Netflix's Major App Redesign: How the Streaming Giant Is Competing with Social Platforms for Daily Engagement

Introduction: The Blurring Lines Between Streaming and Social

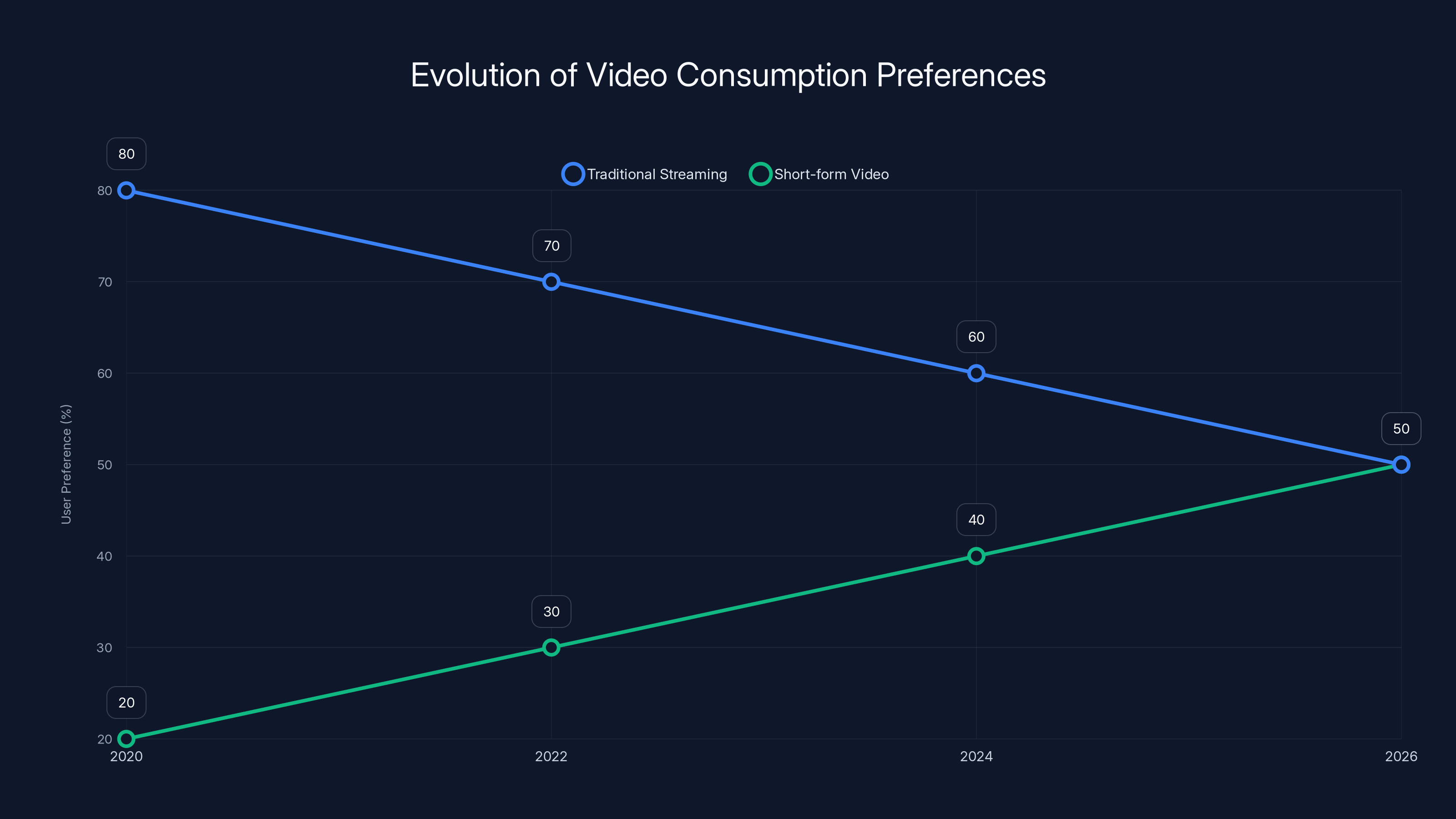

For decades, Netflix built its empire on a simple premise: sit down, pick a show or movie, and watch it for hours. It was a passive experience, a retreat from the chaos of daily life. But something fundamental has shifted in how people consume video. The rise of TikTok, Instagram Reels, and YouTube Shorts has fundamentally rewired user expectations. Now, audiences expect discovery to be instantaneous, frictionless, and endlessly scrollable. They want to stumble upon content they didn't know they needed, and they want it all in a vertical format that feels natural on mobile.

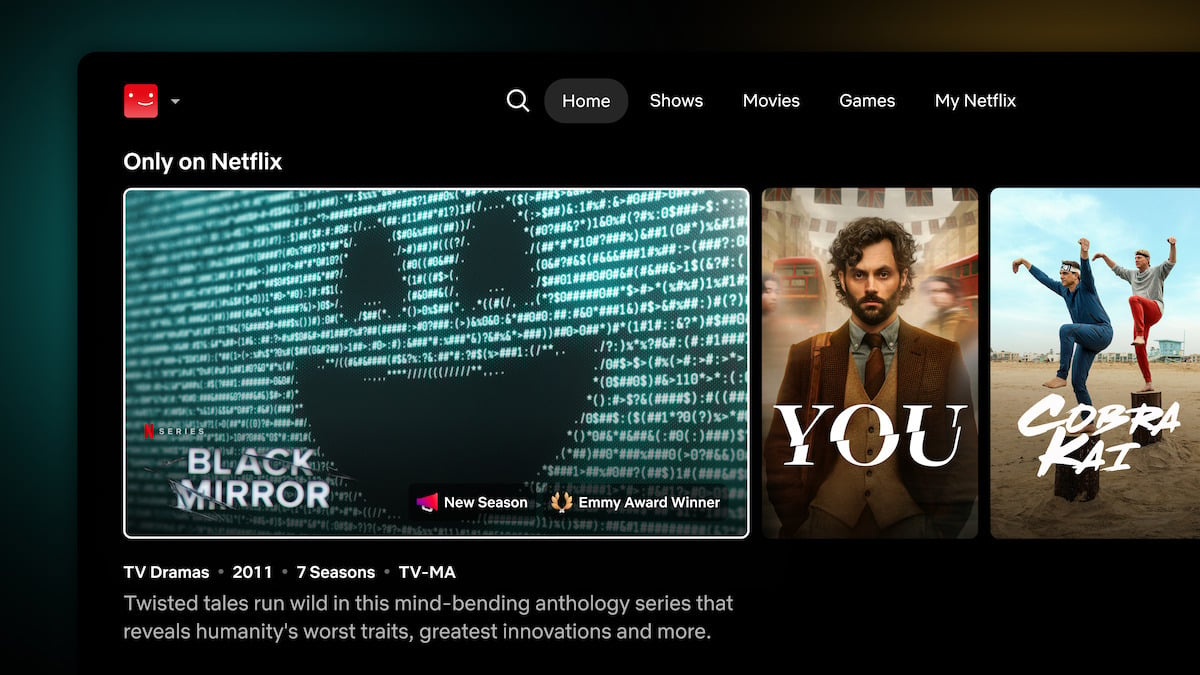

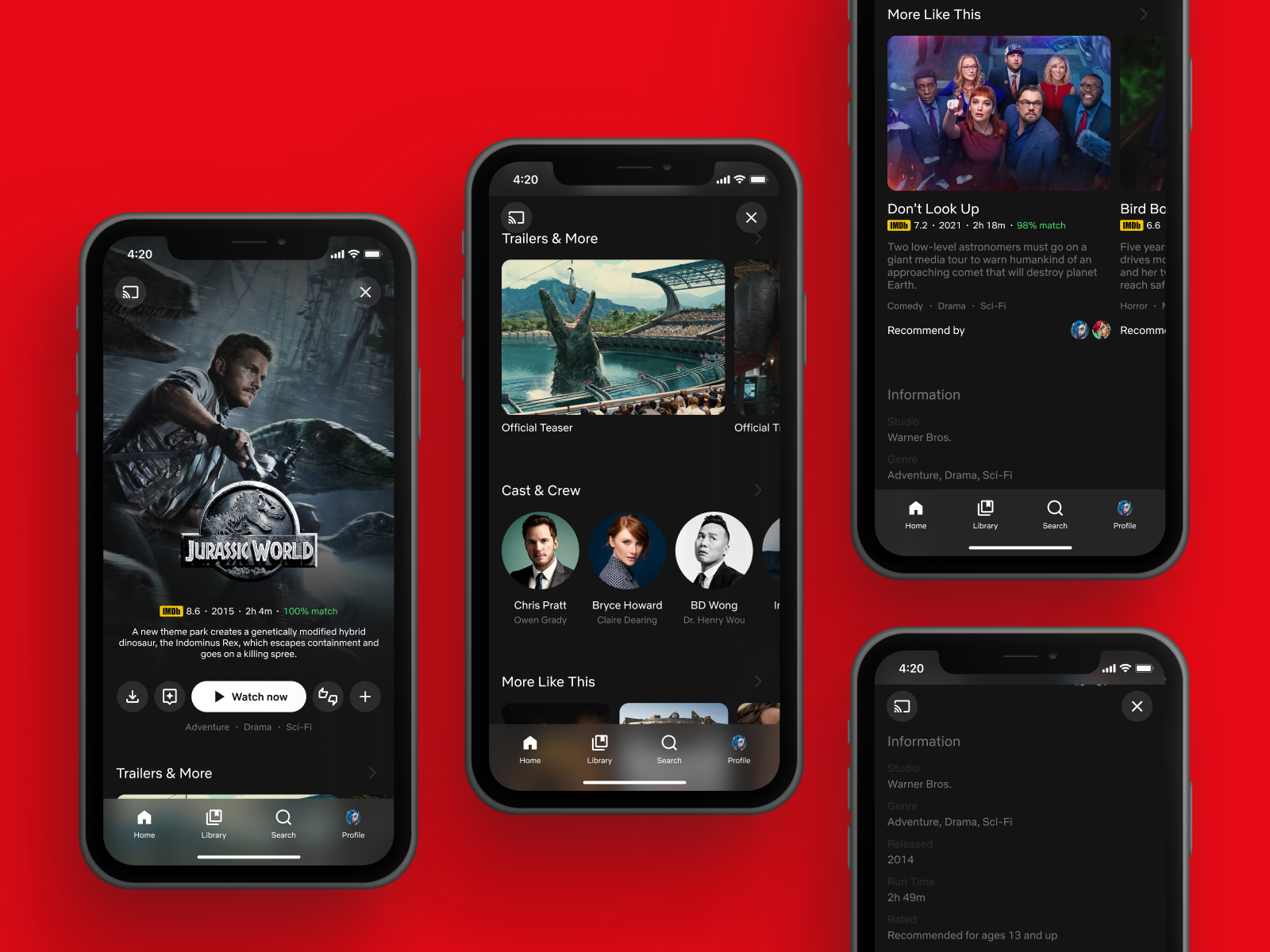

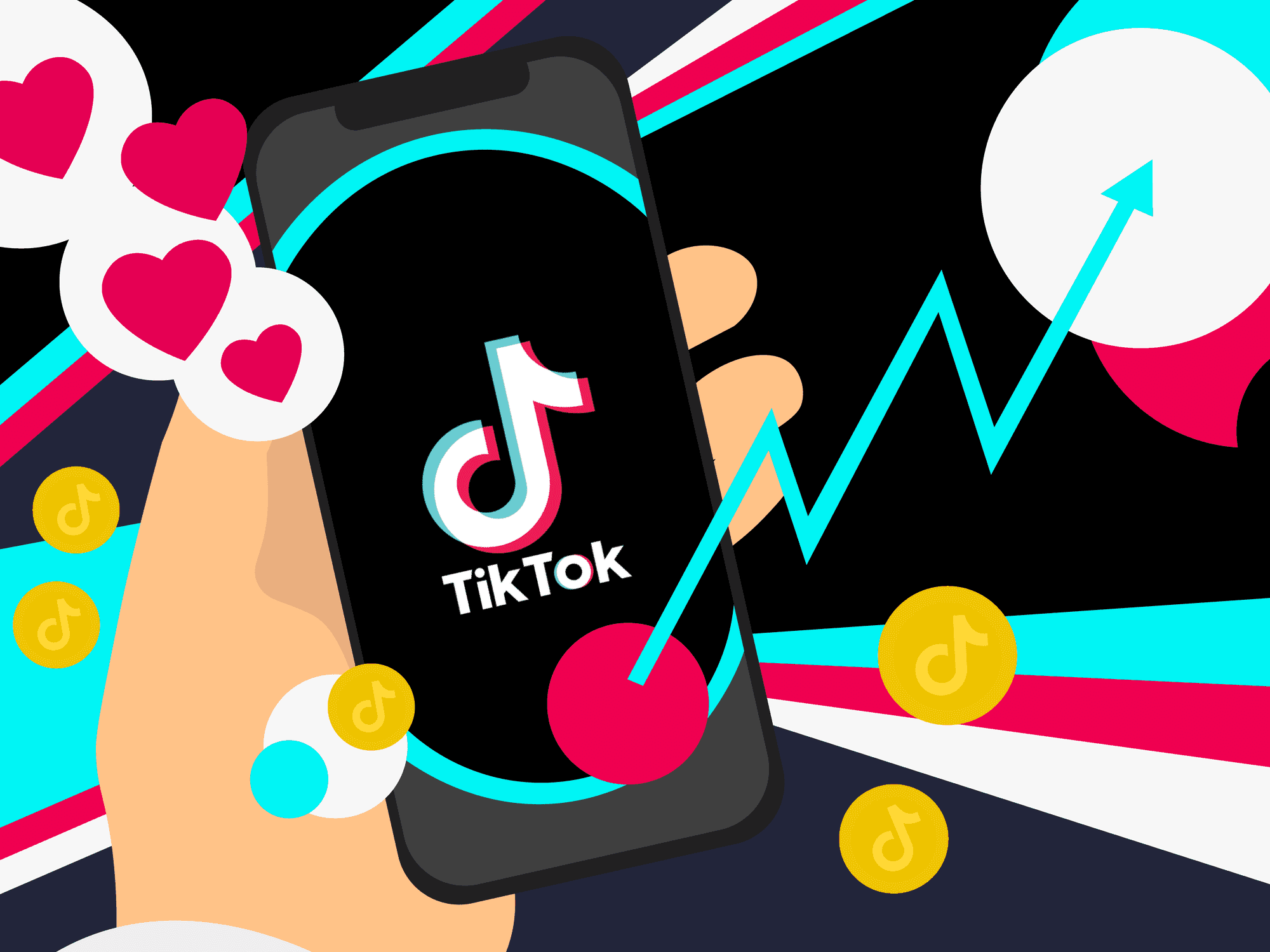

Netflix's leadership has watched this transformation with growing urgency. During the company's fourth-quarter earnings call in early 2026, the company announced a sweeping redesign of its mobile app—a move that signals Netflix isn't just adapting to the new landscape, it's attempting to redefine its entire position within it. At the heart of this redesign is something that would have seemed unthinkable just five years ago: vertical video feeds featuring short clips from Netflix content, displayed in a format that closely mirrors TikTok and Instagram Reels, as reported by The Hollywood Reporter.

This isn't Netflix dabbling in short-form video. It's Netflix recognizing that the attention economy has fundamentally changed, and if it wants to maintain relevance with younger audiences, it needs to meet them where they actually are. The redesign launches later in 2026, but the implications are already clear: the lines separating streaming services, social media platforms, and entertainment discovery are dissolving faster than anyone predicted.

What makes this shift particularly fascinating is that Netflix executives are being careful not to position this as "becoming TikTok." Instead, they frame it as strengthening entertainment discovery through mobile-first features. But the distinction is semantic. A vertical feed of short clips optimized for swipeable consumption is, functionally, what TikTok does. The question isn't whether Netflix is copying the format—it clearly is. The question is whether this strategy will actually work to retain the daily engagement Netflix desperately needs to justify its subscription model in an increasingly crowded market.

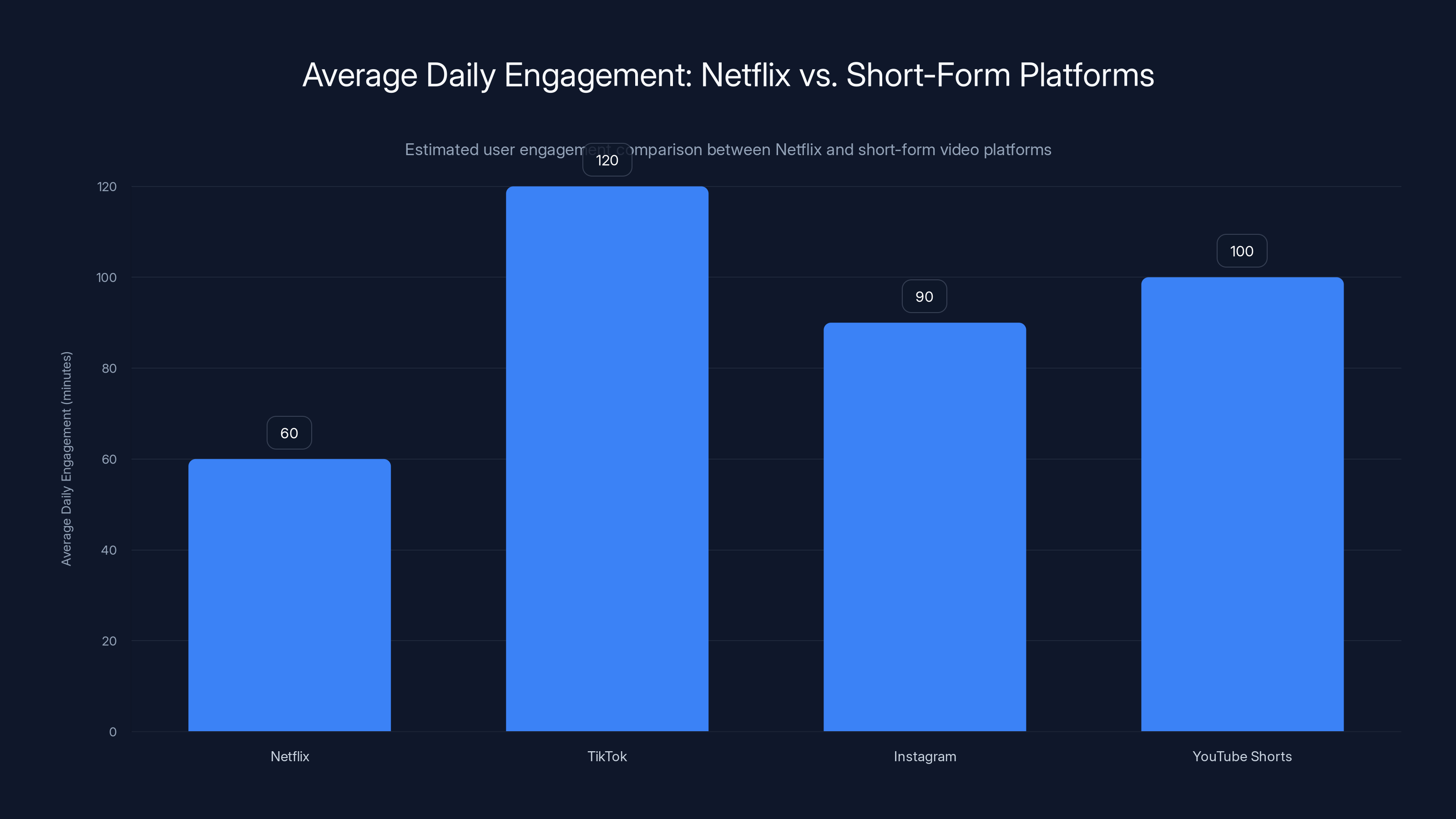

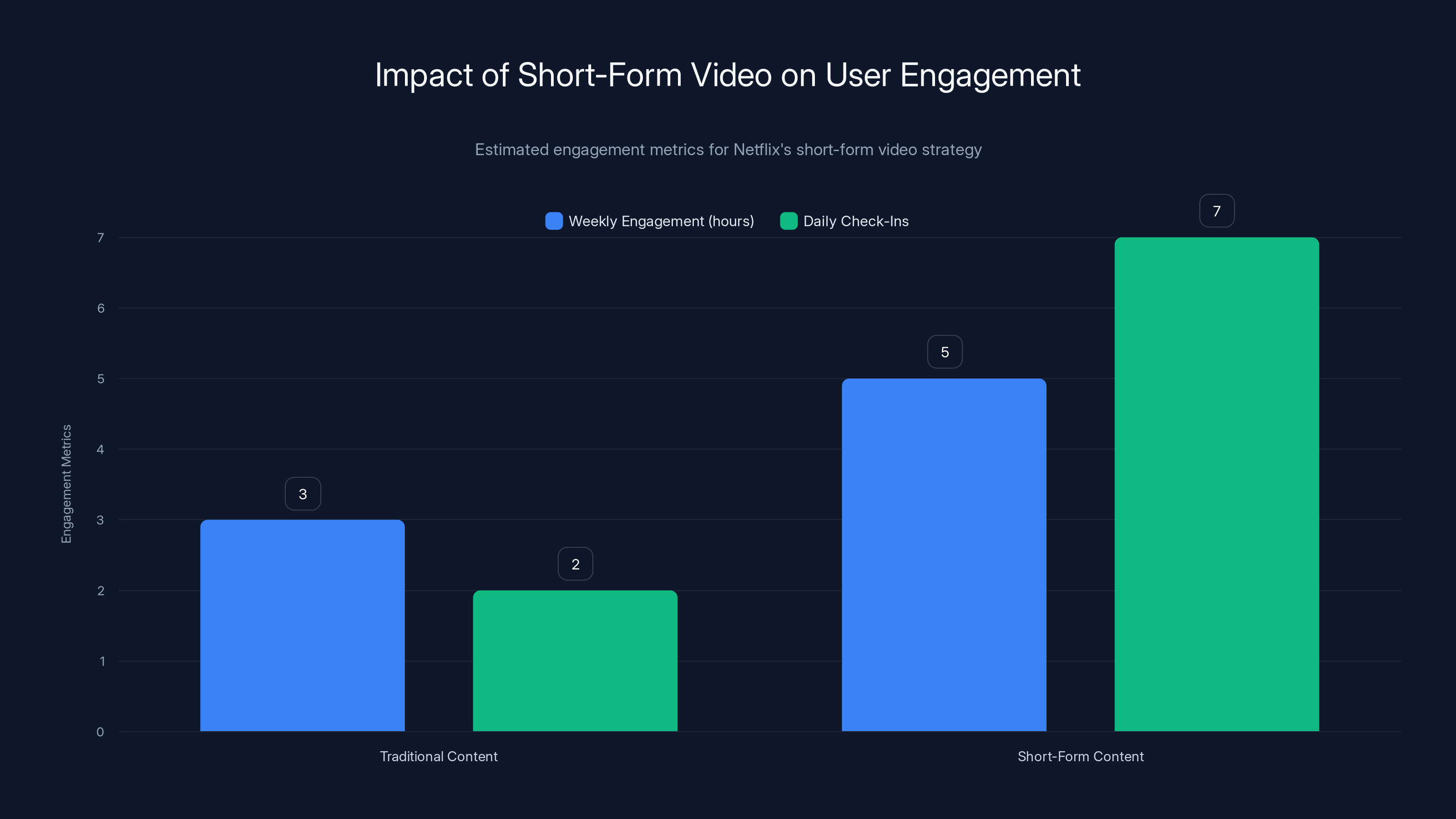

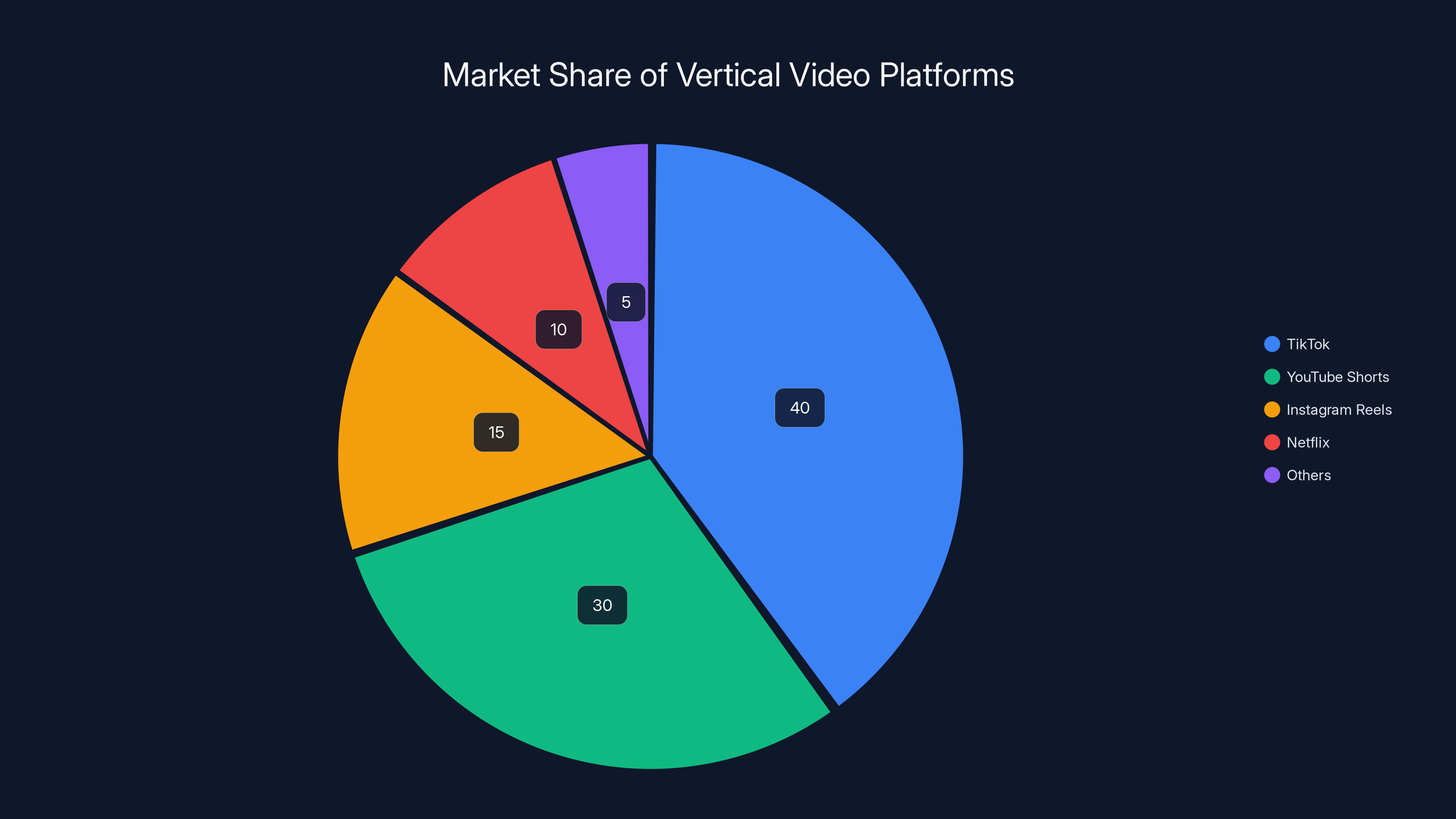

Estimated data shows short-form video platforms like TikTok and Instagram have higher average daily engagement compared to Netflix, highlighting the challenge Netflix faces in capturing user attention.

TL; DR

- Netflix is launching a complete app redesign in 2026 featuring vertical video feeds and short-form clip integration, directly competing with TikTok and Instagram for daily user engagement

- Short-form video feeds have been in testing since May 2025, with the company using clips from shows and movies to encourage content discovery and increased app time

- Video podcasts are now a major growth vector, with Netflix launching original shows from Pete Davidson, Michael Irvin, and securing partnerships with Spotify and iHeartMedia, as noted by ContentGrip

- The competitive landscape has completely changed, with traditional streaming services now competing against YouTube, TikTok, Instagram, and even the NFL and Oscars for audience attention

- This redesign represents a fundamental shift in Netflix's business model, from "pick and watch" to "discover and scroll," fundamentally changing how the platform generates daily engagement and retention

Why Netflix Is Abandoning Its Traditional Format

Netflix's core challenge right now isn't content quality. The company produces excellent shows and films. The problem is far more existential: user engagement. More specifically, daily active user engagement. Unlike social platforms where users open the app expecting to spend 30 minutes scrolling through feeds, Netflix users typically open the app with a specific intention—find something to watch, start watching it, and close the app. The average Netflix session is deliberate and finite.

This behavioral pattern creates a structural disadvantage when competing for digital attention. An hour spent on TikTok generates massive algorithmic data, multiple ad impressions, and exceptional user retention metrics. That same hour spent watching a Netflix original series counts as a single viewing session, no matter how many interactions happened within it. From a pure engagement metrics perspective, TikTok wins.

Consider the reality of how younger audiences interact with entertainment. Someone aged 18-25 might spend 90 minutes on Instagram, scrolling through Reels, liking posts, and watching short-form video content. In that same 90-minute window, they might watch one Netflix episode and close the app. Netflix's engagement metrics are dramatically lower despite providing objectively more entertainment value. This gap isn't about content quality—it's about interface design and user behavior patterns.

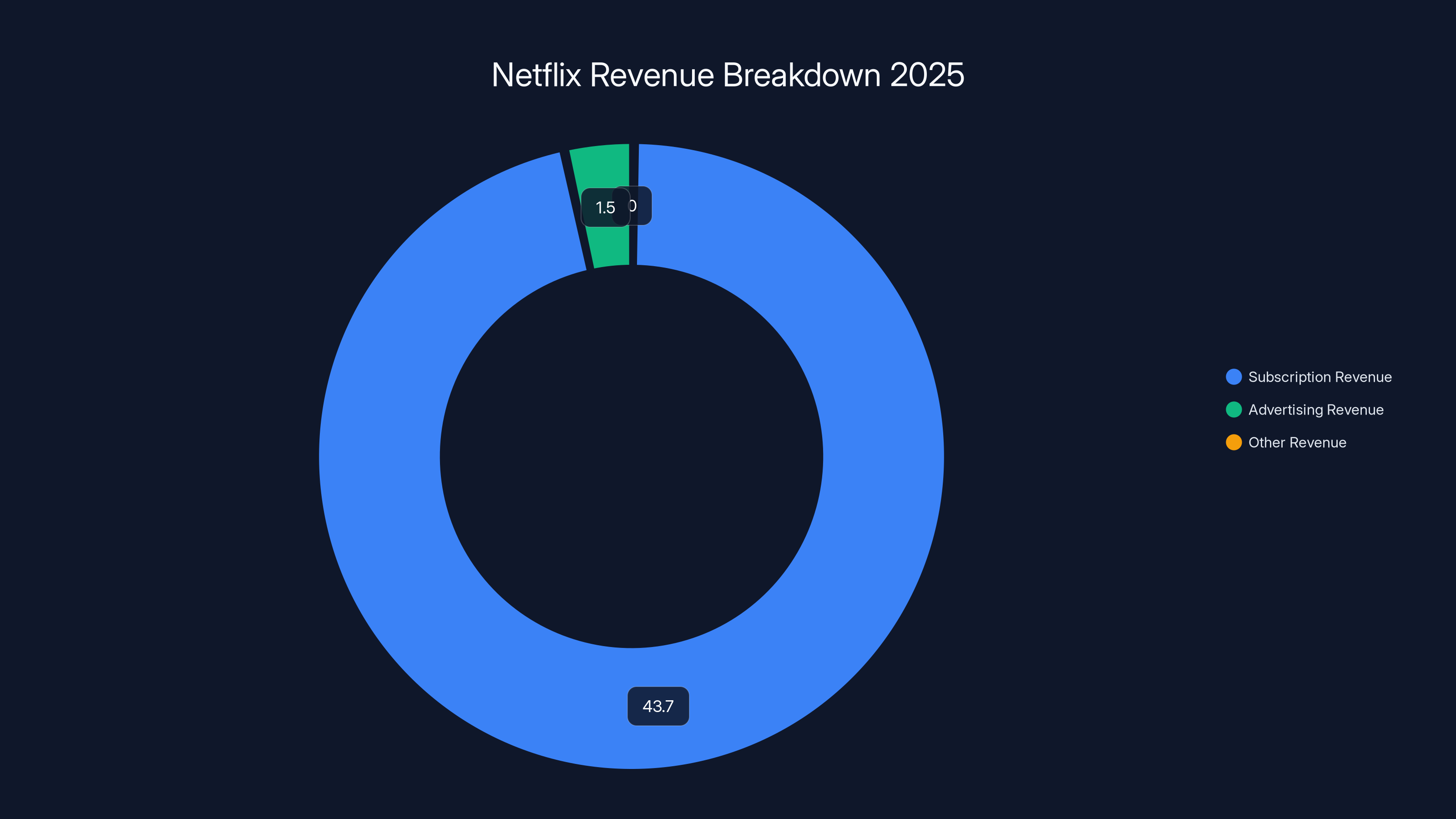

The financial implications are enormous. Netflix's advertising model, which launched in 2022 and now generates over $1.5 billion in annual revenue, depends on maximizing user engagement metrics. More time in the app means more ad impressions, higher engagement rates, and better pricing for advertisers. Similarly, retention metrics directly influence subscription churn rates. If users don't open Netflix daily, they're more likely to cancel when they don't find something to watch immediately. Making Netflix a social-first platform fundamentally changes this dynamic.

There's also the creator economy angle. Traditional Netflix viewers are passive consumers. They watch what Netflix recommends or what they actively search for. But social platforms have made creators central to the value proposition. People follow creators on TikTok and Instagram, not algorithms. They return to the app to see what their favorite creators posted today. If Netflix could somehow replicate this creator-following behavior, it would transform user stickiness entirely. That's partially why video podcasts are suddenly so important—they create recurring creators that users might return to see daily.

Netflix is essentially trying to solve an unsolvable problem using social media mechanics. How do you make a consumption-based service behave like a discovery-based service? The answer, apparently, is to blur the line between the two until they become indistinguishable.

In 2025, Netflix's total revenue is projected to be

The Vertical Video Feed: Netflix's Answer to TikTok

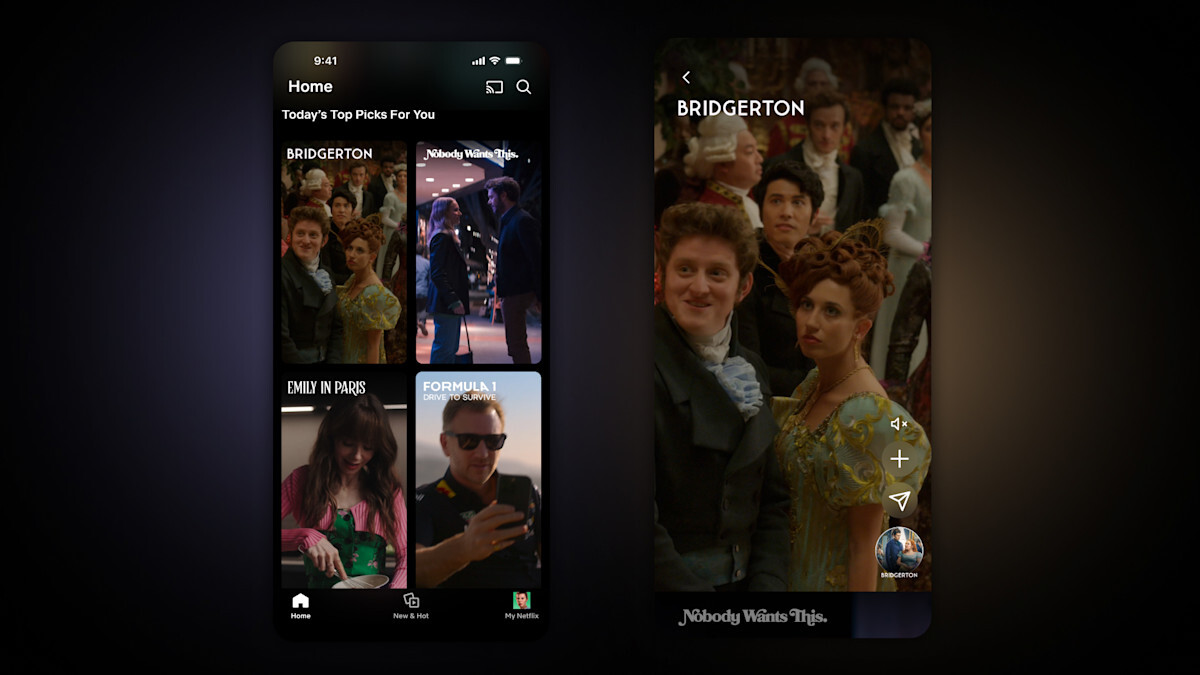

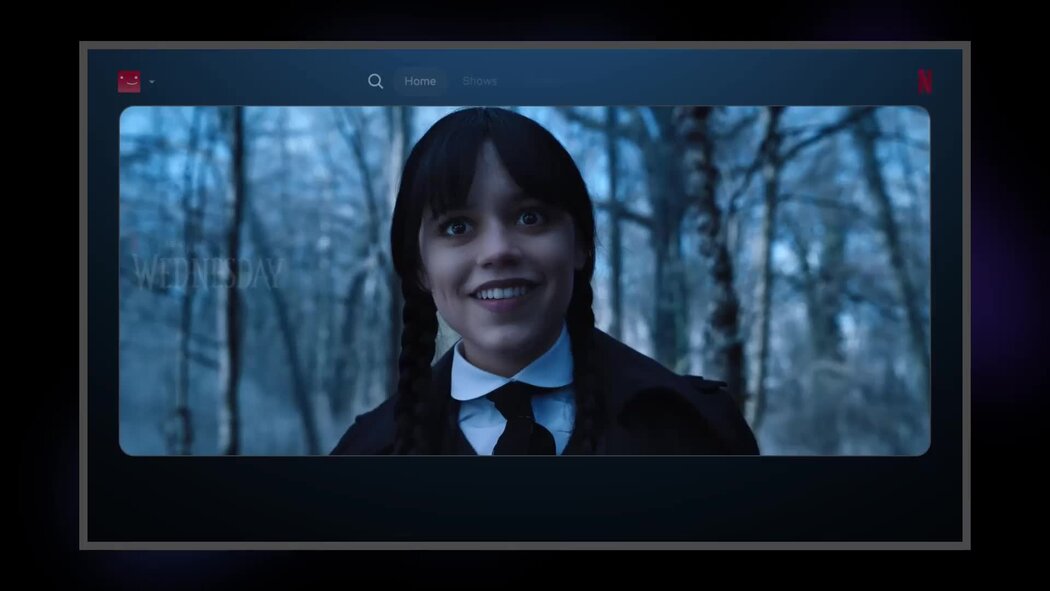

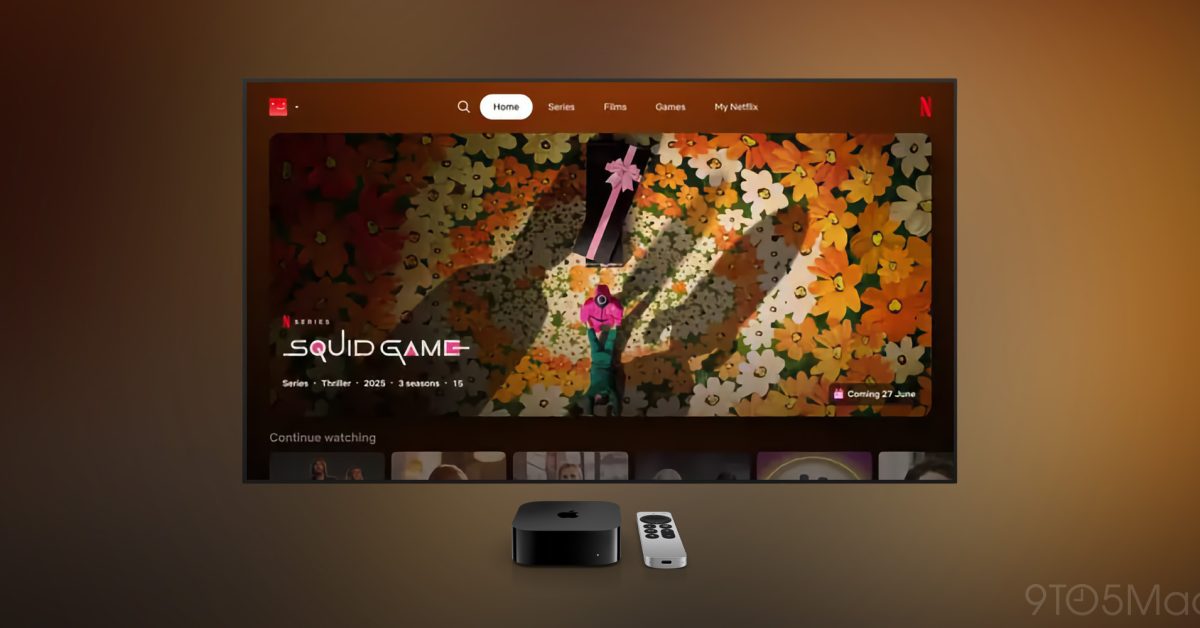

At the absolute center of Netflix's redesign is a deceptively simple feature: a vertical video feed of short clips from Netflix content. When you open the app, instead of seeing rows of shows and movies to choose from, you'd see an Instagram Reels-style interface. Swipe up, get another clip. Swipe up again, get another one. Each clip is 15-30 seconds of content designed to hook you into watching the full episode or movie.

This feature has been in limited testing since May 2025, which means Netflix has had nine months to gather behavioral data about how users interact with this format. The results must have been compelling enough to justify building an entire app redesign around the concept. But the mechanics are straightforward: swipeable clips work. They're proven. TikTok, Instagram, and YouTube have demonstrated that vertical video discovery is incredibly effective at driving both engagement and engagement time.

What makes Netflix's approach different from simply copying TikTok is that Netflix's clips have a built-in conversion mechanism: they're designed to drive you to watch the full content on Netflix's platform. You watch a 30-second clip of a comedy special, it hooks you, you tap to watch the full hour. You see a clip from the latest season of a hit show, curiosity draws you to watch the episode. The social platform mechanics serve as a funnel into Netflix's core consumption experience.

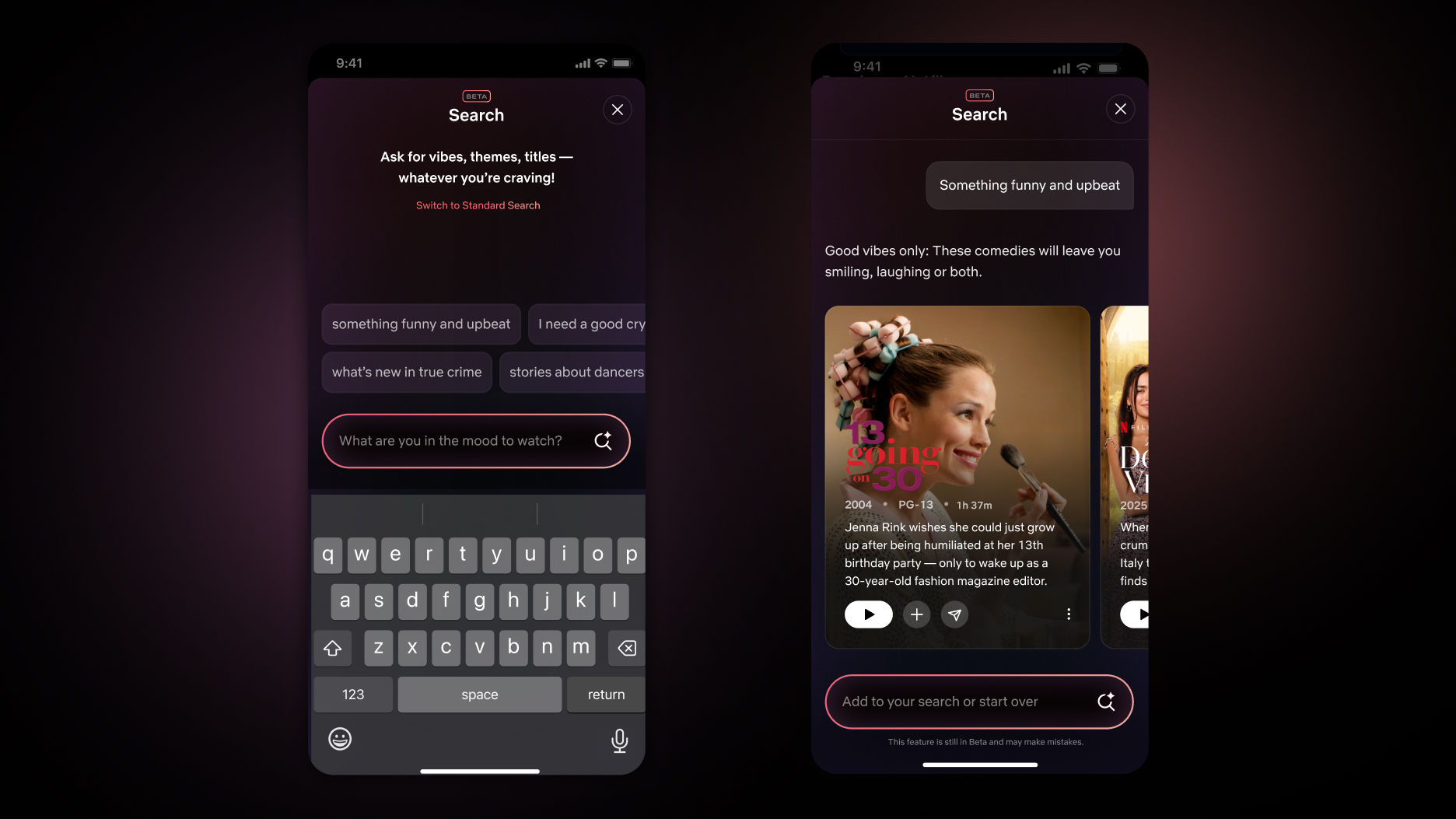

But here's where it gets sophisticated. Netflix isn't just randomly selecting clips. The algorithm behind which clips appear on your feed is using data about your watch history, what you've paused, what genres you tend to engage with, and what patterns other users with similar profiles have watched. This creates what Netflix calls "entertainment discovery," but it's really sophisticated algorithmic recommendation dressed up in social media clothing.

The vertical feed also solves a massive discovery problem Netflix has always had. You know that feeling when you have hundreds of shows available but can't find anything to watch? That paralysis of choice has probably cost Netflix billions in lost engagement time. By presenting content in a constant stream that feels serendipitous (even though it's algorithmic), Netflix removes the choice paralysis. You don't decide what to watch. The algorithm decides what to show you. You just swipe.

Netflix is also experimenting with different clip lengths and formats. Some clips might be 15-second teasers designed purely to intrigue you. Others might be 45-second comedy bits or dramatic scenes that stand alone as complete pieces of entertainment. The feed is becoming a mixed-media experience where short content has value independent of whether you watch the full thing.

This raises an interesting question: what happens to Netflix's watch-time metrics if people spend hours swiping through clips without watching full episodes? The company is likely banking on the assumption that clip engagement drives full content engagement. You watch a clip, get interested, and click through to watch the full show. But it's also possible that some users become satisfied by the clip consumption alone, which would actually reduce overall watch time even if engagement metrics improve.

The Strategic Role of Short-Form Video in Netflix's Growth

Vertical video feeds don't exist in isolation. They're part of a broader strategic pivot where Netflix is treating short-form content as a genuine growth vector, not just a feature. During the earnings call, co-CEO Greg Peters made this explicit: "You can imagine us bringing more clips based on new content types, like video podcasts." This suggests Netflix sees short-form as fundamental to its future, not a temporary experiment.

The strategic logic is sound: short-form video has lower production costs per unit of content than traditional shows. You can create dozens of clip variations from a single episode. A comedy special that runs 60 minutes can be divided into 100+ 30-second clips, each one potentially a viral hit. A dramatic scene from a hit show can be edited multiple ways to appeal to different audiences. Suddenly, Netflix's existing content library becomes infinitely more valuable because it can be repurposed and redistributed through short-form distribution channels.

More importantly, short-form video creates daily habits. Traditional content creates weekly habits (I watch my show every Thursday) or consumption-based habits (I watch when I want to relax). Short-form creates daily-check-in habits, which is exactly what Netflix needs to compete with social platforms. If Netflix can get users to check the app daily—even if it's just for a five-minute clip scroll—that transforms retention and engagement metrics dramatically.

There's also a content production angle. Netflix has spent years building original content, but it's increasingly expensive and time-consuming to produce a full season of television. What if Netflix could shift some of its production investment toward creators who generate short-form content regularly? Imagine a filmmaker, comedian, or music artist with a Netflix deal, uploading clips, behind-the-scenes content, and exclusive short-form material regularly. That creator becomes a draw for daily engagement.

Netflix is also recognizing that short-form is where younger audiences actually discover entertainment. If you ask someone aged 20 what their favorite TV show is, they might discover it through a TikTok clip, not Netflix's homepage. The top talent, the emerging creators, and the cultural moment setters are all on short-form platforms. If Netflix wants to remain culturally relevant and capture emerging audiences, it can't ignore this reality.

Video Podcasts: Netflix's New Content Frontier

If vertical video feeds are the delivery mechanism for short-form content, video podcasts are the content type Netflix is betting will drive recurring viewership. The company literally just launched its first original video podcasts during the quarter when it announced the app redesign. This isn't coincidental. Netflix is hedging its content strategy.

Traditional podcasts are audio—you listen while doing something else. Video podcasts require your visual attention but are often more casual and unscripted than traditional television. They're also incredibly popular on YouTube, where creators can build massive audiences by simply talking about interesting topics with guests. Now Netflix is bringing established video podcast franchises to its platform and creating original video podcasts featuring high-profile personalities.

The first wave included video podcasts hosted by Pete Davidson and Michael Irvin, as highlighted by The Verge. These aren't traditional entertainment products. They're personality-driven content where the appeal comes from the host's ability to be interesting, funny, or insightful while talking with guests. This is revolutionary for Netflix because it means the company is now competing directly for the same talent and audience that makes personalities like Joe Rogan or Andrew Tate massive draws on YouTube.

But there's another strategic advantage: recurring content. A traditional Netflix show might release 10 episodes over three months. Then it's gone, and you have to wait for season two. A video podcast might release weekly. Suddenly, you have a reason to open Netflix every week, which transforms engagement patterns. Add enough podcasts, and you've turned Netflix into a destination for recurring content, not just binge-watch shows.

Partnership deals with Spotify and iHeartMedia extend this reach. These partnerships mean Netflix is bringing established podcasts—shows that already have millions of listeners—into the Netflix ecosystem. Users of those podcasts will start seeing Netflix video versions alongside Spotify audio versions, creating cross-platform discovery and driving Netflix adoption among audiences that might not otherwise use the platform, as noted by Radio Insight.

There's also a revenue angle. Video podcasts are cheaper to produce than traditional television while still commanding significant viewer attention. A two-hour video podcast shot with a single camera in a studio costs a fraction of what a scripted drama costs to produce, yet it can generate comparable engagement. This dramatically improves Netflix's content cost-per-engagement metrics, making the business model more efficient.

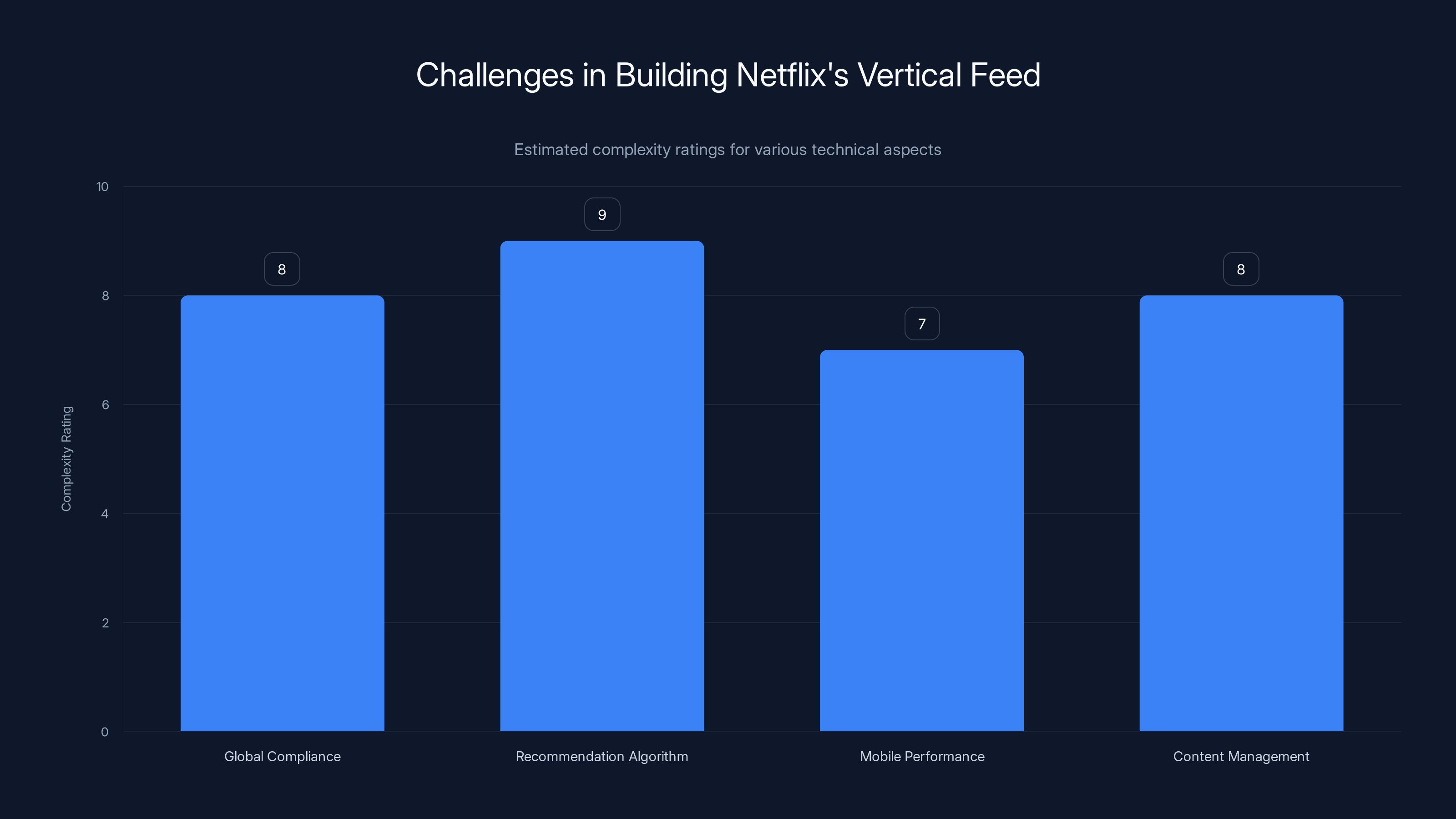

Building Netflix's vertical feed involves high complexity, especially in algorithm development and global compliance. Estimated data.

The Competitive Landscape Has Fundamentally Changed

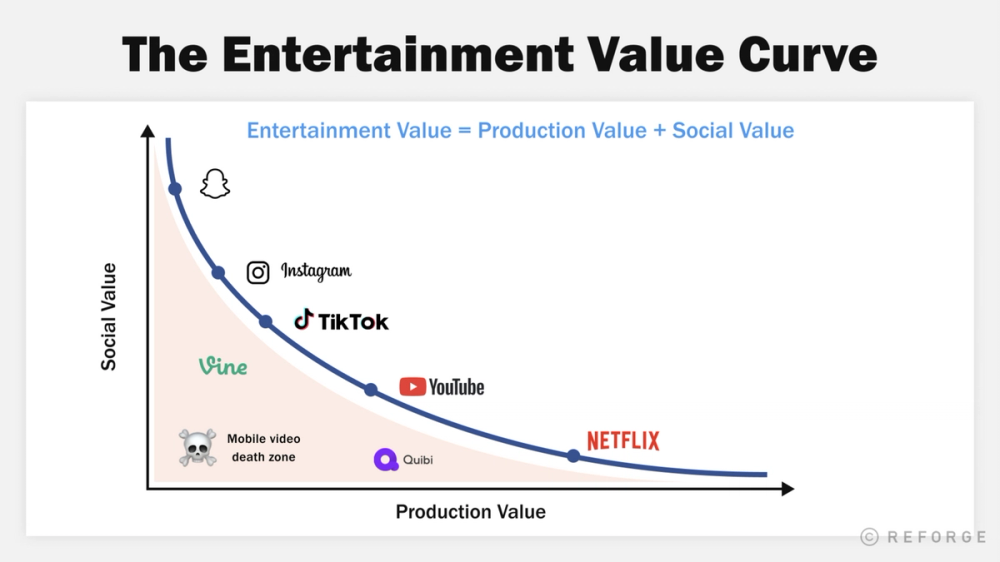

What's fascinating about Netflix's strategy shift is what it reveals about the company's understanding of its competitive position. During earnings, co-CEO Ted Sarandos made an explicit statement that challenges the traditional view of streaming competition: "There's never been more competition for creators, for consumer attention, for advertising and subscription dollars. The competitive lines around TV consumption are already blurring."

Translate that to plain language: Netflix isn't primarily competing with HBO Max, Disney+, and Paramount+. Those are all running similar strategies—build a library of content, charge for subscriptions. The real competition is with every entertainment option that captures user attention. That means TikTok is a Netflix competitor. So is Instagram. So is YouTube. Gaming platforms are Netflix competitors. Even real-world activities are Netflix competitors because they're all fighting for limited user attention.

Sarandos also referenced something that would have seemed absurd a few years ago: "The Oscars and the NFL are on YouTube. Apple's competing for Emmys and Oscars, and Instagram is coming next." This is profoundly true and profoundly disruptive to the traditional media hierarchy. Prestige programming is increasingly platform-agnostic. A show can be prestigious whether it airs on Netflix, HBO, YouTube, or Instagram. The platform doesn't determine the legitimacy of the content anymore—quality does.

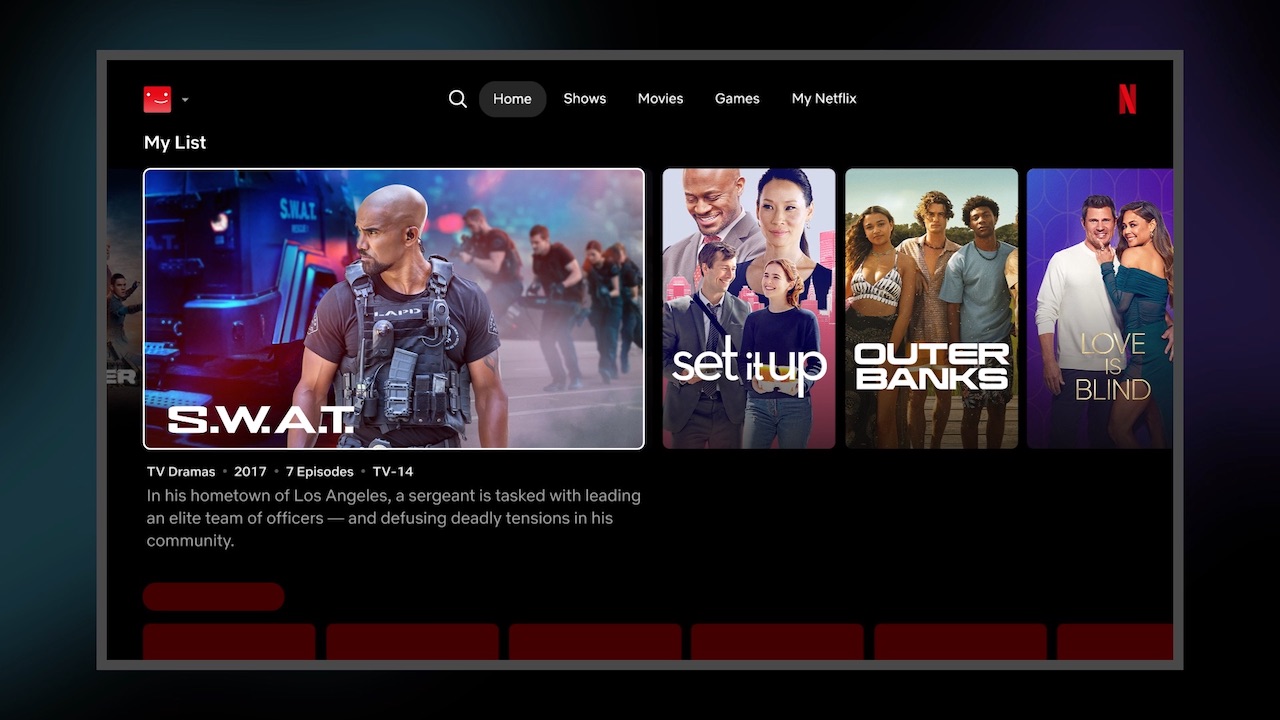

This shifts Netflix's entire strategic position. For years, Netflix competed by having exclusive content—shows you could only watch on Netflix. That advantage has largely disappeared because all streaming services have exclusive content, and increasingly, platform doesn't determine access. What Netflix now needs is usage frequency. It needs users opening the app multiple times per day, not just once per week.

The NFL, Oscars, and major cultural moments appearing on YouTube and other platforms tells us something critical: distribution is democratizing. Any platform with sufficient infrastructure can host any content type. This means Netflix's competitive advantage can't come from having exclusive access to content—it has to come from providing a better interface, better recommendations, better social features, or better integration into daily media consumption.

What Netflix is essentially saying with its redesign is this: we can't out-content YouTube or out-social TikTok. We can't beat the NFL at live sports (yet) or Oscars at prestige events (yet). What we can do is provide a better interface for discovering and consuming entertainment, and we can use social mechanics to increase daily engagement. That's a more modest positioning than Netflix's historical dominance, but it's more realistic given the current landscape.

How the Redesign Changes Netflix's Revenue Model

Netflix's financial structure depends on two core metrics: subscribers and engagement. Subscribers generate recurring subscription revenue. Engagement determines how long subscribers keep paying and how much advertising revenue can be captured. The 2025 numbers tell the story:

The app redesign directly impacts both metrics. For subscribers, the vertical feed and social mechanics are designed to reduce churn. A user who doesn't engage with the app regularly is more likely to cancel when they're billed. By making daily app openings more rewarding and less friction-laden (swipe instead of search), Netflix is trying to increase daily active users as a percentage of total subscribers.

For advertising, the redesign is transformative. Every swipe on a vertical feed is an impression opportunity. Every video clip is an ad placement opportunity. Netflix could show ads between clips, ads around the edges of the feed, or sponsor specific clips. The engagement mechanics mean users are actively choosing to spend time in the app, which makes ad inventory more valuable. An advertiser might pay a premium to place ads on Netflix's vertical feed because the audience is actively engaged and discovery-focused.

Sarandos commented on the theatrical release strategy Netflix is pursuing, including the acquisition of Warner Bros.' motion picture division. This signals that Netflix is thinking about revenue diversification beyond subscriptions and advertising. If Netflix can produce tentpole films that go to theaters, those films generate theatrical revenue, then streaming revenue, then merchandise, then downstream licensing. Traditional film studios have perfected this model over decades. Netflix is now adopting it.

The video podcast strategy also has a revenue angle. Podcasts can be monetized through advertising (sponsors mention products during the episode), sponsorship deals (companies pay for ad reads), or partnerships (like the Spotify and iHeartMedia deals where Netflix presumably receives revenue for providing the video component). As Netflix builds a library of popular video podcasts, advertising inventory within those podcasts becomes increasingly valuable.

All of this points to Netflix's future looking less like a subscription streaming service and more like a diversified media company that happens to own a streaming platform. Subscriptions will remain important, but they'll be one revenue stream among many. That's a fundamental shift in business model, and the app redesign is the mechanism through which Netflix is executing this shift.

The Technical Complexity Behind the Vertical Feed

If you're thinking that building a vertical video feed is straightforward, you'd be underestimating Netflix's engineering challenge. Creating the interface is simple. Creating an interface that works at Netflix's scale while maintaining quality and performance is dramatically harder.

Consider the technical requirements. Netflix operates in nearly 200 countries across multiple languages, currencies, and content regulations. A vertical feed that works in the US might violate content guidelines in another country. Building a feed that respects these regulations across all markets while maintaining user experience is non-trivial.

Then there's the algorithm. Netflix's recommendation system is arguably its most valuable asset. The algorithm needs to figure out which clips to show you, in what order, and how to balance showing you content you're likely to love against showing you new content you might discover. The vertical feed interface changes what data the algorithm has access to. Instead of just knowing that you watched episode three of show X, the algorithm now knows you watched a 23-second clip of a dramatic scene and didn't swipe to the next clip immediately. That behavioral signal is valuable but also different from traditional viewing data.

Mobile performance is another challenge. The feed needs to load quickly, stream video smoothly on 2G connections (in markets where low bandwidth is common), and handle the specific demands of vertical video playback. This is more complex than it sounds because video streaming algorithms are optimized for horizontal formats and variable-length content. Netflix has spent years optimizing for these constraints, and now they're rebuilding for different constraints.

Then there's the content management piece. Every clip shown in the feed needs metadata attached—title, description, full show link, user rating, recommendation confidence, and dozens of other data points. Netflix's content library contains hundreds of thousands of videos. Creating clip versions of all of them, categorizing them, and making them discoverable in a feed is a massive data problem.

Estimated data suggests short-form content could significantly increase daily check-ins and weekly engagement hours, enhancing user retention.

Market Response and Competitive Threats

Netflix's announcement that it's building a vertical feed naturally raises the question: what's everyone else doing? The answer is that Netflix is probably behind the curve here. YouTube has been optimizing short-form content since launching YouTube Shorts. Instagram has Reels. TikTok obviously owns the space. Even niche platforms like Twitch and Discord have vertical video features.

What Netflix is attempting is therefore a catch-up move, not innovation. But sometimes catch-up moves matter more than innovation. Netflix likely has more entertainment content than any other platform. If it can make that content discoverable through a familiar interface (vertical feed), it could quickly amass an engaged audience on this feature, even if it's not novel.

Disney+ has started similar experiments with a home screen redesign that emphasizes discovery. Amazon Prime Video is pushing original content harder. Apple TV+ is focusing on quality over quantity. HBO Max is emphasizing prestige programming. Everyone is trying to figure out how to maximize engagement on a fixed subscriber base because subscriber growth is slowing across the industry.

But Netflix has advantages these competitors don't. Netflix's scale means it invests more in content than competitors. Netflix's recommendation algorithm is more sophisticated than most. Netflix's technical infrastructure is built for streaming at scale. The vertical feed isn't revolutionary, but Netflix's execution of it probably will be more polished than most competitors can achieve.

The real threat to Netflix comes from platforms that can offer both short-form discovery and full-length content consumption in a seamless experience. YouTube is dangerous because it does this. TikTok is dangerous because it's so effective at discovery. A platform that combined TikTok's interface with Netflix's content library would be unstoppable.

For now, Netflix's strategy is defensive. It's trying to ensure that as users increasingly consume entertainment via vertical feeds, Netflix remains in the conversation. The redesign is also offensive—by making Netflix's interface more social and discovery-focused, the company might pull users away from competitor platforms.

The Role of AI in Content Discovery and Personalization

Underlying everything Netflix is announcing—the vertical feed, video podcasts, short clips—is artificial intelligence and machine learning. The algorithms that decide which content appears on your feed, in what order, with what timing are increasingly sophisticated, and Netflix is investing heavily in AI to stay ahead of this curve.

The original challenge Netflix solved was recommending content based on viewing history. If you watched show X, Netflix recommends show Y because users who liked X also liked Y. That's collaborative filtering, a foundational machine learning approach. But the vertical feed requires something more sophisticated: real-time personalization based on micro-interactions.

When you swipe past a clip without pausing, what does that signal mean? Does it mean you're not interested, or did you simply not see a hook in that particular preview? When you pause on a clip for two seconds, does that indicate genuine interest or just accidental hovering? Netflix's algorithm needs to distinguish these signals in milliseconds and use them to adjust what clips show next.

This is computationally expensive and requires massive amounts of training data. Netflix has billions of user interactions it can use to train these models, which is a competitive advantage. Most competitors don't have comparable data volume. But it also means Netflix's algorithm improves continuously as more users interact with the feed. The first few months of rollout will be suboptimal, but by month six, Netflix's algorithm will probably be demonstrably better than competitors' because it's trained on more interactions.

There's also a content creation angle to AI. Netflix might be experimenting with AI-generated clips—automatically extracting the most interesting 30-second sequences from longer content using computer vision and audio analysis. This would allow Netflix to create thousands of clip variations from existing content without human involvement. Combined with AI understanding of what types of clips perform well for different audience segments, Netflix could scale clip production to match demand.

User Experience and Interface Design Implications

The shift from a traditional Netflix interface to a vertical feed represents a fundamental change in user experience philosophy. Traditional Netflix puts you in control. You browse categories, search for titles, or see recommendations. You decide what you want to watch. A vertical feed inverts this dynamic. The algorithm decides what to show you. You decide whether to engage or skip.

This change might feel minor, but it has massive implications for behavior. When users are in control, they're making deliberate choices, which means they're evaluating options. This can lead to paralysis (too many choices) or satisfaction (I found exactly what I wanted). When an algorithm is in control, users are reacting to suggestions, which is faster but potentially less satisfying if the algorithm is wrong.

Netflix is banking that the algorithm will be right often enough that users prefer the speed and discovery feeling of a vertical feed over the control of traditional browsing. Engagement metrics from the testing period probably support this assumption, otherwise the company wouldn't be rolling this out company-wide.

The user experience implications extend to content creators and studios. Currently, a Netflix show succeeds or fails based on whether enough people choose to watch it. With a vertical feed, a show succeeds if enough people engage with clips shown to them. This might change how content is produced. Shows might optimize for "clip-ability"—creating scenes or moments specifically designed to hook viewers in a 30-second format. Comedy shows optimize for this already (SNL sketches, stand-up specials), but dramas might change their pacing or structure.

For the average user, the experience shift probably feels like moving from intentional browsing to passive discovery. Some users will prefer this. Others will find it exhausting or unsatisfying. Netflix's interface will likely include toggles to switch between discovery (vertical feed) and search/browse modes. The question is what mode becomes the default, which will determine how most users interact with the platform.

TikTok leads the vertical video market with an estimated 40% share, followed by YouTube Shorts at 30%. Netflix is entering the market with a 10% share, leveraging its vast content library. (Estimated data)

Global Considerations and Regulatory Challenges

One complexity Netflix glosses over in earnings calls is the global regulatory environment. A vertical feed optimized for US audiences might not work in Europe, where different regulations govern algorithmic recommendation systems. Similarly, content regulations differ dramatically across countries.

Europe's Digital Services Act specifically regulates algorithmic recommendation systems for platforms with over 45 million users. Netflix definitely qualifies. The DSA requires transparency about how algorithms work and mandates user choice regarding algorithmic recommendation. This might mean European users see a different feed experience than US users, or it might mean Netflix needs to add additional controls to its feed algorithm.

Then there's content regulation. A clip Netflix shows in the US might violate content guidelines in India or Saudi Arabia. Netflix's algorithm needs to account for not just user preferences but also local content regulations. This is solvable technically but adds complexity to the feed algorithm.

There's also the question of whether a vertical feed is actually appropriate for Netflix's geographic distribution. In regions with limited mobile data, endless swiping through video clips might not be practical. Netflix might need to optimize the vertical feed for lower bandwidth, perhaps showing shorter clips or lower-resolution previews. This optimization complexity increases as Netflix expands the feature globally.

Implications for Netflix's Theatrical Strategy

Sarandos mentioned Netflix's evolving theatrical release strategy and the company's acquisition of Warner Bros.' motion picture division. This might seem unrelated to the app redesign, but there's actually a strategic connection.

If Netflix is positioning itself as an entertainment discovery platform rather than just a streaming service, theatrical releases become another distribution channel. A Netflix film could go to theaters for a window, then premiere on the app, then be repurposed into vertical clips. This hybrid distribution model actually makes more sense when you control the entire distribution chain from theatrical through streaming through social.

The app redesign enables this by turning Netflix into a destination for entertainment discovery across formats. Currently, Netflix is the place you go to watch something you decide to watch. Future Netflix might be the place you go to discover what entertainment is available today across theatrical, streaming, and social formats. That's a massive shift in positioning.

The Long-Term Vision: Netflix as an Entertainment OS

When you zoom out from the specific features—vertical feeds, video podcasts, short clips—and look at Netflix's overall strategy, a bigger vision emerges. Netflix isn't trying to become TikTok. Netflix is trying to become an entertainment operating system.

Think of it this way. An operating system is the foundation layer that everything else runs on. Windows is an OS for computers. iOS is an OS for phones. Netflix, in this view, could become an OS for entertainment consumption. You open Netflix not to watch a specific show but because you want entertainment, and Netflix's interface adapts to show you exactly what you should consume right now.

This vision requires the company to own multiple content types (shows, movies, podcasts, clips, interactive content, games). It requires algorithmic sophistication to personalize at the individual level. It requires platform integration with social features so discovery feels social. And it requires engagement mechanics that make daily usage habitual.

Netflix is systematically checking all these boxes. The vertical feed provides algorithmic discovery. Video podcasts and shows provide content variety. Partnerships with creators provide social elements. The architecture is becoming increasingly sophisticated.

If this strategy works, Netflix's long-term advantage isn't based on having exclusive content (because that advantage is temporary and replicable). It's based on owning the primary interface through which people discover entertainment. That's a defensible, durable competitive advantage because switching costs are high and the habit is sticky.

Estimated data shows a growing preference for short-form video content over traditional streaming from 2020 to 2026.

Monetization Strategy: Advertising and Subscription Convergence

The app redesign also enables better monetization. An engaged audience in a vertical feed creates more advertising inventory. Every swipe is a potential ad impression. Netflix can insert sponsored clips into feeds, recommend branded content, or partner with studios to prominently feature their content.

This isn't just about traditional advertising. It's about discovery. When Netflix partners with a studio, that partnership can mean the studio's content gets algorithmic boost in personalized feeds. This becomes a revenue stream—studios pay for better feed placement, which generates more engagement, which generates more subscriptions or advertising revenue.

Subscription and advertising are also converging. Theoretically, Netflix could charge more for ad-free subscription and less for ad-supported subscription. But as subscriptions mature and growth slows, advertising becomes increasingly important. A redesigned interface that drives more engagement makes advertising more valuable because there are more ad impressions available.

Sarandos noted that Netflix passed 325 million paid subscriptions in Q4 2025. That's growth, but at a slower pace than previous quarters. The company is unlikely to reach 500 million subscribers even over the next five years. This reality means future revenue growth will come from monetizing existing subscribers better through advertising, not adding new subscribers. The app redesign is the mechanism for better advertising monetization.

Risks and Potential Downsides

Despite the strategic logic, there are real risks to this approach. The first risk is that users might simply not want Netflix to behave like TikTok. A vertical feed optimized for algorithmic discovery removes user control, which some users find frustrating. If Netflix's test audiences had more negative reactions to the interface, the company wouldn't be rolling it out. But that doesn't mean all users will prefer it.

There's also the risk of engagement at the expense of satisfaction. Netflix could have users swiping through clips for hours while engagement time increases but satisfaction decreases. The company might have more data about what users watched but less understanding of whether they enjoyed it. This could create a long-term retention problem where users eventually churn despite high short-term engagement.

Then there's the competitive risk. If YouTube or TikTok implement better integration with premium video content, they could outcompete Netflix's vertical feed. A platform that offered YouTube's short-form discovery plus Netflix's content would be stronger than Netflix alone. That risk drives Netflix to execute quickly and maintain product superiority.

There's also the content creator risk. If the vertical feed becomes the primary way users discover content, creators might optimize for clip-ability over overall quality. This could reduce the perceived quality of Netflix's original content, which is Netflix's primary competitive advantage. The company needs to balance feed optimization with content quality maintenance.

Industry Implications: What This Means for Competitors

Netflix's redesign sends a clear signal to the entire entertainment industry: the vertical feed is becoming the dominant discovery interface. Every streaming platform will eventually need to implement something similar. HBO Max, Disney+, Amazon Prime Video, and others are already experimenting with different approaches.

But Netflix's scale and resources give it advantages competitors can't easily replicate. Netflix's recommendation algorithm is trained on more data. Netflix's engineering resources are deeper. Netflix's content library is broader. A competitor like Disney+ could build a vertical feed, but it would probably be inferior to Netflix's because it has less training data and fewer engineering resources.

This creates an interesting dynamic. Netflix is essentially pushing the entire industry toward a format that plays to Netflix's strengths. The company is essentially saying "everyone's going to have vertical feeds eventually, but we'll do it better." That's a reasonable strategic move, but it also reveals Netflix's confidence that it can compete in this format.

For creators and content studios, the implication is that traditional distribution models are becoming obsolete. Content doesn't go to Netflix and succeed or fail. Content goes to Netflix, gets distributed through vertical feeds, gets featured in podcasts, gets repurposed into clips, and succeeds based on its performance across all these formats. This requires a different content strategy than traditional streaming demanded.

Predictions: The Next Wave of Entertainment Platforms

If Netflix's strategy works, we should expect several developments. First, other streaming platforms will launch similar vertical feed features within 6-12 months. Disney+, HBO Max, and others can't afford to lag too far behind Netflix on this feature.

Second, we'll see integration between streaming and social platforms accelerate. YouTube might add subscription management to YouTube Premium. TikTok or Instagram might add longer-form content. The lines between platforms will blur more dramatically than they already have.

Third, the creator economy will further merge with traditional entertainment. Podcasters will become increasingly important to streaming platforms. Gaming streamers will cross over to traditional content platforms. The distinction between "creator content" and "professional content" will continue eroding.

Fourth, algorithmic recommendation will become even more central to consumer choice. Instead of browsing, users will primarily react to algorithmic suggestions. This creates both opportunity (better personalization) and risk (filter bubbles, reduced serendipity, algorithmic manipulation).

Finally, advertising will become increasingly integrated into content itself. Sponsored clips, branded partnerships, and product placement will grow more sophisticated. Users might not notice whether they're watching a Netflix show or a sponsored clip because the interface treats them the same.

The Bigger Picture: Streaming's Evolution

Netflix's redesign is part of a larger evolution in the streaming industry. The first generation of streaming was about replacing cable with a library of on-demand content. The second generation (where we currently are) is about competing on original content and global distribution. The third generation (which Netflix is entering) is about engagement mechanics and platform stickiness.

We're witnessing the maturation of the streaming industry. Growth rates are slowing. Competition is intense. The path to continued revenue growth isn't through adding more subscribers but through monetizing existing subscribers better. That drives Netflix toward engagement mechanics, advertising, diversification, and platform integration.

Streaming services are becoming less like "Netflix" and more like "Netflix the platform that happens to have entertainment content." They're becoming media companies, distribution networks, and discovery engines simultaneously. That's a more complex business than traditional streaming, but it's also one that offers more defensible competitive advantages.

For consumers, this evolution is mixed. On one hand, there's more entertainment available across more platforms. On the other hand, the experience is becoming more algorithmically mediated and less under user control. On the third hand (bear with me), the engagement mechanics are likely better designed because competition is so intense. Everyone is optimizing for user experience because everyone has access to the same data about what works.

Netflix's redesign is therefore not just a feature update. It's a signal that the company is adapting to a fundamentally changed entertainment landscape. The strategy is reasonable, the execution is being led by competent people, and the resources committed are substantial. Whether it works depends on whether users will actually prefer vertical feeds over traditional browsing and whether engagement translates to retention and revenue.

Based on the strength of Netflix's earnings and management commentary, there's a reasonable chance this strategy will work. But the company is making significant bets here, and if the vertical feed adoption is lower than expected or doesn't translate to improved retention, Netflix's growth trajectory could be affected.

For now, the redesign is officially launching later in 2026. The real story will be how users respond and how quickly competitors respond. If the redesign is successful, expect every streaming platform to have a similar interface within a year. If it's unsuccessful, expect Netflix to quickly pivot and try something else. Either way, we're in an interesting moment where the foundational design of streaming platforms is being fundamentally reconsidered.

FAQ

What is Netflix's new app redesign?

Netflix is launching a complete redesign of its mobile app in 2026 that centers around vertical video feeds similar to TikTok and Instagram Reels. The interface will display short clips from Netflix shows, movies, and video podcasts in a swipeable format designed to improve content discovery and increase daily engagement with the platform.

Why is Netflix adding a vertical video feed?

Netflix is adding vertical video feeds because social platforms have proven that this format dramatically increases daily user engagement. Users spend more time discovering content through swiped feeds than traditional browsing. Netflix sees daily engagement as critical to subscriber retention and advertising revenue growth, especially as subscriber growth rates have slowed.

When will the Netflix app redesign launch?

Netflix announced that the redesigned app will launch sometime later in 2026. The feature has been in limited testing since May 2025, giving Netflix nine months to refine the algorithm and interface before wider rollout. The company is positioning this as the first major redesign in several years.

How will Netflix's vertical feed differ from TikTok?

Netflix's vertical feed is designed to drive users to watch full shows and movies, not just to keep users swiping through clips. Each short clip shown on the feed includes a link to the full content. The algorithm is optimized based on Netflix's existing watch history data and recommendation systems, not just engagement metrics. Additionally, Netflix's feed will include original video podcasts alongside entertainment clips.

Will the vertical feed replace Netflix's traditional interface?

It's likely that Netflix will keep both experiences available, at least initially. Users will probably be able to toggle between the discovery feed and traditional browsing/search modes. However, the vertical feed will probably become the default interface for most users, with traditional browsing becoming a secondary option for users who prefer it.

Why is Netflix investing in video podcasts now?

Video podcasts create recurring content that gives users a reason to open the app multiple times per week (or daily). Unlike traditional shows that have season finales, podcasts often release new episodes weekly or regularly. This recurring schedule creates more habitual engagement. Video podcasts also allow Netflix to build audiences around personality-driven creators rather than just scripted content, which is a major draw on platforms like YouTube.

How will Netflix compete with YouTube and TikTok if both already have vertical feeds?

Netflix's advantages include its existing library of premium entertainment content, its sophisticated recommendation algorithm trained on billions of user interactions, its resources for content production, and its brand as a quality entertainment destination. While Netflix is implementing a format that others pioneered, the company likely has resources to execute better than competitors and integrate the feed with premium content more effectively.

Will Netflix's redesign make the platform more like social media?

Yes. Netflix is explicitly adopting social media engagement mechanics—vertical feeds, algorithmic recommendation, short-form content, creator-driven content—to increase daily usage frequency and engagement time. However, the company maintains that it's not becoming social media but rather improving entertainment discovery. The distinction is mostly semantic.

Could Netflix's vertical feed reduce the quality of content Netflix produces?

There's a risk that if content creators optimize for clip-ability (short dramatic moments, punchy scenes), it could affect overall show quality. However, Netflix's financial incentives remain aligned with producing high-quality content because quality drives subscriptions and retention. The vertical feed might change how content is structured, but it shouldn't reduce overall quality significantly.

How will advertising work in the vertical feed?

Netflix hasn't provided specific details, but the vertical feed creates natural advertising opportunities. The company could insert sponsored clips between regular clips, offer studios premium feed placement in exchange for payment, or integrate traditional advertising between clips. An engaged audience actively swiping through feeds represents more valuable advertising inventory than passive viewers.

Return to the basics: Netflix needs daily engagement to compete with social platforms, vertical feeds have proven effective at driving this engagement, and the company has the resources and content to execute this strategy better than competitors. Whether it works depends on user adoption and whether engagement translates to improved retention metrics over the next 12 months.

Key Takeaways

- Netflix is launching a complete app redesign in 2026 with vertical video feeds to compete with TikTok and Instagram for daily user engagement

- The vertical feed has been in testing since May 2025, allowing Netflix to gather behavioral data and refine algorithms before wider rollout

- Video podcasts are becoming Netflix's major growth vector, with partnerships from Spotify and iHeartMedia bringing established creator audiences to the platform

- Netflix's 325 million subscribers represent mature market saturation, making advertising revenue and engagement metrics more important than subscriber growth

- The competitive landscape has fundamentally changed—Netflix now competes with social platforms, live events, and gaming for audience attention, not just other streaming services

Related Articles

- FTC Meta Monopoly Appeal: What's Really at Stake [2025]

- Netflix's Mobile UI Overhaul 2025: What the Redesign Means for Streaming [2025]

- FTC's Meta Antitrust Appeal: What's at Stake in 2025

- Netflix Ads Revenue Hits $1.5B in 2025: What This Means [2025]

- Netflix's Star Search Live Voting: How Interactive TV Is Reshaping Competition Shows [2025]

- Prime Video's Steal: A Thrilling Heist That Delivers [2025]

![Netflix's Major App Redesign: Competing with TikTok for Daily Engagement [2025]](https://tryrunable.com/blog/netflix-s-major-app-redesign-competing-with-tiktok-for-daily/image-1-1768957779900.jpg)