Parloa's Historic $3 Billion Valuation: What It Means for AI-Powered Customer Service

In January 2025, Berlin-based Parloa announced a funding milestone that sent shockwaves through the AI and automation industry. The startup raised

The funding round was led by existing investor General Catalyst, with strong participation from returning backers including EQT Ventures, Altimeter Capital, Durable Capital, and Mosaic Ventures. The fact that existing investors doubled down on their bets demonstrates deep conviction in Parloa's execution capabilities and market opportunity. This wasn't a speculative bet on a promising startup; it was a validation of an established company demonstrating real commercial traction in an increasingly crowded competitive landscape.

Parloa's rapid ascent must be understood within the broader context of the customer service automation market, which represents one of the largest untapped opportunities in enterprise software. The global contact center industry employs approximately 17 million agents worldwide, according to Gartner, each handling repetitive, rule-based inquiries that are prime candidates for AI automation. The economic incentive is compelling: companies spending millions annually on customer service labor can dramatically reduce costs while improving response times and customer satisfaction metrics. This convergence of technology readiness, economic necessity, and competitive pressure has created a gold-rush mentality among both venture capitalists and established technology firms.

Understanding Parloa's positioning within this landscape requires examining not just its technology capabilities, but how it differentiates from increasingly well-funded competitors, the specific use cases where it excels, and what this funding announcement reveals about broader trends in AI-driven automation. Additionally, for organizations evaluating customer service automation solutions, understanding Parloa's strengths and limitations—alongside alternative approaches—is essential for making informed technology decisions.

The AI Customer Service Automation Market: Scale, Competition, and Opportunity

Market Size and Growth Projections

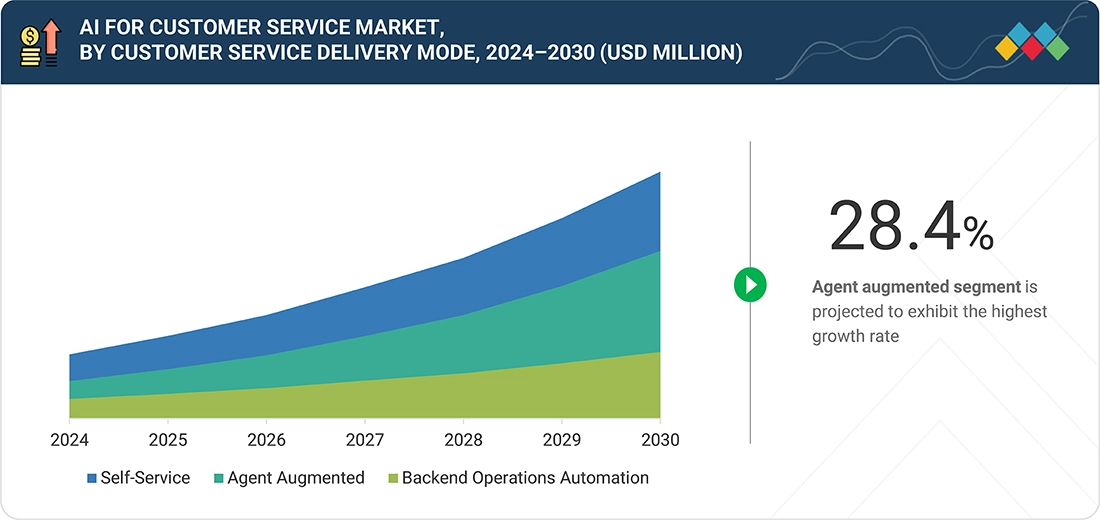

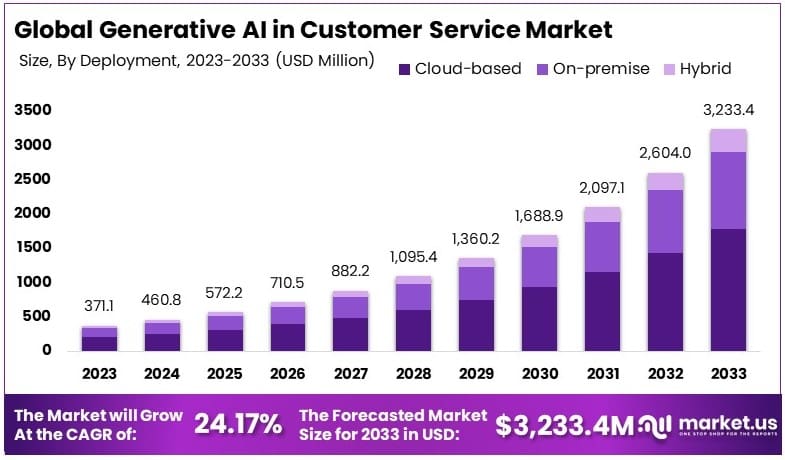

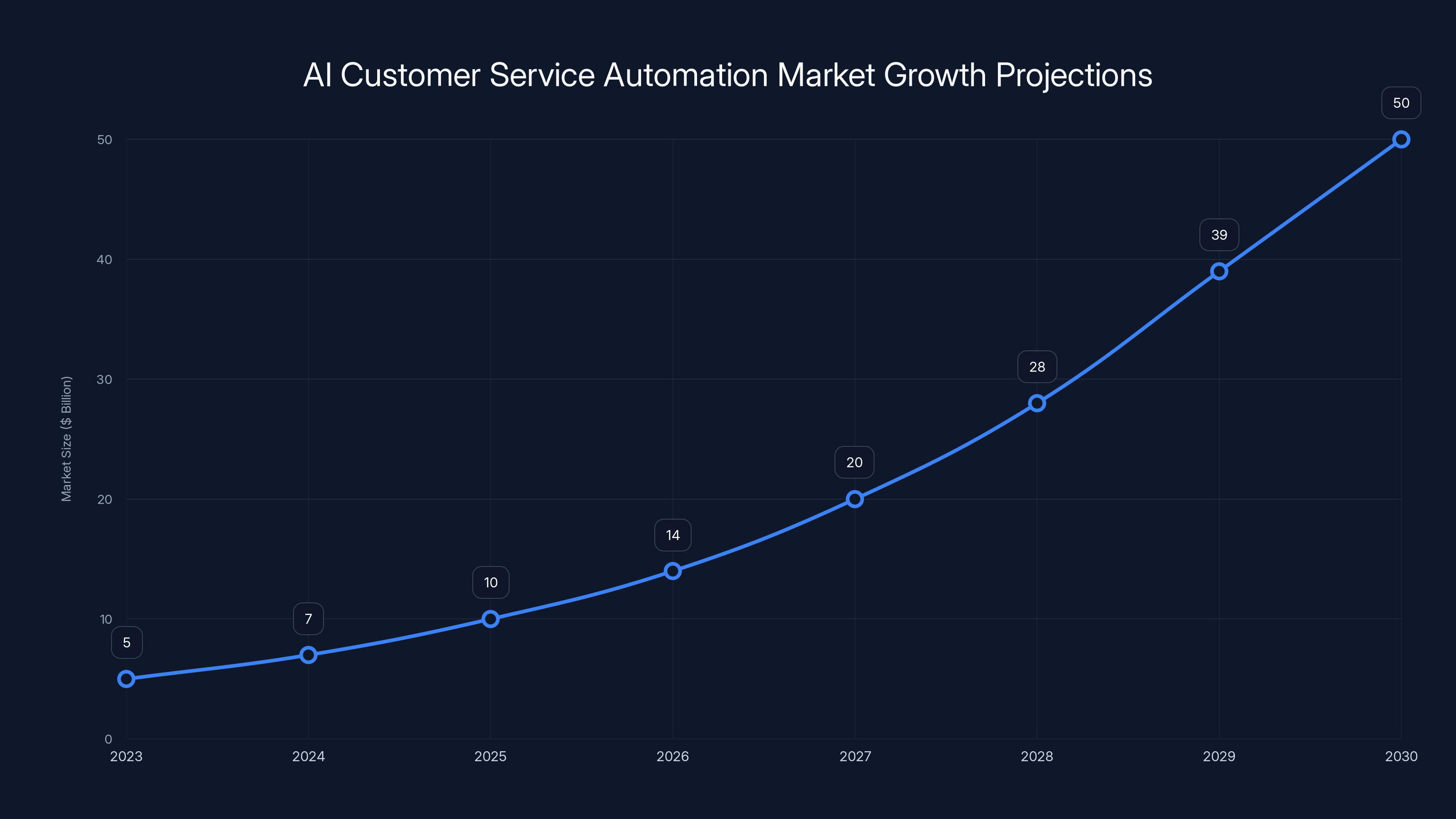

The customer service automation market sits at an inflection point. The total addressable market (TAM) for AI-powered customer service solutions encompasses multiple segments: enterprise contact centers, small business customer support, e-commerce chat, healthcare scheduling, financial services inquiries, and dozens of vertical-specific applications. When you aggregate the potential market across these segments—considering that customers spend billions annually on contact center labor, technology, and infrastructure—the addressable opportunity exceeds $50 billion globally across the next decade.

This market growth is driven by several structural factors. First, customer expectations for responsiveness continue to accelerate. Consumers increasingly expect 24/7 availability, immediate responses to inquiries, and omnichannel support across phone, email, chat, and social media. Most companies struggle to meet these expectations with traditional staffing models. Second, labor costs continue rising in developed economies while availability of customer service workers remains challenging post-pandemic. Third, AI technology has reached a capability threshold where it can handle 40-60% of inbound customer inquiries without human intervention, with that percentage increasing monthly as models improve.

Industry analysts project the conversational AI market will grow at 40-50% compound annual growth rates (CAGR) through 2030. Unlike many hyped technology categories, this growth is backed by genuine business metrics: measurable cost reductions, documented customer satisfaction improvements, and real revenue impact in companies' financial statements.

The Competitive Landscape: Parloa's Rivals and Their Valuations

Parloa's $3 billion valuation must be contextualized against aggressive competitors who have also raised substantial capital. The competitive set includes several well-funded players, each with distinct positioning:

Sierra (

Decagon (reportedly in advanced fundraising discussions for $4+ billion valuation) focuses on voice-based interactions and has demonstrated impressive customer retention metrics. The company's positioning emphasizes call handling quality and natural conversation flow, critical differentiators for enterprise customers concerned about brand perception.

Poly AI (

Intercom, an older player founded in 2011, has shifted toward AI-powered customer service as part of its broader conversational automation platform. Intercom's advantage lies in its existing customer base of over 25,000 companies and its established position in the product adoption and customer communication space.

Kore.ai takes a different approach, positioning itself as an enterprise-grade, white-label platform for building custom AI agents rather than a specific customer service application. This platform approach offers flexibility but requires more integration effort from customers.

The sheer capital deployed across this competitive set—exceeding $1 billion in venture funding in 2024 alone—demonstrates that venture capitalists view customer service automation as potentially the next "must-have" enterprise software category, comparable in scale to the CRM revolution that created Salesforce, or the collaborative software revolution that built companies like Slack and Microsoft Teams.

Market Timing and Technology Maturity

Parloa's success must also be understood through the lens of technological maturity. Large language models have reached a point where they can:

- Understand context across multiple conversation turns without losing thread of customer issues

- Route complex inquiries appropriately to specialized human agents when needed

- Learn from feedback and optimize responses through reinforcement learning

- Handle multiple languages and dialects with improving accuracy

- Integrate with existing enterprise systems (billing platforms, CRM systems, knowledge bases) to provide informed, accurate responses

Three years ago, many of these capabilities simply didn't exist at production-ready quality. The democratization of advanced AI models through APIs from OpenAI, Anthropic, and others has enabled startups to build sophisticated customer service agents without requiring proprietary large language models—significantly reducing the engineering complexity and capital requirements.

Parloa's valuation tripled from

Parloa's Technology: Core Capabilities and Differentiation

Multi-Channel, Contextual AI Agents

Parloa's core value proposition centers on building what the company describes as "multi-model, contextual experiences" that recognize customer identity and specific needs regardless of the channel through which they initiate contact. This means a customer who starts a conversation via a company's mobile app, switches to a phone call with an AI agent, then continues via email, should experience seamless continuity. The AI agent maintains context about the customer's issue, identity, and previous interactions throughout this omnichannel journey.

This capability, while straightforward to describe, is substantially complex to implement in practice. It requires:

- Unified customer identity resolution across disparate systems (phone systems, email platforms, mobile app backends, chat platforms)

- State management that maintains context across conversation channels and time periods

- Integration with enterprise knowledge bases to access accurate, current information about products, policies, and procedures

- Natural language understanding sophisticated enough to infer customer intent and emotion from varied communication modalities

- Graceful handoff protocols that route conversations to human agents at optimal moments

Parloa's competitive advantage lies not in any single component of this architecture, but in the integration quality and the company's accumulated knowledge about enterprise customer service operations. The company works with large, complex customers like Allianz (global insurance), Booking.com (travel and hospitality), SAP (enterprise software), and Sedgwick (claims management), which means they've solved real-world problems like handling regulatory compliance in financial services, managing peak volumes during travel booking surges, and processing insurance claims with appropriate documentation verification.

Outbound Calling and Proactive Engagement

While many customer service AI agents focus on inbound support (responding when customers contact a company), Parloa has invested heavily in outbound capabilities. This means AI agents can proactively reach out to customers for appointment reminders, payment follow-ups, satisfaction surveys, or cross-sell opportunities. This capability has proven particularly valuable in verticals like healthcare (appointment reminders reduce no-shows by 20-30%) and insurance (payment reminders improve collection rates).

Outbound calling requires solving additional challenges:

- Regulatory compliance with telemarketing laws, GDPR, CCPA, and other privacy regulations

- Personality and tone variation to avoid the robotic, unpleasant experience of traditional automated calling systems

- Call quality assessment to ensure agents don't damage brand reputation through poor calling experiences

- Do-not-call list management and compliance across jurisdictions

Parloa's ability to execute across both inbound and outbound channels gives it a broader serviceable market than competitors focused solely on inbound support.

Enterprise-Grade Reliability and Compliance

Parloa serves enterprise customers with strict requirements for data security, regulatory compliance, and system uptime. The platform must operate with 99.99% availability targets (less than 52 minutes of downtime per year), maintain compliance with GDPR, HIPAA, SOC 2, and industry-specific regulations, and handle sensitive customer data with enterprise-grade encryption and access controls.

Building and maintaining this level of operational rigor is resource-intensive. It requires dedicated compliance, security, and operations teams—a category of investment that doesn't directly generate new features but is absolutely essential for enterprise sales. The $350 million funding round reflects, in part, Parloa's need to scale these operational capabilities alongside product development.

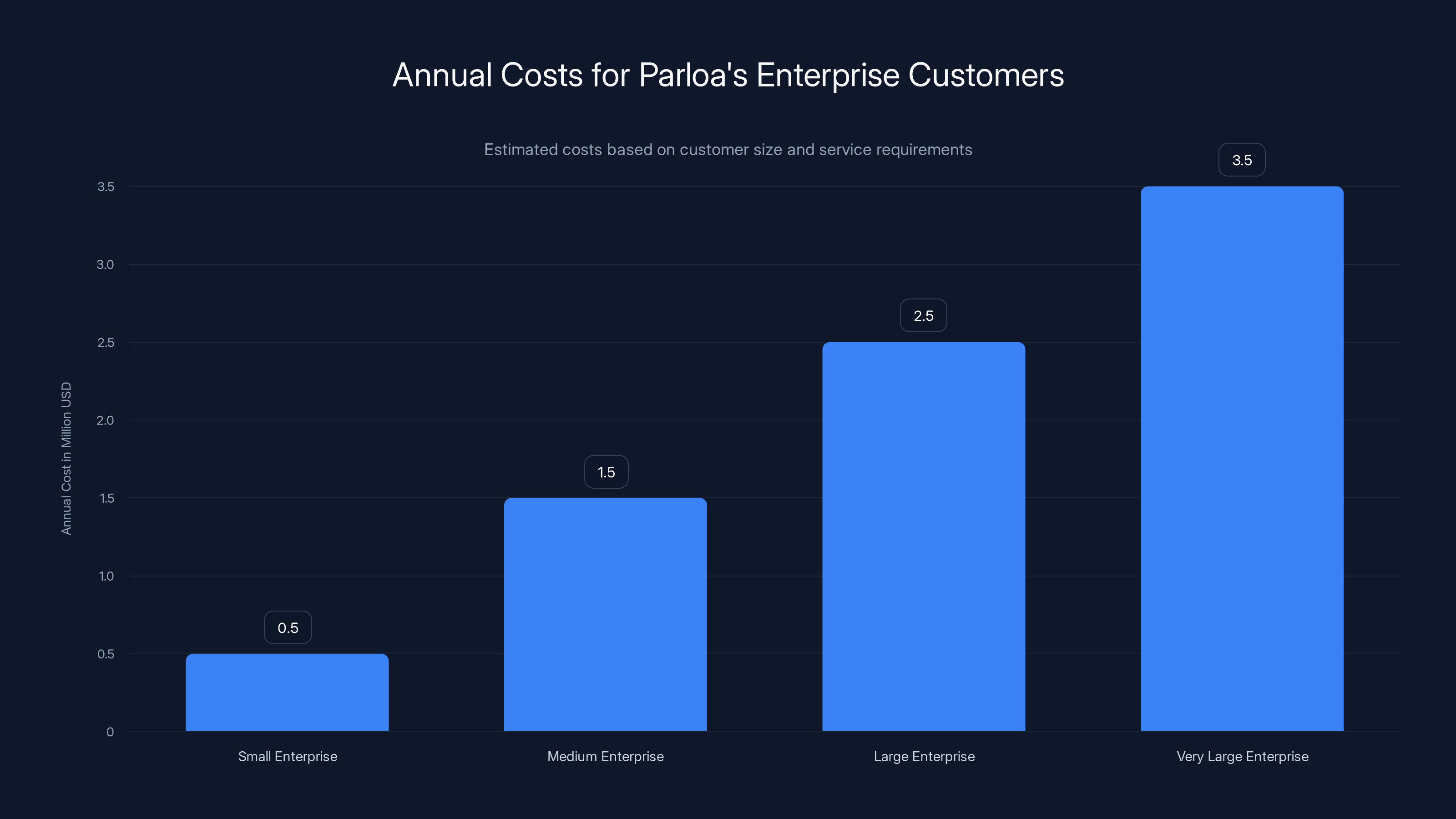

Estimated data shows that Parloa's enterprise customers typically pay between

Revenue Traction and Unit Economics

Annual Recurring Revenue Achievement

Parloa disclosed that it achieved more than

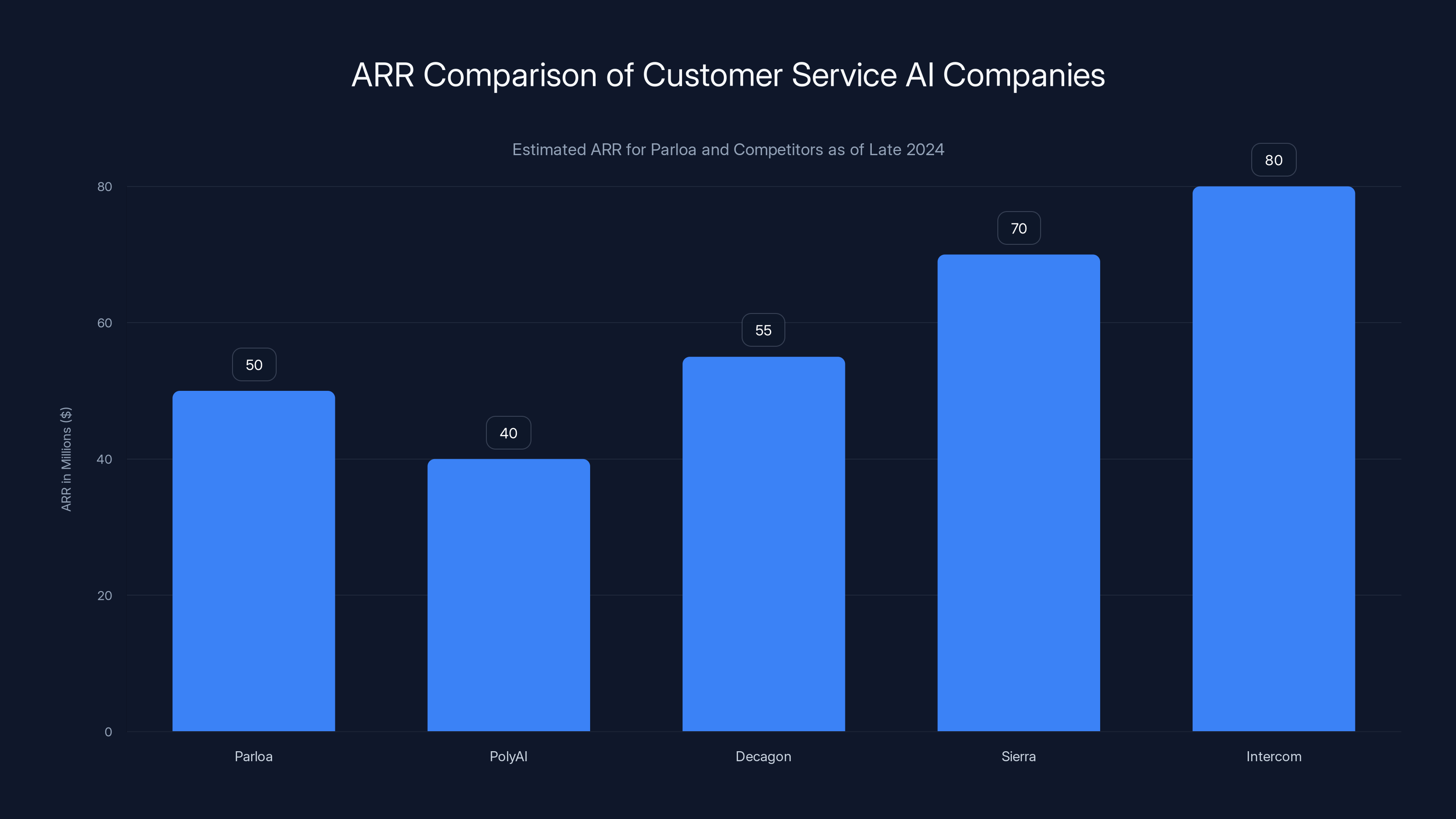

However, interpreting this metric requires understanding how it compares to competitors and what growth trajectory it suggests. Consider the competitive context:

- Poly AI expected to end 2025 with ARR of approximately $40 million—suggesting Parloa maintains a modest revenue lead despite being founded around the same time

- Decagon is reportedly generating "significantly more" than 50-60 million, putting it in Parloa's range or above

- Sierra and Intercom, with their significantly higher valuations, almost certainly have higher ARRs, though exact figures are proprietary

What these numbers reveal is that the customer service AI market is still in early stages despite the aggressive funding. None of these companies are generating $100M+ ARR yet, which would be expected for a truly mature software category. This suggests enormous room for growth and that most enterprise customers are still in pilot or early deployment phases rather than full production deployments.

Unit Economics and Scalability

The venture capital market's enthusiasm for Parloa and competitors suggests investors are confident in the unit economics of customer service AI businesses. The fundamental economics are compelling:

Customer Acquisition: Enterprise customers typically come through top-down sales efforts (requiring specialized sales engineers to understand customer requirements) rather than self-serve signup. Sales cycles range from 3-6 months, and typical enterprise customers are large enough (Fortune 500, large mid-market companies) that a single customer can represent $1-5 million in annual contract value (ACV).

Customer Success: Once deployed, AI agents require ongoing training, fine-tuning, and integration management, creating sticky relationships and ongoing professional services revenue. This generates customer lifetime values (LTV) of 5-8x annual contract value, significantly higher than the 3-4x typical for basic software products.

Gross Margins: As the technology matures, gross margins (revenue remaining after payment for computing infrastructure and direct operational costs) should exceed 75%, eventually approaching 85%+ for mature SaaS businesses. At this margin profile, enterprise software businesses can be highly profitable with relatively modest market share.

These favorable unit economics explain the venture funding enthusiasm—the companies that successfully establish market leadership in this category could generate billions in operating profit annually.

Customer Base and Enterprise Deployment Success

Marquee Customer Portfolio

Parloa's customer roster reveals insights into where customer service AI has achieved production maturity. The disclosed customers include:

Allianz - The global insurance giant operates massive contact centers handling millions of customer inquiries annually. Insurance customer service involves regulatory complexity, policy knowledge management, and claims processing—precisely the domain where AI agents face the highest stakes if they make mistakes. Allianz's adoption suggests Parloa has solved enterprise-grade reliability and accuracy challenges.

Booking.com - As a global travel platform handling millions of daily transactions, Booking.com customer service spans multiple languages, timezone concerns, and seasonal demand volatility. During peak travel seasons, customer inquiries spike dramatically, making AI-augmented support a critical business capability.

SAP - The enterprise resource planning giant represents both a potentially skeptical customer (SAP has sophisticated IT capabilities to build custom solutions) and a critical reference customer for enterprise sales. SAP's adoption signals that Parloa's technology meets sophisticated technical requirements.

Health Equity - Healthcare customer service involves HIPAA compliance, patient privacy concerns, and complex medical information. Health Equity's deployment suggests Parloa can operate in highly regulated industries.

Sedgwick - The large claims management company must process workers' compensation, auto, and liability claims with proper documentation and compliance. Deploying AI agents in this environment requires sophisticated document handling and regulatory navigation.

Swiss Life - Another insurance customer, indicating Parloa's strength in the insurance vertical specifically.

These customers represent some of the most sophisticated enterprise deployments in the world. If Parloa serves Allianz, Booking.com, and SAP successfully, the company has effectively solved many of the hardest technical and operational challenges in enterprise customer service automation.

Geographic and Vertical Concentration

Parloa's customer concentration reveals a "beachhead" strategy focused on specific geographies and verticals. The company's Berlin headquarters and European funding base suggest particular strength in European enterprises, especially insurance and financial services companies. This concentration offers both advantages and risks:

Advantages: Vertical specialization (insurance, financial services) allows the company to develop deep expertise in regulatory requirements, industry workflows, and customer pain points. European focus simplifies compliance navigation compared to managing multi-jurisdictional US regulations.

Risks: Heavy vertical and geographic concentration creates dependency on specific industries and regions. Economic downturns in European insurance or travel markets could disproportionately impact Parloa's revenue.

As the company scales, successful ventures in this category typically expand into adjacent verticals and geographies. Parloa's expanded funding base now includes strong US investors (Altimeter Capital, Durable Capital), suggesting planned US market expansion.

The AI customer service automation market is projected to grow significantly, reaching over $50 billion by 2030, driven by increasing customer expectations and advancements in AI technology. Estimated data.

Funding Dynamics and Investor Conviction

The Series D Round: Scale and Composition

The

The fact that existing investors doubled down (led by General Catalyst with participation from EQT Ventures, Altimeter Capital, Durable Capital, and Mosaic Ventures) rather than new investors replacing them indicates strong momentum and enthusiasm from those closest to the company's operations. Venture investors have detailed insight into customer satisfaction, churn, expansion metrics, and operational efficiency—information not available to external observers. Their continued participation signals that these internal metrics are impressive.

What This Funding Enables

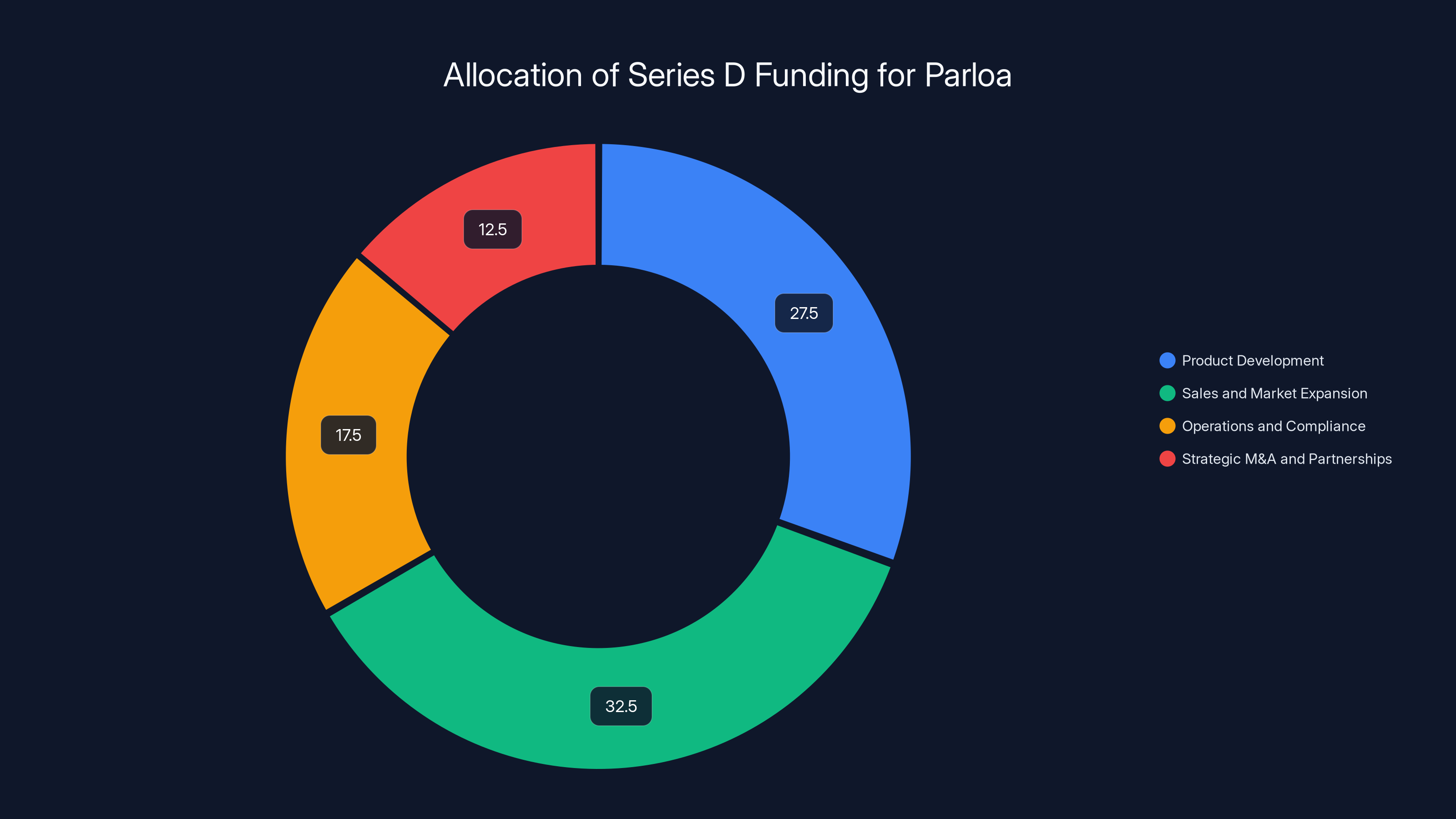

The $350 million is substantial enough to fund Parloa through profitability—or at least to achieve "venture profitability" (growing revenue faster than operating expenses, even if not yet GAAP profitable). This capital will likely be deployed across several priorities:

Product Development (25-30% of capital): Enhanced AI reasoning capabilities, support for additional languages, new vertical-specific solutions, and improved analytics and reporting.

Sales and Market Expansion (30-35% of capital): Building enterprise sales teams in North America, Asia-Pacific, and additional European markets; expanding from insurance/financial services into healthcare, retail, and manufacturing.

Operations and Compliance (15-20% of capital): Scaling customer success teams, building regulatory compliance infrastructure, enhancing security and data privacy capabilities.

Strategic M&A and Partnerships (10-15% of capital): Potential acquisitions of specialized AI capabilities, vertical solutions, or regional players; partnerships with system integrators and consulting firms to reach enterprise customers.

This deployment strategy explains the company's ambition to build contextual, personalized experiences mentioned in the funding announcement—it requires sustained investment in AI research, product management, and customer engineering to achieve effectively.

Competitive Positioning: Parloa's Differentiation Strategy

The Crowded Market Reality

CEO Malte Kosub's statement that "the number of competitors is decreasing significantly" appears surprising given that customers like Sierra, Decagon, and Poly AI are all well-funded and active. However, the statement reflects a sophisticated understanding of what actually constitutes competitive threat. Many companies are building customer service chatbots and AI agents, but few have achieved:

- Enterprise-scale reliability (99.99%+ uptime across global infrastructure)

- Vertical expertise in complex regulated industries

- Full-stack capabilities spanning inbound, outbound, voice, chat, and email

- Production ARR traction with recognized enterprise customers

- Sufficient capital to sustain 3-5 year sales cycles while building product

When filtered through these criteria, the truly competitive set shrinks to perhaps 5-7 companies globally. Many others will face funding challenges, founder departures, or pivot requirements if they haven't achieved traction within 18-24 months.

Parloa's Specific Competitive Advantages

Based on publicly available information, Parloa appears to differentiate on several dimensions:

Outbound Capabilities: While most competitors focus on inbound customer service, Parloa's investment in outbound calling and proactive engagement opens additional use cases and creates stronger enterprise value propositions. Outbound is harder technically and requires stronger regulatory compliance, creating a higher barrier to entry for competitors.

Insurance and Financial Services Expertise: Parloa's customer concentration in these verticals has forced the company to develop deep knowledge of regulatory requirements, compliance challenges, and industry-specific workflows. This specialized expertise is difficult for broader competitors to replicate quickly.

European Foundation: While this appears to be a disadvantage in a US-dominated venture capital ecosystem, it may actually be a strength in Europe, where regulatory requirements (GDPR, local data residency) are complex and where European enterprises often prefer vendors with local presence and understanding.

Integration Depth: Customer testimony suggests Parloa has achieved sophisticated integrations with customer backend systems—billing platforms, knowledge bases, CRM systems—that enable contextual, knowledgeable AI interactions. This integration work is largely invisible but highly valuable to enterprise customers.

Challenges to Parloa's Market Leadership

Despite its impressive capital raise and traction, Parloa faces substantive competitive and market challenges:

Larger Competitors with Enterprise Relationships: Sierra's Bret Taylor connection to OpenAI and Salesforce creates institutional advantages in enterprise software relationships. Intercom and Kore.ai bring existing customer relationships and established brand recognition.

In-House Development Pressure: Sophisticated enterprises like Google, Amazon, and Microsoft may develop internal customer service AI rather than buying specialized vendors. This "build vs. buy" decision becomes more likely as the technology matures.

Price Compression: As the market matures, customers will increasingly compare offerings on price rather than capability. This could squeeze margins for all players in the category.

Economic Sensitivity: Customer service is a cost center, not a revenue-generating function. During economic downturns, enterprises may freeze implementations or reduce scope, impacting growth trajectories.

Parloa leads PolyAI but is in a competitive range with Decagon, Sierra, and Intercom, highlighting the growth potential in the customer service AI market. (Estimated data for Sierra and Intercom)

The Broader Implications: What This Funding Round Reveals

Market Maturity Signals

Parloa's $3 billion valuation and the broader funding dynamics in customer service AI reveal several important signals about market maturation:

First, the market has clearly transitioned from exploratory pilots to production deployments. Customers are not testing whether AI agents can handle customer service; they're negotiating contracts for implementation across customer service centers. This shift from "does this work?" to "how do we scale this?" is a critical inflection point indicating the technology has achieved production viability.

Second, consolidation is inevitable. The venture ecosystem will fund multiple competitors, but the customer service market is not large enough to sustainably support 10-15 well-funded competitors. Over the next 5-7 years, expect significant consolidation through acquisition, failure, or merger. Companies that haven't achieved $50M+ ARR by 2027 will face difficult strategic decisions.

Third, vertical specialization is increasingly valuable. While horizontal "build a chatbot for any use case" approaches attracted early venture funding, the companies that will ultimately win are those that develop deep expertise in specific verticals (insurance, healthcare, financial services, e-commerce, etc.). Parloa's focus on insurance appears to be a deliberate vertical specialization strategy.

Venture Capital Perspective

From a venture capital perspective, Parloa's funding trajectory reveals confidence that customer service automation is reaching venture scale inflection. The

This return profile, while modest compared to OpenAI or other mega-winners, is attractive relative to venture capital risk. It explains why top-tier venture firms continue investing heavily in customer service AI despite competitive crowding.

Alternative Approaches and Competitive Solutions

Comparing AI Customer Service Platforms

For organizations evaluating customer service automation, understanding how Parloa compares to alternatives is essential. The market offers several distinct approaches:

| Platform | Positioning | Strengths | Best For | Pricing Model |

|---|---|---|---|---|

| Parloa | Multimodal contextual AI agents | Outbound capabilities, vertical expertise, enterprise reliability | Large enterprises in regulated industries | Enterprise contracts, usage-based |

| Sierra | AI reasoning and CRM integration | OpenAI connections, Salesforce integration, high reasoning capability | Salesforce-heavy enterprises | Enterprise contracts |

| Decagon | Voice-first AI agents | Natural voice interaction, call quality | Contact centers prioritizing voice experience | Per-minute or contract-based |

| Poly AI | Conversational AI platform | Natural conversation, accent handling | Multilingual, globally distributed customers | Flexible, usage-based |

| Intercom | Conversational automation suite | Existing customer base, product adoption workflows | Companies already using Intercom | Tiered SaaS pricing |

| Kore.ai | Enterprise AI agent platform | Platform flexibility, white-label capability | Enterprises building custom agents | Platform licensing |

Each platform addresses the customer service automation opportunity differently. Parloa's emphasis on regulated industry expertise and omnichannel capabilities appeals to specific customer segments, while Sierra's Salesforce integration appeals to CRM-centric enterprises.

Internal Development and Open-Source Alternatives

A growing percentage of enterprises are building custom AI agents using open-source models and development frameworks. This "build vs. buy" decision requires examining:

Open-Source Models: Llama, Mistral, and other open-source large language models now provide sufficient quality for many customer service use cases. Enterprises can fine-tune these models on proprietary customer interaction data, maintaining confidentiality while achieving customization.

Development Frameworks: LangChain, Llama Index, and other frameworks accelerate development of AI agent applications, reducing the technical complexity of building custom solutions.

Hosting Infrastructure: Cloud platforms (AWS, Google Cloud, Azure) provide serverless computing and managed services that simplify deployment and scaling.

The economics of custom development are increasingly attractive for large enterprises with sophisticated engineering teams. A Fortune 500 company with 100+ engineers might develop a more customized solution in 6-12 months than buying a general-purpose platform, while maintaining greater control and customization. This threat explains why platform vendors emphasize ease of deployment, vertical templates, and rapid time-to-value—making the case that buying is faster than building.

Cost Considerations: Buying vs. Building

For a mid-market company handling 50,000-100,000 customer service interactions monthly, the total cost of ownership differs substantially between buying and building:

Buying Platform (Annual Cost):

- Parloa or similar platform: 2M depending on usage and contract terms

- Implementation and integration: 300K

- Ongoing professional services: 200K annually

- Total: 2.5M annually

Building Custom Solution (Annual Cost):

- Engineering team (3-5 engineers): 750K annually

- Infrastructure and hosting: 200K annually

- Compliance, security, operations: 150K annually

- Total: 1.1M annually

The internal build approach shows lower net cost, but includes substantial hidden costs: opportunity cost of engineering capacity, risk of project delays, responsibility for maintaining compliance and security, and lack of access to vendor roadmap improvements and new features. For most mid-market companies, buying a platform provides lower total cost of ownership when all factors are considered.

The Series D funding round of $350 million for Parloa is primarily allocated towards Sales and Market Expansion (32.5%) and Product Development (27.5%), indicating a strong focus on growth and innovation. Estimated data.

Implementation Considerations and Success Factors

Deployment Models and Timelines

Parloa and similar platforms typically offer deployment models spanning implementation timelines and customization depth:

Quick Start (6-12 weeks): Leveraging pre-built templates for common customer service scenarios (billing questions, appointment scheduling, frequently asked questions). Minimal customization, rapid time-to-value, but limited differentiation.

Standard Implementation (3-6 months): Custom integration with customer backend systems, training on customer-specific workflows, development of custom conversation flows for vertical-specific processes. Balanced approach between speed and customization.

Full Enterprise Deployment (6-12 months): Comprehensive integration with multiple backend systems, development of sophisticated reasoning capabilities for complex scenarios, full compliance validation, internal change management and training. Longest timeline but highest sophistication.

Parloa's customer base (Allianz, Booking.com, SAP) almost certainly involved standard or enterprise implementation timelines, explaining why sales cycles extend 6+ months and why customer acquisition costs are substantial. Shorter implementations would reach smaller customer segments with lower ACV.

Critical Success Factors

Organizations deploying customer service AI agents must prioritize several factors:

1. Clear ROI Definition: Define measurable objectives before implementation—cost reduction targets, response time improvements, customer satisfaction metrics, first-contact resolution rates. Without clear ROI expectations, implementations drift and fail to achieve stakeholder buy-in.

2. Change Management and Training: Customer service representatives view AI agents as potential job threats. Successful implementations position AI as augmentation (handling routine inquiries, freeing agents for complex issues) rather than replacement. Training agents on how to work effectively with AI systems is essential.

3. Conversation Flow Design: The quality of conversation flows (scripts, routing logic, escalation criteria) dramatically impacts customer experience. Poor conversation design creates frustration and support tickets. Invest in conversation design expertise and iterative testing.

4. Data and Integration Quality: AI agents are only as intelligent as their access to customer data and business logic. Invest in data quality, system integration, and knowledge management as much as in the AI platform itself.

5. Continuous Optimization: AI agents improve through continuous feedback loops—analyzing conversation recordings to identify failure patterns, iterating on conversation flows, retraining on customer feedback. Organizations treating AI agents as "set and forget" products typically see degraded performance over time.

Market Trends and Future Directions

The Voice-First Revolution

While chat-based customer service has dominated recent AI automation discussions, a significant market trend involves voice-first AI agents. Consumers still prefer voice calls for complex issues, and phone interactions remain the highest-value channel for many businesses. Competitors like Decagon have built significant businesses focusing specifically on voice quality, accent handling, and natural conversation flow in voice modality.

Parloa's multi-modal approach addresses this trend by supporting voice alongside other channels, but whether the company can match specialists' voice quality remains an open question. Future competitive differentiation will likely increasingly depend on voice agent sophistication.

Reasoning and Complex Problem-Solving

Current AI agents excel at classification and retrieval (identifying customer issue type, retrieving relevant information), but struggle with reasoning and complex problem-solving requiring multiple steps or creative thinking. Emerging AI models with improved reasoning capabilities will enable customer service agents to:

- Solve multi-step problems (e.g., "My billing shows duplicate charges AND my service isn't working")

- Engage in negotiation (price adjustments, service credits, contract modifications)

- Handle novel situations requiring judgment beyond pre-defined workflows

- Provide explanations for decisions in ways that feel natural and trustworthy

Vendors investing heavily in reasoning-focused capabilities (Sierra's positioning emphasizes this) may eventually differentiate significantly from those using more basic retrieval approaches.

Vertical and Domain-Specific AI Agents

A major market trend involves vertical-specific agents—AI systems trained specifically on insurance claims processes, healthcare scheduling, financial services compliance, e-commerce returns, etc. These systems can be more sophisticated, accurate, and compliant than horizontal platforms due to deep domain knowledge.

Parloa's customer concentration in insurance and financial services positions the company well for this trend, but it also creates an opportunity for specialized competitors in healthcare, e-commerce, manufacturing, and other verticals. Future market structure may feature multiple domain-specific leaders rather than a single dominant horizontal platform.

Integration with AI-Powered Back-Office

Customer service AI agents will increasingly integrate with AI-powered back-office systems. A customer calling about a billing issue could trigger an AI agent that not only answers the customer inquiry but also automatically generates a refund, initiates a claims process, or schedules a technician visit. This end-to-end automation (customer-facing through back-office resolution) represents the ultimate goal but requires sophisticated system integration and business process redesign.

Parloa's valuation surged from

Financial Perspective and Exit Potential

IPO Timeline and Valuation Progression

Based on Parloa's funding progression and current ARR, potential IPO timelines can be estimated. Venture-backed software companies typically go public once they achieve

IPO valuation for software companies depends on growth rate and profitability profile. A customer service AI company with 60%+ year-over-year growth and path to 30%+ operating margins could command 8-12x revenue multiples at IPO, suggesting potential IPO valuation in

This valuation progression—from

Acquisition Risk and Strategic Buyer Interest

Alternatively, Parloa could be acquired by a larger technology company seeking to enhance its customer service capabilities or customer data platform. Potential strategic buyers include:

Salesforce: Could acquire Parloa to enhance its Service Cloud customer service platform, though Salesforce already owns significant customer service IP.

SAP: One of Parloa's existing customers; SAP might acquire to enhance its cloud ERP customer service capabilities.

Microsoft: Through Microsoft Cloud for Customer Engagement or Azure cloud services expansion.

IBM: As part of enterprise AI platform ambitions.

Consulting/System Integration Firms: Accenture, Deloitte, or other large integrators might acquire to strengthen customer service transformation offerings.

For acquisition to occur, Parloa would likely need to demonstrate clear paths to

Building an AI Customer Service Strategy

Assessment Framework for Technology Evaluation

Organizations evaluating customer service AI platforms should employ a systematic assessment framework:

1. Capability Assessment:

- Does the platform support your required interaction modalities (phone, chat, email, social)?

- Does it handle your required languages and dialects?

- Can it integrate with your existing backend systems?

- Does it provide required compliance certifications (GDPR, HIPAA, SOC 2)?

2. Vertical Fit Assessment:

- Does the vendor have experience in your industry?

- Does the platform include pre-built templates or workflows for your vertical?

- Can the vendor reference customers in your industry segment?

- Does the vendor understand your regulatory environment?

3. Vendor Financial Assessment:

- Is the vendor well-funded with clear path to profitability?

- Does the vendor have strong institutional investor backing?

- What is the customer concentration risk (too few large customers)?

- Is the vendor's burn rate sustainable with current funding?

4. Total Cost of Ownership Analysis:

- License and usage costs over 3-5 year period

- Implementation and integration costs

- Ongoing professional services and support costs

- Internal resource costs for integration management

- Training and change management costs

5. Strategic Alignment Assessment:

- Does this platform align with your broader AI and automation strategy?

- Can the vendor support your planned expansion (additional channels, geographies, use cases)?

- What is the vendor's roadmap for emerging capabilities you'll need in 2-3 years?

Through systematic assessment across these dimensions, organizations can make informed vendor selection decisions rather than pursuing "best in class" based on funding or valuation metrics.

Exploring Alternative Solutions for Specific Use Cases

For Cost-Conscious Mid-Market Organizations

Mid-market companies with

Runable offers an interesting approach for organizations seeking AI-powered automation without enterprise platform costs. At $9/month per user with AI-powered document generation, workflow automation, and content creation capabilities, Runable provides accessibility to AI-driven automation for teams that can't justify six-figure platform investments. While Runable is positioned primarily for developers and content teams rather than customer service specifically, its automation capabilities and AI agents for workflow optimization could be adapted for customer service use cases in simpler deployments.

Freshdesk/Freshchat: Offers integrated customer service and AI capabilities with lower pricing ($15-40 per agent monthly) suitable for small-to-mid-market companies.

Zendesk AI: Integrated AI capabilities within Zendesk's platform, suitable for organizations already using Zendesk infrastructure.

Intercom: Accessible tiered pricing starting at $39-99/month, suitable for growing companies.

For Enterprise Organizations with Specific Vertical Needs

Large enterprises in specific verticals should evaluate specialist vendors:

Healthcare: Consider Pager, Nurse Line, or healthcare-specific AI vendors rather than horizontal platforms.

Insurance: Parloa's strength, but also consider EXL Service, ICCC, and insurance-specific vendors.

E-Commerce: Evaluate Up Keep, Gorgias, or e-commerce-specific solutions.

Banking/Financial Services: Consider Kasisto, ADA, or fintech-specialized vendors.

Vertical specialization often provides superior domain knowledge and pre-built workflows compared to horizontal platforms.

Key Takeaways and Strategic Implications

What Parloa's Success Reveals About Market Maturity

Parloa's rapid valuation growth from

-

Customer service automation has achieved production maturity. The technology no longer requires pilots or proof-of-concepts; enterprises are committing to deployment at meaningful scale.

-

Multiple well-funded competitors will coexist in the market. Unlike some software categories where one dominant player emerges, customer service AI will likely support multiple $1-10 billion companies serving different customer segments and verticals.

-

Enterprise specialization creates defensible competitive positions. Parloa's focus on insurance and regulated industries, combined with outbound capabilities, has created a differentiated position that survives well-funded horizontal competitors.

-

Capital and execution remain separate. While Parloa has raised

50M+ ARR demonstrates that capital alone doesn't guarantee success. Superior execution in customer deployments matters as much as large funding rounds. -

The venture market is rewarding companies demonstrating real business momentum. Parloa's Series D funding was justified by existing customers, ARR achievement, and enterprise logos—not just market opportunity size.

Strategic Recommendations for Prospective Customers

For enterprises considering customer service AI investments:

-

Define your specific use case and ROI targets before evaluating vendors. Generic "modernize customer service" objectives are too vague to drive purchasing decisions.

-

Prioritize vendor vertical expertise over market leadership position. A vendor with deep insurance experience serves insurance customers better than a horizontal leader without vertical knowledge, regardless of overall valuation.

-

Evaluate implementation timelines and change management capabilities alongside technology capabilities. Technology is only 40% of deployment success; organizational change management is equally important.

-

Structure contracts with clear performance metrics and escalation clauses. Tie vendor payments to achievement of defined ROI metrics to ensure accountability.

-

Plan for multi-year optimization cycles. Customer service AI improves through continuous feedback and conversation redesign. Budget for 2-3 years of optimization, not just initial implementation.

The Broader Automation Economy

Parloa's rise is part of a broader trend toward AI-powered automation across enterprise processes. As large language models mature and integration capabilities improve, companies like Parloa in customer service, Runable in developer productivity and content automation, and specialists in finance, HR, and supply chain automation will collectively drive enterprise work transformation.

The organizations that successfully implement these solutions—treating automation as strategic capability rather than tactical cost-reduction—will achieve competitive advantages through:

- Faster customer response times improving satisfaction and retention

- Reduced customer service labor costs improving profitability

- Freed-up team capacity for strategic work rather than routine tasks

- Better customer data insights enabling product and service improvements

Parloa's $3 billion valuation reflects venture capital's conviction that this transformation is underway and that companies executing well in specific segments can build very large, valuable businesses.

FAQ

What is customer service AI and how does it differ from traditional chatbots?

Customer service AI uses advanced large language models and reasoning capabilities to handle complex customer interactions, understand context across multiple conversation turns, and integrate with enterprise systems to provide knowledgeable responses. Traditional chatbots rely on rule-based decision trees and keyword matching, enabling them to handle only simple, pre-defined scenarios. Modern AI agents like Parloa can understand nuance, manage multi-step problem-solving, and gracefully escalate to human agents when needed—representing a fundamental capability shift beyond earlier generations of chatbot technology.

How does Parloa generate revenue and what are typical customer costs?

Parloa operates on an enterprise contract basis where pricing is customized based on customer size, interaction volume, deployment complexity, and integration requirements. Large enterprise customers typically pay

What regulatory and compliance challenges do customer service AI platforms face?

Customer service AI platforms operating in regulated industries must maintain compliance with GDPR (European data privacy), CCPA (California privacy), HIPAA (healthcare privacy), PCI-DSS (payment card security), and various industry-specific regulations. Parloa's customers in insurance, healthcare, and financial services require certifications and audit trails demonstrating compliance. The platform must implement encryption, access controls, audit logging, and data residency requirements—creating substantial operational complexity. This regulatory burden actually protects market leaders like Parloa, as building compliant-by-design systems from scratch is resource-intensive, creating barriers to entry for new competitors.

How do AI customer service agents handle situations requiring human judgment or escalation?

Modern AI customer service platforms implement sophisticated escalation protocols based on confidence scores, complexity signals, and escalation triggers. When an AI agent encounters an issue requiring human judgment—complex complaints, novel situations, regulatory decisions—it can seamlessly hand off conversations to human agents while maintaining context about the customer's situation and previous interactions. Platforms like Parloa track escalation patterns to identify areas needing improvement in conversation design or AI training. High escalation rates indicate the AI agent needs refinement; low escalation rates may indicate the agent is handling cases it shouldn't, creating risk.

What is the total addressable market for customer service AI and how does it compare to other software categories?

The global customer service automation market encompasses approximately 17 million contact center agents worldwide spending an estimated

How does Parloa's vertical focus on insurance and financial services affect its competitive position versus horizontal platforms?

Vertical focus creates both advantages and constraints. Advantages include: deep regulatory expertise, pre-built workflows for vertical-specific processes, language and terminology matching customer needs, and strong reference customers enabling enterprise sales. Constraints include: geographic and industry concentration risk, slower expansion into adjacent verticals, and potential for specialists to emerge in each vertical. Parloa's strategy appears to build dominant position in insurance/financial services first, then expand into adjacent verticals (healthcare, travel/hospitality) where regulatory complexity and contact center scale create similar dynamics. Horizontal platforms like Sierra must serve all verticals, potentially diluting vertical expertise.

What factors determine success in customer service AI implementations and how do organizations avoid common mistakes?

Successful implementations require: (1) clear ROI definition with measurable metrics, (2) strong change management addressing employee concerns about job displacement, (3) investment in conversation flow design and quality assurance, (4) rigorous data quality and system integration, (5) continuous optimization based on conversation analysis and customer feedback. Common mistakes include: treating AI agents as "set and forget" technology, deploying without change management creating employee resistance, failing to design high-quality conversation flows, insufficient integration with backend systems limiting agent knowledge, and unrealistic ROI expectations. Organizations allocating 30-40% of implementation budgets to change management and training, rather than 100% to technology, typically achieve superior results.

How will customer service AI technology evolve over the next 3-5 years and what capabilities will become differentiating?

Expected evolution includes: (1) improved reasoning capabilities enabling multi-step problem-solving and negotiation, (2) voice agent sophistication matching human quality across accents and dialects, (3) vertical-specific domain models trained on industry data, (4) end-to-end automation integrating customer-facing agents with back-office processes, (5) predictive capabilities identifying customer needs before they're articulated. Capabilities that will increasingly differentiate leaders from laggards include: voice quality and naturalness, reasoning sophistication, industry expertise, and integration depth. Platforms that cannot achieve quality voice agents or vertical specialization will likely compete primarily on price, creating margin pressure.

What alternative approaches exist to buying customer service AI platforms and when should organizations build versus buy?

Alternatives include: (1) building custom agents using open-source models (Llama, Mistral) and development frameworks (LangChain), (2) consulting firms implementing solutions, (3) in-house development, (4) integration with existing platforms (Salesforce, SAP, Intercom). Build-versus-buy analysis should consider: total cost of ownership including engineering labor, time-to-value and opportunity costs of delays, access to vendor roadmap and continuous improvements, maintenance and compliance responsibility. Most mid-market companies (

Conclusion: Parloa in the Context of Enterprise AI Transformation

Parloa's remarkable journey from a promising Berlin-based startup to a $3 billion-valued company in just six years represents far more than a single company's success story. It embodies a fundamental shift in how enterprises approach customer service operations and reflects the venture capital ecosystem's recognition that AI-powered automation has reached a point of genuine business criticality and scalability.

The company's tripling of valuation in just eight months, coupled with its achievement of $50M+ annual recurring revenue and deployment with some of the world's most sophisticated enterprises (Allianz, Booking.com, SAP), demonstrates that customer service AI has transitioned from experimental proof-of-concept to production-critical infrastructure. This isn't hype about potential future value; it's validation of already-achieved, measurable business impact in active customer deployments.

What makes Parloa's position particularly interesting is how it navigates the fundamental tension between horizontal and vertical strategies. While competitors like Sierra pursue horizontal platforms with maximum flexibility and SAP relationships, Parloa has deliberately concentrated on specific verticals—insurance, financial services, and regulated industries—where the complexity and stakes are highest, and where regulatory compliance and domain expertise create defensible competitive positions. This vertical focus strategy mirrors historical success patterns in enterprise software, where dominant market leaders often emerged from vertical specialization rather than horizontal platforms.

The funding round's composition—led by existing investor General Catalyst with strong participation from returning backers—signals that those closest to Parloa's operations, with detailed visibility into customer satisfaction, churn rates, and expansion metrics, have substantially increased conviction in the company's execution and market opportunity. In venture capital, this kind of investor enthusiasm from those with operational insight often proves more predictive of long-term success than acquisition of new headline investors.

For enterprises evaluating customer service automation strategies, Parloa's emergence as a well-capitalized, well-traction'd player creates both opportunity and challenge. The opportunity lies in having a credible vendor with sufficient capital to invest in ongoing product development, customer success infrastructure, and compliance management—reducing risk of vendor failure or product stagnation. The challenge lies in competitive tension: Parloa's success has spurred competitors to raise substantial capital and pursue aggressive go-to-market strategies, meaning customers have multiple legitimate options from which to choose.

Making informed vendor decisions in this landscape requires moving beyond valuation headlines to fundamental assessment of fit: Does the vendor have deep expertise in your industry and use cases? Can the vendor credibly integrate with your existing systems? What is the vendor's track record of successful customer deployments in your specific context? Organizations answering these questions rigorously, rather than chasing market leaders, typically achieve superior ROI from customer service automation investments.

The venture capital investment trajectory—from

Looking forward, Parloa faces the challenge that has confronted every enterprise software company: executing on its promise at scale. Large funding rounds create expectations. General Catalyst and other investors expect Parloa to leverage this capital to achieve market leadership, expand into new verticals and geographies, and ultimately achieve IPO-scale revenue within 3-5 years. Missing these targets would create pressure from investors and potential challenges in recruiting talent and retaining customers.

Yet Parloa's existing traction—real customers, real revenue, real AI-driven impact—suggests the company has earned the right to this capital and has the operational sophistication to deploy it effectively. The real test will come not from funding announcements, but from Parloa's ability to maintain customer satisfaction and growth rates as the company scales operations, expands teams, and navigates the inevitable challenges of turning startup momentum into sustainable enterprise growth.

For the broader market, Parloa's success validates that customer service automation is not a passing hype cycle, but a genuine shift in how enterprises organize and execute customer service operations. Over the next 5-10 years, customers who strategically implement AI-powered service automation—treating it as a strategic capability rather than tactical cost reduction—will accumulate substantial competitive advantages through faster response times, lower costs, and better customer data insights. Parloa and its competitors will battle for market share in what will ultimately be a multi-billion-dollar category supporting numerous well-capitalized companies, each capturing different customer segments and use cases.

The companies, teams, and organizations that navigate this transformation thoughtfully—investing in change management and capability building, not just technology procurement—will emerge stronger. Those that view automation merely as labor reduction and fail to invest in employee transition and organizational redesign will find themselves caught in the disruption rather than benefiting from it. Parloa's $3 billion valuation reflects the magnitude of opportunity; executing on that opportunity with wisdom and foresight is the challenge that lies ahead.

Related Articles

- Google Gemini vs OpenAI: Who's Winning the AI Race in 2025?

- ElevenLabs $330M ARR: How AI Voice Disrupted SaaS Growth Curves

- Bank of England's Oracle Migration Cost Triples to £21.5M [2025]

- Apple & Google AI Partnership: Why This Changes Everything [2025]

- Claude Cowork: Complete Guide to AI Agent Collaboration [2025]

- Google Gemini Powers Apple AI: Complete Partnership Analysis & Alternatives