The Robotics Industry Just Got More Interesting

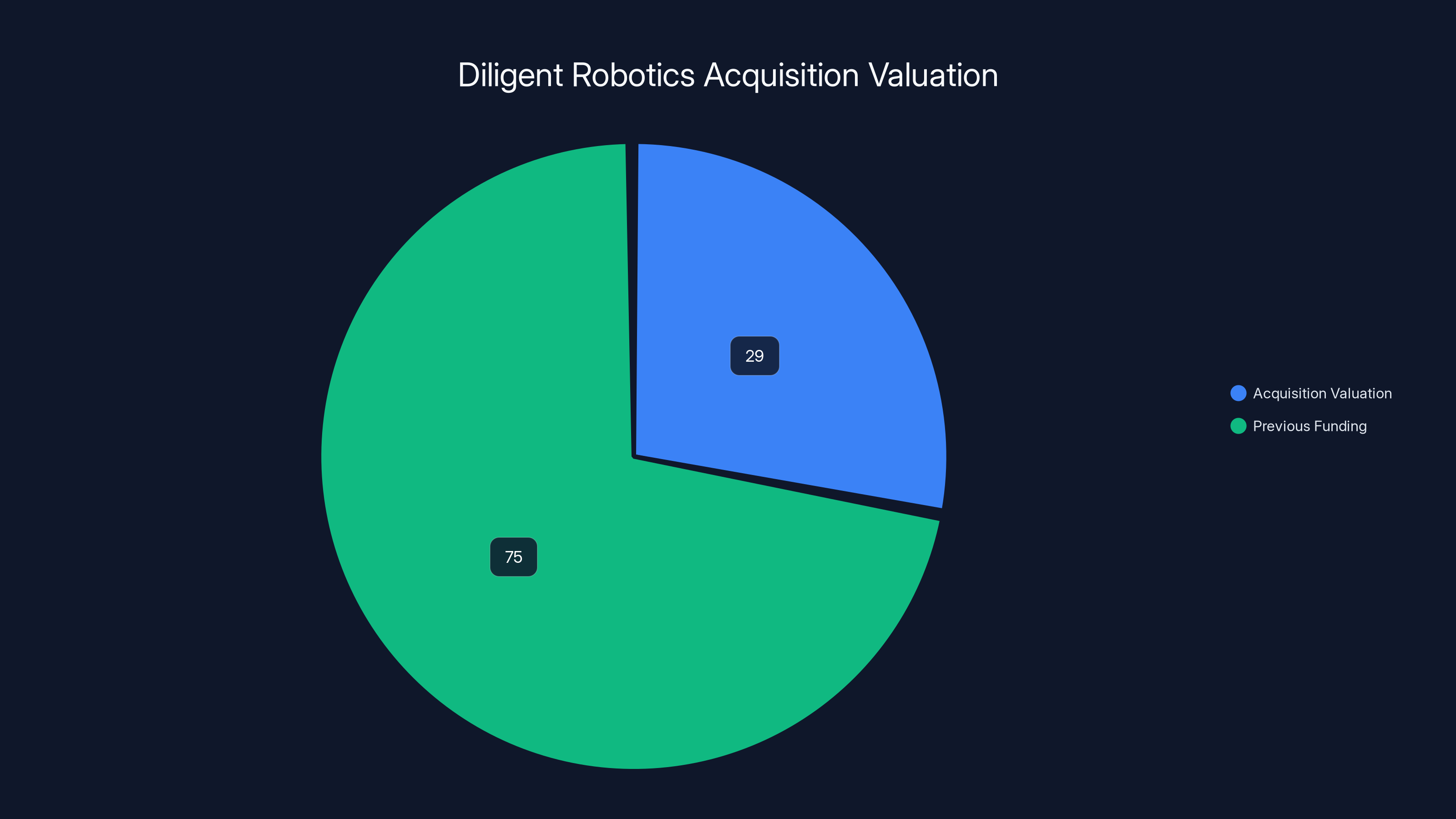

Let me set the scene. It's early 2025, and Serve Robotics, the sidewalk delivery robot company backed by some seriously heavyweight investors like Nvidia and Uber, just made a bold move: they acquired a hospital robot startup called Diligent Robotics for $29 million. On the surface, this sounds like a random pivot. A company known for delivering burritos through city streets is suddenly buying robots that move hospital supplies around sterile corridors. But here's what actually happened: two companies with nearly identical DNA realized they were solving the same core problem, just in different environments.

This acquisition matters way more than it initially appears. It's not just about Serve expanding into healthcare. It's about what this merger signals for the future of autonomous robotics, last-mile automation, and how companies that solve one "last-mile" problem can scale into completely different industries. The deal also reveals something crucial about venture capital and startup strategy: sometimes the best acquisitions aren't about desperate pivots, but about recognizing when two aligned teams can accelerate each other's missions.

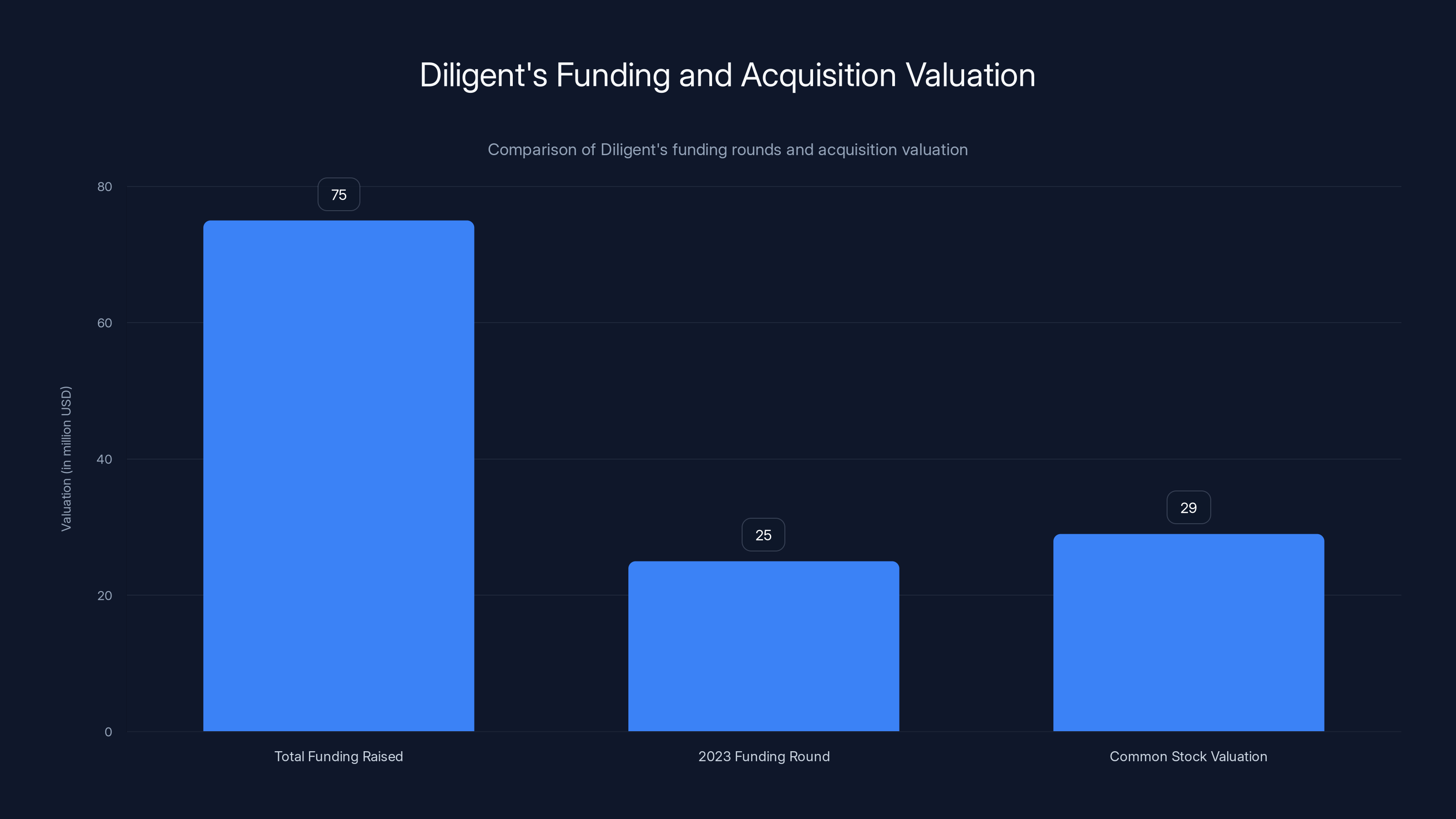

Diligent Robotics, founded in 2017 by Andrea Thomaz and Vivian Chu, has raised over

Serve Robotics' acquisition strategy here isn't about killing a competitor or hoarding technology. It's about recognizing that autonomous navigation in complex human environments is the hard part, and once you've solved that problem, the specific delivery context becomes almost secondary. Whether you're delivering a sandwich or a blood sample, the robot still needs to navigate, avoid obstacles, interact with unpredictable humans, and complete its task reliably. That's the real innovation. The market opportunity that Serve and Diligent are both chasing is exponentially larger than either company could capture alone.

Let's dig into what this acquisition actually means for robotics, healthcare, enterprise automation, and what it tells us about where autonomous systems are heading.

Understanding Serve Robotics and Its Strategic Vision

Serve Robotics has an interesting origin story. The company was incubated inside Postmates, the food delivery platform, back in 2017. When Uber acquired Postmates in 2020, Serve continued operating within Uber's ecosystem before spinning off as an independent company in 2021. Then in April 2024, Serve went public through a reverse merger. That trajectory tells you something important: this company has legitimate backing and has proven it can attract institutional investors.

The core mission at Serve has always been about autonomous last-mile delivery in real-world environments. Their sidewalk robots operate in urban spaces where conditions are unpredictable. Rain, snow, pedestrians, cyclists, cars, construction, uneven pavement, and countless edge cases exist in every single block of city terrain. Building robots that can handle this complexity is genuinely difficult. Most robotics startups test in controlled environments. Serve's approach is different: they build in production, in real cities, with real variables.

This philosophy is crucial to understanding why they'd acquire Diligent. When Ali Kashani, Serve's co-founder and CEO, talks about the acquisition, he doesn't frame it as a pivot away from food delivery. Instead, he frames it as recognition that the core problem Serve has already solved applies to other environments. His exact quote to media outlets was revealing: "This is a kind of a classic example of a prepared mind meets opportunity." Translation: they didn't go hunting for healthcare acquisitions, but when they recognized that Diligent was solving the same fundamental problem in a different context, the opportunity was too obvious to ignore.

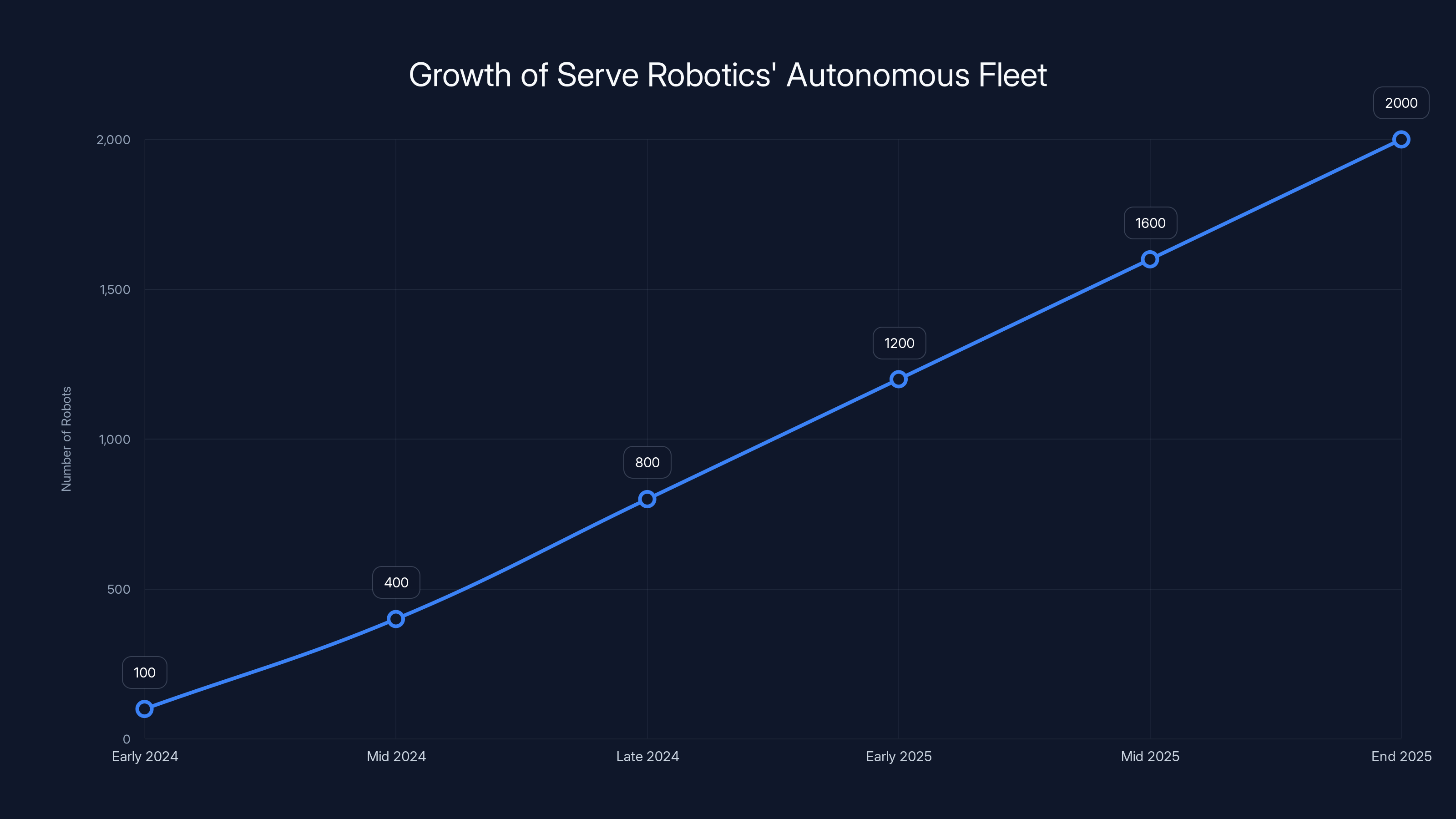

Serve's growth trajectory in 2025 also demonstrates why they had the capital and confidence for this acquisition. The company grew its autonomous fleet from 100 robots in early 2024 to over 2,000 robots by the end of 2025. That's a 20x increase in deployed units within a single year. More importantly, Serve signed a partnership with DoorDash in October 2024 to facilitate deliveries in Los Angeles, giving the company access to DoorDash's massive order volume and logistics network. This partnership legitimized Serve's technology at scale and provided proof that their robots could integrate into existing logistics infrastructure.

Kashani has been vocal that the sidewalk delivery business is "what's fueling everything" at Serve. The company is intentionally building one of the largest autonomous robot fleets in the world because that fleet generates the data, the operational insights, and the proven technology that makes adjacent markets like healthcare viable. You can't fake this. You either have a fleet of robots operating reliably in production, or you don't. Serve demonstrably does.

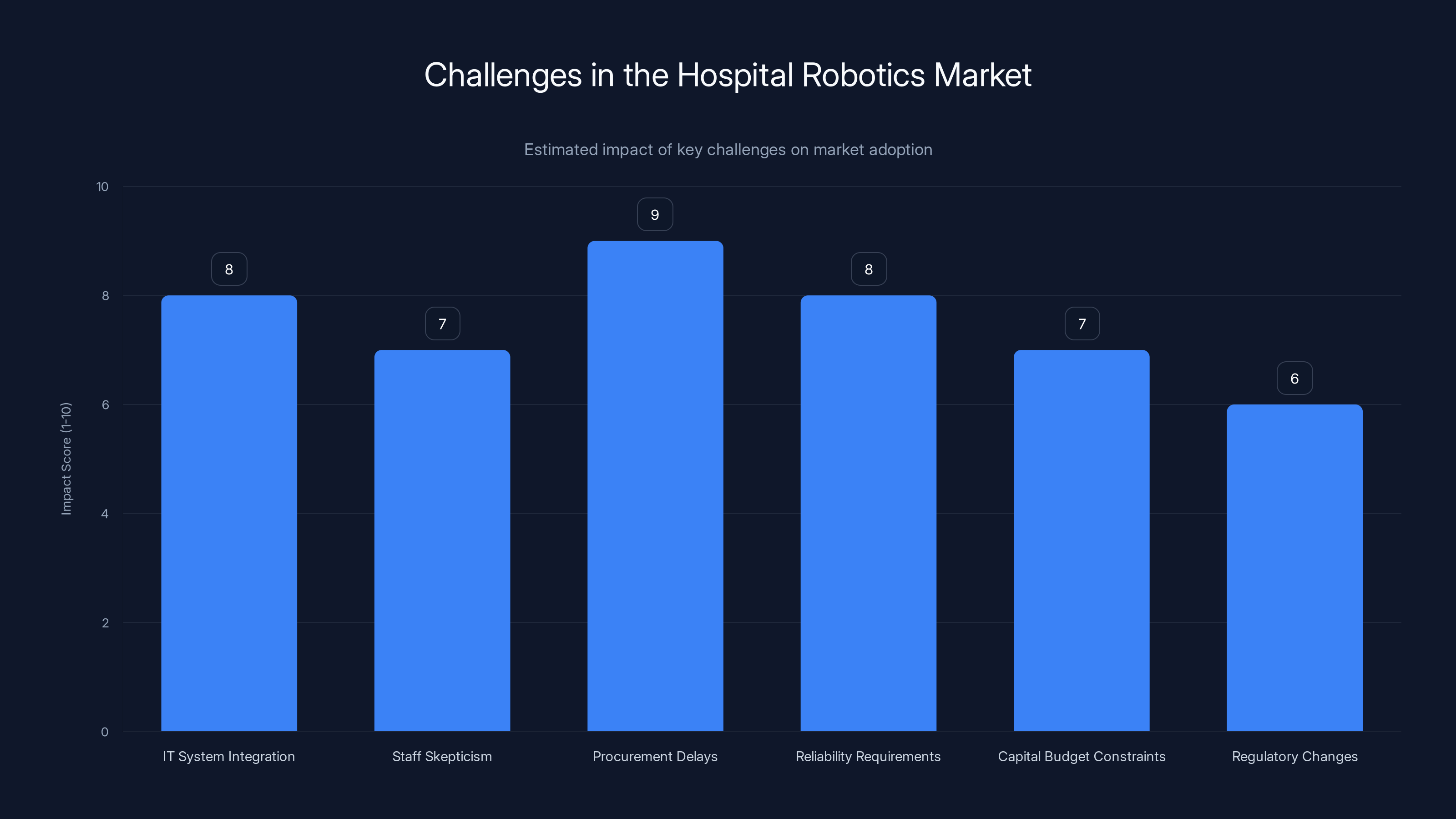

Integration with existing IT systems and procurement delays are the most significant challenges in the hospital robotics market. Estimated data.

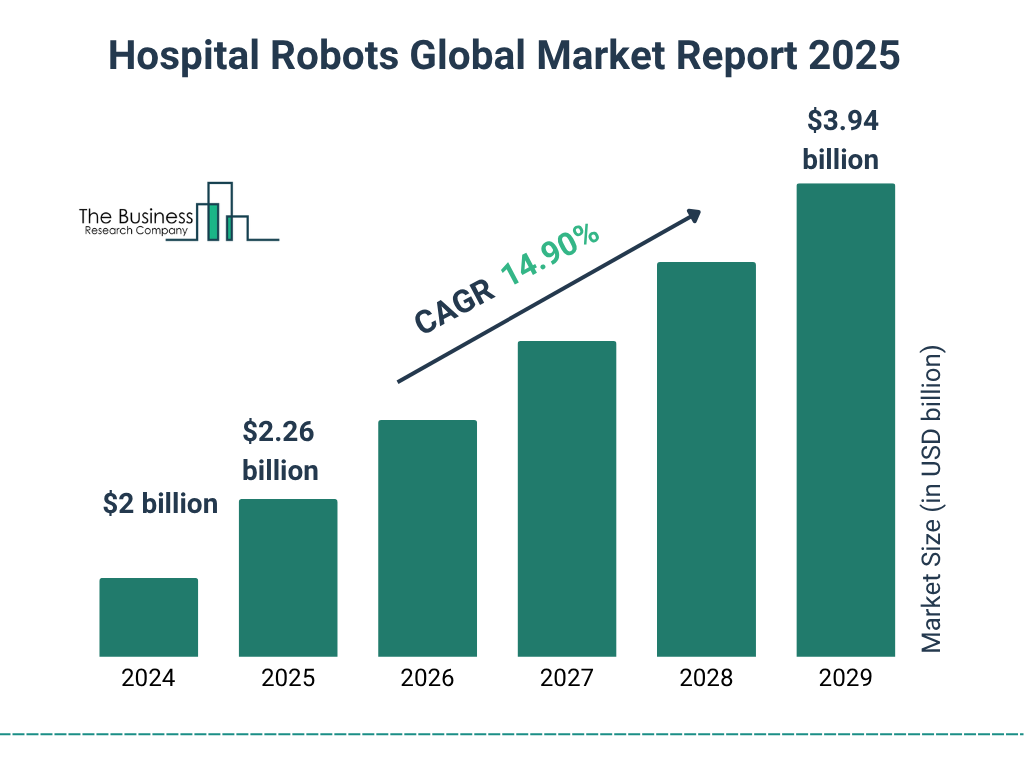

The Hospital Robotics Market: Why Healthcare Is the Next Frontier

Hospitals are complex. Really complex. If you've ever worked in a hospital or spent significant time in one, you've noticed that hospitals operate with extreme inefficiency in some areas and extreme precision in others. Nurses spend roughly 30 percent of their time on non-patient activities: walking to supply rooms, retrieving lab samples, delivering paperwork, moving medications between departments. That's wasted labor capacity in an industry that's chronically understaffed and overstressed.

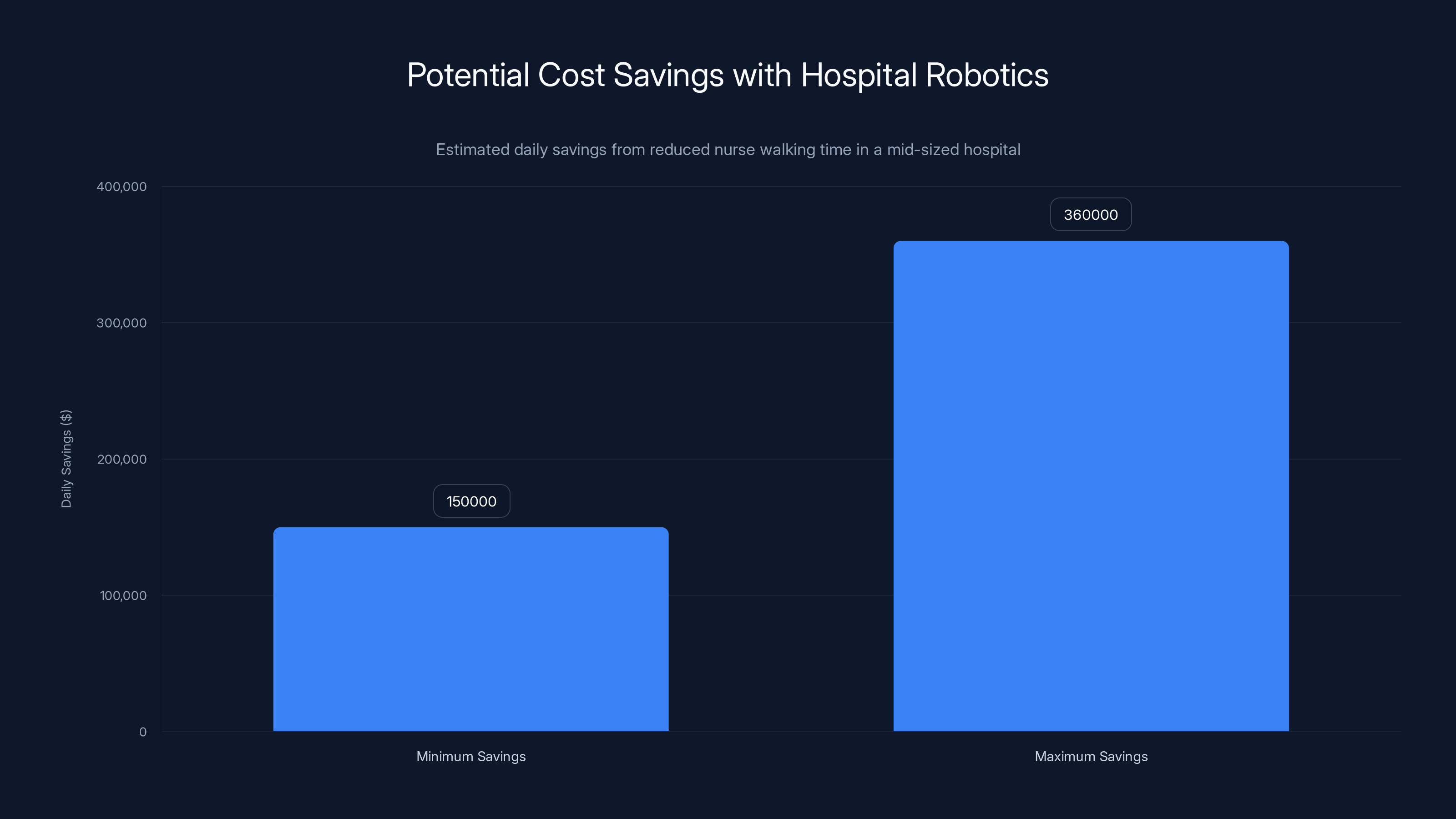

Discuss this from an operational perspective. A typical hospital bed costs approximately

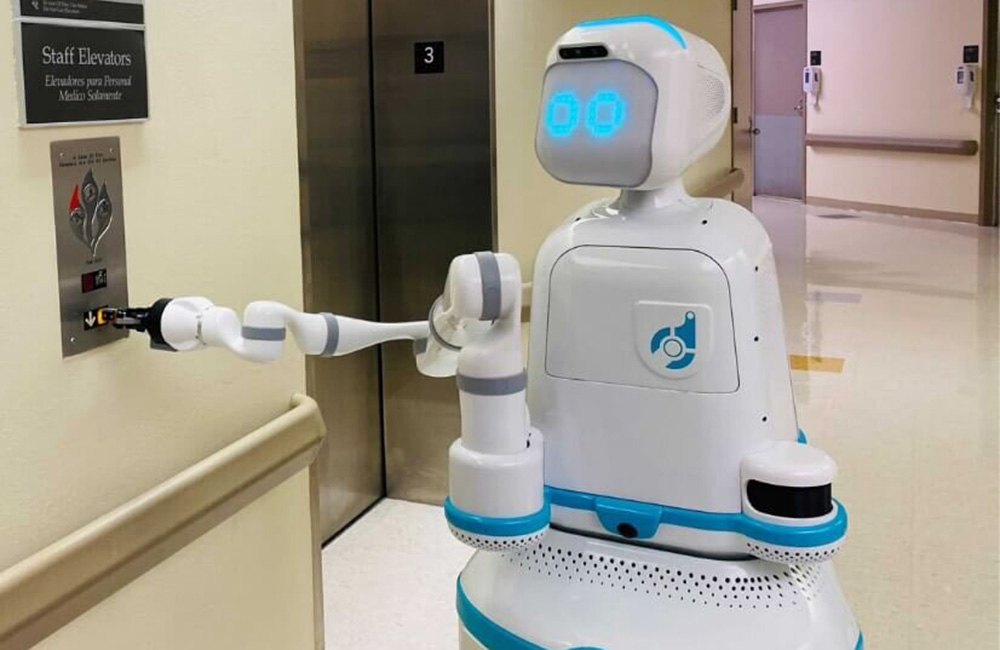

Moxi, Diligent's robot, is designed specifically to handle these tasks. It operates on hospital floors, navigates around people, enters elevators, and delivers supplies to the exact location requested. Unlike factory robots or delivery robots that operate in somewhat predictable environments, Moxi must navigate around patients on gurneys, staff rushing between rooms, IV stands, equipment carts, and the general chaos of a functioning hospital. The robot must also be safe enough that if it bumps into someone, it doesn't cause harm. It must be quiet enough not to startle patients. It must be reliable enough that critical supplies arrive on time.

The regulatory environment for hospital robots is substantial but not insurmountable. Medical devices in the United States must clear FDA review, but robots that don't directly touch patients or dispense medication face lower regulatory barriers than other categories. Moxi's existing certifications and FDA clearances represent significant competitive moats that Serve is now inheriting through acquisition.

The market opportunity is genuinely enormous. There are approximately 6,000 hospitals in the United States alone. If even 30 percent of those hospitals deploy just one autonomous delivery robot, that's 1,800 units. At an estimated cost of

But market size alone doesn't justify acquisitions. What matters is whether the company making the acquisition has the right team and technology to execute at scale. Diligent's existing partnerships with major hospital systems, their proven deployment experience, and their accumulated knowledge about healthcare operations represent invaluable assets that would take Serve years to build from scratch.

What Makes This Acquisition Different From Other Tech M&A

Most acquisitions in technology follow a predictable pattern: a larger company buys a smaller company to acquire technology, talent, or customer relationships. The smaller company's independence typically dissolves within 18 months as the acquiring company integrates teams and consolidates operations. But Serve's stated approach with Diligent is explicitly different.

Kashani emphasized that Diligent will "continue to operate relatively independently within Serve." This is significant. Rather than absorbing Diligent's team into Serve's existing structure, the two companies are planning to operate as distinct units that share technology and infrastructure. This approach has real advantages. Diligent's team understands hospital operations, regulatory requirements, and healthcare sales cycles. Serve's team understands autonomous fleet management at scale. By keeping these teams separate while enabling deep technical collaboration, both sides can preserve institutional knowledge while leveraging each other's expertise.

The collaboration model also signals something important about Serve's strategy: they're not trying to become a generalist robotics company. They're trying to become the best autonomous navigation and fleet management company in the world, and they're willing to let specialized teams build on top of that foundation. This is similar to how Nvidia doesn't build every AI application; they provide the chips and compute that enable others to build applications.

Serve will tap into Diligent's existing customer relationships and hospital sales channels. Diligent will leverage Serve's fleet management software, autonomous navigation algorithms, and operational experience managing thousands of robots simultaneously. This is a genuine exchange of capabilities, not a subsumption.

Kashani was also explicit about what this acquisition doesn't signal. It's not a pivot for Serve. It's not the beginning of an acquisition spree. He said Serve would "keep our eyes open" for interesting companies, but emphasized that the sidewalk delivery business remains the core focus and the primary profit engine. This messaging is important because it prevents Wall Street and investors from misinterpreting the acquisition as a sign that Serve's original business isn't working.

The acquisition valuation of Diligent Robotics at

The Technology Stack: Autonomous Navigation as Core Competency

Here's the key insight that makes this acquisition make sense from a pure technology perspective: autonomous navigation is the hard problem. Everything else follows from solving that.

When Serve built its sidewalk robots, they had to solve navigation in environments with extreme variability. A city street includes:

- Pedestrians moving unpredictably in all directions

- Cyclists, cars, and other autonomous vehicles

- Weather conditions ranging from rain to snow to intense sun

- Dynamic obstacles like parked cars, construction, and temporary barriers

- Uneven terrain, curbs, crossings, and surface variations

- Human social norms and expectations about where robots should and shouldn't go

Solving autonomous navigation in this context requires sophisticated computer vision, LIDAR, real-time obstacle detection, path planning algorithms, and continuous learning from real-world data. It requires testing edge cases at scale because you can't anticipate all failure modes.

A hospital environment has some parallels but different specific challenges:

- Indoor spaces with predictable layouts but dynamic human movement

- Constrained corridors where precision matters more than open-space navigation

- Sterile environments where the robot itself must not introduce contamination

- Interaction with elevators, doors, and building systems

- Coordination with human staff who have established workflows

- Reliability requirements because supply delays can impact patient care

But the core problem—navigating autonomously among humans in real environments—is identical. The algorithms, the sensor suites, the testing methodologies, and the operational approaches that Serve developed for sidewalk delivery are directly applicable to hospital navigation. This is why the acquisition makes genuine technical sense, not just financial sense.

Moxi uses a combination of sensors to achieve this navigation. The robot likely includes multiple LIDAR sensors for 360-degree awareness, stereo cameras for object recognition, and possibly additional depth sensors. The processing pipeline includes perception (what's around the robot), prediction (where are humans and objects moving), planning (what path should the robot take), and control (how should the robot execute that path). All of this software and hardware represents years of development and optimization that Serve can now leverage for hospital applications.

Market Consolidation and the Future of Enterprise Robotics

The Serve-Diligent acquisition fits into a broader pattern in enterprise robotics: consolidation is beginning, and it's moving faster than most observers anticipated. The robotics market for the past decade has been fragmented, with numerous startups building specialized robots for specific applications. A company for warehouse automation, another for last-mile delivery, another for healthcare, another for construction, another for hospitality.

What's changing is that the core technology—autonomous navigation, computer vision, real-time sensing—is becoming commoditized. That doesn't mean it's easy or cheap. It means that the barriers to entry are lower than they were five years ago, and companies that have already solved autonomous navigation well are now looking to apply that solution across multiple industries.

Serve's acquisition of Diligent is part of this wave. We'll likely see similar consolidation across other robotics verticals. The companies that have proven fleet management capabilities and reliable autonomous navigation will acquire or partner with companies that understand specific vertical markets. The robotics company provides the technology platform, and the vertical specialists provide market knowledge and customer relationships.

This consolidation is actually positive for the robotics industry. It reduces the number of companies that must solve autonomous navigation from scratch, which is expensive and difficult. Instead, those resources can be directed toward solving vertical-specific challenges and scaling solutions that work.

The other major trend this acquisition reflects is the shift from speculation to execution. For years, investors talked about robots transforming industries. For most of that time, the robots didn't exist at meaningful scale, or they existed in labs but not in production. Serve and Diligent are different because they both operate robots at meaningful scale in real environments. Serve has 2,000 robots deployed. Diligent has multiple hospital installations generating real operational data. This is execution, not speculation.

The Competitive Landscape and Alternative Solutions

Serve Robotics isn't the only company pursuing autonomous delivery, and Diligent Robotics wasn't the only company pursuing hospital robotics. Understanding the competitive context helps explain why this particular acquisition makes strategic sense.

In the sidewalk delivery space, Serve competes with or has competed with companies like Nuro (which has pivoted to include Walmart partnerships), Amazon's Zoox (which is broader autonomous vehicle strategy), and various smaller autonomous delivery startups. Most of these competitors have focused on either delivery in dense urban areas or on autonomous vehicles that operate on streets alongside traffic. Serve differentiated itself by building a fleet approach and proving economics at scale.

In the hospital robotics space, Diligent faces competition from companies like Autonomous Mobile Robots (AMRs) providers such as MiR (Mobile Industrial Robots), which has robots in some hospital settings, and from internal development efforts by large hospital systems themselves. But most hospital robots to date have been specialized for single tasks: medication dispensing, cleaning, or specific logistics functions. Moxi's value proposition is being a general-purpose task robot that can be deployed for multiple functions.

By acquiring Diligent, Serve is essentially combining the economics and scale of sidewalk delivery with the vertical specialization of hospital robotics. This gives them competitive advantages in the healthcare space that neither company alone would possess. Serve's competitors in sidewalk delivery are probably still wondering how to profitably deploy robots at scale. Diligent's competitors in hospital robotics are probably still wondering how to handle fleet management and operational complexity at scale.

Serve Robotics experienced a significant growth in their autonomous fleet, expanding from 100 robots in early 2024 to over 2,000 by the end of 2025, marking a 20x increase.

Financial Implications and Investor Returns

The

This isn't uncommon in acquisitions of venture-backed companies. The last funding round typically sets a ceiling on valuation. Once a company reaches a plateau in growth or faces challenges in achieving profitability, later acquisitions often occur at lower valuations than recent rounds. From Diligent's perspective, selling to Serve solves a real problem: the company was facing a difficult path to independent profitability in healthcare, which is a slow-moving market with extended sales cycles.

For Serve's shareholders, the acquisition is a bet on strategic expansion. Serve is betting that the operational expertise and customer relationships they're acquiring from Diligent will allow them to efficiently expand into healthcare. If they're right, this investment in Diligent now could unlock a market opportunity that represents a significant portion of Serve's long-term revenue.

From an investment return perspective, venture capitalists who invested in Diligent early are getting partial returns (the $29 million to common stockholders), and they're getting continued exposure to upside through their preferred shares potentially converting to Serve equity. Early Diligent investors might see solid returns depending on their entry price and the total deal value.

Operational Integration and Execution Challenges

Now let's be honest about the challenges. Acquiring a company is easy. Integrating it successfully is hard. Serve has explicitly stated that Diligent will operate independently, which suggests they want to avoid integration disasters, but independence also means separated teams, potentially duplicated functions, and coordination overhead.

The biggest operational challenge is probably customer success. Hospital systems are not like food delivery customers. Hospitals evaluate capital purchases over multi-year cycles, involve multiple stakeholders in purchasing decisions, and require extensive validation before deploying new technology. A hospital robot that fails or requires constant maintenance doesn't just disappoint a customer; it disrupts critical operations.

Serve's strength is fleet operations and scaling systems that are already proven. Their weakness is likely enterprise sales, healthcare regulatory knowledge, and hospital operations understanding. Diligent's strength is exactly those healthcare verticals. But integrating these strengths isn't automatic. It requires hiring, training, and building cross-functional teams that understand both autonomous systems and healthcare operations.

Another challenge is technology integration. Serve has built fleet management software for managing thousands of delivery robots. Diligent has built control software for hospital robots. These systems are different in important ways. Delivery robots operate in open spaces where failure modes include running into a parked car or a pedestrian. Hospital robots operate in constrained spaces where failure modes include disrupting patient care. The software stacks might need significant rework to support both use cases.

There's also the question of regulatory approval and certification. Serve's robots presumably have whatever certifications they need for sidewalk operation (probably mostly related to occupancy permits and local regulations). Diligent's robots have healthcare-specific certifications and FDA clearances. Moving Serve's technology into hospital environments might require revalidation and recertification. This is expensive and time-consuming.

The Broader Implications for Enterprise Automation

Beyond Serve and Diligent, this acquisition signals something important about enterprise automation and robotics in 2025: the market is maturing beyond concept proof to implementation reality. This means:

First, companies are willing to invest in robots as capital equipment with multi-year payoff periods. Five years ago, most businesses were experimenting with robots. Now they're deploying them as permanent infrastructure investments. That's a fundamental shift in market maturity.

Second, robots are becoming more general-purpose. The era of single-purpose robots (this robot only cleans, this robot only moves packages) is giving way to robots that can be reprogrammed for multiple tasks. Moxi's value is partly that it can deliver lab samples, move supplies, or transport equipment depending on the task assignment. This generalization increases ROI because each robot can support multiple use cases.

Third, the competitive advantage is shifting from hardware to software and operations. The physical robot is necessary but increasingly commoditized. What separates winning companies from failing companies is fleet management software, autonomous navigation algorithms, operational reliability, and integration with existing systems. Serve's acquisition of Diligent reflects this shift.

Fourth, vertical expertise still matters enormously. Even though autonomous navigation is becoming more standardized, the healthcare market is different enough from delivery that specialized knowledge is valuable. Serve is paying for Diligent's healthcare expertise, not just for their robot hardware.

Implementing hospital robotics like Moxi can save a mid-sized hospital between

Case Studies: How Autonomous Robots Are Actually Being Deployed

Let's move past theory and talk about real deployments. Understanding how these robots are actually being used in practice gives context for why acquisitions like Serve-Diligent matter.

Hospital robotics deployments typically follow a pattern: identify high-impact, low-complexity tasks first. A hospital might start by using Moxi to deliver lab samples from patient rooms to the laboratory. Lab sample delivery is straightforward: it's a point-to-point task, there's a clear efficiency gain, and it doesn't involve medication or direct patient care (which are more heavily regulated). Once the hospital staff becomes comfortable with robots, more complex tasks are assigned.

Second-stage deployments might include supply deliveries: moving medications, linens, surgical supplies, or food from central storage to different hospital areas. This is more complex because it involves coordinating with multiple departments, managing inventory, and ensuring that supplies reach the right location at the right time.

Third-stage deployments involve robots becoming integrated into workflow systems. Rather than a human saying "robot, deliver this," the hospital's internal systems automatically dispatch robots based on workflow requirements. A surgical schedule creates automatic supply requests that route to robots for delivery. This level of integration requires deep connectivity between hospital systems and robot systems.

Why do these stages matter? Because each stage requires different technical capabilities and organizational readiness. A company that can support hospitals at stage one might struggle at stage three. Serve's claim is that they can support hospitals across all three stages because they've already solved fleet management and autonomous navigation at scale.

Investment in Robotics: Why Capital Is Flowing Into This Space

The Serve-Diligent acquisition happened because there's genuine venture capital and strategic investor interest in robotics. Understanding that capital context helps explain the acquisition itself.

Nvidia, which is a major Serve investor, has been aggressive about investing in robotics and autonomous systems. Why? Because Nvidia's GPU compute is becoming the standard for any machine learning-intensive robotics application. Every modern robot uses computer vision, which requires GPU acceleration. By supporting robotics companies like Serve, Nvidia is creating future demand for its chips.

Uber's early investment in Serve through Postmates represented a strategic bet on last-mile economics. Uber was already operating food delivery at massive scale and was trying to figure out how to make the final mile (apartment delivery, order handoff) more efficient. Serve robots were an obvious solution. Once Serve spun out as independent, Uber maintained strategic interest but allowed the company to pursue opportunities beyond food delivery.

Other investors in robotics include major corporations trying to handle their own automation challenges and venture firms betting on the robotics wave becoming real. The total capital flowing into robotics startups is in the billions annually. But capital alone doesn't make companies successful. Capital combined with solid execution and clear market needs does.

The Regulatory Landscape: Why Robots Moving Autonomously Require Approval

Robots operating in public spaces or sensitive environments face regulatory scrutiny. Understanding this context explains why companies like Diligent have significant value even at early-to-mid revenue stages: their regulatory approvals are moats.

For sidewalk robots, the regulatory environment is emerging. Cities are still figuring out rules for autonomous sidewalk robots. Some cities have granted permission for extensive testing (San Francisco, Los Angeles). Others are more restrictive. The regulatory landscape is shifting rapidly, and companies that have proven safe operations in multiple jurisdictions have advantages over companies still seeking approvals.

For hospital robots, the regulatory environment is more established because hospitals are already heavily regulated. The FDA has oversight of medical devices, and robots in hospitals might fall under that jurisdiction depending on their function. Diligent's Moxi has obtained necessary FDA clearances and hospital certifications. These clearances represent genuine assets because competitors can't just clone Moxi without going through equivalent regulatory processes.

The point is that regulation, while sometimes frustrating to entrepreneurs, creates lasting competitive moats once a company has achieved compliance. Serve is acquiring not just technology but also regulatory advantages.

Diligent's common stock valuation at

What Comes Next: Future Scenarios for Serve Robotics

Serve's acquisition of Diligent sets up several possible scenarios for the company's future. Which scenario plays out will determine whether this acquisition was brilliant or merely strategic.

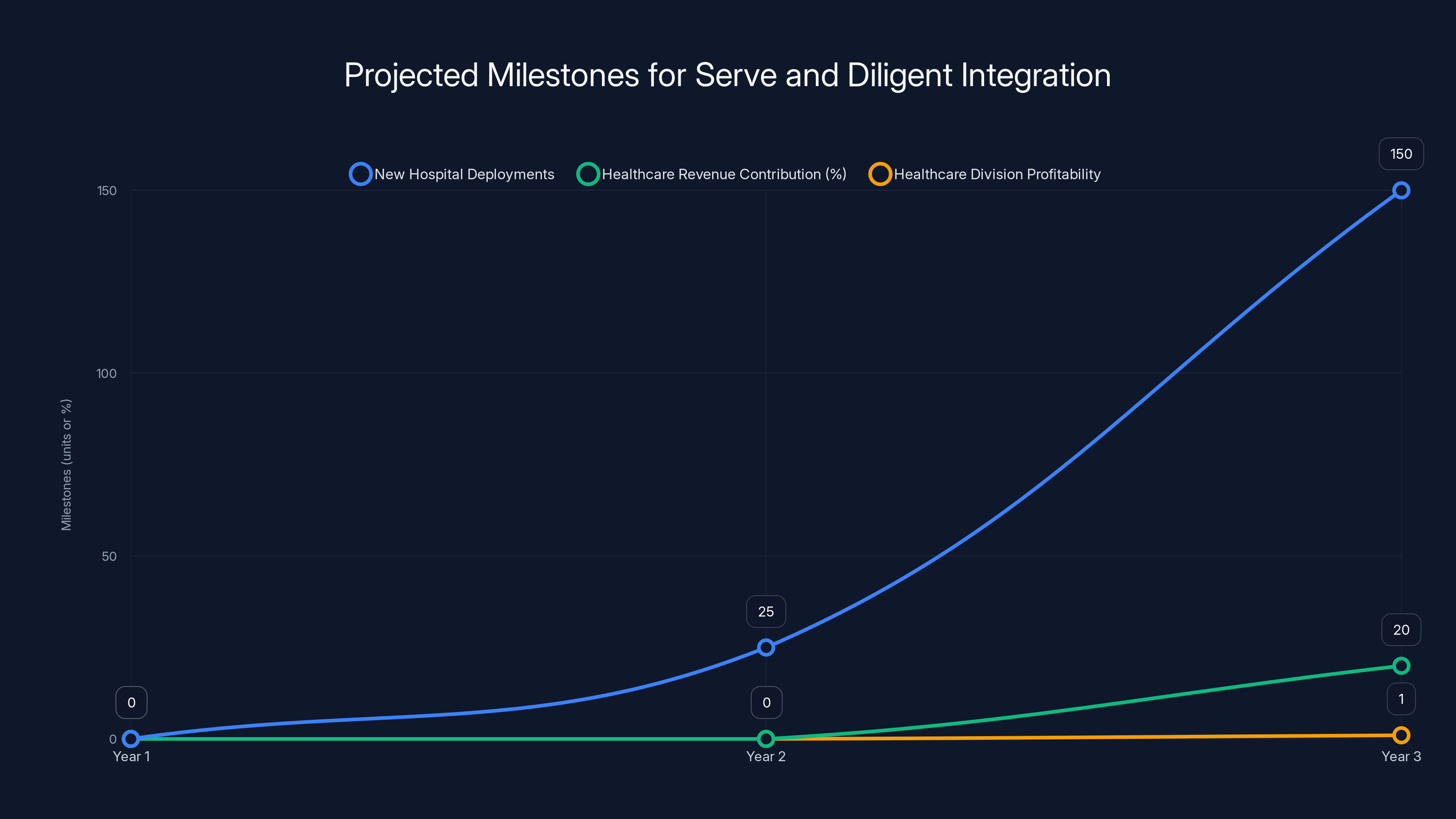

Optimistic scenario: Serve successfully applies its fleet management expertise to hospital operations. Within three years, Moxi robots are deployed in hundreds of hospitals across the United States. Hospitals see real ROI from labor savings and supply chain efficiency. Serve's healthcare division becomes 30 to 40 percent of total revenue. The company's valuation increases substantially as investors recognize the scalability of the healthcare market. Serve remains independent or gets acquired by a healthcare-focused conglomerate at a premium valuation.

Moderate scenario: Serve makes progress in healthcare but at a slower pace than hoped. Healthcare sales cycles are longer and hospital decision-making is more complex than anticipated. Within three to five years, Serve has robots in 50 to 100 hospitals. The healthcare division becomes 10 to 20 percent of revenue. Serve continues growing its sidewalk delivery business and explores one or two other verticals. The company remains independent but faces pressure to show diversified revenue streams.

Challenging scenario: Serve's healthcare expansion doesn't deliver expected returns. Hospital adoption is slower than modeled, competition from specialized hospital robotics companies intensifies, and Serve's generalist robotics platform doesn't differentiate sufficiently in healthcare. The healthcare division generates minimal revenue, and Serve refocuses on sidewalk delivery. This wouldn't be a failure—sidewalk delivery alone is a billion-dollar opportunity. But it would signal that the acquisition didn't achieve strategic objectives.

Based on the companies' track records and the complementary nature of their skills, the moderate scenario seems most likely. Neither optimistic nor pessimistic, but indicating real progress and expanded opportunity.

Broader Industry Shifts: What This Acquisition Signals

When a company like Serve acquires a company like Diligent, it signals something to the entire robotics industry. Here's what investors and competitors are likely thinking:

First: the autonomous navigation problem is sufficiently solved that companies can now focus on market expansion. If autonomous navigation were still a significant research problem, an acquisition like this would focus on underlying technology. Instead, it's focused on market application and customer relationships. That's a maturity indicator.

Second: last-mile delivery economics are probably harder to achieve at scale than initially expected, which is why Serve is expanding into adjacent markets. Serve's sidewalk delivery robots are cool, but the business model might have lower margins or slower growth than initial models suggested. Diversification makes sense if sidewalk delivery alone can't fund company growth and profitability goals.

Third: robots that operate among humans are becoming a core capability that applies across industries. The company with the best human-robot interaction, navigation among pedestrians, and safe autonomous operation in complex environments will have advantages regardless of specific vertical market. Serve is betting it has that capability.

Fourth: consolidation in robotics is beginning. For a decade, the industry was fragmented with hundreds of robotics startups each pursuing narrow markets. Now larger companies are acquiring smaller ones to build more comprehensive platforms. This trend will accelerate.

Comparing Serve's Healthcare Strategy to Competitors

To understand why Serve chose acquisition over building organically, it's useful to compare their healthcare strategy to how other companies have entered adjacent markets.

Some companies invest in hiring and organic development. This approach is slow but preserves independence and control. A company might hire ten healthcare experts and spend two years developing hospital-specific features. By year three, they might have their first hospital customer.

Other companies partner with specialists. A company might establish a partnership with a healthcare consulting firm, train their team on hospital operations, and develop hospital-specific features while preserving independence. This is faster than organic development but creates dependency on external partners.

Acquisition is the fastest path to healthcare market entry. By acquiring Diligent, Serve gets instant customer relationships, healthcare domain expertise, regulatory clearances, and operational experience. The company doesn't need to rebuild relationships or revalidate technology. They inherit a functional healthcare robotics business and apply their strengths (fleet management, scale) to expand it.

The trade-off is that acquisition requires capital and integration effort. Serve has capital (they went public in April 2024 and presumably have stock currency for M&A). Integration effort is non-zero but manageable if approached correctly.

The integration aims for significant growth in hospital deployments and revenue contribution by the third year. Estimated data.

The Human Element: Why Company Culture Matters in M&A

One of the most overlooked aspects of acquisitions is organizational culture. Whether an acquisition succeeds often depends less on whether the technology is complementary and more on whether the teams can work together effectively.

Kashani explicitly noted that both Serve and Diligent have "similar DNA" with a shared approach of building "in real life" rather than "in a lab." This cultural alignment is significant. It suggests that the two companies have compatible philosophies about how to build robotics companies. They're not trying to force together a scrappy startup with a buttoned-up enterprise software company. They're combining two mission-driven robotics companies that share similar values.

This cultural alignment probably explains why Diligent agreed to the acquisition and why Serve felt confident about integrating Diligent. When you acquire a company with very different culture, integration becomes much harder. People leave, institutional knowledge walks out the door, and the whole purpose of the acquisition gets undermined.

The fact that Diligent will operate relatively independently within Serve suggests respect for the existing team and confidence in their capabilities. This is healthier than a traditional integration where the acquired company gets fully absorbed and existing leadership gets sidelined.

Long-Term Strategic Vision: Where Is This Going?

If you zoom out and look at Serve's trajectory and this acquisition, a longer-term strategic vision emerges. Serve is positioning itself as the autonomous navigation platform company for enterprise robotics. They're not trying to build robots for every use case. They're trying to build the underlying autonomous navigation, perception, and fleet management technology that other companies can build on.

This vision resembles how Nvidia positioned itself in GPUs or how Google positioned itself with Android. The platform company doesn't serve every end customer directly. Instead, they provide the underlying infrastructure that enables specialized companies to serve specific markets efficiently.

If this vision plays out, Serve might eventually spin off or license their technology to multiple vertical specialists. A healthcare partner (possibly keeping Diligent independent) focuses on hospital operations. Another partner focuses on warehouse automation. Another focuses on factory logistics. Serve maintains the core platform and collects licensing fees or equity stakes in specialized implementations.

This is speculative, of course. Companies often describe a vision different from what actually happens. But the Diligent acquisition hints at this possibility by explicitly keeping Diligent independent while enabling deep technical collaboration.

The Economics of Autonomous Delivery: Why This Matters Now

Autonomous delivery robots only make economic sense under specific conditions. Understanding those conditions explains why Serve is expanding into healthcare now, not earlier.

For sidewalk food delivery, the economics work in dense urban areas where:

- Population density justifies robot deployments

- Delivery distances are relatively short (2-5 miles)

- Delivery times aren't urgent (30-60 minutes acceptable)

- Weather is manageable (not extreme snow or rain consistently)

- Regulatory environment allows operation

These conditions are present in cities like San Francisco and Los Angeles. But they're not present everywhere. Serve's sidewalk delivery business is inherently limited to urban markets where density justifies robots.

For hospital delivery, the economics work because:

- Hospitals are dense environments with high vertical integration

- Delivery within a hospital is short-distance (100 meters to 1 km)

- Supply delivery is urgent and time-sensitive

- There's significant labor cost savings justifying robot investment

- Regulatory environment is established and functional

These conditions exist in almost every hospital in developed countries. The healthcare market is geographically larger and potentially more economically valuable than sidewalk delivery. This is probably why Serve views the acquisition as strategic expansion rather than pivot.

Implementation Timeline and Milestones

When Serve and Diligent integrate, certain milestones will indicate success or failure. Understanding these milestones helps evaluate whether the acquisition is working.

First-year milestones might include:

- Successful data integration between Serve's fleet software and Diligent's hospital operations

- Launch of joint sales and marketing for hospital deployments

- Retention of key Diligent customers and expansion of relationships

- Hiring of healthcare specialists within Serve

- Completion of any necessary regulatory updates for expanded Moxi capabilities

Second-year milestones might include:

- Deployment of robots in 20-30 new hospital customers (beyond Diligent's existing base)

- Introduction of new Moxi capabilities leveraging Serve's autonomous navigation algorithms

- Achievement of positive unit economics in hospital deployments

- Expansion into adjacent healthcare facilities (clinics, rehabilitation centers, assisted living)

Third-year milestones might include:

- Healthcare division generating 15-25 percent of total Serve revenue

- Deployment of 100-200 hospital customers

- Profitability at the healthcare division level

- Possible international expansion of hospital robots

If these milestones are achieved, the acquisition will likely be considered successful. If the company significantly misses these milestones, investors might question the strategic fit.

Challenges and Risks in the Hospital Robotics Market

Let me be clear about what could go wrong. Hospital robotics sounds promising, but the market has real obstacles.

First, hospital IT systems are notoriously fragmented and resistant to change. A hospital might run payroll on one system, patient records on another, supply chain on a third, and physical plant management on a fourth. Integrating a new robot system requires connecting to some combination of these systems. This integration is tedious and time-consuming.

Second, hospital staff are often skeptical of new technology. Nurses who've worked in hospitals for twenty years have established workflows. A robot that disrupts those workflows, even if the disruption eventually saves time, faces resistance. Implementation requires careful change management and staff training.

Third, hospital procurement is slow and bureaucratic. A decision to deploy a robot might require approval from administrators, medical directors, IT, facilities management, and multiple other stakeholders. A contract negotiation that would take weeks in a commercial setting might take six months in a hospital.

Fourth, reliability requirements are high and consequences of failure are severe. If a delivery robot breaks down in a hospital, it's not just an inconvenience—it might disrupt patient care. This means robots need to be extremely reliable and require rapid maintenance response.

Fifth, capital budgets in healthcare are constrained. Hospitals operate on thin margins and carefully manage capital spending. A robot that costs

Fifth, regulatory changes could impact the market. If regulations around medical robots become more restrictive or if reimbursement models change, hospital adoption could slow significantly.

Serve and Diligent are aware of these challenges. That's not a criticism; it's recognition that hospital robotics, while promising, isn't a slam-dunk market.

Real Talk: What Could Make This Acquisition Fail

Let's be direct about failure scenarios. Acquisitions fail when:

The acquiring company underestimates integration complexity. Serve has expertise in sidewalk robotics. Healthcare is different. If they assume their expertise directly transfers without acknowledging the differences, integration will be painful.

Key employees leave. If Diligent's experienced healthcare team leaves because they don't want to work within Serve's structure, the acquisition loses significant value. Retaining talent is critical and non-trivial.

Technology integration fails. If Serve's fleet software and Diligent's hospital software can't integrate efficiently, they end up running parallel systems. This is expensive and defeats the purpose of the acquisition.

Market adoption is slower than expected. Healthcare adoption is notoriously slow. If Serve expects 20 new customers per year and gets 5, the acquisition won't generate expected returns.

The strategic vision doesn't align with financial reality. Serve might discover that the healthcare market, while large, doesn't generate the margins or growth rates needed to justify the acquisition price.

Competitive pressure emerges. If other companies launch better hospital robots, or if existing competitors like MiR expand aggressively into healthcare, Serve's first-mover advantage (if any) gets eroded.

None of these scenarios are inevitable. But they're plausible. Smart investors and executives should understand these risks when evaluating the acquisition.

The Broader Context: Robotics as an Industry Coming of Age

The Serve-Diligent acquisition is part of a larger story about robotics transitioning from research and development stage to commercial deployment stage. That transition is important and underappreciated.

For decades, robotics was mostly research. University labs and robotics startups worked on underlying problems: how to make robots move, perceive, and navigate. The technology was nascent. Deployment was mostly in controlled environments like factories.

Over the past five to ten years, autonomous perception and navigation have matured. Companies like Serve and Diligent can now deploy robots in uncontrolled, unpredictable environments. The technology works reliably enough for commercial deployment.

What's happening now is that companies are taking proven autonomous technology and applying it to multiple markets. Serve started with food delivery. They're adding healthcare. Other companies are pursuing warehouse automation, construction, manufacturing, and hospitality.

This is the transition from technology research to business scaling. It's exciting because it means robots are finally moving from headlines to practical use. It's challenging because scaling is harder than building prototypes.

The Serve-Diligent acquisition is a key signal of this transition. It shows that companies are confident enough in autonomous technology to make significant capital commitments. That confidence is probably justified by the deployments we're seeing work.

Conclusion: Why This Matters Beyond the Companies Involved

The Serve Robotics acquisition of Diligent Robotics for $29 million might seem like another incremental tech deal. But it represents something more significant: validation that autonomous navigation is becoming a core technology platform that applies across multiple industries, and that companies solving last-mile logistics problems can scale beyond their initial markets.

For Serve, the acquisition addresses a real strategic challenge: how to grow beyond the constrained sidewalk delivery market. Healthcare offers a genuinely large opportunity with favorable economics. The acquisition gets Serve into that market years faster than building organically.

For Diligent, the acquisition provides an exit to founders and early investors while enabling the company to scale more aggressively with Serve's operational resources and fleet management expertise. It's a mutually beneficial transaction.

For the broader robotics industry, the acquisition signals maturity and consolidation. Fragmented robotics startups each solving narrow problems are giving way to platform companies with broader reach. That consolidation will likely accelerate as autonomous technology becomes more standardized and as companies realize the real business model is platform services, not hardware sales.

For hospitals and healthcare systems, the acquisition matters because it means more sophisticated, better-funded robotics companies will be competing to solve healthcare logistics problems. That competition will drive innovation and improve outcomes.

The most important takeaway is that autonomous robotics is finally moving past speculation to implementation. Serve and Diligent aren't promising to build robots. They've already built them and deployed them at scale. Now they're scaling further. That's progress.

For investors, this acquisition is worth watching as a barometer of whether autonomous robotics can generate real returns at scale, or whether the business models remain challenged despite impressive technology.

FAQ

What does Diligent Robotics do?

Diligent Robotics builds and deploys autonomous robots called Moxi that operate in hospital environments. Moxi robots navigate hospital corridors autonomously to deliver lab samples, medical supplies, linens, medications, and other materials to specific locations within hospitals. The robots are designed to safely interact with human staff and patients while handling routine logistics tasks that typically consume significant nursing time.

Why did Serve Robotics acquire Diligent Robotics?

Serve Robotics acquired Diligent to expand from sidewalk food delivery into healthcare market opportunities. The core technology—autonomous navigation in complex human environments—applies directly to hospital operations. The acquisition gives Serve instant access to hospital customers, healthcare domain expertise, regulatory clearances, and operational experience that would take years to develop internally. Both companies share similar philosophies about building robots in real-world environments rather than laboratories.

How much did Serve Robotics pay for Diligent Robotics?

Serve Robotics valued Diligent Robotics' common stock at

Will Diligent Robotics operate independently after the acquisition?

Yes, according to CEO Ali Kashani, Diligent Robotics will continue to operate "relatively independently" within Serve. Rather than absorbing Diligent into Serve's structure, the companies plan to operate as distinct units that share technology infrastructure and collaborate on development. This approach preserves Diligent's healthcare expertise while enabling both teams to leverage each other's strengths in autonomous navigation and fleet management.

What is Moxi, and what can it do?

Moxi is Diligent Robotics' autonomous robot designed specifically for hospital environments. The robot navigates hospital corridors using autonomous perception and navigation systems to deliver lab samples, medical supplies, medications, linens, and other materials. Moxi can operate elevators, navigate around people, and reliably complete assigned tasks in complex indoor environments. The robot's design emphasizes safety, reliability, and compatibility with existing hospital workflows.

How does Serve Robotics' sidewalk delivery experience apply to hospital robotics?

Both sidewalk delivery and hospital robotics require solving the same core problem: autonomous navigation in complex, unpredictable human environments. Serve's expertise in fleet management, autonomous perception, LIDAR sensing, and real-time obstacle detection directly applies to hospital operations. By acquiring Diligent, Serve transfers its operational scaling experience to healthcare, while gaining healthcare domain expertise and customer relationships. The technology stack is complementary even if the market context differs.

What is the addressable market for hospital robotics?

The United States has approximately 6,000 hospitals. If 30 percent deploy even one autonomous delivery robot, that represents 1,800 units. At

What are the regulatory requirements for hospital robots?

Robots operating in hospitals must comply with FDA medical device regulations if they directly interact with medication, patient care, or medical workflows. However, robots that handle non-medical logistics tasks like sample delivery face lower regulatory barriers. Diligent's Moxi has obtained necessary FDA clearances and hospital certifications, which represent significant competitive advantages. Regulatory approval can take years and substantial resources to achieve, creating lasting barriers to entry for competitors.

What challenges does hospital robotics deployment face?

Hospital robotics faces several obstacles: fragmented and resistant IT infrastructure, skeptical staff with established workflows, slow bureaucratic procurement processes, high reliability requirements, constrained capital budgets, and potential regulatory changes. Hospital decisions require approval from multiple stakeholders including administrators, medical directors, IT departments, and facilities management. Despite these challenges, the economic case for hospital robots is strong because they address chronic labor shortages and supply chain inefficiencies.

Could this acquisition signal the beginning of consolidation in robotics?

Yes. The Serve-Diligent acquisition fits a broader trend of consolidation in robotics as the industry matures. For the past decade, robotics was fragmented with numerous startups each pursuing narrow markets. Companies that have solved autonomous navigation well are now acquiring or partnering with companies that understand specific vertical markets. This consolidation is efficient because it allows companies with proven navigation technology to apply that technology across multiple industries without each company solving navigation from scratch.

Key Takeaways

- Serve Robotics acquired Diligent Robotics' $29 million common stock valuation to expand from sidewalk delivery into high-opportunity healthcare markets

- The acquisition demonstrates that autonomous navigation technology solves fundamental problems across multiple industries, enabling platform companies to scale beyond initial markets

- Hospital robotics represents a 360M+ addressable market in the US alone, driven by chronic nursing shortages and supply chain inefficiencies

- Diligent will operate independently within Serve while leveraging fleet management expertise, preserving healthcare domain knowledge while enabling technical collaboration

- This acquisition exemplifies broader consolidation in robotics as companies with proven autonomous technology acquire vertical specialists to achieve market-specific scale

Related Articles

- Biotics AI Wins FDA Approval for AI-Powered Fetal Ultrasound Detection [2025]

- Ocean Robots in Category 5 Hurricanes: Oshen's Breakthrough [2025]

- AI Healthcare Revolution: Why Tech Giants Are Racing Into Medicine [2025]

- Anthropic's Cowork: Claude's Agentic AI for Non-Coders [2025]

- VoiceRun's $5.5M Funding: Building the Voice Agent Factory [2025]

- AI Agent Orchestration: Making Multi-Agent Systems Work Together [2025]

![Serve Robotics Acquires Diligent: Why Healthcare Robots Are the Next Frontier [2025]](https://tryrunable.com/blog/serve-robotics-acquires-diligent-why-healthcare-robots-are-t/image-1-1768947145839.png)