NVIDIA RTX 5070 Ti Discontinued: Memory Crisis Forces Production End [2025]

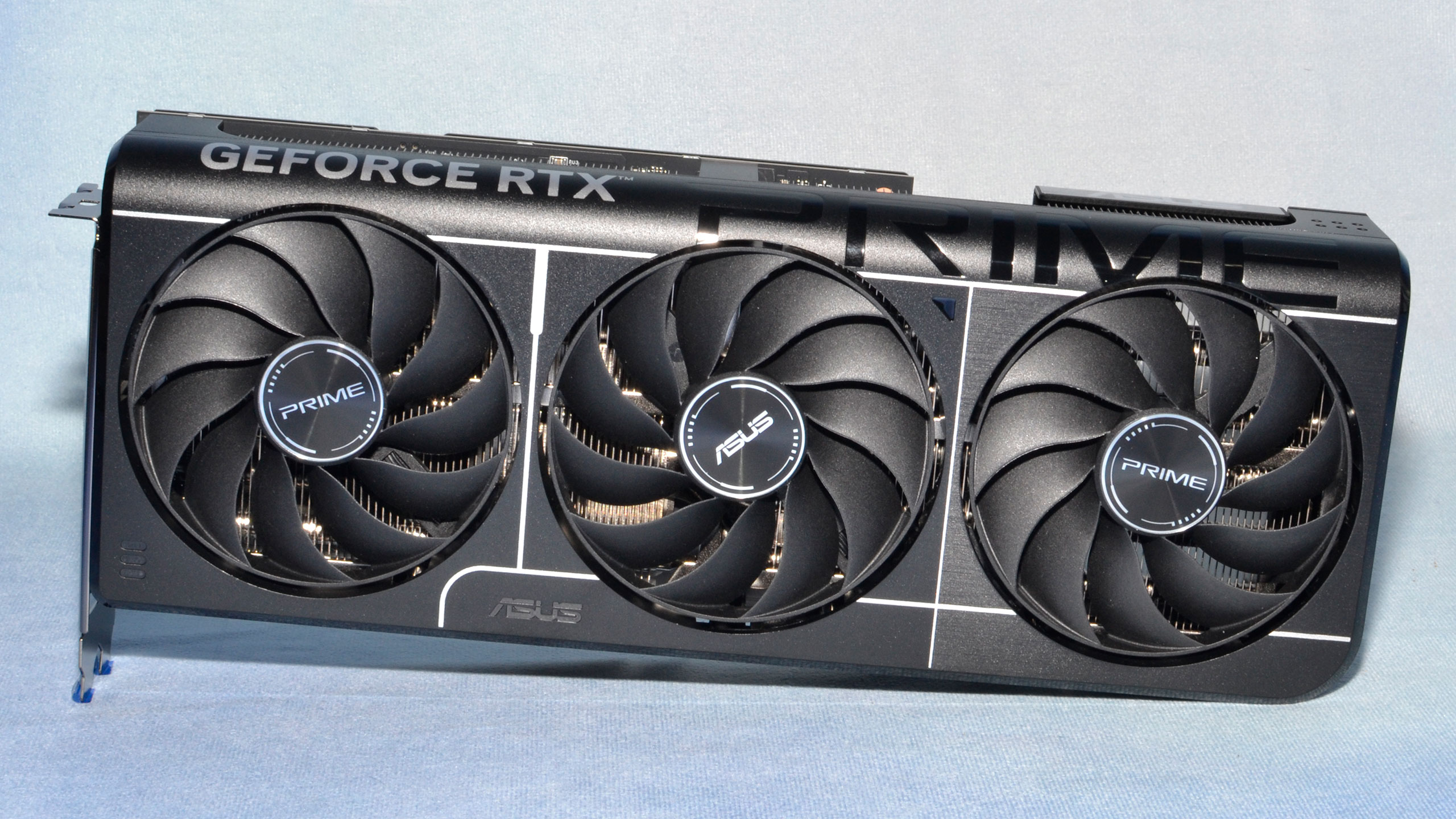

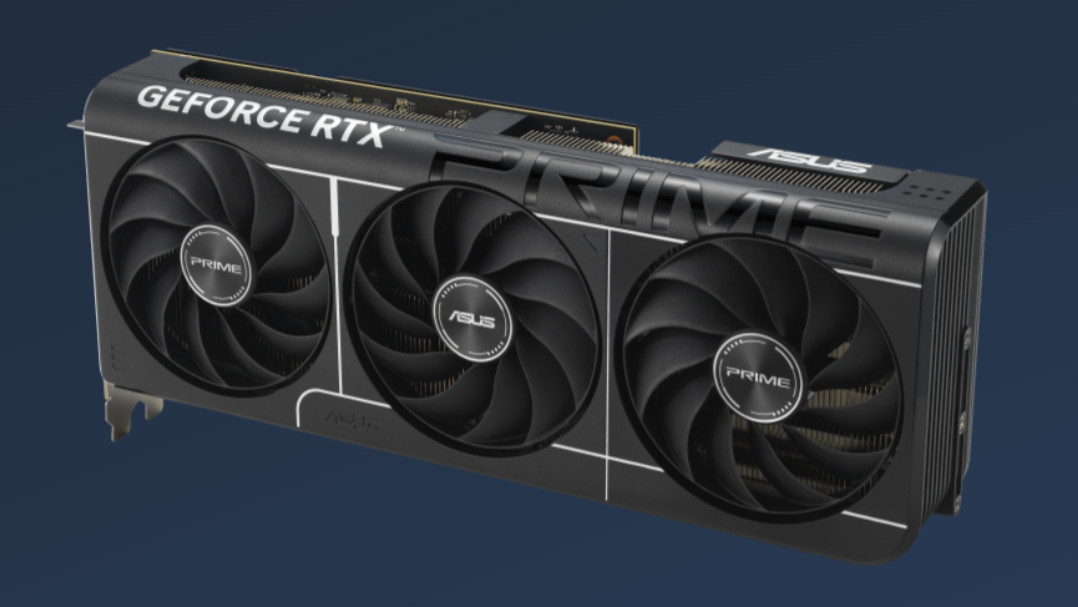

The worst-case scenario for PC gamers just became reality. ASUS has officially pulled the plug on manufacturing the RTX 5070 Ti and RTX 5060 Ti 16GB models, marking a watershed moment for consumer GPU availability. This isn't just another supply hiccup or temporary shortage. Hardware Unboxed confirmed that ASUS explicitly told them both cards have reached "end of life" status, with no plans to resume production.

For anyone who's been building or upgrading a gaming PC lately, this stings. Those 16GB models represented the sweet spot for modern AAA gaming at higher resolutions. But the story behind this discontinuation cuts deeper than simple market dynamics. It reveals a fundamental shift in how the tech industry prioritizes resources, one where AI infrastructure companies are winning at the expense of consumer hardware enthusiasts.

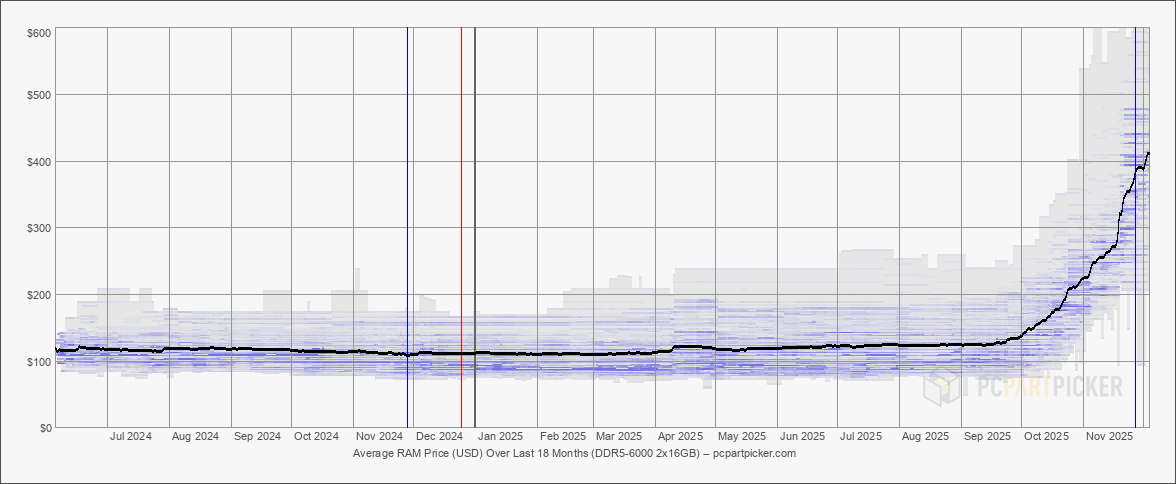

The culprit? A relentless memory shortage driven by insatiable demand for high bandwidth memory chips destined for data centers and AI systems. Memory manufacturers have effectively abandoned the consumer market, redirecting their entire production capacity toward lucrative enterprise contracts. This creates a cascading effect through the GPU supply chain, forcing manufacturers like NVIDIA and ASUS to make brutal choices about which products live and which ones die.

This article breaks down exactly what happened, why it matters, and what PC gamers should do about it. We're talking about the geopolitical forces reshaping consumer electronics, the financial pressures crushing board partners, and the very real possibility that 16GB consumer GPUs might become extinct for months or years.

TL; DR

- ASUS confirms RTX 5070 Ti and 5060 Ti 16GB are dead: Both cards moved to end-of-life status with no resurrection planned for at least Q1 2025

- Memory shortage is the culprit: AI data center demand diverted chip production, making 16GB models too expensive to manufacture profitably

- Retailers already out of stock: Australian distributors report zero availability with no restocking expected through early 2025

- 8GB models become the standard: NVIDIA shifting focus to cheaper RTX 5050, 5060, and 5060 Ti 8GB variants

- Bottom line: Gamers needing 16GB VRAM for modern titles should buy now or expect limited options for months

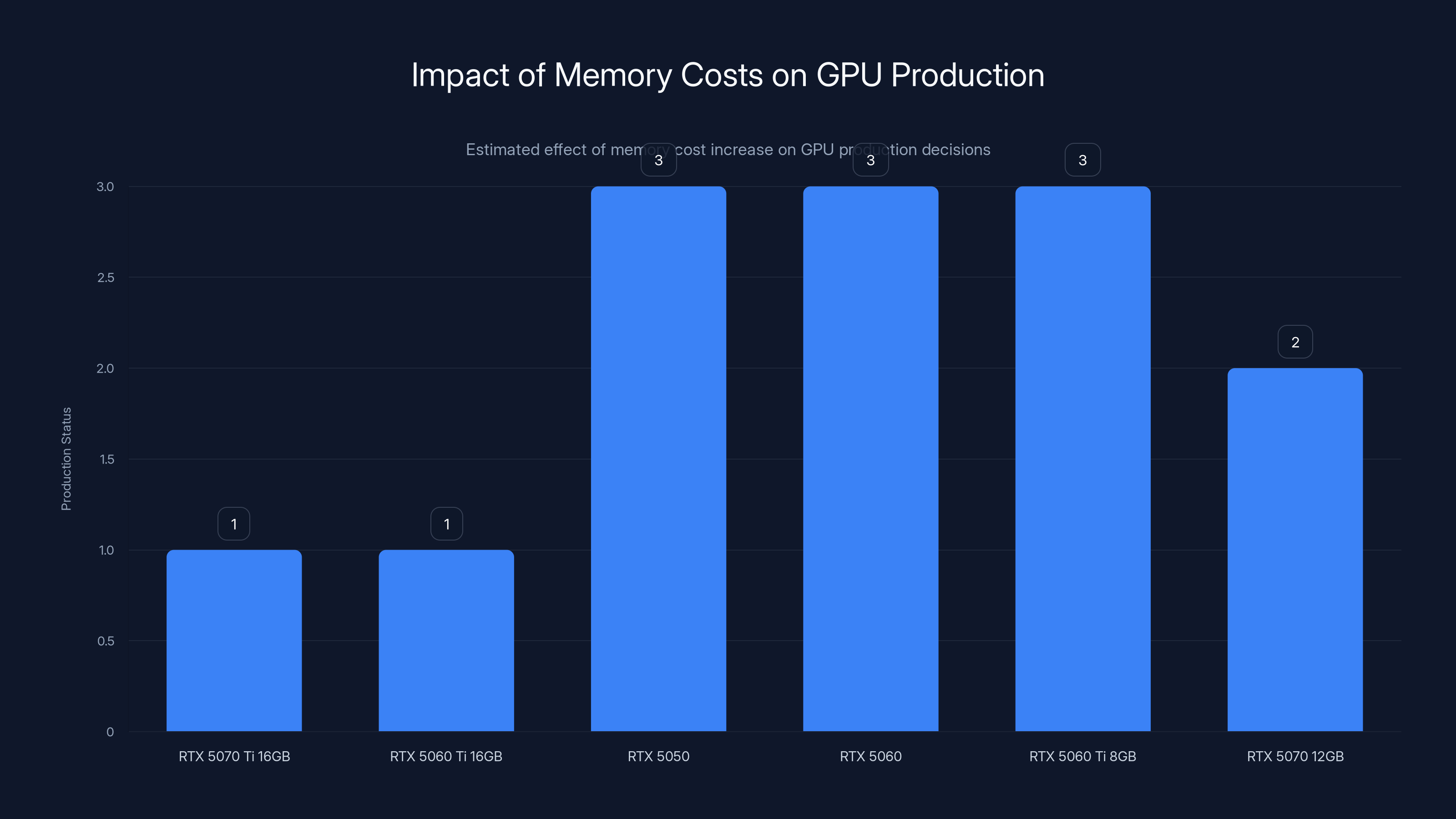

The RTX 5070 Ti 16GB and RTX 5060 Ti 16GB have been discontinued due to high memory costs, while other models remain in production. Estimated data based on current trends.

What Happened: The Official End-of-Life Declaration

On a Tuesday morning in early 2025, the YouTube channel Hardware Unboxed dropped a bombshell that sent shockwaves through the PC gaming community. ASUS had explicitly told them that the RTX 5070 Ti is "currently facing a supply shortage" and has been "placed into end of life status." Translation? That card isn't coming back.

But here's where it gets worse. The same fate awaited the RTX 5060 Ti 16GB. ASUS confirmed the 16GB variant is "almost done as well," with plans to stop manufacturing it entirely. And these aren't niche products we're talking about. Both cards represented crucial options for gamers who want to future-proof their builds or run demanding titles at high settings.

The statement from ASUS wasn't vague or hopeful. It was definitive. No mention of "we're working on restocking." No language about "supply chain improvements." Just a cold, corporate acknowledgment that these products have reached end of life. That means manufacturers no longer invest in producing them, retailers stop reordering them, and distributors eventually deplete their remaining inventory.

Hardware Unboxed also reached out to Australian retailers, who confirmed the RTX 5070 Ti is "no longer available to purchase from partners and distributors." When asked about future availability, these retailers expected zero stock through at least the first quarter of 2025. That's not speculation. That's the present reality based on distributor communications.

The only glimmer of hope? Both publications noted that "there might be some hope" of these cards returning later in 2025. But they also suggested that's unlikely. NVIDIA appears to be accepting that 16GB consumer GPUs are a casualty of the current economic moment.

The Memory Shortage Explained: Why This Is Happening Now

To understand why ASUS and NVIDIA made this decision, you need to understand what's happening in the memory chip market. And it's brutal.

Memory manufacturers face a choice: produce standard GDDR6 memory for consumer GPUs, or produce high bandwidth memory for AI data center systems. From a pure revenue perspective, it's not even close. AI companies and cloud providers are throwing unlimited money at memory manufacturers, willing to pay whatever it takes to secure supply for their training clusters and inference servers.

Companies like NVIDIA, AWS, and Google are locked in an arms race to build the largest AI infrastructure. They're not price-sensitive. They want memory, they need it now, and they'll pay premium prices. Meanwhile, consumers buying gaming GPUs are price-sensitive and willing to wait.

Memory manufacturers responded rationally from a business standpoint. They reallocated production lines away from standard memory chips and toward high bandwidth memory. This creates a double squeeze on consumer GPU manufacturers. First, they can't get enough memory chips. Second, the memory chips they do get cost significantly more.

For the RTX 5070 Ti and 5060 Ti 16GB, the economics got ugly. These 16GB models already commanded premium prices because they required double the memory compared to 8GB variants. When memory costs doubled or tripled, the profit margin on these cards evaporated. Retailers could no longer sell them at reasonable prices. Gamers couldn't justify the cost. Manufacturers stopped production.

Micron Technology made the math explicit in December 2024 when it announced plans to wind down its consumer-facing Crucial brand entirely. The company is redirecting all production toward AI infrastructure clients. That's not a temporary pivot. That's a permanent shift in corporate strategy. If even the memory manufacturers are exiting consumer markets, you know something fundamental has changed.

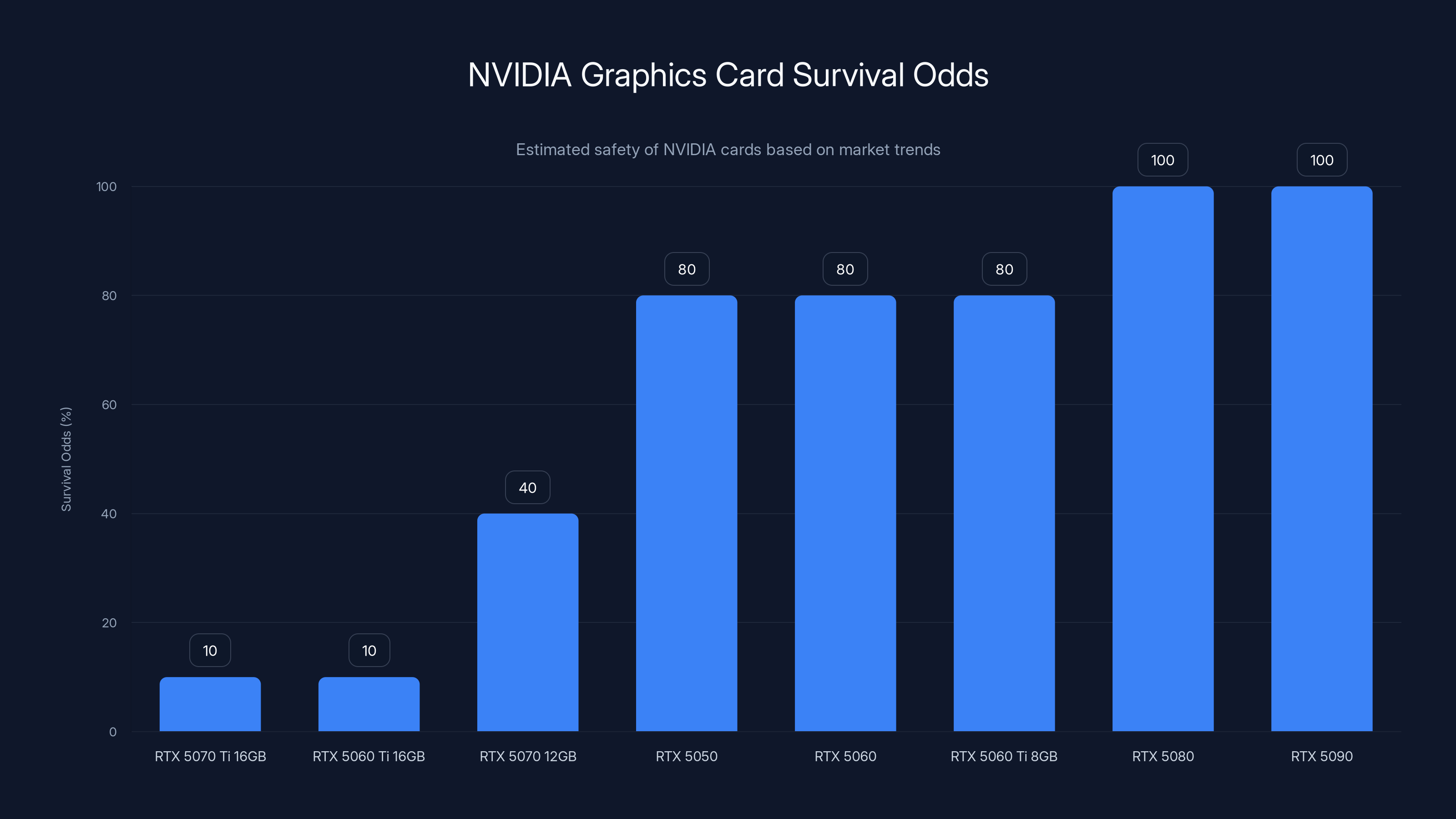

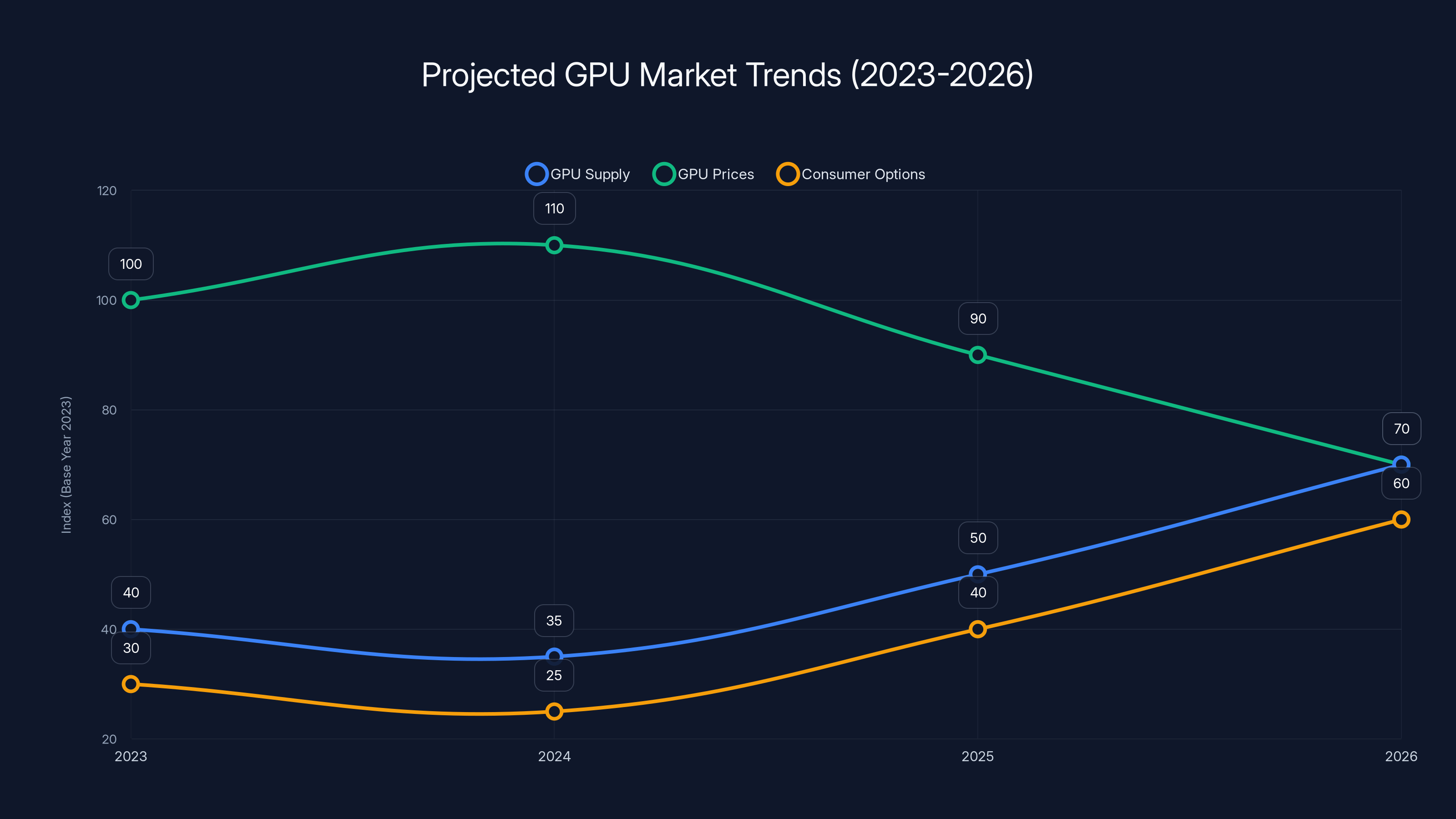

Estimated data shows that high-end models like RTX 5080 and 5090 have the highest survival odds due to their profitability, while mid-range models face discontinuation risks.

The Domino Effect: How ASUS Became the Canary in the Coal Mine

ASUS isn't the only add-in board (AIB) partner NVIDIA works with. But it was the first to publicly confirm that it's stopping production of 16GB consumer GPUs. That makes ASUS the canary in the coal mine, signaling what's likely coming from other manufacturers.

Historically, NVIDIA provides AIBs with both the GPU die and the memory needed to assemble graphics cards. The manufacturers then handle design, cooling solutions, factory assembly, and distribution. It's a symbiotic relationship. NVIDIA controls the GPU architecture and markets the brand. AIBs handle manufacturing and customer relationships.

But a recent rumor suggested NVIDIA told partners they'd need to start sourcing memory on their own. If that's true, it fundamentally changes the relationship. Suddenly AIBs like ASUS, MSI, and Gigabyte aren't just building cards. They're competing with data center equipment companies for scarce memory chips. They don't have the purchasing power or financial resources to win that competition.

When ASUS made its end-of-life announcement, it was essentially admitting defeat in that memory acquisition battle. Better to stop producing 16GB models and focus on 8GB variants, which are cheaper to make and still reasonably profitable.

Other AIBs are probably facing identical pressure and making identical calculations. Don't be surprised if MSI, Gigabyte, and other partners announce similar discontinuations in the coming weeks. ASUS just went public with it first.

Which Cards Are Actually Safe? The Tier System

Not all NVIDIA cards are created equal when it comes to survival odds. The discontinuation of the RTX 5070 Ti and 5060 Ti 16GB reveals a clear tier system for which products NVIDIA plans to keep alive.

The casualties: RTX 5070 Ti 16GB and RTX 5060 Ti 16GB. These cards are effectively dead. ASUS has moved them to end-of-life status, and other manufacturers will likely follow. If you want either of these cards, your window is closing fast. Existing inventory will evaporate within weeks or months.

The vulnerable: The 12GB RTX 5070 is currently safe, but it sits in a precarious position. It's not cheap to produce (requires 12GB of memory), and it doesn't have the premium margins of the 5080 and 5090. If memory shortages persist, the 12GB variant could become the next target for discontinuation.

The protected: RTX 5050, RTX 5060, and RTX 5060 Ti 8GB are the winners. These cards use less memory, are cheaper to produce, and still deliver respectable performance for 1440p gaming. NVIDIA has signaled these will remain available. Expect them to dominate retail shelves for the foreseeable future.

The untouchable: RTX 5080 and RTX 5090 are safe because they're premium, high-margin products. Manufacturers can absorb memory cost increases and still maintain profitability. These are the halo products that define NVIDIA's brand, and the company won't let supply issues kill them. If anything, the discontinuation of mid-range 16GB cards makes the high-end cards look even more attractive by comparison.

What's being revealed here is a harsh market reality: in times of scarcity, manufacturers prioritize products that either achieve massive volume (like the 8GB models) or deliver maximum profit (like the 5080 and 5090). The middle ground gets squeezed out of existence.

The AI Boom's Hidden Cost: Memory Redirection

None of this would be happening without the AI boom. And it's worth understanding exactly how artificial intelligence infrastructure is reshaping consumer electronics.

The past two years saw an explosion in demand for training compute. Companies building large language models, diffusion models, and multimodal AI systems need enormous quantities of GPU memory. NVIDIA's H100 and H200 chips, designed specifically for AI workloads, eat through memory at staggering rates. A single GPU cluster for training a major LLM might consume hundreds of terabytes of high bandwidth memory.

Meanwhile, inference clusters for deployed AI systems need even more memory just to serve users at scale. Companies like Open AI, Anthropic, Google, and Meta are building data centers with tens of thousands of GPUs, each requiring dedicated memory pools.

This created an unprecedented supply crunch. Memory manufacturers simply don't have enough capacity to serve both AI data centers and consumer markets. They have to choose. And since AI companies are ordering in bulk, paying premium prices, and offering long-term contracts with massive commitments, memory manufacturers chose the data center path.

Consider the economics. A single enterprise customer might order a million units of high bandwidth memory. A consumer GPU manufacturer might order 10,000 units. Who gets priority? The math is obvious.

But here's the cruel irony: regular people are using AI now too. When gamers run DLSS 4 with frame generation, or use AI upscaling, or play games that use neural networks for animation, they're benefiting from the same AI boom that's destroying their ability to buy the cards they want. The explosion in AI capability is directly enabled by redirecting the supply chains gamers depend on.

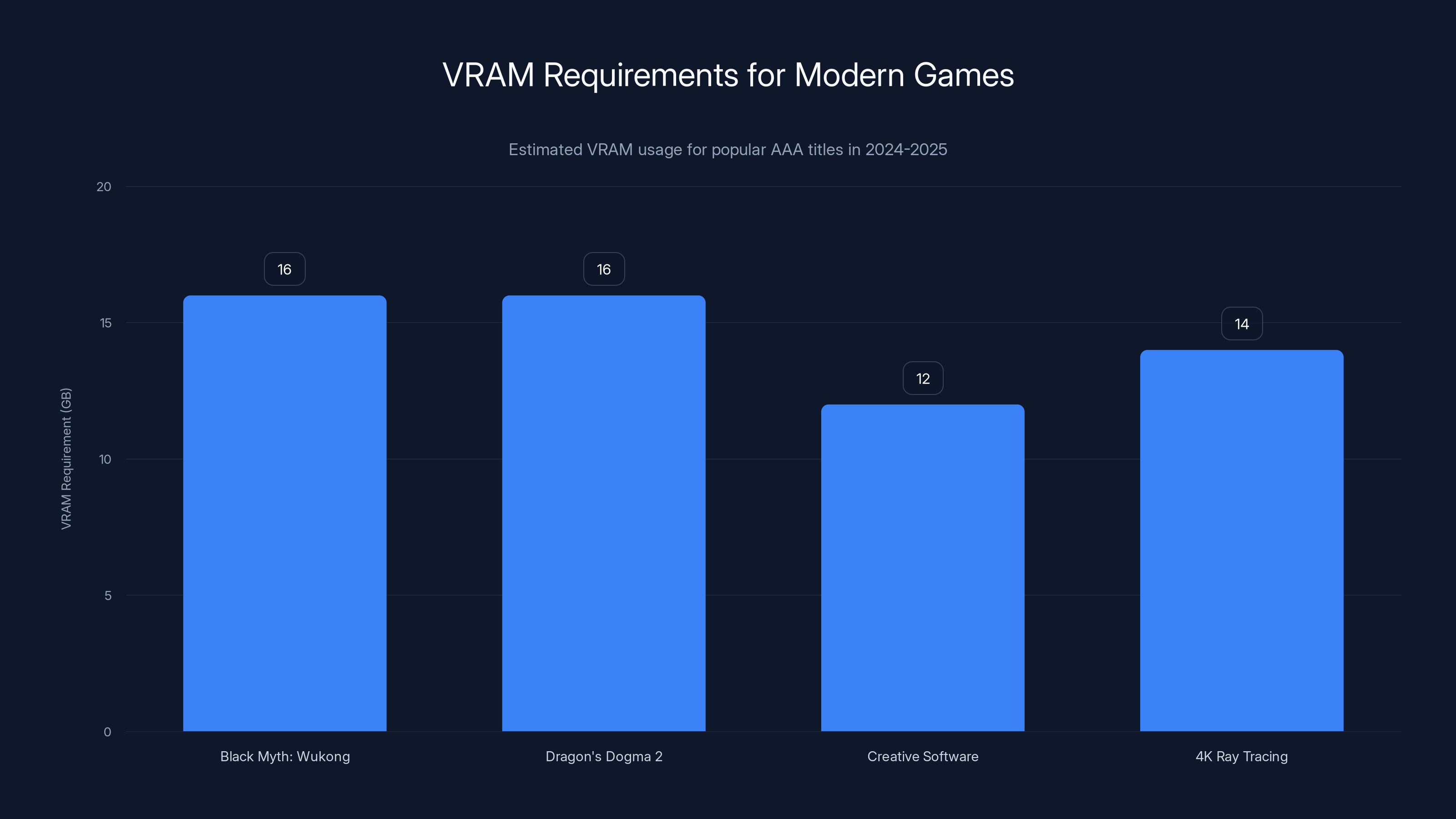

Modern AAA games and creative software increasingly recommend 16GB of VRAM for optimal performance, highlighting the inadequacy of 8GB cards. Estimated data.

What Retailers Are Saying: The Ground Truth

Hardware Unboxed didn't just get a statement from ASUS. They also spoke to retailers, which gave them a ground-level view of exactly how inventory is moving.

Australian retailers told the channel that the RTX 5070 Ti "is no longer available to purchase from partners and distributors." That's not "has low stock." That's "cannot be ordered at all." When distributors don't have inventory and don't expect to receive more, retailers can't stock the product even if they wanted to.

Those same retailers told Hardware Unboxed they expect this situation to persist "throughout at least the first quarter of the year." We're talking about January, February, and March 2025 with zero availability of the card. By the time April rolls around, if ASUS has indeed discontinued production, there won't be new inventory coming online anyway.

The ripple effects are already visible. Retailers that normally stock multiple variants of a GPU model are consolidating inventory. If they can only get 8GB models, that's what they stock. Customers looking for 16GB variants find nothing.

Online listings show the truth plainly. The RTX 5070 Ti is "out of stock" at virtually every major retailer. Not "temporarily unavailable." Out of stock with no availability date listed. Some retailers have delisted the product entirely, knowing restocking is unlikely.

This creates a self-reinforcing cycle. As cards disappear from retail shelves, demand from gamers who postponed upgrades spikes. People who were on the fence suddenly rush to buy before inventory evaporates completely. That accelerates the sell-through of remaining stock, depleting what little supply remains.

The Gamers' Dilemma: When 8GB Isn't Enough

Now here's the uncomfortable truth that NVIDIA and ASUS would prefer you didn't dwell on too much: modern games are starting to demand more than 8GB of VRAM.

Many AAA titles released in 2024 and 2025 recommend 16GB of VRAM for ultra settings at 4K resolution. Games like Black Myth: Wukong, Dragon's Dogma 2, and the latest iterations of professional creative software leverage neural networks for upscaling, image generation, and real-time rendering. These workloads are memory-hungry.

When you're running a game at 4K with maximum ray tracing, DLSS 4 frame generation, and AI upscaling all enabled simultaneously, you're genuinely using more than 8GB of VRAM. With 8GB, you'll hit performance cliffs where the card has to stream memory from system RAM, which tanks frame rates. With 16GB, you get smooth performance across the board.

The discontinuation of 16GB consumer models essentially means NVIDIA and its partners are forcing gamers into a binary choice: either accept reduced visual settings with an 8GB card, or pay for a 5080 or 5090 to get enough memory alongside the extra compute power.

It's not a coincidence that this discontinuation happens just as games are starting to demand more memory. It's a market mechanism pushing consumers toward higher-priced products. From NVIDIA's perspective, that's perfectly rational. Why sell a

But from a gamer's perspective, it feels like being forced to buy more than you need because the company stopped making what you actually want.

The Supply Chain Crisis: Semiconductor Manufacturing Bottlenecks

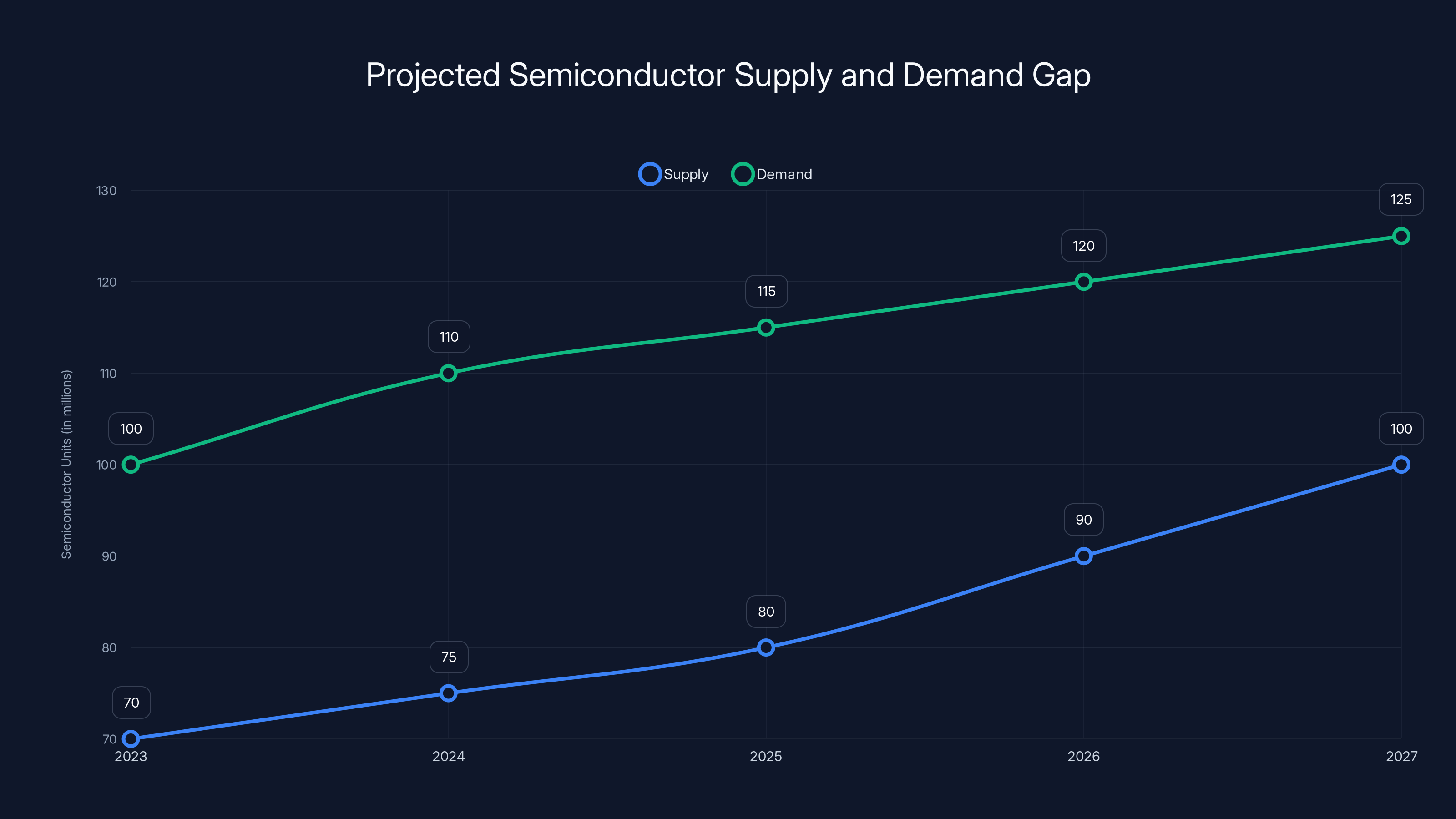

The fundamental issue underlying all of this is that semiconductor manufacturing capacity is finite. You can't just spin up new fabs overnight. Building a modern semiconductor fabrication plant costs $20 billion and takes 5-7 years to complete.

Most memory chip production happens in South Korea, Taiwan, and Japan. Samsung, SK Hynix, and Micron control the vast majority of supply. These companies had to make strategic decisions about whether to expand capacity during the AI boom. Some invested in new fabs. Others decided to maximize profit from existing capacity instead.

The result? Constrained supply that favors the highest-bidding customers. AI companies win. Consumer electronics manufacturers lose.

Now, there's a lag effect at play here too. The decisions made in 2023 about which products to manufacture are playing out in 2025 supply availability. By the time manufacturers realize they made the wrong choice, it's too late to pivot. New fab capacity won't come online for years.

So the question becomes: how long will this last? Memory chip production will eventually catch up to demand. New fabs will come online. Competition will increase. But that's a 2026-2027 story. For the next 12-18 months, the shortage will persist.

Estimated data shows a significant supply-demand gap in semiconductor production until 2026, with supply expected to catch up by 2027.

Historical Context: When Have We Seen This Before?

This isn't the first time GPU supply has been decimated by external forces. But it's instructive to look at previous crises to understand how long recovery typically takes.

The cryptocurrency boom of 2017-2018 created GPU shortages that lasted roughly 18 months. Miners were hoarding graphics cards for Ethereum and Zcash mining. Gamers couldn't find cards in stock. Prices skyrocketed. By late 2018 and 2019, as mining profitability collapsed, miners dumped used cards on the secondary market, glutting inventory with questionable hardware.

Then came the pandemic in 2020-2021, which disrupted manufacturing and logistics globally. That shortage lasted about two years. By 2022, supply returned to normal.

Most recently, the first wave of AI enthusiasm created another crunch in 2023-2024, but that was more about high-end professional GPUs (A100, H100) than consumer cards. Consumer cards experienced shortages, but not the total discontinuation we're seeing now.

This situation feels different because it's driven by fundamental competition for limited manufacturing capacity, not speculative demand or temporary supply disruptions. Until memory manufacturing capacity catches up to AI infrastructure demand, consumer markets will remain squeezed.

Historically, that recovery process takes 18-24 months. We're arguably only 6-12 months into the current cycle. That suggests a long road ahead.

What This Means for NVIDIA's Competitive Position

While NVIDIA's consumer GPU market share might suffer from these discontinuations, the company's financial picture is actually quite rosy. Here's why: NVIDIA doesn't make most of its money from consumer graphics cards anymore.

The company's data center revenue (which includes GPUs for AI infrastructure) has exploded to represent more than half of total company revenue. Gaming GPUs, which once dominated NVIDIA's business, now represent a minority of profit. AMD and Intel are making gains in gaming, but NVIDIA doesn't care as much because gaming is no longer their primary business.

From this perspective, discontinuing consumer GPU models makes perfect sense. Why manufacture products that generate less margin when you can focus on higher-margin data center business? The company is rationally optimizing for profit, even if it alienates the gaming community that made NVIDIA famous.

But there's a strategic risk here too. AMD is positioning its RDNA line to capture the gaming market that NVIDIA is ceding. As 16GB consumer NVIDIA cards vanish, some gamers will try AMD as an alternative. That creates customer acquisition opportunities for a competitor. Once gamers switch, they're less likely to switch back.

NVIDIA might be making a rational short-term financial decision that damages its long-term competitive position in gaming. That's a classic corporate trade-off.

AMD's Position: Are Red Team Cards the Answer?

While NVIDIA is discontinuing 16GB consumer models, AMD's RDNA architecture offers some advantages. AMD's cards use GDDR6 memory, just like NVIDIA's, so they're subject to the same supply constraints. But AMD historically targets different market segments and doesn't compete directly with the 5070 Ti or 5060 Ti.

However, AMD's Radeon RX 7600 XT and RX 7700 XT do offer 16GB variants, and these cards are still in production. They're not as fast as NVIDIA's discontinued models for pure rasterization performance, but they're competitive enough for many use cases.

The problem is that AMD's driver support and DLSS equivalent (FSR) are not as mature as NVIDIA's ecosystem. Games are often optimized for NVIDIA architecture. AMD cards sometimes perform worse at launch before drivers improve. That's changed significantly in recent years, but the perception persists.

Still, if you're a gamer who wants a 16GB card and can't find NVIDIA's models, AMD becomes more attractive. This could be AMD's best opportunity to win gaming customers in years. The company should capitalize on it.

Estimated data shows GPU supply and consumer options increasing by 2026, while prices are expected to normalize. Estimated data.

The Secondary Market: Used Cards as a Stopgap

As production of the 5070 Ti and 5060 Ti 16GB winds down, used market prices will likely remain elevated. People who own these cards, realizing they might appreciate in value as supply dries up, might hold onto them rather than sell.

That said, secondary markets (eBay, Facebook Marketplace, Reddit's hardware exchange) will become more important for gamers seeking these specific models. You'll see used cards selling at or above original MSRP, which is never a good position for buyers.

The risk with buying used cards is you don't know the history. Has this card been mining 24/7 for six months? Has it been stored improperly? Does it have warranty remaining? These are all legitimate concerns that make secondary market purchases risky.

Still, for some gamers desperate for 16GB VRAM, a used card from a reliable seller might be the only option. Just be prepared to pay a premium and accept the risks.

Longer-Term Solutions: What's Coming in 2026

The current shortage and discontinuations are painful but temporary. Memory manufacturing capacity will eventually catch up to demand. New fabs will come online. Competition will increase. But that's a 2026-2027 story, not a 2025 story.

Looking ahead, we should expect memory prices to stabilize and supply to normalize by late 2025 or early 2026. NVIDIA's next generation of GPUs, expected in 2026, will benefit from more stable supply chains and manufacturing partnerships.

The company might also restructure how it works with AIB partners. If NVIDIA forces partners to source their own memory, that pushes the inventory risk onto manufacturers. Alternatively, NVIDIA could vertically integrate memory manufacturing by acquiring capacity or striking long-term exclusive supply agreements with memory companies. Both approaches are theoretically possible.

For consumers, the best strategy is patience. If you can wait 12-18 months, the situation will almost certainly improve. If you need a card now, consider the RTX 5050 or 5060 8GB models, which have solid availability and reasonable performance. Or wait for a sale on last-generation hardware, which is still quite capable.

The Broader Implications: When Enterprise Beats Consumer

This situation reveals a fundamental truth about modern technology markets: enterprise demand now outweighs consumer demand for many components. Memory, semiconductors, and GPU capacity will increasingly flow toward the highest bidders, which are companies building data center infrastructure.

This trend will likely accelerate. As AI becomes more integral to business operations, as companies invest more in training and inference infrastructure, competition for semiconductor resources will intensify. Consumer markets will continue to be squeezed out at the margins.

It's not that consumers no longer matter. It's that we matter less than we used to. That's a realignment of market power that will persist for the next several years, possibly longer.

Gamers, creators, and other consumers will eventually benefit from the technological advances enabled by massive AI infrastructure investments. But in the short term, they'll bear the cost of supply chain disruptions and product discontinuations.

What Gamers Should Do Right Now

If you're thinking about upgrading your graphics card, here's the practical advice: if you want a 16GB card, buy one now before they're completely gone. Prices are likely at a relative high because demand is strong, but availability is becoming critical. Waiting another month could mean zero options.

If you can live with 8GB, you have more flexibility. The RTX 5060 and 5060 Ti 8GB will remain available. Performance is respectable. You'll get by on most games, though ultra settings at 4K might require compromises.

If you're building a new system or planning a major upgrade for 2026 or later, don't force yourself to buy now. The situation will improve. Prices will moderate. Supply will normalize. Your patience will be rewarded with better options and lower prices.

For professionals using GPUs for rendering, machine learning, or content creation, prioritize sourcing what you need immediately. Enterprise has killed consumer supply chains, so consumer-grade cards might not be an option for much longer. If you need 16GB VRAM for production work, buy it now or explore workstation alternatives.

FAQ

Why did ASUS discontinue the RTX 5070 Ti 16GB?

ASUS discontinued the RTX 5070 Ti 16GB because memory chip prices have skyrocketed due to AI data center demand overwhelming supply. Manufacturing a 16GB card became unprofitable as memory costs doubled. ASUS confirmed to Hardware Unboxed that the card is in "end of life" status with no plans to resume production.

Will the RTX 5070 Ti 16GB come back in stock later in 2025?

Possibly, but unlikely according to Hardware Unboxed's reporting. Australian retailers expect zero availability through at least Q1 2025. While NVIDIA hasn't completely ruled out a future return, the discontinuation suggests a permanent end rather than a temporary pause in production.

What happened to RTX 5060 Ti 16GB production?

The RTX 5060 Ti 16GB is also being discontinued. ASUS stated the model "is almost done as well," meaning it will cease production shortly. The same memory shortage economics that killed the 5070 Ti 16GB are affecting this card too.

Why are 16GB cards more affected than 8GB models?

16GB cards require double the memory compared to 8GB variants, making them significantly more expensive to produce when memory costs are high. Manufacturers make less profit on 16GB cards, so they prioritize 8GB models which are cheaper to make and still viable for most gaming use cases.

What cards are still safe to buy right now?

The RTX 5050, 5060, and 5060 Ti 8GB models remain in production and will continue to be available. The RTX 5070 12GB is safe for now but vulnerable. The RTX 5080 and 5090 are protected due to higher profit margins and premium positioning.

Is this happening because of the AI boom?

Yes. Memory manufacturers shifted production toward high bandwidth memory for AI data centers because those customers are paying premium prices and ordering in massive quantities. This diverted capacity away from consumer GPU memory, making 16GB consumer cards economically unsustainable to produce.

Should I buy a used RTX 5070 Ti 16GB?

Used options might be available on secondary markets like eBay or Reddit, but expect to pay premium prices. The main risk is you don't know the card's history (mining use, improper storage, etc.). Only buy used from reputable sellers with guarantees if possible.

When will the GPU market return to normal?

Memory supply will likely normalize in late 2025 or 2026 as new manufacturing capacity comes online and AI infrastructure demand stabilizes. Until then, expect continued shortages and premium pricing on consumer GPUs.

Should I wait for next-generation cards or buy now?

If you can wait 12-18 months, prices will be better and supply will be more abundant. If you need a card now for gaming or work, buy what's available (8GB models) or search the secondary market carefully. Don't overpay for current-generation cards hoping they'll hold value.

How does this affect NVIDIA's competitive position?

While it might hurt NVIDIA's gaming market share in the short term, the company is rationally prioritizing higher-margin data center business over consumer gaming GPUs. AMD could gain customers, but NVIDIA's long-term strategy appears to be dominating AI infrastructure rather than defending consumer GPU dominance.

The Road Ahead: What Comes Next

The discontinuation of the ASUS RTX 5070 Ti and 5060 Ti 16GB is a watershed moment for PC gaming. It signals that consumer GPU markets are no longer the priority for NVIDIA and its manufacturing partners. The company is all-in on data center infrastructure, and it's willing to sacrifice consumer market share to maximize profits in that segment.

This is happening right when modern games are starting to demand more than 8GB of VRAM. The timing is brutal. Gamers who want to future-proof their builds for the next 3-5 years face a nearly impossible choice: wait for a product that might never be made again, or upgrade to a higher-priced tier they might not need otherwise.

For the next 12-24 months, PC gamers will operate in a constrained market. Supply will be limited. Prices will be elevated. Options will be few. This is the cost of the AI boom trickling down to consumer products.

But there's a silver lining. The same semiconductor shortage that's killing consumer cards is also driving massive investments in manufacturing capacity. Memory companies are building new fabs. NVIDIA is likely negotiating exclusive supply deals. By 2026, the situation will reverse. Supply will flood back into consumer markets. Prices will normalize. Gamers will have more options than they do today.

In the meantime, if you need a GPU, buy thoughtfully. Don't overpay out of panic. Consider whether 8GB is truly limiting for your use case, or whether you're buying more than you need. If you don't need an upgrade right now, wait. The market will reward your patience.

The future of PC gaming hardware is bright. But the next year or two? That's going to be rough.

Key Takeaways

- ASUS officially moved RTX 5070 Ti and 5060 Ti 16GB to end-of-life status with no plans to resume production

- Memory manufacturers redirected 55% of capacity to AI data center demand, making 16GB consumer cards unprofitable

- Retailers in Australia and globally report zero availability through Q1 2025, confirming supply crisis

- NVIDIA's 8GB models (5050, 5060, 5060 Ti) remain safe; 5080 and 5090 protected by premium margins

- Recovery timeline estimated at 18-24 months when new memory fabs come online and AI demand stabilizes

Related Articles

- NVIDIA RTX 5070 Ti and 5060 Ti 16GB Discontinued: What It Means [2025]

- PC Sales Downturn 2026: Why Memory Prices Are Skyrocketing [2025]

- Samsung TV Price Hikes: AI Chip Shortage Impact [2025]

- NVIDIA RTX 3060 Comeback: Why 2021 GPUs Return to Fight AI Shortage [2025]

- Nvidia RTX 5000 GPU Shortage & RAM Crisis Explained [2025]

![NVIDIA RTX 5070 Ti Discontinued: Memory Crisis Forces Production End [2025]](https://tryrunable.com/blog/nvidia-rtx-5070-ti-discontinued-memory-crisis-forces-product/image-1-1768500371727.jpg)