The Hidden Chaos Behind Financial Reporting

Every quarter, thousands of accountants sit down at their computers and face the same brutal reality: financial statement preparation is a Frankenstein of spreadsheets, Word documents, and manual verification. It's not broken enough to fail, but it's broken enough that people spending their entire careers doing this work describe it with the kind of exhaustion usually reserved for describing a terrible commute.

The pain is real. A single 10-K filing—that dense annual report publicly traded companies must submit to the SEC—can take weeks to assemble. And it's not because the accounting is complicated (that's hard too, but at least it's standardized). It's the busywork: copying numbers from one system to another, checking that formatting is consistent, ensuring commas are placed correctly, verifying that a number appearing in three different places actually matches.

Legacy platforms like Workiva and Donnelley Financial Solutions have dominated this space for years, charging enterprise prices for tools that still require accountants to do most of the actual work. They're the incumbent solutions that nobody loves but everybody uses because the switching costs are astronomical.

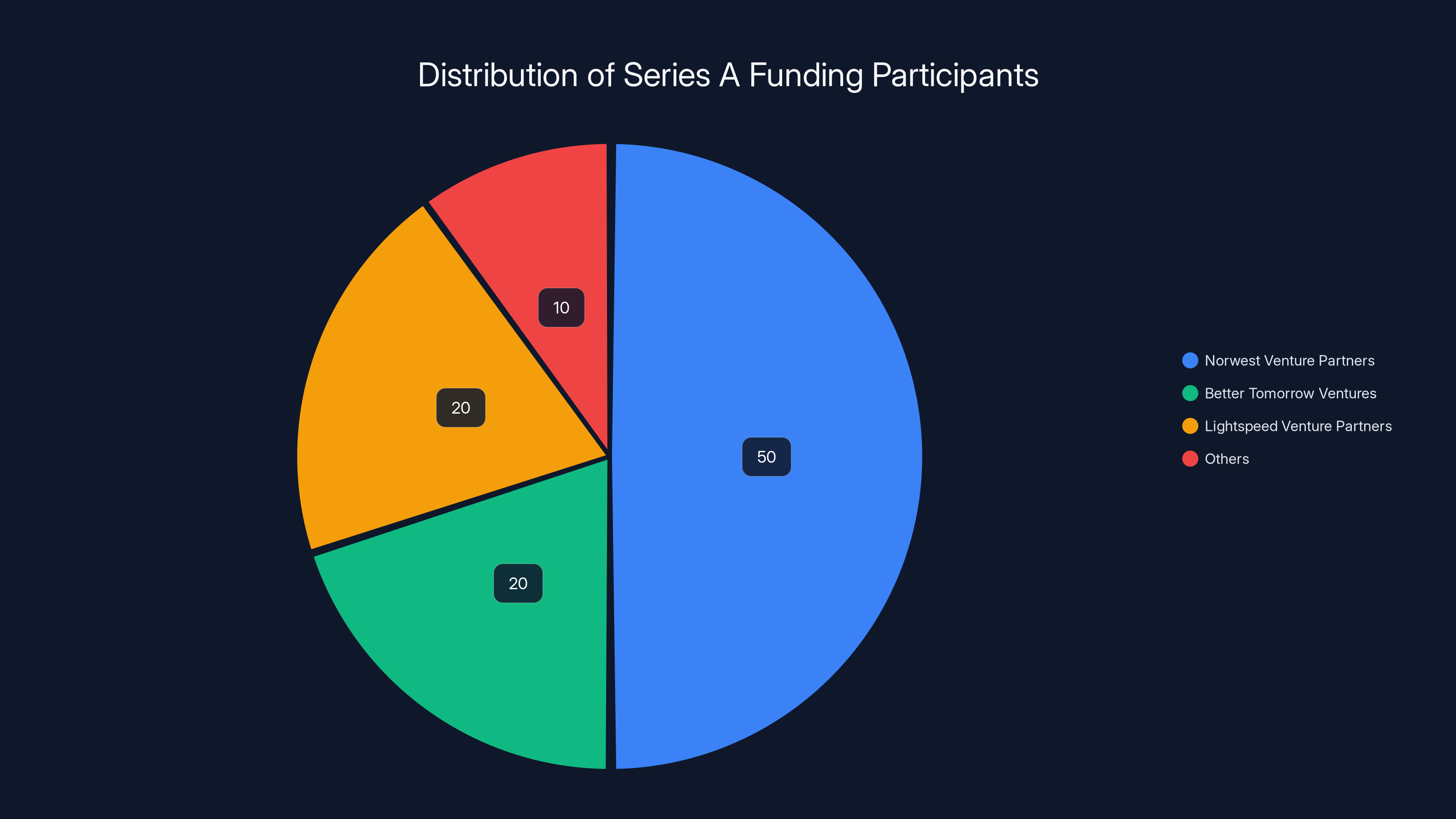

Then in 2023, two accountants who had worked at Flexport, Miro, Hopin, and Thrive Global decided they'd had enough. Mary Antony and Kelsey Gootnick founded In Scope, an AI-powered financial reporting platform that actually tackles the manual busywork that's eating accountants' time. In February 2026, they announced a $14.5 million Series A funding round led by Norwest Venture Partners, with participation from Storm Ventures and existing backers Better Tomorrow Ventures and Lightspeed Venture Partners.

What makes In Scope different isn't just that it's newer or that it uses AI (everyone uses AI now). It's that the founders actually know what they're solving because they've spent years inside the accounting trenches at fast-growing companies. That context matters enormously in enterprise software, where most founders are trying to optimize a process they've never actually done.

This article breaks down what In Scope is doing, why it matters, how the financial reporting space actually works, and what this funding round means for the future of automation in accounting.

TL; DR

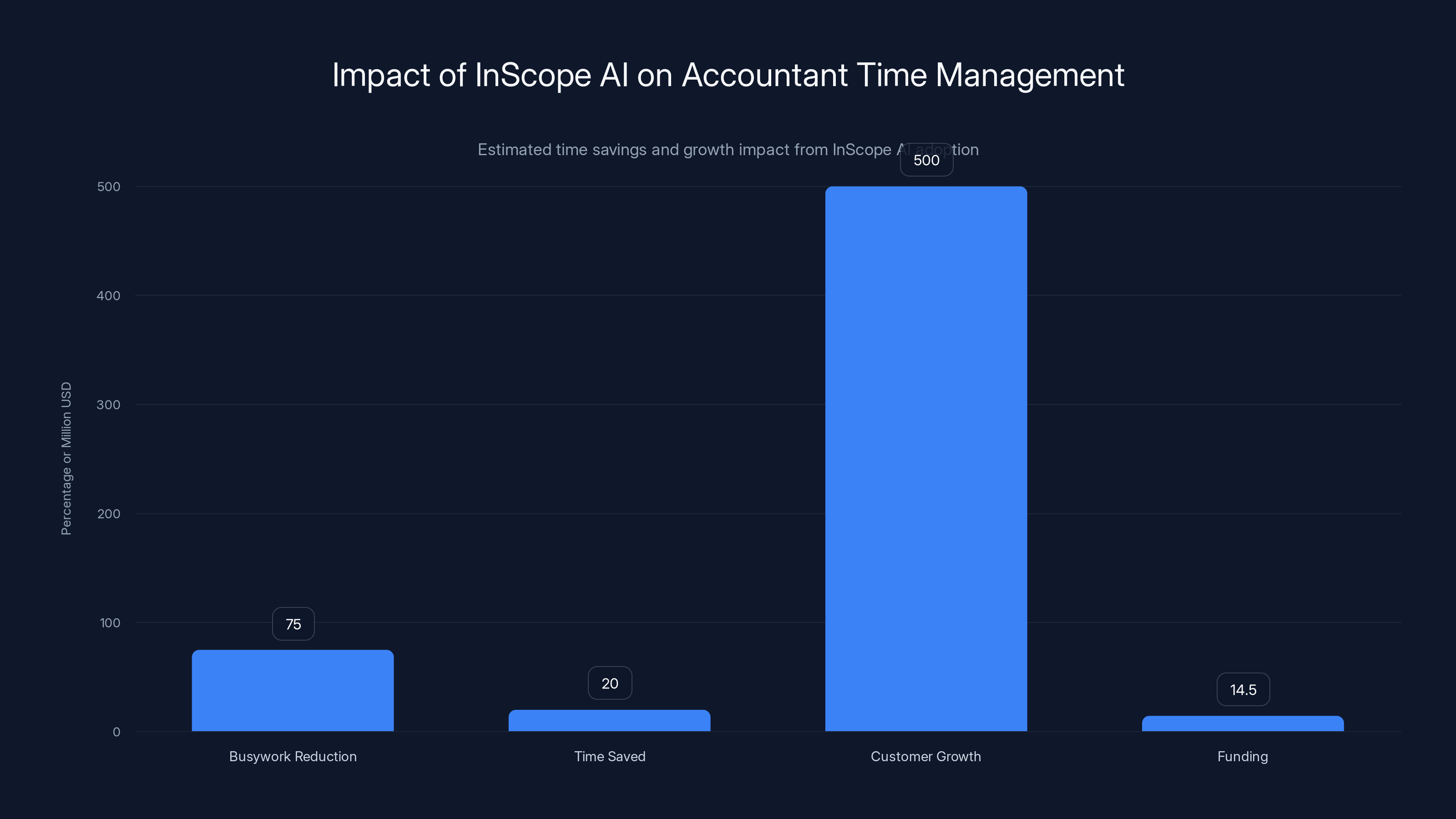

- The Problem: Financial statement preparation is 70-80% busywork—formatting, verification, data movement—that consumes massive amounts of accountant time

- The Solution: In Scope uses AI to automate formatting, verification, calculations, and document generation, saving accountants up to 20% of their time on core tasks

- The Traction: 5x customer growth over 12 months with major firms like Cohn Reznick (top 15 nationally) adopting the platform

- The Funding: $14.5M Series A with strong investor backing signals confidence in the team and market opportunity

- The Vision: Full automation of financial statement generation, though accountant risk-aversion means adoption will be gradual

InScope can save accountants up to 20% of their time by automating tasks such as formatting, verification, and data movement. Estimated data.

Understanding Financial Statement Preparation (The Unsexy Reality)

Before you can understand why In Scope is valuable, you need to understand what accountants actually spend their time doing when preparing financial statements. It's less "complex analysis" and more "data janitor."

Financial statement preparation involves three core components: the income statement (showing revenue and expenses), the balance sheet (showing assets and liabilities), and the cash flow statement (showing how money moved). These three statements tell the complete financial story of a company over a period (usually a quarter or a year).

Here's the problem: the data for these statements lives everywhere. Accounts payable data is in one system. Revenue data is in another. Payroll is in a third. Asset depreciation calculations happen in spreadsheets. Tax information comes from yet another tool. An accountant's job involves pulling data from all these sources, reconciling it (making sure it all matches), adjusting for accounting standards, and compiling it into a coherent narrative.

Then comes the formatting nightmare. A 10-K filing needs to follow extremely specific formatting rules. Dollar amounts need dollar signs. Large numbers need commas in the right places. Column headers need to match across pages. Footnotes need to be numbered consistently. If you've ever seen accounting documents, you know they're obsessed with alignment and consistency—and for good reason, since regulators and investors use these documents to make decisions.

Then there's verification. An accountant might need to check that the total assets on the balance sheet equals liabilities plus equity (they must, by definition). They need to verify that revenue numbers in the income statement match revenue numbers on the balance sheet. They need to check that month-to-month revenue progression makes sense and flag anything unusual.

All of this happens in Excel. Lots and lots of Excel. Numbers get copied, pasted, reformatted, moved to Word documents, emailed back and forth between the accounting team and the audit team and the finance leadership and sometimes external accountants. Changes require multiple people updating the same file. Version control is a nightmare (which Excel file is the "real" one?).

According to Antony, simply ensuring that formatting is uniform—dollar signs, commas, decimal places—can consume up to 20% of an accountant's time on a single filing. That's not an exaggeration. That's just the reality of working with legacy tools that don't intelligently handle formatting.

Large accounting firms deal with this multiplied across dozens of clients. A mid-size accounting firm doing work for 50 companies might have hundreds of hours each year consumed just by the tedious, error-prone work of compiling financial statements. That's opportunity cost. That's why In Scope is relevant.

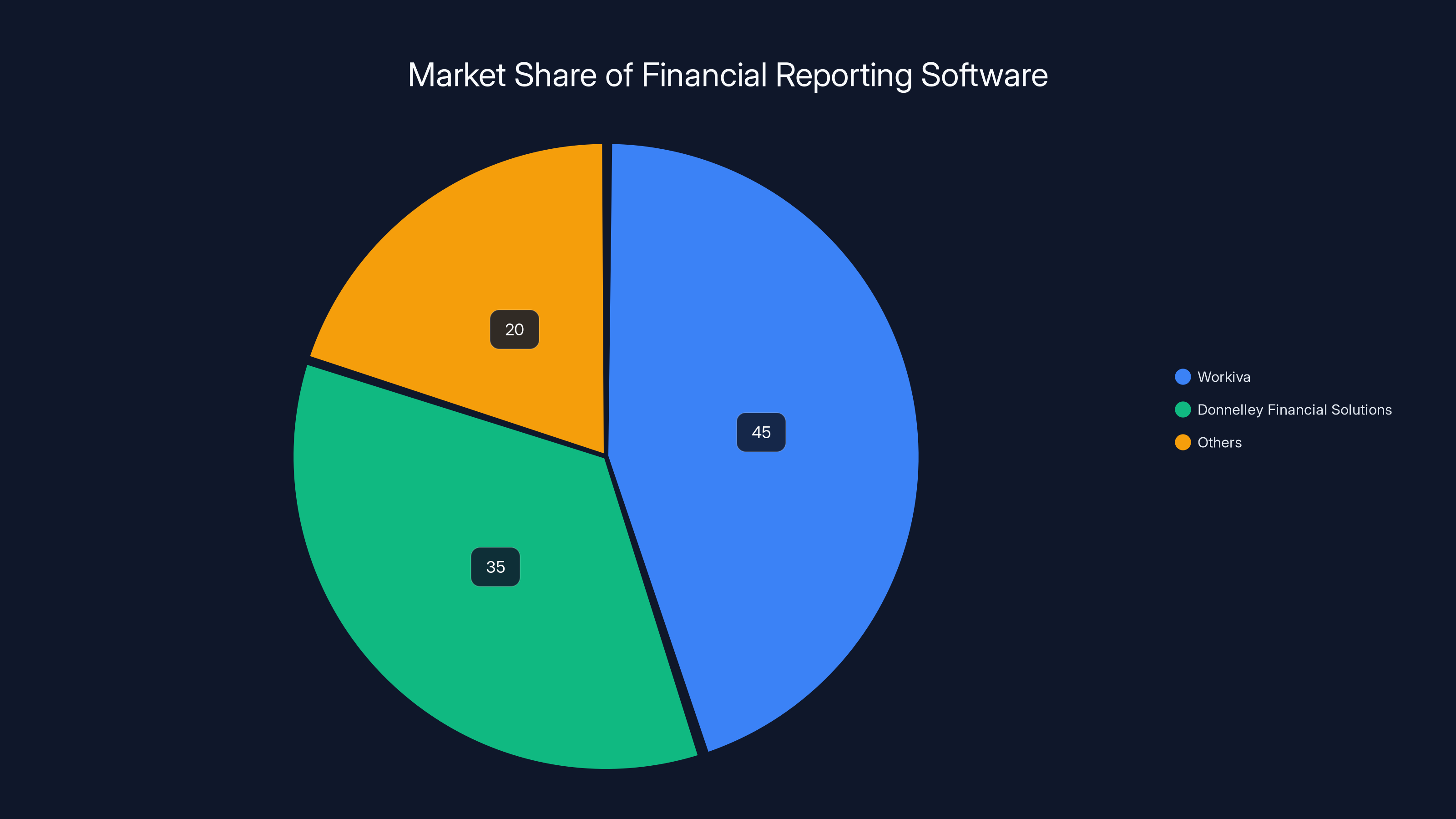

Workiva and Donnelley Financial Solutions dominate the financial reporting software market, together holding an estimated 80% share. Estimated data.

The Founders' Journey: From Exhaustion to Entrepreneurship

Mary Antony and Kelsey Gootnick didn't start their careers dreaming of fixing financial reporting software. They became accountants, moved into controller roles at high-growth startups, and gradually realized that the tools they were using were fundamentally broken.

Their origin story matters because it explains why they saw the problem clearly. They met seven years ago at Flexport, the logistics unicorn that at the time was growing at an insane pace. Gootnick was serving as controller (the person responsible for managing all accounting operations and financial reporting). Antony was assistant controller. They were in the trenches together, filing financials, preparing statements, dealing with auditors.

When they left Flexport and took roles at other high-growth companies—Antony to Miro, Gootnick to Hopin and then Thrive Global—they kept running into the exact same problems. Different companies, different industries, different scales, but the same underlying pain: the tools available were legacy systems designed for a different era.

What's interesting is that they stayed in touch even as they moved between companies. They weren't just venting about tools; they were consistently identifying the same bottlenecks across organizations. That's a strong signal that the problem is structural, not situational.

In 2023, they decided to start In Scope. The timing was significant: AI tooling had matured enough that intelligent document parsing, verification, and generation were actually possible. The technology finally existed to solve problems that couldn't be solved three years earlier.

Their background in high-growth startups also gave them something that pure accountants might not have: an understanding of how to build a product company. They'd seen how products are built, how markets are prioritized, how technical decisions are made. They weren't trying to automate accounting from a purely financial standpoint; they were thinking like product builders.

Antony became CEO, which makes sense given that she'd had exposure to leadership at Miro, a product company. Gootnick brought the controller-level expertise and deep understanding of the actual financial reporting workflow. That combination—technical expertise in the domain plus product company instincts—is exactly what you want in early-stage founders solving enterprise problems.

They raised a seed round initially (details aren't disclosed) and spent their first two years building the product and landing customers. By 2024, they'd grown their customer base 5x year-over-year and attracted major accounting firms, including Cohn Reznick, currently ranked in the top 15 accounting firms nationally.

That traction is the real story. It's easy to say you're going to fix an incumbent market; actually landing customers at major firms is hard.

What In Scope Actually Does: Breaking Down the AI-Powered Approach

In Scope isn't trying to fully automate financial statement generation yet. That's important to understand. They're being realistic about what's possible today and what accountants will actually trust.

Instead, they're automating the busywork: the manual labor that surrounds the actual accounting work. Here's what that means in practice.

Data Extraction and Reconciliation: In Scope can read data from multiple source systems—accounting software, ERP systems, spreadsheets—and automatically reconcile it. If accounts payable shows

Formatting and Presentation: This might sound trivial, but it's actually where a ton of time goes. In Scope can take financial data and automatically format it according to filing standards. Dollar signs, commas, decimal places, column alignment, footnote numbering—all handled. An accountant can focus on substance instead of appearance.

Verification and Validation: The system can check that fundamental accounting equations hold. Assets must equal liabilities plus equity. Revenue from multiple sources must reconcile. Unusual variances can be flagged automatically. The accountant still needs to investigate anomalies, but the system finds them first.

Document Generation: In Scope can generate sections of the financial statements automatically based on data inputs. This isn't writing original analysis; it's taking data and structuring it into the standard format that filings require.

Change Tracking: When accountants are working collaboratively on statements (and they are—multiple people touch the same documents), tracking who changed what and when becomes critical. In Scope manages version control and change logging.

The key point: In Scope is augmenting accountants, not replacing them. Accountants still make judgments about what adjustments to record, how to interpret the accounting standards, what disclosures are necessary. But they're not wasting time on format consistency or data entry verification.

Antony said that simply ensuring formatting is correct can save up to 20% of time. If an accountant spends 40 hours preparing a quarterly filing, that's 8 hours saved just on formatting. Multiply that across an accounting firm with 50 clients, and you're talking about hundreds of hours per quarter.

But the real value isn't just time savings. It's accuracy. Manual processes are error-prone. When you're moving numbers between systems and formatting documents, mistakes happen. A missing comma in a financial footnote might not matter materially, but it requires rework and can cascade into additional questions during audit.

Automation reduces error rates. There's less human hands touching the data, which means fewer opportunities for transcription errors. Verification happens consistently, not sporadically depending on how busy the accountant is.

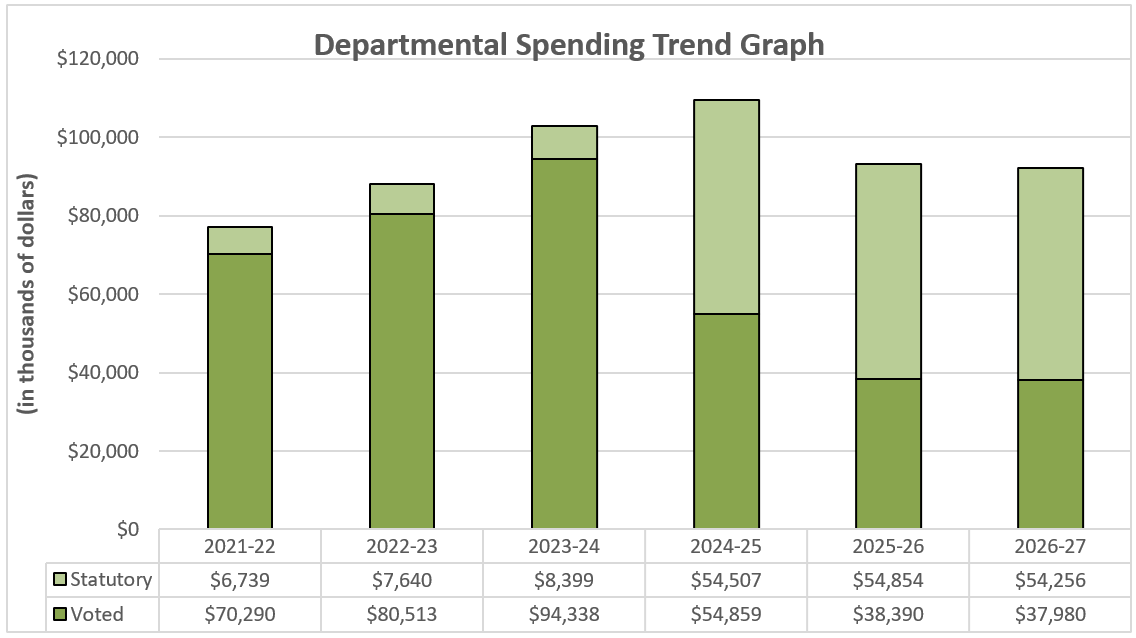

Norwest Venture Partners led the Series A round with a significant portion of the $14.5M investment, indicating strong confidence in InScope's market potential. (Estimated data)

The Market Opportunity: Why This Matters Now

The financial reporting software market is worth billions globally, but it's been dominated by a handful of legacy players for decades. Workiva has essentially owned the market for companies that need to file financial statements with regulators. Donnelley Financial Solutions dominates in certain segments. These companies charge tens of thousands of dollars annually and have customer lock-in so strong that switching costs are prohibitive.

Yet despite their dominance and their pricing, these platforms are basically glorified document management systems. They help you organize documents and workflows, but they don't actually do the work. They're better than nothing (barely), but they're not truly solving the core problem.

That's an opening. In every market dominated by incumbent solutions that customers hate but are stuck with, there's room for a better solution. Workiva's customer satisfaction scores are notoriously low. Firms complain constantly about the cost and the lack of innovation.

In Scope is entering at exactly the right moment. AI capabilities have matured. Accountants are desperate for better tools. Major accounting firms are actively looking for solutions. The regulatory environment hasn't changed in ways that would make the problem easier (if anything, disclosure requirements are getting more extensive).

Furthermore, accounting is a high-margin profession. If In Scope can save an accounting firm 10-20% of their time on financial reporting, that's transformative. That time can be redeployed to higher-value work: actual advisory, strategic analysis, deeper auditing. Or it just reduces the headcount needed to serve the same number of clients, which dramatically improves profitability.

The market size is substantial. The top 10 accounting firms in the US alone employ tens of thousands of accountants. If In Scope can achieve even 10% penetration in mid-market accounting firms, that's a billion-dollar opportunity.

But the real addressable market is broader. Every company that files financial statements—public companies, private companies seeking financing, nonprofits with complex filings—needs this. Every accounting firm needs this. The TAM is genuinely large.

Series A Funding: What $14.5M Signals About Market Validation

The Series A funding round tells you several important things about where investors see the market heading and how seriously they're taking In Scope.

First, the lead investor. Norwest Venture Partners is a tier-one VC firm with deep expertise in B2B software and enterprise markets. They're not known for marketing hype or betting on unproven concepts. They invest in companies with real traction and real market validation. The fact that Norwest led the round suggests they've done their diligence and see a genuine opportunity.

Second, the size.

Third, the participation from existing investors. Better Tomorrow Ventures and Lightspeed Venture Partners both doubled down. This is important. Early investors doubling down means they're seeing the company execute on the plan and hit its milestones.

Sean Jacobsohn, the Norwest partner leading the investment, told people he invested because multiple of his client companies (which include large enterprises and accounting firms) told him that In Scope was saving them significant time. That's strong validation. He's not investing based on theoretical market size; he's investing because his portfolio companies are using the product and seeing value.

Jacobsohn also made an insightful observation: few founders have the specific expertise needed to reinvent financial reporting technology. Most founders are generalists trying to solve problems in domains they don't fully understand. Antony and Gootnick are the opposite—they're domain experts who are applying product and technical thinking to a legacy market.

The $14.5 million will be deployed strategically. Some will go to product development—expanding capabilities beyond current automation features. Some will go to sales and marketing—reaching accounting firms and companies that need the solution. Some will go to compliance and security infrastructure, which is critical for a tool handling sensitive financial data.

What's notable is what the funding round doesn't represent: a "bet everything on hype" moment. In Scope isn't raising at a

This suggests a sustainable growth trajectory rather than a hype cycle. The company has real customers, real traction, and real funding to execute the next phase.

InScope AI reduces busywork by 75%, saving accountants 20% of their time. It achieved 500% customer growth and secured $14.5M in funding. Estimated data.

Customer Traction: 5x Growth and Major Firm Adoption

The most impressive metric from the announcement is simple: 5x customer growth over the past 12 months.

That's not "5x free trial signups" or "5x website visitors." That's 5x paying customers. In enterprise software, where sales cycles are long and risk-aversion is high, acquiring customers at that rate is genuinely difficult.

Better yet, the customers aren't just small accounting shops. In Scope has landed Cohn Reznick, currently ranked in the top 15 accounting firms nationally. These are firms with hundreds of millions in revenue and thousands of employees. They have their own software development teams. They've probably evaluated multiple solutions. The fact that they're using In Scope is a strong endorsement.

When a major firm adopts new software, it's not a casual decision. IT infrastructure has to be evaluated. Compliance and security requirements need to be met. The tool needs to integrate with existing systems. There's an implementation period and training period. For Cohn Reznick to use In Scope, all of that had to check out.

Moreover, when major firms adopt software, it creates network effects. Other firms in the same industry start hearing about it. Sales conversations become easier because the risk is lower—if Cohn Reznick is using it, it must be legitimate.

The 5x growth trajectory also sets expectations for future performance. The company is clearly operating in a real market with real demand. Now the question is whether they can maintain that growth curve while building out product capabilities and expanding the team.

Typically, a company with this traction and this funding would be targeting 2-3x annual growth in the next 12 months as they scale from

The Accounting Profession's Relationship With Risk and Innovation

One important context: accountants are notoriously risk-averse. This isn't a character flaw; it's by design. Accountants are responsible for financial accuracy and regulatory compliance. Taking risks with accuracy is not an option.

This creates a specific adoption challenge for In Scope. Even if the product is objectively better, even if it saves time and improves accuracy, accountants will be cautious. They need to trust that the automation is correct before they can rely on it.

Antony acknowledges this explicitly. The ultimate goal is full automation of financial statement generation, but she recognizes that accountants won't feel comfortable with that for years. Instead, In Scope is taking a staged approach: automate the low-risk, high-volume tasks first (formatting, verification), prove accuracy and reliability, then gradually expand into more complex automation.

This is a smart strategy. It reduces customer risk, builds trust, and creates a natural expansion path. A firm that starts using In Scope for formatting verification might, after six months of seeing reliable results, trust it with more complex tasks.

The industry also has structural factors that favor adoption of new tools. Compliance requirements keep expanding. More disclosures are required. Standards like XBRL (for digital financial filings) add new complexity. As regulatory burden increases, automation becomes less of a nice-to-have and more of a necessity.

Furthermore, there's significant demographic turnover in accounting. Younger accountants who've grown up with modern software tend to be less attached to legacy systems like Workiva. They expect software to actually be good. As the profession turns over generationally, appetite for better tools increases.

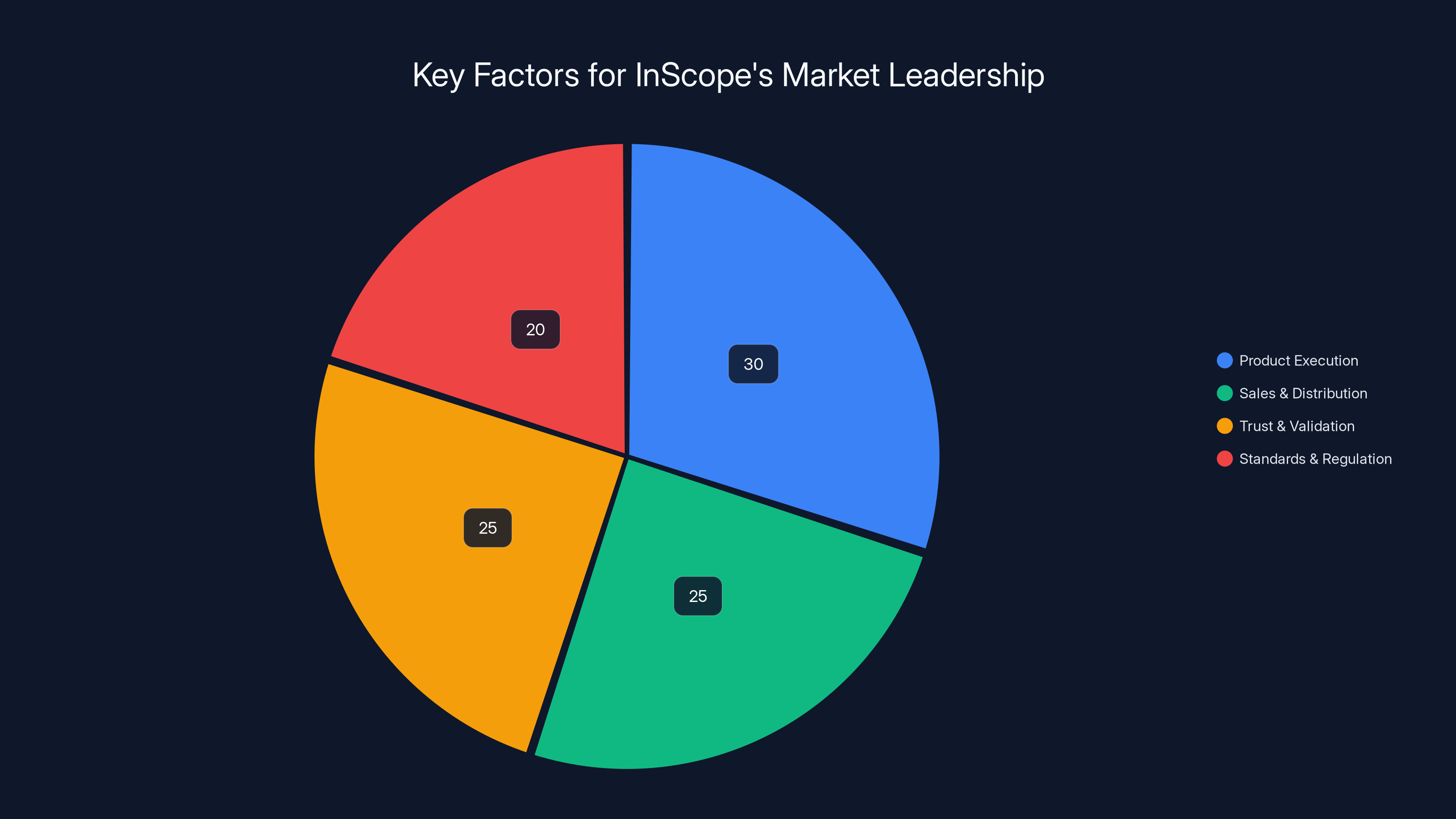

Estimated distribution of InScope's focus areas for achieving market leadership. Product execution and sales are key, each accounting for a significant portion of their strategy.

Technical Architecture: How AI Fits Into Financial Reporting

Understanding how In Scope actually works technically gives insight into why the solution is valuable and what its limitations might be.

Financial reporting involves structured data (numbers that follow specific rules) and semi-structured workflows (the process of preparing statements follows patterns but isn't entirely rule-based). This is exactly the kind of domain where modern AI can be valuable.

On the data side, In Scope likely uses machine learning models trained on financial data patterns to:

- Automatically categorize transactions: Identifying whether a transaction should be classified as revenue, accounts payable, tax expense, etc.

- Detect anomalies: Flagging unusual transaction patterns that might indicate errors or require investigation

- Extract data from documents: Reading PDFs, scanned documents, or unstructured data and extracting relevant financial information

- Verify consistency: Checking that numbers across different documents and systems match

On the document generation side, large language models are useful for:

- Generating boilerplate text: Financial statements include a lot of standard language (footnotes, disclosures, methodology descriptions). LLMs can generate these consistently and correctly

- Formatting and structuring: Taking raw data and organizing it into the specific format required for filings

- Identifying missing information: Flagging when a statement is incomplete or when required disclosures are missing

The key insight is that In Scope isn't trying to teach AI to do accountants' judgment work. It's not trying to have the AI decide which accounting treatment to use for a complex transaction. It's using AI to handle the mechanical work that doesn't require judgment.

There are interesting technical challenges here. Financial data is highly regulated. If In Scope generates a number that appears in a filing, that number has to be correct. There's zero tolerance for "probably correct." This means the AI models need to be built to a higher standard than, say, a chatbot that gives pretty good answers 90% of the time.

This is probably why In Scope is starting with lower-risk automation (formatting, verification) and expanding gradually. It's easier to verify that formatting is correct than to verify that an AI-generated financial calculation is accurate. Building trust in the system comes first.

Competitive Landscape: Incumbent Vendors and New Entrants

In Scope isn't competing in an empty market. Workiva is a publicly traded company with $600+ million in annual revenue. Donnelley Financial Solutions is also a major player. These aren't scrappy startups; they're entrenched incumbents with deep customer relationships.

However, incumbents have a specific weakness: they optimize for their current business model. Workiva makes money by charging high annual fees for platform access. They have no incentive to dramatically automate tasks that currently require professional services. In fact, automation might threaten their business model.

In Scope has the opposite incentive. They want to automate as much as possible because that's what customers value. They're not trying to maintain a legacy business; they're building a new company from scratch.

There's also room for specialization. Workiva tries to serve multiple markets (financial reporting, regulatory disclosure, internal controls). In Scope is focused laser-tight on financial statement preparation. That focus allows for deeper solutions for that specific problem.

Other potential competitors might emerge. Large consulting firms like Deloitte or EY could build competitive tools. Software-as-a-service platforms like Stripe or Stripe's accounting partners could theoretically move into this space. But execution is hard, and In Scope is building a two-year head start.

InScope achieved a 5x increase in paying customers over the past year, indicating strong market demand and successful customer acquisition strategies. Estimated data.

The Path to Market Leadership: Scale and Consolidation

Looking forward, In Scope's success will depend on several factors.

First, product execution. They need to keep expanding automation capabilities while maintaining accuracy and reliability. The roadmap probably includes deeper integration with major accounting software packages, more sophisticated AI-driven insights, and eventually more full-featured financial statement generation.

Second, sales and distribution. B2B software companies make money by reaching customers efficiently. In Scope will likely focus on selling to mid-market and enterprise accounting firms initially, where deal sizes are large enough to justify sales effort. Over time, they might expand to companies doing their own financial reporting.

Third, trust and validation. Every new customer reference, every major firm adoption, every successful audit cycle with In Scope-processed statements builds trust in the market. Trust is cumulative and valuable.

Fourth, standards and regulation. As regulatory bodies increasingly require digital filing formats (like XBRL in the US or i XBRL in the UK), having software that natively understands these standards becomes valuable. In Scope should be building deep expertise in these regulatory frameworks.

Eventually, the trajectory for a successful company in this space is acquisition or IPO. The software market rewards companies that can capture even 5-10% of large markets. In Scope's TAM is large enough that a $500 million exit (or higher) is plausible if they execute well.

Alternatively, they could be acquired by one of the incumbents. Workiva or Donnelley might eventually decide it's cheaper to buy In Scope's technology than to build it themselves. That's actually a common exit path in enterprise software.

Implications for the Accounting Profession

In Scope is part of a broader trend: automation of knowledge work. It's happening in law (contract review AI), in medicine (diagnostic imaging AI), in finance (portfolio management AI). Accounting is no different.

The implications are nuanced. For individual accountants, automation means fewer hours spent on busywork and (potentially) more hours on higher-value work. If In Scope saves an accountant 10 hours per week on formatting and verification, what do they do with those 10 hours? Ideally, deeper analysis, more client consulting, better strategic advice.

For accounting firms, automation improves profitability. If you can serve the same number of clients with 10% fewer accountants, that's dramatically higher profit per employee. It also allows firms to take on more clients without hiring proportionally.

For the profession at large, automation might actually make accounting more attractive as a career. If the boring work is automated, accounting becomes more intellectually interesting. That could help address talent shortages in the profession.

Of course, there are transition risks. Accountants in junior positions might have fewer opportunities to learn basic financial reporting (since the tool does it for them). Career paths might compress if firms need fewer junior accountants. But these are solvable problems with good training and career design.

The accounting profession has successfully adapted to major changes before. The switch from manual bookkeeping to spreadsheets, then to accounting software, then to cloud-based systems all disrupted and ultimately improved the profession. In Scope is the next step in that evolution.

The Broader Implication: Enterprise Software Coming of Age

In Scope's funding and traction represent something deeper: the maturation of AI-powered enterprise software.

For years, AI was primarily used in consumer applications: recommendation systems, content moderation, chatbots. More recently, it's become viable in enterprise software. Companies like Stripe (which uses ML for fraud detection), Salesforce (which integrates AI into CRM), and others have shown that AI can be valuable in business contexts.

But what makes In Scope interesting is that it's not trying to be an all-purpose AI tool. It's deeply specialized in a specific domain and solving a specific problem. That's the pattern that tends to work well in enterprise software: deep domain expertise plus smart technology.

We'll likely see more companies like In Scope emerge: specialized AI tools for specific professional domains. Insurance claims adjustment, contract analysis, medical coding, tax preparation—all of these involve repetitive, rule-based work that can be significantly improved with AI.

The companies that win in this space will be those that:

- Understand the domain deeply (like Antony and Gootnick do)

- Build for genuine pain points (not theoretical problems)

- Start with low-risk automation (building trust first)

- Expand gradually (proving the concept before going deeper)

- Focus on compliance and accuracy (not just speed)

In Scope hits all of these points. That's why the funding and traction are credible.

What's Next: Roadmap and Expansion

We don't know In Scope's exact roadmap (companies typically keep that private), but we can reasonably infer where they're likely heading based on the current product and market dynamics.

Near-term (6-12 months):

- Expand automation to more complex financial statement sections

- Deepen integrations with major accounting software (QuickBooks Enterprise, NetSuite, SAP, etc.)

- Build out features for different types of entities (nonprofits have different reporting requirements, as do insurance companies and financial institutions)

- Expand internationally (financial reporting requirements differ significantly by country)

Medium-term (1-2 years):

- Likely launch features for audit support (auditors have their own workflow needs that In Scope could address)

- Expand into related domains like financial planning and analysis (FP&A) where similar automation principles apply

- Build out analytics and insights features that go beyond just preparing statements

Long-term (2+ years):

- Full end-to-end financial statement generation for straightforward cases

- Integration with external systems like investor relations platforms and regulatory filing systems

- Expansion into specialized financial reporting (segment reporting, consolidation statements, complex balance sheet items)

The company will likely also face typical scaling challenges: hiring engineering talent (hard in this market), maintaining culture as the team grows, managing customer success as the customer base expands.

Critical Success Factors

In Scope's success isn't guaranteed. Several factors will determine whether this becomes a significant company or a decent acquihire.

Product-market fit at scale: They've found some initial customers, but can they scale to hundreds of customers? The product needs to handle diverse scenarios and edge cases from many different firms.

Retention and expansion: It's one thing to land customers; it's another to keep them happy and grow revenue per customer. In accounting software, this is critical because switching costs are high but customers are extremely demanding.

Regulatory navigation: Financial reporting is heavily regulated. In Scope needs to stay compliant with SOX, SOC 2, GDPR, and numerous other regulatory frameworks. One compliance failure could tank the business.

Market education: Most accounting firms don't yet know In Scope exists. They need to build awareness and trust in a market that's skeptical of new vendors.

Talent retention: Building great enterprise software requires deep technical and domain expertise. The company will be competing for talent against larger, well-funded companies.

These aren't insurmountable obstacles, but they are real challenges.

Lessons for Founders and Investors

In Scope's story offers several lessons worth thinking about.

For founders: Having deep expertise in your domain is a superpower. Antony and Gootnick could see problems that other founders would miss because they'd been in the trenches. Find problems in domains where you have real experience.

For investors: Founder expertise matters. Track record matters. Traction (5x growth) matters. A team with credible domain expertise, previous wins, and real customer adoption is a much safer bet than a team with a great idea but no execution history.

For enterprise software broadly: The incumbents don't always win. Legacy software companies become complacent. Their products become bloated and expensive. There's always room for a focused, modern alternative built by people who actually understand the problem.

For automation and AI specifically: The highest-value use cases are in high-stakes domains like finance, where accuracy matters and time savings have clear ROI. AI adoption will be fastest in professional services and knowledge work because these are the highest-cost activities.

The Bigger Picture: Automation's Impact on Work

In Scope is one of thousands of companies working to automate knowledge work. As these tools mature and proliferate, the nature of work itself is changing.

Pessimistic narratives focus on job losses: AI will eliminate accountants, lawyers, consultants, etc. But that's not how technology usually works. Typewriters didn't eliminate writers; they expanded who could write and how much they could write. Spreadsheets didn't eliminate accountants; they made accountants more valuable and shifted their work toward analysis rather than data entry.

Automation of routine work usually results in:

- Reduced cost of professional services (more people can access accounting, legal, consulting help)

- Higher wages for skilled professionals (the ones who can do the analysis and judgment work)

- Increased demand (as services become more affordable, more people use them)

- Career shift (the work changes, but skilled people adapt)

Accountants in 2030 probably won't spend time on formatting or basic data verification. But they'll spend more time on areas like:

- Strategic financial planning: Using automated reporting to focus on forward-looking analysis

- Advisory services: Helping companies interpret financial information and make better decisions

- Regulatory navigation: Understanding complex rules and helping companies stay compliant

- Technology implementation: Managing relationships with software vendors and ensuring systems work well

The profession shifts, but demand for skilled accountants likely remains strong.

FAQ

What is In Scope?

In Scope is an AI-powered financial reporting platform designed to automate the time-consuming, manual aspects of preparing financial statements. Founded in 2023 by Mary Antony and Kelsey Gootnick (both former accountants at Flexport, Miro, Hopin, and Thrive Global), the platform helps companies and accounting firms streamline financial statement preparation by automating formatting, verification, calculations, and document generation. The company raised $14.5 million in Series A funding in February 2026 led by Norwest Venture Partners.

How does In Scope work?

In Scope uses machine learning and natural language processing to automate several aspects of financial statement preparation. The platform extracts financial data from multiple source systems (accounting software, ERPs, spreadsheets), automatically reconciles discrepancies, formats data according to regulatory standards, verifies accounting equations and consistency, and generates document sections. Instead of fully automating financial statement generation (which accountants still aren't comfortable with), In Scope focuses on automating the low-risk, high-volume tasks that consume significant time, like formatting and verification.

What are the benefits of In Scope?

In Scope delivers several concrete benefits to accounting firms and companies preparing financial statements. Time savings are substantial—the platform can save accountants up to 20% of their time by handling formatting, verification, and data movement tasks. This translates to cost savings for accounting firms and more time for accountants to focus on higher-value advisory work. The platform also improves accuracy by reducing manual transcription errors and consistently verifying financial data across documents. Additionally, In Scope reduces risk by ensuring regulatory compliance through standardized formatting and systematic verification of all financial information.

Why did In Scope raise $14.5 million?

The Series A funding round reflects strong market validation and investor confidence in the founding team and business model. In Scope demonstrated 5x customer growth over 12 months and attracted major accounting firms like Cohn Reznick (ranked in the top 15 nationally). Norwest Venture Partners led the round partly because multiple portfolio companies reported significant time savings using In Scope. The capital will fund product development to expand automation capabilities, sales and marketing to reach more accounting firms, and infrastructure for compliance and security in handling sensitive financial data.

What problem does In Scope solve?

In Scope solves the fundamental problem that financial statement preparation is 70-80% busywork despite being high-stakes work. Accountants spend enormous time moving data between systems, ensuring formatting consistency, verifying calculations, and managing versions across email and spreadsheets. Legacy platforms like Workiva and Donnelley Financial Solutions have dominated the market for decades despite being expensive and not actually automating this work. In Scope addresses this gap by automating the mechanical, rule-based tasks while maintaining the oversight and judgment that accountants must provide.

Who are In Scope's customers?

In Scope primarily serves accounting firms and companies with complex financial reporting requirements. Early adopters include mid-market and large accounting firms like Cohn Reznick. The platform is valuable for any organization that files audited financial statements, prepares 10-K or 10-Q filings, or manages complex financial consolidations. The addressable market includes the top accounting firms, mid-market firms with significant financial reporting workloads, and large companies with in-house accounting departments managing complex financial statements.

How does In Scope compare to Workiva?

While Workiva is the incumbent leader in financial reporting software, it primarily functions as a document management and workflow platform. It helps organize financial reporting processes and maintain compliance workflows but doesn't substantially automate the actual work. In Scope, by contrast, uses AI to actively automate formatting, verification, and calculation tasks that Workiva doesn't address. Workiva is also significantly more expensive and was designed for a different era of technology. In Scope is purpose-built for modern cloud infrastructure and AI-powered automation, which is why it's attracting customers away from legacy platforms.

What are the limitations of AI in financial reporting?

AI in financial reporting excels at rule-based, mechanical tasks but cannot replace accountant judgment. The platform cannot decide which accounting treatment to use for complex transactions, cannot interpret ambiguous situations, and cannot make strategic financial decisions. Additionally, accountants are (appropriately) risk-averse, which means adoption of AI automation will be gradual and cautious. In Scope acknowledges this by starting with low-risk automation and gradually expanding trust as the system proves reliable. Regulatory requirements also mean that any AI-generated numbers in filings must be verified and approved by qualified accountants.

Will In Scope replace accountants?

No, In Scope won't replace accountants in the foreseeable future. Instead, it will automate the routine work that currently consumes a significant portion of accountants' time. This frees accountants to focus on more valuable work: analysis, advisory, strategic planning, and ensuring accuracy. Historically, automation in professional services (law, medicine, accounting) has increased demand for skilled professionals by reducing costs and expanding access. The profession will shift, but the need for skilled accountants will likely remain strong. Accountants will spend less time on busywork and more time on interpretation, strategy, and higher-level work.

In Scope represents a genuine inflection point in financial reporting technology. For the first time in decades, there's a credible alternative to legacy incumbents built by founders who understand the problem deeply. With strong funding, real customer traction, and clear product-market fit, the company is positioned to capture meaningful market share.

But more importantly, In Scope signals that even entrenched enterprise software markets are vulnerable to disruption by modern companies using AI effectively. The founders' insight that accountants were risk-averse was crucial—rather than trying to replace accountants with AI, they built tools that augment accountants and gradually build trust through low-risk automation.

That's a playbook worth watching. In the next five years, we'll likely see similar companies emerge in other professional domains: tax preparation, contract review, medical coding, and more. The pattern is the same: find a high-stakes domain where smart people spend enormous time on routine work, build tools to automate that work intelligently, and you have a significant business opportunity.

In Scope's $14.5 million Series A isn't just funding for one company. It's validation that AI-powered automation of professional knowledge work is both real and valuable.

Key Takeaways

- InScope raised $14.5M Series A to automate the mechanical, time-consuming aspects of financial statement preparation that accountants currently handle manually

- The founding team's deep domain expertise (both worked as controllers at Flexport, Miro, Hopin, and Thrive Global) gave them insight into real pain points that legacy vendors like Workiva haven't solved

- 5x customer growth in 12 months with adoption by top-15 accounting firms (CohnReznick) demonstrates genuine market validation beyond early adopters

- InScope's strategy of starting with low-risk automation (formatting, verification) rather than full statement generation shows realistic understanding of how accountants' risk aversion will limit adoption speed

- The addressable market is massive (billions globally) with clear pricing power, suggesting InScope could become a significant business if execution continues

Related Articles

- Neo's Low-Dilution Accelerator Model: Reshaping Founder Economics [2025]

- How AI Is Transforming Customs Brokerage in the Age of Trade Chaos [2025]

- DG Matrix Raises $60M: Solid-State Transformers Transform Data Center Power [2025]

- Thrive Capital's $10B Fund: What It Means for AI and Venture Capital [2026]

- Why B2B Software Isn't Dead: What AI Really Means for SaaS [2025]

- Anthropic's $14B ARR: The Fastest-Scaling SaaS Ever [2025]

![InScope Raises $14.5M to Automate Financial Reporting [2025]](https://tryrunable.com/blog/inscope-raises-14-5m-to-automate-financial-reporting-2025/image-1-1771616640084.jpg)