US Government Takes 25% Cut of AMD and NVIDIA AI Chip Sales to China

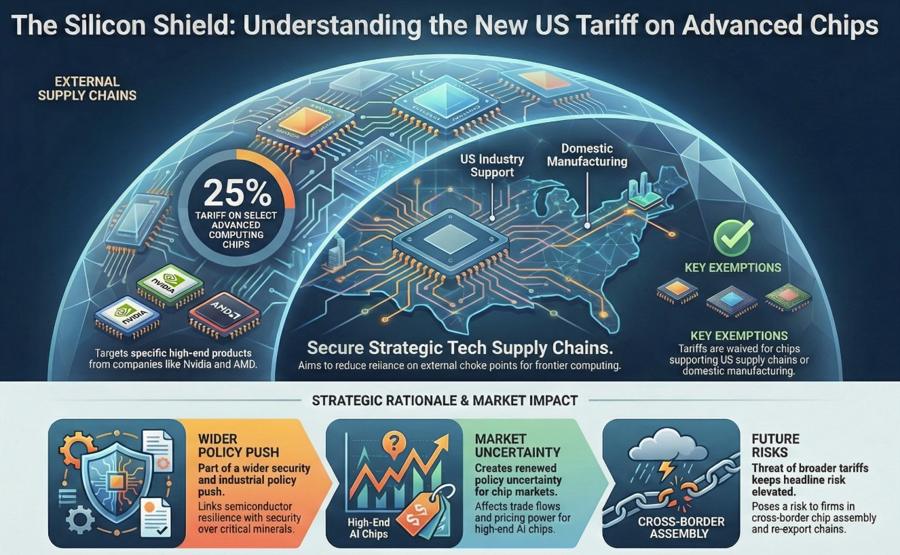

The Trump administration just pulled off something nobody expected. In a move that blurs the line between trade policy and outright profit-sharing, the US government announced it would take a 25% cut of all advanced AI chip sales that NVIDIA and AMD send to China. This isn't a traditional tariff. It's more like a partnership agreement where Washington becomes an unwilling stakeholder in semiconductor commerce, as outlined in the Information Technology and Innovation Foundation's report.

Let that sink in for a second. The government isn't just regulating technology exports anymore. It's creating a revenue stream from them. And the companies involved, while publicly welcoming the move, are probably doing the math on what this means for their bottom line and their relationship with Beijing.

This decision represents a fundamental shift in how the US government approaches technology control and international trade. Rather than outright banning exports of cutting-edge AI processors, the administration found a clever workaround: allow limited exports, but take a financial cut. It's transactional, it's unusual, and it's designed to survive the legal challenges that will almost certainly come, as detailed in Morgan Lewis's analysis.

TL; DR

- The Deal: US government takes 25% of revenues from NVIDIA H200 and AMD MI325X chip sales to China

- The Mechanism: New Section 232 tariffs implemented through presidential proclamation designed to withstand legal challenges

- The Stakes: Affects not just China trade but signals a new model for technology export control across multiple industries

- The Timeline: Announced in December 2025 with implementation through new tariff framework

- The Strategy: Allows semiconductor companies to access Chinese market while generating government revenue and maintaining export control

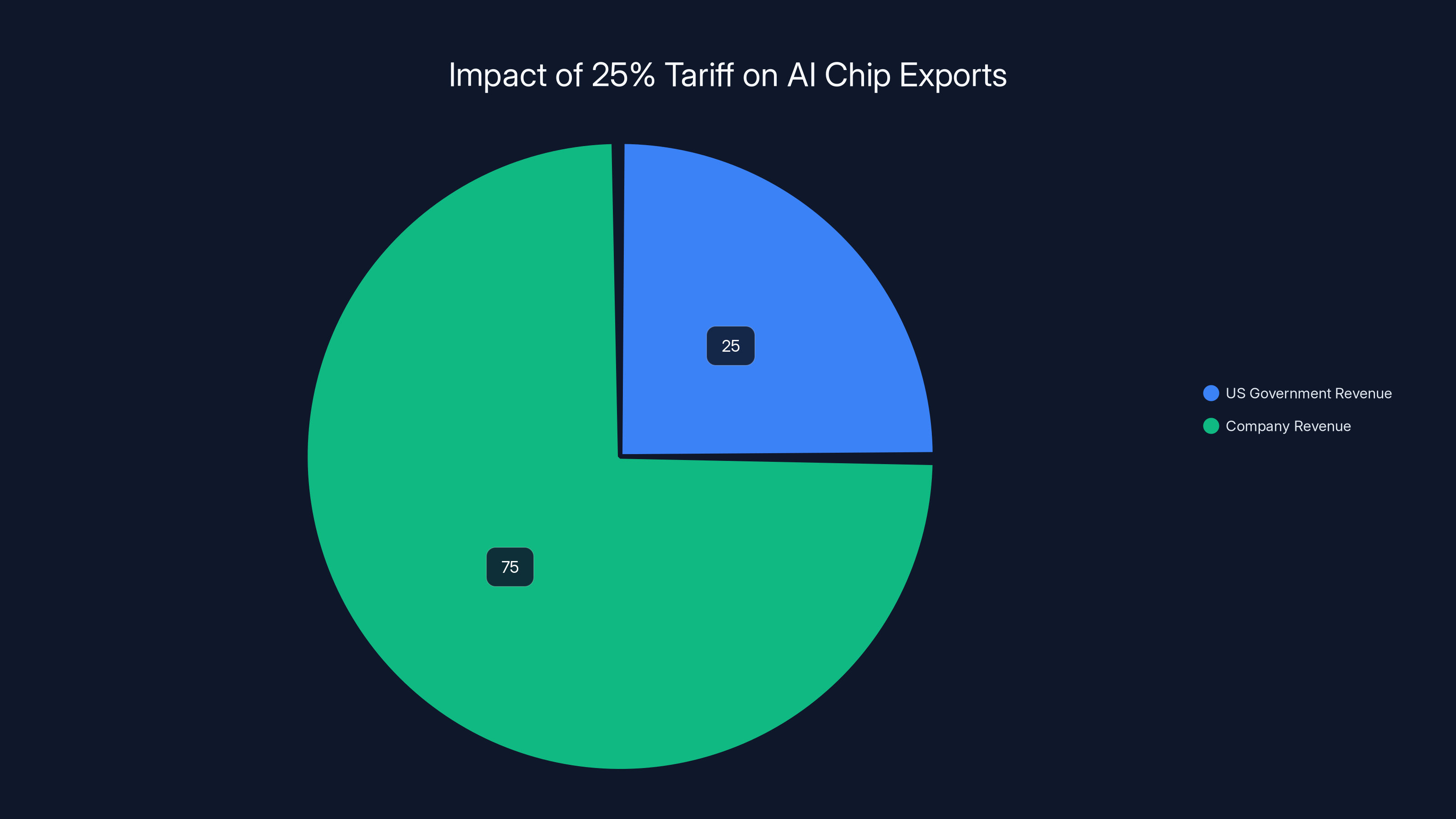

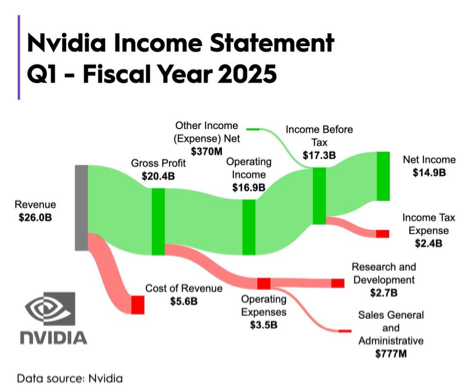

The US government collects 25% of the revenue from AI chip exports to China, significantly impacting company profits. Estimated data based on $100 million sales.

Understanding the 25% Revenue-Sharing Arrangement

On the surface, this looks simple: NVIDIA and AMD can sell their advanced AI chips to China, but the US government gets 25% of the sale value. If NVIDIA sells an H200 chip for

But the mechanics get more complicated when you dig into the details. The new tariffs specifically target chips that are imported into the United States and then "transshipped" to customers around the world. This is the critical language. It's not about where the chips are manufactured. It's about the routing through US ports and distribution networks, as explained in Thompson Hine's trade analysis.

Here's why that matters: NVIDIA designs chips but doesn't manufacture them. Taiwan Semiconductor Manufacturing Company (TSMC) produces NVIDIA's hardware, including the H200 processor. Those chips are then shipped globally. If they come through US ports as part of the distribution process, they fall under these new tariffs. This creates a chokepoint that the government can monitor and tax.

The H200 is an older generation chip compared to NVIDIA's latest Blackwell processors, but it's still advanced enough to handle serious AI workloads. AMD's MI325X processor is in a similar category. Both are precisely the kind of hardware that Beijing desperately wants for training large language models and building out domestic AI infrastructure.

The revenue split isn't random either. A 25% cut is significant enough to create meaningful government revenue while still leaving enough profit margin for companies to actually engage in the export business. If the percentage were 50%, companies might choose not to sell. If it were 10%, the government wouldn't fund the effort. Twenty-five percent represents an equilibrium point that theoretically works for everyone.

But here's the catch nobody's talking about: China might not accept the deal. After the tariffs were announced, reports emerged that Chinese customs officials told logistics companies not to submit clearing requests for H200 chips. Whether that's temporary posturing or a sign that Beijing will reject this arrangement entirely remains unclear, as reported by CNBC.

The US government collects 25% of the revenue from NVIDIA's H200 chip sales to China, leaving 75% for NVIDIA. This arrangement balances government revenue with company profit margins.

The Legal Architecture: Why These Tariffs Might Hold Up

Trump's previous tariff attempts faced serious constitutional questions. Some relied on what lawyers call "emergency powers" that gave the president broad authority to impose duties. The Supreme Court has a case pending that could strike down this entire legal framework.

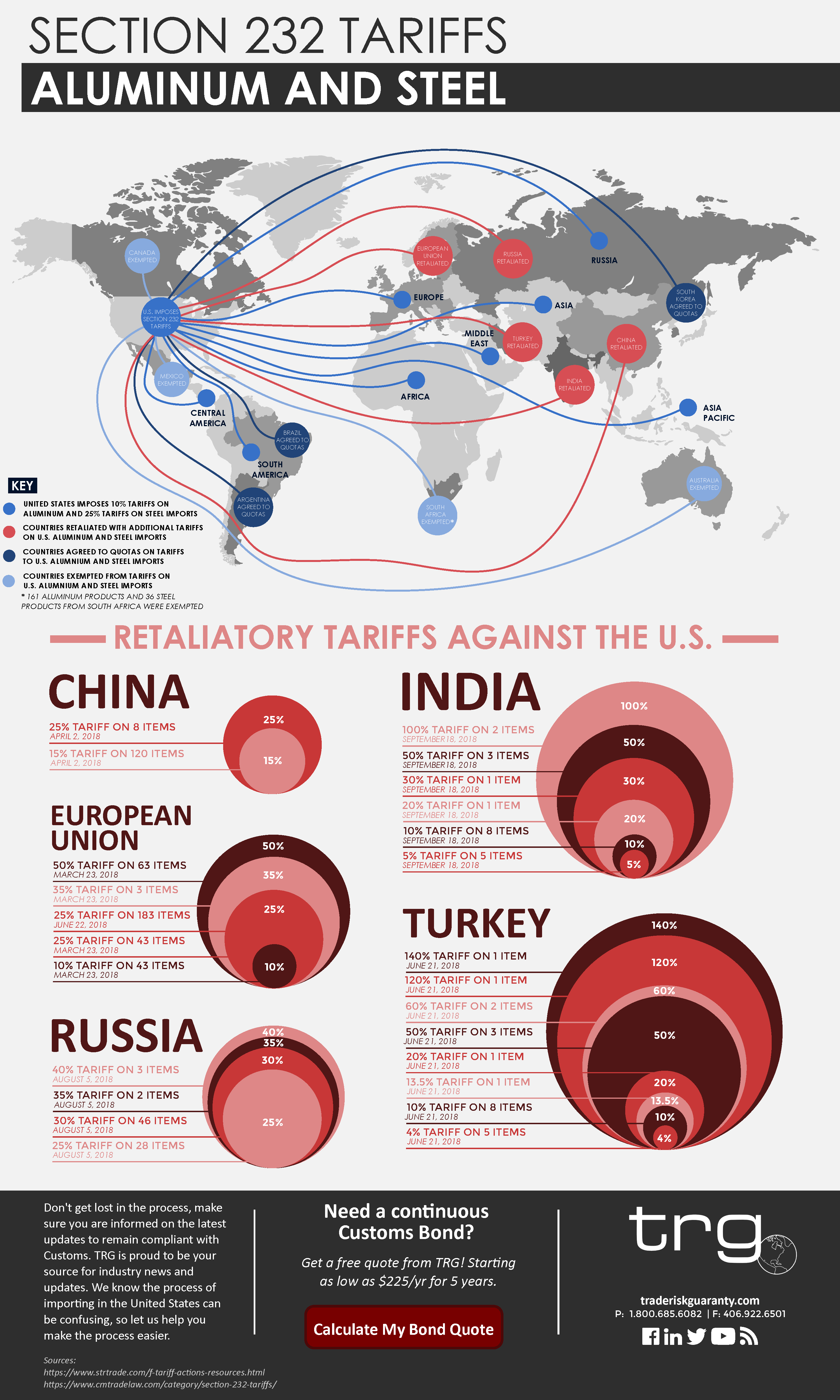

These new tariffs are different. They're based on Section 232 of the Trade Expansion Act of 1962, which allows the president to impose duties for national security reasons. This is a different legal foundation than the emergency powers approach, which matters enormously for survival in court, as noted by Barron's.

Why does this distinction matter? Because Section 232 has decades of legal precedent. Courts have upheld national security tariffs under this section multiple times. It's not bulletproof against legal challenge, but it's far more defensible than the emergency powers approach.

The presidential proclamation announced on Wednesday explicitly framed the AI chip restrictions as a national security measure. The reasoning goes like this: allowing unlimited exports of advanced AI chips to China threatens US national security by enhancing Beijing's AI capabilities. Therefore, restricting or taxing these exports is a legitimate national security tariff under Section 232.

Industry executives familiar with the legal reasoning say this structure was deliberately designed to withstand constitutional scrutiny. They're not relying on emergency powers. They're using established law.

But that doesn't mean the tariffs are invulnerable. Companies and potentially China's government could challenge them on grounds that the "national security" justification is pretextual, that the actual purpose is economic protectionism rather than genuine security concerns. That's a real argument to watch for in coming months.

The Economic Impact on NVIDIA and AMD

On paper, NVIDIA and AMD welcomed the decision. Both companies issued statements saying the policy strikes a good balance and allows them to serve markets responsibly. But that's corporate-speak for "we're trying not to anger either the US government or Chinese customers."

The real impact on these companies is complex. In the best case scenario, the 25% cut is just a tax on export revenue they otherwise wouldn't have had access to. In the worst case, it becomes a permanent friction point that makes Chinese customers shop for alternatives from companies not subject to these restrictions.

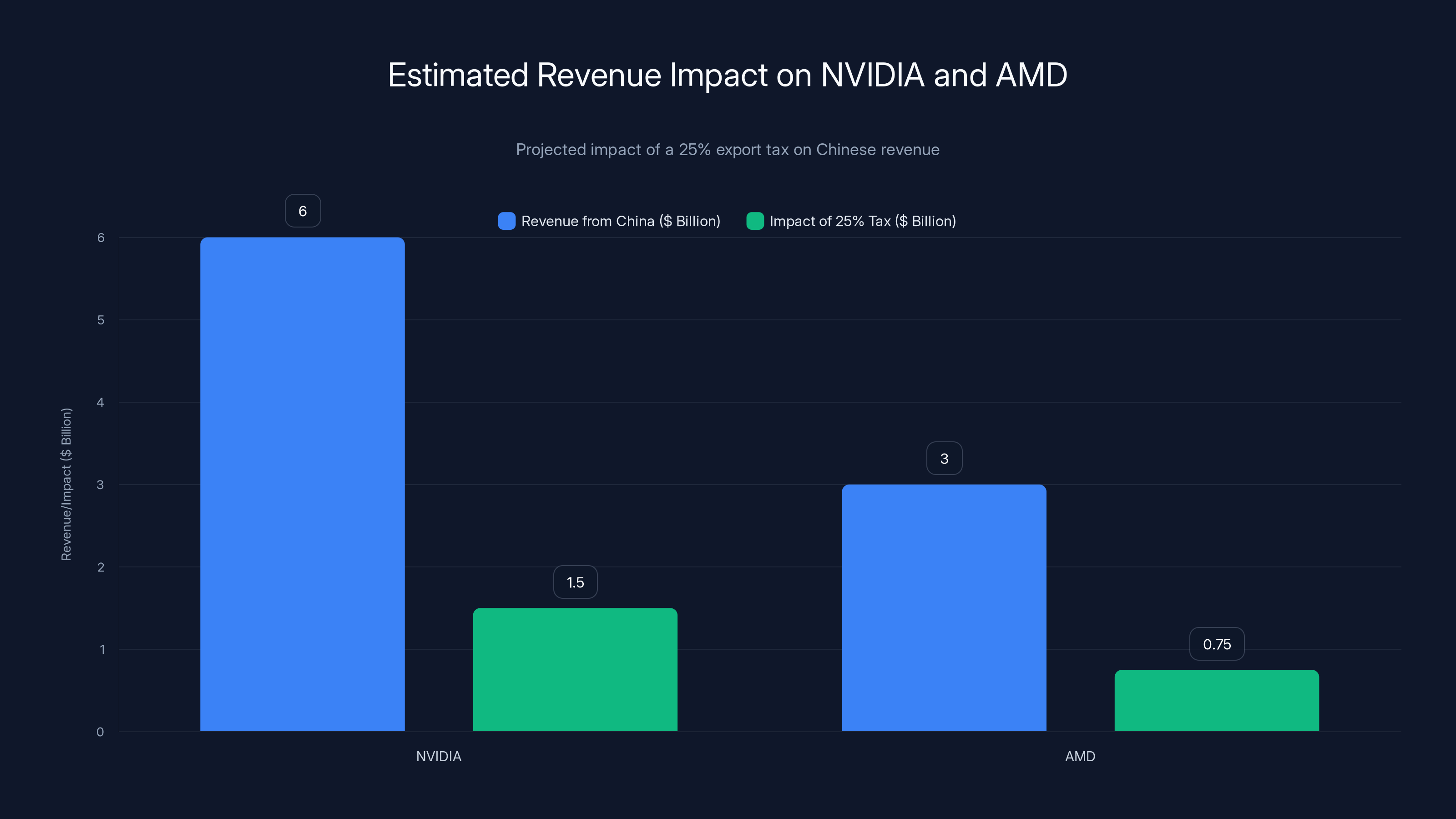

Consider the financial math: NVIDIA's annual revenue is roughly

For AMD, the percentage might be smaller since AMD has a smaller share of the high-end AI chip market, but the principle is the same. Every dollar subject to this 25% tax is a dollar of profit reduction.

But here's what might actually hurt more: uncertainty. Companies making long-term investment decisions need to know the rules won't change. The White House proclamation warned that "a second phase of the national security probe could result in broader tariffs on imports of semiconductors and their derivative products." That's a thinly veiled threat. Behave, or we'll make this worse.

That kind of regulatory uncertainty is actually more damaging than the 25% cut itself. It makes capital allocation decisions harder and discourages investment in infrastructure that depends on Chinese market access.

Estimated data shows NVIDIA could lose

Why China Might Reject the Deal

From Beijing's perspective, this arrangement has problems. China's government has been pushing domestic companies to use homegrown chips as part of a self-sufficiency strategy. Relying on NVIDIA's H200 chips, even if the US government is taking a 25% cut, contradicts that goal.

Plus, accepting this deal implicitly acknowledges US authority over China's technology supply chains. The moment Chinese companies agree to the 25% tariff arrangement, they're accepting the principle that Washington gets to tax their imports. That's a significant political concession.

Reports from logistics companies at Chinese ports suggest customs officials instructed them not to submit clearing requests for H200 chips. Whether that's a coordinated rejection of the deal or just temporary bureaucratic caution isn't clear yet. But it's worth watching, as noted by Reuters.

There's another layer: Chinese tech companies like Alibaba, Byte Dance, and Tencent do want access to high-performance chips. They prefer NVIDIA's technology because it's more mature and easier to maintain than alternatives. So there's actual demand for this deal from end users in China, even if the government is skeptical.

The real question is whether Beijing's government strategy wins out over the preferences of Chinese tech companies. Historically, government policy tends to override private preferences, but this involves real business losses, so the pressure from companies could be substantial.

The Broader Trade War Context

This AI chip tariff isn't happening in a vacuum. It's part of a sweeping trade war that the Trump administration launched against most major US trading partners. These Section 232 tariffs on semiconductors are just one piece of a much larger strategy, as discussed in The Register.

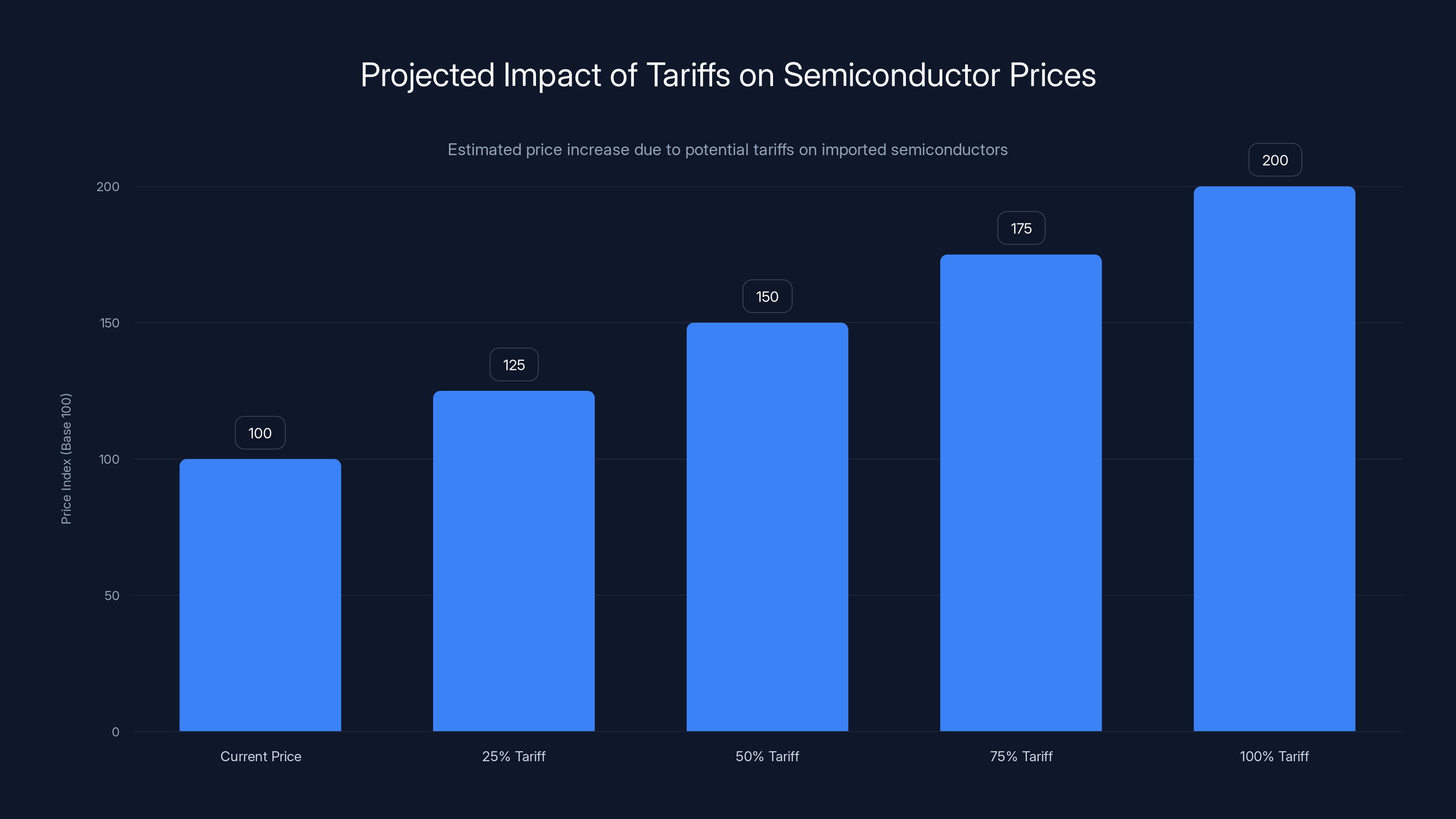

The broader "national security probe" that the White House launched has already resulted in tariffs on various products and threatened tariffs on others. The proclamation specifically warns that chips could see duties "up to 100 percent" if negotiations don't proceed as the administration wants.

That's not a small threat. A 100% tariff would double the price of imported semiconductors. It would upend the global chip supply chain overnight. So when the administration says "up to 100 percent," it's essentially saying to companies and foreign governments: accept our terms, or things get much worse.

This is the transactional approach that defines Trump's trade policy. It's not ideological. It's not about free trade versus protectionism in the traditional sense. It's about extracting maximum value from every trade relationship through a combination of incentives and threats.

For semiconductor companies, this creates a strange negotiating environment. NVIDIA and TSMC can appeal for exemptions and carve-outs by promising to build manufacturing capacity in the US. TSMC has been doing exactly this, investing

But here's the circular problem: building manufacturing capacity in the US takes years. In the meantime, companies still need access to profitable export markets to fund those investments. The 25% tariff creates a weird incentive structure where companies are incentivized to both invest in US manufacturing and find ways around the tariffs.

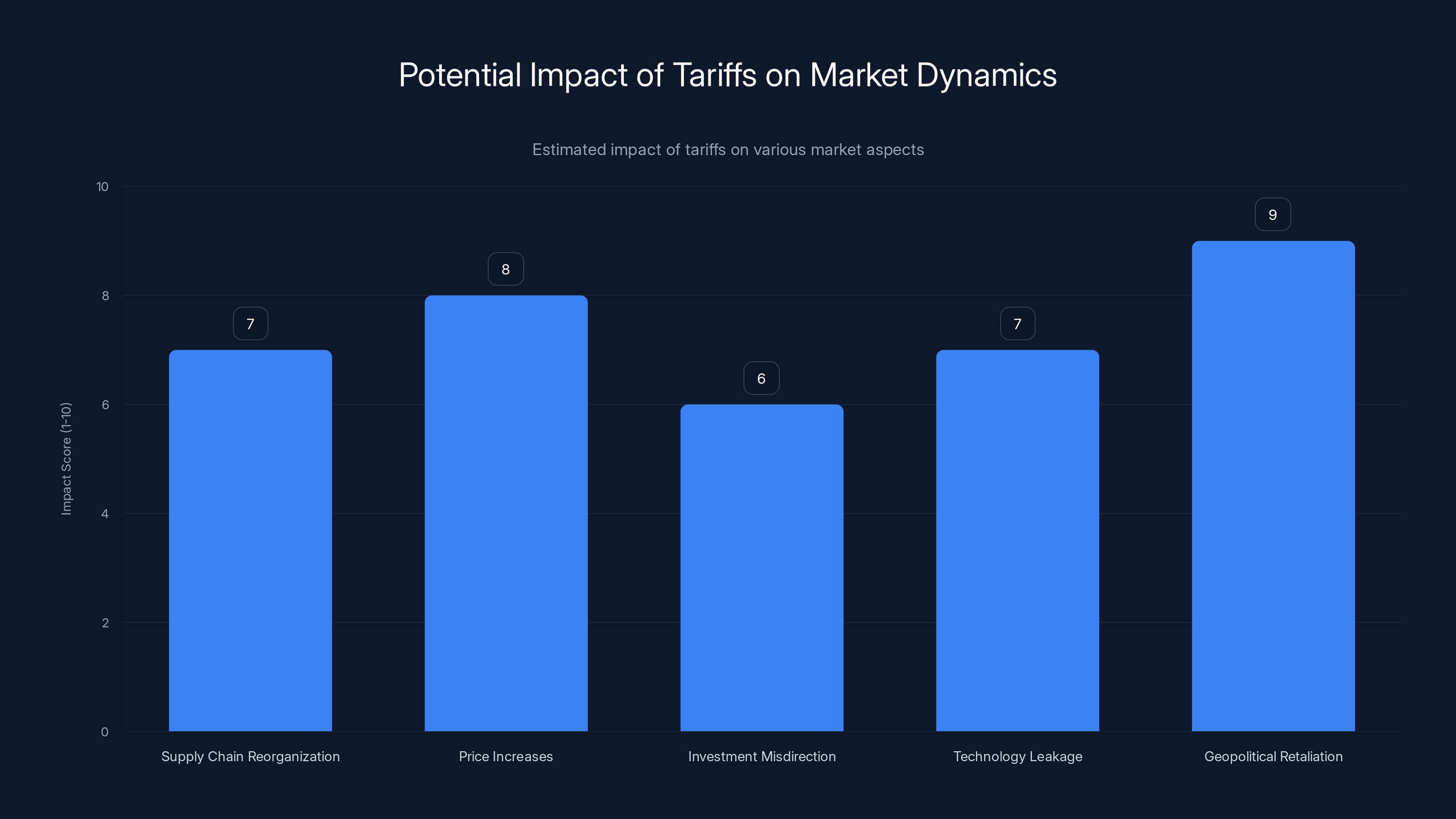

Estimated data suggests that geopolitical retaliation and price increases have the highest potential impact due to tariffs, with scores of 9 and 8 respectively. Estimated data.

Manufacturing Reality: Why Taiwan Still Dominates

Understanding this tariff arrangement requires understanding why the US can't just build more chips domestically. The short answer: TSMC is really, really good at manufacturing advanced chips, and the US can't replicate that capability overnight.

TSMC manufactures NVIDIA's most advanced chips in Taiwan. Some of those chips are destined for US customers, some for global distribution. Only recently did TSMC's Arizona facility start producing NVIDIA's Blackwell chips for the first time in October 2024.

But the Arizona plant isn't yet producing the most advanced chips at scale. It takes time to ramp manufacturing, test yields, and reach cost-effectiveness. Meanwhile, most of the world's cutting-edge semiconductors are still manufactured in Taiwan, then shipped globally for packaging, installation, and final delivery to customers.

This is why the tariff specifically targets chips that are "imported to the US and transshipped." It's acknowledging reality: most advanced AI chips come from Taiwan. If they pass through US ports, they're vulnerable to these tariffs. If they go directly from Taiwan to China via other ports, they might avoid the tariff entirely.

That creates an incentive for supply chain reorganization. Companies might route shipments differently to avoid the US tariff. They might increase direct Taiwan-to-China shipments. The tariff could actually encourage the exact opposite of what US policy intends: concentrating supply chains away from US ports and distribution networks.

The Precedent This Sets

Beyond the immediate impact on NVIDIA and AMD, this tariff arrangement sets a significant precedent. It demonstrates that the US government is willing to monetize export controls in novel ways.

Historically, export controls were binary: you could export something, or you couldn't. Sanctions were either on or off. Tariffs were either applied or waived. But this 25% revenue-sharing model creates a new category. It's a partial export control that generates government revenue.

Other industries are watching. If this works for AI chips, could the government apply similar logic to other sensitive technologies? Biotech? Quantum computing? Aerospace components? The precedent suggests that future administrations might consider revenue-sharing arrangements for other restricted technologies, as discussed in Atlantic Council's analysis.

From an international relations perspective, this is also novel. It's the government explicitly partnering with private companies to profit from export restrictions. China will certainly view this as hostile. It's not just regulating trade, it's literally taking money from China-bound commerce.

That could have consequences for US relations with allies too. If the US government starts taking cuts of exports, other countries might retaliate with their own revenue-sharing tariffs on US products. It could trigger a spiral of increasingly creative protectionist measures.

A 100% tariff could double the price of imported semiconductors, significantly impacting the global supply chain. Estimated data.

Critical Minerals and Broader Security Strategy

On the same day the semiconductor tariffs were announced, the White House released results from an investigation into critical minerals. The administration concluded that US dependence on imported critical materials posed a national security threat.

This investigation identified minerals like gallium, germanium, and rare earths as strategically important. The White House directed the Commerce Secretary to negotiate deals with trading partners that might include "trade-restricting measures" such as price floors or export quotas.

China dominates the market for many of these critical minerals. Rare earths are particularly important for advanced electronics and defense applications. China produces roughly 70% of the world's rare earths and controls significant processing capacity for materials like gallium and germanium.

The critical minerals investigation didn't immediately impose tariffs, but it warned that broader tariffs could come if negotiations don't succeed within 180 days. The administration is essentially using the threat of tariffs as a negotiating tool to force trading partners into supply agreements that favor US interests.

This broader context matters because it shows the semiconductor tariffs aren't isolated. They're part of a coordinated strategy to reduce US dependence on Chinese supplies and technologies. The semiconductor tariffs control the outflow of advanced chips. The critical minerals negotiations try to control the inflow of raw materials. Together, they represent an attempt to decouple the US and Chinese economies in strategic sectors.

What Companies Should Actually Do

For NVIDIA, AMD, and TSMC, the next steps are complex. They need to navigate several competing pressures simultaneously.

First, they need to understand their actual exposure to these tariffs. Which shipments will be affected? What's the realistic impact on margins? Companies with sophisticated supply chain analytics already know these numbers. For others, this is an urgent analysis project.

Second, they need to make investment decisions about US manufacturing. The White House is essentially offering a deal: invest heavily in US manufacturing capacity, and you might get exemptions or better treatment. That sounds attractive, but manufacturing decisions lock in capital for decades. You can't undo a $20 billion fab investment if the trade policy changes.

Third, they need to manage customer relationships. If Chinese customers face new tariffs, they'll push back on pricing. Companies need to decide how much of the tariff impact they'll absorb and how much they'll pass through to customers.

Fourth, they need to monitor the legal challenges. These tariffs will face court challenges. The outcome could significantly change the regulatory landscape. Companies shouldn't make irreversible decisions before understanding the legal status.

The Real Wildcard: Technology Alternatives

Here's something that doesn't get enough attention: China might not actually need NVIDIA chips going forward.

Chinese companies have been investing heavily in homegrown AI hardware. Huawei has developed its own chips. Other Chinese firms are building alternatives. They're not quite at NVIDIA's performance level yet, but they're closing the gap.

The longer the US restricts access to NVIDIA hardware, the more incentive Chinese companies have to complete their indigenous alternatives. In five to ten years, it's plausible that Chinese AI systems will run on entirely homegrown hardware, making export controls irrelevant.

From the US perspective, this is a problem. Export controls work if the target actually needs the restricted technology. But if the target can develop alternatives, the controls become less effective over time. The 25% tariff arrangement might accelerate this process by making NVIDIA chips more expensive and less attractive compared to developing local alternatives.

This is the long-term strategic risk that the administration might be underestimating. Short-term revenue extraction from export restrictions could backfire by accelerating development of competitive alternatives, reducing future leverage over China's technology development.

International Response and Diplomatic Fallout

Europe and other US allies are watching this closely. The US is essentially unilaterally controlling global supply chains by taxing shipments that happen to pass through US ports. Other countries might question whether their own supply chains are next.

European companies in semiconductors, biotech, and other advanced industries might start rerouting shipments to avoid US ports if they fear similar tariff treatment. That could undermine US port revenue and logistics infrastructure while driving commerce through other hubs.

Allies might also retaliate. If the US government takes revenue cuts from exports of protected technologies, why can't other countries do the same? The precedent is dangerous for the global trading system.

On the flip side, some allies might welcome this approach if they benefit from it. If US policy is protecting allied technology markets from Chinese competition, companies in allied countries might prefer the tariff approach to alternatives. The actual international response will depend heavily on whether this arrangement is perceived as fair or as arbitrary protectionism.

Timeline and Implementation Details

The tariffs were announced on Wednesday (the article was published in early 2026). Implementation likely follows a phased approach. The White House proclamation warned of a "second phase" that could include broader semiconductor tariffs.

This suggests the administration is starting with a targeted approach on AI chips and potentially expanding if negotiations with trading partners don't proceed as desired. Companies have a window of time to adjust supply chains and pricing before broader measures potentially kick in.

The 180-day timeline for critical minerals negotiations creates another important date. By mid-2026 (approximately six months from announcement), the administration will either have negotiated deals with trading partners or will impose broader tariffs on critical materials. That could cascade into additional restrictions on semiconductor manufacturing.

For companies, these timelines create decision windows. The window to negotiate exemptions or special treatment is probably open now but could close quickly. The window to reorganize supply chains to avoid tariffs is also time-limited. Once tariffs are fully implemented and the dust settles, adjustment becomes harder and more expensive.

How This Changes the Technology Export Landscape

This tariff arrangement marks a fundamental shift in how governments approach technology exports. Rather than pure export controls (allow or deny), we're now seeing revenue-sharing models where the government becomes a financial stakeholder in export transactions.

This changes the negotiating dynamics. Companies can't simply appeal to free trade principles because the government is extracting revenue. They also can't easily argue they're just following the law because they technically are, but under fundamentally new terms.

The model also creates ongoing monitoring requirements. The government needs to track which chips are being sold, at what prices, and to whom, to calculate its 25% cut. That requires new administrative infrastructure and creates new opportunities for disputes about valuation, pricing, and what counts as "AI chips."

Other countries will likely develop similar mechanisms. If the US is monetizing export controls, why wouldn't Japan, South Korea, or Taiwan do the same for their strategic technologies? The precedent could trigger a wave of revenue-sharing tariffs across multiple sectors and countries.

For the long-term competitiveness of US technology companies, this is a double-edged sword. On one hand, it protects them from competition by restricting Chinese access to advanced hardware. On the other hand, it reduces their profit margins and creates disincentives for doing business with China, potentially shrinking their addressable market.

Unintended Consequences and Market Distortions

When governments impose novel tariffs, unintended consequences often follow. Here are several risks worth considering.

Supply Chain Reorganization: Companies might route shipments through non-US ports to avoid tariffs. This doesn't prevent exports to China, it just bypasses US ports. From a national security perspective, you lose visibility into the supply chain.

Price Increases: If companies pass the 25% tariff through to customers, it makes NVIDIA and AMD chips less price-competitive. That could accelerate adoption of lower-performance but more affordable alternatives, potentially helping local Chinese chip makers indirectly.

Investment Misdirection: Companies might over-invest in US manufacturing not because it's economically optimal, but because they're responding to government incentives and threats. That's inefficient capital allocation that reduces overall productivity.

Technology Leakage: Higher prices for Western chips incentivize reverse-engineering and intellectual property theft. Companies facing expensive options might take riskier approaches to develop homegrown alternatives.

Geopolitical Retaliation: China could respond with its own tariffs or restrictions on US companies operating in China. The trade escalation spiral gets worse from there.

None of these consequences are inevitable, but they're plausible enough that policymakers should have considered them. Whether they did is unclear from public statements.

FAQ

What exactly is the 25% tariff on AI chip exports?

The US government will collect 25% of the dollar value of advanced AI chip sales (specifically NVIDIA H200 and AMD MI325X processors) that are exported to China through US ports. If a company sells

Why did the Trump administration create this revenue-sharing arrangement instead of just banning exports?

A complete export ban would be simpler but would eliminate potential revenue for the US government and would more aggressively constrain companies' access to the Chinese market. By allowing limited exports with a 25% government cut, the administration preserves some market access for companies while still controlling the flow of advanced technology and generating revenue. This approach is also designed to be more legally defensible than absolute bans.

How does this tariff affect NVIDIA and AMD's profitability?

Depends on the volume of AI chips actually exported to China. If significant volumes flow, the 25% cut directly reduces profits. The bigger concern for many analysts is the uncertainty this creates. Companies making multi-billion-dollar manufacturing decisions need stable regulatory environments. These tariffs introduce significant uncertainty about future profit margins, which could depress investment and stock valuations.

Will China accept this arrangement and import the chips despite the tariff?

That's unclear. Recent reports suggest Chinese customs officials instructed logistics companies not to submit clearing requests for H200 chips, which could mean China is rejecting the arrangement. China prefers developing domestic chip alternatives as part of its self-sufficiency strategy. However, Chinese tech companies like Byte Dance and Alibaba actually want high-performance chips, so there might be pressure from end users to accept the deal.

What legal basis allows the US government to impose these tariffs?

These tariffs are authorized under Section 232 of the Trade Expansion Act of 1962, which allows the president to impose duties on imports deemed necessary for national security reasons. This is a different legal foundation than some of Trump's other tariffs and has stronger historical precedent. However, companies and other governments could challenge the tariffs by arguing the "national security" justification is pretextual and the true motivation is economic protectionism.

Could these tariffs be struck down by courts?

It's possible but not certain. Section 232 tariffs have survived past legal challenges, and the framework has decades of precedent. However, the specific application here—taxing exports of technology to one country as a national security measure—is novel enough that courts could find it overreaches the original authority. The Supreme Court is also considering related tariff cases, and an adverse ruling could affect the legal status of these tariffs.

Why do NVIDIA and AMD rely on Taiwan for chip manufacturing if export controls are a risk?

Because TSMC is the only company with the technological capability and scale to manufacture the most advanced chips. The US doesn't have equivalent domestic capacity yet, despite government investments. NVIDIA and AMD would prefer to manufacture more in the US to reduce trade risk, but TSMC's factories are necessary for now. This is why both companies are investing in US manufacturing—to reduce their dependence on Taiwan in the long term.

What happens to companies that don't have US ties, like China's domestic chip makers?

They're not directly affected by these tariffs since they don't manufacture chips through the US supply chain. However, if Chinese governments restrict imports of foreign chips in response, or if these tariffs trigger broader trade tensions, Chinese companies could face higher costs for other strategic inputs or equipment. The ripple effects could affect any company with US supply chain dependencies.

Could the US government expand these revenue-sharing tariffs to other technologies?

Yes, and this is why many tech industry observers view this as a significant precedent. If the AI chip tariff arrangement works, future administrations might apply similar logic to biotech, quantum computing, semiconductors broadly, or other advanced technologies. The revenue-sharing model could become the new standard for export-restricted technologies.

What should companies do about these tariffs?

First, conduct detailed supply chain analysis to understand exposure. Second, model financial impact under various scenarios (tariffs upheld, struck down, modified). Third, engage with government on exemptions or carve-outs if applicable. Fourth, evaluate US manufacturing investments not just as a strategic hedge but as part of long-term tariff avoidance. Fifth, communicate clearly with customers about potential pricing impacts. Finally, monitor legal challenges and trade negotiations closely, as regulatory outcomes could change significantly in coming months.

What Comes Next: Watching the Semiconductor Trade War Unfold

The 25% tariff arrangement is fascinating not because it solves anything, but because it creates new problems that governments and companies now have to navigate.

In the next six to twelve months, watch for these developments: actual import volumes of H200 chips through US ports, Chinese government decisions about whether to accept the arrangement, legal challenges to the tariff authority, negotiations over broader semiconductor tariffs, and investment announcements from TSMC and other manufacturers about US facility expansion.

Each of these data points will tell us whether this novel revenue-sharing approach is working as intended or whether it's creating distortions and unintended consequences.

From a broader perspective, this tariff arrangement reflects a fundamental change in how the US government approaches technology competition. It's not just about controlling exports anymore. It's about monetizing control. It's about extracting value from the flow of strategic technologies. It's about using government power to reshape the global technology landscape in ways that benefit American interests.

Whether this approach actually achieves its goals—whether it slows China's AI development, whether it triggers investments in US manufacturing, whether it generates meaningful revenue, whether it survives legal challenges—those are the real questions. The proclamation gives us the policy. Reality will determine whether it works.

Key Takeaways

- The US government created an unprecedented 25% revenue-sharing arrangement where it captures 25% of AI chip sales to China, establishing a new model for monetizing export controls

- These tariffs use Section 232 national security authority from 1962, which has stronger legal precedent than the emergency powers approach facing Supreme Court challenges

- The arrangement specifically targets chips like NVIDIA's H200 and AMD's MI325X that are imported to the US and transshipped globally, creating a chokepoint at US ports

- NVIDIA generates roughly 27% of revenue from China (approximately $13.5 billion), making these tariffs significantly impactful to one of the company's largest markets

- China may reject the deal entirely, with reports suggesting customs officials instructed logistics companies to avoid submitting clearing requests for H200 chips

- The tariffs represent a precedent that could spread to other restricted technologies like biotech, quantum computing, and other strategic sectors under future administrations

Related Articles

- Nvidia's Upfront Payment Policy for H200 Chips in China [2025]

- 7 Biggest Tech Stories: CES 2026 & ChatGPT Medical Update [2025]

- AMD Instinct MI500: CDNA 6 Architecture, HBM4E Memory & 2027 Timeline [2025]

- AMD Ryzen AI Max+ & 9850X3D: Desktop Computing Revolution [2025]

- Photonic AI Chips: How Optical Computing Could Transform AI [2025]

![US Government 25% Tariff on AI Chip Exports to China [2025]](https://tryrunable.com/blog/us-government-25-tariff-on-ai-chip-exports-to-china-2025/image-1-1768487772499.jpg)