaming film? Will people stop scrolling through the interface to watch it? Will they finish it in one sitting? The writing changes to accommodate streaming's different consumption patterns.

The same shift applies to directing, cinematography, editing, and every other creative decision. Theatrical and streaming both require filmmaking excellence, but they require different kinds of excellence. Theatrical rewards spectacle, visual scope, and large-format cinematography. Streaming rewards intimacy, accessible storytelling, and edits optimized for smaller screens.

When Netflix owns a major studio, it has incentive to gradually shift the studio's creative output toward streaming-optimized content. That doesn't mean no theatrical releases, but it means the proportion of theatrical-optimized content shrinks over time.

This creates challenges for talent that wants to work in theatrical film. Directors who dream of making theatrical blockbusters find fewer opportunities at major studios. If theatrical is becoming a secondary release option rather than a primary creative ambition, the talent ecosystem shifts. The best talent gravitates toward the companies that still prioritize theatrical—which might be fewer than there are today.

Netflix isn't trying to destroy theatrical film. Netflix is just optimizing for Netflix's business model. Unfortunately, that optimization is fundamentally different from theatrical optimization. The two can coexist, but theatrical isn't the default anymore. It's the option.

This matters for the entire entertainment industry because film schools, talent development, and creative pipelines are all shaped by where opportunities exist. When Netflix becomes a major player in theatrical distribution but doesn't actually care about theatrical success, it cascades through the entire ecosystem.

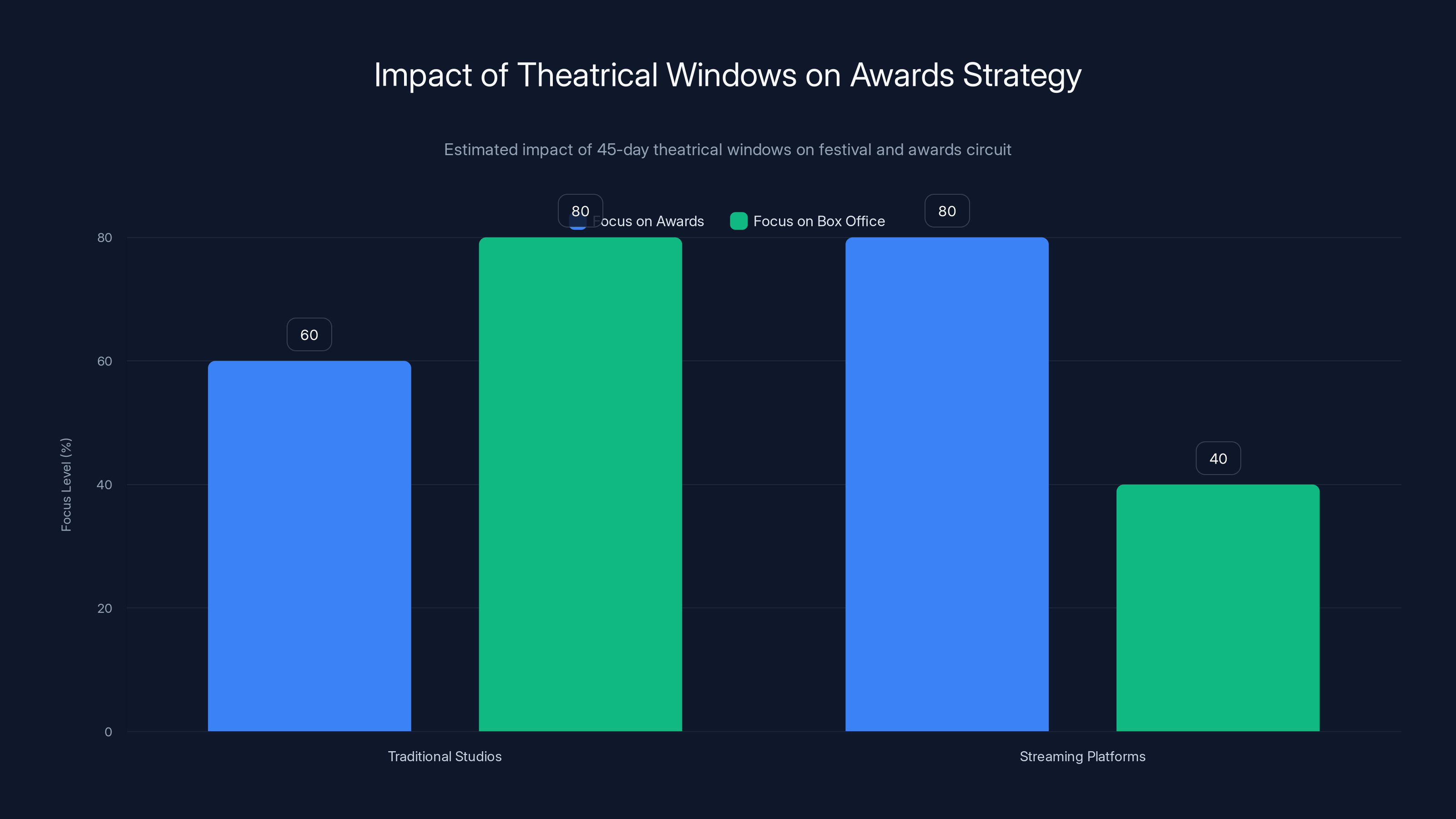

Streaming platforms like Netflix prioritize awards over box office revenue, with an estimated 80% focus on awards compared to 60% for traditional studios. Estimated data.

The Consumer Impact: What Audiences Should Expect

From a viewer's perspective, the 45-day theatrical window might not mean much. If you prefer watching films at home, 45 days is a short wait. You'll get the film on Netflix roughly six weeks after theatrical release. If you prefer theatrical experiences, 45 days is long enough that you'll have plenty of opportunities to catch films in theaters.

But the bigger picture matters for consumers too. If theatrical margins compress too much and theaters close, suddenly you lose the option to see films theatrically. And some films genuinely are meant for theatrical experiences. Action movies, horror films, animated features, and prestige dramas often create meaningful experiences in theaters that home viewing can't replicate.

The question is whether enough theater capacity will survive to deliver those experiences. Right now, theaters are viable because they service a broad audience. If theatrical becomes a niche distribution channel only for major tentpoles, smaller cities might lose theaters entirely. You'd need to travel to major metropolitan areas to catch most theatrical releases.

Consumers also lose choice when theatrical options disappear. Right now, if you want to watch a new theatrical release, you can do so. In 45 days, you can watch it on Netflix. You have choices. If theatrical shrinks too much, you lose the theatrical option. Your choice set shrinks.

The 45-day window is actually pro-consumer in that way. It preserves consumer choice. It lets people who care about theatrical experiences access them, while also ensuring that people who prefer streaming get quick access. The problem is that this balance only works if enough theatrical infrastructure survives to make the choice meaningful.

The International Dimension and Market Variations

The 45-day theatrical window is a commitment Netflix made for domestic releases. But Netflix's international strategy is more complex. Different markets have different theatrical ecosystems, different regulatory environments, and different streaming penetration rates.

In international markets where streaming penetration is lower and theatrical remains the primary distribution channel, Netflix might need to commit to longer windows than 45 days. Markets like India, Nigeria, and much of Southeast Asia still rely primarily on theatrical distribution. Streamers can't dominate those markets the way they do in North America.

In contrast, in markets where streaming is already dominant—parts of Scandinavia, for example—the 45-day window might be longer than market conditions justify. Netflix could probably move content to streaming faster and face minimal market resistance.

This creates a complex implementation challenge. Netflix needs to enforce consistent promises to Hollywood regulators and theater operators. But Netflix also needs to optimize for different market conditions globally. That tension will need to be resolved over time.

The international angle also matters for theatrical economics. Warner Bros. generates more international box office revenue than domestic box office for many of its films. If Netflix reduces international theatrical windows or deprioritizes international theatrical releases, it could significantly impact global box office.

International film industries also rely on timely access to theatrical content. If Warner Bros. delays international releases to coordinate with Netflix's platform roadmap, it could disrupt markets that already depend on theatrical as a primary distribution channel.

Netflix hasn't fully worked through these international implications. The 45-day domestic commitment is clear. The international commitment is less so. How this plays out will tell us a lot about whether Netflix genuinely cares about theatrical distribution or whether the 45-day window is primarily a domestic PR move.

The Festival and Awards Circuit Implications

One consequence of shorter theatrical windows that doesn't get discussed much is the impact on festivals and awards season. Traditionally, films need theatrical runs to qualify for major awards. The Academy Awards require at least seven consecutive days of theatrical exhibition in a major market. The Golden Globes, BAFTA, and other major awards have similar requirements.

Short windows complicate festival strategy. A film needs enough time to do festival runs (Sundance, Berlin, Cannes, Venice, Toronto, etc.), then theatrical release, and still have time to qualify for awards before year-end eligibility deadlines. With 45-day windows, that timeline gets tight.

Netflix has been pushing to change awards eligibility rules to allow streaming-exclusive films to compete. They've had some success with that push. But traditional theatrical releases still get preferential treatment in awards voting because voter perception is that theatrical releases represent higher quality or greater artistic ambition.

The 45-day window is long enough to accommodate festival strategy and awards qualification. But it's tight enough that studios have to plan carefully. This matters because awards attention drives subscriber interest on streaming. A Best Picture winner can generate massive subscriber interest when it arrives on Netflix.

Netflix is willing to make sacrifices at the box office to win awards. Awards generate prestige and subscriber interest. The math works for Netflix. For traditional studios, box office and awards were aligned. For Netflix, they're potentially misaligned. Awards are more valuable to Netflix than box office revenue.

This reshapes incentives throughout the industry. If Netflix is willing to sacrifice $50 million in box office revenue to win a Golden Globe, that's economically rational for Netflix. But it shifts what kind of films get made and how they're positioned. Prestige over blockbuster. Art over commerce. That's a meaningful cultural shift if Netflix really does pursue it systematically.

Honest Assessment: Why the Promise Might Actually Stick

All the cynicism about Netflix's 45-day commitment is justified. The economic incentives are real. The potential for Netflix to change its mind later is real. But there are also genuine reasons Netflix might actually maintain the commitment.

First, litigation risk. If Netflix violates a public commitment to theater operators, it opens itself up to contract disputes and potential antitrust litigation. The cost of violating the commitment could exceed the benefit of shortening windows. Netflix is sophisticated enough to understand that calculation.

Second, talent relationships. If Netflix becomes known as a studio that publicly commits to things and then quietly changes them, it damages relationships with filmmakers who care about theatrical releases. Top-tier talent might avoid Netflix projects if they believe their work will be deprioritized for streaming. Netflix wants to be seen as a serious studio partner, not just a streamer that occasionally does theatrical releases.

Third, regulatory environment. The FTC is watching this acquisition carefully. If Netflix violates publicly made commitments to theater operators, it signals bad faith to regulators. That could impact future regulatory approvals or acquisitions. Netflix probably wants a clean track record.

Fourth, competitive dynamics. If Netflix shortens windows aggressively, other studios will accelerate their own streaming efforts or compress windows further. Netflix might be better served by maintaining something approaching industry norms rather than being the aggressive disruptor.

Fifth, consumer expectations. If Netflix trains audiences to expect 45-day windows, shortening those windows creates consumer backlash. People adjust their behavior based on expected timing. Netflix wants predictable behavior, not surprises.

These aren't sentimental reasons. They're economic reasons. Netflix might actually keep its 45-day commitment not because Sarandos cares about theaters, but because the cost of breaking it exceeds the benefit.

That said, we should pay attention to edge cases. How does Netflix handle films that underperform in theaters? Films that have different release dates in different markets? Films acquired from third parties? The 45-day commitment might hold for Warner Bros. major releases while shortening at the margins through creative implementation.

Looking Ahead: What Happens Next

The next two to three years will be crucial for determining what the 45-day commitment actually means. We need to watch several things.

First, how many Warner Bros. films actually get theatrical releases? Netflix might honor 45-day windows for films that get theatrical releases, while shifting more films to streaming-only. That would technically honor the commitment while reducing theatrical volume.

Second, how are theatrical releases marketed? Are they positioned as theatrical events or as "coming to Netflix in 45 days"? Marketing positioning matters enormously for box office outcomes.

Third, how does Netflix handle international release timing? Does the 45-day window apply globally or just domestically? International variation in the commitment would reveal whether Netflix views it as substantive or symbolic.

Fourth, what changes does Netflix make to Warner Bros.' production slate? Do they continue financing mid-tier theatrical releases, or do they shift toward larger tentpoles and streaming-exclusive content?

Fifth, how do theater operators respond? Will they accept 45-day windows as the new norm, or will they use this as a transition period to restructure their business around non-theatrical revenue?

These questions will be answered over the next couple of years. The 45-day commitment is one signal. The actual choices Netflix makes across these dimensions will tell the real story about Netflix's commitment to theatrical distribution.

Frequently Asked Questions

What is a theatrical release window?

A theatrical release window is the exclusive period of time during which a film is available only in movie theaters before becoming available through other distribution channels like streaming, home video, or cable television. Traditional theatrical release windows in Hollywood have historically ranged from 60 to 120 days, depending on the film's expected performance and studio strategy. The window is negotiated between studios and theater chains and is central to how the film industry's financial model works.

Why did Netflix commit specifically to 45 days?

Netflix committed to 45 days because that's the number the theatrical industry had already identified as their minimum viable window. Cinema United and other theater trade associations had been advocating for exactly 45 days as a new baseline standard needed for theater industry survival. By committing to this specific number, Netflix was essentially matching what the industry had already determined was necessary, rather than proposing something more aggressive.

Does the 45-day window apply to all Warner Bros. films or just theatrical releases?

Netflix's public commitment has been to Warner Bros. theatrical releases. The language hasn't explicitly addressed whether all future Warner Bros. content will get theatrical releases or whether some content will go directly to streaming. This ambiguity is actually important because it means Netflix could theoretically honor the 45-day commitment while reducing the absolute number of films that get theatrical releases at all.

How does this commitment affect consumers?

For consumers, the 45-day window creates a clear window of opportunity. If you want to watch a new Warner Bros. film in theaters, you'll have 45 days to do so. If you prefer to watch it at home, you'll know it arrives on Netflix roughly six weeks after theatrical release. This choice is actually valuable for consumers who have different preferences about how they consume entertainment.

Could Netflix shorten the window later, or is it locked in?

Technically, Netflix could change its policy in the future, but there are significant costs to doing so. Violating a public commitment would damage Netflix's relationships with theater operators, filmmakers, and regulators. It would also signal bad faith to the FTC, which is already scrutinizing the acquisition. While no commitment is permanently locked in, the economic incentives actually align with Netflix maintaining it.

What does this mean for other studios and theatrical release windows in general?

If Netflix maintains the 45-day window with consistency, it effectively becomes a new industry baseline. Other studios would face pressure to match it or risk being seen as less collaborative with theater operators. This represents a significant compression from the traditional 90-120 day windows studios maintained before streaming became dominant. The theatrical industry hopes 45 days becomes the floor, not the ceiling.

Why didn't Netflix commit to longer windows if they say they support theaters?

Longer windows would cut into Netflix's ability to capitalize on theatrical buzz and transition content to streaming while audience interest remains high. It's also a balancing act between supporting theaters and optimizing for Netflix's streaming business model. Netflix is essentially offering theater operators what the industry determined was necessary for survival, not more than that.

Could theatrical windows continue to compress even with this commitment?

Absolutely. This commitment applies to Warner Bros. films specifically. Netflix's own original releases, acquired third-party films, and future acquisitions aren't bound by the same commitment. Additionally, how Netflix implements the 45-day window in terms of marketing, release date placement, and strategic prioritization could affect theatrical outcomes even with windows technically honored.

What happens if a film underperforms at the box office during its 45-day window?

Netflix's commitment doesn't specify whether underperforming films must complete the full 45 days or whether Netflix could move them to streaming earlier if theatrical performance is weak. This is a notable gap in the commitment that could be exploited as a loophole, or it could reflect that the parties believe most films will have sufficient demand to justify the full window.

Is the 45-day window enough to save the theatrical industry?

No. The 45-day window is necessary but not sufficient. Theater operators also need consistent volume of quality releases, ticket price stability, and diversified revenue streams beyond box office. The window provides a foundation, but theaters must build sustainable business models around it. Many theater chains are investing in concessions, alternative content, and premium experiences as additional survival strategies.

The Bottom Line

Ted Sarandos' promise of 45-day theatrical windows is a genuine commitment, but it's more measured than it sounds. Netflix isn't saying it will prioritize theatrical distribution. It's saying it will honor a standard that the theatrical industry had already determined was minimally necessary for survival. Those are very different things.

The 45-day window will likely stick because Netflix's economic interests align with honoring it. Breaking the commitment would be costly in terms of talent relationships, regulatory approval, and competitive positioning. But honoring the window doesn't require Netflix to revolutionize how it approaches theatrical distribution or to view theaters as anything other than a marketing channel for its streaming service.

What really matters now is what happens at the margins. How many Warner Bros. films actually get theatrical releases versus streaming-only releases? How are those releases marketed? How does international strategy vary? How does Netflix handle films that underperform theatrically? The answers to these questions will determine whether the 45-day window represents genuine support for theatrical distribution or clever theater-operator-management.

For theater operators, the 45-day commitment is better than nothing. For filmmakers who care about theatrical experiences, it creates a protected window where theatrical releases can occur. For audiences, it preserves the choice to see films in theaters if they want to. But for the theatrical industry long-term, the real challenge isn't the length of the window. It's whether sufficient theatrical infrastructure survives once Netflix is controlling a major production and distribution pipeline.

The 45-day window will likely hold. But what happens in the remaining 320 days of the year might matter far more.

Key Takeaways

- Netflix committed to 45-day theatrical windows for Warner Bros. films, matching the theatrical industry's minimum viable baseline rather than offering something more generous

- The 45-day window will likely stick due to economic incentives: litigation risk, talent relationships, regulatory scrutiny, and competitive positioning make breaking the promise costly for Netflix

- The real question isn't whether Netflix honors 45 days but how they implement it: marketing positioning, film slate changes, and international variation could reduce impact even with window respected

- Theater operators view the commitment as necessary but insufficient for long-term survival—they're simultaneously investing in concessions, premium experiences, and alternative revenue streams

- Netflix's acquisition of Warner Bros. signals a structural shift from theatrical-first to streaming-first content strategy, with theatrical windows preserved as tactical but not strategic elements

Related Articles

- Netflix's 45-Day Theater Window: What It Means for WBD [2025]

- Why Stranger Things Finale in Theaters Proved Streaming's Missing Piece [2025]

- Netflix's $82B Warner Bros Deal: What It Means for Movie Theaters [2025]

- Netflix's Sony Deal: Zelda Movie, $7B Investment & Global Streaming Rights [2025]

- Game of Thrones: Knight of the Seven Kingdoms Almost Became a Film [2025]

- 2026 BAFTA Film Awards Longlist: What Netflix's Absence Reveals [2025]

![Netflix's 45-Day Theatrical Window: What It Means for Cinema [2025]](https://tryrunable.com/blog/netflix-s-45-day-theatrical-window-what-it-means-for-cinema-/image-1-1768588920549.jpg)