Nevada vs. Kalshi: The Prediction Markets Battle Reshaping Gambling [2025]

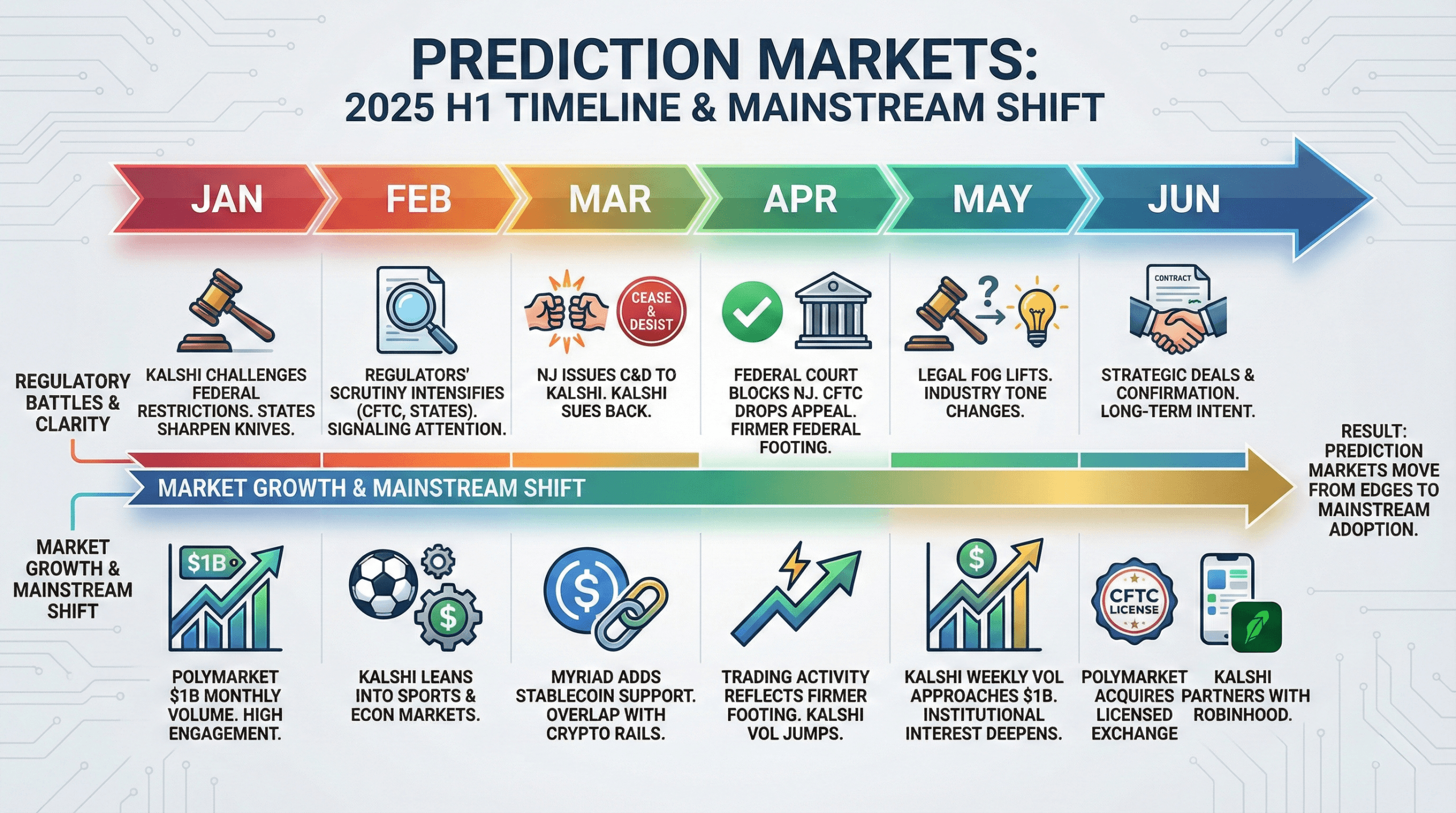

Prediction markets are having a moment. They're growing faster than anyone expected, making real money for some users while raising serious red flags for regulators. But here's where it gets messy: Nevada just sued Kalshi, one of the biggest prediction market platforms, and the Trump administration stepped in to claim federal authority over the entire industry. This isn't just a legal dust-up. It's a clash over who gets to control a rapidly growing financial system, with potential connections to insider trading and billions of dollars at stake.

Let me walk you through what's actually happening, why it matters, and what comes next.

TL; DR

- Nevada sued Kalshi for operating sports gambling without state licenses and serving users under 21, as detailed in The Wall Street Journal.

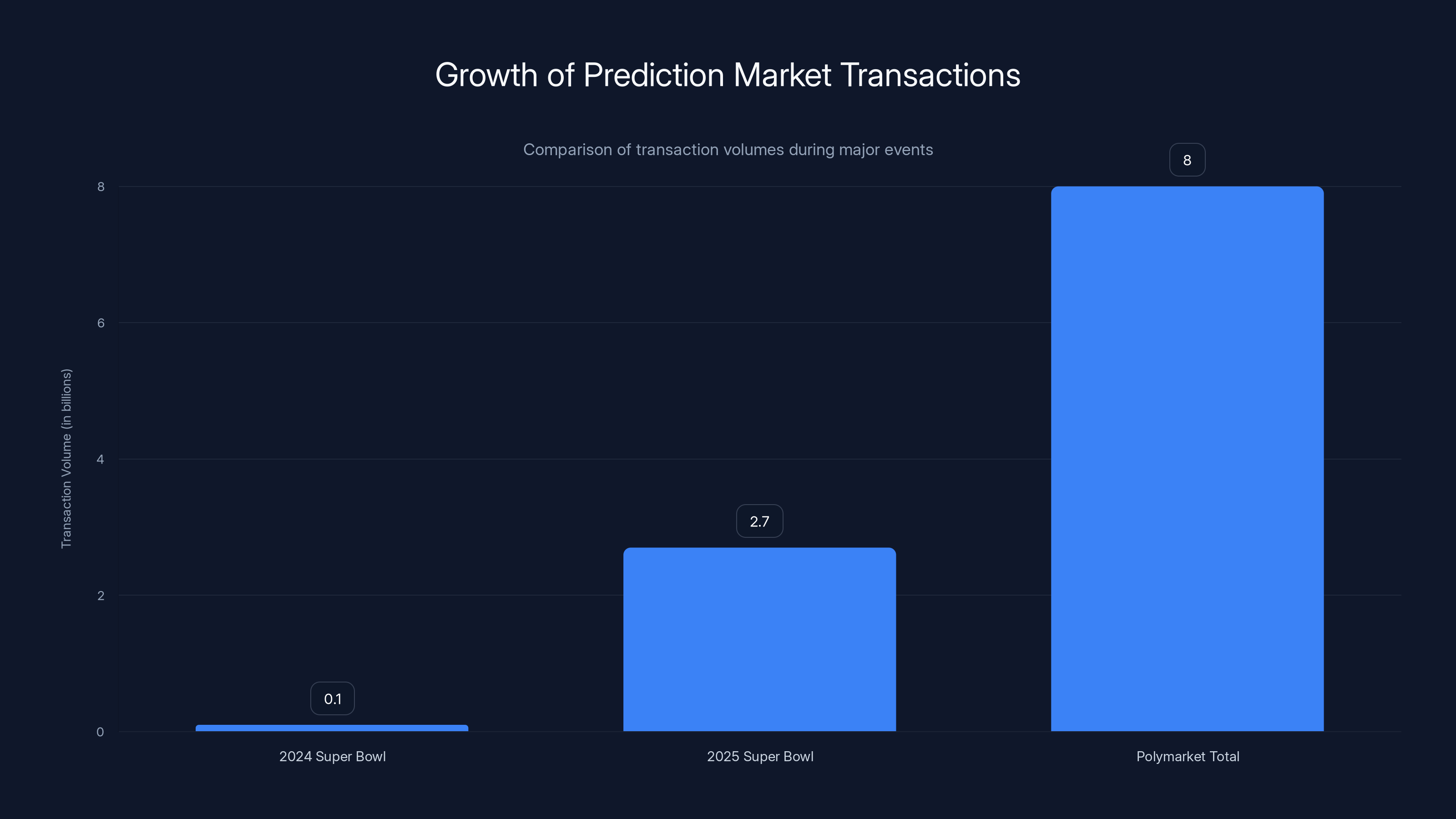

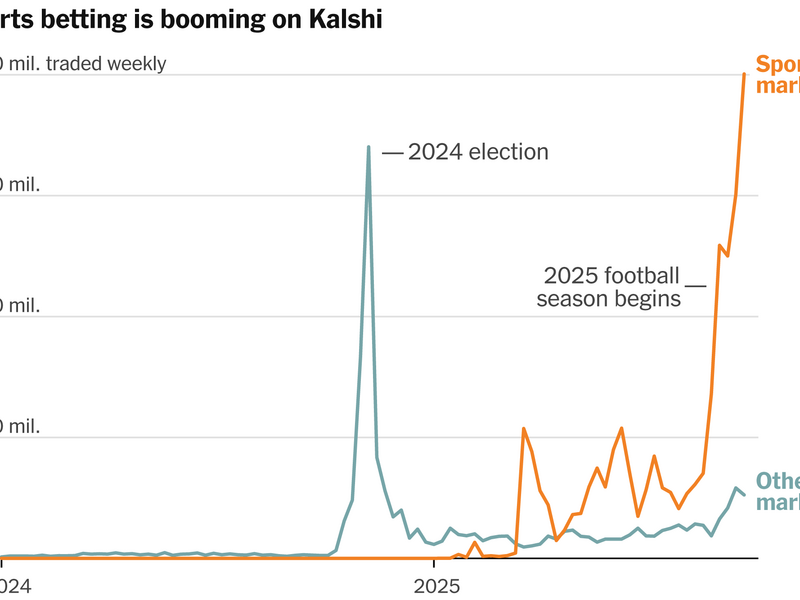

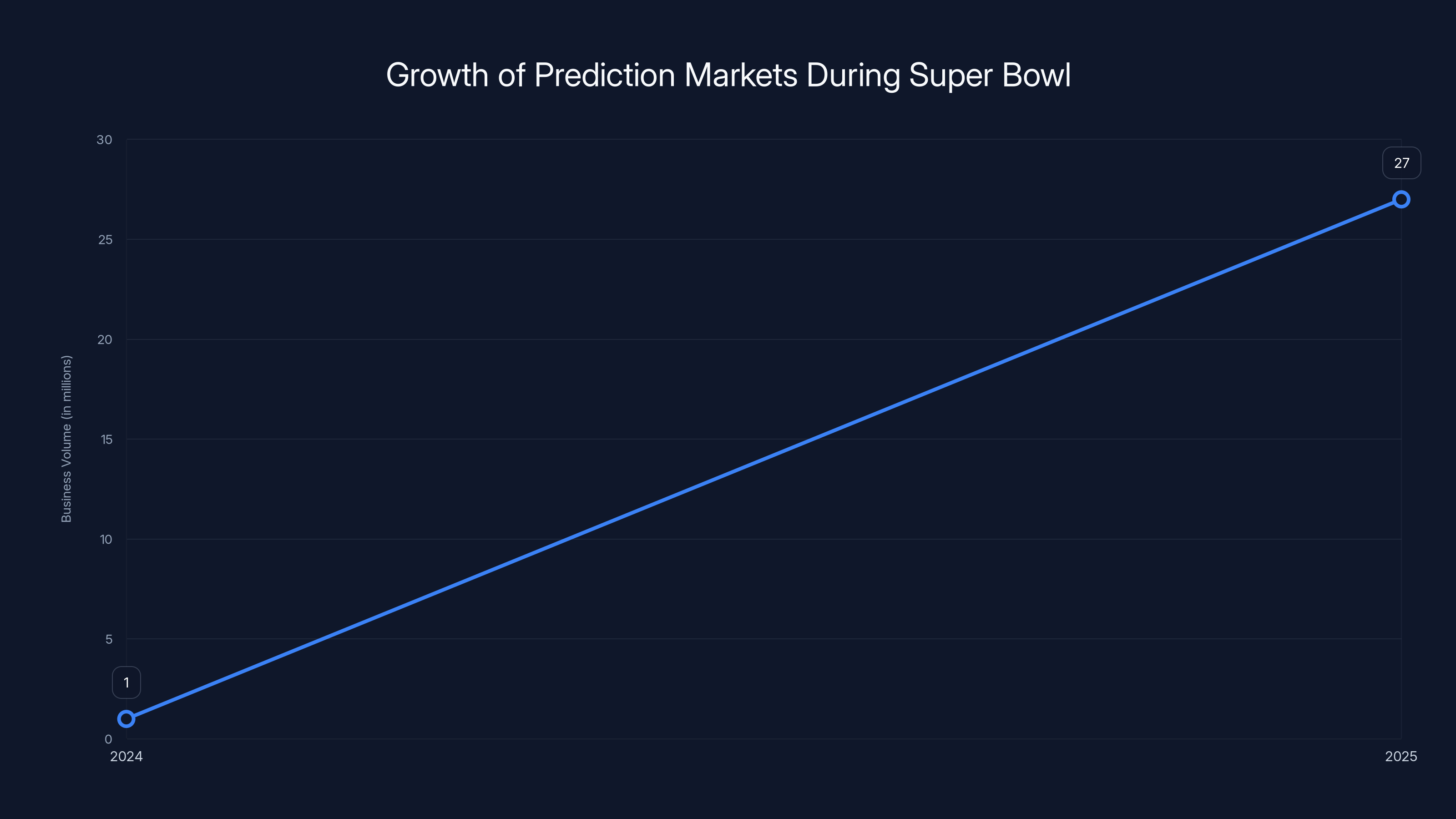

- Prediction markets exploded in popularity, doing 27 times more business during Super Bowl 2025 than the previous year, according to CBS News.

- Trump administration intervened, claiming only federal authorities (CFTC) can regulate these markets, as reported by PBS NewsHour.

- Insider trading red flags emerged, with some users making massive profits on suspiciously timed bets, highlighted by Vanderbilt Law.

- Business implications include potential regulatory crackdowns, platform shutdowns, or federal restructuring, as analyzed by Sportico.

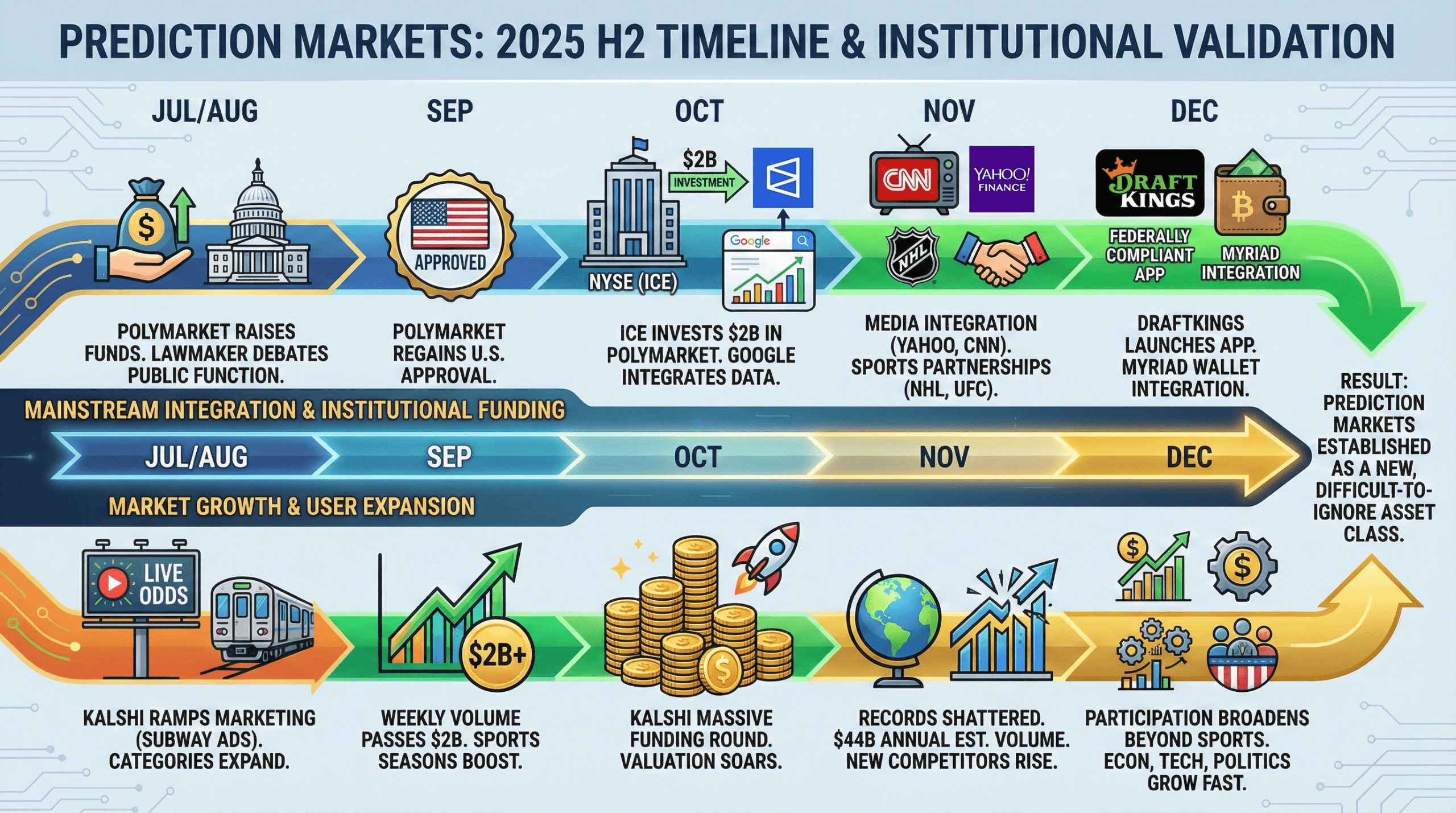

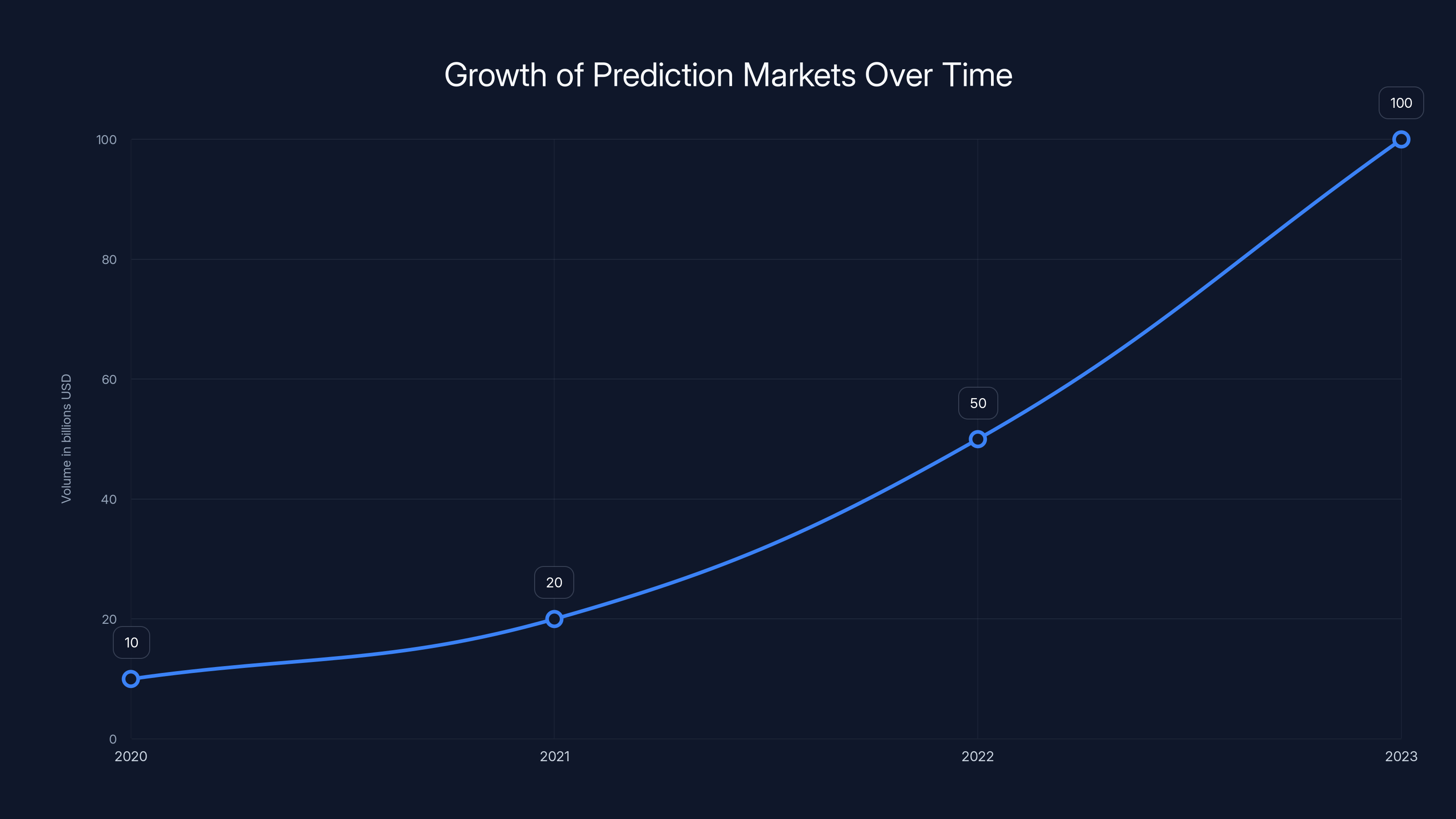

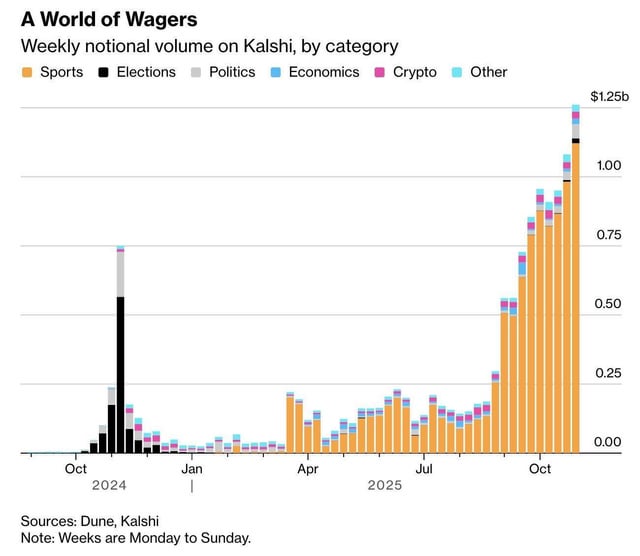

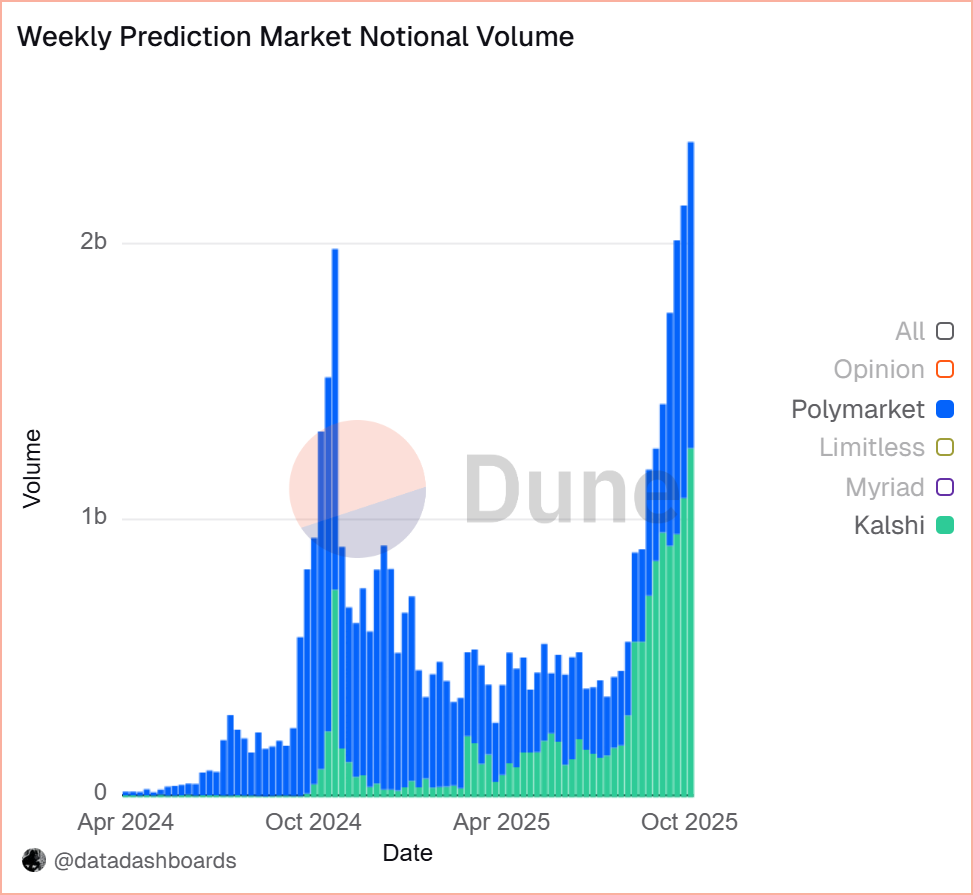

Kalshi's transaction volume grew 27 times from the 2024 to the 2025 Super Bowl, indicating rapid growth in the prediction market industry. Polymarket has processed over $8 billion since its launch, as noted by Gambling Insider.

What's Actually Happening: The Nevada Lawsuit

Let's start with the basics. Nevada's gambling regulators and attorney general filed a lawsuit against Kalshi this week. The state alleges that Kalshi is operating an illegal sports gambling operation without proper state licenses. More specifically, they're saying Kalshi violates Nevada law in two ways: first, by offering sports gambling services without state approval, and second, by allowing users under 21 to participate, as detailed by Legal Sports Report.

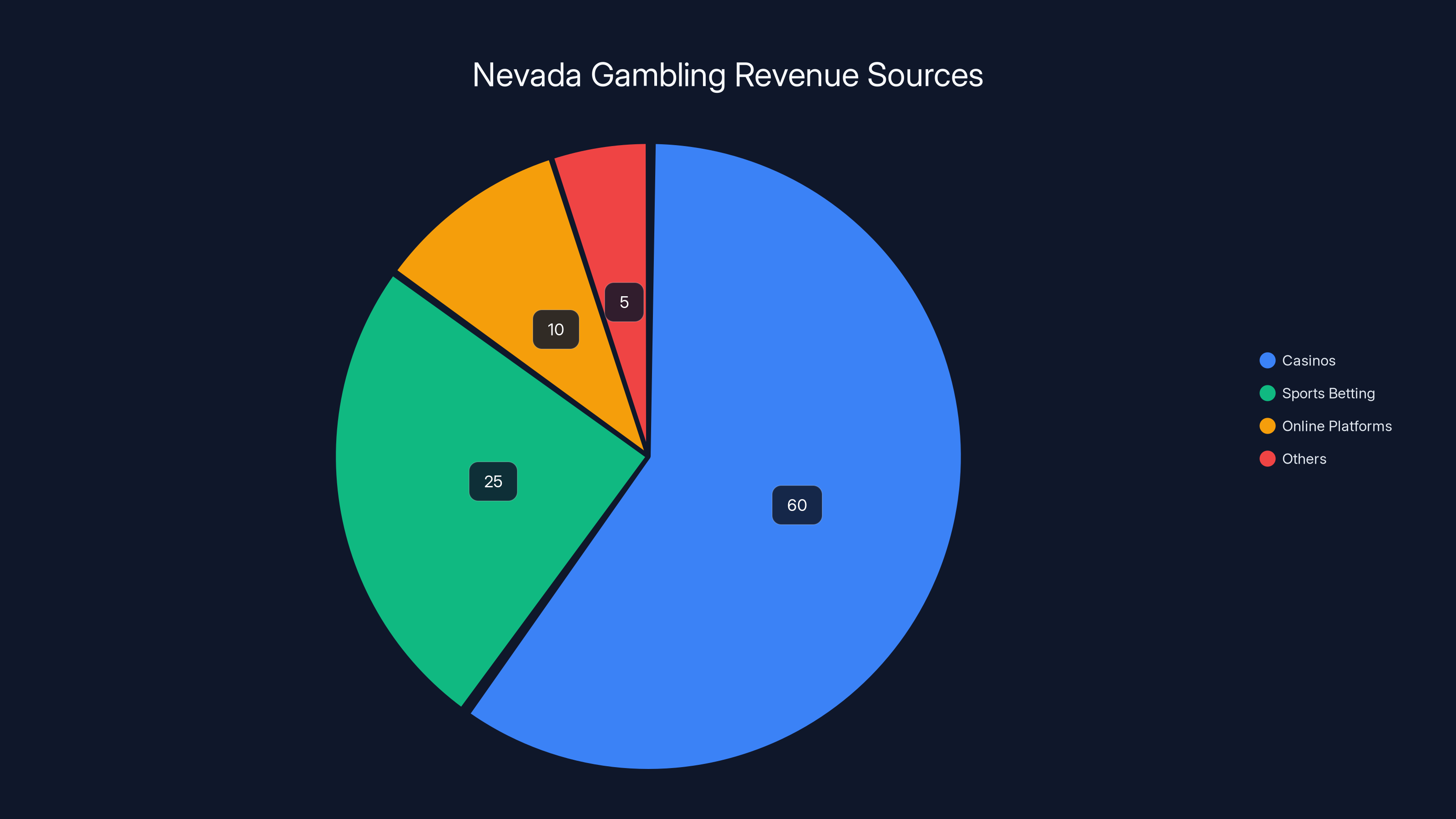

This isn't some minor regulatory complaint. Nevada takes gambling seriously. The state generates billions in revenue from regulated casinos, sports betting operations, and gaming, as reported by The Nevada Independent. When a platform like Kalshi starts offering sports betting without going through official channels, regulators see it as both a legal violation and a threat to their entire regulatory framework.

The lawsuit comes right after a federal appeals court rejected Kalshi's attempt to block Nevada from taking legal action. So Kalshi had one shot to stop this in court, and it didn't work. Now Nevada is moving forward aggressively, as reported by The Wall Street Journal.

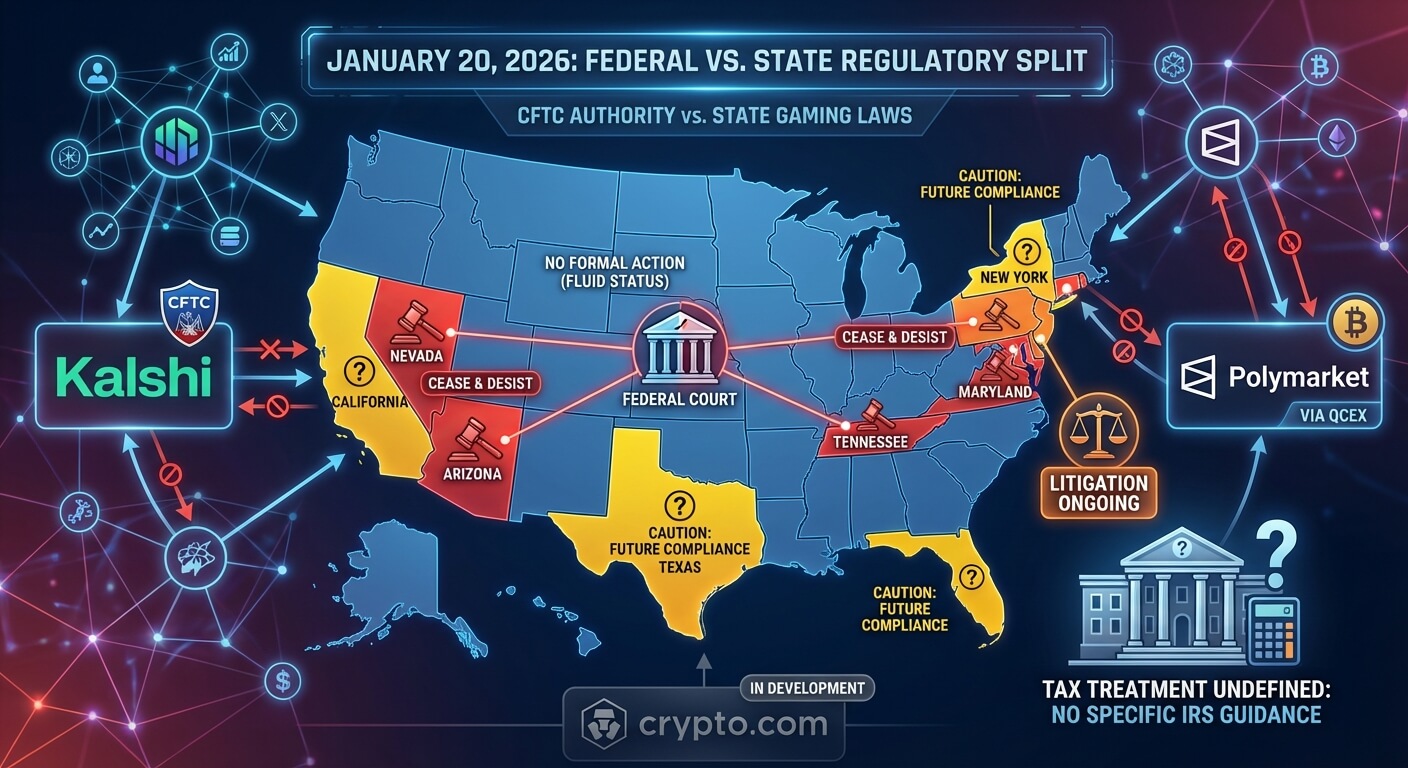

What makes this lawsuit particularly significant is the timing. It came one day after the Trump administration made a bold claim: only the federal government has the right to enforce regulations over prediction markets. This sets up a direct conflict between state and federal authority, as detailed by PBS NewsHour.

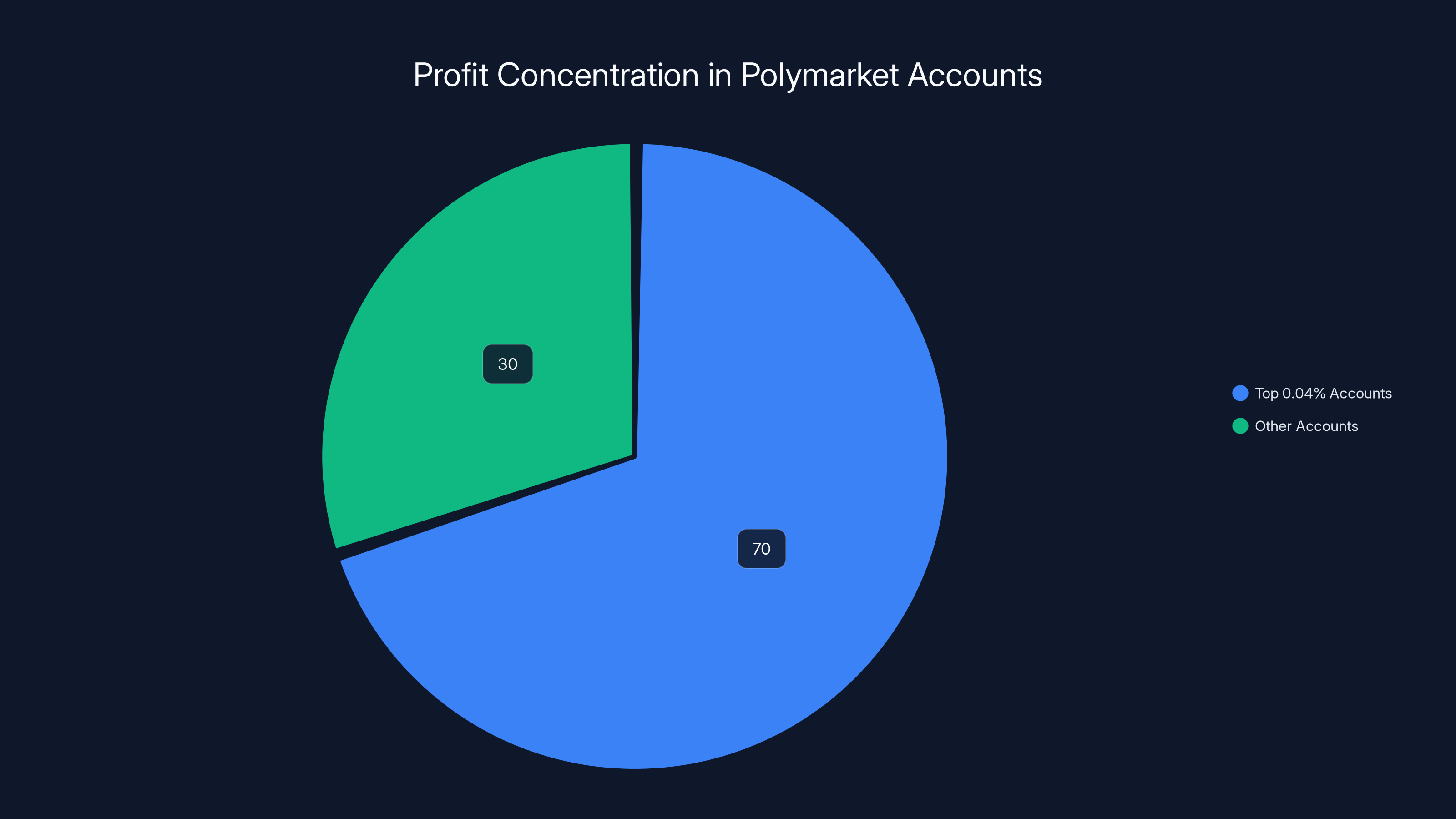

An estimated 0.04% of Polymarket accounts capture 70% of the platform's total profits, highlighting significant profit concentration among a very small group of users. Estimated data.

The Trump Administration's Federal Power Play

Here's where things get complicated. The CFTC (Commodity Futures Trading Commission), the federal agency responsible for regulating commodity futures markets, issued a statement through its Chair claiming exclusive authority over prediction markets. The Chair, Michael Selig, didn't mince words. He basically said that states are overstepping by trying to regulate these markets locally, as reported by Corporate Compliance Insights.

Selig wrote that the CFTC "will no longer sit idly by while overzealous state governments undermine the agency's exclusive jurisdiction." That's language suggesting they're about to get aggressive in defending their turf.

The legal argument is that prediction markets should be treated as financial instruments (specifically, event contracts) rather than gambling. If they're financial instruments, they fall under federal jurisdiction. If they're gambling, they fall under state jurisdiction. Kalshi and its competitor Polymarket have been making this argument for a while, and now the Trump administration is backing them up, as noted by PBS NewsHour.

But here's the conflict of interest that nobody's hiding: the Trump family has financial stakes in these prediction market platforms. Donald Trump Jr. serves as a paid adviser to Kalshi and holds investor status plus unpaid adviser role at Polymarket. In January, the Trump family's social media company (Truth Social's parent company) announced plans to launch its own prediction market platform, as highlighted by NBC News.

You don't need to be a cynic to see how the family's financial interests might align with federal authority claims that benefit these platforms.

The Explosive Growth of Prediction Markets

To understand why this is such a big deal right now, you need to see the numbers. Prediction markets have experienced wild growth, particularly around major events. During this year's Super Bowl, Kalshi did 27 times as much business as it did during last year's game, as reported by CBS News.

Let that sink in. 27 times more. In twelve months.

This growth is happening so fast that it's actually eating into Nevada's own gambling revenue. The state's regulated gambling operations did less business during this year's Super Bowl compared to the previous year. Money that would traditionally flow to Nevada casinos and state-regulated sportsbooks is instead going to platforms like Kalshi and Polymarket, as noted by The Nevada Independent.

Kalshi itself has been expanding aggressively. Nevada regulators noted in a recent letter that "Kalshi has continued to dramatically expand its business, rather than attempting to maintain any kind of status quo." Translation: they're not slowing down. They're pushing harder, as reported by CNBC.

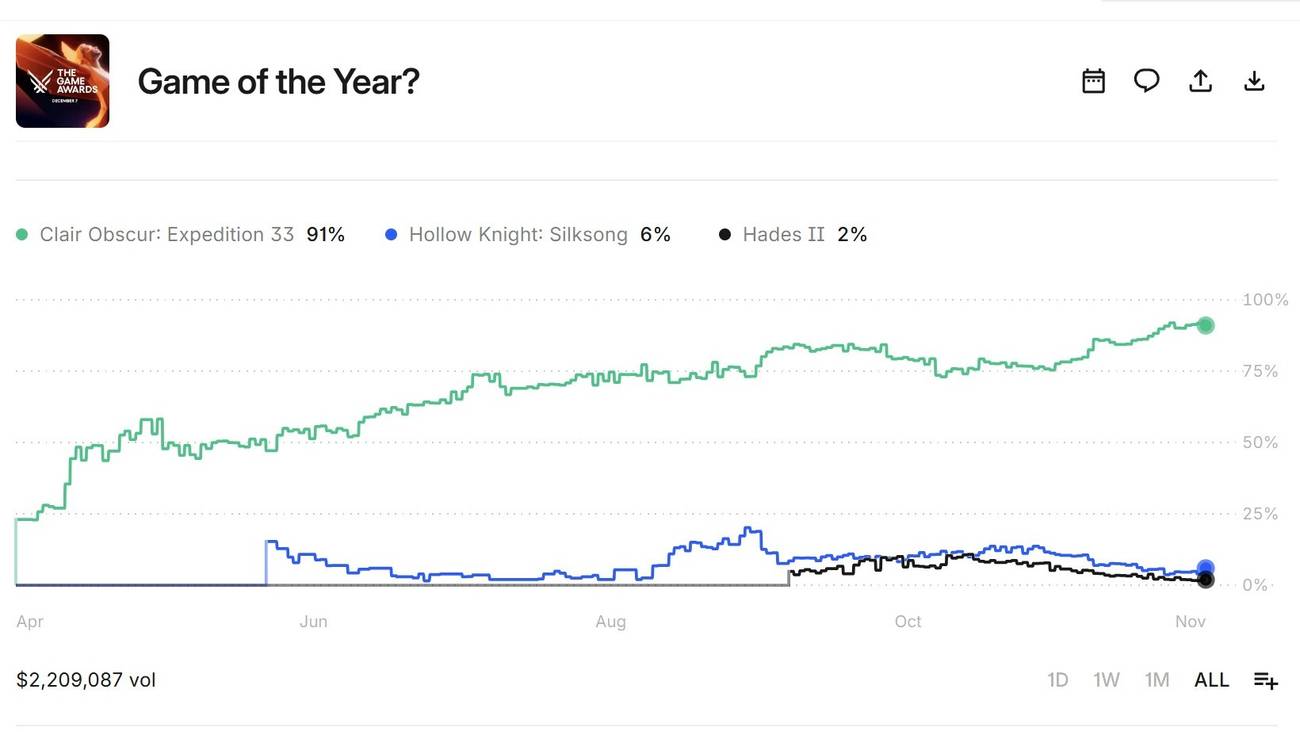

The appeal is obvious. Prediction markets offer something traditional gambling doesn't: the ability to bet on any outcome you can imagine. Election results, war developments, technological breakthroughs, business earnings, weather patterns. You name it, you can bet on it.

Prediction markets have seen explosive growth, with estimated annual volumes potentially reaching $100 billion by 2023. Estimated data based on industry trends, as noted by Gambling Insider.

The Insider Trading Problem Nobody's Talking About

Here's where this gets genuinely concerning. Prediction markets have a built-in insider trading problem that regulation hasn't caught up with yet.

Blockchain analyst De Fi Oasis found that fewer than 0.04 percent of Polymarket accounts have captured over 70 percent of the platform's total profits, totaling more than $3.7 billion. Let that number sit with you. Less than one-tenth of one percent of users control most of the profits, as reported by Vanderbilt Law.

That concentration is... suspicious.

Take the Israel-Iran situation last month. A Polymarket user placed tens of thousands of dollars in bets on "yes" to the question: "Israel's military action against Iran by Friday?" Within 24 hours, Israel actually bombed Iran, resulting in hundreds of casualties. The user made $128,000 on that single bet, as highlighted by Vanderbilt Law.

Blockchain data traced that wallet to an X account with its location set to Beit Ha'shita, a northern Israeli settlement. Even more suspicious: the user later transferred those bets to two different accounts, apparently to avoid detection.

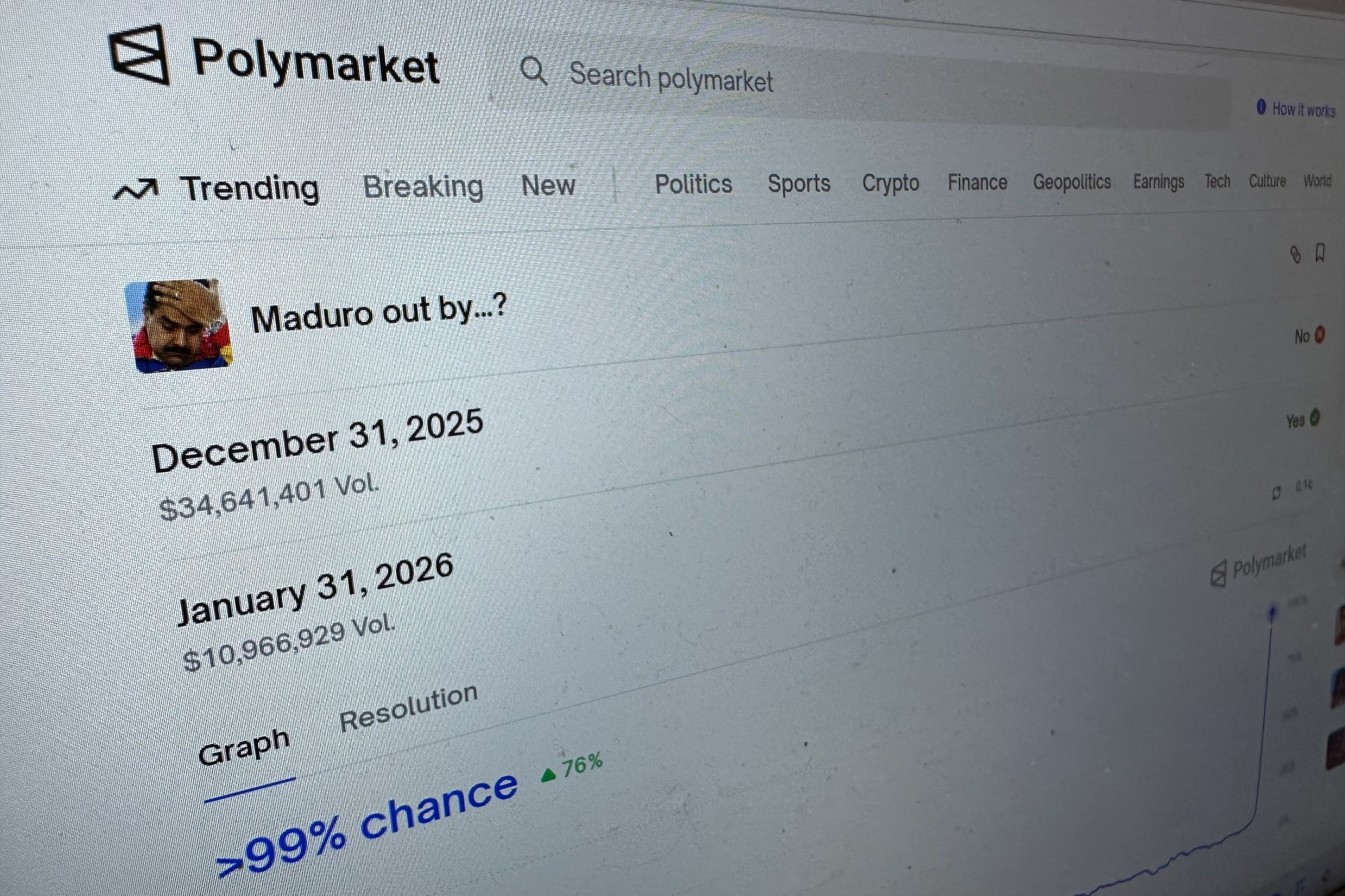

Another example: an anonymous user made over $400,000 by betting that Nicolás Maduro would be ousted by the end of January. Those bets were placed in the hours and days right before U. S. military strikes on Venezuela. The timing isn't coincidental. This is the exact pattern you'd see with inside information, as noted by Vanderbilt Law.

Then there's the case of eight jointly-owned accounts with handles like "fmaduro," "madurowilllose," "striketheboats," and "trumpdeservesit." These accounts collectively generated over $161,000 betting on María Corina Machado Parisca winning the Nobel Peace Prize. The number of accounts, the naming pattern, the coordinated betting, and the timing all suggest coordination based on non-public information.

This is what insider trading looks like in the prediction market world. But unlike traditional securities markets, where insider trading is heavily prosecuted, prediction markets have virtually no oversight mechanism. No one's watching. No one's investigating. Until now.

State vs. Federal Authority: A Constitutional Showdown

The lawsuit in Nevada represents the first major test of this conflict. Which authority actually has the power to regulate prediction markets: states or the federal government?

Historically, gambling has been a state issue. Each state decides what's legal within its borders. That's why you have casinos in Nevada, Nevada's sports betting, but different rules in New Jersey, New York, or California. States set their own standards, as noted by Legal Sports Report.

But the Trump administration and the CFTC are arguing that prediction markets are different. They're not gambling. They're financial instruments. And financial instruments fall under federal jurisdiction via the Commodity Exchange Act, as reported by Corporate Compliance Insights.

The problem with that argument is that it's conveniently vague. What makes something a financial instrument versus gambling? Both involve money, both involve risk, both involve uncertain outcomes. The distinction is semantic and, frankly, politically convenient for those benefiting from the current regulatory vacuum.

Legal scholars are divided. Some argue the CFTC does have a legitimate claim to jurisdiction under existing federal law. Others argue that states have a clear right to regulate gambling operations within their borders, and prediction markets are essentially sports gambling, which Nevada already regulates, as analyzed by Vanderbilt Law.

The outcome of Nevada's lawsuit will likely determine how this plays out nationally. If Nevada wins, expect other states to follow with their own lawsuits and regulatory enforcement. If Kalshi wins, you'll see prediction markets flourish nationwide without state-level oversight.

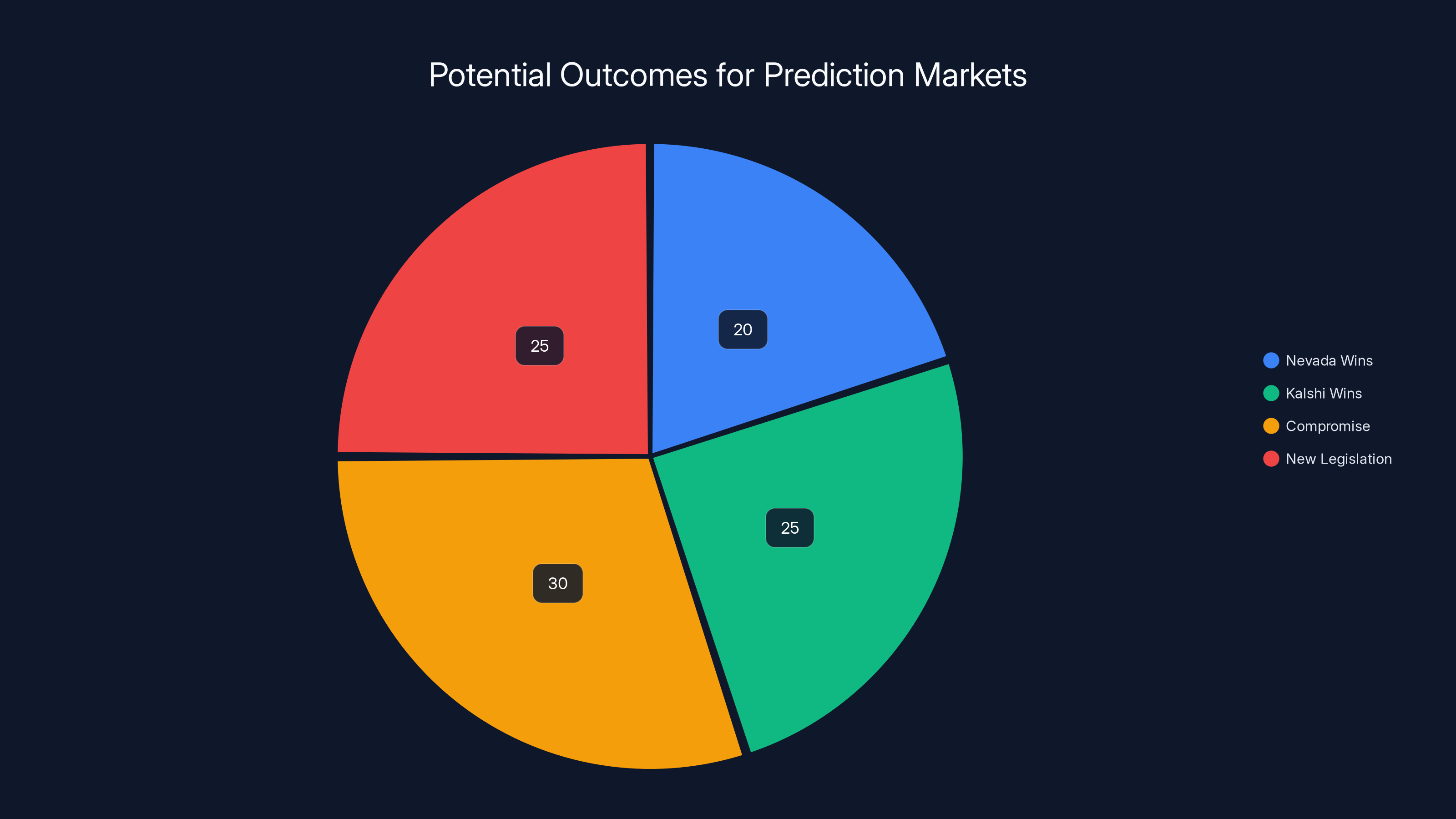

Estimated data suggests a balanced likelihood across scenarios, with 'Compromise' slightly more probable. This reflects the complexity and uncertainty in regulatory environments.

Why Kalshi and Polymarket Are Calling This "Not Gambling"

Kalshi and Polymarket's core argument is sophisticated, even if it feels like legal gymnastics. They say their platforms offer "event contracts," not gambling bets.

The distinction, they argue, is that prediction markets serve an economic information function. Prices on these markets reflect crowd wisdom about future outcomes. Economists use this information to understand what collective knowledge predicts about real-world events. It's not just speculation; it's price discovery, as noted by JD Supra.

There's actually something to this argument. Prediction market prices do contain real predictive information. Studies have shown that prediction markets often outperform traditional polling or expert forecasts when predicting election outcomes or other events, as highlighted by JD Supra.

But that doesn't make the "not gambling" argument airtight. A poker game played by brilliant strategists still involves gambling, even if the players are making informed decisions. A sports bet based on sophisticated analysis is still gambling, even if the bettor has done their homework.

The real issue is that Kalshi and Polymarket want the benefits of being financial markets (lighter regulation, larger size, institutional participation) while avoiding the drawbacks of being classified as gambling (state licensing requirements, responsible gambling protections, stricter oversight), as analyzed by Sportico.

It's a strategy that works as long as regulators accept the argument. But Nevada isn't buying it, and based on the lawsuit, other states likely won't either.

The Business Impact: Nevada's Gambling Revenue Problem

Nevada isn't suing Kalshi out of spite. They're suing because these platforms are genuinely hurting state gambling revenue.

Nevada's entire economy has been built around gambling. The state generates roughly 6 percent of its general fund revenue directly from gaming, which amounts to billions of dollars annually. This money funds schools, infrastructure, public safety, and other essential services, as reported by The Nevada Independent.

When users bet on prediction markets instead of Nevada sportsbooks, that money leaves the state's revenue system entirely. Kalshi doesn't pay Nevada taxes. Polymarket doesn't contribute to Nevada's gaming fund. The platforms operate in a regulatory gray area, taking advantage of not paying state licensing fees or gaming taxes, as noted by Yahoo Finance.

The financial impact is significant. If prediction markets continue growing at current rates, Nevada could lose billions in annual gaming revenue over the next five years. That's not a hypothetical. That's a direct threat to state funding, as analyzed by Legal Sports Report.

Nevada's lawsuit isn't just about legal principle. It's about economic survival. The state is defending its revenue model against a new competitor that's operating in a regulatory vacuum.

Casinos dominate Nevada's gambling revenue, contributing an estimated 60%, while sports betting accounts for 25%. Unlicensed platforms like Kalshi threaten this ecosystem. (Estimated data)

Licensing, Compliance, and the Age Verification Problem

One of Nevada's key complaints in the lawsuit is that Kalshi allows users under 21 to participate. This is a big deal.

Nevada's gambling regulations explicitly prohibit anyone under 21 from participating in any form of gambling. State casinos, sportsbooks, poker rooms, slot machines, all of it requires age verification. Nevada takes this seriously because underage gambling is linked to addiction, financial ruin, and social problems, as reported by Legal Sports Report.

If Kalshi is indeed allowing users under 21 to place bets, that's a clear violation of Nevada law. Even if Kalshi argues it's a financial market, not gambling, age restrictions still apply to many financial activities.

The licensing issue is even more fundamental. Nevada requires anyone operating a gambling operation to be licensed. Kalshi hasn't obtained that license. Why? Because licensing means complying with Nevada regulations, paying taxes, and undergoing compliance audits. The entire point of calling prediction markets "financial instruments" is to avoid those requirements, as noted by Legal Sports Report.

But if regulators succeed in reclassifying prediction markets as gambling, then licensing becomes mandatory. No license, no operation. That's how Nevada enforcement works.

The Trump Connection: Conflicts of Interest and Regulatory Capture

This is the awkward part that everyone's thinking about but few are discussing directly.

The Trump administration, through the CFTC, is defending prediction market platforms. The CFTC Chair filed an amicus brief literally on Tuesday, the same day Nevada sued Kalshi, arguing for federal-only jurisdiction, as reported by Corporate Compliance Insights.

Meanwhile, Donald Trump Jr. is a paid adviser to Kalshi. He's also an investor in Polymarket. And the Trump family's social media company is launching its own prediction market platform, as highlighted by NBC News.

If that doesn't look like a conflict of interest, I'm not sure what does.

This situation meets the textbook definition of regulatory capture. Regulatory capture is when an industry gains control over the regulators that are supposed to oversee it. In this case, the industry (prediction markets) has direct personal connections to senior government officials (the Trump family), who then use their power to ensure the industry gets favorable regulatory treatment, as analyzed by Vanderbilt Law.

The appearance of impropriety is significant, even if there's technically no explicit quid pro quo. When the government's position on an industry aligns perfectly with the personal financial interests of senior officials in that government, public trust erodes.

Critics argue this situation shows why prediction markets need better oversight, not less. If the platforms are important enough to warrant federal regulation, they should be regulated in a way that protects users and prevents insider trading, not in a way that maximizes profits for early insiders and platform founders, as noted by Vanderbilt Law.

Prediction markets saw a dramatic increase in business volume, growing 27 times during the Super Bowl 2025 compared to 2024. (Estimated data)

Polymarket: The Bigger, Unregulated Competitor

Kalshi isn't the only prediction market platform in the crosshairs, though it's the one Nevada targeted with the lawsuit. Polymarket is actually larger and has even more serious problems.

Polymarket operates on blockchain technology, which gives it some technical advantages for censorship resistance but creates regulatory nightmares. Polymarket's governance is opaque, its reserve backing is unclear, and it's had multiple issues with market manipulation and fraud, as reported by TradingView.

The blockchain foundation of Polymarket also makes it harder for regulators to shut down. You can't just get a court order and shut down a blockchain-based platform the way you could shut down a centralized website. It requires coordination across multiple jurisdictions and technical sophistication that most regulators don't have, as noted by TradingView.

Polymarket has benefited from the same vague regulatory environment that Kalshi has. The platform operates internationally, accepting users from many countries (though officially excluding U. S. users, though enforcement is unclear). It handles billions in volume, as reported by TradingView.

The insider trading examples I mentioned earlier? Many of those happened on Polymarket, not Kalshi. Polymarket's lack of oversight makes it even more attractive for people with inside information, as noted by Vanderbilt Law.

The difference between Kalshi and Polymarket is that Kalshi has been more cooperative with trying to get regulatory clarity. Kalshi has actually engaged with regulators, sought guidance, and attempted to demonstrate compliance. Polymarket has largely ignored the regulatory conversation and relied on technical architecture to avoid enforcement, as reported by TradingView.

The Legal Battle Ahead

Nevada's lawsuit is just the opening move in what will likely be a multi-year legal battle.

Kalshi will almost certainly argue that it's regulated by the CFTC and therefore exempt from Nevada's authority. The CFTC has indicated it will defend this position. Kalshi will also argue that the CFTC's recent statement supports federal-only jurisdiction, as reported by Corporate Compliance Insights.

But Nevada will counter that states have explicit constitutional authority over gambling within their borders. The state will also argue that regardless of how platforms classify themselves, if they're allowing gambling activity, they need to comply with gambling regulations, as noted by Legal Sports Report.

The case will probably go through multiple appeals. Federal courts will need to decide whether the CFTC's claim of exclusive jurisdiction is legitimate under existing law, or whether states retain the right to regulate gambling.

Meanwhile, other states are likely preparing their own lawsuits or regulatory actions. New York, California, and Florida all have significant gambling regulatory frameworks and won't appreciate unlicensed gambling platforms operating within their borders, as analyzed by Legal Sports Report.

The legal basis for Nevada's case is actually fairly strong. The state has existing gambling laws, explicit authority to regulate gambling, and can argue that prediction markets with monetary stakes are gambling regardless of technical classification, as noted by Legal Sports Report.

Kalshi's legal basis relies on a newer, more aggressive interpretation of CFTC authority that hasn't been fully tested in court. The Trump administration's amicus brief helps, but it doesn't guarantee victory, as reported by Corporate Compliance Insights.

Market Reactions and Business Implications

The lawsuit and federal intervention have created significant uncertainty for the prediction market industry.

In the short term, platforms will likely try to demonstrate compliance or move operations to friendlier jurisdictions. Some might restrict U. S. users, following Polymarket's approach. Others might accelerate moves to obtain proper licenses, though that's difficult given regulatory ambiguity, as noted by Sportico.

In the medium term, expect consolidation. Smaller platforms without institutional backing or legal resources will probably fold. Larger platforms with capital reserves and legal teams will survive and potentially dominate, as analyzed by Sportico.

In the long term, the outcome depends entirely on court decisions and regulatory rulemaking. If prediction markets are regulated as financial instruments, you'll see institutional investment, proper licensing frameworks, and mainstream adoption. If they're regulated as gambling, you'll see state-by-state licensing, compliance requirements similar to sports betting, and reduced speculative volume, as reported by Sportico.

For users, the implication is clear: the current unregulated environment likely won't last. Prices might reflect longer-term arbitrage opportunities as regulations change, but those opportunities won't exist forever, as noted by Sportico.

The Insider Trading Enforcement Challenge

Regulating prediction markets effectively requires solving the insider trading problem.

Traditional financial markets have the Securities and Exchange Commission (SEC) actively investigating suspicious trading patterns. The SEC has sophisticated tools for detecting insider trading, and enforcement is aggressive. People face criminal charges and civil penalties, as noted by Vanderbilt Law.

Prediction markets currently have no equivalent enforcement mechanism. The CFTC could potentially take on this role, but the agency lacks expertise in analyzing prediction market data. Blockchain-based platforms like Polymarket make investigation even harder because transactions are pseudonymous, as reported by Vanderbilt Law.

Solving insider trading in prediction markets would require:

- Real-time monitoring systems to detect suspicious trading patterns

- KYC (Know Your Customer) requirements to identify users behind wallets

- Cooperation from platforms to provide data to regulators

- International coordination since users and platforms span multiple countries

- New legal frameworks that apply securities law concepts to event contracts

None of this exists today. The current regulatory vacuum is actually ideal for insider traders. The risk of getting caught is near zero, as analyzed by Vanderbilt Law.

This is a key argument for more aggressive regulation. If prediction markets are going to exist at scale, they need oversight mechanisms that prevent insider trading. Otherwise, they're just a legal mechanism for people with non-public information to profit at the expense of everyone else, as noted by Vanderbilt Law.

International Implications and Regulatory Arbitrage

What happens in Nevada doesn't stay in Nevada. Prediction markets operate globally, and regulatory uncertainty in the U. S. is already driving innovation and migration offshore.

Polymarket explicitly avoids U. S. users (though many still access it via VPNs). Kalshi is U. S.-focused but could potentially move operations to friendlier jurisdictions if Nevada enforcement becomes too aggressive, as reported by TradingView.

Other countries are moving faster on prediction market regulation. Some have created clear frameworks, others have banned them outright. The fragmented international landscape creates opportunities for regulatory arbitrage, where platforms operate from jurisdictions with lenient rules while serving users globally, as noted by TradingView.

The Trump administration's position might actually accelerate this process. If the federal government credibly establishes CFTC jurisdiction and creates a clear framework, platforms might consolidate in the U. S. If federal claims are weakened by court challenges, platforms might migrate offshore, as analyzed by TradingView.

The Political Economy of Prediction Markets

Understanding this situation requires looking beyond law to politics and economics.

Prediction markets are fundamentally about concentration of wealth. As we saw with Polymarket, a tiny fraction of users control most of the profits. This happens because markets reward people with information advantages, capital reserves, and sophisticated trading strategies, as noted by Vanderbilt Law.

Prediction markets also concentrate political power. When a handful of wealthy traders can profit by accurately predicting political outcomes, they gain incentive to influence those outcomes. If you've bet hundreds of millions on a candidate, you have motivation to spend money on that candidate's campaign. The boundaries between prediction and influence get blurry, as analyzed by Vanderbilt Law.

The Trump family's involvement in prediction markets can be viewed through this lens. Having financial stakes in platforms that profit from accurate predictions of political outcomes creates misaligned incentives. Good government requires that political officials not have direct financial stakes in the accuracy of their own predictions about political outcomes, as noted by Vanderbilt Law.

Nevada's lawsuit, then, is partly about protecting a public good. Prediction markets can serve useful functions, but unregulated prediction markets with insider trading, underage participation, and concentrated wealth present more risks than benefits, as analyzed by Vanderbilt Law.

What Comes Next: Potential Outcomes

There are several plausible scenarios:

Scenario 1: Nevada Wins. The court rules that states have authority to regulate prediction markets as gambling. Nevada shuts down Kalshi's operations unless it obtains a license. Other states follow suit. Prediction markets shrink to only states that explicitly allow them, similar to sports betting evolution. Polymarket and other blockchain platforms continue operating internationally, as noted by JD Supra.

Scenario 2: Kalshi Wins. The court rules that the CFTC has exclusive jurisdiction. Nevada's lawsuit is dismissed. The CFTC establishes a regulatory framework that's lighter than state gambling regulations. Prediction markets grow rapidly, particularly for financial and political events. Insider trading remains largely unaddressed, as analyzed by JD Supra.

Scenario 3: Compromise. States and the federal government reach an agreement. Prediction markets are regulated at the federal level for baseline requirements, but states retain authority over local prohibitions and additional consumer protections. Platforms must obtain federal CFTC approval plus state-specific licenses in states where they want to operate. This creates a complex licensing landscape but one that's clearer than today, as noted by JD Supra.

Scenario 4: New Legislation. Congress passes new legislation creating a clear framework for prediction markets. The legislation might be permissive (federal-only regulation with light touch) or restrictive (banning or heavily restricting prediction markets). This is probably the most likely outcome in a normal political environment, but political will is uncertain, as analyzed by JD Supra.

Each scenario has different implications for platforms, users, and regulators.

Conclusion: The Stakes Are Bigger Than One Lawsuit

Nevada's lawsuit against Kalshi looks like a standard regulatory enforcement action. But it's actually a catalyst for determining the future of prediction markets in America.

The lawsuit raises fundamental questions: Should prediction markets exist at all? If they do, who should regulate them? How do we prevent insider trading and protect minors? Should politicians and government officials be allowed to have financial stakes in prediction market platforms?

These questions matter because prediction markets are about to become much more important. As artificial intelligence improves, as more events become quantifiable, as more capital seeks alternative investments, prediction markets will grow. They're not a passing fad.

The regulatory choices made in the next year or two will determine whether prediction markets become a valuable tool for price discovery and risk management, or whether they become a playground for insider traders with government connections.

Kalshi probably won't disappear regardless of Nevada's lawsuit. But the outcome will shape the entire industry. If Nevada wins, expect state-by-state regulatory chaos followed by industry consolidation. If Kalshi wins, expect rapid growth followed by eventual federal rulemaking to address insider trading and other risks.

The Trump administration's intervention suggests they believe federal jurisdiction is a done deal. But courts have a way of surprising everyone. Nevada's case might just be the beginning of a long legal battle that determines whether prediction markets can coexist with traditional gambling regulation, or whether they represent something entirely new that requires new frameworks.

One thing's certain: prediction markets aren't going away quietly. Neither is Nevada's determination to protect its economic interests. The collision between these forces is just beginning.

FAQ

What are prediction markets?

Prediction markets are platforms where users can buy and sell contracts tied to the outcome of future events. Users bet on whether specific events will occur by purchasing contracts if they think the event is likely or selling them if they think it's unlikely. Prices fluctuate based on aggregate betting, effectively creating a market-based forecast. Examples include betting on election outcomes, sports results, economic indicators, or geopolitical events, as noted by JD Supra.

Why does Nevada consider prediction markets gambling?

Nevada treats prediction markets as gambling because users are putting money at risk based on uncertain outcomes, with the potential to win or lose money depending on results. Regardless of whether platforms market themselves as financial instruments or event contracts, the core mechanism matches Nevada's definition of gambling: wagering money on the outcome of uncertain events. Nevada requires all gambling operations to obtain licenses and comply with state regulations to operate legally, as reported by Legal Sports Report.

How fast has the prediction market industry been growing?

The growth has been explosive. Kalshi reported doing 27 times as much business during the 2025 Super Bowl compared to the 2024 Super Bowl, as noted by CBS News. Polymarket has processed over $8 billion in transaction volume since its launch, as highlighted by Gambling Insider. This growth is significant enough that it's measurably impacting Nevada's traditional gambling revenue. At current growth rates, prediction markets could become a multi-billion-dollar industry within years, as analyzed by Gambling Insider.

What evidence of insider trading exists in prediction markets?

Multiple cases have raised insider trading concerns. A Polymarket user bet tens of thousands on Israel bombing Iran within 24 hours before it actually happened, making

How are the Trump family involved in prediction markets?

Donald Trump Jr. serves as a paid adviser to Kalshi and holds investor status with unpaid advisory role at Polymarket, as reported by NBC News. The Trump family's social media company announced plans in January to launch its own prediction market platform, as highlighted by NBC News. These financial connections have raised conflict-of-interest concerns as the Trump administration's CFTC takes positions supporting federal-only regulation of prediction markets, which would benefit platforms like Kalshi and Polymarket, as noted by NBC News.

Why does the Trump administration claim federal authority over prediction markets?

The CFTC argues that prediction markets are financial instruments called "event contracts" that fall under the Commodity Exchange Act, giving the agency exclusive federal jurisdiction, as reported by Corporate Compliance Insights. The CFTC Chair filed an amicus brief claiming states cannot regulate prediction markets, as noted by Corporate Compliance Insights. This position benefits prediction market platforms by avoiding state-level licensing requirements and gambling regulations. However, states argue they retain constitutional authority over gambling within their borders, as analyzed by Legal Sports Report.

What's the difference between Kalshi and Polymarket?

Kalshi is a centralized platform headquartered in the U. S. that has engaged with regulators and sought clarity on compliance, as reported by CNBC. Polymarket is a blockchain-based, decentralized platform that is more resistant to government enforcement and operates internationally, as noted by TradingView. Polymarket has larger volume and handles more suspicious-looking trades, as highlighted by Vanderbilt Law. Polymarket officially excludes U. S. users though enforcement is unclear, while Kalshi focuses primarily on U. S. users, making Kalshi the more obvious regulatory target, as analyzed by CNBC.

What happens if Nevada wins the lawsuit?

If Nevada wins, it would establish that states have authority to regulate prediction markets as gambling operations, as noted by JD Supra. Kalshi would need to either obtain Nevada gambling licenses or cease operations in the state, as reported by The Wall Street Journal. Other states would likely follow with similar enforcement, as analyzed by Legal Sports Report. Prediction markets would shrink to only jurisdictions that explicitly permit them, similar to how sports betting evolved state-by-state, as noted by JD Supra. Blockchain-based platforms might continue operating internationally while avoiding U. S. users, as reported by TradingView.

Could prediction markets be banned entirely?

Yes, that's one possible outcome. Some countries have already banned or heavily restricted prediction markets due to concerns about insider trading, political manipulation, and concentration of wealth, as noted by Vanderbilt Law. If courts rule against prediction market platforms and Congress passes restrictive legislation, the U. S. could ban them entirely, as analyzed by JD Supra. However, the current Trump administration's position suggests they favor permissive federal regulation rather than bans, as reported by Corporate Compliance Insights.

What regulations might prediction markets eventually face?

Potential regulations could include: federal CFTC licensing requirements, state-specific additional licenses, strict age verification (21+ only), position limits to prevent manipulation, insider trading enforcement mechanisms, reserve requirements to guarantee solvency, conflict-of-interest disclosures, and real-time transaction monitoring, as noted by Vanderbilt Law. The specific framework depends on whether they're treated as gambling or financial instruments, and whether regulation is primarily federal or state-level, as analyzed by JD Supra.

Key Takeaways

- Nevada's lawsuit against Kalshi represents the first major test of state vs. federal authority over prediction markets, with implications for the entire industry, as reported by The Wall Street Journal.

- Prediction markets exploded 27x in volume year-over-year during the 2025 Super Bowl, significantly impacting Nevada's traditional gambling revenue, as noted by CBS News.

- Multiple documented cases of insider trading on platforms like Polymarket (Israel-Iran bombing bet, Venezuela sanctions bets) raise serious regulatory concerns, as highlighted by Vanderbilt Law.

- The Trump family's financial stakes in prediction market platforms create conflicts of interest as the federal CFTC claims exclusive jurisdiction, as reported by NBC News.

- Three likely outcomes: Nevada wins (state-level regulation wins), Kalshi wins (federal deregulation wins), or compromise requiring both federal and state licensing, as analyzed by JD Supra.

Related Articles

- Nevada Sues Kalshi: Prediction Betting Market Legal Battle [2025]

- Digital Resistance: How Video Evidence Challenges Government Power [2025]

- EPA Revokes Greenhouse Gas Endangerment Finding: What It Means for Climate Policy [2025]

- Waymo's DC Robotaxi Campaign: How AI Companies Are Reshaping City Regulation [2025]

- Trump's EPA Kills Greenhouse Gas Regulations: What It Means [2025]

- EPA Clean Air Act Endangerment Finding Repeal: Impact & Implications [2025]

![Nevada vs. Kalshi: The Prediction Markets Battle Reshaping Gambling [2025]](https://tryrunable.com/blog/nevada-vs-kalshi-the-prediction-markets-battle-reshaping-gam/image-1-1771440255459.jpg)