The Rippling-Deel Corporate Espionage Saga: When Silicon Valley Competition Turns Criminal

In the competitive landscape of human resources and payroll management software, few rivalries have captured the intensity and dramatic flair of the battle between Rippling and Deel. What began as a straightforward commercial competition between two well-funded HR startups has evolved into what many observers describe as the most significant legal drama in the history of Silicon Valley's HR tech sector. The escalation from civil litigation to alleged criminal investigation by the Department of Justice represents an unprecedented moment in the industry, raising serious questions about corporate ethics, competitive conduct, and the boundaries of acceptable business practices in the tech sector.

The transformation of this conflict from a standard competitive dispute into a potential criminal matter signals a fundamental shift in how venture-backed startups are expected to compete. Unlike typical business disagreements resolved through market performance and customer satisfaction, the allegations now involving federal law enforcement suggest conduct so egregious that it has crossed into territory typically reserved for organized crime investigations. The involvement of the Department of Justice, combined with revelations of surveillance, financial wire transfers, and potential racketeering violations, creates a case study that will likely influence how tech companies approach competitive intelligence and employee management for years to come.

For industry observers, entrepreneurs, and professionals in the HR tech space, understanding this case requires examining not just the surface-level allegations but the deeper implications for corporate culture, the role of venture capital funding in incentivizing aggressive behavior, and the legal mechanisms available to combat corporate espionage. This comprehensive analysis explores every dimension of the Rippling-Deel scandal, providing essential context for understanding one of Silicon Valley's most consequential legal battles.

Timeline of Escalation: From Civil Suit to Federal Investigation

The Initial Lawsuit and Spy Confession

The Rippling-Deel conflict became public in May 2025 when Rippling filed a lawsuit alleging that Deel had hired a corporate spy to infiltrate its organization and extract confidential information. Rather than remaining an abstract claim, the allegations were supported by concrete evidence: a confessed spy who had worked at Rippling and subsequently admitted to being paid by Deel executives to steal sensitive company information. The spy, whose identity has been protected in many court filings, admitted in sworn testimony delivered through an Irish court to collecting and transferring multiple categories of proprietary information to Deel contacts.

The types of information allegedly stolen painted a troubling picture of comprehensive corporate espionage. According to the court documents and sworn statements, the spy accessed and copied sales leads that represented the company's pipeline of potential revenue, product roadmaps that detailed Rippling's strategic direction and planned features, customer account information that could reveal the company's market positioning, and the names of key technical and business talent. This wasn't selective theft of competitive information—it was systematic harvesting of nearly every category of data that would provide a competitor with strategic and tactical advantages.

Rippling's revised complaint in June 2025 elevated the severity of the allegations by invoking the Racketeer Influenced and Corrupt Organizations (RICO) Act, a federal statute traditionally used to prosecute organized crime syndicates. By framing Deel's alleged conduct as a "criminal syndicate" engaged in racketeering, Rippling signaled that the company viewed Deel's actions as more than simple corporate espionage—they represented a pattern of organized criminal activity that deserved the most serious legal consequences available under federal law.

Deel's Counter-Allegations and Denial Strategy

Deel responded to the Rippling lawsuit with a dual strategy: categorical denial of involvement in espionage activities combined with counter-allegations suggesting that Rippling itself had engaged in improper competitive conduct. Deel's counterclaim alleged that Rippling had planted operatives posing as customers to infiltrate Deel's operations and gather intelligence. This tit-for-tat accusation added complexity to the legal battle, suggesting that if espionage had occurred, both parties might be implicated in unethical conduct.

The company's public statements emphasized the alleged campaign to damage Deel's market position through false narratives rather than acknowledging any involvement in information theft. Deel's position was that Rippling, despite superior market performance and funding, had resorted to a "smear campaign" designed to undermine its competitor's standing with customers and investors. This framing attempted to shift focus from the concrete evidence of the confessed spy to abstract accusations about reputational damage.

The Surveillance Revelation and Family Safety Concerns

As the legal case progressed through discovery and testimony, a new and deeply troubling dimension emerged: allegations that Deel had conducted surveillance operations against the confessed spy. The spy's lawyers brought motions alleging that individuals, whom the spy believed to be employed by Deel, were following him and monitoring his movements. The allegations went beyond professional surveillance of a potentially hostile witness—they included claims that the spy's family was living in fear and experiencing psychological harm due to the persistent presence of individuals they believed to be monitoring them.

Initially, Deel's legal team denied that the company had authorized any surveillance activities. This denial became untenable when discovery revealed that Deel had indeed hired a surveillance firm to watch the spy. The revelation that a company would escalate from hiring a mole to conducting ongoing surveillance of that same individual once they became a cooperating witness demonstrates an aggressive and potentially illegal approach to managing adverse testimony. This surveillance revelation provided additional leverage to Rippling's narrative of organized criminal conduct.

The DOJ Investigation Announcement

In January 2026, the Wall Street Journal reported that the Department of Justice had opened a criminal investigation into Deel's activities related to the alleged hiring of a corporate spy. This marked the most significant escalation yet, moving beyond civil litigation into the realm of federal criminal prosecution. Unlike a civil suit where damages are monetary and the standard of proof is preponderance of the evidence, a criminal investigation operates under the much higher standard of proof "beyond a reasonable doubt" and carries the potential for prison sentences and felony convictions.

When contacted about the investigation, Deel issued a carefully worded statement claiming to be "not aware of any investigation" while simultaneously pledging full cooperation with authorities and offering to provide any necessary information in response to valid inquiries. This formulation allowed the company to deny knowledge while preserving its legal position should the investigation proceed. The statement's commitment to cooperation stood in contrast to the company's aggressive defense strategy in the civil case, suggesting that Deel's legal team understood the far more serious implications of federal criminal exposure.

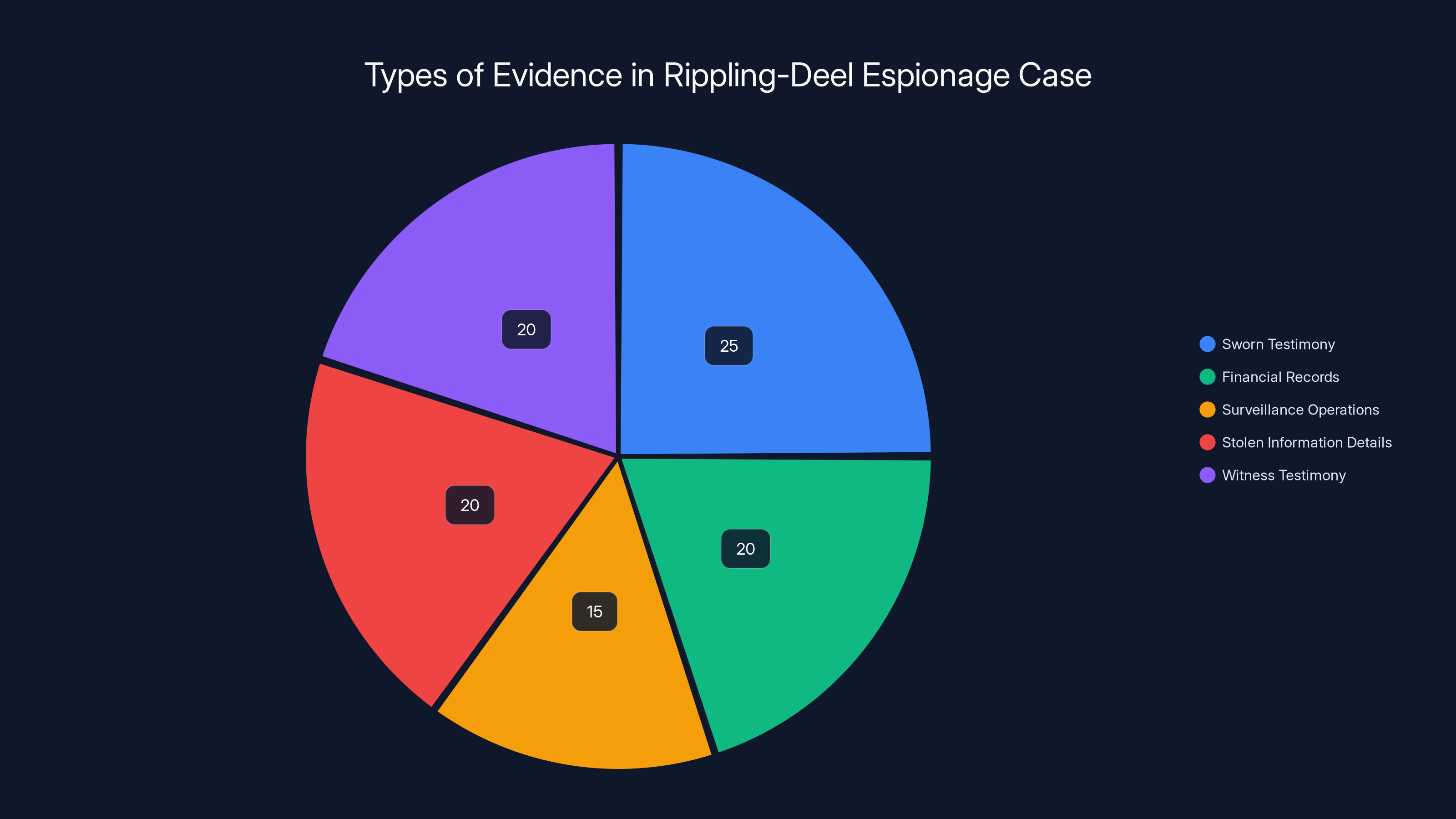

The pie chart illustrates the distribution of different types of evidence in the Rippling-Deel espionage case, highlighting the substantial role of sworn testimony and financial records. Estimated data.

Key Evidence and Legal Arguments

The Bank Records Revelation

One of the most damaging pieces of evidence emerged in late November 2025 when Rippling obtained bank records through the discovery process. These records revealed a suspicious financial transaction pattern that suggested potential payment for espionage services. The sequence of events captured in the bank records showed that Deel transferred funds into an account held in the name of Deel's Chief Operating Officer's wife, and precisely 56 seconds later, that account transferred an identical amount to an account held by the confessed spy.

The timing of the transfer—56 seconds between movements of money—is almost certainly not coincidental. Such rapid successive transfers suggest a deliberate laundering pattern designed to obscure the direct connection between Deel and the spy's compensation. This mechanism creates multiple transfer points, making it more difficult to trace the ultimate source of funds to Deel while providing plausible deniability about the relationship between corporate leadership and payment to the spy. The use of the COO's spouse's account adds another layer of complexity and potential legal liability, as it suggests knowledge and participation by senior company leadership in the payment scheme.

From a criminal investigation perspective, these bank records likely provided prosecutors with probable cause for charges including wire fraud (using financial systems to execute a fraud scheme), potentially money laundering, and conspiracy. The digital trail of financial transactions is often considered the most compelling evidence in white-collar crime cases because it leaves an objective record that cannot be attributed to misunderstanding or miscommunication.

The Spy's Cooperation Agreement and Protected Status

The confessed spy agreed to cooperate with Rippling's legal team and testify in the civil case. To facilitate this cooperation, Rippling agreed to cover the spy's legal expenses and travel costs related to providing testimony. This arrangement is standard in complex litigation and served the legitimate purpose of enabling a critical witness to participate in the legal process. However, Deel's legal strategy has characterized this arrangement as evidence that the spy is a "paid witness," implying that the cooperation agreement financially incentivizes false testimony.

The distinction between compensating a witness for legitimate expenses and improperly incentivizing testimony is crucial to understanding the ethical dimensions of the case. Courts routinely permit fact witnesses to recover reasonable expenses for participating in litigation, and such arrangements do not typically undermine witness credibility. However, if the cooperation agreement included payments beyond reasonable expense reimbursement—such as contingency fees based on favorable testimony or witness protection payments of unusual size—it could raise legitimacy questions about the witness's motivation.

The legal framework addressing cooperating witnesses in organized crime or fraud cases often includes protective measures, witness relocation assistance, and expense reimbursement as standard components. The spy's acceptance of legal protection represents a calculated decision that the risk of testifying against a powerful, well-funded company with resources to conduct surveillance was acceptable given legal assistance and financial protection for his family.

RICO Allegations and Organized Crime Framework

Rippling's invocation of the RICO statute represented a strategic choice to frame Deel's alleged conduct within the legal paradigm traditionally reserved for organized crime prosecution. The RICO statute criminalizes participation in an enterprise engaged in a pattern of racketeering activity. The definition of "racketeering activity" includes mail fraud, wire fraud, and various state crimes. To establish a RICO violation, prosecutors must demonstrate an enterprise, participation in its affairs, a pattern of racketeering activity, and injury to the plaintiff caused by that pattern.

Applying RICO to corporate espionage is not unprecedented, but it remains relatively uncommon. The statute's application here suggests that Rippling viewed Deel's alleged conduct not as isolated misconduct by rogue employees but as a systematic pattern of illegal activity directed and approved by senior management. The characterization as a "criminal syndicate" language in Rippling's complaint was deliberately chosen to invoke the statute's organized crime framework and signal the severity of the allegations.

For federal prosecutors evaluating whether to bring criminal charges, a RICO violation provides powerful prosecutorial tools, including potential for enhanced sentencing, forfeiture of assets, and civil liability exposure. If the DOJ investigation concludes that evidence supports criminal charges, RICO allegations could form part of the charging document, carrying serious implications for any individual defendants and the company itself.

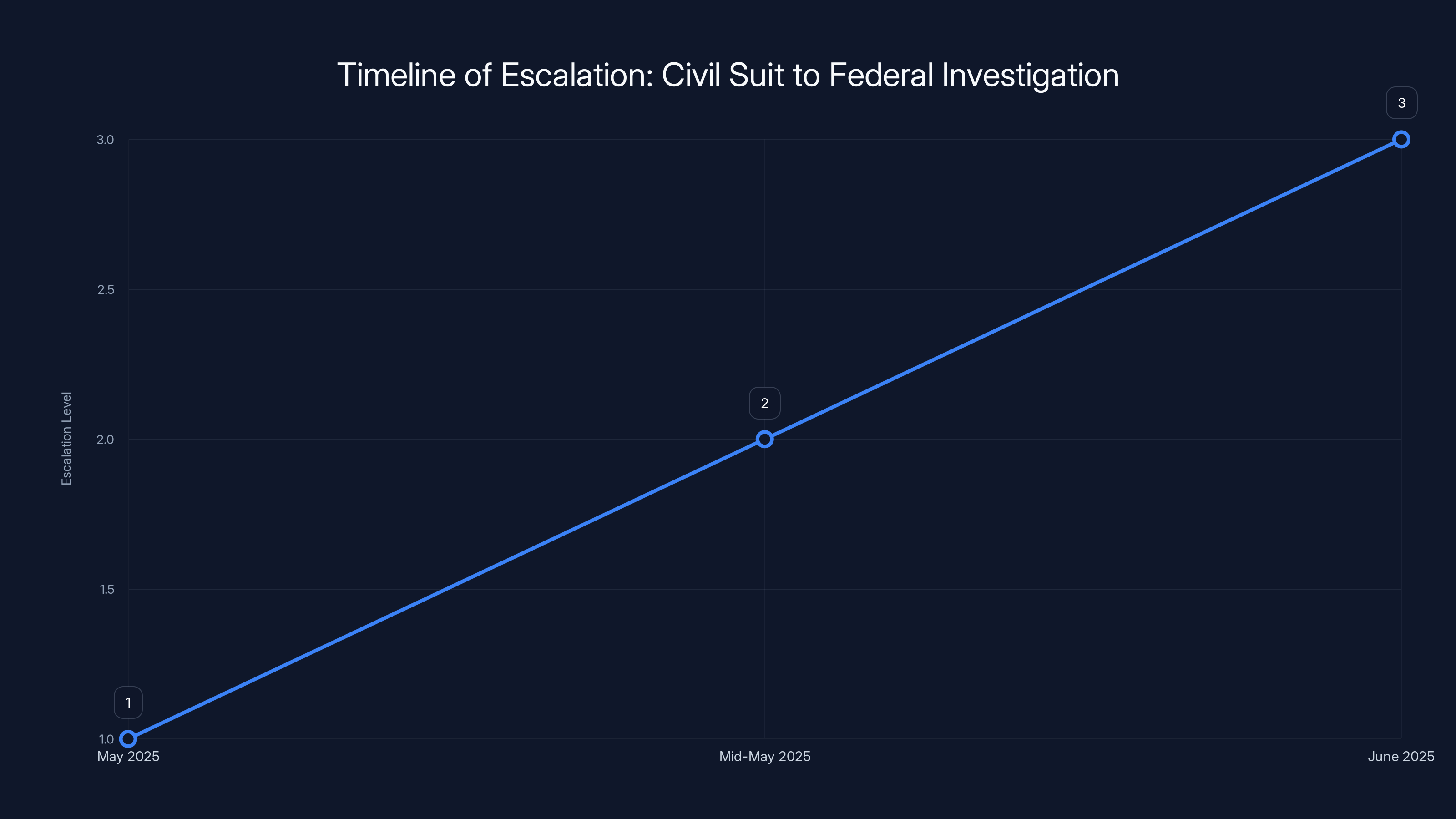

The timeline shows the escalation from the initial lawsuit in May 2025 to invoking the RICO Act by June 2025, indicating a significant increase in legal severity. Estimated data.

The High-Powered Legal Teams and What They Signal

Deel's White Collar Defense Strategy

Deel's decision to retain William Frentzen as representation for CEO Alexandre Bouaziz sends a clear signal that the company is preparing for serious criminal exposure. Frentzen is a partner in the white collar defense group at Morrison & Foerster, one of the nation's most prestigious law firms, and previously served as chief of the corporate and securities fraud unit for the U. S. Attorney's Office for the Northern District of California. This background means Frentzen has spent his career prosecuting exactly the type of cases that Deel now faces and understands the prosecutorial mindset, investigative techniques, and legal strategies that federal prosecutors employ.

The retention of such specialized counsel indicates that Deel's legal team believes criminal investigation and potential prosecution are realistic possibilities. Companies typically retain white collar defense specialists only when leadership has assessed that criminal exposure is serious enough to warrant the substantial investment required for such representation. Frentzen's experience as a former federal prosecutor provides Deel with strategic advantages in understanding how the DOJ investigation might proceed and what documentary evidence or witness testimony might be most damaging.

Rippling's Prosecution-Ready Legal Arsenal

Rippling's choice of Alex Spiro from Quinn Emanuel represents a complementary strategy focused on aggressive litigation and protecting client interests. Spiro, a former prosecutor for the Manhattan District Attorney's Office, brings prosecutorial experience combined with a reputation for aggressive client advocacy. His client list reportedly includes high-profile individuals from entertainment and business, suggesting experience in representing clients under intense scrutiny and public attention. The choice of Quinn Emanuel, a litigation powerhouse known for its combative approach and willingness to take cases to trial, signals that Rippling is prepared for extended litigation rather than a negotiated settlement.

The contrast between the two legal teams reflects their different interests: Deel's focus on managing criminal exposure and negotiating with federal prosecutors versus Rippling's focus on maximizing damages in the civil case and protecting its reputation. Both strategies suggest that the case will not be quickly resolved and that significant legal resources will be deployed by both parties.

The Investment Landscape: Money Continues Despite Scandal

Deel's Funding and Valuation Trajectory

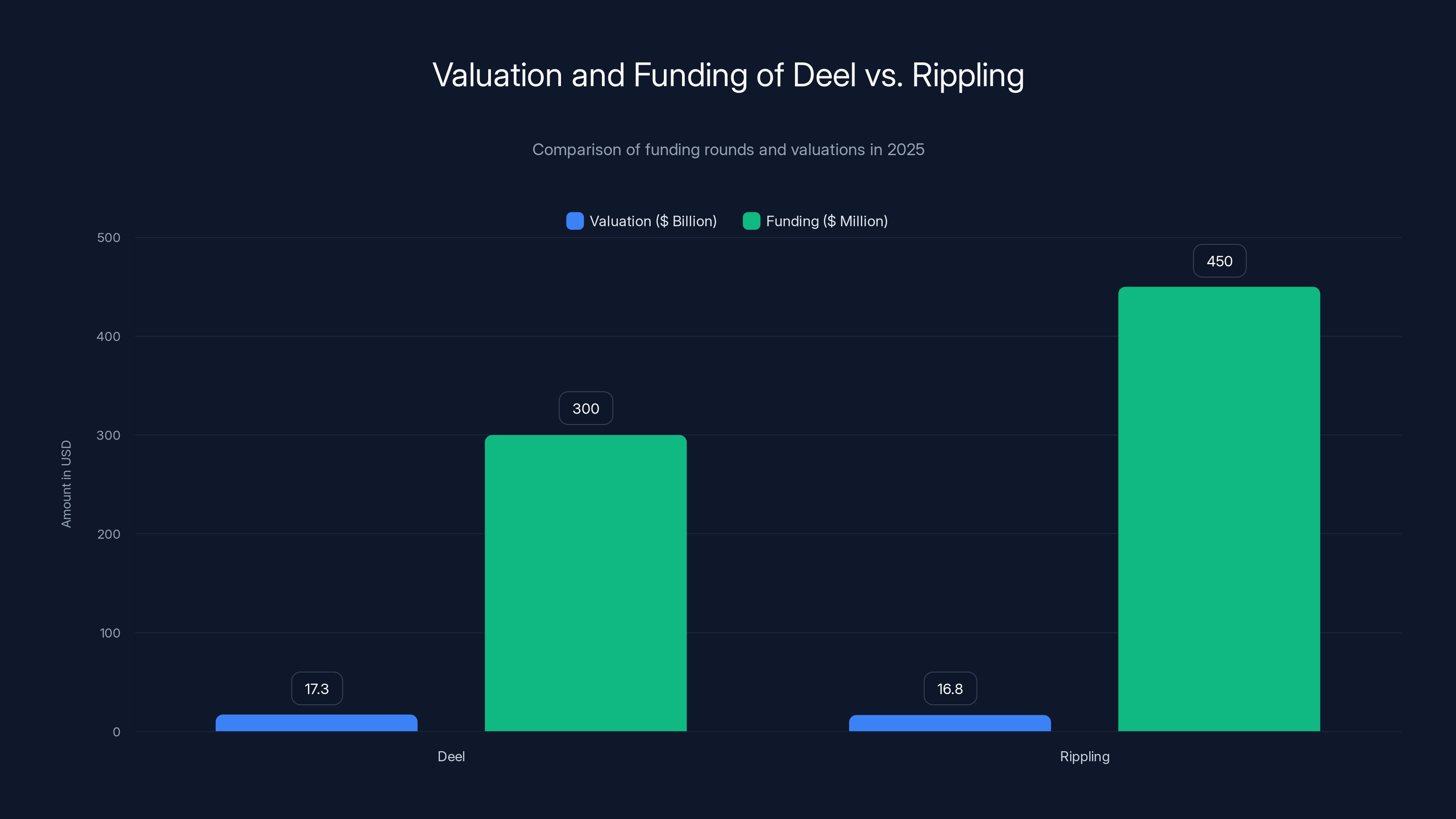

Despite the escalating legal crisis, Deel announced in October 2025 that it had achieved a valuation of

For investors, continued funding indicates either confidence in management's ability to successfully defend against the allegations or assessment that even in a worst-case scenario of criminal conviction and substantial settlements, the company's valuation and market position would remain valuable. This investor confidence stands in stark contrast to the company's legal situation and raises questions about whether venture capital firms have adequately factored legal and reputational risks into their investment decisions.

Rippling's Parallel Fundraising Success

Rippling achieved its own valuation milestone of

The near-parity in valuations between two companies engaged in bitter litigation is notable. Rather than the company defending against espionage (Rippling) being valued significantly higher than the company accused of perpetrating it (Deel), both companies command approximately $17 billion valuations. This suggests that investors view the HR and payroll software market as sufficiently large and growing rapidly enough that both companies can achieve substantial value despite the legal and reputational challenges they face.

What Continued Investment Signals About Market Dynamics

The willingness of top-tier venture capital firms to continue investing in both companies despite the scandal suggests several dynamics about the current investment environment. First, the HR and payroll software market represents a large, valuable opportunity with strong growth tailwinds. Second, investors may be confident that legal outcomes, even if adverse, will not fundamentally impair the companies' ability to serve their market and generate returns. Third, venture capital decision-makers may have assessed that neither company's core business or customer relationships are sufficiently threatened by the scandal to merit withdrawal of support.

Alternatively, the continued investment could reflect a phenomenon where mega-rounds and high valuations become self-perpetuating: once a company reaches a certain valuation tier, major investors are reluctant to withdraw support because doing so would signal a loss of confidence that could damage the entire market segment. Understanding investor psychology and the dynamics of late-stage venture capital is essential to interpreting why companies facing serious legal exposure continue to attract substantial new funding.

Despite legal challenges, Deel and Rippling achieved high valuations and substantial funding in 2025, reflecting strong investor confidence. Estimated data.

The Broader Context: Competition in HR Tech Market

Market Dynamics and Competitive Intensity

The Rippling-Deel conflict cannot be understood in isolation from the broader competitive dynamics of the HR and payroll management software market. This sector has experienced explosive growth over the past decade as companies increasingly adopt cloud-based, integrated solutions that consolidate functions previously handled by multiple vendors. The market opportunity has attracted enormous venture capital investment, with dozens of well-funded competitors pursuing overlapping segments and customer bases.

Rippling, founded by Parker Conrad in 2016, entered a market already populated by established players including Workday, Bamboo HR, and others. The company differentiated itself through a platform approach that integrated HR, IT, and payroll functions, targeting primarily mid-market companies between 100 and 5,000 employees. Deel, founded by Alex Bouaziz in 2018, focused initially on international payroll and contractor payments, addressing a specific pain point for companies with distributed, global workforces.

Both companies benefited from tailwinds in distributed work adoption following the COVID-19 pandemic. Rippling's integrated platform appealed to companies managing increasingly complex remote workforces, while Deel's focus on international payments aligned perfectly with the rise of fully distributed companies hiring talent globally without traditional office locations. The competitive intensity in this space is underscored by the fact that despite facing serious legal challenges, both companies command multi-billion-dollar valuations and continue to attract institutional investment.

The Incentive Structure for Aggressive Competition

One critical dimension of the scandal is examining what incentive structures in venture capital may have contributed to the alleged conduct. Venture capital operates on a model where returns are driven by company valuations and exit multiples. Founders and early employees have substantial financial incentives to accelerate growth, capture market share, and achieve high valuations. In hyper-competitive markets where multiple well-funded competitors pursue similar customers, competitive advantage becomes paramount.

If Deel's leadership believed that Rippling was outpacing them in product development and market adoption due to superior intelligence about market needs and competitive positioning, the temptation to level the playing field through information gathering might have seemed justified in the context of extreme competitive pressure. The alleged spying can be understood as a choice made within a context of intense market competition where losing ground to a competitor could mean failure to achieve projected growth rates and investor return expectations.

This context does not justify illegal conduct, but it provides crucial background for understanding how otherwise intelligent, successful entrepreneurs might have made decisions that crossed ethical and legal lines. The venture capital system's emphasis on hypergrowth and market dominance creates structural incentives that can override normal ethical constraints, particularly in competitive markets where multiple companies pursue similar customers and the difference between success and failure is often determined by access to superior information.

Criminal Investigation Implications

Elements of Potential Federal Crimes

A Department of Justice criminal investigation into Deel's alleged activities could potentially result in charges under several federal statutes. Wire fraud is a common charge in corporate espionage cases involving the use of electronic communications or financial transfer systems. Wire fraud charges require proof that the defendant participated in a scheme to defraud another party of property or money and that electronic communications were used as part of the scheme. The bank transfers documented in the discovery phase of the civil case would likely constitute wire fraud if prosecutors can prove the transfers were made with intent to defraud Rippling of valuable proprietary information.

Money laundering charges could potentially arise from the structured transfers between accounts designed to obscure the connection between Deel and payments to the spy. Money laundering prohibits engaging in financial transactions knowing the funds derive from specified unlawful activity with the intent to promote that unlawful activity or conceal its source. The rapid sequential transfers between the COO's spouse's account and the spy's account suggest potential laundering of funds derived from the underlying espionage.

Conspiracy charges could apply if prosecutors can demonstrate agreement between Deel executives and the spy to commit the underlying crimes. Conspiracy requires proof of an agreement to commit the crime and at least one overt act in furtherance of the conspiracy. The payments to the spy and his transmission of information would constitute overt acts supporting a conspiracy charge.

RICO charges, as initially invoked by Rippling in its civil complaint, could potentially be brought if prosecutors view Deel as an enterprise engaged in a pattern of racketeering activity. RICO carries substantially enhanced penalties and provisions for asset forfeiture, making it a powerful prosecutorial weapon in organized crime and complex fraud cases.

Sentencing Exposure and Individual Liability

If criminal charges are brought and result in conviction, the sentencing exposure depends on the specific crimes charged. Wire fraud typically carries maximum sentences of 20 years imprisonment per count, with potential for consecutive sentencing if multiple wire transfers occurred. Money laundering carries maximum sentences of 10 years per violation. These federal sentences are substantial, and defendants convicted of multiple counts face potential imprisonment measured in decades rather than years.

Crucially, criminal liability extends not just to individuals who directly participated in the illegal conduct but to those who knew of the conduct and took affirmative steps to conceal or facilitate it. If the DOJ investigation concludes that CEO Alexandre Bouaziz approved or directed the spying activity, or if the COO knew that her account was being used to funnel payments to a hired spy, both individuals face potential individual criminal liability in addition to any corporate liability Deel itself might face.

White collar crime prosecutions often focus on individual defendant exposure because financial penalties imposed on corporations can potentially be passed through to shareholders or ultimately absorbed through restructuring. Individual criminal liability, by contrast, creates direct consequences—imprisonment, fines, and felony convictions—that cannot be transferred or mitigated through corporate restructuring. This dynamic explains why Deel retained specialized white collar defense counsel and why understanding potential individual liability is crucial to assessing the case's severity.

Comparison to Historic Corporate Espionage Cases

The Rippling-Deel case, while unique in many specifics, follows patterns established in previous corporate espionage investigations. The case bears some similarity to the prosecution of Economic Espionage Act violations, which specifically criminalize theft of trade secrets. The EEA carries maximum sentences of 15 years imprisonment and provides for both civil and criminal penalties. However, the Rippling-Deel case appears to involve more complex criminal conduct including wire fraud and potential money laundering rather than charges purely under the EEA.

Another relevant precedent is the prosecution of employees or contractors for theft of proprietary information while working for a competitor. These cases typically result in criminal convictions when evidence shows intentional theft of trade secrets, particularly when the defendant received compensation for providing the information. The presence of a confessed perpetrator willing to testify in both the civil and potentially the criminal case substantially increases the likelihood that federal prosecutors could secure criminal convictions if charges are brought.

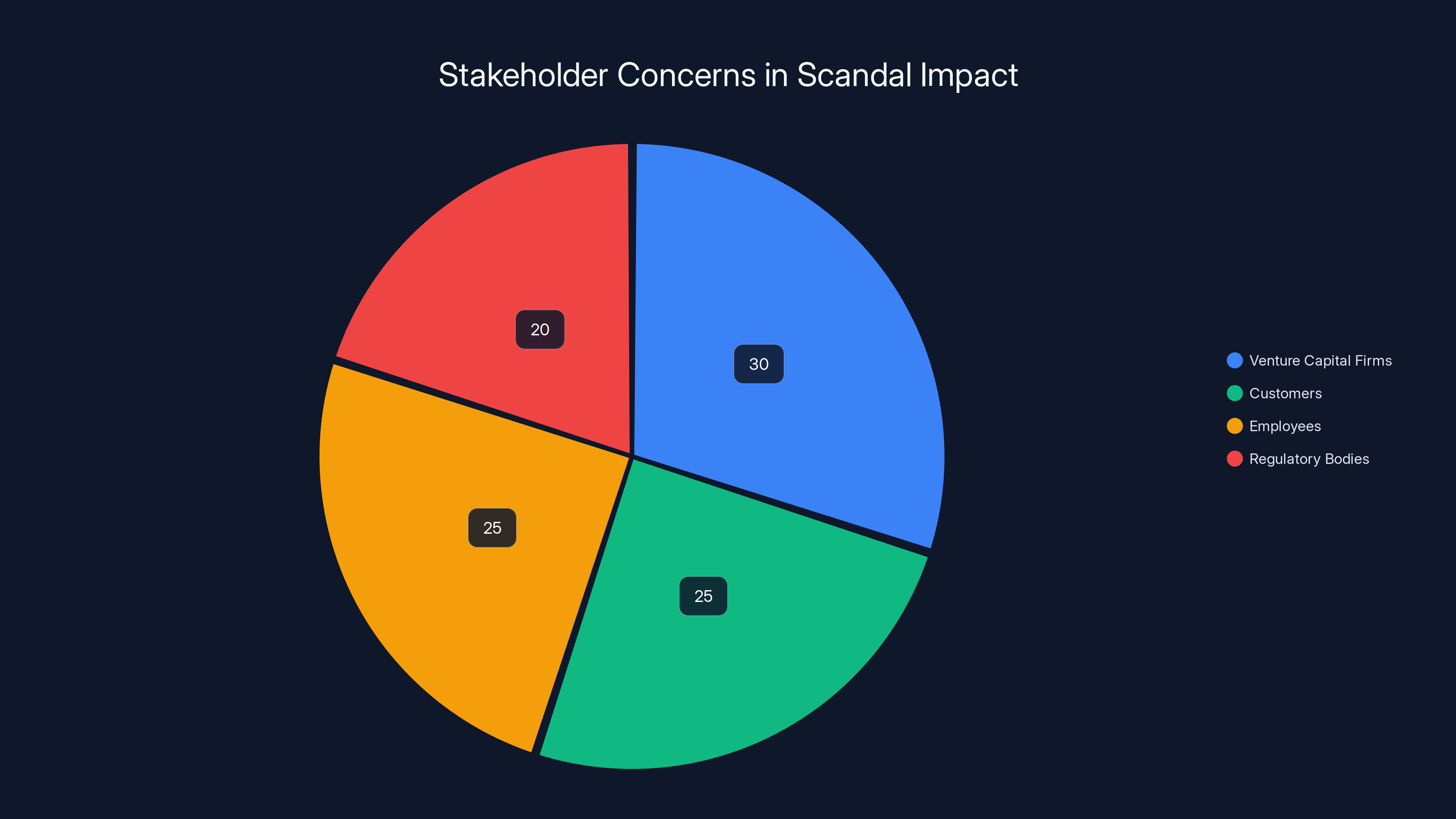

Estimated data suggests venture capital firms and customers share the highest concern levels, each at around 30% and 25% respectively, due to reputational and data security risks. Employees and regulatory bodies also hold significant concern, highlighting the broad impact of the scandal.

Rippling's Competitive Advantage from Espionage Defense

Narrative Control and Market Positioning

Despite being the victim of alleged espionage, Rippling has effectively used the scandal to strengthen its competitive and market positioning. The company's aggressive pursuit of litigation, comprehensive documentation of the alleged misconduct, and public disclosure of evidence has positioned Rippling as the defending party in a David-versus-Goliath narrative, despite both companies having similar valuations and funding. By transparently engaging with the legal process and providing detailed evidence of the alleged misconduct, Rippling has effectively communicated to customers, partners, and investors that it competes on superior product and execution rather than through illicit means.

This narrative positioning provides Rippling with competitive advantages in customer acquisition and retention. Prospective customers evaluating HR and payroll solutions can view Rippling as the company that refused to engage in espionage despite competitive pressure and maintained ethical standards. This reputational advantage, particularly among enterprise customers with rigorous vendor governance requirements, could translate into increased market share even if Deel ultimately prevails in some aspects of the legal dispute.

Customer and Partner Confidence

HR and payroll software companies handle extraordinarily sensitive information about employees, compensation, benefits, and payroll data. The scandal raises legitimate concerns among customers about whether their data stored with Deel might be vulnerable to unauthorized access or disclosure. While the alleged espionage targeted another company rather than Deel's customers, the revelation that Deel allegedly hired individuals to steal confidential information could undermine customer confidence in the company's information security practices and data governance.

Rippling can leverage this customer confidence concern in its competitive sales process, highlighting its commitment to ethical conduct and robust security practices. Customers making vendor selection decisions may view the scandal as evidence that Rippling takes security and ethical conduct seriously, while Deel's alleged conduct represents a potential vulnerability in its corporate culture and leadership.

Partnership Ecosystem Impact

Both Rippling and Deel operate within broader ecosystem partnerships with other vendors, integrations partners, and service providers. Partners selecting which platform to integrate with or which company to work more closely with may be concerned about reputational association with a company engaged in espionage allegations. This ecosystem dynamic could provide Rippling with advantages in securing partnerships and integrations that might otherwise be negotiated with either platform.

Venture capital investors and other funding sources might also exhibit increased risk aversion toward Deel given the federal investigation, potentially making future fundraising more difficult or requiring higher returns to compensate for increased legal and reputational risk. Rippling, by contrast, can position itself as a lower-risk investment with stronger ethical foundations, potentially securing more favorable fundraising terms and investor valuations.

Regulatory and Governance Implications

Corporate Governance and Board Oversight

The alleged espionage at Deel raises important questions about corporate governance and board oversight of executive conduct. For Deel as a private company, the composition and effectiveness of its board of directors in preventing or detecting unauthorized conduct by senior management becomes relevant. If board members and governance structures failed to detect or prevent alleged espionage activities, this raises questions about the adequacy of governance structures at late-stage venture-backed companies.

Most late-stage venture-backed companies maintain boards of directors comprising company founders, venture capital representatives, and potentially independent directors. The question of whether Deel's board had adequate visibility into the company's competitive intelligence gathering activities and could exercise effective oversight becomes relevant. If board oversight proved insufficient to detect or prevent alleged misconduct, this suggests potential governance gaps that should concern investors and partners.

For Rippling, the fact that the company maintained sufficient internal controls to detect the infiltration by a planted spy and possessed sufficient documentation to bring legal claims with strong evidentiary support suggests stronger governance and information security practices. The contrast between the two companies' internal controls and detection capabilities becomes another dimension of competitive differentiation.

Implications for HR Tech Regulatory Landscape

The Rippling-Deel scandal could prompt regulatory scrutiny of the HR and payroll technology sector more broadly. Regulators concerned about data security, information governance, and the protection of sensitive employee information might respond to the scandal by proposing new regulations or enforcement priorities targeting HR technology companies. This regulatory environment would disproportionately favor larger companies like Rippling that can invest in compliance infrastructure and might burden smaller competitors that lack equivalent resources.

Similarly, regulators might target not just information security practices but also the competitive conduct of HR technology companies, establishing clearer standards for permissible competitive intelligence gathering versus prohibited espionage. This normalization of enforcement expectations could reshape competitive dynamics in the industry by establishing legal guardrails that constrain the more aggressive competitive tactics that may have previously been tolerated.

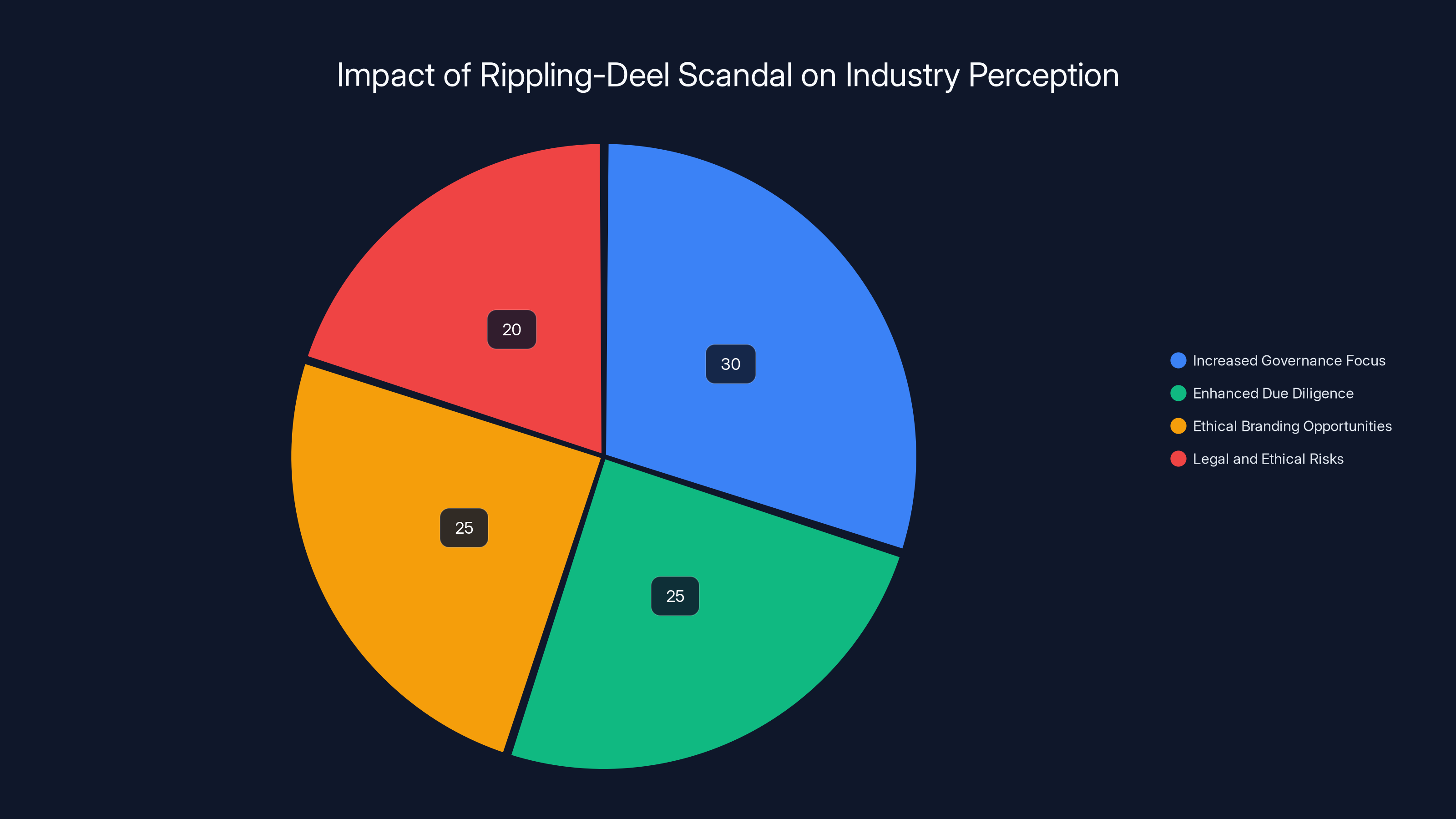

The Rippling-Deel scandal is estimated to increase focus on governance (30%) and due diligence (25%), while creating opportunities for ethical branding (25%) and highlighting legal risks (20%). Estimated data.

Witness Testimony and Evidentiary Strength

The Confessed Spy's Cooperation Agreement

The confessed spy's decision to provide sworn testimony about his role in the alleged espionage provides prosecutors with substantial evidentiary advantage. Unlike cases that rely primarily on documentary evidence or circumstantial proof of intent, this case benefits from direct testimony from someone with firsthand knowledge of the alleged conspiracy. The spy's written statement describing the types of information he was asked to gather, how he gathered it, and the individuals to whom he reported creates a comprehensive evidentiary narrative.

The cooperation agreement that compensates the witness for legal expenses and testimony travel represents standard prosecutorial practice in complex fraud cases. However, Deel's characterization of the spy as a "paid witness" attempts to undermine his credibility by suggesting financial motivation for favorable testimony. This dynamic represents a credibility battle that prosecutors or civil litigators would need to address through careful examination of the witness's testimony, corroboration through documentary evidence (particularly the bank records), and cross-examination of any conflicting testimony from Deel representatives.

Documentary Evidence and Digital Records

The bank records obtained in discovery constitute perhaps the most powerful evidence in the case because they are contemporaneous, objective, and difficult to challenge or reinterpret. Unlike testimony that can be subject to memory distortion, bias, or motive for falsification, financial records create an objective historical record. The sequence of transfers from Deel through an account held by the COO's spouse to the confessed spy, completed in 56 seconds, suggests intentional concealment rather than innocent payment for legitimate services.

Additionally, any electronic communications between Deel executives and the spy—emails, messages, call logs—would provide corroborating evidence of the conspiracy. Such communications would likely have been preserved in discovery and would provide crucial evidence of planning, instruction, and approval of the spying activities. Email records showing requests for specific information and communications acknowledging receipt of that information would establish a clear chain of knowledge and intent.

Surveillance Evidence and Witness Protection Concerns

The revelation that Deel conducted surveillance on the confessed spy after he became a cooperating witness adds another evidentiary dimension and raises potential additional criminal exposure. Intimidation of a witness or potential witness through surveillance could constitute witness tampering or intimidation, federal crimes that carry additional criminal liability. If the spy's family experienced harassment or threats as a result of the surveillance, this could support charges of witness intimidation with enhanced sentencing exposure.

The documented surveillance by a firm hired by Deel, combined with the spy's credible belief that he and his family were being monitored, creates a compelling narrative of aggressive conduct that goes beyond the original espionage allegations. For federal prosecutors, evidence of witness intimidation provides additional charging options and demonstrates a pattern of conduct escalating from information theft to active suppression of potential evidence.

Settlement Prospects and Resolution Pathways

Civil Settlement Dynamics

While the criminal investigation proceeds, the civil lawsuit between Rippling and Deel will likely continue through the court system. Settlement negotiations in cases of this magnitude typically involve complex discussions about damages valuations, contribution to loss, and the reputational and strategic interests of both parties. For Deel, a significant settlement payment could signal a desire to resolve the matter and move forward, though it would acknowledge some liability. For Rippling, a substantial settlement would provide financial recovery for the loss of proprietary information and the competitive harm the espionage allegedly caused.

Settlement negotiations in cases involving RICO allegations and multiple causes of action become complicated because settling one claim does not necessarily resolve exposure on all claims. Rippling might pursue settlement of the civil case while cooperating with federal prosecutors on the criminal investigation, effectively using both civil and criminal proceedings as leverage to maximize pressure on Deel to accept unfavorable settlement terms.

Plea Negotiations and Immunity Considerations

If the federal investigation results in charges, plea negotiations might offer pathways to resolution that would benefit both sides. Deel could potentially negotiate a guilty plea to lesser charges or a single count with agreed-upon sentencing recommendations, avoiding the uncertainty and publicity of trial. In exchange, prosecutors might agree not to pursue more serious charges such as RICO violations or related charges against multiple individuals.

For individuals involved in the alleged espionage, cooperation agreements might offer immunity from prosecution in exchange for truthful testimony about the conduct of superiors. This dynamic has potential to create substantial pressure on CEO Alexandre Bouaziz and other senior executives, as they face potential criminal liability if subordinates testify about their knowledge of and participation in the espionage activities. The combination of individual criminal exposure and potential cooperation agreements creates leverage that prosecutors can use to negotiate favorable outcomes.

Reputational and Strategic Considerations

Beyond legal and financial outcomes, both companies face strategic decisions about how aggressively to pursue litigation versus negotiating settlements that might limit ongoing reputational damage. For Deel, continued litigation without settlement risks extended media attention, ongoing customer concern about trustworthiness, and difficulty in fundraising or pursuing strategic transactions. A settlement, while expensive, might limit the duration of negative publicity and allow the company to move forward.

For Rippling, aggressive pursuit of litigation and cooperation with federal prosecutors provides opportunities to maximally damage Deel's competitive position and brand, but carries risks of being perceived as overly punitive or vindictive by customers and partners. The company must balance vindication against the risks of appearing to weaponize legal processes against a competitor in ways that might undermine its own reputation for ethical conduct.

Workday leads the HR tech market with an estimated 30% share, followed by Rippling and Deel with 20% and 15% respectively. Estimated data based on market trends.

Implications for Cybersecurity and Information Governance

Insider Threat Detection and Prevention

The Rippling-Deel scandal highlights the importance of effective insider threat detection programs and information governance practices. The fact that Rippling discovered the planted spy and documented evidence of information theft suggests that the company maintained adequate controls to detect suspicious employee activity. This might have included unusual access to sensitive systems, bulk downloads of confidential files, or pattern-of-life analysis suggesting the employee was gathering information outside their normal job responsibilities.

Organizations facing competitive pressure or suspected espionage activities should implement robust insider threat programs that combine technical controls (system access monitoring, data loss prevention tools, email surveillance) with human intelligence (reporting mechanisms for suspicious activity, investigation protocols, employee interview techniques). The successful identification of the spy and extraction of admissions suggests Rippling had adequate investigative capabilities to uncover the scheme.

Data Classification and Access Controls

The specificity of information alleged to have been stolen—sales leads, product roadmaps, customer account data, employee names—suggests that this information lacked adequate classification or access controls. In mature information governance systems, information at different sensitivity levels (confidential, internal, public) is classified and access is restricted based on job responsibility. Sales lead information and product roadmaps, being highly sensitive competitive information, should be restricted to individuals with legitimate need for such information.

If the confessed spy held a position with legitimate access to this sensitive information (such as a sales operations or product management role), the challenge of preventing theft becomes more difficult. Restricting access based on role requires sophistication in defining which roles require access to which information and implementing technical controls that enforce those policies consistently.

Monitoring for Information Exfiltration

Modern data loss prevention and security monitoring tools can detect attempts to exfiltrate large volumes of information from corporate systems through email, cloud storage, file transfer mechanisms, or other channels. The fact that Rippling apparently did not detect the information theft in real-time suggests that either the spy used sophisticated techniques to avoid detection (such as gradual copying of information rather than large bulk transfers), or the company lacked adequate monitoring capabilities.

Alternatively, the spy may have used legitimate access patterns to view and mentally absorb information rather than directly copying files, making technical detection difficult. In such cases, detecting suspicious activity requires analysis of access patterns, unusual access times or locations, and correlation of system access with known contacts of competitive companies.

Precedent and Future Implications

Historical Corporate Espionage Cases

The Rippling-Deel case, while dramatic, is not the first instance of corporate espionage in Silicon Valley or the broader business world. Historical precedents provide context for understanding how federal prosecutors approach such cases and what outcomes are likely. Cases involving theft of trade secrets, particularly when the alleged conduct involves payment to employees or contractors to gather information, typically result in federal prosecution and conviction.

The involvement of venture capital-backed companies facing significant competitive pressure and the existence of a confessed perpetrator substantially strengthens the evidentiary position for federal prosecutors. Unlike cases that rely primarily on circumstantial evidence or digital forensics, this case benefits from direct testimony about intent and conduct by a participant.

Systemic Implications for Tech Industry Competitive Norms

The Rippling-Deel scandal signals a potential shift in how the tech industry and federal law enforcement view aggressive competitive practices. While competitive intensity has long characterized the venture capital-backed startup ecosystem, the federal investigation into Deel suggests that there are legal and enforcement limits beyond which companies cannot go in pursuing competitive advantage. This boundary-testing could reshape competitive norms in the HR tech sector and similar markets.

Future competitive behavior by companies in similar markets will likely be influenced by the outcome of the Rippling-Deel investigation and litigation. If Deel faces significant criminal consequences or substantial civil liability, other companies in competitive markets will likely recalibrate their tolerance for aggressive competitive intelligence gathering. Conversely, if Deel successfully defends against the allegations, the case would signal that such conduct falls within acceptable competitive bounds.

Stakeholder Perspectives and Ecosystem Impact

Venture Capital Firm Interests and Governance

The venture capital firms that have funded both Deel and Rippling—including Ribbit Capital, Andreessen Horowitz, Goldman Sachs Alternatives, and Y Combinator—face reputational and financial risks related to the scandal. If an invested company engages in criminal conduct or ethical violations, the investors' selection and governance processes come under scrutiny. This particularly impacts firms like Andreessen Horowitz, which brands itself on founder selection and company culture, if one of its investments is implicated in corporate espionage.

Venture capital firms theoretically exercise governance oversight through board representation, but the Deel scandal raises questions about whether such oversight proved effective in detecting or preventing alleged misconduct. Investors may increasingly implement governance structures specifically designed to detect and prevent insider threats, corporate espionage, and other ethical violations that could expose them to regulatory scrutiny or reputational damage.

Customer and Employee Concerns

For customers evaluating HR and payroll solutions, the scandal creates legitimate concerns about data security and vendor trustworthiness. Customers considering Deel must weigh the company's product capabilities and pricing against the risks associated with the ongoing investigation and allegations. For existing Deel customers, the scandal raises questions about whether the company has adequate security controls and information governance to protect their sensitive employee data.

Employee perspectives also matter significantly. Employees of both companies face different contexts: Rippling employees can view the company as defending itself against unethical competitive conduct, while Deel employees must contend with the implications of working for a company facing federal criminal investigation. Recruitment and retention at Deel could face headwinds as talented individuals question whether joining a company with such reputational and legal challenges is prudent.

Market Dynamics and Competitive Landscape Impact

The scandal has potential to reshape competitive dynamics in the HR and payroll technology market. If Deel's growth slows due to customer defections or difficulties securing new deals, other competitors including Rippling could capture displaced customers. The scandal effectively provides Rippling with a competitive advantage despite Deel maintaining comparable valuation and funding, because prospective customers and partners can view Rippling as the ethical alternative.

Smaller competitors in the HR tech market might also benefit if the scandal causes customers to question whether they should consolidate on solutions from well-funded megacorps. The scandal could drive customers toward smaller, more specialized vendors that lack the resources to engage in alleged espionage but offer focused product capabilities without the reputational concerns of companies engaged in high-stakes litigation.

Expert Analysis and Industry Commentary

What Cybersecurity and Legal Experts Observe

Experts in corporate espionage, cybersecurity, and white-collar criminal law have noted that the Rippling-Deel case exemplifies the intersection of technological sophistication and old-fashioned human intelligence operations. The case involves neither particularly sophisticated technical espionage nor dramatic international spy craft—instead, it involves hiring employees to steal information and funneling payments through intermediary accounts, techniques that would be familiar to law enforcement professionals who prosecute organized crime.

Legal experts emphasize that the use of the RICO statute in the civil complaint and the potential for federal criminal charges mark this case as unusually serious. Most competitive disputes between tech companies are resolved through market competition or civil litigation focused on specific intellectual property or contract breaches. The application of organized crime frameworks suggests that both Rippling and potential federal prosecutors view the conduct as systematic and coordinated rather than isolated misconduct by rogue employees.

Governance and Ethics Professionals

Corporate governance and ethics professionals view the scandal as a cautionary tale about the potential for venture capital's hypergrowth orientation to create incentive structures that override ethical considerations. When founders and executives have substantial financial interest in achieving high valuations and market dominance, and when competitive pressure from well-funded rivals threatens those objectives, the temptation to employ questionable tactics can become acute.

Ethics and governance professionals recommend that boards of directors at venture-backed companies implement robust ethics programs, compliance training, and whistleblower mechanisms to detect and prevent corporate misconduct. They also recommend that investors conduct more thorough due diligence on founders' ethical track records and corporate culture, because allegations of espionage or other unethical conduct can substantially damage company valuations and create legal liability for investors.

Conclusion: Lessons from the Rippling-Deel Scandal

The Rippling-Deel corporate espionage scandal represents a watershed moment in Silicon Valley's competitive history, demonstrating that the boundaries of acceptable competitive conduct have been tested and found to be narrower than some market participants apparently believed. What began as a civil lawsuit alleging hiring of a corporate spy has escalated into an alleged federal criminal investigation, transforming a business dispute into a potential criminal matter with profound implications for all involved parties.

The scandal reveals multiple layers of complexity: the alleged conduct of hiring and paying a spy, the subsequent revelation of surveillance operations, the sophisticated financial transfers designed to obscure payment sources, and the involvement of senior company leadership in approving or facilitating the alleged activities. The credibility of this narrative is substantially strengthened by the existence of a confessed perpetrator willing to testify about the conduct, contemporaneous bank records documenting suspicious financial transactions, and physical evidence of surveillance activities.

For the venture capital industry, the scandal should prompt serious reflection on governance structures, due diligence practices, and the incentive frameworks that might encourage otherwise ethical founders to pursue ethically questionable competitive tactics. The case demonstrates that even well-funded, well-regarded companies facing competitive pressure can cross legal and ethical lines, and that federal law enforcement will investigate and potentially prosecute such conduct.

For the HR and payroll technology market more broadly, the scandal creates competitive opportunities and risks that will shape the industry's future competitive dynamics. Companies that successfully brand themselves as ethical alternatives to competitors implicated in espionage allegations will benefit from customer preference and market share gains. Conversely, companies facing allegations or investigations suffer substantial reputational and competitive damage that can persist for years.

For prospective customers evaluating HR and payroll solutions, the scandal highlights the importance of assessing vendor trustworthiness, information security practices, and corporate governance as factors alongside product capabilities and pricing. A vendor that handles sensitive employee and payroll information should be evaluated not just on feature sets but on demonstrated commitment to ethical conduct, security practices, and transparent governance.

The ultimate resolution of the Rippling-Deel scandal—whether through criminal prosecution of Deel executives, substantial civil settlements, guilty pleas with agreed outcomes, or some combination thereof—will provide crucial guidance about the boundaries of acceptable competitive conduct in venture-backed technology companies. Regardless of the ultimate legal outcome, the scandal has already reshaped competitive perceptions and demonstrated that allegations of corporate espionage have consequences far beyond financial damages, affecting reputation, recruitment, customer relationships, and the ability to secure future funding.

As the federal investigation proceeds and civil litigation continues, both companies face substantial uncertainty about outcomes, costs, and long-term competitive implications. The investment community's continued support for both companies suggests confidence in their ultimate competitive positions, but the reputational scars from alleged espionage and federal investigation will likely persist for years, shaping how these companies are perceived by customers, partners, and investors.

FAQ

What is the Rippling-Deel corporate espionage scandal?

The Rippling-Deel corporate espionage scandal involves allegations that Deel, an HR and payroll software company, hired a corporate spy to infiltrate Rippling, its primary competitor, and steal confidential information including sales leads, product roadmaps, and customer data. Rippling sued Deel in May 2025, later filing a revised complaint that invoked federal racketeering law (RICO) and characterized the conduct as organized criminal activity. In January 2026, the Wall Street Journal reported that the Department of Justice had opened a criminal investigation into Deel's alleged activities, elevating the dispute from civil litigation to potential federal criminal prosecution.

What evidence supports the espionage allegations?

The primary evidence supporting the allegations includes: (1) a confessed spy who provided sworn testimony admitting to stealing information from Rippling and transferring it to Deel executives; (2) bank records showing suspicious financial transfers from Deel through an account held by Deel's COO's spouse to an account held by the confessed spy, completed within 56 seconds; (3) documented surveillance operations conducted by Deel against the confessed spy and his family; (4) specificity about the types of information allegedly stolen (sales leads, product roadmaps, customer information); and (5) cooperation agreements and witness testimony that corroborate the conspiracy narrative. This combination of eyewitness testimony, financial documentation, and physical evidence creates a substantial evidentiary record supporting the allegations.

What are the potential criminal charges Deel could face?

If the DOJ investigation results in criminal charges, Deel could potentially face charges including wire fraud (using financial systems to execute a fraud scheme), money laundering (engaging in financial transactions with funds derived from unlawful activity), conspiracy (agreement to commit crimes with overt acts in furtherance), and potentially RICO violations (participation in an enterprise engaged in a pattern of racketeering). Wire fraud carries maximum sentences of 20 years per count, money laundering carries maximum sentences of 10 years, and RICO carries enhanced penalties and asset forfeiture provisions. The presence of a confessed perpetrator and documented financial transactions substantially increases prosecutorial likelihood of securing convictions.

How does the DOJ investigation differ from the civil lawsuit?

The civil lawsuit filed by Rippling seeks monetary damages and injunctive relief based on alleged tort violations and contract breaches, with the burden of proof being "preponderance of the evidence" (more likely than not). The DOJ's criminal investigation seeks to establish guilt beyond a reasonable doubt for violations of federal criminal statutes, with potential consequences including imprisonment, criminal fines, and felony convictions. Criminal investigation typically targets individual defendants for personal criminal liability rather than just seeking corporate liability. The criminal investigation carries far more severe consequences for individuals convicted, potentially including lengthy prison sentences and permanent felony records.

Why did Deel continue to raise funding despite the scandal?

Deel announced a

What does the surveillance evidence reveal about Deel's conduct?

The revelation that Deel hired a surveillance firm to monitor the confessed spy after he agreed to cooperate with Rippling raises serious concerns about witness intimidation and potentially criminal obstruction of justice. The spy and his family allegedly lived in fear of being monitored, creating emotional and psychological harm. This escalation from information theft to active surveillance of a cooperating witness demonstrates aggressive conduct that goes beyond the original espionage allegations and provides potential basis for additional criminal charges including witness tampering and intimidation. Deel's initial denial of surveillance followed by the discovery that the company had actually hired surveillance operatives damaged the company's credibility and suggested consciousness of guilt.

How do the bank records implicate senior Deel leadership?

The bank records obtained in discovery reveal a suspicious transfer pattern: Deel transferred funds into an account held by Deel's Chief Operating Officer's wife, and 56 seconds later, that account transferred an identical amount to an account held by the confessed spy. This timing and structure suggests intentional laundering designed to obscure the direct connection between Deel and payments to the spy, while the use of the COO's account implies knowledge and participation by senior company leadership. For prosecutors, these records create a documentary trail that is difficult to challenge or reinterpret, unlike testimony that can be subject to bias or memory distortion. The involvement of the COO's account specifically implicates that executive in the payment scheme, creating individual criminal liability exposure for participating in or approving payments to the hired spy.

What role does RICO law play in this case?

Rippling's invocation of the Racketeer Influenced and Corrupt Organizations (RICO) statute in its civil complaint is significant because RICO is traditionally used to prosecute organized crime. RICO requires proving an enterprise, participation in its affairs, a pattern of racketeering activity (including wire fraud and mail fraud), and injury caused by that pattern. By framing Deel's alleged conduct as participation in a "criminal syndicate," Rippling signaled that it viewed the conduct as systematic and coordinated rather than isolated misconduct. RICO carries enhanced penalties including potential for treble damages in civil cases and asset forfeiture in criminal cases. If federal prosecutors adopt similar RICO framing in criminal charges, the case becomes dramatically more serious with substantially enhanced sentencing exposure and civil liability implications.

What are the implications for HR technology market competition?

The scandal reshapes competitive dynamics in the HR and payroll technology market by creating reputational advantages for companies that can position themselves as ethical alternatives. Rippling benefits from being perceived as defending itself against unethical conduct while maintaining ethical standards, while Deel faces customer concerns about trustworthiness and information security. Prospective customers evaluating vendors must now consider not just product capabilities and pricing but also vendor ethics, governance practices, and information security as factors. The scandal could drive customer preference toward competitors perceived as ethically superior, could accelerate consolidation in the market as smaller competitors gain advantages, and could prompt regulatory scrutiny of the sector focusing on data security and competitive conduct standards.

What warnings does this case provide for other tech companies?

The Rippling-Deel scandal provides several crucial warnings: (1) Federal law enforcement will investigate and prosecute corporate espionage, particularly when evidence is strong and perpetrators cooperate; (2) Paid informant arrangements and sophisticated financial transfers designed to obscure payment sources are prosecutable as money laundering and fraud; (3) Surveillance of potential witnesses or cooperating parties creates additional criminal exposure for witness intimidation and obstruction of justice; (4) Venture capital funding and company valuations provide no protection against federal criminal investigation or prosecution; and (5) Reputational damage from espionage allegations can be substantially more costly than the immediate legal and financial costs because it affects customer relationships, recruitment, partnerships, and future fundraising. Companies should implement robust ethics programs, compliance training, and insider threat detection to prevent or quickly identify similar conduct before it escalates to federal investigation levels.

How might the case be resolved?

The Rippling-Deel case could be resolved through several pathways: (1) Federal prosecution resulting in guilty pleas or trial convictions; (2) civil settlement between the companies resolving monetary damages and potentially incorporating confidentiality terms limiting public disclosure; (3) cooperation agreements with individuals (potentially CEO Bouaziz or other executives) in exchange for testimony against others; (4) plea agreements with reduced charges or agreed sentencing recommendations; or (5) some combination of criminal prosecution of individuals with corporate settlement agreements. The presence of a confessed cooperating witness, documented financial evidence, and potential witness intimidation strengthens federal prosecutors' negotiating position and creates pressure toward unfavorable outcomes for Deel. Ultimate resolution will likely involve substantial financial costs, individual criminal liability for executives, and ongoing reputational damage that persists well beyond legal resolution.

Key Takeaways

- The Rippling-Deel scandal escalated from civil litigation to alleged federal criminal investigation, marking unprecedented use of organized crime frameworks in tech competition disputes

- Evidence includes a confessed spy providing sworn testimony, suspicious bank transfers showing payment through the COO's account, and documented surveillance operations against witnesses

- Potential criminal charges could include wire fraud (20-year maximum sentences), money laundering, conspiracy, and RICO violations with enhanced penalties and asset forfeiture

- Both companies continue attracting venture capital funding (16.8B for Rippling) despite legal exposure, suggesting investor confidence in market opportunities

- The case has transformed corporate competitive norms by demonstrating that federal law enforcement will prosecute organized espionage, reshaping expectations for ethical conduct in venture-backed startups

- Bank records showing 56-second transfer sequence between Deel, COO's spouse account, and alleged spy account created objective documentary evidence of payment mechanism

- Rippling positioned itself as defending against unethical conduct while maintaining ethical standards, creating competitive advantages in customer preference and market share

- The scandal reveals governance gaps in venture-backed companies and raises questions about board oversight effectiveness in detecting and preventing corporate misconduct

- Ongoing litigation and investigation create multiple resolution pathways including federal prosecution, civil settlement, cooperation agreements, and potentially guilty pleas with reduced charges

- For HR technology market and broader tech industry, the case establishes legal boundaries for competitive conduct and signals that aggressive competitive intelligence gathering can cross into federal criminal liability

Related Articles

- OpenAI's Sales Leader Joins Acrew VC: AI Startup Moat Strategy 2025

- Why Deepinder Goyal Stepped Down as Eternal CEO in 2025

- Thinking Machines Cofounder: Workplace Misconduct & AI Exodus

- Thinking Machines Lab Exodus: OpenAI's Talent War & AI Industry Implications

- AI Companies & US Military: How Corporate Values Shifted [2025]

- Shadow AI in 2025: Enterprise Control Crisis & Solutions