Introduction: The Mega-Fund Revolution Is Here

When Thrive Capital announced it had closed a

This isn't just a fundraise announcement. It's a referendum on artificial intelligence, on the founders Thrive has backed, and on the future of venture capital itself. The firm's portfolio companies include some of the most valuable private companies on the planet: Open AI, Stripe, and Space X. These companies have transformed from speculative bets into market-moving forces.

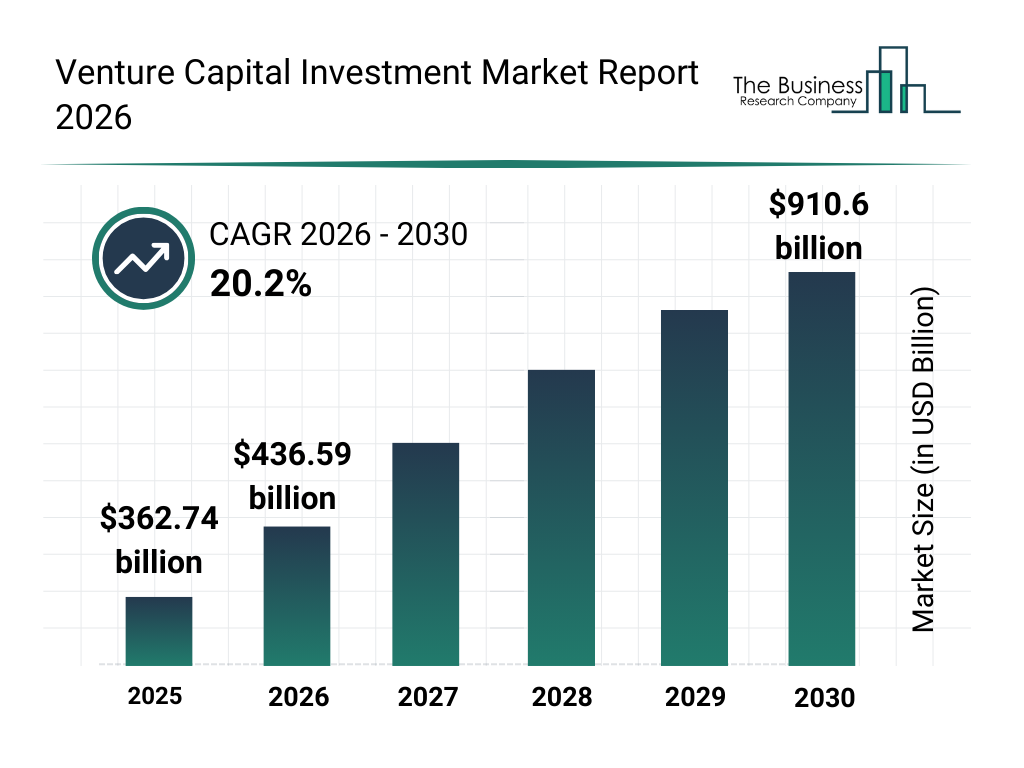

The timing matters too. We're at an inflection point where limited partners—the pension funds, endowments, and family offices that back VCs—are finally seeing massive returns on their AI bets. Rumors swirl about Open AI and Space X heading toward IPOs. When that happens, the capital returned to LPs could be unprecedented.

For founders, this means something else entirely: capital is abundant if you're in the right category. For the venture industry, it means concentration is accelerating. The winners are getting more capital faster, and everyone else is competing for scraps. Understanding Thrive's $10 billion raise means understanding the future of startup funding itself.

Let's break down what just happened, why it happened, and what comes next.

TL; DR

- Thrive's $10B Fund X: Nearly double the size of their previous fund, marking the largest raise in the firm's history

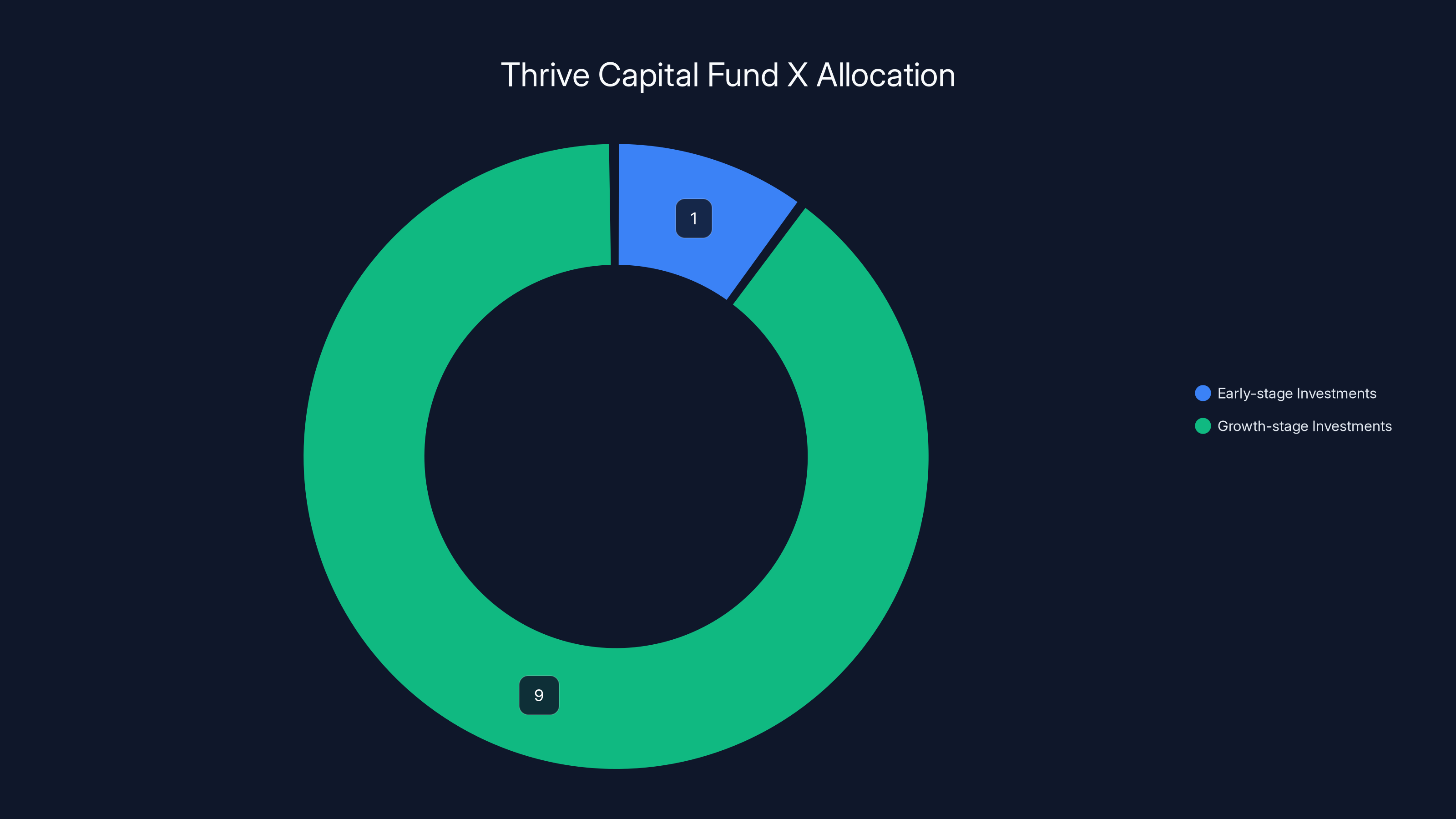

- Capital allocation: 9 billion for growth-stage companies

- Portfolio strength: The fund was oversubscribed, showing massive LP demand for Thrive's thesis

- Proven track record: Holdings include Open AI, Stripe, and Space X, three of the most valuable private companies globally

- Industry implication: Signals unprecedented confidence in AI-backed businesses and wealth concentration among top-tier firms

Thrive's portfolio includes companies like OpenAI, SpaceX, and Stripe, with valuations ranging from

The Scale: Why $10 Billion Matters in 2026

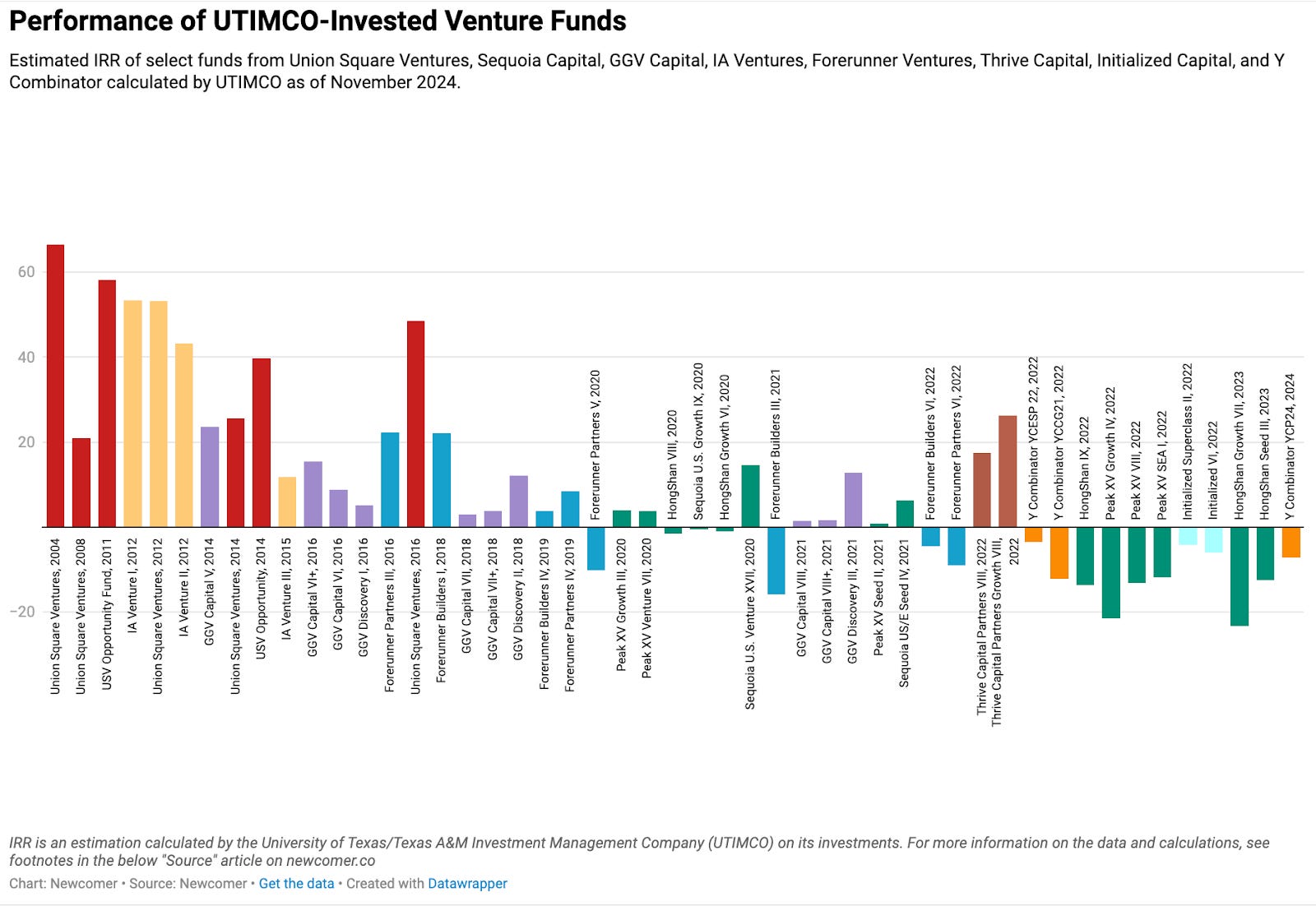

Ten billion dollars sounds abstract until you think about what it actually means. In 2024, the average venture capital fund raised was somewhere in the

To put this in perspective,

This concentration of capital in a single fund is remarkable because it reflects something deeper about the venture market. The winners consolidate. If you've had three massive hits—Open AI, Stripe, and Space X—LPs throw more money at you because the math is obvious. One $500 billion company compensates for a thousand failed early-stage bets.

The fund was oversubscribed, meaning LPs wanted to commit more capital than Thrive was willing to take. That's the opposite of most fundraising dynamics. When demand exceeds supply, you've got institutional investors lined up, confident in your ability to deploy capital effectively. Pension funds that manage trillions of dollars are essentially saying: "We trust you with our LPs' money more than we trust most alternatives."

For context, this happens rarely. Most mega-funds struggle to close. Thrive closed easily because of execution and returns. The venture world operates on reputation and track record more than almost any other industry.

The Portfolio: Why Investors Are Bullish

You can't separate Thrive's fundraising success from the companies they've backed. The firm's portfolio reads like a highlight reel of the most valuable private companies on Earth.

Open AI is the obvious anchor tenant. The company redefined what's possible with large language models, and its influence over artificial intelligence development is now undeniable. Chat GPT reached 100 million users faster than any app in history. From Thrive's perspective, this wasn't a lucky bet. It was strategic conviction about AI's importance.

Stripe represents something different: infrastructure. The company made payment processing simple for the internet. It's not as headline-grabbing as Open AI, but it's arguably more foundational. Every online business either uses Stripe or competes against it. The company has been valuable for so long that people forget it's still private.

Space X shows Thrive's willingness to back founders with "unrealistic" visions. Elon Musk started Space X when people thought reusable rockets were science fiction. Now they're routine. The company's valuation is somewhere in the $180 billion range based on secondary market trades.

Beyond the mega-winners, Thrive also backs Databricks (data and AI infrastructure), Anduril (defense tech), and Cursor (AI-powered code editor). The pattern is clear: infrastructure, AI, and founders who think differently.

Thrive also incubates companies in-house. Twelve companies have spun up so far, and at least six have reached unicorn status. This means Thrive isn't just writing checks—they're creating companies from scratch. They identify problems, hire founders, and build solutions. It's a different model than traditional VC, and it works when you have conviction and capital.

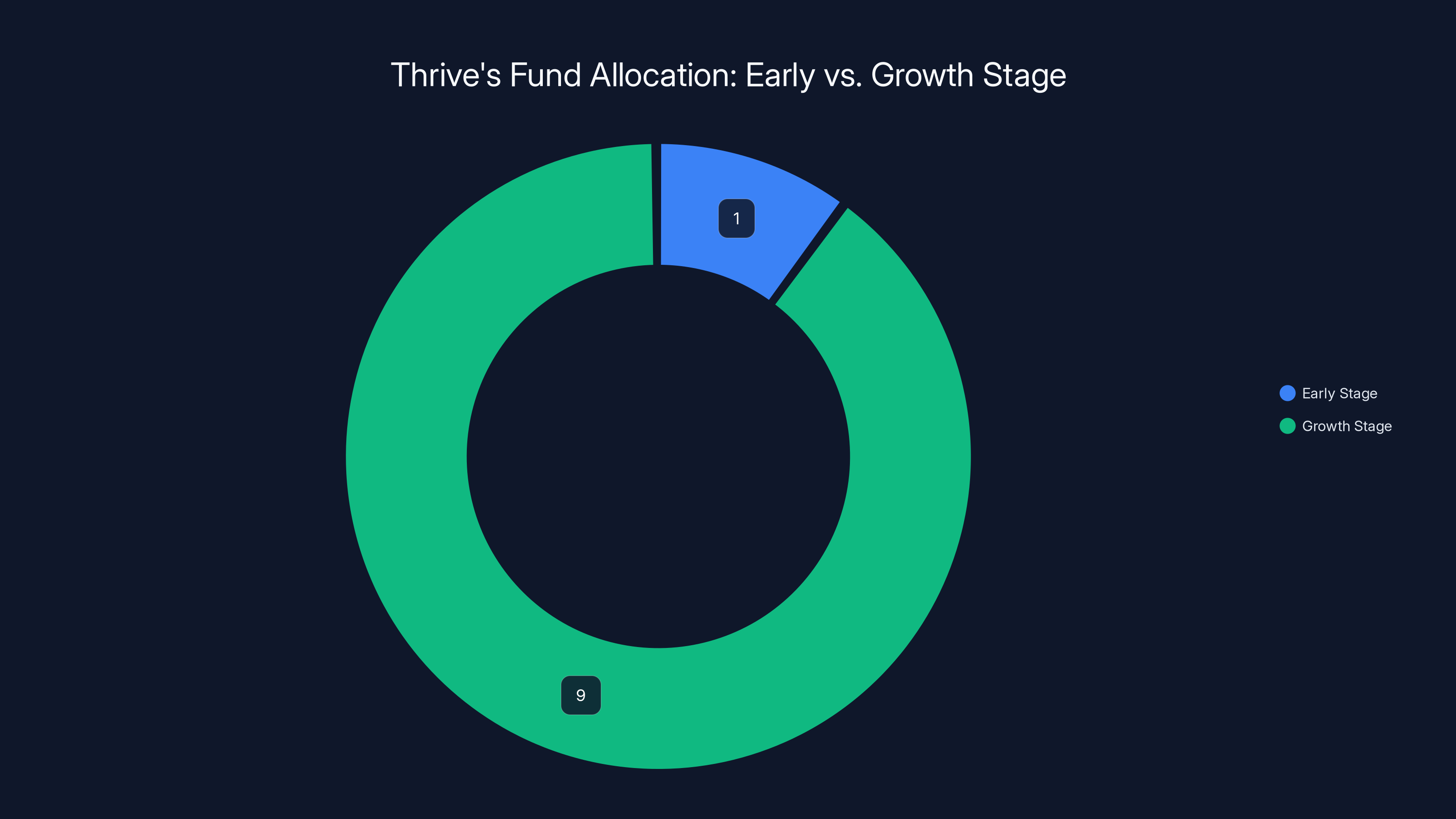

Thrive allocates

Fund Composition: Early Stage Meets Growth Stage

The $10 billion breaks down into distinct buckets, and understanding that breakdown tells you a lot about Thrive's current thesis.

One billion dollars goes to early-stage investments. In 2026, that means seed rounds, Series A, and maybe early Series B. For founders, this is meaningful because it shows Thrive is still backing young companies. The firm hasn't abandoned early-stage investing entirely in favor of mega-rounds. But the ratio is stark:

That 9-to-1 ratio is the most interesting number in this announcement. It signals that Thrive's real conviction is in growth-stage companies that are already winning. The early-stage bucket might seem small, but

The growth-stage allocation is where the real capital lives. This money funds scaling: expanding into new markets, building distribution, acquiring talent. If a company has found product-market fit and proven its business model, growth-stage capital turns that into a multi-billion-dollar business.

For the venture industry, this allocation strategy reflects a macro shift. Early-stage investing used to be the glamorous part of VC. You back 10-year-olds, watch them grow, take them public. But those economics have changed. When Series A rounds now regularly top

This also creates a narrative problem for traditional VC. If the biggest firms concentrate on growth stage, what happens to seed-stage founders? They increasingly turn to micro-VCs, angel syndicates, and accelerators. The venture market is stratifying into tiers: mega-funds for winners, everyone else for aspiring winners.

The Timing: Why Now?

You could ask: Why did Thrive raise now instead of 2024 or 2023? The answer involves markets, technology, and returns.

First, the returns narrative. Thrive's major investments have appreciated substantially. Open AI's last secondary valuation was around

Second, the AI moment. Generative AI has moved from theoretical to practical. Enterprises are deploying AI tools. Cost of compute is falling. New models are becoming more capable. The question isn't whether AI will matter—it clearly does. The question is which companies will dominate. Thrive's bets on infrastructure and foundational models position them well.

Third, the IPO rumors. Markets are speculating about Open AI and Space X going public. If either company IPOs, the returns to early Thrive investors will be staggering. That prospect draws capital. LPs want to participate in more mega-outcomes.

Fourth, institutional appetite is strong. The Federal Reserve's interest rate policy, while restrictive compared to pandemic lows, is stabilizing. Markets aren't in crisis mode. Pension funds and endowments have capital to deploy. Thrive arrived at a moment when the conditions aligned.

What This Means for Limited Partners

Think of limited partners as the people who actually own the capital. They're not the venture capitalists. They're the pension funds, endowments, family offices, and institutions writing the checks to Thrive.

For them, Thrive's success is personal. If their capital in the firm returned 10x, they're seeing concrete evidence that concentrated bets on founders work. That evidence justifies more capital allocation to VC. Within a portfolio, VC is risky, but high-returning. An endowment might allocate 5-10% of its portfolio to venture because that segment funds massive returns elsewhere.

Thrive's $10 billion raise signals LP confidence that the firm can continue executing. The oversubscription means demand exceeded supply—LPs wanted to commit even more. That's rare and valuable. It tells you institutional capital trusts Thrive's ability to deploy capital effectively.

But there's also a subtle signal here about concentration. If the largest, most successful VCs keep raising larger and larger funds, capital becomes increasingly concentrated among elite firms. For middle-tier VCs and emerging fund managers, this is concerning. Capital is flowing up, not down.

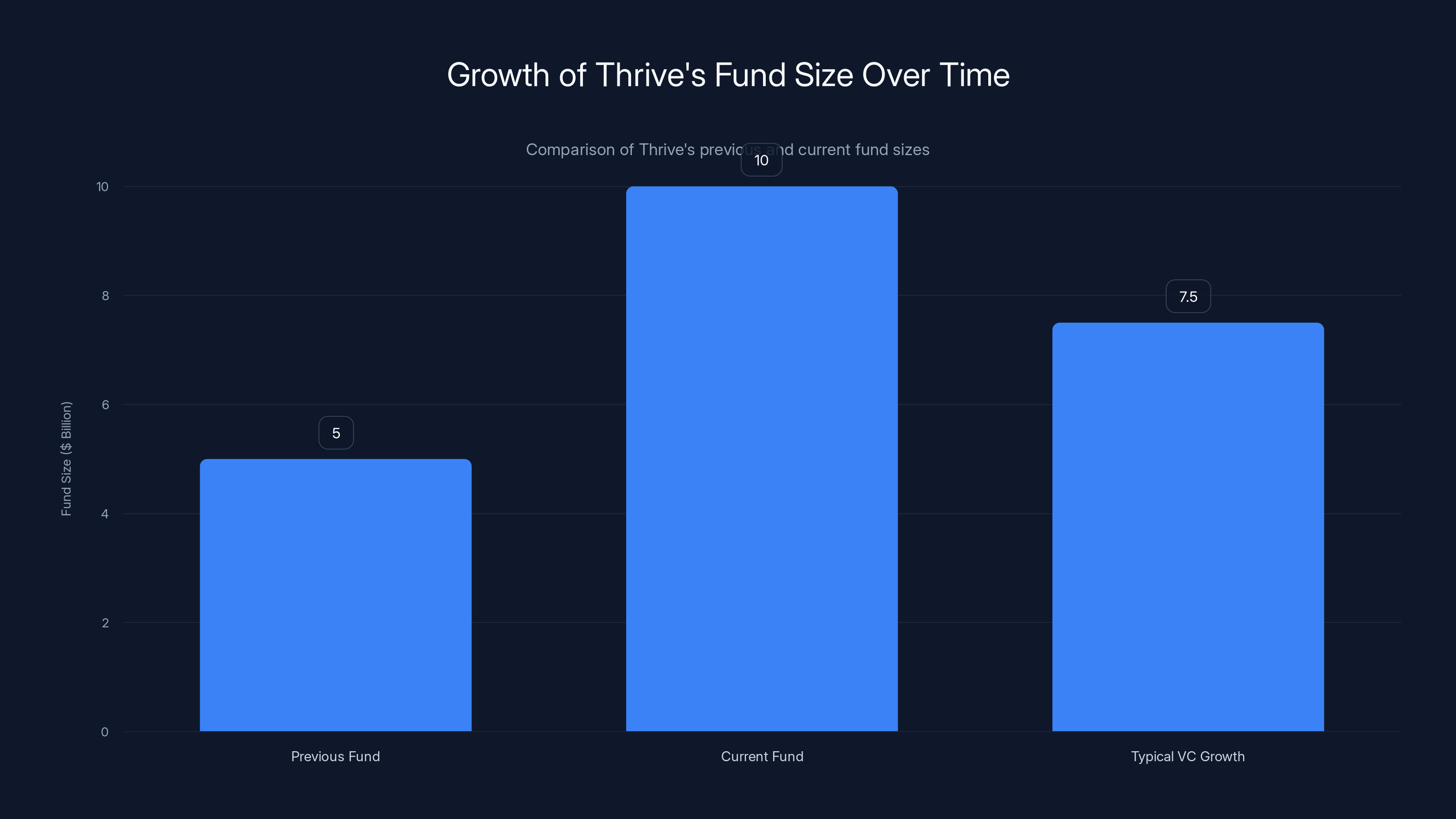

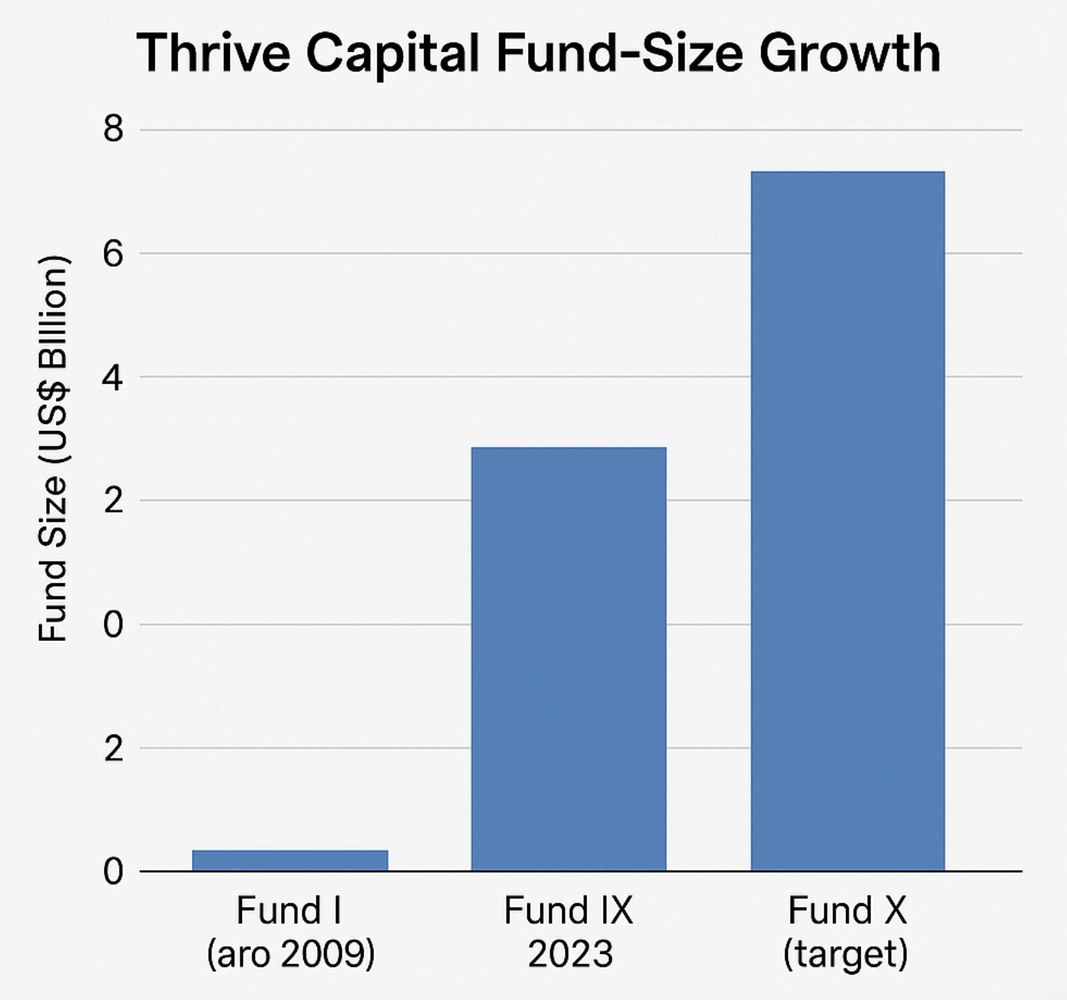

Thrive's new fund size has doubled from

What This Means for Founders

Thrive's mega-fund creates both opportunity and pressure for founders.

The opportunity: Thrive has more capital to deploy. If you're a promising founder building in AI, infrastructure, or defense tech, Thrive might be interested. The firm's check sizes can scale to your needs. A growth-stage founder needing

The pressure: Thrive is now even more selective. With $9 billion for growth-stage, they can afford to wait for the clearest winners. They don't need to fund 50 companies hoping one succeeds. They can fund 10 and expect several to become multi-billion-dollar businesses. For founders, this means the bar is higher.

It also creates a narrative advantage for well-funded founders. If Thrive backs you in growth stage, it's a stamp of approval. Institutional credibility. Other investors follow. Partners take you seriously. The halo effect of Thrive's capital is real.

For early-stage founders, Thrive's $1 billion early-stage bucket is theoretically accessible. But in practice, the firm likely reserves that capital for founders who've already proven something: traction, product-market fit, or exceptional founding teams. Early-stage in Thrive's context probably means Series A at best, not pre-seed.

The Concentration Trend: Winners Take Most

Thrive's raise is part of a larger trend: concentration. The venture capital industry is consolidating into tiers.

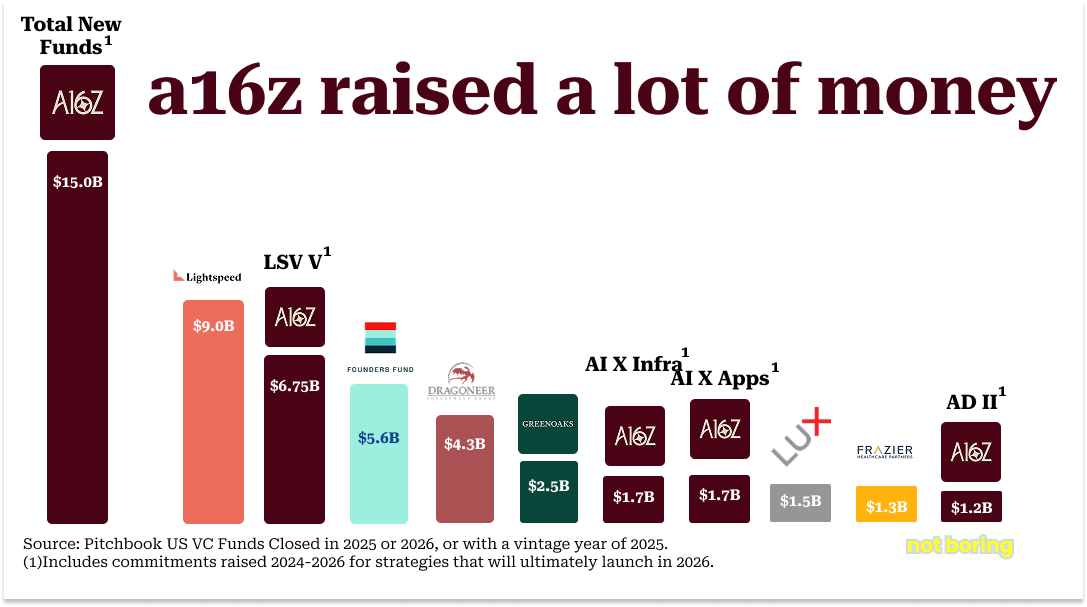

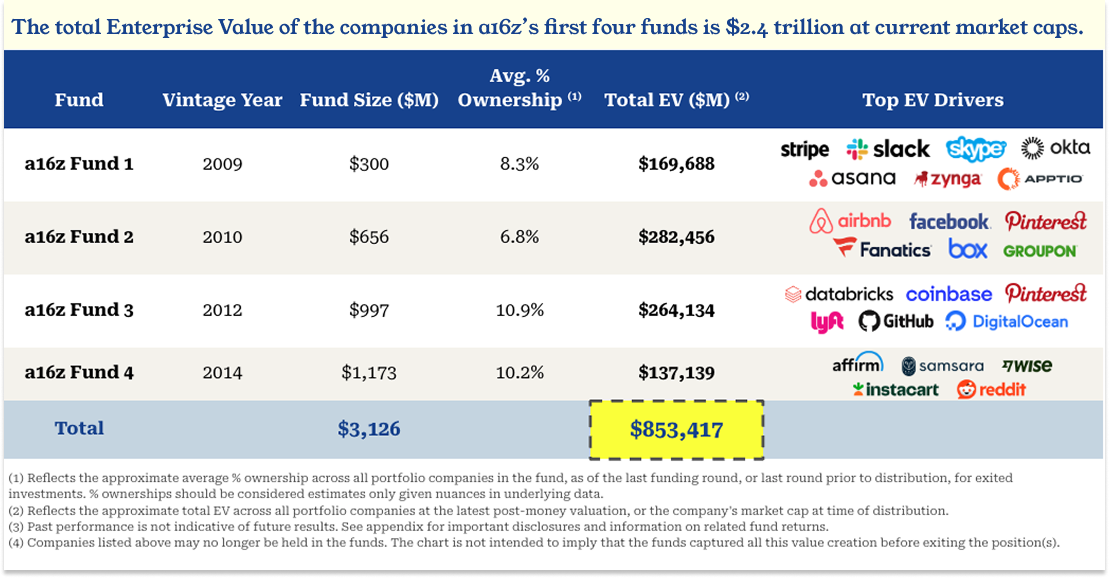

Top tier: Mega-funds like Sequoia, a 16z, and Thrive. These firms have unmatched track records, raising funds in the $8-15 billion range. They pick winners and amplify them.

Second tier: Strong regional or thesis-driven funds in the $1-3 billion range. Benchmark, Greycroft, and others. These funds focus on specific niches or regions but have proven success.

Third tier: Traditional VCs raising

Fourth tier: Micro-VCs, angel syndicates, and accelerators. These fund the earliest stages and compete on access and founder relationships.

This stratification has consequences. The mega-funds can fund companies from seed to growth, capturing most of the upside. They can also support each other through follow-on rounds. A company backed by Sequoia in seed round gets follow-ons from a 16z and Thrive. Capital is concentrated among the winners and their backers.

For founders outside the top tier, this is challenging. You need to prove yourself with smaller investors before top-tier VCs take you seriously. The fundraising journey gets longer. Or you skip VC entirely and bootstrap, taking longer to scale but retaining more equity.

For the industry, concentration raises questions. Does the entire venture ecosystem become dependent on a few mega-fund decision-makers? What happens to diversity of thought if capital concentrates among like-minded partners? These are structural questions that will shape venture capital for years.

The AI Thesis: Why Now Makes Sense

Thrive's conviction in artificial intelligence is embedded in this fund. The firm isn't raising $10 billion for "any founder with a good idea." They're raising it because they believe AI and AI infrastructure will drive the next decade of value creation.

Consider their portfolio through an AI lens: Open AI is foundational models. Stripe is payments infrastructure now being redesigned around AI workflows. Space X uses AI for satellite communications and autonomous systems. Databricks is data and ML infrastructure. Cursor is AI-powered development. Even Anduril uses AI for defense technology.

This isn't coincidence. Thrive has a thesis: AI is moving from research to production. Companies are building on top of AI. Infrastructure companies supporting AI will be valuable. Founders who understand AI but weren't trained as ML researchers will build the next generation of products.

Josh Kushner, Thrive's founder, told investors: "The winners of the AI boom will be bigger than we can ever imagine." He's saying the opportunity set is massive and still nascent. Most of the value creation is ahead.

If that thesis is correct, Thrive's

Of course, not every bet pays off that way. But one mega-win can justify the entire portfolio. That's the leverage of venture capital when you pick winners right.

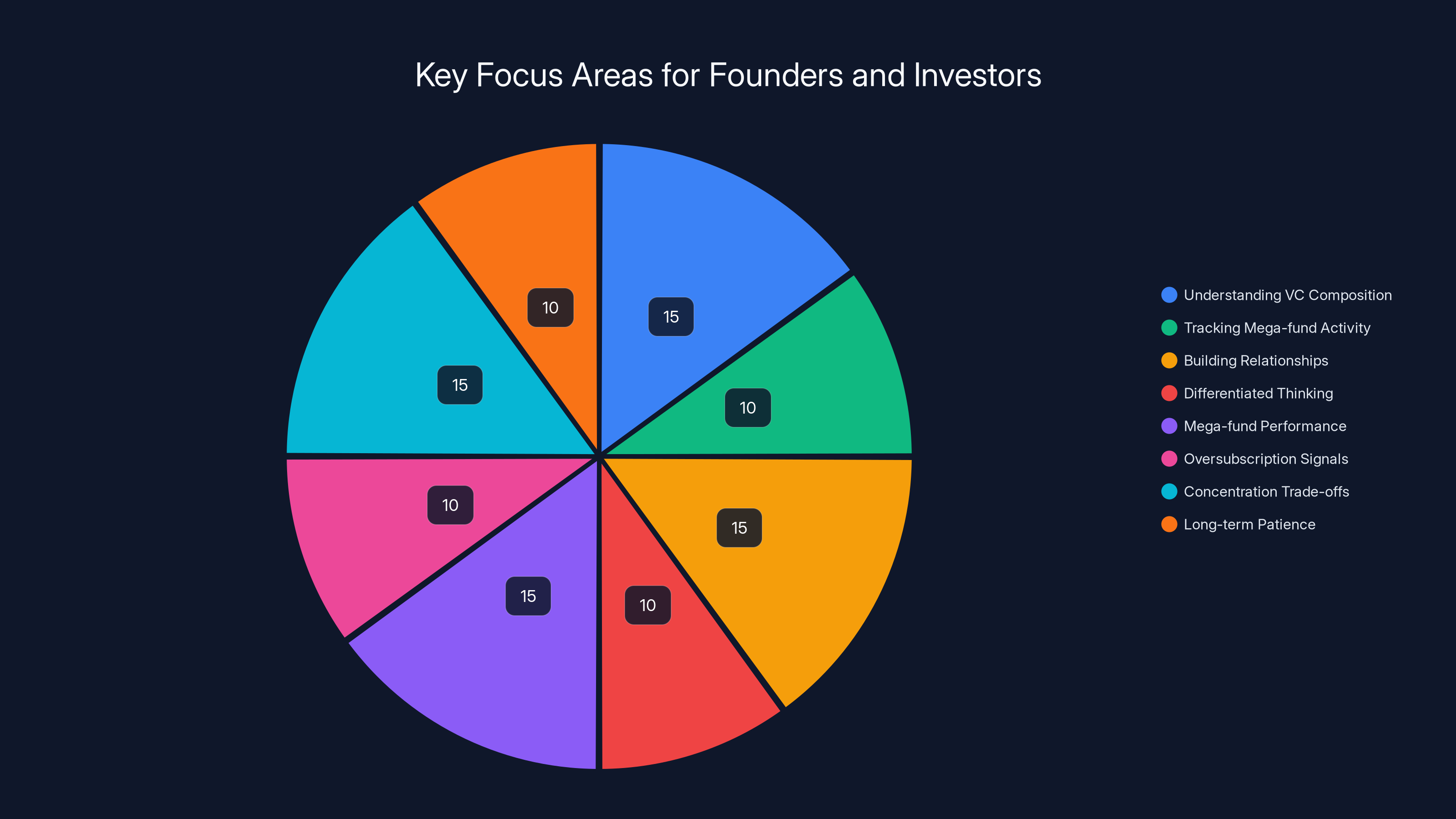

Estimated data shows a balanced focus across key areas for founders and investors, with emphasis on understanding VC composition and mega-fund performance.

The IPO Signal: What Returns Are Coming

Thrive raised this fund with clear visibility into potential returns. The rumors about Open AI and Space X approaching IPO are significant.

If Open AI goes public at a $500+ billion valuation, Thrive's stake becomes worth tens of billions. That single return satisfies every LP for multiple fund cycles. It validates the entire thesis.

If Space X IPOs, similar math applies. The company is worth at least $180 billion based on secondary market activity. Potentially more if market conditions are favorable and the company continues executing.

When mega-exits happen, capital floods back to VCs. They can then raise the next fund larger. More capital attracts better deals. The cycle compounds.

But there's also a timing factor. If these IPOs happen in the next 2-3 years, Thrive's LPs will see returns while the fund is still deploying capital. New commitments from LPs will be based on real returns, not projections. That's powerful.

For the venture industry, mega-exits reshape capital flows. When one fund makes outsized returns, every LP wants exposure. Capital chases the winners. Thrive's raise reflects confidence that mega-exits are coming.

The Incubation Model: Building Companies, Not Just Funding

Thrive doesn't just write checks. The firm also incubates companies in-house. Twelve companies have spun out so far, with at least six reaching unicorn status. This is a different venture model than pure VC.

The idea: Thrive partners with founders to identify a problem, hire a team, and build a solution. Rather than waiting for entrepreneurs to come with ideas, Thrive proactively creates companies.

This requires different skills. Traditional VCs evaluate existing teams and ideas. Incubators assemble teams and validate problems first. It's more capital-intensive early on but can de-risk the investment if you choose the right problems.

For founders, this model is interesting. If Thrive identifies a problem you're passionate about, you get funded immediately with experienced partners advising you. You don't need to bootstrap or pitch dozens of VCs. The trade-off is you're not the solo founder building your vision—you're part of a Thrive-led team.

For Thrive, incubation generates deal flow and reduces selection risk. The firm knows the founding team. The problem has been validated. The business model is outlined. It's like starting a company with the best advisors in the world available.

Six unicorns from twelve incubated companies is an exceptional hit rate. Maybe 50% of incubated startups reach $1 billion valuations. Traditional VC hit rates are more like 5%. The difference might be Thrive's capital, guidance, and network, or selection bias (Thrive only incubates companies they have conviction in).

Either way, incubation is part of Thrive's flywheel. More capital → better incubation support → better companies → stronger track record → more capital raised.

Capital Allocation Strategy: Concentration of Bets

Thrive's philosophy is explicit: "Commit deeply to a small number of founders." This is concentration strategy.

Instead of writing 200 checks across different sectors hoping a few pay off, Thrive writes maybe 20-30 checks and invests heavily in winners. This means:

Larger check sizes per company. Growth-stage companies need $100M+. Thrive can accommodate that without needing 50 LP syndications.

Deeper involvement. Thrive provides more than capital—they bring operational expertise, recruiting support, distribution help, board advice. This requires bandwidth, so it only works with fewer companies.

Longer-term view. Thrive won't exit a company at 3x returns. They'll hold for 10+ years waiting for 100x outcomes. This requires patient capital from LPs.

Patient capital is key. Most institutional investors want liquidity on a 5-10 year timeframe. Thrive's LPs accept longer because the return potential is enormous. Open AI might take 15+ years to IPO, but returns could be 1,000x.

For founders, concentration strategy is double-edged. If you're in Thrive's portfolio, you get deep support. If you're not, Thrive won't fund you. There's no "let's stay in touch for Series B" option. The firm makes conviction-based bets early and doubles down.

For the industry, concentration raises questions about diversification. If venture capital concentrates on a few mega-bets, what happens to founders in non-obvious categories? They need other sources of capital. The ecosystem fragments into winners and everyone else.

Thrive Capital's Fund X allocates

The Oversubscription Signal: LP Demand Is Extreme

Thrive's fund was oversubscribed. This single fact deserves deep analysis because it reveals market dynamics.

Oversubscription means LPs wanted to commit more capital than Thrive accepted. The firm controlled the fundraise by choosing which LPs to take and how much capital to accept.

This is rare and powerful. Most fundraises are supply-constrained: VCs chase LPs hard trying to close commitments. Oversubscribed fundraises are demand-constrained: LPs are lined up and VCs pick and choose.

For Thrive, oversubscription validates the investment thesis. It says: "The market believes in our ability to deploy $10 billion at strong returns."

For LPs, oversubscription is frustrating. You want exposure to a top fund, but your check got trimmed or rejected. So you're left allocating capital to secondary-tier firms or other asset classes. Some of the largest endowments might get allocation to Thrive. Smaller endowments might not.

For the venture industry, oversubscription reflects structural imbalance. Capital is abundant globally, but allocation to top-tier VC is limited. Only 50 or so funds can raise $5+ billion funds. Trillions of institutional capital chases those 50 firms. The supply-demand mismatch is fundamental.

One consequence: mega-funds keep raising larger and larger funds. Thrive raised

Comparing to Previous Funds: The Doubling Effect

Thrive's last fund was approximately

Doubling fund size between successive funds is ambitious. It signals confidence that deployment can happen at scale without reducing returns. Capital doesn't have diminishing returns if markets are big enough and founders are numerous.

For context, most VCs try to grow funds by 30-50% per cycle. Doubling is aggressive. It suggests:

Either Thrive deployed the previous

Probably both. Thrive's track record supports more capital. And the AI market is genuinely expanding, with more billion-dollar opportunities than ever.

But there's a risk. Deploying

If Thrive has to fund mediocre companies just to deploy capital, returns suffer. The firm seems confident this won't happen. We'll see if that confidence is justified over the next 5 years.

The Broader Implications: What This Means for Startups

Thrive's mega-fund raise has ripple effects throughout the startup ecosystem.

For well-funded startups in hot categories: More capital arrives. Thrive will fund growth rounds. Competition for talent becomes fiercer (because other funded startups are hiring too). Valuations could compress or expand depending on supply of capital relative to demand for equity.

For moderately-funded startups: Pressure increases. If everyone around you is raising from Thrive or Sequoia at mega-valuations, you look behind. You have two choices: raise more capital at stretched valuations to keep up, or find a different path (bootstrap, acquihire, or pursue profitable growth).

For seed-stage startups: Less direct impact from Thrive since they focus growth stage. But indirect impact: VCs that fund seeds lose their growth-stage checks to Thrive, so they raise new seed funds more urgently. More seed funds arrive. More competition for limited seed-stage capital. Your pitch might be better-received, but valuations for seeds might also compress as funds fight over allocation.

For founders in non-AI categories: Marginal impact. Thrive focuses AI and adjacent verticals. Other funds still fund B2B Saa S, marketplaces, etc. But mega-funds raise more, so capital overall concentrates at the top. Your fundraising becomes harder because investors check Thrive/Sequoia first, settling on you only if those meetings don't work out.

Overall, Thrive's raise accelerates existing trends: concentration, mega-rounds, and valuation inflation for winners. The venture landscape tilts further toward a few mega-funds backing a few mega-companies.

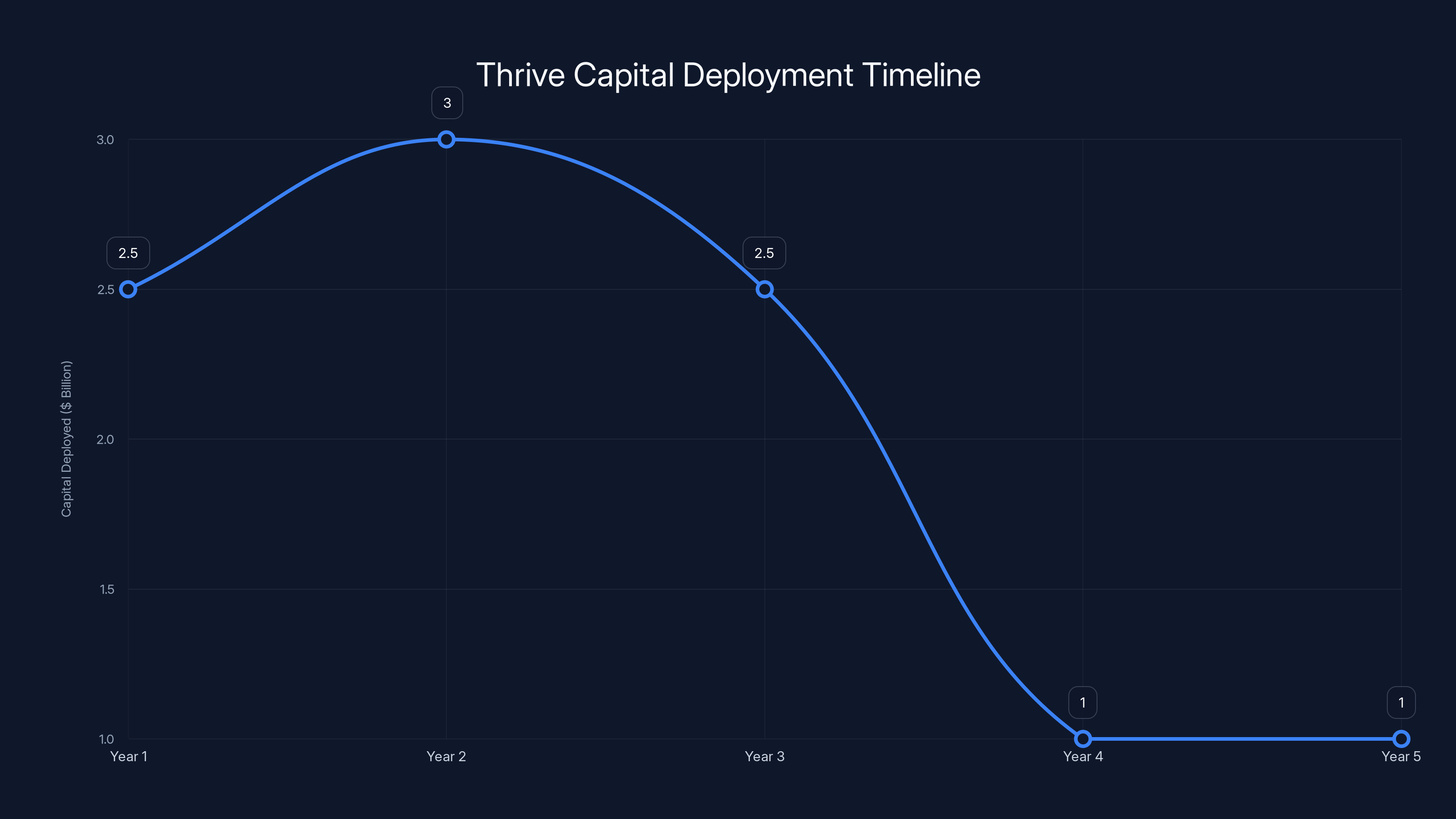

Thrive plans to deploy $10 billion over 5 years, with an initial focus on early-stage investments. Estimated data suggests a balanced approach to maximize both early-stage growth and late-stage returns.

Fund Structure and Investor Classes: Who Gets In?

When Thrive raises $10 billion, the capital comes from specific types of LPs, and the structure matters.

Sovereign wealth funds: Countries like Singapore, Abu Dhabi, and Norway manage enormous asset pools. They allocate small percentages to VC because returns are exceptional but should be concentrated.

Pension funds: Teachers' retirement, Cal PERS, and similar funds manage billions. They need long-term growth assets. VC provides that. A 2-3% allocation to venture is acceptable for a pension fund.

Endowments: Harvard, Yale, Stanford. These institutions have perpetual capital and can accept VC's long-term nature. Endowments are among Thrive's likely LPs.

Family offices: Ultra-wealthy individuals' investment vehicles. They can take concentrated bets on managers like Thrive.

Insurance companies: Some insurance companies allocate capital to VC because VC returns support dividend payments for policyholders.

Corporate venture arms: Large tech companies sometimes LP into external VCs for strategic insight and portfolio companies.

The investor class changes what the fund looks like. Sovereign wealth funds want exposure to mega-outcomes. Pension funds want stable returns. Endowments can wait 15 years for an exit. This mix of LPs with different return horizons allows Thrive to pursue longer-term strategies.

Funds also have tiers of commitment. Some LPs commit

For Thrive, the oversubscription means they could be selective about LP quality. They might have rejected capital from LPs that would be burdensome (demanding, inexperienced with venture, or pursuing agendas). The final LP base is probably best-in-class.

The Deployment Timeline: When Will This Capital Be Used?

Thrive raised $10 billion, but they won't deploy it all at once. Deployment typically happens over 3-5 years, sometimes longer.

Year 1: Initial deployment at 20-30% of capital. Thrive makes early bets, often in companies already in the pipeline.

Year 2-3: Main deployment phase. The firm accelerates funding as companies scale and new opportunities emerge.

Year 4-5: Final deployment and reserves. Thrive holds capital for follow-on rounds in existing companies and late-arriving opportunities.

Undeployed capital sits in stable assets (money market funds, short-term bonds) earning minimal returns. So deployment pace matters. Too slow and capital erodes in value. Too fast and quality suffers.

For founders, this timeline matters. If you're fundraising in 2026, Thrive is actively deploying Year 1 capital. This is actually good—the fund is hot, partners are motivated, and capital is moving. By 2028, Thrive might be more selective as they approach final deployment.

The deployment timeline also affects the fund's return profile. Early-stage companies have more time to grow (and return more). Late-stage companies might show returns faster. Thrive's balanced approach—

Exit Planning: When Does Thrive Get Paid?

Thrive raises $10 billion knowing they'll need to exit companies to return capital to LPs. The timeline and exit paths matter.

IPOs: Companies like Open AI and Space X can IPO for enormous valuations. This returns massive capital. Expected in next 2-5 years based on rumors.

Acquisitions: Smaller companies within Thrive's portfolio get acquired. Less dramatic but steady returns. Expected continuously.

Secondary sales: Thrive sells stakes to other investors before an official exit. This provides interim returns and de-risks the portfolio.

Dividends: If portfolio companies become profitable and distribute cash, Thrive gets carried interest. Rare in venture-backed startups but possible for mature ones.

Writedowns: Some investments will fail entirely. Thrive writes these down, reducing portfolio value. Expected at maybe 15-20% of companies.

The exit strategy shapes investment decisions. If Thrive expects an IPO pop in 2028, they might hold portfolio companies tight until then. If they expect ongoing acquisitions, they can exit earlier at lower valuations.

For LPs, exit timing determines when they get capital back. A pension fund might prefer steady exits (acquisitions) over concentrated mega-exits (IPOs). Thrive's portfolio mix supports both strategies.

Competition and Positioning: How Thrive Stacks Up

Thrive isn't the only mega-fund, but it's among the top tier. Understanding positioning helps.

Sequoia Capital: The gold standard. Backed the most legendary companies (Apple, Google, You Tube). Track record is unmatched. Likely raised $10B+ for their latest fund.

Andreessen Horowitz (a 16z): Pioneered crypto investing. Massive fund ($20B+). Focused on earlier stages and infrastructure.

Silver Lake: Growth equity specialists. $28B fund. Focuses more on late-stage and buyouts.

Kohlberg Kravis Roberts (KKR): Buyout giant. Huge capital base. Less focused on VC, more on private equity.

Thrive's positioning: Concentrated bets, founder-friendly, AI-focused. Smaller than Sequoia but with better track record on recent mega-hits (Open AI, Stripe, Space X). More focused than a 16z on growth stage and mega-outcomes.

The positioning matters for founders. If you're raising from Thrive, you get concentrated support and patient capital. If you're raising from a 16z, you get broader ecosystem and more active follow-on capital. Different funds optimize for different outcomes.

For the industry, more mega-funds mean more capital at the top and more competition for deploying it. When Thrive, Sequoia, a 16z, and others are all raising $8-20B funds, they need quality companies. The standard for what "quality" means keeps rising.

Future Outlook: Where Venture Capital Is Heading

Thrive's $10 billion raise is a data point in a larger trend about venture capital's future.

Trend 1: Mega-funds continue growing. As returns improve and LPs see proof of concept, top-tier funds raise larger sizes. In 5 years, $10B might be the median mega-fund size.

Trend 2: Concentration accelerates. Fewer firms control more capital. Winners keep winning because they can fund their entire portfolio from Series A to exit.

Trend 3: AI dominance continues. Venture capital is increasingly focused on AI companies and companies using AI. Non-AI startups get less capital and attention.

Trend 4: Geographic concentration. Most mega-fund capital flows to Silicon Valley and a few other hubs (NYC, London). Secondary tech hubs struggle for capital.

Trend 5: Founder returns increase but founder equity decreases. Founders get more capital faster, but also face more dilution from mega-rounds and mega-funds taking larger percentages.

These trends compound. More capital to winners attracts more founders wanting to be winners. Competition intensifies. Values increase. The market becomes increasingly bimodal: mega-successes and everything else.

For long-term venture health, this might be concerning. If capital concentrates, innovation concentrates. If founders know only mega-funds can support them, they optimize for mega-fund theses (AI, defense, etc.). Interesting companies in unsexy categories get starved of capital.

But markets self-correct. When mega-funds become too concentrated, returns suffer. Then new entrants see opportunity and raise capital at different thesis or stage-focus. The cycle continues.

Key Lessons for Founders and Investors

What should you take away from Thrive's $10 billion raise?

For founders seeking capital:

-

Understand your target VC's fund composition. Thrive has $9B for growth stage. They're not your Series A fund. Pitch accordingly.

-

Track mega-fund activity as market signal. When top funds double in size, it signals where the market thinks growth is happening. Ride those signals.

-

Concentration means selectivity. Mega-funds pick fewer companies but back them deeper. If you're selected, you get incredible support. But selection is harder.

-

Build relationships before you need capital. Thrive's portfolio wasn't random. They had conviction about founders early. Being on their radar years before your Series B helps.

-

Differentiated thinking matters more than credentials. Thrive backs founders with unique visions (Musk, Altman, Collison). What makes your approach different?

For investors and LPs:

-

Track mega-fund performance. Thrive's $10B is justified by returns. Other mega-funds might not have the same track record. Due diligence matters.

-

Oversubscription is a signal of confidence. When a fund is oversubscribed, it suggests LPs believe in the thesis. That's valuable market signal.

-

Concentration has trade-offs. Mega-funds offer better returns but less diversification. Smaller funds offer portfolio diversification but maybe lower returns. Balance your VC allocation accordingly.

-

Long-term patience is rewarded. Thrive's returns come from holding Open AI, Stripe, and Space X for many years. Short-term traders miss these returns.

For the industry:

-

Consolidation continues. The venture industry will likely have 30-50 mega-funds and hundreds of smaller funds. Structure is shifting toward a bifurcated model.

-

Returns follow concentration. Mega-funds can make more concentrated bets because they have more capital. That concentration can generate outsized returns. Or it can fail spectacularly. Time will tell.

-

Founder selection matters more than capital amount. Thrive's fund works because of Open AI, Stripe, and Space X, not because of $10B in capital. Capital follows great founders, not vice versa.

FAQ

What is Thrive Capital?

Thrive Capital is a venture capital firm founded by Josh Kushner that focuses on backing growth-stage companies in AI, infrastructure, and other strategic verticals. The firm has built a track record of investments in some of the world's most valuable private companies, including Open AI, Stripe, and Space X. Thrive also incubates companies in-house, having spun out twelve companies with at least six reaching unicorn status.

How much capital did Thrive raise in Fund X?

Thrive raised

Why is a $10 billion fund significant?

A $10 billion fund is significant because it represents massive concentration of capital and signals strong LP confidence in Thrive's investment thesis. Most venture funds are substantially smaller; mega-funds of this size are rare and exclusive. The oversubscription demonstrates that institutional investors believe Thrive can deploy capital effectively to generate strong returns. The size also allows Thrive to write very large checks for growth-stage companies and maintain deep involvement with portfolio companies.

What does Thrive invest in?

Thrive primarily focuses on AI, infrastructure, and defense technology. Notable investments include Open AI (foundational AI models), Stripe (payments infrastructure), Space X (space exploration), Databricks (data and AI infrastructure), Anduril (defense tech), and Cursor (AI-powered code editor). The pattern suggests Thrive focuses on founders building foundational technologies or tools that could support massive markets.

What does Thrive's capital allocation mean for founders?

Thrive's allocation of

How does Thrive compare to other mega-funds?

Thrive operates at a similar scale to other top-tier VCs like Sequoia and Andreessen Horowitz, but with different strengths. Sequoia has the longest and most legendary track record. a 16z is larger (raised a $20+ billion fund) and more active in earlier stages. Thrive's differentiation is concentrated conviction in founders and recent mega-hits in AI (Open AI). The firm takes a more founder-centric approach than some peers, providing deep operational support rather than just capital and connections.

What does the oversubscription of Thrive's fund tell us?

Oversubscription means limited partners wanted to commit more capital than Thrive accepted into the fund. This is a strong signal that institutional investors have confidence in Thrive's investment strategy and track record. Oversubscribed funds are rare; most fundraises struggle to hit targets. The oversubscription suggests that LPs believe Thrive can generate exceptional returns with $10 billion and want exposure to the firm's opportunity set. It also gives Thrive the luxury of being selective about which institutional investors to accept, allowing them to curate a high-quality LP base.

Could Open AI or Space X IPOs significantly boost Thrive's returns?

Yes. If Open AI IPOs at valuations being discussed (

What is Thrive's incubation model?

Thrive incubates companies in-house by identifying problems, hiring founders, and building solutions rather than simply writing checks to existing teams. Twelve companies have been incubated so far, with at least six reaching unicorn status. This model differs from traditional VC because Thrive proactively creates companies instead of waiting for entrepreneurs to pitch. The approach allows Thrive to de-risk investments by validating problems and assembling experienced founding teams before formal fundraising. For founders, incubation with Thrive means immediate funding and access to world-class mentorship and resources.

How long does it take Thrive to deploy a $10 billion fund?

Typical deployment timeline for mega-funds is 3-5 years. Year 1 involves deploying 20-30% of capital into initial bets. Years 2-3 represent the main deployment phase as companies scale and new opportunities emerge. Years 4-5 involve final deployment and reserved capital for follow-on rounds. Undeployed capital sits in stable assets earning minimal returns, so deployment pace matters. For founders, if you're raising in 2026 when Thrive just closed the fund, the firm is actively deploying Year 1 capital and partners are motivated to make bets.

Conclusion: Understanding Capital Concentration in Modern Venture

Thrive Capital's $10 billion fund raise isn't just a fundraising announcement. It's a data point in the story of how capital is concentrating in the venture industry, how returns flow to founders with the right backing, and how the AI boom is reshaping where investors place their money.

The fund's oversubscription signals that institutional investors have enormous confidence in Thrive's ability to deploy capital effectively. The firm's track record—anchored by Open AI, Stripe, and Space X—justifies that confidence. When one VC firm has backed companies that could become worth hundreds of billions of dollars, LPs want more exposure to that firm's next fund.

For founders, Thrive's mega-fund is both opportunity and warning. Opportunity because Thrive has capital to back ambitious founders building on AI and infrastructure. Warning because the concentration of capital means fewer, larger checks. If you're not the type of founder Thrive wants to back, you'll need to fundraise elsewhere. The venture landscape is increasingly bifurcated: mega-funds for mega-bets, smaller investors for everyone else.

For the venture industry, mega-funds like Thrive's represent a maturation of capital markets. Trillions of institutional capital are chasing the best-performing VCs. Only 50 or so funds globally can absorb multi-billion-dollar commitments. That concentration will likely accelerate. The question for the industry is whether concentration improves venture returns (because focused capital backs better companies) or whether it reduces diversity of thought and returns (because mega-funds all pursue similar theses).

The answer probably includes both dynamics. Thrive's $10 billion will likely return excellent results because the firm has proven judgment. But the broader venture ecosystem might fragment into tiers: mega-funds backing mega-companies, and everyone else fighting for crumbs.

What's clear is this: in 2026, if you want

Track Thrive's deployment over the next 3-5 years. Watch for exits from their portfolio. Monitor which founders they back next. Thrive's $10 billion fund is essentially the venture capital market in microcosm: capital following winners, founders chasing that capital, and the industry consolidating around an increasingly narrow group of elite firms.

That's the new venture capital reality, and Thrive's mega-fund is proof.

Key Takeaways

- Thrive Capital raised $10 billion for Fund X, nearly doubling its previous fund size and marking the largest raise in firm history

- The fund was oversubscribed, signaling extreme institutional demand for Thrive's proven investment thesis anchored by OpenAI, Stripe, and SpaceX

- Capital allocation shows 9 billion for growth-stage, reflecting Thrive's focus on funding proven winners at scale

- Mega-fund consolidation is accelerating across venture capital, concentrating capital among elite firms and creating a bifurcated startup funding ecosystem

- Thrive's concentration strategy of backing fewer founders deeply rather than spreading capital thinly reflects how top-tier VCs are approaching AI-era opportunities

Related Articles

- Cherryrock Capital's Contrarian VC Bet on Overlooked Founders [2025]

- AI Rivals Unite: How F/ai Is Reshaping European Startups [2025]

- Thomas Dohmke's $60M Seed Round: The Future of AI Code Management [2025]

- Venture Capital Split Into Two Industries: SVB 2025 Report Analysis [2025]

- Mesh Optical Technologies $50M Series A: AI Data Center Interconnect Revolution [2025]

- AI Data Centers Hit Power Limits: How C2i is Solving the Energy Crisis [2025]

![Thrive Capital's $10B Fund: What It Means for AI and Venture Capital [2026]](https://tryrunable.com/blog/thrive-capital-s-10b-fund-what-it-means-for-ai-and-venture-c/image-1-1771360624015.jpg)