Introduction: When the Automaker Becomes a Tech Company

Last quarter, something quietly seismic happened at Tesla. The company killed off the Model S and Model X, the original flagship vehicles that made Tesla a household name. Not because they weren't selling. Not because the market demanded it. But because Elon Musk and his team made a strategic bet that the future doesn't belong to traditional car manufacturing. According to NBC News, this decision was made to focus on the production of the Optimus humanoid robot.

This is a watershed moment, and it deserves serious attention.

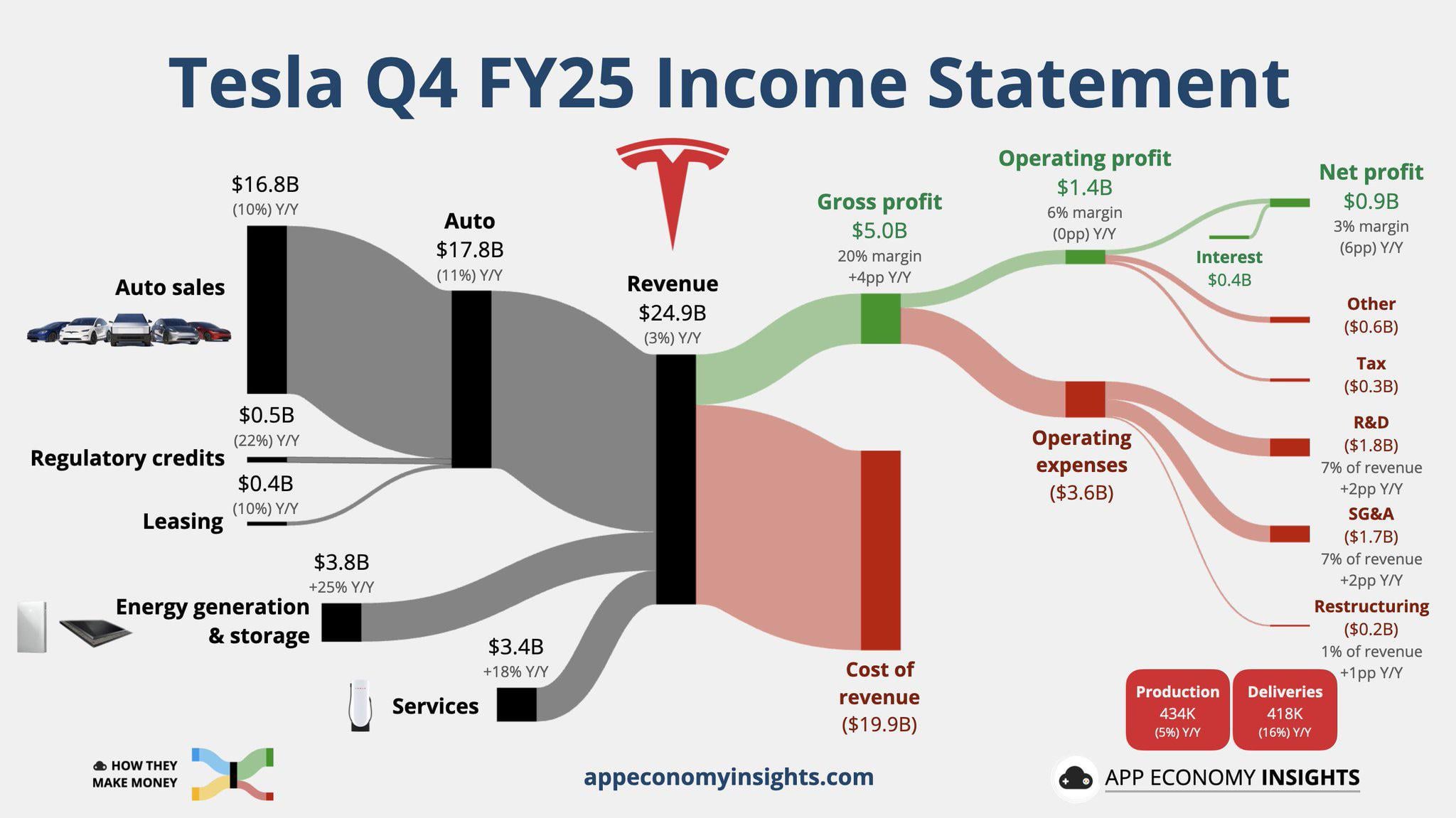

Tesla just reported

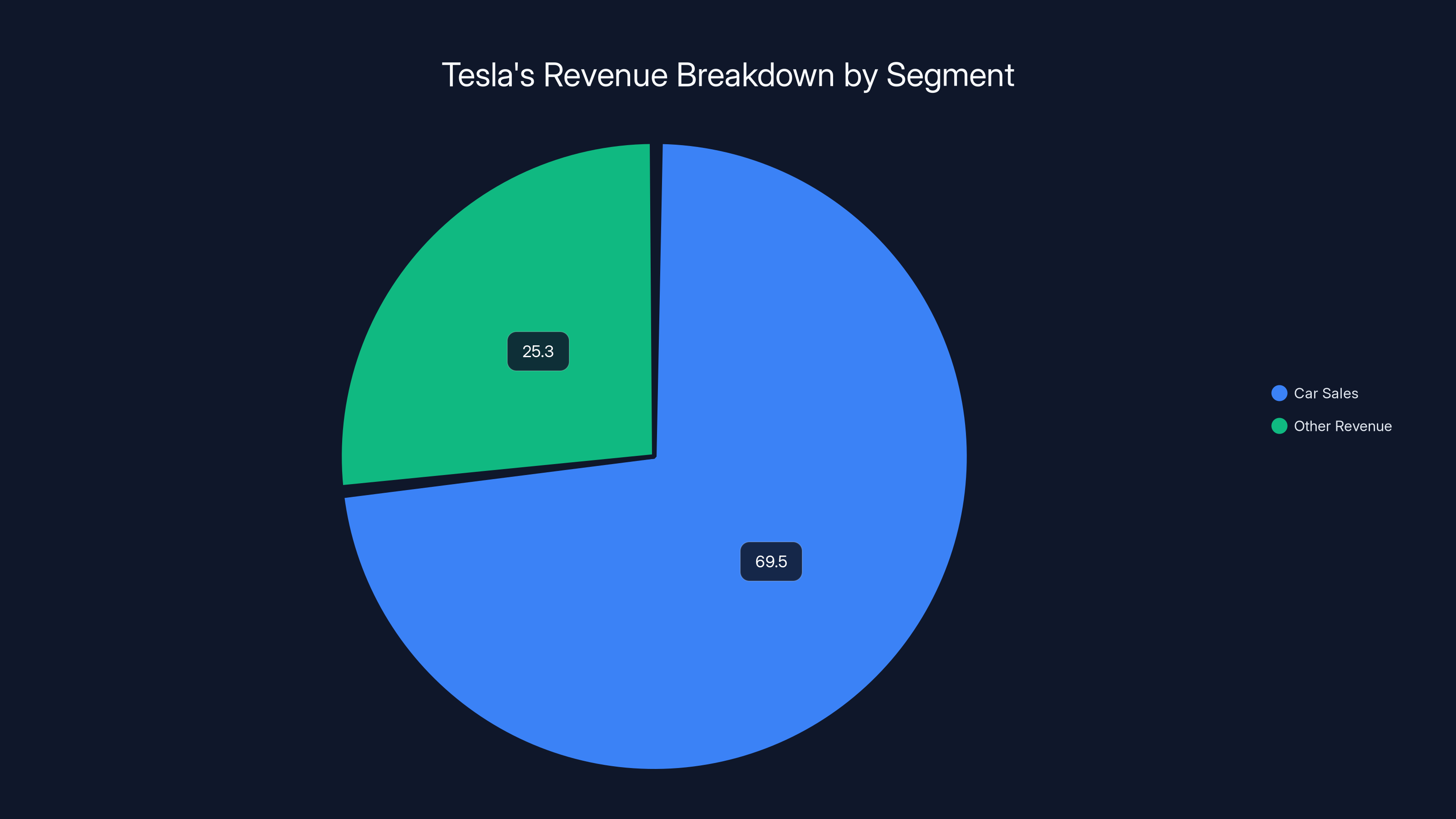

Here's the tension nobody's talking about loudly enough: Tesla still depends almost entirely on car sales for revenue. Yet leadership is effectively saying cars are a legacy business. They're betting the company on technologies that don't exist yet in any meaningful production capacity. It's an audacious gamble. The question is whether it's visionary or delusional.

I spent the last two weeks digging into earnings calls, industry reports, and expert analysis. What emerges is a picture of a company in a fundamental identity crisis. Is Tesla an automaker racing to phase out cars? A robotics startup with a century-old industry problem? An AI company that happens to own factories? Or is Musk simply recycling old promises with new technology swapped in?

Let's break down what's actually happening, what it means, and whether the pivot makes sense.

TL; DR

- Tesla's revenue is still 73% dependent on car sales, yet leadership frames the company as AI and robotics-focused

- The company discontinued Model S and Model X to allocate manufacturing capacity to the Optimus humanoid robot, as reported by Technology.org

- Full Self-Driving subscriptions hit 1.1 million users, representing 38% quarterly growth and a shift toward recurring revenue, according to InsideEVs

- Musk predicts 1-5% of future miles driven will be human-operated, betting everything on autonomous vehicles becoming ubiquitous

- The model is risky: no other automaker is abandoning car production this dramatically, and autonomous vehicles remain years away from regulatory approval and profitable scale

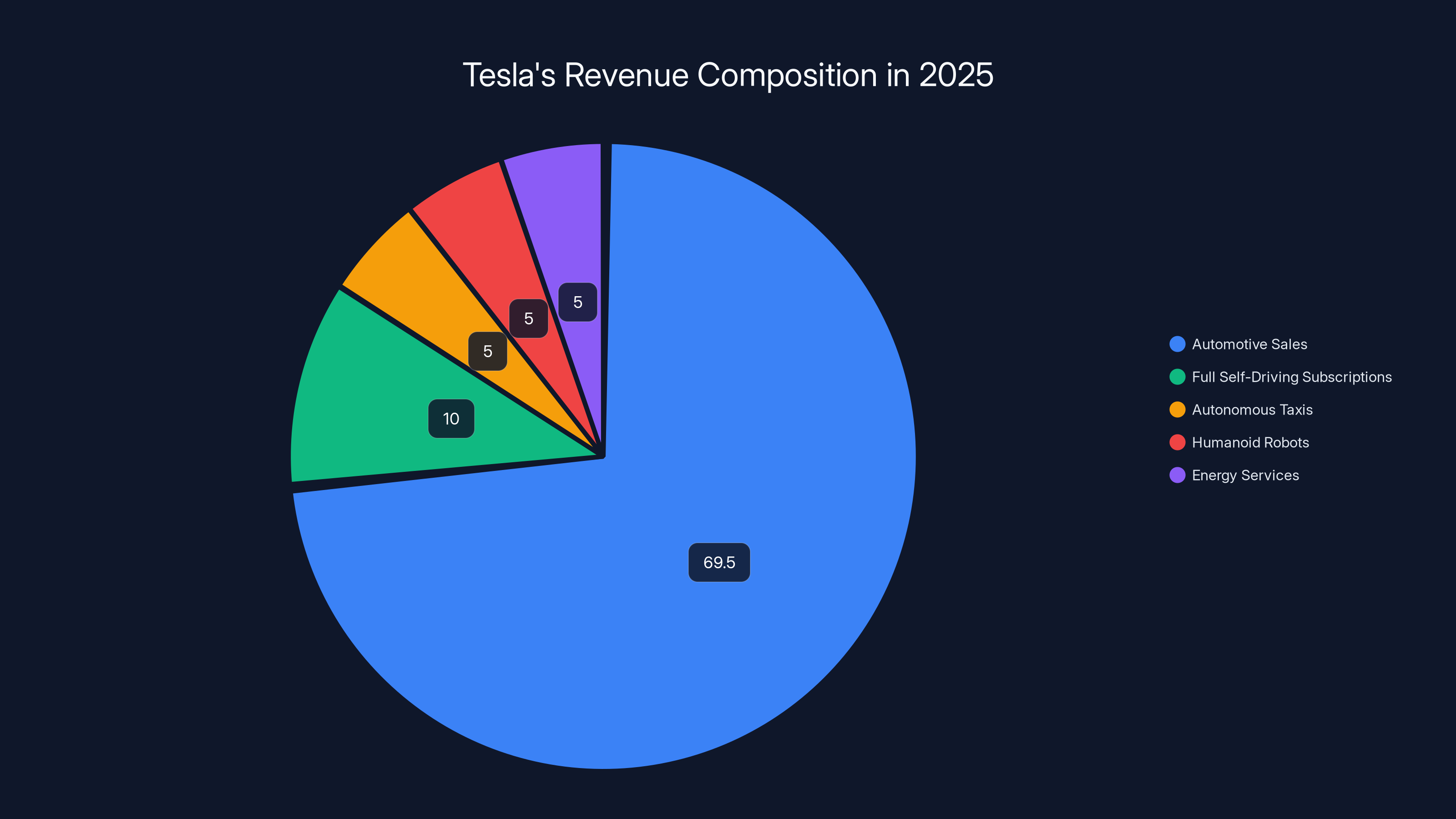

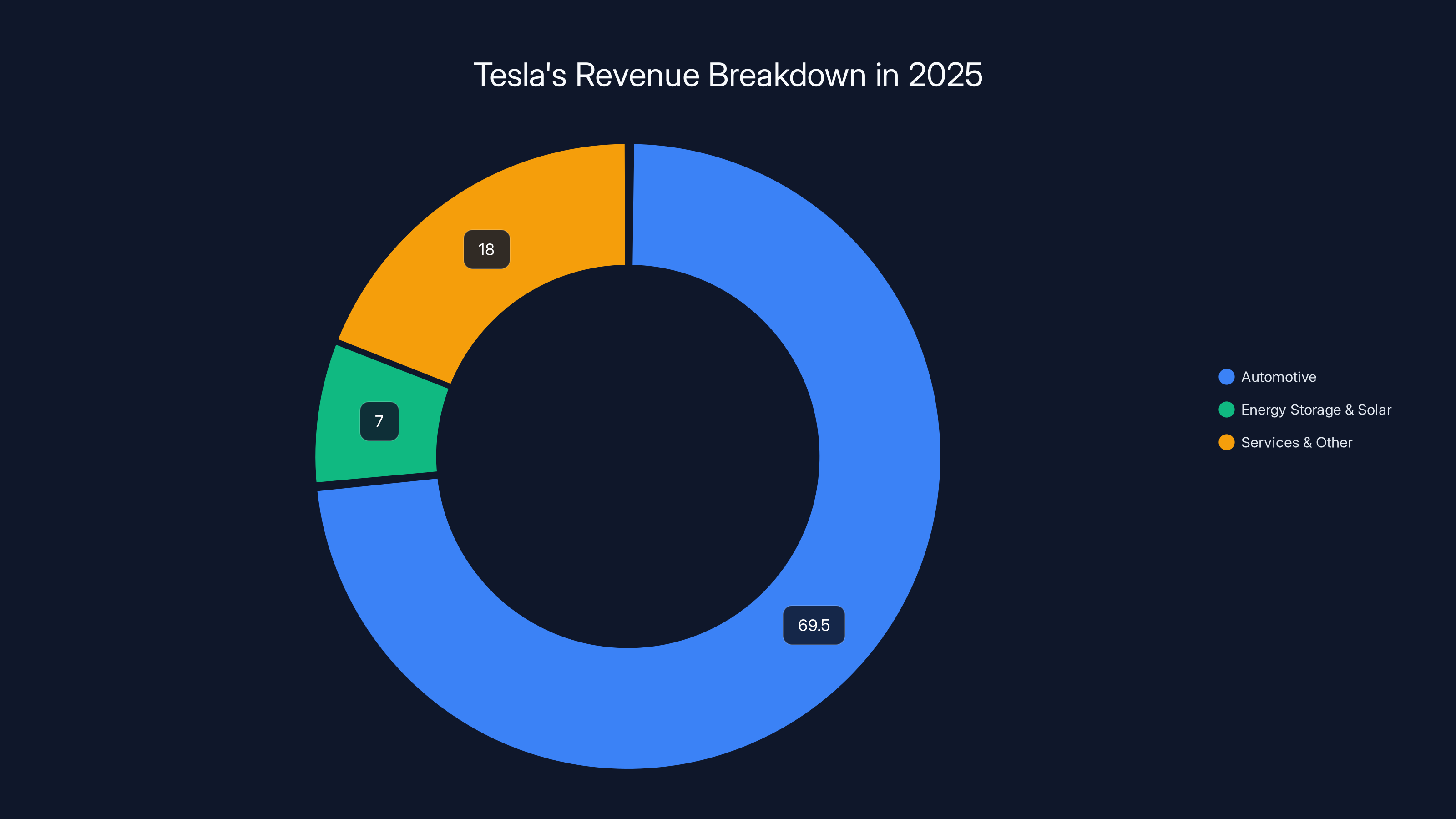

Car sales account for 73% of Tesla's $94.8 billion revenue in 2025, highlighting the company's current dependency on automotive sales despite strategic shifts towards robotics and autonomous technology.

The Death of Tesla's Flagship: What Discontinuing the Model S and Model X Really Means

When Tesla announced it was discontinuing the Model S and Model X, the business press treated it like a footnote. It wasn't. It was a statement of intent.

These weren't niche vehicles. The Model S defined the luxury EV segment when it launched in 2012. It proved that electric cars could be fast, desirable, and expensive. The Model X brought that luxury positioning to the SUV market. Together, they established Tesla's brand identity beyond memes and Elon drama. They were the company's proof that electrification worked at the premium end.

Yet Musk killed them to free up production lines for the Optimus robot, as detailed by Desert Sun.

Let's pause on the absurdity here. Tesla is discontinuing successful products to manufacture a robot that, by Tesla's own public demonstrations, can barely fold a t-shirt without dropping it. The Optimus robot has been shown struggling with basic manual tasks. It moves awkwardly. Its hands are barely functional. And Musk is betting the future of a company worth hundreds of billions of dollars on the idea that this technology will somehow become worth more than selling luxury electric sedans and SUVs that people actually want to buy.

The strategic logic is this: if autonomous taxis and humanoid robots represent the future, then traditional car sales are a sunset industry. Why invest in selling cars to individuals when you could own the robots that replace those cars entirely? It's not a bad argument on paper. In practice, it's a massive bet with no margin for error.

Tesla's executive team tried to frame this during earnings as a natural evolution. One top executive explicitly said the company should be viewed as "transportation as a service" rather than an automaker. That's corporate speak for "we're not sure we want to be in the car business anymore." But here's the problem: they still are.

Revenue Reality: Why 73% of Tesla's Money Still Comes From Cars

Let's talk numbers, because they tell a clearer story than Musk's optimistic rhetoric.

Tesla brought in

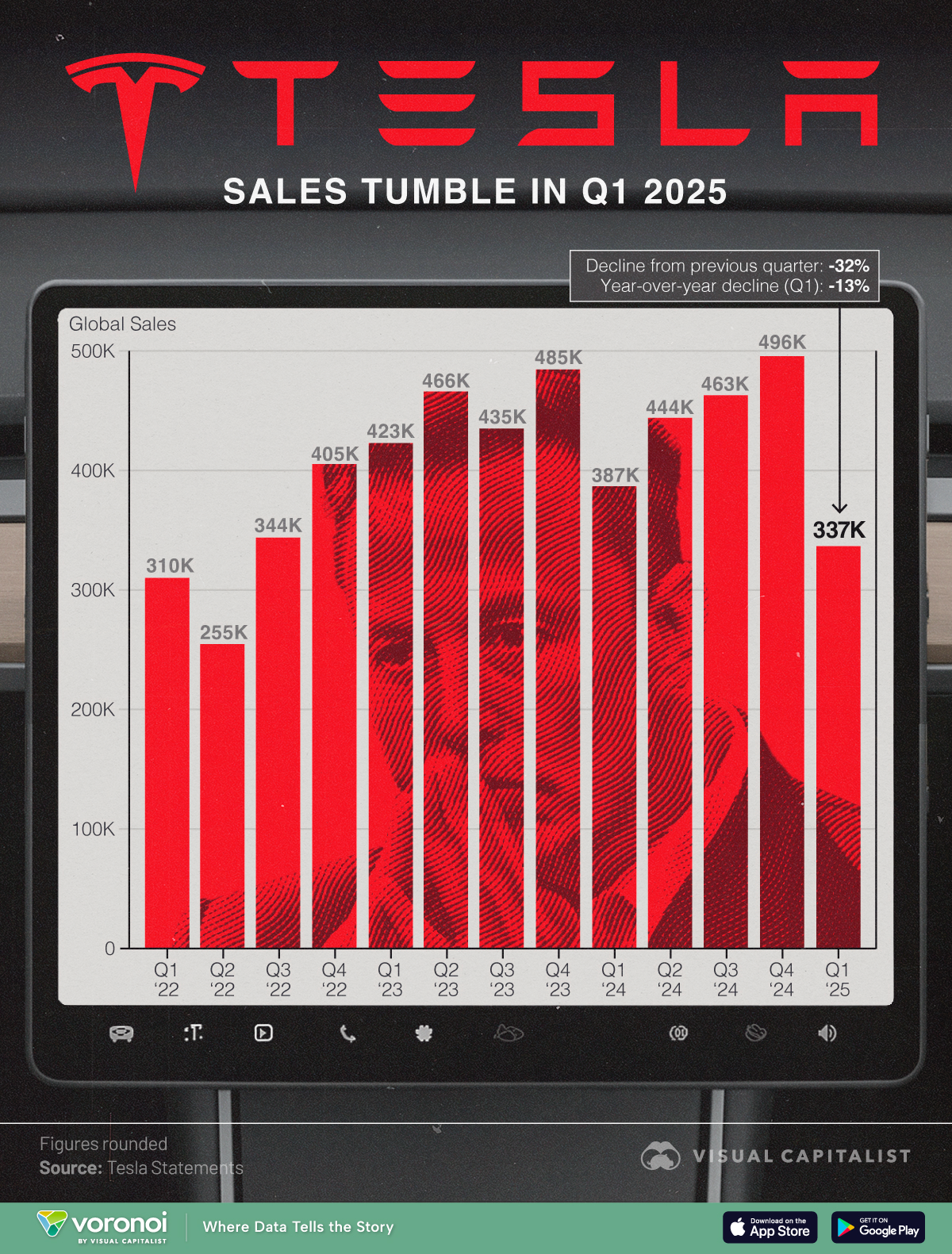

But here's what matters: automotive revenue is declining. It's down 10 percent year-over-year. And this happened during a period when the company released new versions of its core models and actually tried harder to compete on price.

Why the decline? Several factors are colliding at once:

EV incentives are disappearing globally. Many countries reduced or eliminated subsidies for electric vehicle purchases. This was particularly brutal in Europe and parts of Asia. Without tax credits, EVs become more expensive relative to gas cars, and price-conscious buyers stick with internal combustion engines. Musk himself contributed to this in the US by supporting political figures who oppose EV subsidies, as noted by Statesman.

Competition has exploded. Every major automaker now has EV offerings. For years, Tesla had the category mostly to itself. Now you can get an electric SUV from Hyundai, Volkswagen, BMW, Mercedes, Ford, GM, Rivian, and two dozen other manufacturers. Many of these are genuinely good cars. The free ride is over.

Chinese competitors are eating Tesla's lunch. BYD, the Chinese automaker, dethroned Tesla as the global EV sales leader. This wasn't supposed to happen. Tesla was supposed to be unbeatable. BYD is now selling more than 5 million electric and plug-in hybrid vehicles annually. That's more than double Tesla's deliveries. And BYD has an enormous cost advantage due to lower labor and manufacturing costs, as reported by Focus2Move.

The brand has become toxic for a core demographic. Musk's political activities and public persona have alienated a significant portion of Tesla's original customer base: urban, progressive, environmentally conscious professionals. These buyers made Tesla cool. Now, a substantial chunk views the brand as politically charged. That's not a small problem for a luxury brand that runs on desirability, as highlighted by The New York Times.

This revenue cliff is the real reason Tesla is pivoting. Not because cars are bad. But because selling individual vehicles to consumers is increasingly difficult, margin-compressing, and labor-intensive. If Musk can convince the world that Tesla will someday own a fleet of autonomous taxis and humanoid robots, then Tesla stock doesn't have to justify itself on current car sales. The stock can trade on future potential instead.

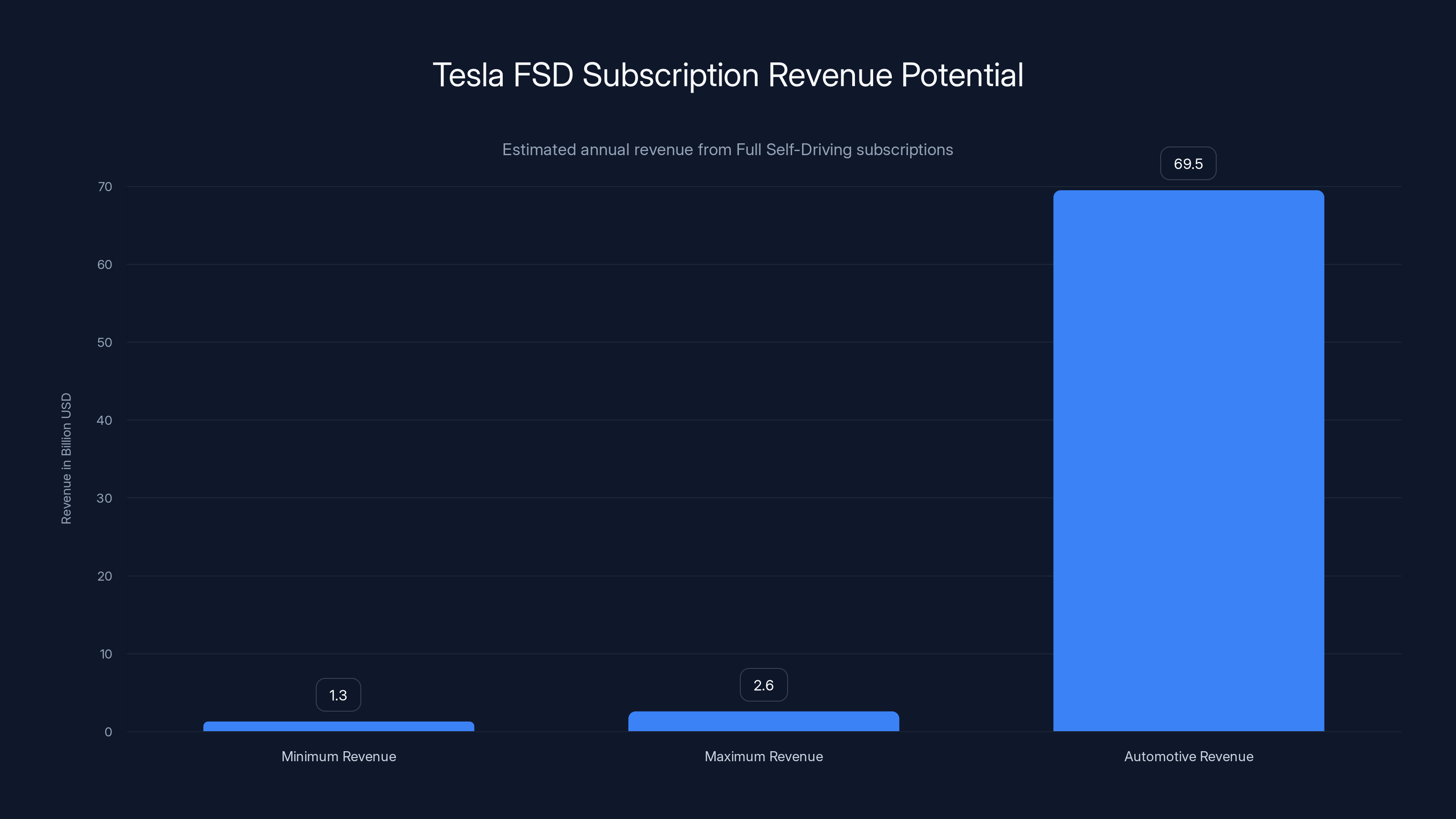

Tesla's FSD subscriptions could generate

The Full Self-Driving Gambit: Can Subscriptions Replace Manufacturing?

For the first time, Tesla disclosed something investors have been desperate to know: the number of Full Self-Driving (Supervised) active subscriptions. The number is 1.1 million. Musk claims it grew 38 percent in one quarter, as reported by InsideEVs.

That's genuinely impressive growth. But it reveals the strategy: shift from selling cars as one-time purchases to selling autonomous driving as a recurring subscription. One-time car sales generate a lump sum revenue. Subscriptions generate recurring revenue streams, higher margins over time, and more predictable cash flow.

Here's the FSD model: Tesla owners pay for the Full Self-Driving subscription, which allows hands-free driving on highways and in urban areas. Drivers have to keep their eyes on the road and be ready to take control if the system fails or encounters something it can't handle. It's not true autonomy. It's an advanced driver assistance system. But it's being marketed as a path toward full autonomy.

Musk recently announced that Tesla will stop selling FSD as a standalone purchase and shift entirely to subscription. That's a critical move. It transforms FSD from a luxury upgrade into a recurring revenue stream. If you want autonomous driving features, you have to keep paying every month.

Now, the math question: if 1.1 million people are paying for FSD subscriptions at

More critically, FSD remains controversial. Tesla has faced multiple lawsuits and regulatory investigations regarding the safety and marketing claims of FSD. The National Highway Traffic Safety Administration has opened multiple investigations. Some states and cities have pushed back on deployments of FSD in their jurisdictions. And the technology itself is still fundamentally unreliable in unexpected situations. It's better than it was, but it's not close to true autonomy, as noted by Ars Technica.

Yet Musk is doubling down. He announced Tesla will reveal the "Gen 3" Optimus robot by the end of 2027, claiming it will be ready for mass production. He's also promising autonomous taxis in "dozens" of US cities this year—a prediction he's made before and missed.

The subscription play is smart operationally. But as a full replacement for car sales, it's still vaporware.

The Optimus Problem: Can Humanoid Robots Actually Work?

The centerpiece of Tesla's pivot is the Optimus humanoid robot. Musk has been talking about humanoid robots for years. Now, he's willing to kill profitable car production lines to manufacture Optimus at scale, as reported by HotCars.

There's one problem: the robot doesn't work very well yet.

Public demonstrations of Optimus have shown it struggling with basic manual tasks. Folding clothes. Picking up objects. Moving with natural coordination. These aren't hard for humans. They're impossibly hard for current robotics technology. The robot has limited dexterity, poor spatial reasoning, and moves with the grace of an early-1990s CGI character.

This is a legitimate technological frontier. Getting humanoid robots to work at human levels is genuinely difficult. But Musk is claiming the Gen 3 version will be ready for production in two years. Most roboticists would say that's wildly optimistic.

Here's the bigger issue: even if Optimus works, what is it actually for? Musk hasn't clearly articulated the economic use case. Manufacturing? There's already industrial robotics for that, and they're better at it. Household tasks? That requires extreme dexterity and contextual understanding. Caregiving? That raises profound ethical and safety questions.

Musk has hinted that Optimus could function as a "universal worker" for any physical task. But that's science fiction until proven otherwise. A general-purpose humanoid robot capable of doing arbitrary physical labor is one of the hardest problems in robotics. It might be solvable. But not on a two-year timeline.

Yet Tesla is restructuring its manufacturing to bet everything on it. That's not strategic planning. That's faith.

The Autonomous Taxi Vision: Disruption or Delusion?

Musk's core thesis is that the future of transportation is autonomous taxis. Instead of owning cars, people will summon self-driving vehicles on demand. Tesla will own the fleet. Musk will become the world's first trillionaire from the passive income generated by robot taxis.

It's a seductive vision. And it's not impossible. Autonomous vehicles could theoretically disrupt transportation the same way Uber disrupted taxis.

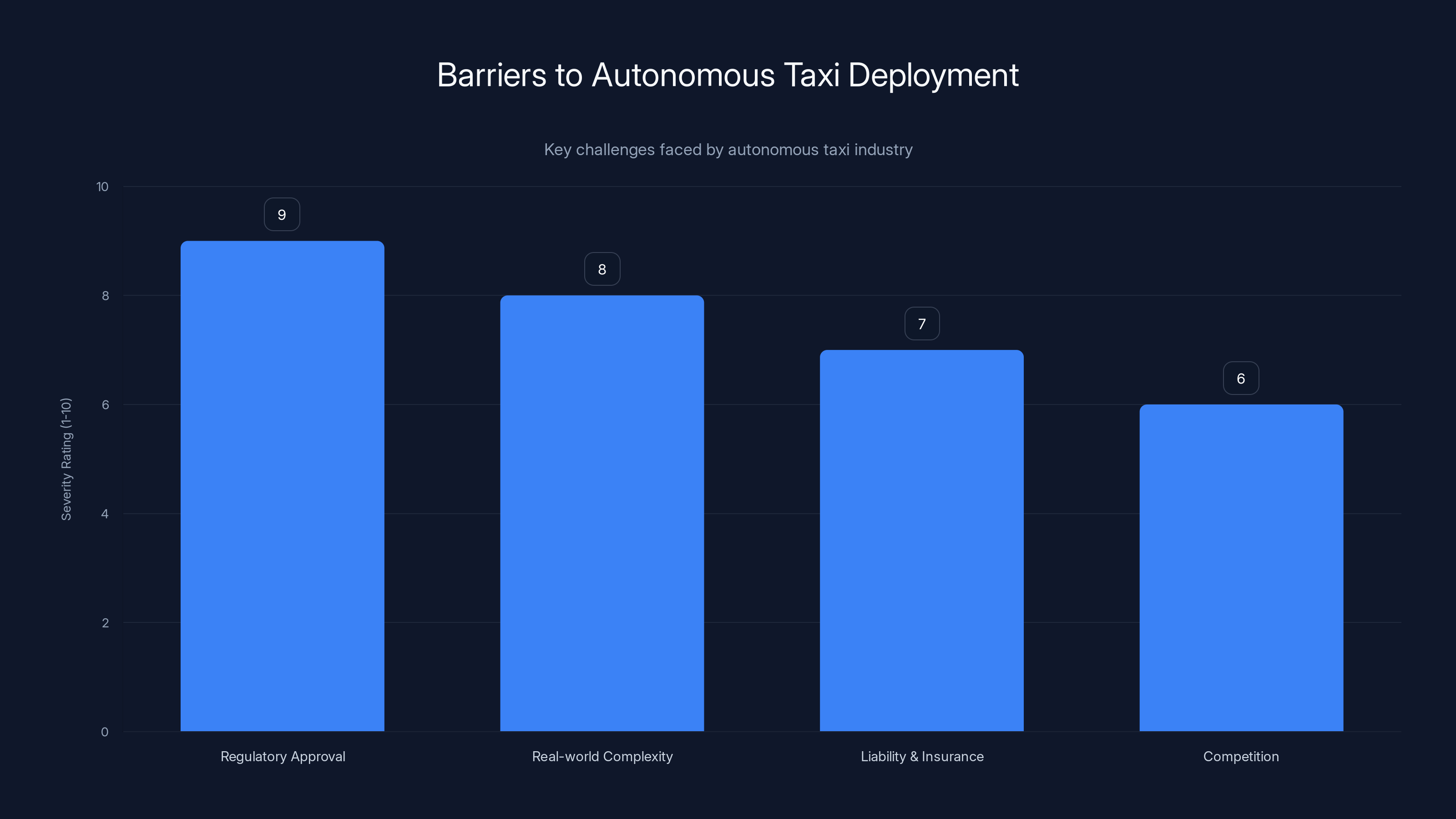

But there are massive barriers:

Regulatory approval. No government has given blanket approval for fully autonomous taxis at scale. California has limited approvals in specific geographic zones. Most countries require human oversight and have strict liability frameworks. Getting regulatory approval for autonomous taxis across dozens of US cities would require demonstrations of safety that don't exist yet. The timeline is measured in years, not months, as noted by Statesman.

Real-world complexity. Autonomous driving in structured highway environments is relatively easy. Autonomous driving in dense urban environments with unpredictable behavior—jaywalking pedestrians, cyclists, construction, weather, edge cases—is exponentially harder. Tesla's FSD works best on highways. In cities, it's less reliable. And most of the value of autonomous taxis is in dense urban deployment.

Liability and insurance. Who is liable if an autonomous taxi causes an accident? Is it Tesla? The software? The fleet operator? Legal frameworks don't exist yet. Insurance models don't exist. Until that's settled, autonomous taxis at scale aren't happening.

The competition problem. Tesla isn't the only company working on autonomous vehicles. Alphabet's Waymo has been testing autonomous taxis in multiple cities and has deeper real-world data. Traditional automakers are investing billions into autonomous technology. If the market materializes, Tesla won't have a monopoly.

Musk's prediction that 95 to 99 percent of miles driven will eventually be autonomous is probably right over a 50-year timeline. But his claim that Tesla will be operating autonomous taxis in dozens of cities in 2025? That's not a prediction. That's a wish.

In 2025, 73% of Tesla's $94.8 billion revenue came from automotive sales, highlighting its current dependence on car sales despite a strategic pivot towards AI and robotics. Estimated data.

The Subscription Pivot: Why Tesla Needs Recurring Revenue

Underlying all of this is a fundamental shift toward subscription and recurring revenue models.

Tesla's traditional model was one-time car sales. You buy the car, Tesla gets the revenue. The problem with one-time transactions is that you have to keep selling more cars to grow revenue. It's exhausting. Margins compress. Competition intensifies. Growth plateaus.

Subscription models are different. If you can get people to pay monthly for something they value, revenue becomes predictable and recurring. Margins are typically higher. And the lifetime value of a customer goes up dramatically.

Tesla's push to make FSD subscription-only is part of this. So is the energy storage business, which has recurring service components. So is the push toward autonomous taxis, which would generate recurring revenue from fleet operations.

It's a smart financial strategy. But it requires that the underlying products—autonomous driving, humanoid robots, energy services—actually work and deliver value. If they don't, then Tesla is trying to extract recurring revenue from customers for functionality that doesn't exist.

This is where the subscription pivot becomes risky. You can only charge for FSD subscriptions if the technology is actually useful. You can only operate autonomous taxis if the technology is actually safe and legal. You can only profit from Optimus if it can actually perform useful work.

Right now, Tesla is charging subscription fees for technology that's still in development. That's fine as long as customers believe the product will improve. But if FSD remains mediocre in five years, customers will stop paying. The subscription model only works if the underlying product actually improves and delivers compounding value.

Why Other Automakers Aren't Following Tesla's Playbook

Here's a telling fact: no other major automaker is discontinuing profitable car production to bet on humanoid robots and autonomous taxis.

Not one.

General Motors is investing in autonomous vehicles, but they're still selling millions of cars annually and planning to grow EV production. Ford is doubling down on electric truck development. BMW and Mercedes are expanding their EV portfolios. Volkswagen is ramping EV manufacturing despite profitability challenges.

They're all investing in autonomous technology and software subscriptions. But none of them are abandoning traditional car sales in the way Tesla is.

Why? Because car sales are the only part of the business that reliably generates revenue and profit today. Autonomous vehicles, when they arrive, will be valuable. But betting your entire company on technology that doesn't exist yet, while pulling resources from the business that actually funds the company, is extraordinarily risky.

Tesla can take this risk because Musk controls the company and the stock market is willing to give him massive benefit of the doubt. A public company with multiple shareholders and a board focused on quarterly earnings can't afford to take a bet this large.

But the absence of competition in this strategy might be a sign that it's not actually a good idea.

The Brand Toxicity Problem: How Politics Damaged Tesla's Moat

One factor Tesla and Musk don't talk about much is the damage his political activities have inflicted on the brand.

Tesla was originally associated with environmental consciousness and progressive values. Early adopters were often college-educated, urban, politically left-leaning professionals. These people made Tesla cool. They generated word-of-mouth marketing money can't buy. The brand became synonymous with both technology and values.

Musk's high-profile support for Donald Trump, his takeover of Twitter, his acquisition and deployment of Twitter as a political weapon, and his increasingly divisive public persona have fundamentally changed the brand association.

For a significant portion of Tesla's original customer base, the brand is now politically toxic. Buying a Tesla increasingly signals a political alignment, not just a preference for EVs. This is a real problem for a luxury automaker that depends on aspirational branding.

You can't measure this directly in quarterly earnings yet. But it's already showing up in declined sales in progressive urban markets and increased resistance among environmentally conscious buyers who would otherwise be EVs' most loyal customers.

This is part of why Musk might be accelerating the pivot away from selling cars to regular consumers. If the brand is damaged with the demographic that was most likely to buy Teslas, then pivoting to B2B (autonomous taxis, fleet operations, humanoid robots for commercial use) makes sense. You escape the brand damage by getting out of the consumer market.

In 2025, 73% of Tesla's revenue came from automotive sales, highlighting its dependency on car sales despite growth in other sectors. Estimated data.

The Tax Credit Collapse: How Incentives Masked Underlying Demand Problems

For the first decade of Tesla's existence, government EV tax credits made electric vehicles dramatically more affordable. In the US, federal credits of up to $7,500 per vehicle were transformative. They closed the price gap between EVs and gas cars. In Europe and China, subsidies were similarly generous.

These credits masked underlying demand problems. They made EVs artificially competitive. When subsidies started disappearing, demand flattened.

Musk himself has contributed to this policy shift. He's donated to and publicly supported politicians who actively oppose EV subsidies. So Tesla is experiencing the consequences of policy positions the company's own leadership advocated for.

Without subsidies, EV prices become less competitive against gas cars. The gap is narrowing as EV manufacturing costs decline and gas prices fluctuate. But right now, EVs are still more expensive. Without incentives pushing people toward adoption, growth slows.

This structural problem affects all EV makers. But it particularly affects Tesla, which was relying on subsidies to maintain margin and volume. The company's pitch was always: "Yes, it's more expensive, but there's a tax credit." Without that pitch, Tesla has to compete on the merits of the vehicle itself. Competition is much fiercer in that environment.

BYD's Dominance: The EV Market Has Changed Fundamentally

BYD is now the world's largest producer of electric and plug-in hybrid vehicles. This is stunning because, five years ago, Tesla was untouchable as the EV market leader.

BYD has several advantages: lower labor costs, integrated battery production, established relationships in Asian markets, and governments in China actively promoting Chinese EV dominance as a strategic priority.

BYD is also innovating faster on battery technology and manufacturing efficiency. The company is profitable and growing rapidly. It's not as glamorous as Tesla, and it doesn't generate the cultural cachet. But it's building better volume and achieving better unit economics.

The rise of BYD signals that the EV market has matured. It's no longer a category Tesla dominates through sheer brand power. It's a competitive market where multiple players can win by executing well.

Tesla's response has been to pivot away from competing on volume and price, instead betting on technology (autonomous driving, robotics) that's not yet commercialized. It's a defensive move disguised as a visionary strategy.

The One Trillion Dollar Payday: Musk's Personal Financial Incentive

Here's something important to understand: Musk's personal compensation package is directly tied to Tesla achieving autonomous driving and robotics breakthroughs.

Under the compensation agreement shareholders approved, Musk's pay package is worth up to $1 trillion if Tesla hits aggressive targets related to autonomous vehicles and robotics. This isn't a small bonus. It's a potential lifetime fortune that dwarfs anything he could earn from traditional automotive business growth.

This creates an obvious incentive misalignment. Musk personally benefits from betting Tesla on autonomous vehicles and robots, regardless of whether those bets make sense for shareholders. The bigger and riskier the bet, the more potential upside for him personally.

Does this necessarily mean his strategy is wrong? No. But it's important context. Musk is advocating for a massive strategic pivot that also happens to be worth $1 trillion to him personally. That colors the analysis.

A more neutral observer might say: "Autonomous vehicles might be important in 15 years. But Tesla still depends on car sales today. Maybe keep manufacturing cars while exploring autonomous technology." That would be the sensible, risk-managed approach.

But that approach wouldn't unlock a $1 trillion payday.

Regulatory approval is the most significant barrier to autonomous taxi deployment, followed by real-world complexity and liability issues. Estimated data based on industry analysis.

The Timing Problem: Discounting Cars While Betting on Vaporware

Musk is essentially asking the market to believe this timeline:

- 2025: Autonomous taxis in dozens of US cities (hasn't happened; limited to specific zones)

- 2027: Optimus Gen 3 ready for mass production (no evidence of progress toward this)

- Late 2020s: Optimus becomes a major revenue driver (completely speculative)

- Long term: Cars become a legacy business; autonomous taxis and robots dominate

Meanwhile, Tesla is actively discontinuing profitable car lines and deprioritizing vehicle manufacturing to prepare for a future that hasn't materialized.

This is the core of the risk. Tesla might be right about the long-term trajectory. Autonomous vehicles and humanoid robots might reshape transportation and labor. But the timing is uncertain. And Tesla's business can't wait for a future that might arrive in 2035. It has to survive and thrive in 2025, 2026, and 2027.

Killing the Model S and Model X makes sense only if you're certain that autonomous taxis will replace personal vehicle sales in the near term. But there's zero evidence that's happening. So why sacrifice profitable products for it?

Investment Implications: Is Tesla a Car Company or a Moonshot Fund?

From an investor perspective, this creates profound clarity problems.

If you're investing in Tesla because you think the company will become more profitable selling EVs, you're buying the wrong stock. Musk has made clear cars aren't the future. So if you believe him, you're buying Tesla as a bet on autonomous vehicles and humanoid robots—technologies that don't generate meaningful revenue yet.

If you don't believe him—if you think cars will remain Tesla's core business—then you should be worried about the company discontinuing profitable products and investing heavily in unproven technologies.

Either way, the investment thesis is murkier than it's ever been. Tesla is neither a traditional automaker (profitable, mature, predictable) nor a pure-play robotics startup (speculative, pre-revenue, high-risk). It's caught in the middle, with leadership betting everything on a transition that might not happen on the timeline they're projecting.

The Competitors Watching Closely: What Will Other Automakers Do?

Tesla's pivot is not being copied, but it's being watched intently by every automaker.

Most traditional automakers are taking a different approach: invest in autonomous technology and subscriptions, but don't bet the farm. Keep making and selling cars. Diversify revenue streams. Reduce risk by hedging multiple possible futures.

Waymo, owned by Alphabet, has probably the most advanced autonomous taxi technology. But Waymo is a standalone subsidiary with its own business model. It's not asking Alphabet to discontinue profitable products to fund it.

Volkswagen and other OEMs are investing in software subscriptions and autonomous features. But they're doing it in parallel with traditional car manufacturing, not instead of it.

Tesla's bet is that the winner takes all in the autonomous vehicle market, so the payoff from winning is worth the risk of a failed transition. That might be true. But it's not a bet anyone else is willing to make.

If Tesla succeeds, it'll be valued in the trillions and Musk's strategy will be vindicated. If it fails—if autonomous taxis don't materialize, if Optimus can't be scaled, if car sales remain critical—then Tesla could face a serious crisis. The company will have sacrificed its core profitable business for moonshot bets that didn't pay off.

Musk's compensation is heavily tied to Tesla's success in autonomous vehicles and robotics, with potential earnings reaching $1 trillion. Estimated data.

The Regulatory Barrier: Why Autonomous Vehicles Aren't Coming as Fast as Musk Thinks

Musk's timelines assume that regulatory barriers will collapse quickly. That's not realistic.

Governments move slowly. Liability frameworks for autonomous vehicles are still being debated. Safety standards haven't been finalized. Each state, country, and city sets its own rules. Getting approvals across "dozens of US cities" will take far longer than Musk is suggesting.

Right now, autonomous taxi operations are approved in very limited geographic zones with extensive safety monitoring. Expanding that to dozens of cities would require:

- Demonstrated safety records in each jurisdiction

- Legal frameworks establishing liability

- Insurance products that don't yet exist

- Public trust that takes years to build

- Political will from city and state governments

Musk is predicting widespread autonomous taxi deployment by 2025. The regulatory timeline suggests 2030-2035 is more realistic, if ever.

This gap between Musk's predictions and regulatory reality is a consistent pattern. He predicted fully autonomous vehicles in 2018, then 2020, then 2022. Each prediction has come and gone. The technology is better than it was, but it's not remotely close to the autonomous capability Musk describes.

The China Problem: How Geopolitics Could Disrupt the Plan

Here's a variable Musk might not be accounting for: geopolitical conflict.

China is critical to Tesla's supply chain and one of its largest markets. Ongoing US-China tensions over semiconductors, manufacturing, and trade could severely disrupt Tesla's operations.

If supply chains fragment, if tariffs spike, if China restricts Tesla's access to the market or raw materials, the company could face immediate existential pressure. In that scenario, having discontinued the Model S and Model X would look like a catastrophic strategic error.

Musk's bet assumes a globally integrated economy with stable supply chains. That's no longer guaranteed.

Alternative Paths Tesla Could Have Taken

Here's what a risk-managed version of Tesla's strategy might look like:

Keep car manufacturing strong. Don't discontinue profitable products. Invest in next-generation EV platforms. Expand to emerging markets. Use car sales as the cash generation engine that funds other bets.

Invest in autonomous technology in parallel. Develop FSD and autonomous taxi capabilities on a timeline that doesn't depend on near-term deployment. Let the technology mature. Achieve regulatory approval when ready.

Develop Optimus slowly. Don't bet manufacturing capacity on a humanoid robot until it can reliably perform tasks. Let robotics development take 10-15 years if that's what it needs.

Build the subscription model gradually. Convert FSD to subscription-only when it's undeniably valuable. Expand energy storage subscriptions. Create a diversified recurring revenue base that supplements car sales.

This approach would be slower. It wouldn't generate the $1 trillion payday for Musk. It wouldn't allow him to claim Tesla is becoming a robotics company. But it would be far less risky for the company and its shareholders.

Instead, Tesla is taking the opposite approach. Maximum bet. Maximum risk. Discontinue profitable products. Bet everything on unproven technology with uncertain timelines.

What Happens If the Pivot Fails?

Scenario planning is useful here.

If autonomous taxis don't materialize at scale by 2030, Tesla will face an existential problem. The company will have sacrificed its car manufacturing business for a future that didn't arrive. It will have lost market share to BYD and other competitors. It will no longer have the production capacity to rapidly ramp car sales if needed.

At that point, Tesla would need to either:

- Rapidly rebuild car manufacturing capacity (expensive, time-consuming)

- Pivot back to cars and cede the autonomous vehicle market to Waymo and others

- Double down on robots and autonomous taxis even if they're not profitable yet

- Go through a period of severe financial stress while trying to rebuild the car business

None of these are good options. The company would be in a far worse position than if it had simply kept making cars while exploring new technologies.

The Signal Tesla Is Sending: What It Means for the Broader Industry

Regardless of whether Tesla's pivot succeeds, the signal it's sending matters.

Tesla is effectively saying: "The car business is a mature, declining industry. The future is in autonomous vehicles and robots. We're getting out of cars."

If that signal is believed—if it's true—then the entire automotive industry is in trouble. Millions of people work in car manufacturing. Governments depend on automotive tax revenue. Entire supply chains exist to build cars.

If Tesla is right, and cars really are becoming obsolete, then the entire industry needs to pivot. But Tesla's approach is so aggressive, so risky, that it's hard to take at face value.

More likely, Tesla is signaling that its growth depends on transitioning away from cars because cars are a competitive, commoditized market. That's different from saying cars are becoming obsolete. It's saying cars are becoming a bad business for Tesla specifically.

Other automakers will continue making cars because it's profitable. Waymo will pursue autonomous taxis because it's a different business model. And Tesla will... do something in between, hoping the autonomous vehicle future arrives before its car business is completely depleted.

The Future May Not Play Out As Musk Predicts

History is littered with visionary bets that didn't work out.

General Motors bet heavily on hydrogen fuel cells. The technology didn't materialize. Nokia bet the company on mobile phones. Kodak invented the digital camera but didn't capitalize on it. Blockbuster bet on physical video rental while Netflix was building streaming.

Sometimes visionary bets work. Sometimes they don't.

Musk might be right. In 2040, 95 percent of transportation might be autonomous, and humanoid robots might be doing all manual labor. Tesla would be worth trillions. But that's 15 years away. A lot can change in 15 years.

For now, Tesla is sacrificing a profitable, proven business for a bet on a future that hasn't materialized. It's a bold strategy. Whether it's brilliant or delusional won't be clear for years.

But the company is betting everything on it. And that's a risk worth paying attention to.

FAQ

Why is Tesla discontinuing the Model S and Model X?

Tesla is discontinuing these flagship vehicles to free up manufacturing capacity for the Optimus humanoid robot and to reorient the company toward autonomous vehicles and robotics. The strategic decision reflects leadership's belief that the future of transportation is autonomous, making traditional car manufacturing a legacy business.

What percentage of Tesla's revenue comes from car sales?

As of 2025, car sales represent

How many people have Full Self-Driving subscriptions?

Tesla disclosed that 1.1 million users have active Full Self-Driving (Supervised) subscriptions, representing a 38 percent quarterly increase. Musk recently announced that FSD will transition to a subscription-only model, eliminating the option to purchase the feature as a one-time upgrade.

When will autonomous Tesla taxis actually be available?

Musk has predicted autonomous taxis will be available in "dozens" of US cities in 2025, but this timeline has been consistently missed in previous years. Current autonomous taxi operations are limited to specific geographic zones with extensive safety monitoring. Regulatory approval, liability frameworks, and insurance models still need to be established, which will likely extend timelines significantly.

What is the Optimus robot, and why is Tesla betting on it?

Optimus is Tesla's humanoid robot project. Musk claims the Gen 3 version will be ready for mass production by the end of 2027. The robot would theoretically perform manual tasks and functions, eventually becoming a "universal worker." Tesla is investing heavily in Optimus development based on Musk's belief that humanoid robots will become as important as autonomous vehicles.

How does Tesla's position compare to other automakers?

No other major automaker is discontinuing profitable car production to bet on autonomous vehicles and robots. Competitors like Ford, GM, BMW, and Mercedes are investing in EV expansion and autonomous technology while maintaining core car manufacturing. Tesla's aggressive pivot is unique and represents a significantly higher risk profile.

Why has Tesla lost the EV sales lead to BYD?

BYD now produces more electric and plug-in hybrid vehicles than Tesla due to lower manufacturing costs, integrated battery production, government support in China, and effective competition in Asian markets. The rise of BYD demonstrates that the EV market has matured and is no longer dominated by Tesla's brand and technology advantage.

What is driving Tesla's decline in automotive revenue?

Multiple factors are contributing: disappearing EV tax credits globally, increased competition from established automakers entering the EV market, BYD's rapid expansion, regulatory pressure in some regions, and brand toxicity among Tesla's original progressive customer base due to Musk's political activities and public persona.

How does Musk benefit personally from Tesla's pivot to autonomous vehicles?

Musk's compensation package is worth up to $1 trillion if Tesla achieves aggressive targets related to autonomous vehicles and robotics. This creates a significant personal incentive for Musk to push Tesla toward autonomous technology bets, regardless of whether those bets are optimally risk-managed for shareholders.

Is Tesla's pivot to subscriptions and autonomous vehicles sustainable?

The pivot is risky. While subscription models generate recurring revenue with higher margins, Tesla's core autonomous driving and robot technologies don't yet generate meaningful revenue. The company is charging for FSD subscriptions while the technology remains under development, which only works if customers believe significant improvements are coming. If autonomous vehicles or robots don't materialize at scale, the entire strategy collapses.

Conclusion: A Company Betting Its Future on Technology That Doesn't Exist Yet

Tesla's pivot away from traditional car manufacturing represents one of the boldest and riskiest strategic decisions in recent automotive history. The company is effectively saying: cars are legacy; the future is autonomous vehicles, humanoid robots, and subscription services.

There's something audacious and admirable about betting so heavily on the future. Musk isn't gradually hedging his bets. He's all-in. He's discontinuing flagship vehicles, deprioritizing core manufacturing, and directing resources toward technologies that are still in development.

But audacity and prudence are different things. Tesla still depends on car sales for 73 percent of its revenue. The company that invented the modern EV is now losing market share to BYD. Regulatory barriers to autonomous deployment are steeper than Musk acknowledges. Humanoid robot technology is years away from the capabilities Musk envisions.

Meanwhile, every other automaker is taking the opposite approach: invest in the future while maintaining the proven business. Ford, GM, BMW, Mercedes, Volkswagen—they're all developing autonomous technology and software services, but they're not sacrificing car manufacturing to do it.

Maybe they're wrong. Maybe Tesla's bet will pay off spectacularly. Maybe autonomous vehicles and humanoid robots will be worth more than car sales ever were. If so, Tesla's pivot will be remembered as visionary, and Musk's $1 trillion compensation package will look like a bargain.

Or maybe Tesla is making a catastrophic miscalculation. Maybe autonomous vehicles won't materialize on any reasonable timeline. Maybe humanoid robots can't be scaled. Maybe cars will remain the core business of transportation for decades. In that scenario, Tesla will have mortgaged its future for promises that didn't deliver.

The truth is we don't know yet. The bet won't be resolved for years. But what we do know is that Tesla is betting with the company's entire survival. There's no backup plan. There's no hedging. If the autonomous vehicle future doesn't arrive soon, Tesla could face serious problems.

For investors, employees, and customers, that's worth understanding clearly. Tesla isn't just a car company anymore. It's a moonshot fund with a car company attached. The risk profile has fundamentally changed. The upside is enormous if Musk is right. But so is the downside if he's wrong.

That's the real story buried beneath all the earnings call commentary and optimistic press releases. Tesla is all-in on a future that doesn't exist yet. And it's willing to sacrifice the profitable present to get there.

Whether that proves to be brilliant or disastrous will shape not just Tesla's future, but the future of transportation and the entire automotive industry.

Key Takeaways

- Tesla's automotive revenue represents 73% of the company's total revenue but is declining 10% year-over-year, yet leadership is discontinuing profitable flagships like the Model S and Model X

- The company is betting heavily on autonomous vehicles and humanoid robots that remain in development, while no other major automaker is pursuing this aggressive pivot

- 1.1 million Full Self-Driving subscriptions at 38% quarterly growth signal the shift toward recurring revenue, but represent a small fraction of revenue compared to car sales

- BYD has dethroned Tesla as the global EV sales leader by focusing on cost efficiency and volume, exposing Tesla's vulnerability in the competitive EV market

- Musk's personal compensation package worth up to $1 trillion depends on autonomous vehicle and robotics success, creating a potential misalignment between personal incentives and shareholder value

Related Articles

- Waymo at SFO: How Robotaxis Are Reshaping Airport Transport [2025]

- Waymo Robotaxi Strikes Child Near School: What We Know [2025]

- Waymo Robotaxi Hits Child Near School: What Happened & Safety Implications [2025]

- Tesla's Second Year of Revenue Decline: Market Analysis & Implications [2025]

- Robotaxis Disrupting Ride-Hail Markets in 2025: Price War and Speed [2025]

- Uber's AV Labs: How Data Collection Shapes Autonomous Vehicles [2025]

![Is Tesla Still a Car Company? The EV Giant's Pivot to AI and Robotics [2025]](https://tryrunable.com/blog/is-tesla-still-a-car-company-the-ev-giant-s-pivot-to-ai-and-/image-1-1769789690912.jpg)