Why Deepinder Goyal's CEO Departure Signals a Massive Shift in Indian Quick Commerce

On a Wednesday in January 2026, the Indian startup world got a shock. Deepinder Goyal, the co-founder and CEO of Zomato and its parent company Eternal, was stepping down. After nearly two decades building one of India's most successful food delivery empires, he was handing the keys to Albinder Dhindsa, the CEO of Blinkit, Eternal's quick-commerce division. According to Reuters, this leadership change marks a significant shift in the company's strategic direction.

But here's the thing. This wasn't a sudden departure. Goyal wasn't forced out. He's staying on as vice chairman. This was a calculated move, and it says something profound about where Indian commerce is heading. As reported by Indian Express, Goyal's decision reflects his desire to focus on more experimental ventures outside the constraints of a public company.

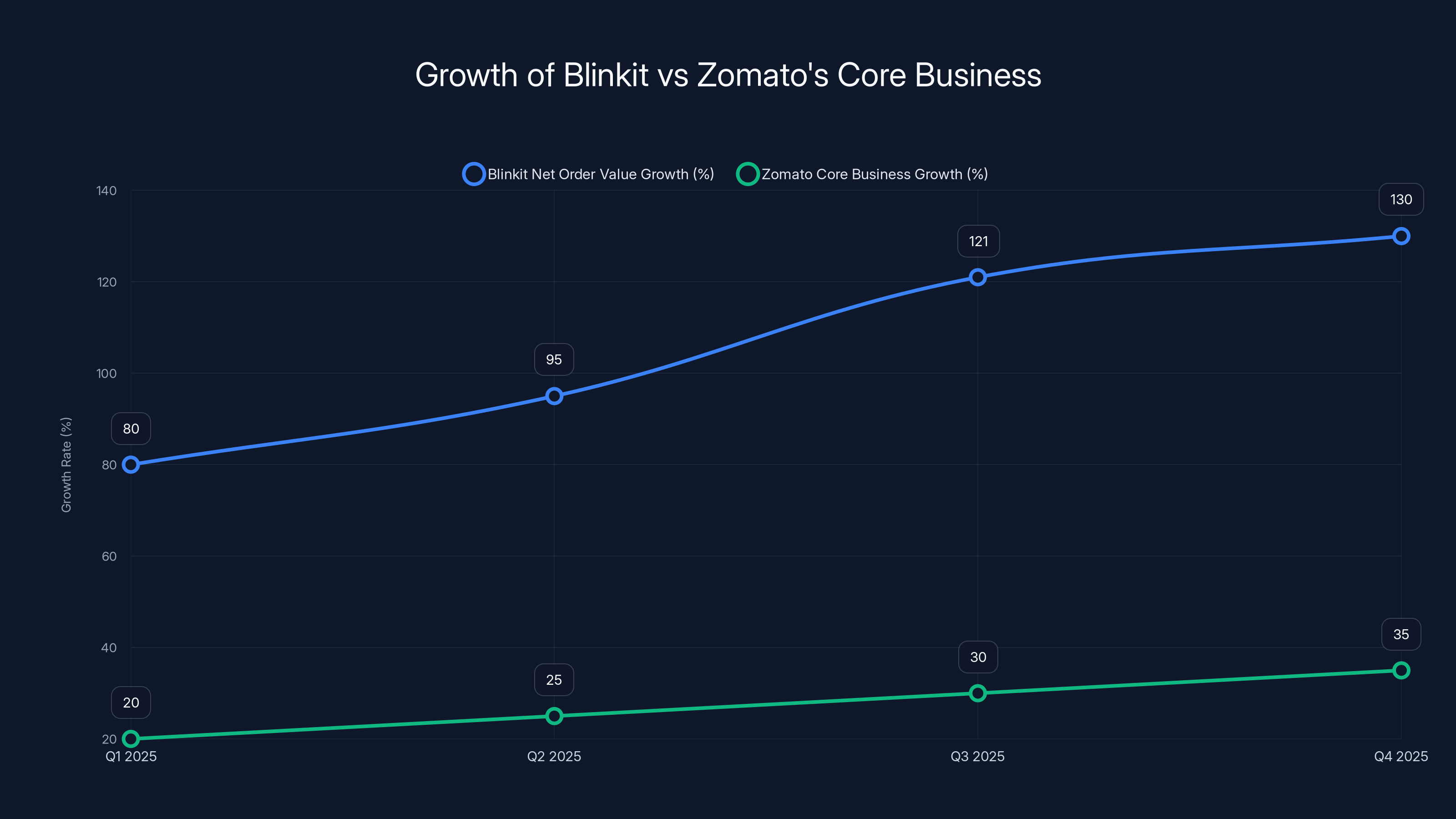

The quick-commerce sector has exploded. Blinkit is now moving faster than Zomato's core food delivery business. That's not speculation—the numbers prove it. In the third quarter alone, Blinkit's net order value jumped 121%, while the company's overall profitability climbed 73%. When one division starts outpacing your flagship business, leadership questions get real fast. According to MSN, Blinkit's growth trajectory has been a key factor in the leadership transition.

Goyal's public reasoning was candid. He wanted to focus on "higher-risk exploration and experimentation," harder to pursue inside a listed company. He's already invested in longevity research through his project Continue Research, developed a brain-health wearable called Temple, and co-founded LAT Aerospace. These aren't side hustles. They're serious bets on the future. But they'd be impossible to pursue while managing an $18+ billion company with quarterly earnings calls and investor expectations.

What makes this transition remarkable isn't just the leadership change. It's what it reveals about market dynamics, founder psychology, and the future of commerce in India. Quick commerce isn't just growing faster than food delivery anymore. It's consuming resources, attention, and strategic focus.

Let's unpack what actually happened, why it matters, and what comes next.

The Zomato Origin Story: From Foodie Bay to Food Delivery Empire

Deepinder Goyal and Pankaj Chaddah started Zomato in 2008 as Foodie Bay while working at Bain & Company. The original idea was simple but ambitious: aggregate restaurant information and reviews across Indian cities. They weren't trying to deliver food. They were trying to solve a basic problem: how do you find a good restaurant?

Back then, India's internet adoption was fragmented. Restaurant discovery was chaotic. You'd ask friends, check printed guides, or just pick something random. Foodie Bay aimed to digitize that. Predictably, eBay's legal team objected to the name. In 2010, they rebranded as Zomato.

The rebranding wasn't cosmetic. It represented a shift in thinking. The company was moving beyond a city-by-city approach to building a platform designed for scale. They expanded aggressively across Indian metros and into Southeast Asia.

But restaurant discovery has limits. The real money was in food delivery. In 2015, Zomato entered the delivery market. This was controversial internally. Delivery is capital-intensive. It requires drivers, infrastructure, and logistics. Discovery is software. Delivery is operations. Goyal believed they could build both simultaneously.

He was right. By 2018, when co-founder Pankaj Chaddah left to pursue other ventures, Zomato was already on track to dominate India's food delivery market. Goyal's strategic acquisitions proved prescient. In 2020, Zomato acquired Uber Eats' India operations for a reported

That acquisition looked expensive at the time. Quick commerce was nascent. Delivery riders attempting 10-minute delivery windows seemed like insanity. But Goyal saw something others missed: the infrastructure Zomato had built for food delivery could be repurposed for quick commerce. The logistics network, the rider base, the warehousing expertise—all transferable.

Blinkit's growth trajectory has vindicated that bet spectacularly, as noted in Bloomberg.

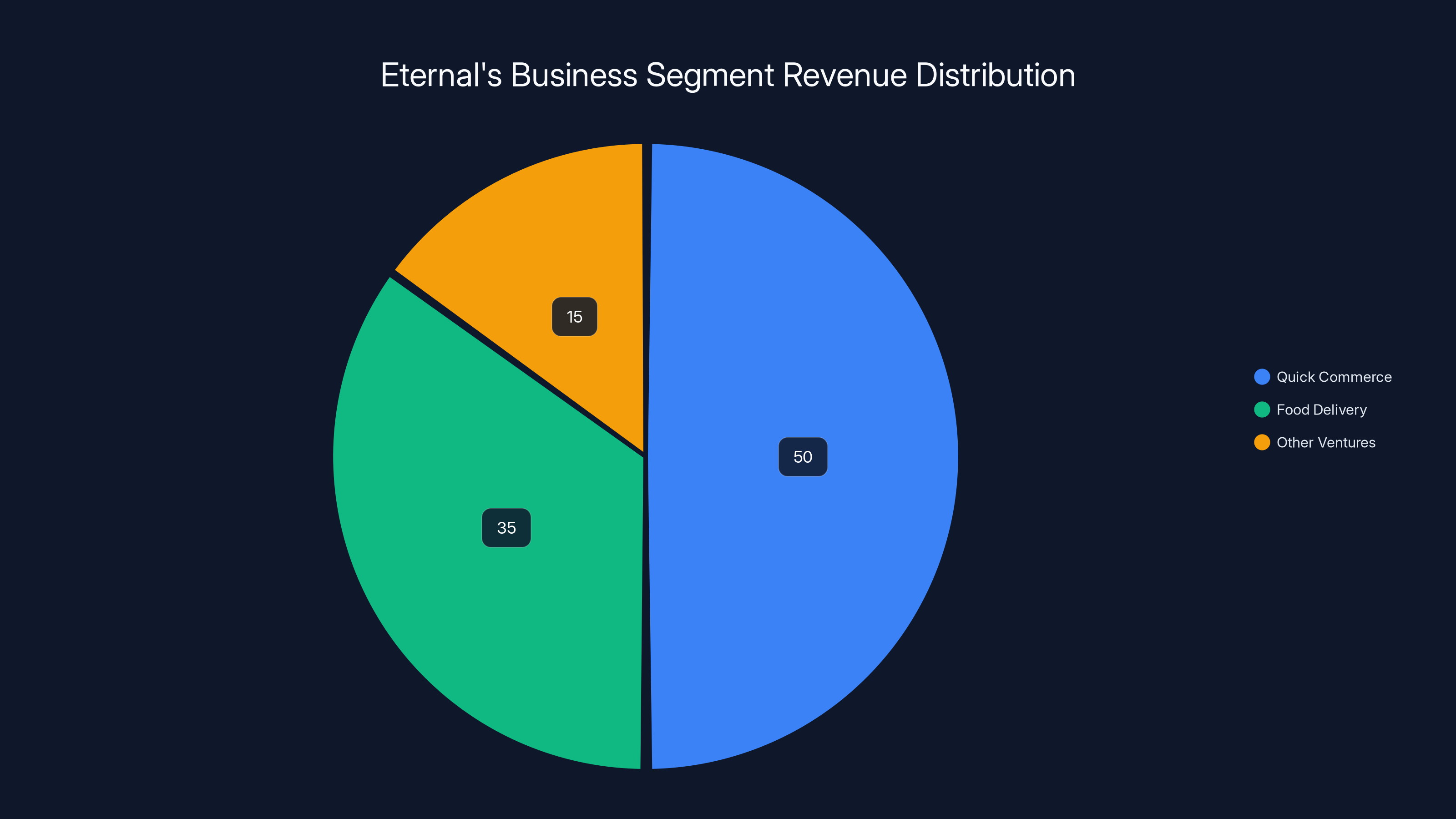

Quick commerce is estimated to be the largest revenue segment for Eternal, reflecting its strategic priority and rapid growth. Estimated data.

The Rise of Quick Commerce: Why 10-Minute Delivery Changed Everything

Quick commerce didn't invent convenience. It just weaponized it. The premise is radical: order groceries, snacks, household items, electronics, and get them delivered in 10 minutes. Sometimes less. Blinkit's marketing hammered this relentlessly. Ten minutes became the industry standard to chase.

From a logistics perspective, this is insanely complex. You need micro-warehouses in residential neighborhoods, sophisticated routing algorithms, and gig workers who can work at a blistering pace. You need unit economics to work at scales that make most logistics companies nervous.

But it worked. Particularly in urban India where millions of young professionals live in cramped apartments without time to shop. Late-night snack cravings? Blinkit. Forgot milk? Blinkit. Wine at midnight? Blinkit.

The market responded aggressively. By early 2026, quick commerce had become the fastest-growing commerce segment in India. Growth rates that would make traditional retail blush. Blinkit's net order value grew 121% year-over-year. That's not sustainable forever, but it's the trajectory of a category hitting mainstream adoption.

Food delivery, meanwhile, has matured. The market is crowded. Competition is fierce. Margins are thin. Growth rates are respectable but incremental. Zomato reports growth, but it's growth from a massive base, not explosive percentage jumps. That changes the narrative. As a CEO running a listed company, you're pressured to drive growth. When one division is growing at double-digits percentage-wise and another is growing single digits, where does your attention go?

For a founder, the calculation is different. Goyal saw the shift coming. Quick commerce is hungrier, riskier, and requires different thinking than food delivery. The best founder for food delivery might not be the best founder for quick commerce. Dhindsa proved himself running Blinkit through hypergrowth. Maybe he's the right person to lead the entire organization.

But there's another factor no one explicitly mentions. As a listed company, Zomato faces regulatory scrutiny. When you're public, you answer to the board, institutional investors, and regulators. When working on cutting-edge, experimental projects—like brain-health wearables or aviation startups—you operate in legal and regulatory gray areas. Those projects need founder-level attention, but they can't get it inside a public company structure. Goyal recognized that tension and resolved it cleanly.

Albinder Dhindsa: The Blinkit CEO Ready to Lead Eternal

Albinder Dhindsa isn't a household name outside Indian startup circles, but he should be. Dhindsa took over Blinkit after its acquisition by Zomato and steered it through explosive growth. He managed the integration, maintained company culture, and navigated the chaotic quick commerce market without losing focus. According to Moneycontrol, Dhindsa's leadership has been pivotal in Blinkit's success.

That's harder than it sounds. When you're acquired by a larger company, cultural clashes are typical. Blinkit had a scrappy startup ethos. Zomato was already an established organization. Dhindsa held the line on what made Blinkit special while integrating with Eternal's infrastructure where it made sense.

His track record running Blinkit speaks clearly. The division is outpacing food delivery. That performance earned him this promotion. In Indian corporate culture, this is notable. Founders typically don't hand off the reins unless succession planning forces them or they trust deeply. Goyal's public endorsement of Dhindsa carried weight.

Dhindsa's leadership style appears to align with what quick commerce requires: speed, operational excellence, and comfort with chaos. Food delivery matured into a quasi-operational, quasi-SaaS business. Quick commerce is still pure logistics theater. It's driver management at scale, real-time routing, micro-decisions about warehouse placement. Different skill set. Different mindset.

The question investors immediately asked: Can Dhindsa lead an $18+ billion conglomerate? Blinkit is a high-growth division, but Eternal includes multiple business units, regulatory complexity, board dynamics, and investor relations. It's a different role. We'll find out.

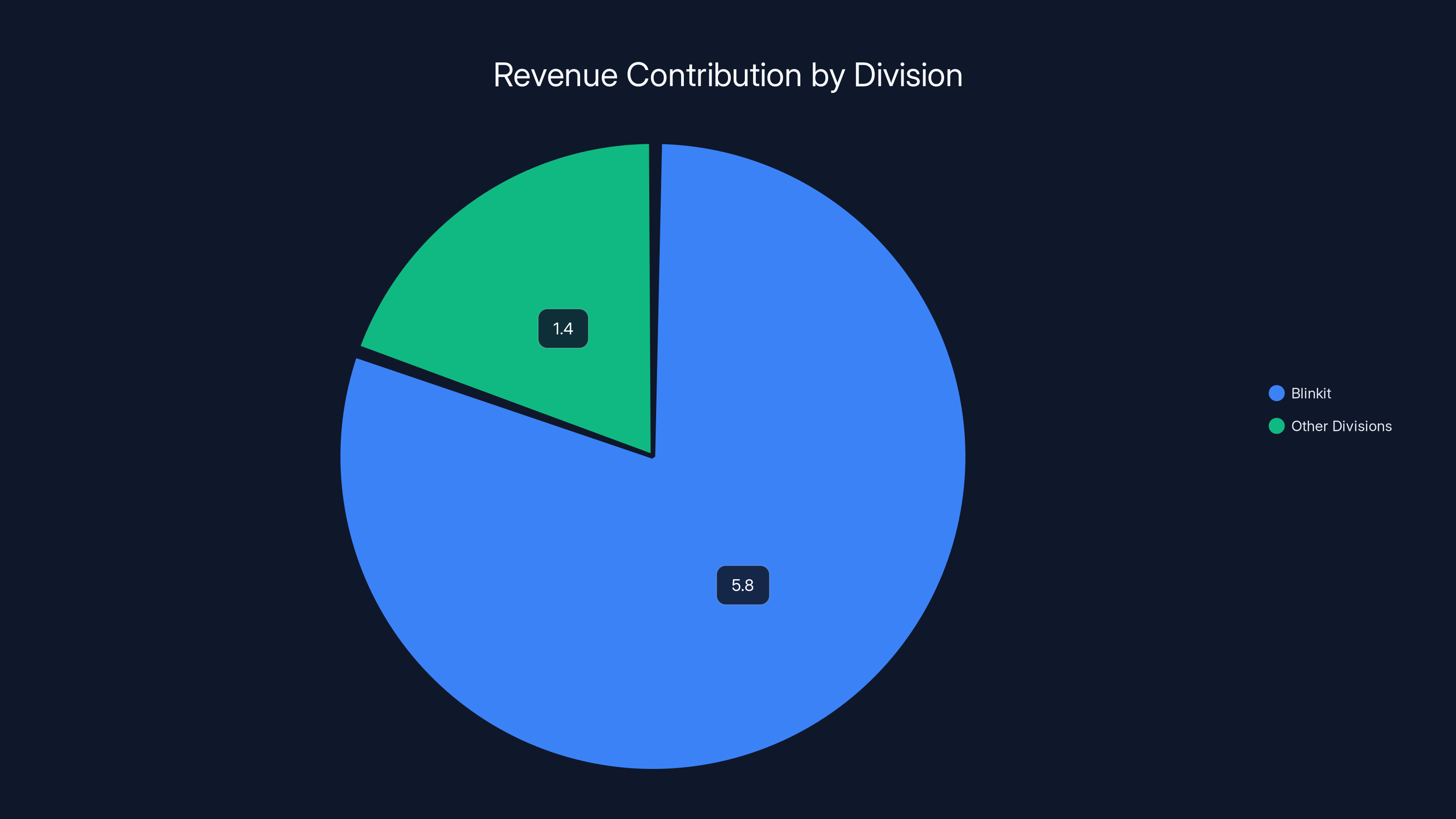

Blinkit contributes approximately

Why Goyal's Move to "Higher-Risk Exploration" Matters More Than It Seems

Goyal's stated reason for stepping down was revealing. He wanted space for "higher-risk exploration and experimentation," harder inside a listed company. That phrasing deserves decoding.

Public companies live in quarterly cycles. Investors demand predictability. Earnings calls require explanations for variance. New initiatives that don't contribute to quarterly revenue are viewed skeptically. When you're allocating resources, shareholders want those resources deployed in core business or clearly marked "R&D with defined ROI timelines."

Goyal's projects don't fit that box. Continue Research focuses on longevity science. That's long-term, speculative, and might never generate revenue for Eternal. Temple, a brain-health wearable, is experimental biotech. LAT Aerospace is aviation. These aren't adjacent to food delivery or quick commerce. They're completely orthogonal bets.

Inside a public company, that looks like distraction. Founder distraction can spook investors. It signals declining focus on the core business. Goyal's move sidesteps that entire narrative. By stepping down, he gains freedom to pursue these projects while keeping investors happy.

But there's a deeper point. Goyal is explicitly choosing optionality and exploration over operational leverage. He could have stayed CEO, raked in the salary, and maintained status. Instead, he's stepping back into a vice chairman role—influential but not day-to-day operational. The revenue potential from his new projects is uncertain. The status is lower. But the freedom is total.

This choice reveals something about how successful founders think. After building something worth $18+ billion, the marginal utility of another billion dollars diminishes. What becomes valuable is autonomy, interesting problems, and the ability to think long-term. Staying CEO would have locked him into managing quarterly performance. Stepping down unlocked everything else.

Investors should recognize this. Goyal's commitment to Eternal didn't vanish. He remains vice chairman. His reputation is tied to the company's success. He has board influence. But his daily decision-making bandwidth is allocated toward new frontiers. That's arguably better than a distracted CEO.

The Financial Numbers Behind This Transition

Eternal's third-quarter results provide crucial context for understanding why this transition happened now rather than later.

Profit rose approximately 73% year-over-year to ₹1.02 billion, which converts to roughly

Adjusted revenue hit ₹166.92 billion, or about $1.8 billion, up 190% from the prior year. This is explosive growth at scale. A company growing revenue 190% year-over-year while operating at profitability is rare globally. That said, the profitability margins are thin. You're looking at roughly 0.6% net profit margins on that revenue.

That margin structure tells a story. Eternal operates in brutally competitive sectors. Food delivery margins are notoriously thin. Quick commerce is even thinner because of the infrastructure required. Every rupee of growth requires heavy investment in logistics, warehousing, and labor.

Blinkit's numbers are where momentum concentrates. Net order value jumped 121% to ₹133.0 billion, or roughly

From a capital allocation standpoint, quick commerce is sucking resources. It's also generating growth that investors pay premiums for. Food delivery is mature. Quick commerce is explosive. As a CEO, you want to pivot resources and attention toward growth. As a founder tired of operational management, you want to hand off those responsibilities to someone designed for the job.

These financial dynamics explain why now was the right time. Dhindsa's appointment signals confidence that quick commerce growth can continue under new leadership. It also signals that Goyal's energy was better spent elsewhere.

Quick Commerce's Regulatory Challenges: The Labor Question

Here's where the story gets complicated. Quick commerce's explosive growth has created a labor controversy. India's labour ministry recently asked quick commerce platforms to drop the "10-minute delivery" marketing and implement measures to improve working conditions for delivery personnel.

The issue is real. Achieving 10-minute deliveries requires workers to move at an unsustainable pace. There are documented cases of exhaustion, injury, and burnout among quick commerce workers. The pressure to maintain speed creates an environment where corners get cut on safety.

Ethically and legally, this matters. India's labour ministry isn't joking around. Regulatory pressure on gig platforms is rising globally. When regulators push, companies face choices: slow down, pay workers more, or find ways to maintain speed while improving conditions. All three impact margins.

For Dhindsa, this is a leadership test. How does he manage growth while navigating labour scrutiny? Goyal's pivot away from day-to-day operations means he won't own the regulatory strategy personally. That responsibility falls on Dhindsa. It's a harder job than maintaining momentum at growth stage. It's about managing tensions between growth, profitability, and social responsibility.

The regulatory environment will likely get tighter as quick commerce matures. European regulators have already been aggressive with gig platforms. India will follow. Whoever leads Eternal needs to think about that trajectory, not just Q1 growth numbers.

This regulatory headwind is almost certainly part of why Goyal stepped down. These complications are easier to manage if you're not responsible for quarterly earnings. As vice chairman, Goyal can advise strategy without bearing accountability for regulatory friction.

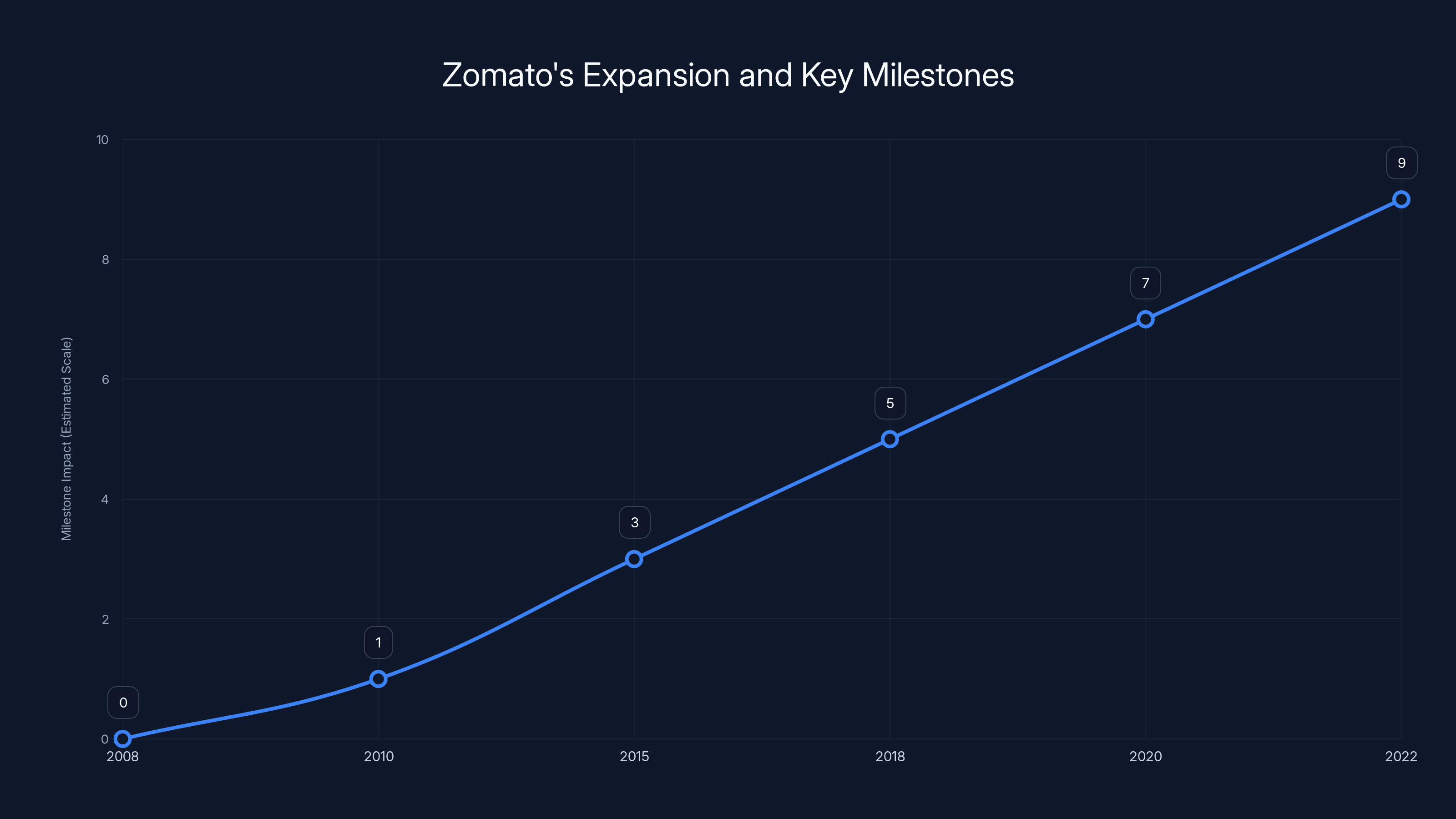

Zomato's journey from FoodieBay to a food delivery giant involved strategic rebranding and acquisitions, with major milestones in 2010, 2015, 2020, and 2022. Estimated data reflects key strategic moves.

The Competitive Landscape: Blinkit vs. Rivals

Blinkit isn't alone in quick commerce. The market includes Dunzo, Instacart-backed players, and new entrants funded by aggressive VCs. Competition is fierce and only intensifying.

Blinkit's advantages are structural. The Zomato/Eternal integration gives it logistics infrastructure and driver relationships that took years to build. When Zomato acquires Blinkit, it's acquiring not just the company but the network effects and operational capability. Most quick commerce startups have to build logistics from scratch. Blinkit inherited a head start.

But advantages erode. Competitors are well-funded. They're learning from Blinkit's playbook. Growth rates are converging. Market share battles are intensifying. Blinkit's 121% growth is impressive, but if competitors are growing 100%+, the narrative shifts from "we're dominating" to "we're one of several fast-growing players."

Under Goyal, Eternal could afford to think patient. The founder's long-term vision could temper short-term pressure to sacrifice margin for growth. Under Dhindsa, there's more uncertainty. How aggressive will he be on growth vs. profitability? Will he maintain Goyal's strategic patience or pivot toward faster monetization? These questions matter for Blinkit's long-term position.

The competitive intensity makes Goyal's departure timing smart. Quick commerce will get harder to compete in. Margins will compress. Working conditions will improve, raising costs. The easy growth phase is ending. The harder phase—sustainable, profitable quick commerce operations—is beginning. Dhindsa is taking over when the game shifts from expansion to optimization.

Goyal's New Ventures: Continue Research, Temple, and LAT Aerospace

Understanding Goyal's next act requires understanding his new projects. These aren't passion projects. They're deliberate bets on emerging categories.

Continue Research focuses on longevity science. The premise is straightforward: aging is a disease. Most medical research fights diseases like cancer or heart disease. Longevity research treats aging itself as the problem. It's a controversial field, but it's attracting serious capital. Companies like Calico (backed by Google/Alphabet) and Human Longevity Inc. have raised hundreds of millions. Goyal sees opportunity in this space.

Temple is a brain-health wearable. That's vague intentionally—the product is still experimental. But the category is real. Neurotechnology is advancing rapidly. Devices that monitor brain health, detect early cognitive decline, or optimize mental performance are coming. Goyal's bet on Temple suggests he believes brain health will become a major health category over the next 10 years.

LAT Aerospace is the wildcard. Aviation is capital-intensive, regulated, and hard. Why would a founder obsessed with software-driven logistics suddenly invest in aerospace? Probably because the macro-level trend (sustainable aviation, electric vehicles, autonomous flight) is compelling. Goyal might see parallels between on-demand delivery logistics and autonomous air mobility. He's hedging across multiple long-term bets.

Collectively, these projects paint a picture of a founder thinking about problems that are 10-20 years out. Food delivery was a 5-year problem (solved). Quick commerce is a 3-5 year problem (being solved). But longevity, brain health, and autonomous aviation are 10+ year problems. You can't pursue those seriously while managing quarterly earnings calls.

Goyal's stepping down isn't retirement. It's redeployment toward different time horizons.

Leadership Transitions in Founder-Led Companies: Lessons and Risks

Founder transitions are always delicate. The company was built in the founder's image. Culture, strategy, and decision-making patterns all reflect the founder's personality. When the founder steps down, there's inherent risk of cultural drift or strategic whiplash.

Goyal mitigated this by staying on the board as vice chairman. That keeps him involved in major decisions. It also signals to employees and investors that he's not abandoning the company. His reputation is still tied to Eternal's success.

But there are risks. Goyal and Dhindsa might disagree on strategy. How does Dhindsa handle that dynamic? Is he confident enough to make decisions Goyal would have made differently? Or does he defer to the founder? If Dhindsa defers too much, he's not really leading. If he diverges too much, he risks alienating Goyal and spooking investors.

Successful founder transitions hinge on clarity. What decisions is the new CEO empowered to make unilaterally? Which require board input? How often does the founder weigh in? These questions should be answered explicitly, not left ambiguous.

Global precedent is mixed. Satya Nadella took over Microsoft from Steve Ballmer (not the founder, but the guard) and thrived. Mark Zuckerberg remained CEO while bringing in Sheryl Sandberg and others—that worked. Sundar Pichai took the Alphabet/Google CEO role from Larry Page—also successful. But there are failures too. HP's CEO transitions were chaotic. Microsoft's pre-Nadella years saw multiple leadership changes that didn't stick.

The difference often comes down to founder involvement. When founders stay engaged but don't micromanage, transitions work. When they disappear entirely, successors lack guidance. When they're overbearing, successors lack autonomy. Goyal's vice chairman role seems designed to split the difference.

Albinder Dhindsa excels in speed and operational excellence, crucial for quick commerce. Estimated data based on his track record.

What This Means for Eternal's Strategic Direction

So what happens to Eternal's strategy now? Several scenarios are plausible.

Scenario 1: Acceleration. Dhindsa is less risk-averse than Goyal. He accelerates quick commerce expansion. Invests more aggressively in adjacent categories. Pushes for margin compression in favor of market share growth. Blinkit becomes the strategic focus. Food delivery becomes a cash cow.

Scenario 2: Diversification. Dhindsa sees quick commerce growth as inevitable but wants to reduce concentration risk. He expands Eternal into new categories (cloud services, SaaS, edtech, payments). Builds multiple growth engines instead of betting everything on quick commerce.

Scenario 3: International. Dhindsa sees opportunity in exporting Eternal's model to Southeast Asia. Singapore, Indonesia, Philippines. Uses Eternal's brand and infrastructure to launch regional quick commerce. Becomes an Asian champion, not just Indian.

Scenario 4: Stabilization. Dhindsa focuses on sustainable, profitable growth. Less emphasis on explosive percentage gains. More emphasis on unit economics, retention, and long-term viability. This would disappoint growth-obsessed investors but align with building durable business.

Goyal's departure gives Dhindsa the latitude to choose. Under a founder, options are constrained by founder vision. Dhindsa can make that choice himself. The question is which direction he chooses and whether investors support it.

Likely outcome: Probably a mix. Dhindsa probably accelerates quick commerce while maintaining food delivery profitability. That's the safest play. It delivers growth for investors, maintains base business stability, and reduces existential risk. But it's also less innovative than the other scenarios.

The Indian Tech Ecosystem: What Goyal's Move Signals

Goyal's departure is notable beyond Eternal. It signals something about the maturation of India's tech ecosystem. The age of founder-as-permanent-CEO is ending. Successful Indian founders are increasingly comfortable with succession planning, board structures, and bringing in professional management.

Compare this to 2010. Back then, founder-CEO was the norm in Indian tech. Stepping down meant failure or death. Today, it's a strategic choice. Founders can think about their own time allocation. They can pursue other opportunities without abandoning their creations.

This is healthy for the ecosystem. It creates stability. It allows capital to cycle. It enables founder energy to be redeployed toward new problems. Goyal stepping down from Eternal doesn't hurt Zomato/Eternal. It strengthens the ecosystem by freeing founder capital for new ventures.

You see this globally too. Sundar Pichai stepping into the Alphabet CEO role freed Larry Page to think bigger picture. Sheryl Sandberg taking operational roles at Facebook freed Mark Zuckerberg to focus on product and strategy. Professional management enables founder leverage.

For India, this is progress. The startup ecosystem is mature enough to handle complex organizational structures where founders aren't permanently in operational roles.

Quick Commerce's Unit Economics: The Underlying Math

Why is quick commerce growing so fast? Because customers love it. But why can companies afford to offer it? Unit economics.

Food delivery has notoriously bad unit economics. Restaurants make money. Delivery platforms barely profit on individual orders, relying on volume and ecosystem lock-in. Quick commerce has different dynamics.

Consider a typical quick commerce order: $15-20 value. Basket size is small but multiple-times-per-week frequency is high. A customer might order from Blinkit 3-4 times weekly instead of Zomato 2-3 times weekly. Higher frequency drives better cohort economics.

Second, quick commerce margins on goods are different. Restaurants set menu prices. Blinkit negotiates with CPG brands. That's different leverage. Gross margins on quick commerce goods are often higher than on restaurant meals. A bottle of soda has better margins than a delivery-pizza meal.

Third, quick commerce can be more efficient logistically. Food delivery requires thermals, careful handling, temperature control. Groceries are more forgiving. The logistics are simpler. Lower operational cost per order.

Fourth, quick commerce can be subsidized more easily. Early-stage quick commerce companies can afford to lose money on individual orders to build volume and data. They're betting that as volume grows, unit economics improve through network effects and scale.

This math changes as quick commerce matures. Subsidies end. Margins compress. Efficiency improvements plateau. That's when the real business emerges. Quick commerce's hypergrowth phase might be 3-5 years. Then it normalizes into a stable, profitable business or consolidates into a few leaders.

Blinkit might already be in that inflection. The company is established. Growth is strong. But investor expectations are rising. Dhindsa will need to maintain growth while improving profitability. That's harder than pure growth phase management.

Leadership transitions impact investor priorities differently. Continuity and M&A optionality are top concerns, reflecting the importance of stability and potential acquisition opportunities. Estimated data.

The Investor Perspective: Why This Transition Matters for Eternal's Valuation

Investors in Eternal will scrutinize this transition carefully. Leadership changes can trigger repricing. Here's what matters to institutional investors:

Continuity: Goyal staying on the board as vice chairman is reassuring. It signals the founder hasn't abandoned ship. Investors worry about leadership changes that feel adversarial or unplanned. This feels deliberate.

Growth outlook: Dhindsa's promotion signals confidence that growth will continue. If Goyal was worried about growth stalling under new leadership, he wouldn't hand over. The promotion implicitly signals growth runway.

Profitability path: Quick commerce is still burning money at unit level in many segments. Blinkit's 121% growth is exciting but margins are thin. Will Dhindsa continue growth-at-any-cost or pivot toward profitability? Investors will ask this repeatedly. Goyal's vagueness on the strategy handoff suggests strategy continuity, which probably means growth-prioritization continues.

Risk assessment: Dhindsa is less known globally than Goyal. That adds execution risk. Investors might demand better terms (lower valuations) until Dhindsa proves himself. Over time, as he establishes his track record, risk premiums should compress.

M&A optionality: Major tech companies (Google, Amazon, Microsoft) are hungry for Indian commerce assets. Eternal's market position makes it valuable. A founder-led company is harder to acquire (founder ego, alignment issues). A professionally-led company is easier. This transition might increase Eternal's acquisition probability. Investors in late-stage private companies often want exit options. That could be a silent motivator for this transition.

Overall, institutional investors probably read this transition neutrally to positively. Goyal stepping down while staying involved signals maturity. That's good for institutional confidence.

International Expansion: Could Eternal Go Global?

Zomato and Blinkit have been relatively India-focused. Other markets get tested but capital is primarily deployed in India. Why?

India's market is massive and underpenetrated. A company can grow for a decade in India without needing international expansion. Growth rates are higher at home. Unit economics are better because costs are lower. Competition is more fragmented. It makes sense to optimize India first.

But eventually, every successful Indian company faces the question: do we go global? Can we replicate our success in other markets?

Under Goyal, expansion was cautious. He tested Southeast Asia but didn't commit heavily. Under Dhindsa, that calculus might shift. Quick commerce is nascent globally. Most countries haven't seen Blinkit-style competitors yet. If Dhindsa believes in quick commerce's potential, he might see global opportunity.

Southeast Asia is the natural first step. Similar demographics to India. Similar internet penetration trajectory. Similar regulatory environment in many countries. Blinkit or Eternal could theoretically export the model to Singapore, Thailand, Indonesia, Philippines.

The obstacles are real though. Each market requires localization. Regulatory environments differ. Existing players have advantages. International expansion would require significant capital. It would distract management focus. Given the labour scrutiny domestically, adding international complications might be too much.

Most likely outcome: Dhindsa focuses on India dominance first. International expansion comes later if at all. But it's a possibility now that Goyal's freed up bandwidth.

What Happens to Zomato's Restaurant Discovery Business?

Eternal owns Zomato (food delivery) and Blinkit (quick commerce) and other ventures. Quick commerce is getting strategic focus now. But what about Zomato's discovery business?

When you order food, you're using Zomato's discovery engine to find restaurants. That's valuable. Restaurants depend on Zomato for customer discovery. Diners depend on Zomato for restaurant discovery. That discovery layer creates network effects.

Foodtech globally has shown that discovery is high-margin and defensible. Open Table owns restaurant discovery in US/Europe. Zomato has dominant position in India. That's valuable real estate.

Under Goyal, discovery probably stayed as a core business. Under Dhindsa, the temptation might be to milk discovery for cash while investing heavily in quick commerce growth. That would be a strategic error. Discovery businesses have long tail value—they don't need heavy investment but they generate steady returns forever.

Likely outcome: Zomato discovery becomes a steady-state business. Good margins, limited growth investment. It funds quick commerce expansion. This is common in conglomerate structures. You have cash cow businesses (discovery) that fund growth businesses (quick commerce).

But there's risk. If Zomato discovery is starved for investment while competitors improve, market share could erode. Unlikely, but possible. Dhindsa will need to be thoughtful about resource allocation across the portfolio.

Blinkit's net order value grew by 121% in Q3 2025, significantly outpacing Zomato's core business growth, indicating a shift in focus towards quick commerce. Estimated data based on trends.

The Bigger Picture: When Founders Step Back, What Do They Do?

Goyal's move into longevity research, brain-health wearables, and aerospace raises a broader question: what comes after building a unicorn?

Historically, founders had limited options. Stay in the company (trapped). Sell the company and retire. Go VC. But successful modern founders increasingly pursue a different path: build companies, hand off operations, then pursue personal interests and bets.

This is enabled by wealth. After building a multi-billion dollar company, the founder has capital to fund new ventures without external investors. Personal wealth removes financial pressure. That's liberating.

It's also enabled by ecosystem maturity. Early in a startup's lifecycle, the founder is essential. Over time, operations can be delegated. Once operations are delegated, the founder's time becomes optional. They can stay involved at strategic level but not day-to-day operational level.

Goyal's move is part of this broader evolution. He's not the first founder to do this. He won't be the last. The question for Eternal is whether the organization can sustain excellence when the founder's full attention is split.

History suggests it can. But it requires the right succession (Dhindsa seems capable), the right board (staying as vice chairman helps), and the right culture (Eternal seems reasonably founder-independent). The factors seem to align.

Regulatory Winds: Where Quick Commerce Goes Next

We touched on labour ministry scrutiny earlier, but the regulatory story is broader. Quick commerce operates in a grey zone. The regulatory environment is still being defined. As quick commerce matures, regulation will tighten.

Likely regulatory focus areas:

Labor standards: Working conditions, minimum pay, benefits. This is already happening. Regulations will likely require platforms to improve worker welfare, which raises costs.

Consumer protection: Return policies, quality guarantees, liability for damaged goods. As quick commerce scales, consumer disputes will increase. Regulation will force clearer standards.

Taxation: Is quick commerce taxed the same as traditional retail? Current rules are ambiguous. Governments will likely close these gaps, increasing tax burden.

Data privacy: Quick commerce companies collect massive amounts of user data (location, purchase history, preferences). GDPR-style regulations are coming to India. Data handling practices will be heavily regulated.

Competition law: If quick commerce consolidates to 2-3 players, antitrust scrutiny will follow. Practices that are okay with many competitors (aggressive pricing, exclusive deals) might be illegal with fewer competitors.

Dhindsa taking over means he'll navigate this regulatory transformation. It's a harder job than Goyal's early growth phase. But it's also a necessary step in quick commerce's maturation.

The Talent Question: Retaining Eternal's Best People

Founders are magnets for talent. Working for the founder means you're connected to the original vision. When the founder steps back, talent concerns emerge. Will the best people stay?

Goyal's move addresses this partially by staying on as vice chairman. That keeps founder-level involvement visible. But it's not a complete solution. Over time, talented people who joined to work with Goyal might leave to work with Goyal on his new ventures.

Dhindsa will need to build his own talent magnetism. He'll need to articulate his vision for quick commerce and Eternal. He'll need to promote people and create opportunities. He'll need to show that working for him is as valuable as working for Goyal.

This is a classic challenge in founder transitions. The organization's culture needs to evolve from "founder-centric" to "mission-centric." Dhindsa will need to deliberately build that.

Likely outcome: There will be some talent rotation. People working directly with Goyal might leave. People excited about Dhindsa's vision will stay or join. Over time, this is healthy—it prevents founder-worship from calcifying culture. But it requires careful management.

Lessons for Indian Startups: Succession Planning and Founder Transitions

Goyal's move offers several lessons for other Indian founders and investors:

Succession planning is strategic, not tactical. Goyal's transition wasn't forced. It was deliberate. Founder-led companies should start thinking about succession early, not in crisis. It enables better planning.

Founder involvement doesn't end at the handover. Goyal stays on the board. This is common in successful transitions. The founder's judgment is too valuable to discard. But the founder's daily involvement should decrease. Finding that balance requires intentionality.

Multiple founder careers are possible. Goyal isn't retiring. He's starting new ventures. That's increasingly possible for successful founders. It's healthy for the ecosystem.

Professional management enables founder leverage. By stepping back from operations, Goyal frees his time for strategic projects that might have higher upside than optimization of Eternal. This is economically rational.

The market rewards thoughtful transitions. Companies that handle succession well tend to maintain valuations or grow. Companies that fumble it see valuations compressed. Goyal's handling appears thoughtful.

Quick Commerce's Long-Term Economics: Sustainability Questions

Here's the uncomfortable question nobody asks explicitly: Can quick commerce be a sustainable business long-term?

The current model relies on thin margins offset by high volume. Costs are kept artificially low through venture funding subsidies. Wages for drivers are kept as low as possible. Prices to consumers are kept low to drive volume. This works in a growth phase but eventually hits reality.

As quick commerce matures, margins need to improve. This happens through:

-

Scale efficiencies. Spreading fixed costs over more orders. Reducing delivery times through better routing. Better warehouse utilization.

-

Pricing power. Raising prices as customers become dependent. Introducing premium services with higher margins.

-

Automation. Robots in warehouses. Autonomous delivery. Reducing labor dependency. Still years away but plausible.

-

Adjacent services. Expanding from groceries to services (repairs, beauty, health). Higher-margin adjacent categories.

Blinkit is probably working on all four. But the fundamental tension remains: quick commerce trains customers to expect instant gratification at low prices. Raising prices contradicts that value prop. Blinkit might have to earn margin through efficiency, not pricing.

This is a 5-10 year problem, not an immediate crisis. But it's there. Investors should keep it in mind. So should Dhindsa. He's inheriting a high-growth business with structural margin challenges. His job includes solving that.

Competitive Threats: Where Could Quick Commerce Lose?

Blinkit isn't unbeatable. What competitive threats should Dhindsa worry about?

Amazon entry. Amazon has entered quick commerce in some markets. Amazon brings capital, tech, and a global brand. If Amazon commits to Indian quick commerce, Blinkit faces a formidable competitor.

Reliance entry. Reliance Industries (conglomerate, enormous capital) could launch quick commerce. Reliance's retail network provides infrastructure advantages. Blinkit would face a well-capitalized competitor.

Dunzo scale. Dunzo is Blinkit's primary Indian competitor. If Dunzo raises significant capital and scales, it could take market share. Blinkit can't assume it's unbeatable.

Emerging market entrants. VCs are funding quick commerce startups globally. If international quick commerce grows faster than Indian quick commerce, capital might flow to international players, leaving Blinkit with lower relative growth.

Regulatory pressure. Labour regulations could make quick commerce dramatically more expensive. Consumer regulations could reduce profitability. If regulations hit Blinkit harder than competitors (because of size), it could lose ground.

Blinkit's advantages (scale, integration with Zomato, operator efficiency) are defensible. But they're not insurmountable. Dhindsa's job includes defending market share while pursuing growth.

The Path Forward: What Happens Next for Eternal

So where does this lead? Best guess scenario for the next 2-3 years:

Year 1-2: Dhindsa establishes himself. Accelerates quick commerce growth while maintaining food delivery profitability. Navigates regulatory scrutiny. Retains key talent. Possibly makes a strategic acquisition in adjacent category (payments, fintech, supply chain).

Year 2-3: Quick commerce profitability improves through scale and efficiency. Food delivery remains steady. International pilots might launch. Board and investors gain confidence in Dhindsa's vision. Valuation potentially increases.

Year 3-5: Quick commerce becomes the dominant business by revenue. Food delivery mature and stable. Eternal becomes less of a "Zomato with Blinkit" company and more of a "Blinkit with Zomato" company. Strategic partnerships or acquisitions in adjacent categories. Possible IPO for Blinkit as separate entity (or remains consolidated).

Risks in this path: Regulatory backlash slows growth. Competitors consolidate and catch up. Dhindsa's vision diverges from investor expectations. Goyal's absence creates strategic drift.

But the base case is probably the above. Dhindsa takes over at an inflection point—quick commerce is proven, growth is explosive, the company needs professional management instead of founder-driven strategy. It's a good succession at a good time.

Lessons for Investors and Founders on Leadership Transitions

This transition offers a masterclass in how founder-led companies can evolve. For investors evaluating startup leadership:

Look for intentional succession planning. If the founder can articulate why the successor is right for the next phase, that's positive. If it feels reactive or forced, that's a red flag.

Assess founder involvement post-handoff. Founders who stay on boards (but don't micromanage) create the best outcomes. Founders who disappear entirely leave organizations rudderless. Founders who stay too involved cripple successors.

Consider division strategy. Sometimes, the successor should inherit the whole company (Dhindsa's situation). Sometimes, divisions split and different leaders take different parts. Eternal chose consolidation under new leadership. That's a valid choice.

Watch cultural continuity. The best successors maintain founder culture while making it more scalable. Dhindsa needs to keep what makes Eternal special while adding professional discipline. That's the challenge.

Track founder redeployment. Goyal's new ventures tell you what he thinks the future holds. Smart investors pay attention to founder activities post-handoff. They're valuable signals.

Broader Implications for Indian Startups and Tech Ecosystem Maturity

Goyal's move isn't just about Eternal. It's a signal about Indian tech's maturity. The ecosystem is past the point where founders must be permanent CEOs. Professional management is acceptable, even desirable.

This has cascading effects:

More founder optionality. Founders can start multiple companies sequentially. They can take on advisory roles. They can pursue personal interests. Ecosystem becomes more flexible.

Better capital deployment. If founder energy isn't locked into permanent CEO roles, that energy can flow toward new opportunities. New ventures get better founding teams.

Institutional strengthening. As professional management becomes normal, institutional investors are more comfortable deploying capital. Boards work better. Governance improves.

Global competitiveness. Indian startups that embrace professional management earlier will scale faster globally. They'll be less founder-dependent, which makes them more attractive to international investors.

Goyal's transition is a symbol of this maturation. Five years ago, it would have been controversial. Goyal steps down? The company must be in trouble. Today, it's seen as strategic. That change in perception matters.

Conclusion: A New Chapter for Eternal and Its Ecosystem

Deepinder Goyal stepped down as Eternal's CEO not because he failed, but because he succeeded. He built Zomato from Foodie Bay into an $18+ billion company. He navigated food delivery's explosive growth and maturation. He saw quick commerce coming and positioned Eternal for the next wave.

Now, he's handing the operational keys to Albinder Dhindsa, a leader who's proven himself running Blinkit through hypergrowth. Goyal remains as vice chairman, providing strategic guidance while pursuing personal ventures in longevity research, brain health, and aerospace.

This transition matters because it shows how successful founder-led companies evolve. It's not about the founder failing or the company declining. It's about recognizing that different phases require different skills. Growth phase needs founder intensity. Scale and optimization require professional management. Goyal recognized this inflection and managed it intentionally.

For Eternal, this is an opportunity. Dhindsa can chart his own course while respecting what Goyal built. Quick commerce can be the strategic priority. International expansion becomes possible. Adjacent ventures can be explored.

For Goyal, this is liberation. He can pursue moonshots without quarterly earnings pressure. He can think 10-20 years out instead of 3-months out. He remains tied to Eternal's success but isn't consumed by its daily operations.

For India's startup ecosystem, this is a maturing moment. Founder succession is becoming normal. Professional management is becoming accepted. The ecosystem is getting more sophisticated.

The question now is simple: Can Dhindsa execute the vision? Can he maintain Eternal's momentum while navigating regulatory complexity and intensifying competition? Can he lead an $18+ billion company through its next inflection?

Based on his track record running Blinkit through explosive growth, he probably can. But the market will judge. Dhindsa's first year will be closely watched. Investors will scrutinize quarterly results. Employees will evaluate his leadership. Competitors will test his strategy.

For now, the transition is complete. Goyal has passed the torch. Dhindsa is holding it. The quick commerce chapter of Indian commerce is being written. The story continues, but with a new captain at the helm.

What that means for Eternal's next phase remains to be written. But the foundation Goyal built is solid. That foundation can support whatever Dhindsa chooses to build next.

FAQ

Why did Deepinder Goyal step down as Eternal's CEO?

Goyal stepped down to focus on "higher-risk exploration and experimentation" that he felt would be constrained within a publicly listed company. He wanted to pursue personal ventures including Continue Research (longevity science), Temple (a brain-health wearable), and LAT Aerospace, which operate in longer-term, more experimental domains than core business operations. His statement emphasized this was "a change in title, not in commitment toward outcomes," and he remains on Eternal's board as vice chairman.

Who replaced Deepinder Goyal as CEO?

Albinder Dhindsa, the CEO of Blinkit (Eternal's quick-commerce division), replaced Goyal as CEO of Eternal. Dhindsa has proven his capability by leading Blinkit through explosive growth, with net order value jumping 121% year-over-year. His promotion reflects Blinkit's increasingly dominant role within Eternal's portfolio and signals confidence in his ability to lead the broader organization.

What is the significance of quick commerce to Eternal's strategy?

Quick commerce has become Eternal's fastest-growing segment, with Blinkit's quarterly net order value reaching approximately $1.45 billion. This represents a significant shift from food delivery, which has become a mature business with slower growth rates. Quick commerce's hypergrowth trajectory suggests it will become the company's strategic priority under Dhindsa's leadership, reshaping how Eternal deploys capital and directs management attention.

How did Zomato become such a dominant player in Indian food delivery and quick commerce?

Zomato started as Foodie Bay in 2008 as a restaurant discovery and reviews platform before rebranding in 2010. The company entered food delivery in 2015 and consolidated its position through strategic acquisitions, including Uber Eats' India business in 2020 and Blinkit for $568 million in 2022. These acquisitions provided Zomato with scale, logistics infrastructure, and market dominance that enabled it to expand into quick commerce.

What are the regulatory challenges facing quick commerce in India?

India's labour ministry has asked quick commerce platforms to drop "10-minute delivery" marketing and implement measures to improve working conditions for gig workers. The sector faces scrutiny over worker exhaustion, injury risks, and unsustainable pace requirements. Additionally, platforms will likely face tighter regulations around taxation, consumer protection, data privacy, and competition law as quick commerce matures.

Can quick commerce be a sustainable, profitable business long-term?

The current quick commerce model operates on thin margins offset by high volume and venture funding subsidies. Long-term sustainability requires achieving margin improvement through scale efficiencies, strategic pricing power, automation (robots, autonomous delivery), and adjacent higher-margin services. The fundamental tension between customer expectations for instant gratification at low prices and the need for profitability remains a key challenge for the industry's long-term viability.

What competitive threats does Blinkit face in quick commerce?

Blinkit's primary competitors include Dunzo domestically, with Amazon and Reliance Industries as potential market entrants. International quick commerce startups funded by venture capital represent indirect threats. Regulatory changes that impose higher labor costs or operational restrictions could disproportionately impact Blinkit despite its scale. The company's defensible advantages include scale, integration with Zomato's infrastructure, and operational efficiency, but these are not insurmountable.

What does Goyal's departure signal about Indian startup ecosystem maturity?

Goyal's deliberate transition from operational CEO to vice chairman reflects ecosystem maturity where founder succession is now seen as strategic rather than a sign of failure. This evolution enables founder redeployment, better capital allocation toward emerging opportunities, institutional strengthening through professional management acceptance, and increased global competitiveness. It signals that Indian startups can now embrace professional management practices comparable to global enterprises.

What was Eternal's financial performance in Q3 that preceded this leadership change?

Eternal reported strong Q3 results with net profit rising 73% year-over-year to approximately

How does Goyal's remaining role as vice chairman affect the leadership transition?

Goyal's retention as vice chairman provides continuity and strategic oversight while reducing his day-to-day operational responsibilities. This structure signals to employees, investors, and partners that the founder remains committed to the company's success and vision. It allows Dhindsa autonomy as CEO while providing access to founder judgment on major decisions, creating a balanced succession model that has proven successful in other mature tech companies globally.

Key Takeaways

- Deepinder Goyal stepped down as Eternal CEO to pursue high-risk ventures including longevity research and brain-health technology, remaining as vice chairman

- Albinder Dhindsa, Blinkit's CEO, took over Eternal leadership, reflecting quick commerce's emergence as the company's primary growth driver with 121% quarterly growth

- Eternal's Q3 results showed explosive expansion with revenue up 190% year-over-year and net profit rising 73%, validating the strategic shift toward quick commerce

- Quick commerce faces intensifying regulatory scrutiny around labor conditions, with India's labour ministry requesting removal of '10-minute delivery' marketing and improved worker protections

- The leadership transition represents maturation of Indian startup ecosystem where founder succession is now strategic rather than crisis-driven, enabling founder redeployment toward new ventures

- Quick commerce's long-term sustainability depends on improving unit economics through scale efficiencies, strategic pricing, automation, and adjacent high-margin services

- Blinkit faces competitive threats from Dunzo domestically and potential entry from Amazon and Reliance Industries, requiring defensive strategy under new leadership

Related Articles

- Nvidia's AI Startup Investments 2025: Strategy, Impact & Alternatives

- Google's Search Antitrust Appeal: Monopoly Ruling & Data Sharing Impact 2025

- Jensen Huang's Reality Check on AI: Why Practical Progress Matters More Than God AI Fears [2025]

- Mario Götze's Path from World Cup Champion to Venture Investor [2025]

- OnePlus Foldable Phone 2026: Strategic Case for Market Re-entry

- 16 Top Logistics & Manufacturing Startups: Disrupt Battlefield 2026 [2025]