The Prediction Markets Explosion: A $2 Trillion Market at War

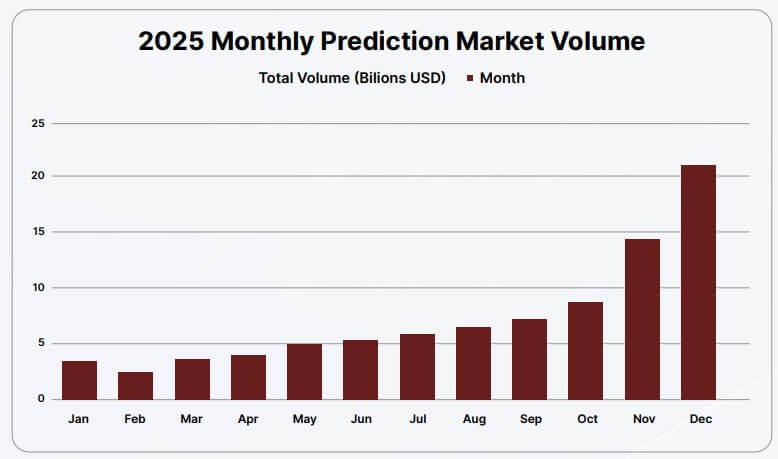

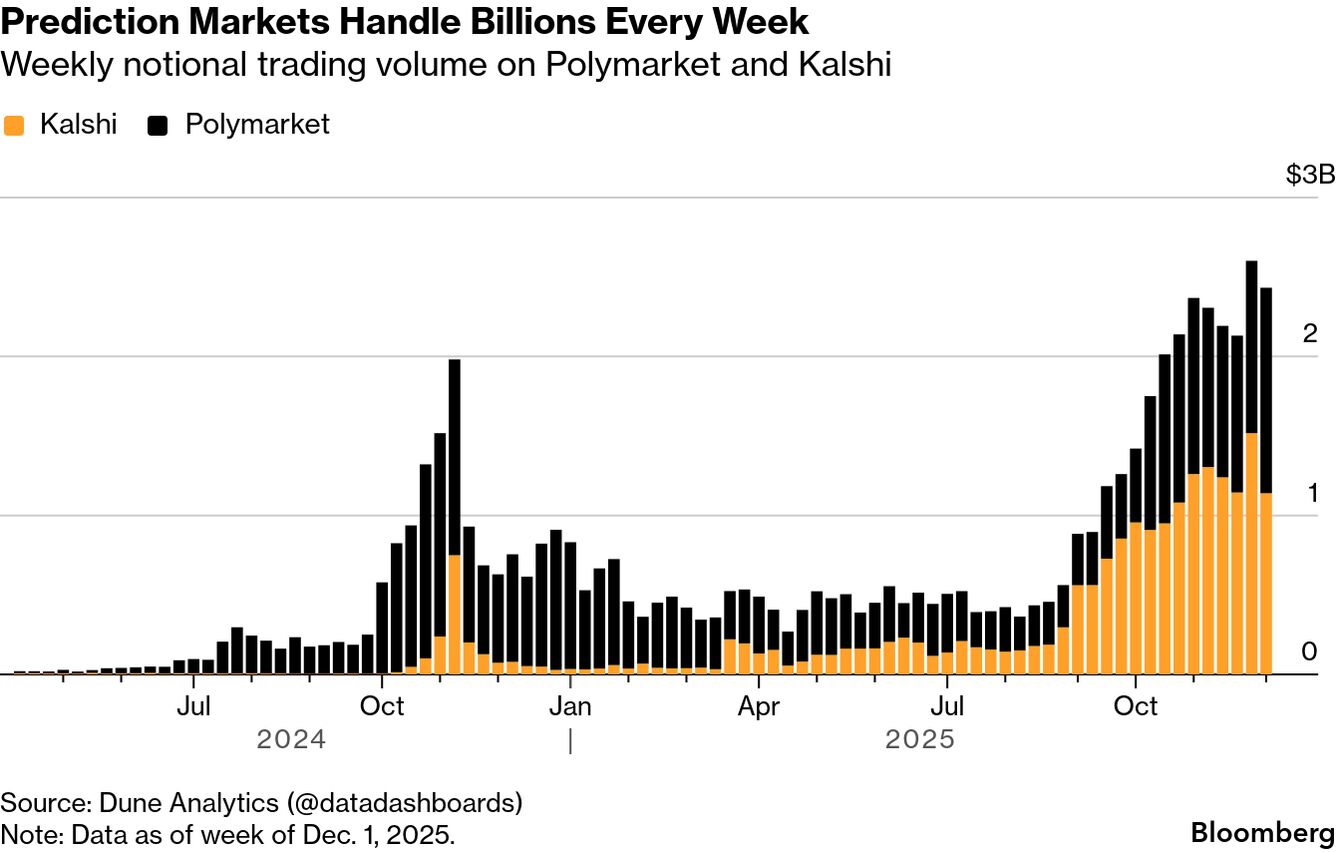

Something wild is happening in the corners of the internet where finance meets betting. Prediction markets—platforms where you can literally bet money on almost anything, from who wins the 2026 election to whether AI will pass the bar exam—have exploded from niche financial experiments into genuine mainstream phenomena.

On Super Bowl Sunday 2024, Kalshi alone processed over $1.3 billion in trades on event contracts. That's not chump change. That's more volume than many entire stock exchanges handle on regular trading days. And yet, most people still don't know what prediction markets even are.

Here's the thing: prediction markets aren't new. The concept dates back centuries. But what's different now is the technology. Platforms like Kalshi, Polymarket, and a dozen others have made it dead simple for anyone with a smartphone to trade on basically anything. Want to bet on whether the Fed will raise interest rates? Done in 30 seconds. Think Elon Musk will tweet about crypto today? Put money on it. Curious if Netflix stock will close above $250? Trade it.

The problem is nobody agreed on whether this is legal. Regulators didn't plan for it. States didn't regulate it. And now a genuinely bizarre political coalition has formed—conservative Mormons, Las Vegas casino executives, MAGA influencers, liberal Democrat lobbyists, and Trump himself are all waging war over the future of these platforms.

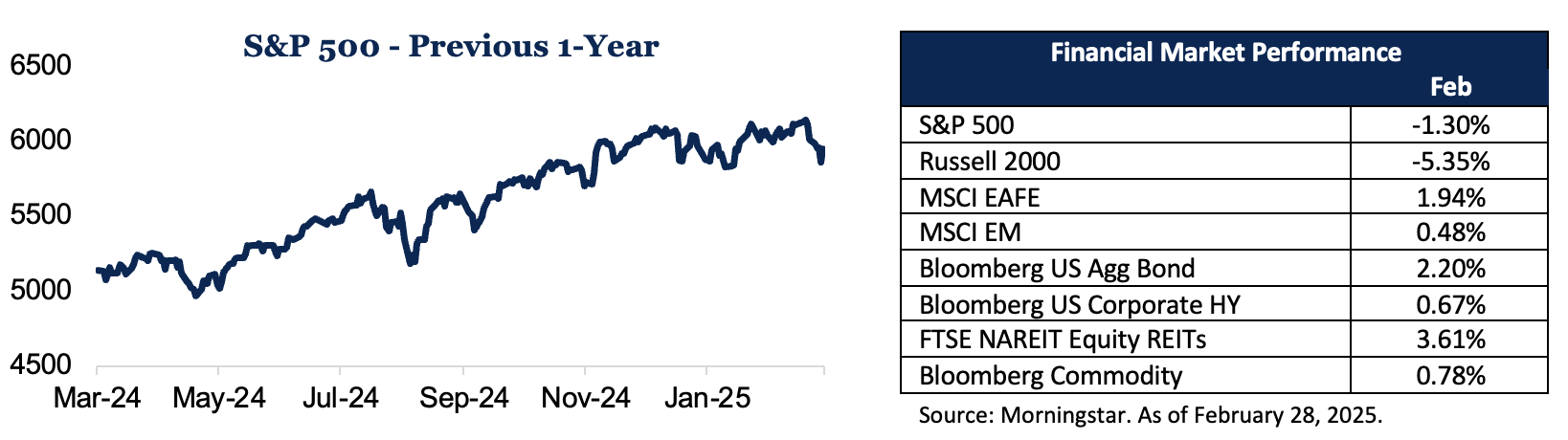

The stakes are enormous. The prediction market industry has already created billion-dollar companies. Venture capital is pouring money in. Tech entrepreneurs see it as the future of financial markets. But states see it as illegal gambling they're not taxing. And the federal government is caught in the middle, with different agencies claiming authority over the exact same platforms.

This isn't a situation that resolves itself. Someone's going to win this fight, and their victory will reshape how Americans access financial markets, how information flows, and whether the next election prediction will come from a pollster or a betting market.

TL; DR

- Prediction markets hit $1.3B in Super Bowl trading volume alone, demonstrating explosive mainstream adoption

- Kalshi operates in all 50 states, while Polymarket was banned in 2022 but returned in limited form after regulatory pressure

- Political coalitions are bizarre and unpredictable: MAGA allies support prediction markets while some conservative Utah lawmakers oppose them

- The regulatory battle is real: 19 lawsuits target Kalshi, the CFTC is asserting federal authority, and states want gambling tax revenue

- Bottom line: Prediction markets are reshaping finance, but the regulatory outcome will determine if they thrive or get crushed

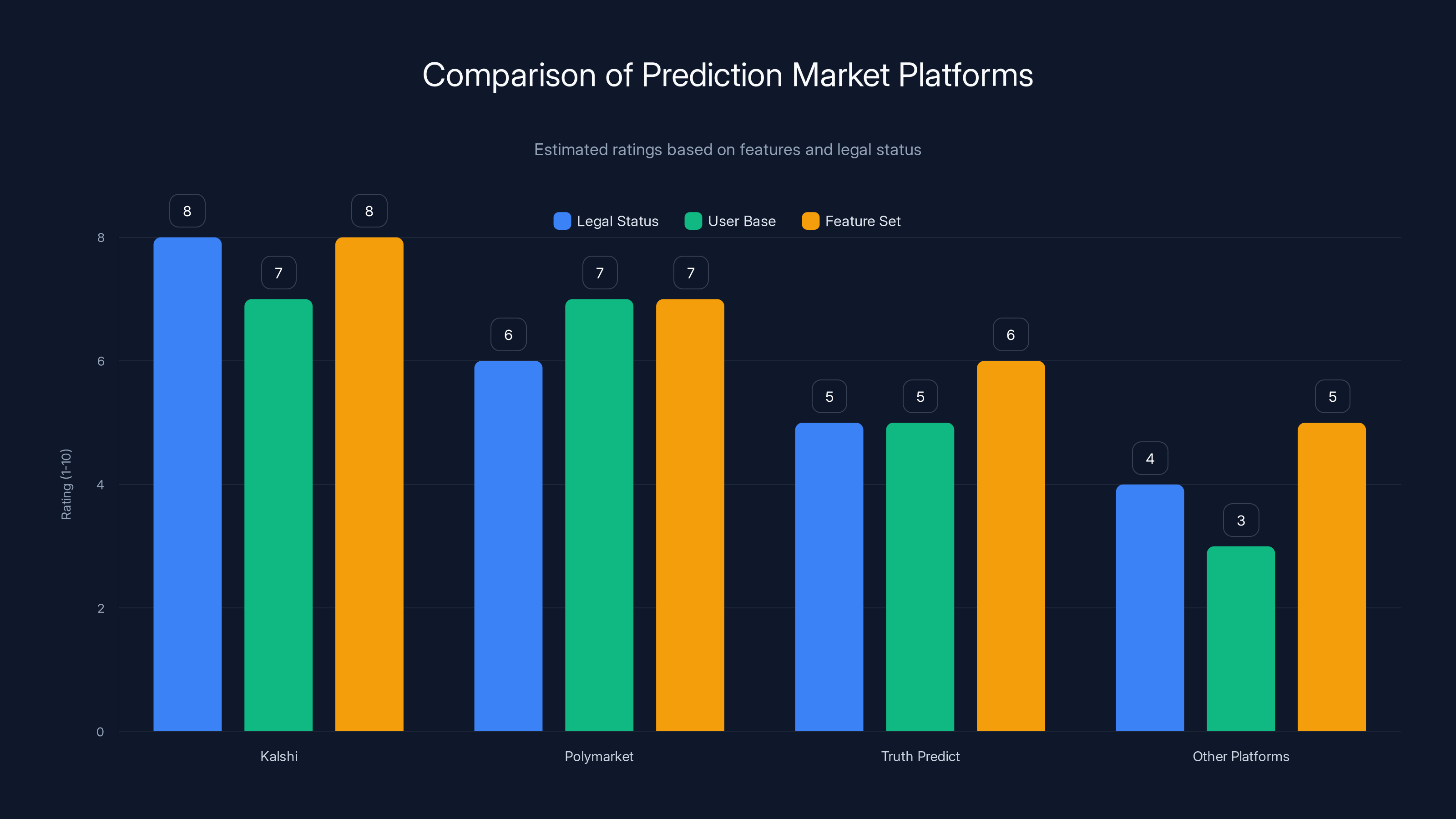

Kalshi leads in legal status due to CFTC approval, while Polymarket and Truth Predict have strong user bases and feature sets. Estimated data based on available information.

What Are Prediction Markets, Really?

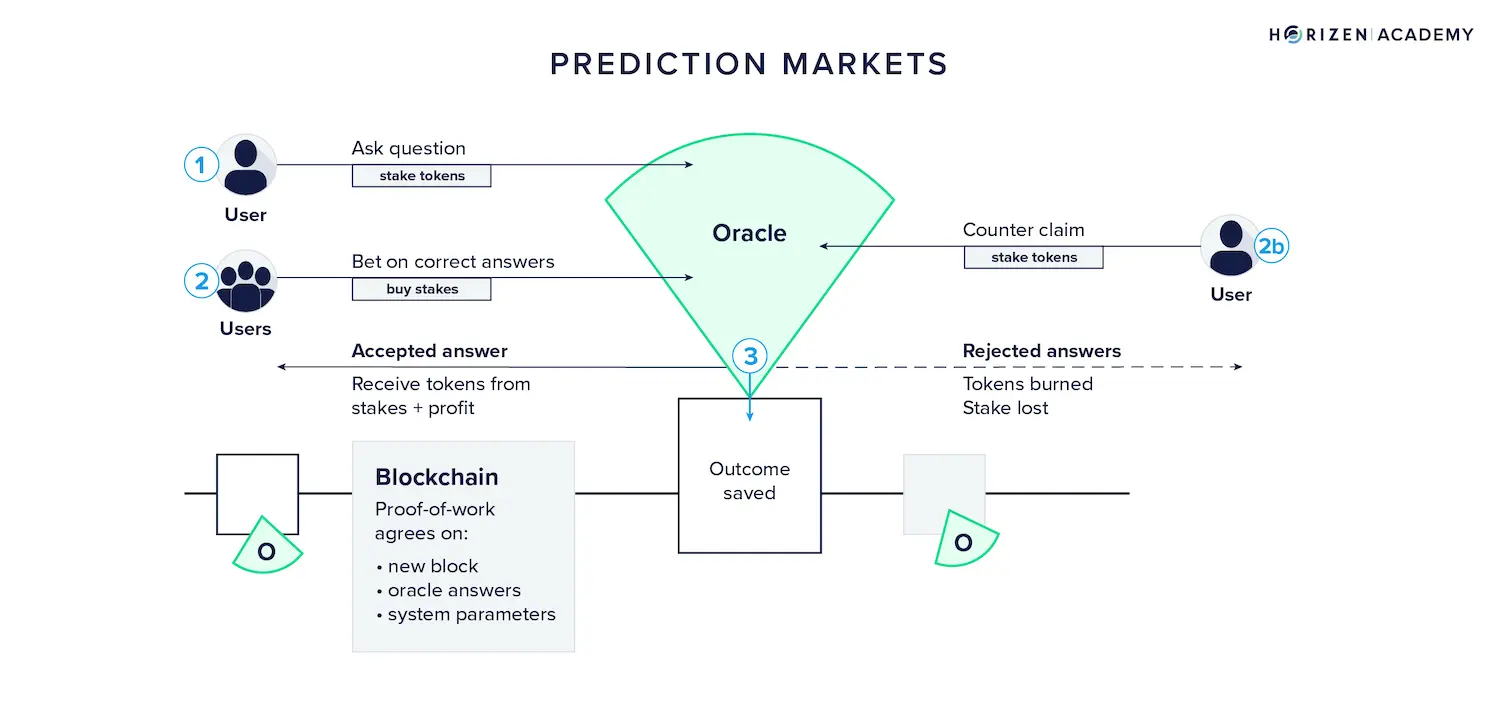

Let's start with the fundamentals because this matters. A prediction market is essentially a financial marketplace where you buy and sell contracts that pay out based on whether something happens. That's it. That's the whole concept.

You think candidate Harris will win Nevada? You buy a contract that says "Harris Nevada" at whatever the current price is. If she wins, your contract becomes worth $1. If she doesn't, it becomes worthless. The magic is in the price discovery. Right now, before the election, the market price reflects what thousands of people think the probability actually is.

Compare this to traditional polling. Pollsters ask 1,000 people, "Who will you vote for?" and report back. Prediction markets ask millions of dollars, "How confident is money that this outcome happens?" There's something pure about financial incentives. If you're wrong, you lose your own money. If you're right, you make it. That creates different behavior than answering a poll.

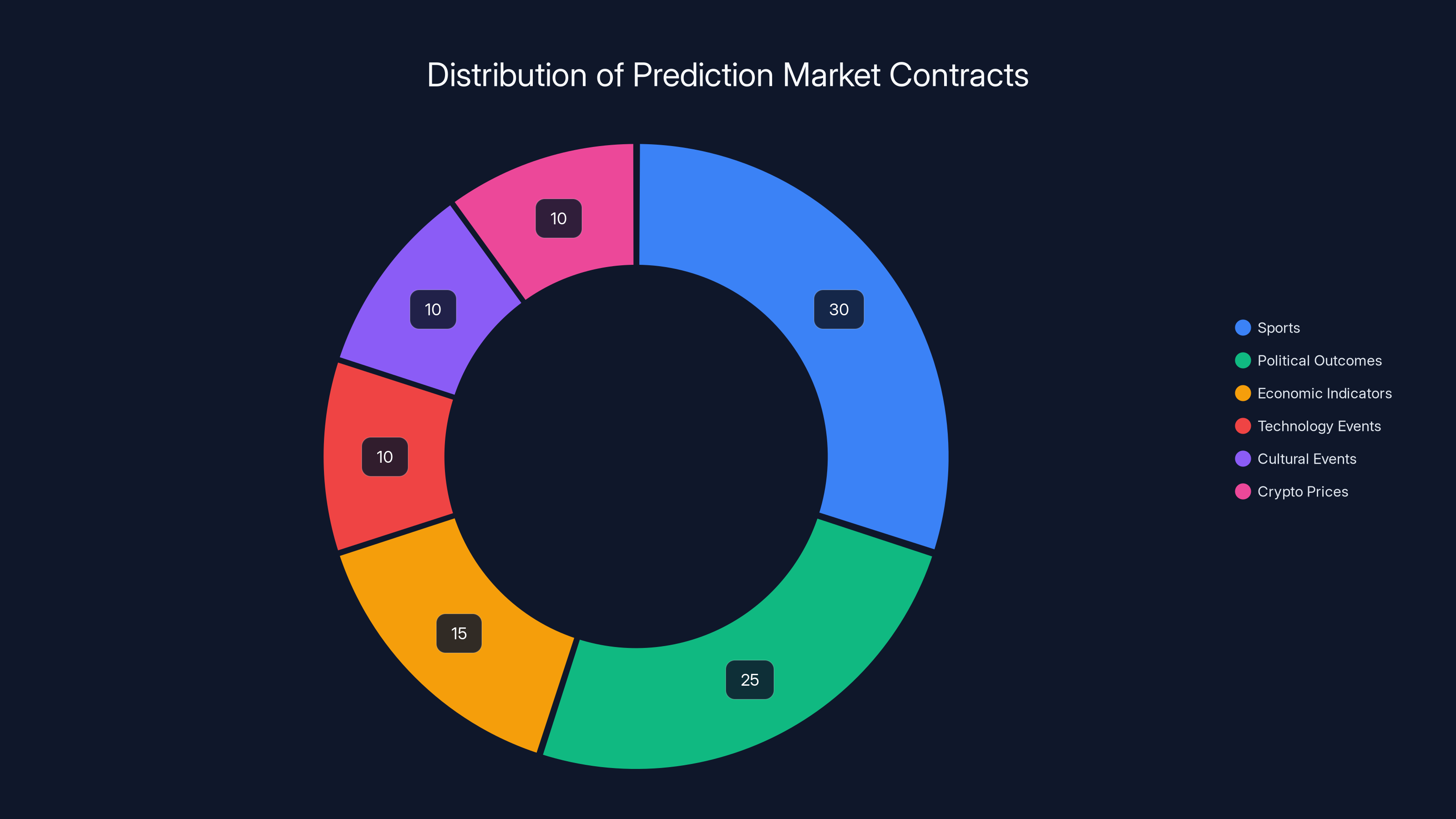

The most popular contracts are sports. Because sports have clear, unambiguous outcomes. You can predict what the final score will be, who wins the championship, whether a player will score in the first quarter. These aren't subjective. They're either true or false. This is why Kalshi reported $800 million in a single day of Super Bowl trading. Everyone understands sports outcomes.

But platforms have expanded far beyond sports. You can now trade on:

- Political outcomes: Who wins elections, which party controls Congress, whether specific bills pass

- Economic indicators: Will unemployment stay below 4%? Will inflation exceed 5%? What will the Fed do?

- Technology events: Will OpenAI release GPT-5 this year? Will Elon Musk's Neuralink implant succeed in a human subject?

- Cultural events: Which actor wins the Oscar? Does Taylor Swift perform at a specific award show?

- Crypto prices: What will Bitcoin cost at year-end? Will Ethereum exceed $3,000?

- Literally anything else: Will it rain in New York tomorrow? Will a specific company's stock price hit a certain level?

The beauty of the model is that you don't need a middleman saying, "This is a fair price." The market discovers the fair price through supply and demand. If you think something is overpriced, you sell. If you think it's underpriced, you buy. This is peer-to-peer financial discovery.

The platforms operate differently from traditional casinos. There's no house taking a cut on every bet. Instead, they take a small fee or commission on trades. Kalshi charges around 0.2% per side of transactions. Compare that to a casino taking 5% or more on sports bets, and you can see why traders prefer the prediction market model.

The Historical Evolution: From Iowa to Billions

Prediction markets didn't appear out of nowhere in 2024. They've been around since the late 1980s, and understanding the history helps explain the current regulatory mess.

It started with an academic experiment at the University of Iowa. Researchers created something called the Iowa Electronic Market—basically a prediction market for fun, using play money and real money in equal measure. The whole point was asking: can markets predict outcomes better than traditional forecasting methods?

The answer shocked economists. The Iowa Electronic Market was remarkably accurate at predicting election outcomes. More accurate than polls. More accurate than expert consensus. There was something about the financial incentive that made crowds smarter.

Fast forward to 2007, and the CFTC—the federal agency that regulates commodities and derivatives—created what they called the "Futures Commission Merchant" exemption specifically for prediction markets. This was the federal government basically saying, "Okay, we've thought about this, and these markets are fine. They're derivatives, and we regulate derivatives."

For years, nothing happened. Prediction markets stayed niche. They were interesting to economists but not mainstream. Most people had never heard of them.

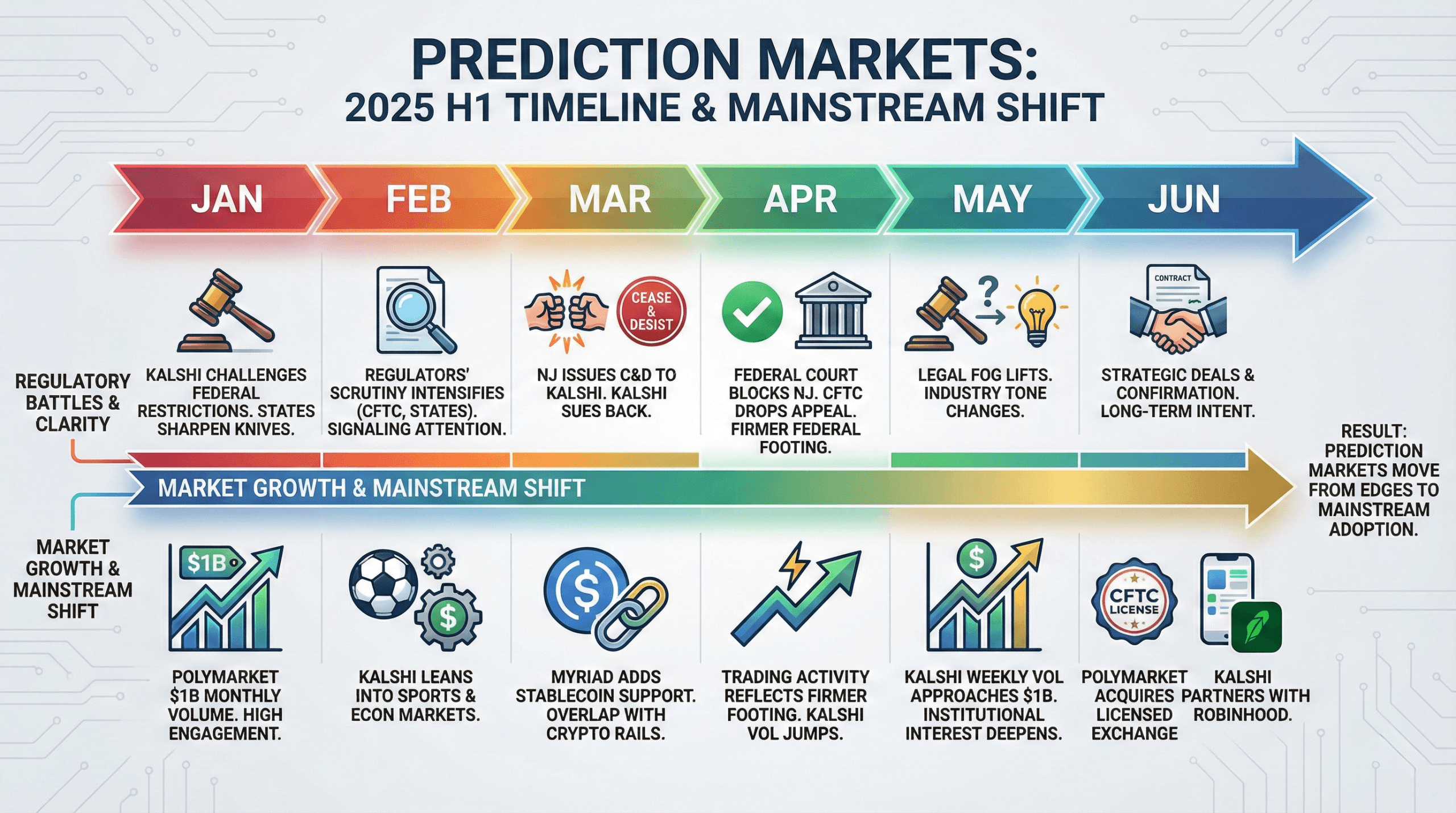

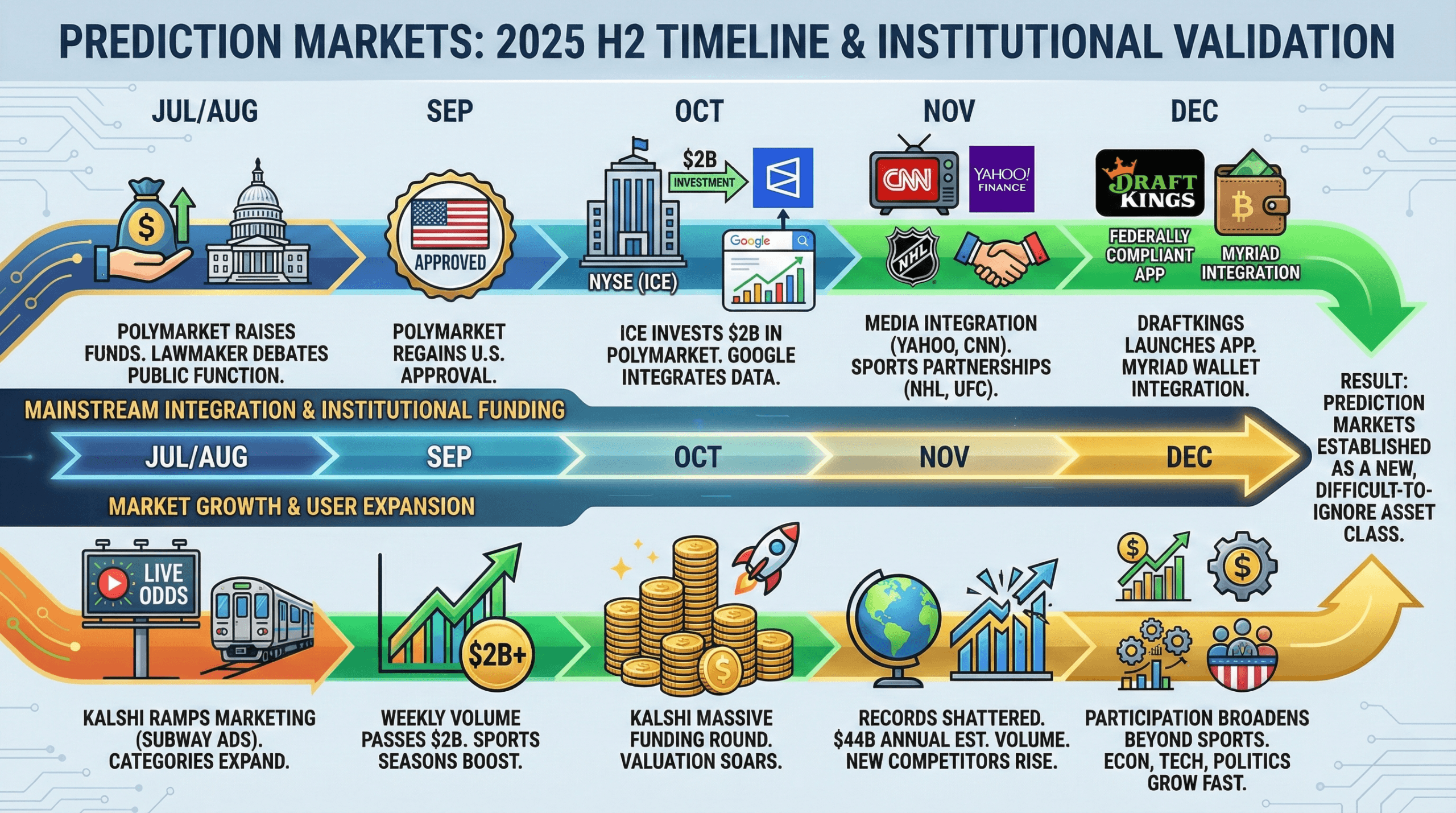

Then in 2022, everything changed. Polymarket—a prediction market platform that had been operating offshore and letting Americans trade on it anyway—got noticed by regulators. The CFTC essentially shut it down by sending cease-and-desist letters. Polymarket was offering prediction contracts without registering as a proper financial exchange. This violated federal law. So Polymarket folded in the U.S. market and moved most of its operations offshore again.

But Kalshi was different. Kalshi actually applied for federal approval to operate as a regulated financial exchange. And in 2023, they got it. The CFTC approved Kalshi to operate legally in all 50 states as a Designated Contract Market (DCM). This was huge. It meant at least one prediction market platform had genuine federal backing to operate.

That approval is the core of the current controversy. Because Kalshi's federal approval directly conflicts with state gambling laws. States argue that prediction markets are illegal gambling under their rules. The federal government says Kalshi is operating under legitimate federal authority over derivatives markets. And now we're in a full-blown constitutional crisis over whether states or the federal government gets to regulate this industry.

Sports contracts dominate prediction markets, with political outcomes also being significant. Estimated data based on market trends.

The Money Involved: Kalshi, Polymarket, and the Billion-Dollar Race

Let's talk about the economic engine driving this fight. Prediction markets aren't interesting just because they're novel. They're interesting because they're generating enormous amounts of money and attracting serious capital.

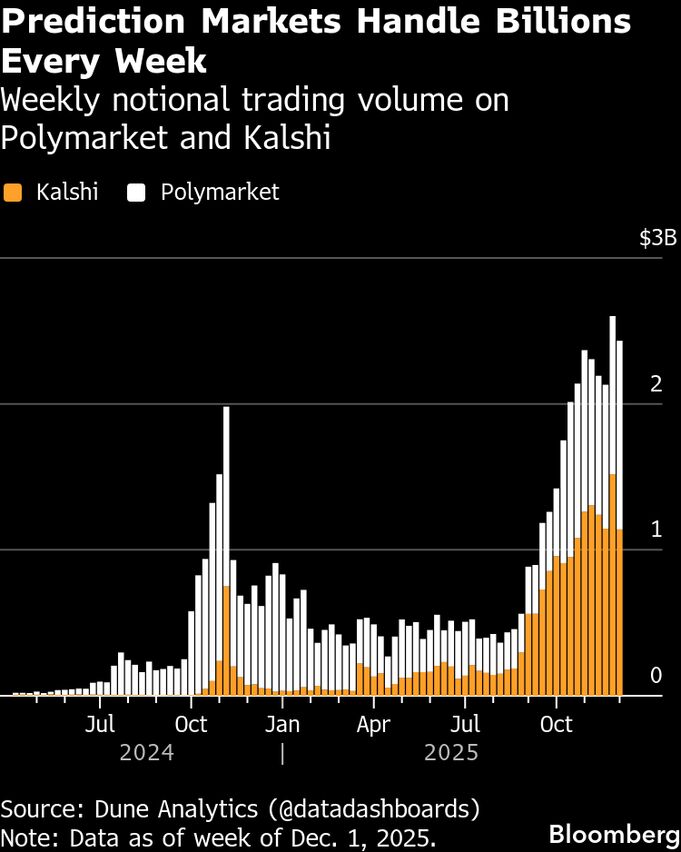

Kalshi is the dominant player in the U.S. The company has raised funding at valuations that put it in the billion-dollar unicorn category. It processes more volume than its competitors by far. The $1.3 billion Super Bowl volume isn't an outlier—it's just the most notable data point. On regular days, Kalshi processes hundreds of millions in trades.

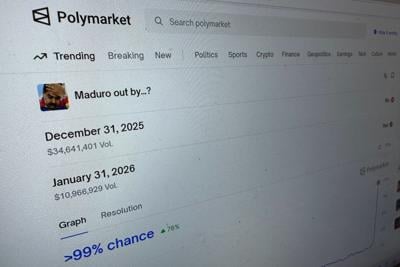

Polymarket is the scrappy competitor, and it's a more interesting story from a business perspective. Polymarket was founded by Shayne Coplan and initially built a platform where anyone could trade on anything. No registration required. Just send them crypto, start trading, make money or lose it. It was designed to operate in a legal gray area, offshore, serving U.S. customers anyway.

When the CFTC shut Polymarket down in 2022, most people thought that was the end of it. But Polymarket came back. They registered as a proper broker-dealer, got legal opinions saying they could operate, and relaunched for U.S. customers in 2023. The business didn't die. It just had to get legal.

Beyond these two, there are dozens of smaller platforms. Some operate legitimate prediction markets. Some are more like illegal gambling sites operating under the prediction market guise. And some operate entirely offshore, serving Americans who know they're in a gray area.

The venture capital flowing into this space is staggering. When Polymarket raised funding after the government shutdown, it attracted investors at valuations suggesting a future where prediction markets are as mainstream as stock trading. Kalshi has taken venture funding from tier-one investors. Even newer entrants are pulling in millions.

Why? Because if you're right about the long-term outlook, the total addressable market is enormous. Traditional options markets in the U.S. trade trillions per year. Futures markets trade even more. If prediction markets capture even a tiny fraction of that volume, and you own the platform, you're printing money. The take rate on billions in daily volume adds up fast.

But here's what's interesting: the money isn't just American. Crypto investors from all over the world use prediction markets. Because crypto and prediction markets share a community—people comfortable with financial risk, skeptical of traditional institutions, and excited about decentralized markets. Polymarket runs on the blockchain and uses stablecoins. That matters to a certain demographic.

Kalshi uses regular money. You fund your account with a bank transfer. This appeals to more traditional traders and casual users who aren't crypto-native. So you have a split: the crypto-native prediction market (Polymarket) and the traditional-finance-friendly prediction market (Kalshi) battling it out.

The Political Weirdness: MAGA Allies and Mormon Critics

This is where the situation gets genuinely bizarre, and it tells you something important about how American politics actually works when money is involved.

You'd expect the political battle over prediction markets to break down along predictable lines. Maybe Republicans opposing gambling and Democrats supporting financial innovation? Or the reverse? Something clean?

Instead, you get political coalitions that make no sense unless you understand the actual incentives driving each group.

Team Pro-Prediction Markets includes:

-

Donald Trump and his family: This is huge. Trump plans to launch his own prediction market platform called Truth Predict. His son, Donald Trump Jr., is an advisor to both Kalshi and Polymarket. His firm 1789 Capital is invested in Polymarket. The Trump Media and Technology Group has a partnership with Crypto.com, which also offers prediction contracts. Trump himself sees prediction markets as aligned with his goals—he wants platforms where people can express opinions freely without moderators shutting them down. A prediction market is pure expression. You vote with your money.

-

Liberal Democrat lobbying groups: This is shocking to people, but progressive thinkers actually love prediction markets. They argue that they're more accurate than traditional polling. If you're a Democrat strategist and you can get real-time information about what crowds actually think will happen versus what they hope will happen, that's valuable. Plus, there's a civil liberties angle. Some Democratic strategists argue that prediction markets are just expression—financial expression, but expression nonetheless.

-

Venture capitalists and crypto enthusiasts: This group spans the political spectrum, but they're unified in wanting prediction markets to succeed. They've invested money. They see the future of finance here. They want deregulation, not more regulation.

-

Utah's Governor Spencer Cox: Wait, this is interesting. Utah's Republican governor supports prediction markets. Why? Because he's libertarian-leaning on this particular issue. He thinks adults should be able to bet on whatever they want.

Team Against Prediction Markets includes:

-

Las Vegas casino operators: This is perhaps the most powerful lobbying group. Las Vegas has built an entire economy on legal gambling. They control sports betting in Nevada. If prediction markets expand nationally, they represent direct competition. The casino industry doesn't want a new gambling alternative. So they're fighting prediction markets hard. Chris Christie, the former New Jersey governor, advises the American Gaming Association. He's opposed to prediction markets because he understands that legal gambling needs to be centralized and taxed.

-

State governments broadly: States have been legalizing sports betting over the last decade specifically because it generates tax revenue. Legal sports betting brings in tax money for states. Prediction markets, if unregulated, bring in nothing for states. From a state fiscal perspective, prediction markets are competitors that don't contribute tax revenue. So virtually every state wants to regulate or ban them.

-

Conservative Mormons and religious groups: Utah's official church—the Church of Jesus Christ of Latter-day Saints—is opposed to gambling. Some conservative members in Utah oppose prediction markets on moral grounds. This aligns them with pro-regulation advocates despite their usually being on the libertarian side of issues.

-

Some Republican state attorneys general: Particularly in states with strong traditional gambling industries, Republican AGs are fighting prediction markets just as hard as Democratic ones. This isn't partisan. It's about money. States with legalizing sports betting want to protect that revenue stream.

The result is political chaos. Trump supports prediction markets. Some Democrats support them. Some Republicans oppose them. Some Democrats oppose them. The traditional political spectrum doesn't apply here.

What matters more is: Do you benefit financially from prediction markets succeeding? If yes, you're supporting them. Do you have financial incentive for them to fail? Then you're fighting them.

The Regulatory Nightmare: Federal vs. State Authority

Here's where the legal and constitutional issues get really complex, and they matter because they determine who wins this fight.

In the U.S., there's supposed to be a clear division of authority between the federal government and states. The federal government regulates interstate commerce and financial markets. States regulate gambling and consumer protection. These jurisdictions aren't supposed to overlap, but with prediction markets, they do—catastrophically.

The Federal Case:

The CFTC argues that prediction markets are derivatives—financial instruments regulated by federal law since the 1930s. The Commodity Futures Trading Commission was created specifically to regulate this stuff. In 1974, Congress gave the CFTC authority over futures, options, and derivatives. In 2000, Congress updated this to include "security futures" and gave the CFTC explicit authority.

When the CFTC approved Kalshi as a Designated Contract Market in 2023, they were essentially saying: "These contracts are derivatives under our authority. Kalshi is a properly registered financial exchange. We regulate it. States can't touch it."

CFTC Chairman Michael Selig doubled down in a video released in 2024, literally saying, "To those who seek to challenge our authority in this space, let me be clear—we will see you in court." This is a federal agency asserting exclusive authority. Not suggesting it. Asserting it.

The State Case:

States counter that prediction markets look a lot like illegal gambling under state law. Every state has laws against illegal gambling. Sports betting contracts that people are trading on prediction markets look like illegal sports bets from a state's perspective.

States argue that even though the CFTC approved Kalshi, the CFTC doesn't have the authority to override state gambling laws. Federal regulation and state regulation aren't mutually exclusive. Just because the federal government regulates securities doesn't mean states can't also regulate them. (This is actually true—states regulate financial products all the time.)

Furthermore, states point out that the 2000 law giving the CFTC authority specifically excluded "games of chance" and stated that agricultural commodities and mining futures were the point. Prediction contracts on random events look a lot like games of chance.

So you have a genuine constitutional clash. The federal government says it has authority and has exercised it. States say they have concurrent authority over gambling and are exercising it. Both sides aren't backing down.

The evidence of this conflict is everywhere. Kalshi is facing 19 separate lawsuits across the country from state attorneys general and state gambling regulators. In Massachusetts, state regulators moved to temporarily shut down Kalshi entirely. They were only stopped by a court order blocking the shutdown, but the lawsuit is ongoing. Other states are considering similar action.

Meanwhile, the CFTC is fighting back. The agency filed an amicus brief in support of Crypto.com when Nevada regulators sued that company over its prediction market offerings. The CFTC is basically saying: "Nevada, get in line. We regulate this. You don't." This is a war, and it's being fought in courts across the country.

Kalshi leads the prediction market with an estimated $1.3 billion in trading volume, significantly outpacing Polymarket and other smaller platforms. (Estimated data)

The Arguments: Who Actually Has a Point?

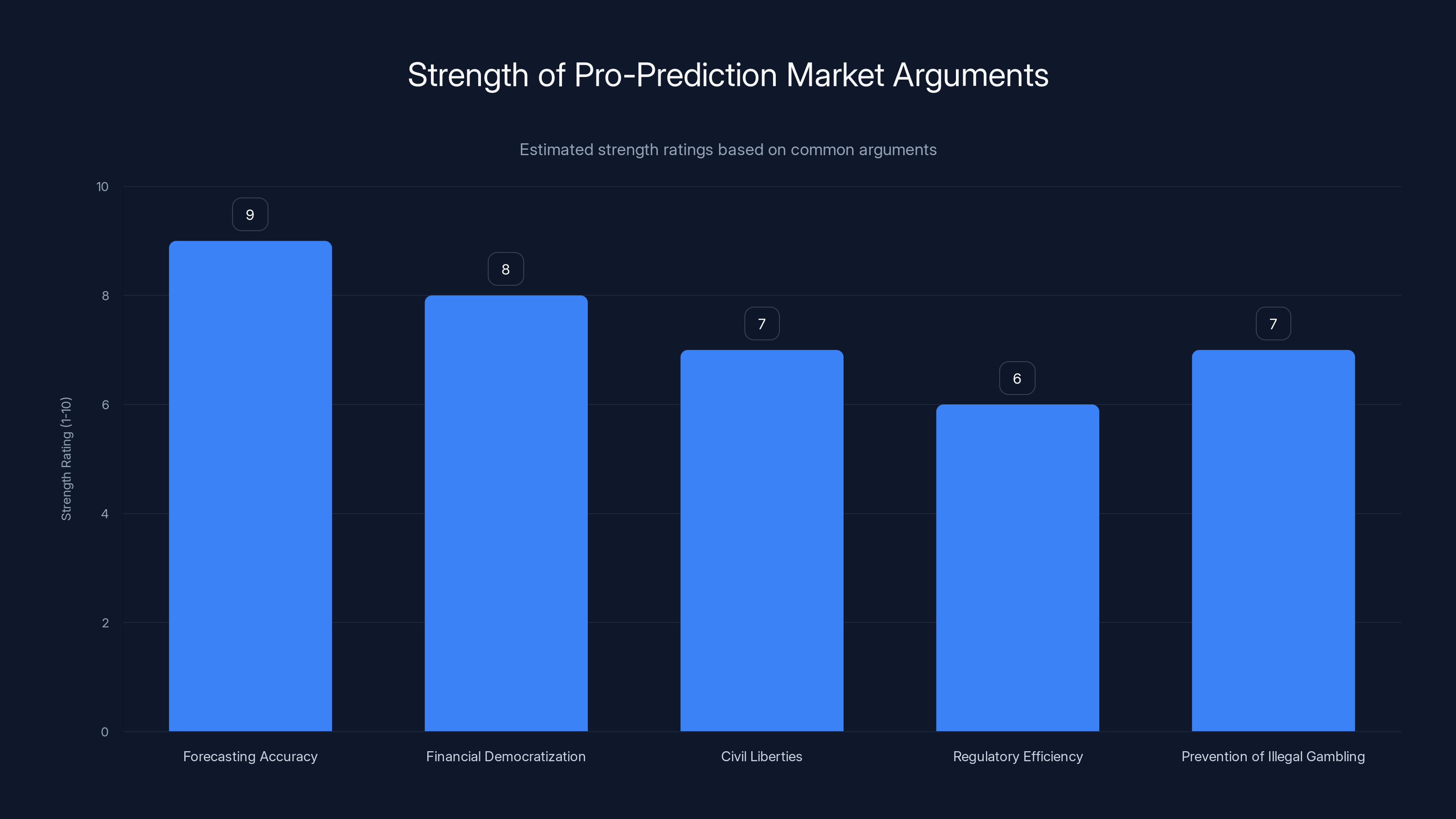

Once you get past the political theater, there are some genuinely interesting legal and policy arguments on both sides.

The Pro-Prediction Market Argument:

Advocates make several coherent points. First, prediction markets are actually useful. They're better forecasters than traditional methods in many cases. Elections, economic outcomes, and sports events are predicted more accurately by markets than by polls or expert consensus. This is documented in academic research. If the goal is to know what will actually happen, prediction markets are tools that work.

Second, from a financial innovation perspective, prediction markets democratize access to derivatives trading. Traditionally, derivatives trading was expensive and available only to institutions and wealthy individuals. You needed

Third, the civil liberties argument: People should be allowed to do what they want with their own money. Adults making voluntary financial decisions shouldn't need the government's permission. Prediction markets are voluntary. You choose to put money in. You choose to trade. If you lose money, that's your choice. Why should the government stop you?

Fourth, there's a practical argument: The federal government already regulates these via the CFTC. States don't need to regulate them additionally. Kalshi is a registered financial exchange. It has compliance officers. It reports to federal regulators. It's not operating in a vacuum. Adding state regulation just creates duplicative bureaucracy and confusion.

Finally, there's the argument that prediction markets actually prevent illegal gambling. If you allow legitimate prediction markets to operate openly, they create a legal outlet for people who want to speculate. Without legitimate markets, people use illegal gambling sites. Better to have a regulated market than an unregulated one.

The Anti-Prediction Market Argument:

Opponents also make coherent points. First, these look like gambling, smell like gambling, and function like gambling, even if they're called "derivatives trading." You're putting money on an uncertain future outcome. You win or lose based on luck and skill. That's gambling. Just using financial market terminology doesn't change what it fundamentally is.

Second, the consumer protection argument: Most people trading on prediction markets aren't sophisticated investors. They're casual users who don't understand the risks. Prediction markets can be predatory. The platforms encourage constant trading. They use psychological tactics to keep people engaged. They're essentially slot machines dressed up as financial instruments. Vulnerable people lose significant money on these platforms, and they need protection.

Third, from a tax perspective: Legal gambling generates tax revenue for states. Prediction markets operating in gray areas generate nothing. If the government is going to allow gambling, it should at least get tax revenue from it. Currently, prediction market platforms are mostly escaping taxation.

Fourth, there's the constitutional argument that states have legitimate interest in regulating gambling within their borders. This isn't a new power. States have regulated gambling for centuries. The federal government's authority over derivatives doesn't eliminate state authority over gambling. Both can be true. Prediction markets might be derivatives, but they're also gambling, and states get to regulate gambling.

Finally, opponents argue that the CFTC approval of Kalshi might have been a mistake. The CFTC may have exceeded its authority. Just because an agency approved something doesn't mean the approval was legally sound. Courts could overturn it.

The Actual Truth:

Both sides have valid points. Prediction markets are genuinely useful financial instruments and they're also genuinely similar to gambling. You can hold both truths simultaneously. The real question isn't about validity of the arguments—it's about which value society prioritizes.

Do we prioritize financial innovation and individual freedom? Or do we prioritize consumer protection and state revenue?

There's no objectively correct answer. This is a values question, not a facts question. Which is why the political fight is so fierce.

The Current Legal Battles: 19 Lawsuits and Counting

The abstract debate is one thing. The actual legal fights happening right now are concrete and consequential.

Kalshi is facing at least 19 separate lawsuits across the country. These aren't small suits. These are state attorneys general and state gambling regulators suing to either shut down Kalshi's operations in their states or regulate them as gambling under state law.

Each suit follows a similar pattern:

- A state attorney general or gambling regulator demands that Kalshi stop operating in their state

- Kalshi argues it has federal authority to operate as a registered financial exchange

- The state argues that federal registration doesn't override state gambling law

- The case goes to court

- Either the state wins and Kalshi gets banned, or Kalshi wins and operates freely

What's notable is that Kalshi has actually won most of these cases so far. Courts are consistently siding with the argument that the CFTC has authority here. But the war isn't over. States keep filing suits. Eventually, one might succeed, or a state might appeal to a higher court and win on appeal.

The Massachusetts case is particularly instructive. In 2024, Massachusetts gambling regulators tried to temporarily shut down Kalshi entirely, claiming they had authority to regulate the platform as an illegal gambling operation. A court issued a temporary restraining order stopping Massachusetts from shutting Kalshi down, finding that Kalshi likely had a strong case that federal authority preempts state gambling law.

But here's the thing: Massachusetts didn't give up. The lawsuit is ongoing. They're arguing in court that the CFTC approval was improper and doesn't give Kalshi authority to operate against state gambling law.

Beyond individual state lawsuits, there's also congressional activity. In 2024, 23 Democratic senators sent a letter to the CFTC and Department of Justice arguing that prediction markets should be subject to state gambling laws. This is political pressure trying to signal that Congress might pass legislation giving states more authority.

Meanwhile, the CFTC is aggressively defending its turf. The agency filed an amicus brief in support of Crypto.com when Nevada tried to regulate that company. The message from the CFTC was clear: "We have authority. You don't." CFTC Chairman Michael Selig literally posted a video asserting this. The government is fighting back.

Polymarket's Complicated Journey

Polymarket's story is worth examining in detail because it shows the evolution of how regulators are thinking about this issue.

Polymarket started as an offshore platform. Shayne Coplan and his co-founders built a prediction market platform that accepted crypto and operated entirely offshore, but welcomed U.S. users. There was no legal compliance, no regulatory registration, no licensing. It was a bet that regulators would tolerate the platform as long as it operated offshore.

For years, this worked. Polymarket built a thriving community. Crypto-native traders used it extensively. The platform became known as the prediction market for serious traders who understood the regulatory gray area.

Then in 2022, the CFTC shut it down. The agency sent cease-and-desist letters saying Polymarket was operating as an unregistered derivatives exchange. Polymarket had to comply. They essentially blocked U.S. users from the platform.

But here's what's interesting: the shutdown didn't kill the business. In 2023, Polymarket relaunched for U.S. users. The company got legal opinions from experienced financial attorneys saying that they could operate under exemptions in securities law. They registered as a broker-dealer. They got approval to operate.

The new Polymarket operates differently from Kalshi. It's still offshore in terms of where servers are. It still uses crypto. But it's a properly licensed broker-dealer serving U.S. customers. And it's booming.

Polymarket's resurgence is significant because it shows that even when regulators try to shut something down, if there's demand and the business model works, people will find a way to operate legally. Polymarket didn't disappear. It just got legal.

This also explains some of the current political dynamics. Donald Trump Jr. is an advisor to Polymarket. The platform has come back as a legitimate business. It's not an illegal gambling site anymore. It's a legally operating broker-dealer offering prediction contracts. This made Trump alignment with prediction markets plausible.

Forecasting accuracy is considered the strongest argument for prediction markets, followed by financial democratization. Estimated data based on typical argument strength.

The Role of Crypto: Why Blockchain Matters Here

One thread running through this story that's crucial to understand is the role of cryptocurrency and blockchain. Polymarket explicitly uses blockchain. Kalshi doesn't (yet). But the connection between prediction markets and crypto is deeper than just technology.

Prediction markets and crypto share a community. Crypto enthusiasts tend to be skeptical of traditional financial institutions. They want decentralized systems they don't need to trust. Prediction markets on blockchain appeal to this constituency because they're transparent, decentralized, and don't require trusting a central authority.

Polymarket's use of Ethereum and stablecoins makes sense from this perspective. The contract terms are publicly visible on-chain. The settlement is automatic and transparent. No central authority can freeze your account or reverse transactions (though Polymarket does operate broker-dealer infrastructure on top of the blockchain).

Kalshi's traditional finance approach appeals to a different constituency—people who understand traditional trading and want to use it without crypto friction.

The fact that cryptocurrency exchanges like Crypto.com are offering prediction contracts is also significant. Crypto.com fights Nevada regulators over whether its prediction contracts constitute illegal gambling. The CFTC sided with Crypto.com.

What's interesting is that stablecoins and blockchain actually make regulation easier in some ways and harder in others. On one hand, everything is transparent and auditable. On the other hand, if Polymarket operates on Ethereum with stablecoins, the regulatory authority is unclear. Is the platform subject to U.S. law even if servers are offshore? What about the stablecoin issuer?

These are exactly the questions courts will have to answer.

The Trump Administration Influence: Truth Predict and Appointments

Donald Trump's return to power in 2025 is a turning point in this story. Trump is directly incentivized to support prediction markets, which shapes policy.

Trump's family has direct financial interest. Trump Jr. advises Kalshi and Polymarket. His firm 1789 Capital invested in Polymarket. The Trump Media and Technology Group has a partnership with Crypto.com. This isn't incidental. This is core to the Trump family's business interests.

Beyond financial interest, Trump sees prediction markets philosophically. They're platforms where people can express themselves. They're alternatives to traditional media narratives. If the mainstream media says one candidate is winning, but prediction markets say the opposite, that creates a counter-narrative. Trump loves that.

Plus, Trump is launching Truth Predict—his own prediction market platform. This will tie into Truth Social and the broader Trump ecosystem. For Trump, prediction markets aren't just investments. They're core infrastructure for his alternate media universe.

CFTC Chairman Michael Selig is a Trump appointee. When Selig posted that video asserting CFTC authority and saying he'd fight in court, he was effectively saying the Trump administration backs prediction markets. This matters because regulatory discretion is enormous. The CFTC could approve more platforms. It could interpret rules more favorably. It could fight harder for Kalshi against states.

The political science here is clear: Trump administration = favorable regulatory environment for prediction markets. A Democratic administration would likely be more sympathetic to state gambling regulators.

This means the outcome of the prediction market fight is now intertwined with electoral politics. If Trump wins reelection in 2028, expect prediction markets to thrive. If Democrats win, expect state regulation to accelerate.

Consumer Harm and Protection: The Legitimate Concerns

Beyond the political and regulatory fights, there's a real consumer protection issue at stake.

Prediction markets can be addictive. The interfaces are designed to encourage constant trading. You see a new contract appear, and you're tempted to trade on it. Win or lose, you're encouraged to put money on the next one. This is psychologically similar to slot machines.

For vulnerable populations—people with gambling problems, young people, people in financial distress—prediction markets can be harmful. There are documented cases of people losing significant sums of money on prediction markets and experiencing serious financial hardship.

The platforms say they have responsible gambling features. They allow you to set limits. They provide resources for problem gambling. Kalshi has policies about account restrictions. But these are voluntary. The platforms aren't required to enforce them the way a casino is required to check if someone has self-excluded from gambling.

Furthermore, the prediction market industry has almost no transparency about harm. We don't know how much money is being lost by vulnerable users. We don't know what percentage of users are losing more than they can afford. The platforms don't publish this data.

Compare this to traditional gambling. States require casinos to publish data on problem gambling, revenue by game type, and demographic information. None of this exists for prediction markets.

This is the strongest argument for regulation. Not that prediction markets shouldn't exist, but that they should be regulated similarly to other gambling operations. There should be responsible gambling requirements. There should be consumer protection standards. There should be transparency about who's losing money and how much.

The platforms resist this because regulation increases compliance costs. But the costs are reasonable. States could require prediction market platforms to:

- Publish anonymized data on betting patterns

- Implement account limits

- Require disclosure of odds and house edge

- Fund gambling addiction treatment

- Implement identity verification

- Report suspicious activity

None of this would shut down the industry. It would just make it safer.

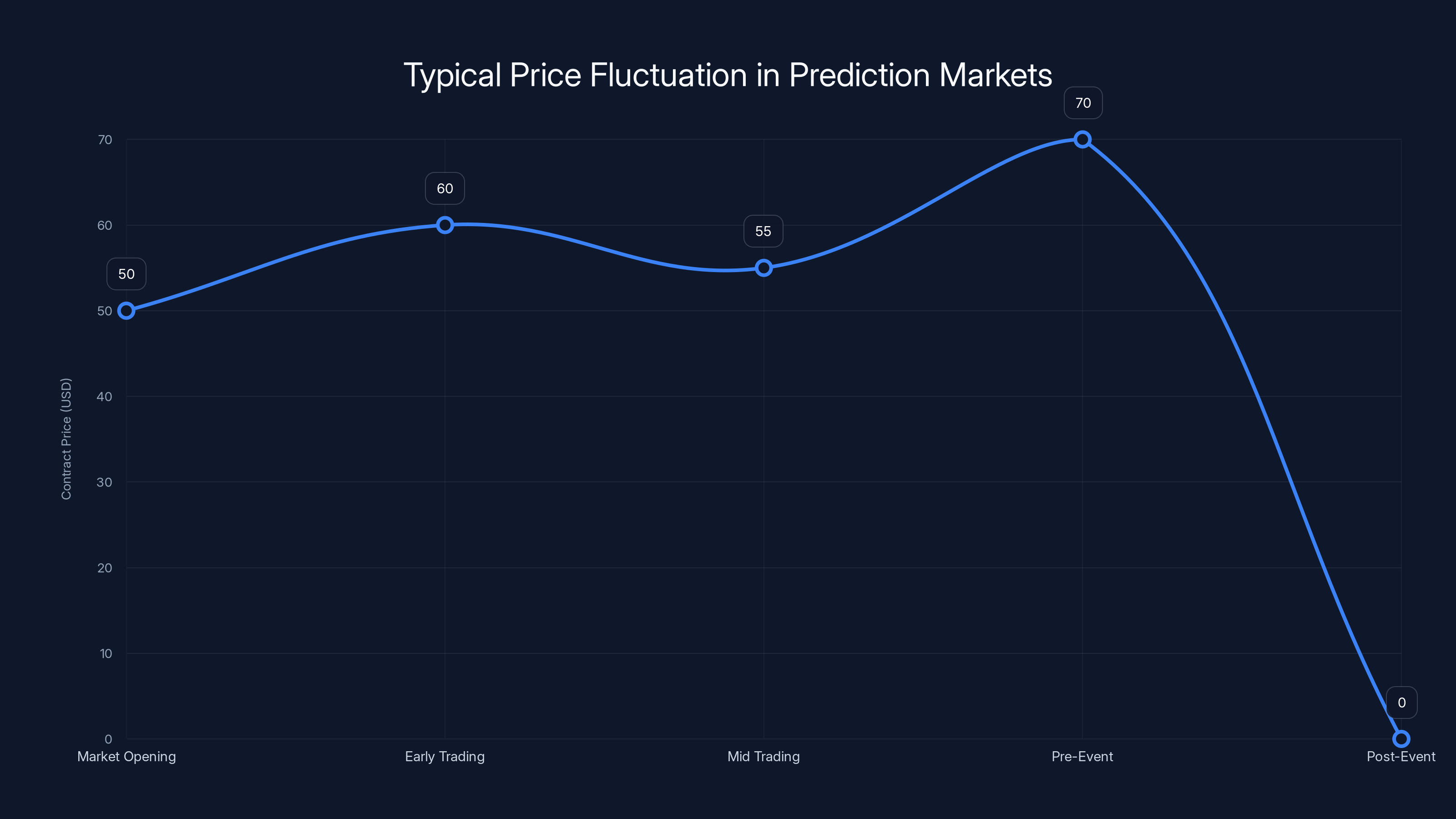

This chart illustrates a typical price trend for a prediction market contract, showing how prices can rise and fall based on trader sentiment and event outcomes. Estimated data.

The Accuracy Question: Do Prediction Markets Actually Forecast Better?

There's a fascinating research question underlying all of this: Are prediction markets actually better at forecasting than alternatives?

The academic evidence suggests yes, with caveats. Prediction markets are often more accurate than polls, expert consensus, and formal forecasts. But they're not always. And they're subject to manipulation and biases just like any other forecasting method.

During the 2024 election, prediction markets showed Trump's chances rising as traditional polling was slower to update. Post-election analysis showed that prediction markets were indeed more accurate than traditional polls at forecasting the outcome. The market reflected what happened before polls caught up.

But prediction markets can also be dramatically wrong. During the 2020 election, some prediction markets showed Trump with much higher chances than polls, and polls turned out to be more accurate. Markets can be overconfident.

What we know from research:

- Markets beat polls on average when both are trying to forecast the same event

- Markets are faster to update when new information emerges

- Markets can be manipulated by large traders with deep pockets

- Markets reflect the opinions of their most confident and wealthy participants, which might not be representative

- Markets tend to be overconfident about extreme outcomes (very high or very low probabilities)

The strongest evidence comes from academic studies of the Iowa Electronic Market, which has been running since 1988. That market's predictions consistently outperform polls and expert consensus on election outcomes.

But there's also evidence of limitations. When event contracts are thinly traded, prices don't reflect true probability. When large traders take positions, they can move prices. Markets are only as good as the people participating in them.

For policy purposes, the question is: should we use prediction market prices as public information? Some proposals have suggested using prediction markets to forecast government outcomes and using those forecasts in policy decisions. That's more controversial because markets can be biased or manipulated.

The bottom line: prediction markets are useful forecasting tools, but not magic. They're better than some alternatives and worse than others. They're most useful when combined with other forecasting methods.

The Offshore Question: Why Does Jurisdiction Matter?

Much of the prediction market ecosystem lives in jurisdictional gray areas. Polymarket operates offshore. Some users access Kalshi via VPN from countries where it's not available. Other platforms are entirely unregulated.

Why does jurisdiction matter? Because it determines which laws apply, who can sue, who can regulate, and what happens if something goes wrong.

If a prediction market platform is incorporated and operates servers in the United States, it's subject to U.S. law. Regulators can shut it down. Courts can issue orders. Congress can pass laws affecting it.

If a platform operates offshore but serves U.S. users, the situation is murkier. The U.S. government has to either: (1) cooperate with foreign governments to shut it down, (2) put pressure on intermediaries like payment processors, or (3) declare the operation illegal and threaten enforcement.

Polymarket initially operated offshore specifically to avoid U.S. regulation. The CFTC sent cease-and-desist letters, which worked because Polymarket didn't want to directly violate federal law. But if a different platform decided to ignore cease-and-desist letters, enforcement becomes harder.

This is why Polymarket's return as a regulated broker-dealer is significant. The platform was willing to submit to U.S. regulation. Other platforms might not be.

There's also a trust question. If you're using an offshore platform that isn't regulated, and something goes wrong—the platform gets hacked, mismanages funds, or disappears—you have almost no recourse. Your money is just gone. This is why most serious traders prefer platforms like Kalshi that operate with regulatory oversight.

But there's also a freedom question. Some people prefer offshore platforms precisely because they're not regulated. They value privacy and freedom over security. Crypto-native traders often fall into this camp.

The future likely involves a split market: U.S.-regulated platforms like Kalshi serving mainstream users who want security and peace of mind, and offshore platforms serving users who prioritize privacy and are comfortable with higher risk.

The Sports Betting Conflict: Why Vegas Cares So Much

The Las Vegas casino industry's opposition to prediction markets isn't random. It's rooted in real economic threat.

Legal sports betting has become a massive revenue source for states and casinos over the last decade. In 2023, Americans wagered over

Casinos make money from the vigorish—the commission they take on bets. On a typical sports bet, the casino takes about 4-5% of all wagered money. This seems small, but on hundreds of billions in volume, it's enormous.

Prediction markets cut the casino's middle out. Users trade with each other. The platform takes a small commission. Users don't pay a vigorish. The economics are simply better for users.

If prediction markets become the primary way Americans place sports bets, states lose tax revenue and casinos lose vigorish. This is existential threat to them.

That's why Las Vegas operators are fighting so hard. They're not fighting because prediction markets are evil. They're fighting because prediction markets are economically superior competitors to their gambling operations.

The irony is that legalized sports betting was supposed to protect gamblers by giving them a regulated alternative to illegal betting. Prediction markets do the same thing, but more efficiently. From a consumer protection standpoint, prediction markets might actually be better than traditional sports betting because the odds are set by markets rather than by casinos trying to balance their books.

But from a revenue standpoint, casinos prefer the current situation where they're the only legal option.

Kalshi leads with an estimated $0.7B in trading volume, showcasing its dominance in the prediction market space. Estimated data.

International Precedents: What Other Countries Are Doing

The U.S. isn't the only country grappling with prediction market regulation. Other jurisdictions have taken different approaches.

United Kingdom: The UK regulates prediction markets explicitly. The Gambling Commission oversees them as gambling operations. Platforms operating in the UK must be licensed and regulated. This works relatively smoothly because the UK has a clear framework for financial products and gambling. It's regulated but not banned.

Europe: Individual European countries have different approaches. Some regulate prediction markets as gambling. Some as financial derivatives. Some haven't decided yet. The European Union hasn't created a unified regulatory framework, so platforms navigate country-by-country regulations.

Australia: Australia's regulators have taken a harder line, generally treating prediction markets as illegal gambling. Platforms like Betfair operate but face restrictions.

Singapore: Singapore has created a specific regulatory framework for prediction markets through the Monetary Authority of Singapore. Platforms can operate if they're licensed and comply with strict requirements.

Canada: Canada hasn't created specific prediction market regulation. This is why some platforms have expanded Canadian operations.

The international experience shows that there's no one correct way to regulate this. Some countries allow it with strict licensing. Some ban it entirely. Most are in the messy middle figuring it out.

The lesson for the U.S. is that the regulatory approach will matter more than whether regulation happens. Smart regulation could allow prediction markets to thrive while protecting consumers. Bad regulation could destroy the industry.

The Technical Infrastructure: How Prediction Markets Actually Work

Understanding the technical side of prediction markets helps clarify why regulation is so tricky.

Prediction markets use order book matching systems similar to stock exchanges. When you want to buy a contract, your order goes into a book. When someone wants to sell that contract, the system matches them. The price is set by supply and demand.

For sports betting specifically, the workflow is:

-

Contract creation: The platform identifies an event and creates contracts for possible outcomes. Super Bowl LIX: Chiefs win vs. Chiefs don't win. The contract can be fractional, allowing for various outcomes.

-

Market opening: Users can start trading contracts immediately after creation, or after a specified time.

-

Price discovery: As traders buy and sell, prices adjust based on supply and demand. If everyone thinks the Chiefs will win, the contract price rises. If people start selling, it falls.

-

Trading: Users can buy and hold contracts, or actively trade, taking profits or cutting losses.

-

Resolution: When the event concludes, the contract settles automatically. If the outcome matches the contract terms, it pays out. Otherwise, it expires worthless.

The simplicity is part of why these platforms are appealing. You don't need to understand complex financial math. You just need to buy low and sell high before the event resolves.

Regulating this infrastructure is technically complex. From a regulator's perspective, you need to ensure:

- Fair pricing: Markets aren't being manipulated by large traders

- Consumer protection: Users understand the risks and aren't being deceived

- Financial integrity: The platform can't lose your money through negligence or fraud

- Tax collection: The platform reports data needed for taxation

Blockchain-based platforms like Polymarket add complexity. Since trades happen on-chain, there's transparency but also less ability for the platform to implement certain regulatory requirements like account freezing or transaction blocking.

This is why Kalshi chose traditional financial infrastructure despite being newer. Traditional infrastructure gives regulators more control and consumers more protection (in theory).

Looking Forward: Three Possible Futures

The prediction market industry is at a fork in the road. The regulatory battle will determine which path we take.

Future 1: Federal Victory

In this scenario, the CFTC's assertion of authority holds up in courts. Kalshi continues operating nationwide. The federal government clarifies that prediction markets are derivatives under federal authority, and states can't regulate them as gambling.

In this future, prediction markets become a thriving industry in the U.S. More platforms launch. Volume grows. The industry attracts institutional investors and becomes more professional.

The downside: there's less consumer protection than there would be under gambling regulation. Prediction market platforms might not have the same responsible gambling requirements as casinos.

Future 2: State Victory

In this scenario, courts decide that states do have concurrent authority over prediction markets as gambling. States implement gambling regulations for prediction market platforms. Kalshi has to comply with 50 different state gambling regulatory schemes.

Some states allow it with licensing. Some states ban it entirely. Some states treat it as a tax opportunity.

In this future, prediction markets continue to exist but operate under significant regulatory burden. The industry fragments—some platforms operate in certain states but not others. Compliance costs are higher. Growth is slower.

The upside: consumer protections are clearer. Users have more certainty about what they're doing and what protections apply.

Future 3: Compromise

In this scenario, Congress passes legislation clarifying that prediction markets are under federal jurisdiction but must comply with certain consumer protection standards. The law creates a hybrid framework where the CFTC has primary authority but must implement responsible gambling requirements.

Prediction markets operate nationwide but with clear rules about consumer protection, responsible gambling, and disclosure requirements.

This seems like the most likely outcome because it splits the difference. The industry gets the certainty it wants. Consumers get protection. States lose some authority but can still collect some taxes.

Each future has different implications for prediction market companies, users, and the broader financial ecosystem.

The Bigger Picture: Why This Matters Beyond Predictions

The prediction market fight isn't just about whether you can bet on sports outcomes. It's about something deeper: how the U.S. regulates new financial technologies and whether states or the federal government controls financial markets.

The same federal vs. state regulatory battle happening with prediction markets will happen with other financial innovations. Decentralized finance, tokenized securities, new derivatives—all of these will hit the same jurisdictional question.

Also, prediction markets are becoming infrastructure for decision-making. Serious organizations now use prediction market data when making decisions. If prediction markets become regulated and trusted, they might become part of how government and business actually forecast and plan.

Think of it this way: if prediction markets prove they're better forecasters than official forecasts, does the government start relying on them? Does the Pentagon use prediction market prices to guide military spending decisions? Does the Federal Reserve use them in monetary policy?

This is speculative, but it's the kind of future some prediction market advocates envision. A future where market prices aren't just financial speculation but actual decision-making infrastructure.

From this perspective, the regulatory fight is about whether the U.S. government embraces or rejects this future. It's about whether America's financial system evolves to include these new mechanisms or whether regulation locks them in amber.

Trump's support for prediction markets suggests the administration wants to embrace them. But it's not guaranteed. Technology policy is unpredictable.

FAQ

What exactly is a prediction market contract?

A prediction market contract is a financial instrument that pays out based on whether a specific event occurs. For example, a contract might say, "This contract is worth

Is trading on prediction markets legal in the United States?

It's complicated and actively contested. Kalshi has federal approval from the CFTC to operate as a financial exchange in all 50 states. However, multiple states are suing Kalshi, arguing that prediction markets should be regulated as illegal gambling. Courts have sided with Kalshi so far, but the fight is ongoing. The legality varies by state and platform, and the regulatory situation is changing rapidly.

How are prediction markets different from illegal gambling?

From a technical perspective, prediction markets work like financial exchanges—you're trading contracts with other users rather than betting against a house. From a legal perspective, prediction market operators argue they're regulated financial derivatives, not gambling operations. But opponents argue they function identically to gambling and should be regulated as such. The answer depends on whether you emphasize the mechanism (financial trading) or the outcome (risk-taking on uncertain events).

Why do Trump and his family support prediction markets?

Donald Trump Jr. is an advisor to Kalshi and Polymarket, and his investment firm is invested in Polymarket. The Trump family is planning to launch their own prediction market platform called Truth Predict. Philosophically, Trump sees prediction markets as platforms for free expression and alternatives to traditional media narratives. Financially, the family has direct stakes in the industry's success.

What's the difference between Kalshi and Polymarket?

Kalshi is a U.S.-regulated platform that operates under CFTC approval. It uses traditional financial infrastructure and accepts regular bank transfers. Polymarket operates offshore using blockchain and cryptocurrency (specifically Ethereum and stablecoins). Kalshi is more mainstream and regulatory-friendly. Polymarket appeals to crypto-native users who value decentralization and privacy. Both offer prediction contracts on similar events, but with different user bases and regulatory approaches.

Could prediction markets actually improve government decision-making?

Maybe. Academic research shows that prediction markets are often better at forecasting outcomes than expert consensus or traditional methods. Some proposals suggest using prediction market prices as part of government forecasting infrastructure. However, markets can be manipulated or biased, so they're best used as one input among many, not as the primary basis for decisions.

What are the main consumer protection concerns with prediction markets?

The primary concern is that prediction markets can be addictive and harmful to vulnerable populations. People can lose significant money. The platforms use psychological design elements that encourage constant trading. Unlike regulated casinos, prediction market platforms aren't required to implement responsible gambling features, report problem gambling data, or fund addiction treatment. Regulation could address these issues but would increase compliance costs.

Why are Las Vegas casinos fighting prediction markets so hard?

Legal sports betting generates enormous tax revenue for states and vigorish profit for casinos. Prediction markets are economically superior competitors—users get better odds and prices because they trade with each other rather than against a casino house edge. If prediction markets become the primary way Americans place sports bets, casinos and states lose significant revenue. That's why they're fighting to regulate or ban them.

What happens if the federal government wins the regulatory battle?

If the CFTC's assertion of authority holds up, prediction markets operate nationwide under federal oversight. More platforms likely launch. The industry grows. Regulation is lighter than it would be under gambling laws. However, this assumes less consumer protection than gambling regulation would provide. Users get access to efficient markets but fewer mandatory safeguards.

Could prediction markets eventually replace polling?

Unlikely to completely replace polling, but they could become significant alternatives. Prediction markets are faster to update and often more accurate than polls. But they only reflect people with money to bet and confidence in their opinions. Polling provides broader demographic insight. The two will likely coexist and complement each other rather than one replacing the other.

The Prediction Market Decision Point

We're at a decision point. The next 2-3 years will determine whether prediction markets become a standard part of American finance or get heavily restricted by regulation.

The Trump administration is pushing toward a light-touch regulatory approach that lets prediction markets thrive. The CFTC is asserting federal authority and fighting states. Meanwhile, states and gambling regulators are pushing back hard, filing lawsuits and calling for stricter regulation.

Congress might step in to clarify the rules, but that's unpredictable. Different congressional sessions will have different views. Democratic congresses are likely more sympathetic to state gambling regulation. Republican congresses are likely more sympathetic to financial innovation.

What's clear is that this fight will shape not just prediction markets but also how Americans trade financial instruments broadly. Will the U.S. embrace financial innovation even when it disrupts existing industries? Or will it protect regulated gaming industries from competition?

The answer will tell you something important about where American capitalism is headed.

Key Takeaways

- Prediction markets process $1.3B+ in daily volume, with Kalshi operating in all 50 states under CFTC approval while Polymarket returned after being shut down in 2022

- The regulatory battle is genuinely bizarre: Trump family backs prediction markets, MAGA allies support them, but conservative Mormons and Vegas casinos oppose them

- Federal CFTC authority directly conflicts with state gambling laws—19 separate lawsuits target Kalshi as courts decide whether federal or state regulation prevails

- Prediction markets are demonstrably more accurate than traditional polling for forecasting outcomes, but also create consumer protection risks similar to gambling addiction

- The outcome of this regulatory fight will shape not just prediction markets but broader questions about financial innovation, state vs federal authority, and whether America embraces or restricts new fintech

Related Articles

- Nevada vs. Kalshi: The Prediction Markets Battle Reshaping Gambling [2025]

- Prediction Markets Battle: MAGA vs Broligarch Politics Explained

- Nevada Sues Kalshi: Prediction Betting Market Legal Battle [2025]

- Mark Zuckerberg's Testimony on Teen Instagram Addiction [2025]

- Texas Sues TP-Link Over Hidden China Ties and Security Risks [2025]

- Texas Sues TP-Link Over China Links and Security Vulnerabilities [2025]

![Prediction Markets Regulation Battle Heats Up [2025]](https://tryrunable.com/blog/prediction-markets-regulation-battle-heats-up-2025/image-1-1771585869318.jpg)