Netflix's $82.7B Warner Bros. Acquisition: The Historic Megadeal That Changes Everything [2025]

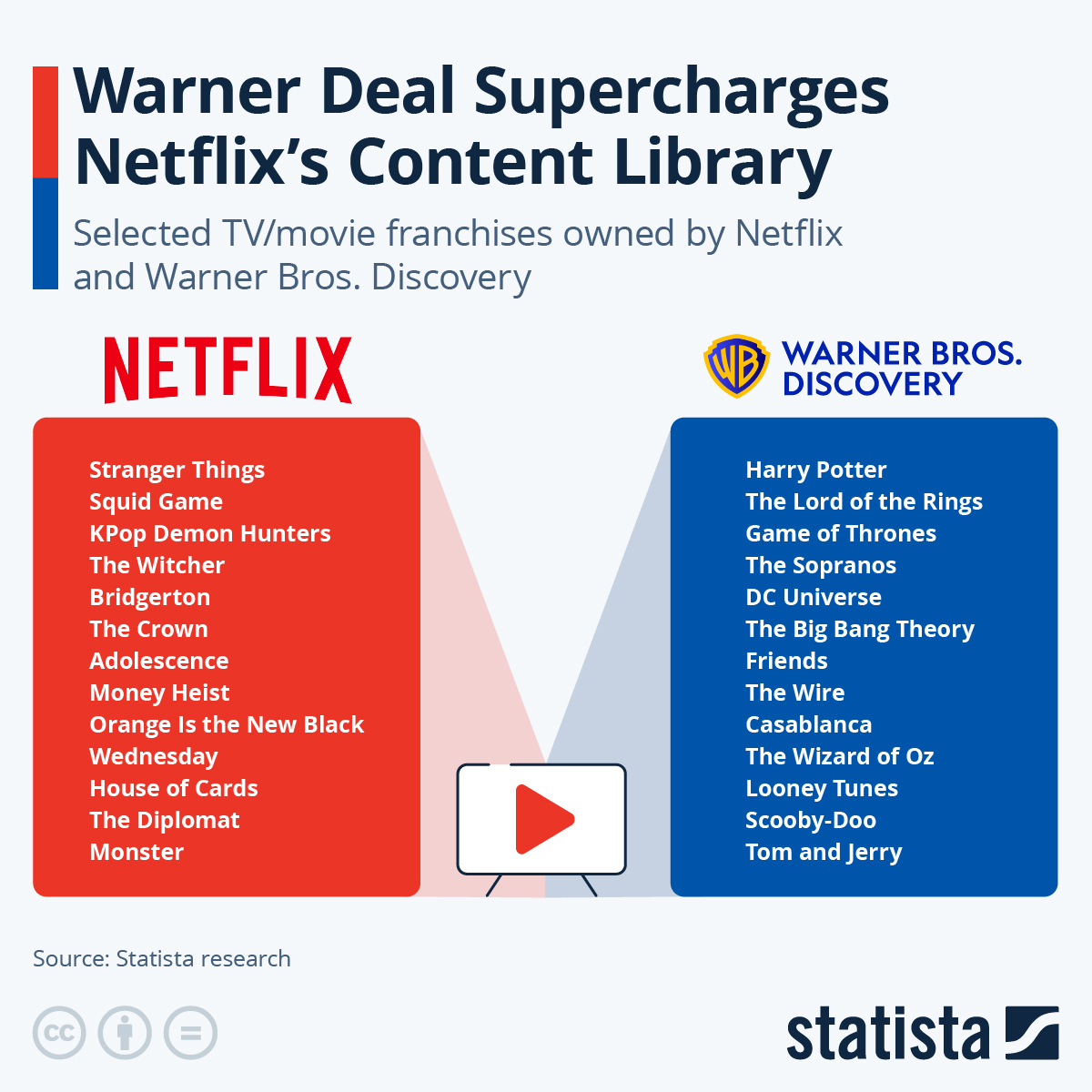

Let's be honest: the entertainment industry just witnessed something genuinely unprecedented. In early December 2024, Netflix announced it was acquiring Warner Bros.' film and television studios, HBO, HBO Max, and a massive collection of legendary franchises all for roughly $82.7 billion. Game of Thrones. Harry Potter. The entire DC Comics library. James Bond. The Matrix. All of it heading under one roof.

If you thought streaming wars were intense before, buckle up. This deal doesn't just reshape the entertainment landscape—it fundamentally rewrites the rules for how content gets made, distributed, and monetized.

I've spent the last few weeks digging through regulatory filings, industry analysis, and expert commentary to understand exactly what's happening, why it matters, and what comes next. The reality is more complex and consequential than the headlines suggest.

TL; DR

- The Deal: Netflix is acquiring Warner Bros.' studios, HBO, and streaming assets for $82.7 billion in an all-cash transaction

- What's Included: Over 125 years of content including Game of Thrones, Harry Potter, DC Comics, James Bond, and thousands of films and shows

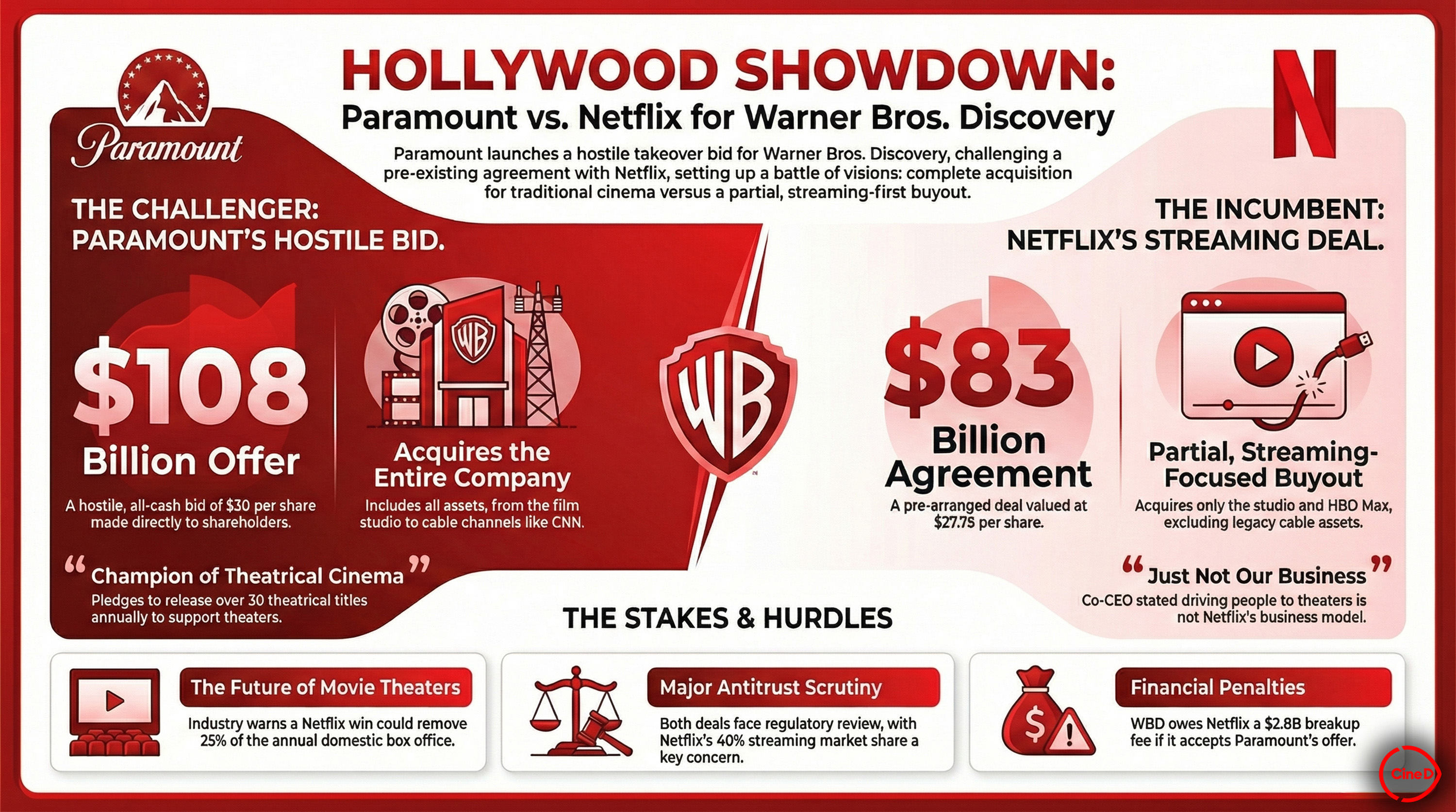

- The Competition: Paramount's $108 billion bid was rejected due to concerns about debt load and financial risk as reported by Reuters

- Regulatory Challenges: Intense antitrust scrutiny from lawmakers including Senators Warren, Sanders, and Blumenthal according to Bloomberg Law

- Timeline: Expected to close in 2025 pending regulatory approval, with a $5.8 billion breakup fee if blocked

- What Changes: Potential job consolidation, theatrical release window compression, and fundamental shifts in how Hollywood operates

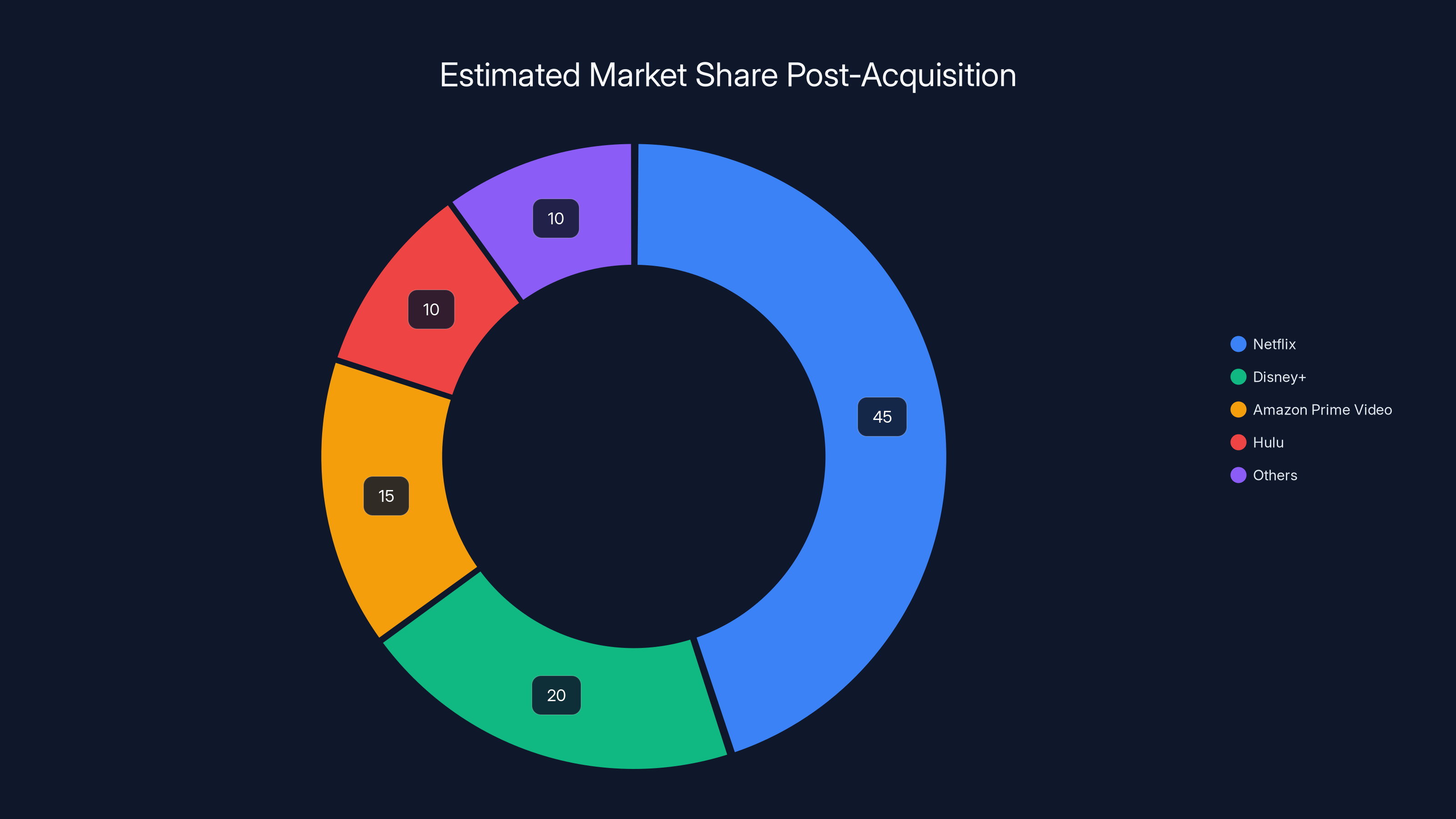

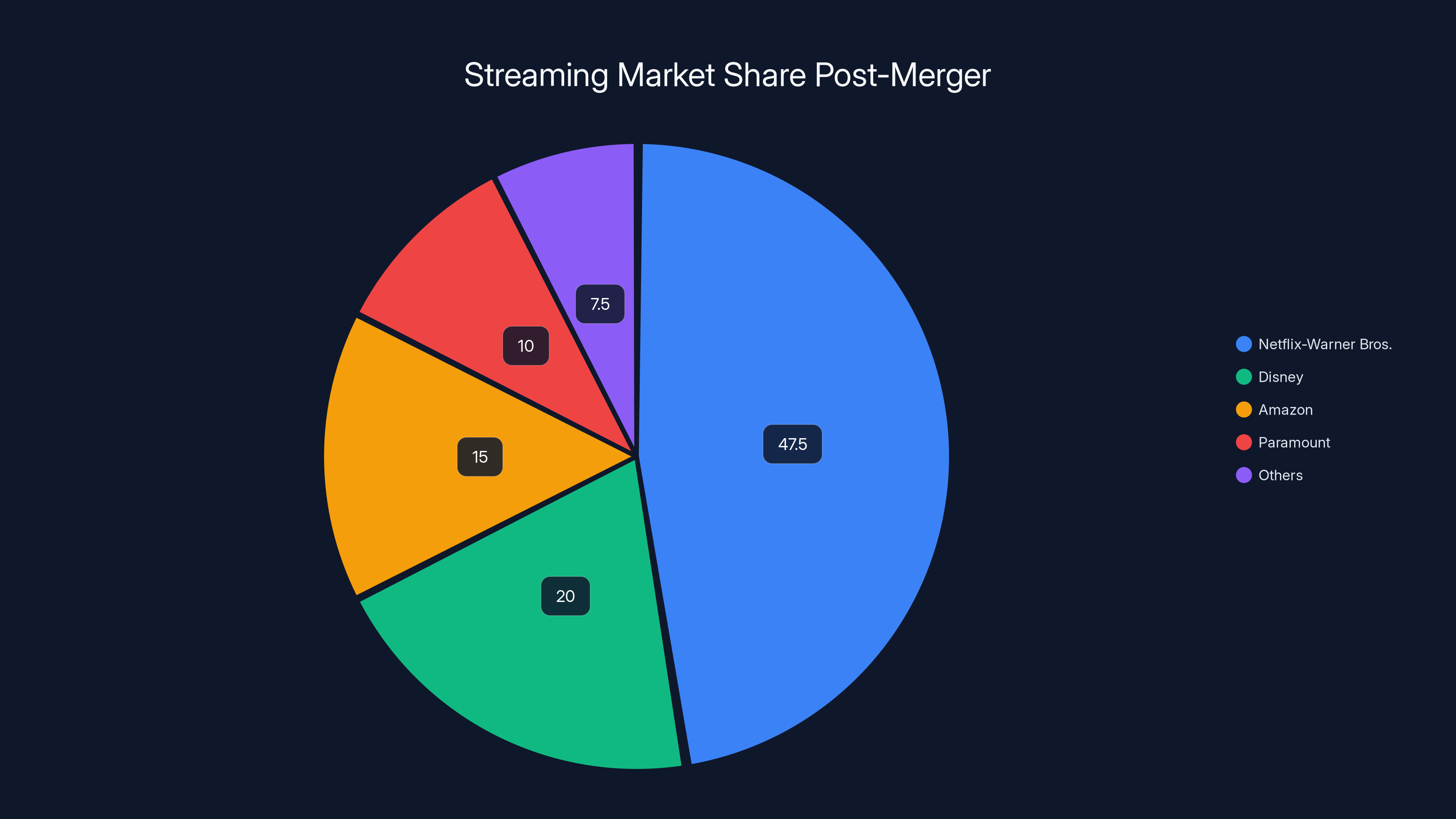

Estimated data suggests Netflix could control 45% of the streaming market post-acquisition, raising regulatory concerns about market dominance.

How We Got Here: The Financial Crisis That Started Everything

Warner Bros. Discovery didn't wake up in October 2024 thinking "let's sell the company." The path to this moment was paved with years of financial struggles, strategic missteps, and a rapidly changing media landscape that left the company gasping for air.

WBD inherited a toxic combination of problems. First, the company carried approximately $55 billion in debt following its merger with Discovery Network. That's not a typo. Fifty-five billion. Add streaming losses, declining cable revenue, and you've got a company hemorrhaging money faster than it could stabilize.

The numbers tell the story. In 2023 alone, WBD lost roughly $10 billion in operating profit compared to 2022. HBO Max—supposed to be the future—was burning cash while chasing growth. Cable networks that once generated reliable profits were watching viewership collapse as cord-cutting accelerated. The company faced an existential question: keep bleeding or make a drastic move.

By mid-2024, WBD's leadership realized they had three options: break apart the company piece by piece, find a strategic buyer, or continue drowning. Breaking up seemed inevitable anyway. The board explored options and discovered something remarkable—several major players were quietly interested in acquiring the entertainment crown jewel.

That unsolicited interest triggered the formal sale process in October. And that's when things got wild.

The Bidding War: How Netflix Outmaneuvered Paramount

When the news broke that WBD was exploring a sale, the industry held its breath. Three serious contenders emerged almost immediately: Netflix, Paramount, and Comcast. Each player saw different value in the assets, and each brought different strategies.

Paramount came in swinging hard. The company offered roughly $108 billion in an all-cash deal to acquire the entire WBD entity. On the surface, it looked dominant. Paramount's bid valued the company at a premium, signaling confidence and financial capability. But here's where the story gets interesting.

The board's decision wasn't purely about the dollar amount. They looked at the total package. Paramount's offer included debt assumption—the combined company would carry approximately $87 billion in total debt. That structure terrified the board. They'd be trading one debt crisis for potentially two. The financial risk profile was untenable.

Netflix's approach was entirely different. The streaming giant focused exclusively on acquiring the entertainment assets—the studios, the content, the streaming services, the intellectual property. Netflix wasn't interested in Paramount's television network operations or corporate overhead. More importantly, Netflix offered a cleaner financial structure. An all-cash offer at $27.75 per share for specific assets meant WBD could emerge from bankruptcy-like circumstances into a more manageable situation as detailed by Reuters.

Paramount wasn't ready to accept defeat. The company kept pushing, kept bidding, kept trying different angles. But the board kept rejecting each proposal, citing debt concerns and financial risk. This went on for months. By January 2025, it became clear Netflix had won.

Paramount's response? They filed a lawsuit demanding more information about Netflix's deal and continued publicly arguing their offer was superior. The legal fight continues, though most observers see it as more desperate than strategic according to ABC News.

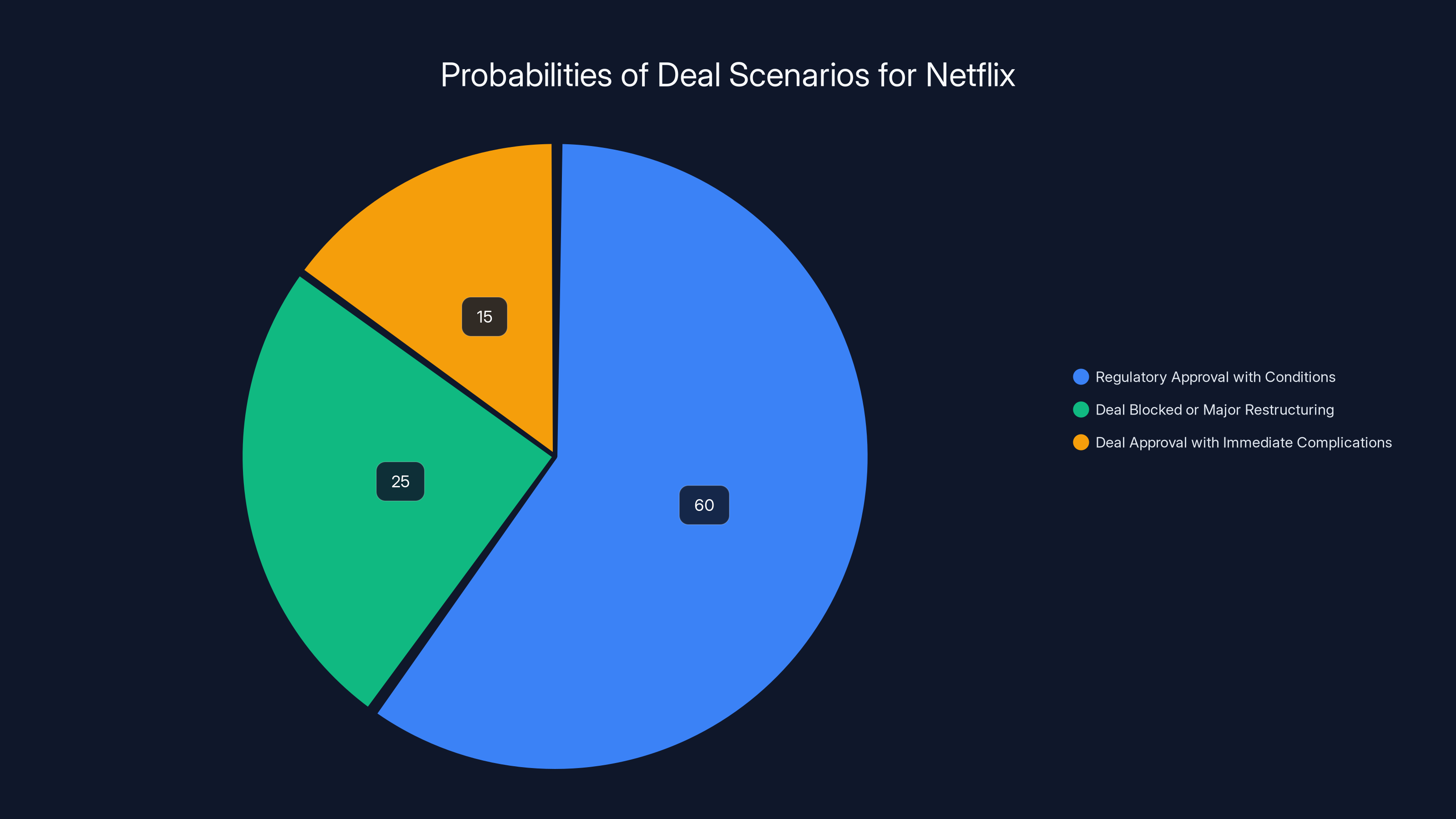

The most likely scenario is regulatory approval with conditions at 60%, followed by the deal being blocked or requiring major restructuring at 25%, and finally, approval with immediate complications at 15%.

What Netflix Is Actually Getting: The Content Crown Jewels

Let's break down exactly what Netflix is acquiring because it's genuinely staggering in scope. We're not just talking about a few popular shows and movies. This is roughly 125 years of entertainment history consolidated under one entity.

The Franchises and Properties:

- Game of Thrones and the entire Westeros universe (plus House of the Dragon)

- Harry Potter and Fantastic Beasts (eight films and counting)

- The entire DC Comics cinematic and animated universe (Superman, Batman, Wonder Woman, Aquaman)

- The Matrix franchise

- James Bond films

- Dune (if applicable under acquisition terms)

- The Wizard of Oz and countless classic films

- Dozens of ongoing television series

The Studios and Infrastructure:

- Warner Bros. Studios lot in Burbank (the actual physical production facilities)

- HBO as a premium content brand

- HBO Max as a streaming platform with 50+ million subscribers

- Discovery+ integration opportunities

- Warner Bros. Television production capabilities

The Libraries:

- Roughly 10,000 films and television shows

- 20+ Academy Award-winning films

- Iconic animated properties (Looney Tunes, DC animated series)

- Reality television content

- Documentary archives

This isn't just content. This is cultural infrastructure. Netflix isn't just acquiring entertainment products—they're acquiring the ability to generate entirely new universes from existing intellectual property for decades.

From a strategic standpoint, Netflix solves several problems simultaneously. First, content scarcity. Netflix was increasingly dependent on expensive original programming. These franchises provide ready-made audience attachment and dramatically lower acquisition costs compared to building audiences from scratch.

Second, theatrical presence. Netflix has struggled with film credibility. Now they control a major studio with established theatrical distribution relationships and production capabilities.

Third, international leverage. These franchises have global recognition and monetization potential Netflix couldn't build independently in reasonable timeframes.

The Regulatory Minefield: Why Antitrust Might Block Everything

Here's where this deal gets genuinely complicated. Regulators aren't just rubber-stamping this. Far from it.

Several U. S. Senators raised formal concerns to the Justice Department's Antitrust Division. Specifically, Senators Elizabeth Warren, Bernie Sanders, and Richard Blumenthal argued the merger could give Netflix excessive market power, enabling them to raise prices without competitive pressure and stifle independent voices in entertainment as noted by Bloomberg Law.

Their argument has merit. Netflix currently controls roughly 30-35% of streaming subscribers in the U. S. market. Adding HBO's subscriber base, the franchises, and the production infrastructure consolidates enormous power. Competitors like Disney, Paramount, and Amazon suddenly look dramatically smaller.

The Justice Department's Antitrust Division is investigating whether the merger meets antitrust standards. Netflix co-CEO Ted Sarandos was scheduled to testify before Senate committees—an unusual step that signals lawmakers are taking this very seriously.

The antitrust concerns break into several categories:

Market Concentration: After the acquisition, Netflix-Warner Bros. controls roughly 45-50% of subscription streaming market share. That's approaching monopoly territory in some economists' opinions.

Pricing Power: With reduced competition, Netflix could raise prices more aggressively without fear of losing customers to viable alternatives. This directly harms consumers.

Content Gatekeeping: Netflix could theoretically restrict access to premium franchises, forcing competitors to pay licensing fees or withdraw from markets entirely.

Independent Creator Impact: Smaller production companies, screenwriters, and independent studios face a future where one entity controls distribution for 30-40% of potential viewers.

Employment Concentration: The combined entity would employ roughly 35,000+ people in entertainment. Consolidation typically means layoffs and reduced wage competition.

Regulators aren't being unreasonable. The merger genuinely raises legitimate competitive concerns. The Justice Department has signaled it's taking an unusually hard look at this deal.

Netflix included a

Historically, deals this large face 18-24 month regulatory review periods. We're likely looking at this remaining contentious through late 2025 or early 2026.

Industry Reactions: Who's Freaking Out and Why

Reactions from the entertainment industry have been overwhelmingly negative. Not because people dislike Netflix, but because this deal threatens existing power structures, distribution models, and creative independence.

The Writers Guild of America (WGA) immediately called for the deal to be blocked on antitrust grounds. They articulated concerns that consolidation would reduce demand for screenwriters, compress negotiation leverage, and create artificial scarcity of opportunities. Their statement pointed out that the last major industry consolidation (the 1998 Paramount-Viacom merger) led to decades of reduced writer compensation and employment.

Directors, cinematographers, and craft unions expressed similar concerns. Consolidation historically means fewer independent productions, fewer competing studios bidding for talent, and reduced leverage for negotiating compensation and working conditions.

Independent production companies face genuine existential threat. If Netflix controls 45% of streaming distribution and HBO's production infrastructure, smaller studios have dramatically fewer viable revenue paths. This isn't paranoia—it's market mathematics.

Theater owners are nervous about streaming window compression. Historically, studios release films theatrically for 45-90 days before moving to streaming. Netflix has already shortened this timeline compared to studios. Combined with HBO's theatrical release strategy, the new entity could dramatically compress windows or eliminate them entirely, devastating theater economics.

International regulators are watching closely. The EU, UK, and other markets have different antitrust standards and are investigating whether the deal violates their competition laws. Several countries may impose conditions or block the deal entirely, which could reshape the deal's economics.

Interestingly, Paramount's public statements have become more aggressive. Beyond the lawsuit, they're making media appearances arguing the deal should be blocked. Whether this is genuine concern or strategic maneuvering to disrupt a rival isn't entirely clear, but it adds political pressure on regulators as reported by Barchart.

Netflix's acquisition of Warner Bros. involves a premium valuation at 16x EBITDA, compared to the typical industry range of 8-12x, reflecting a strategic bet on synergies and growth.

Content Strategy Implications: What Gets Made and How

This is where the deal becomes fascinating from a creative perspective. Netflix's content strategy will fundamentally change under Warner Bros. ownership.

Historically, Netflix pursued quantity-focused original content creation. Spend billions creating hundreds of shows and films, keep what works, cancel what doesn't. The model was mathematically brutal—cancel rates exceeded 50%. But it generated cultural relevance and constant content novelty.

Warner Bros.' content strategy was different. They focused on franchises, theatrical releases, and brand-building through carefully managed intellectual property. Quality over quantity. Long-term IP management over short-term subscriber acquisition.

The merged entity needs to find a middle ground. Netflix can't afford Warner Bros.' cautious theatrical strategy. But Warner Bros. probably can't sustain Netflix's scorched-earth cancellation policies—that destroys franchises and talent relationships.

Here's what we're likely to see:

Franchise Focus: Netflix will shift away from standalone originals and toward building interconnected universes. Game of Thrones-style expansions, DC Universe integration, and theatrical-to-streaming pipelines become standard.

Theater Windows: Netflix co-CEO Ted Sarandos publicly stated theatrical releases would continue through existing HBO schedules. But he also hinted windows would compress over time. Expect 30-45 day theatrical windows to become standard instead of current 45-90 days.

Production Consolidation: Warner Bros.' lot will become Netflix's primary U. S. production hub. This likely means reduced independent production commissions, more in-house development, and fewer external deals.

International Content: Netflix's international original program focus likely expands through HBO's global distribution infrastructure and production capabilities.

Animation and DC: The DC animated universe has been consistently excellent. Netflix will likely expand this dramatically, recognizing DC's animation value that theatrical efforts haven't fully captured.

Reality and Unscripted: Discovery's extensive unscripted library and production capabilities represent enormous value Netflix was weak in. Expect more reality, documentary, and unscripted content on Netflix platforms.

Employment and Workforce Implications: The Consolidation Reality

When Netflix and Warner Bros. consolidate operations, redundancies become inevitable. Both organizations have overlapping functions, infrastructure, and talent.

Current estimates suggest 5,000-8,000 job losses across corporate overhead, technical duplications, and production consolidations. That's roughly 15-20% of the combined workforce. For context, when AT&T-Time Warner completed integration, roughly 8,000 jobs were eliminated within 18 months.

Where the cuts likely hit hardest:

Corporate Functions: Executive teams, finance, legal, human resources—completely duplicative across both organizations. Expect massive layoffs here.

Technology and Engineering: Both companies have streaming platforms, content management systems, and analytics infrastructure. Netflix's technology is generally considered superior, so WBD's systems will likely be decommissioned.

International Operations: WBD has 50+ international offices. Netflix has similar infrastructure in the same markets. Consolidation creates overlap.

Production Infrastructure: Warner Bros.' lot has production facilities that might get consolidated with Netflix's existing relationships and external production company deals.

Where employment might actually grow:

Content Creation: More franchises and theatrical production might increase production crew demand—though this is speculative.

International Expansion: Combined resources might enable faster international service rollout.

Animation Studios: DC animation and WBD animation studios might expand under Netflix's investment.

For creative talent—writers, directors, actors, cinematographers—the impact is mixed. More IP ownership means potentially more ongoing franchise opportunities. But consolidation means fewer competing studios bidding for exclusive talent, which historically reduces compensation.

Subscriber and Pricing Impact: What Changes for Viewers

This is the question subscribers care most about: does this deal mean higher prices or better content?

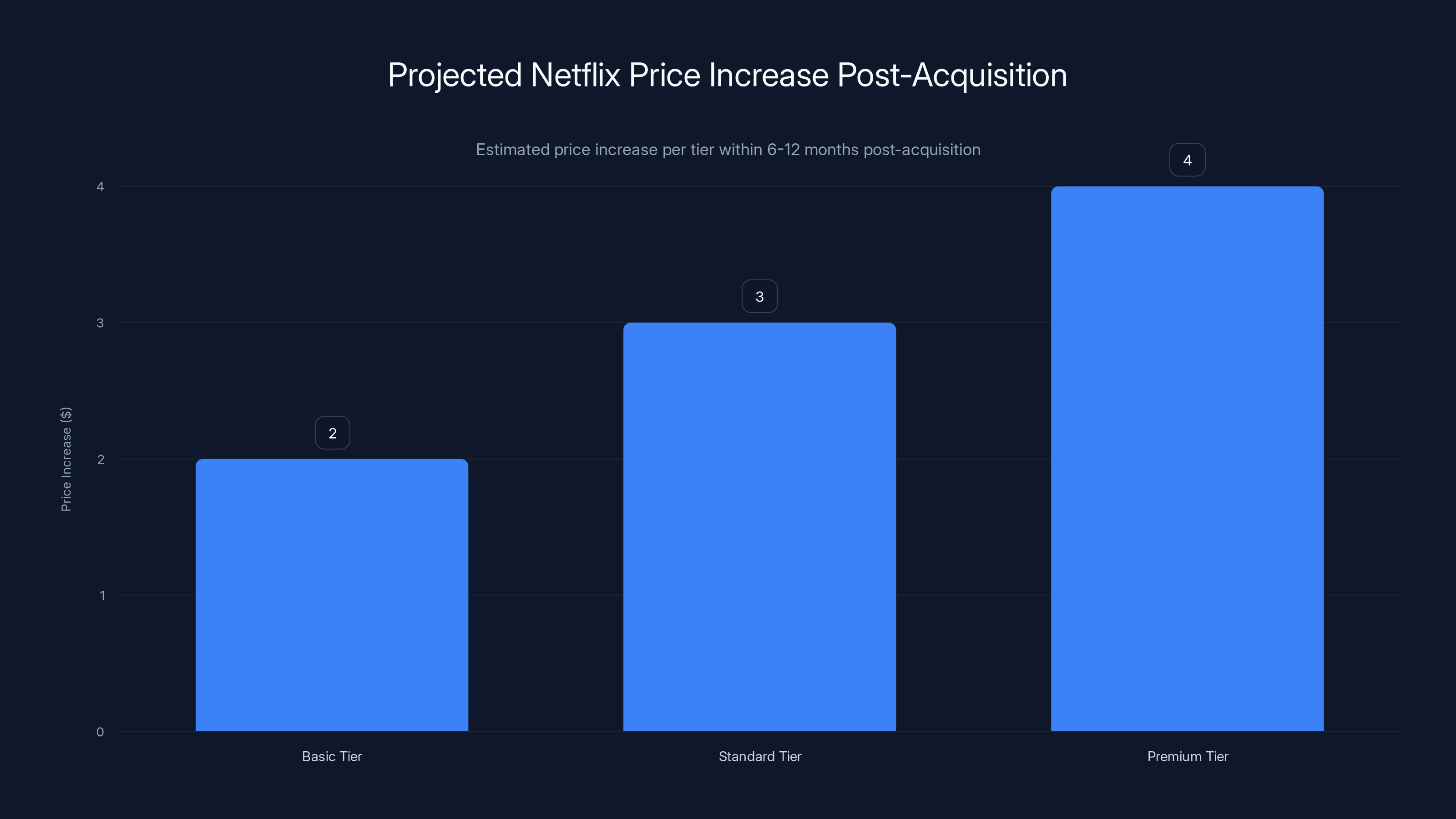

Netflix has consistently raised prices post-acquisition. The pattern is predictable: acquire company, wait 6-12 months, implement price increases citing "content investment needs." There's no reason to expect different behavior here.

Expect Netflix price increases within 6-12 months post-closing, roughly $2-4 per tier. Netflix co-CEO Sarandos has already hinted at this, suggesting subscriber value increases justifying price increases.

For content, the situation is mixed. On the positive side, subscribers gain access to HBO originals, Game of Thrones, Harry Potter, and DC content under single subscriptions. That's genuine value. International subscribers particularly benefit, as some franchises weren't previously available in certain territories.

On the negative side, Netflix will likely reduce content spending growth. Current projections show Netflix planning $17-20 billion annual content spending. Combined with Warner Bros.' existing spending, the entity won't increase spending proportionally. Instead, they'll consolidate, eliminate duplicative projects, and focus on bigger franchises over diverse originals.

Translation: you get higher prices, slightly more prestige content, fewer experimental originals, and less diverse storytelling.

For competitors and alternatives, the situation degrades. Paramount+, Apple TV+, and Amazon Prime Video all face a rival with dramatically increased content library depth and production capability. Subscriber defection to Netflix-HBO becomes more likely.

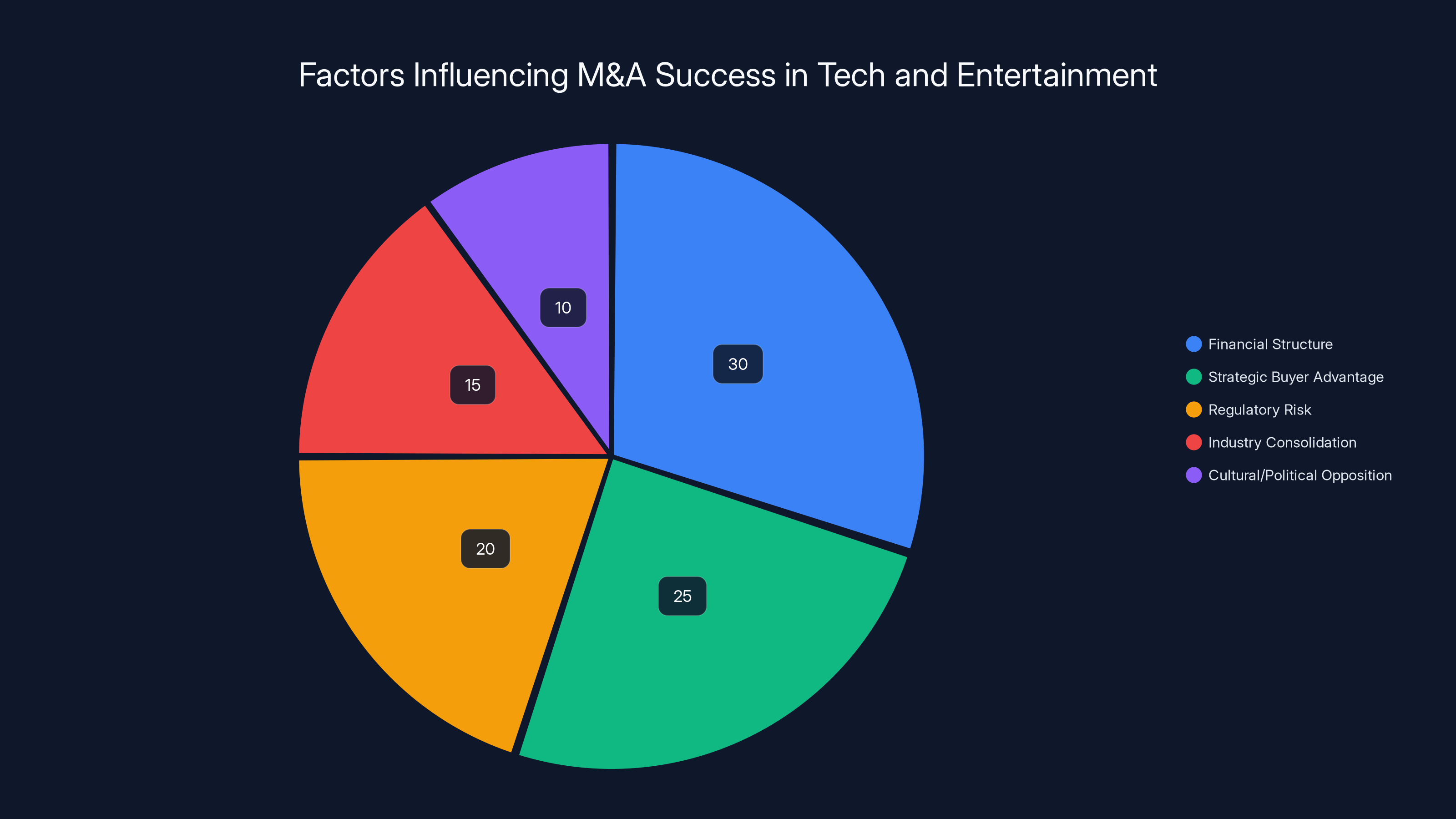

Financial structure and strategic buyer advantage are key factors in M&A success, with regulatory risk and industry consolidation also playing significant roles. (Estimated data)

International Expansion and Global Implications

This deal has massive international implications that American media focuses less on, but which matter tremendously for Netflix's future.

Warner Bros.' international distribution infrastructure, particularly in developed markets, is superior to Netflix's in certain regions. HBO has long-standing relationships with international pay-TV providers, theatrical partners, and licensing agreements Netflix can leverage.

Specific regions where this matters:

India: Warner Bros.' production and distribution capabilities in India are substantial. Netflix has struggled gaining market share in India due to price sensitivity. Combined with Warner Bros.' content library and production volume, Netflix could accelerate in this crucial market.

Latin America: HBO Latin America has decades of relationships and trusted brand equity. This gives Netflix immediate credibility and distribution partners in markets where they've historically been viewed as an American import.

Middle East and North Africa: Warner Bros.' relationships navigating content sensitivities and regulatory requirements could help Netflix expand in regions where cultural sensitivity is essential.

Europe: Primarily, this expands HBO Europe's already-strong position and gives Netflix theatrical distribution partners it previously lacked.

Japan and Asia-Pacific: Similar to India, Warner Bros.' production capabilities and partnerships provide Netflix expansion pathways in markets where they've faced challenges.

From a content perspective, Warner Bros.' international production footprint means Netflix gains studios in the UK, Canada, Australia, and multiple European countries. This reduces production costs, enables local-language content creation, and provides currency diversification for budgeting.

Theatrical Distribution: The Future of Movies

One of the most consequential changes will be how movies get distributed theatrically versus streamed.

Traditional Hollywood theatrical windows are 45-90 days before streaming release. This benefits theaters through exclusive theatrical runs. Netflix has generally been hostile to this model—they've pushed for simultaneous releases or minimal windows.

Warner Bros., particularly HBO, has a different history. They've maintained theatrical relationships for decades. Merging these philosophies creates tension.

Ted Sarandos promised theatrical releases would continue. But his language suggested windows would compress over time. Here's what we expect:

Franchise Films: Game of Thrones movie potential, Harry Potter remakes, DC theatrical universe content—these get traditional theatrical windows (60-90 days) to maximize box office. Netflix understands franchise films drive subscriber growth through cultural relevance.

Mid-Budget Films: $40-80 million budget films get 30-45 day windows. Enough for profitable theatrical runs, but faster path to streaming captures both revenue streams.

Low-Budget Films: Direct-to-streaming becomes standard for films under $20 million. Theaters don't get exclusive windows.

International Variations: Different markets have different theatrical traditions. The merged entity will likely create region-specific strategies—longer windows in markets where theaters matter economically, compressed windows in digital-primary markets.

This fundamentally threatens theater economics. If Netflix controls major franchises and compresses windows, smaller theaters suffer disproportionately. Netflix is essentially choosing which theaters survive and which don't through release window decisions.

Competitive Landscape: How This Repositions the Industry

This deal doesn't just affect Netflix and Warner Bros.—it reshapes competitive dynamics across entertainment.

Disney+: Already the second-largest streamer, Disney faces a competitor with comparable content depth. Disney has Marvel, Pixar, Star Wars—Netflix now has DC, Harry Potter, Game of Thrones. It's roughly competitive, but Netflix's production capability might exceed Disney's.

Paramount+: Already struggling with subscriber growth, Paramount now faces a competitor with twice the content library depth and significantly stronger franchises. This potentially accelerates Paramount's decline or forces them toward niche positioning.

Amazon Prime Video: Amazon's advantage was breadth and bundling. Netflix with Warner Bros.' franchises might attract more standalone subscribers, reducing Prime Video's differentiation.

Apple TV+: Positioned as premium, quality-focused streaming. This remains viable but against a competitor with vastly larger library, Apple's position becomes harder.

Max (formerly HBO Max): This is interesting. HBO Max might become Netflix's premium tier instead of standalone service. This could consolidate subscribers and revenue while eliminating a separate brand.

International Competitors: Globally, services like Now TV, Sky, and local streamers face a Netflix-HBO entity with unprecedented production and distribution resources in developed markets.

The industry consolidation trend accelerates. If Netflix can acquire Warner Bros., Disney might acquire another player. We're likely seeing entertainment consolidation continue toward oligopoly structure with 3-4 dominant global players.

Estimated data shows Netflix-Warner Bros. could control nearly half of the U.S. streaming market post-merger, raising antitrust concerns.

Financial Models and Deal Economics: The Math That Matters

Understanding the deal's financial structure reveals how Netflix justifies the $82.7 billion valuation.

The acquisition uses an earnings multiple approach. Netflix is valuing Warner Bros.' entertainment assets at roughly 15-17x EBITDA. For comparison, typical entertainment company multiples range from 8-12x. Netflix is paying a significant premium as noted by Fortune.

Here's the financial math:

Revenue Synergies: Combined entity generates roughly

Content Spending Efficiency: Separately, Netflix and Warner Bros. spent roughly

Subscriber Revenue: Netflix-HBO combined probably reaches 150+ million subscribers long-term. At

The equation for deal payback:

- Cost: $82.7 billion

- Annual free cash flow generation: $12-18 billion (assuming 12-16% margins)

- Payback period: 5-7 years

This is reasonable for a major entertainment acquisition, but not extraordinary. The deal only works if Netflix successfully integrates operations, eliminates overhead, and maintains subscriber growth.

Any major complications—regulatory blocking, significant subscriber loss during integration, or failed franchise launches—rapidly turns this from profitable acquisition to expensive mistake.

Timeline and Closing Mechanics: When This Actually Happens

Unlike most acquisitions you read about, this deal isn't closed yet. Several steps remain before Netflix formally owns Warner Bros.' assets.

Current Status: The deal was announced in December 2024 with regulatory approval expected throughout 2025.

Regulatory Review: The Justice Department and FTC are reviewing antitrust implications. This process typically takes 12-18 months for deals of this scale. We're probably looking at mid-to-late 2025 for regulatory decisions.

Conditions and Divestitures: Regulators might approve the deal conditionally, requiring Netflix to divest certain assets to maintain competition. Possible forced divestitures include certain international businesses, specific franchises, or technology infrastructure. These reduce deal value but make regulatory approval more likely.

Shareholder Votes: WBD shareholders need to vote on the deal, likely in mid-2025. This is typically formality but could become contested if major shareholders oppose the deal.

International Approval: UK, EU, and other major markets have separate approval processes. Some might impose additional conditions or delays.

Expected Closing: Assuming regulatory approval without major conditions, expect deal close in Q3-Q4 2025. If significant conditions or opposition emerges, closing could slip into 2026.

Breakup Fee Reality: If regulators block the deal, Netflix pays

The Cultural and Creative Impact: What Audiences Should Care About

Beyond finances and regulation, this deal reshapes what stories get told and how.

Historically, independent production, diverse voices, and risk-taking happen at smaller studios with creative freedom. Netflix's acquisition of Warner Bros.—along with other consolidation—dramatically reduces the number of viable pathways for unconventional storytelling.

Specific concerns from creative communities:

Franchise Dependence: Combined entity prioritizes Game of Thrones spin-offs, DC cinematic universes, and Harry Potter expansions. Diverse storytelling, experimental narratives, and unconventional tales become lower priority.

Streaming as Default: Theatrical releases become increasingly limited to franchise tentpoles. Mid-budget dramas, independent films, and unconventional narratives stream-only (or direct-to-garbage). This eliminates the cultural prestige and audience reach these films previously captured.

International Voices: Paradoxically, while consolidation reduces American independent production, it might increase international production as Netflix leverages Warner Bros.' studios globally. But this is producer-controlled content, not genuinely independent voices.

Cancel Culture Intensifies: Netflix's brutal cancellation model likely extends to more properties. Creative teams work toward franchises specifically because standing-alone originals get canceled at higher rates.

Wage and Employment: Fewer competing studios means reduced negotiating power for writers, directors, actors, and technical crews. Consolidation historically leads to wage suppression despite rhetoric about "creating opportunities."

For audiences, this means:

- More content in franchises you already know

- Fewer surprising discoveries and experimental storytelling

- Higher prices

- Potential service redundancy (HBO and Netflix might merge into single service)

- Different international content availability

Netflix is expected to increase prices by $2-4 per tier within 6-12 months post-acquisition, citing content investment needs. Estimated data.

Scenarios: How This Actually Plays Out

Let me walk through three plausible scenarios for how this deal unfolds.

Scenario 1: Regulatory Approval with Conditions (60% probability)

The Justice Department approves the deal but requires Netflix to divest certain assets or accept operating conditions. Likely divestitures: international operations in certain markets, specific technology platforms, or content licensing concessions.

Netflix closes the deal in Q4 2025 for roughly $82.7 billion. They spend 2026 integrating operations, consolidating technology, and reducing overhead. Subscriber growth slows slightly during integration, but stabilizes by late 2026. Price increases arrive in 2026, partially offset by perceived value from expanded content library.

Outcome: Deal proceeds as announced, transformation accelerates, competitive pressure increases for rivals.

Scenario 2: Deal Blocked or Major Restructuring (25% probability)

Regulators determine the merger violates antitrust standards. They either block it entirely or require such significant divestitures that Netflix withdraws. Netflix pays the $5.8 billion breakup fee.

Warner Bros. returns to exploring alternatives—potential sale to private equity, strategic buyer from outside entertainment, or breakup and separate asset sales. This could take 12-24 months to resolve.

Outcome: Delayed consolidation, increased uncertainty, temporary advantage for competitors, potential premium valuations for alternative buyers.

Scenario 3: Deal Approval with Immediate Complications (15% probability)

The deal closes, but integration goes poorly. Content quality suffers during consolidation. Key talent departs. Technology integration creates service disruptions. Subscriber churn accelerates beyond projections.

Netflix writes down asset value within 18 months, acknowledging overpayment. Future content strategy shifts toward cost-cutting rather than expansion.

Outcome: Deal viewed as strategic mistake, Netflix's growth slows, competitive position weakens relative to Disney and other players.

Most likely: Scenario 1 plays out. Regulatory approval with some conditions, deal closes, integration happens, and Netflix emerges as an even more dominant entertainment force through 2026-2028.

Practical Impact on Your Streaming Experience

Let me bring this back to what actually matters for people watching stuff.

Short-term (Next 6 months):

- Nothing changes immediately. Services remain separate during integration

- HBO content isn't suddenly available on Netflix (licensing complications)

- Prices probably stay the same until deal closes

Medium-term (6-12 months after closing):

- Price increases for Netflix arrive ($2-4 per tier)

- HBO and Netflix services might consolidate into single app

- New Game of Thrones content becomes Netflix exclusive instead of HBO exclusive

- Theatrical windows for major films compress toward 30-45 days

- Some HBO original series potentially canceled if they don't fit Netflix strategy

Long-term (12-24 months after closing):

- Integrated Netflix-HBO service becomes standard

- Fewer independent productions, more franchise content

- International content expands where HBO had distribution

- Subscriber experience focuses more on algorithmic recommendation of interconnected franchises

- Competitor services lose market share as Netflix-HBO dominates

The reality is less dramatic than headlines suggest but consequential for entertainment industry structure and creative diversity.

What Happens to HBO Max?

This is one of the most critical unresolved questions.

Ted Sarandos publicly stated HBO Max operations would remain largely independent in the near term. Translation: they're not immediately merging HBO Max into Netflix.

But long-term? Three scenarios exist:

Complete Merger: HBO Max and Netflix become single service under Netflix branding. HBO becomes content tier within Netflix. This probably happens within 2-3 years post-closing.

Tiered Services: Netflix remains general entertainment, HBO becomes premium tier with theatrical releases and prestige content. Think similar to Hulu/Disney+ structure. This maximizes pricing power.

Separate Positioning: HBO Max remains independent brand for legacy subscribers, but Netflix becomes primary new subscriber acquisition vehicle. Eventual consolidation happens through attrition.

Most likely: complete merger within 18-24 months. HBO Max as separate service probably disappears by 2027-2028. Subscribers migrate to unified Netflix-HBO experience, potentially retaining HBO branding for premium tier.

This simplifies operations, eliminates technology duplications, and maximizes pricing leverage. For subscribers, expect notification to consolidate accounts and pricing changes at consolidation.

What Could Still Derail This Deal

Despite Netflix's confidence, genuine obstacles remain.

Political Changes: If administration changes in 2025 or 2026, antitrust enforcement priorities might shift. A more aggressive antitrust administration could block the deal mid-review.

Major Competitor Bid: Theoretically, another buyer could make a higher offer during the regulatory review period. Unlikely but possible if market conditions change.

Shareholder Revolts: If WBD shareholders vote down the deal or Netflix shareholders revolt against deal economics, closing becomes impossible.

Regulatory Conditions Too Onerous: If FTC requires divestitures that destroy deal economics, Netflix might withdraw. Example: forced sale of international operations.

Financial Market Disruption: If credit markets freeze or Netflix's stock price collapses, all-cash financing becomes problematic. Unlikely given Netflix's financial position, but possible.

Content Disaster: If major franchises fail dramatically (DC films underperform, Game of Thrones spinoffs flop), deal valuation pressure increases and regulatory arguments about content quality weaken Netflix's case.

Paramount Legal Success: If Paramount's lawsuit discovers damaging information about the deal structure or Netflix's competitive intentions, regulatory obstacles increase.

None of these are highly probable, but cumulatively they represent meaningful deal risk. This explains the $5.8 billion breakup fee—Netflix is betting but hedging.

Lessons for Understanding Tech and Entertainment M&A

This deal teaches several lessons about how major technology and entertainment mergers actually work.

Lesson 1: Financial Structure Often Matters More Than Headline Price

Paramount's

Lesson 2: Strategic Buyer Usually Beats Financial Buyer

Netflix as a strategic buyer (wanting specific assets and operational integration) could offer better terms than financial buyers might. This matters for deal dynamics and pricing power.

Lesson 3: Regulatory Risk Is Real but Priced Into Deal Economics

The $5.8 billion breakup fee suggests Netflix calculated regulatory approval probability at roughly 85-90% and priced accordingly. Major deals always have regulatory risk; savvy acquirers quantify and price it.

Lesson 4: Consolidation Accelerates in Mature Industries

Streaming is becoming mature (growth slowing, competition intense). Consolidation follows. This pattern repeats across industries as competitive dynamics shift from growth to efficiency.

Lesson 5: Cultural and Political Opposition Matters Strategically

Writers Guilds, unions, and lawmakers speaking against the deal create political pressure that translates to regulatory scrutiny. Large mergers aren't just about finance—they're about stakeholder consent.

The Bigger Picture: What This Means for the Future of Entertainment

Zoom out. What does Netflix acquiring Warner Bros. mean for entertainment's future?

We're witnessing consolidation toward oligopoly. In 2015, entertainment had 6-8 major competitors. By 2025, that's compressed to 3-4 (Netflix, Disney, Amazon, Paramount). By 2030, likely 2-3 global players will dominate entertainment.

This consolidation brings efficiency but reduces diversity. Standardized content models emerge. Risk-taking decreases. Franchise dependence increases. Independent creators struggle for distribution.

Paradoxically, AI and technology might reverse some of this. If AI-powered content creation reduces production costs dramatically, barriers to entry lower. Smaller creators regain distribution pathways. We might see bifurcation: mega-franchises from oligopolies, experimental content from AI-enabled independents.

Or consolidation continues unchecked, eventually triggering regulatory intervention that breaks up mega-entities. This has happened in tech multiple times. Entertainment could follow.

The Netflix-Warner Bros. deal is important, but it's also a data point in a larger story about how creative industries consolidate, how technology reshapes competitive dynamics, and how regulatory bodies respond to concentration.

The Bottom Line

Netflix's $82.7 billion acquisition of Warner Bros.' entertainment assets is genuinely historic. It's not just a business deal—it's a signal about entertainment's future.

The deal makes strategic sense for Netflix (content depth, theatrical capability, international expansion) and makes financial sense for Warner Bros. (debt reduction, strategic clarity). But it creates genuine competitive concerns that regulators are right to scrutinize.

Expect the deal to close in late 2025 or early 2026 with some regulatory conditions. Expect significant integration challenges through 2026. Expect price increases, content consolidation toward franchises, and reduced independent production across entertainment.

For subscribers, this means higher prices but arguably better franchise content depth. For creators, fewer opportunities but potentially more resources for those inside the oligopoly. For competitors, existential pressure to consolidate or specialize.

The entertainment industry is fundamentally reshaping. Netflix acquiring Warner Bros. is a watershed moment you should understand—both what it means today and what it signals about entertainment's future.

FAQ

What exactly is Netflix acquiring from Warner Bros.?

Netflix is acquiring Warner Bros.' film and television studios, HBO, HBO Max with 50+ million subscribers, and roughly 10,000 films and television shows including franchises like Game of Thrones, Harry Potter, DC Comics properties, James Bond, and The Matrix. The deal includes production facilities, international infrastructure, and 125+ years of entertainment assets. This is essentially all of Warner Bros.' entertainment operations except some corporate divisions.

Why did Netflix choose this offer over Paramount's higher bid?

Paramount offered

When will the deal actually close and what needs to happen first?

The deal was announced in December 2024 and requires regulatory approval from the U. S. Justice Department and FTC throughout 2025, followed by WBD shareholder vote and international regulatory approvals. Expected closing is Q4 2025 or early 2026, pending regulatory decision. If regulators block the deal, Netflix pays a $5.8 billion breakup fee to Warner Bros. and the transaction terminates.

What are the main regulatory concerns with this deal?

U. S. Senators including Elizabeth Warren and Bernie Sanders argued to the Justice Department that the merger could give Netflix excessive market power controlling 45-50% of subscription streaming. Concerns include potential for price increases without competition, content gatekeeping preventing competitors' access to premium franchises, reduced demand for independent creators, employment concentration, and potential stifling of innovation from smaller competitors who can't match Netflix's scale as reported by Yahoo Finance.

How does this affect pricing for Netflix subscribers?

Expect Netflix to increase prices by $2-4 per subscription tier within 6-12 months after the deal closes, citing expanded content library and investment needs. Subscribers gain access to HBO content, major franchises, and international programming under single subscriptions. However, consolidation likely means fewer experimental originals and more franchise-focused content investment, potentially reducing content diversity despite higher costs.

Will HBO Max and Netflix merge into a single service?

Official statements indicate HBO Max remains separate in the near term, but long-term consolidation is likely. Expect Netflix and HBO Max to merge into a single unified service within 18-24 months post-closing, potentially with tiered pricing that maintains premium positioning for HBO content. This simplifies operations and technology infrastructure while maximizing pricing power through consolidated accounts.

What happens to theatrical film releases after this deal?

Netflix has committed to continuing theatrical releases for existing HBO schedules, but co-CEO Ted Sarandos indicated windows will compress over time. Expect major franchise films to get 60-90 day theatrical exclusivity, mid-budget films to get 30-45 days, and low-budget films to go direct-to-streaming. This threatens traditional theater economics, particularly for smaller multiplex chains lacking major franchise draws.

How many jobs will this deal eliminate?

Estimates suggest 5,000-8,000 job losses within 18 months as overlapping corporate functions consolidate, redundant technology platforms decommission, and duplicate international operations merge. Layoffs will concentrate in executive offices, finance, technology, and international headquarters. Content production employment may remain stable or grow depending on streaming investment strategies, but overall combined workforce will shrink by 15-20% compared to separate operations.

What does this mean for competing streaming services like Disney+ and Paramount+?

Competitors face dramatically increased competitive pressure from a Netflix-HBO entity controlling nearly half the streaming market. Disney+ remains competitive through Marvel and Star Wars franchises but loses content library depth advantage. Paramount+ struggles most given Paramount's lower content investment and production capability. Amazon Prime Video's bundling advantage diminishes. Smaller players face potential acquisition or exit as the market consolidates toward 2-3 dominant global players.

Could this deal actually get blocked by regulators?

While Netflix's $5.8 billion breakup fee suggests high confidence in approval, genuine regulatory risk exists. Aggressive antitrust enforcement, political changes, or conditions so onerous they destroy deal economics could all derail the transaction. Historical precedent (AT&T-Time Warner took 18 months to approve) suggests extended regulatory review, but complete blocking remains possible if Justice Department determines competitive harms outweigh strategic benefits. Probability of approval with conditions: approximately 60-70%, probability of blocking: approximately 20-25%, probability of withdrawal by Netflix: approximately 5-10%.

Looking Ahead

The Netflix-Warner Bros. deal isn't just a financial transaction—it's a signal about entertainment's future. We're seeing consolidation accelerate toward oligopoly structure where 2-3 global players dominate streaming and theatrical distribution.

For creators, this likely means fewer independent pathways but more resources within consolidated entities. For consumers, higher prices but potentially deeper franchise experiences. For regulators, growing pressure to prevent further consolidation or break up existing mega-entities.

The coming months will reveal whether antitrust enforcement succeeds in preventing this merger or simply signals regulatory intent without blocking deal momentum. Either way, the entertainment industry you interact with in 2027 looks fundamentally different from 2025—consolidated, franchise-heavy, and dominated by technology-enabled mega-studios.

Stay tuned. This story isn't ending; it's accelerating.

Key Takeaways

- Netflix's $82.7 billion acquisition of Warner Bros. entertainment assets consolidates Game of Thrones, Harry Potter, DC Comics, and HBO under single ownership

- Paramount's higher 87 billion combined debt burden; Netflix's cleaner financial structure won board approval

- Antitrust regulators are intensely scrutinizing the deal; Netflix co-CEO Ted Sarandos testified before Senate committees about competitive concerns

- Post-merger, Netflix-HBO controls 45-50% of streaming market share, potentially enabling price increases and reducing competitive pressure

- Deal expected to close Q4 2025 or early 2026 pending regulatory approval; $5.8 billion breakup fee applies if blocked

- Consolidation likely eliminates 5,000-8,000 jobs and compresses theatrical release windows from 90 days to 30-45 days

- HBO Max probably merges into Netflix within 18-24 months post-closing; unified service expected by 2027-2028

- Industry consolidation accelerates toward oligopoly; entertainment expects 2-3 dominant global players by 2030

Related Articles

- Netflix's $82.7B Warner Bros Deal: The Streaming Wars Heat Up [2025]

- Netflix's $82B Warner Bros Deal: What It Means for Movie Theaters [2025]

- Best Streaming Shows & Movies This Weekend [January 2025]

- Netflix's Sony Deal: Zelda Movie, $7B Investment & Global Streaming Rights [2025]

- NYSE's 24/7 Tokenized Trading Platform: The Future of Markets [2025]

- The 4 Forces Shaping Social Media in 2026 [2025]

![Netflix's $82.7B Warner Bros. Acquisition: What You Need to Know [2025]](https://tryrunable.com/blog/netflix-s-82-7b-warner-bros-acquisition-what-you-need-to-kno/image-1-1769202839011.jpg)